A Policy Issuance Document Sample for Motor Insurance outlines the key details of the insurance contract, including coverage terms, premium amounts, and vehicle information. This document serves as proof of insurance and provides essential guidelines for claims and renewals. Understanding its structure ensures policyholders are aware of their rights and obligations under the motor insurance policy.

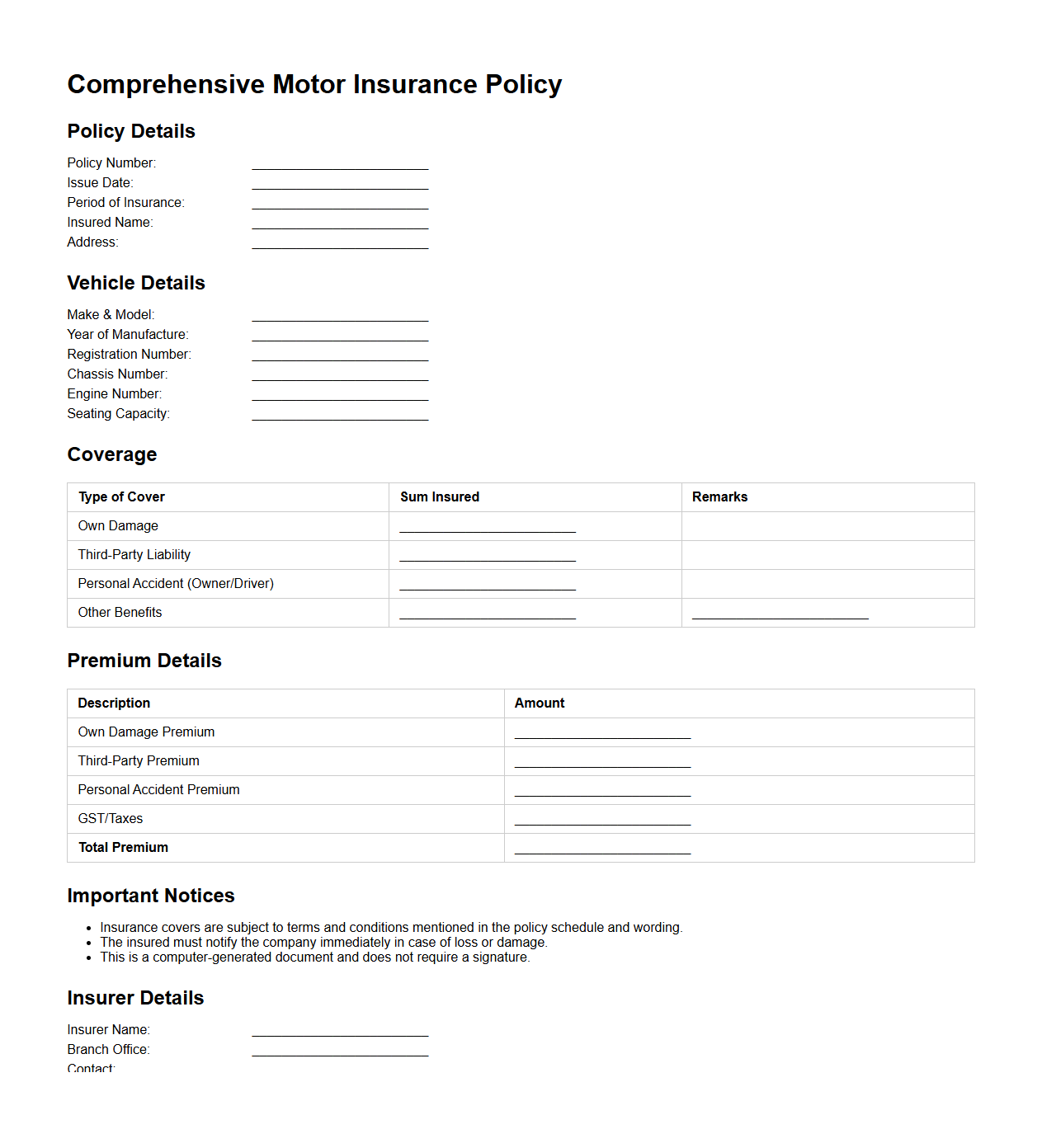

Comprehensive Motor Insurance Policy Issuance Sample

A

Comprehensive Motor Insurance Policy Issuance Sample document serves as a detailed template illustrating the terms, coverage limits, and conditions under which a motor insurance policy is issued. It includes key components such as insured vehicle details, coverage for third-party liabilities, own damage cover, and exclusions. This sample helps policyholders and insurers ensure clarity and completeness in the insurance agreement before the final issuance.

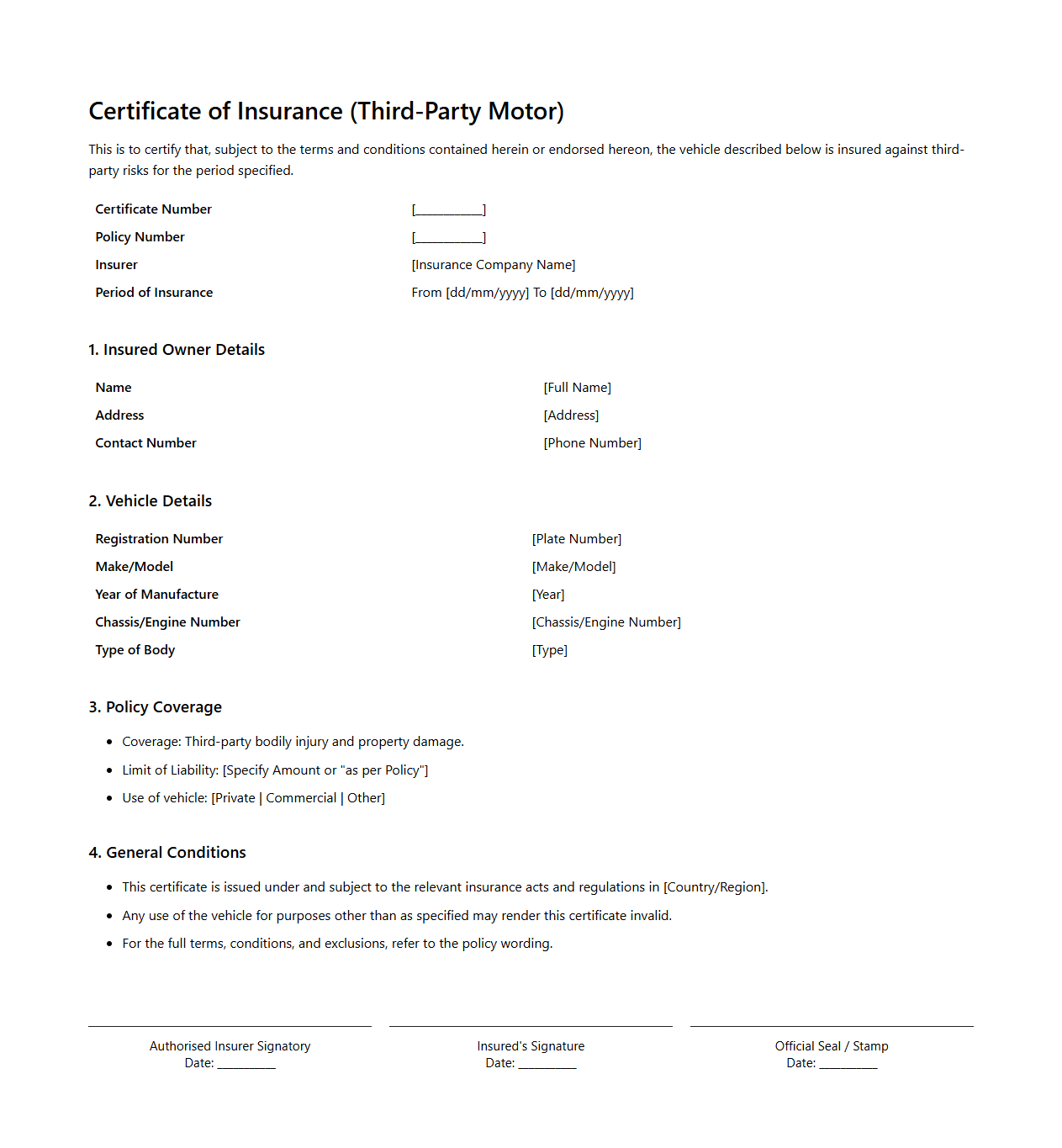

Third-Party Motor Insurance Certificate Template

A

Third-Party Motor Insurance Certificate Template document serves as a standardized format for issuing proof of insurance coverage required by law for vehicle owners. This template includes essential details such as the insurer's information, policy number, vehicle details, and validity period to ensure compliance with regulatory requirements. It simplifies the documentation process for insurance providers while providing vehicle owners with official evidence of third-party liability coverage.

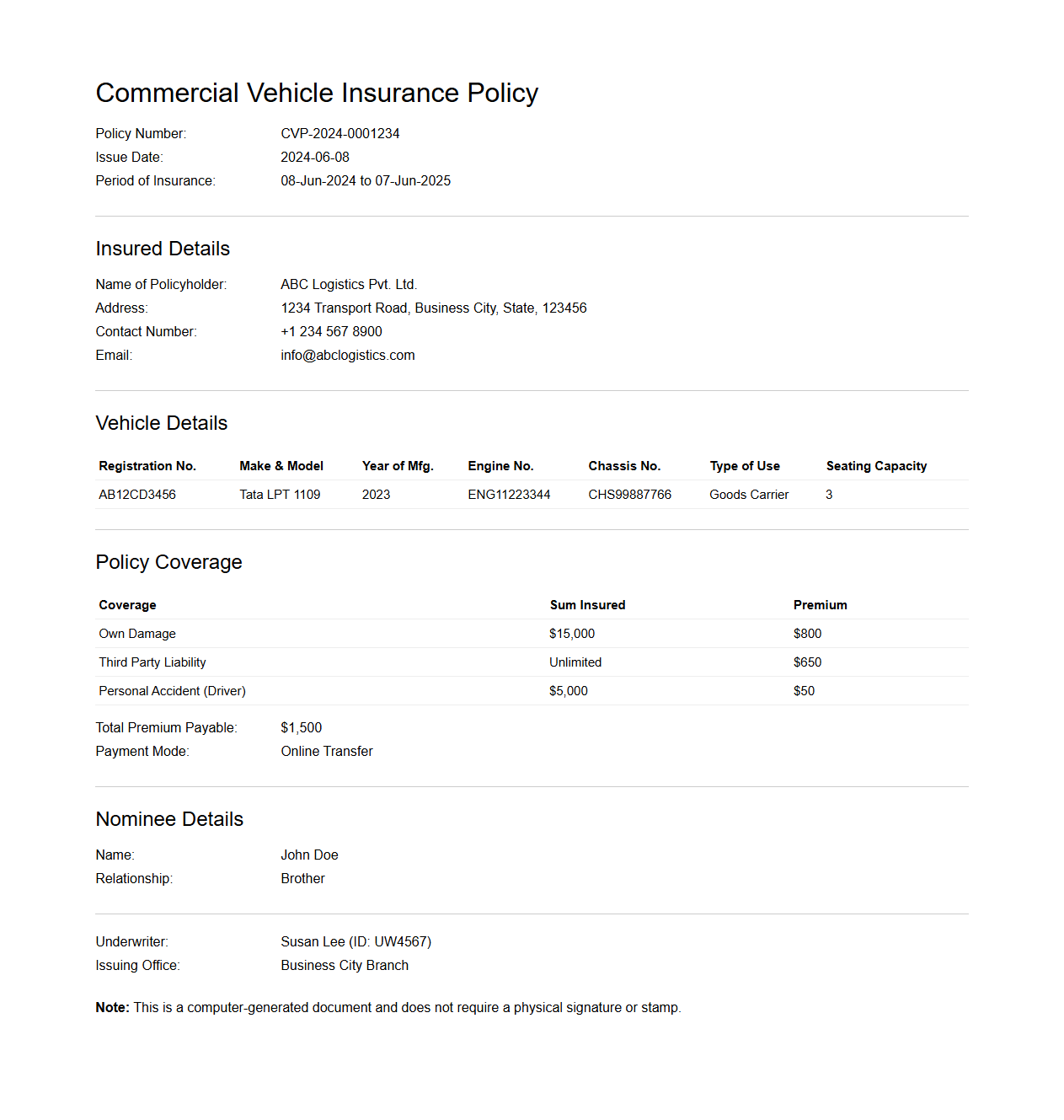

Commercial Vehicle Policy Issuance Document Example

A

Commercial Vehicle Policy Issuance Document example outlines the official insurance contract provided by an insurer to a policyholder for business-use vehicles. It includes key details such as coverage limits, insured vehicle information, premium amounts, and terms and conditions governing the policy. This document serves as proof of insurance and is essential for legal and operational compliance in commercial transportation.

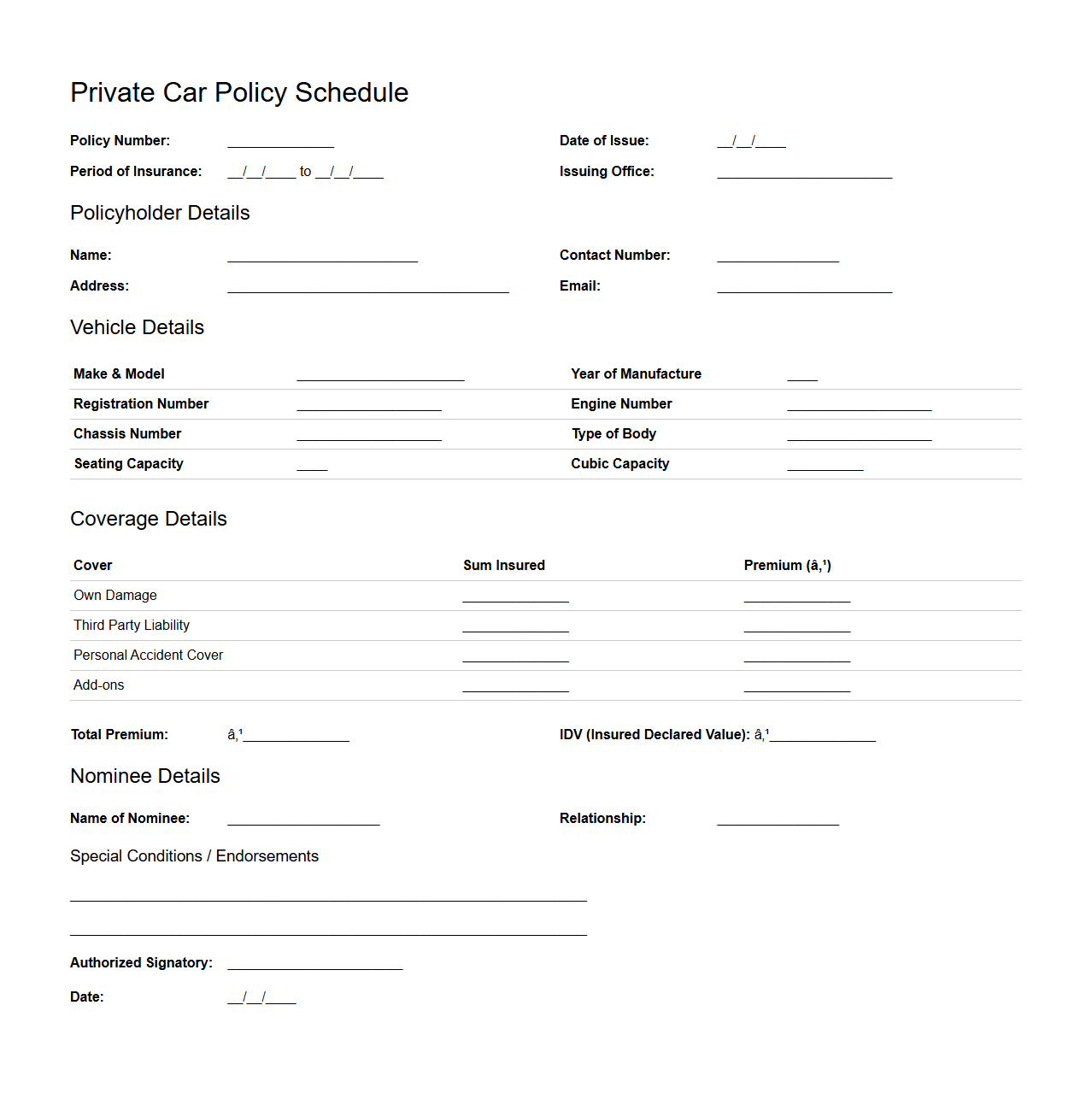

Private Car Policy Schedule Sample

A

Private Car Policy Schedule Sample document outlines the specific coverage details, insured vehicle information, policy duration, and premium amounts associated with an individual's car insurance policy. It serves as a tailored reference that helps policyholders understand their protection scope, including liability limits, deductibles, and any additional endorsements. This document is essential for verifying the terms of the private car insurance contract and facilitating claims processing.

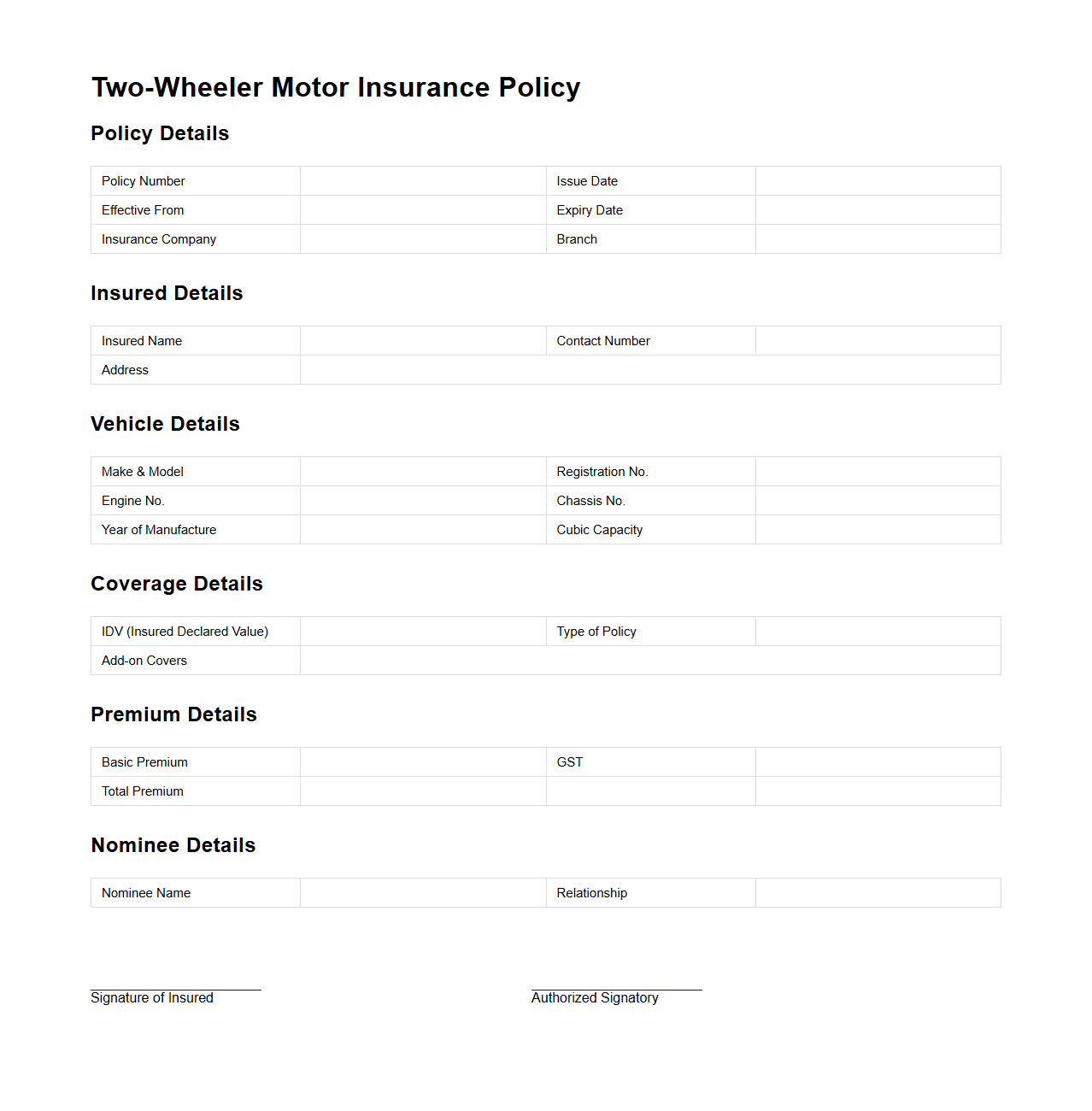

Two-Wheeler Motor Insurance Policy Format

A

Two-Wheeler Motor Insurance Policy Format document outlines the terms and conditions, coverage details, and legal obligations for insuring a motorcycle or scooter against risks such as accidents, theft, and third-party liabilities. This format typically includes the insured vehicle's details, policyholder information, premium amount, coverage period, and claim procedure guidelines. Understanding this document helps policyholders ensure compliance with motor insurance regulations and protects their financial interests in unforeseen events.

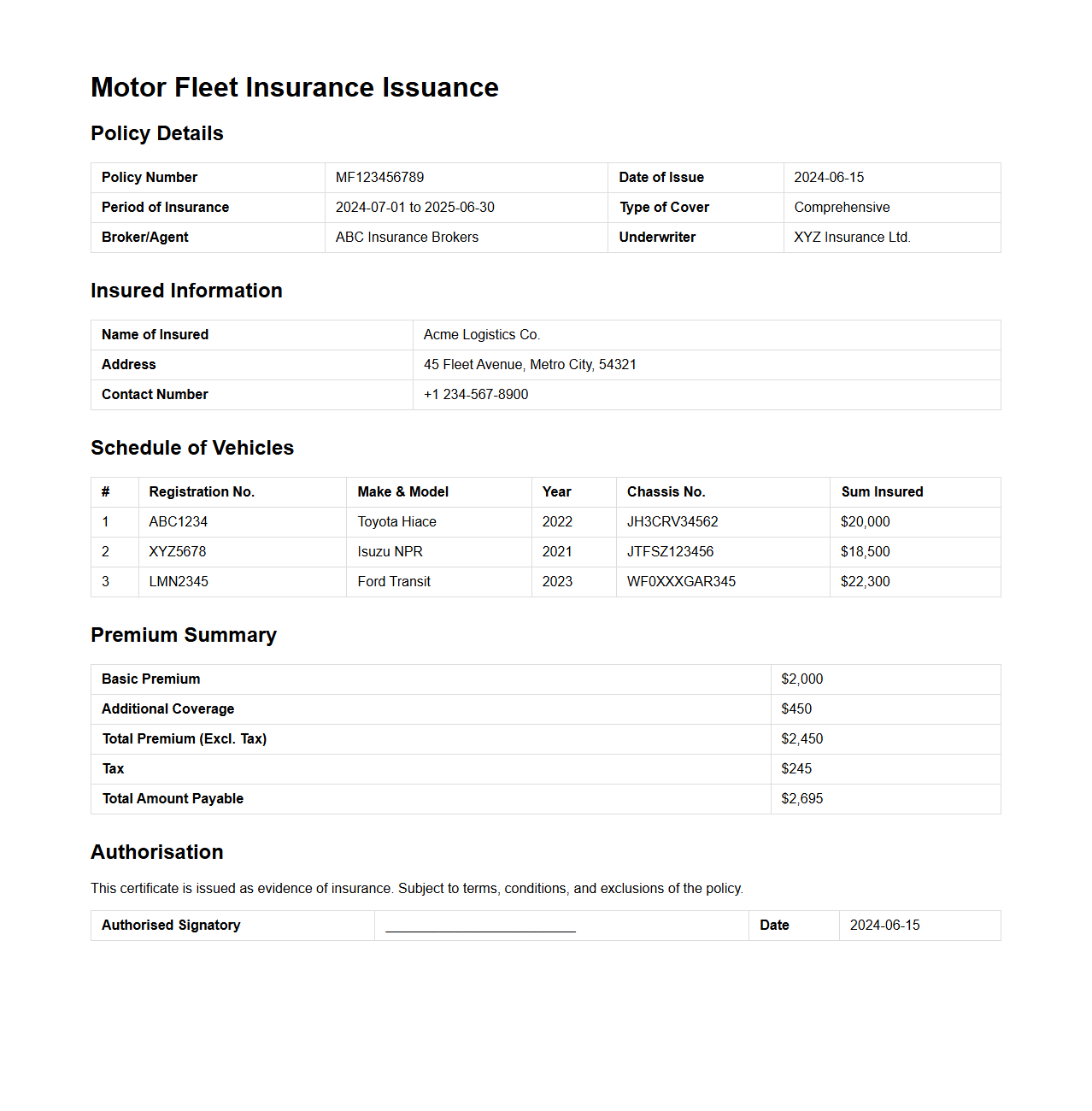

Motor Fleet Insurance Issuance Sample

A

Motor Fleet Insurance Issuance Sample document serves as a formal template outlining the terms, coverage, and conditions of an insurance policy issued to cover multiple vehicles under a single fleet. It details essential data such as the insured parties, vehicle identification numbers (VINs), coverage limits, and premium calculations specific to the fleet. This document is crucial for fleet operators managing risk and ensuring compliance with regulatory requirements in commercial vehicle insurance.

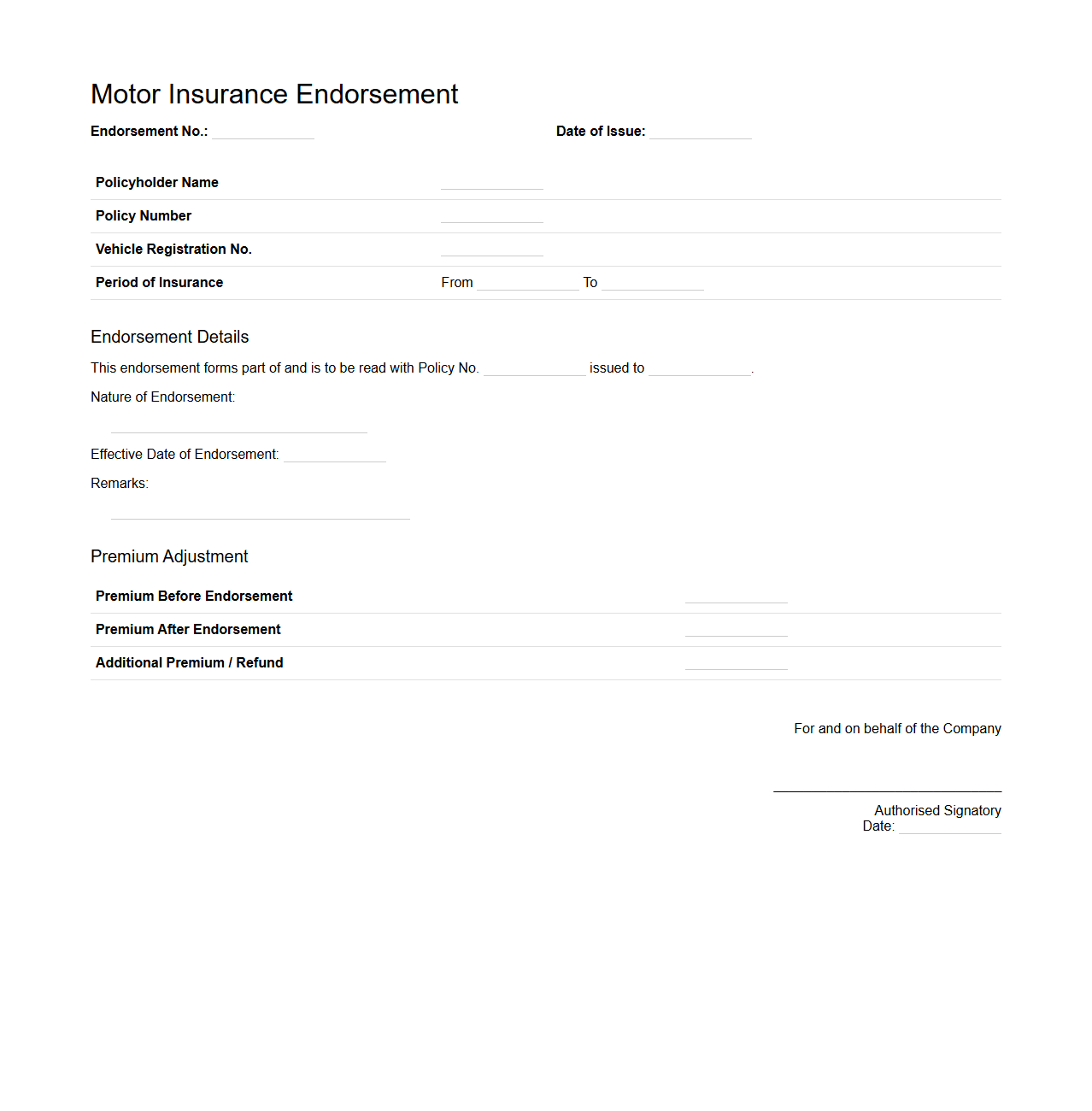

Motor Insurance Endorsement Document Template

A

Motor Insurance Endorsement Document Template is a standardized form used to record changes or updates to an existing motor insurance policy, such as modifications in coverage, insured vehicle details, or policyholder information. This document ensures clarity and legal compliance by specifying the endorsement terms, effective dates, and signatures required. It serves as an essential tool for insurers and policyholders to maintain accurate and up-to-date insurance records.

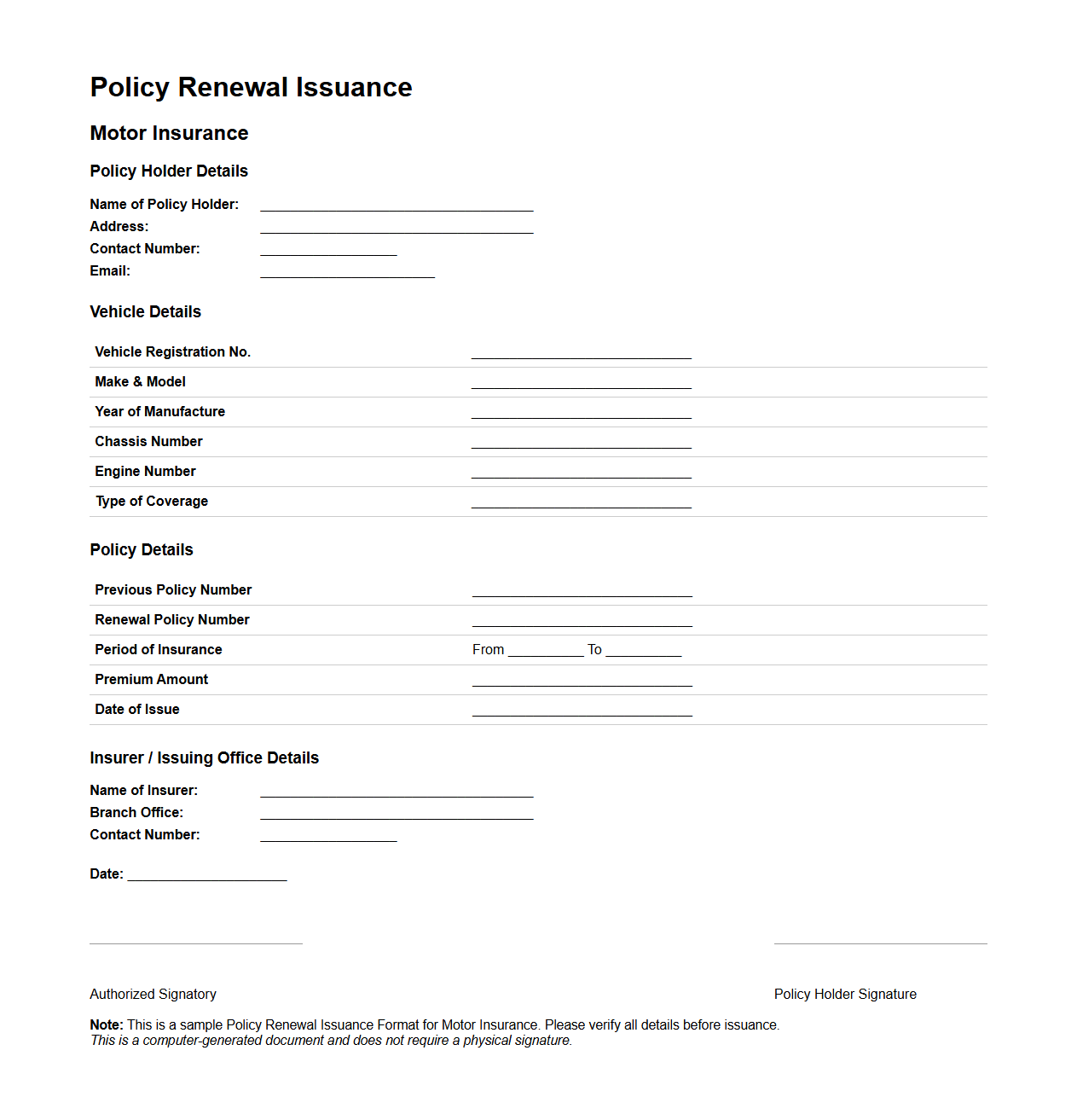

Policy Renewal Issuance Format for Motor Insurance

The

Policy Renewal Issuance Format for Motor Insurance is a standardized document that outlines the terms, coverage details, and premium information for renewing a motor insurance policy. It serves as a formal confirmation of the continuation of insurance protection, ensuring that the vehicle remains insured without any lapse in coverage. This format typically includes policyholder details, vehicle information, renewal period, and updated policy conditions.

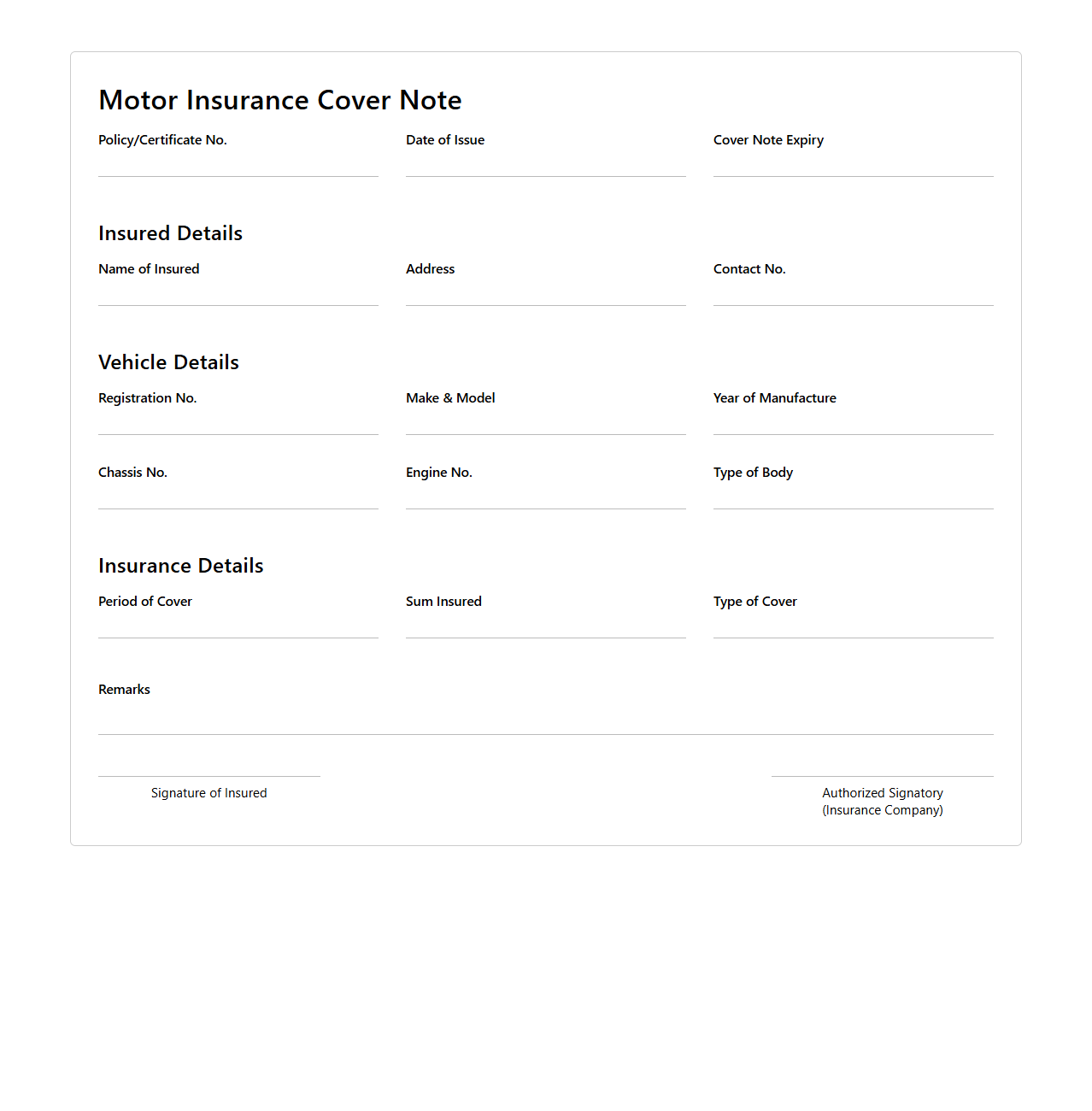

Motor Insurance Cover Note Example

A

Motor Insurance Cover Note is a temporary document issued by an insurance company that provides proof of motor vehicle insurance until the formal policy is delivered. This document outlines essential details such as the vehicle registration number, insured party information, coverage limits, and the policy's validity period. It serves as immediate evidence of insurance coverage, ensuring legal compliance and protection against potential risks while the full policy is being processed.

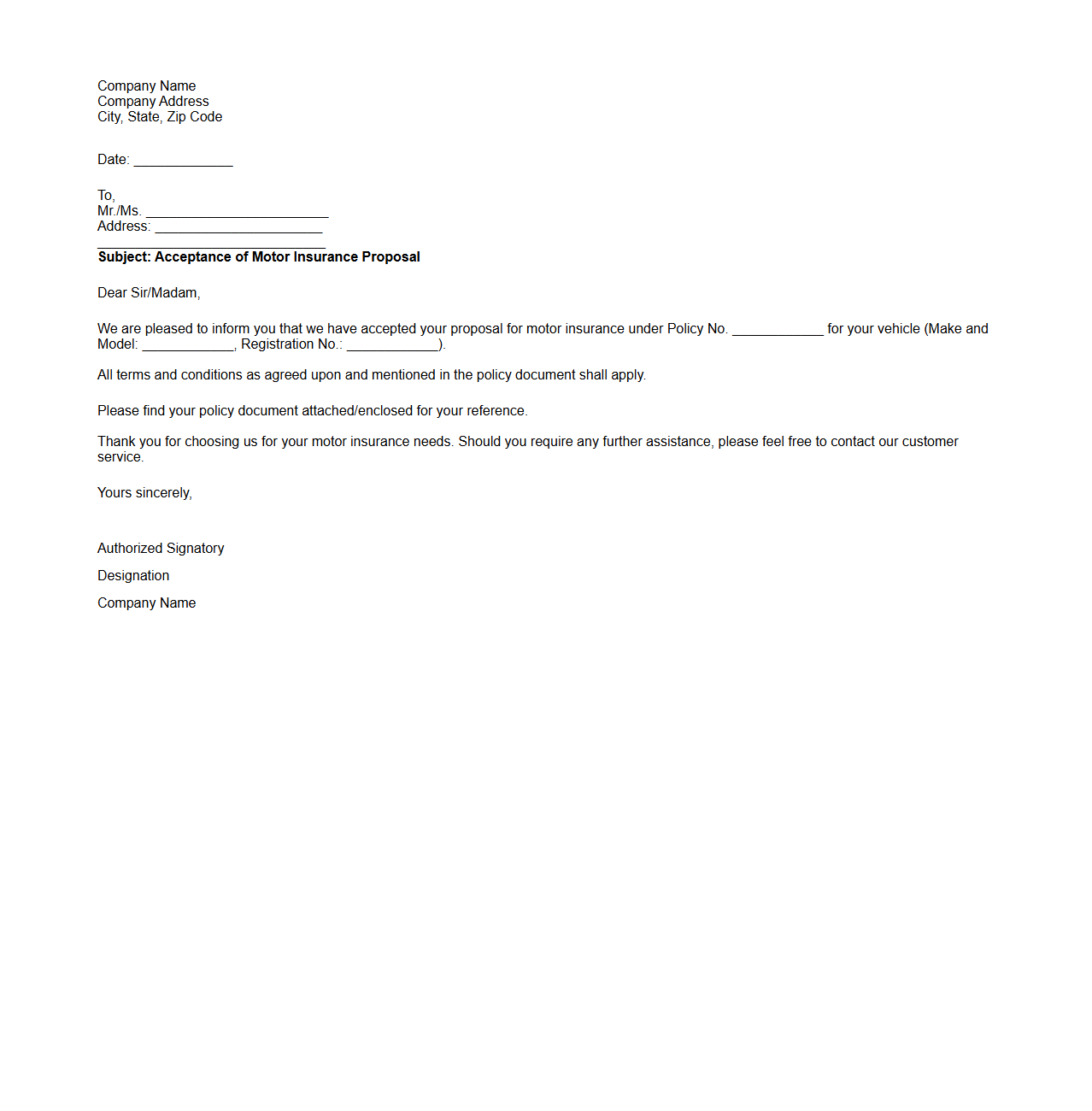

Motor Insurance Proposal Acceptance Letter Sample

A

Motor Insurance Proposal Acceptance Letter Sample document serves as formal confirmation from the insurer that the motor insurance proposal submitted by the applicant has been reviewed and accepted. This letter typically includes policy details, coverage terms, premium amounts, and the effective date of the insurance. It acts as a crucial record for both parties, ensuring transparency and mutual agreement on the insurance contract.

Identification of the Insured and Insured Vehicle

The policy issuance document clearly states the name of the insured to confirm the policyholder's identity. It also provides detailed information about the insured vehicle, including make, model, year, and vehicle identification number (VIN). These details ensure accurate coverage association and prevent identity mismatches.

Coverage, Exclusions, and Endorsements Detailed

The document specifies all covered risks and protection types included in the policy, such as liability, collision, and comprehensive coverage. It outlines exclusions to inform the insured about situations or damages not covered. Furthermore, any endorsements or additional coverages modifying the standard policy are explicitly listed.

Premium Amounts, Payment Terms, and Validity Dates

The premium amount payable by the insured is clearly itemized along with any applicable taxes or fees. The payment terms, including installment options or due dates, are detailed to prevent missed payments. The document also specifies the policy validity period, marking the start and end dates of coverage.

Procedures for Claims, Policy Renewals, and Cancellations

The policy issuance document provides step-by-step claims procedures to guide the insured on how to report incidents and seek compensation. It includes information about policy renewal terms, such as notification periods and renewal options. Additionally, it specifies cancellation conditions outlining rights and obligations of both parties.

Legal Compliance and Regulatory Disclosures

The document incorporates all legal requirements mandated by motor insurance regulations to ensure compliance. It provides regulatory disclosures regarding consumer rights, insurer responsibilities, and dispute resolution mechanisms. This ensures transparency and adherence to governing laws in motor insurance practices.