A Loan Agreement Document Sample for Business Lending outlines the terms and conditions between a lender and a borrower, ensuring clarity on repayment schedules, interest rates, and loan amounts. This sample serves as a legal reference to protect both parties' interests and minimize disputes. It includes essential clauses such as default consequences, collateral details, and confidentiality agreements.

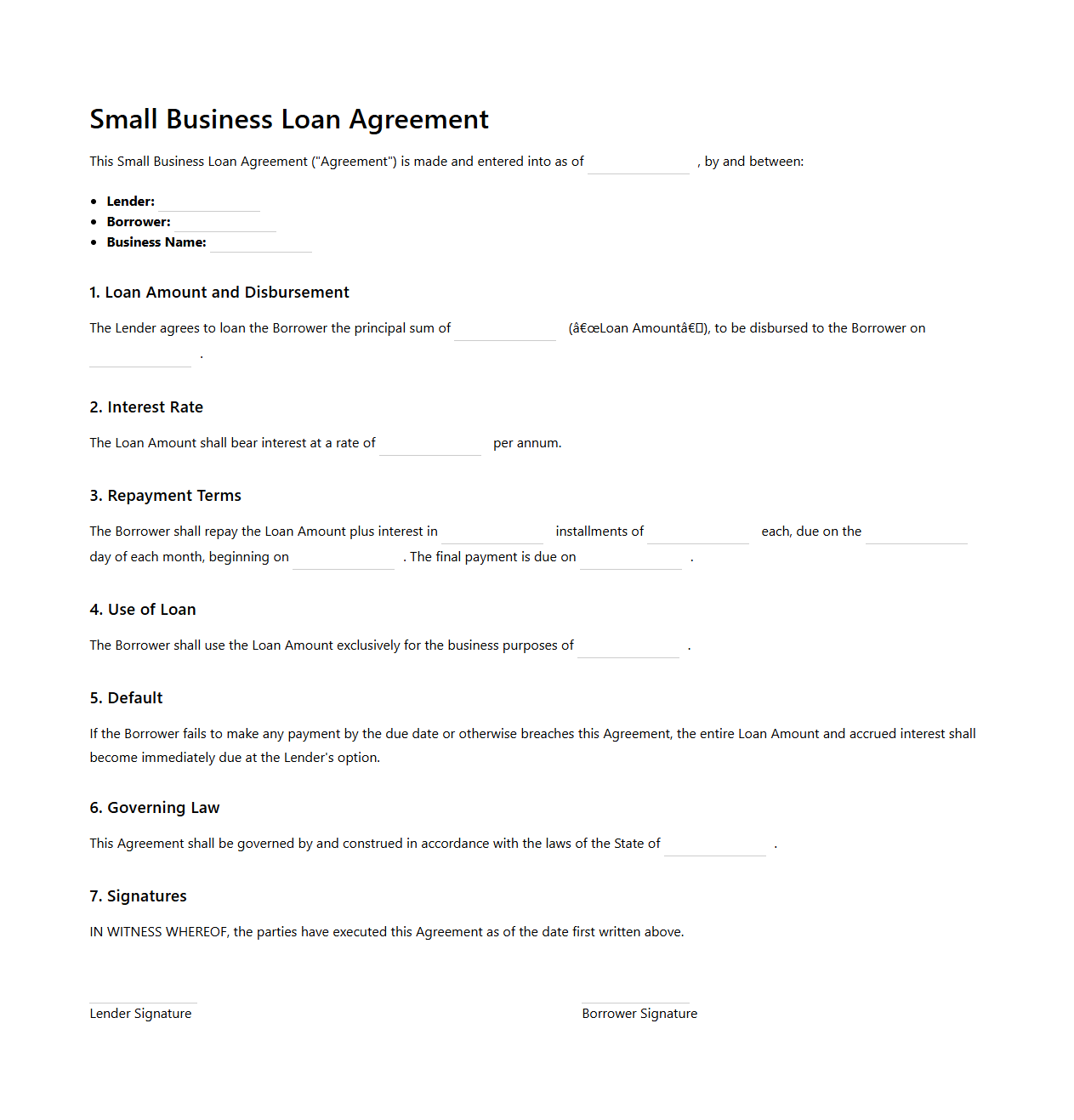

Small Business Loan Agreement Template

A

Small Business Loan Agreement Template document is a pre-structured legal form that outlines the terms and conditions under which a loan is made to a small business. It includes critical details such as loan amount, interest rate, repayment schedule, and responsibilities of both lender and borrower. This template serves to protect both parties by providing a clear framework for the financial transaction.

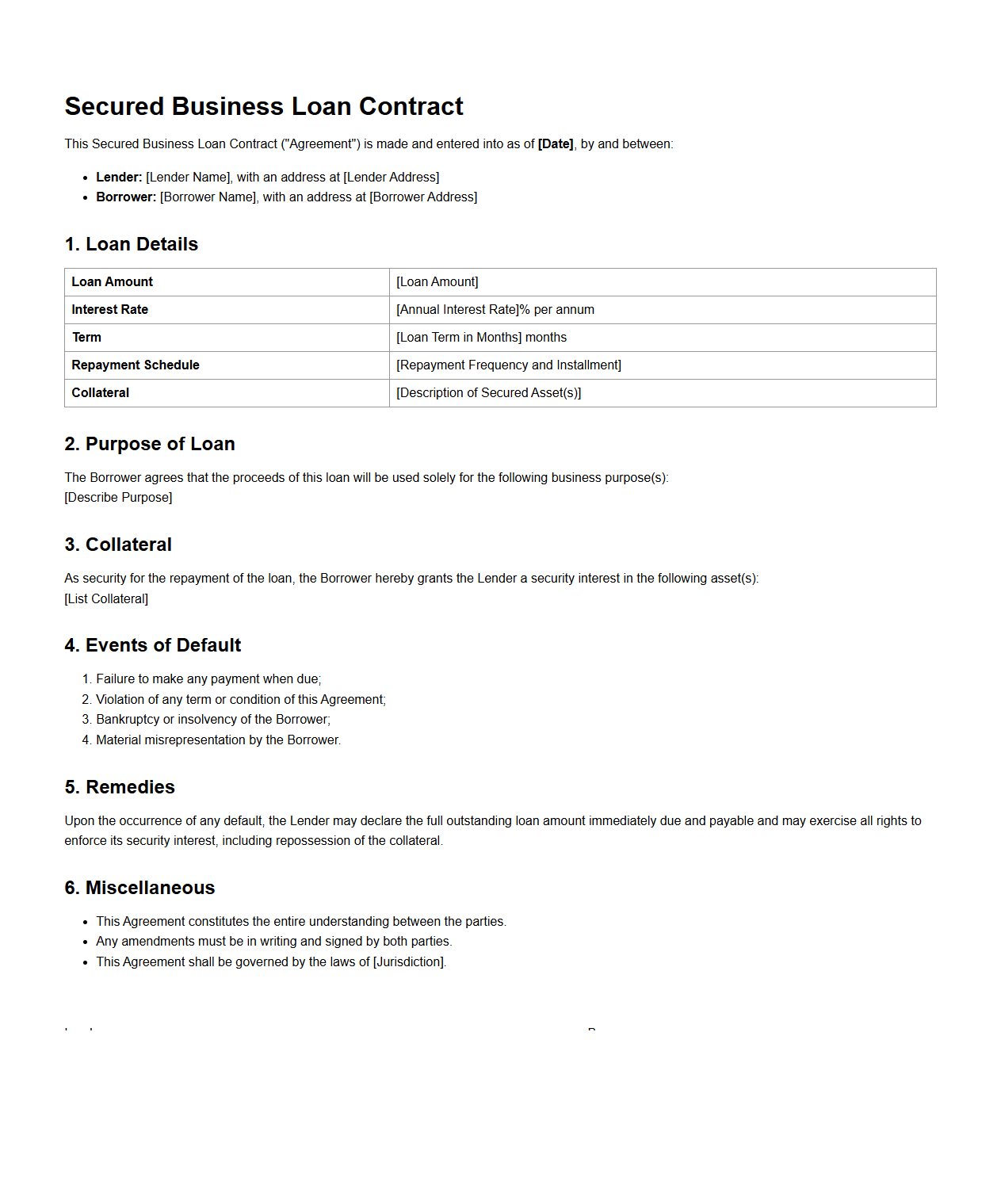

Secured Business Loan Contract Sample

A

Secured Business Loan Contract Sample document outlines the terms and conditions under which a lender agrees to provide a loan to a business, using specific assets as collateral to minimize risk. This sample helps businesses understand the obligations, repayment schedules, interest rates, and default consequences before entering a binding agreement. Reviewing this document ensures clarity on secured loan procedures and protects both parties involved.

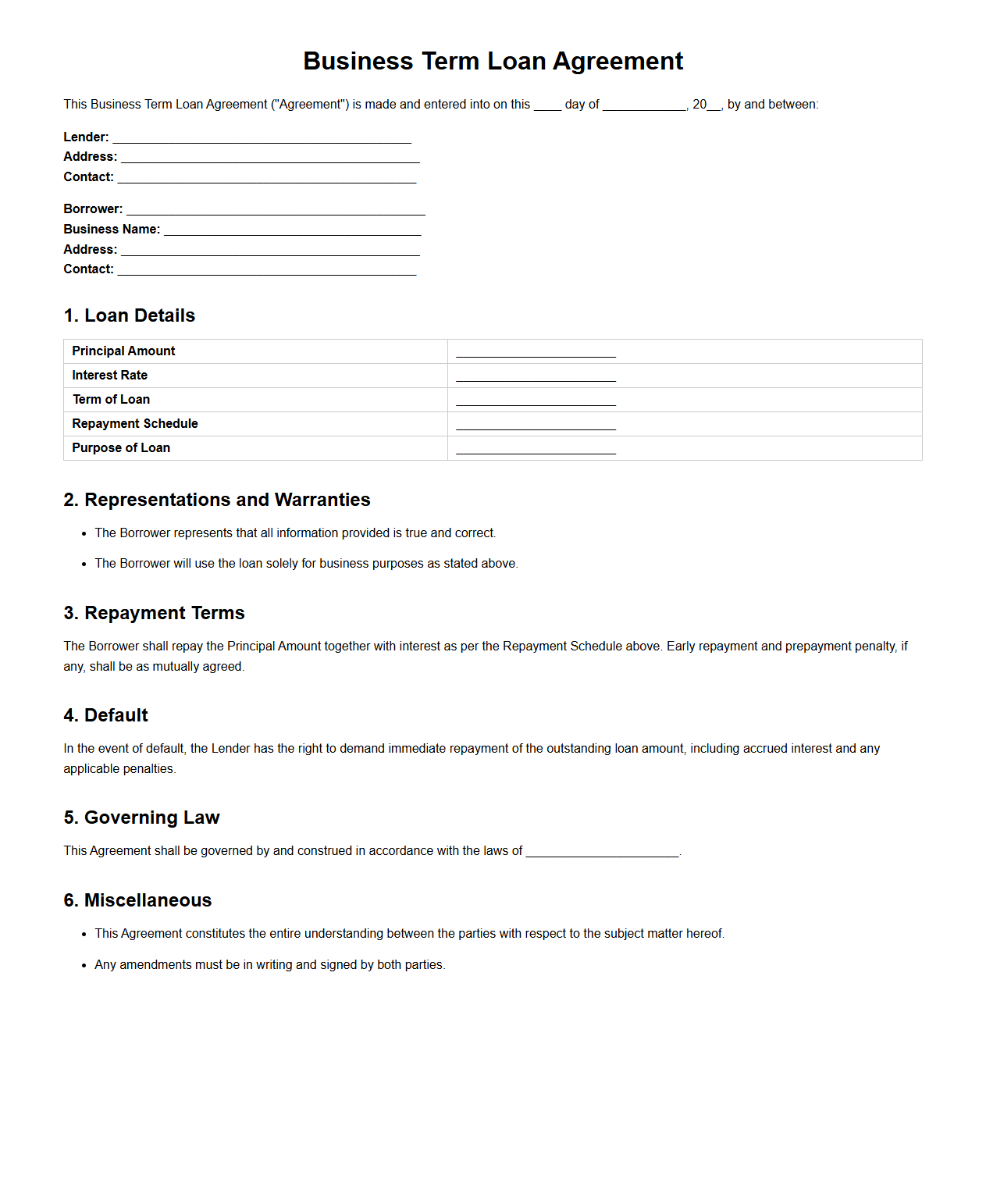

Business Term Loan Agreement Format

A

Business Term Loan Agreement Format document outlines the terms and conditions between a lender and borrower for a specified loan amount, repayment schedule, interest rate, and collateral if applicable. This legally binding contract ensures clarity on obligations, default consequences, and dispute resolution mechanisms, providing security for both parties. Clear documentation supports business financing by defining roles and protecting financial interests throughout the loan period.

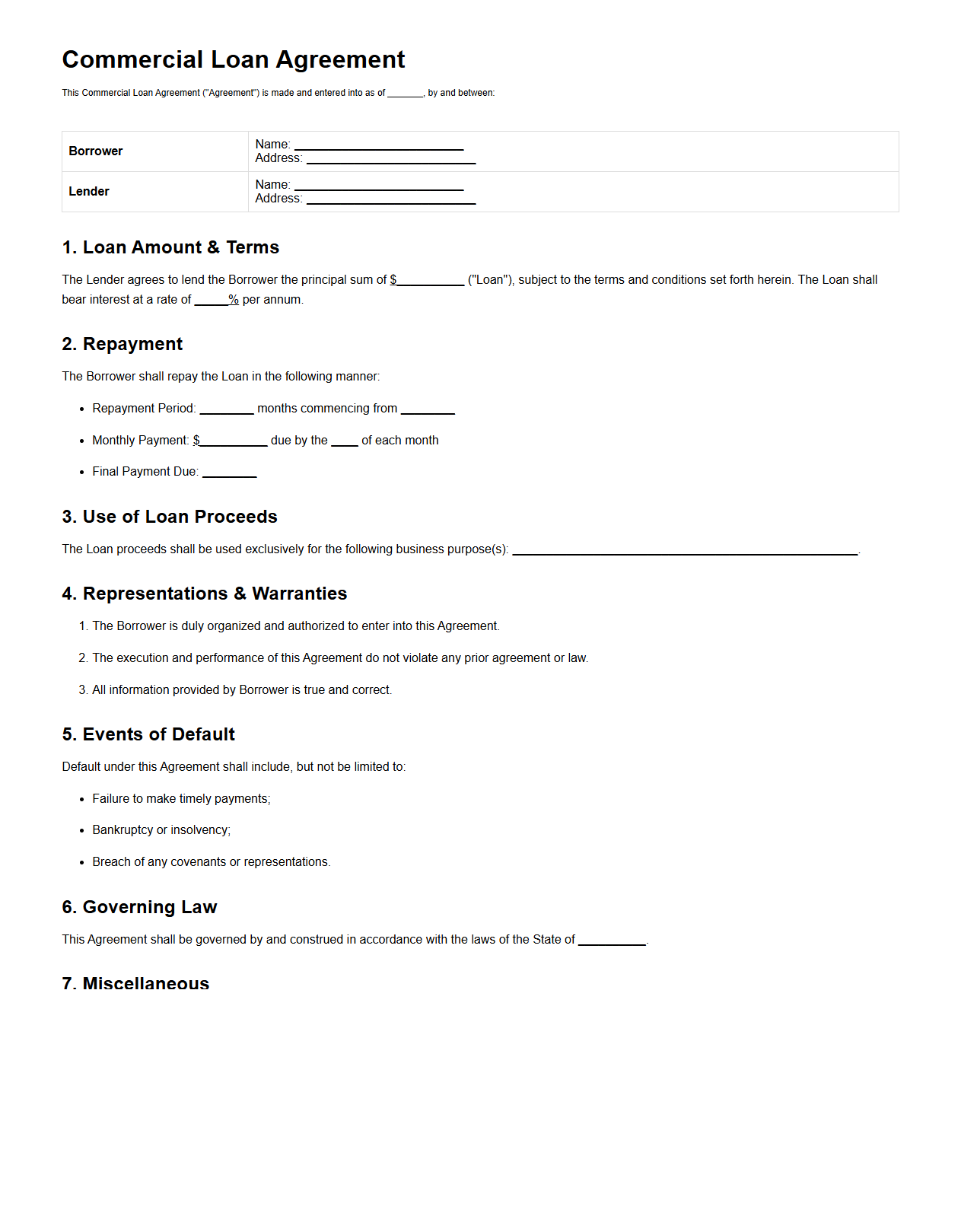

Commercial Loan Agreement Example

A

Commercial Loan Agreement Example document outlines the terms and conditions between a lender and a borrower for business financing. It includes details such as the loan amount, interest rate, repayment schedule, collateral, and default provisions to ensure clarity and legal protection. This example serves as a template to guide businesses in drafting enforceable and comprehensive loan contracts.

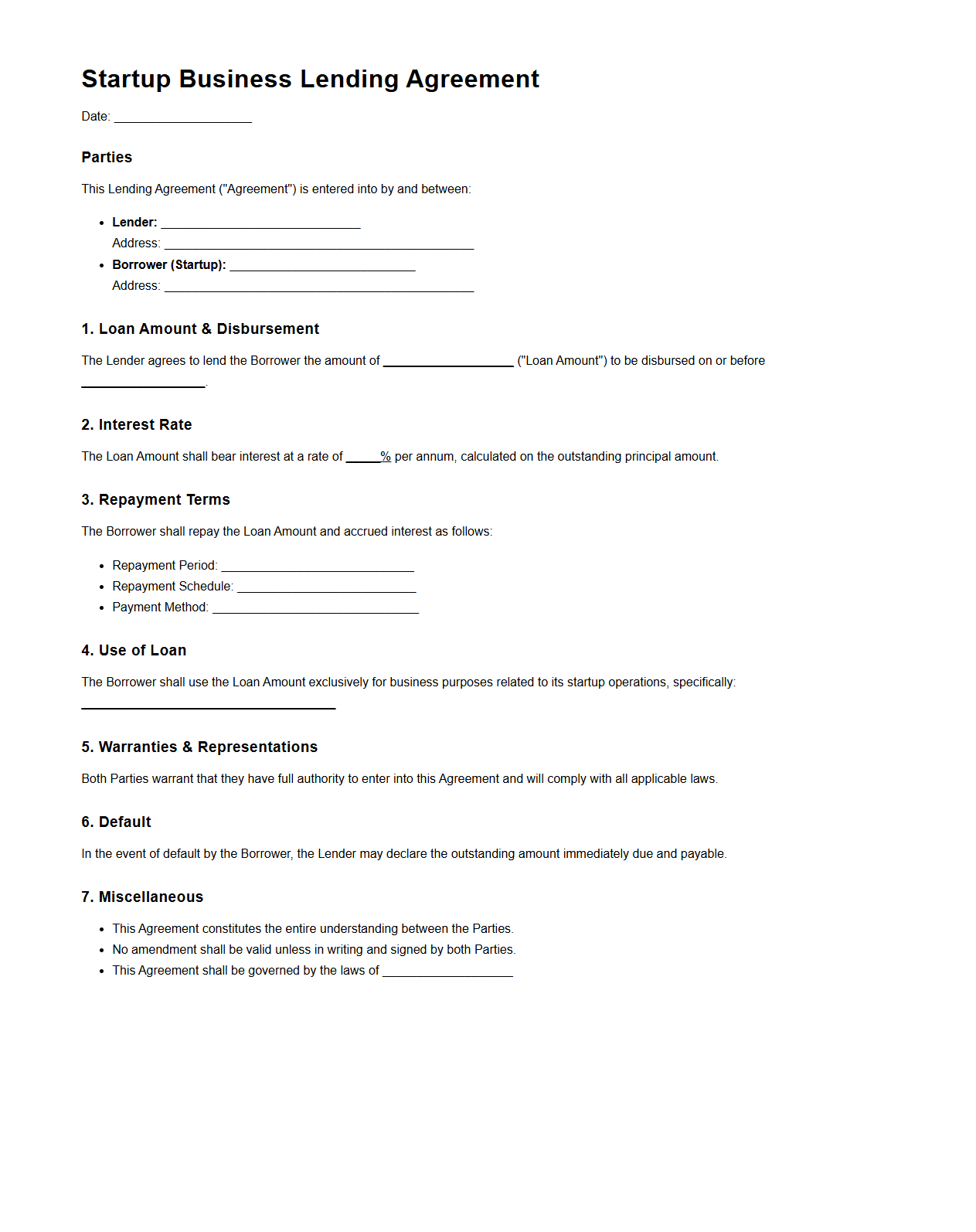

Startup Business Lending Agreement Template

A

Startup Business Lending Agreement Template document is a legally binding contract framework designed to formalize the loan terms between a lender and a startup business. It outlines essential elements such as loan amount, interest rates, repayment schedule, and default conditions, ensuring clarity and protection for both parties involved. Utilizing this template helps streamline the financing process, reduce disputes, and support smooth capital acquisition for emerging enterprises.

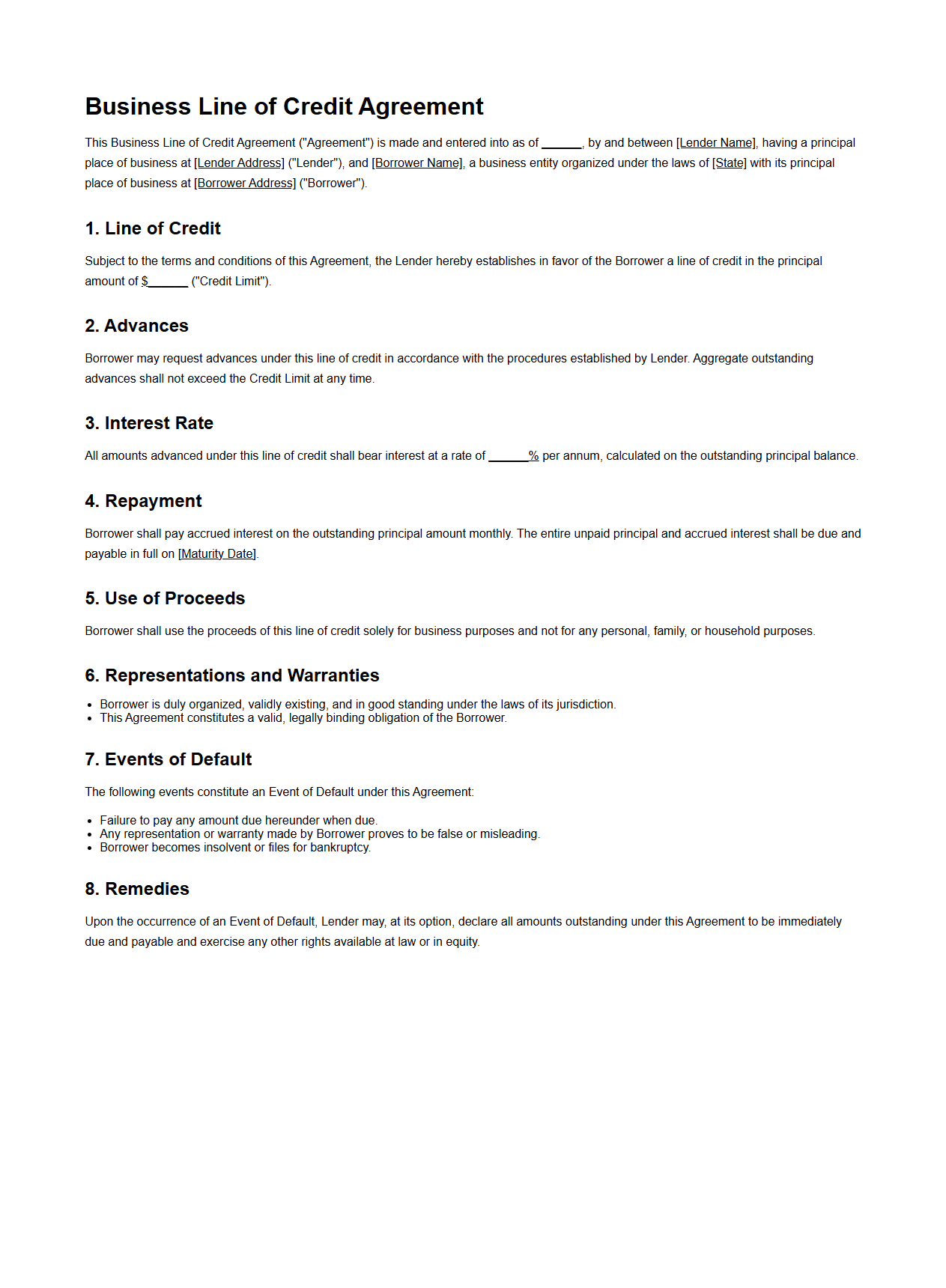

Business Line of Credit Agreement Sample

A

Business Line of Credit Agreement Sample document outlines the terms and conditions between a lender and a business borrower, specifying the credit limit, repayment schedule, interest rates, and collateral requirements. It serves as a legal template to facilitate access to revolving funds for managing cash flow, purchasing inventory, or covering unexpected expenses. This sample helps businesses understand obligations and protects both parties by clearly defining rights and responsibilities.

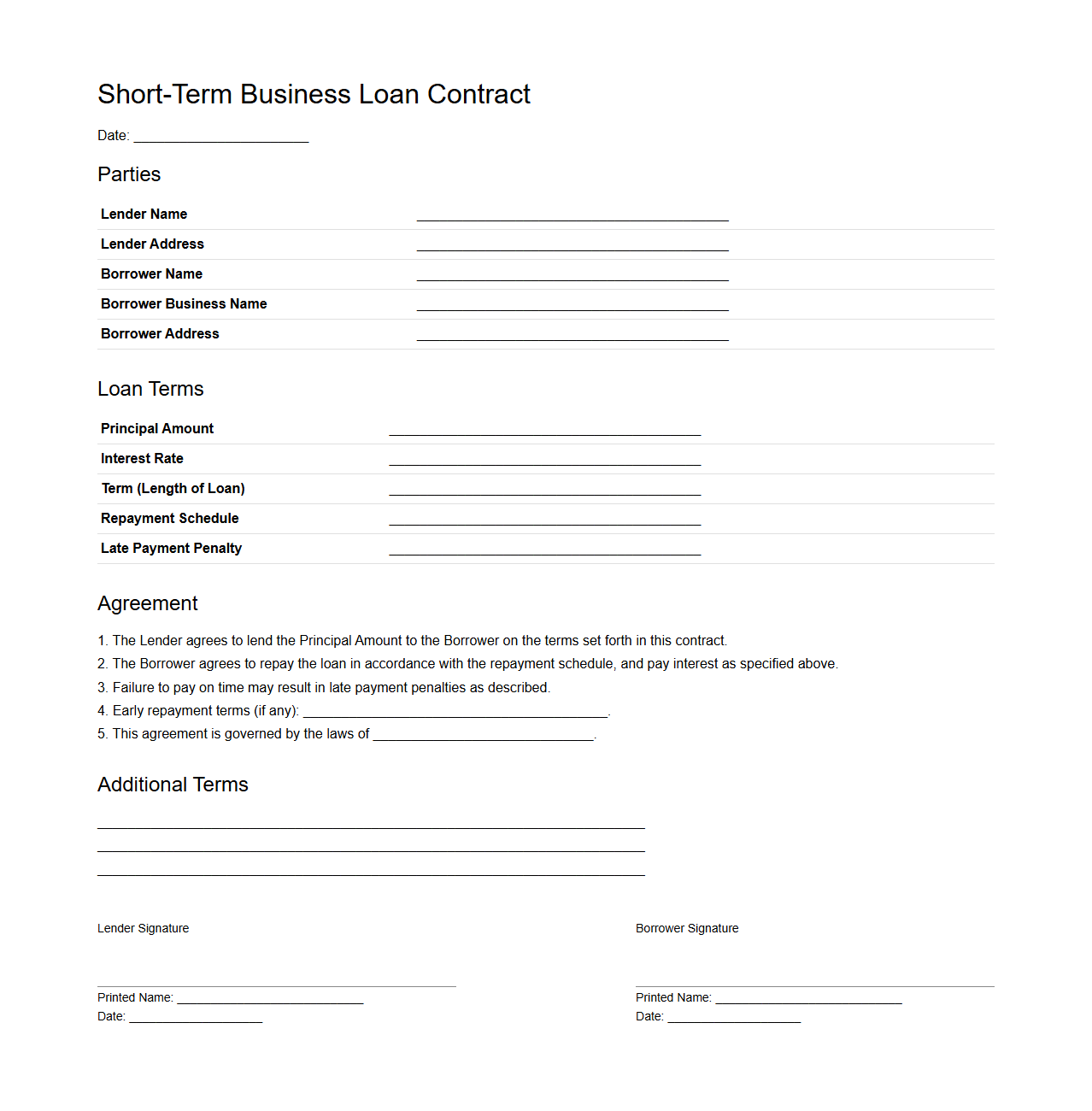

Short-Term Business Loan Contract Template

A

Short-Term Business Loan Contract Template document outlines the specific terms and conditions for a loan agreement between a lender and a borrower, typically covering repayment periods of less than one year. It includes essential details such as loan amount, interest rate, repayment schedule, fees, and default consequences to ensure clear understanding and legal protection for both parties. This template helps streamline the loan process by providing a standardized, legally compliant framework.

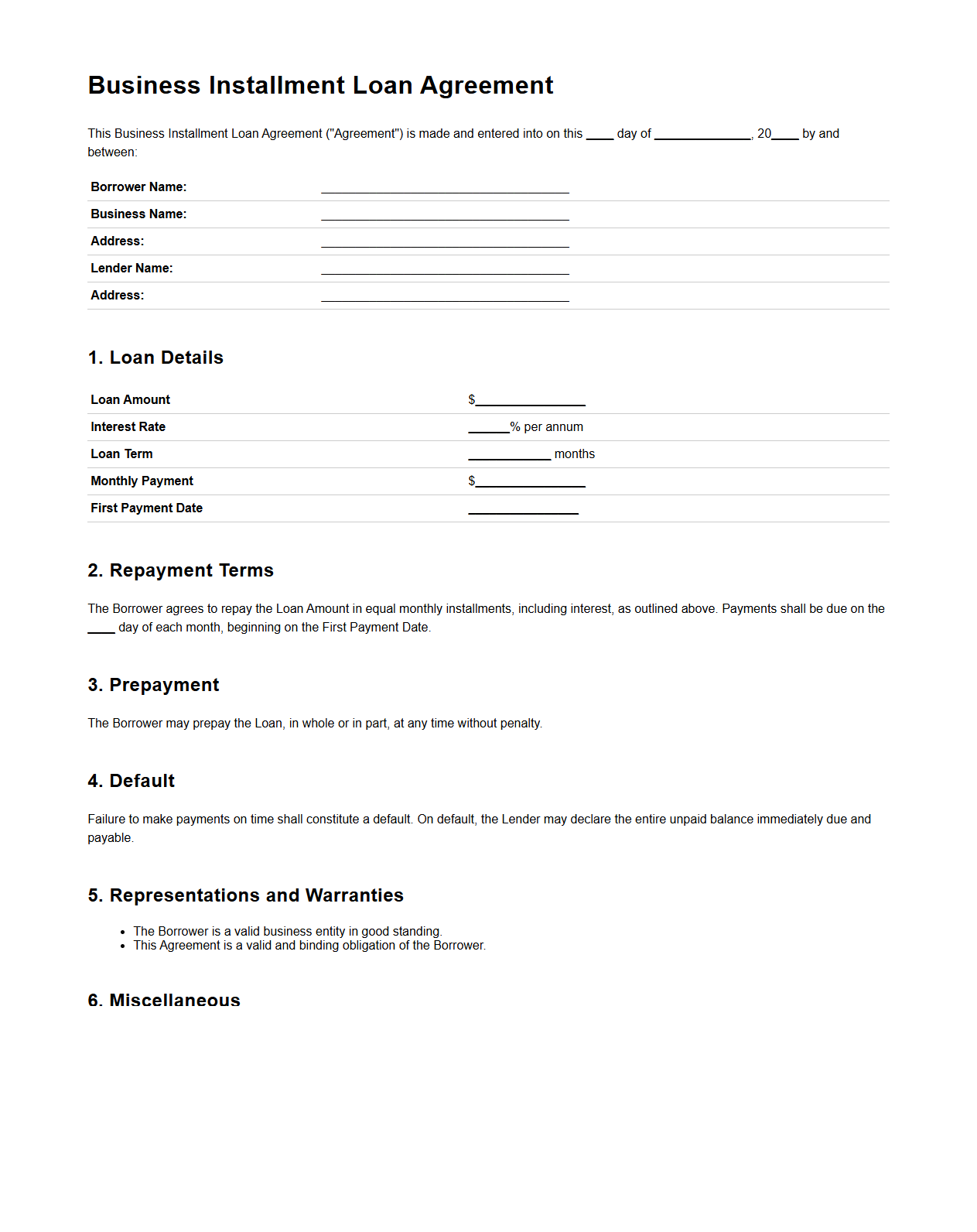

Business Installment Loan Agreement Sample

A

Business Installment Loan Agreement Sample document outlines the terms and conditions under which a borrower repays a loan to a lender in fixed installments over a specified period. It typically includes details such as loan amount, interest rate, repayment schedule, and obligations of both parties. This document serves as a legal reference to ensure clarity and protect the interests of businesses involved in installment loans.

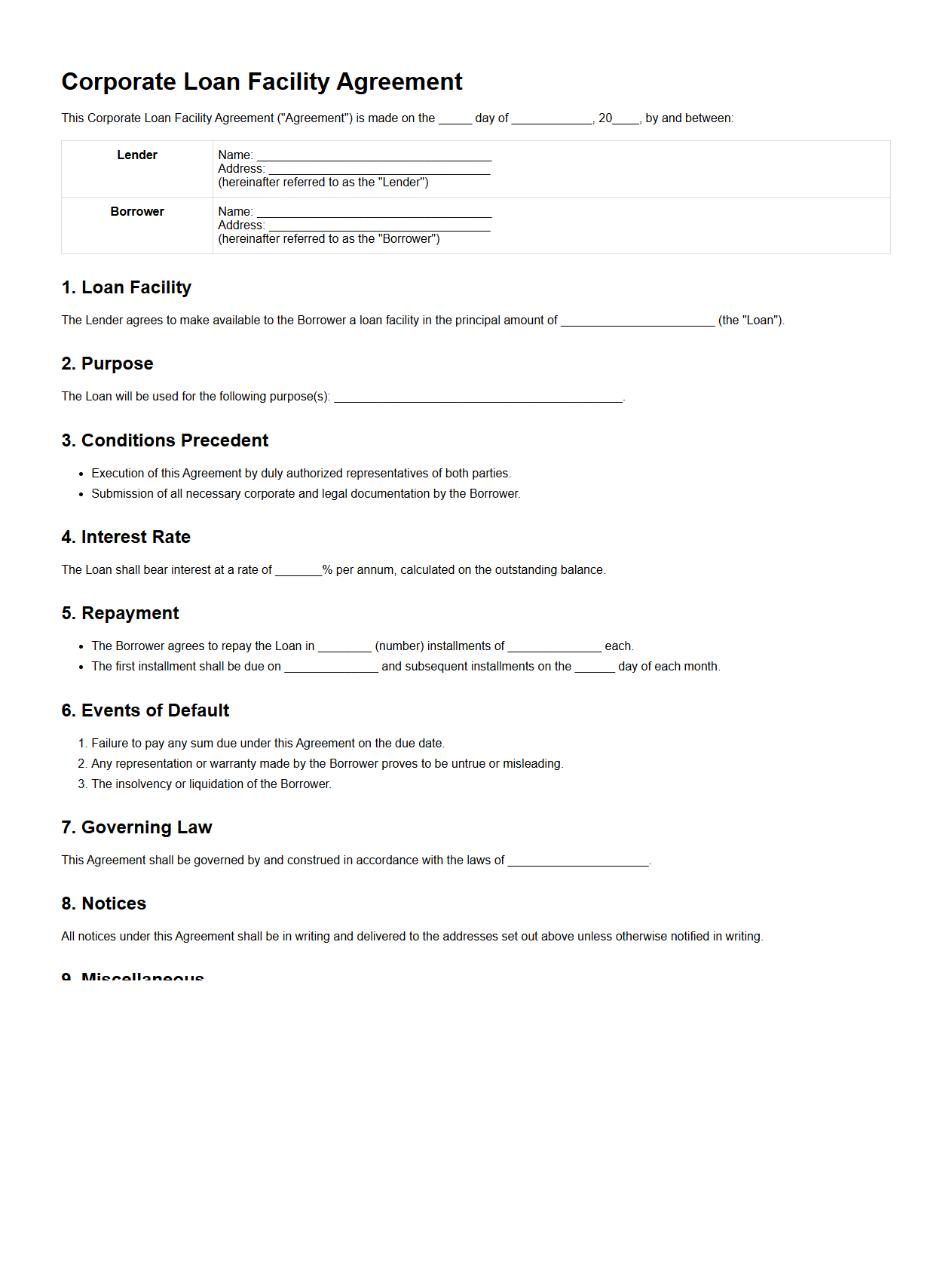

Corporate Loan Facility Agreement Template

A

Corporate Loan Facility Agreement Template is a standardized legal document used to outline the terms and conditions under which a lender provides a loan facility to a corporate borrower. This template includes key elements such as loan amount, interest rates, repayment schedules, covenants, and default provisions, ensuring clarity and compliance for both parties. Utilizing this template streamlines the loan negotiation process and helps mitigate risks associated with corporate lending transactions.

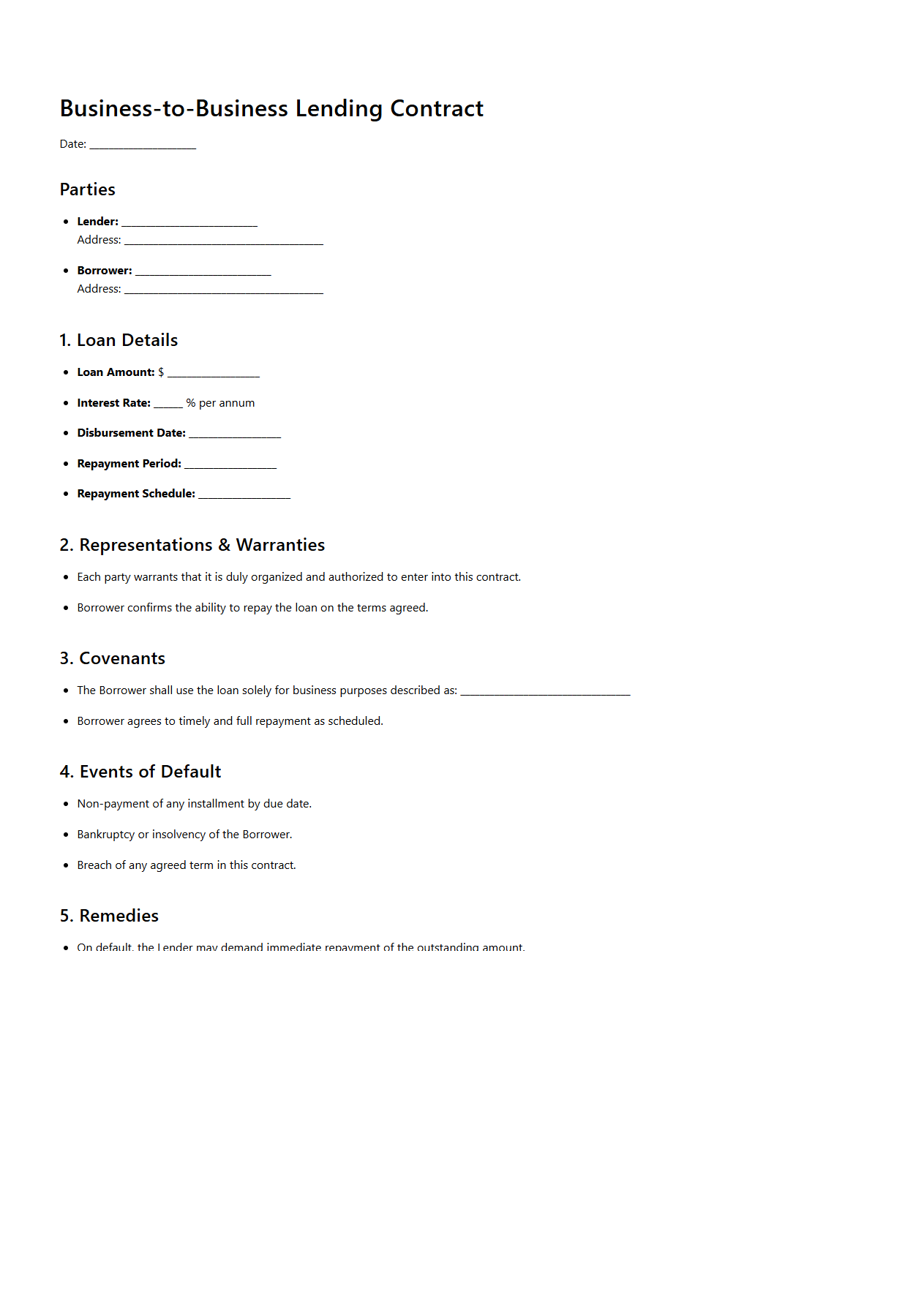

Business-to-Business Lending Contract Example

A

Business-to-Business Lending Contract Example document outlines the terms and conditions of a loan agreement between two companies, specifying the loan amount, interest rate, repayment schedule, and obligations of both parties. It serves as a legal framework to ensure clarity and protect the interests of the lender and borrower during business financing transactions. This document helps streamline negotiations and fosters trust by clearly defining the responsibilities and remedies in case of default.

What are the mandatory covenants included in a business loan agreement?

Mandatory covenants in a business loan agreement typically include financial covenants, such as maintaining specific debt-to-equity ratios and minimum liquidity levels. Operational covenants may require the borrower to adhere to budgeting and reporting guidelines. These covenants protect lenders by ensuring the borrower remains financially stable throughout the loan term.

Which clauses address default and remedies in the business lending document?

Default clauses specify the conditions under which the borrower is considered in default, including missed payments and breaches of covenants. Remedies clauses outline lender actions upon default, such as acceleration of the loan, fees, or legal recourse. These provisions are essential for managing risk and outlining consequences for non-compliance.

How is collateral or security interest outlined and documented?

Collateral and security interests are detailed in specific sections that describe the assets pledged by the borrower to secure the loan. Documentation includes the description, valuation, and perfection of the security interest to ensure lender priority. Clear outlining of collateral protects lenders by providing recourse if the borrower defaults.

What provisions detail early repayment penalties or prepayment terms?

Early repayment provisions specify whether a borrower can repay the loan before maturity and any associated prepayment penalties. These clauses balance lender interests by compensating for lost interest revenue if the loan is repaid early. Detailed terms may include notice requirements and calculation methods for penalties.

Which sections specify borrower reporting and disclosure obligations?

Borrower reporting and disclosure obligations ensure the lender receives timely and accurate financial and operational information. These sections often require periodic financial statements, compliance certificates, and notices of material events. Such transparency helps lenders monitor loan risk throughout the agreement term.