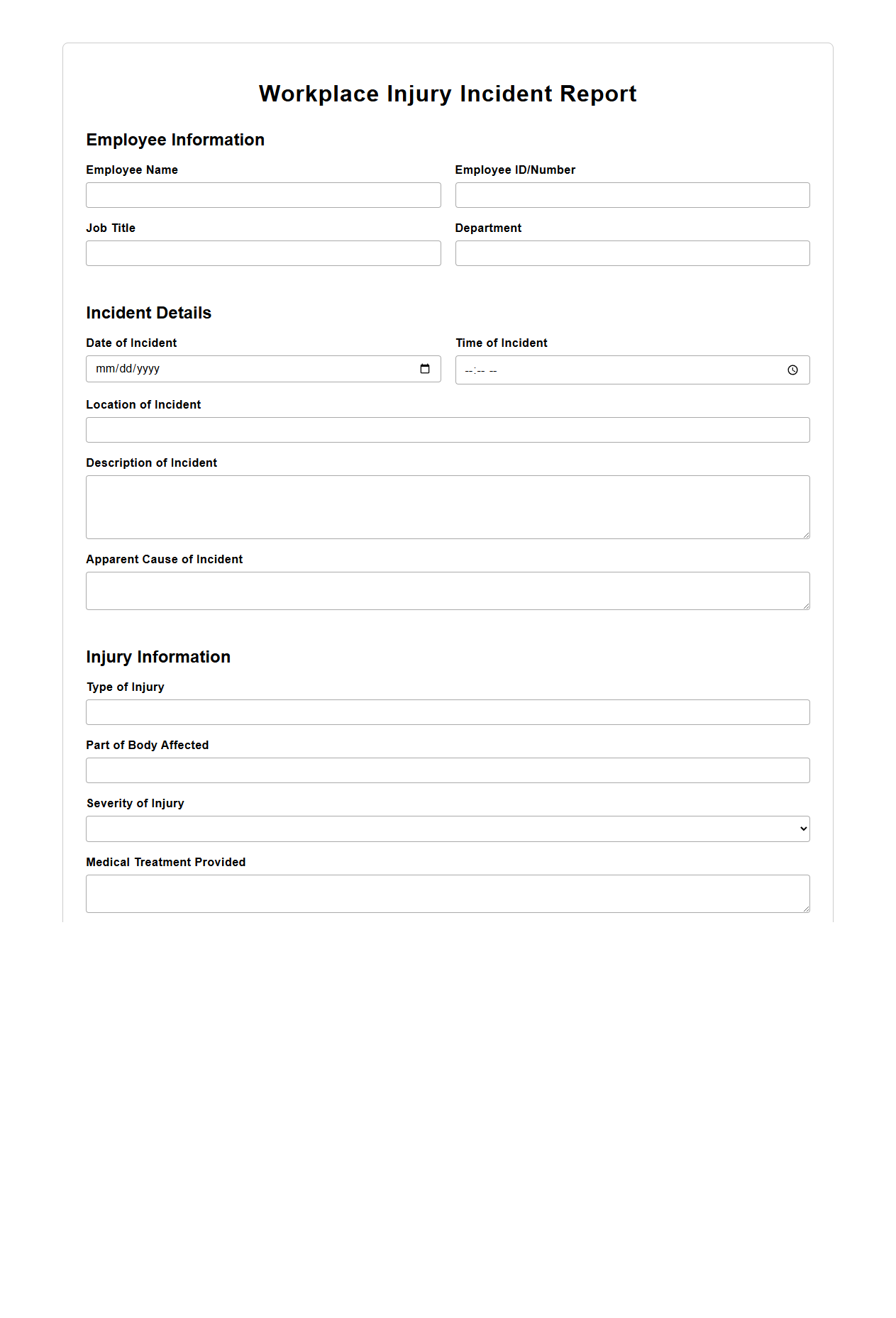

Workplace Injury Incident Report for Liability Insurance

A

Workplace Injury Incident Report for Liability Insurance is a formal document used to detail the circumstances, nature, and consequences of a work-related injury. This report serves as critical evidence for insurance claims, helping to establish liability and support the processing of compensation. Accurate and thorough documentation in this report is essential to ensure proper coverage and legal compliance.

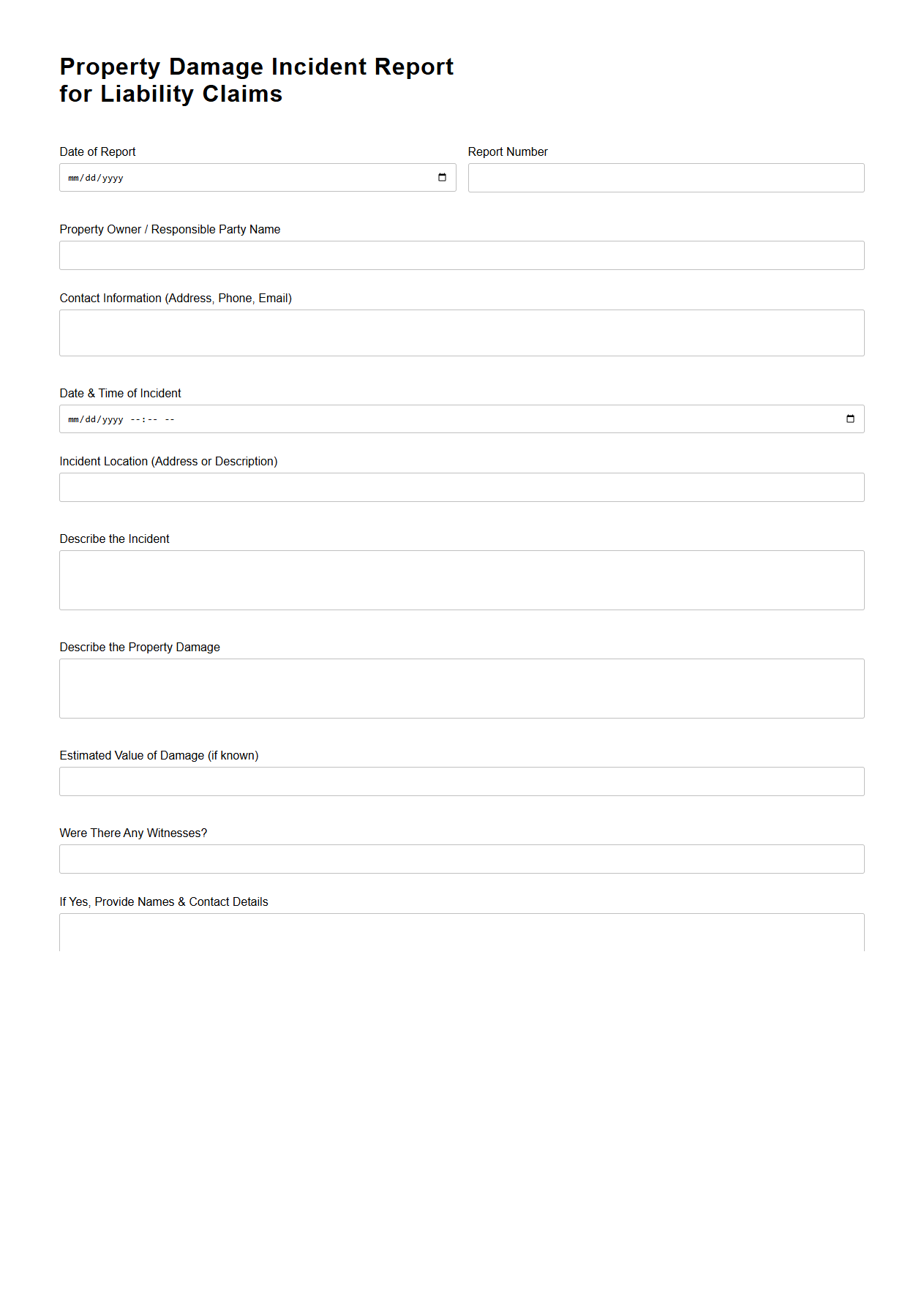

Property Damage Incident Report for Liability Claims

A

Property Damage Incident Report for Liability Claims is a detailed document used to record the specifics of an event resulting in property damage, providing essential information for insurance and legal purposes. It typically includes data such as the date, time, location, parties involved, description of the damage, and any witness statements to establish liability. This report is crucial for accurately assessing claims, supporting investigations, and facilitating fair compensation processes.

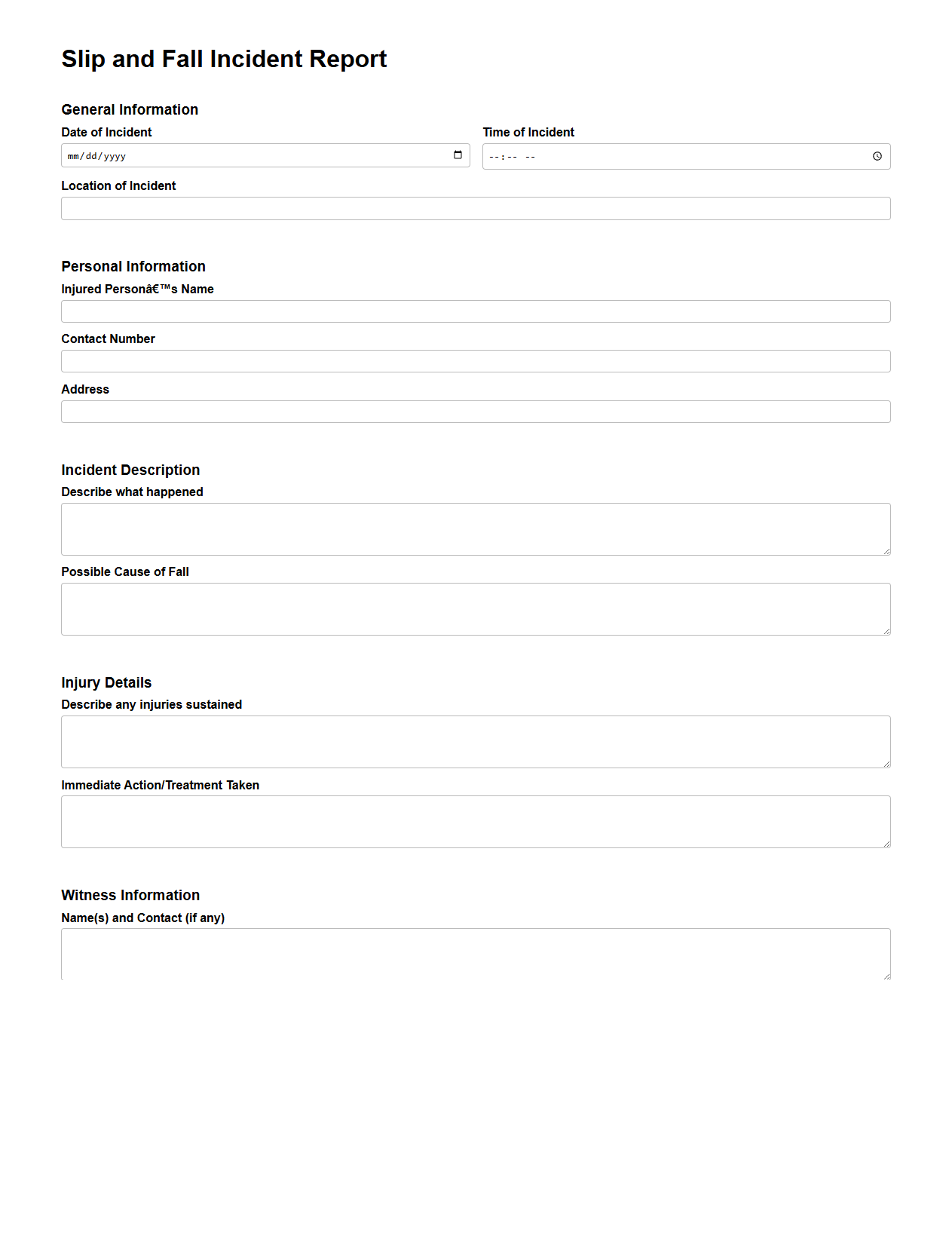

Slip and Fall Incident Report for Insurance Purposes

A

Slip and Fall Incident Report for Insurance Purposes document is a detailed record of the circumstances surrounding a slip and fall accident, created to support insurance claims. It typically includes information such as the date, time, location, description of the incident, witness statements, and any injuries sustained. This report is crucial for accurately documenting the event, facilitating the claims process, and determining liability.

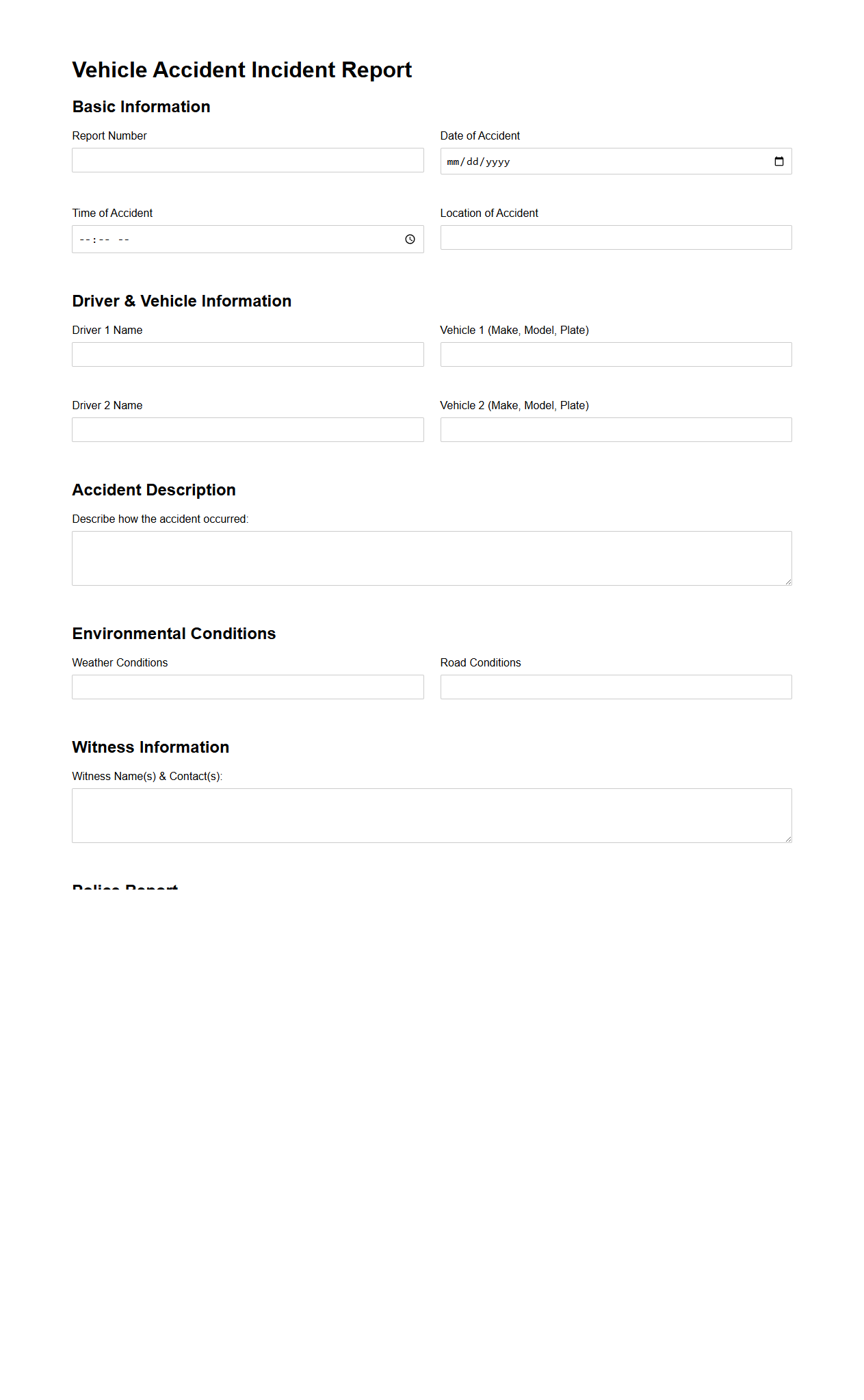

Vehicle Accident Incident Report for Liability Assessment

A

Vehicle Accident Incident Report for Liability Assessment document details the circumstances and key facts surrounding a vehicle collision to determine fault and liability. It includes information such as date, time, location, involved parties, vehicle conditions, witness statements, and damage descriptions. This report is essential for insurance claims, legal proceedings, and resolving accountability in motor vehicle accidents.

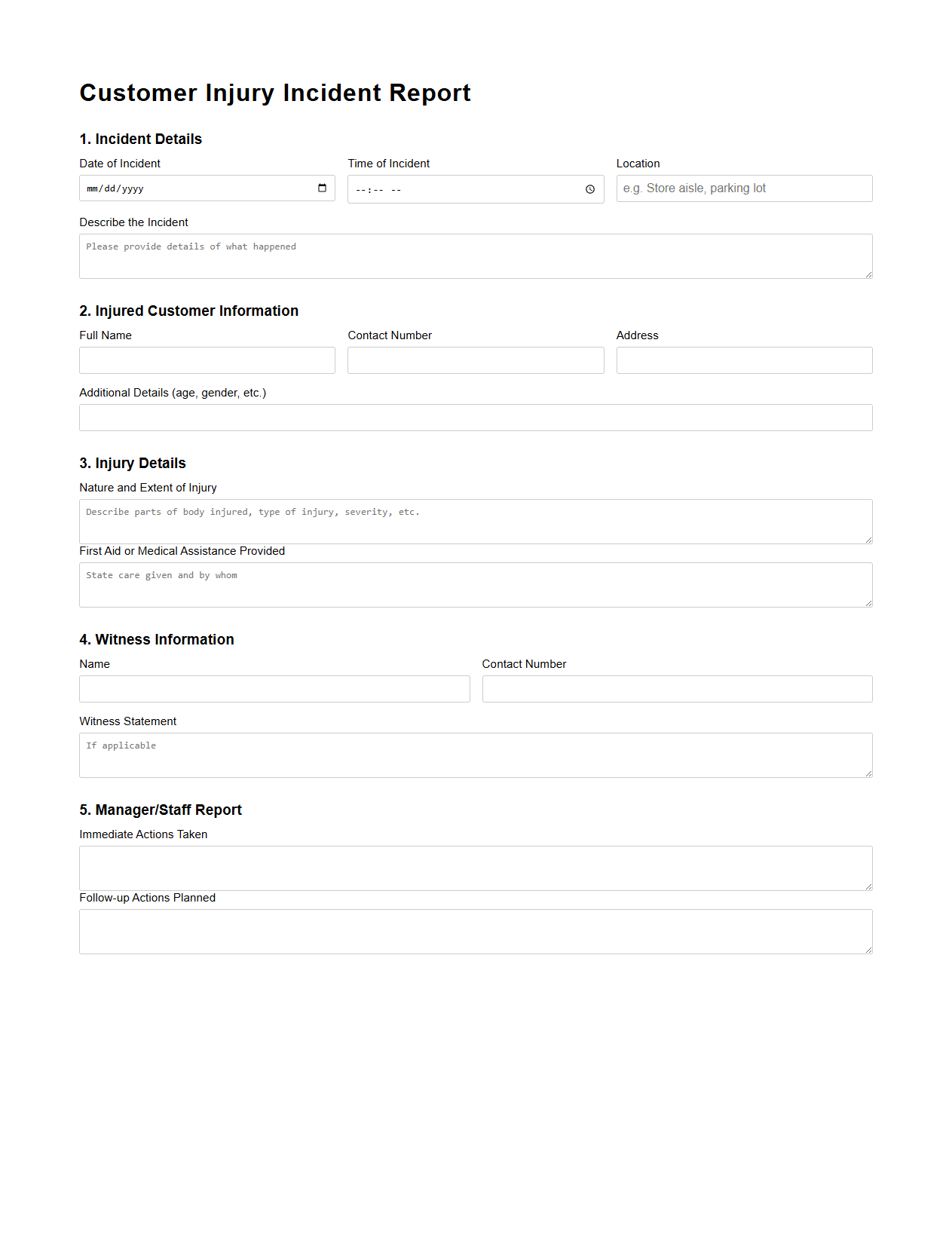

Customer Injury Incident Report for Commercial Liability

A

Customer Injury Incident Report for Commercial Liability is a detailed document used to record the specifics of an injury sustained by a customer on a business premises. It includes critical information such as the date, time, location, nature of the injury, witness statements, and the conditions that contributed to the incident. This report serves as essential evidence for liability claims, helping businesses assess risk, comply with legal requirements, and safeguard against potential lawsuits.

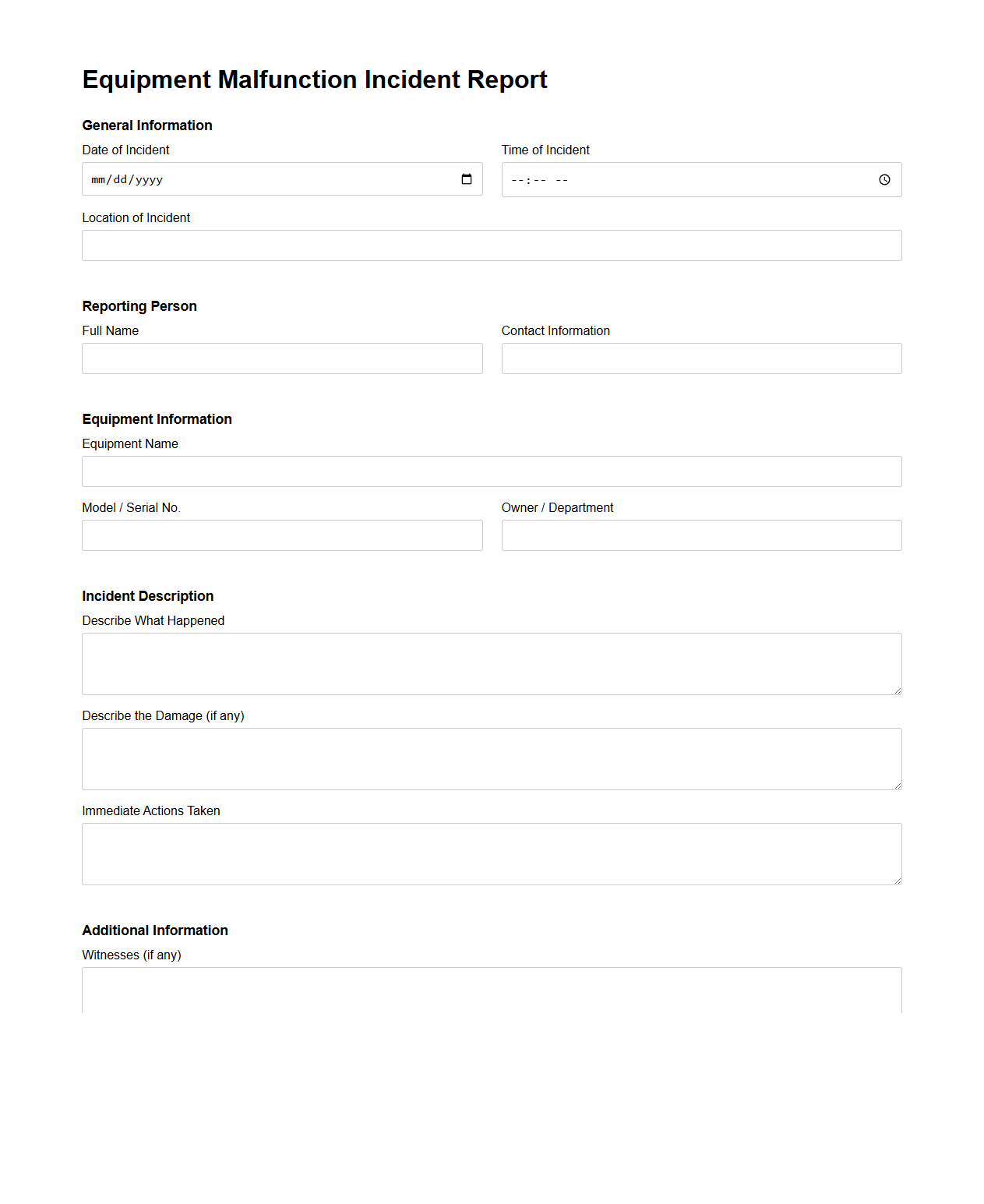

Equipment Malfunction Incident Report for Insurance

An

Equipment Malfunction Incident Report for insurance is a detailed document that records the specifics of a failure or malfunction of machinery or equipment, including the time, cause, and impact. It is essential for insurance claims as it provides evidence and helps assess liability, potential damages, and the extent of loss. Accurate reporting in this document ensures proper validation and processing of insurance coverage related to equipment breakdowns.

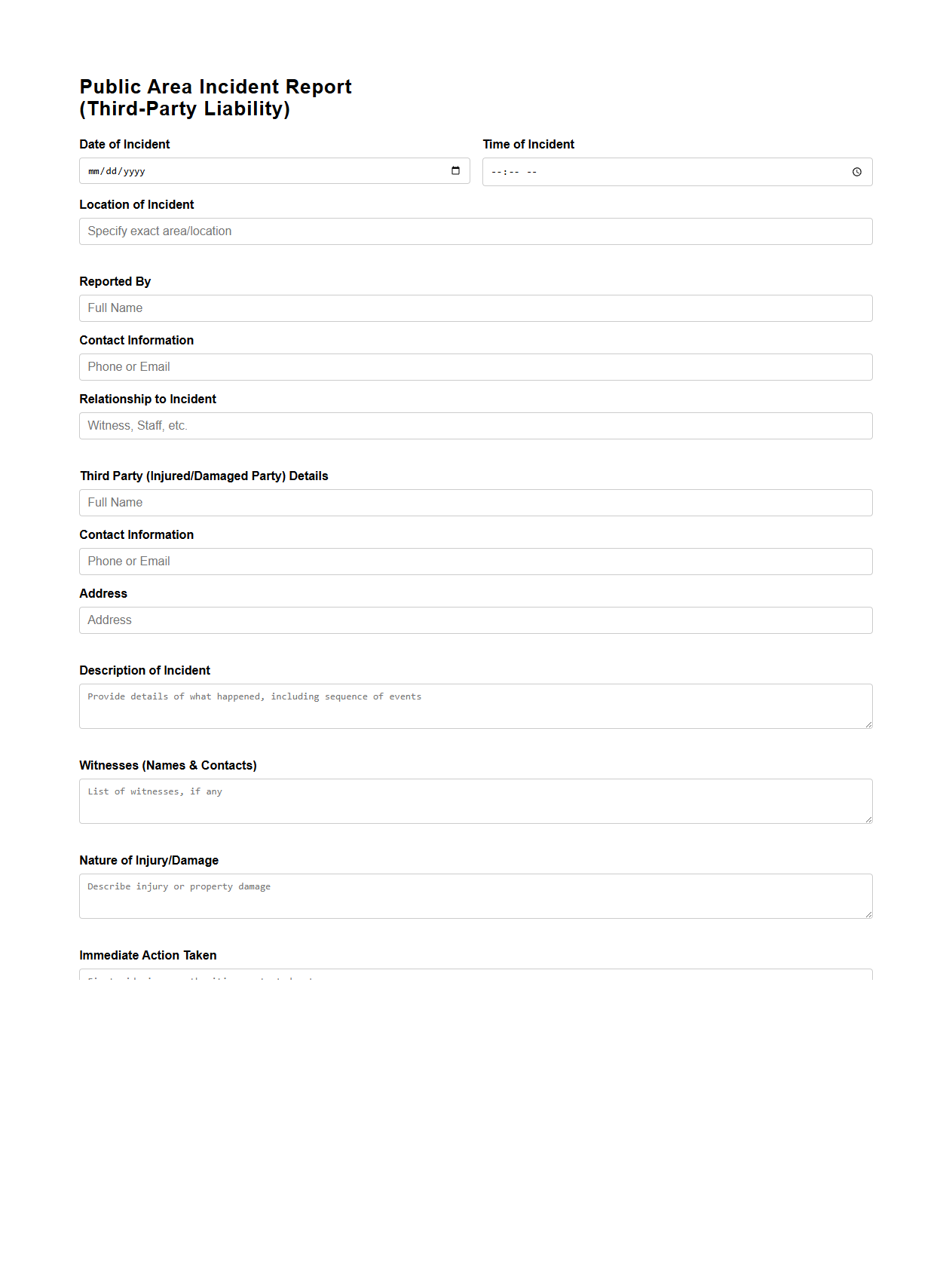

Public Area Incident Report for Third-Party Liability

A

Public Area Incident Report for Third-Party Liability document records detailed information about incidents occurring in public spaces that may result in claims against a third party. It includes precise descriptions of the event, involved parties, location, time, and any potential damages or injuries to support legal and insurance processes. This report is essential for establishing responsibility and facilitating claims management in liability cases.

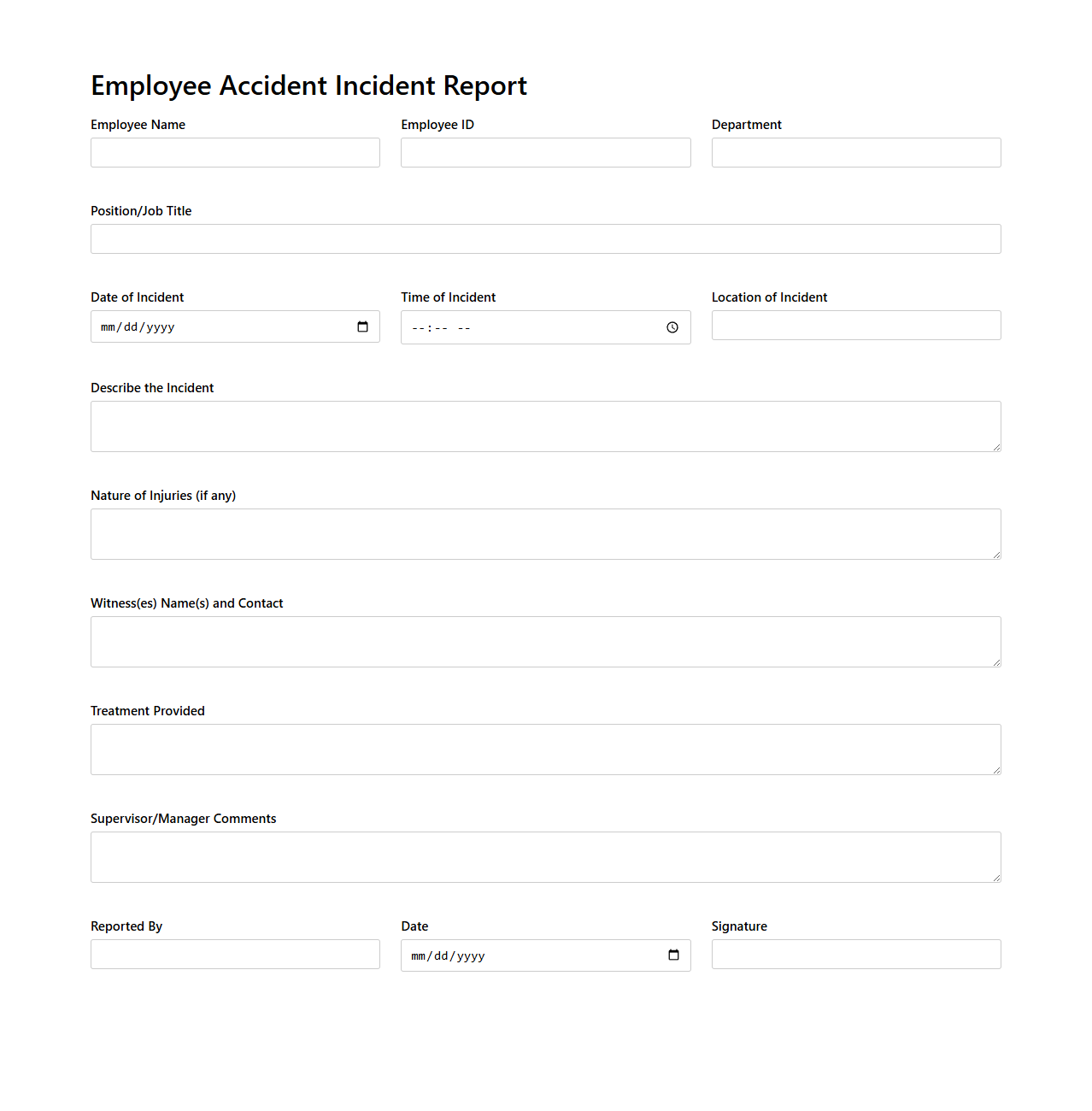

Employee Accident Incident Report for Workplace Insurance

An

Employee Accident Incident Report for Workplace Insurance is a formal document that records the details of an employee's injury or accident occurring at work. It captures critical information such as the date, time, location, nature of the incident, and witness statements, ensuring accurate documentation for insurance claims and legal compliance. This report facilitates timely medical treatment, supports injury prevention strategies, and helps employers meet regulatory requirements.

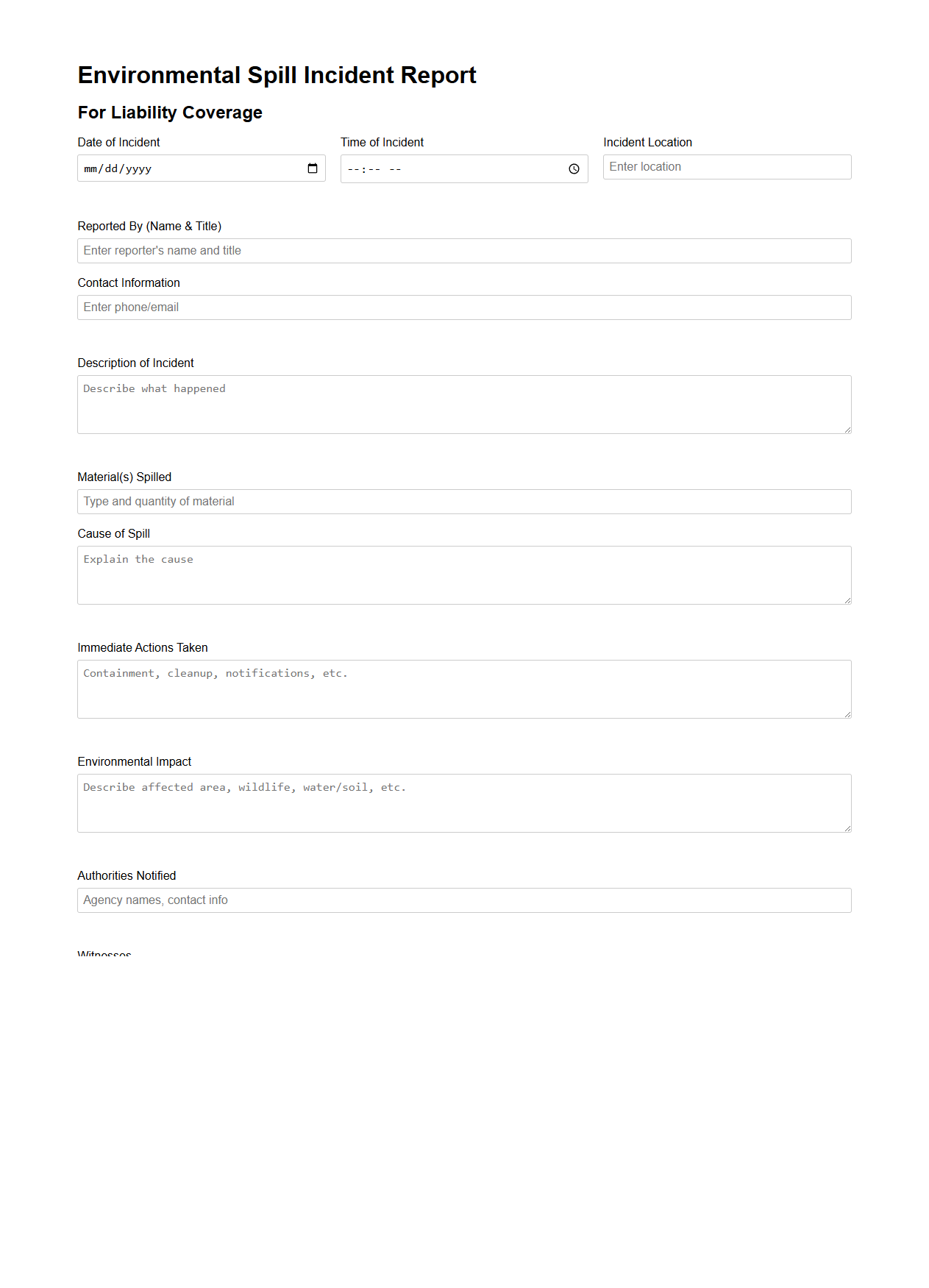

Environmental Spill Incident Report for Liability Coverage

An

Environmental Spill Incident Report for Liability Coverage document records detailed information about the release of hazardous substances to help determine the responsible party and assess potential environmental damage. It serves as a critical tool for insurance claims, ensuring compliance with environmental regulations and facilitating timely remediation efforts. This report typically includes data on the spill's source, type of contaminants, volume released, and immediate actions taken to mitigate risks.

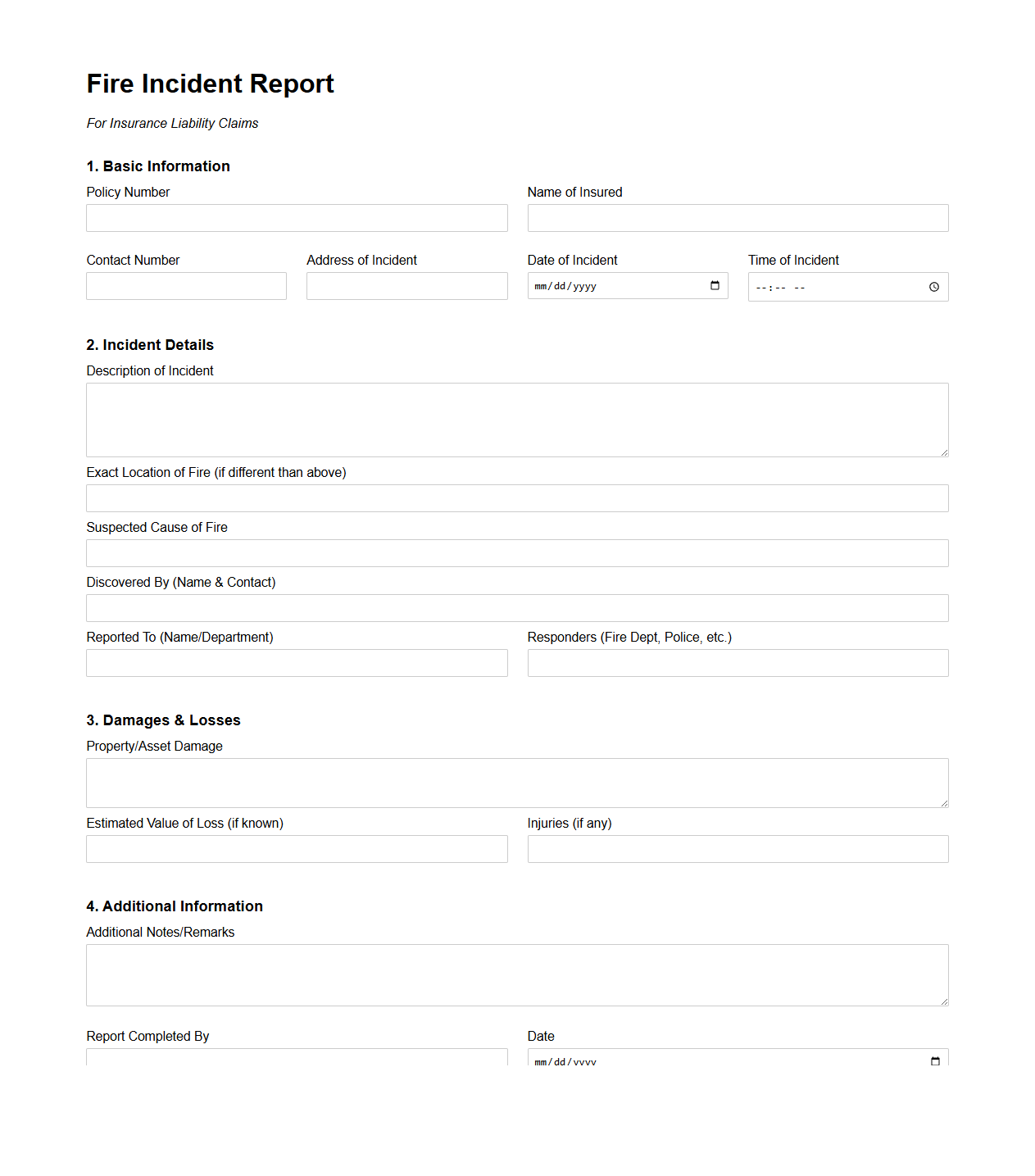

Fire Incident Report for Insurance Liability Claims

A

Fire Incident Report for Insurance Liability Claims is a detailed document that records all relevant information about a fire event, including the cause, extent of damage, and involved parties. This report serves as crucial evidence for insurance companies to assess liability, determine coverage, and process claims accurately. It includes timelines, witness statements, fire department findings, and damage assessments to support the evaluation of risk and responsibility.

What key details should be included in an incident description for liability insurance documentation?

The incident description must clearly outline the who, what, when, and where of the event to provide a comprehensive overview. It should include a factual and unbiased account, emphasizing the cause and effect elements related to the incident. Precise and detailed narratives help ensure the claim's accuracy for liability evaluation.

Which parties involved must be identified in a standard incident report for liability claims?

All persons or entities directly involved in the incident must be clearly identified, including policyholders, claimants, and witnesses. Contact information and roles of each party are essential for follow-up and verification purposes. Proper identification supports the accountability process during the insurance claim investigation.

How does the sample document address the timeline and sequence of events for liability assessment?

The sample document provides a chronological timeline that details each significant event before, during, and after the incident. This sequencing aids in analyzing the progression and establishes the context for liability determination. Clear timestamps and descriptions ensure transparency in the evaluation process.

What supporting evidence or attachments are typically referenced in a liability incident report?

Common attachments include photos, videos, witness statements, and official reports such as police or medical documents. These materials substantiate the incident description and enhance the credibility of the claim. Properly referenced evidence is critical for thorough liability assessment and resolution.

What follow-up actions or contacts are suggested in the sample document for ongoing liability insurance processes?

The sample document recommends prompt communication with the insurance adjuster and legal representatives involved in the case. It also suggests scheduling follow-up investigations or medical evaluations as necessary. Maintaining updated contact information and clear next steps supports efficient claims processing and resolution.