A Share Purchase Agreement Document Sample for Equity Transactions outlines the terms and conditions for the sale and transfer of company shares between parties. It ensures clarity on payment, representations, warranties, and closing procedures, protecting both buyer and seller interests. This document is essential for legally binding equity transfer and minimizing potential disputes.

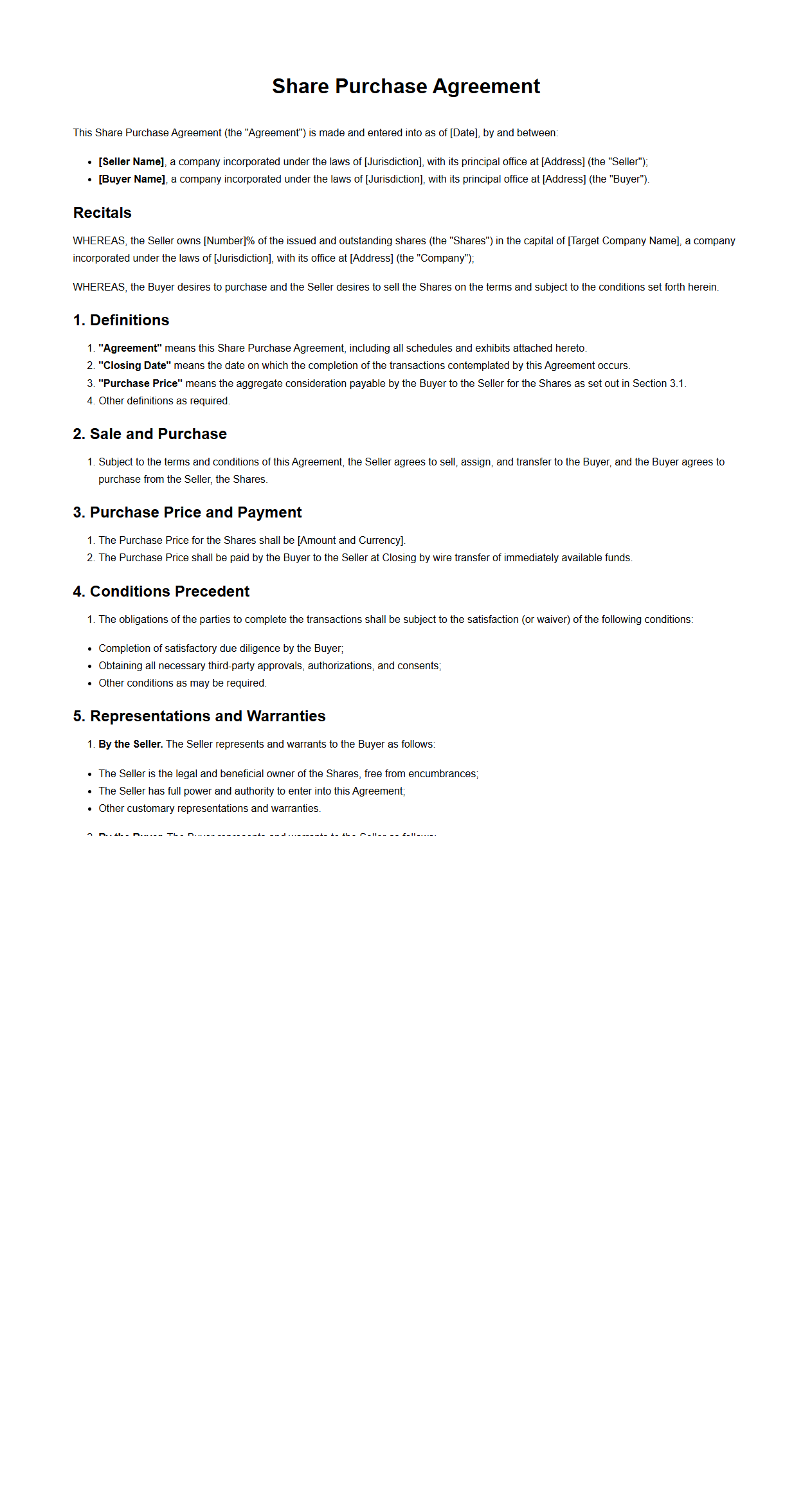

Share Purchase Agreement Template for Private Equity Acquisitions

A

Share Purchase Agreement Template for Private Equity Acquisitions is a legally binding document designed to outline the terms and conditions under which shares of a target company are bought and sold in private equity transactions. It includes critical details such as purchase price, representations and warranties, indemnities, and closing conditions to ensure clear understanding and protection for both buyer and seller. This template streamlines the negotiation process and minimizes risks by providing a standardized framework tailored to complex private equity deals.

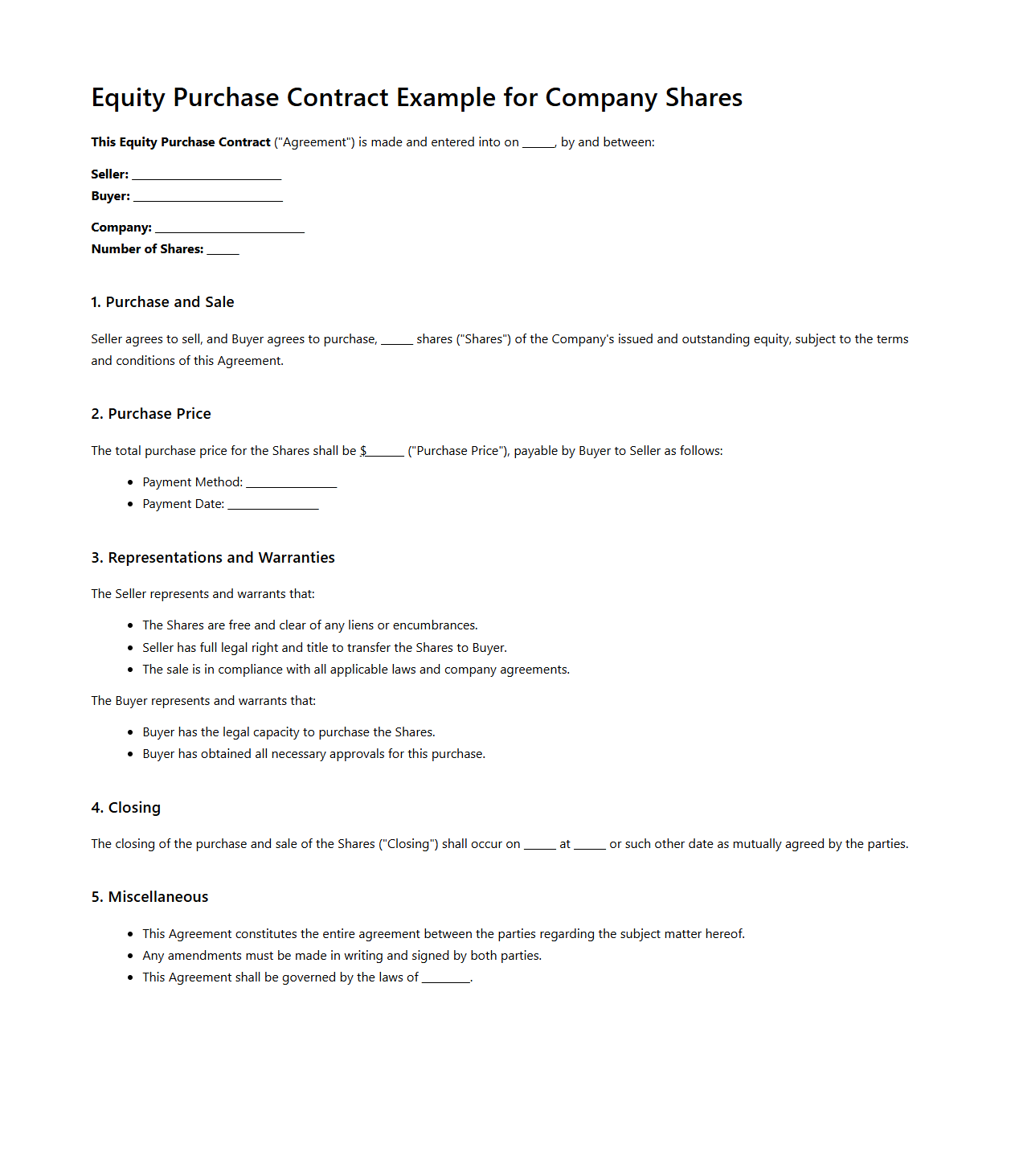

Equity Purchase Contract Example for Company Shares

An

Equity Purchase Contract Example for Company Shares document outlines the terms and conditions under which the buyer agrees to purchase ownership interests in a company. It specifies critical details such as the number of shares being sold, the purchase price, representations and warranties of both parties, and any conditions precedent to closing. This contract serves as a binding legal agreement ensuring clarity and protection for both the seller and buyer in equity transactions.

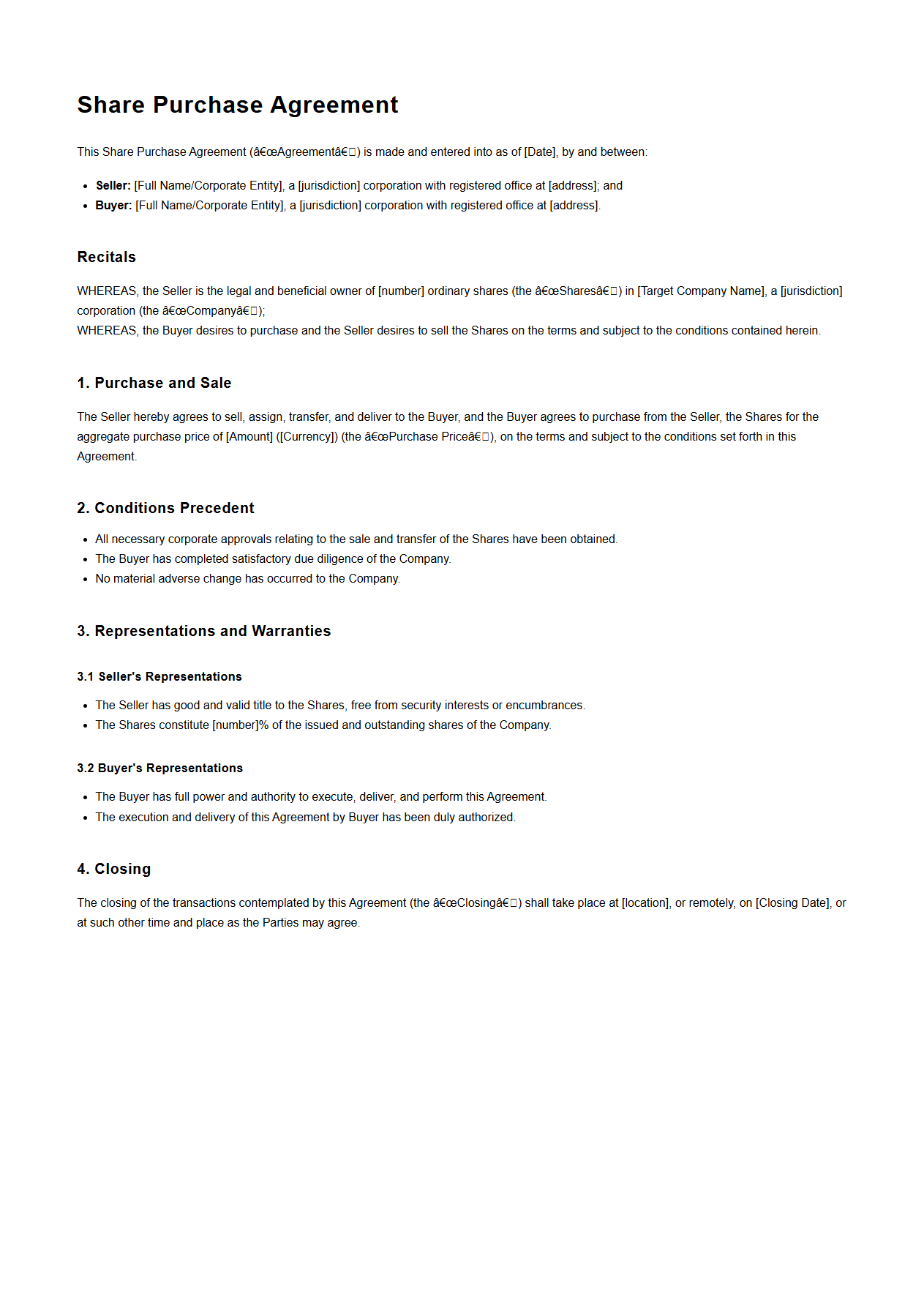

Standard SPA Document for Corporate Share Transactions

The

Standard SPA Document for Corporate Share Transactions is a legally binding agreement that outlines the terms and conditions for the sale and purchase of corporate shares between parties. It details key elements such as the purchase price, representations and warranties, closing conditions, and indemnities to protect both buyer and seller throughout the transaction. This document ensures clarity and reduces risks in share transfer processes within corporate governance frameworks.

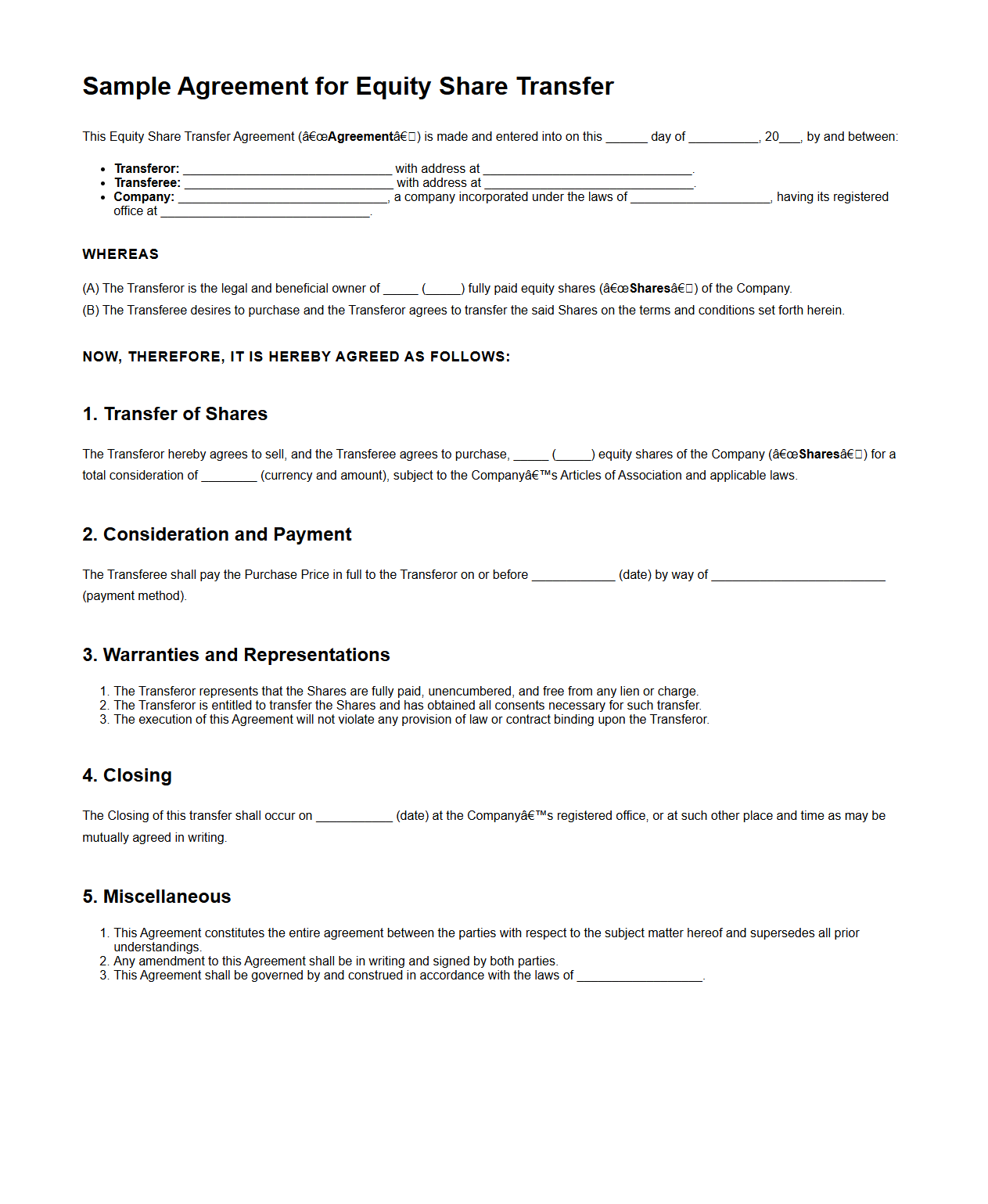

Sample Agreement for Equity Share Transfer

A

Sample Agreement for Equity Share Transfer document outlines the terms and conditions under which equity shares are transferred from one party to another. It specifies the number of shares, transfer price, payment terms, and representations and warranties of both the transferor and transferee. This agreement ensures a legally binding framework to protect the rights and obligations of all involved parties during the transfer process.

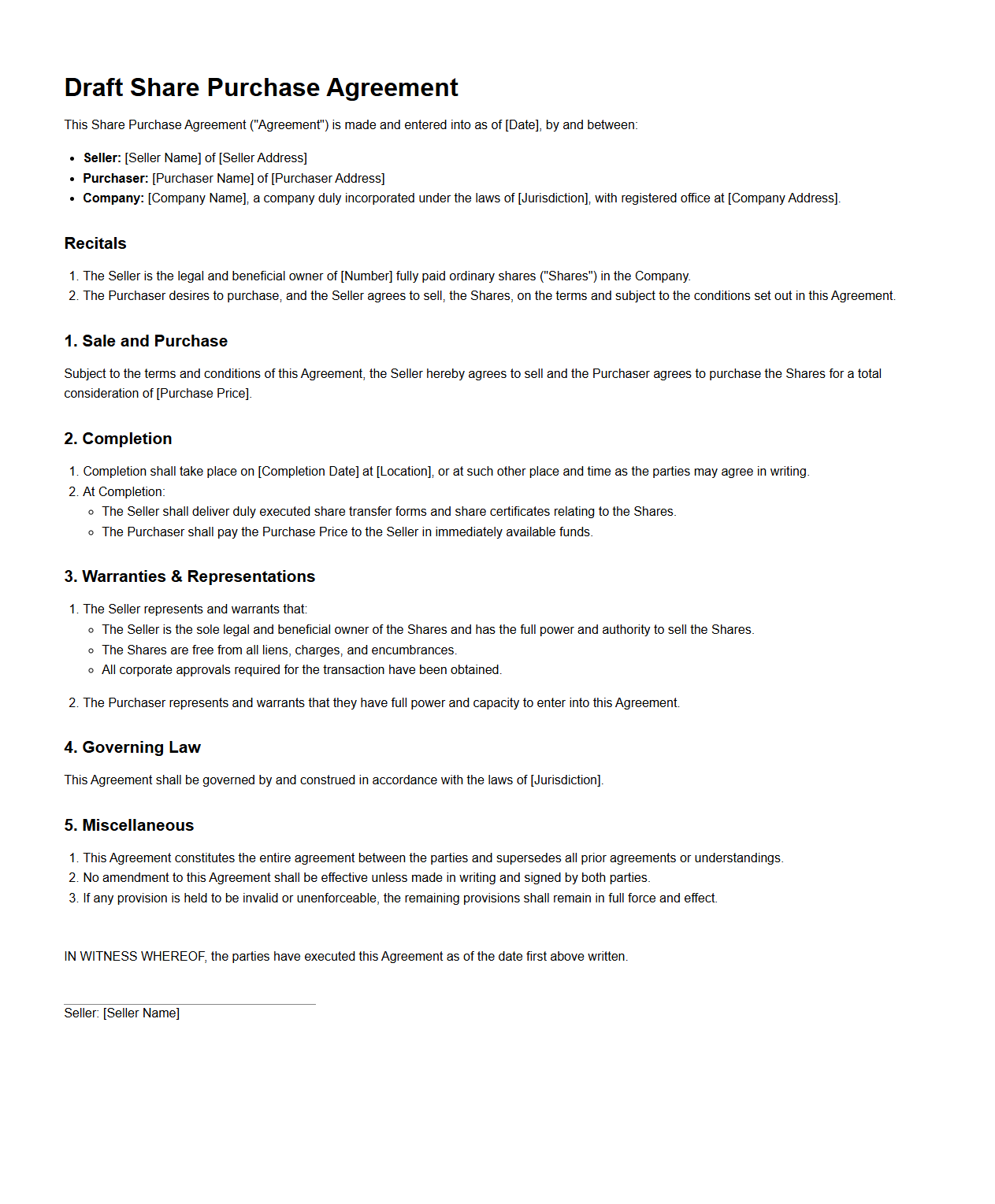

Draft Share Purchase Agreement for Investors

A

Draft Share Purchase Agreement for investors is a preliminary legal document outlining the terms and conditions under which shares in a company are to be bought and sold. It typically includes key details such as purchase price, number of shares, representations and warranties, and closing conditions to protect the interests of both buyers and sellers. This draft serves as a foundation for negotiation, ensuring clarity and alignment before finalizing the transaction.

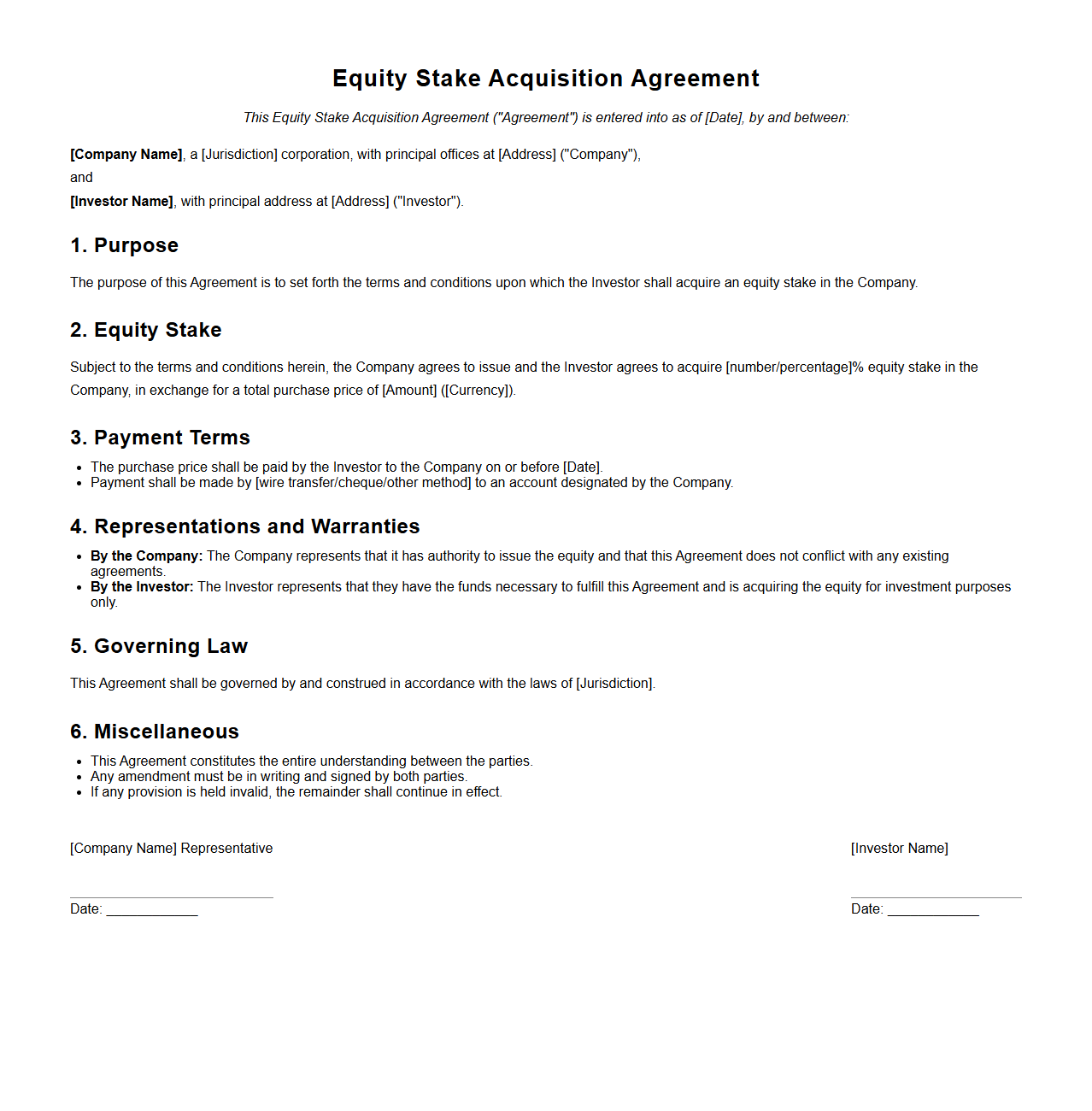

Equity Stake Acquisition Agreement Sample

An

Equity Stake Acquisition Agreement Sample document outlines the terms and conditions under which one party purchases a percentage of ownership in a company from another party. It typically includes details such as the percentage of equity being acquired, purchase price, representations and warranties, and conditions precedent to closing. This sample serves as a legal reference to ensure clear, enforceable rights and obligations for both buyer and seller in equity transactions.

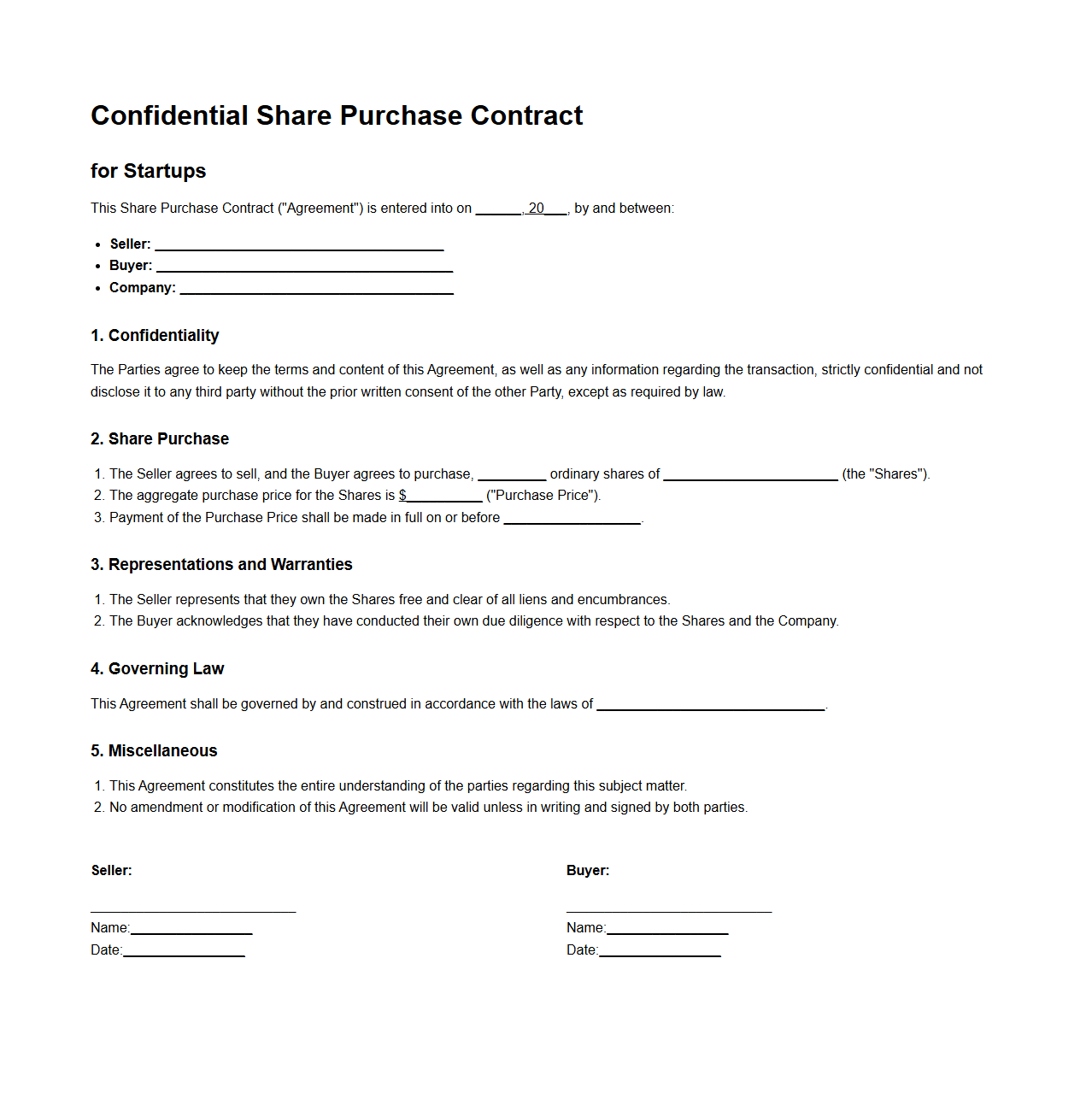

Confidential Share Purchase Contract for Startups

A

Confidential Share Purchase Contract for startups is a legally binding agreement outlining the terms and conditions under which shares are bought and sold while protecting sensitive business information. This document ensures that both parties maintain confidentiality regarding proprietary data, financial details, and business strategies during the transaction process. It is essential for safeguarding intellectual property and maintaining trust between investors and the startup.

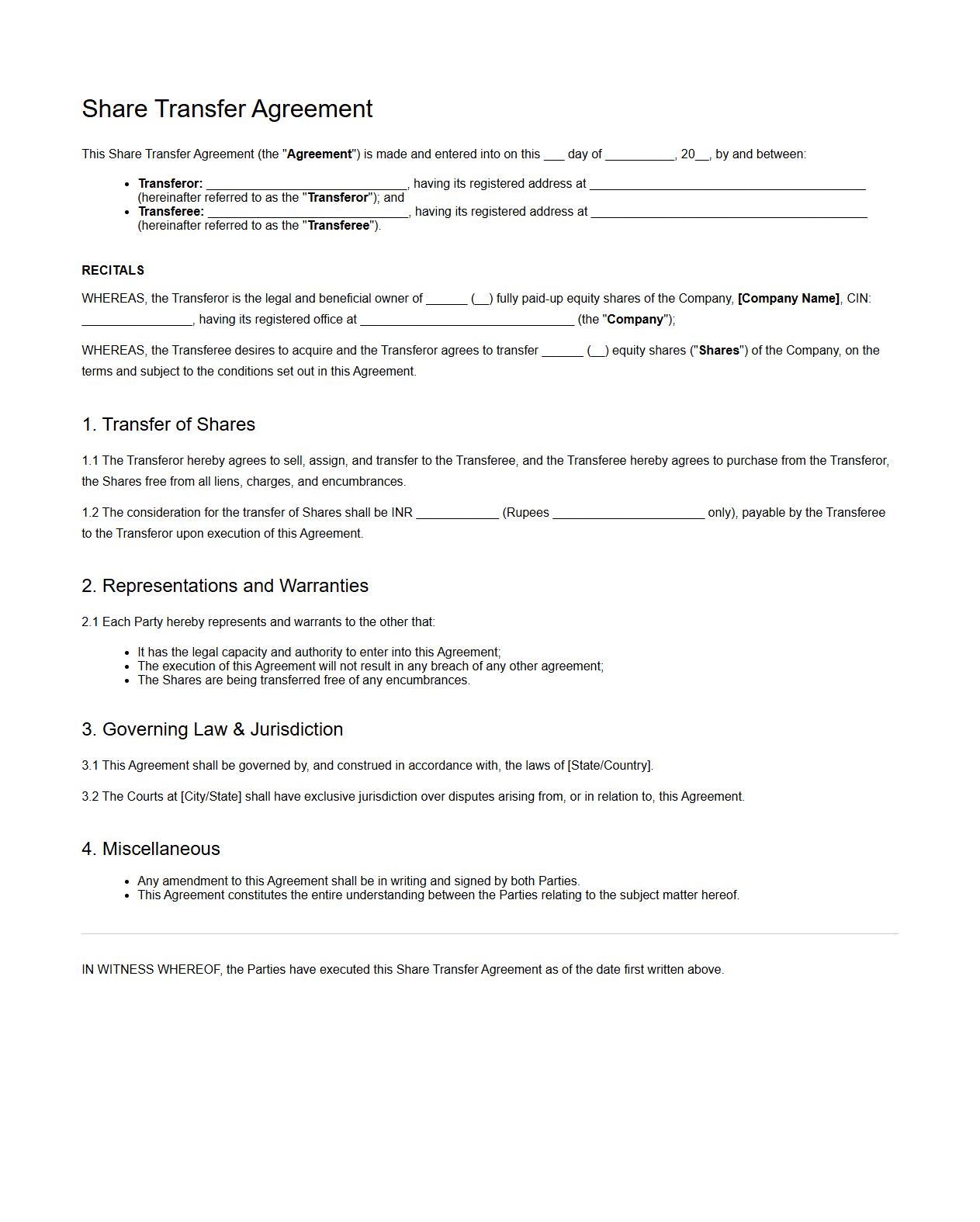

Share Transfer Agreement Example for Equity Investors

A

Share Transfer Agreement example for equity investors is a legally binding document outlining the terms and conditions under which shares in a company are transferred from one party to another. It details essential provisions such as the number of shares, transfer price, warranties, and rights of both the seller and buyer, ensuring clarity and protection for all parties involved. This document is crucial in equity transactions to facilitate smooth ownership changes while minimizing potential disputes.

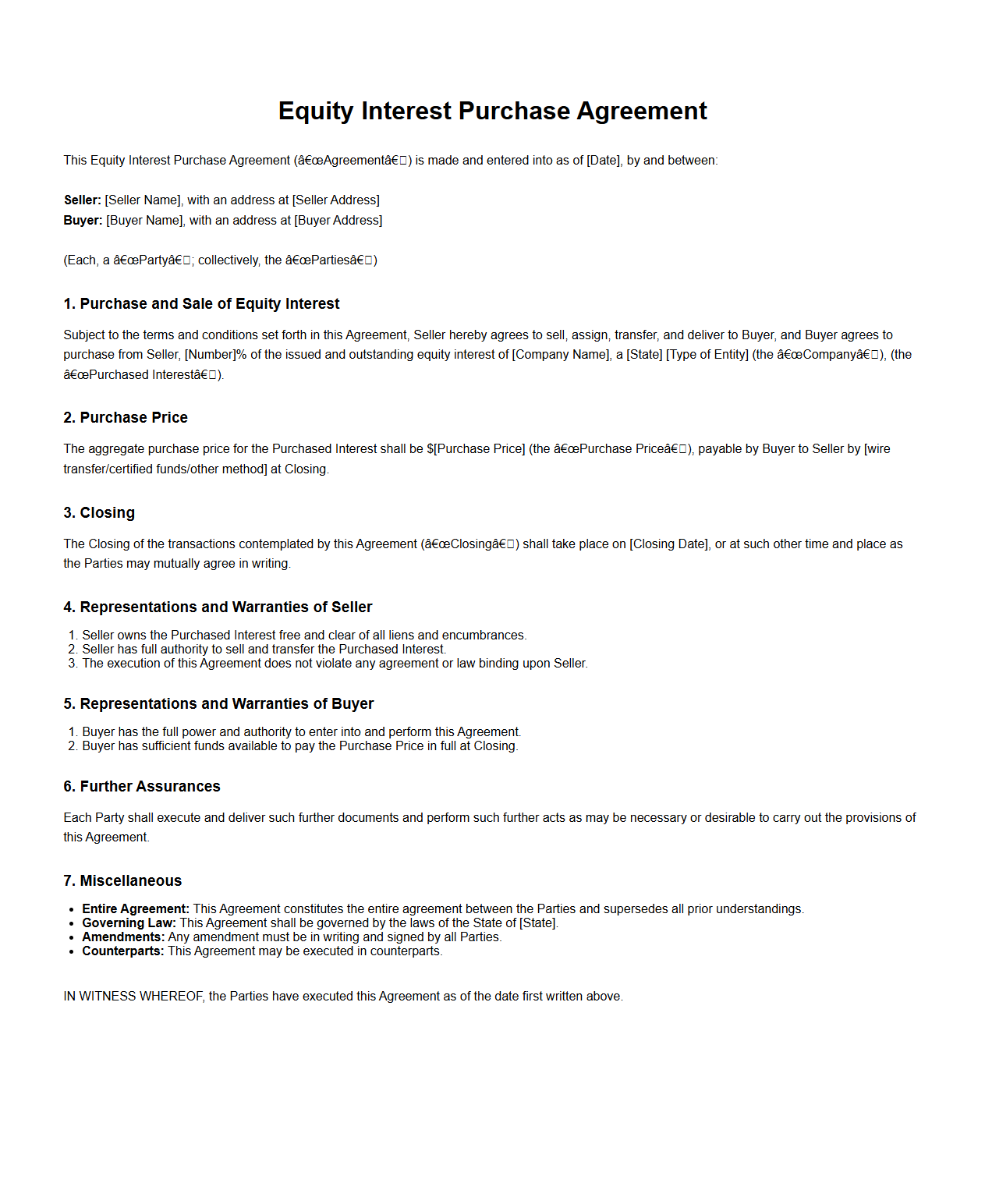

Equity Interest Purchase Agreement Sample for Businesses

An

Equity Interest Purchase Agreement Sample for businesses is a legally binding document template used to outline the terms and conditions under which one party agrees to buy ownership shares from another party in a company. This agreement specifies the purchase price, representations and warranties, closing conditions, and rights and obligations of both the buyer and seller. It serves as a crucial tool for ensuring clarity and protection during the transfer of equity interests in corporate transactions.

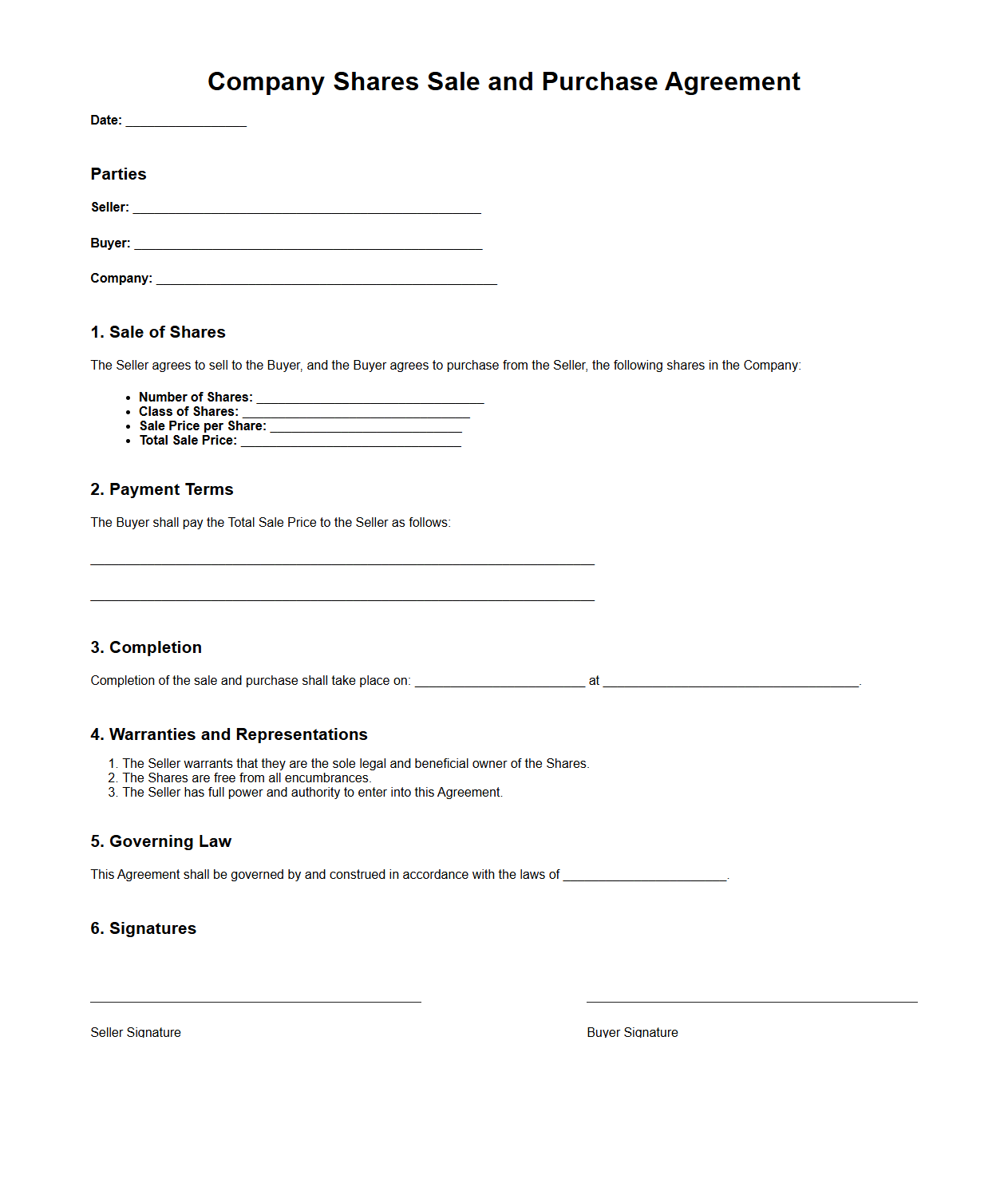

Company Shares Sale and Purchase Agreement Template

A

Company Shares Sale and Purchase Agreement Template document serves as a standardized contract outlining the terms and conditions for the transfer of company shares between parties. It specifies critical details such as the number of shares, purchase price, payment terms, representations, warranties, and obligations of the buyer and seller. This template helps ensure clarity, legal compliance, and protection of rights during the sale and purchase process.

Specific Representations and Warranties Unique to Equity Share Transactions

This SPA includes representations and warranties specific to equity shares, such as the validity of share issuance and the seller's undisputed ownership rights. It ensures there are no outstanding options, liens, or agreements affecting the shares. The buyer is thus assured of acquiring clear and unencumbered equity ownership.

Indemnity Clauses for Breaches Related to Share Ownership

The agreement structures indemnity provisions to protect the buyer from losses due to breaches in share ownership representations. It requires the seller to compensate the buyer if any third-party claims arise from defective title or undisclosed encumbrances. These clauses often specify caps, survival periods, and procedural requirements for claims.

Conditions Precedent Before Equity Transfer

Key conditions precedent in the SPA include necessary corporate approvals, regulatory consents, and the absence of material adverse changes. The parties must ensure all contracts, third-party consents, and compliance certificates are executed. Fulfilling these conditions is essential for the lawful and effective transfer of equity shares.

Pricing Adjustments and Closing Mechanisms Tailored for Equity Deals

The SPA outlines price adjustment formulas accounting for variations in net asset value or working capital at closing. Mechanisms such as escrow arrangements or holdbacks may be used to secure potential indemnity claims. This ensures a fair and balanced financial settlement post-transaction.

Restrictions on Transferability of Purchased Shares Post-Closing

The agreement imposes transfer restrictions including lock-in periods, rights of first refusal, or tag-along rights to protect existing shareholders. These provisions regulate the timing and conditions under which purchased shares can be reassigned. They maintain shareholder control and prevent undesirable ownership changes immediately after closing.