A Escrow Instructions Document Sample for Real Estate Closing outlines the specific terms and conditions agreed upon by the buyer, seller, and escrow agent to ensure a smooth transaction. It details the responsibilities of the escrow holder, including the handling of funds, documents, and instructions necessary for closing. This document serves as a legally binding guide to finalize the sale while protecting all parties involved.

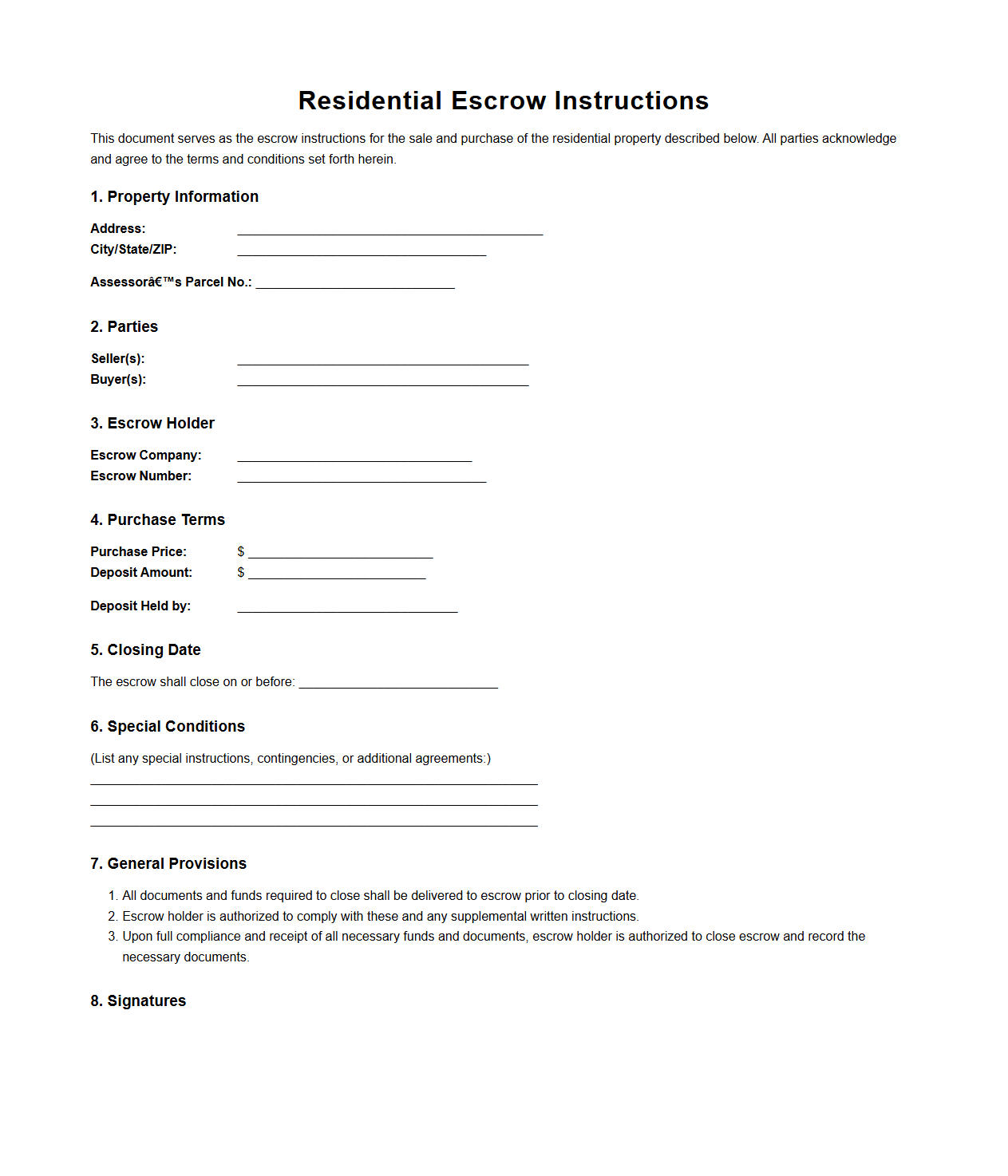

Residential Escrow Instructions Template for Home Sale

A

Residential Escrow Instructions Template for a home sale outlines specific terms and conditions agreed upon by the buyer, seller, and escrow agent to facilitate a smooth property transaction. It details the disbursement of funds, document handling, and contingencies related to inspections, title transfers, and closing requirements. This document ensures clear communication and legal compliance throughout the escrow process, protecting all parties involved.

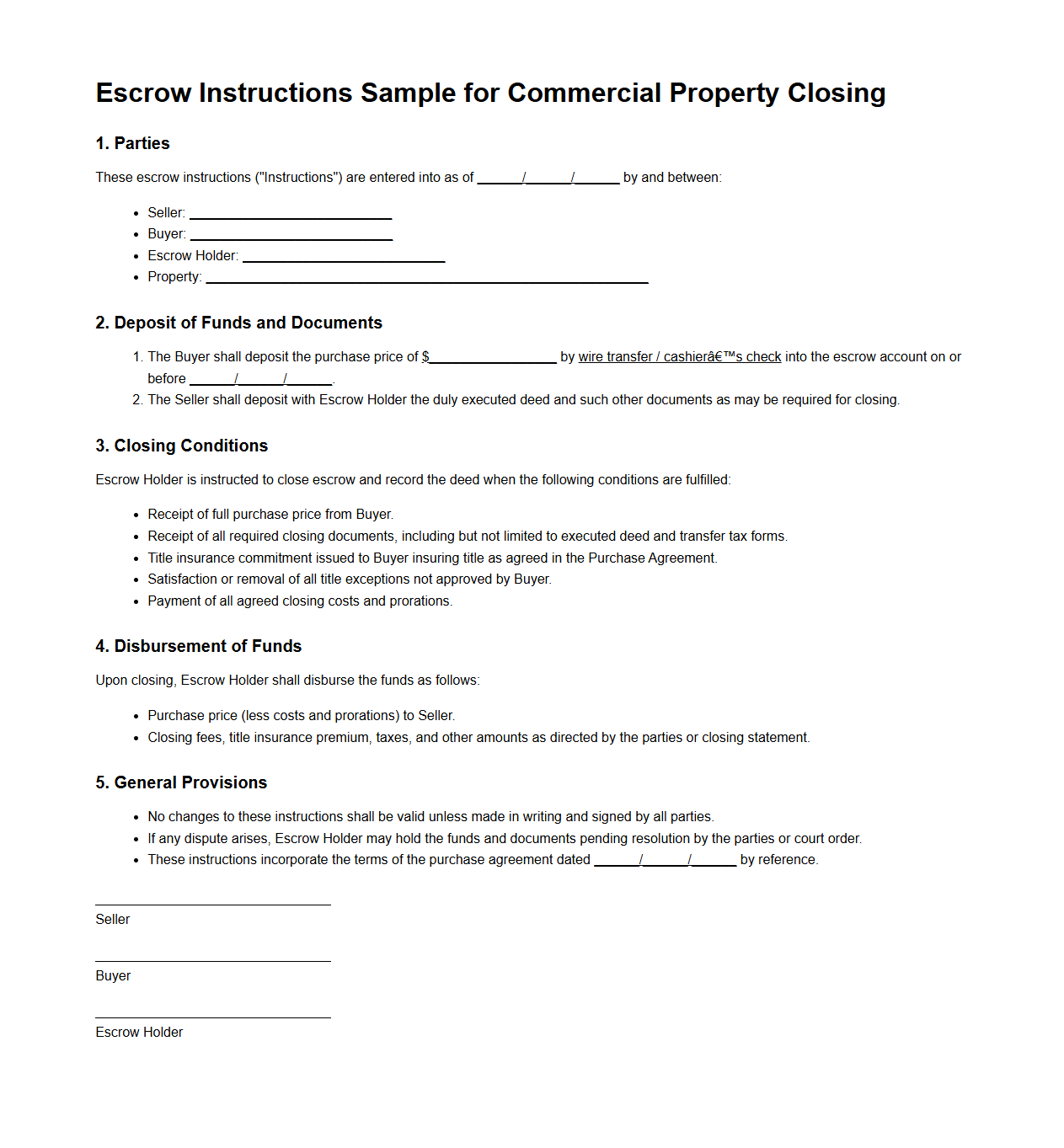

Escrow Instructions Sample for Commercial Property Closing

An

Escrow Instructions Sample for Commercial Property Closing is a detailed document outlining the terms and conditions under which escrow funds and property deeds are held and transferred during the transaction. It specifies the responsibilities of all parties involved, including the buyer, seller, and escrow agent, ensuring that the closing process adheres to legal and financial requirements. This sample serves as a template to prevent disputes and facilitate a smooth, secure transfer of commercial real estate ownership.

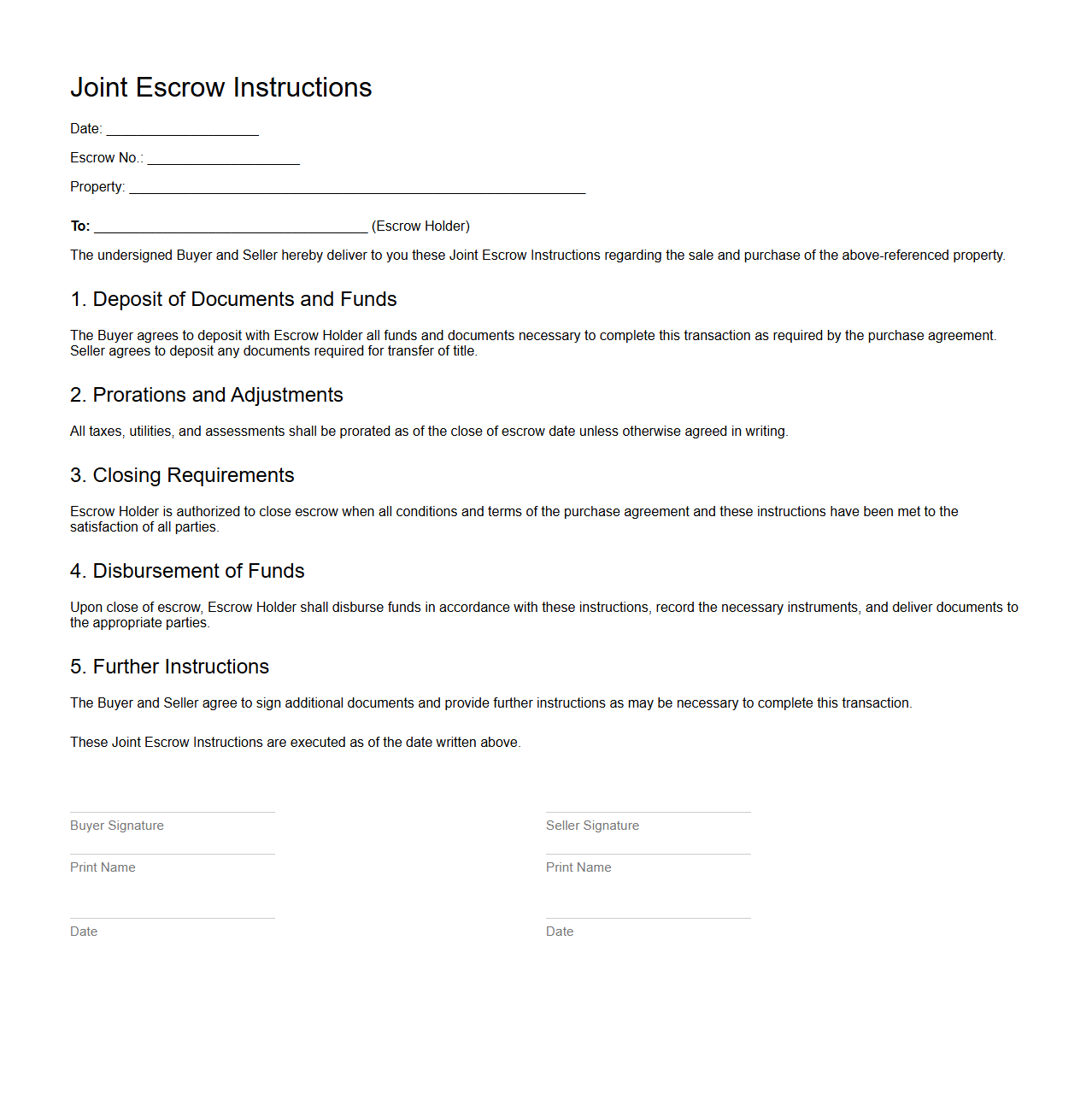

Joint Escrow Instructions for Buyer and Seller

The

Joint Escrow Instructions for Buyer and Seller document outlines the agreed terms and conditions under which an escrow agent will hold and manage funds or property during a real estate transaction. This legally binding agreement ensures both parties' instructions are clearly communicated and followed, minimizing disputes by detailing responsibilities, timelines, and conditions for release of escrowed assets. It serves as a crucial reference to protect the interests of both buyer and seller until the transaction is complete.

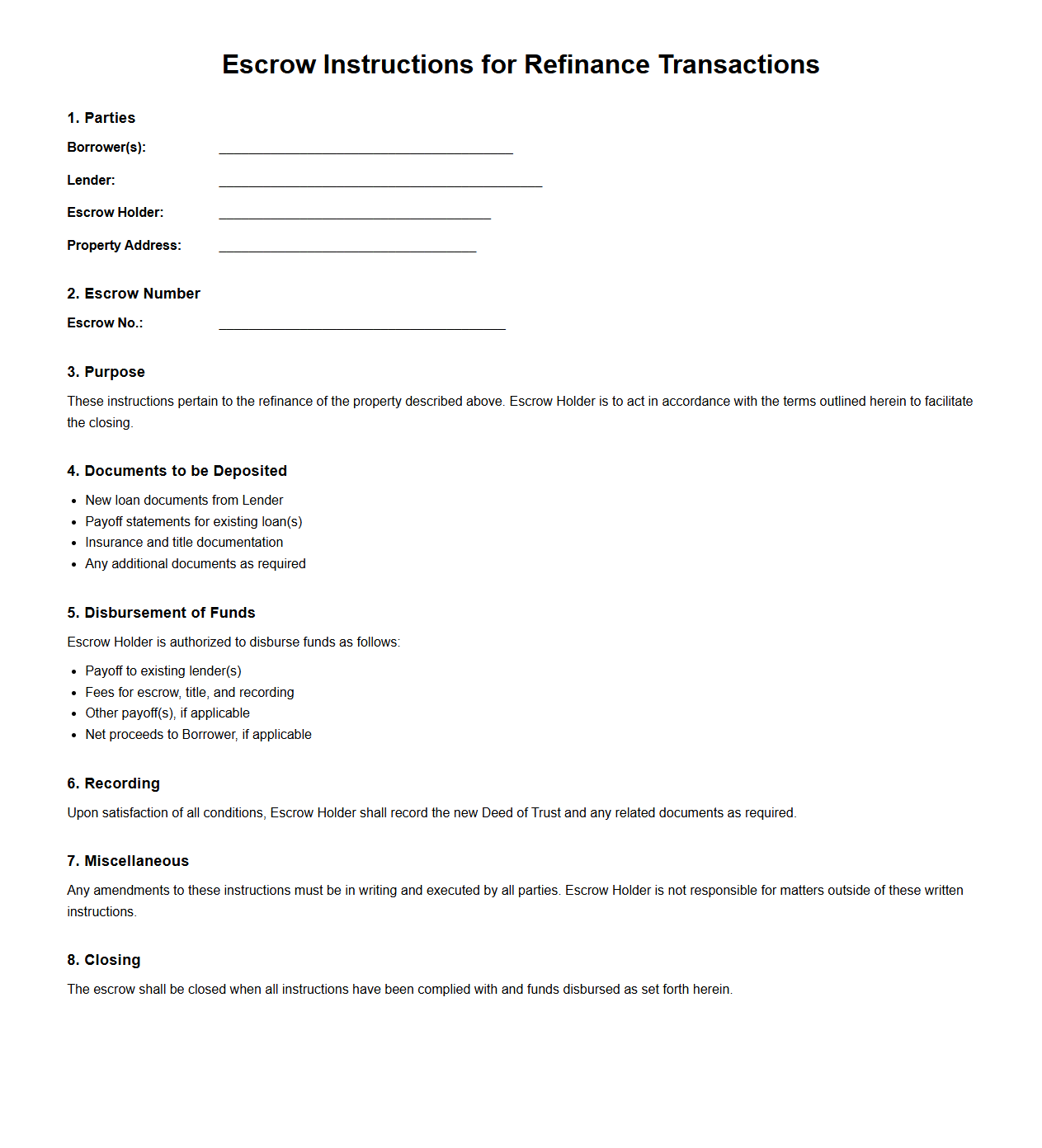

Escrow Instructions for Refinance Transactions

The

Escrow Instructions for Refinance Transactions document outlines the specific guidelines and procedures for managing escrow funds during a mortgage refinance. It details the responsibilities of all parties involved, including the lender, borrower, and escrow agent, ensuring proper handling of payments for taxes, insurance, and other related fees. This document safeguards that funds are correctly disbursed and recorded throughout the refinance process.

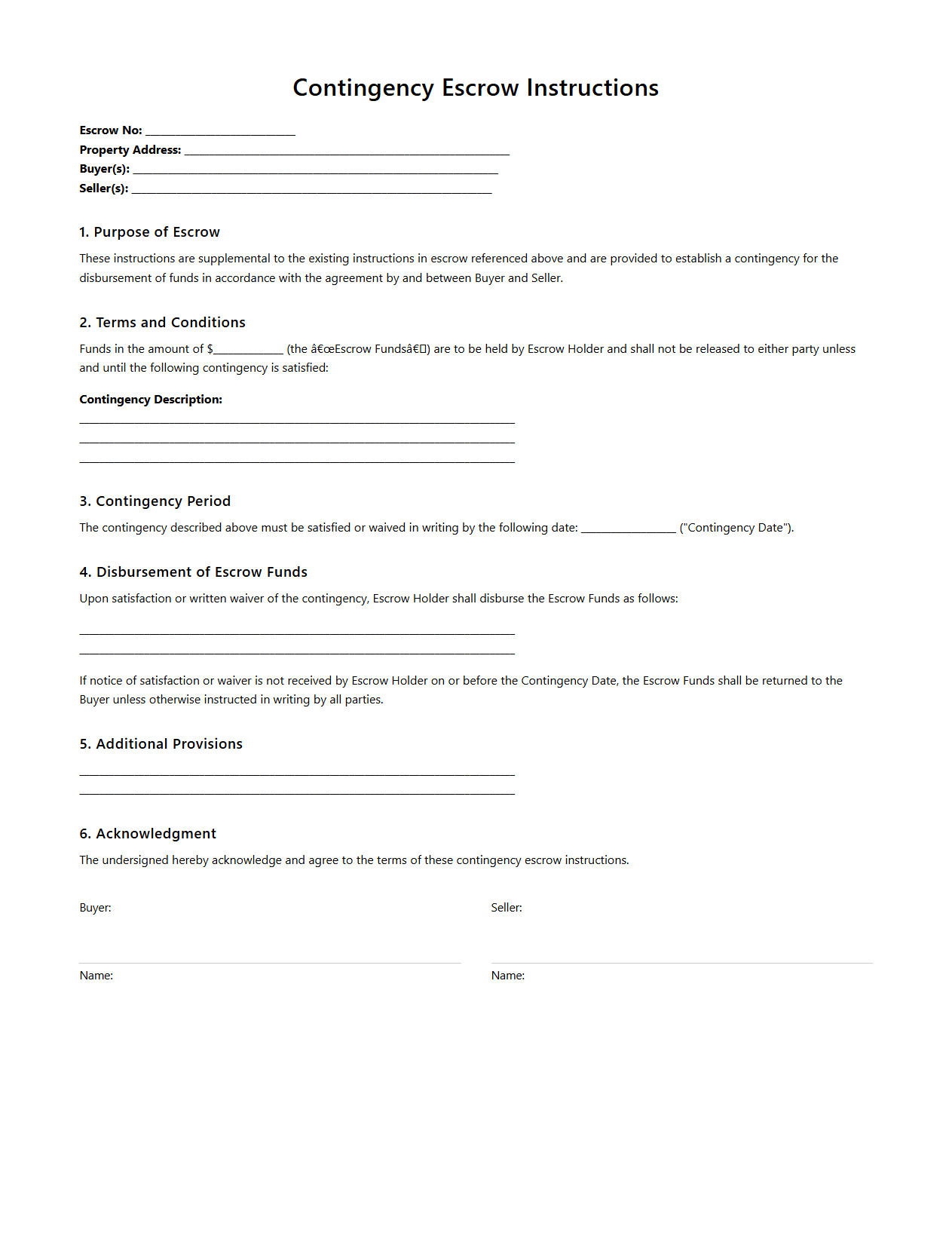

Contingency Escrow Instructions Sample

A

Contingency Escrow Instructions Sample document outlines specific conditions under which escrow funds will be released during a real estate or business transaction. It provides detailed guidelines to ensure all parties meet agreed-upon contingencies, such as inspections, financing, or title clearance, before the escrow agent disburses funds. This document serves as a template to streamline the escrow process and protect stakeholders by clearly defining the terms and procedures for handling escrowed funds.

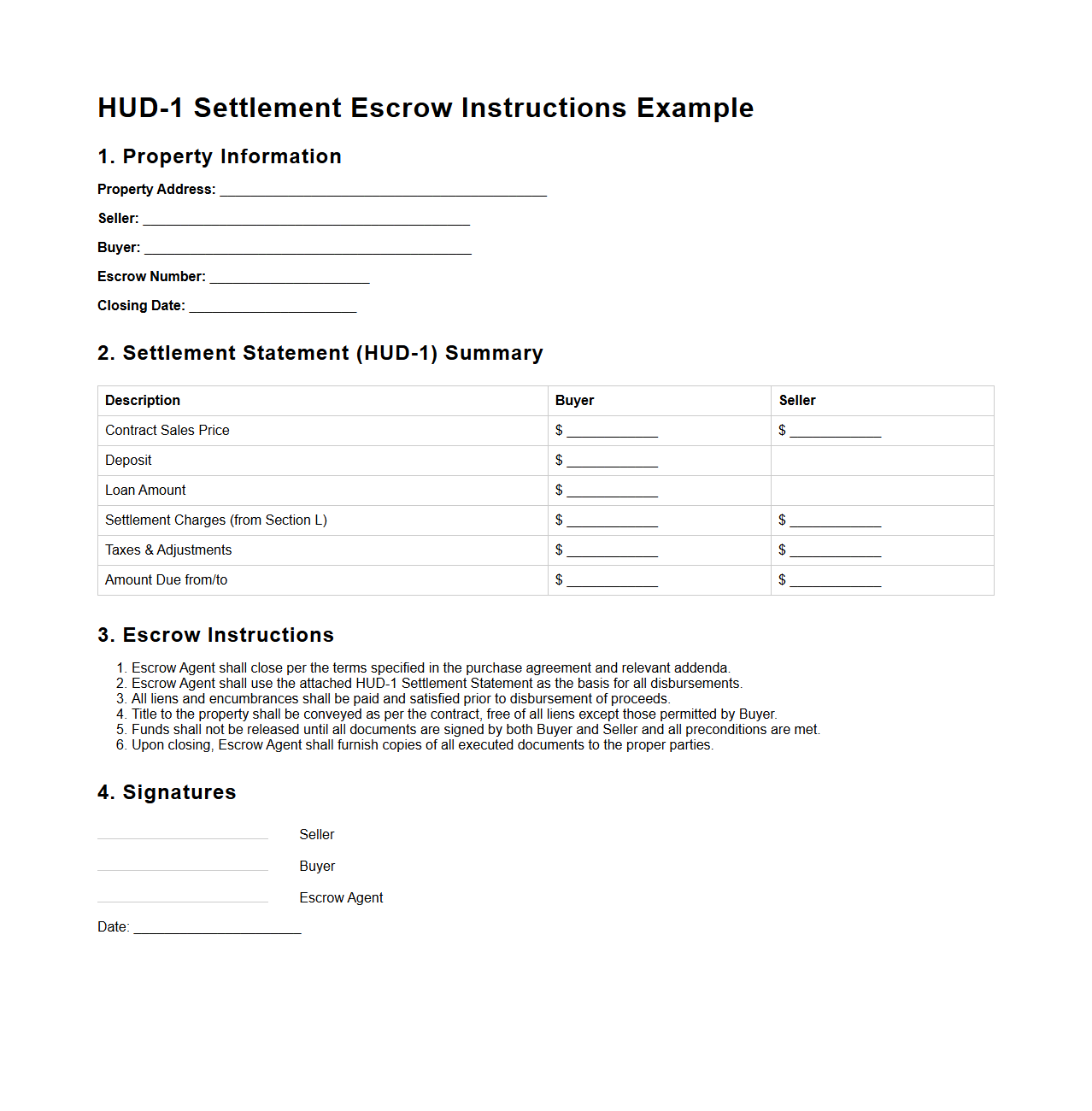

HUD-1 Settlement Escrow Instructions Example

The

HUD-1 Settlement Escrow Instructions Example document provides detailed guidelines for managing escrow accounts during real estate transactions, ensuring all parties understand the allocation of funds related to taxes, insurance, and other closing costs. It serves as a critical reference for lenders, buyers, and settlement agents to accurately process escrow disbursements and maintain compliance with federal regulations. This document helps streamline the closing process by clearly outlining responsibilities and financial obligations.

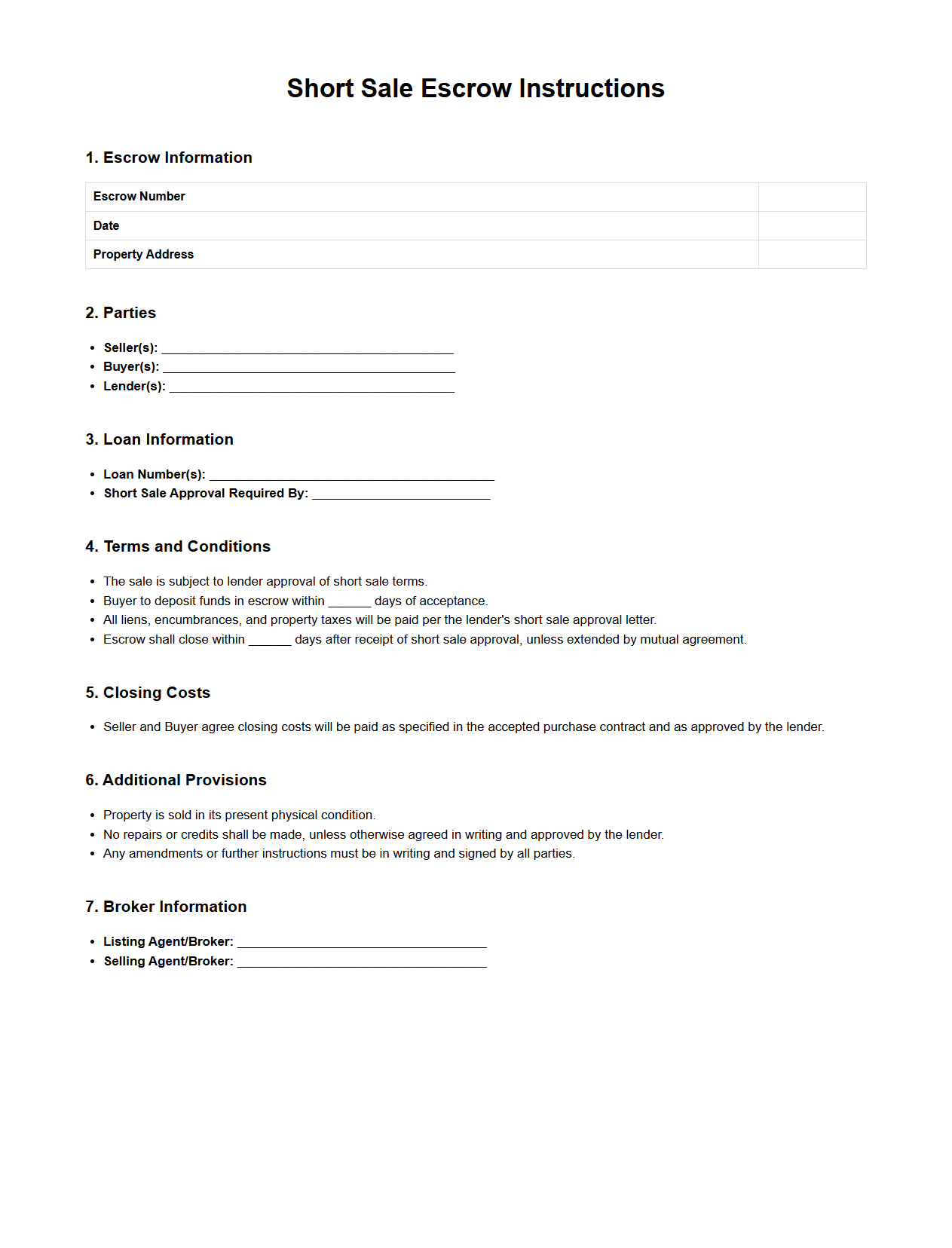

Short Sale Escrow Instructions Template

The

Short Sale Escrow Instructions Template document outlines the specific steps and responsibilities required to manage the escrow process during a short sale transaction. It ensures clear communication between all parties, including the buyer, seller, lender, and escrow agent, by detailing how funds are to be handled and disbursed. This template is essential for preventing misunderstandings and facilitating a smooth, legally compliant closing.

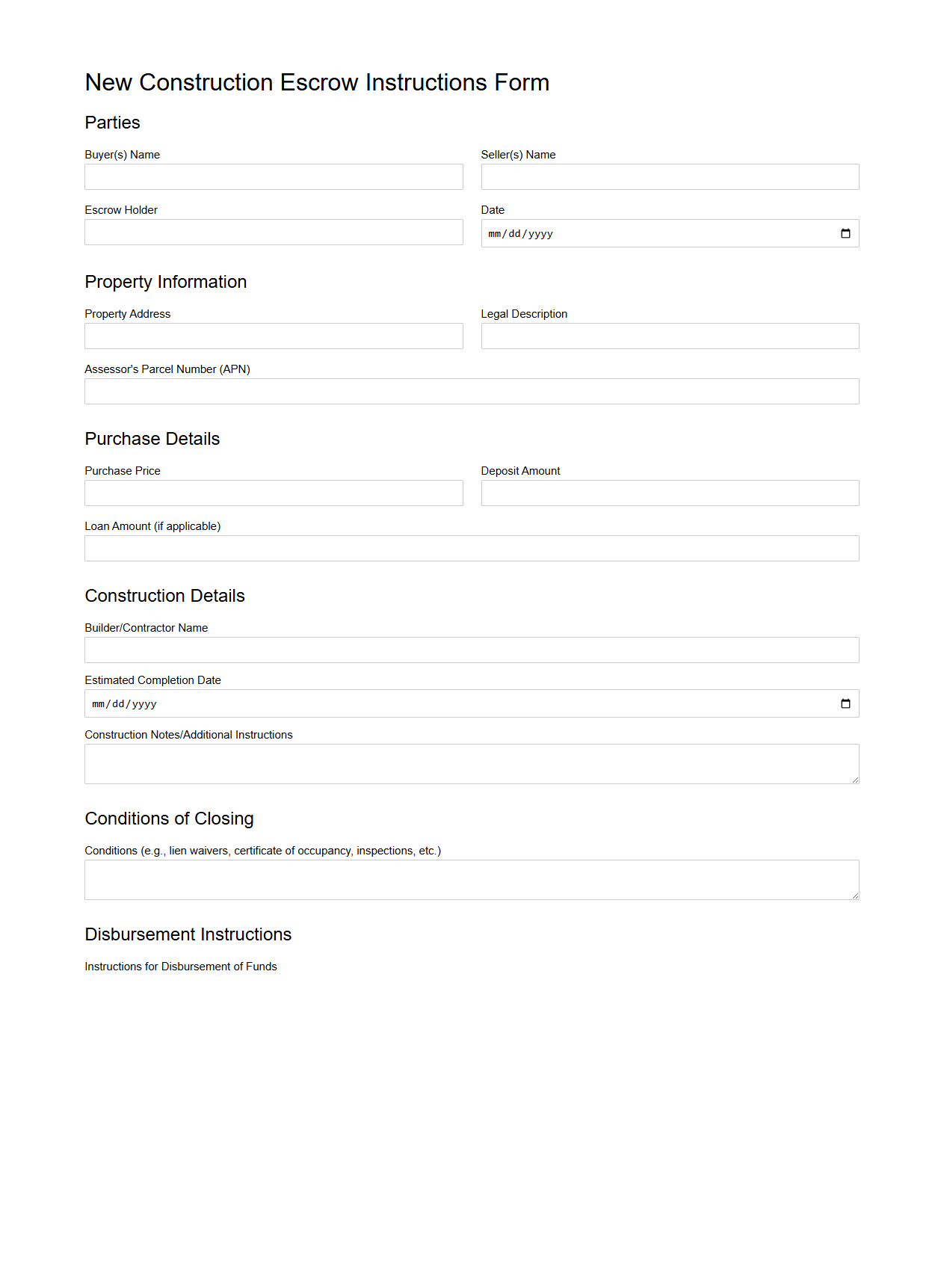

New Construction Escrow Instructions Form

The

New Construction Escrow Instructions Form is a legal document used to outline the specific terms and conditions under which funds will be held in escrow during a new construction project. This form details the responsibilities of the buyer, seller, and escrow agent, ensuring the secure handling of payments tied to project milestones or completion. It serves to protect all parties by clearly defining disbursement procedures, timelines, and requirements related to the construction contract.

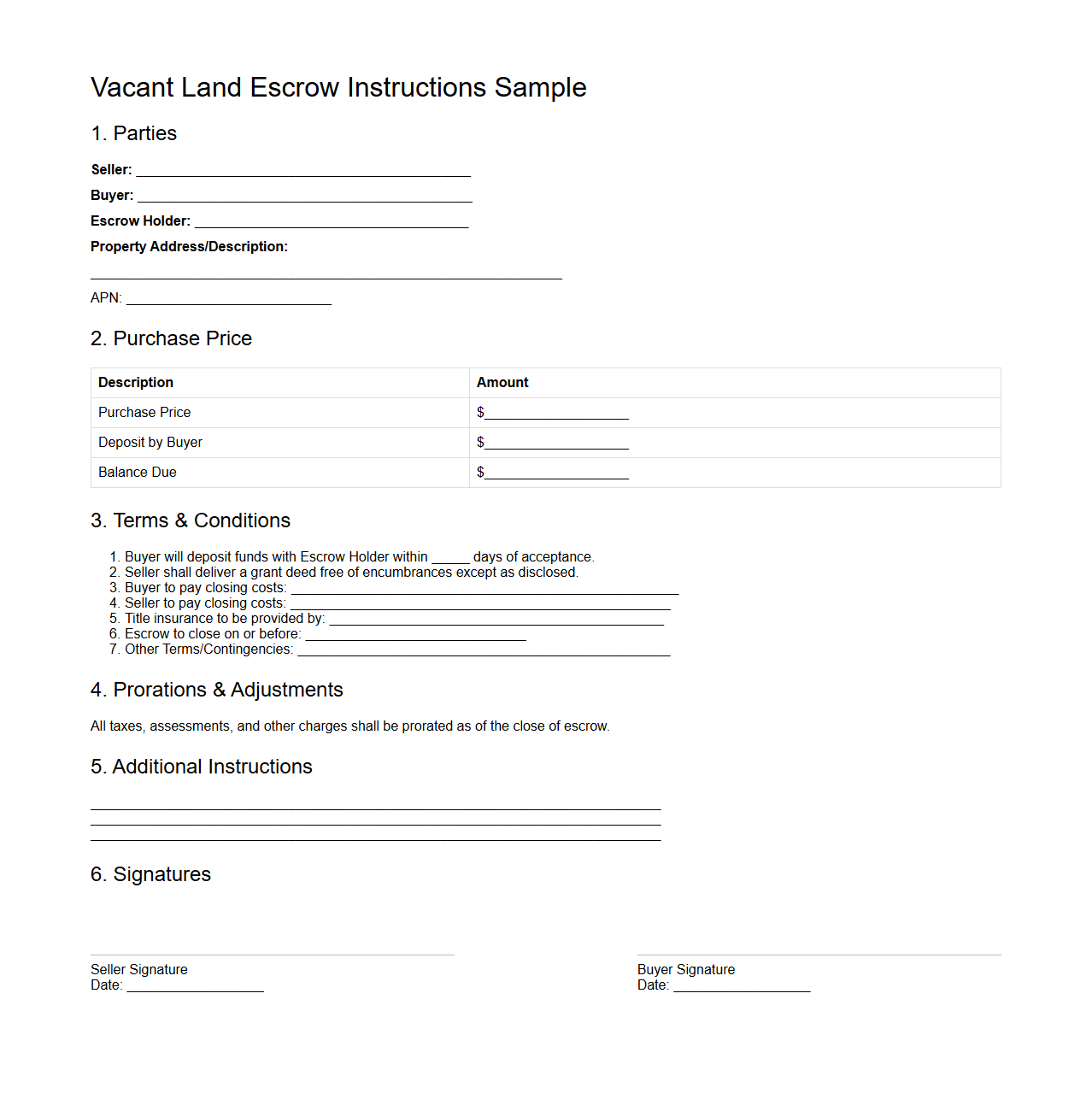

Vacant Land Escrow Instructions Sample

A

Vacant Land Escrow Instructions Sample document serves as a detailed guide outlining the terms and conditions for managing funds and documents during the sale of undeveloped property. This document ensures all parties--buyer, seller, and escrow agent--clearly understand their obligations, payment schedules, and contingencies related to the transaction. It helps facilitate a smooth closing process by providing standardized instructions tailored specifically for vacant land transactions.

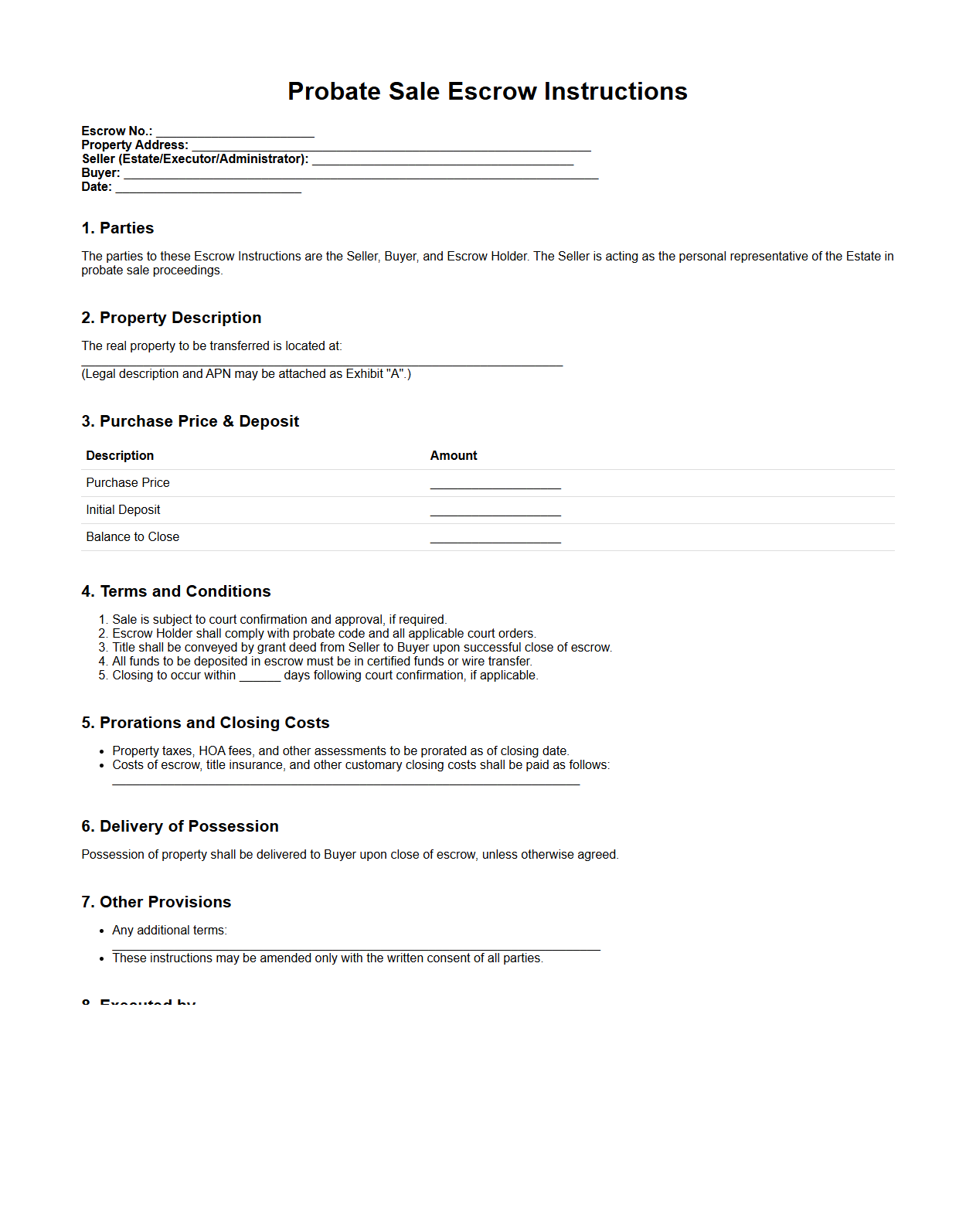

Probate Sale Escrow Instructions Document

The

Probate Sale Escrow Instructions Document is a legal paper used to provide detailed guidelines for handling the escrow process during the sale of a property under probate. It outlines specific terms for disbursement of funds, clearance of liens, and adherence to court orders, ensuring the transaction complies with probate law. This document is essential for protecting the interests of the estate, heirs, and buyers by clearly defining roles and responsibilities throughout the escrow period.

What are the key disbursement conditions specified in the Escrow Instructions Document?

The key disbursement conditions in the Escrow Instructions Document ensure that funds are only released upon the satisfactory completion of agreed-upon requirements. These typically include the confirmation of clear title, completion of all contractual obligations, and receipt of all necessary documentation. Compliance with these conditions safeguards all parties and guarantees a secure transaction process.

How does the Escrow Instructions Document address unresolved title issues?

The Escrow Instructions Document mandates that any unresolved title issues must be cleared prior to the disbursement of funds. It requires proper documentation proving the resolution of title defects or encumbrances. This protects the buyer from taking ownership of a property with legal complications.

What timelines for document delivery are enforced in the escrow instructions?

The escrow instructions specify strict timelines for document delivery to keep the transaction on schedule. Timely submission of required documents is critical to avoid delays in fund release. Typically, these deadlines are clearly outlined to ensure all parties adhere to the agreed-upon closing date.

How are amendments or addenda to the escrow instructions processed?

Any amendments or addenda to the escrow instructions must be documented in writing and agreed upon by all parties involved. This process ensures transparency and legal compliance for any changes made after the initial agreement. Proper documentation prevents misunderstandings and enforces the updated terms during the escrow period.

Which parties must provide written authorization for escrow fund release per the document?

The written authorization for releasing escrow funds generally must come from all principal parties involved, such as the buyer, seller, and escrow agent. This collective consent ensures that funds are disbursed only when all contractual conditions are met. It serves as a critical safeguard to maintain trust and accountability in the transaction.

More Real estate Templates