The Underwriting Assessment Document Sample for Group Insurance provides a detailed framework to evaluate the risk profile of a collective group seeking insurance coverage. It includes key criteria such as member demographics, health history, and claims experience to ensure accurate premium calculation and risk management. This document helps insurers streamline decision-making by standardizing the assessment process for group policies.

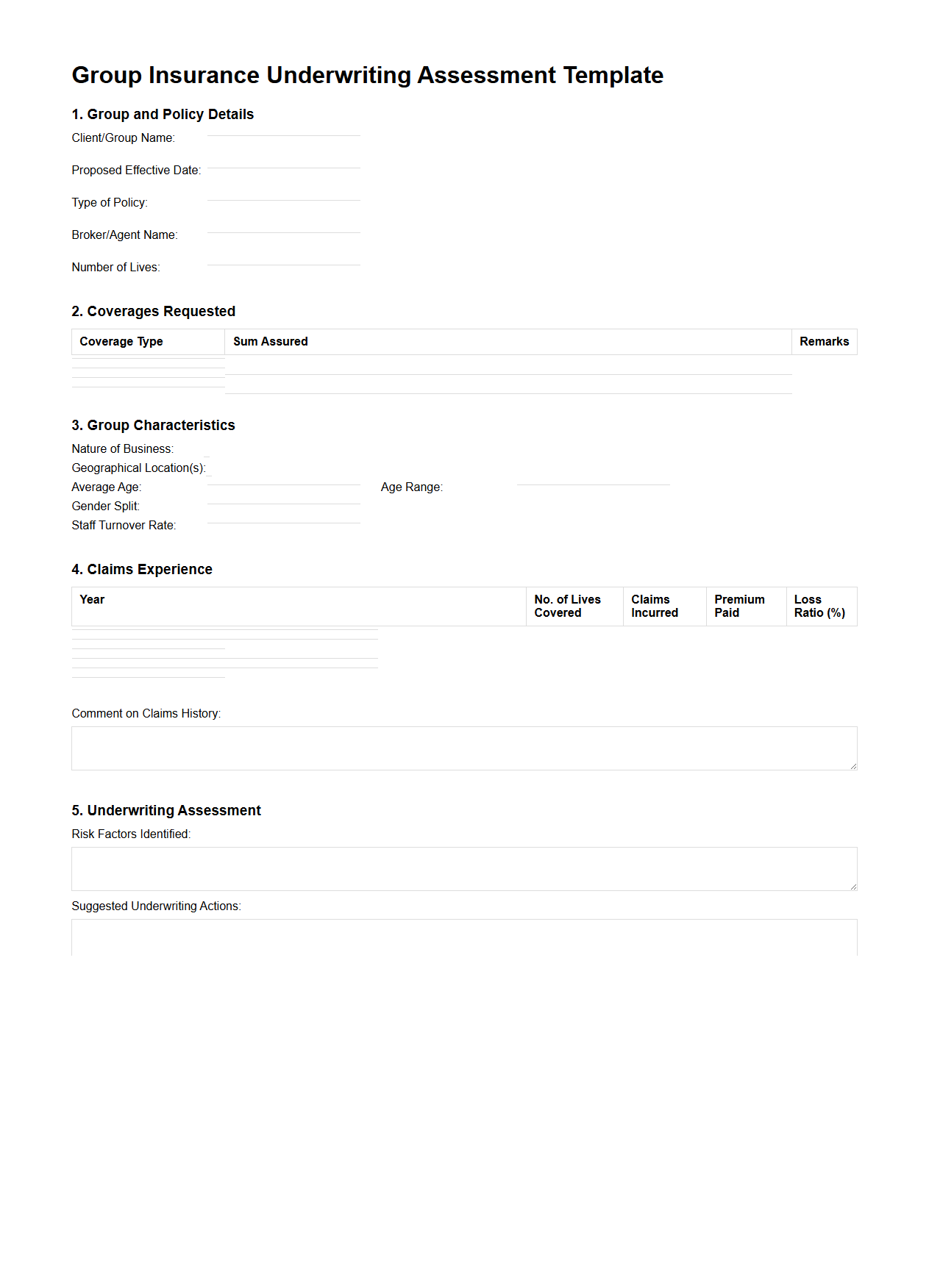

Group Insurance Underwriting Assessment Template

The

Group Insurance Underwriting Assessment Template document serves as a structured framework for evaluating the risks and eligibility of a group seeking insurance coverage. It systematically collects key data such as demographic information, historical claims, and health profiles to facilitate accurate risk analysis and premium determination. This template ensures consistency and efficiency in the underwriting process by standardizing data input and evaluation criteria across multiple applicants.

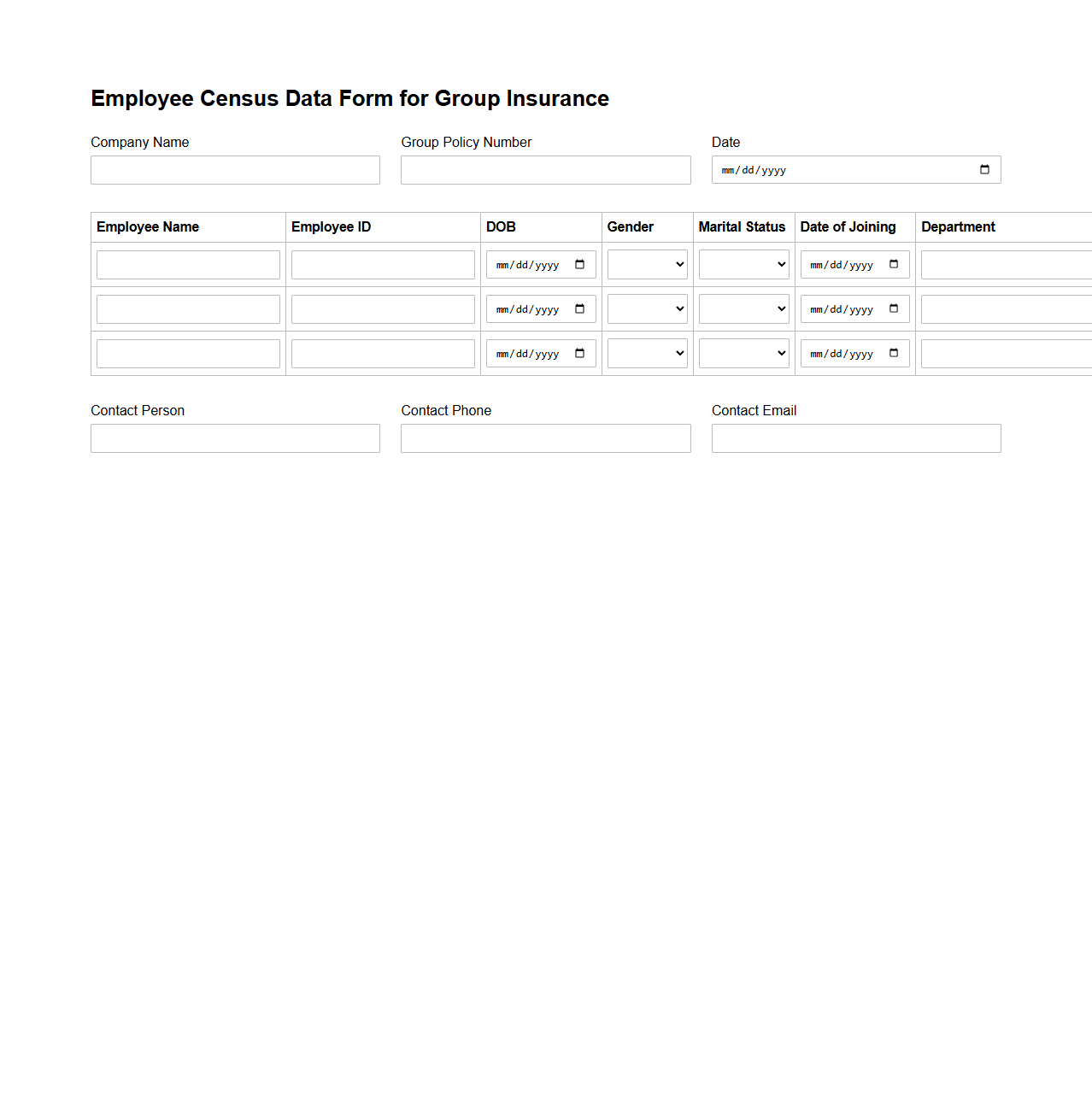

Employee Census Data Form for Group Insurance

The

Employee Census Data Form for Group Insurance is a crucial document used by employers to collect detailed employee information required for group insurance enrollment and underwriting. It typically includes data such as employee names, dates of birth, job titles, employment status, and dependent details. Accurate completion of this form ensures proper coverage eligibility, premium calculation, and smooth claims processing within the group insurance plan.

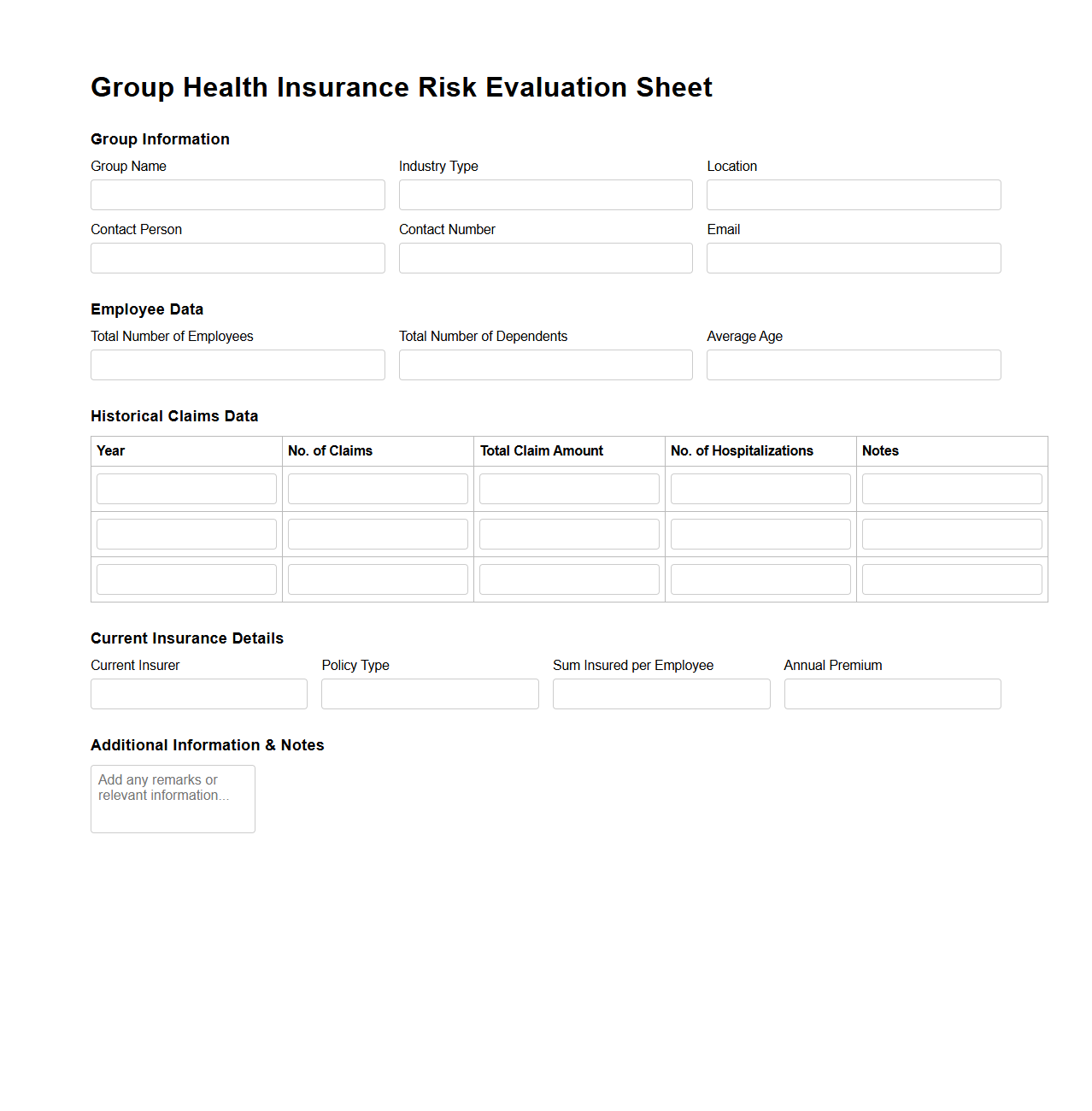

Group Health Insurance Risk Evaluation Sheet

The

Group Health Insurance Risk Evaluation Sheet is a comprehensive document used by insurance providers to assess the overall risk profile of a group seeking health coverage. It details critical factors such as demographic data, past claims history, and prevailing health conditions among members, enabling accurate premium calculation and policy terms. This document ensures tailored risk management strategies to optimize coverage benefits and minimize potential financial losses for insurers.

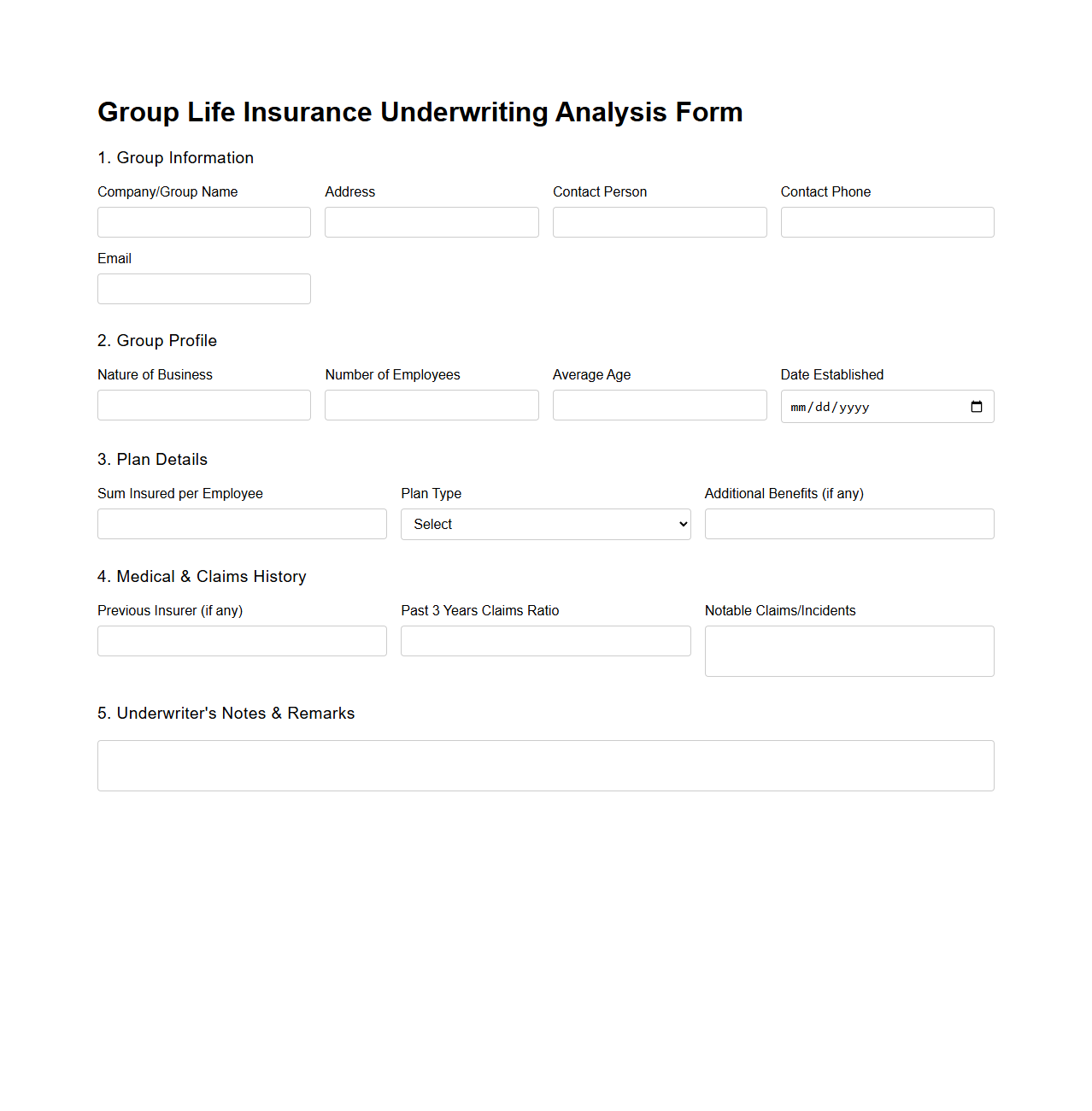

Group Life Insurance Underwriting Analysis Form

The

Group Life Insurance Underwriting Analysis Form is a crucial document used by insurers to evaluate the risk profile of a collective group applying for life insurance coverage. It collects detailed demographic, medical, and occupational information about the group members, enabling underwriters to assess potential liabilities accurately. This analysis supports insurers in determining appropriate premium rates and coverage terms based on the aggregated risk data.

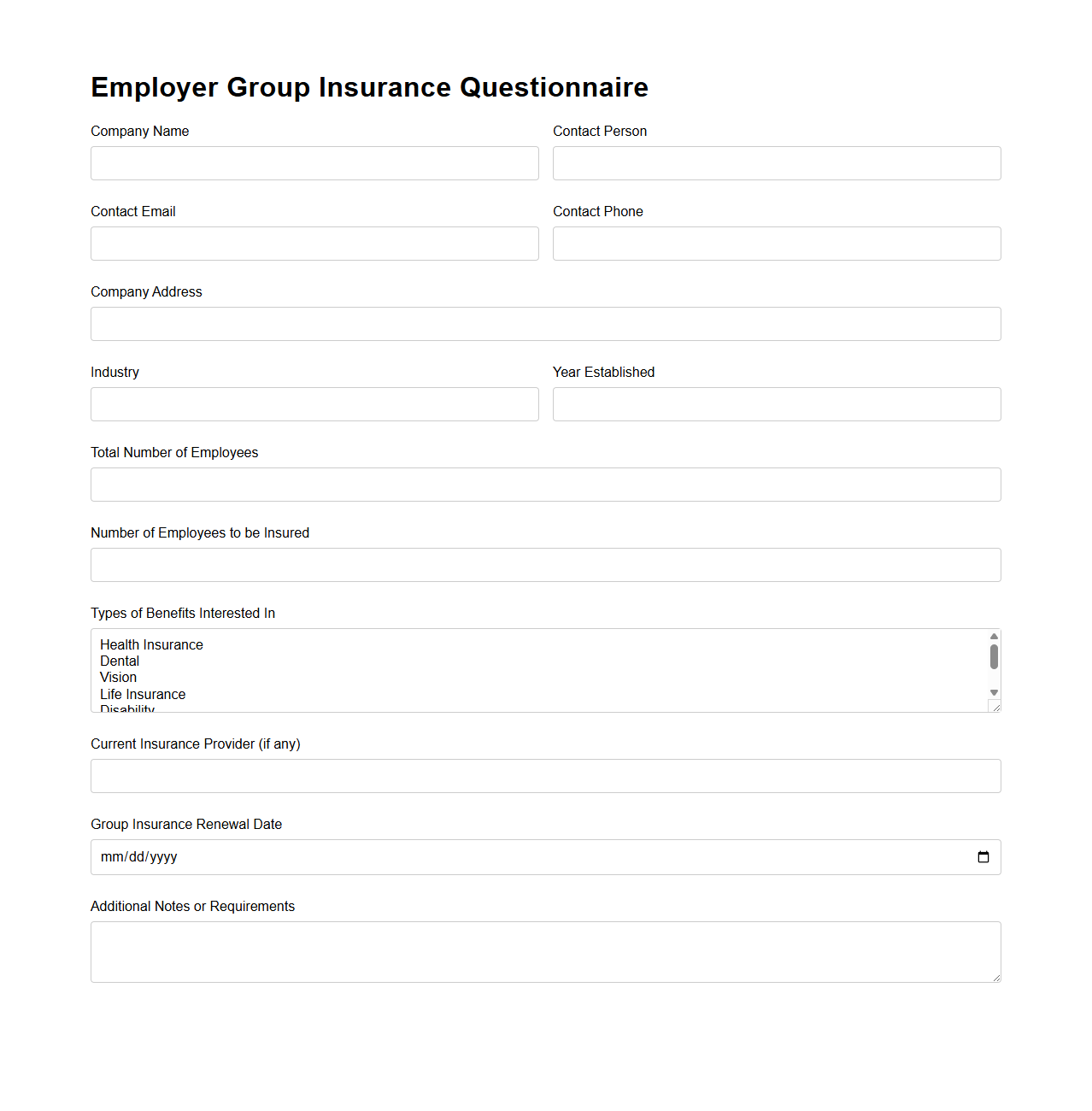

Employer Group Insurance Questionnaire

The

Employer Group Insurance Questionnaire is a document used by insurance providers to gather detailed information about a company's workforce, benefits offerings, and coverage needs. It helps insurers assess group risk factors, determine eligibility, and customize insurance plans accordingly. Accurate completion of this questionnaire ensures appropriate underwriting and competitive premium rates for employer-sponsored health insurance.

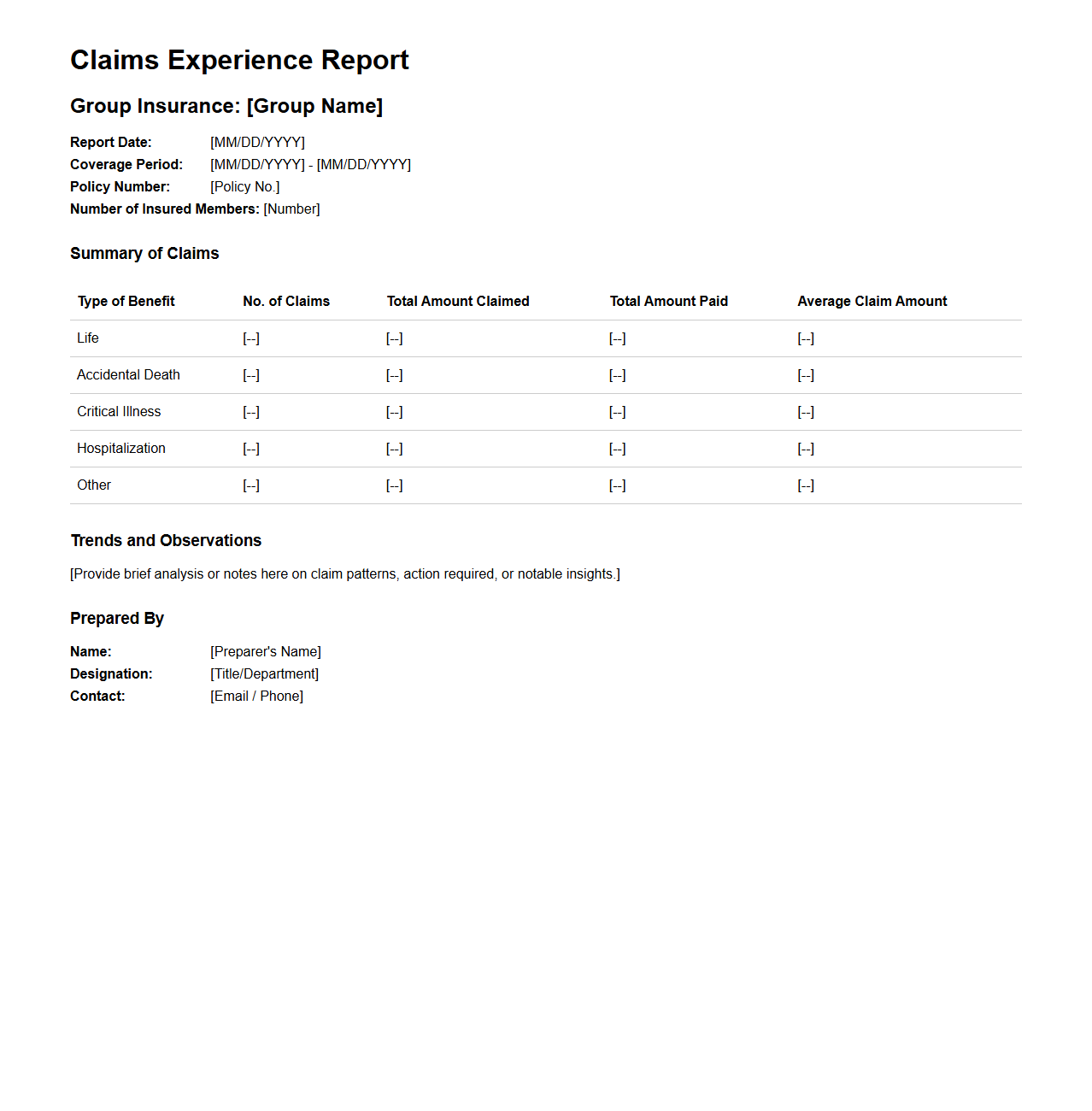

Claims Experience Report for Group Insurance

A

Claims Experience Report for Group Insurance is a detailed document that summarizes the historical claims data submitted by a group policyholder. It provides insights into the frequency, severity, and types of claims filed, helping insurers evaluate risk and adjust premiums accordingly. This report is essential for underwriting, renewal negotiations, and improving risk management strategies.

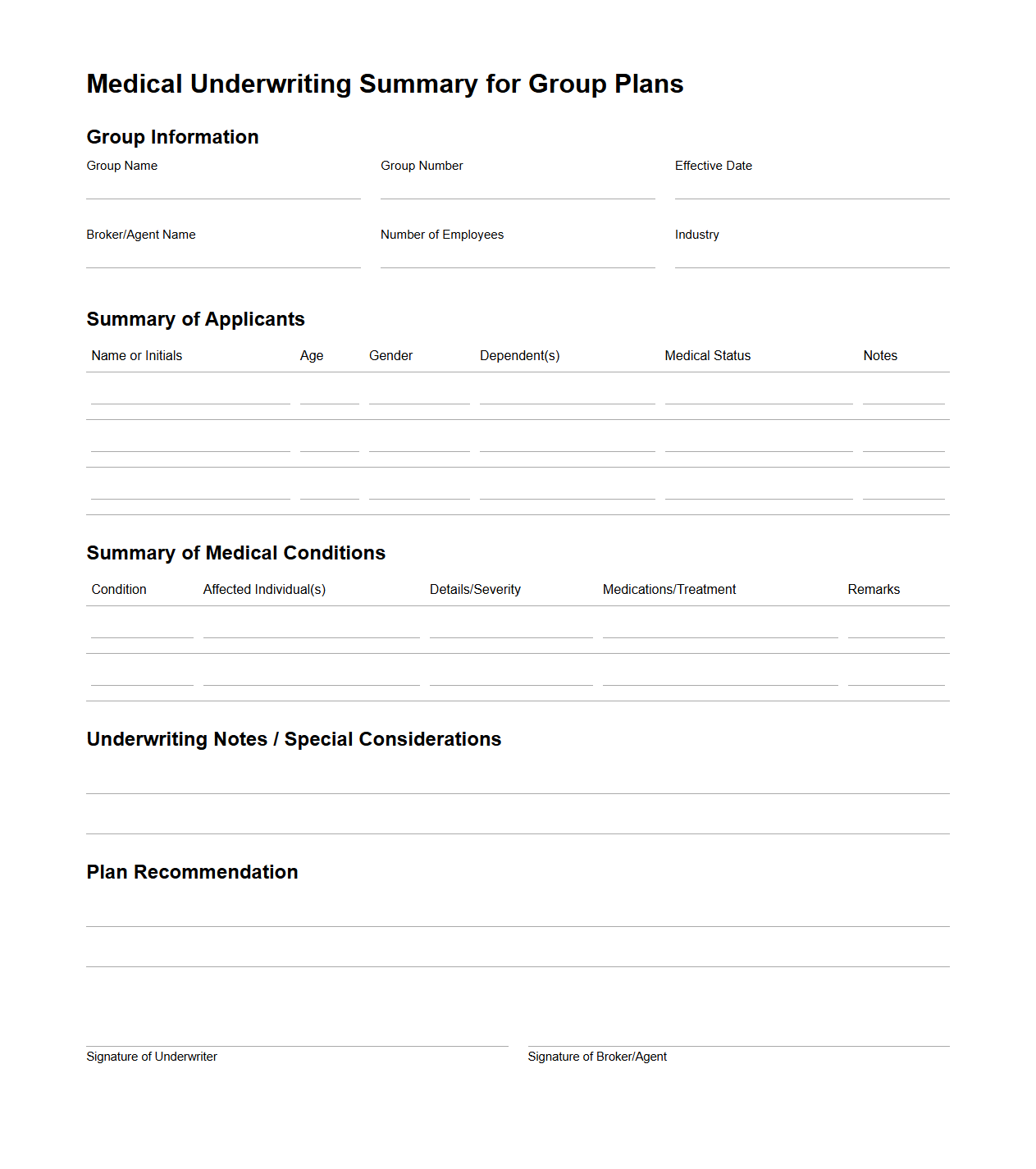

Medical Underwriting Summary for Group Plans

A

Medical Underwriting Summary for Group Plans document provides a comprehensive overview of the health status and risk factors of a group seeking insurance coverage. It consolidates medical histories, diagnostic information, and claims data to facilitate accurate risk assessment and premium determination by insurers. This summary is crucial for tailoring group health insurance plans to meet both the coverage needs and cost expectations of the group members.

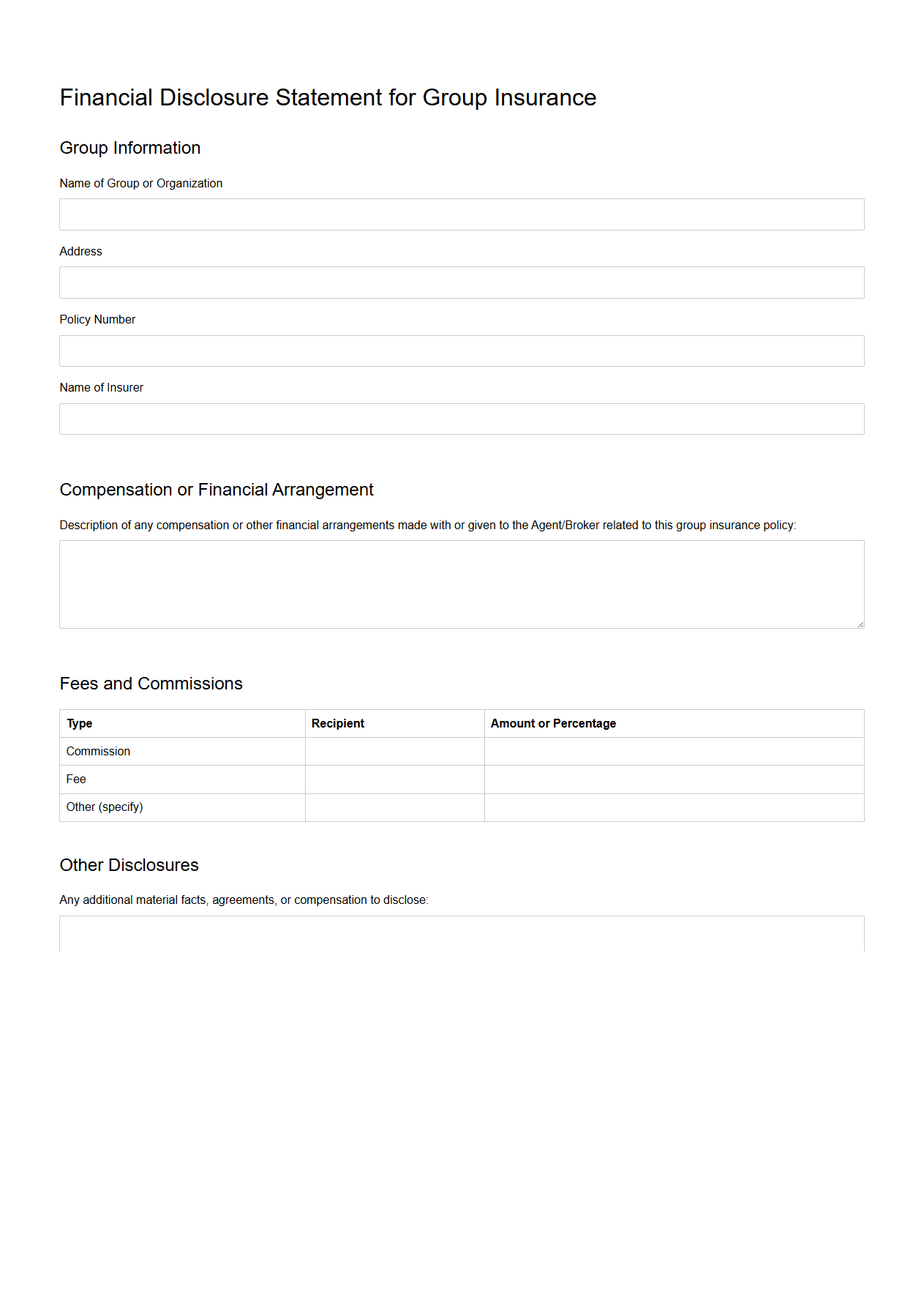

Financial Disclosure Statement for Group Insurance

A

Financial Disclosure Statement for Group Insurance is a document that provides detailed information about the financial status and risk exposure of a group applying for insurance coverage. It includes data such as income, expenses, assets, liabilities, and past claims history to help insurers assess the overall risk profile and calculate appropriate premiums. This statement ensures transparency and aids in underwriting decisions for group insurance policies.

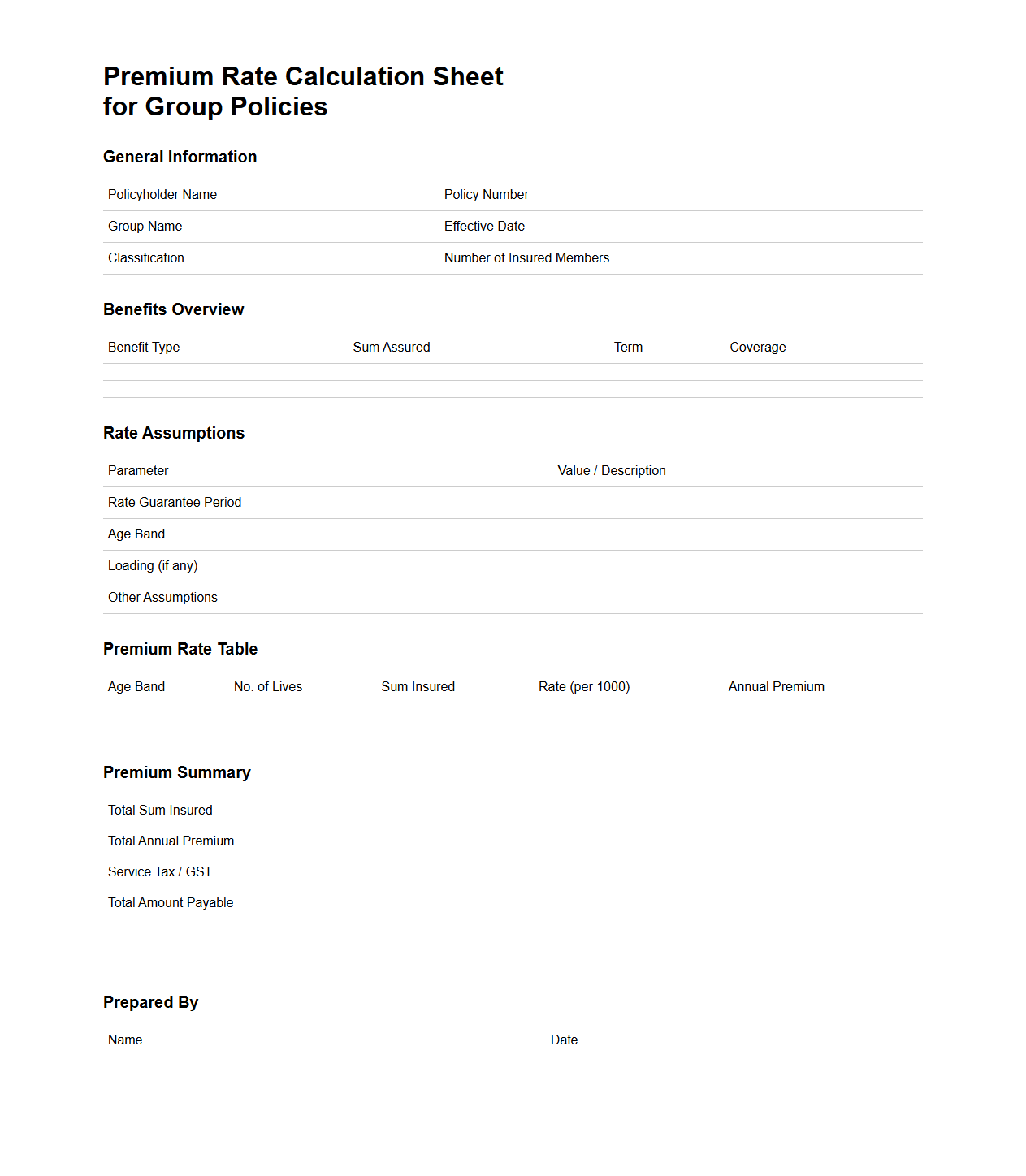

Premium Rate Calculation Sheet for Group Policies

The

Premium Rate Calculation Sheet for Group Policies document outlines the detailed methodology used to determine insurance premium rates for group policies, factoring in variables such as group size, age demographics, coverage levels, and risk profiles. It serves as a crucial tool for actuaries and underwriting teams to ensure accurate pricing and financial stability of group insurance schemes. This sheet helps organizations and insurers assess cost implications and maintain transparency during policy formulation and renewal processes.

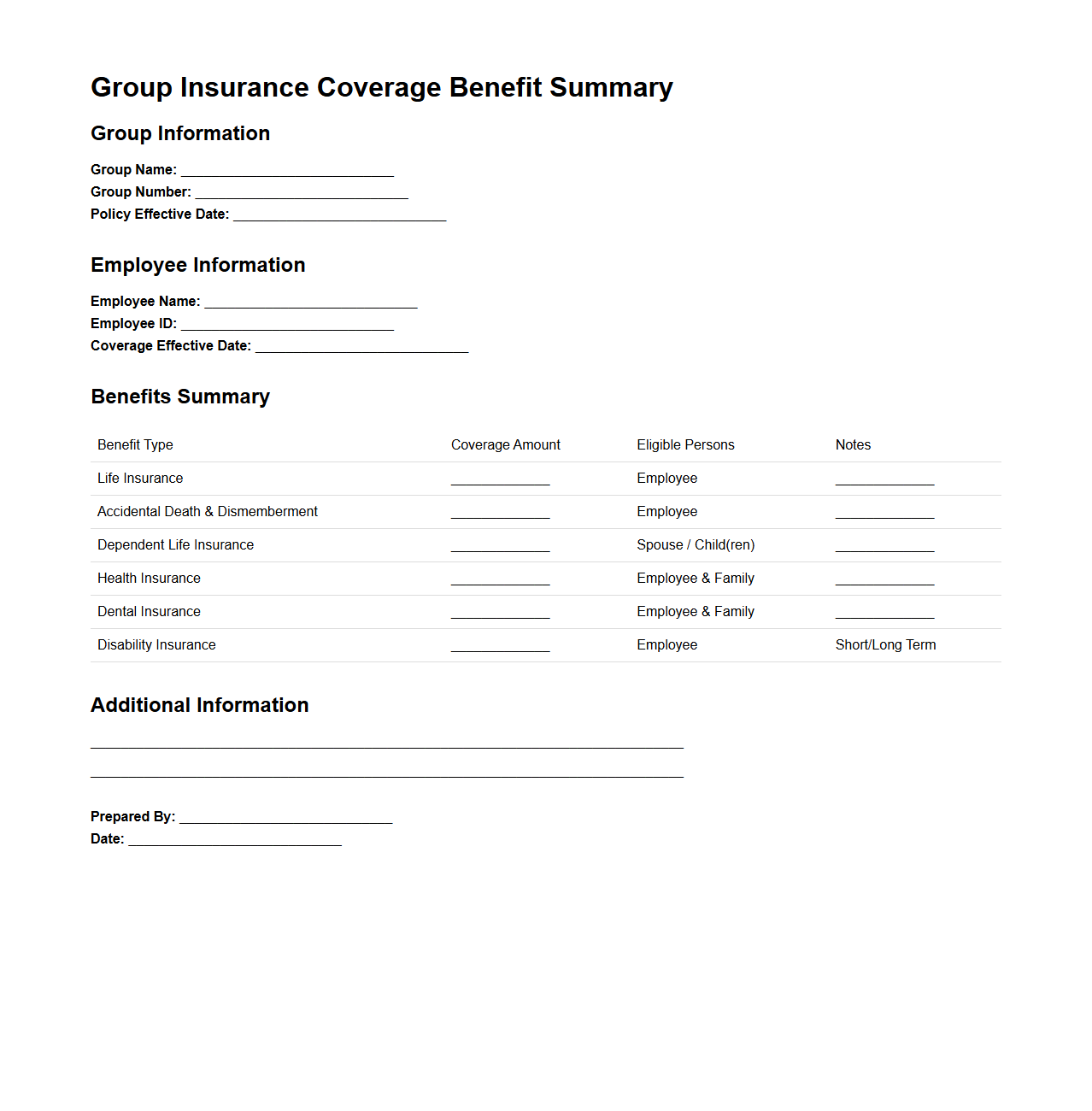

Group Insurance Coverage Benefit Summary

A

Group Insurance Coverage Benefit Summary document provides an overview of the key benefits, coverage limits, and eligibility criteria associated with a group insurance policy offered by an employer or organization. It outlines the types of coverage included, such as health, dental, life, and disability insurance, along with important details like waiting periods, maximum benefits, and claim procedures. This summary helps policyholders quickly understand their coverage options and the financial protection available under the group plan.

What key factors are evaluated in the underwriting assessment for group insurance?

The key factors in underwriting assessment for group insurance include the size of the group, the age distribution of members, and the overall health profile. Underwriters also evaluate occupational risks and geographic location to determine potential exposure. Financial stability of the sponsoring organization is assessed to ensure reliable premium payments.

How are group demographics documented and analyzed in the assessment?

Group demographics are documented through detailed census data, which captures age, gender, and employment classifications. This information is analyzed to estimate risk levels and predict future claims costs. Statistical tools and trend analysis are applied to understand demographic impacts on premium rates.

What risk categories are included in the Underwriting Assessment Document Sample?

The underwriting assessment includes risk categories such as medical history, lifestyle factors, occupational hazards, and environmental risks. It also covers financial risks relating to the group's ability to maintain premiums. Each risk category is evaluated to give a comprehensive risk profile of the insured group.

How does the sample document address previous claims history?

The sample document analyzes previous claims history by reviewing frequency, severity, and types of claims made. This historical data helps predict future claim trends and potential financial exposure. The document highlights patterns that may indicate increased underwriting risk.

What underwriting recommendations are provided within the assessment document?

The underwriting recommendations include suggestions for premium adjustments based on risk evaluation and claims history. It may propose additional exclusions or coverage restrictions to mitigate identified risks. The document also advises on risk management strategies to improve group health and reduce future claims.