A Waiver of Premium Document Sample for Disability Insurance demonstrates how policyholders can retain coverage without paying premiums when they become disabled. This document outlines the conditions under which premium payments are paused, ensuring continued protection during periods of disability. It serves as a useful reference for understanding the specific terms and requirements involved in activating the waiver.

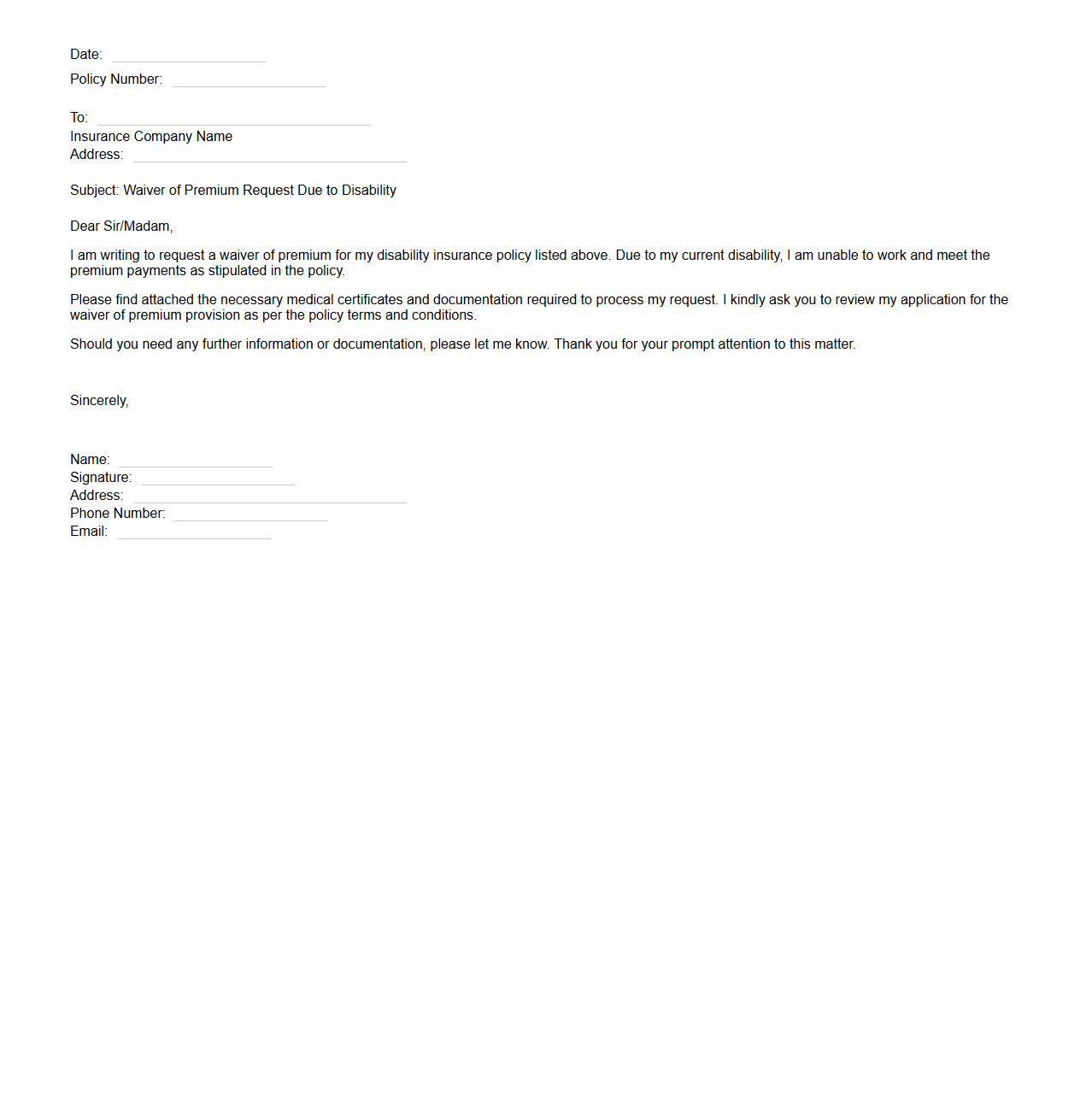

Waiver of Premium Letter Template for Disability Insurance

A

Waiver of Premium Letter Template for Disability Insurance is a formal document used to request the suspension of premium payments during a period of disability. This letter typically includes policy details, the nature of the disability, and a medical professional's certification to support the claim. Insurers use this letter to evaluate eligibility for waiving future premium payments without canceling the policy.

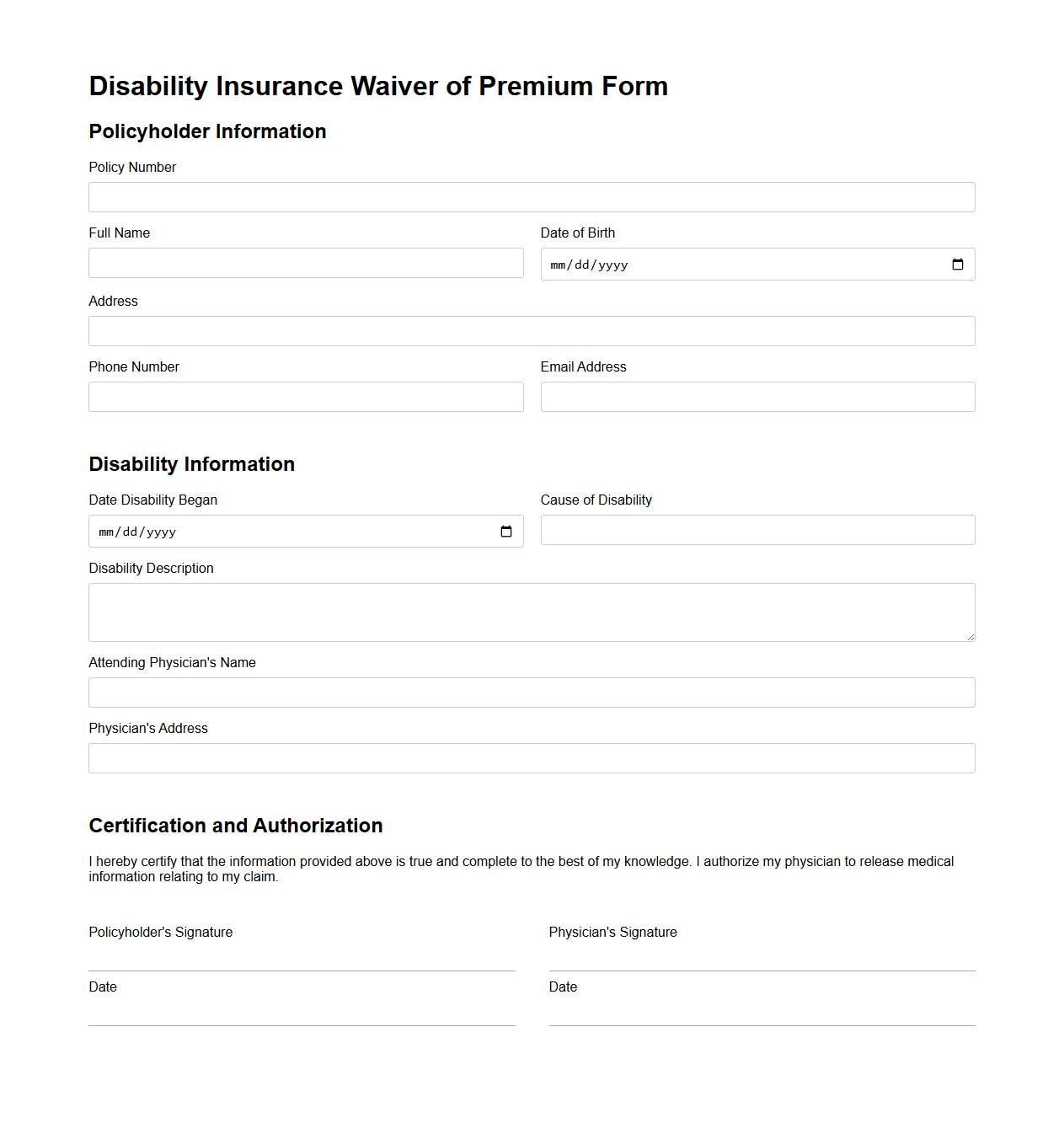

Disability Insurance Waiver of Premium Form Example

A

Disability Insurance Waiver of Premium Form allows policyholders to continue their disability insurance coverage without paying premiums if they become disabled and unable to work. This document typically requires medical evidence of disability and approval by the insurance company to activate the waiver. It ensures that the policy remains active during the period of disability, providing financial protection without interruption.

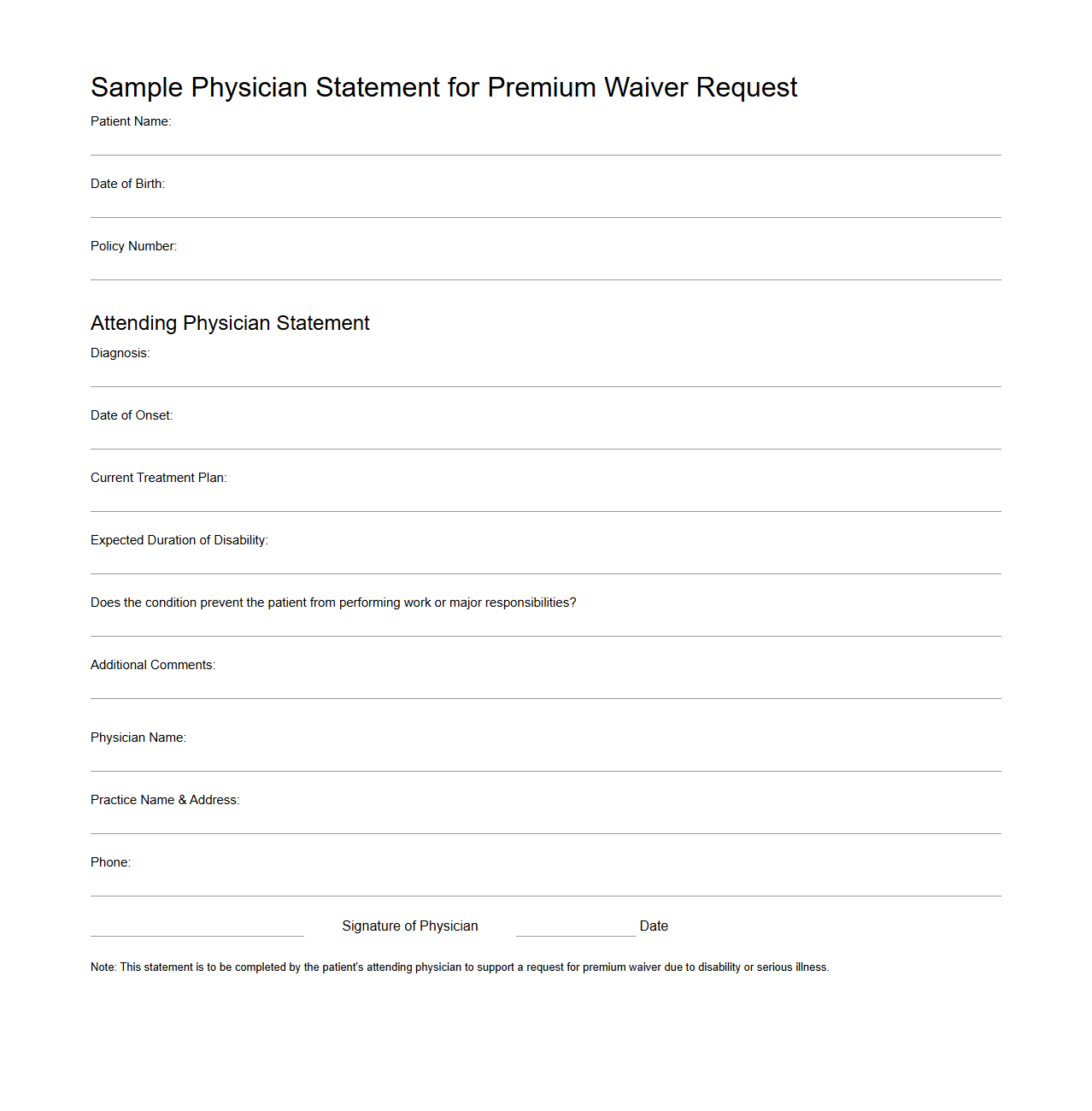

Sample Physician Statement for Premium Waiver Request

A

Sample Physician Statement for Premium Waiver Request document provides detailed medical information from a licensed physician to support a patient's application for a premium waiver on insurance policies. This statement typically includes a thorough diagnosis, treatment history, prognosis, and the impact of the medical condition on the patient's ability to pay premiums. Insurers rely on this document to assess the validity of the waiver request and ensure appropriate financial accommodations are made.

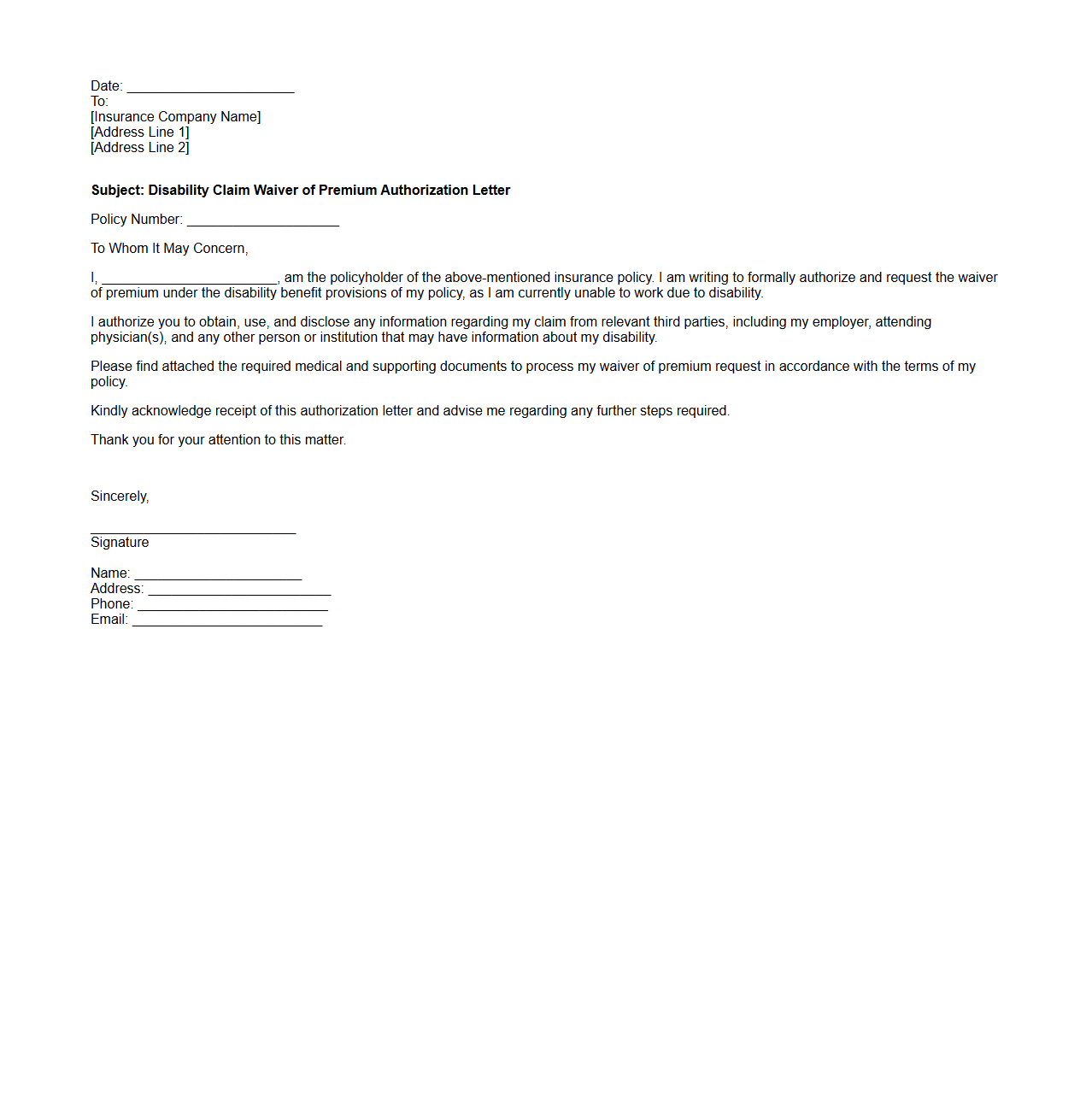

Disability Claim Waiver of Premium Authorization Letter

A

Disability Claim Waiver of Premium Authorization Letter is a formal document used to authorize an insurance company to waive premium payments during a policyholder's period of disability. This letter serves as proof that the insured individual is eligible for the waiver benefit, ensuring continuous insurance coverage without premium payment interruptions. It typically includes essential details such as the policy number, claimant's personal information, and a declaration of disability status.

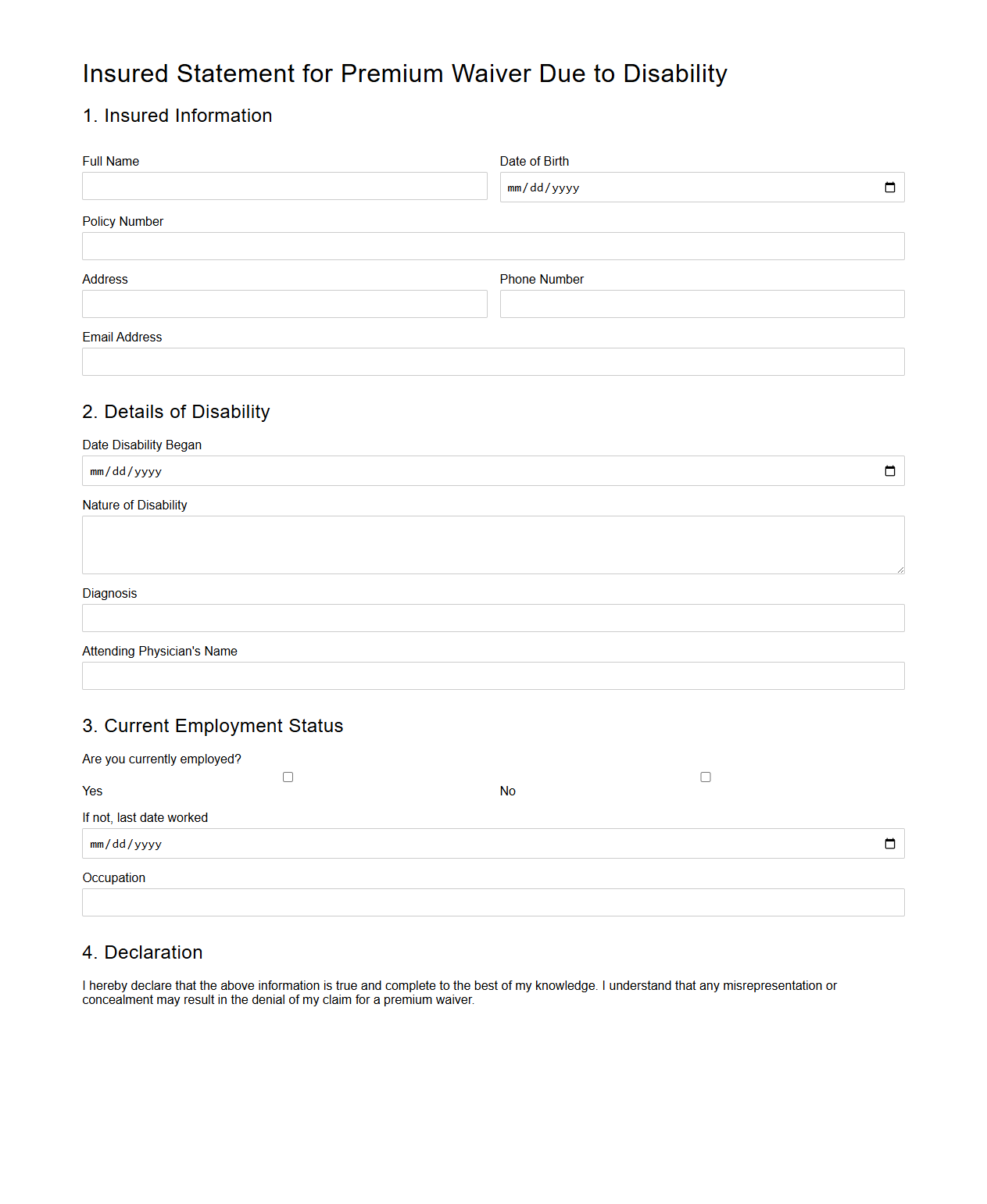

Insured Statement for Premium Waiver Due to Disability

An

Insured Statement for Premium Waiver Due to Disability is a formal document used by insurance companies to verify the insured's disability status, which qualifies them for a premium waiver. This statement typically requires detailed medical information and confirmation from healthcare providers to substantiate the claim of disability. It enables policyholders to maintain insurance coverage without paying premiums during periods of qualifying disability.

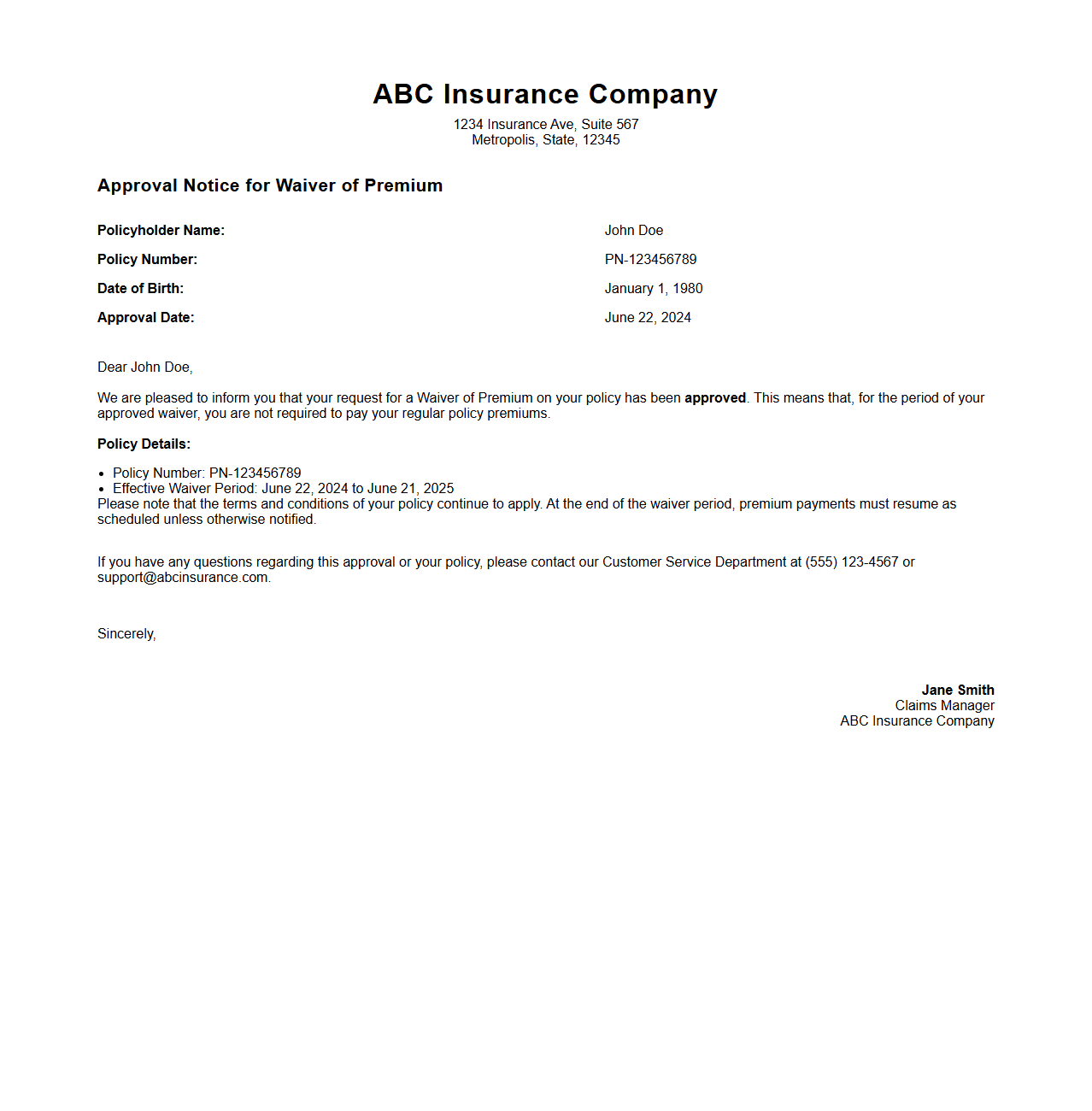

Insurance Company Approval Notice for Waiver of Premium

An

Insurance Company Approval Notice for Waiver of Premium document confirms that an insurance provider has approved a policyholder's request to suspend premium payments due to qualifying circumstances such as disability or critical illness. This notice ensures the policy remains in force while emissions are waived, protecting the insured's benefits without financial burden during the waiver period. It serves as official evidence that the waiver has been granted and premium obligations are temporarily lifted.

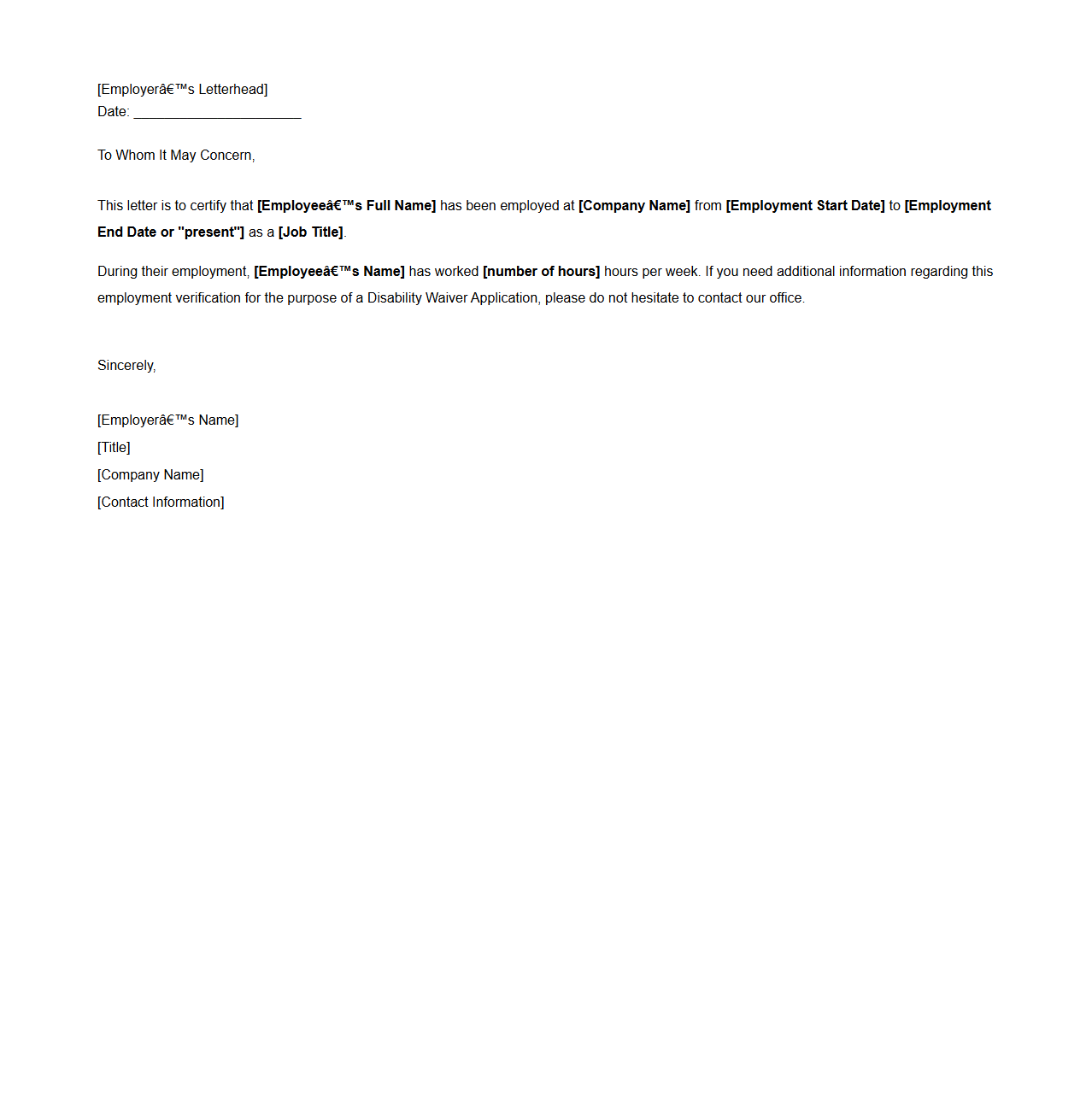

Employer Verification Letter for Disability Waiver Application

An

Employer Verification Letter for a disability waiver application is a formal document provided by an employer confirming the applicant's current employment status, job title, and income details. This letter serves as crucial evidence to support the applicant's disability claim by verifying their financial and work-related information. It helps disability agencies assess eligibility and ensures accurate processing of the waiver application.

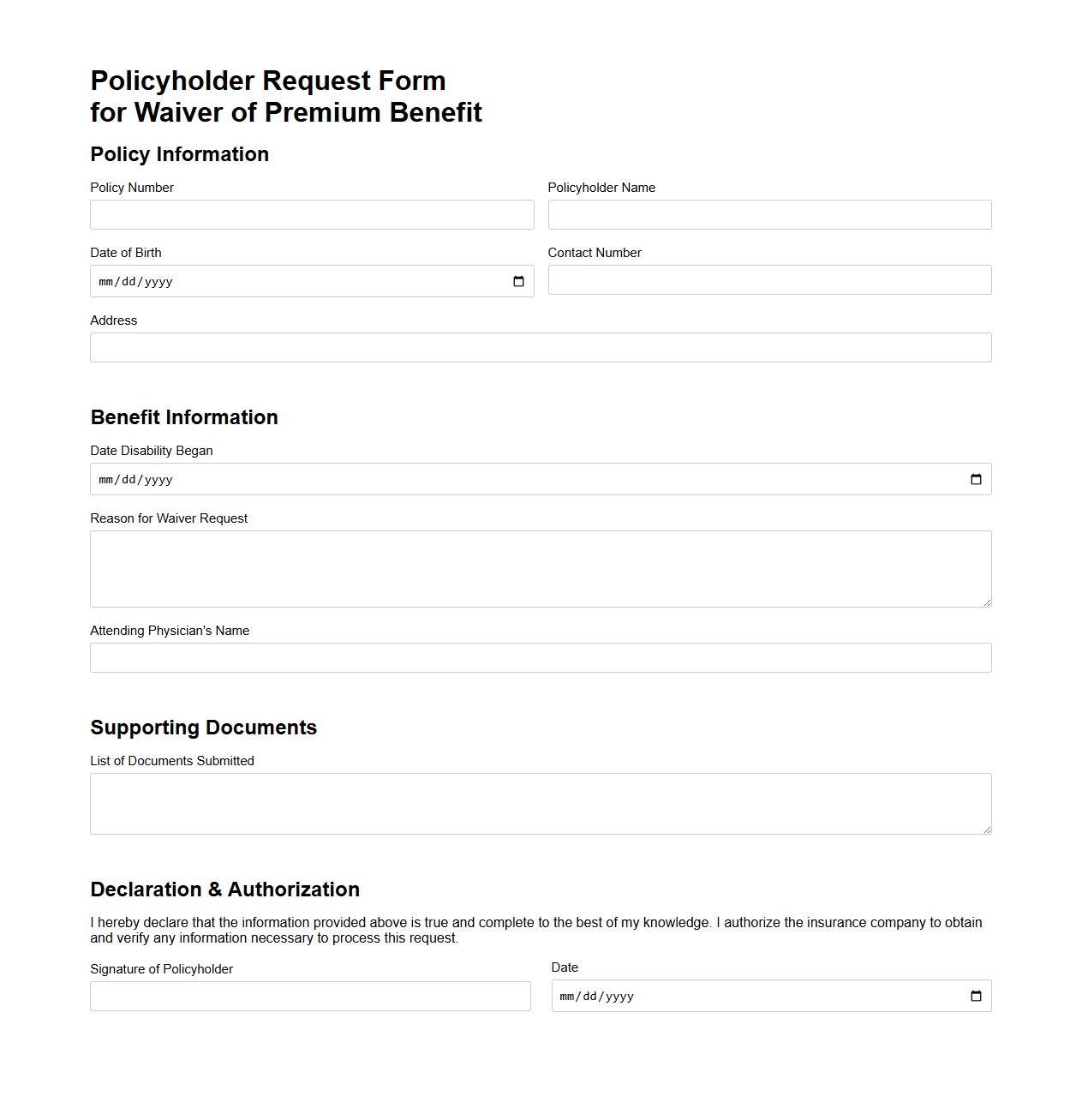

Policyholder Request Form for Waiver of Premium Benefit

The

Policyholder Request Form for Waiver of Premium Benefit is a crucial document that allows insured individuals to apply for a suspension of premium payments when they meet specific criteria, such as disability or critical illness. This form collects essential personal and medical information to verify eligibility for the waiver benefit without canceling the insurance coverage. Insurers use this form to evaluate requests and provide financial relief by temporarily waiving premium obligations under qualifying circumstances.

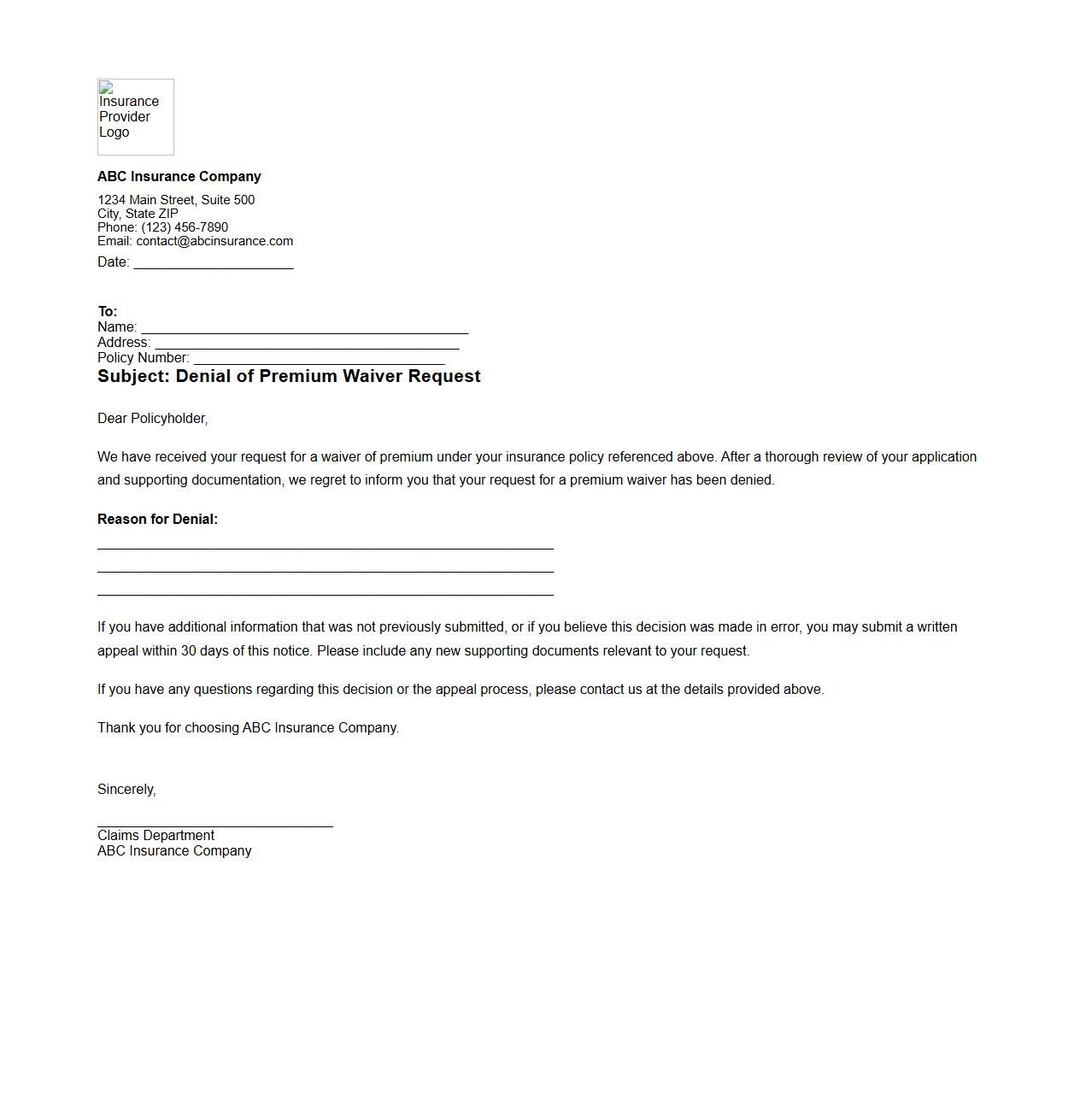

Insurance Provider Denial Notice for Premium Waiver

An

Insurance Provider Denial Notice for Premium Waiver is an official document issued by an insurance company indicating the rejection of a request to waive premium payments. This notice outlines the specific reasons for denial, such as ineligibility or failure to meet policy requirements, and provides details on the claimant's right to appeal. Understanding this document is crucial for policyholders seeking to address coverage concerns or explore alternative financial assistance options.

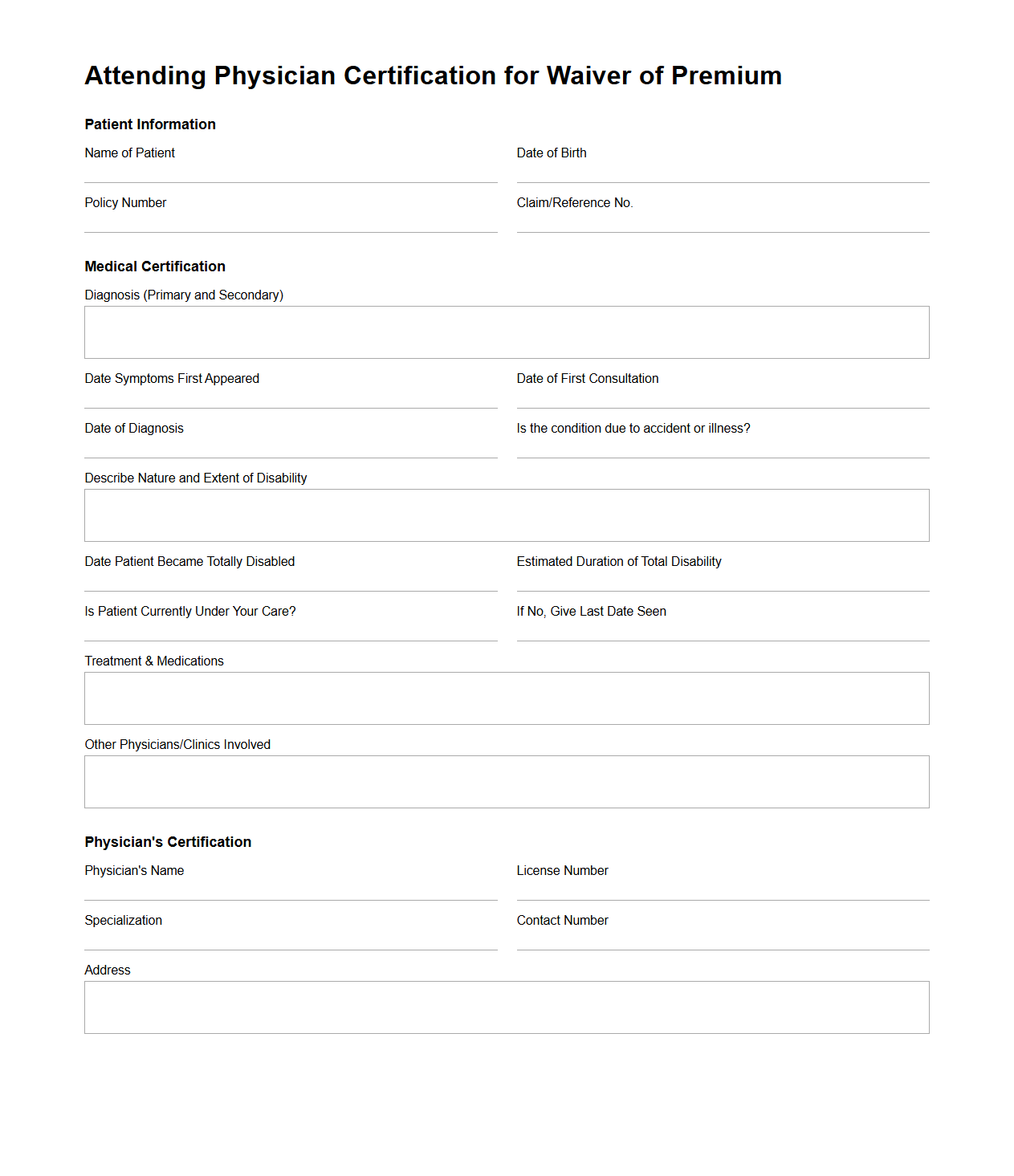

Attending Physician Certification for Waiver of Premium

The

Attending Physician Certification for Waiver of Premium document is a medical form completed by a licensed physician to verify an insured individual's total disability, enabling them to qualify for a waiver of premium benefit in their insurance policy. This certification requires detailed information about the patient's medical condition, prognosis, and treatment, serving as critical evidence for the insurance company to approve premium waivers during periods of disability. The document ensures that the policyholder maintains coverage without premium payments while medically unable to work.

Primary Condition for Waiver of Premium Effectiveness

The waiver of premium becomes effective primarily when the insured is totally disabled as defined in the policy. This condition must be certified and verified within the required timeframe. Only then will the premium waiver benefit be activated to alleviate the financial burden.

Definition of Total Disability for Eligibility

The document defines total disability as the complete inability of the insured to engage in any occupation or perform any work for which they are reasonably qualified. This status must be continuous and medically substantiated. Eligibility hinges on meeting this stringent definition to qualify for premium waivers.

Required Documentation for Waiver of Premium

The policy requires certified medical evidence as proof of the insured's total disability. This includes detailed reports from licensed healthcare professionals. Submission of such documentation is necessary to request and validate the waiver of premium benefit.

Duration of the Waiver Period

The waiver period specified in the document lasts for the duration of the insured's total disability. Typically, this period continues until the insured recovers or reaches a specified maximum age. The policy outlines clear temporal limits to the waiver coverage.

Exclusions or Limitations for Waiver of Premium Coverage

The document states specific exclusions, such as disabilities resulting from self-inflicted injuries or certain pre-existing conditions. Limitations also apply to coverage duration and eligibility criteria. These exclusions ensure that the waiver benefit is provided under defined and controlled circumstances.