A Proposal Form Document Sample for Life Insurance serves as a comprehensive template outlining the key information required from applicants, such as personal details, health history, and beneficiary designations. This document streamlines the application process by clearly presenting necessary questions and declarations, ensuring accurate risk assessment by the insurer. Using a sample form helps applicants prepare their responses and provides insurers with a standardized format for evaluating life insurance coverage requests.

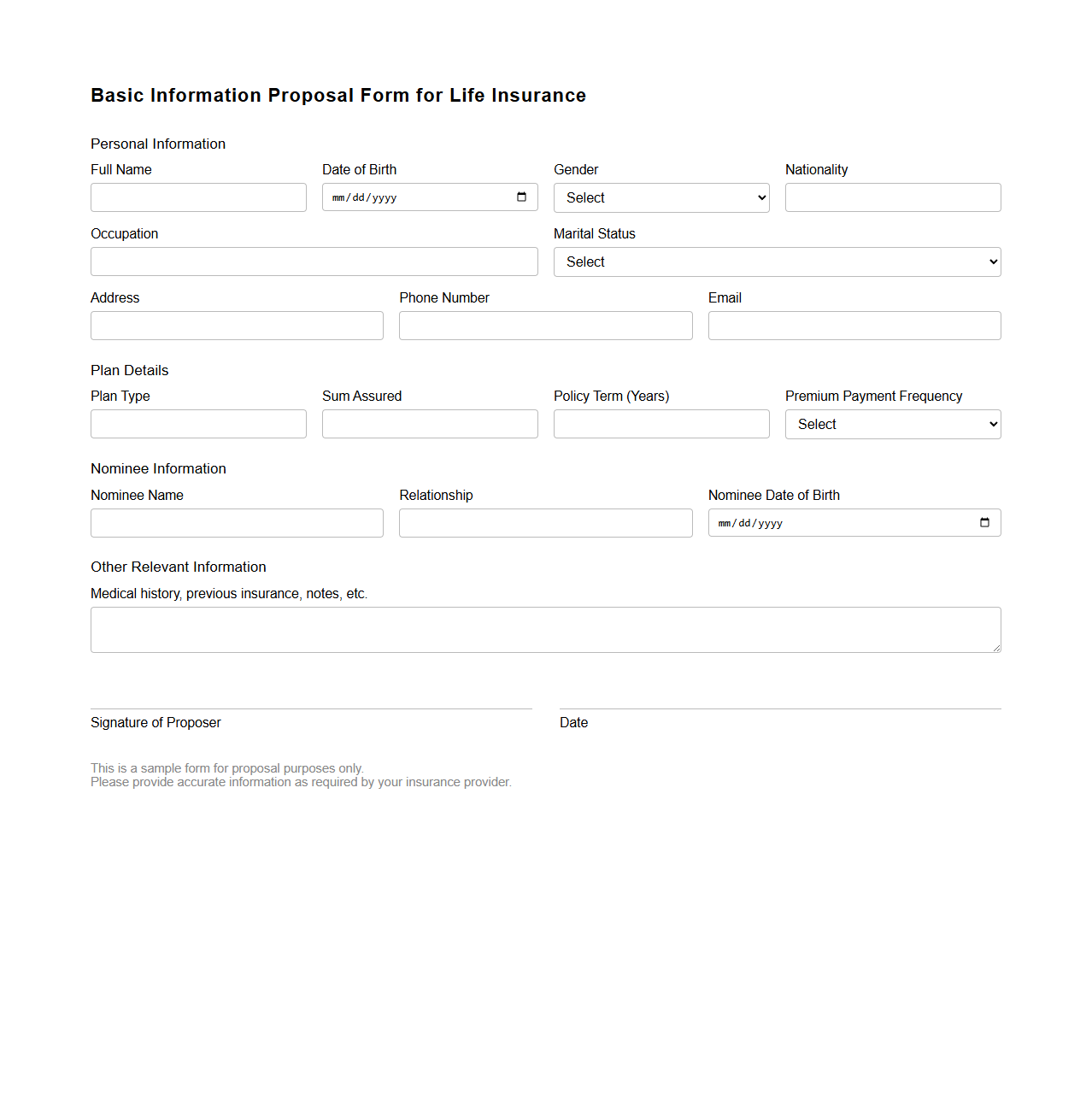

Basic Information Proposal Form for Life Insurance

The

Basic Information Proposal Form for Life Insurance is a critical document used by insurance companies to gather essential personal and health information from applicants. It typically includes details like age, medical history, lifestyle habits, and beneficiaries, which help insurers assess risk and determine premium rates. Accurate completion of this form ensures proper underwriting and timely policy issuance.

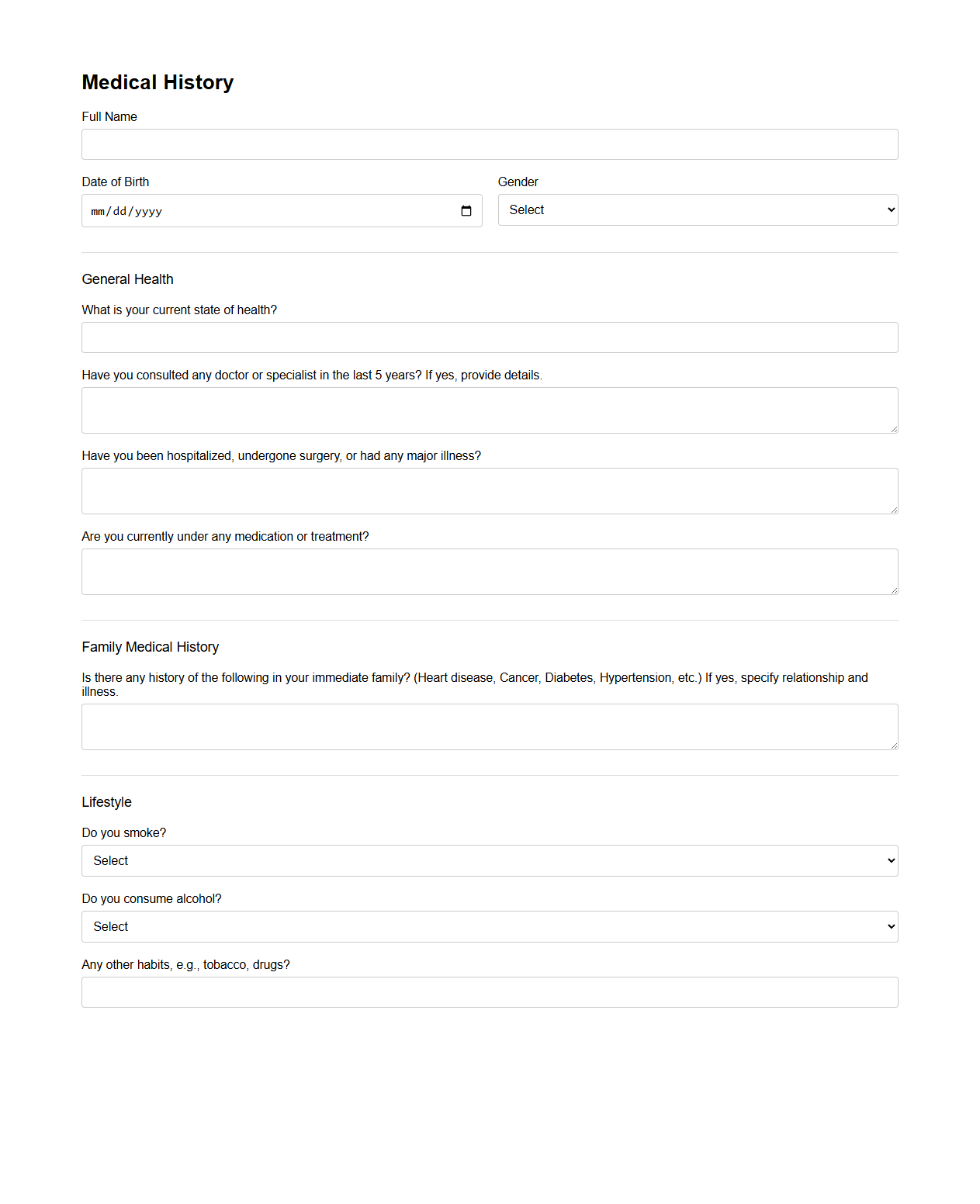

Medical History Section in Life Insurance Proposal

The

Medical History Section in a Life Insurance Proposal document collects detailed information about the applicant's past and current health conditions, surgeries, medications, and family medical background. This data helps insurance underwriters assess the potential risk and determine the appropriate coverage and premium rates. Accurate and comprehensive medical details enhance the accuracy of risk evaluation and ensure proper policy issuance.

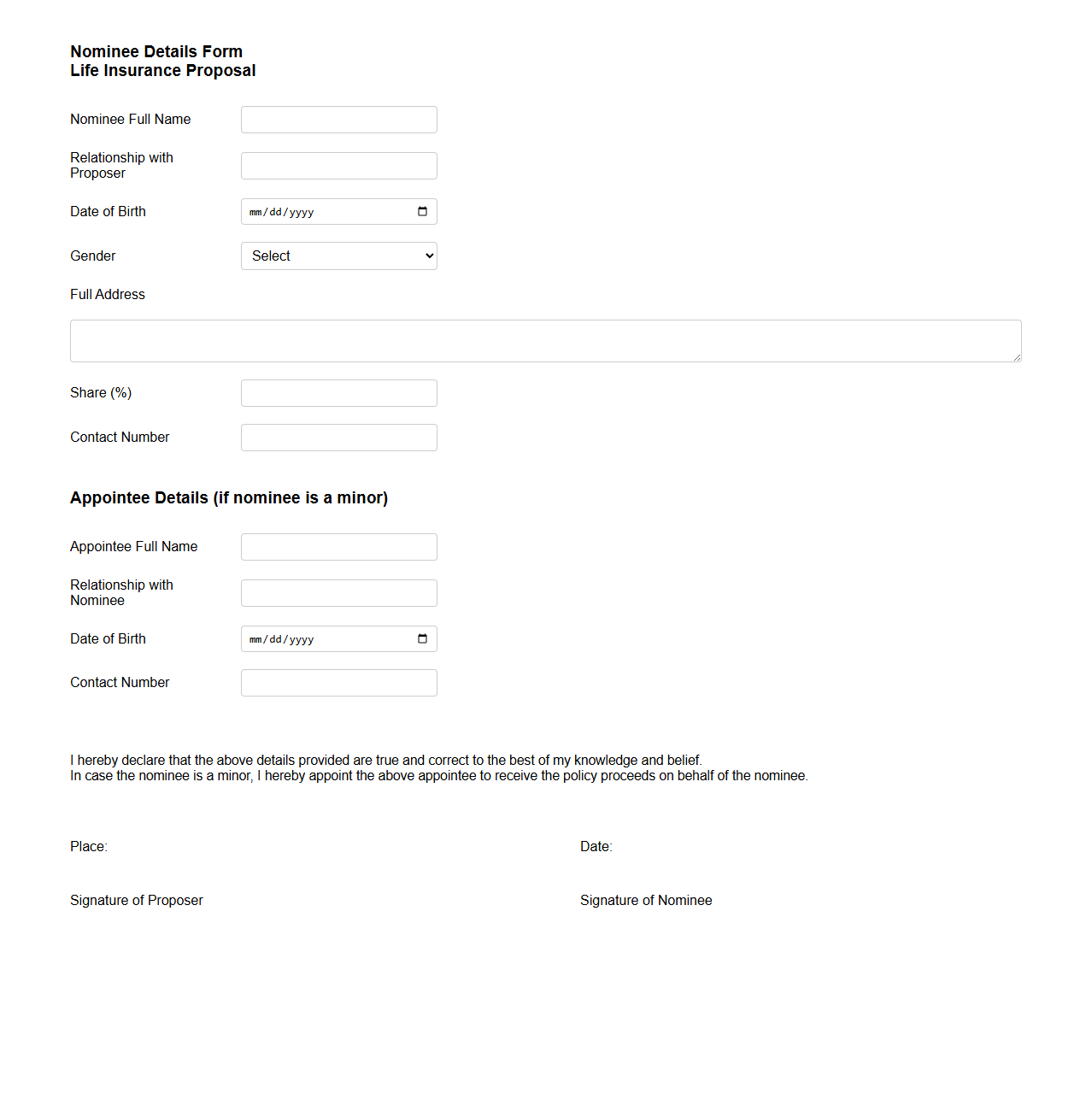

Nominee Details Form for Life Insurance Proposal

The

Nominee Details Form for a Life Insurance Proposal document is a crucial section where the policyholder designates the individual(s) who will receive the insurance benefits upon their demise. This form ensures clarity in beneficiary designation, helping to avoid disputes and delays during claim settlement. It typically requires details such as the nominee's name, relationship to the policyholder, and contact information, ensuring the insurer has accurate and verified data for future reference.

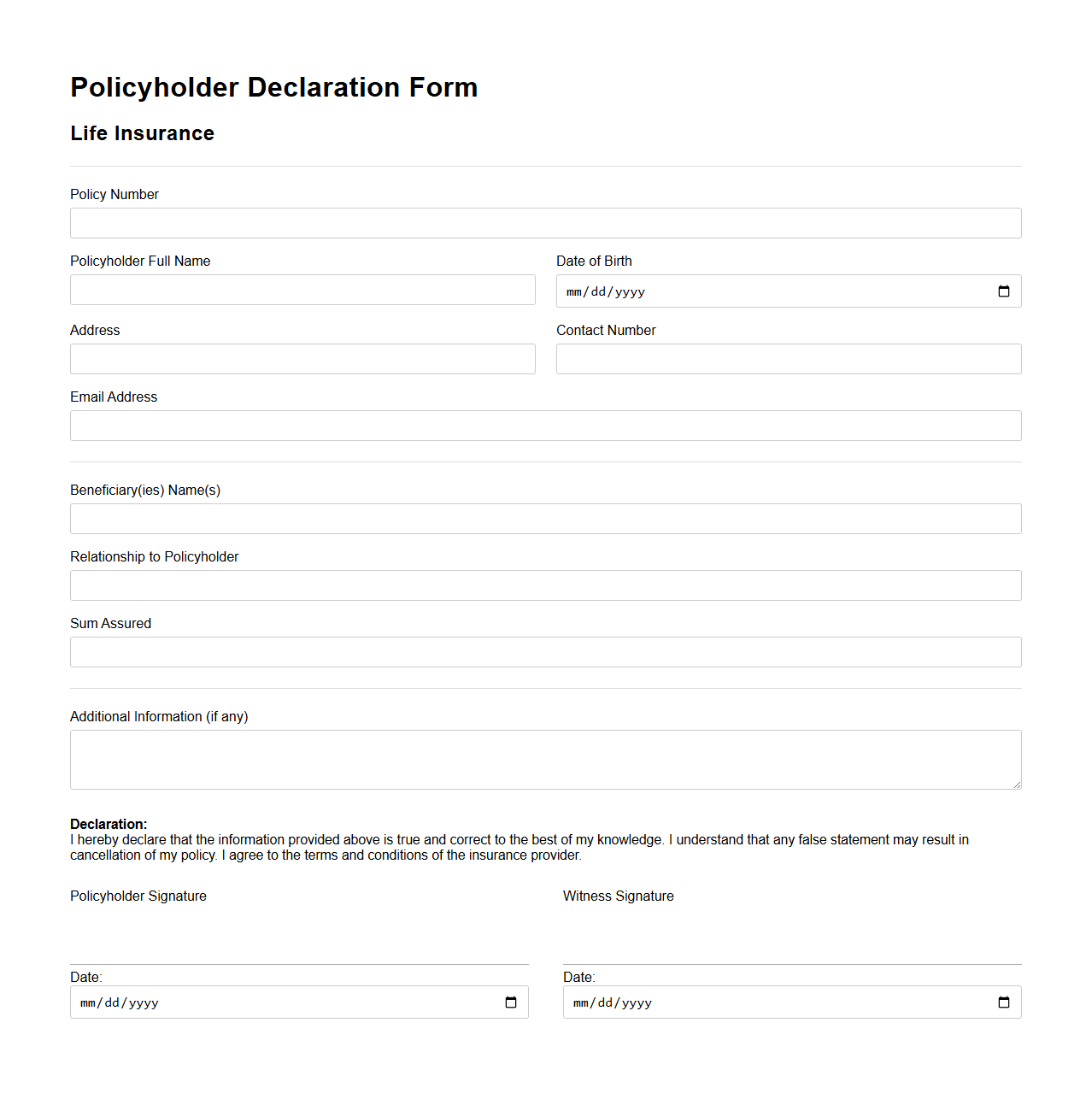

Policyholder Declaration Form for Life Insurance

The

Policyholder Declaration Form for life insurance is a crucial document where the applicant provides accurate personal, medical, and lifestyle information to the insurer. This form helps the insurance company assess the risk and determine policy eligibility, premiums, and coverage limits. Accurate declarations protect both the insurer and policyholder by ensuring transparent communication and reducing the likelihood of claim disputes.

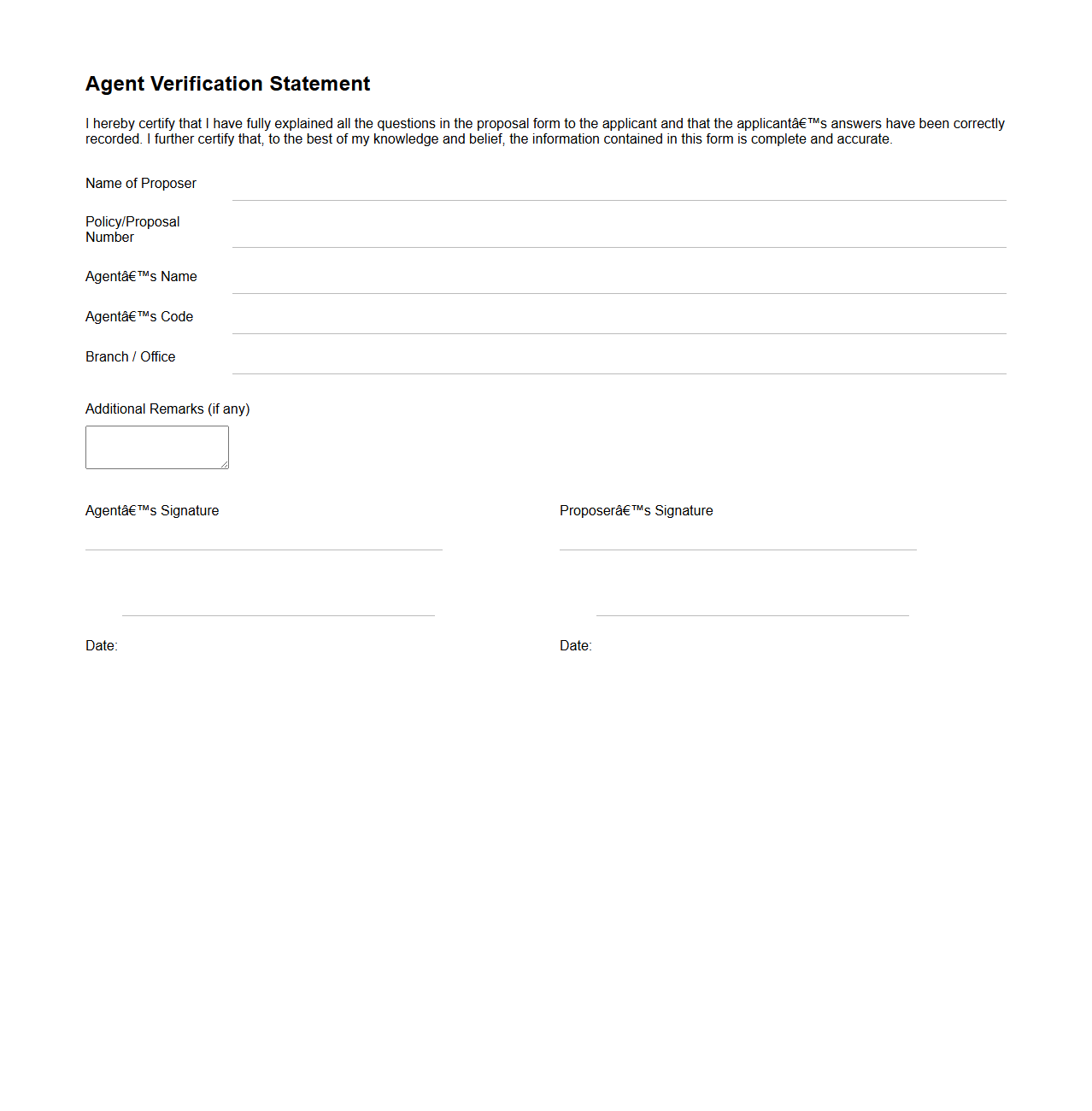

Agent Verification Statement in Life Insurance Proposal

An

Agent Verification Statement in a life insurance proposal document serves as a formal declaration by the insurance agent, confirming that all the information provided by the applicant has been accurately recorded and thoroughly verified. It ensures the authenticity and completeness of the applicant's details, which is critical for accurately assessing risk and underwriting the policy. This statement also holds the agent accountable for the due diligence performed during the policy application process.

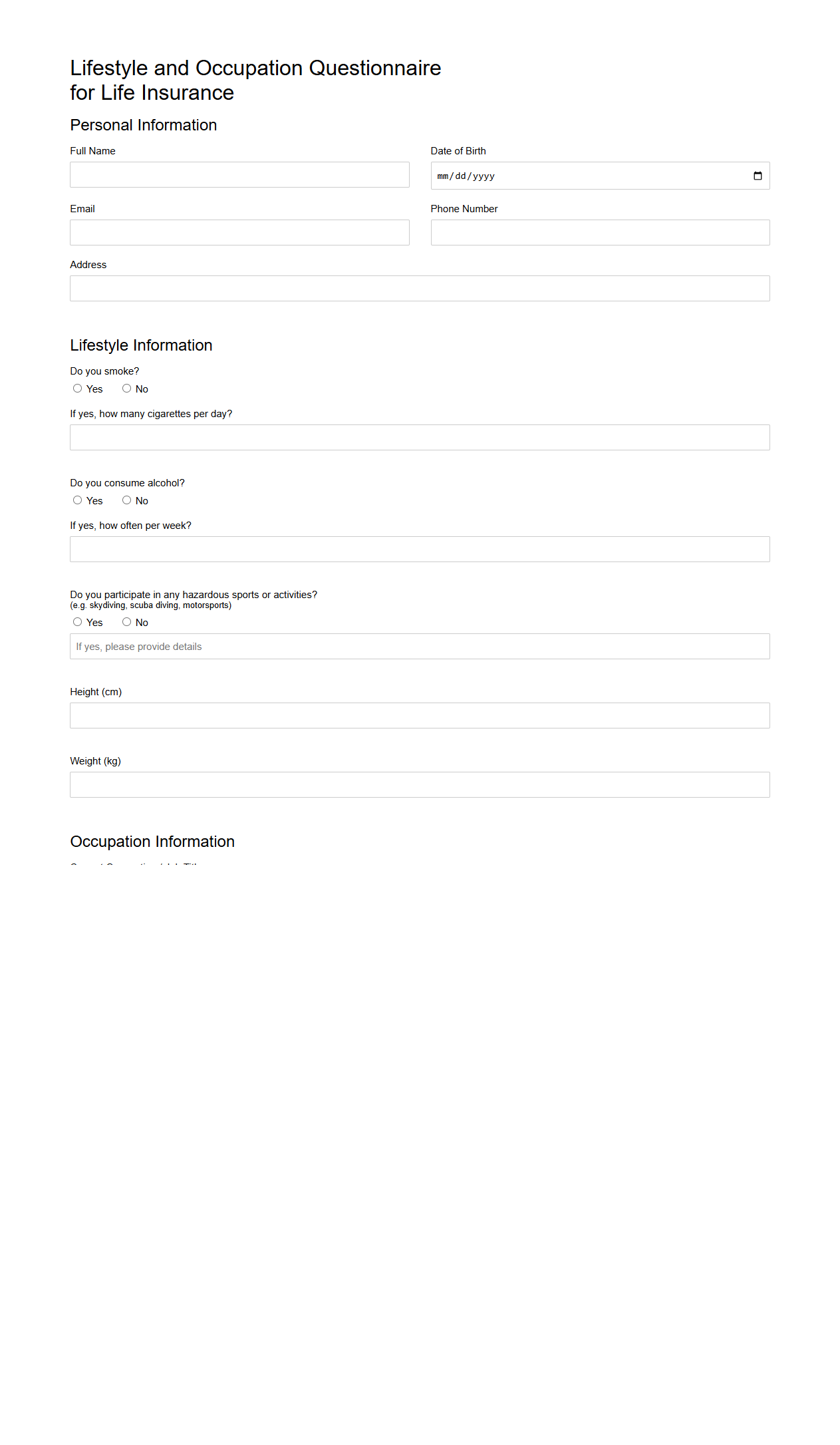

Lifestyle and Occupation Questionnaire for Life Insurance

The

Lifestyle and Occupation Questionnaire is a critical component of the life insurance underwriting process, designed to gather detailed information about an applicant's daily habits, hobbies, and professional activities. This document helps insurers assess risk factors related to health, safety, and potential exposure to hazards, which directly influence policy terms and premium rates. Accurate completion of this questionnaire ensures a fair evaluation and tailored insurance coverage that reflects the applicant's unique lifestyle and occupational risks.

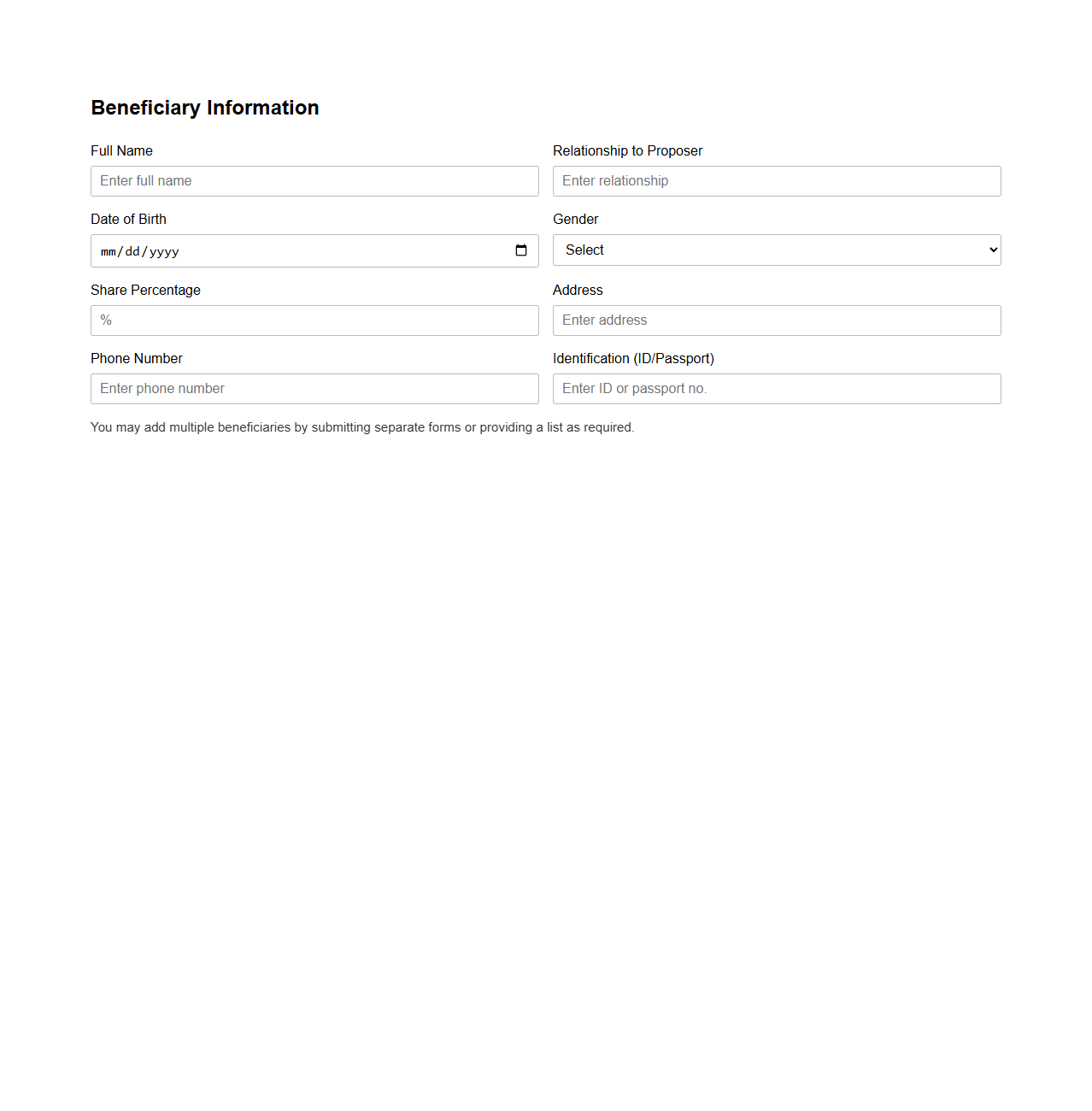

Beneficiary Information Section for Life Insurance Proposal

The

Beneficiary Information Section in a life insurance proposal document details the individuals or entities designated to receive the policy benefits upon the insured's death. This section requires precise personal information such as names, relationships, and percentage allocations to ensure clear and unambiguous benefit distribution. Accurate completion of this section is crucial for seamless claim processing and fulfilling the insured's intentions.

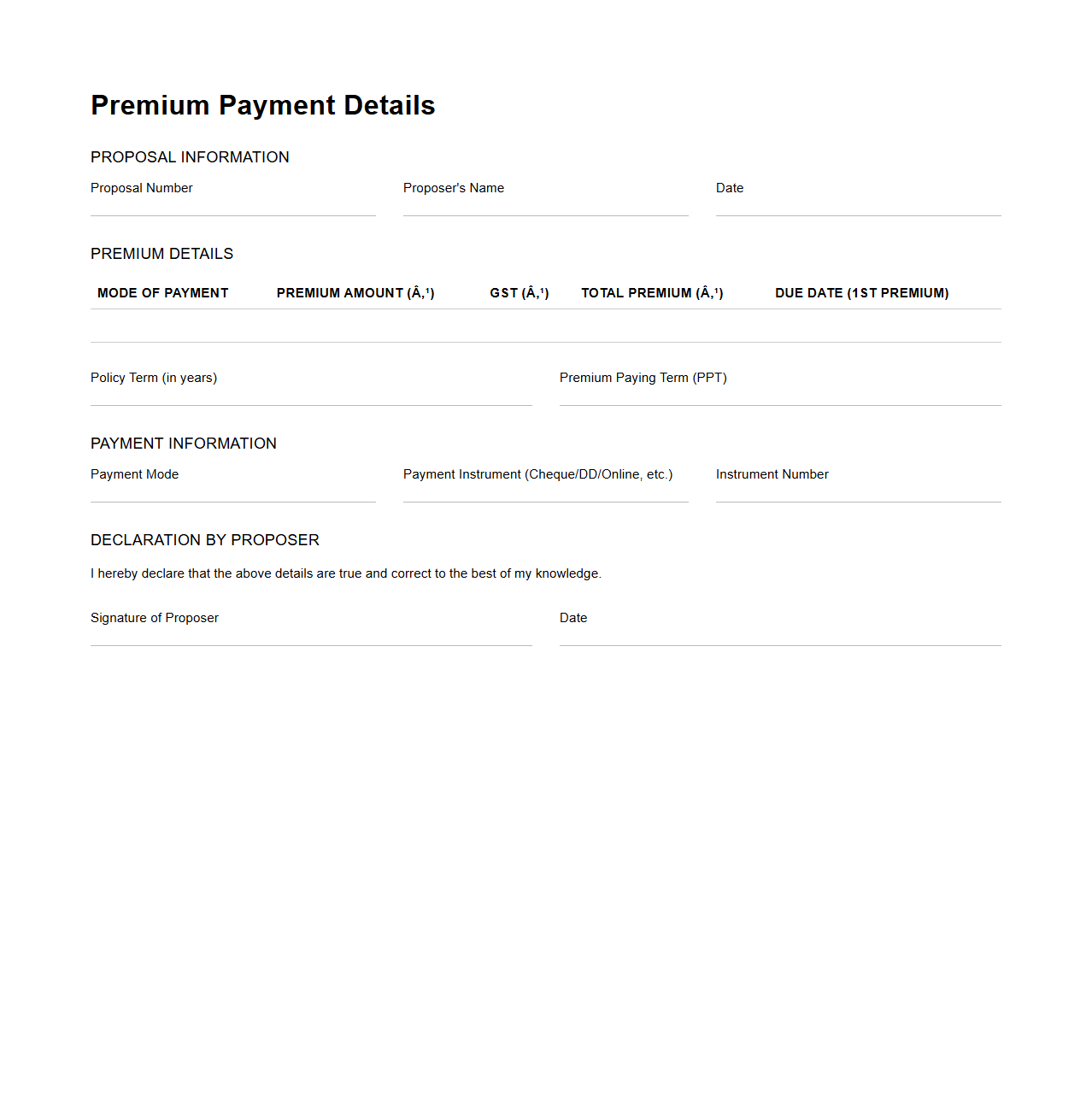

Premium Payment Details in Life Insurance Proposal

Premium Payment Details in a Life Insurance Proposal document outline the specific information about the payment of the insurance premium, including the amount, frequency, mode of payment, and due dates. This section ensures clarity on how the

premium obligations will be met to keep the policy active and avoid lapses. Accurate premium details help both the insurer and insured plan finances and maintain coverage continuity.

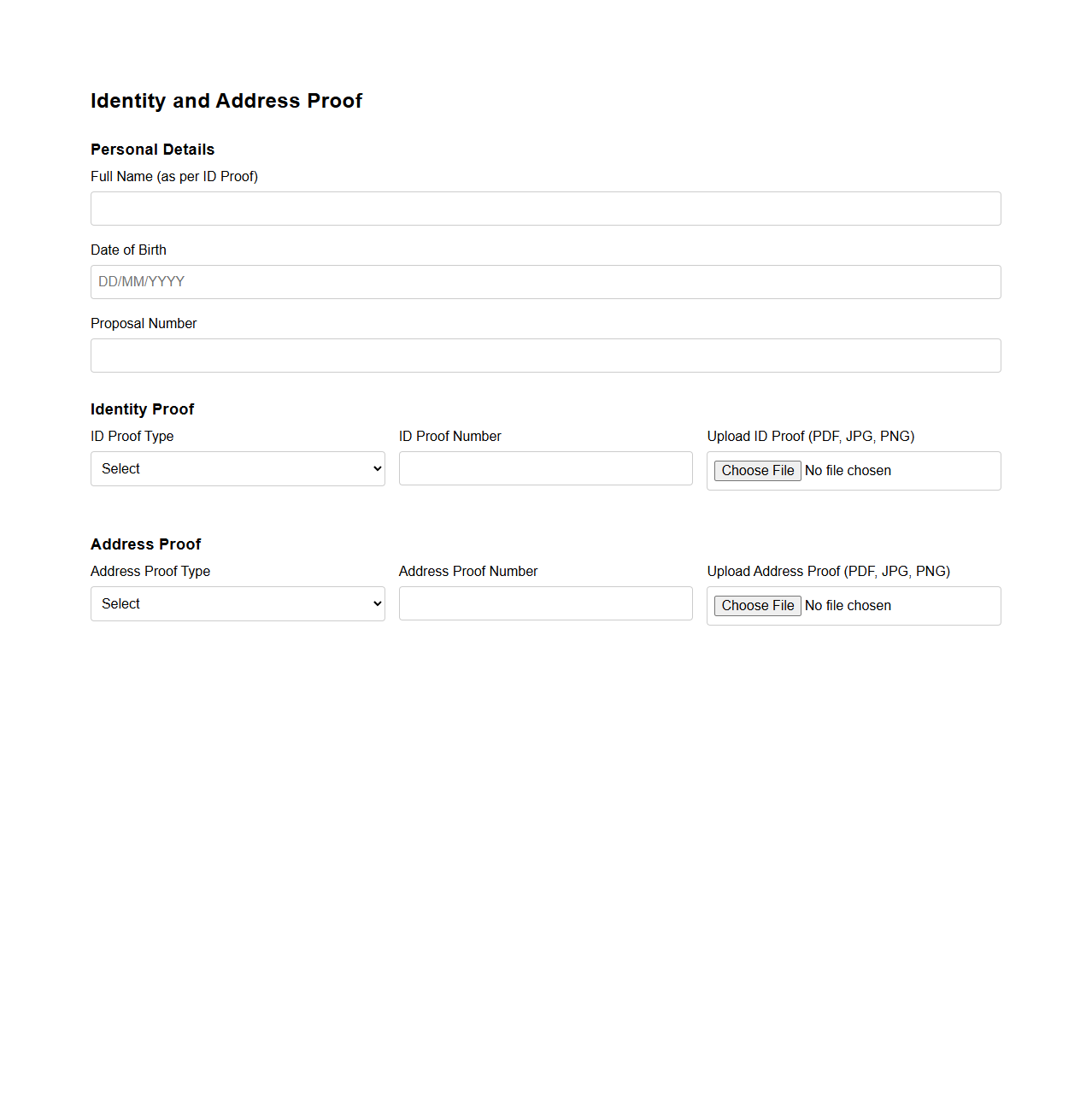

Identity and Address Proof Section in Proposal Form

The

Identity and Address Proof Section in a Proposal Form document serves to verify the applicant's personal details through official documentation. This section requires submission of government-issued IDs such as passports, driver's licenses, or utility bills, ensuring accurate identity confirmation and residence validation. Proper verification in this section is essential to prevent fraud and comply with legal and regulatory standards.

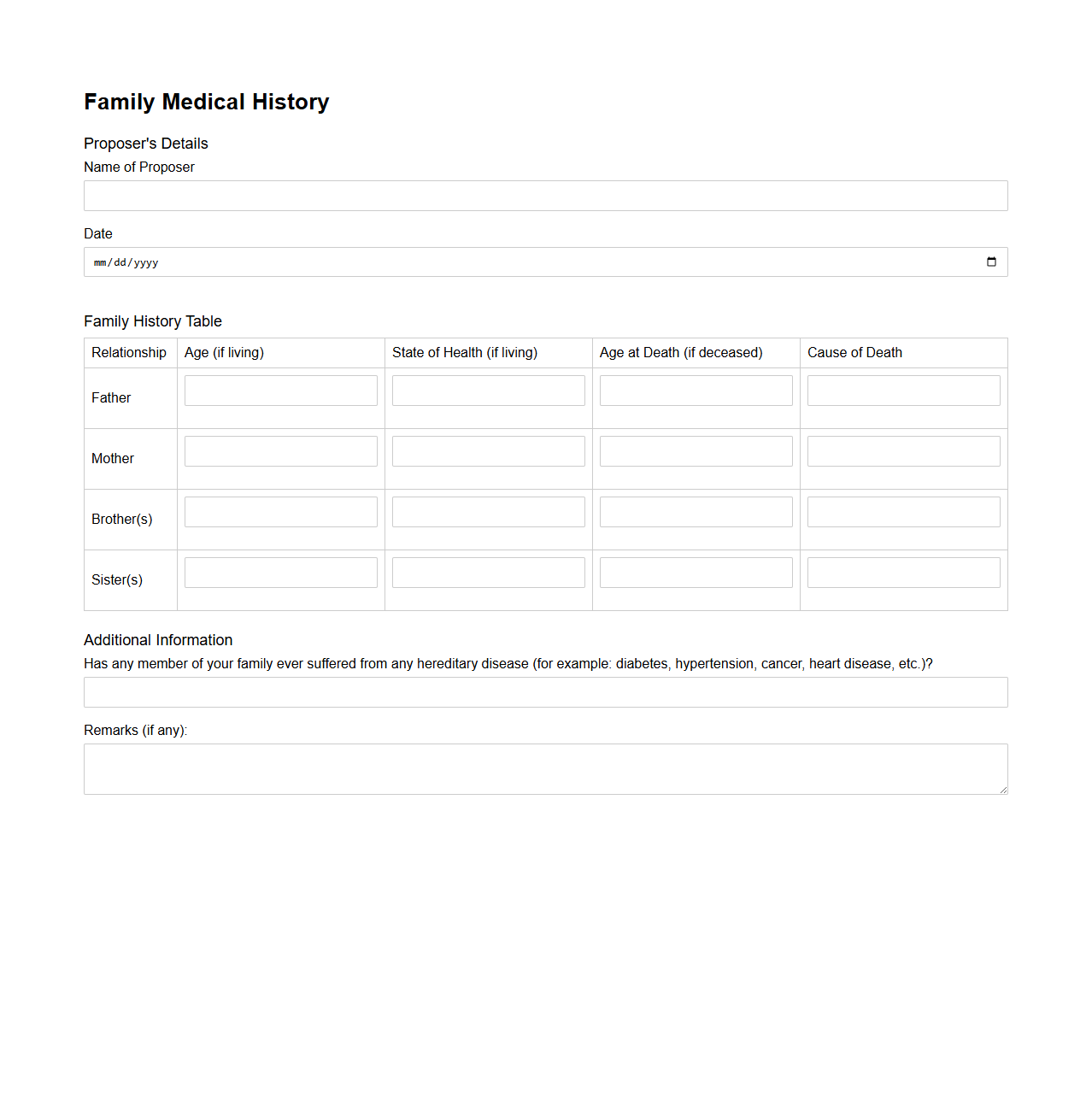

Family Medical History Segment for Life Insurance Proposal

The

Family Medical History Segment in a Life Insurance Proposal document captures detailed information about the health conditions and causes of death of an applicant's immediate family members. This segment helps insurers assess the hereditary risk factors that could impact the applicant's life expectancy and premium rates. Accurate family medical history data enables more precise underwriting decisions, leading to fairer life insurance terms.

What is the primary purpose of the Proposal Form Document in life insurance?

The Proposal Form Document serves as the initial application for life insurance coverage. It collects essential data from the applicant to assess risk and determine eligibility. Insurers use this information to decide on the terms and conditions of the policy.

Which key personal details are typically required in a life insurance proposal form?

The form requires basic personal details such as full name, date of birth, and contact information. It also asks for employment details and income to evaluate financial stability. Accurate data helps in tailoring the coverage amount and premium.

How does the declaration section of a proposal form impact policy issuance?

The declaration section is where applicants confirm the accuracy of the information provided. Any false or misleading statements can lead to rejection or cancellation of the policy. This section ensures both parties understand the legal implications of the contract.

What information about health and lifestyle may be requested in the document?

The proposal form typically asks about medical history, current health conditions, and habits such as smoking or alcohol consumption. Details on any previous illnesses or hospitalizations are also important. These factors influence the risk assessment and premium rates.

Why is accurate nominee information critical in a life insurance proposal form?

Providing precise nominee details ensures the rightful beneficiary receives the death benefit promptly. Incorrect information can cause delays or disputes during claim settlement. Clear nominee data protects the interests of both the insurer and the insured's family.