A Policy Surrender Document Sample for Endowment Insurance outlines the essential details required to process the surrender of an endowment insurance policy. This document typically includes policyholder information, surrender value, and the effective date of termination. It serves as a formal request to the insurer to terminate the policy and receive the surrender benefits.

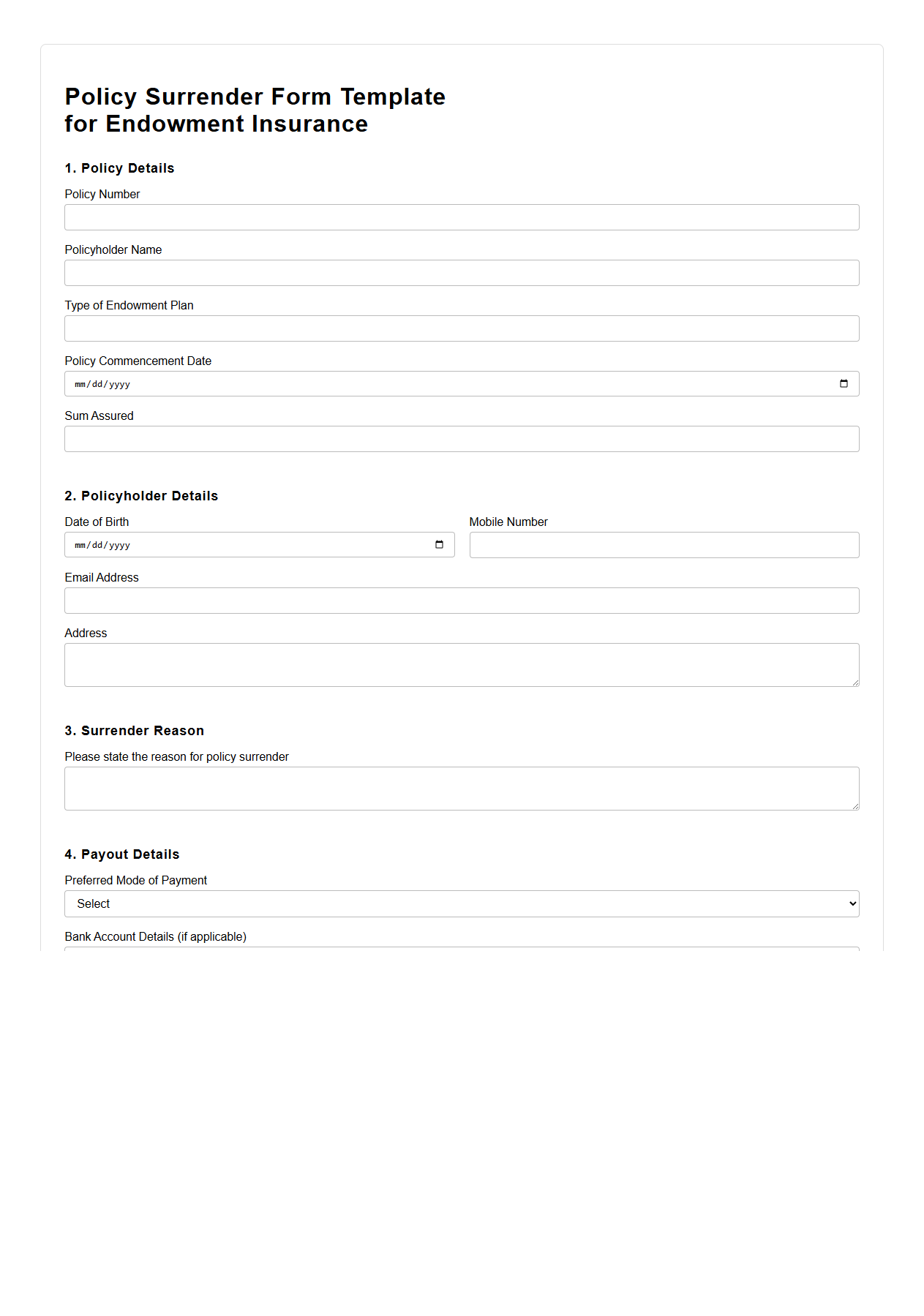

Policy Surrender Form Template for Endowment Insurance

The

Policy Surrender Form Template for Endowment Insurance is a standardized document that policyholders use to formally request the termination of their endowment insurance policy before its maturity. This form captures essential details such as the policy number, insured person's information, surrender date, and acknowledgment of any applicable surrender charges or refunds. Insurance companies rely on this template to ensure clear communication and efficient processing of policy surrender requests.

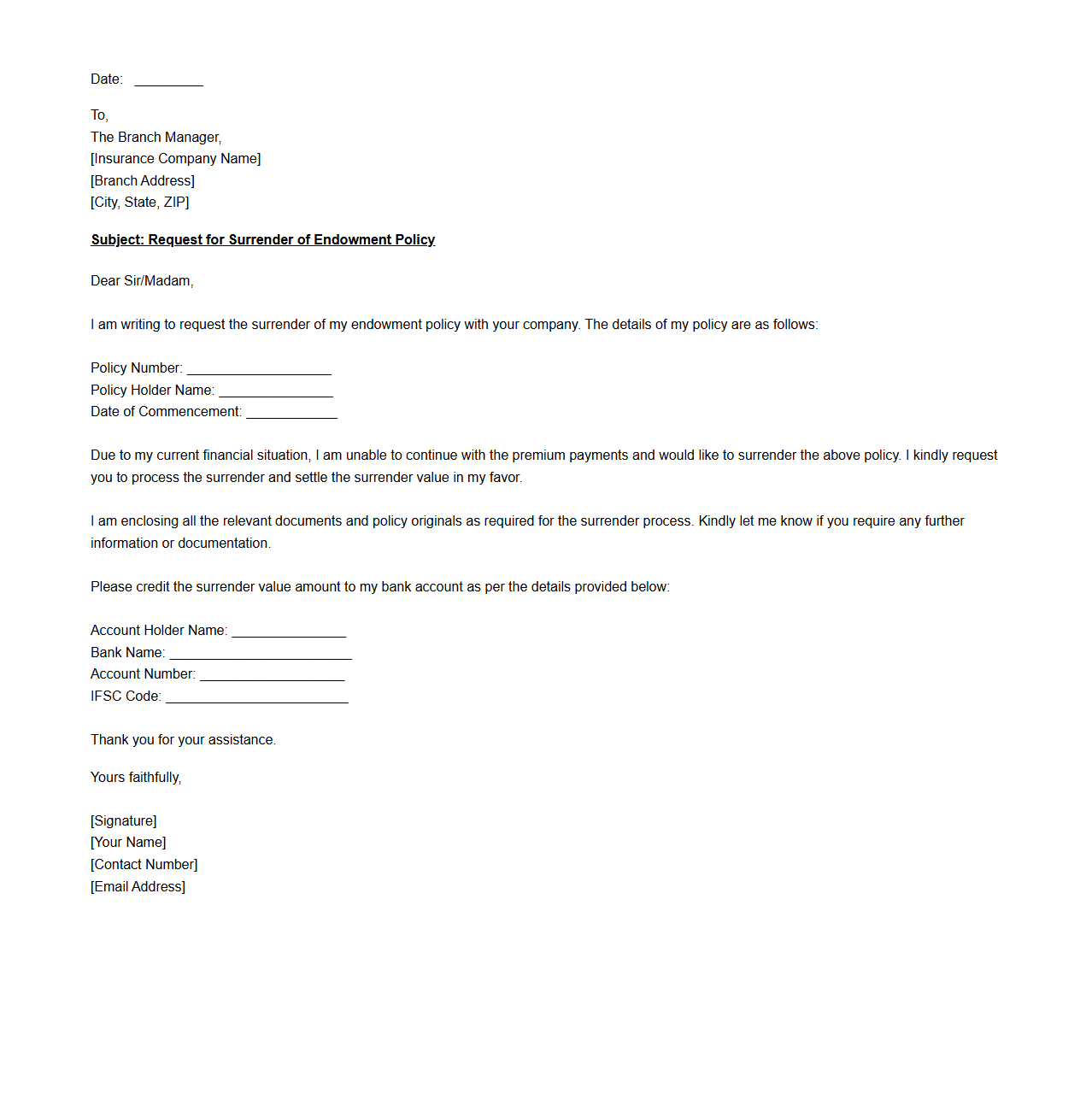

Endowment Policy Surrender Request Letter Example

An

Endowment Policy Surrender Request Letter Example document is a formal written application submitted by a policyholder to their insurance company, requesting the termination of their endowment policy before its maturity date. This letter typically includes essential details such as the policy number, personal identification, date of surrender, and reason for surrender, ensuring clear communication and facilitating the processing of the surrender claim. Using a well-structured example helps policyholders to draft an accurate and professional letter, preventing delays or rejection of their request.

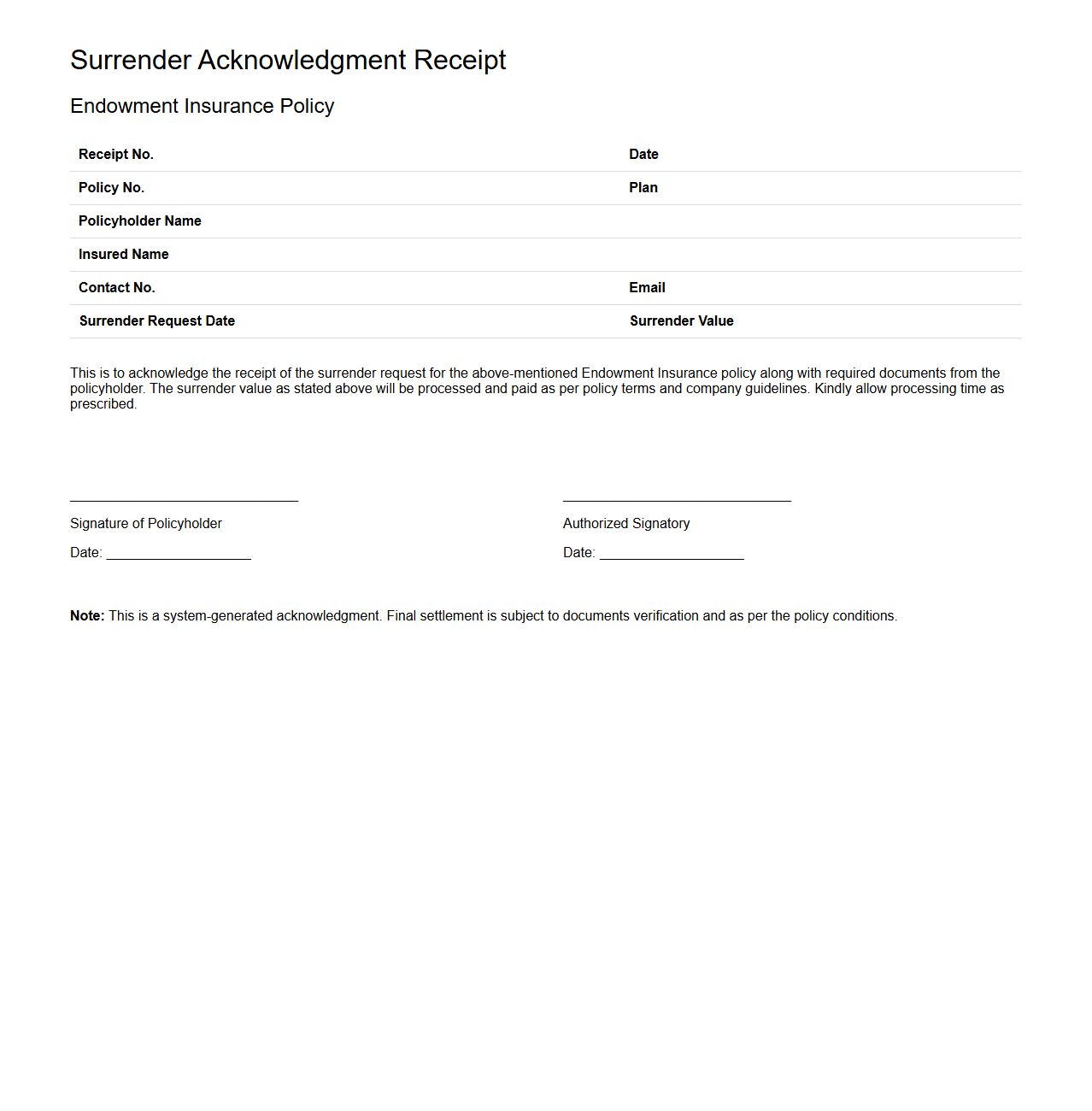

Surrender Acknowledgment Receipt Format for Endowment Insurance

The

Surrender Acknowledgment Receipt Format for Endowment Insurance is a formal document confirming the insurer's receipt of a policyholder's request to surrender their endowment insurance policy. This receipt outlines key details such as the policy number, surrender date, and the amount payable upon surrender. It serves as proof of the transaction, ensuring transparency and proper record-keeping between the insurer and the policyholder.

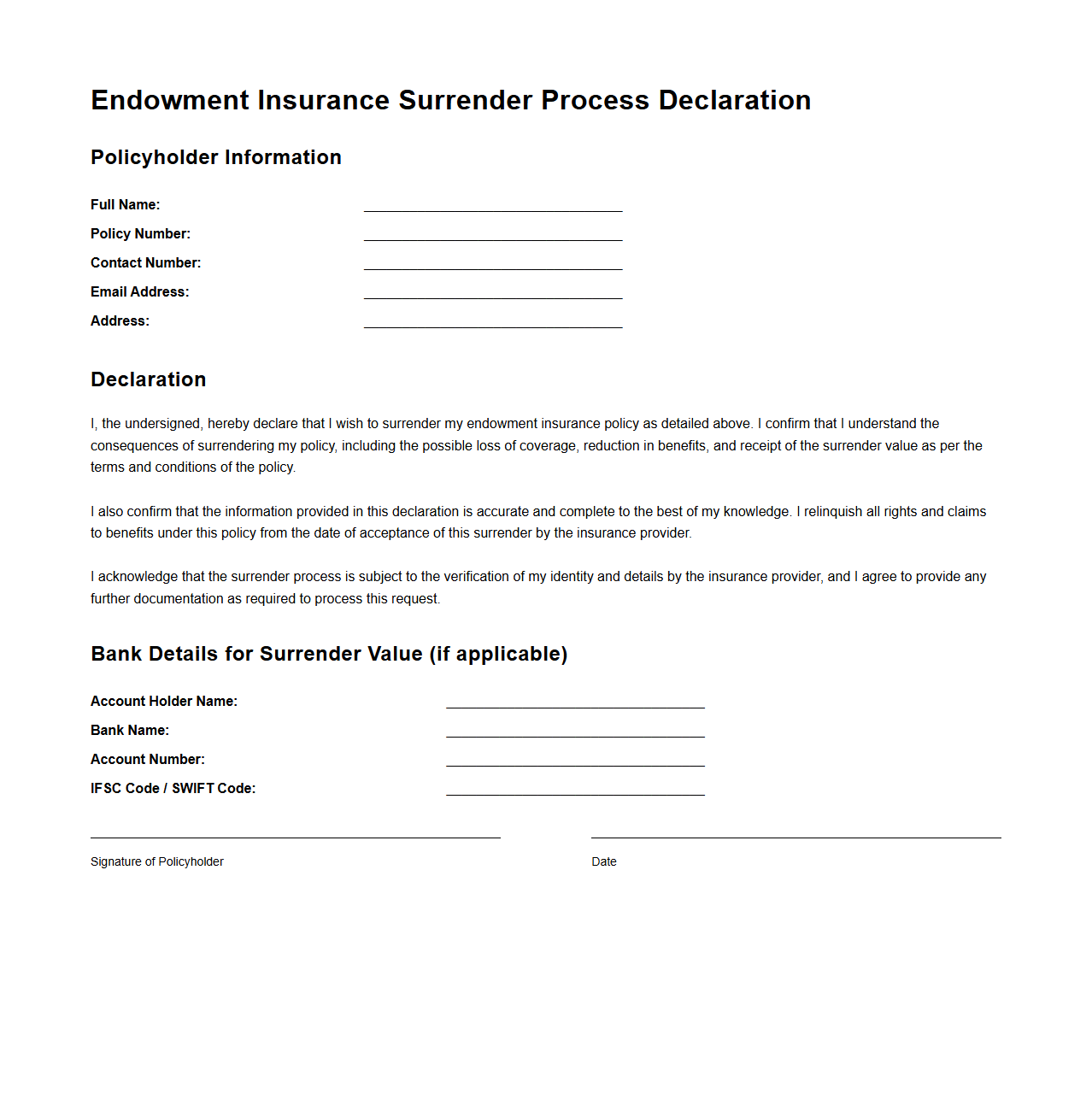

Endowment Insurance Surrender Process Declaration Sample

The Endowment Insurance Surrender Process Declaration Sample document outlines the formal steps and requirements for policyholders to voluntarily terminate their

endowment insurance policy before maturity. It typically includes the policyholder's details, policy number, reason for surrender, and acknowledgment of any surrender charges or reduced benefits. This document ensures clear communication between the insurer and insured, facilitating a smooth and legally compliant surrender process.

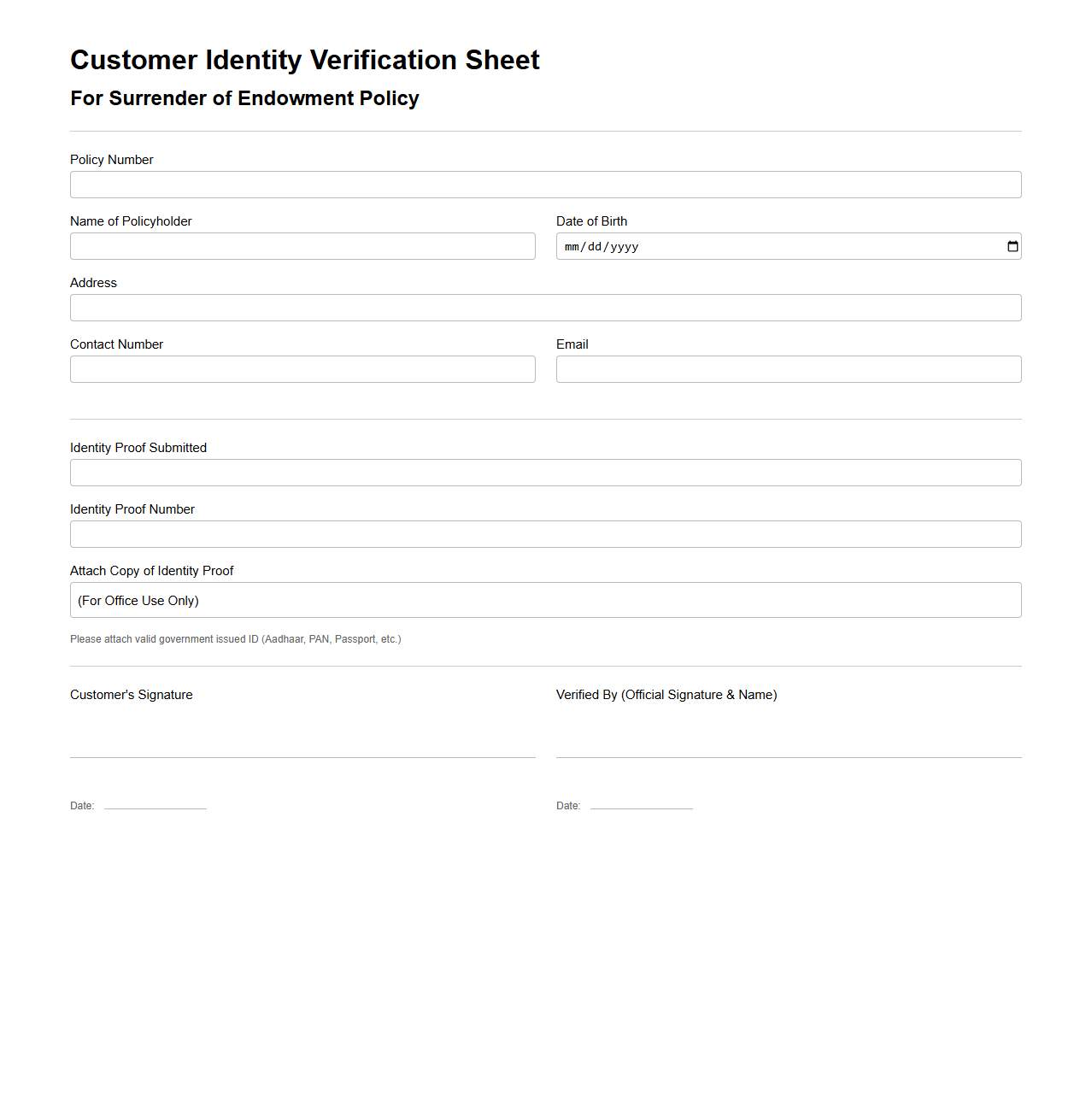

Customer Identity Verification Sheet for Surrender of Endowment Policy

A

Customer Identity Verification Sheet for Surrender of Endowment Policy is a crucial document used to authenticate the identity of the policyholder before processing the surrender request. It includes verified personal details such as government-issued ID numbers, signatures, and contact information to ensure compliance with regulatory standards and prevent fraud. This sheet serves as a formal record that the customer's identity has been thoroughly validated in accordance with company policies and insurance regulations.

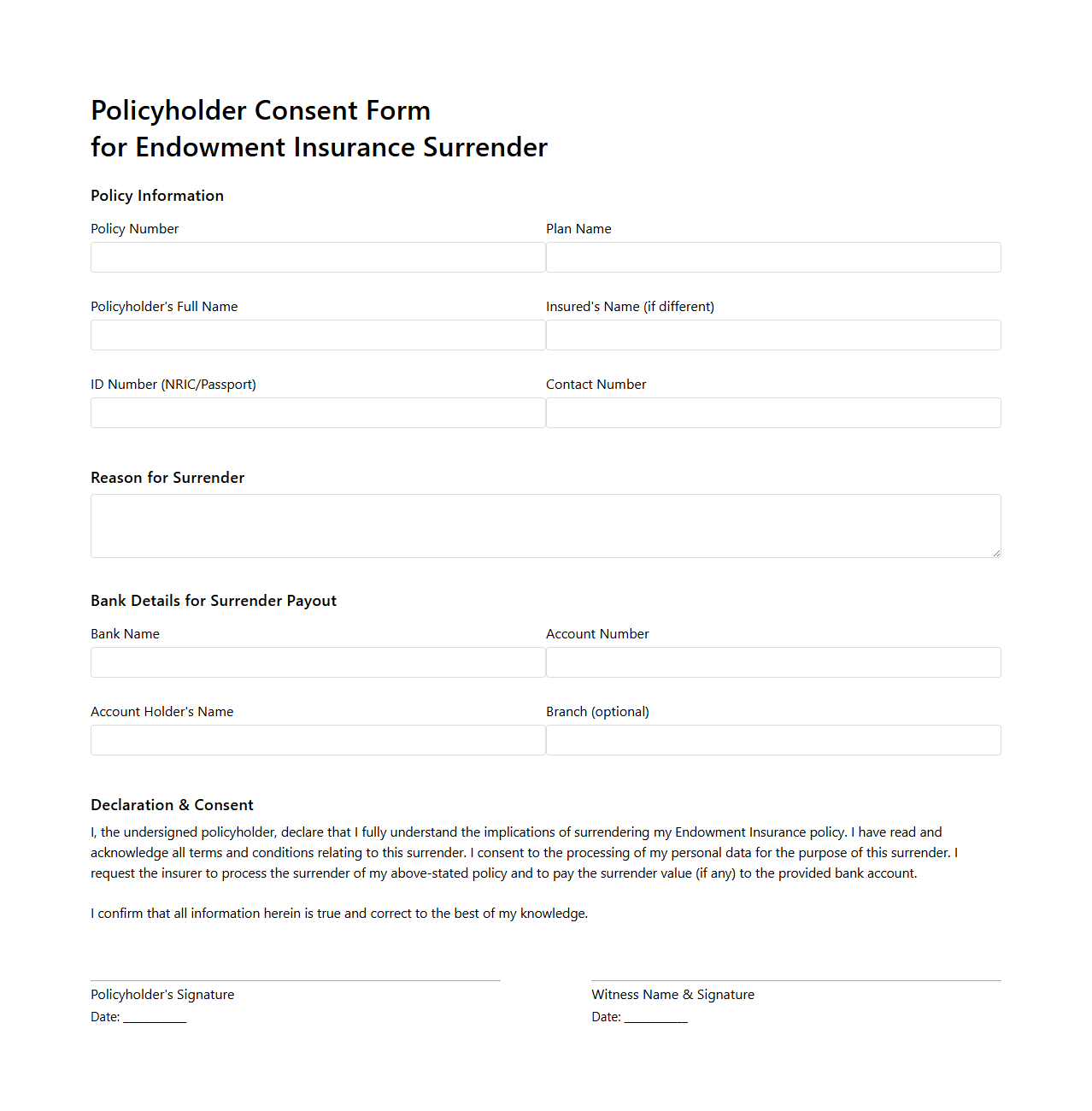

Policyholder Consent Form for Endowment Insurance Surrender

A

Policyholder Consent Form for Endowment Insurance Surrender is a legal document that authorizes the insurance company to process the surrender of an endowment insurance policy. This form confirms that the policyholder agrees to terminate the policy and understands the financial implications, including the surrender value and any potential penalties. It ensures compliance with regulatory requirements and protects both parties by documenting explicit consent before the policy is canceled.

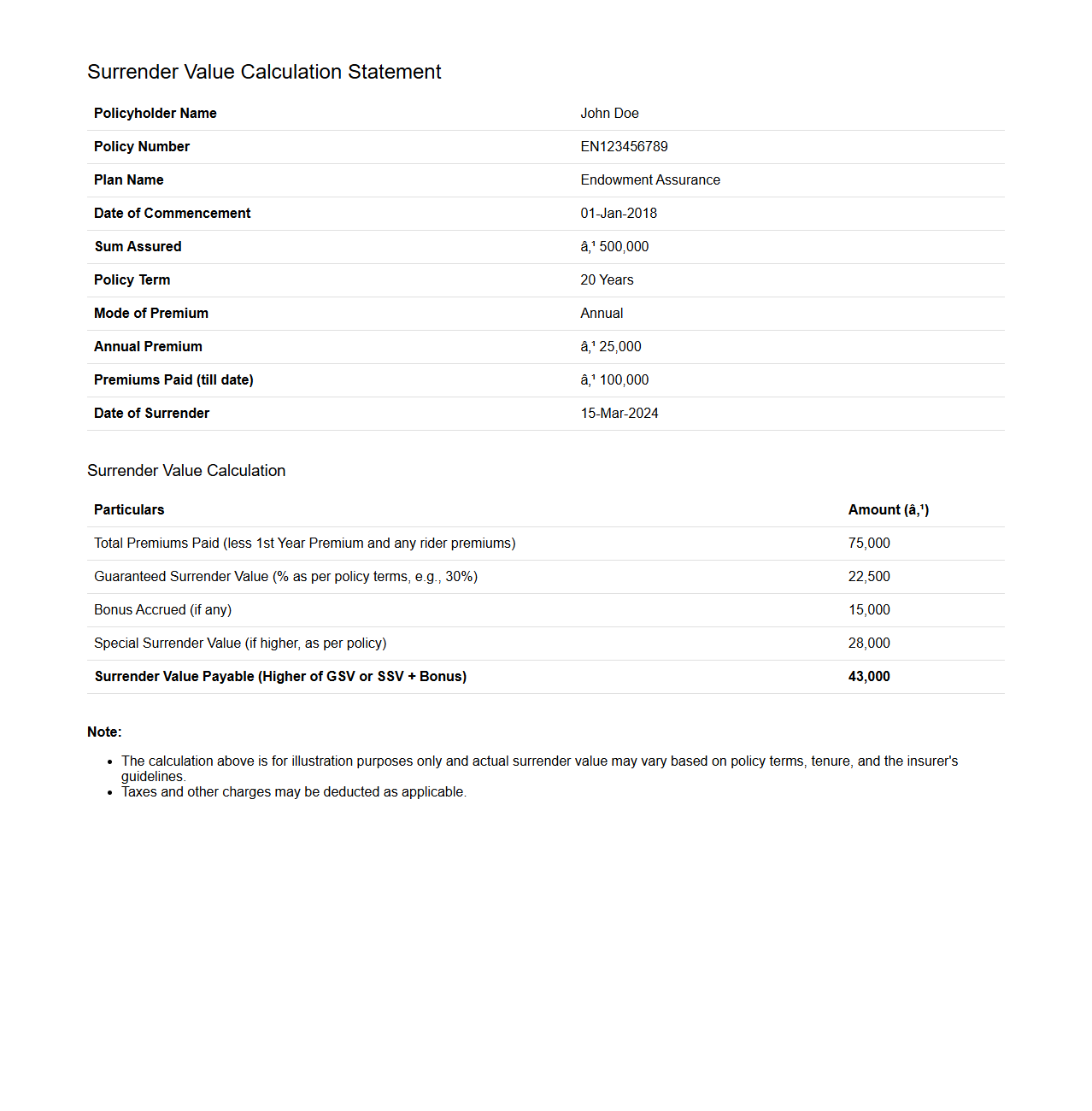

Surrender Value Calculation Statement Example for Endowment Insurance

A

Surrender Value Calculation Statement for an Endowment Insurance document details the amount payable to the policyholder upon early termination of the policy before maturity. It includes key elements such as the total premiums paid, accrued bonuses, guaranteed surrender value percentage, and any applicable deductions or charges. This statement helps policyholders understand the financial return they will receive if they choose to surrender their Endowment Insurance policy prematurely.

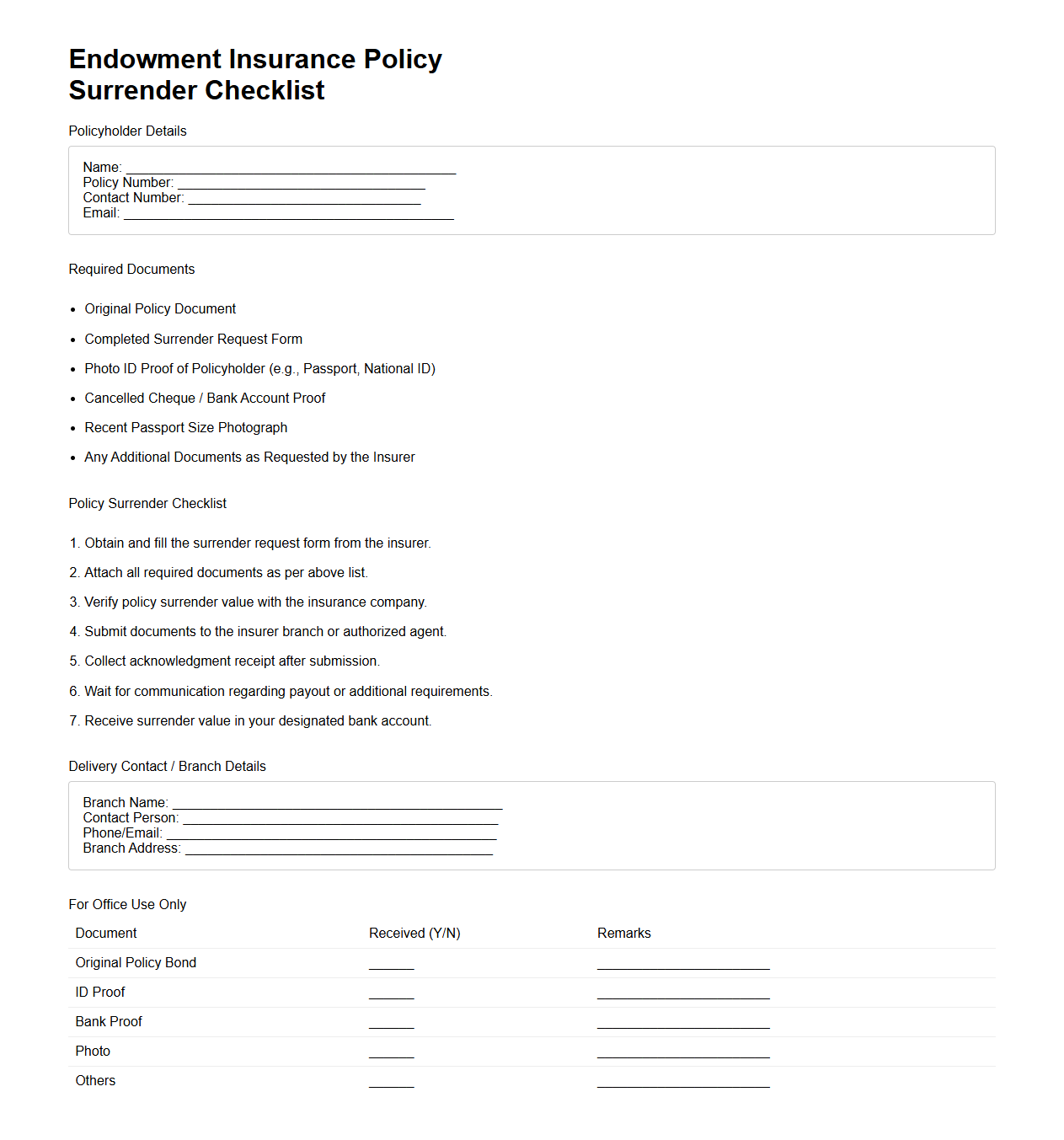

Endowment Insurance Policy Surrender Checklist

The

Endowment Insurance Policy Surrender Checklist document serves as a comprehensive guide outlining the essential steps and required documents needed to surrender an endowment insurance policy. It ensures policyholders provide accurate identification, policy details, and necessary surrender forms to facilitate a smooth and timely claims process. This checklist helps avoid delays and ensures full compliance with insurer requirements during the policy termination.

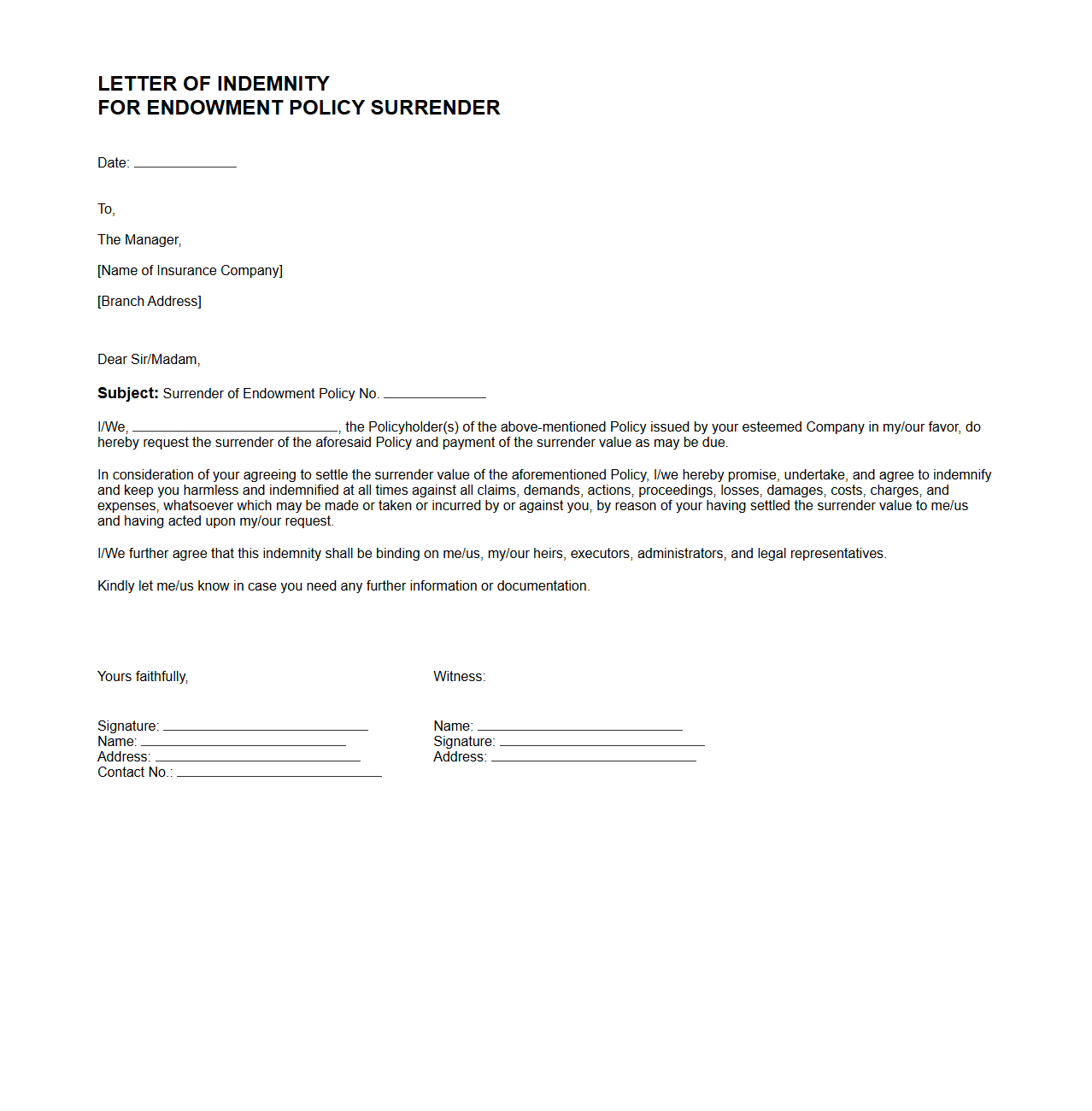

Letter of Indemnity Template for Endowment Policy Surrender

A

Letter of Indemnity Template for Endowment Policy Surrender is a formal document used to protect the insurer from any potential losses or claims arising when a policyholder surrenders their endowment policy before maturity. This letter serves as a written assurance from the policyholder or beneficiary, indemnifying the insurance company against any liability related to the early termination of the policy. It outlines the terms and conditions that ensure the insurer is compensated for any risks associated with processing the surrender request.

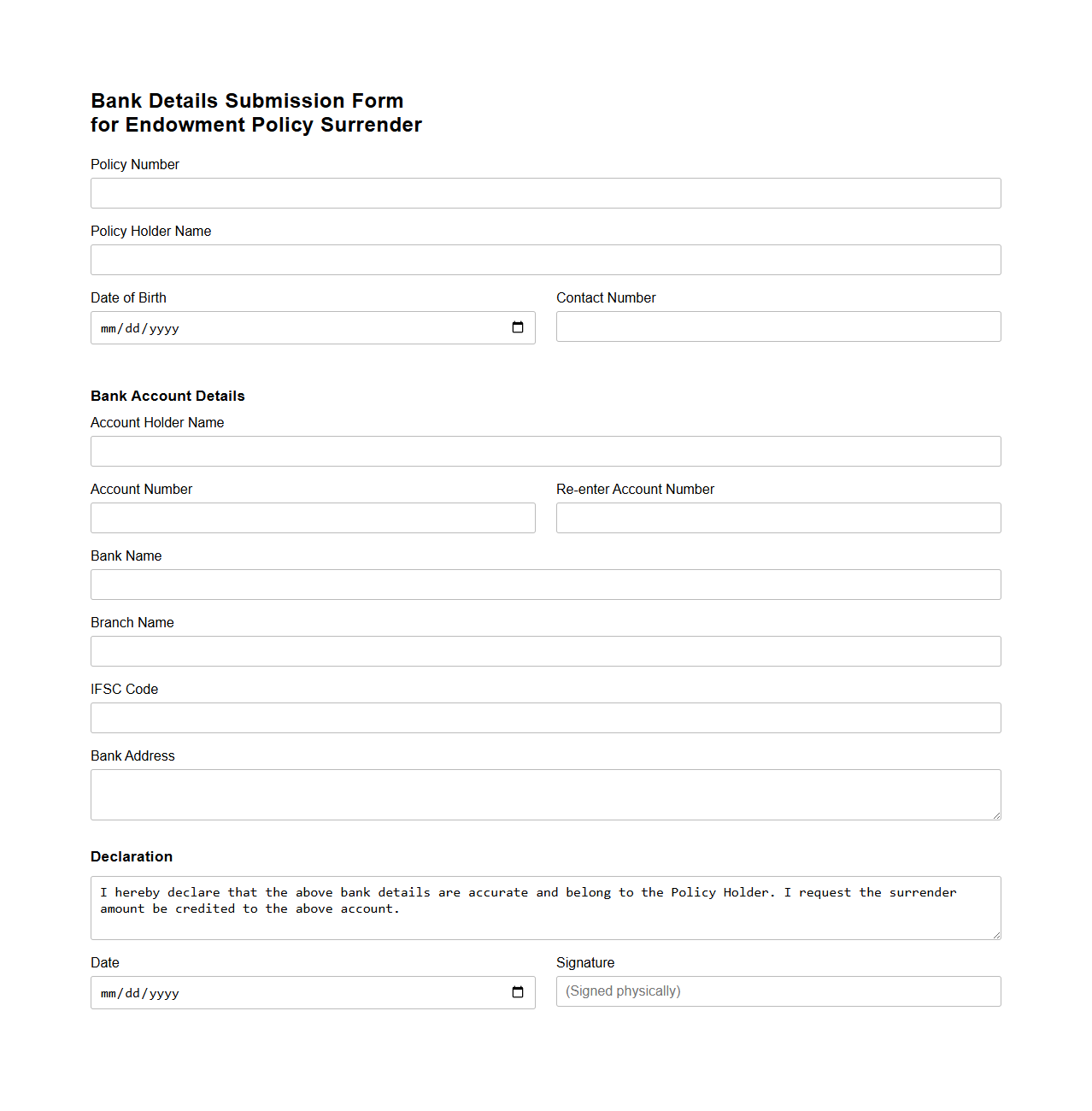

Bank Details Submission Form for Endowment Policy Surrender

The

Bank Details Submission Form for Endowment Policy Surrender document is used to collect and verify the policyholder's bank account information to facilitate the seamless transfer of surrender proceeds. This form ensures accurate payment processing by capturing essential details such as account number, IFSC code, bank name, and branch. Submitting this form correctly minimizes delays and errors in the disbursal of funds upon policy surrender.

What is the effective date of the policy surrender outlined in the document?

The effective date of the policy surrender is the date the insurer receives the written request from the policyholder. This date marks the official commencement of the surrender process. It is crucial to ensure that all conditions are met by this time.

Which conditions must be fulfilled for the policyholder to be eligible for surrender as described in the sample?

To be eligible for policy surrender, the policyholder must have held the policy for a minimum period specified in the document. All due premiums should be paid up to the surrender date. Additionally, there should be no outstanding loans against the policy.

How is the surrender value calculated according to the document's terms?

The surrender value is calculated based on the policy's paid-up value minus any loan balances and surrender charges. The document specifies a formula incorporating the duration the policy has been in force. This ensures the policyholder receives a fair value at surrender.

What are the required documents or identification for processing a policy surrender?

Processing a policy surrender requires submission of the original policy document, a written surrender request, and proof of identity. The insurer may also request additional forms as per regulatory requirements. Providing complete documentation helps expedite the surrender process.

What are the implications for bonuses or additional benefits upon surrender as detailed in the sample?

Upon surrender, any accrued bonuses or additional benefits are adjusted according to the terms stated in the policy. The document clarifies that not all bonuses may be payable if the policy is surrendered early. This impacts the total surrender value received by the policyholder.