A Merger Agreement Document Sample for Corporate Mergers provides a detailed template outlining the terms and conditions essential for combining two or more companies into a single entity. This document covers critical aspects such as asset transfers, liabilities, governance structure, and shareholder rights to ensure a smooth and legally compliant merger process. Utilizing a well-structured sample helps streamline negotiations and reduces the risk of disputes during corporate consolidation.

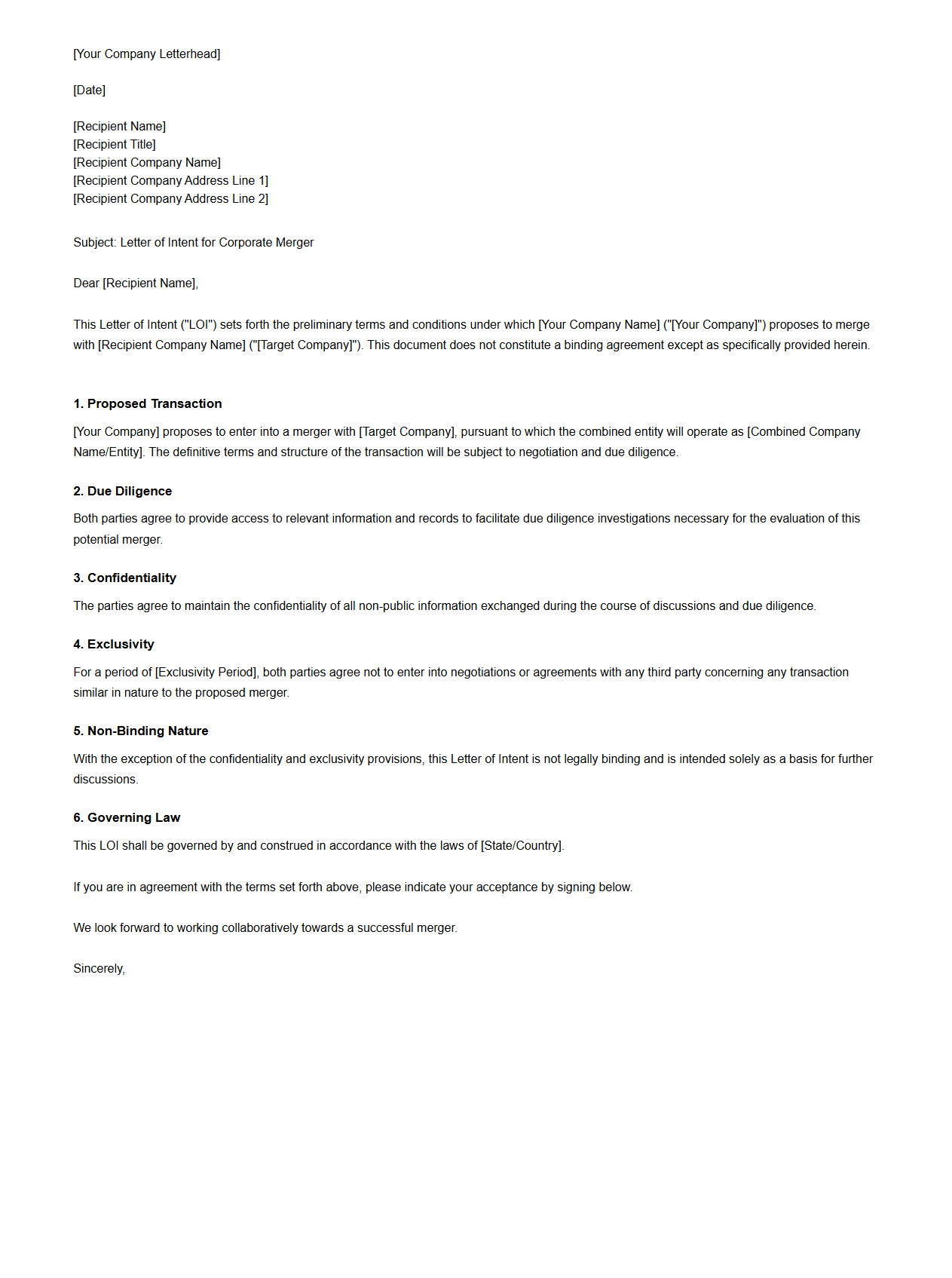

Sample Letter of Intent for Corporate Merger

A

Sample Letter of Intent for Corporate Merger is a formal document outlining the preliminary understanding between two companies planning to merge. It details the proposed terms, conditions, and key elements such as asset valuation, management roles, and timelines, serving as a foundation for further negotiations. This letter helps ensure alignment and commitment before drafting a final, legally binding agreement.

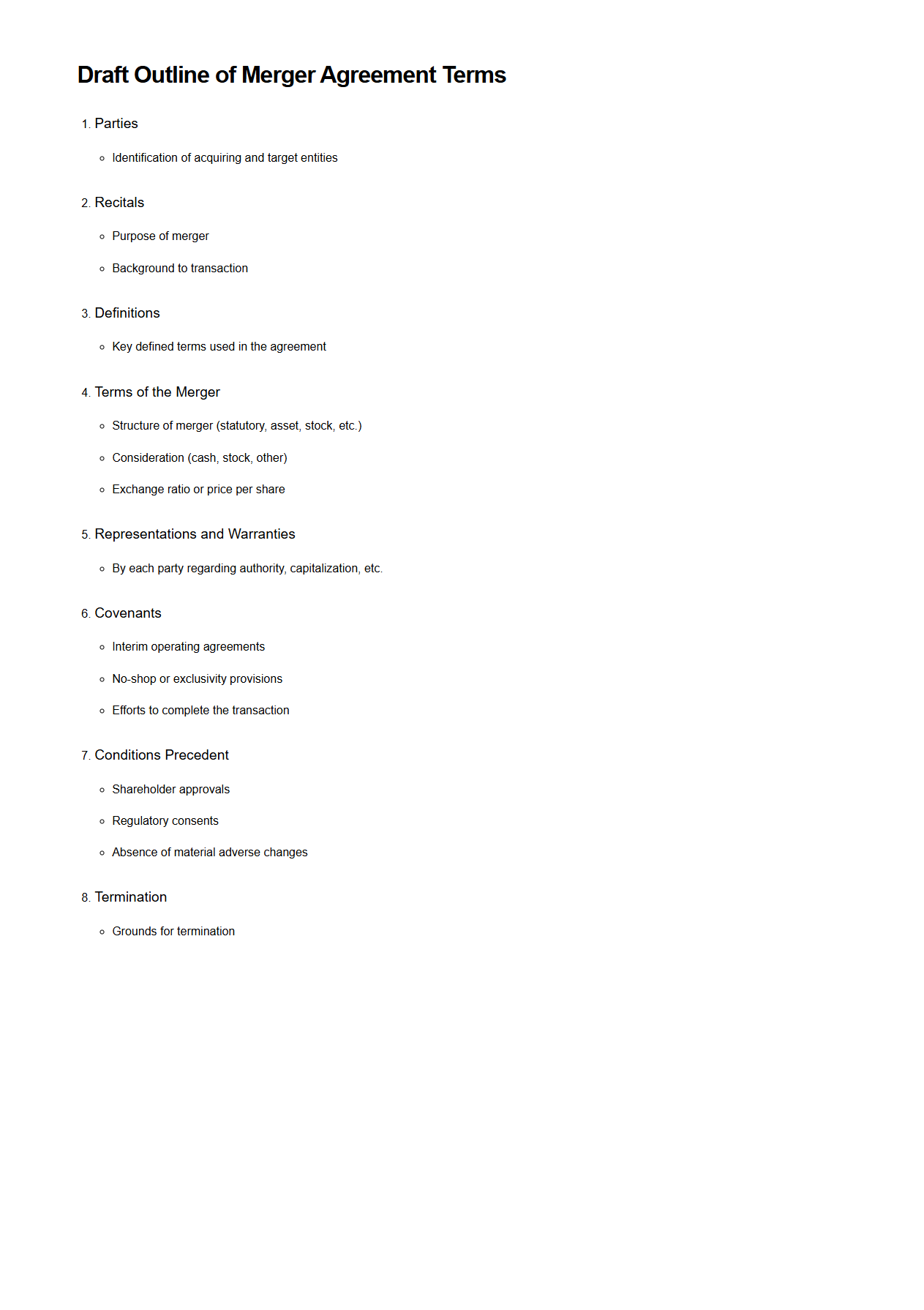

Draft Outline of Merger Agreement Terms

A

Draft Outline of Merger Agreement Terms is a preliminary document that sets forth the essential provisions and conditions agreed upon by merging entities. It typically includes key elements such as purchase price, payment methods, representations and warranties, covenants, and closing conditions. This outline serves as a framework for negotiating and finalizing the detailed terms of the definitive merger agreement.

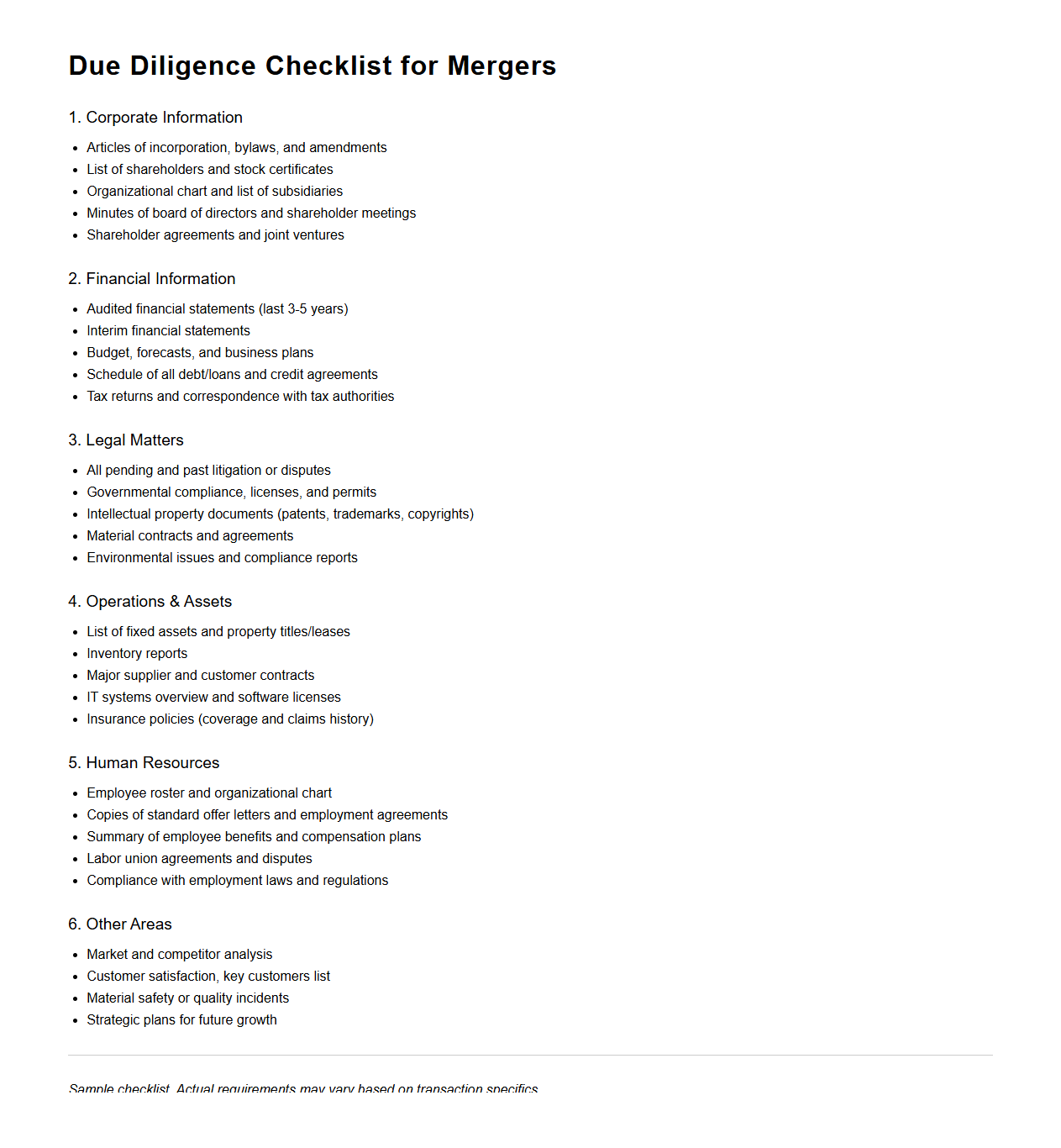

Due Diligence Checklist for Mergers

A

Due Diligence Checklist for Mergers document systematically outlines key financial, legal, operational, and strategic areas that must be reviewed to assess risks and opportunities during a merger process. It helps ensure comprehensive evaluation of the target company's assets, liabilities, contracts, compliance status, and intellectual property. This checklist improves decision-making accuracy and minimizes the potential for unforeseen issues post-merger.

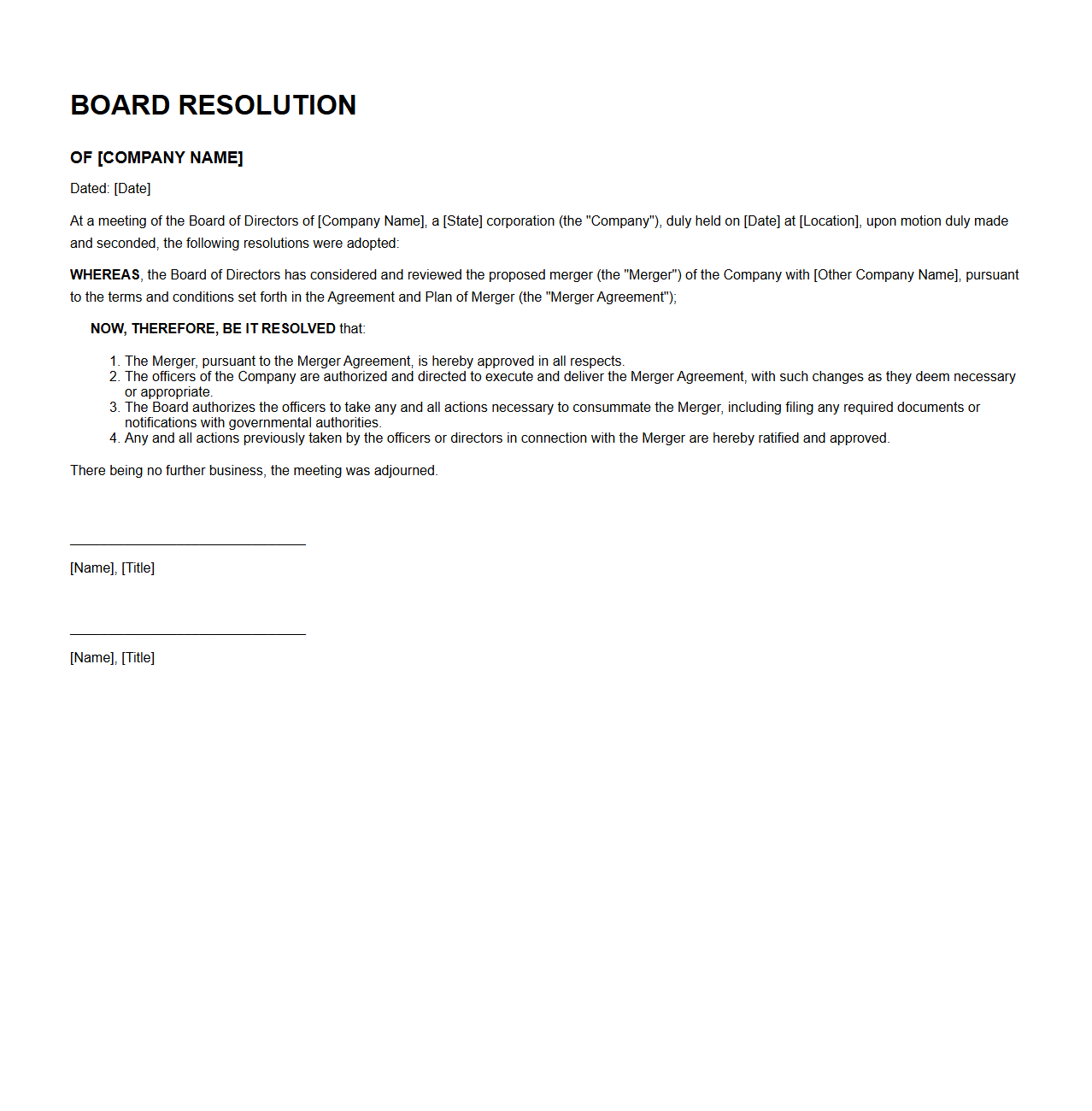

Board Resolution Template for Approving Merger

A

Board Resolution Template for Approving Merger is a pre-designed document that formalizes the decision made by a company's board of directors regarding the approval of a merger with another entity. This template ensures all critical elements such as merger details, approval statements, and authorization signatures are consistently included for legal and corporate governance compliance. Using this template helps streamline the approval process and maintains a clear, documented record for regulatory and internal purposes.

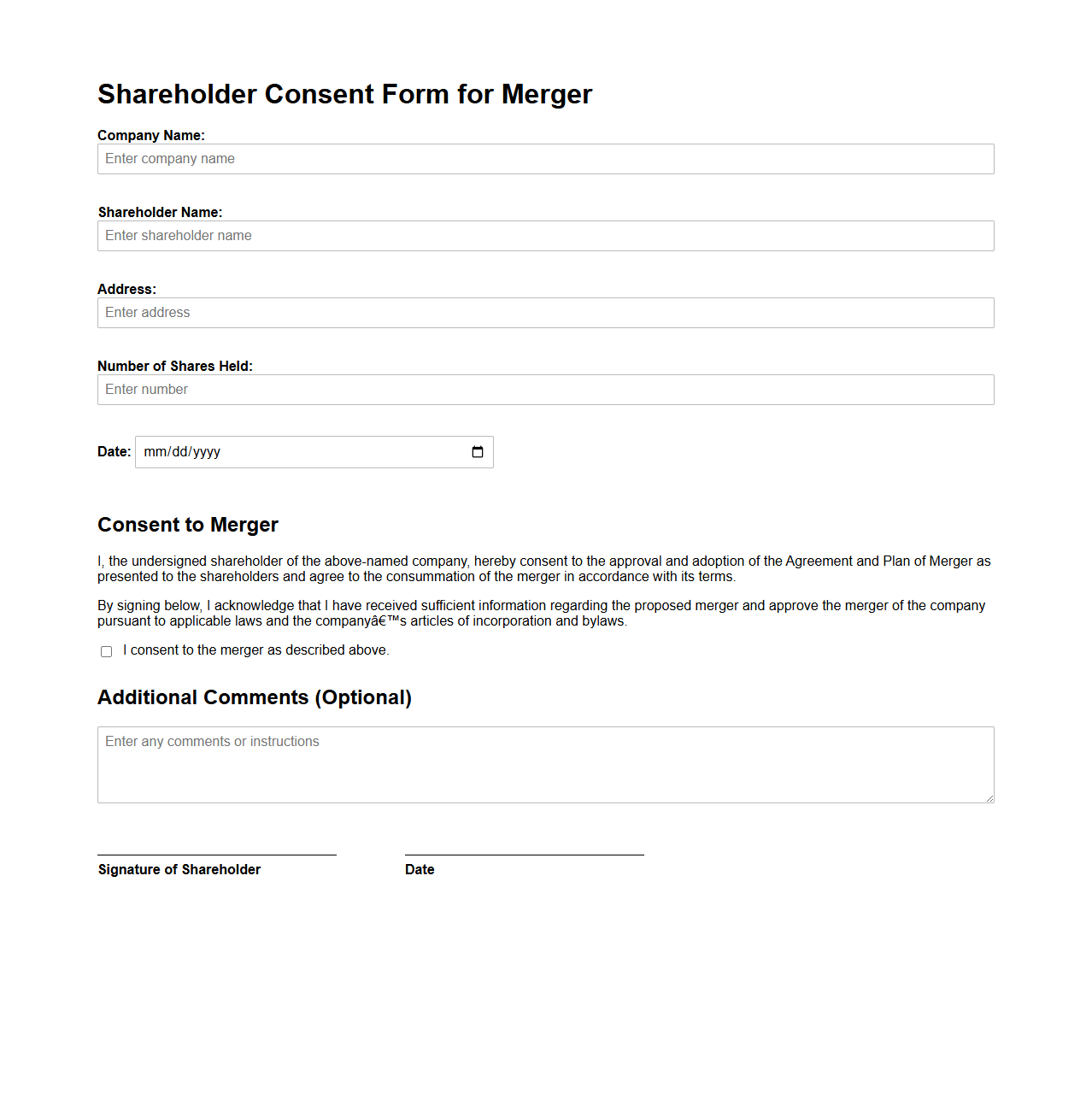

Shareholder Consent Form for Merger

A

Shareholder Consent Form for Merger is a legal document used to obtain approval from shareholders before proceeding with a corporate merger. This form outlines the terms of the merger and ensures that shareholders formally agree to the transaction, complying with corporate governance and regulatory requirements. It serves as proof of consent, enabling companies to move forward with the merger process confidently and legally.

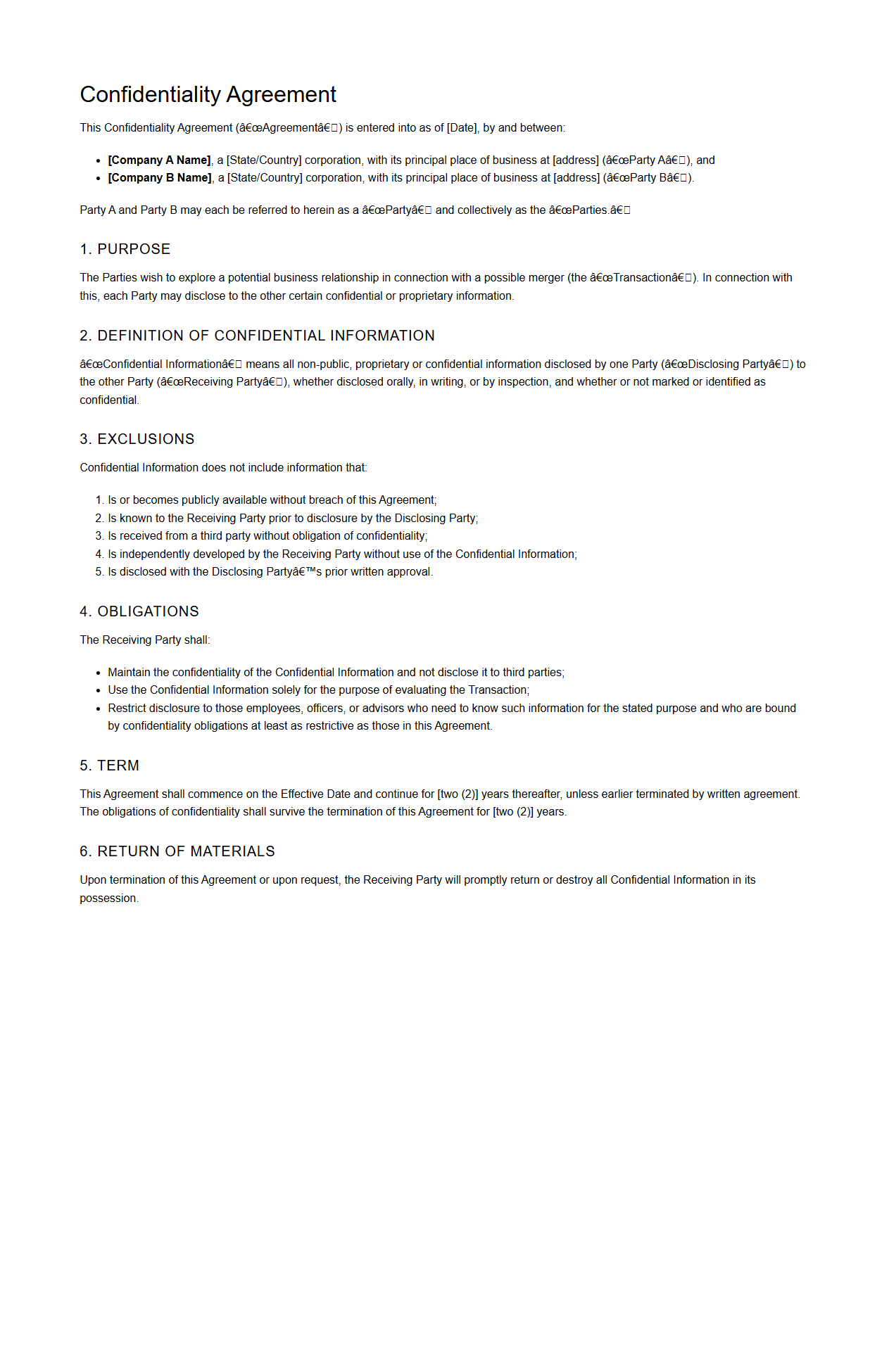

Confidentiality Agreement Template for Merger Negotiations

A

Confidentiality Agreement Template for Merger Negotiations is a legal document designed to protect sensitive information shared between parties during merger discussions. It outlines the obligations of each party to maintain secrecy and restrict the use of proprietary data, financial details, and strategic plans. This template ensures a secure environment for transparent communication while minimizing the risk of information leaks that could jeopardize the merger process.

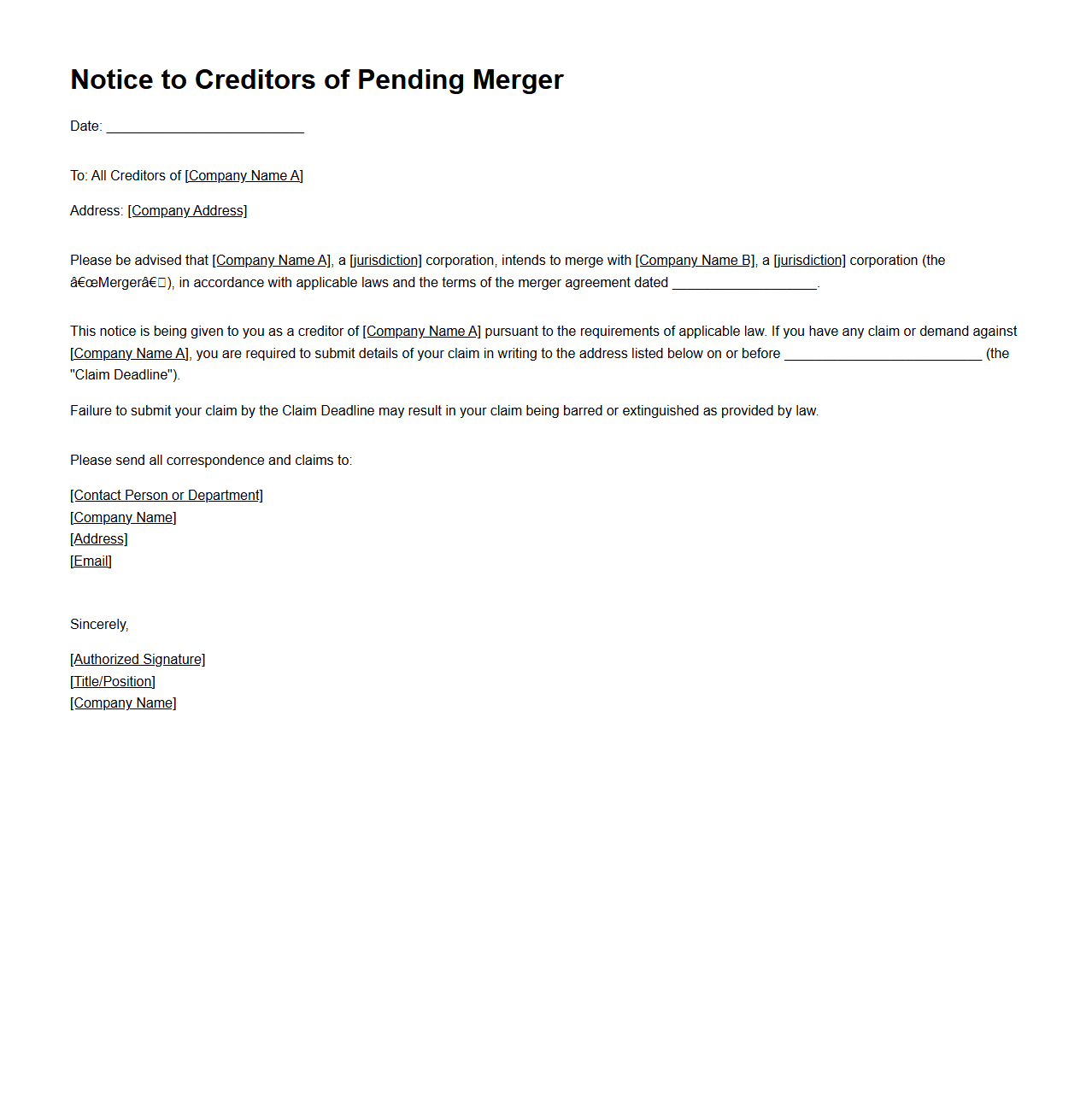

Notice to Creditors of Pending Merger

A

Notice to Creditors of Pending Merger is a formal legal document issued to inform creditors about an impending corporate merger that may affect their claims against the merging entities. It serves to provide creditors with an opportunity to file any outstanding claims or assert rights before the merger is finalized, ensuring transparency and protecting creditor interests. This notice is often a mandatory requirement under state corporate laws to facilitate a smooth transition and prevent future disputes.

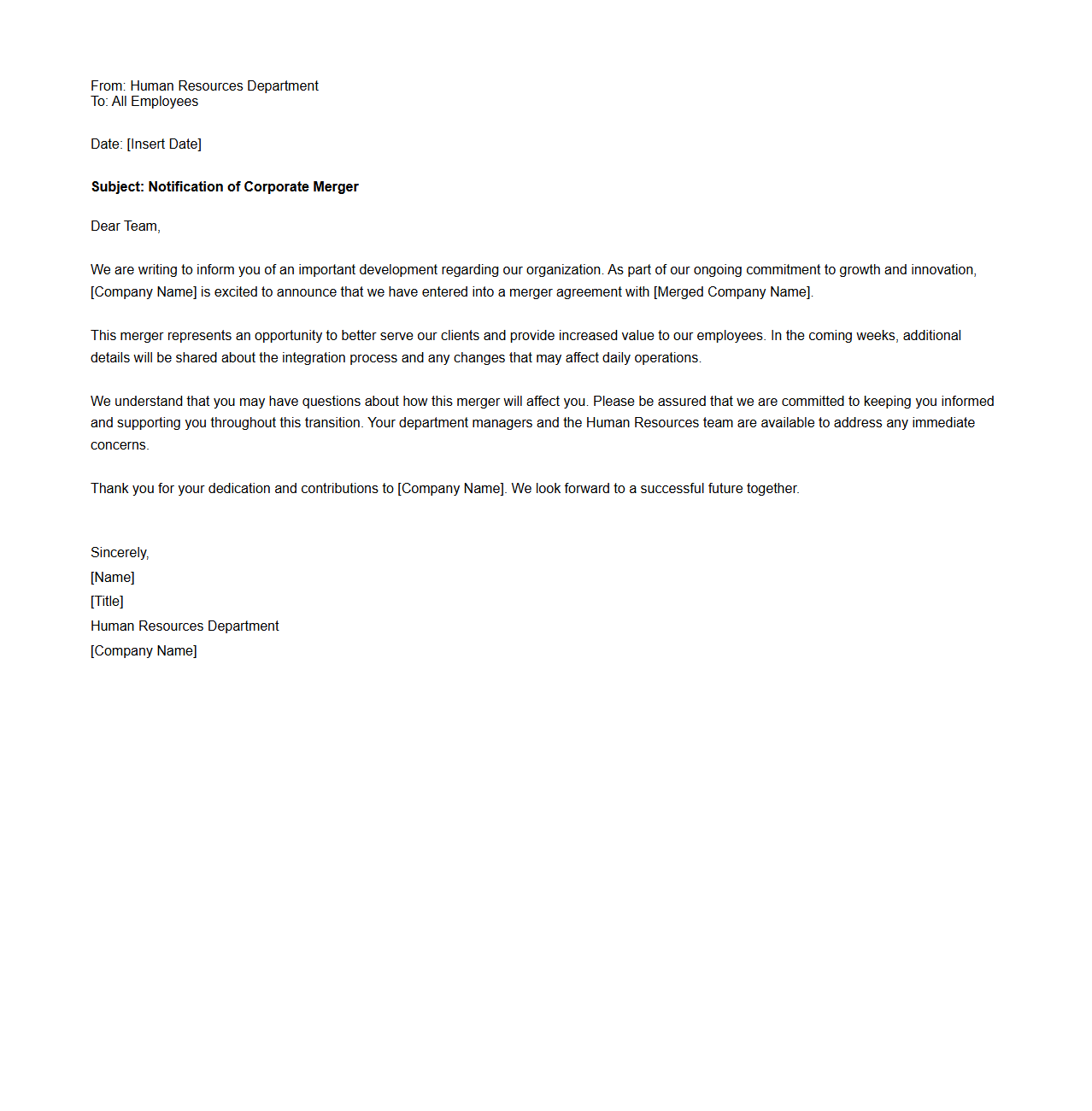

Employee Notification Letter for Corporate Merger

An

Employee Notification Letter for Corporate Merger is a formal document used by companies to inform employees about an upcoming merger between two or more corporate entities. This letter outlines key details such as the merger timeline, potential changes to roles or employment terms, and any impact on benefits or job security. It serves to maintain transparency, manage employee expectations, and comply with legal notification requirements during the merger process.

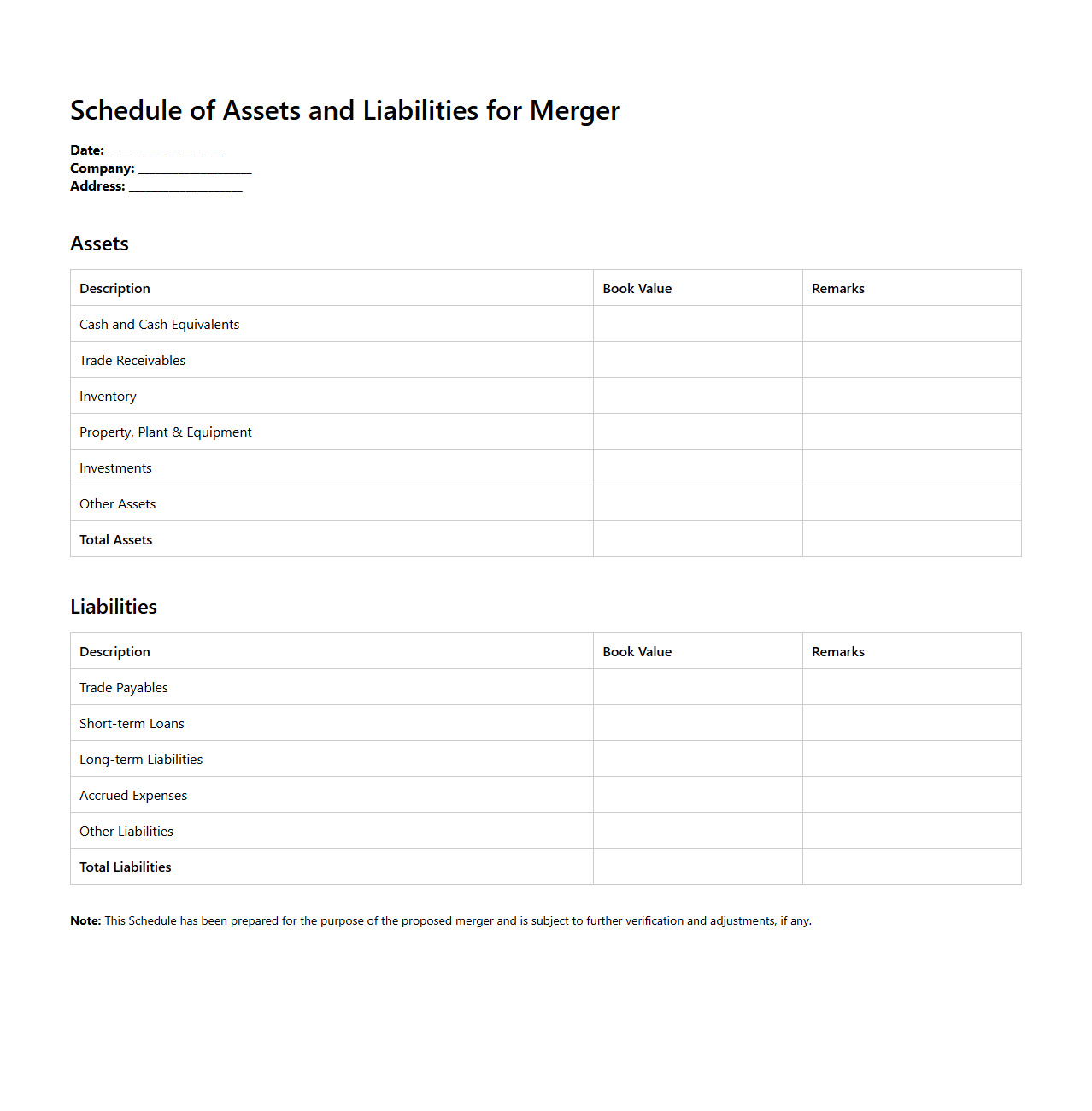

Schedule of Assets and Liabilities for Merger

The

Schedule of Assets and Liabilities for a merger document provides a detailed inventory of all financial and non-financial assets and liabilities of the companies involved. This schedule helps identify the exact value, location, and status of assets such as property, equipment, and intellectual property, alongside liabilities like debts, obligations, and pending litigations. Accurate disclosure of these elements is essential for due diligence, valuation, and risk assessment during the merger process.

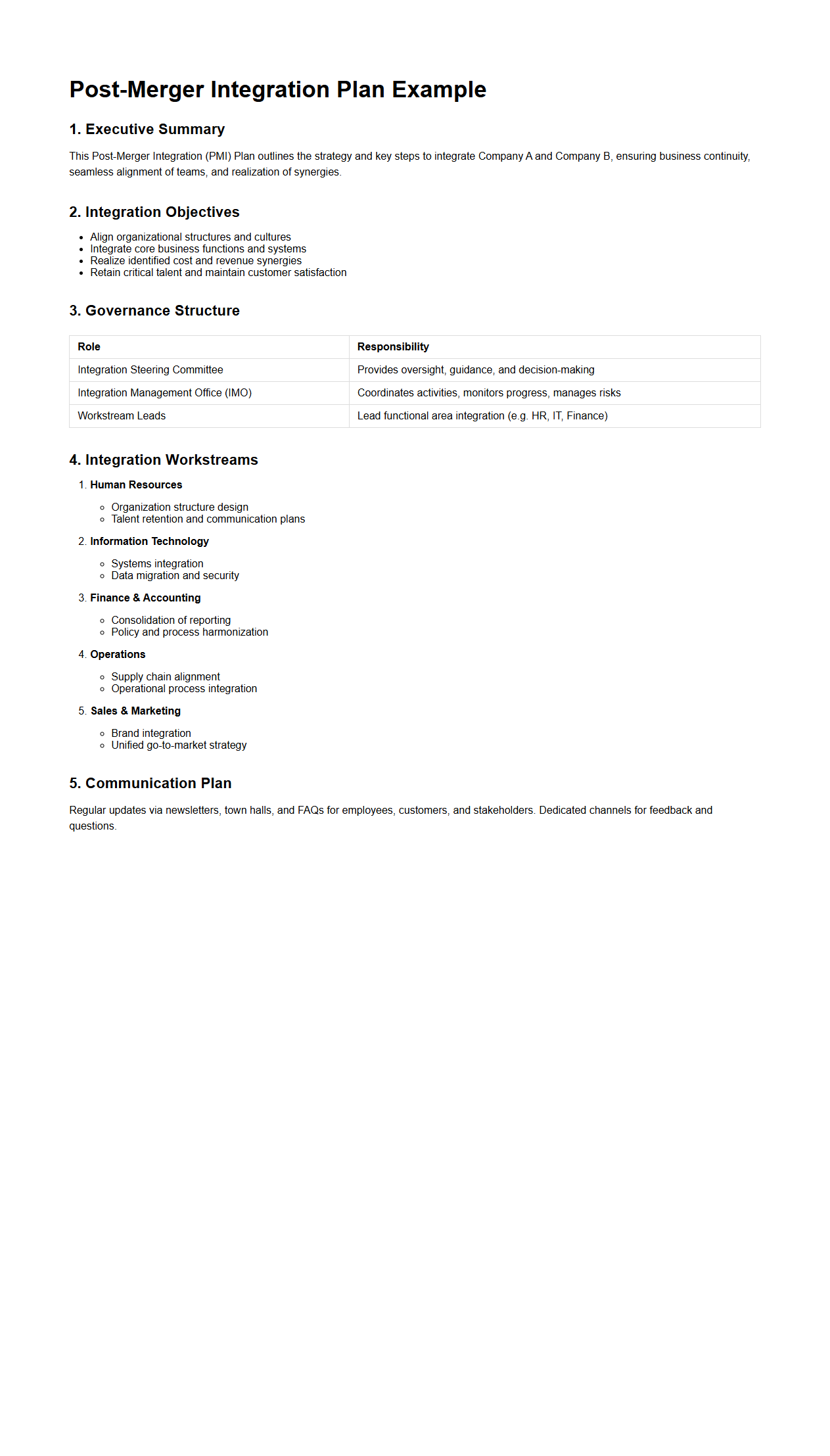

Post-Merger Integration Plan Example

A

Post-Merger Integration Plan Example document outlines the systematic approach and strategic steps a company takes to combine operations, cultures, and systems after a merger or acquisition. It typically includes detailed timelines, roles and responsibilities, communication strategies, and key performance indicators to ensure seamless integration and minimize business disruption. This plan serves as a critical roadmap for aligning resources, streamlining processes, and realizing the anticipated synergies of the merger.

What are the specific anti-dilution provisions outlined in the merger agreement document?

The merger agreement includes anti-dilution provisions designed to protect shareholders from dilution of their equity stake. These provisions typically involve adjustments to the conversion price or share count if new shares are issued. They ensure that existing investors maintain their relative ownership percentage post-merger.

How does the agreement address pre-existing intellectual property disputes between merging entities?

The agreement outlines that pre-existing intellectual property disputes must be disclosed and managed prior to closing. It often requires parties to indemnify each other against any liabilities arising from these disputes. This approach safeguards both entities from unforeseen legal risks related to IP issues.

What representations and warranties are required from each party regarding outstanding employee stock options?

Each party must provide representations and warranties confirming the accuracy and completeness of information related to employee stock options. This includes details on issuance, valuation, and any outstanding obligations. Such assurances ensure transparency and proper accounting of stock-based compensation.

Which conditions precedent must be satisfied before the merger becomes legally effective?

The agreement specifies conditions precedent like regulatory approvals, shareholder consents, and the absence of material adverse changes. These conditions serve as mandatory checkpoints before the merger can legally proceed. Fulfilling them ensures compliance and readiness for the transaction.

How does the agreement allocate responsibility for environmental liabilities post-merger?

The agreement allocates environmental liability responsibility based on the timing and origin of such liabilities. Generally, pre-merger environmental issues remain with the selling party, while post-merger liabilities transfer to the merged entity. This allocation clarifies financial and legal accountability after closing.