The Assignment of Policy Document Sample for Mortgage Insurance outlines the transfer of rights from the original policyholder to the mortgage lender. This document ensures the lender is protected by the insurance policy in case of borrower default. It serves as a legal record confirming the lender's interest in the mortgage insurance policy.

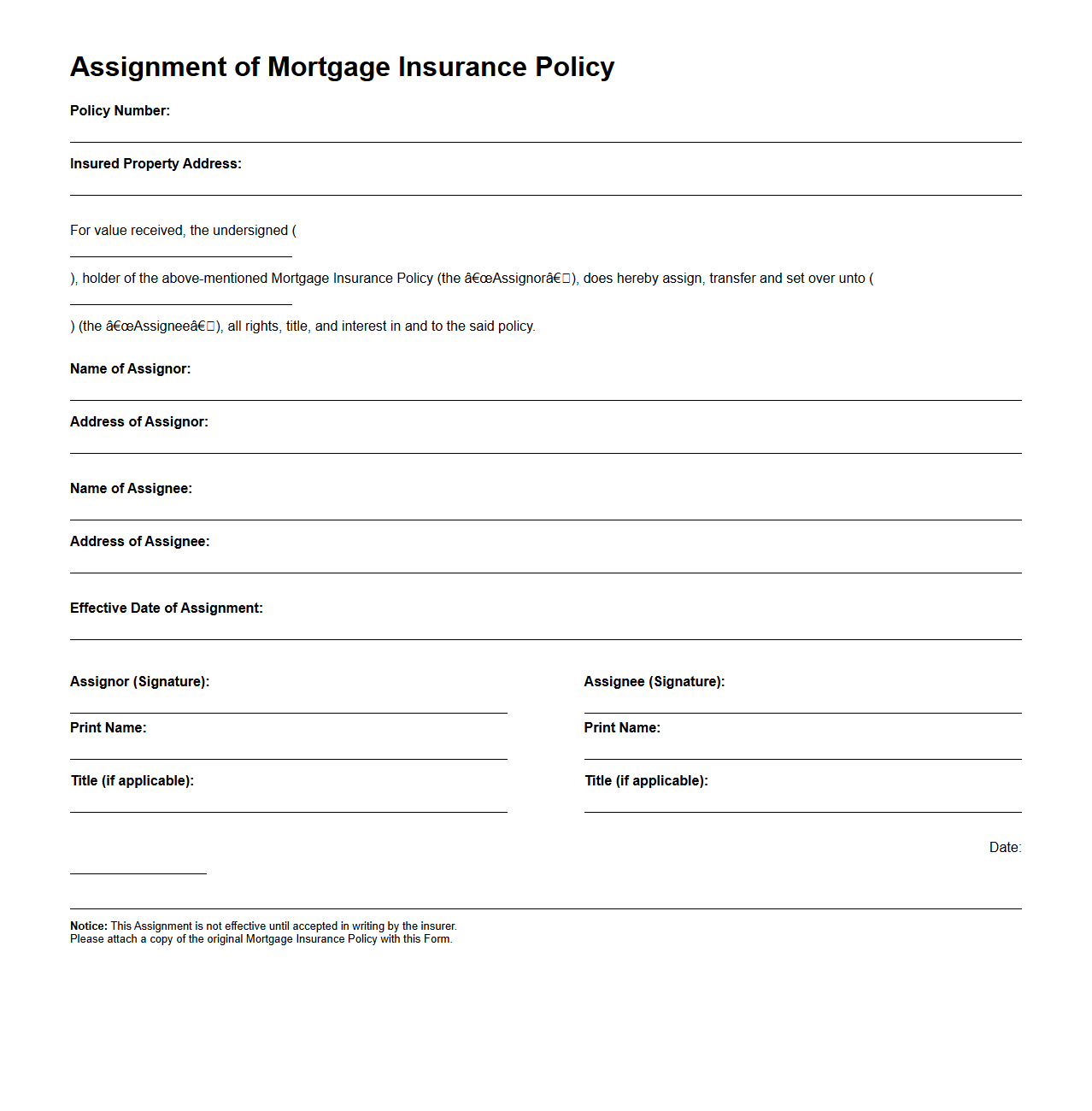

Assignment of Mortgage Insurance Policy Form

The

Assignment of Mortgage Insurance Policy Form is a legal document used to transfer the rights and benefits of a mortgage insurance policy from one party to another. This form ensures that the new holder, often a lender or investor, assumes all interests tied to the mortgage insurance coverage, protecting against borrower default. Proper execution of this assignment is critical for maintaining the enforceability and validity of the mortgage insurance agreement.

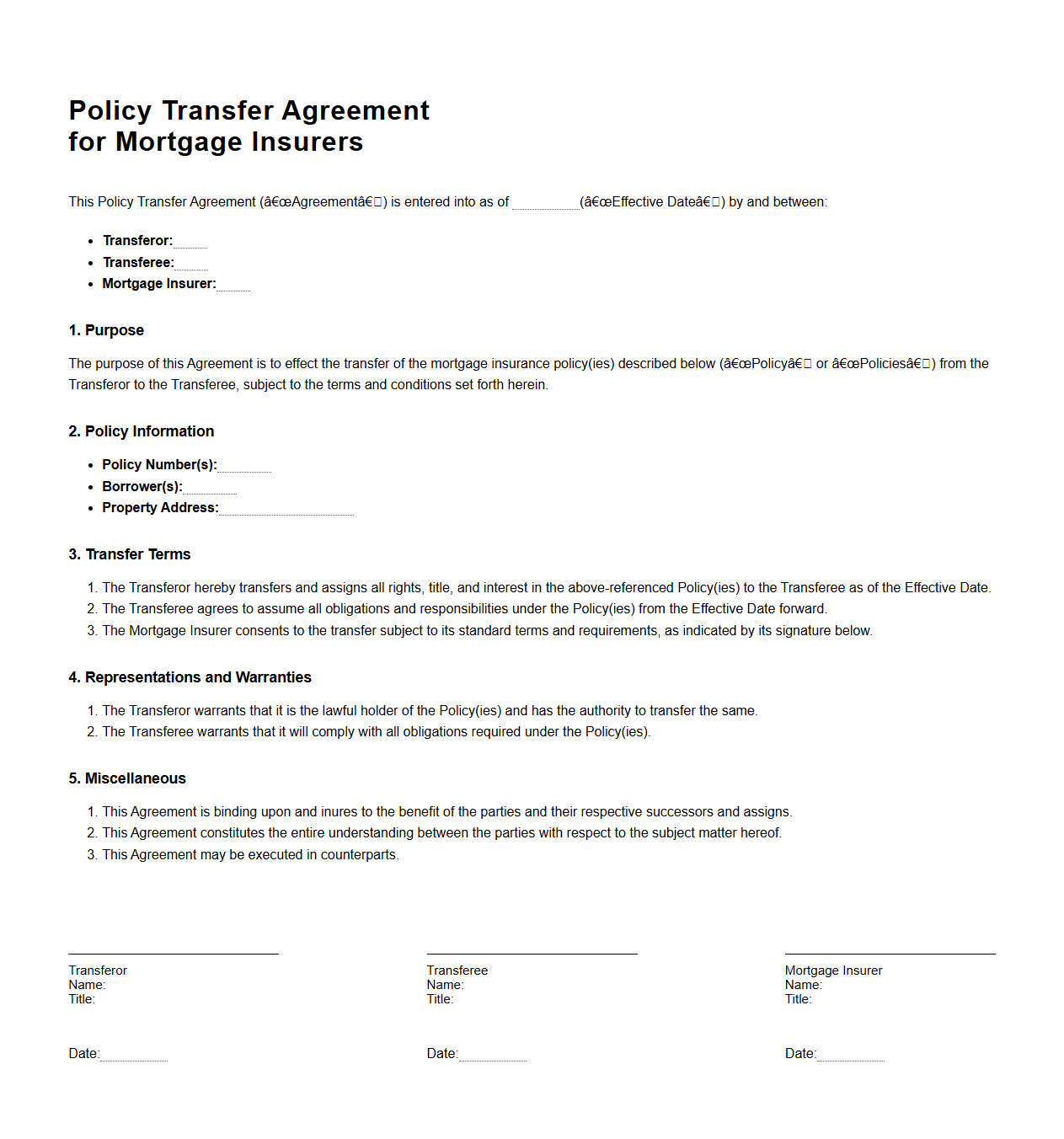

Policy Transfer Agreement for Mortgage Insurers

A

Policy Transfer Agreement for Mortgage Insurers is a legal document that facilitates the transfer of mortgage insurance policies from one insurer to another, ensuring continuous coverage and protection for lenders and borrowers. This agreement outlines the terms, conditions, and responsibilities involved in the transfer process, including the handling of premiums, claims, and policyholder rights. It plays a crucial role in the mortgage insurance industry by maintaining the integrity and stability of coverage during insurer transitions.

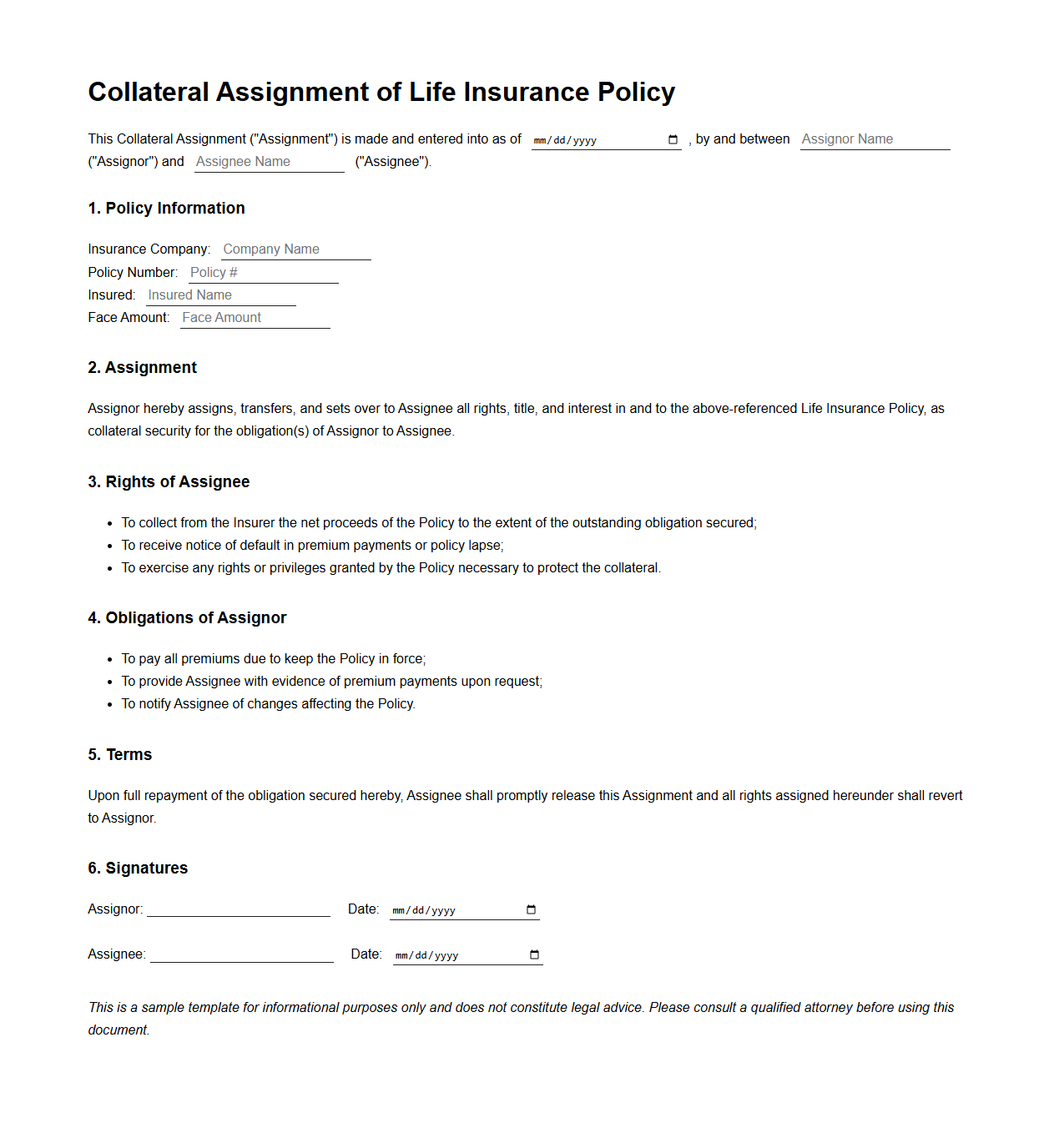

Collateral Assignment of Life Insurance Policy Template

A

Collateral Assignment of Life Insurance Policy Template document is a legal form used to transfer policy rights to a lender or creditor as security for a loan. It ensures the lender can claim the policy's proceeds if the borrower defaults, while the policy owner retains ownership and control unless a default occurs. This template standardizes the assignment process, simplifying negotiations and protecting both parties' interests.

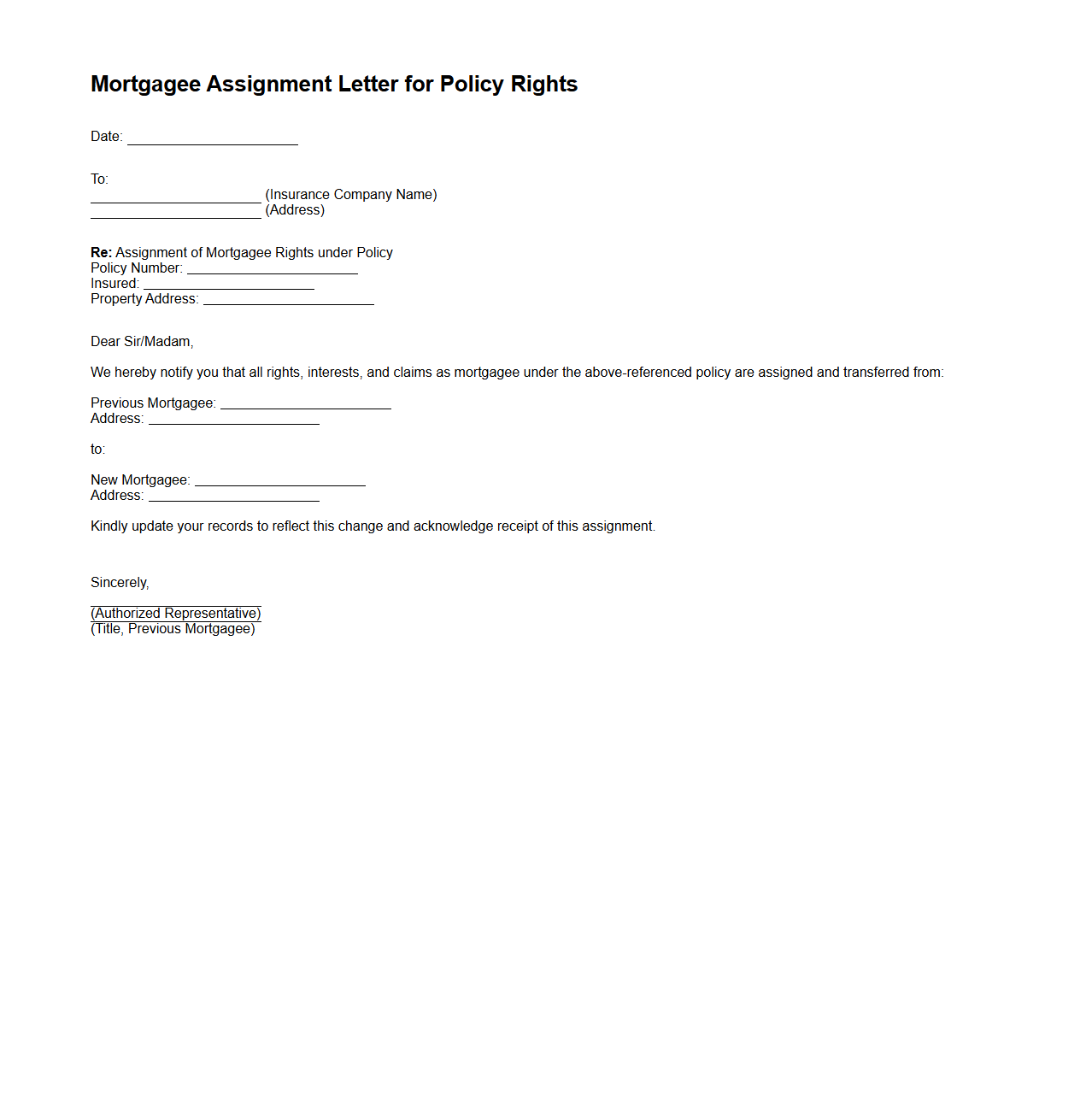

Mortgagee Assignment Letter for Policy Rights

A

Mortgagee Assignment Letter for Policy Rights is a legal document that transfers the rights of an insurance policy from the policyholder to the mortgagee, typically a lender or financial institution. This assignment ensures that the mortgagee has a claim to the insurance proceeds in the event of loss or damage to the insured property, protecting their financial interest. It is essential for maintaining the lender's security interest throughout the duration of the mortgage.

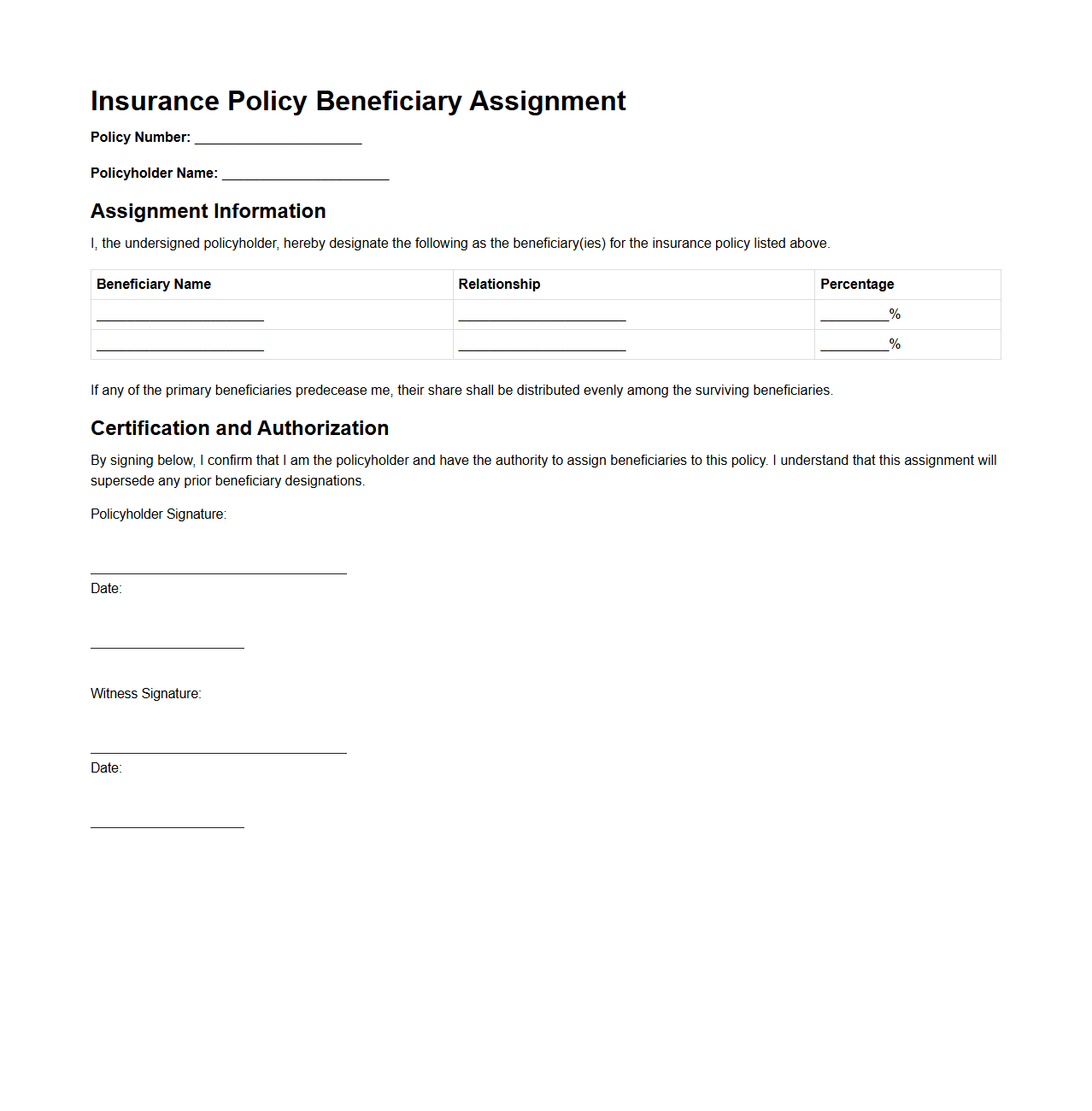

Insurance Policy Beneficiary Assignment Sample

An

Insurance Policy Beneficiary Assignment Sample document illustrates the formal process of transferring beneficiary rights from the original policyholder to another party. It provides a clear template detailing how to assign the benefits of an insurance policy, including important information such as the names of the assignor and assignee, policy details, and signatures. This sample ensures legal compliance and helps avoid disputes by clearly documenting the beneficiary change.

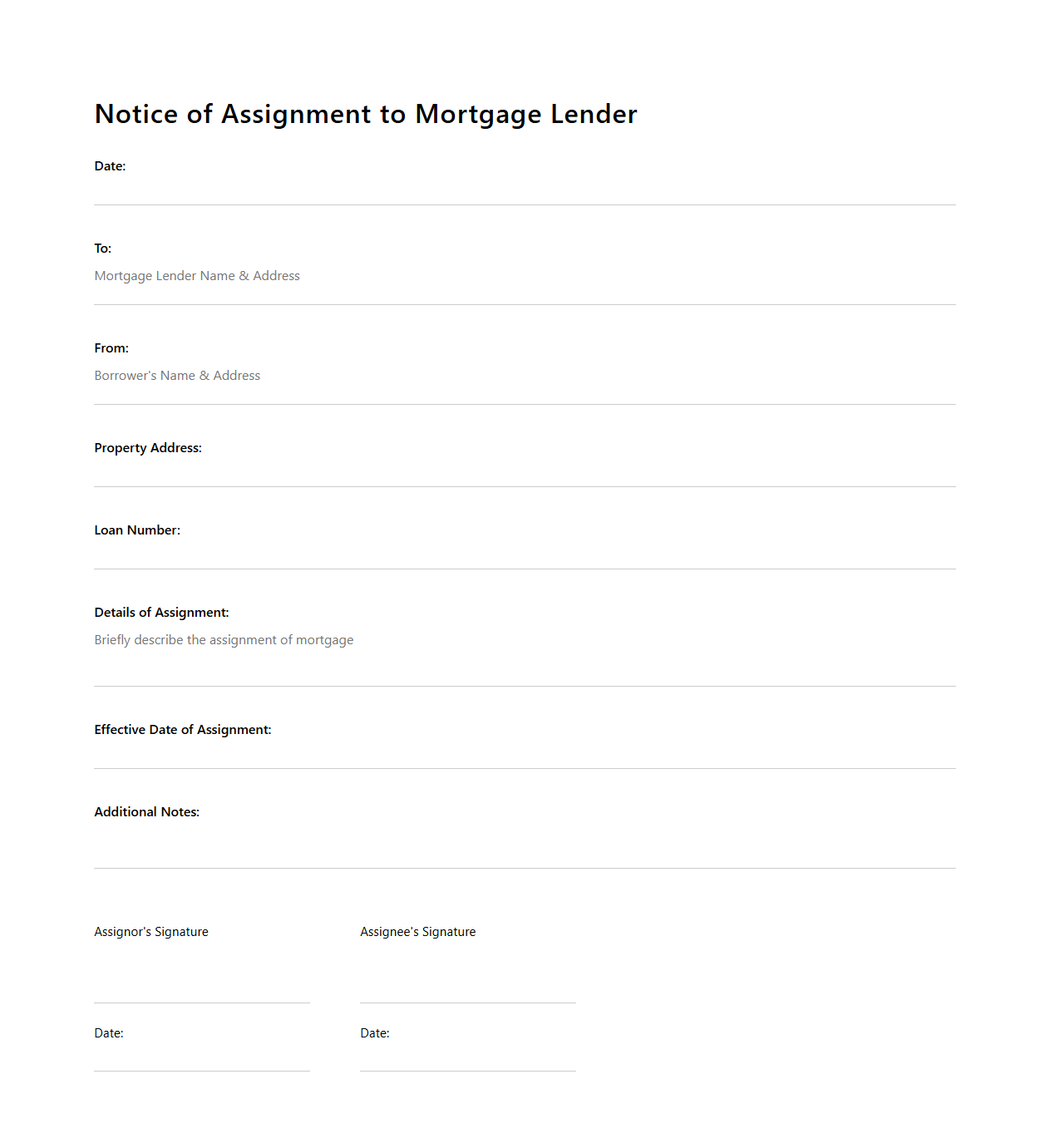

Notice of Assignment to Mortgage Lender Document

A

Notice of Assignment to Mortgage Lender Document is a formal legal notification indicating the transfer of a mortgage from the original lender to a new mortgage lender or assignee. This document details the assignment terms, ensuring all parties are informed about the change in ownership of the mortgage loan. It serves as an essential record for maintaining the chain of title and protecting lender rights in mortgage transactions.

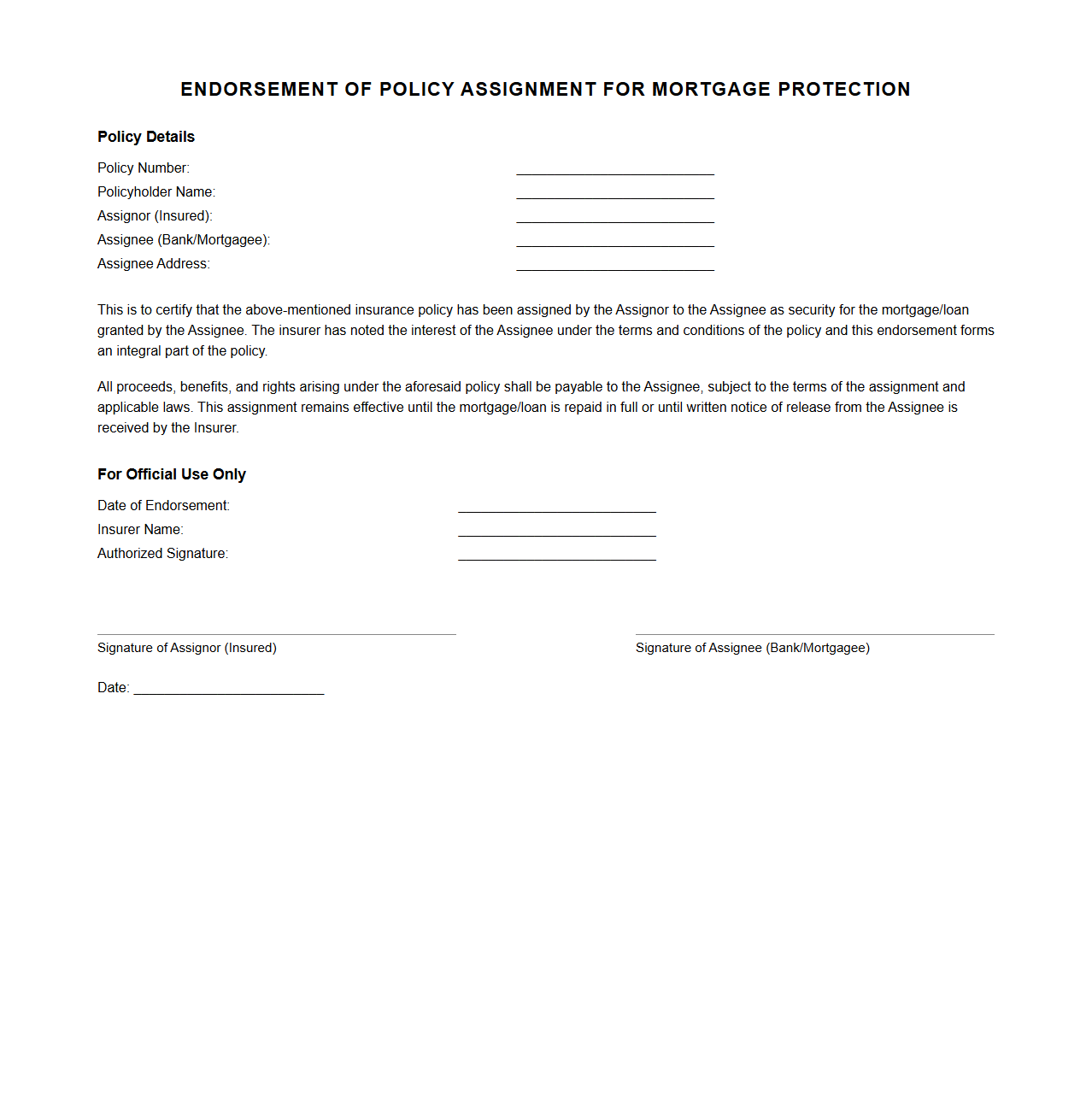

Endorsement of Policy Assignment for Mortgage Protection

The

Endorsement of Policy Assignment for a Mortgage Protection document is a legal amendment that transfers the ownership or beneficiary rights of a mortgage protection insurance policy from the policyholder to a third party, often the lender. This endorsement ensures the lender is protected by the policy in case of the borrower's death, facilitating the payment of the mortgage balance directly to the mortgagee. It effectively secures the lender's interest by making them the assignee of the policy benefits.

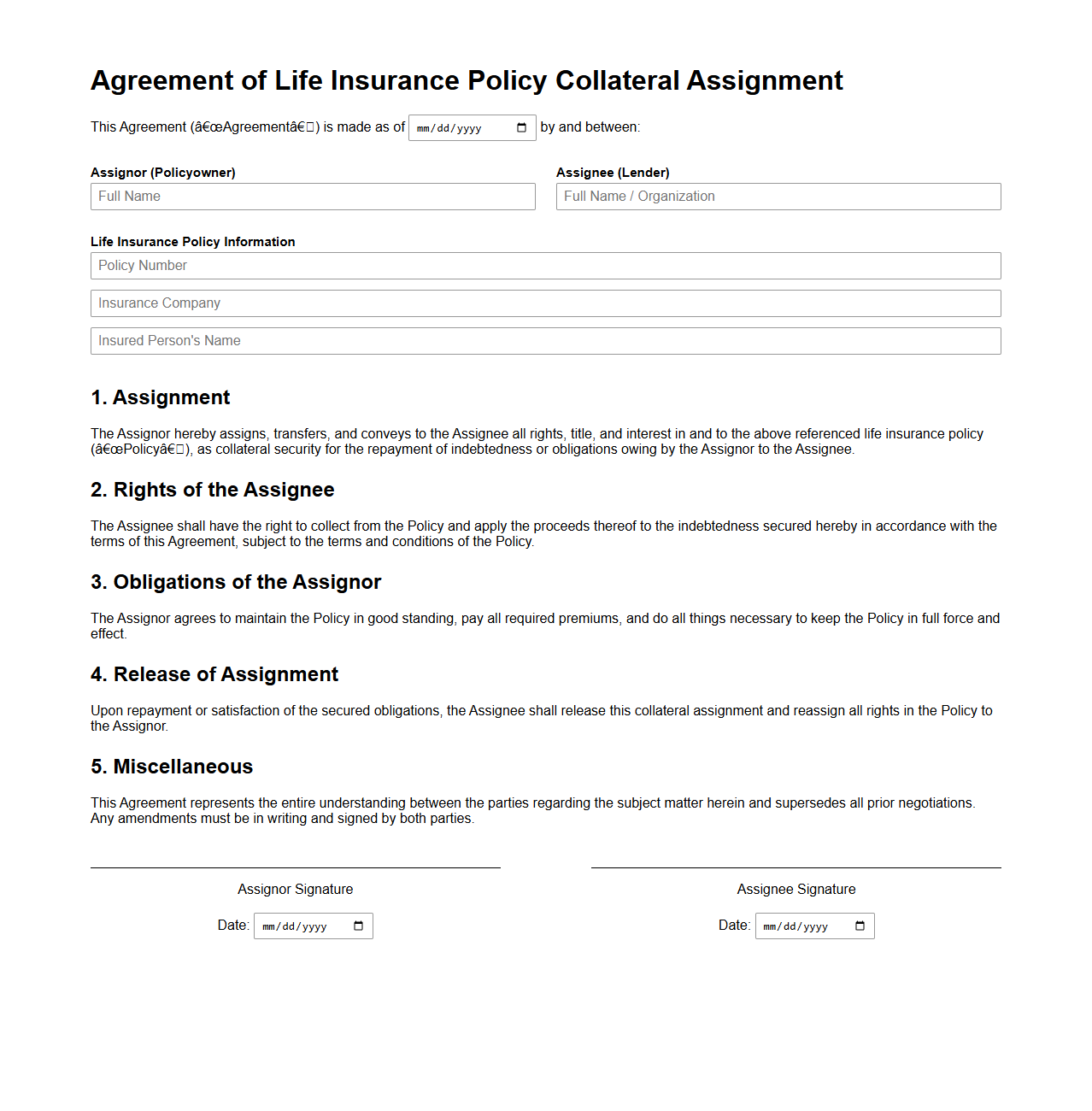

Agreement of Life Insurance Policy Collateral Assignment

An

Agreement of Life Insurance Policy Collateral Assignment is a legal document that transfers partial rights of a life insurance policy to a lender or creditor as security for a loan. It ensures that the lender can claim the policy's cash value or death benefit if the borrower defaults, while the policyholder retains ownership and beneficiary rights. This agreement protects both parties by clearly defining the terms of collateral use without fully transferring policy ownership.

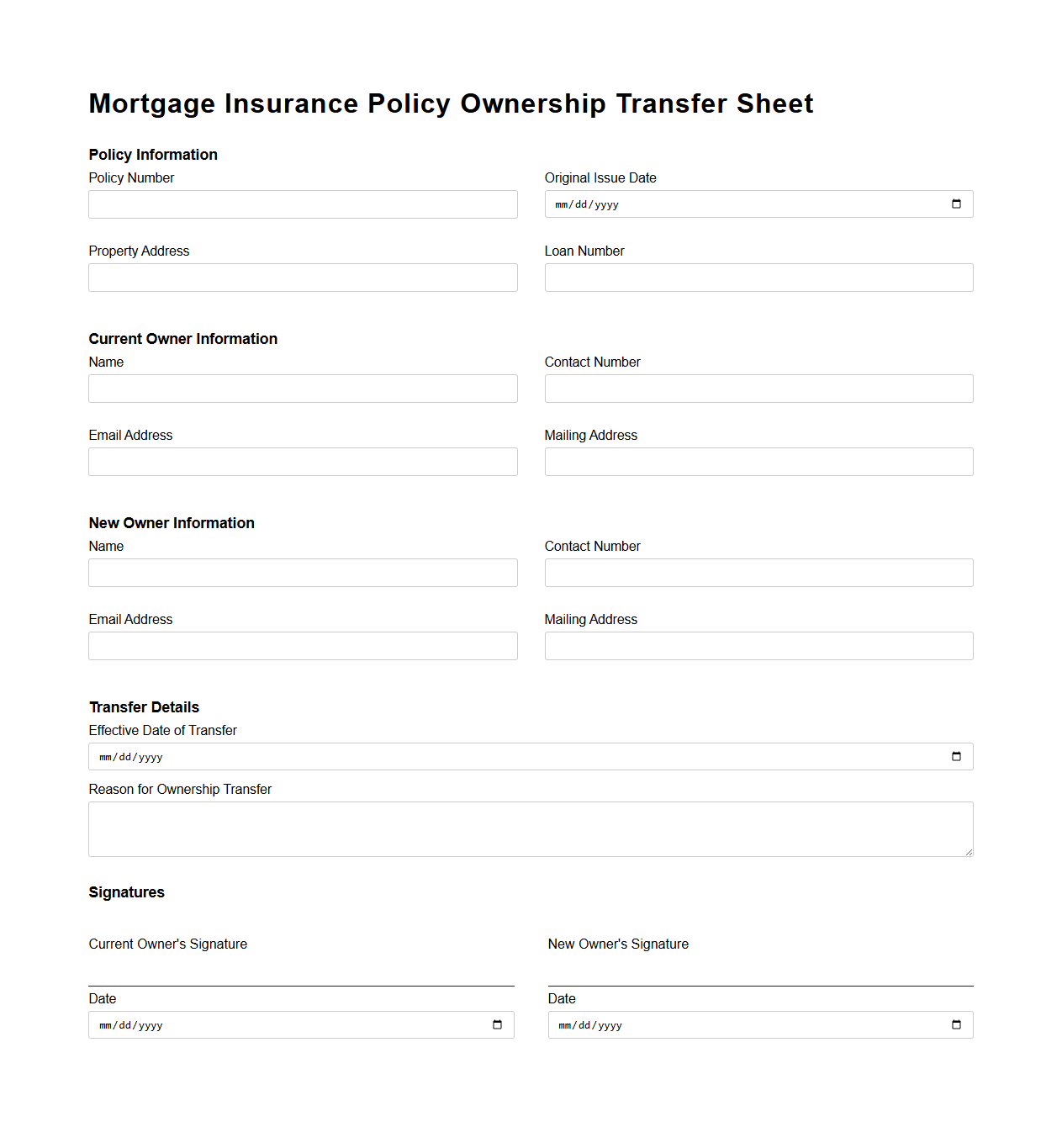

Mortgage Insurance Policy Ownership Transfer Sheet

The

Mortgage Insurance Policy Ownership Transfer Sheet document facilitates the formal transfer of ownership rights of a mortgage insurance policy from one party to another, ensuring legal recognition and protection. It details the involved parties, policy information, and the effective date of transfer to maintain clear records. This document is essential for lenders and borrowers to verify the assignment and continuation of insurance coverage under new ownership.

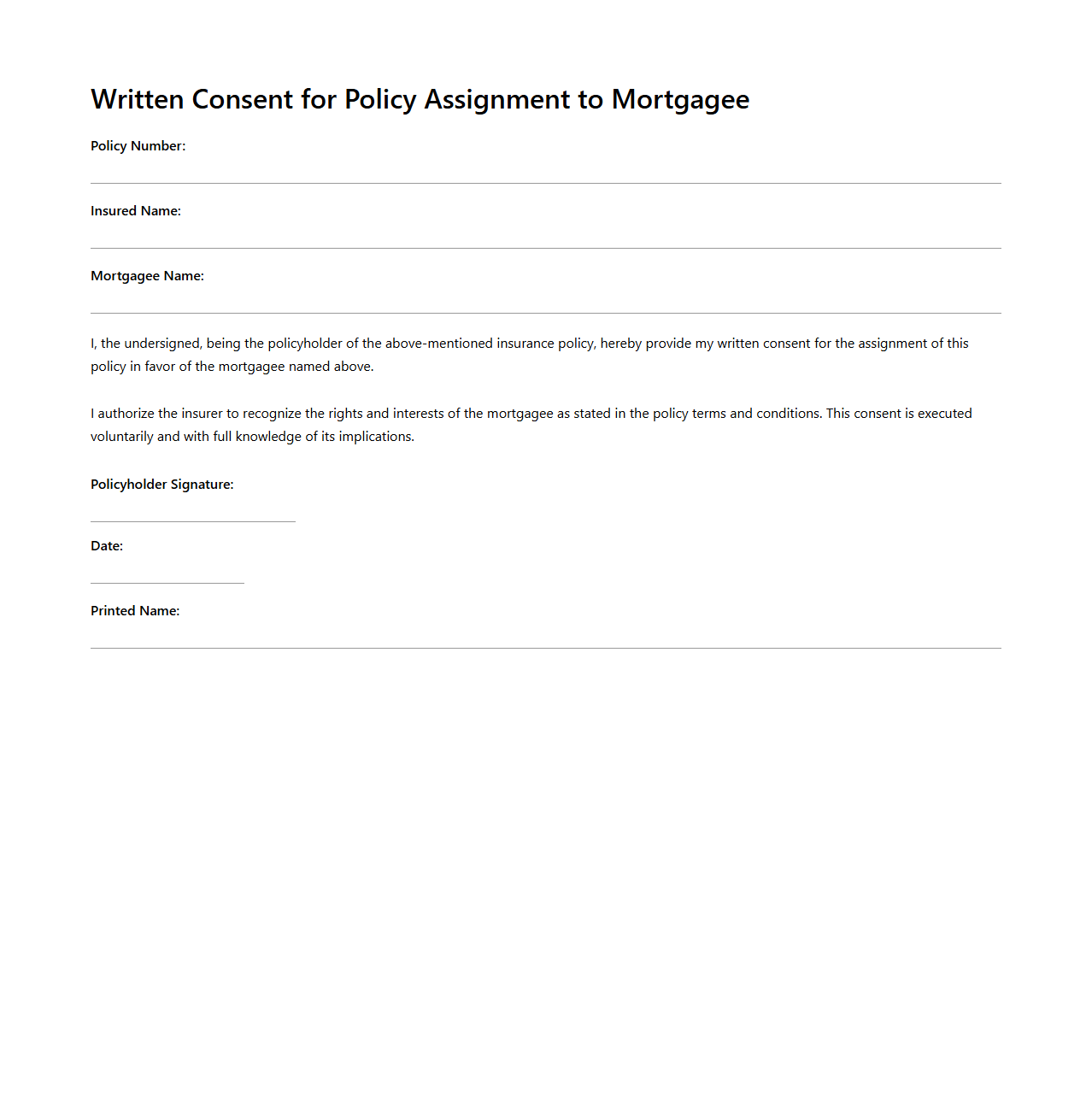

Written Consent for Policy Assignment to Mortgagee

Written Consent for Policy Assignment to Mortgagee is a legal document that formally authorizes the transfer of an insurance policy's rights and benefits from the policyholder to the mortgagee. This consent ensures the mortgagee, often a lender, holds a

secured interest in the insurance policy, protecting their financial stake in the property. It is crucial during loan agreements and property transactions to confirm the mortgagee's protection against potential claims.

What are the primary coverage components outlined in the mortgage insurance policy document?

The mortgage insurance policy primarily covers the borrower's default risk, ensuring the lender is protected against loan non-payment. It also includes protection for property damage that affects the mortgage value. Additionally, the policy outlines coverage for certain legal and administrative expenses related to the mortgage.

How does the policy document define eligible mortgage loans for insurance coverage?

Eligible mortgage loans are those that meet the policy's loan-to-value ratio requirements and borrower credit criteria. The policy specifies that only loans secured by residential properties qualify for insurance coverage. Furthermore, the loans must be used for primary residence purchases or refinances within specified limits.

What exclusions or limitations are specified within the policy regarding claim payouts?

The policy excludes claims arising from fraudulent borrower actions or misrepresentation. It also limits payouts for property damage caused by natural disasters unless additional coverage is purchased. Furthermore, claims are not paid if the borrower voluntarily vacates the property without lender agreement.

How are premiums calculated and when are they due according to the policy document?

Premiums are calculated based on the loan amount, borrower's credit profile, and coverage term. They are typically expressed as a percentage of the original loan balance or outstanding mortgage balance. Premium payments are generally due monthly or annually, as specified in the insurance agreement.

What are the procedural steps for filing a claim as described in the sample mortgage insurance policy?

To file a claim, the lender must first notify the insurer in writing within the designated claim reporting period. The insurer then requires submission of detailed documentation, including proof of borrower default and mortgage status. Lastly, the insurer reviews the claim and processes payment according to the policy terms after validation.