A Indemnity Bond Document Sample for Risk Management provides a standardized template that outlines the agreement to protect one party from potential losses or damages caused by the other. This document clearly defines the scope of responsibility, financial liabilities, and conditions under which indemnity applies, serving as a crucial tool to mitigate risks in business transactions. Using a well-drafted indemnity bond helps ensure legal protection and fosters trust between involved parties.

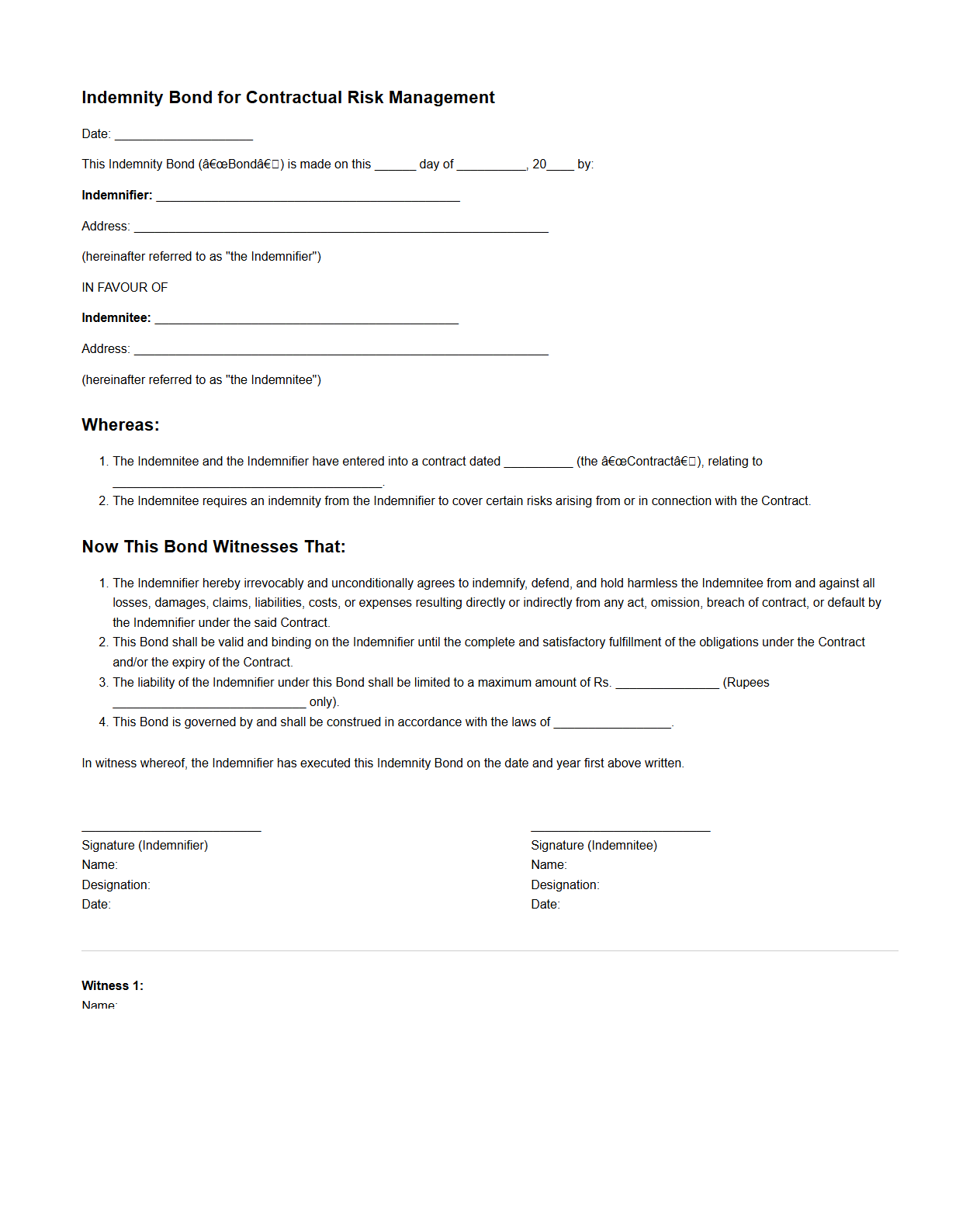

Indemnity Bond for Contractual Risk Management

An

Indemnity Bond for Contractual Risk Management is a legal document that ensures one party compensates the other for any losses or damages arising from specified risks during a contract execution. It serves as a financial guarantee to protect against potential liabilities and claims, mitigating risks associated with breaches, negligence, or unforeseen events. This bond is crucial in safeguarding the interests of all contractual parties by clearly defining indemnity obligations and responsibilities.

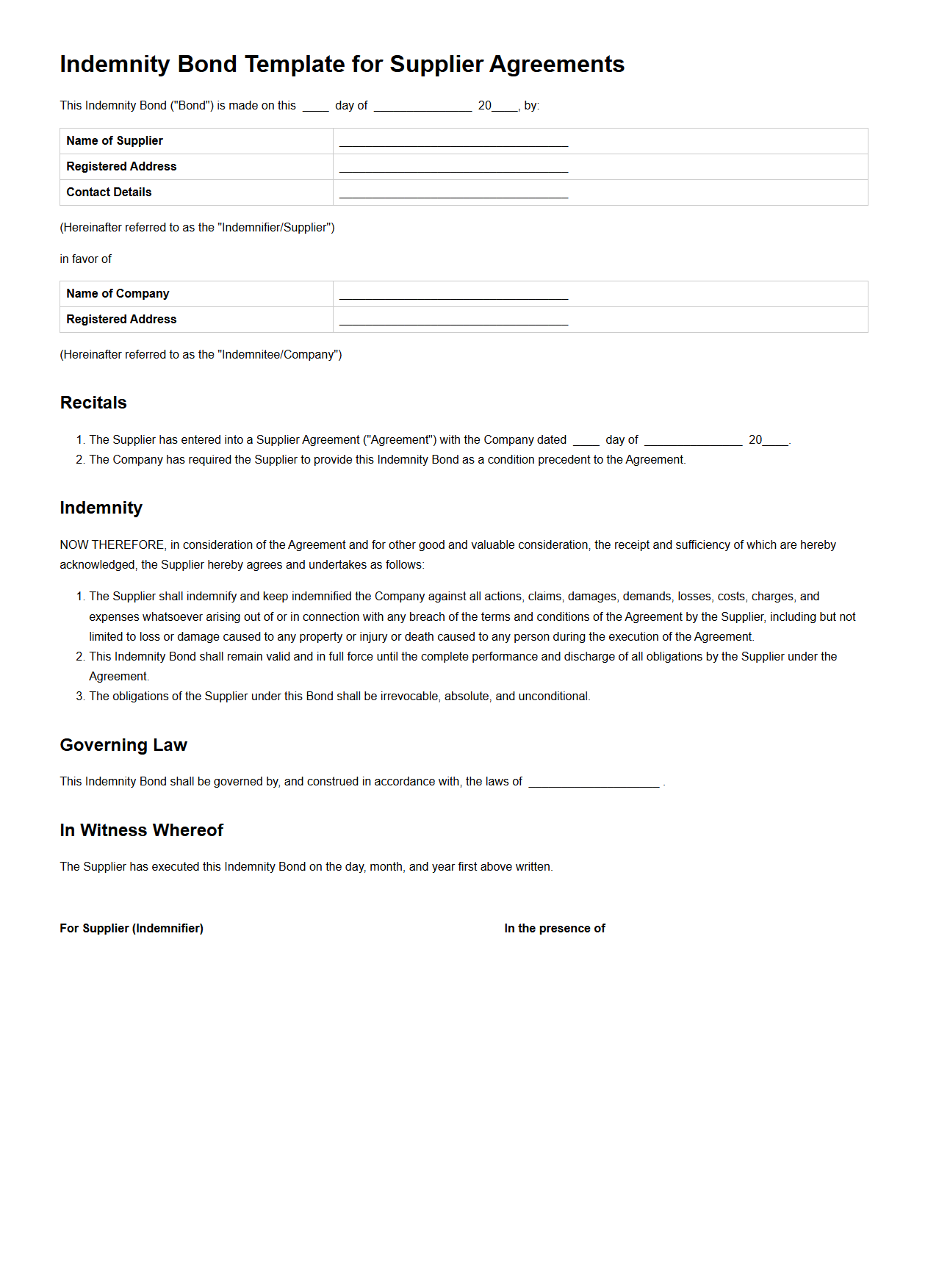

Indemnity Bond Template for Supplier Agreements

An

Indemnity Bond Template for Supplier Agreements is a legally binding document that outlines the supplier's commitment to compensate the buyer for any losses or damages arising from breaches, negligence, or non-performance. It clearly defines the scope, terms, and conditions under which indemnity is provided, protecting both parties from financial risks associated with supplier activities. This template ensures transparency and legal security in supplier relationships by specifying obligations and liabilities.

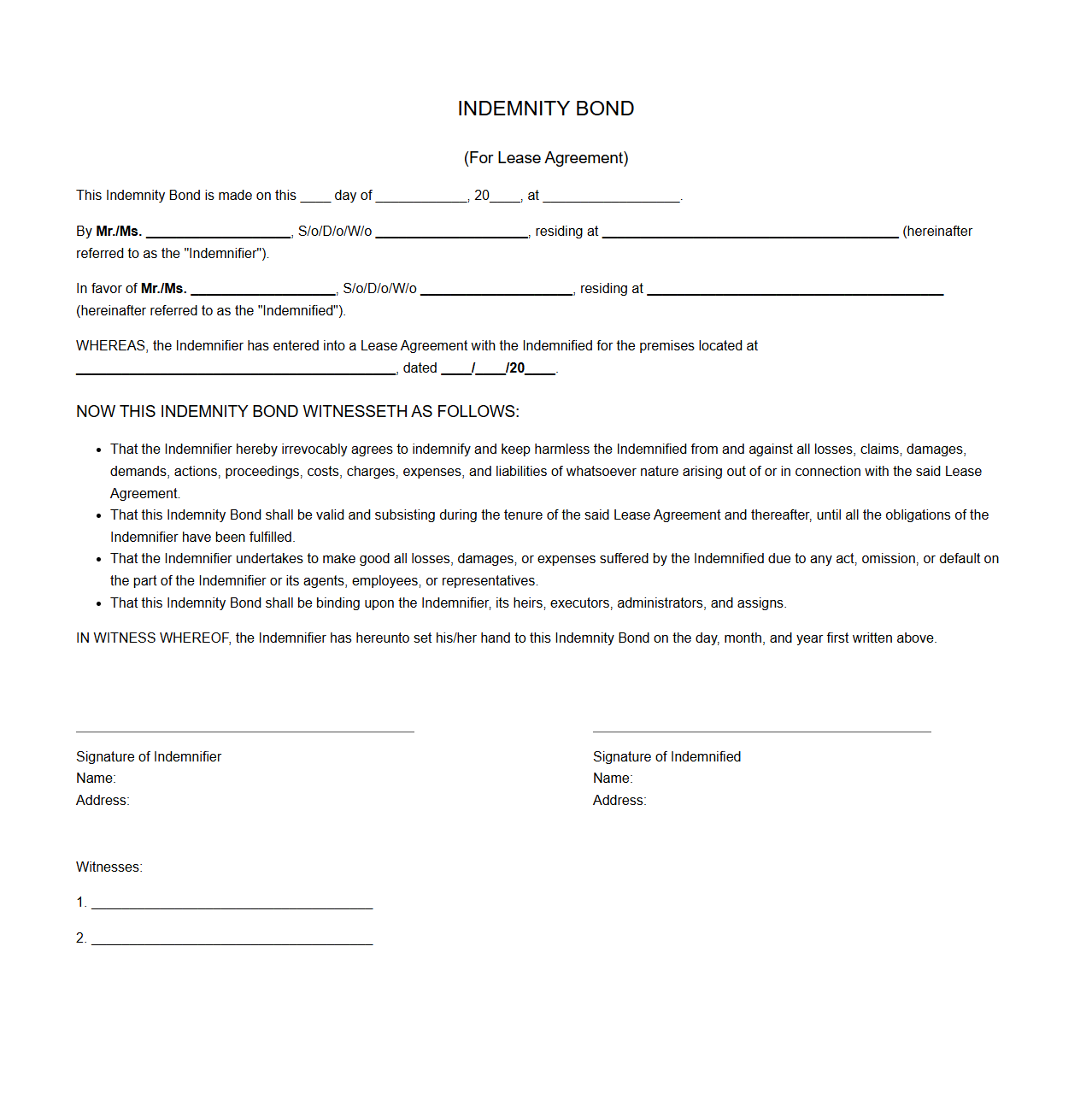

Indemnity Bond Sample for Lease Agreements

An

Indemnity Bond Sample for Lease Agreements is a legal document used to protect landlords from potential financial losses caused by tenant actions during the lease term. It specifies the tenant's obligation to compensate for damages or liabilities beyond normal wear and tear. This document serves as a safeguard ensuring accountability and financial security for property owners.

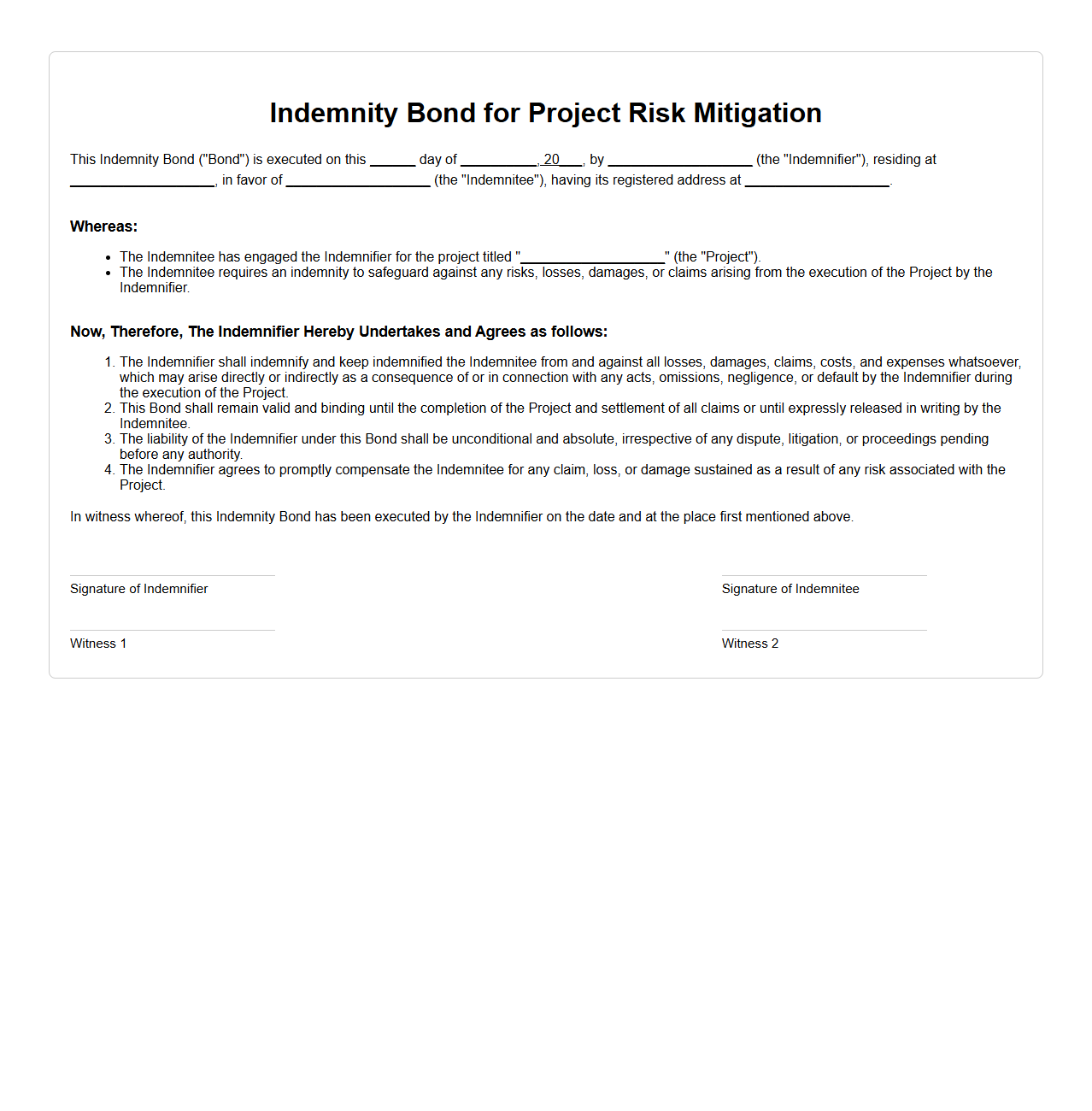

Indemnity Bond for Project Risk Mitigation

An

Indemnity Bond for Project Risk Mitigation is a legally binding document that protects parties involved in a project from financial losses due to unforeseen risks or damages. It serves as a guarantee that one party will compensate the other for any potential claims, liabilities, or damages arising during the project execution. This bond is crucial for managing project uncertainties, ensuring financial security, and maintaining trust among stakeholders.

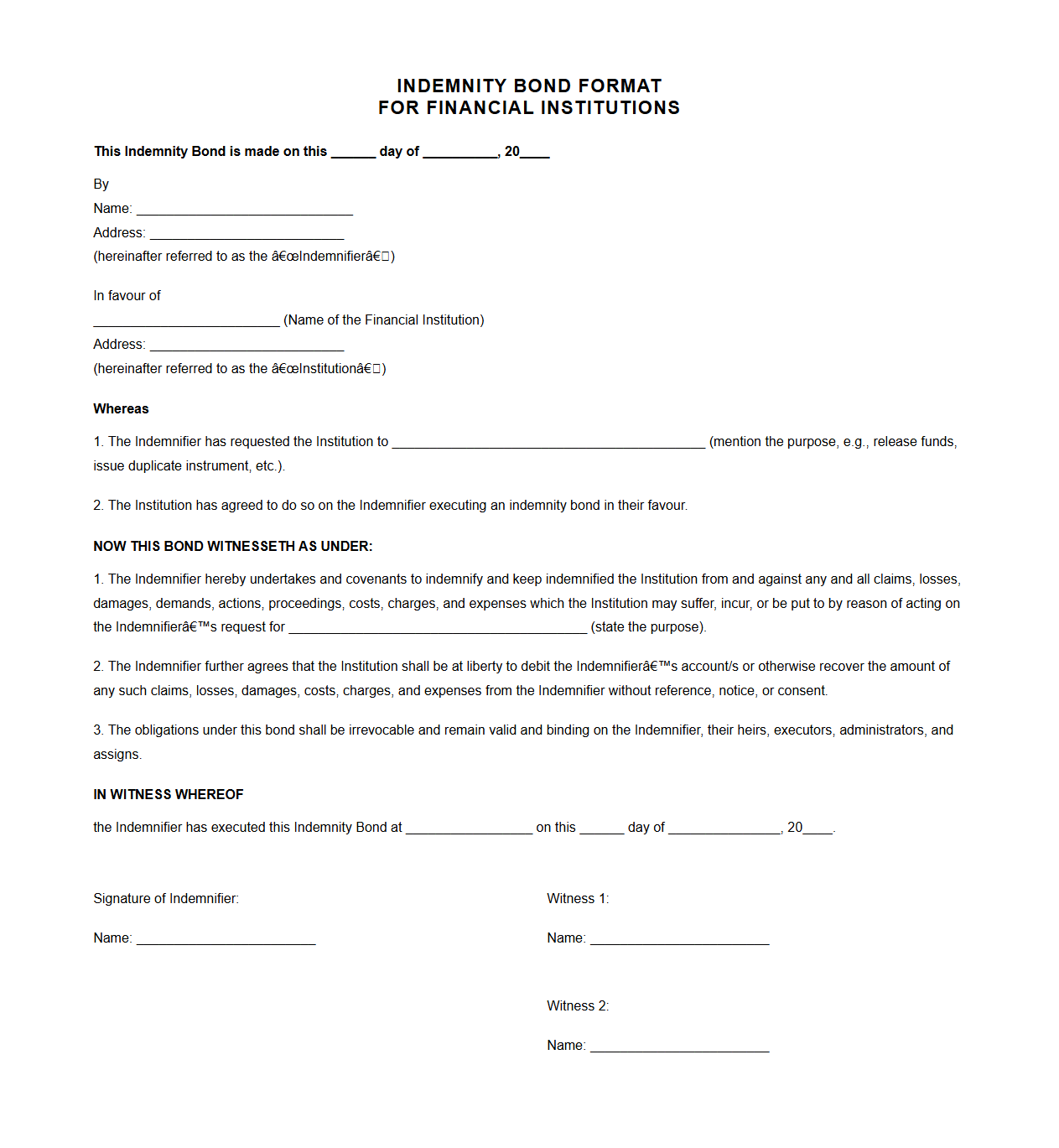

Indemnity Bond Format for Financial Institutions

An

Indemnity Bond Format for Financial Institutions is a legally binding document that outlines the terms and conditions under which one party agrees to compensate another for any financial loss or damage. This format typically includes details such as the names of the parties involved, the scope of indemnity, the bond amount, and specific clauses to protect the institution from potential risks. Financial institutions use this bond to safeguard against liabilities arising from transactions, ensuring secure and accountable financial operations.

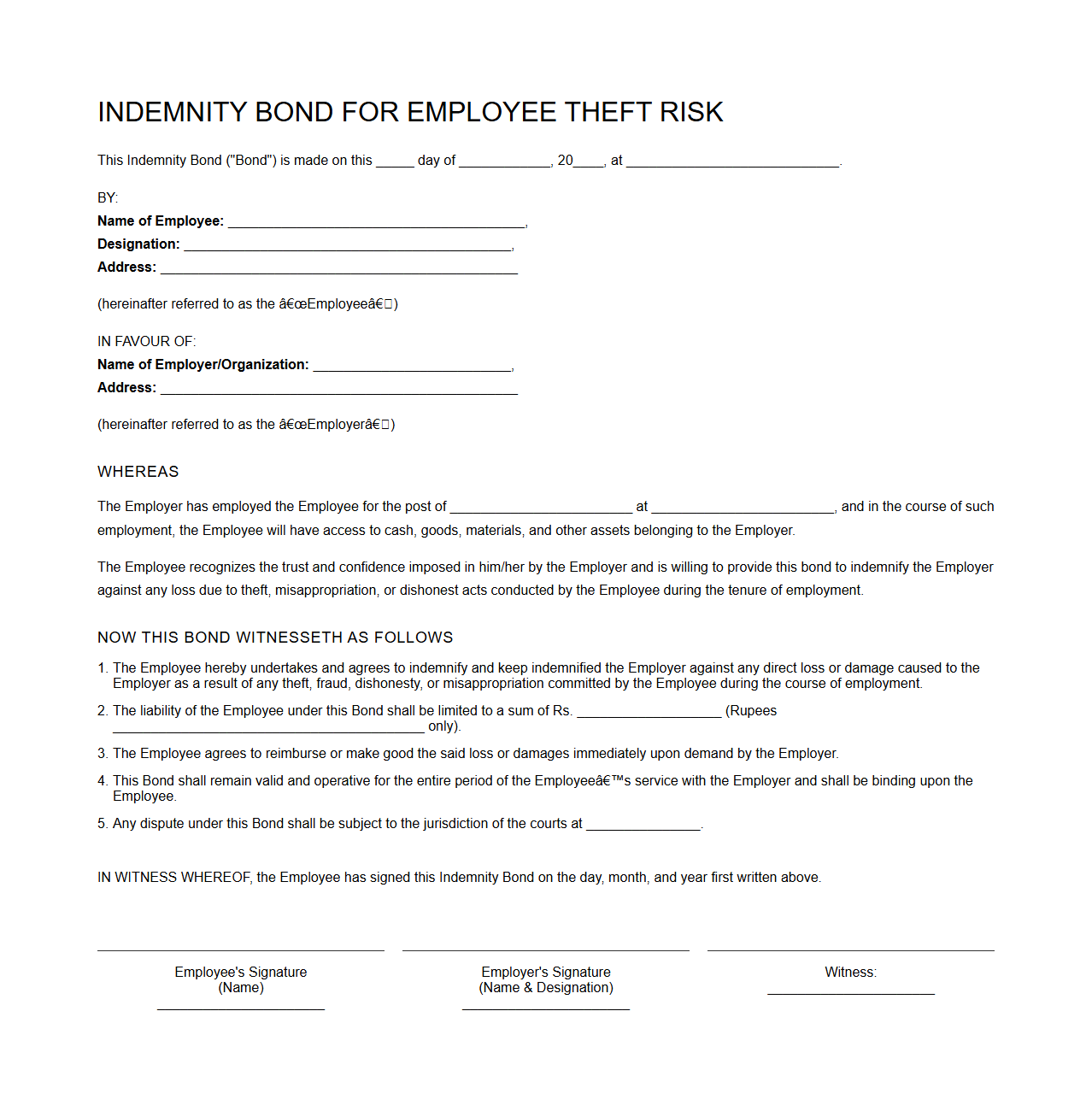

Indemnity Bond for Employee Theft Risk

An

Indemnity Bond for Employee Theft Risk is a legal agreement that protects an employer against financial losses caused by dishonest acts, such as theft or fraud, committed by employees. This document outlines the employee's commitment to compensate the employer for any damage resulting from such misconduct. It serves as a crucial risk management tool to safeguard business assets and ensure accountability within the workforce.

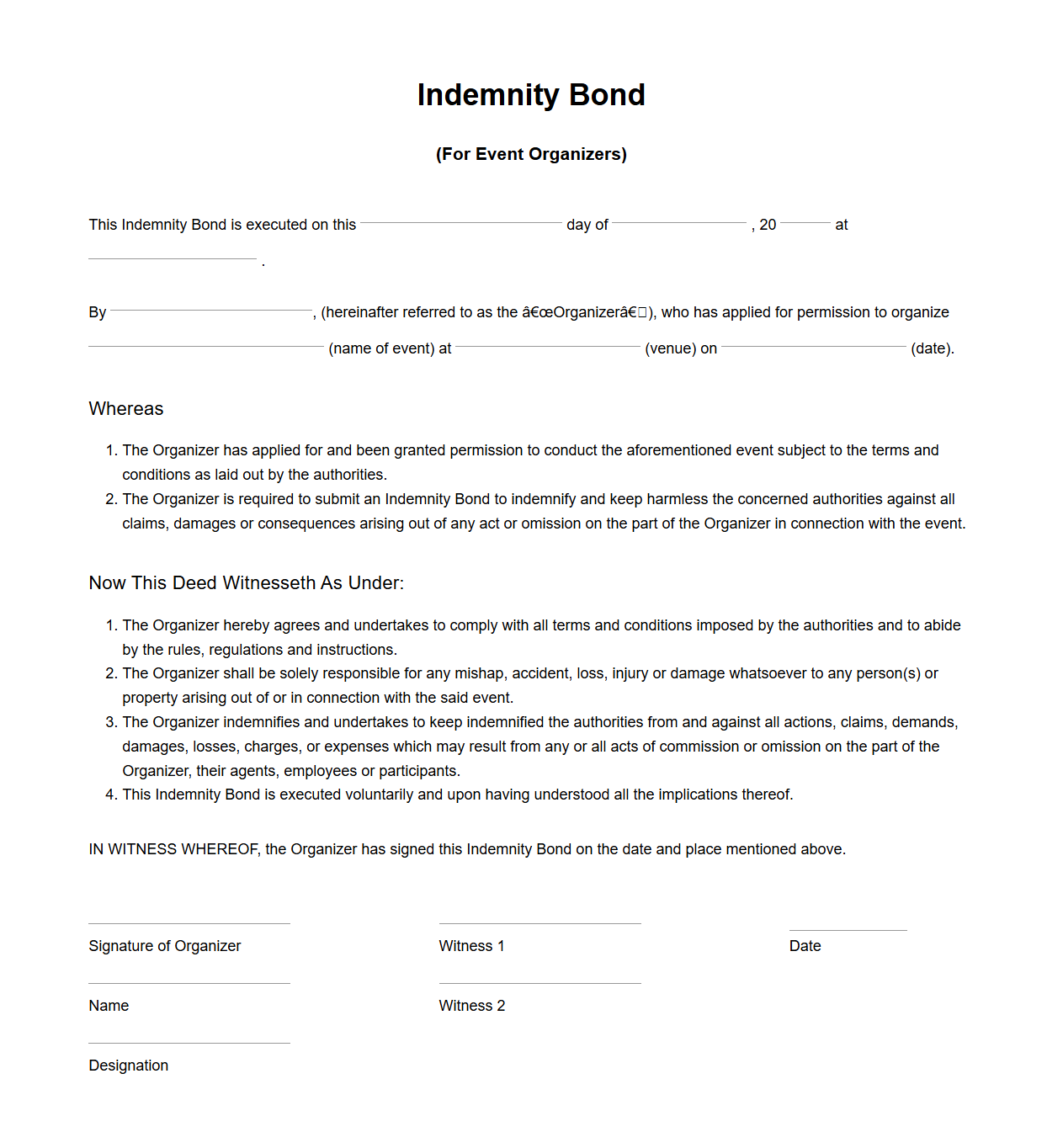

Indemnity Bond Sample for Event Organizers

An

Indemnity Bond Sample for Event Organizers is a legal document that outlines the organizer's agreement to assume responsibility for any potential damages or losses arising during an event. It serves as a formal assurance to venue owners, sponsors, or authorities that the event organizer will compensate for claims related to property damage, personal injury, or other liabilities. This bond sample helps streamline the drafting process, ensuring all critical indemnity clauses are included for comprehensive risk management.

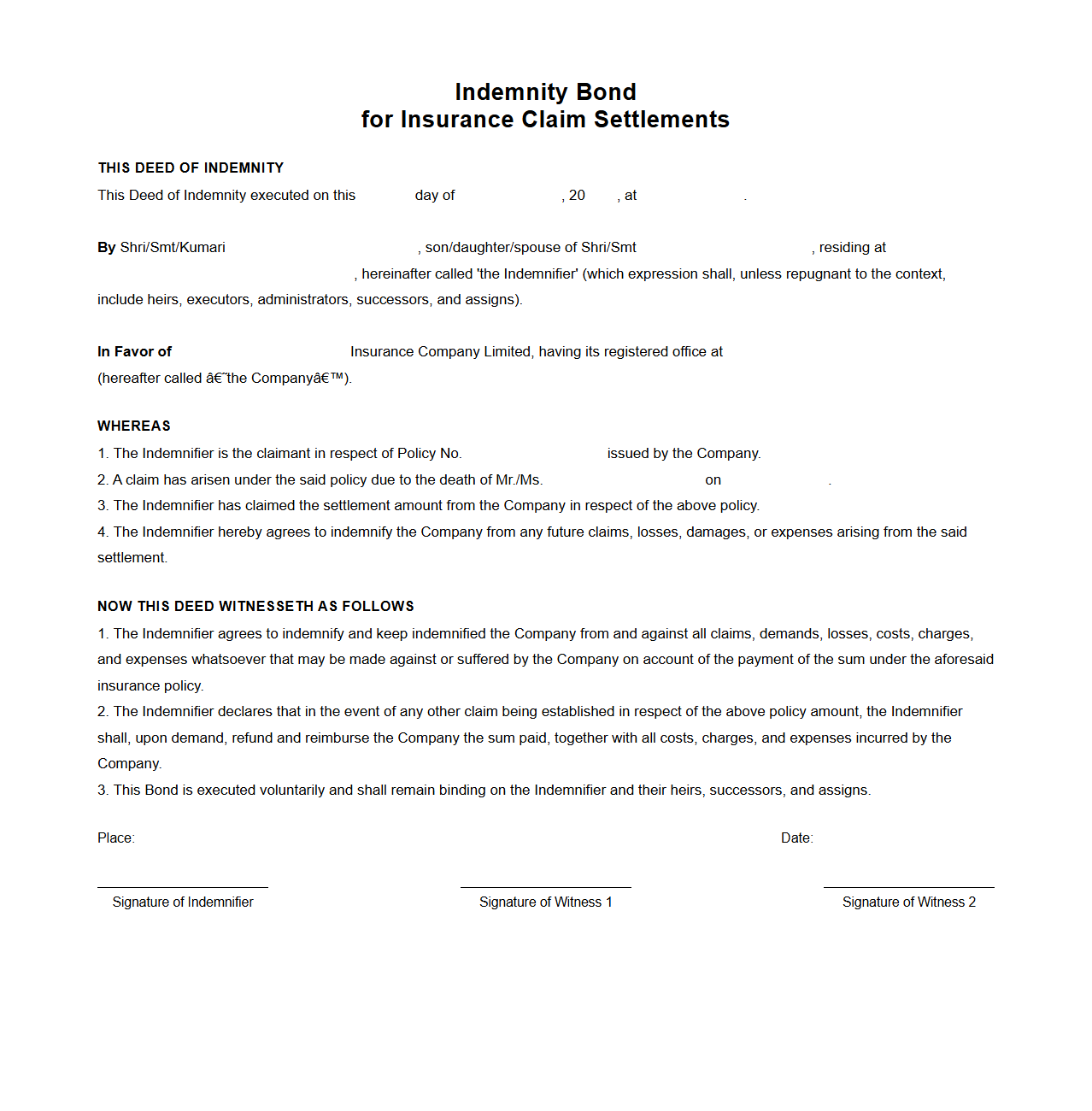

Indemnity Bond for Insurance Claim Settlements

An

Indemnity Bond for Insurance Claim Settlements is a legal document that ensures the claimant agrees to hold the insurer harmless from any future claims related to the settled insurance amount. This bond acts as a guarantee that the claim settlement is final and prevents the claimant from seeking additional compensation for the same loss. It provides financial protection to the insurance company by legally binding the claimant to indemnify the insurer against any subsequent liabilities.

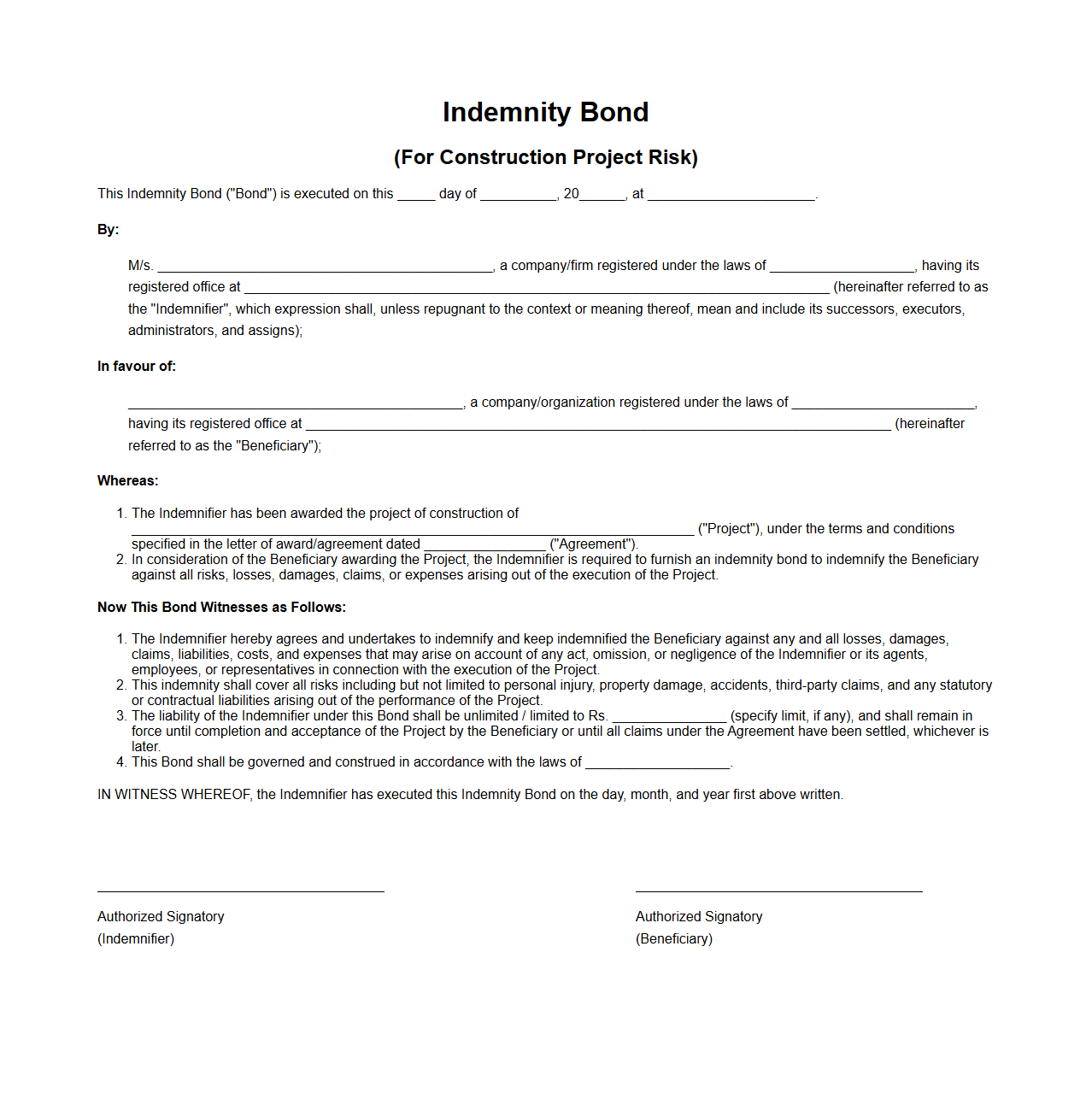

Indemnity Bond for Construction Project Risk

An

Indemnity Bond for Construction Project Risk is a legal agreement that protects parties involved in a construction project against potential financial losses arising from unforeseen risks such as property damage, personal injury, or contractual disputes. This bond ensures that the indemnifying party will compensate the indemnified party for any claims, liabilities, or damages incurred during the project, thereby minimizing financial exposure. It is a critical risk management tool to safeguard investments and maintain project continuity.

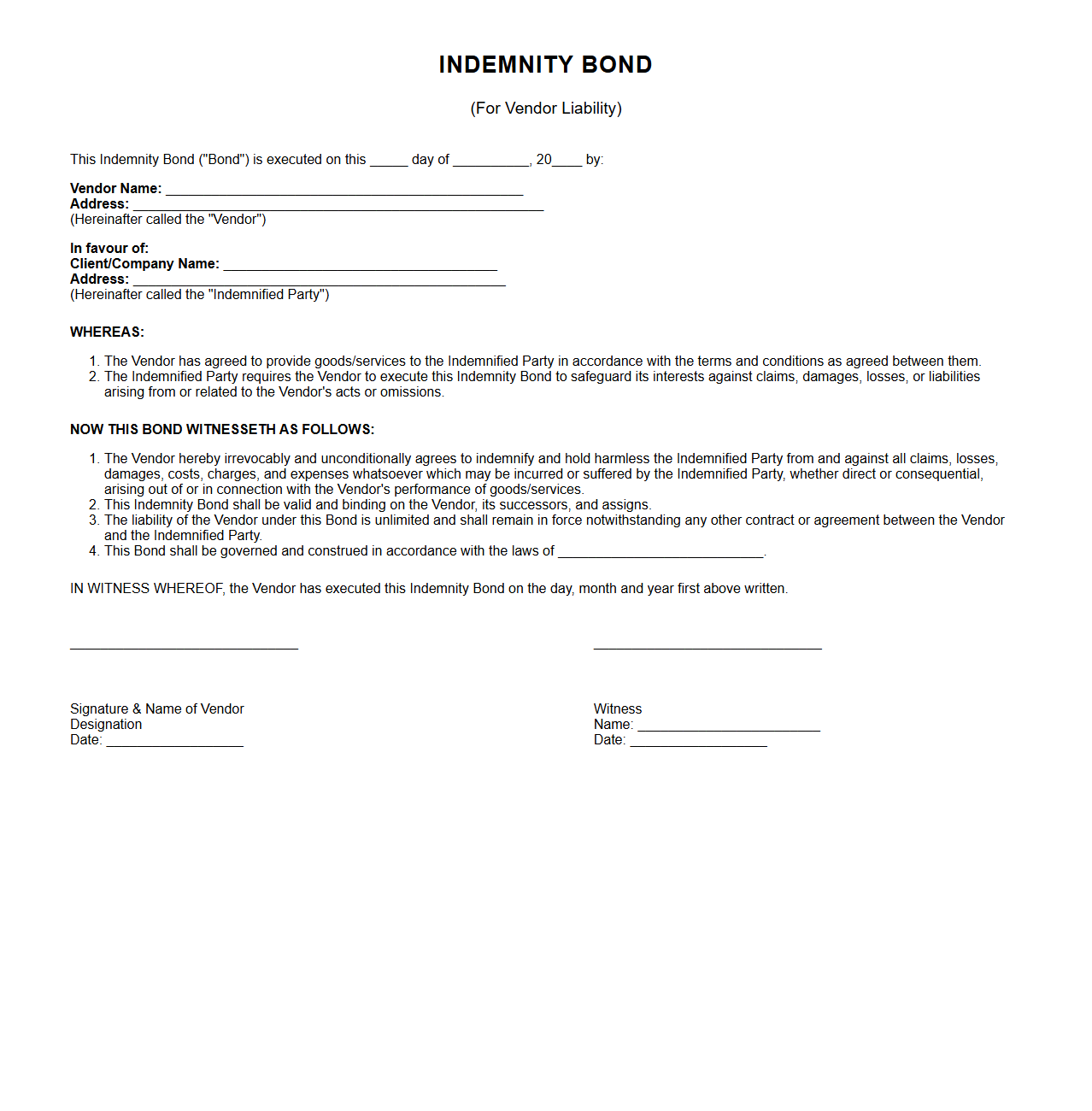

Indemnity Bond Template for Vendor Liability

An

Indemnity Bond Template for Vendor Liability is a standardized legal document used to outline the vendor's obligation to compensate for any losses or damages arising from their services or products. It clearly specifies the extent of the vendor's liability, protecting the client from potential financial risks. This template ensures all parties understand their responsibilities and provides a framework for accountability in vendor agreements.

What key clauses must be included in an indemnity bond for effective risk transfer?

An indemnity bond must include a clear description of the parties involved, specifying who is indemnifying and who is being indemnified. The bond should detail the scope of indemnity, outlining the risks and liabilities covered. Additionally, it must specify the duration and conditions under which the indemnity applies to ensure effective risk transfer.

How does an indemnity bond mitigate third-party liability in contractual agreements?

An indemnity bond mitigates third-party liability by assigning responsibility to the indemnifier for any claims or damages arising from the contract. This protects the indemnified party from financial loss due to actions or omissions of the other party. As a result, the bond serves as a financial guarantee that third-party risks will be managed and compensated appropriately.

What are the typical exclusions stated in risk management indemnity bonds?

Typical exclusions in indemnity bonds often include damages resulting from gross negligence, willful misconduct, or illegal acts. Many bonds exclude liabilities arising from natural disasters or force majeure events outside the control of the indemnifier. These exclusions help define the boundaries of the indemnity, protecting the indemnifier from unlimited exposure.

How does the enforceability of indemnity bonds vary across jurisdictions?

The enforceability of indemnity bonds varies significantly due to differences in local laws and legal interpretations. Some jurisdictions impose strict requirements on the language and scope of indemnity clauses, while others may limit enforceability to prevent unfair contract terms. Understanding these variations is critical for drafting effective bonds that hold up in different legal environments.

What documentation is required to validate an indemnity claim under a risk management bond?

To validate an indemnity claim, comprehensive documentation such as detailed incident reports, proof of loss, and correspondence related to the claim are essential. Additionally, contractual agreements and the original indemnity bond must be submitted to demonstrate terms and coverage. This documentation ensures transparency and supports the claim process for timely settlement.