A Medical Expense Reimbursement Document Sample for Accident Insurance outlines the necessary details and format required to claim medical expenses after an accident. It includes patient information, treatment costs, receipts, and insurance policy details to ensure smooth processing of reimbursement. This sample helps streamline the submission process and prevents delays in receiving compensation.

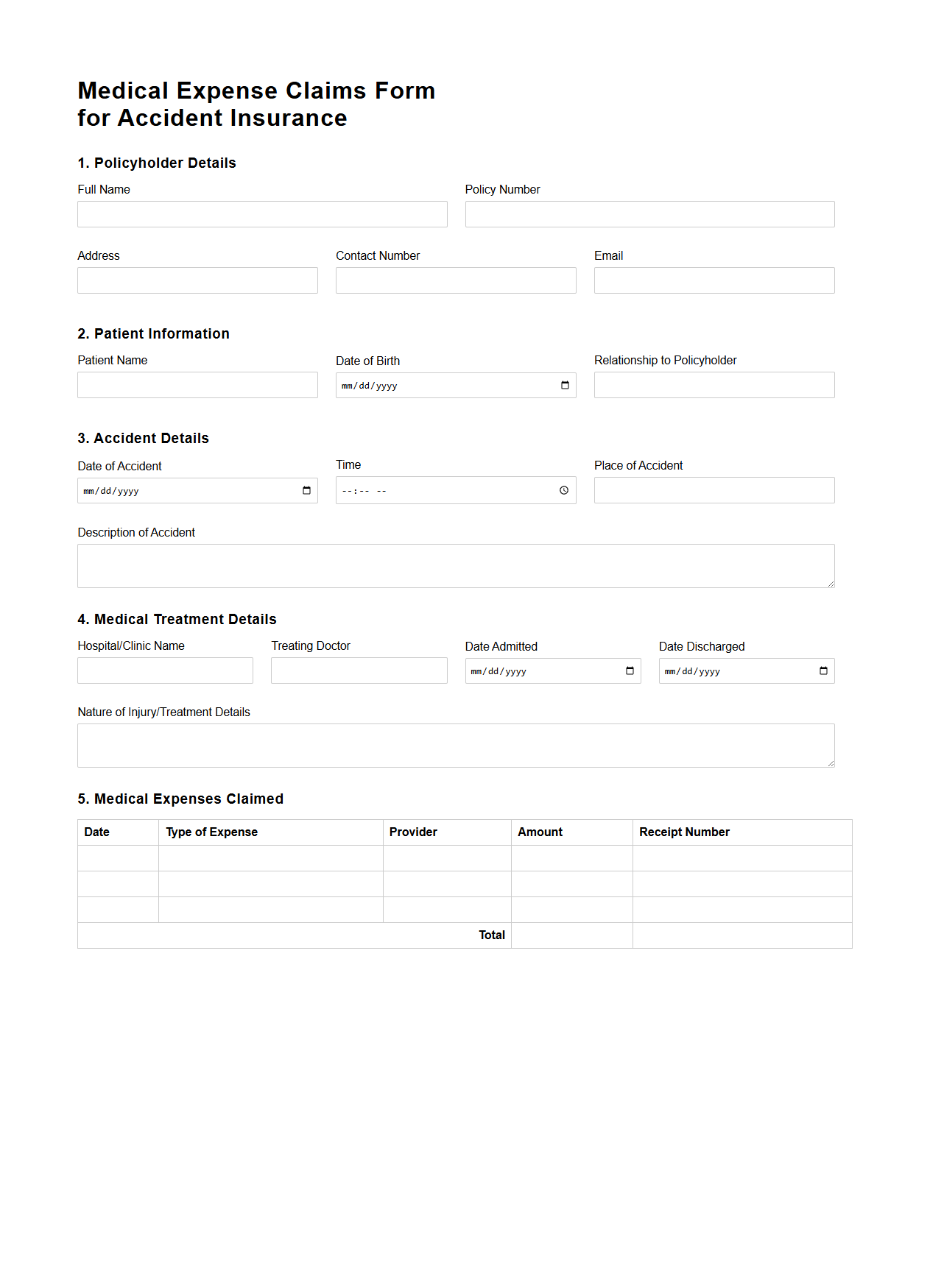

Medical Expense Claims Form for Accident Insurance

A

Medical Expense Claims Form for Accident Insurance is a crucial document used to request reimbursement for medical costs incurred due to an accident. It requires detailed information about the accident, treatment received, and relevant medical bills or receipts. Proper submission of this form ensures prompt processing and payment under the accident insurance policy.

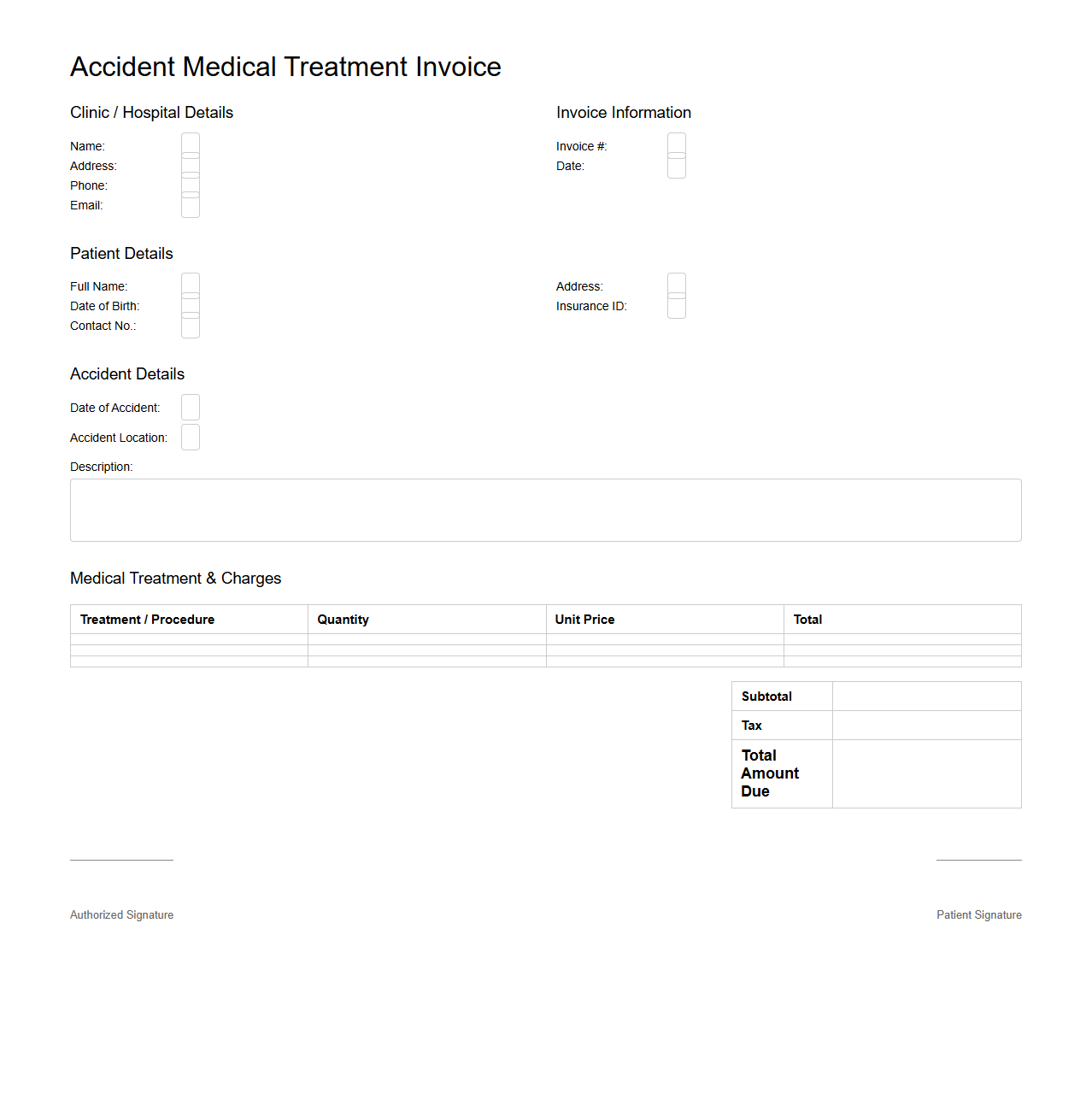

Accident Medical Treatment Invoice Template

An

Accident Medical Treatment Invoice Template is a structured document used to itemize and bill medical services provided to an individual following an accident. It includes crucial details such as patient information, treatment descriptions, dates of service, and cost breakdowns to ensure clear communication between healthcare providers, patients, and insurance companies. This template streamlines the billing process, enhancing accuracy and facilitating prompt reimbursement for medical expenses related to accident care.

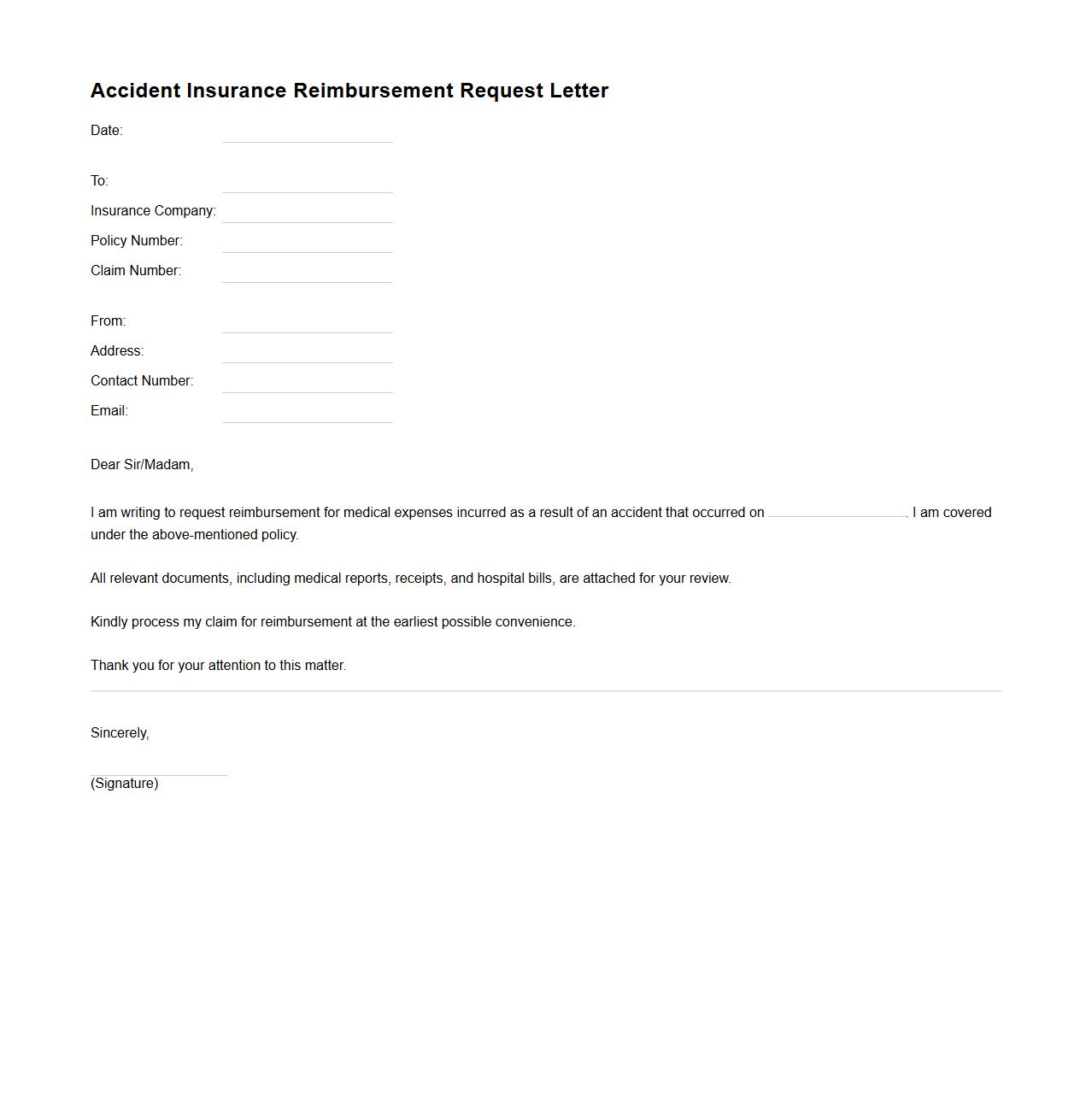

Accident Insurance Reimbursement Request Letter

An

Accident Insurance Reimbursement Request Letter is a formal document submitted to an insurance company to claim compensation for medical expenses or damages incurred due to an accident. This letter includes essential details such as the policyholder's information, accident date, nature of injuries, and the amount being claimed. It serves as a critical communication tool to initiate the reimbursement process and ensure timely financial relief.

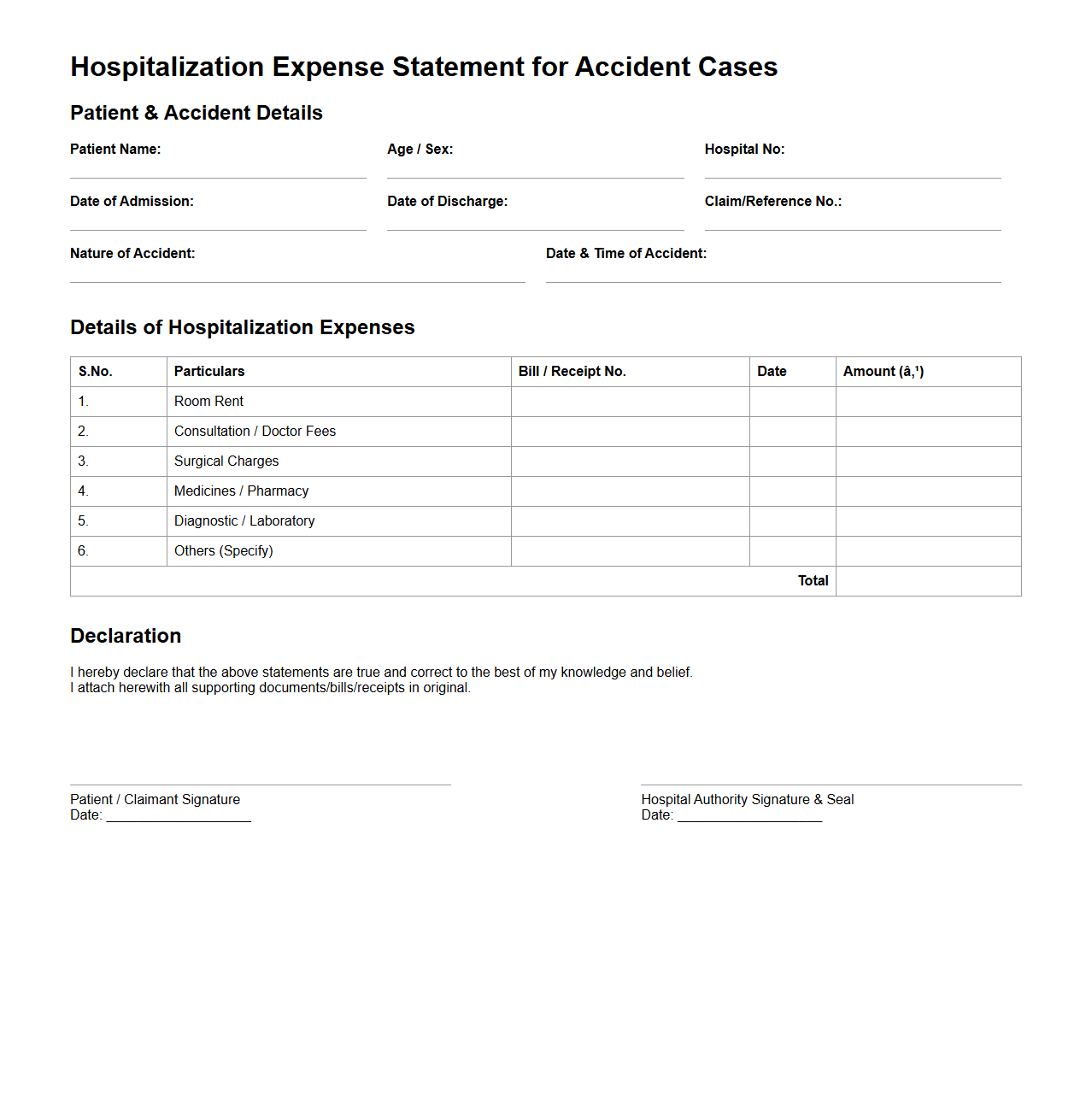

Hospitalization Expense Statement for Accident Cases

The

Hospitalization Expense Statement for Accident Cases is an official document that itemizes medical costs incurred due to injuries sustained in an accident. It includes detailed charges such as room rent, surgical fees, medication, diagnostic tests, and nursing care during the hospital stay. This statement is essential for insurance claims and legal purposes to verify and process reimbursement accurately.

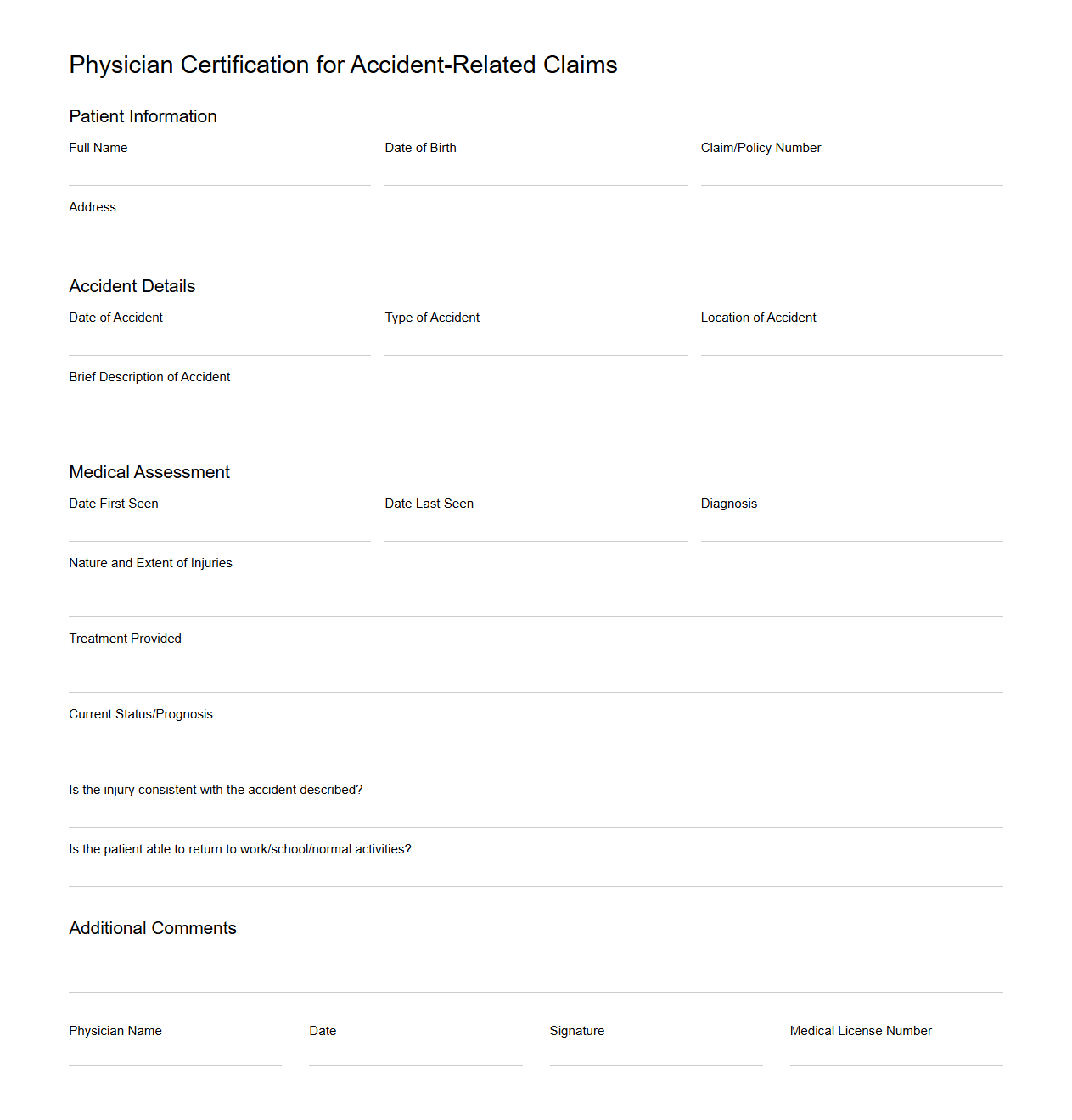

Physician Certification for Accident-Related Claims

The

Physician Certification for Accident-Related Claims document is a formal medical statement provided by a licensed healthcare professional verifying the nature and extent of injuries sustained in an accident. It serves as critical evidence in insurance claims, ensuring that benefits are accurately awarded based on medical evaluation. This certification includes detailed information about diagnosis, treatment, and prognosis related to the accident for claim validation purposes.

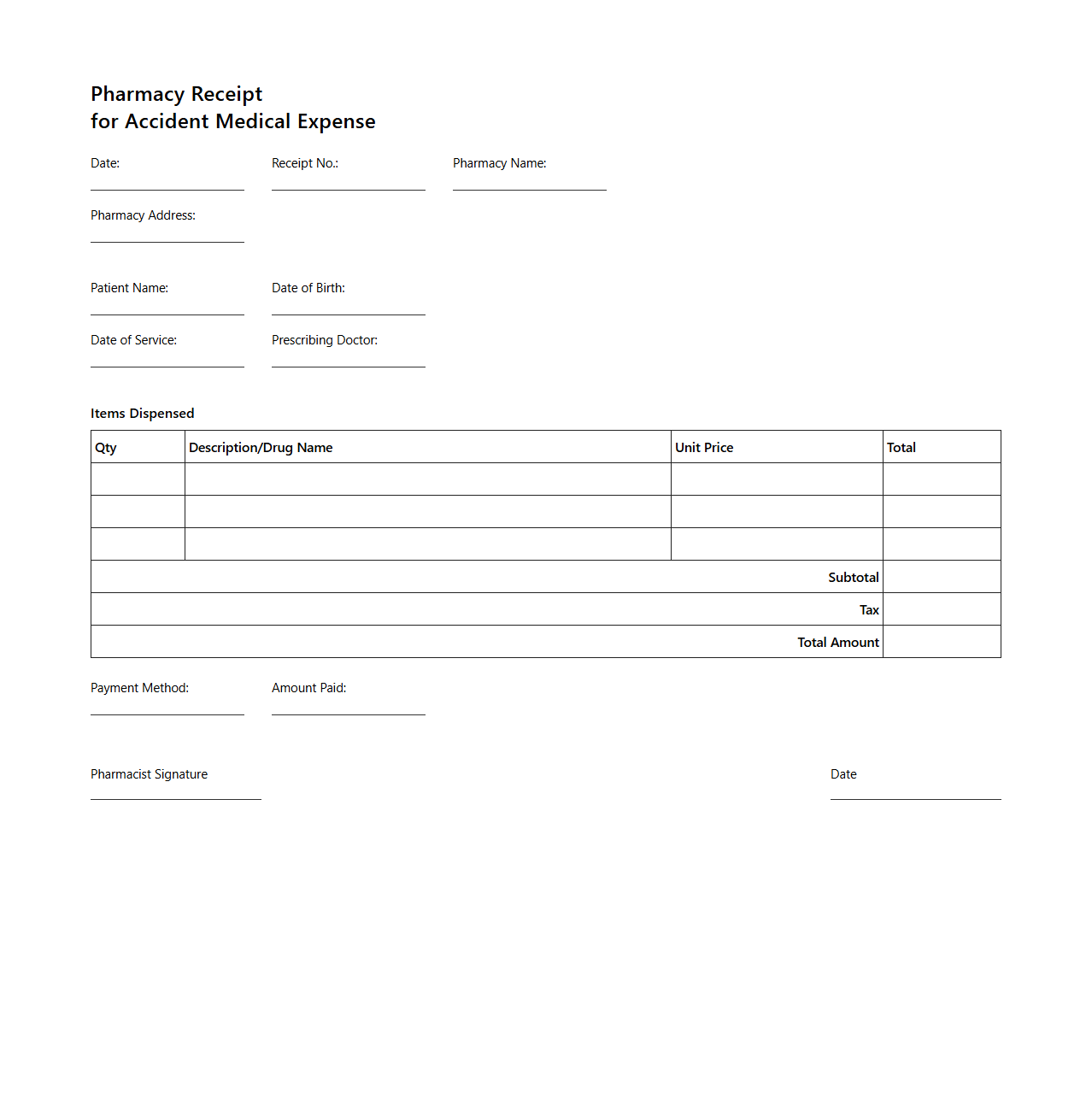

Pharmacy Receipt for Accident Medical Expense

A

Pharmacy Receipt for Accident Medical Expense is an official document that records the purchase of medication related to treatment after an accident. It includes detailed information such as the patient's name, date of purchase, list of medicines dispensed, quantities, prices, and the pharmacy's identification. This receipt is crucial for insurance claims and reimbursement processes concerning medical expenses incurred due to accident-related injuries.

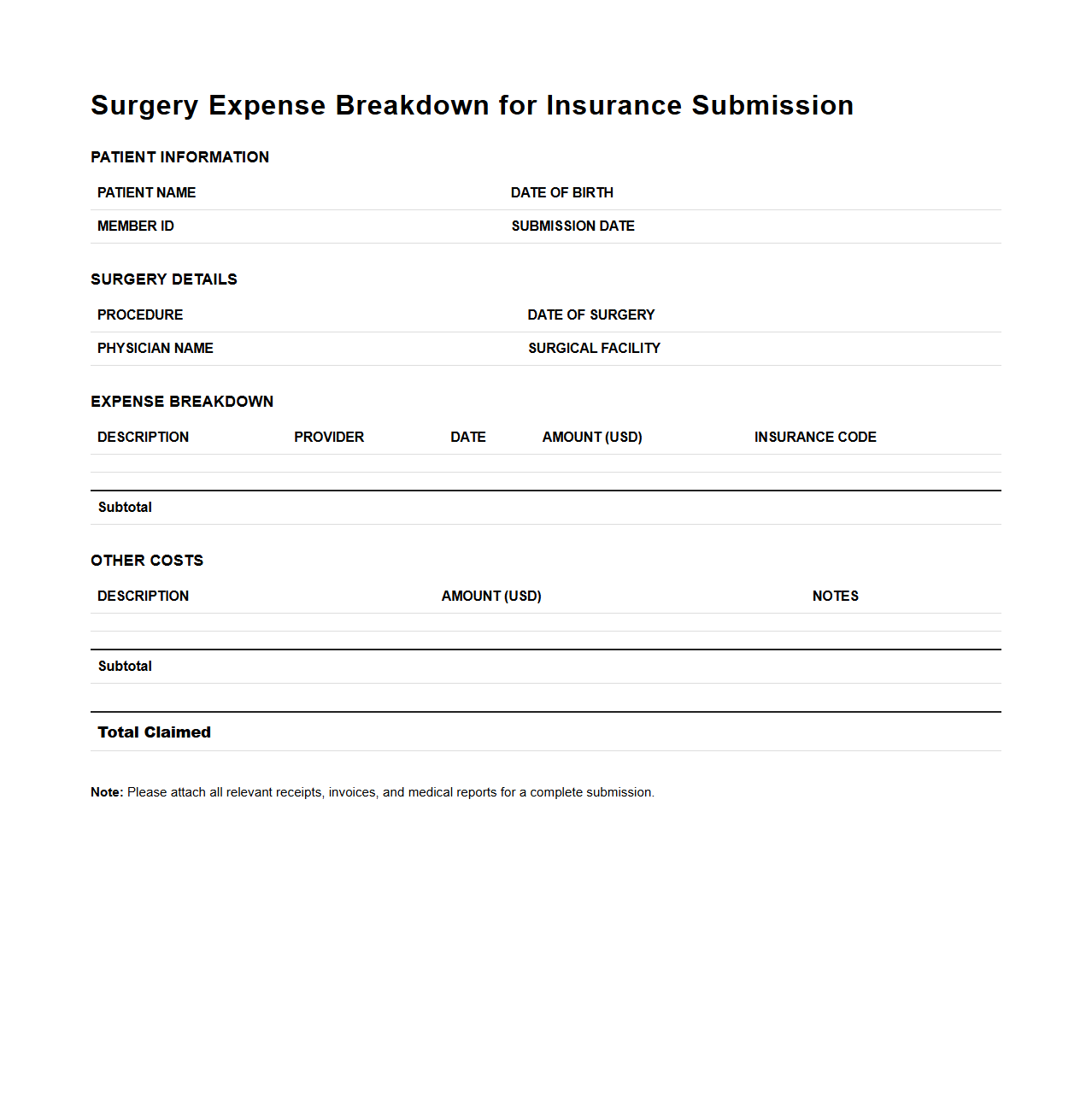

Surgery Expense Breakdown for Insurance Submission

Surgery Expense Breakdown for Insurance Submission is a detailed report itemizing all costs associated with a surgical procedure, including surgeon fees, anesthesia, hospital charges, and post-operative care. This document plays a crucial role in facilitating insurance claims by providing clear, itemized evidence of expenses to ensure accurate reimbursement. Accurate

surgery expense documentation helps prevent claim denials and expedites the insurance approval process.

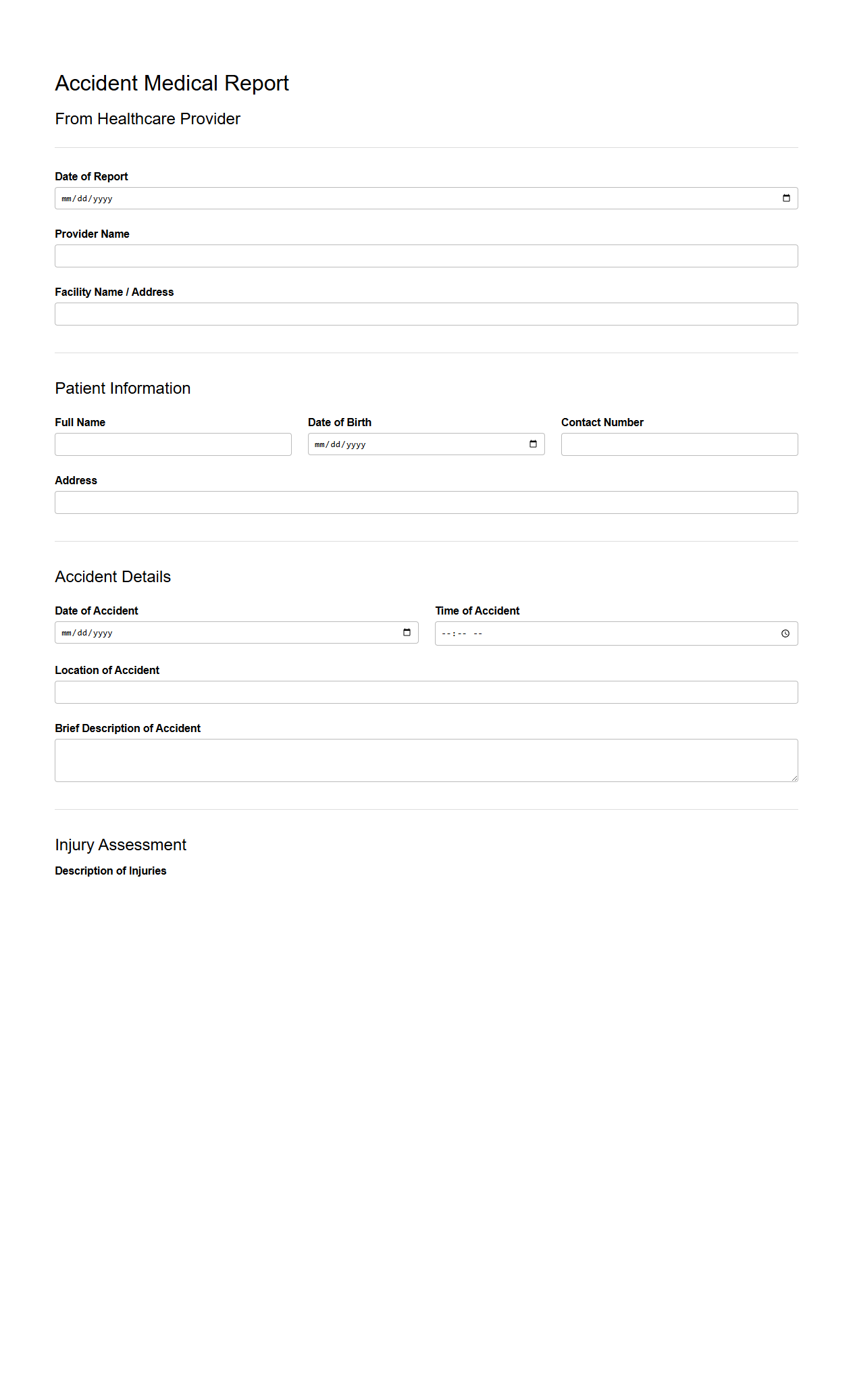

Accident Medical Report from Healthcare Provider

An

Accident Medical Report from a healthcare provider is an official document detailing the medical evaluation, diagnosis, and treatment related to injuries sustained in an accident. This report includes patient information, injury descriptions, treatment plans, and prognosis, serving as crucial evidence for insurance claims and legal proceedings. Accurate and thorough documentation ensures proper medical care continuity and supports claims verification.

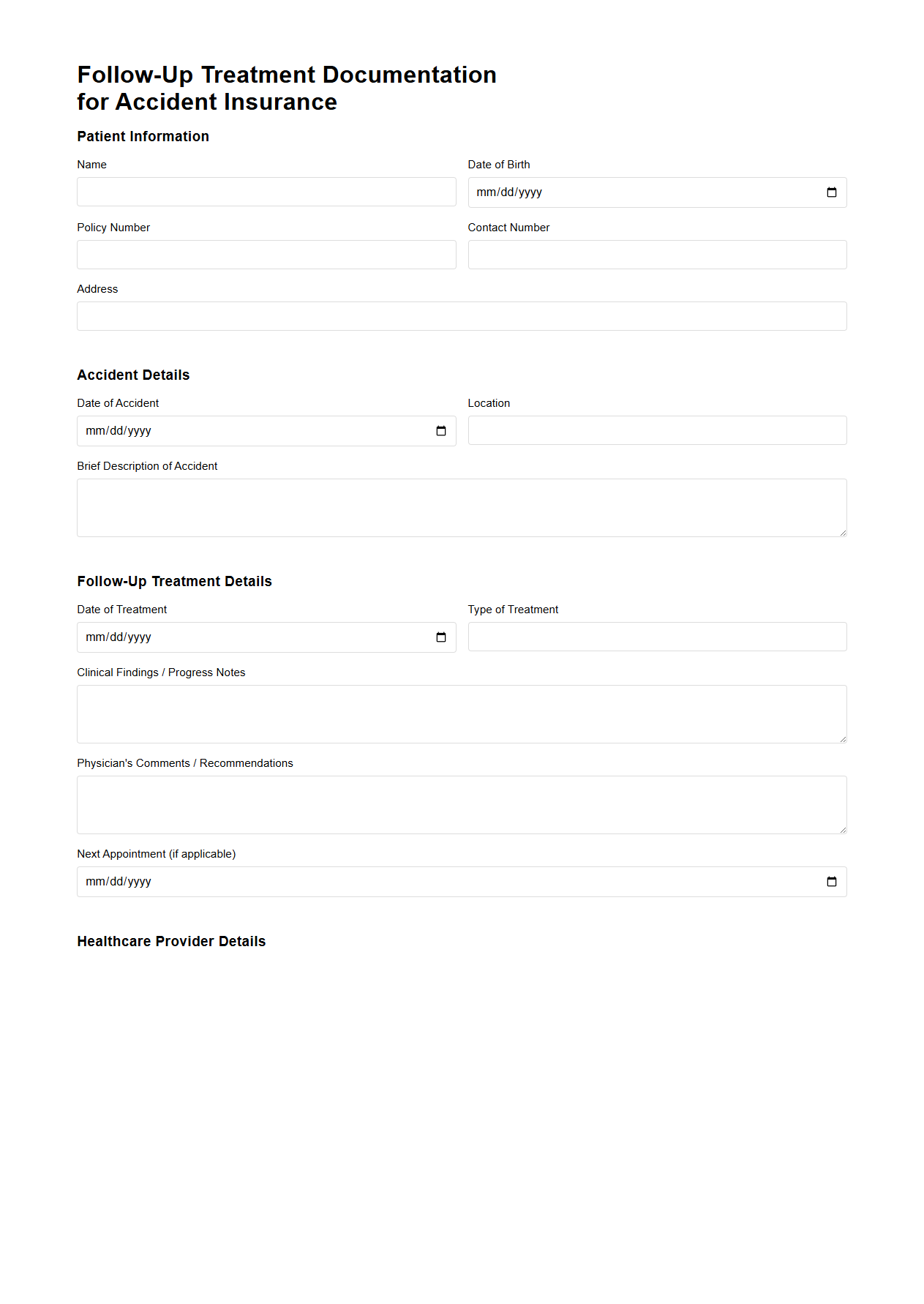

Follow-Up Treatment Documentation for Accident Insurance

Follow-Up Treatment Documentation for Accident Insurance is a critical record that outlines ongoing medical care and recovery progress after an accident. This documentation includes detailed reports from healthcare providers, treatment plans, and any changes in the patient's condition to support insurance claims. Maintaining accurate

Follow-Up Treatment Documentation ensures timely processing and validation of benefits related to accident insurance claims.

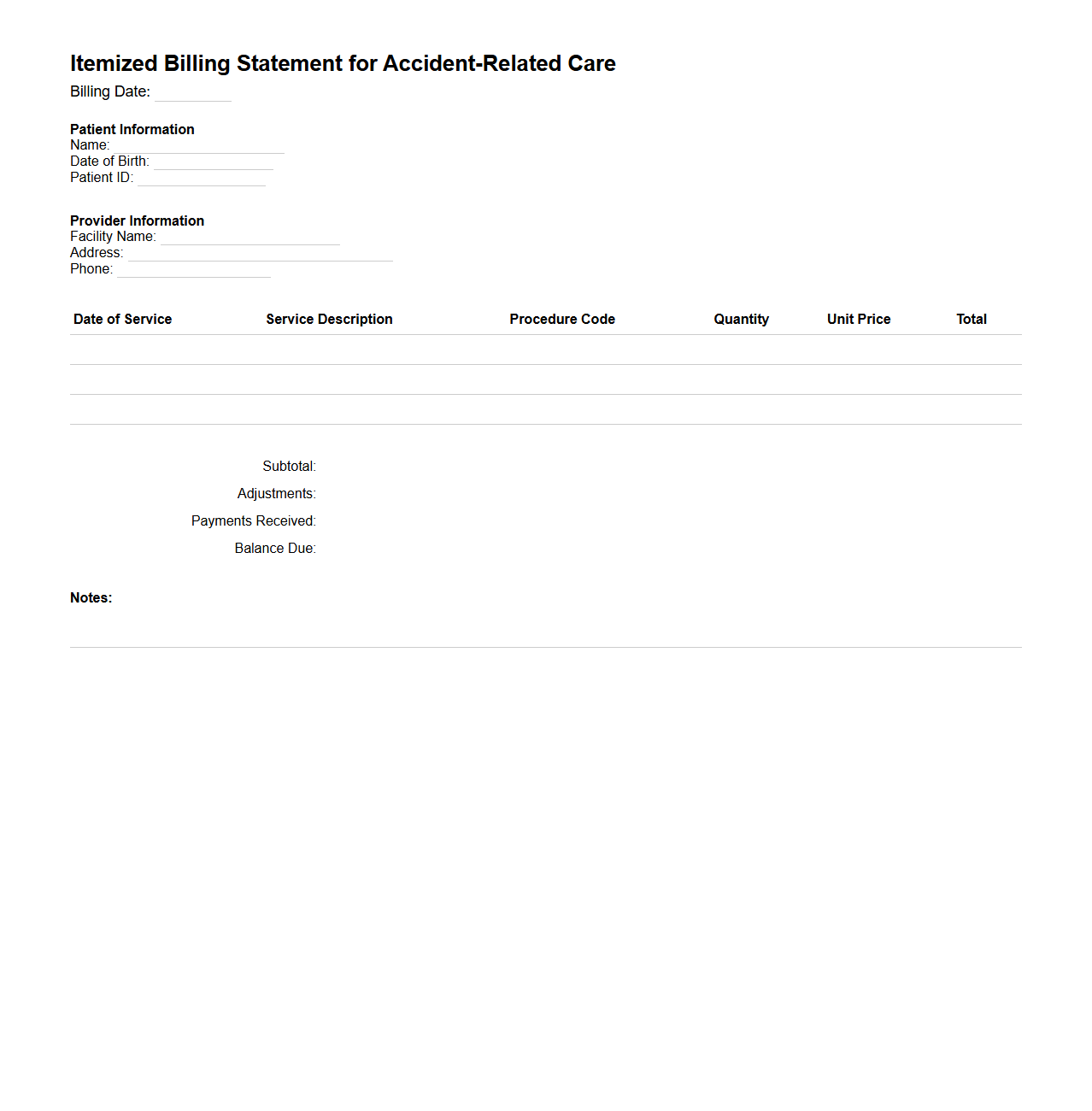

Itemized Billing Statement for Accident-Related Care

An

Itemized Billing Statement for Accident-Related Care is a detailed document that outlines all medical services and treatments provided following an accident. It includes specific charges for each procedure, medication, and consultation to ensure transparency and accuracy in billing. This statement is essential for insurance claims as it helps verify the costs associated with accident-related healthcare.

What specific medical expenses are eligible for reimbursement under this accident insurance policy?

The policy covers medical expenses directly related to injuries sustained in an accident. Eligible costs typically include hospital stays, surgeries, emergency room visits, and necessary medical treatments. Additional covered expenses may include prescribed medications and rehabilitation services.

What documentation is required to support a medical expense reimbursement claim?

To file a claim, the insured must submit detailed medical bills and receipts for treatments received. A physician's report or hospital discharge summary is also usually required to confirm the accident and treatment. Proper documentation ensures timely and accurate processing of the reimbursement request.

Are there any limits or exclusions for certain types of medical treatments or services?

The policy may impose limits on coverage for specific treatments, such as alternative therapies or cosmetic procedures. Exclusions often include pre-existing conditions and injuries caused by non-covered activities. It is essential to review the terms to understand which services may be restricted or excluded.

What is the time frame for submitting a reimbursement request after the accident occurs?

Claims must be submitted within a specified time frame, often between 30 to 90 days following the accident. Failing to meet this deadline may result in denial of reimbursement. Policyholders should verify the exact deadline stated in their insurance policy.

How is the reimbursement amount calculated according to the terms of the policy?

The reimbursement amount is generally based on the allowable charges defined by the policy and the extent of coverage elected. It may involve deductibles, co-payments, or percentage limits on eligible expenses. The insurer calculates the final payout after reviewing all submitted documentation and policy provisions.