A Change of Address Document Sample for Motor Insurance provides a clear template to notify your insurer about your new address. This document ensures accurate policy updates and uninterrupted coverage by including essential details such as the policy number, old and new addresses, and the effective date of the change. Proper submission helps avoid potential claim issues and supports seamless communication with the insurance provider.

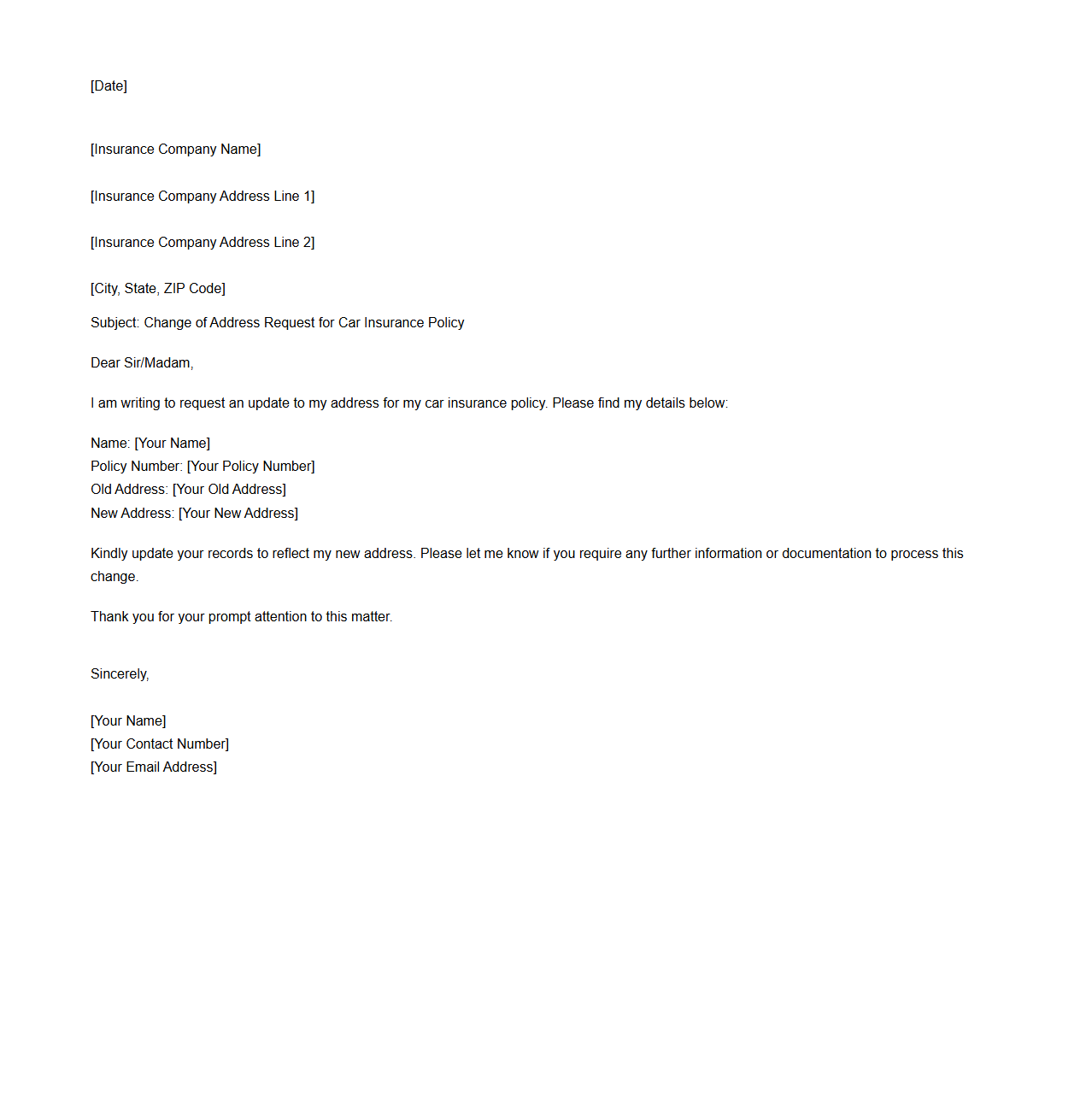

Change of Address Request Letter for Car Insurance Policy

A

Change of Address Request Letter for Car Insurance Policy is a formal document submitted by a policyholder to update their residential or mailing address with the insurance provider. This letter ensures that all communications, billing statements, and policy documents are sent to the correct and current address, helping to avoid lapses in coverage or missed notifications. Timely address updates in the car insurance records are essential for maintaining policy accuracy and compliance with insurer requirements.

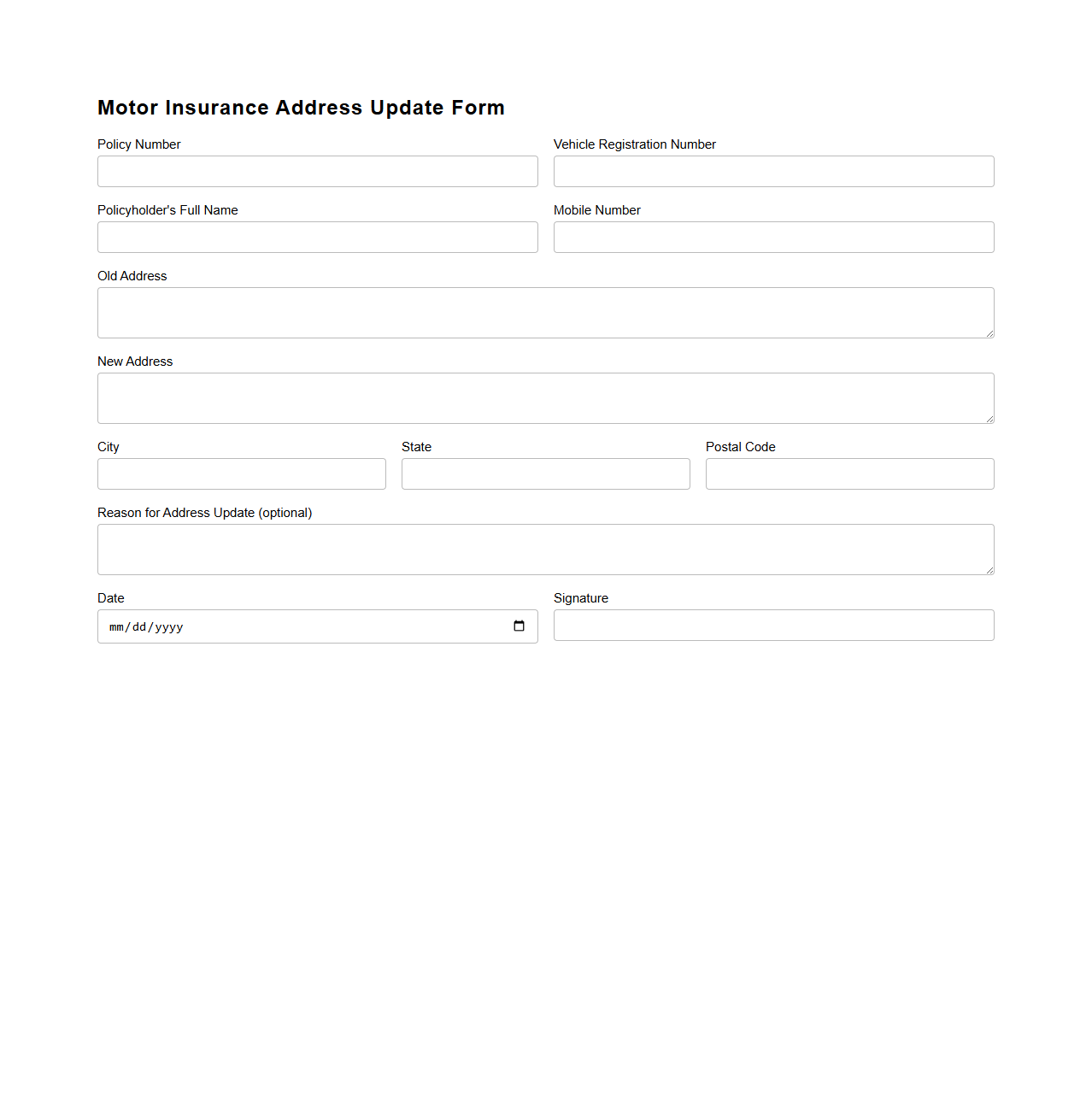

Motor Insurance Address Update Form Sample

The

Motor Insurance Address Update Form Sample is a standardized document used by policyholders to notify their insurance provider of a change in their residential or mailing address. This form ensures that all communications, including policy documents and claims correspondence, are sent to the correct location, maintaining uninterrupted coverage and service efficiency. Completing this form accurately helps avoid potential delays in claim processing or policy updates related to address discrepancies.

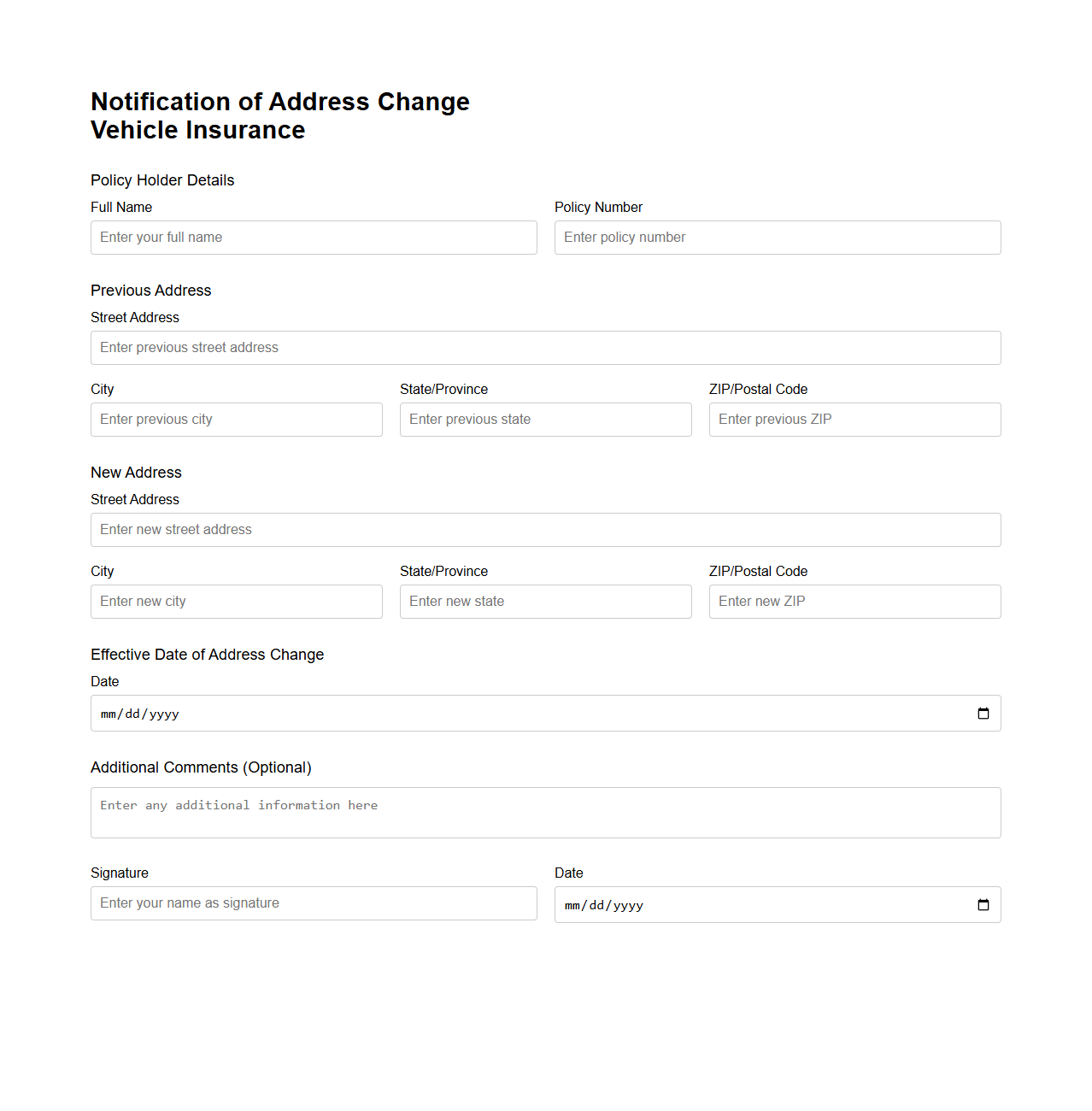

Notification of Address Change for Vehicle Insurance

The

Notification of Address Change for vehicle insurance document is a formal notice submitted to an insurance provider informing them of a change in the policyholder's residential address. This document ensures that all correspondence, including policy updates, renewal notices, and claim information, are sent to the correct location. Keeping the insurance company updated helps maintain policy validity and may affect premium rates based on the new address.

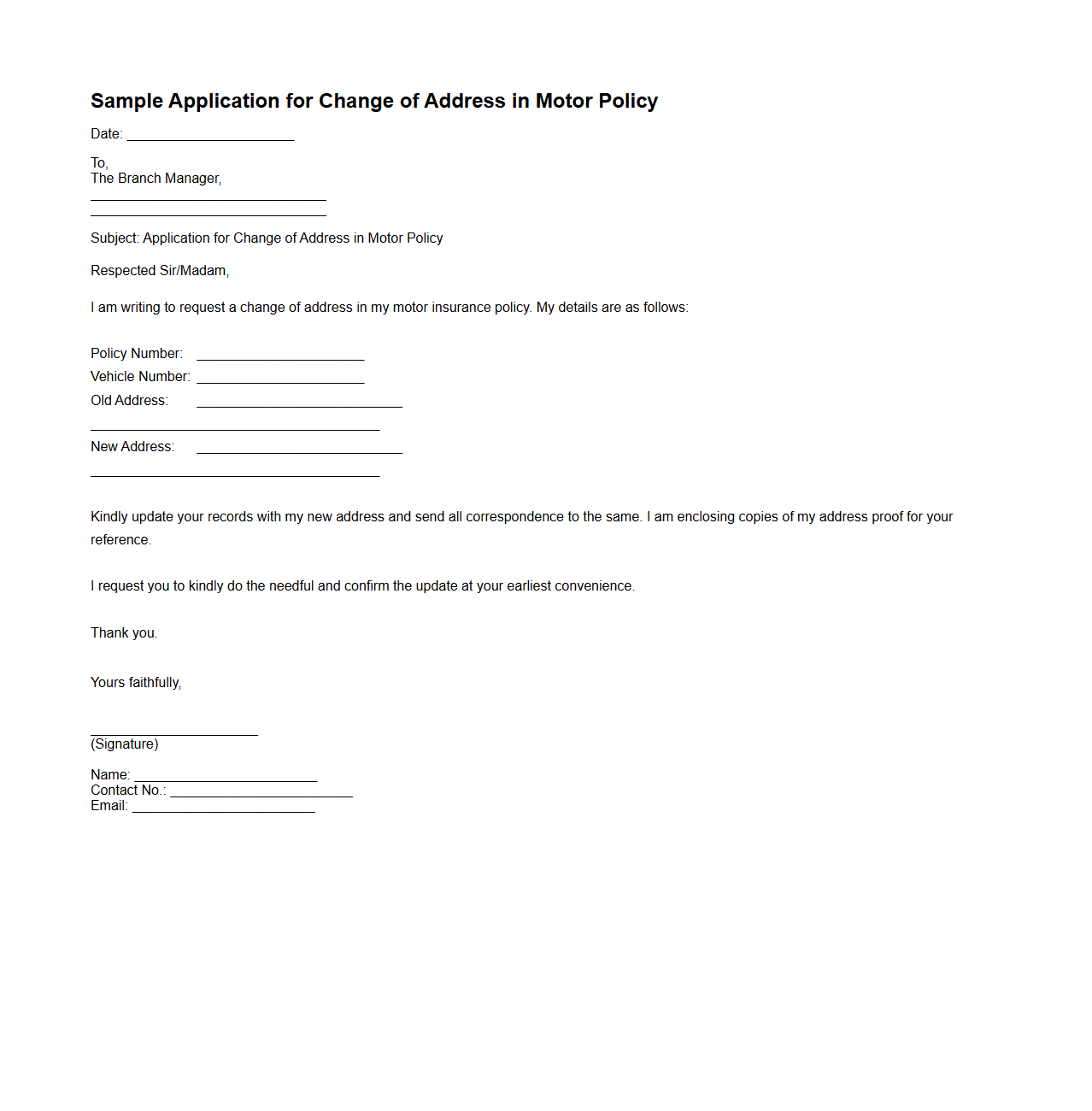

Sample Application for Change of Address in Motor Policy

A

Sample Application for Change of Address in Motor Policy document serves as a formal request submitted by the policyholder to update their residential or registered address in the motor insurance records. This document typically includes the policyholder's details, old and new addresses, policy number, and a reason for the change to ensure accurate communication and compliance with insurance terms. Submitting this application helps maintain the validity of the motor policy and ensures all legal and administrative correspondence reaches the correct location.

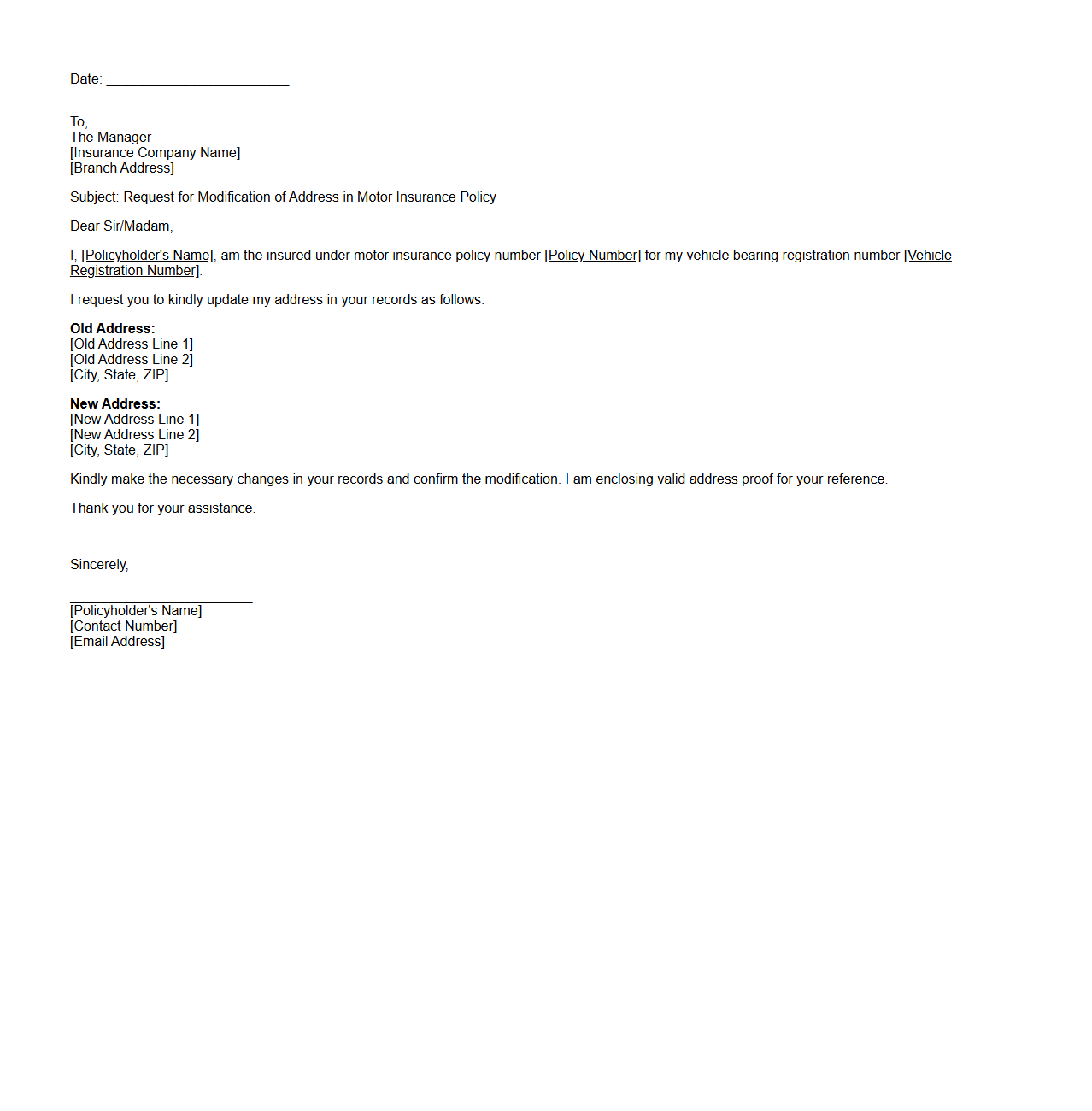

Insured’s Address Modification Letter for Motor Insurance

An

Insured's Address Modification Letter for Motor Insurance is an official document submitted by the policyholder to notify the insurance company of a change in their residential or correspondence address. This letter ensures that all future communications, including policy renewals and claim updates, are sent to the correct address, avoiding any potential disruptions. Maintaining accurate address records is crucial for policy validity and timely service delivery.

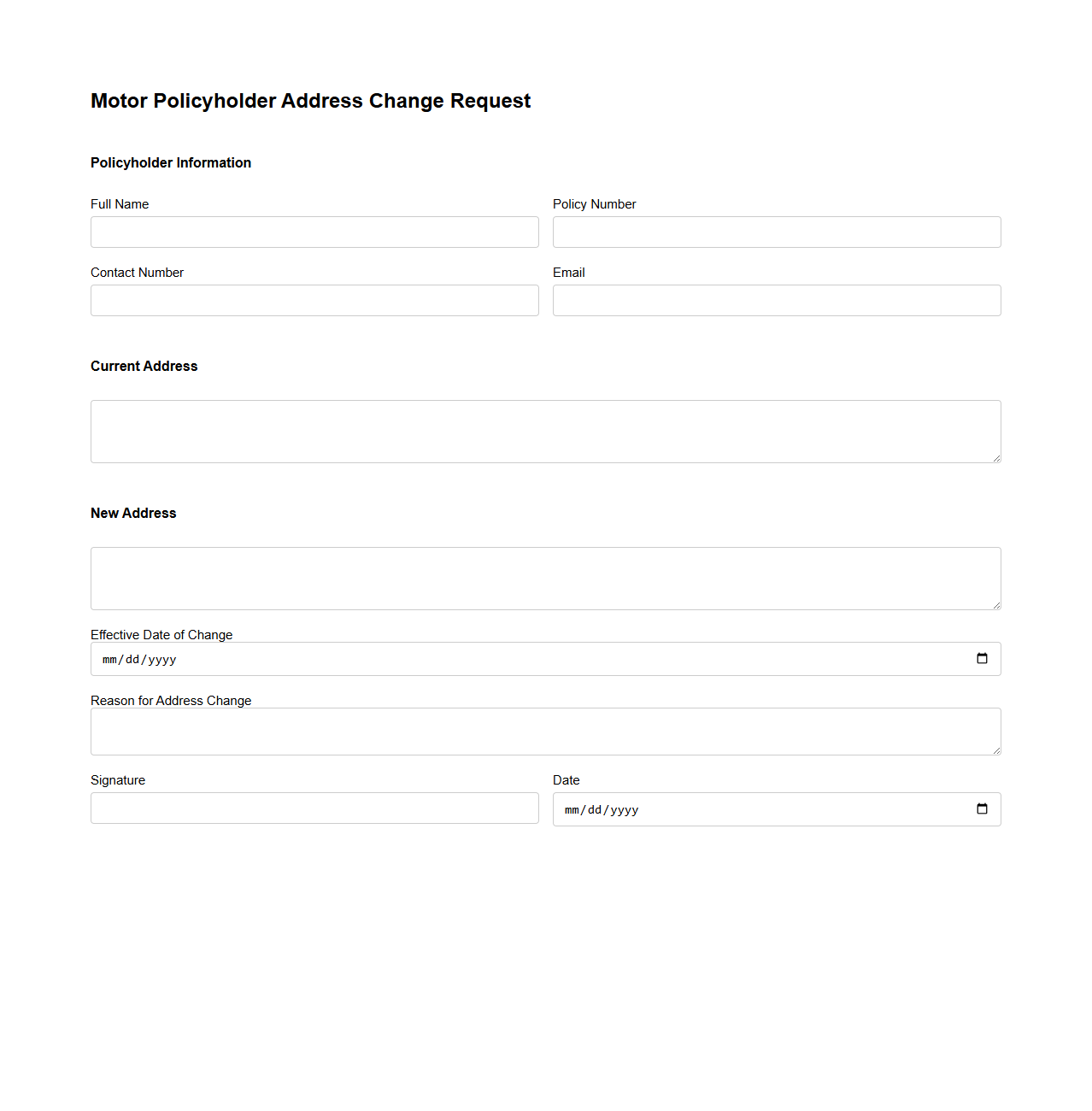

Motor Policyholder Address Change Request Template

A

Motor Policyholder Address Change Request Template document is a formal written format used by insured vehicle owners to notify their insurance provider of a change in their residential or mailing address. This template ensures accurate and updated policy records, preventing communication delays related to policy updates, claims, or renewals. It typically includes fields for the policyholder's name, policy number, old and new addresses, and signature for verification.

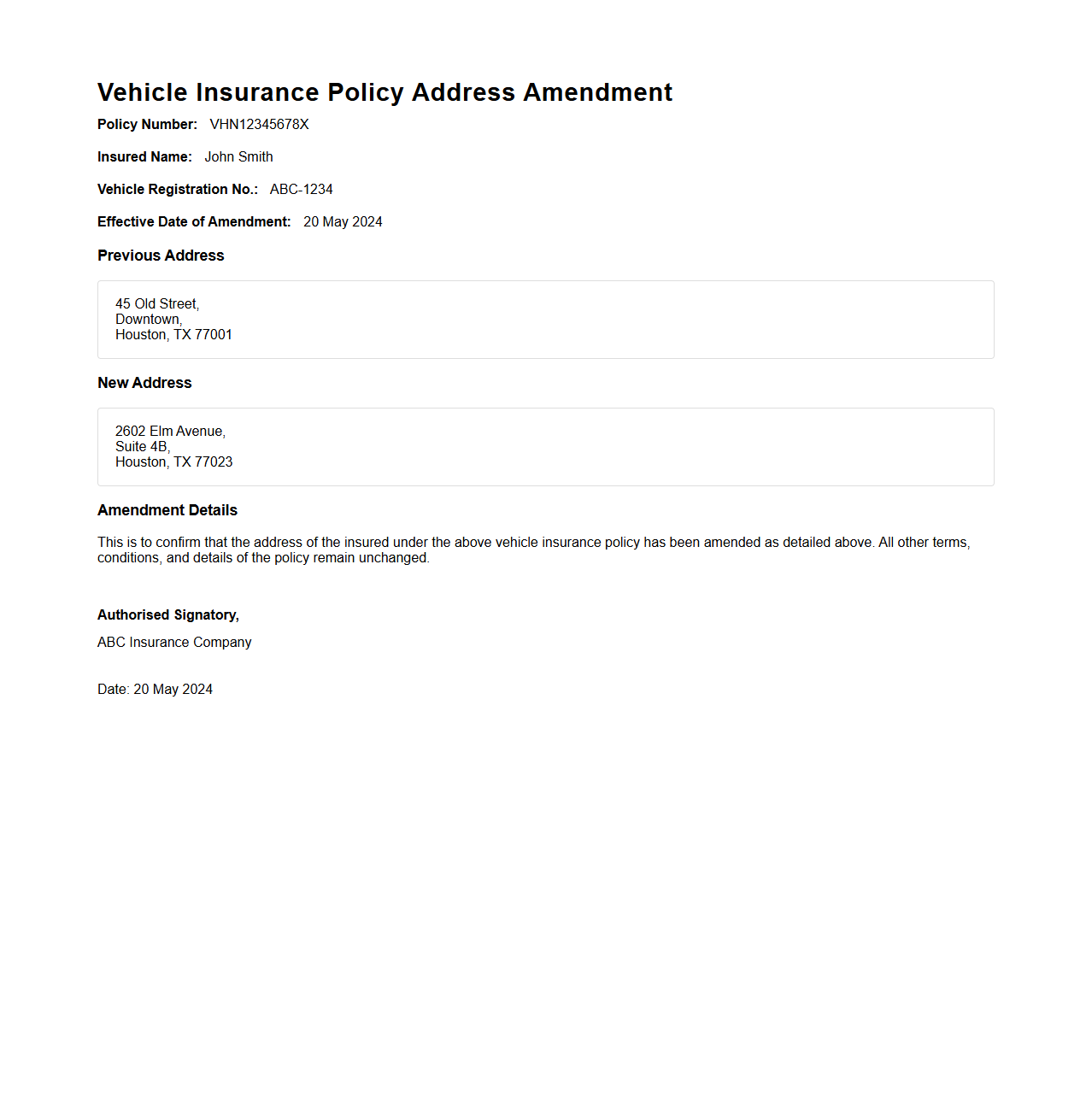

Vehicle Insurance Policy Address Amendment Sample

A

Vehicle Insurance Policy Address Amendment Sample document serves as a formal template for notifying an insurance provider about changes in the policyholder's address. It ensures the accurate update of communication details, preventing miscommunication and maintaining the validity of the vehicle insurance policy. This document typically includes the policyholder's original and new address, policy number, and a request for confirmation of the amendment.

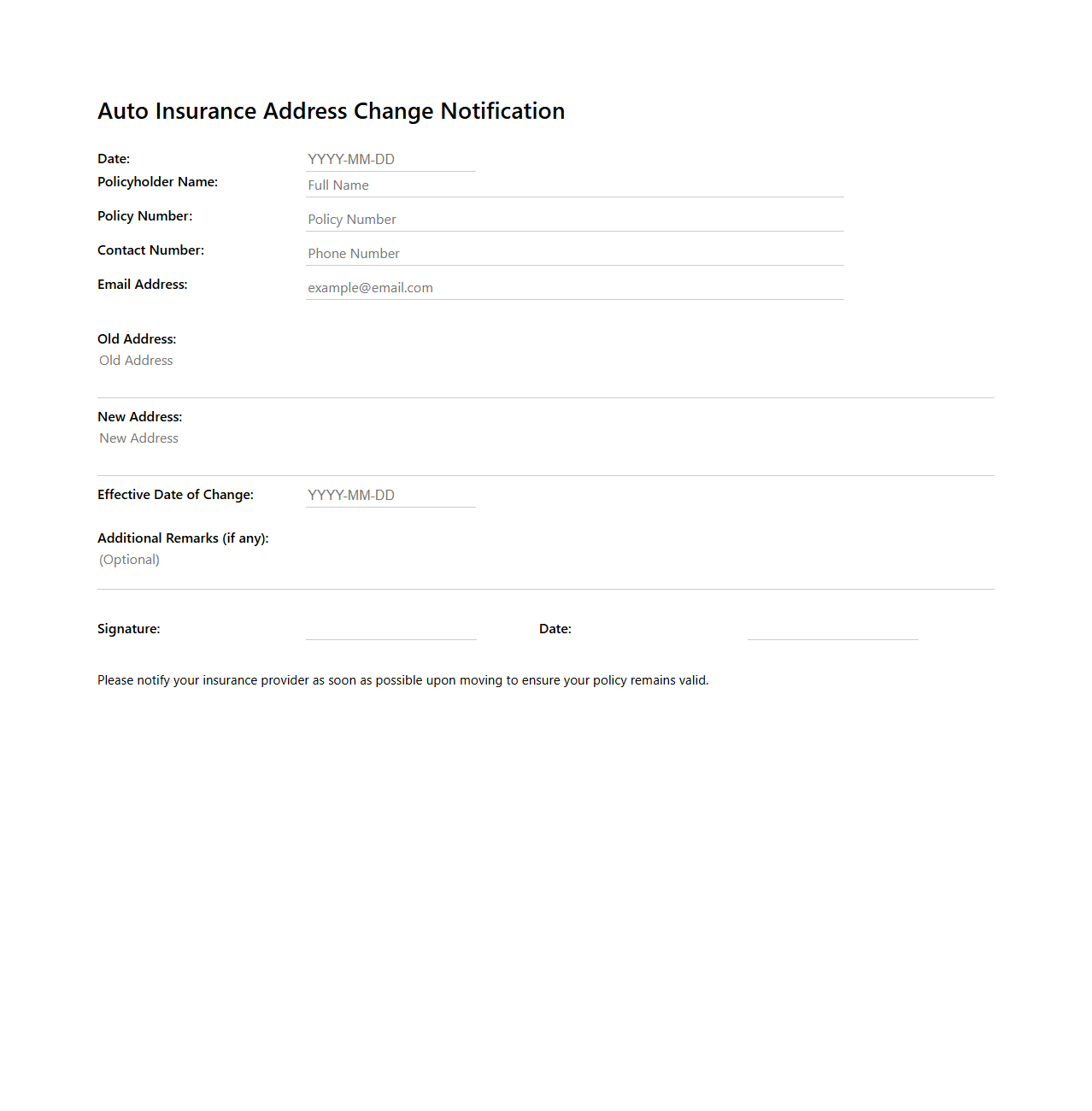

Auto Insurance Address Change Notification Format

The

Auto Insurance Address Change Notification Format document serves as a standardized template for policyholders to formally inform their insurance providers about changes in their residential or mailing address. This ensures accurate record-keeping and uninterrupted coverage by updating essential contact details tied to the auto insurance policy. Maintaining up-to-date address information helps in timely communication of policy updates, claims processing, and billing statements.

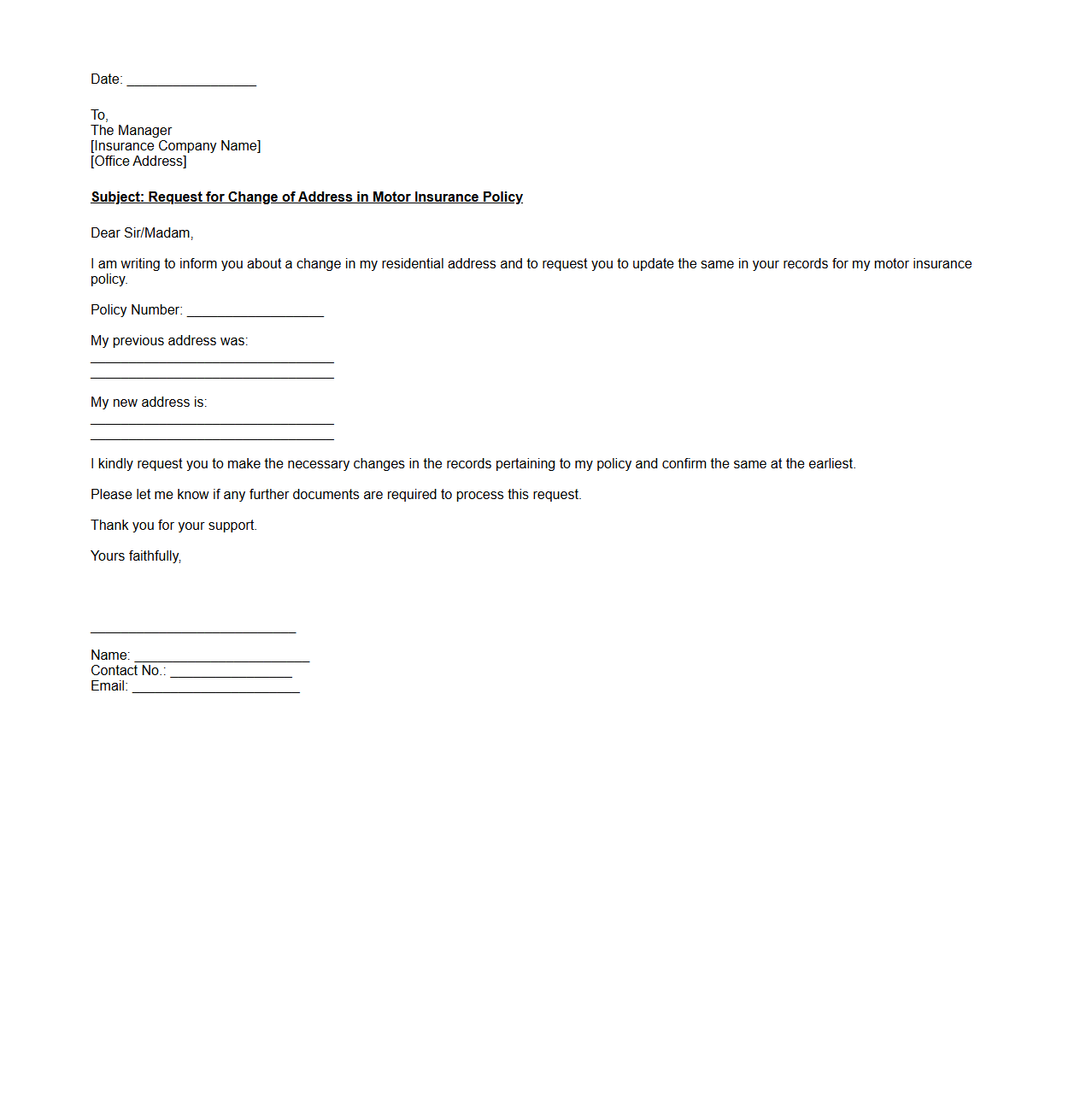

Letter to Insurer for Change of Address in Motor Policy

A

Letter to Insurer for Change of Address in a Motor Policy document is a formal communication requesting the insurance company to update the policyholder's address details. This letter ensures that all future correspondence related to the motor insurance policy, including renewal notices and claim information, is sent to the correct address. Accurate address information is crucial for maintaining valid coverage and receiving timely updates from the insurer.

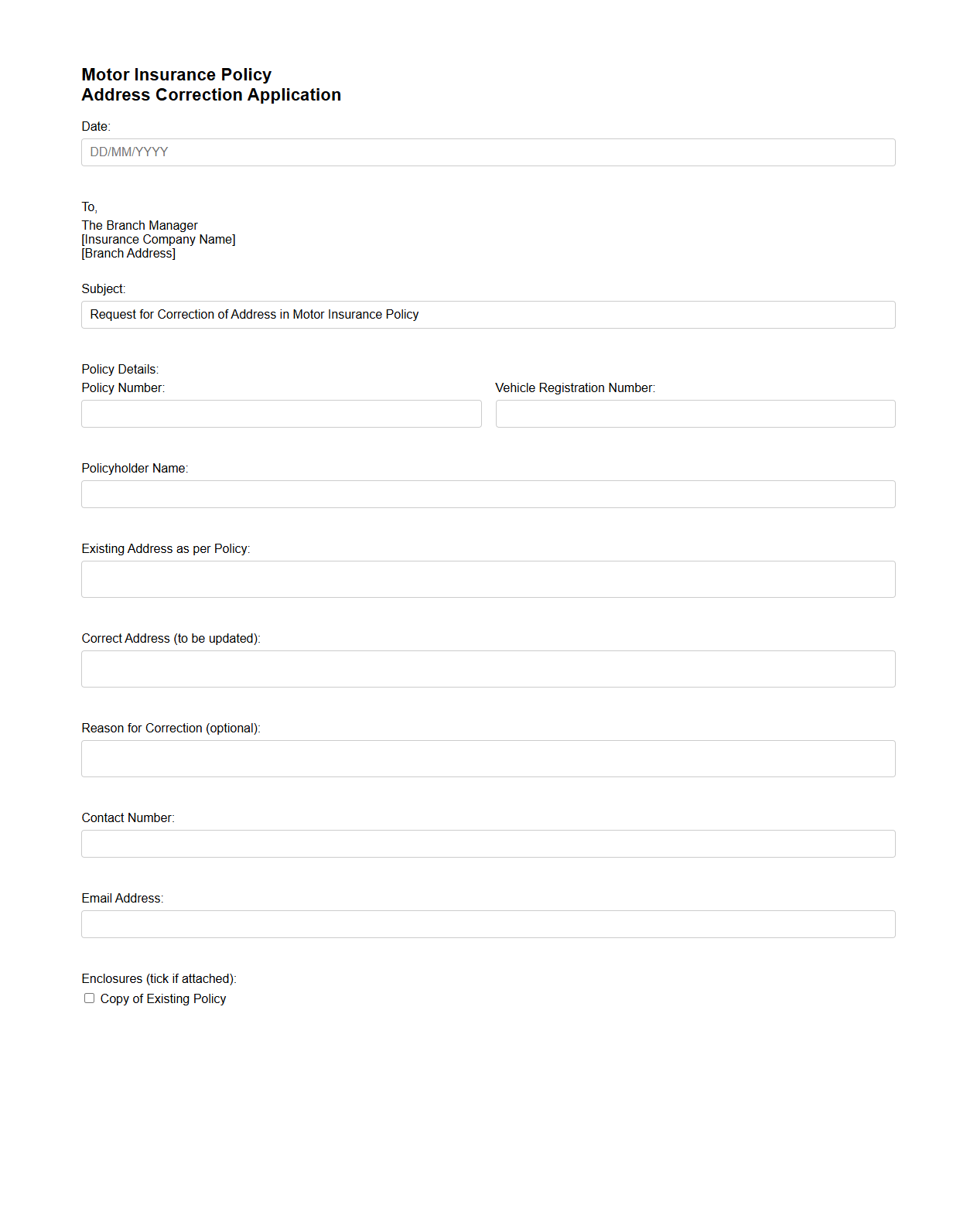

Motor Insurance Policy Address Correction Application

A

Motor Insurance Policy Address Correction Application document is used to request the insurer to update or correct the insured address details in the motor insurance policy records. This application ensures that all communication, including claim-related notifications and policy renewals, are sent to the correct address. Maintaining accurate address information in the policy helps prevent delays and miscommunication during claim processing.

What essential information must be included when requesting a change of address for motor insurance?

When requesting a change of address for motor insurance, it is crucial to provide your current policy number and full name as registered with the insurer. The new address details must be clearly stated, including street, city, state, and postal code to ensure accurate updating of the policy records. Additionally, the effective date of the address change should be specified to avoid any confusion regarding coverage periods.

Which supporting documents are typically required to validate a change of address request for motor insurance?

To validate a change of address request, insurers typically require a proof of new address such as a utility bill, rental agreement, or government-issued ID reflecting the updated address. Some insurers may also request a self-attested affidavit confirming the change for verification purposes. These documents help ensure the accuracy of information and prevent fraudulent changes to the policy.

What is the process flow for submitting a change of address document to a motor insurance provider?

The process flow starts with the insured notifying the motor insurance company through their official website, mobile app, or customer service center. The insured then submits the necessary change of address documents either digitally or in person to the insurer for verification. After review and confirmation, the insurer updates the policy records and sends an acknowledgment or revised policy documents to the policyholder.

How does changing your address impact the terms or premium of your motor insurance policy?

Changing your address can impact the premium of your motor insurance policy because insurance risks vary based on location. Higher risk areas with more incidents of theft or accidents may increase premiums, while safer areas might reduce them. Additionally, the terms of coverage, such as roadside assistance availability and claims service centers, can also be affected by your new address.

Who must sign the change of address document for it to be accepted by the insurance company?

The change of address document must be signed by the policyholder or the insured individual who holds the motor insurance policy. If the policy is under a company or organization, an authorized representative with power of attorney needs to sign. The insurer requires this signature to authenticate the request and ensure it is authorized by the legal policy owner.