A Coverage Verification Document Sample for Mortgage Insurance serves as proof that a borrower's mortgage insurance policy is active and meets lender requirements. It typically includes essential details such as policy number, coverage limits, effective dates, and the insured property information. This document helps streamline the mortgage approval process by confirming adequate insurance coverage.

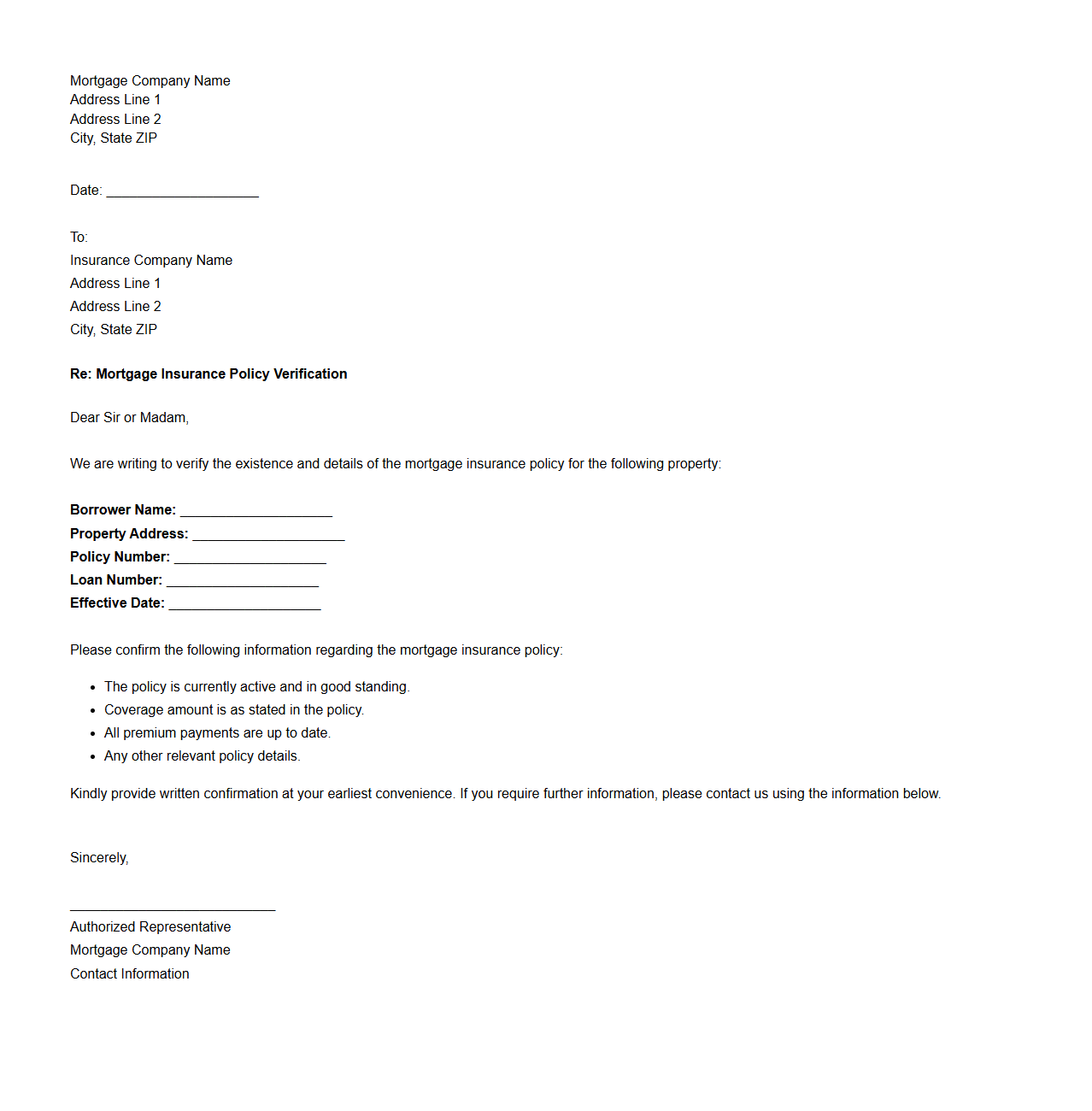

Mortgage Insurance Policy Verification Letter

A

Mortgage Insurance Policy Verification Letter is a formal document issued by an insurance company confirming the existence and details of a mortgage insurance policy. It verifies coverage amounts, policy terms, and the insured loan to protect lenders against borrower default. This letter is essential during loan approval and refinancing processes to ensure accurate risk assessment.

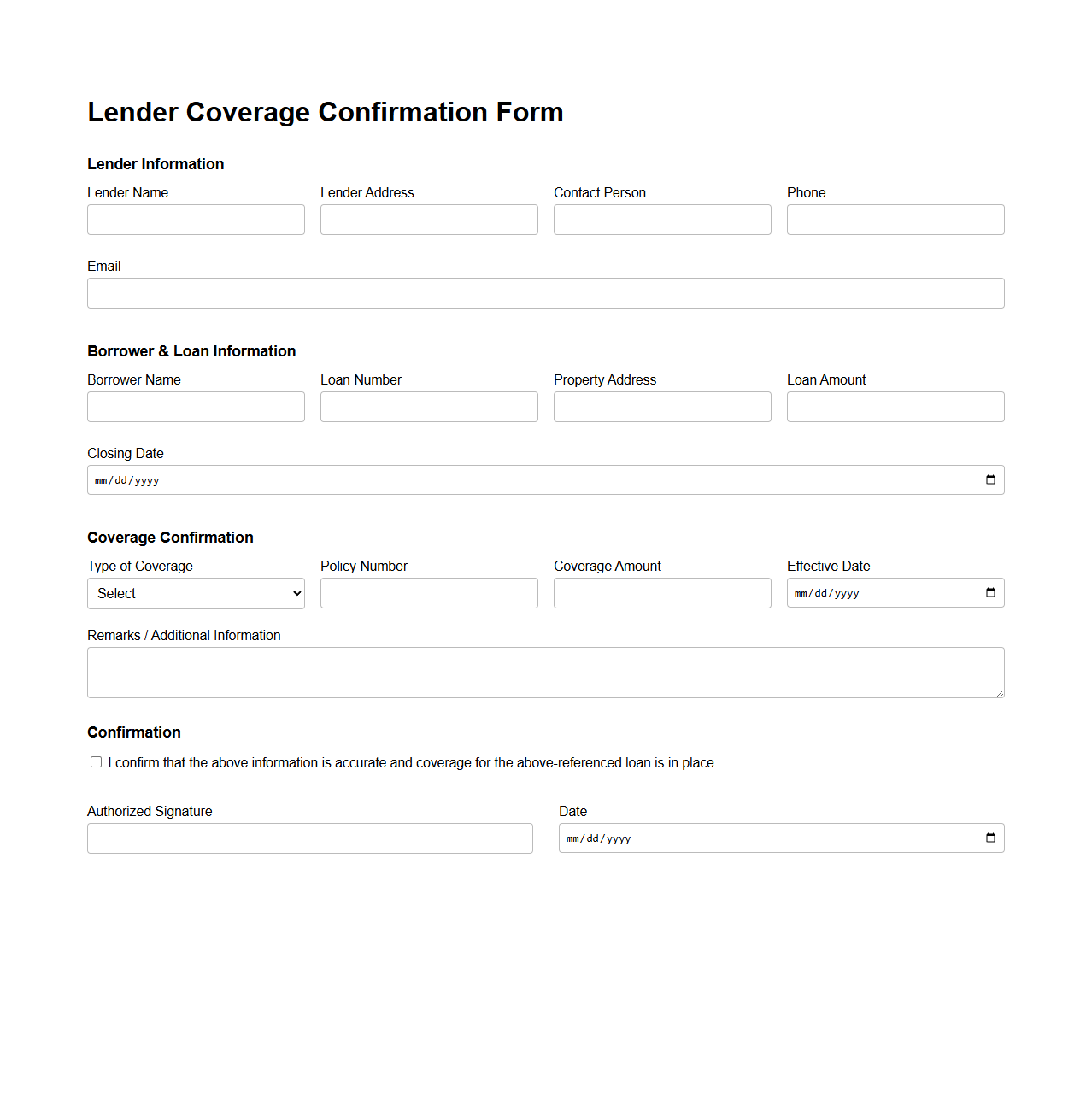

Lender Coverage Confirmation Form

The

Lender Coverage Confirmation Form is a critical document used to verify the extent and specifics of insurance coverage held by a borrower on assets that secure a loan. It ensures that lenders are informed about the insurance policy details, including coverage limits and expiration dates, to mitigate risk associated with asset protection. This form facilitates transparency between borrowers and lenders, supporting compliance with loan agreements and safeguarding financial interests.

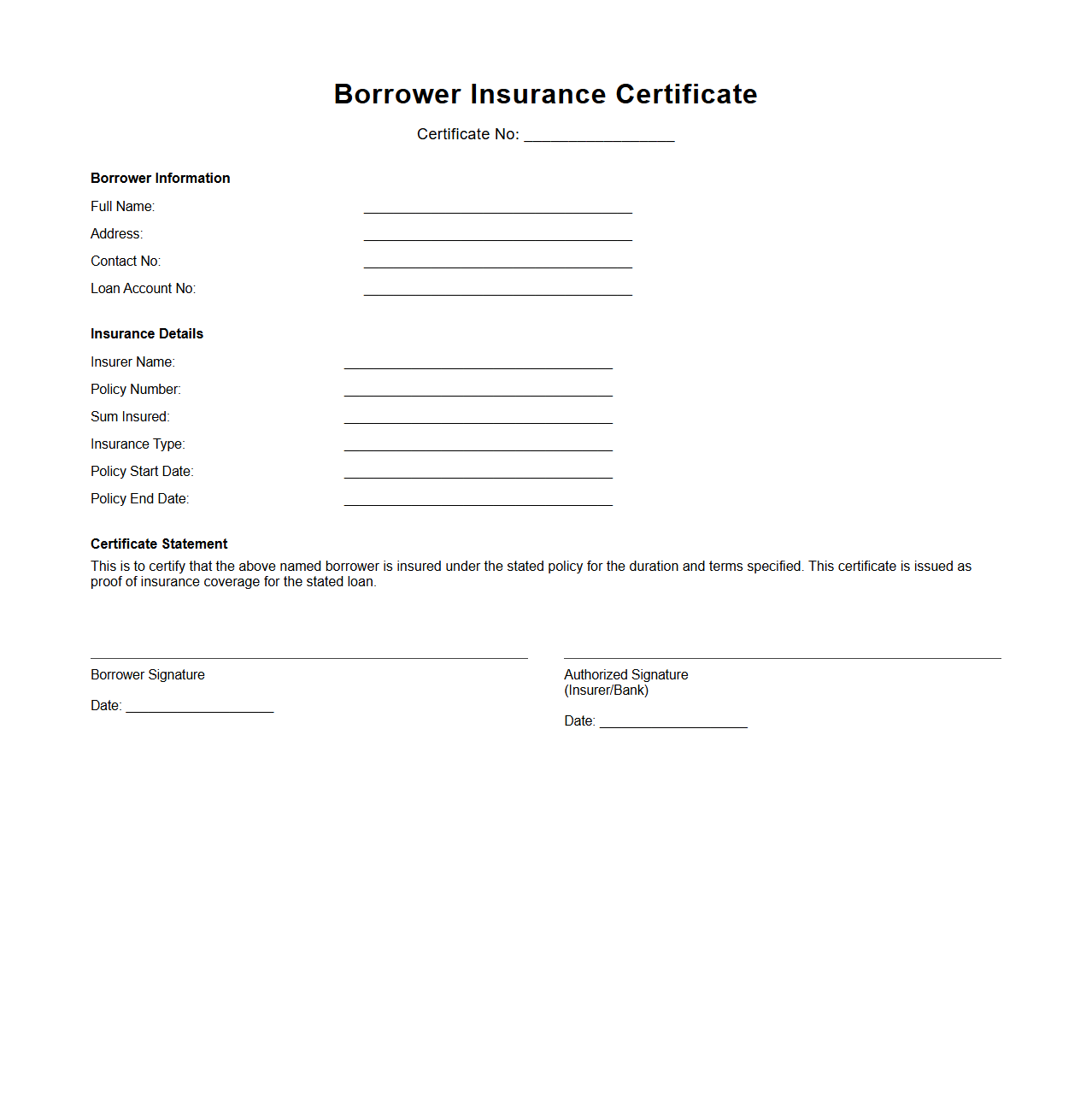

Borrower Insurance Certificate Template

A

Borrower Insurance Certificate Template is a standardized document used to verify that a borrower has active insurance coverage on an asset, typically property or vehicles, involved in a loan agreement. This template outlines key policy details, including coverage limits, policy duration, and insurer information, ensuring both lenders and borrowers have clear proof of insurance. Lenders rely on this certificate to mitigate risk and ensure collateral protection throughout the loan term.

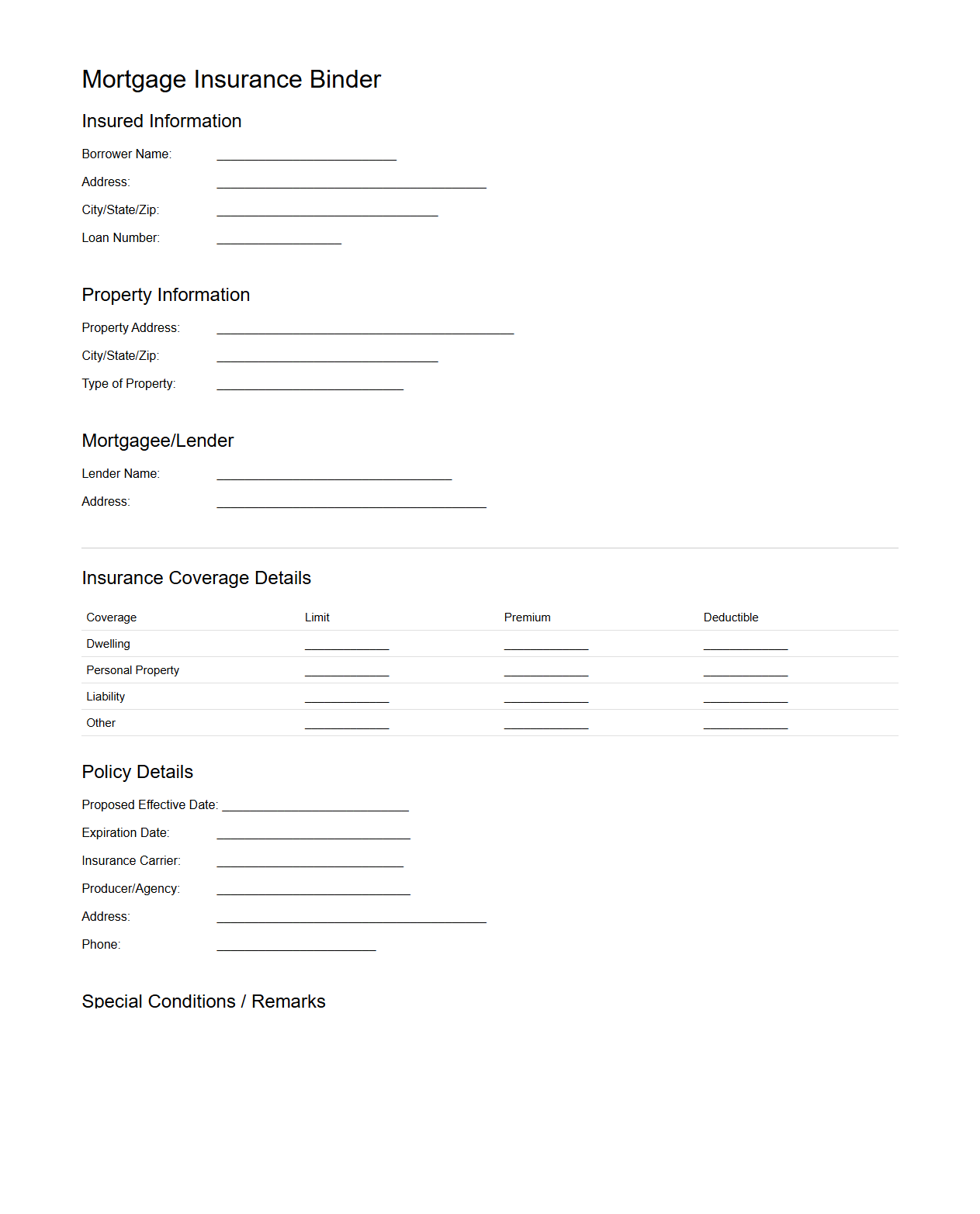

Mortgage Insurance Binder Example

A

Mortgage Insurance Binder is a temporary document that provides proof of mortgage insurance coverage before the official policy is issued. It ensures lenders that the borrower's loan is protected against default during the interim period. This binder typically includes essential details such as coverage amount, policy duration, and the insured property's information.

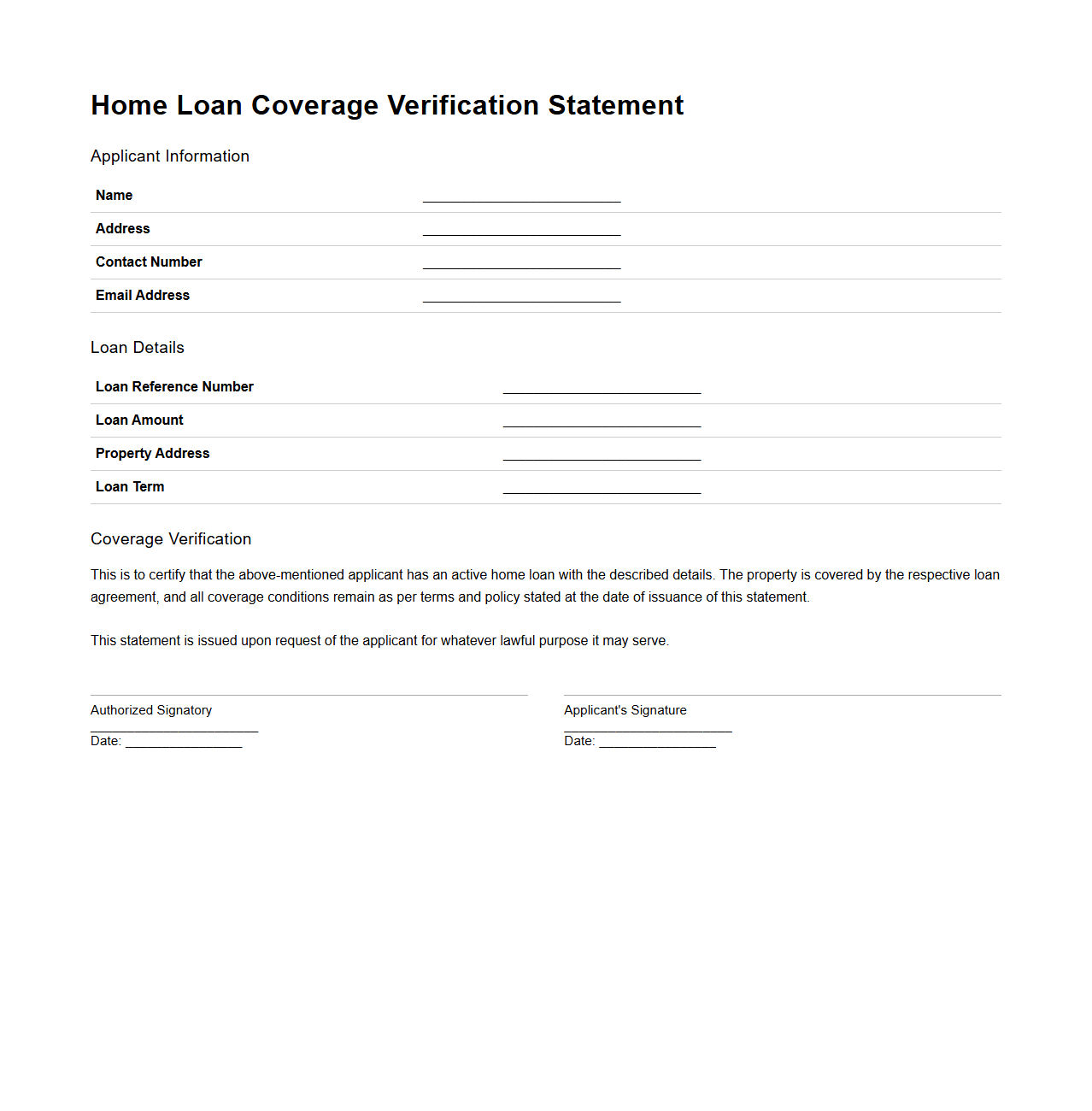

Home Loan Coverage Verification Statement

A

Home Loan Coverage Verification Statement is a crucial document used by lenders to confirm the availability and extent of insurance coverage on a property securing a home loan. It verifies that the insurance policy meets the lender's requirements, protecting both the borrower and lender against potential property damage risks. This statement helps ensure that the loan remains safeguarded throughout its term by confirming continuous and adequate coverage.

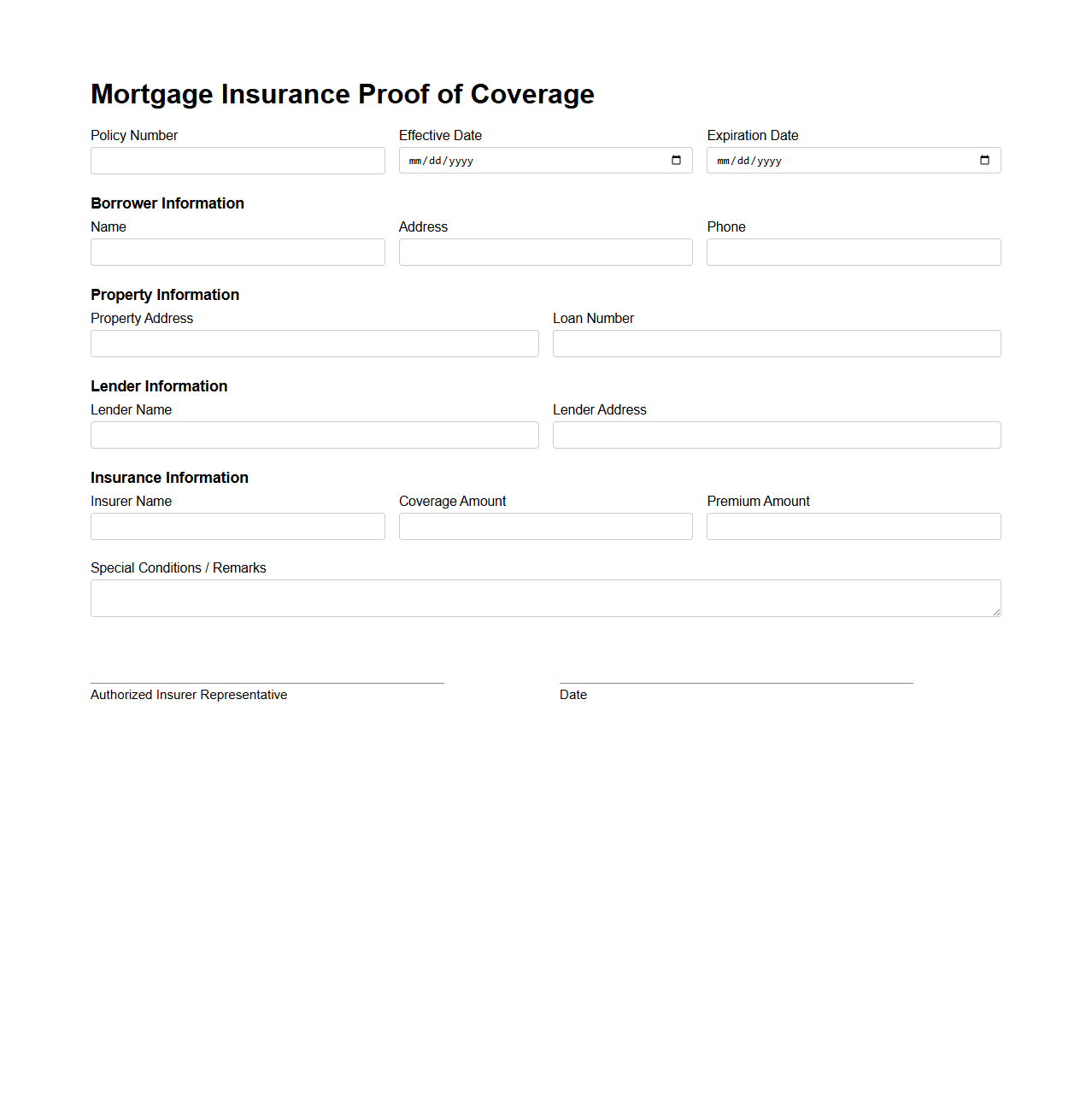

Mortgage Insurance Proof of Coverage Form

The

Mortgage Insurance Proof of Coverage Form document certifies that a borrower has active mortgage insurance protecting the lender against default risk. This form includes essential details such as policy number, coverage amount, and effective dates to verify that the insurance remains in force throughout the loan term. Lenders require this proof to ensure compliance with loan agreements and safeguard their financial interests.

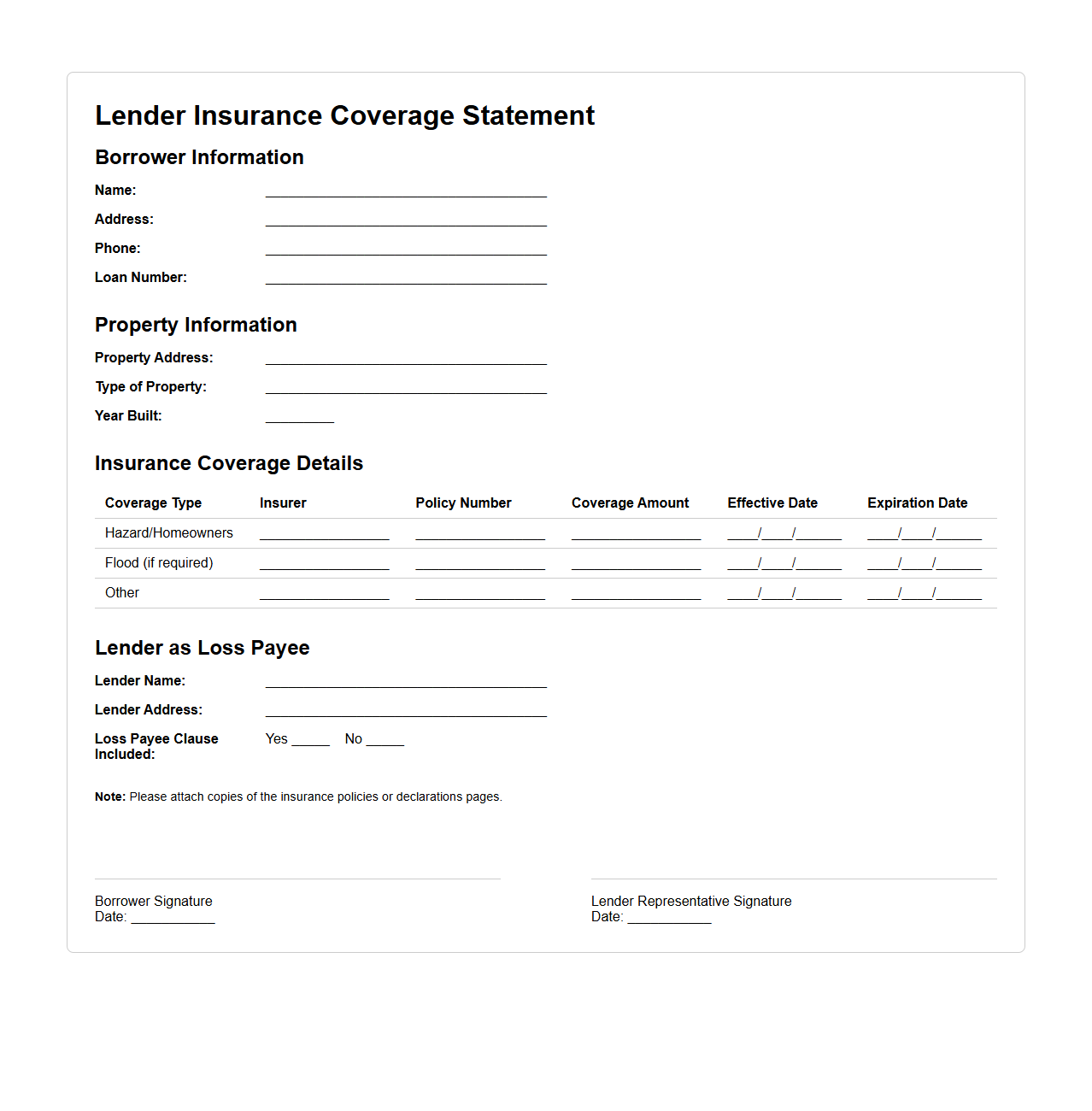

Lender Insurance Coverage Statement Sample

A

Lender Insurance Coverage Statement Sample document outlines the specific insurance policies and coverage amounts that a borrower must maintain to protect the lender's financial interest in a loan. This statement details required coverage types such as property, hazard, and mortgage insurance, ensuring compliance with loan agreements and mitigating risk for the lender. It serves as a reference for both lenders and borrowers to verify insurance status and coverage adequacy during the life of the loan.

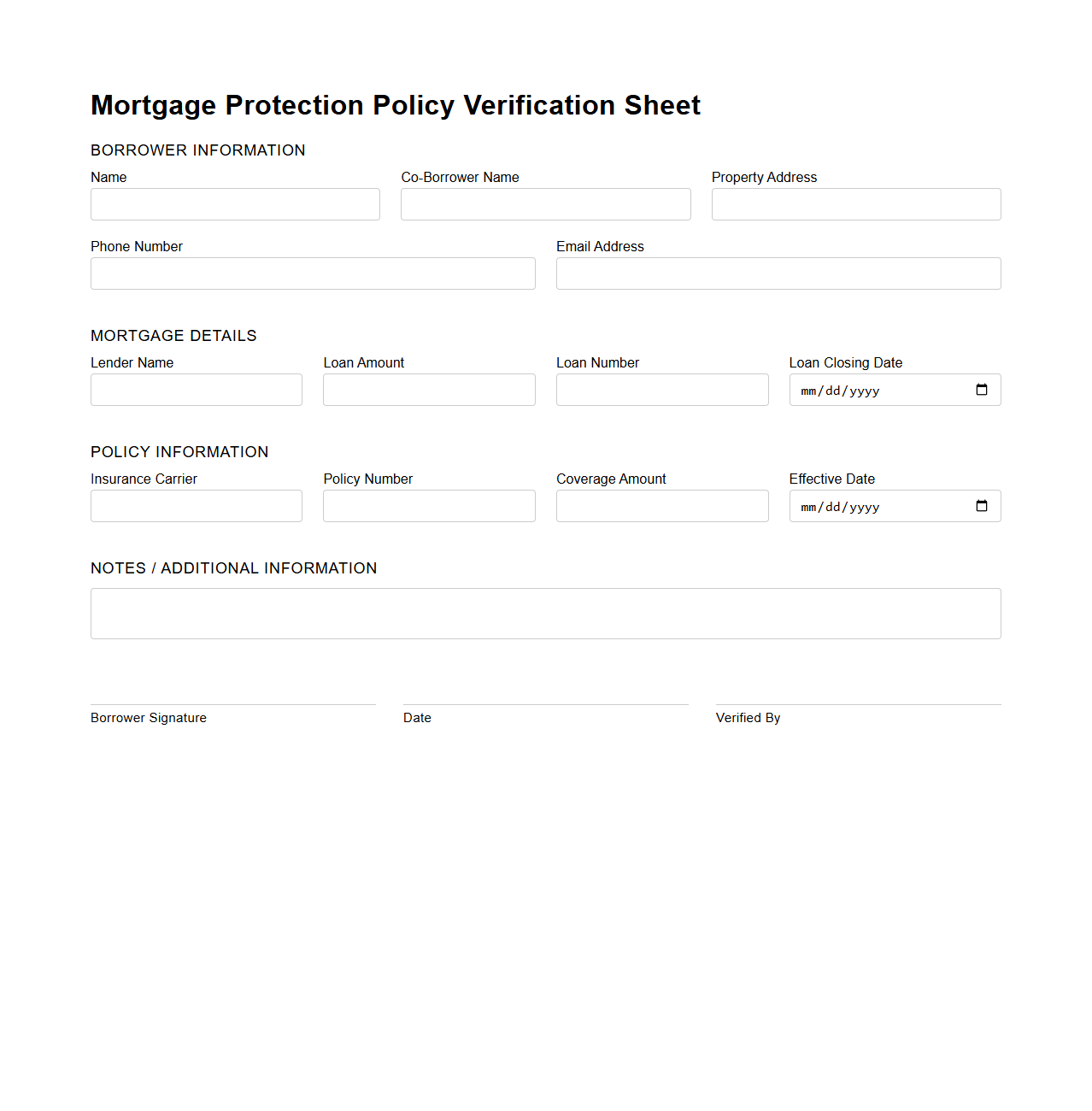

Mortgage Protection Policy Verification Sheet

A

Mortgage Protection Policy Verification Sheet is a document used to confirm the details and validity of a mortgage protection insurance policy. It typically includes information such as the policyholder's name, coverage amount, policy term, premiums, and insurer details to ensure accurate and up-to-date protection coverage. This sheet serves as a critical tool for both lenders and borrowers to verify that mortgage insurance is in place to cover outstanding loan balances in case of unforeseen events.

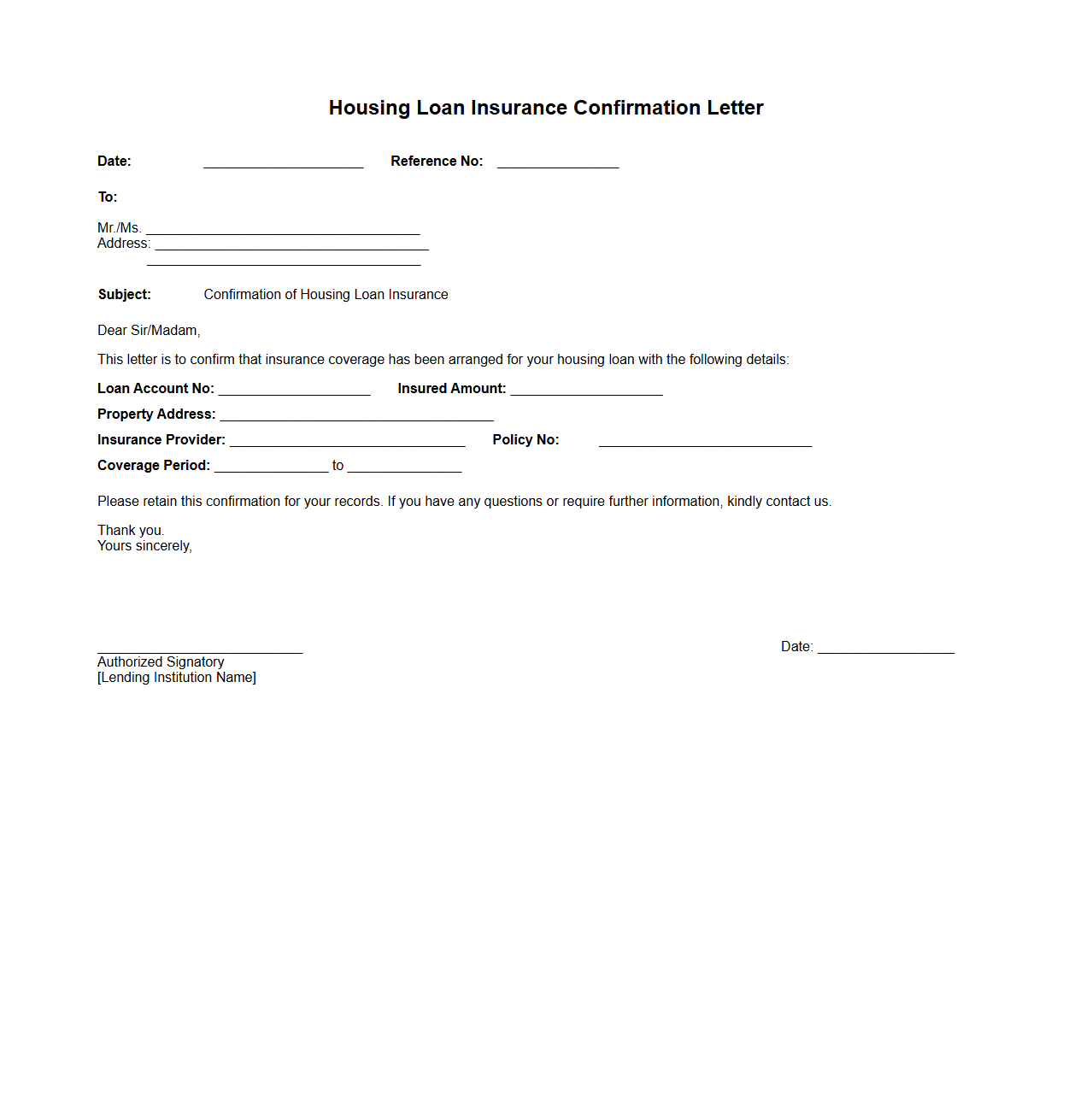

Housing Loan Insurance Confirmation Letter

The

Housing Loan Insurance Confirmation Letter is an official document issued by an insurance provider confirming coverage for a housing loan. It verifies that the borrower's loan is protected against risks such as death, disability, or unemployment, ensuring repayment security. This letter is often required by lenders to finalize mortgage approvals and protect both borrower and lender interests.

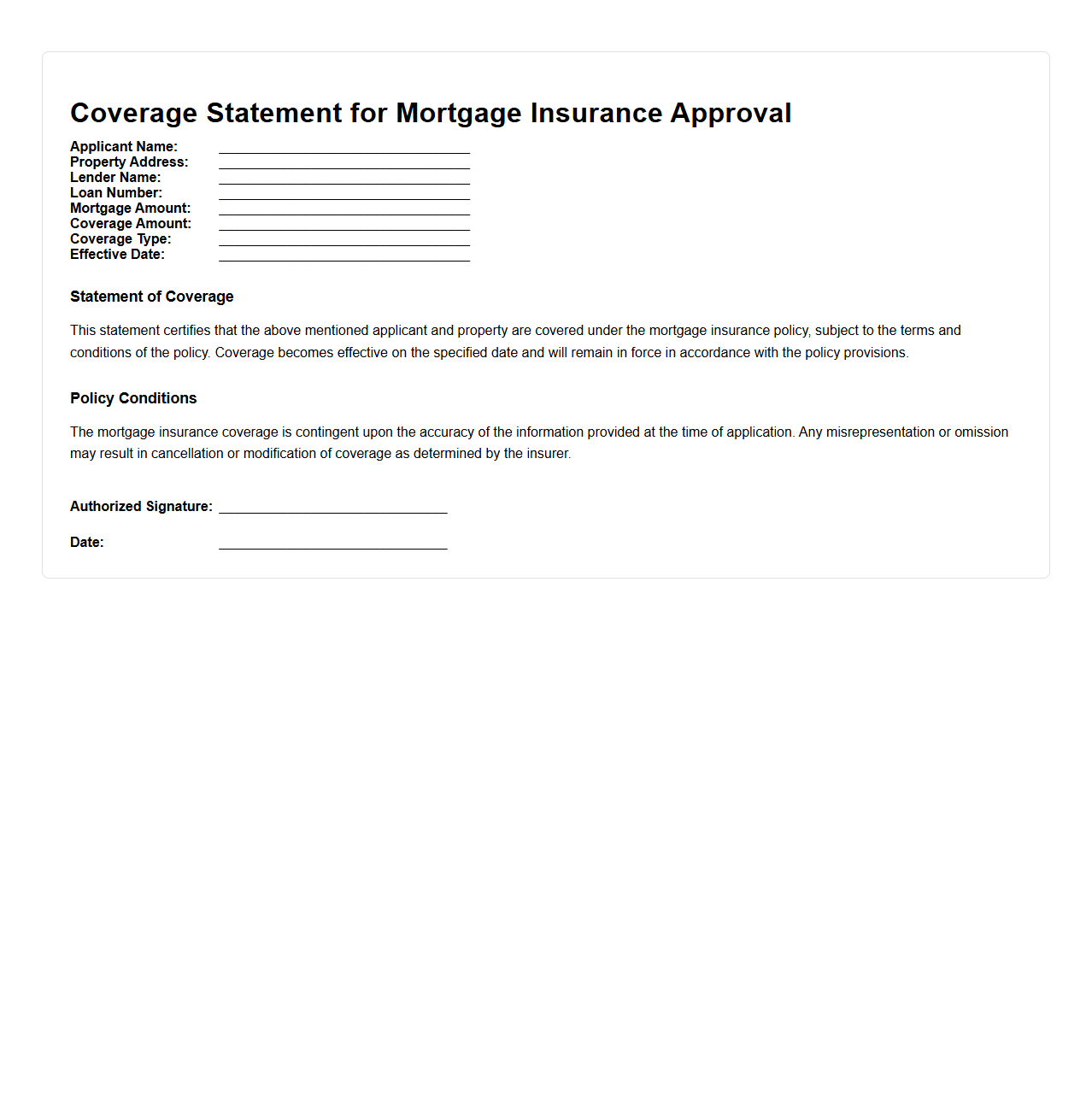

Coverage Statement for Mortgage Insurance Approval

A

Coverage Statement for Mortgage Insurance Approval is a crucial document provided by mortgage insurers that outlines the scope and limits of insurance coverage for a specific loan. It details the conditions under which the insurer agrees to reimburse the lender in case of borrower default, ensuring the mortgage meets investor and regulatory requirements. This statement helps lenders assess risk and confirm that the mortgage is protected according to industry standards.

What specific types of mortgage insurance coverage are detailed in the document?

The document details borrower-paid mortgage insurance (BPMI) and lender-paid mortgage insurance (LPMI) coverage. It outlines protection for both single-family residences and multi-unit properties. Additionally, coverage for high loan-to-value ratios and specialty loan programs is specified.

Which parties are listed as insured and beneficiaries in the sample?

The document lists the borrower as the insured party with the lender as the primary beneficiary. It also specifies that the mortgage insurer holds secondary rights. Both parties have defined roles in the coverage and claim process.

What are the stated policy coverage limits and effective dates in the document?

The policy coverage limits include a maximum insurance amount up to 80% loan-to-value ratio for standard loans. The effective date begins from the loan closing date and typically lasts for the duration of the loan term. Renewal options and coverage terminations are also clearly defined.

Are any coverage exclusions, conditions, or endorsements specified?

The document specifies exclusions such as damages from natural disasters and borrower fraud. Conditions include maintaining timely premium payments and compliance with loan terms. Additionally, endorsements may apply for property type exceptions or loan modifications.

Does the document outline the process for filing and verifying a mortgage insurance claim?

The document outlines a clear procedure to file a mortgage insurance claim, including notice requirements and necessary documentation. It emphasizes verification steps, including loan default confirmation and property valuation. Timelines and contact points for claim resolution are also provided.