The Indemnity Bond Document Sample for Contractual Obligations serves as a legal guarantee protecting parties from potential losses or damages arising during contract execution. This document outlines the responsibilities and liabilities each party agrees to indemnify, ensuring clarity and risk mitigation. Using a standardized sample helps streamline the drafting process while safeguarding contractual interests effectively.

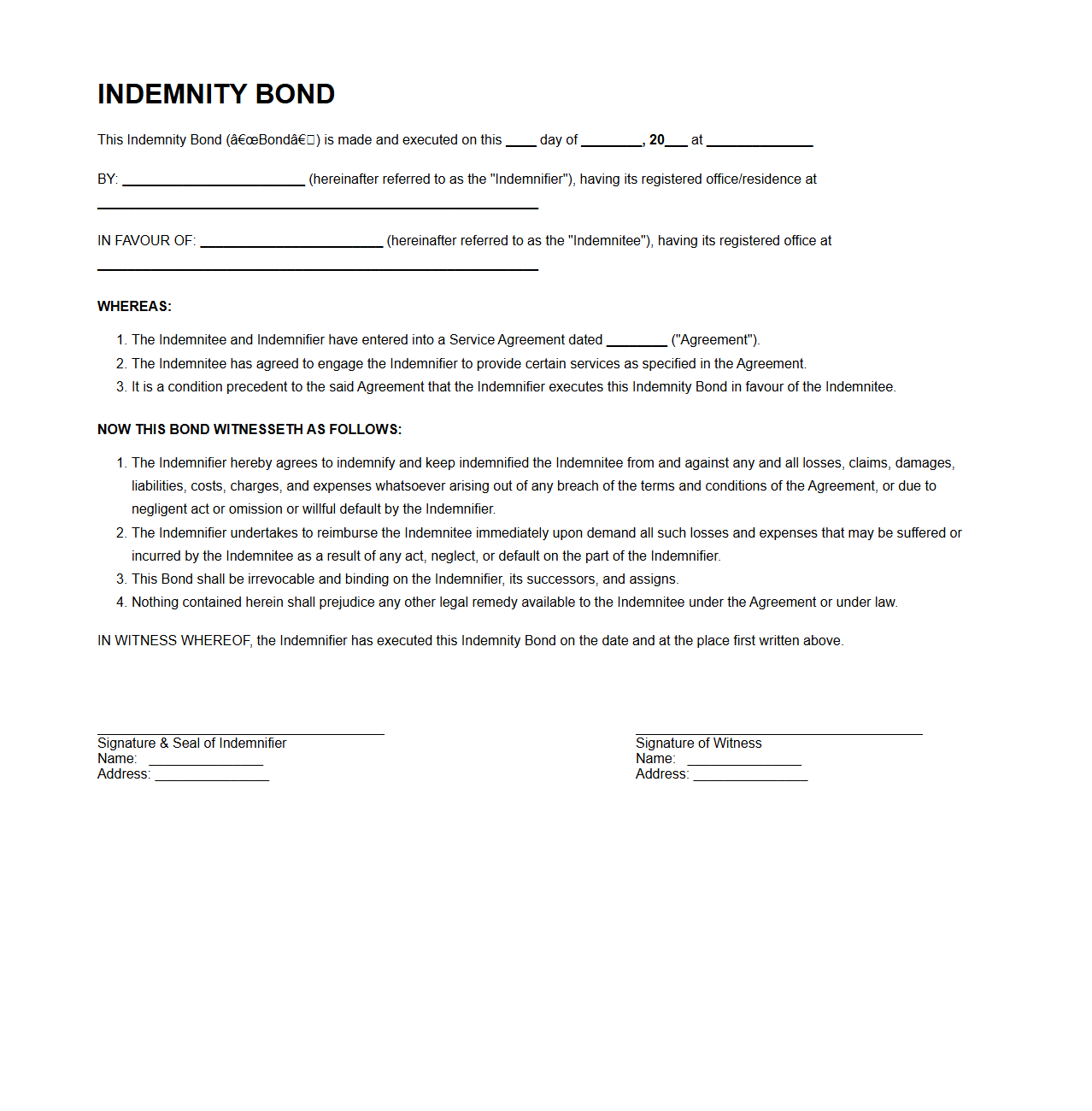

Indemnity Bond Format for Service Agreements

An

Indemnity Bond Format for Service Agreements is a structured legal document that outlines the responsibilities and liabilities of parties involved in a service contract, ensuring one party compensates the other for any losses or damages incurred. This format typically includes clauses specifying the scope of indemnity, duration, and conditions under which indemnification applies. Utilizing a clear indemnity bond format protects both service providers and clients by legally safeguarding their interests against potential claims or disputes during the agreement period.

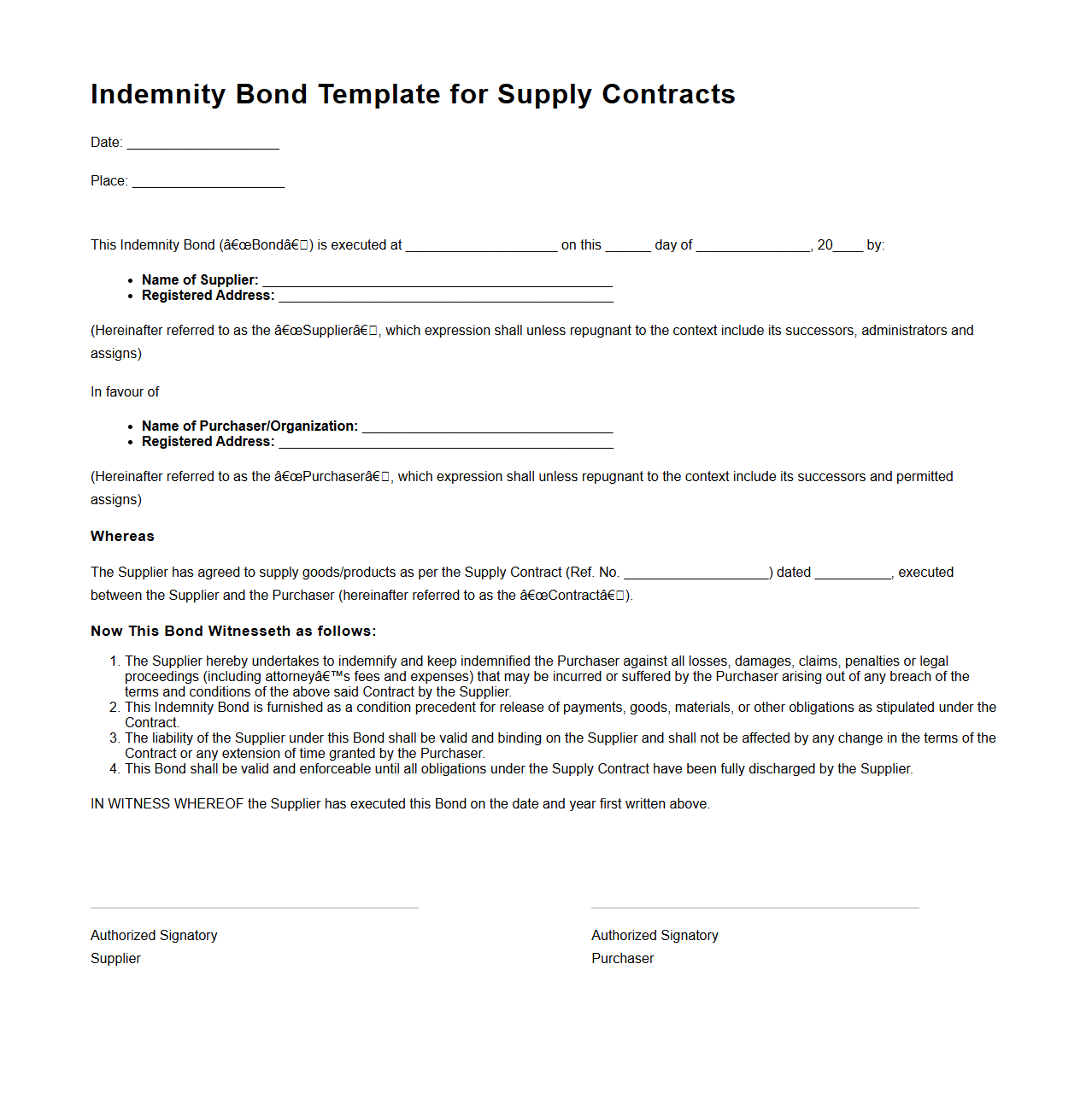

Indemnity Bond Template for Supply Contracts

An

Indemnity Bond Template for Supply Contracts is a legally binding document designed to protect parties involved in supply agreements by outlining the indemnification obligations. This template specifies the responsibilities of the supplier to compensate for any losses or damages arising from breaches or negligence during the contract term. Using such a template ensures clarity on liability limits, risk management, and dispute resolution, thereby safeguarding both the buyer and supplier interests.

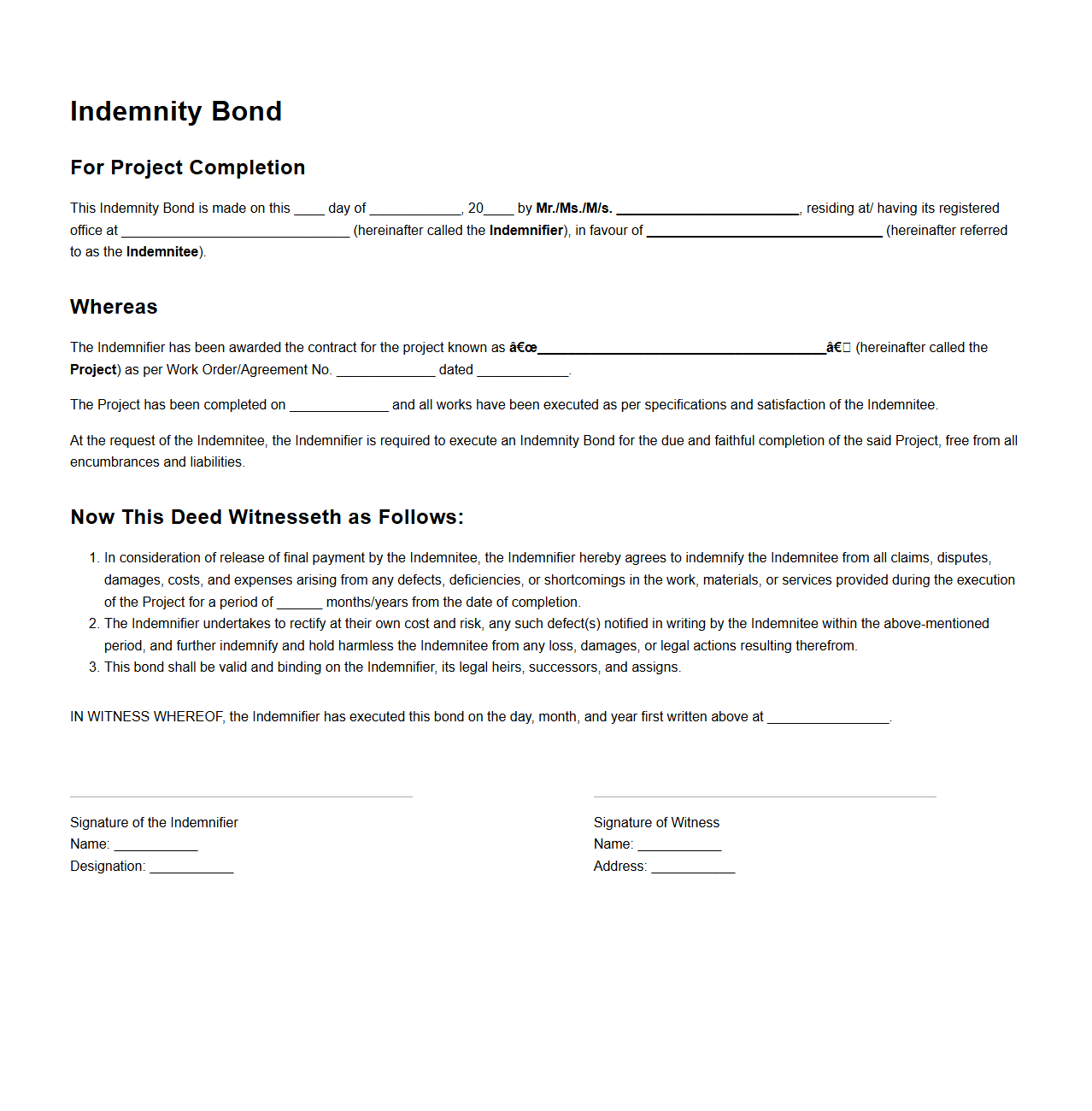

Indemnity Bond Example for Project Completion

An

Indemnity Bond for Project Completion is a legal document assuring that a contractor or party responsible for a project will complete the work as per the agreed terms and conditions. It protects the client by guaranteeing compensation for any losses or damages if the project is not finished on time or fails to meet quality standards. This bond serves as a financial security instrument, reinforcing accountability and minimizing risks associated with incomplete or substandard project delivery.

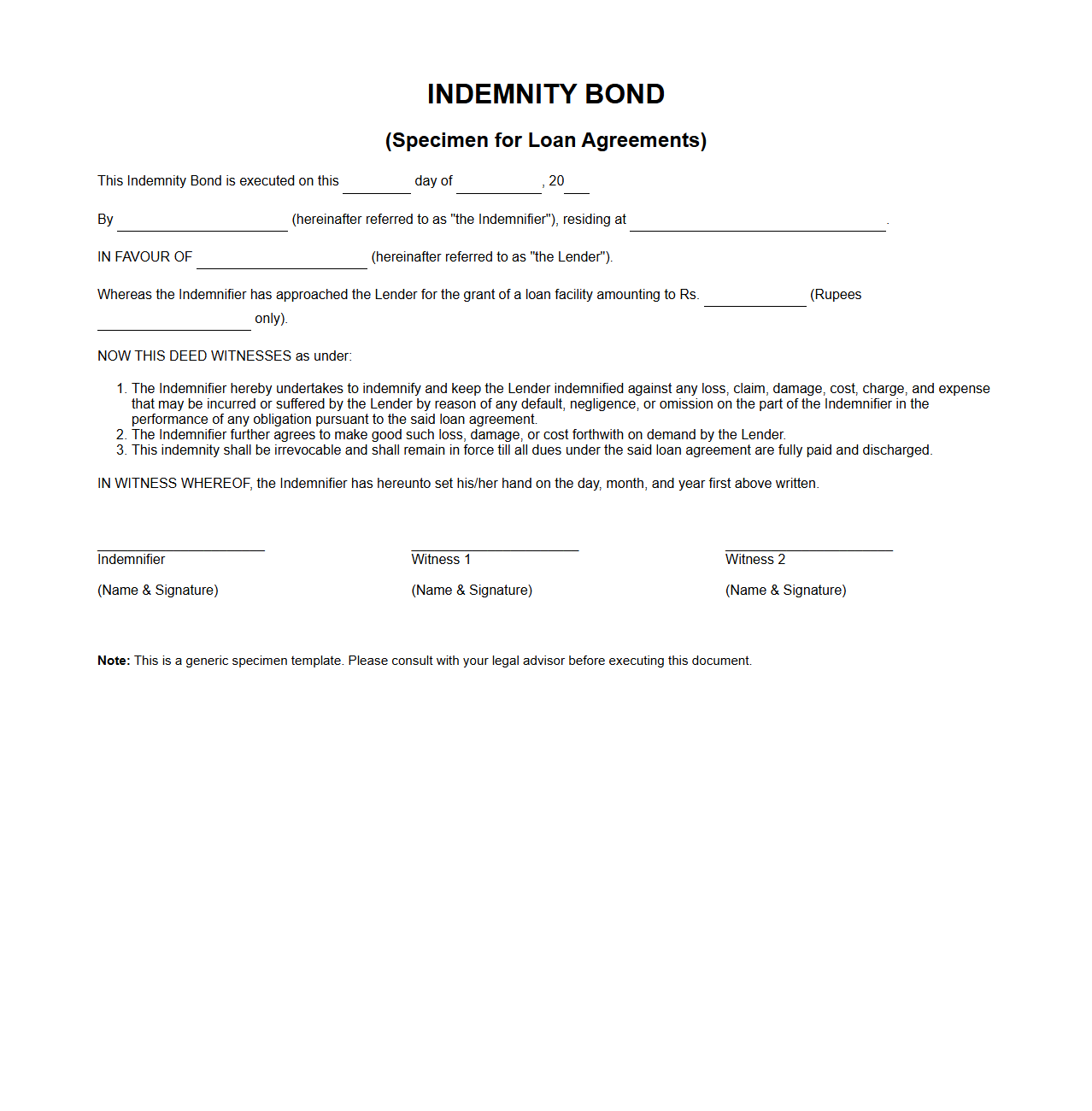

Indemnity Bond Specimen for Loan Agreements

An

Indemnity Bond Specimen for Loan Agreements is a legally binding document used to protect lenders by ensuring the borrower agrees to compensate for any losses or damages arising from the loan transaction. It outlines the borrower's commitment to indemnify the lender against defaults, disputes, or unforeseen circumstances related to the loan. This specimen serves as a template that clearly defines the terms of indemnity, safeguarding the interests of both parties in the loan agreement.

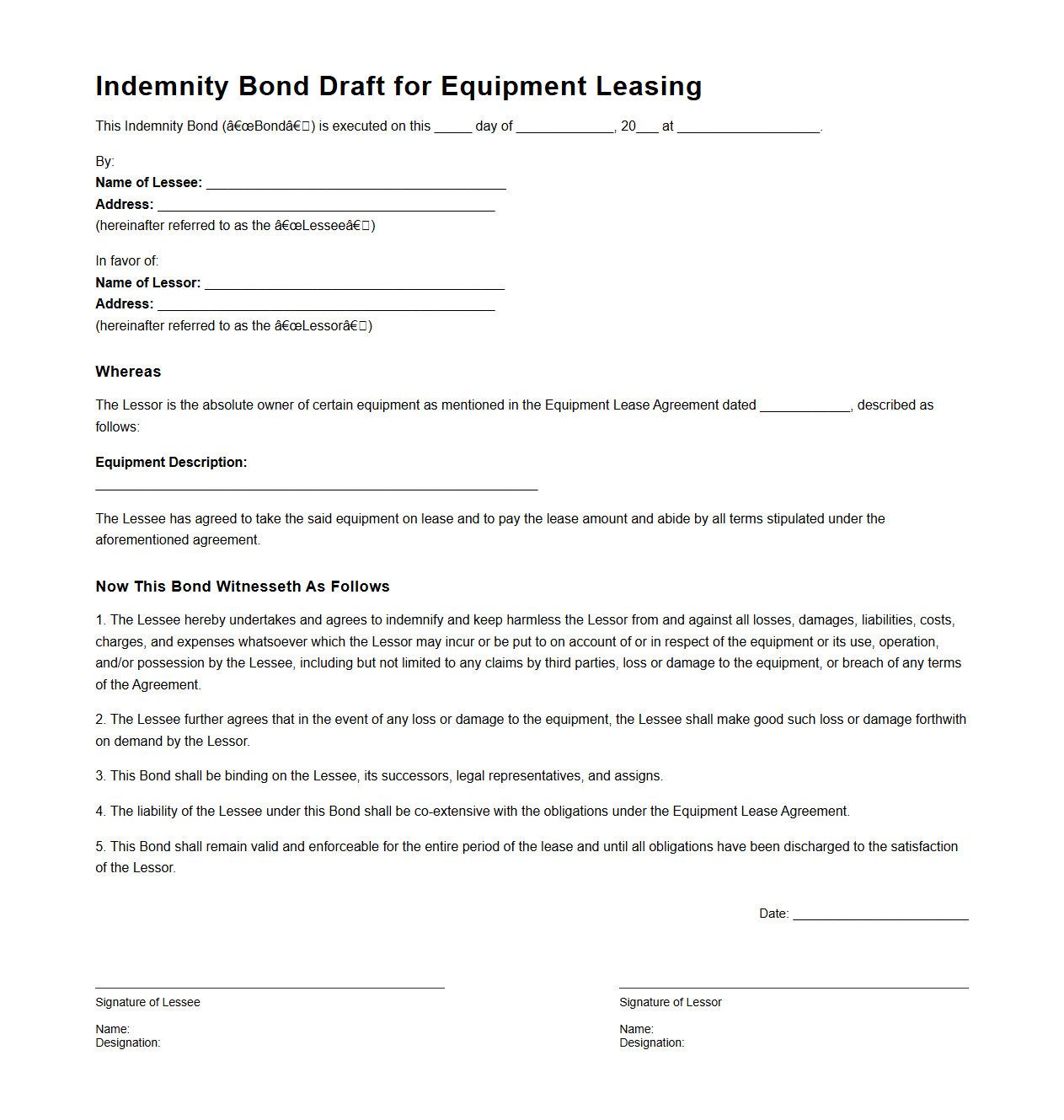

Indemnity Bond Draft for Equipment Leasing

An

Indemnity Bond Draft for Equipment Leasing is a legal document that ensures the lessee protects the lessor against potential losses or damages during the lease period. It outlines the lessee's agreement to compensate for any breaches, damages, or liabilities arising from the use of the leased equipment. This bond serves as a financial guarantee, reinforcing trust and minimizing risk in equipment leasing transactions.

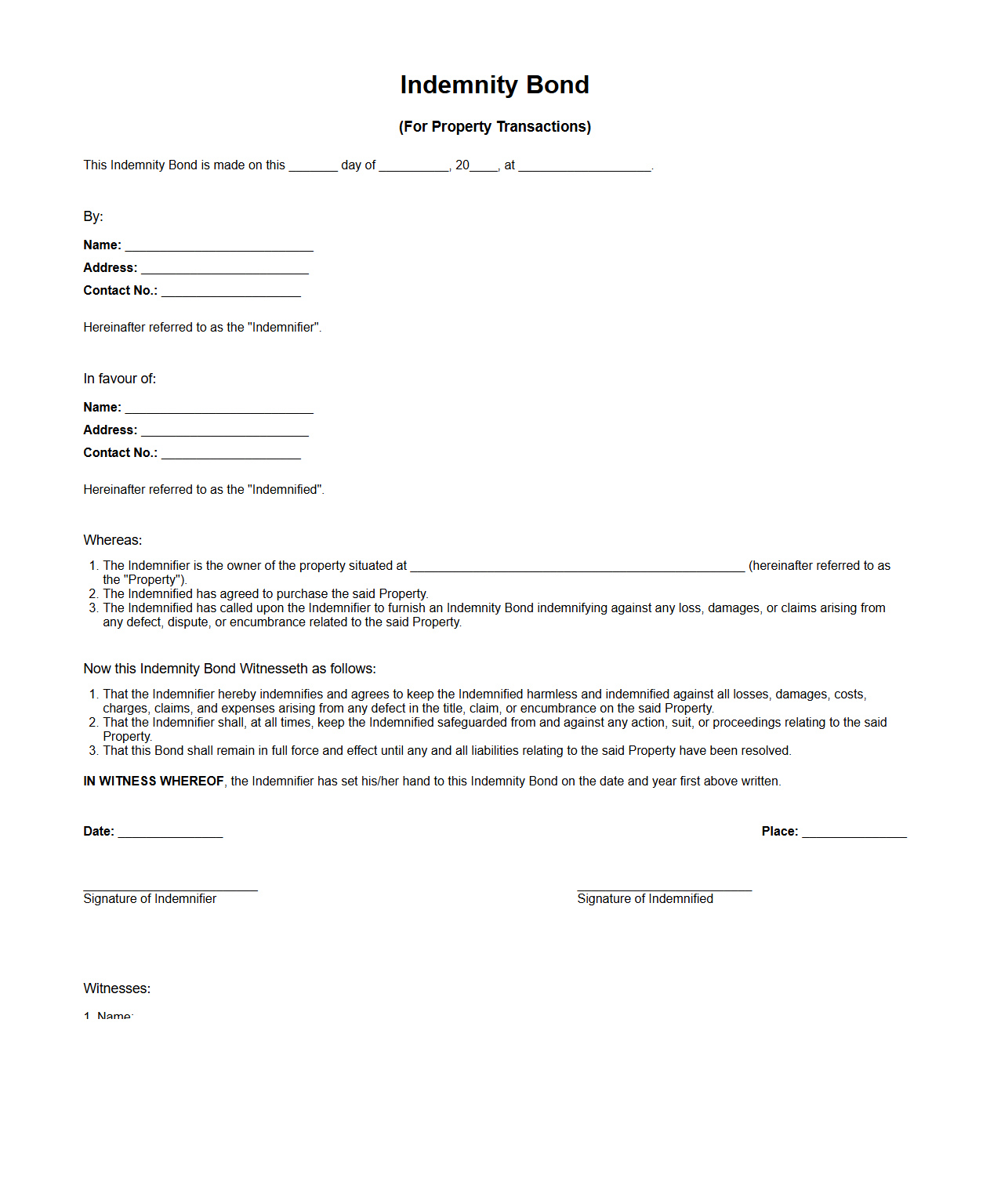

Indemnity Bond Sample for Property Transactions

An

Indemnity Bond Sample for Property Transactions is a legal document used to protect parties involved in real estate dealings against potential losses or damages arising from property disputes or title defects. This bond serves as a formal agreement where one party promises to compensate the other for any financial harm caused during the transaction process. It is commonly required by authorities or financial institutions to ensure security and trust in property transfers.

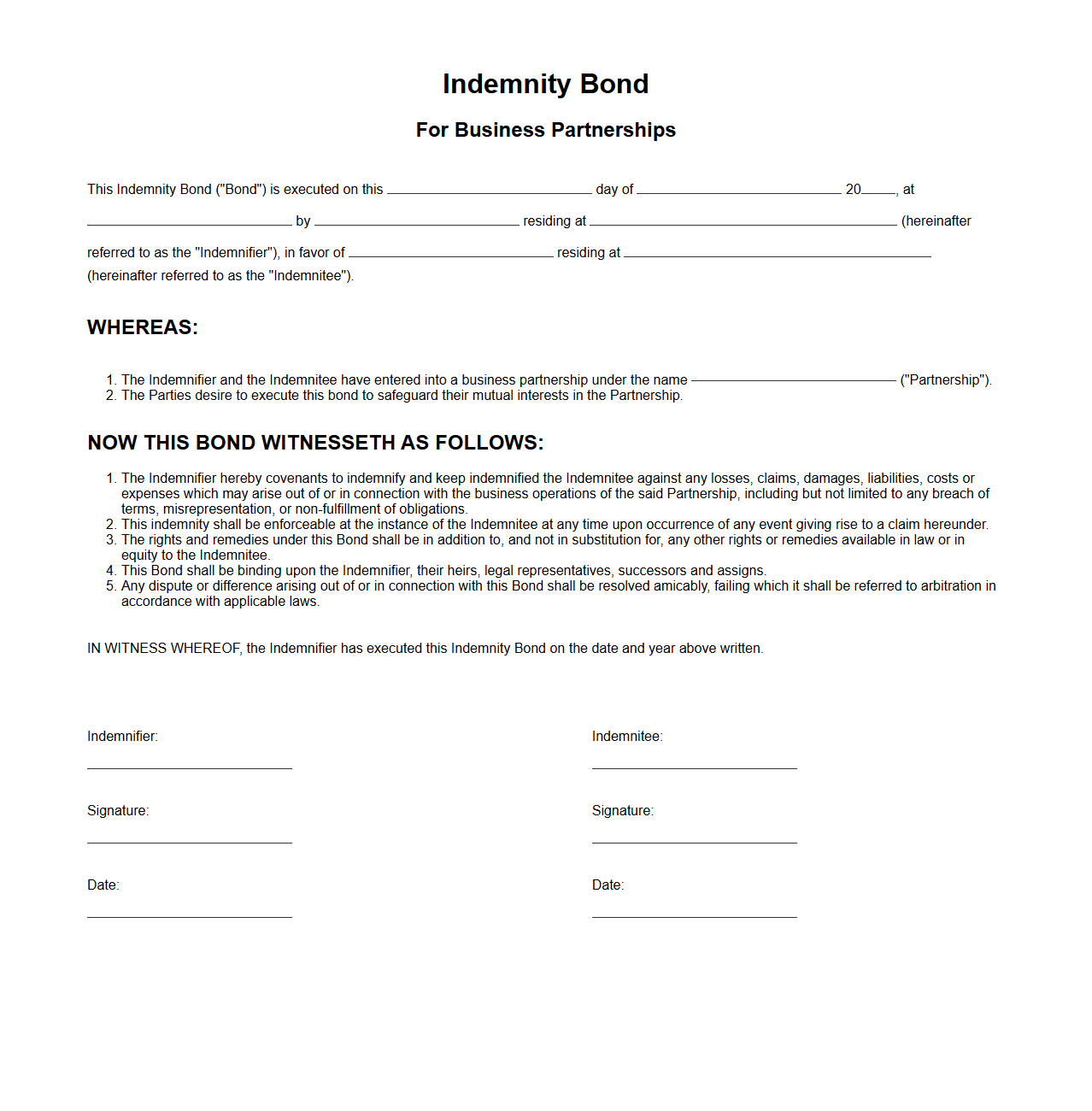

Indemnity Bond Model for Business Partnerships

An

Indemnity Bond Model for Business Partnerships is a legal document designed to protect partners from financial losses or damages arising from specific events or breaches within the partnership. It outlines the obligations of each partner to compensate the other(s) for any liabilities incurred due to negligence, misconduct, or failure to meet contractual responsibilities. This bond ensures risk management and fosters trust by clearly defining indemnity terms and conditions in a business collaboration.

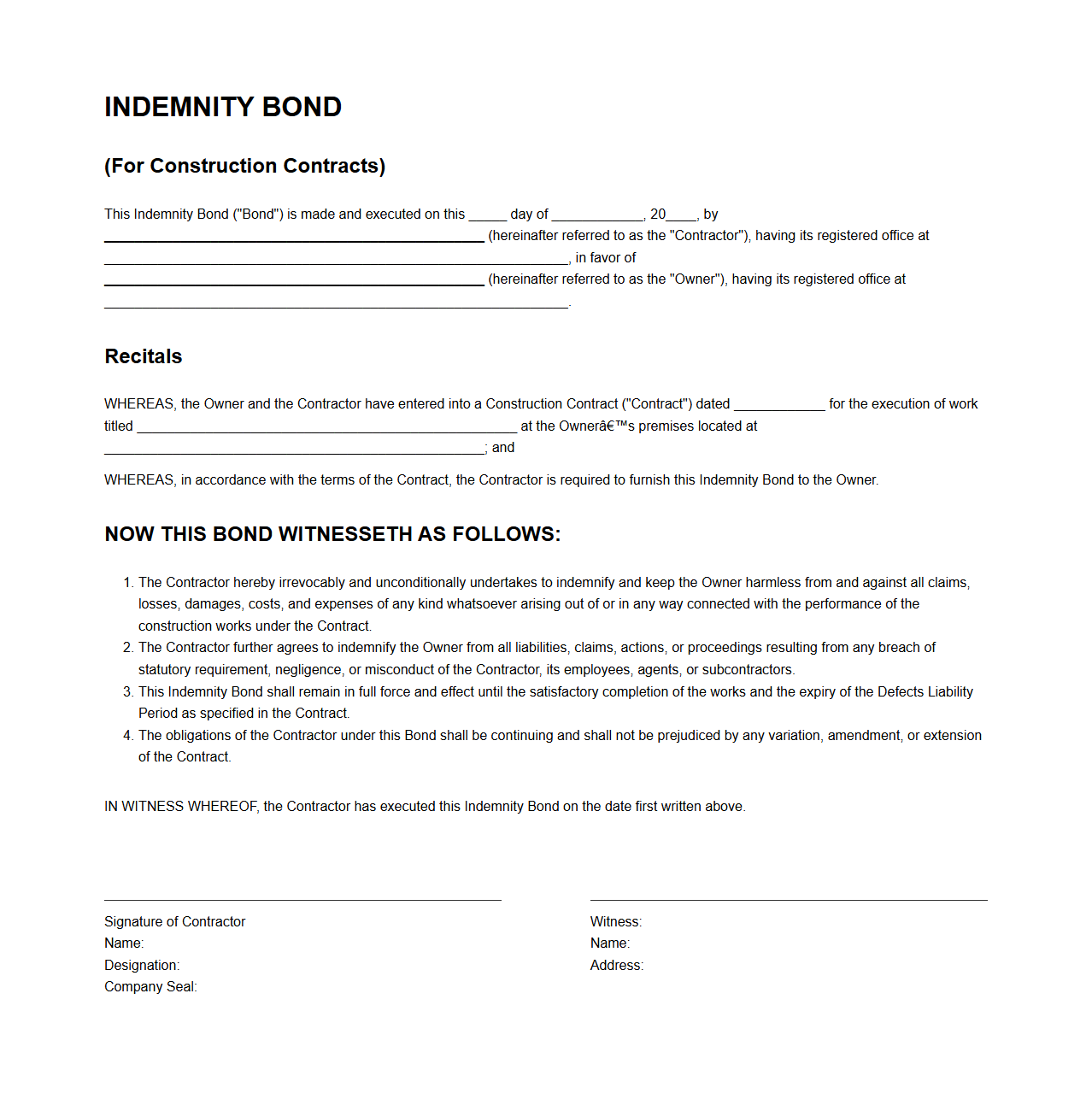

Indemnity Bond Document for Construction Contracts

An

Indemnity Bond Document for construction contracts is a legal agreement where one party agrees to compensate the other for any losses or damages arising during the project. It ensures financial protection against risks such as accidents, property damage, or legal claims occurring on the construction site. This document is crucial for securing accountability and mitigating potential liabilities throughout the contract duration.

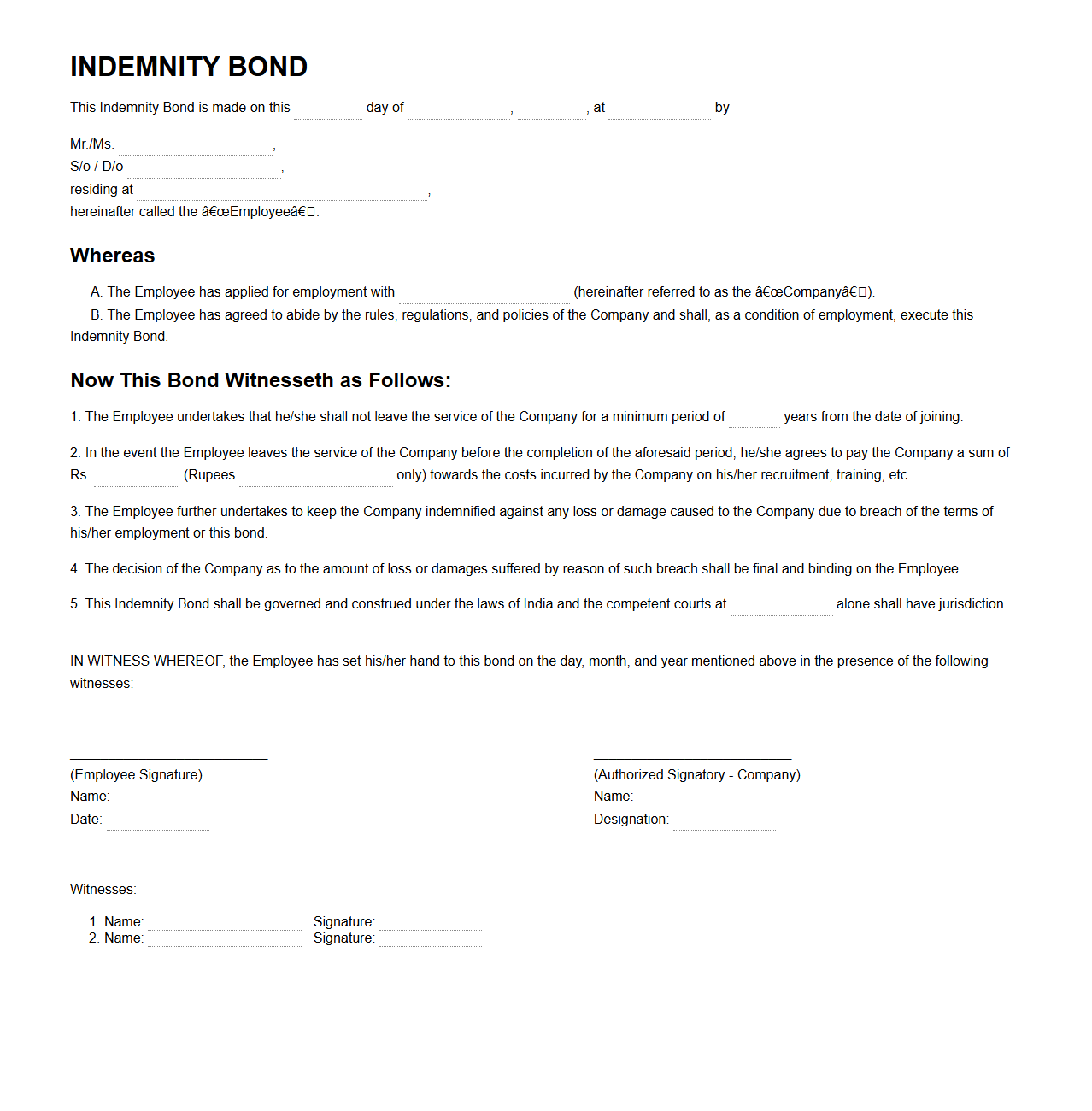

Indemnity Bond Text for Employment Contracts

An

Indemnity Bond in employment contracts is a legal agreement where the employee agrees to compensate the employer for any losses or damages caused due to negligence, breach of contract, or misconduct. This document protects the employer from financial liabilities arising from the employee's actions during the course of employment. It clearly outlines the terms, conditions, and extent of indemnity to ensure both parties understand their responsibilities and liabilities.

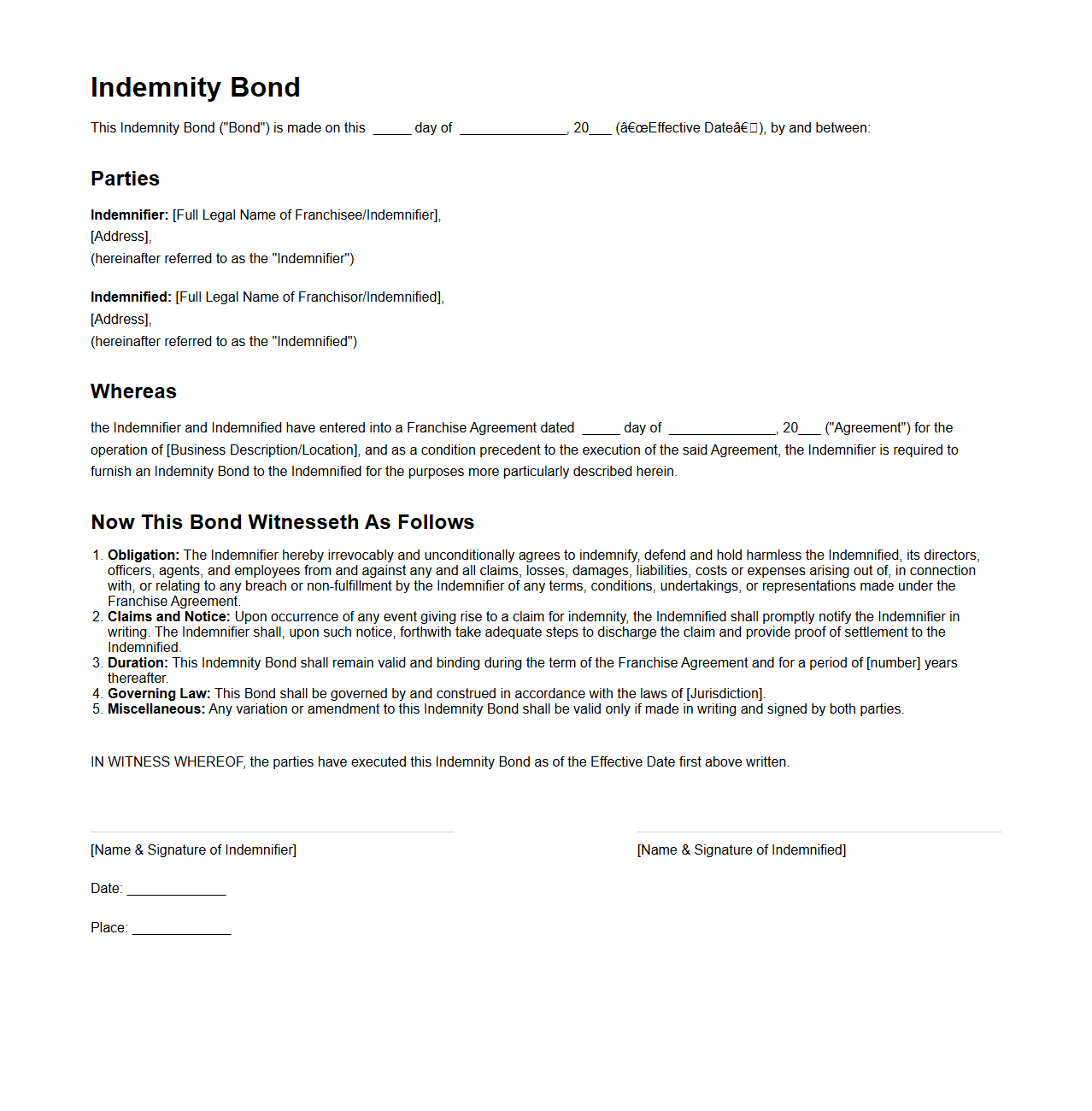

Indemnity Bond Structure for Franchise Agreements

An

Indemnity Bond Structure for Franchise Agreements outlines the legal framework wherein the franchisee agrees to protect the franchisor from losses or damages arising out of specific liabilities. This document specifies the scope of indemnity, conditions triggering indemnification, and the financial limits involved. It serves as a critical risk management tool, ensuring clear responsibilities and safeguarding both parties in the franchise relationship.

What are the mandatory clauses in an Indemnity Bond for contractual obligations?

An Indemnity Bond must include clauses that clearly define the scope of indemnity, specifying the parties involved and the nature of the obligations. It should contain a clause outlining the circumstances under which indemnity applies, ensuring protection against losses or damages. Additionally, the bond must include provisions for the claims process, including notice requirements and timeframes for making indemnity claims.

How is liability limitation defined in an Indemnity Bond document?

The liability limitation clause in an Indemnity Bond restricts the maximum extent of financial responsibility one party bears. It often specifies caps on damages or excludes certain types of losses, such as indirect or consequential damages. This clause is critical to mitigate excessive exposure and clarify the boundaries of legal and financial commitments.

Which legal jurisdictions must be specified in an Indemnity Bond for cross-border contracts?

For cross-border contracts, the Indemnity Bond must clearly specify the governing legal jurisdiction to avoid disputes. Typically, the contract will name a mutually agreed jurisdiction where any legal proceedings will take place. This clause helps ensure clarity and enforceability across different legal systems.

What supporting documents are required to validate an Indemnity Bond?

Supporting documents essential for validating an Indemnity Bond include a duly signed agreement, proof of identity of involved parties, and evidence of the contractual obligations. Additional documents such as licenses, insurance certificates, or financial statements may also be required to establish credibility. These documents collectively ensure the bond's authenticity and legal enforceability.

How should the indemnity period be stipulated in the contract bond?

The indemnity period should be explicitly defined in the contract bond, stating the exact duration during which indemnity obligations remain active. This period often begins from the date of contract execution or completion of work and extends for a specified timeframe. Clear stipulation helps prevent ambiguity and limits the timeframe for potential claims.