A Credit Memo Document Sample for Retail provides a clear template for merchants to issue refunds or adjust invoices efficiently. This document outlines essential details such as customer information, reason for credit, item descriptions, and the amount credited, ensuring transparency and accuracy. Using a standardized sample helps retail businesses streamline their credit processes and maintain accurate financial records.

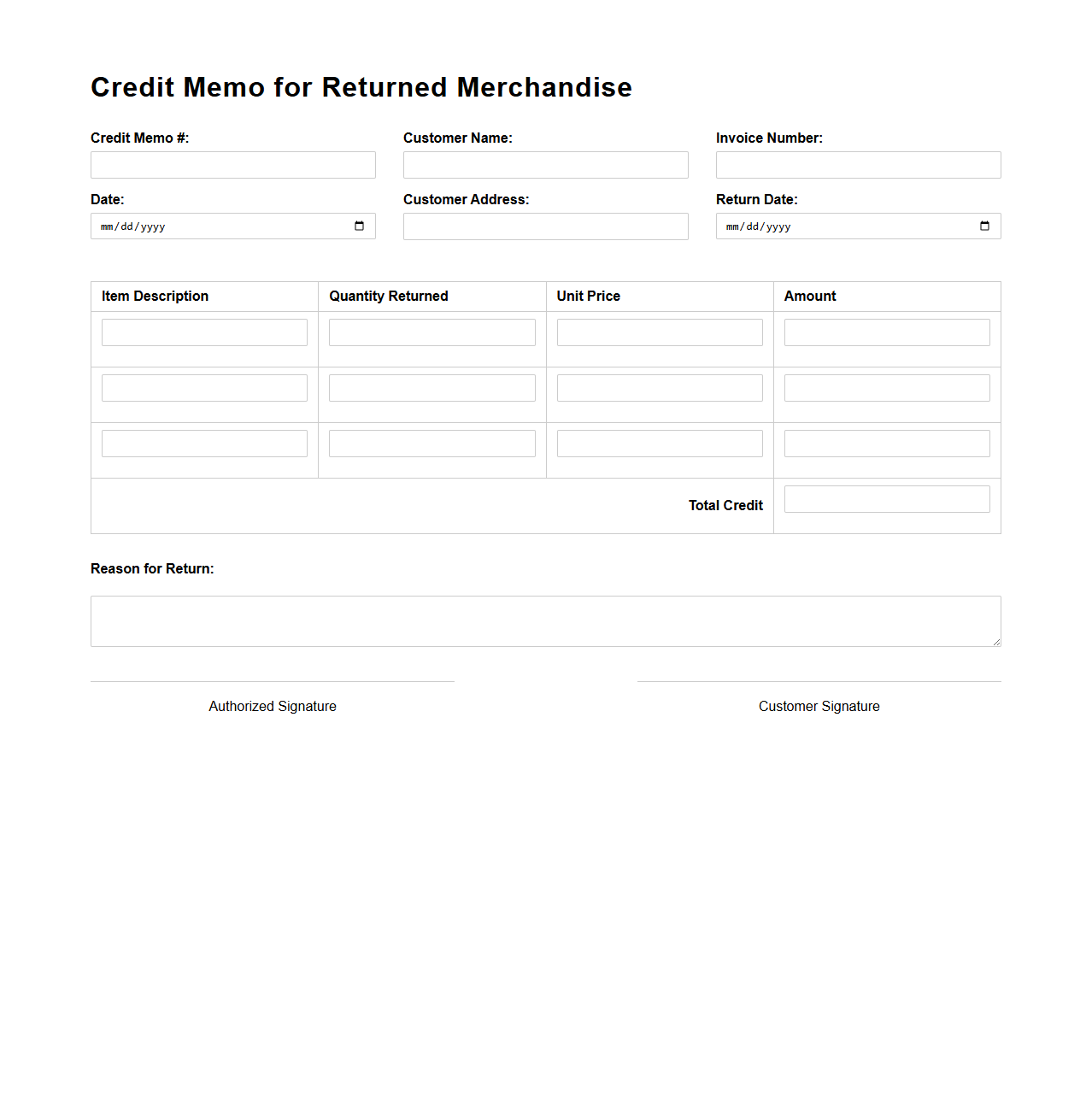

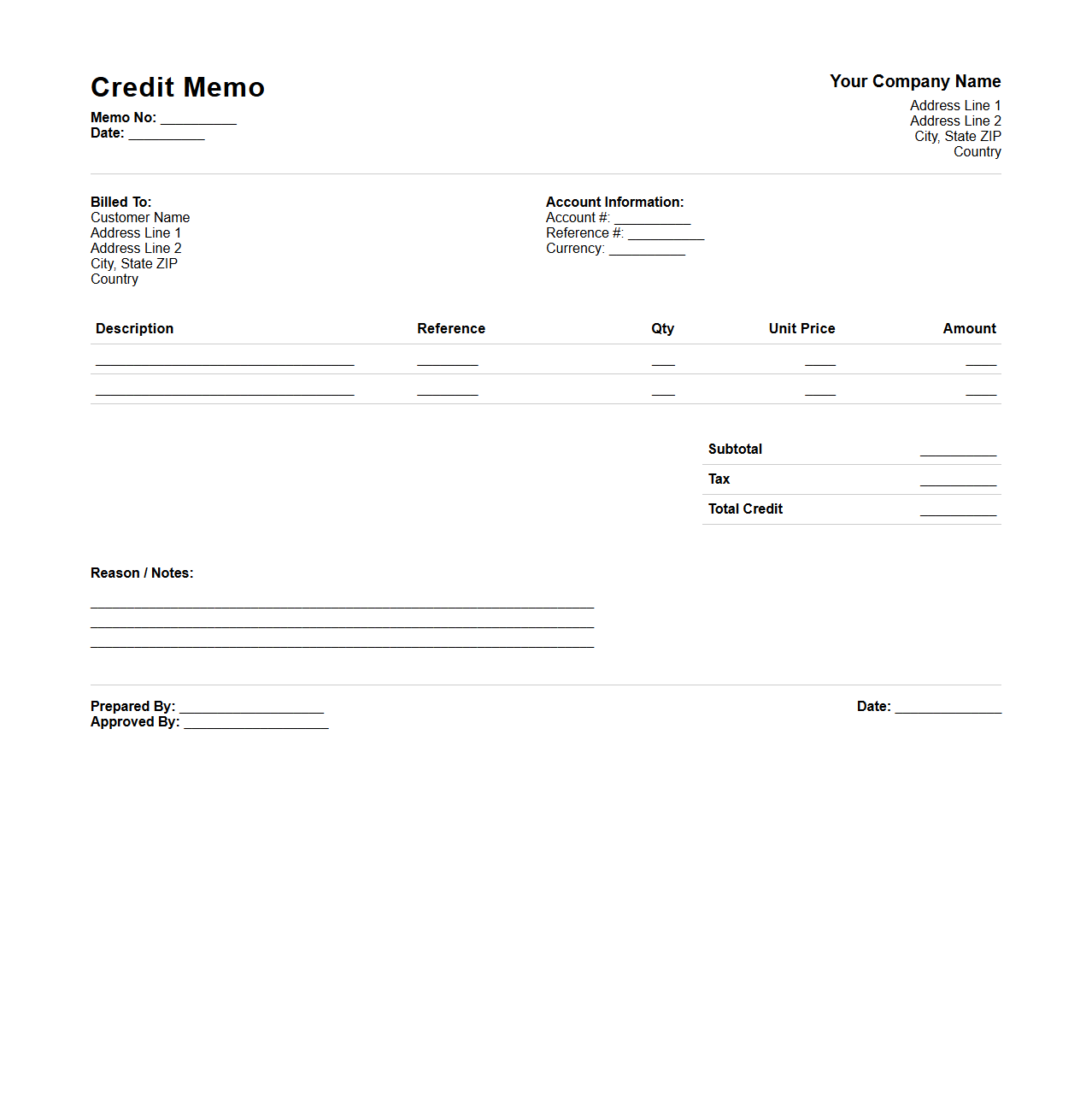

Credit Memo Template for Returned Merchandise

A

Credit Memo Template for Returned Merchandise is a pre-designed document used by businesses to formally acknowledge the return of products from customers and to adjust the customer's account accordingly. This template typically includes details such as the customer's information, return date, items returned, quantities, reason for the return, and the credit amount issued. Using a standardized credit memo template streamlines the return process, improves record-keeping accuracy, and ensures clear communication between the seller and customer.

Credit Memo Example for Damaged Goods

A

Credit Memo for Damaged Goods is a document issued by a seller to a buyer, acknowledging the return or discount due to products received in a damaged condition. It formally adjusts the buyer's account balance by reducing the amount owed, reflecting the value of the damaged items. This document includes details such as original invoice number, product description, damage reason, quantity, and the credit amount issued.

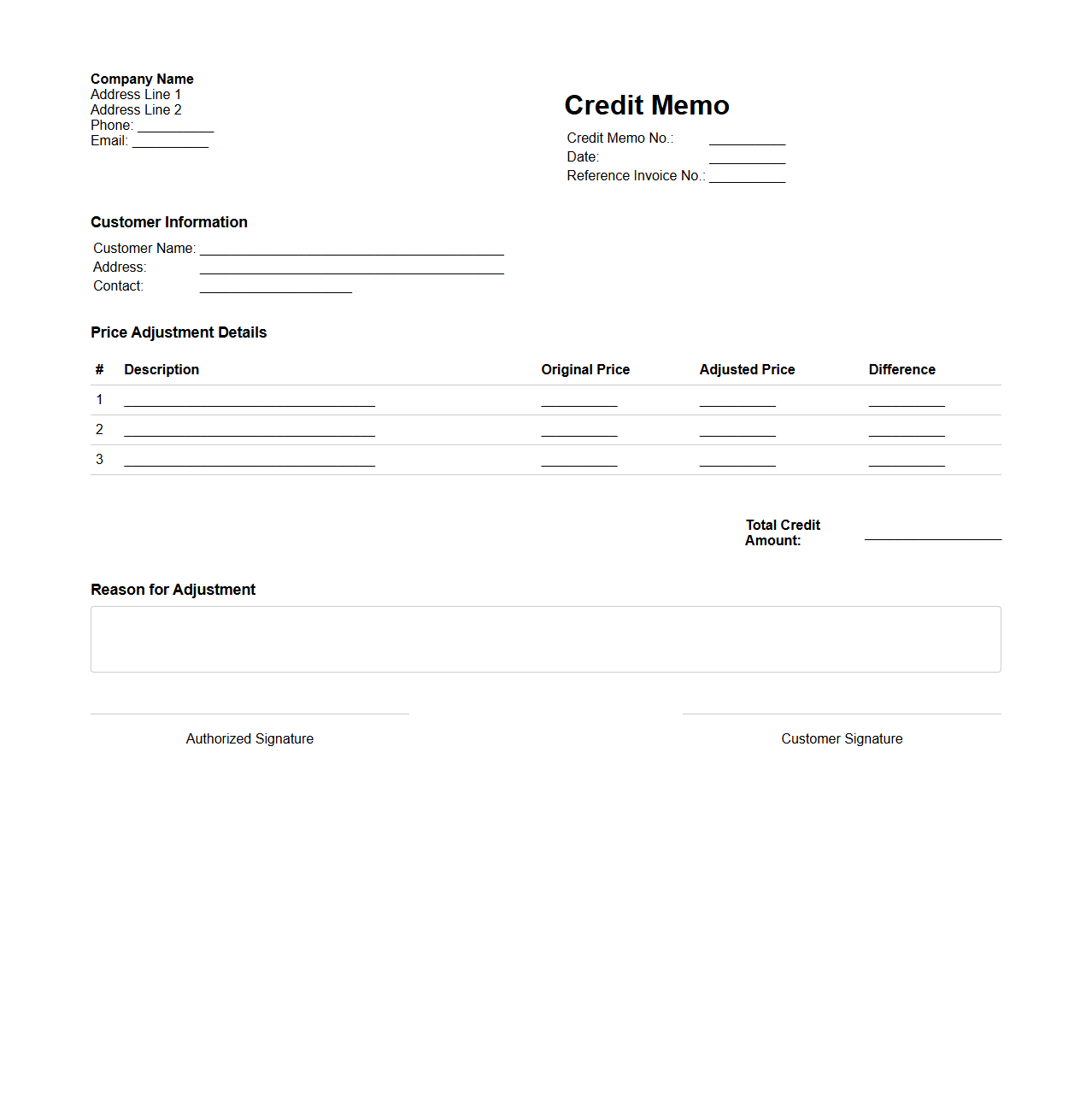

Credit Memo Format for Price Adjustment

A

Credit Memo Format for Price Adjustment document serves as an official record to correct billing discrepancies by adjusting the price of previously invoiced goods or services. It clearly outlines the original invoice details, the reason for the price adjustment, and the revised amounts to ensure transparent communication between seller and buyer. Accurate formatting of this document is essential for maintaining proper accounting records and facilitating smooth financial reconciliation.

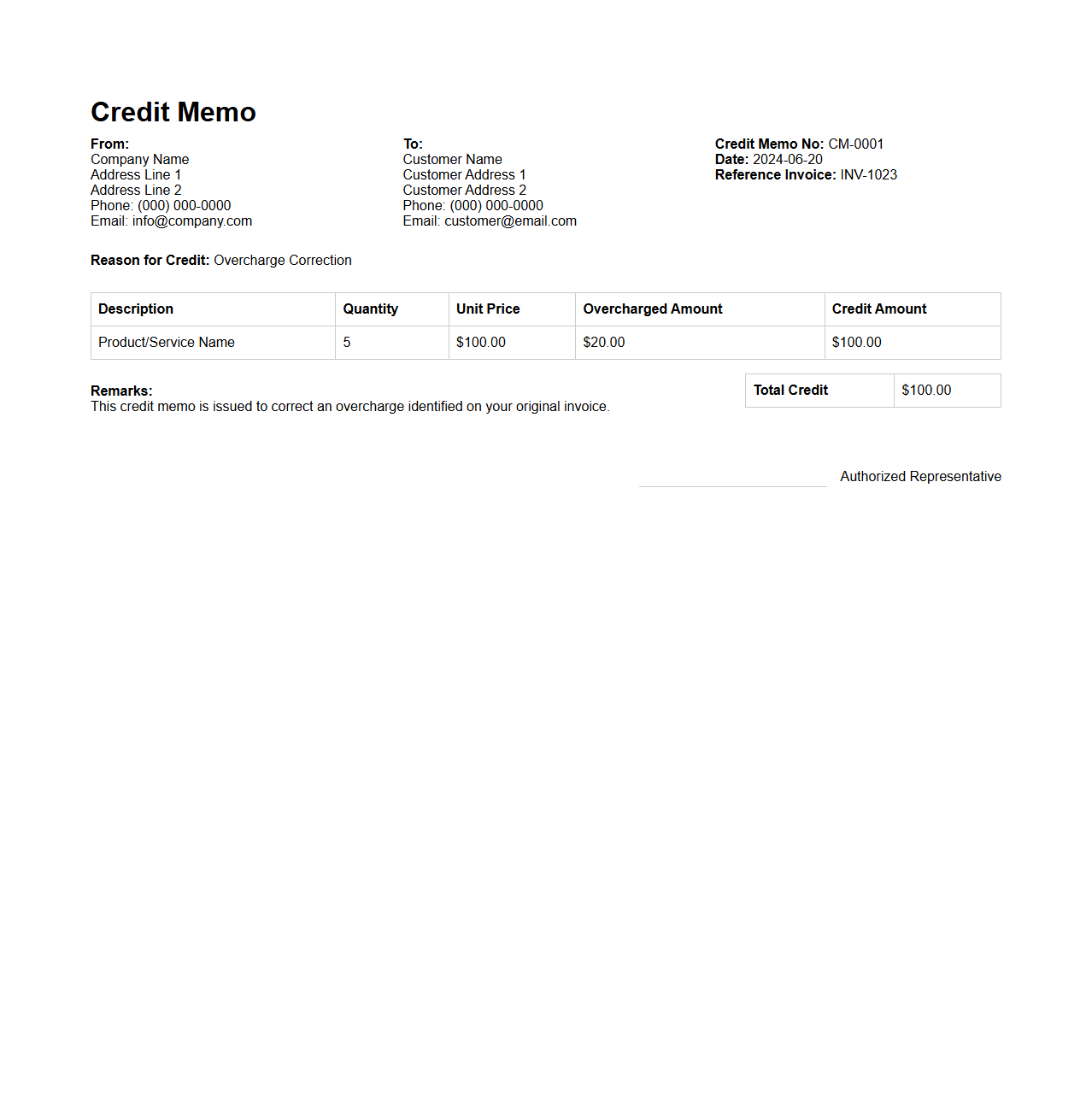

Credit Memo Sample for Overcharge Correction

A

Credit Memo Sample for Overcharge Correction document serves as a formal notice issued by a seller to a buyer, indicating a reduction in the amount owed due to an overcharge on a previous invoice. It details the original invoice number, the nature of the overcharge, the corrected amount, and the total credit applied to the customer's account. This document is essential for maintaining accurate financial records and ensuring transparency in commercial transactions.

Credit Memo Document for Sales Return

A

Credit Memo Document for a Sales Return serves as an official record issued by a seller to a buyer, indicating a reduction in the amount owed due to returned goods or services. It adjusts the accounts receivable by reflecting the value of the returned items, ensuring accurate financial tracking and inventory updates. This document is essential for processing refunds, managing customer accounts, and maintaining transparent transaction histories in sales operations.

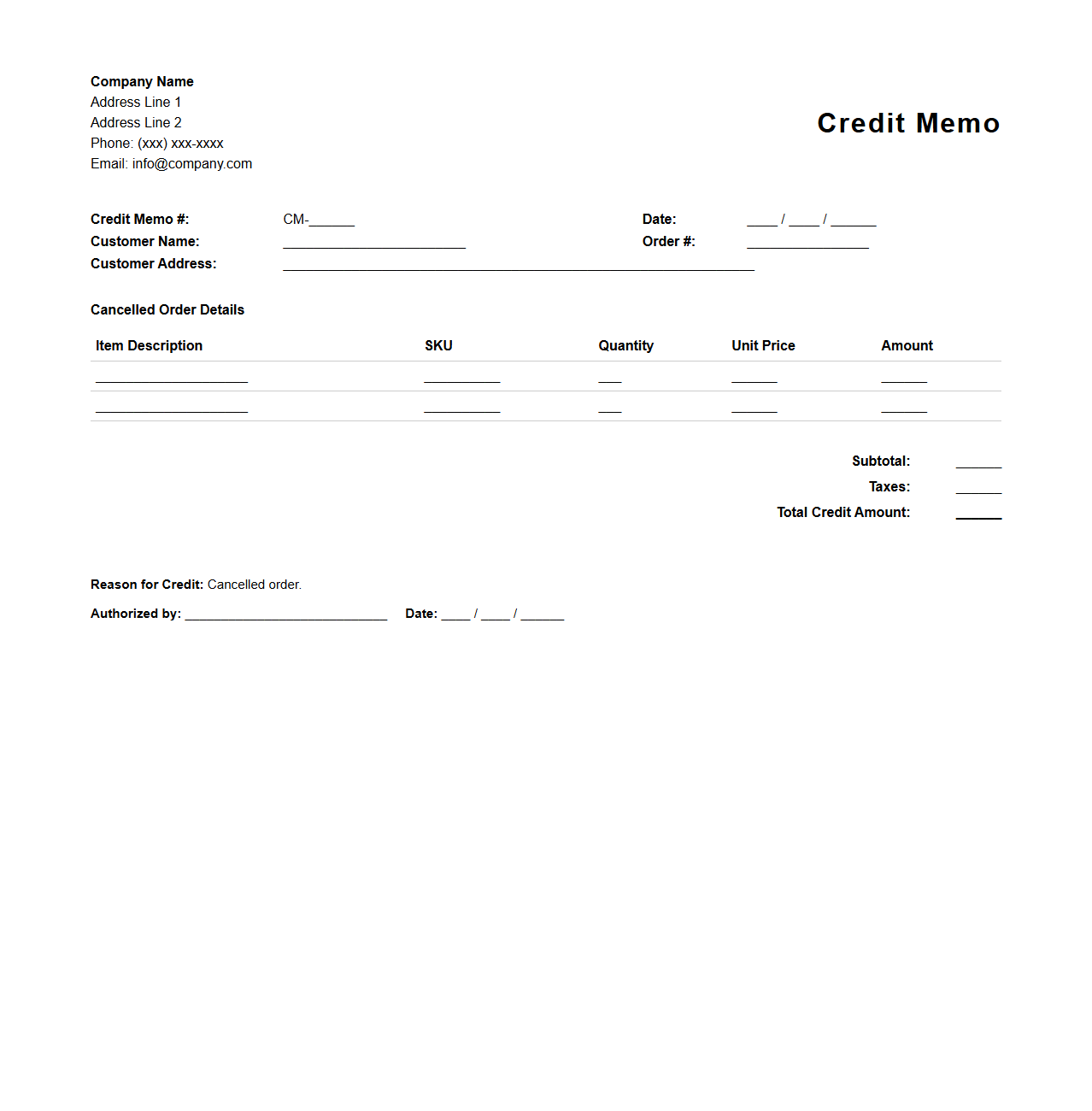

Credit Memo for Cancelled Orders in Retail

A

Credit Memo for Cancelled Orders in retail is an official document issued to customers when an order is canceled, confirming the reversal of charges and the initiation of a refund. It details the canceled products, original transaction amount, and credit issued to the customer's account or payment method. This document ensures accurate financial records and transparent communication in retail transactions.

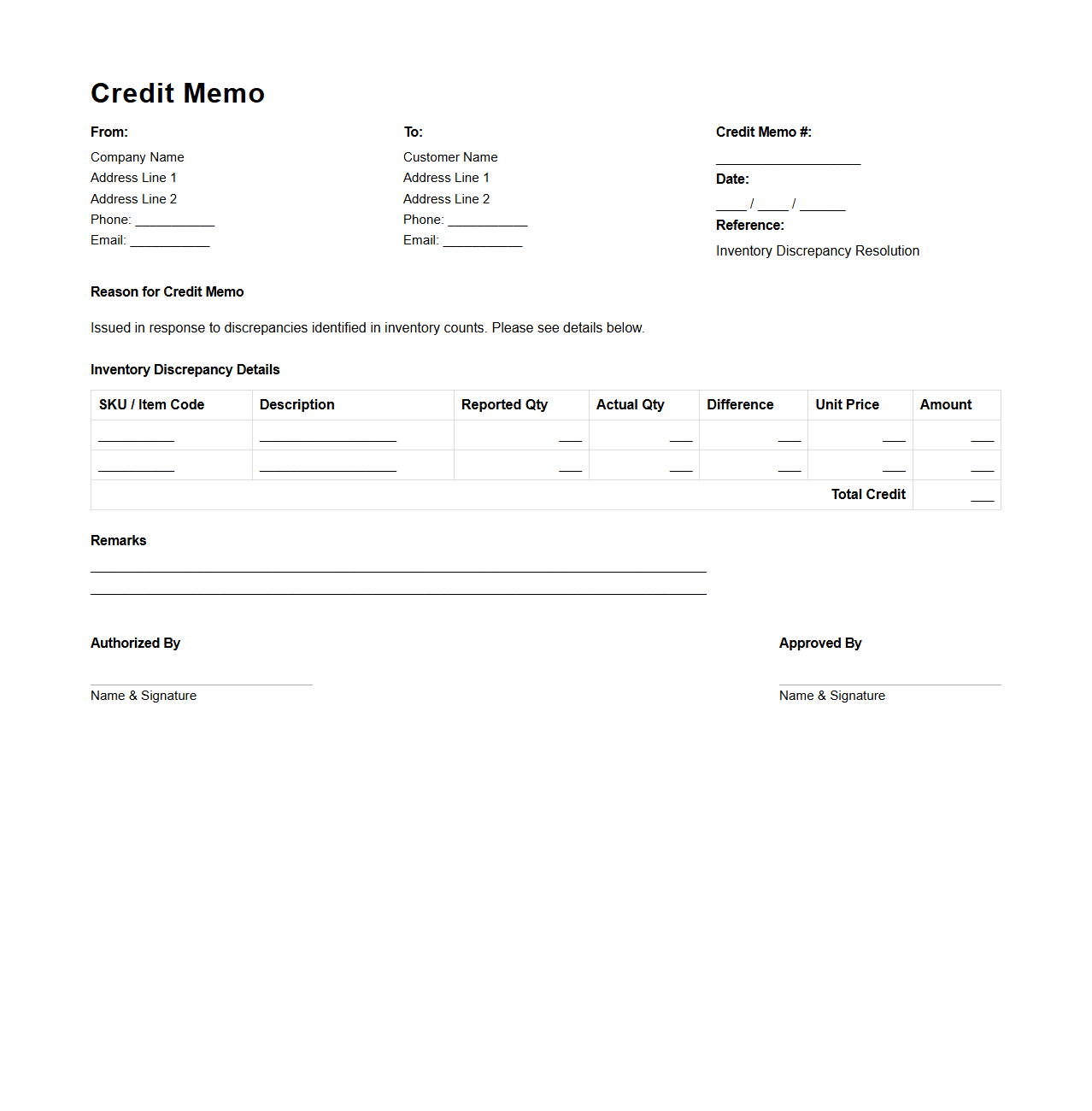

Credit Memo for Inventory Discrepancy Resolution

A

Credit Memo for Inventory Discrepancy Resolution document serves as an official record issued to adjust financial accounts when discrepancies arise between recorded inventory and actual stock levels. It facilitates reconciliation by authorizing credit adjustments to customer or supplier accounts, ensuring accurate inventory valuation and financial reporting. This document is essential for maintaining inventory accuracy and resolving issues such as overcharges, shortages, or damaged goods.

Credit Memo Layout for Account Reconciliation

The

Credit Memo Layout for Account Reconciliation document organizes credit memo details to facilitate accurate matching with customer accounts and outstanding invoices. It includes essential fields such as credit memo number, date, customer information, and adjustment amounts to ensure precise tracking of credits applied against receivables. This structure enhances financial transparency and simplifies the reconciliation process, minimizing errors and discrepancies.

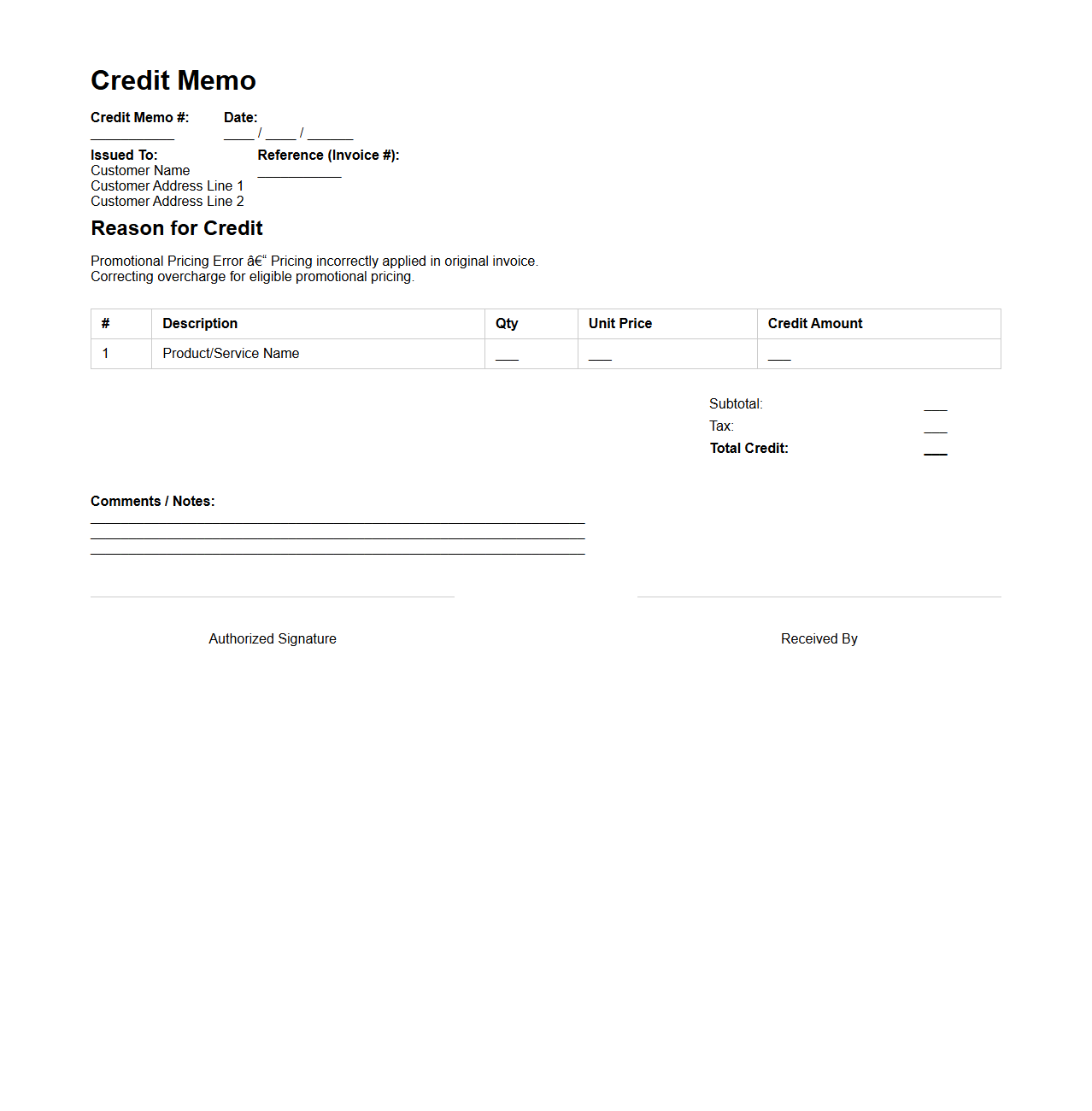

Credit Memo for Promotional Pricing Error

A

Credit Memo for Promotional Pricing Error is a formal document issued to correct billing discrepancies caused by incorrect promotional pricing applied to a customer's purchase. It adjusts the customer's account by crediting the amount overcharged due to pricing errors during promotional campaigns. This ensures accurate financial records and maintains customer trust by rectifying pricing mistakes efficiently.

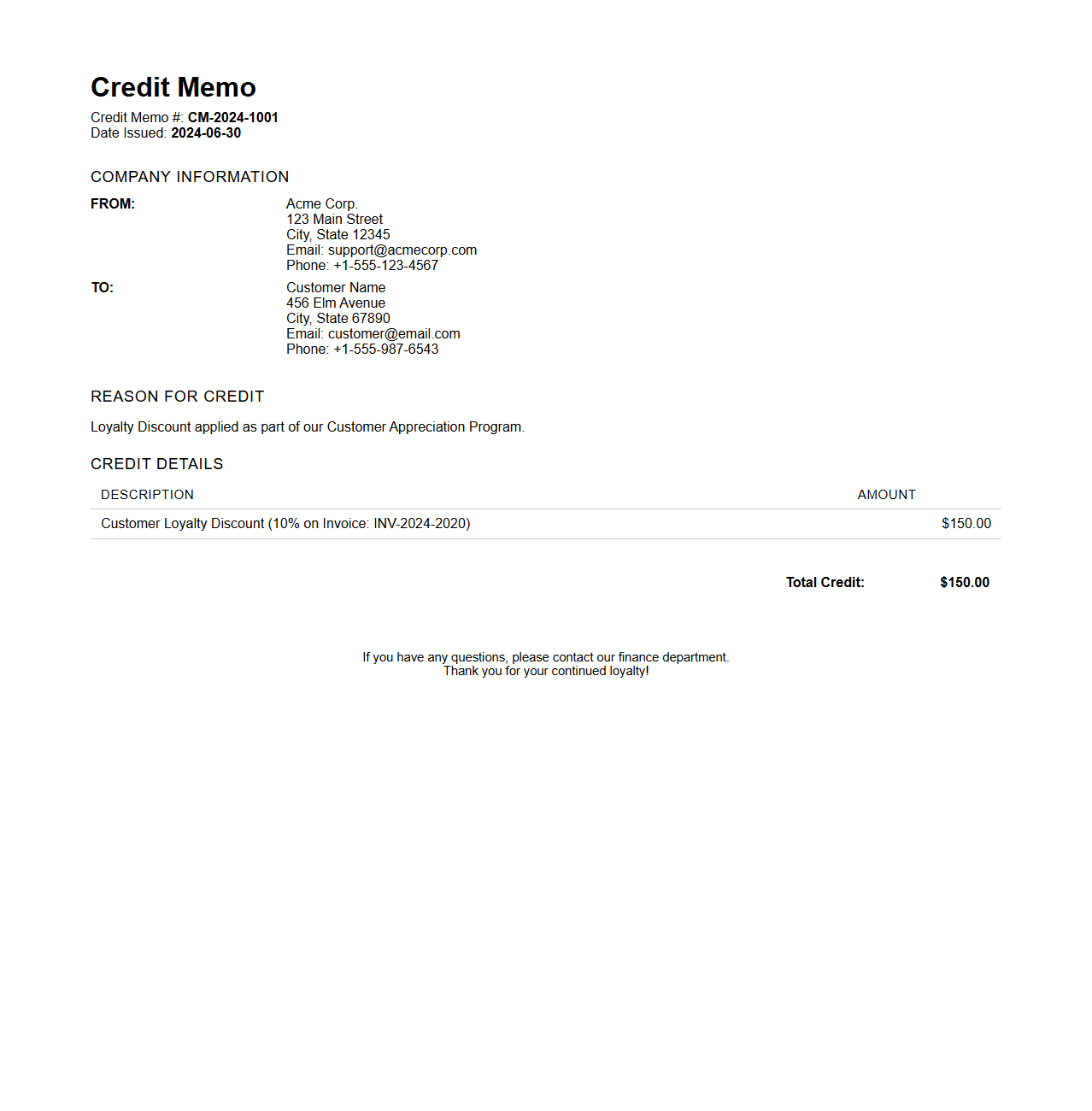

Credit Memo Sample for Customer Loyalty Discount

A

Credit Memo Sample for Customer Loyalty Discount document serves as an official record issued by a business to acknowledge a reduction in a customer's outstanding invoice amount based on their loyalty or repeat business. This document details the discount applied, references the original invoice, and adjusts the customer's account balance accordingly. It helps maintain transparent financial records and reinforces customer retention strategies by rewarding consistent patronage.

What is the primary purpose of a Credit Memo in retail transactions?

The primary purpose of a Credit Memo is to document a reduction in the amount a customer owes due to returned goods or billing errors. It serves as an official acknowledgment from the seller to the buyer that a certain amount is credited to the buyer's account. This helps maintain accurate financial and inventory records in retail transactions.

Which key details must be included in a Credit Memo Document for accuracy?

A Credit Memo must include key details such as the customer's name, the original invoice number, and the reason for the credit issuance. It should also provide the date of issue, item descriptions, quantities returned, and the amount being credited. These elements ensure clarity and help prevent disputes between the customer and retailer.

How is the refunded amount calculated and recorded in a Credit Memo?

The refunded amount is calculated by multiplying the returned item's price by the quantity returned, adjusting for any taxes or fees. This amount is then recorded in the Credit Memo as a negative transaction linked to the original sale. Accurate calculation ensures the customer receives the correct amount credited back to their account.

What distinguishes a Credit Memo from a Debit Memo in document processes?

A Credit Memo indicates a reduction in the amount owed by the customer, while a Debit Memo indicates an increase or additional charge. Credit Memos are used mainly for returned goods or billing corrections, whereas Debit Memos apply to charges such as underbilling or price adjustments. Understanding the differences is crucial for accurate accounts receivable management.

How does a Credit Memo affect the overall customer account balance in retail systems?

When a Credit Memo is issued, it reduces the customer's outstanding balance in the retail accounting system. This adjustment reflects that the customer no longer owes the credited amount due to returns or adjustments. Maintaining updated account balances helps provide transparent and accurate financial information for both the retailer and customer.