A Deed of Trust Document Sample for Mortgage Transactions serves as a legal template outlining the agreement between the borrower, lender, and trustee in securing a loan with real property. This document specifies the terms of repayment, the responsibilities of each party, and the conditions under which the trustee can initiate foreclosure if the borrower defaults. Utilizing a detailed sample ensures clarity and protects the interests of all parties involved in the mortgage process.

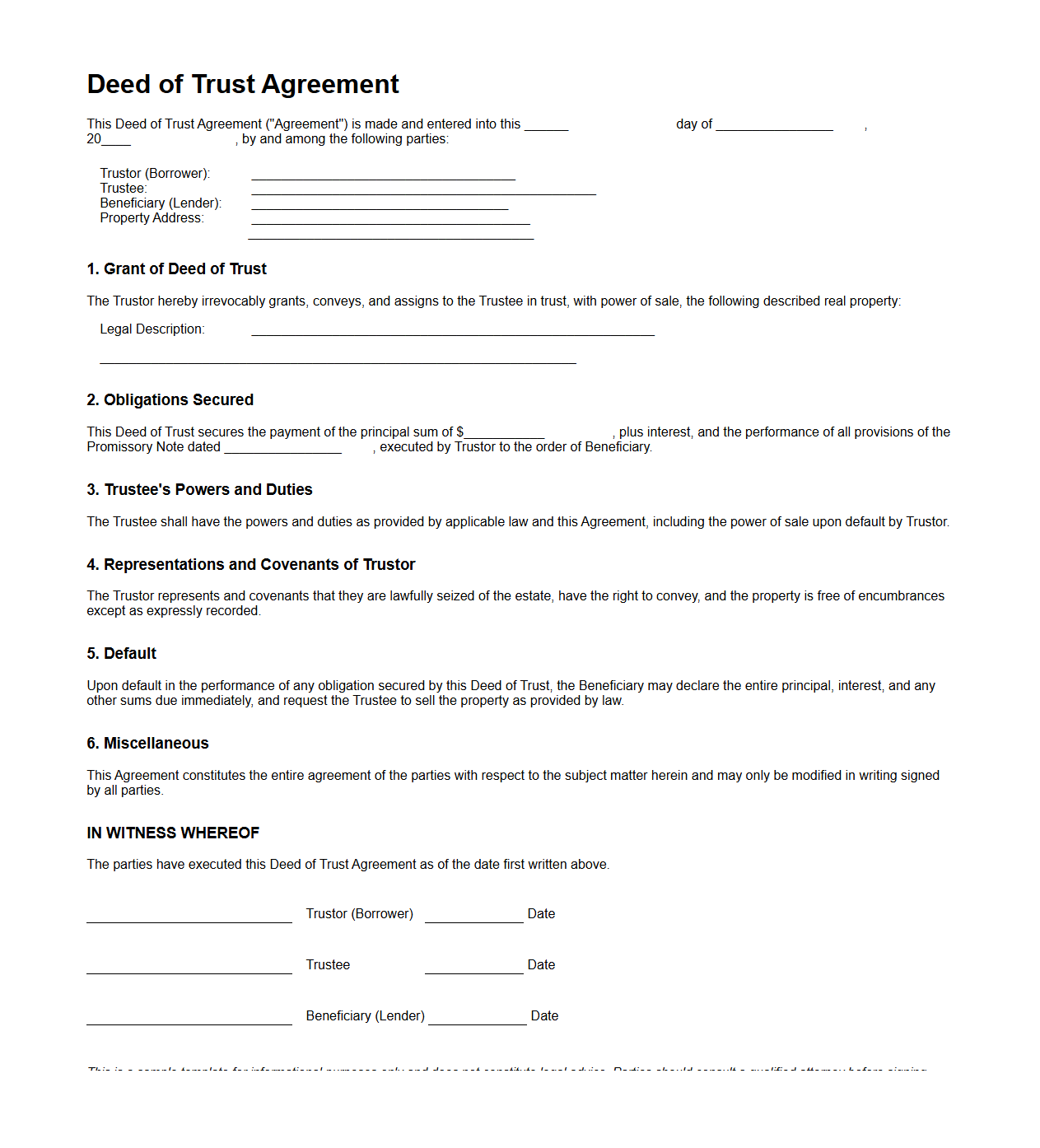

Deed of Trust Agreement Template for Home Purchase

A

Deed of Trust Agreement Template for Home Purchase is a legal document used to outline the terms and conditions between a borrower, lender, and trustee in a real estate transaction. It secures the loan by placing a lien on the property until the debt is fully repaid. This template ensures clarity on payment schedules, interest rates, and responsibilities, protecting all parties involved in the home buying process.

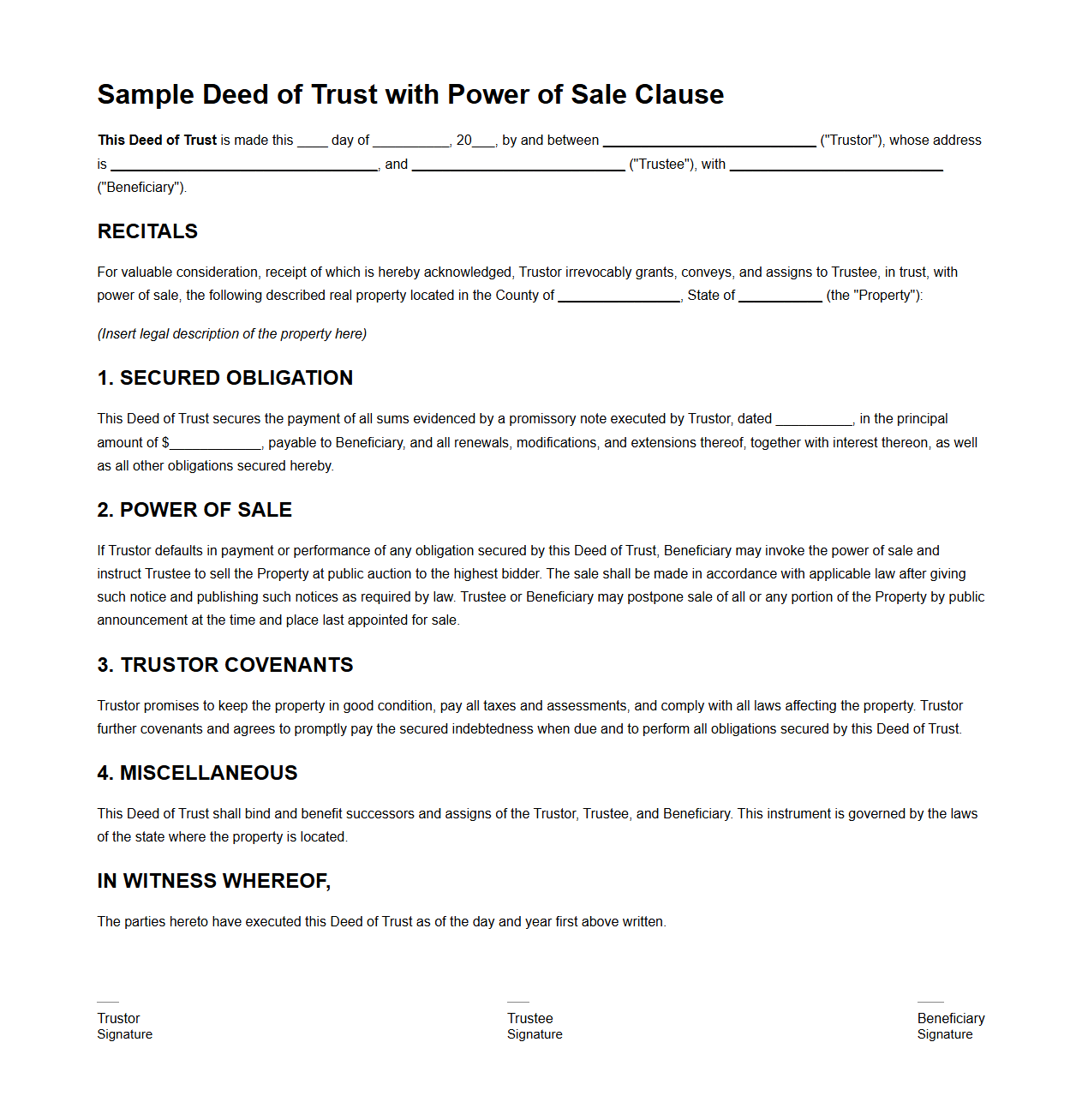

Sample Deed of Trust with Power of Sale Clause

A

Sample Deed of Trust with Power of Sale Clause document serves as a legal instrument used in real estate transactions where the borrower conveys title to a trustee as security for a loan. This document outlines the borrower's obligations and grants the trustee the authority to sell the property without court intervention if the borrower defaults on the loan. It ensures both lender protection and a streamlined foreclosure process under agreed terms.

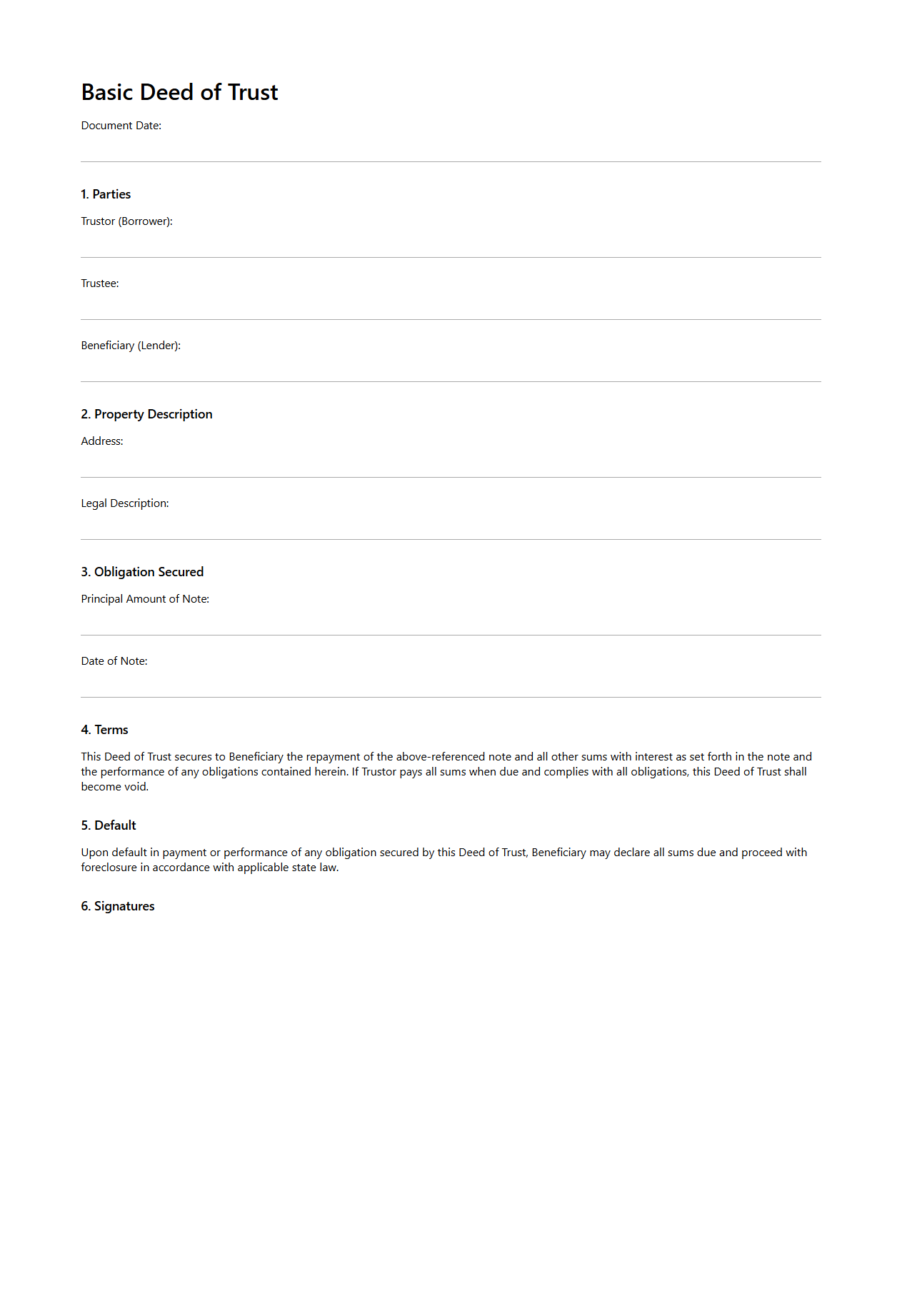

Basic Deed of Trust Form for Mortgage Lending

The

Basic Deed of Trust Form for mortgage lending is a legal document used to secure a loan on real property, transferring the title to a neutral third party known as the trustee. It outlines the borrower's obligations, the lender's rights, and the conditions under which the property can be sold to satisfy the debt if the borrower defaults. This form is essential in establishing the lender's security interest and facilitating the foreclosure process in case of non-payment.

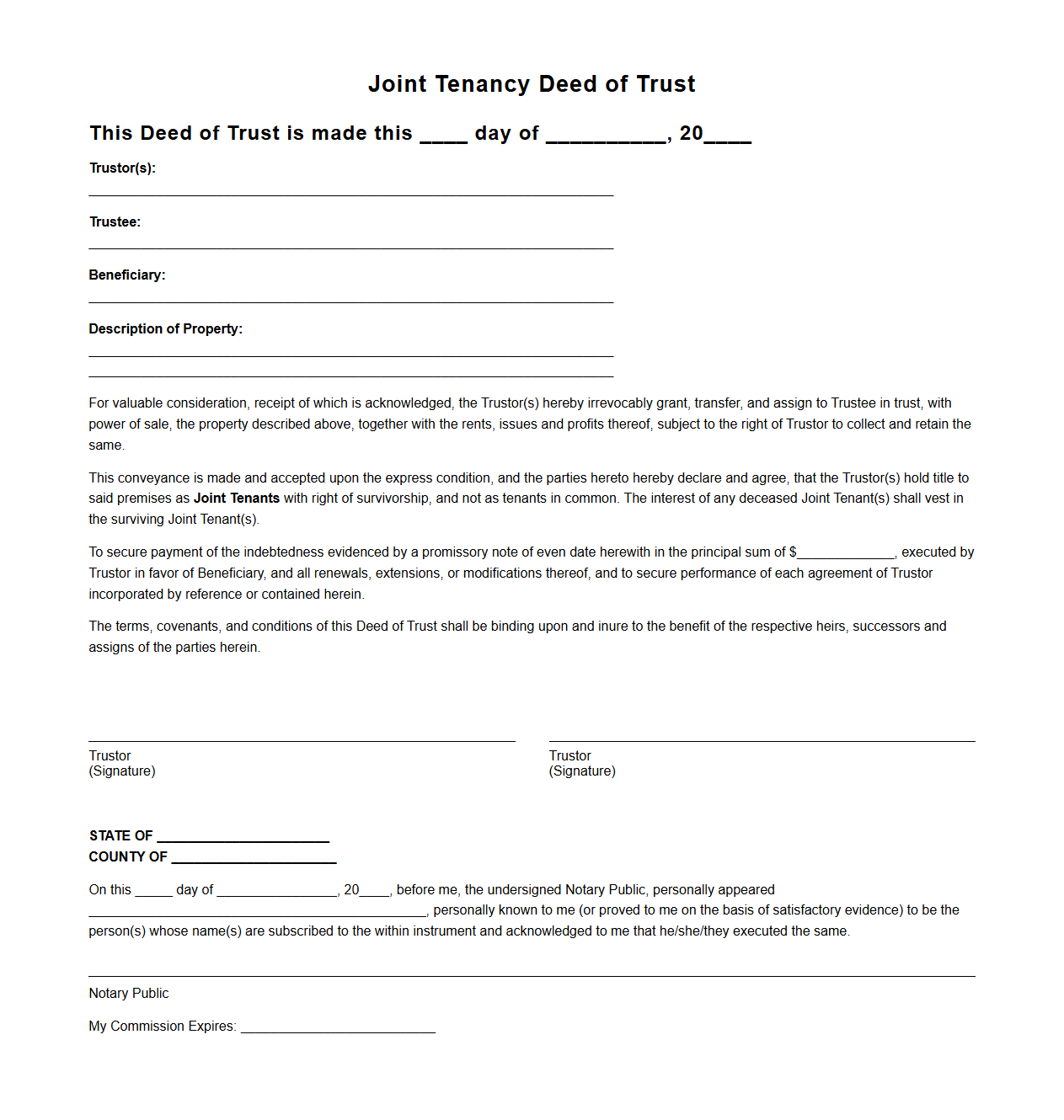

Joint Tenancy Deed of Trust Example

A

Joint Tenancy Deed of Trust is a legal document that establishes shared ownership of property among multiple parties, ensuring equal rights with survivorship benefits. This deed specifies each tenant's interest, responsibilities, and rights regarding the trust property, providing clarity in ownership and management. Such documents are commonly used in real estate transactions to avoid probate and simplify the transfer of ownership upon a tenant's death.

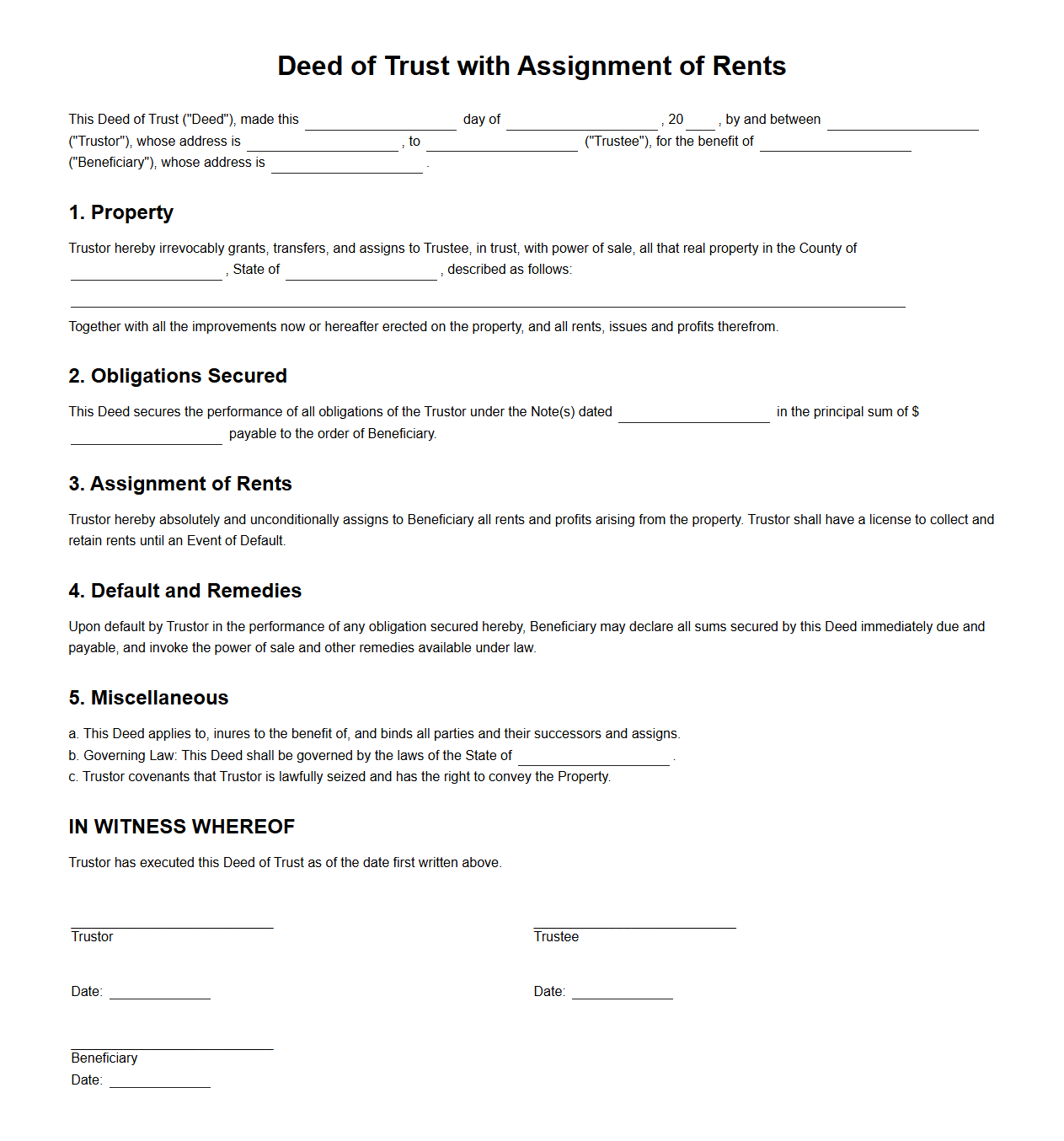

Deed of Trust with Assignment of Rents Template

A

Deed of Trust with Assignment of Rents Template is a legal document used in real estate financing that secures a loan by transferring the property title to a trustee while allowing the lender to collect rental income if the borrower defaults. This template outlines the terms under which the trustee holds the property as security and authorizes the lender to receive rents directly to cover unpaid loan obligations. It protects the lender's interest by ensuring an alternative income stream from the property during default, facilitating loan recovery without immediate foreclosure.

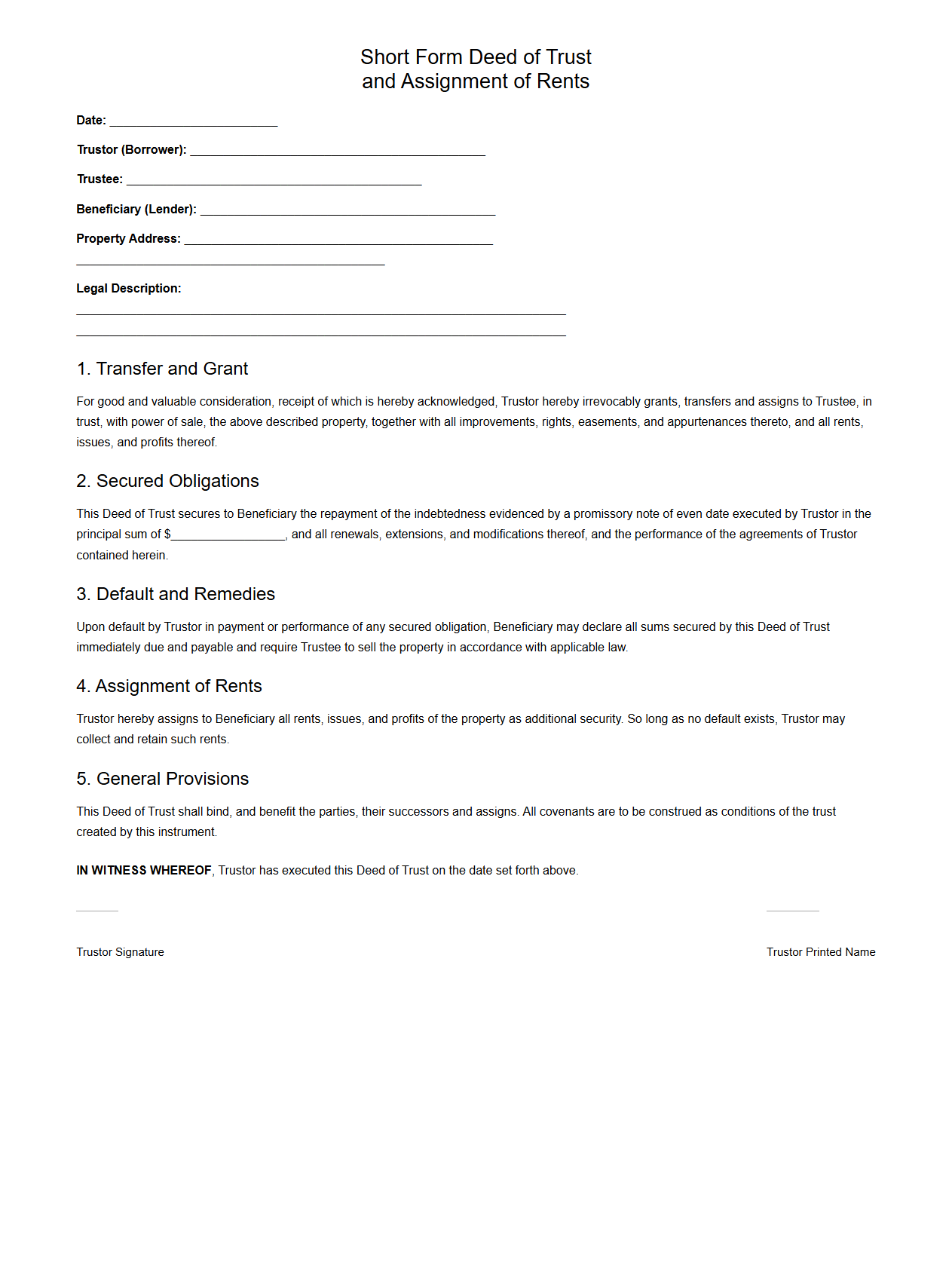

Short Form Deed of Trust for Real Estate Loans

A

Short Form Deed of Trust is a simplified legal document used in real estate loans to secure the borrower's obligation to repay the loan with the property as collateral. It contains essential terms such as the names of the trustor, trustee, and beneficiary, as well as the loan amount and property description, while omitting verbose legal language found in full deeds of trust. This document streamlines the recording process with county offices, ensuring clarity and efficiency in mortgage transactions.

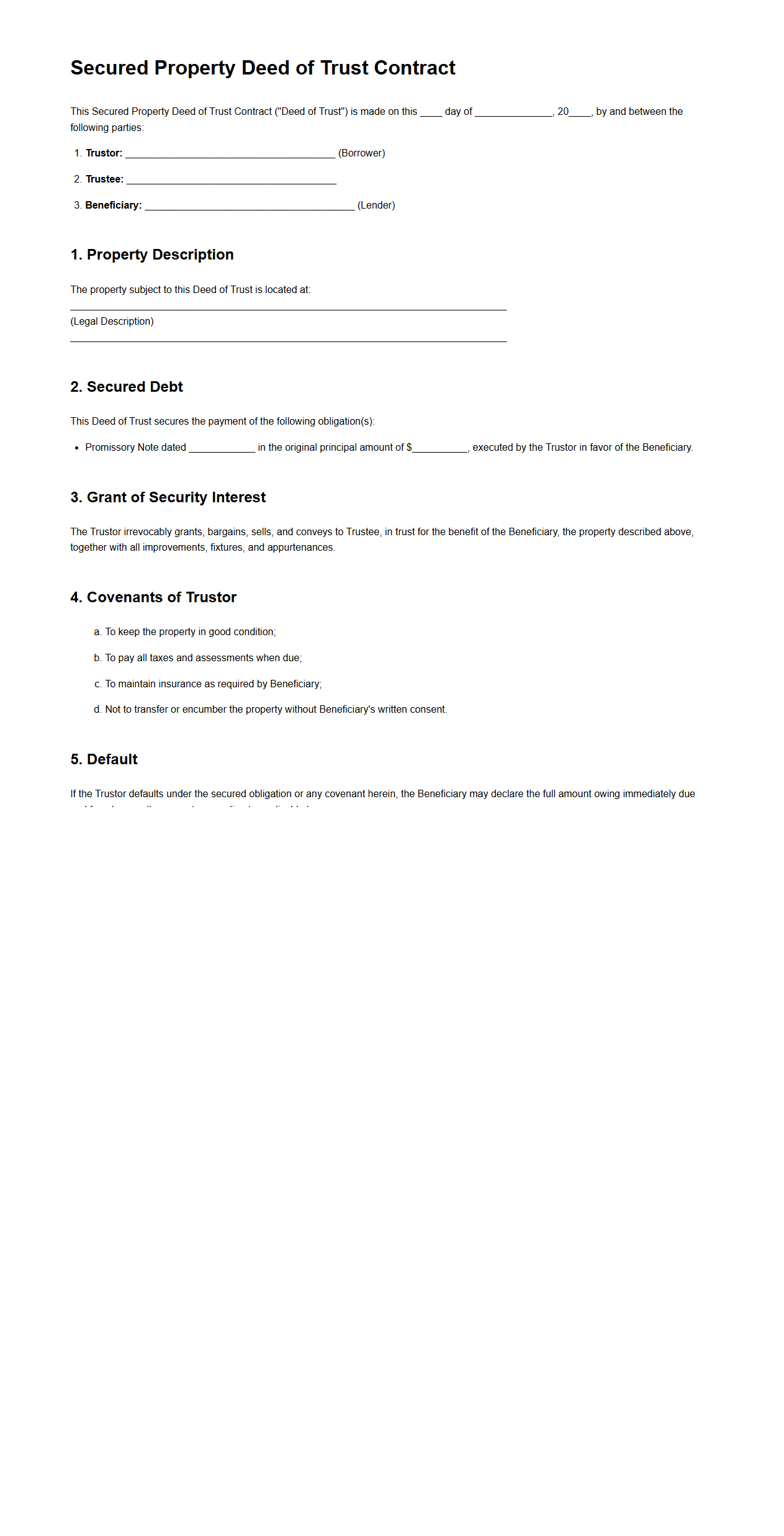

Secured Property Deed of Trust Contract Sample

A

Secured Property Deed of Trust Contract sample document serves as a legal template outlining the agreement between a borrower, lender, and trustee, where real property is used as collateral to secure a loan. This contract specifies the rights and obligations of each party, the loan amount, repayment terms, and conditions under which the lender can initiate foreclosure if the borrower defaults. Utilizing this sample document ensures clarity and legal compliance in property-secured lending transactions.

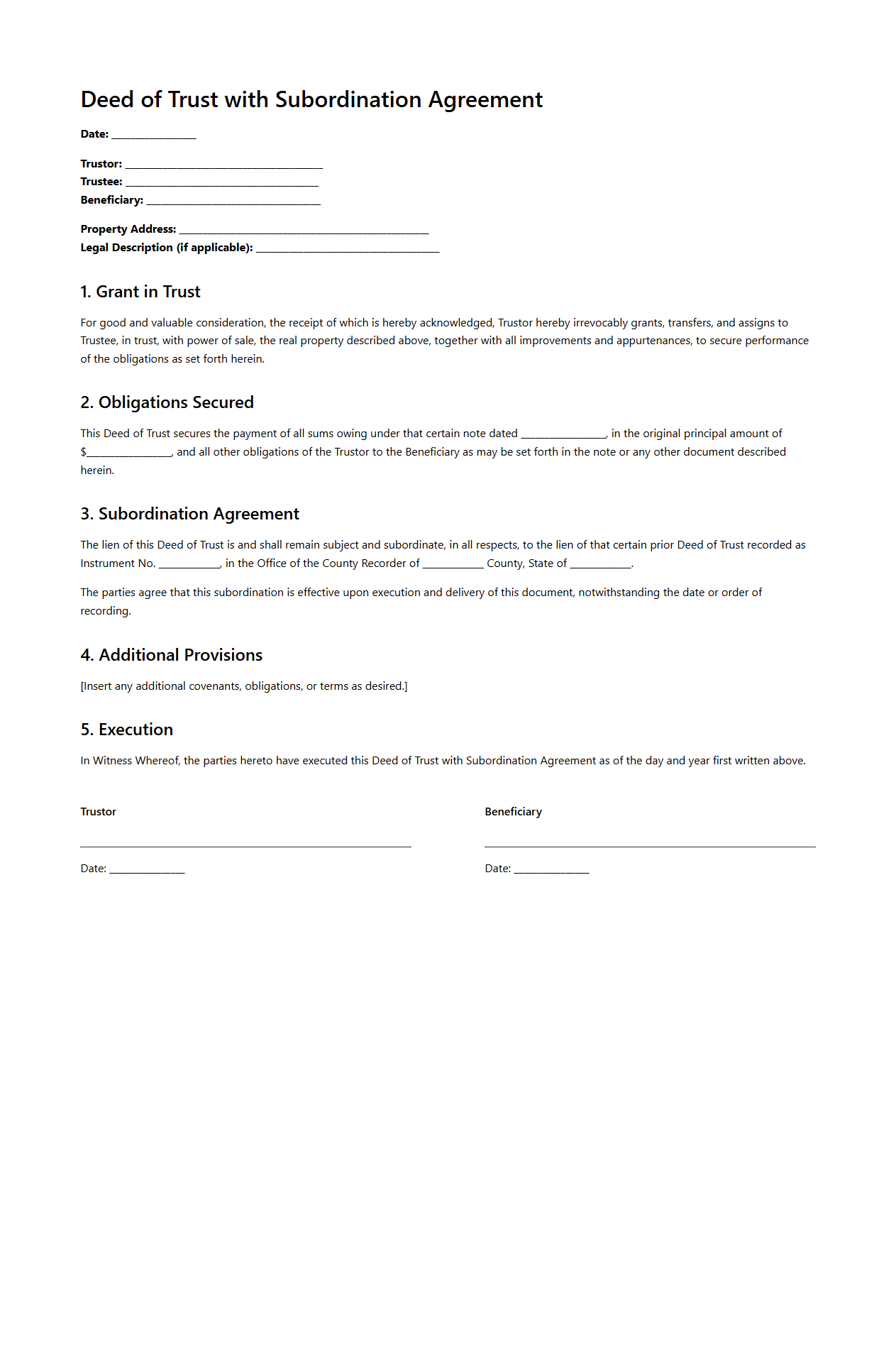

Deed of Trust with Subordination Agreement Example

A

Deed of Trust with Subordination Agreement is a legal document that secures a loan by placing a lien on real property while prioritizing the repayment order among multiple creditors. This agreement explicitly states that one loan will take precedence over another, allowing lenders to manage competing claims on the same asset. For example, if a homeowner refinances their mortgage, the new loan may be subordinated to the original lender's deed of trust to ensure the initial lender retains priority in case of default.

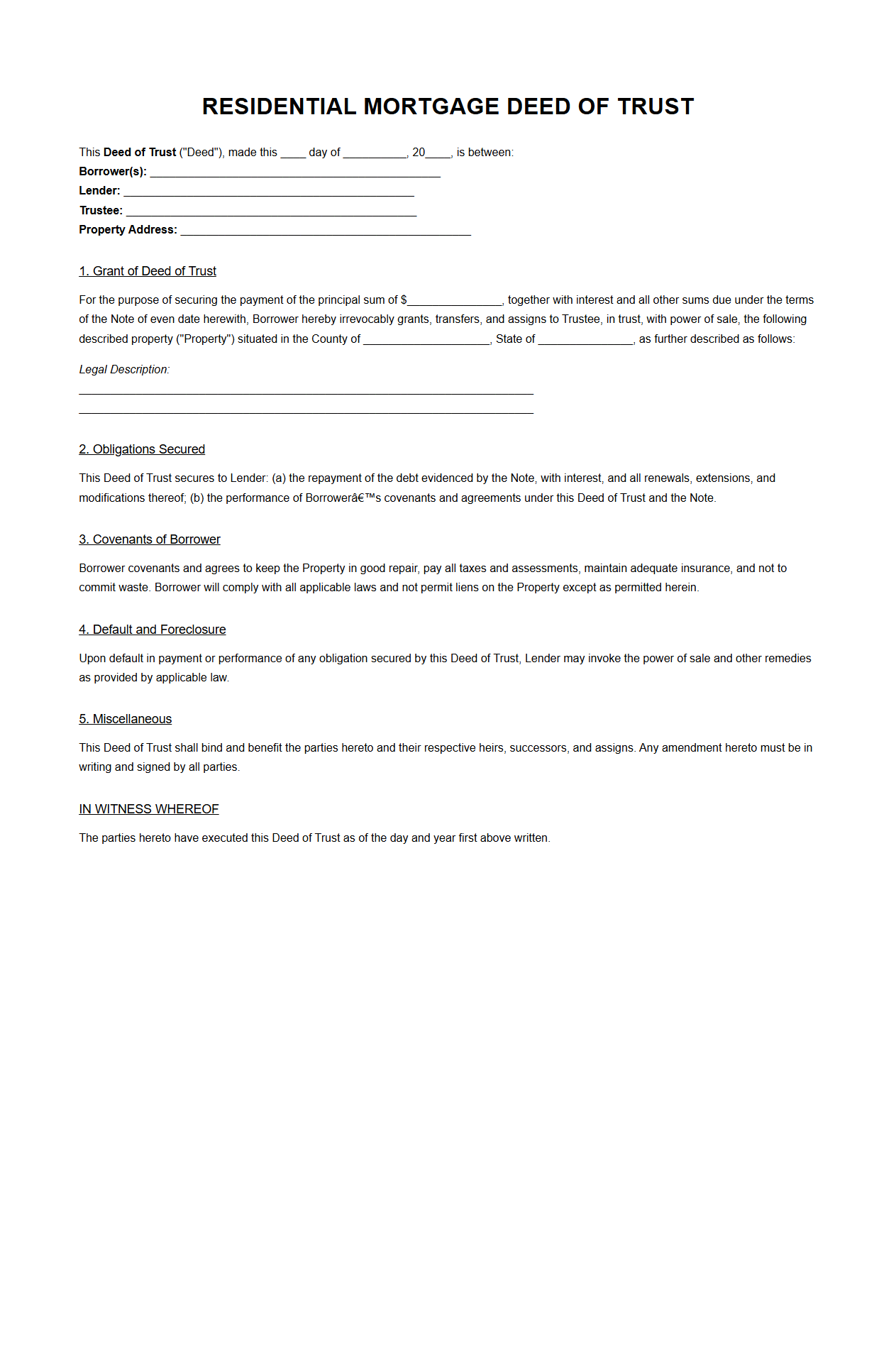

Residential Mortgage Deed of Trust Specimen

A

Residential Mortgage Deed of Trust Specimen document serves as a formal example illustrating the legal framework used in securing a home loan through a deed of trust arrangement. It outlines the roles and obligations of the borrower, lender, and trustee, including terms for repayment, property lien, and foreclosure conditions. This specimen helps borrowers and lenders understand the specific provisions involved in residential mortgage financing and property security interests.

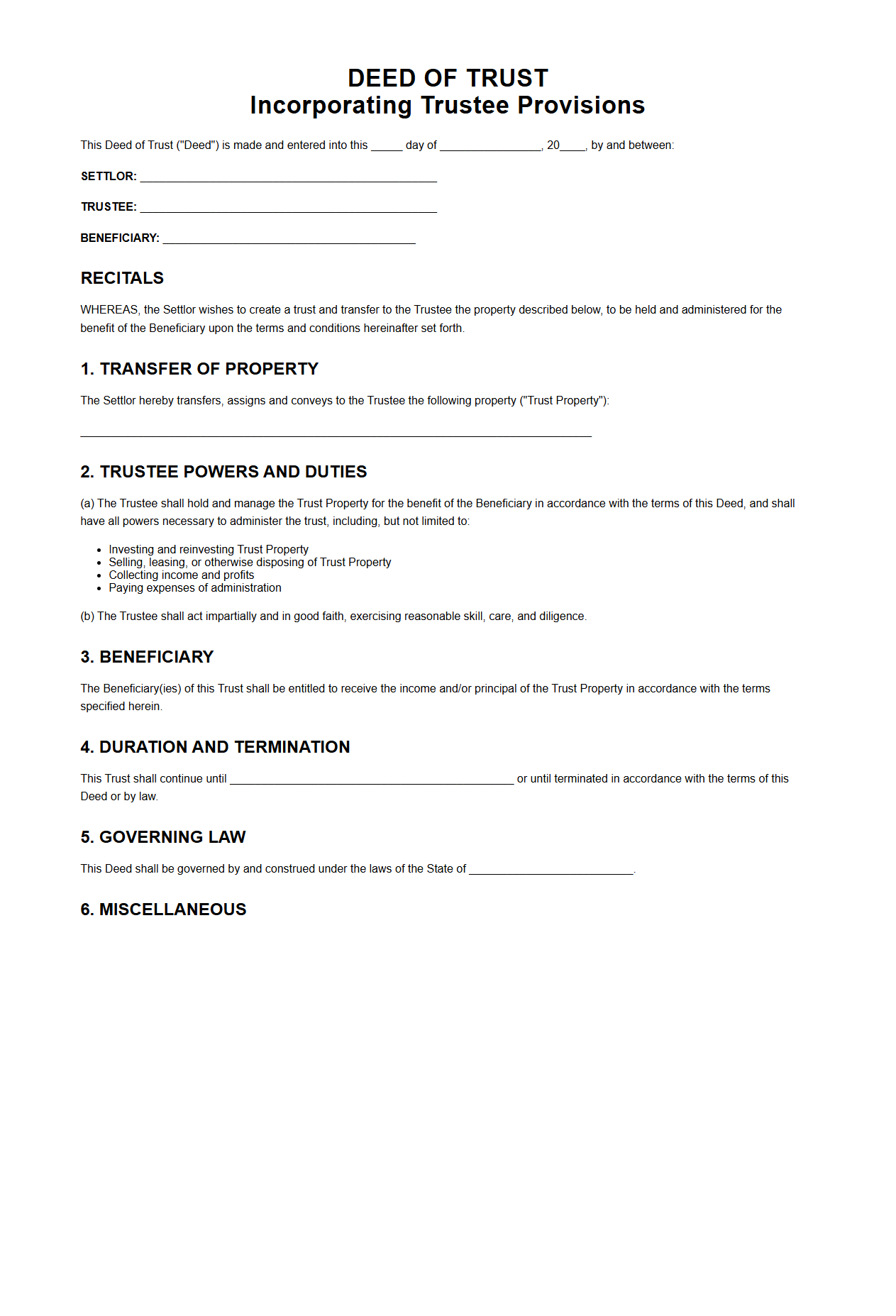

Deed of Trust Incorporating Trustee Provisions

A

Deed of Trust Incorporating Trustee Provisions is a legal document that establishes a trust and outlines the specific powers, duties, and responsibilities of the trustee managing the trust assets. It serves to clearly define the framework within which the trustee operates, ensuring fiduciary obligations are met and providing guidelines for asset management and distribution. This document is crucial for protecting the interests of beneficiaries and maintaining compliance with trust laws.

How does the Deed of Trust outline non-judicial foreclosure procedures?

The Deed of Trust explicitly details the steps for non-judicial foreclosure, allowing the lender to initiate the sale of the property without court intervention. It specifies the notice requirements, including publishing and mailing a notice of default to the borrower. This streamlined process ensures the lender can recover the loan amount efficiently in case of borrower default.

What remedies are specified for Trustee in case of borrower default?

Upon borrower default, the Trustee is authorized to take several remedies including initiating a sale of the secured property. The Deed of Trust empowers the Trustee to collect payments, enforce liens, and ultimately transfer ownership to satisfy the debt. These remedies protect the lender's interest by providing clear enforcement mechanisms.

How are escrow and insurance requirements addressed in the Deed of Trust?

The Deed of Trust mandates that borrowers maintain escrow accounts for taxes and insurance to safeguard the property's value. It requires payment of insurance premiums and property taxes through escrow to prevent lapses. These provisions ensure continuous protection of the property throughout the loan term.

What provisions govern substitution or resignation of the Trustee?

The document includes explicit clauses for the substitution or resignation of the Trustee, allowing for smooth transitions without impacting the foreclosure process. It typically requires a written instrument stating the change, recorded in the appropriate public records. This flexibility maintains the effectiveness of trust administration.

How does the document address release or reconveyance upon loan payoff?

Upon full repayment of the loan, the Deed of Trust stipulates the release or reconveyance of the property title back to the borrower. The Trustee is obligated to execute and record a reconveyance deed to clear the lien. This provision finalizes the borrower's ownership rights, confirming the loan closure.

More Real estate Templates