A Subrogation Letter Document Sample for Liability Insurance serves as a formal notification used by an insurance company to assert its right to recover costs from a third party responsible for an insured loss. This document outlines the details of the claim, the insured party, and the liable third party, establishing a legal basis for reimbursement. Utilizing a well-structured sample ensures clarity and accuracy in pursuing subrogation claims efficiently.

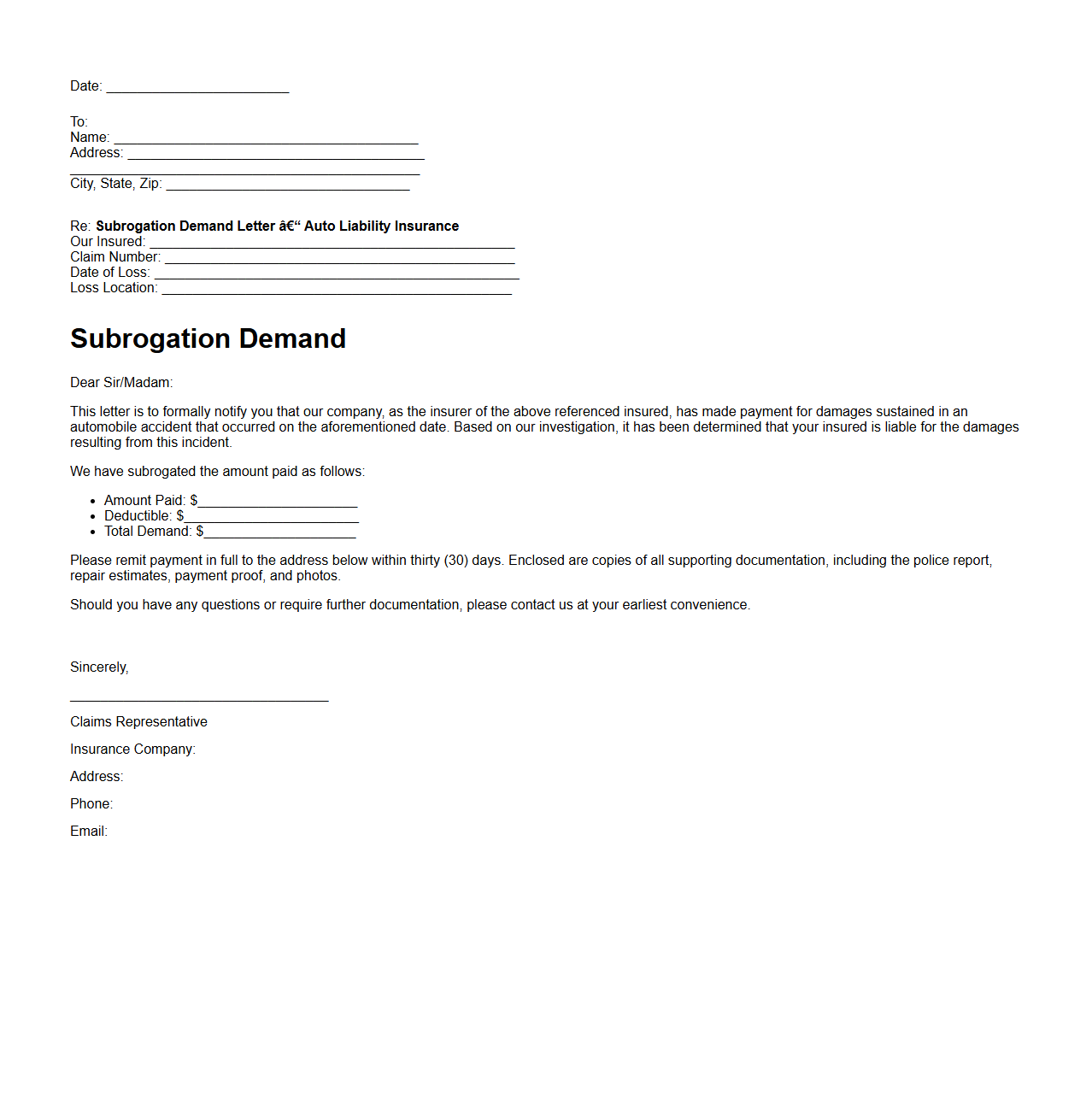

Subrogation Demand Letter for Auto Liability Insurance

A

Subrogation Demand Letter for Auto Liability Insurance is a formal request sent by an insurance company to recover costs from a third party responsible for an accident. This document details the damages paid by the insurer and demands reimbursement to offset the expenses incurred. It serves as a critical step in the subrogation process, enabling insurers to recoup financial losses from the liable party or their insurance carrier.

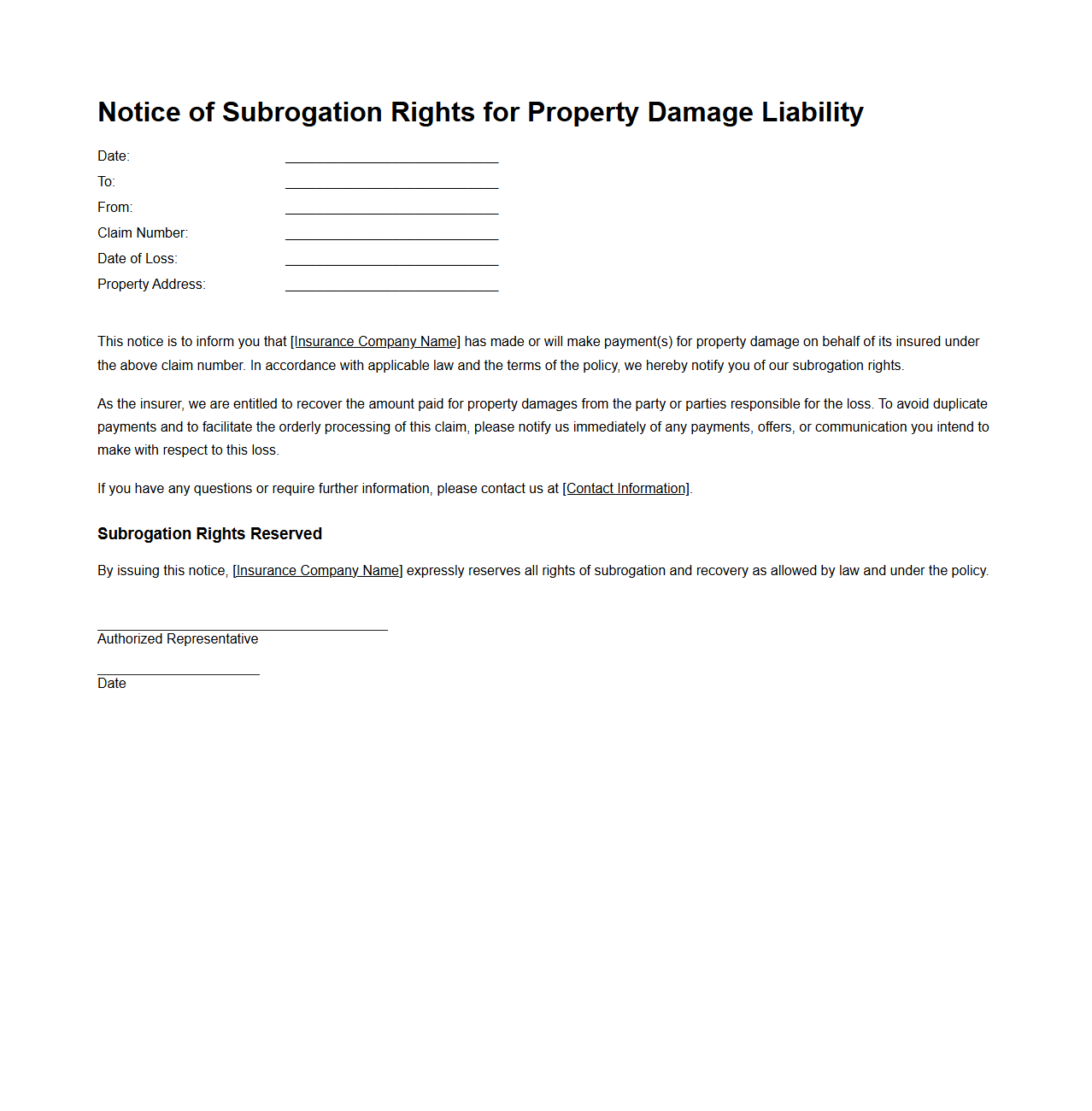

Notice of Subrogation Rights for Property Damage Liability

The

Notice of Subrogation Rights for Property Damage Liability document informs the insured party of their insurer's right to recover costs from a third party responsible for causing property damage. This notice outlines the insurer's legal ability to pursue reimbursement after compensating the insured, ensuring that the responsible party bears financial responsibility. Understanding these rights helps clarify the insurer's claim process and protects the insured's interests in property damage cases.

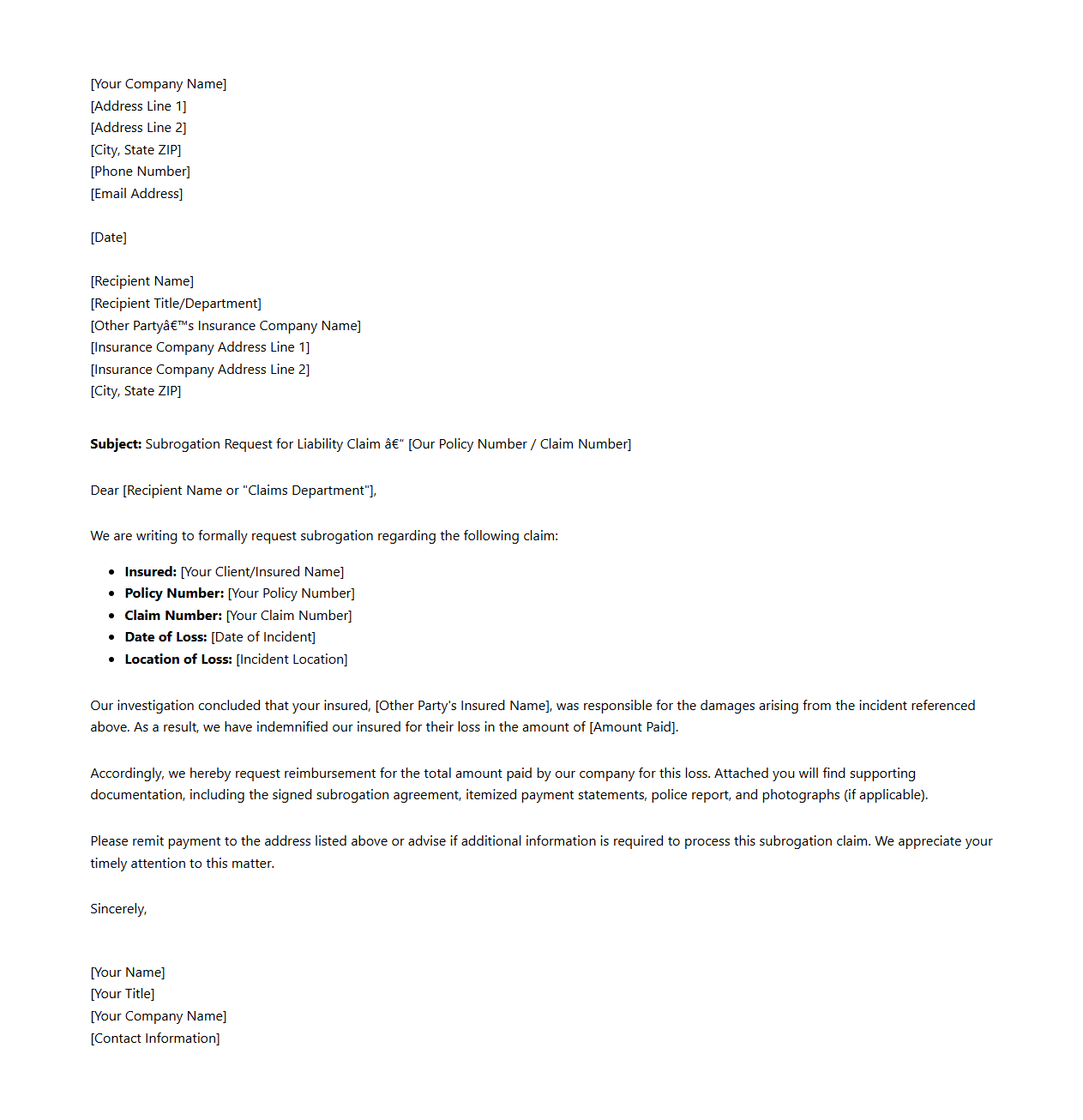

Liability Insurance Subrogation Request Letter

A

Liability Insurance Subrogation Request Letter is a formal document used by an insurer to seek reimbursement from a third party responsible for causing a loss after compensating the insured. This letter outlines the insurer's right to recover payments made under the liability insurance policy and demands cooperation from the at-fault party or their insurer. It plays a crucial role in protecting the insurer's financial interests by enabling the recovery of costs related to claims paid on behalf of the policyholder.

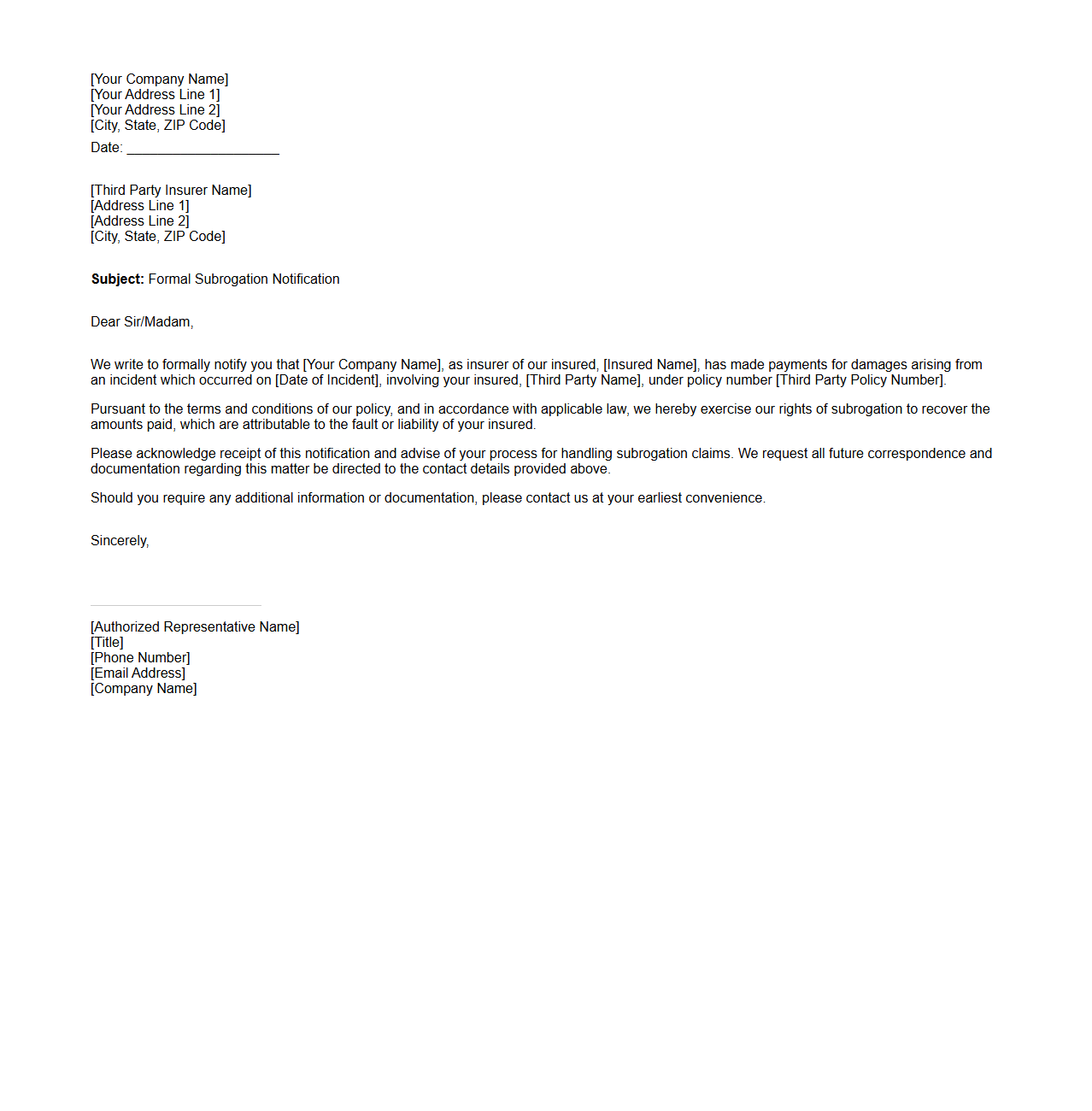

Formal Subrogation Notification to Third Party Insurer

A

Formal Subrogation Notification to Third Party Insurer is a legal document issued by an insurer to inform another insurance company that they intend to recover losses from a third party responsible for a claim. This notification initiates the subrogation process, allowing the insurer to pursue reimbursement for paid claims by claiming the at-fault party's insurance coverage. It ensures clear communication between insurers, helping to streamline the recovery process and prevent duplicate claims.

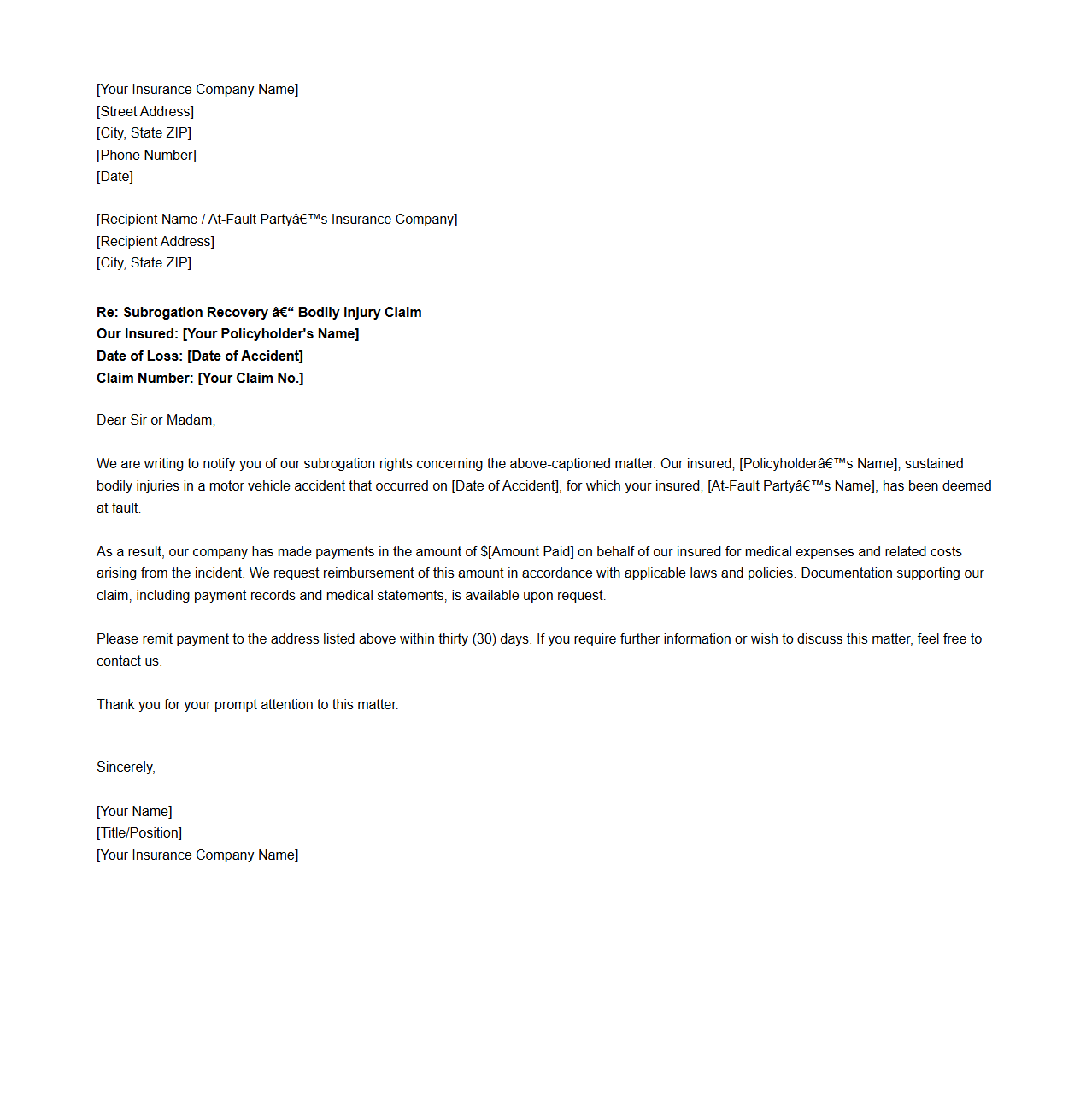

Subrogation Recovery Letter for Bodily Injury Claim

A

Subrogation Recovery Letter for a Bodily Injury Claim is a formal document sent by an insurance company to inform a third party or their insurer of the insured party's claim and the insurer's intention to recover costs associated with medical expenses and damages. It outlines the details of the injury, the payments made, and the insurer's legal right to seek reimbursement from the at-fault party. This letter plays a crucial role in protecting the insurer's financial interests by initiating the subrogation process for claim recovery.

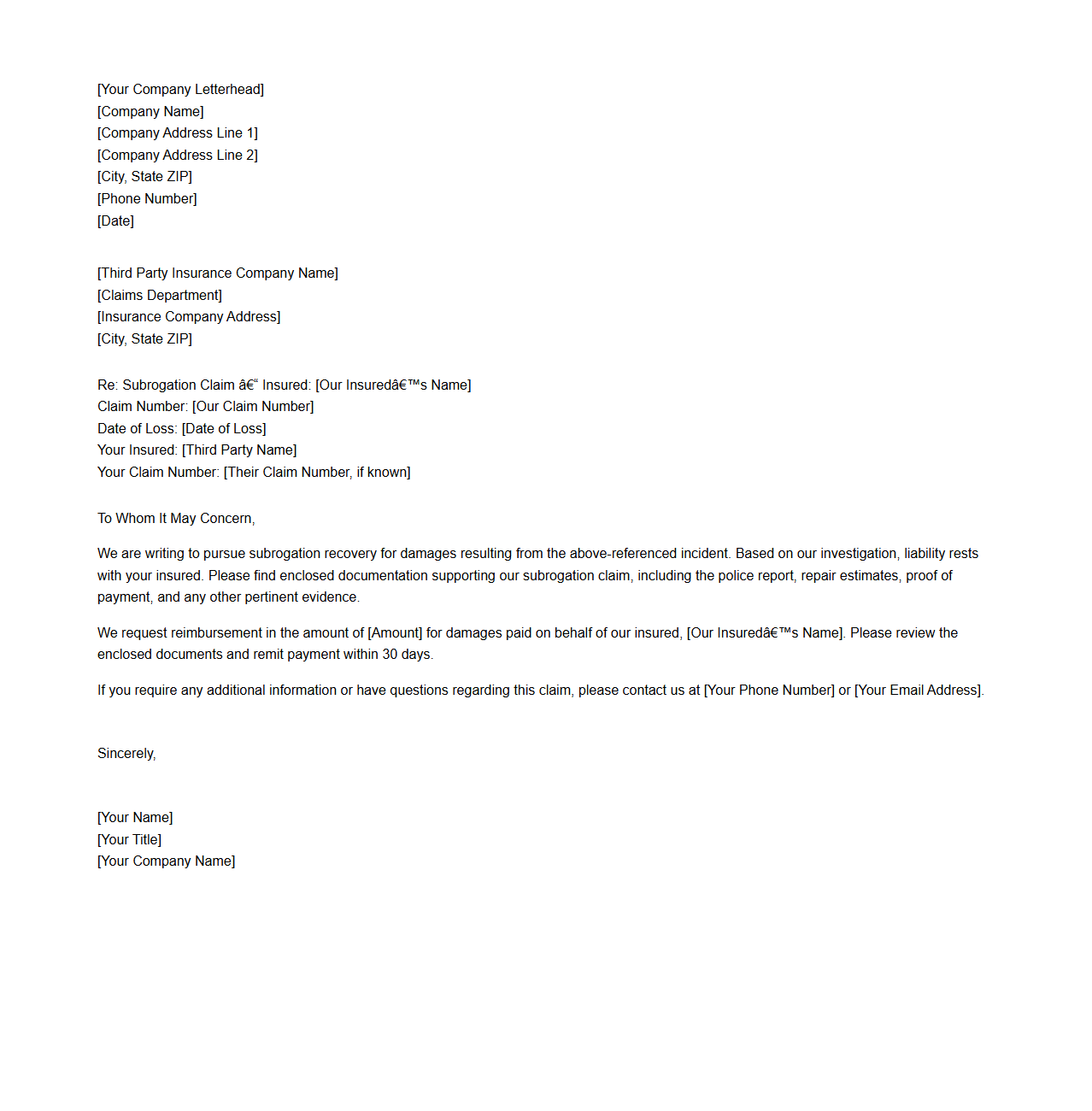

Third Party Claim Subrogation Pursuit Letter

A

Third Party Claim Subrogation Pursuit Letter is a formal document used by an insurance company or claimant to recover costs from a third party responsible for causing a loss or damage. It outlines the facts of the claim, details of the damages incurred, and demands reimbursement for the expenses paid by the insurer. This letter initiates the subrogation process, aiming to hold the third party financially accountable and recoup settlement amounts.

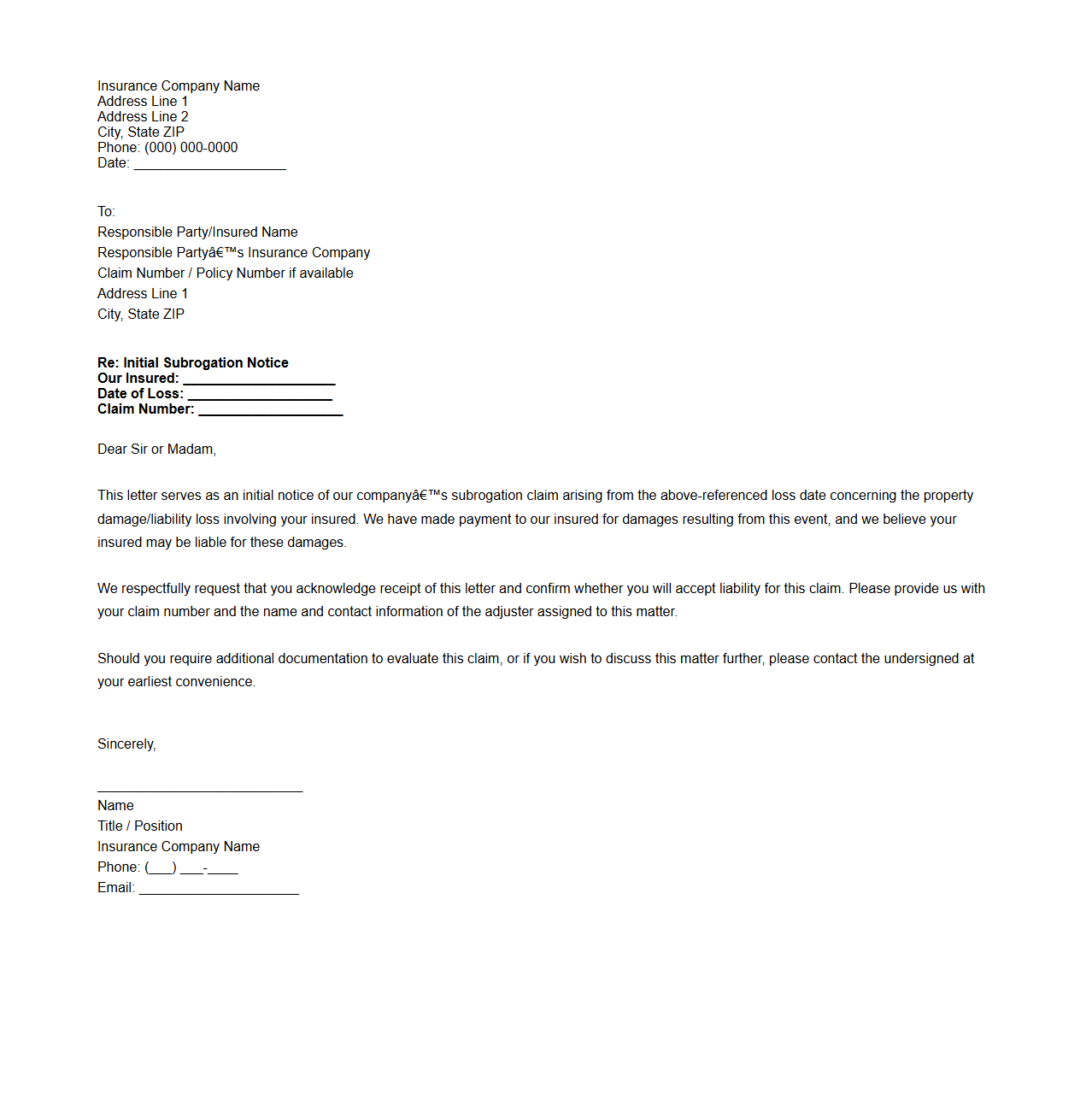

Initial Subrogation Letter for Liability Claim

An

Initial Subrogation Letter for Liability Claim is a formal document sent by an insurance company to a third party suspected of causing a loss or damage. It serves to notify the party of the insurer's intent to recover costs paid to the insured through subrogation rights. This letter initiates the legal process to seek reimbursement for the liability claim expenses.

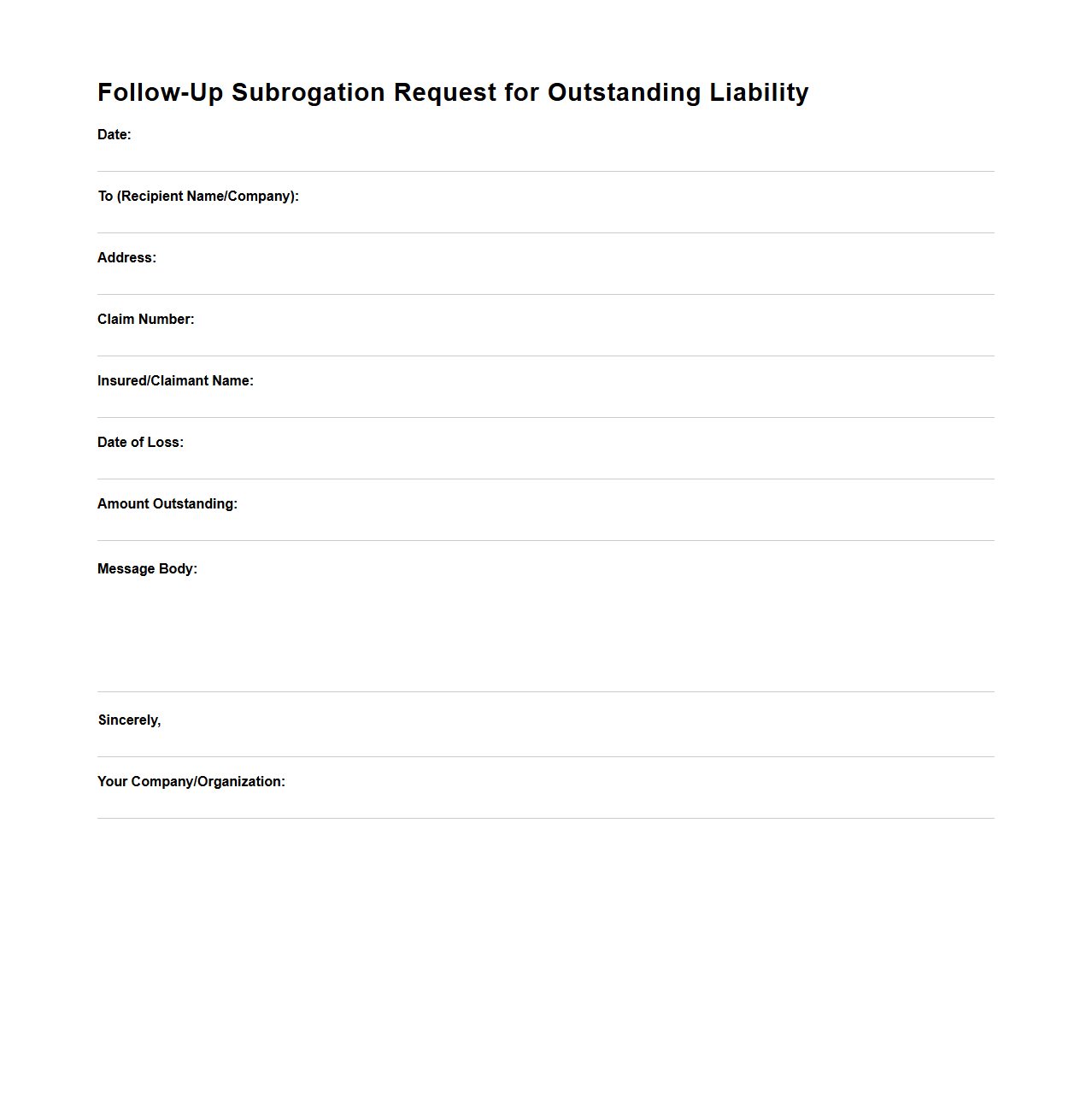

Follow-Up Subrogation Request for Outstanding Liability

A

Follow-Up Subrogation Request for Outstanding Liability document is used to initiate or remind involved parties about recovering costs from a liable third party after initial subrogation efforts. This document outlines the details of the outstanding liability, including claim references, amounts due, and previous communication history to ensure clear and effective resolution. Its purpose is to expedite reimbursement and maintain accurate records of the subrogation process.

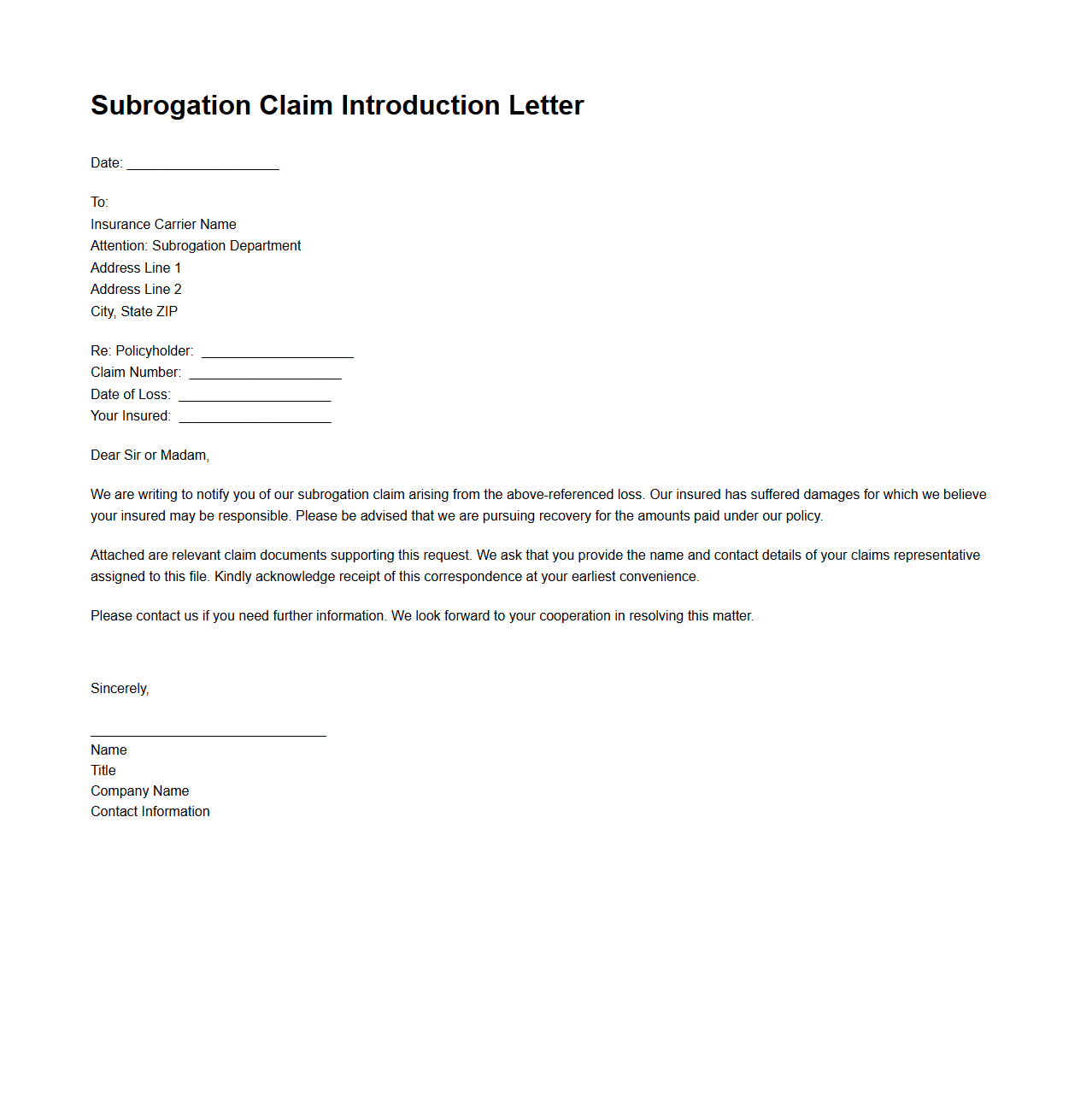

Insurance Carrier Subrogation Claim Introduction Letter

An

Insurance Carrier Subrogation Claim Introduction Letter is a formal document used by an insurance company to notify a third party about their intention to recover costs paid for a claim from the responsible party. This letter initiates the subrogation process, detailing the claim specifics, involved parties, and the amount to be recovered. It serves as an official communication to establish the insurance carrier's right to pursue reimbursement on behalf of the insured.

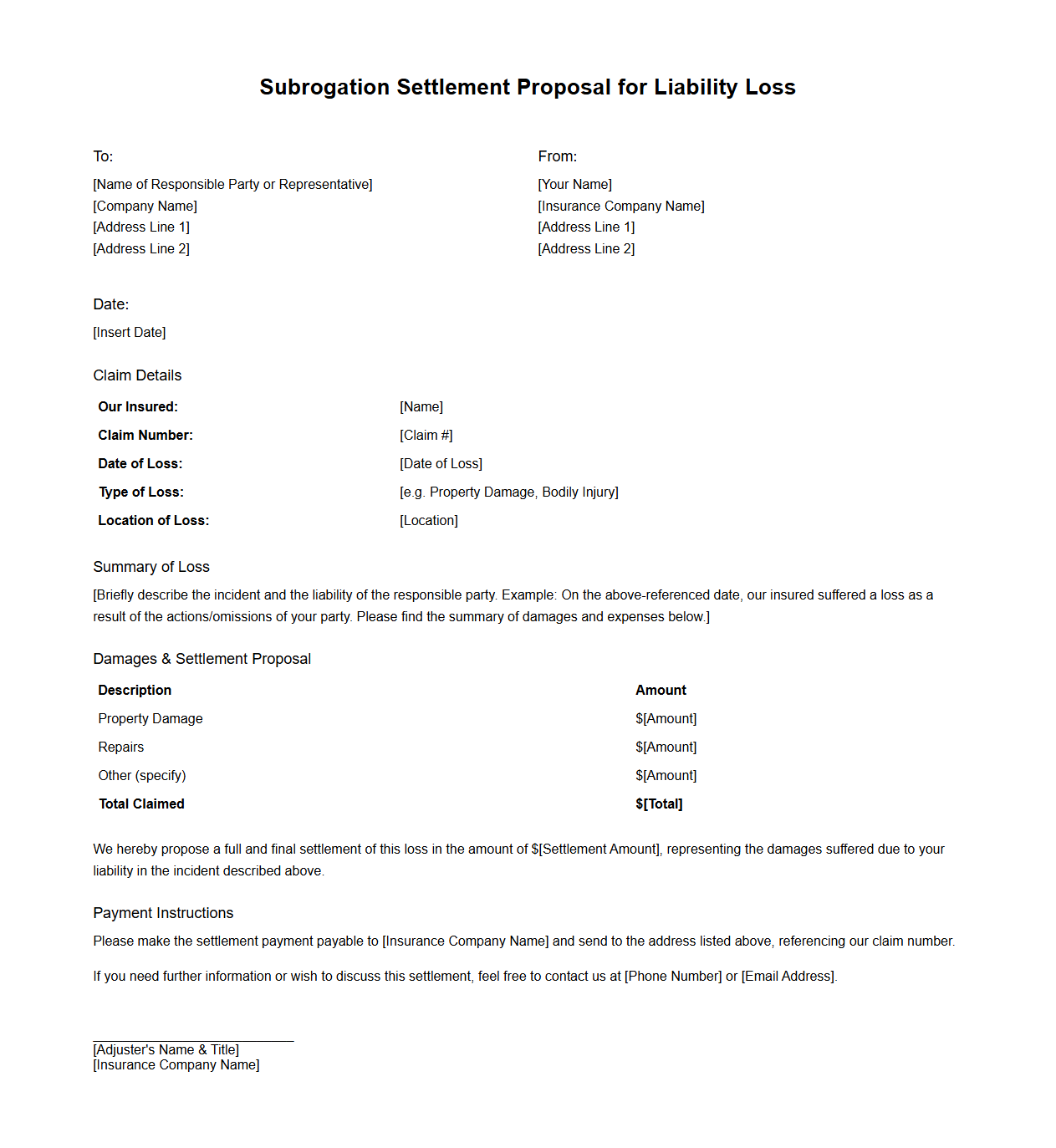

Subrogation Settlement Proposal for Liability Loss

A

Subrogation Settlement Proposal for Liability Loss document outlines an offer to resolve claims where an insurer seeks reimbursement from a third party responsible for causing a loss. It details the liability assessment, proposed settlement amount, and supporting evidence to recover costs incurred due to the insured event. This document is essential in negotiating and finalizing subrogation claims efficiently to minimize financial impact on the insurer.

What is the primary purpose of a subrogation letter in liability insurance?

The primary purpose of a subrogation letter in liability insurance is to notify the responsible party or their insurer that the insurance company intends to recover the amount paid for a claim. This letter formally transfers the insurer's rights to pursue compensation from the at-fault party. It ensures that the insurer can seek repayment without involving the insured directly in legal proceedings.

Which parties are typically involved in a subrogation letter for liability insurance claims?

A subrogation letter typically involves three key parties: the insurer who paid the claim, the insured who suffered the loss, and the third party responsible for the damage or their insurance company. The letter is addressed to the at-fault party or their insurer to initiate the recovery process. This collaboration helps clarify responsibilities and facilitates compensation.

What specific details about the incident must be included in a subrogation letter document?

A subrogation letter must clearly describe the incident details including the date, location, and cause of the loss or damage. It should also outline the nature of the claim, the amount paid by the insurer, and any relevant policy information. Providing these specifics strengthens the claim's validity and supports the recovery effort.

How does a subrogation letter establish the insurer's right to pursue recovery?

The subrogation letter establishes the insurer's right to pursue recovery by asserting that the insurer has compensated the insured and now holds the legal claim against the liable party. It explicitly states that the insurer is stepping into the insured's shoes to seek reimbursement. This legal transfer of rights is critical for enforcing the subrogation process.

What documentation should accompany a subrogation letter to support the liability claim?

Supporting documentation that should accompany a subrogation letter includes claim forms, police reports, repair estimates, photographs, and any correspondence related to the incident. These documents provide evidence of the insurer's payment and the third party's liability. Comprehensive documentation increases the likelihood of a successful recovery from the responsible party.