A Proof of Funds Document Sample for Property Purchase demonstrates a buyer's financial ability to complete a real estate transaction. This document typically includes bank statements or letters from financial institutions verifying sufficient funds. It helps sellers confirm that the buyer is serious and capable of closing the deal promptly.

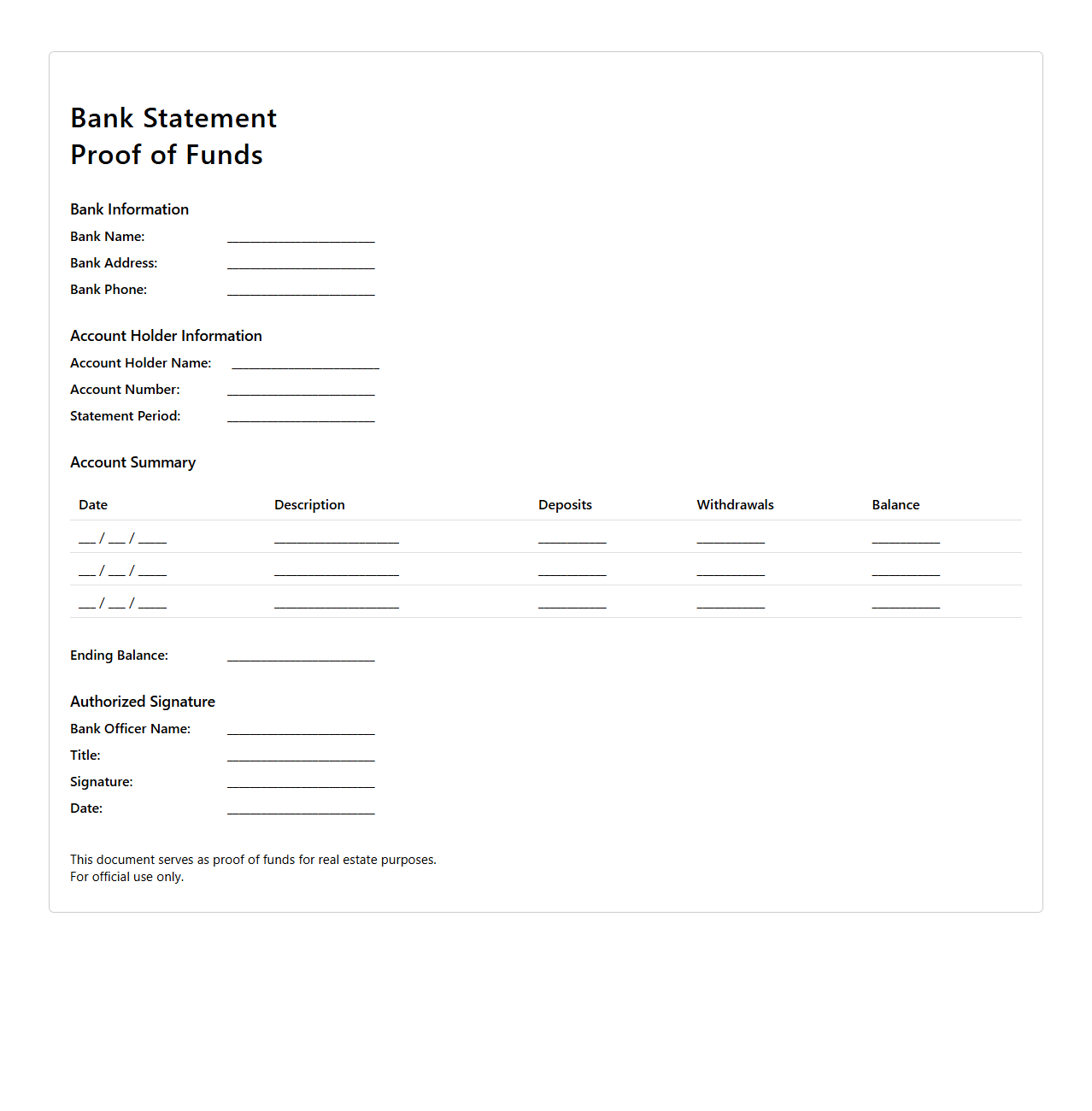

Bank Statement Proof of Funds Template for Real Estate

A

Bank Statement Proof of Funds Template for real estate is a standardized document used to verify a buyer's financial capability to complete a property purchase. It includes detailed information such as account holder's name, account number, current balance, and transaction history, serving as concrete evidence of available funds. This template helps streamline the verification process, ensuring transparency and trust between buyers, sellers, and lenders during real estate transactions.

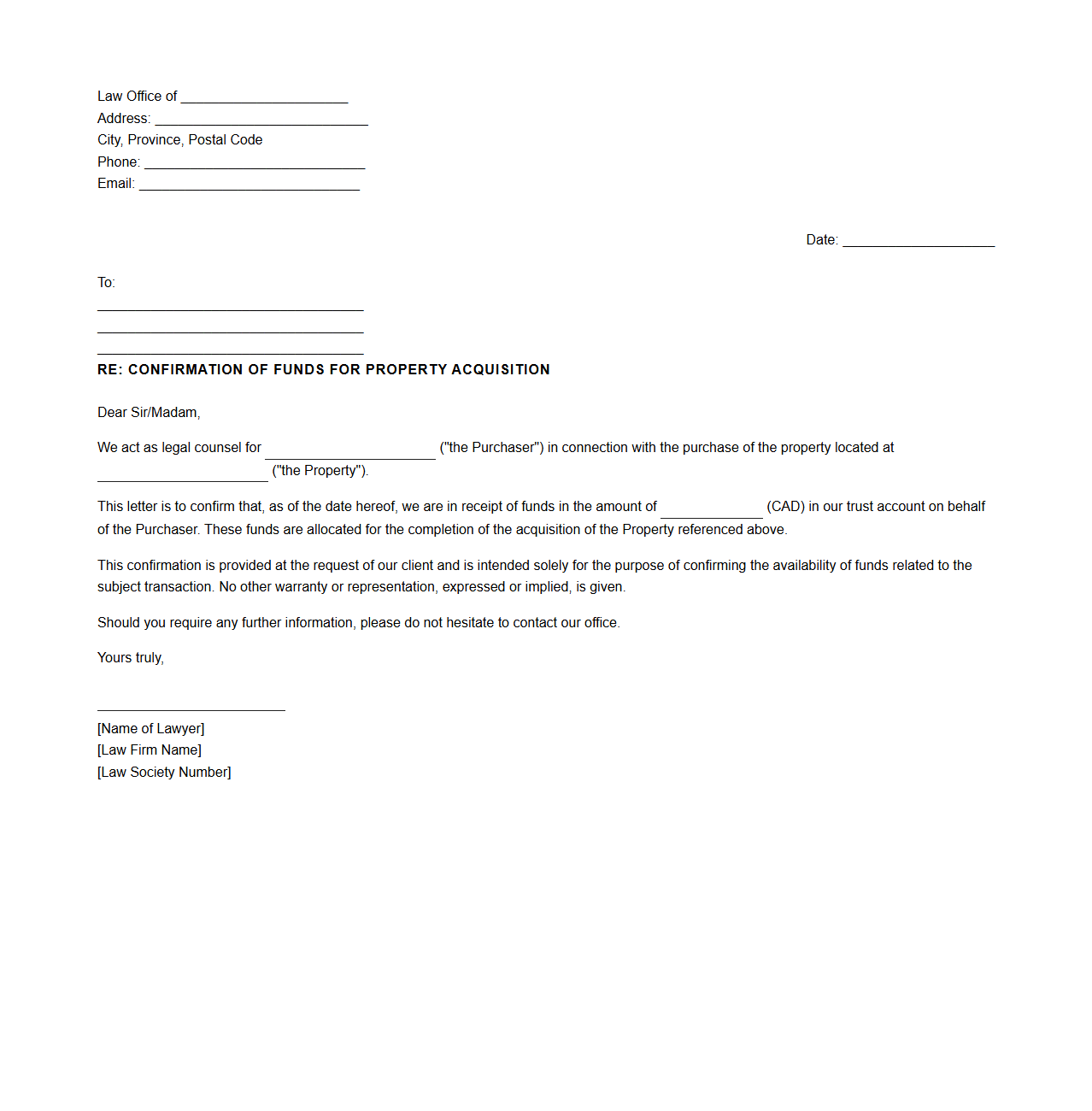

Lawyer Letter Confirming Funds for Property Acquisition

A

Lawyer Letter Confirming Funds for Property Acquisition is a formal document issued by a legal professional verifying that a buyer possesses the necessary financial resources to complete a property purchase. This letter provides assurance to sellers, real estate agents, and financial institutions that the buyer's funds are legitimate and readily available. Such documentation is crucial in property transactions to facilitate trust and streamline the closing process.

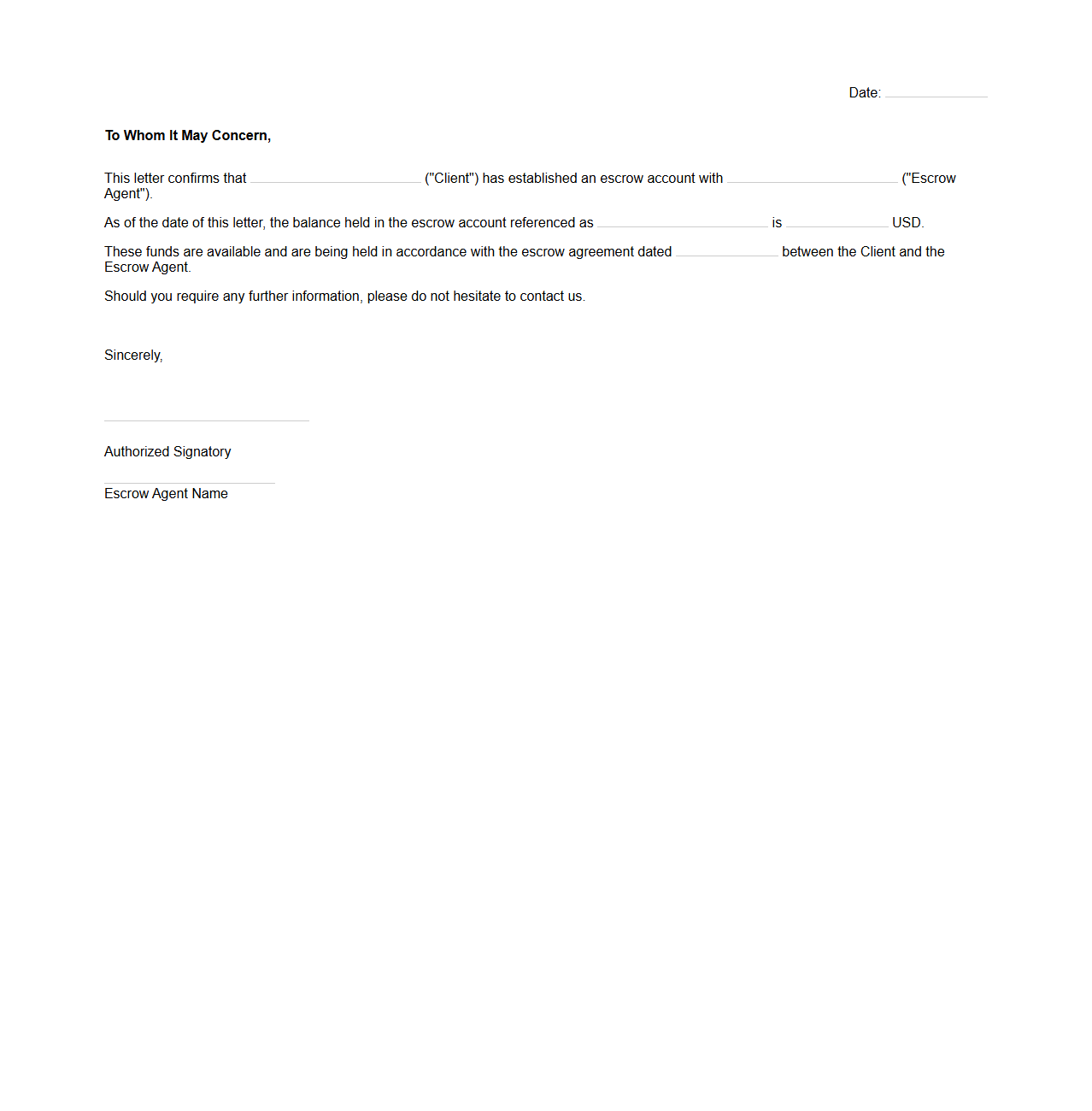

Escrow Account Proof of Funds Letter

An

Escrow Account Proof of Funds Letter is a formal document issued by a financial institution verifying that a specified amount of funds are securely held in an escrow account. This letter serves as evidence of available capital, assuring parties involved in a transaction that the funds are reserved and accessible for completion. It is commonly used in real estate, mergers, and acquisitions to demonstrate financial credibility and support contractual obligations.

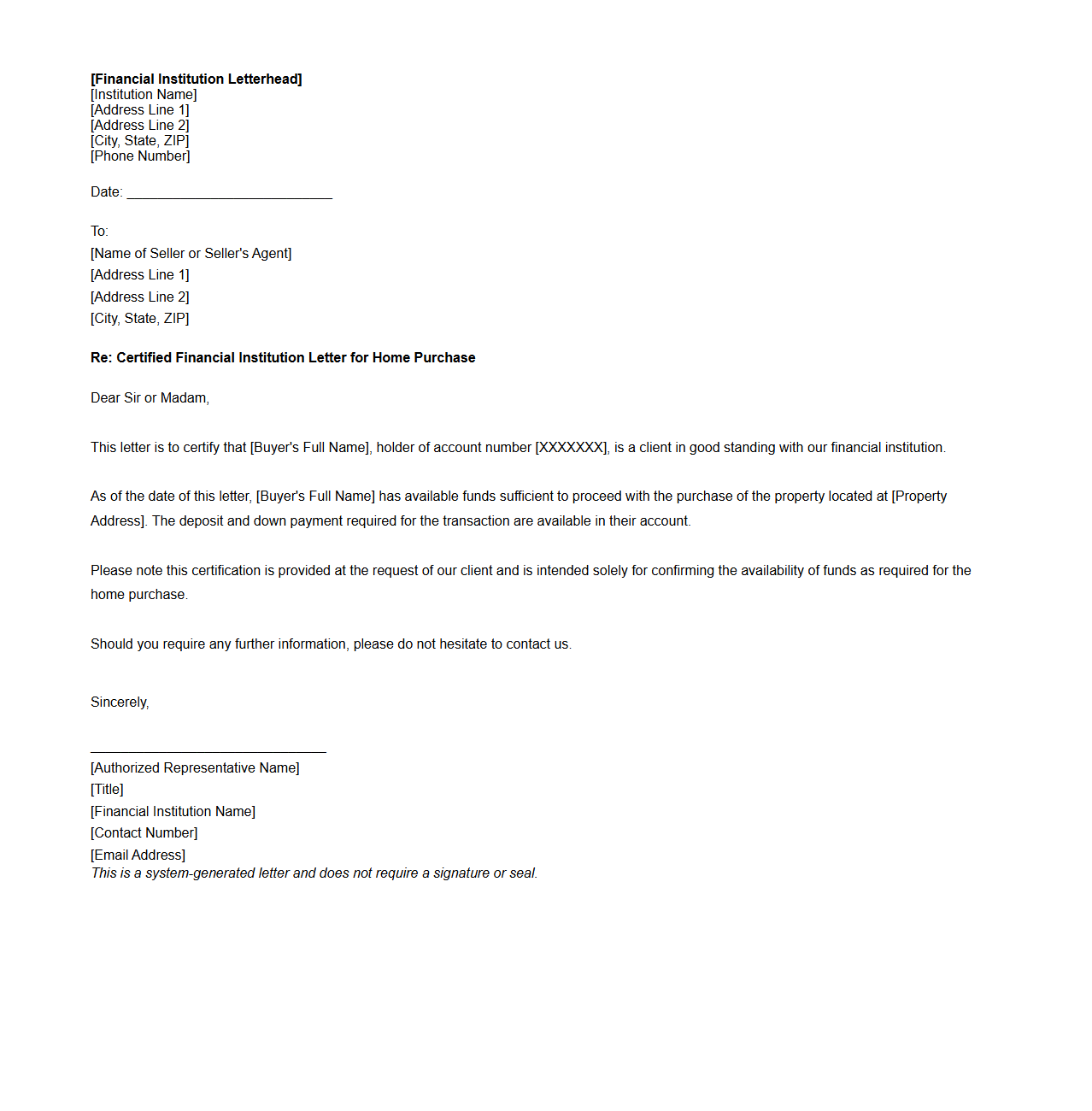

Certified Financial Institution Letter for Home Purchase

A

Certified Financial Institution Letter for Home Purchase is an official document issued by a bank or financial institution verifying a buyer's financial capacity to complete a property transaction. It typically outlines the available funds, loan approval status, or creditworthiness, serving as proof of financial readiness to sellers and real estate agents. This letter plays a crucial role in strengthening a buyer's offer and facilitating smoother negotiations during the home buying process.

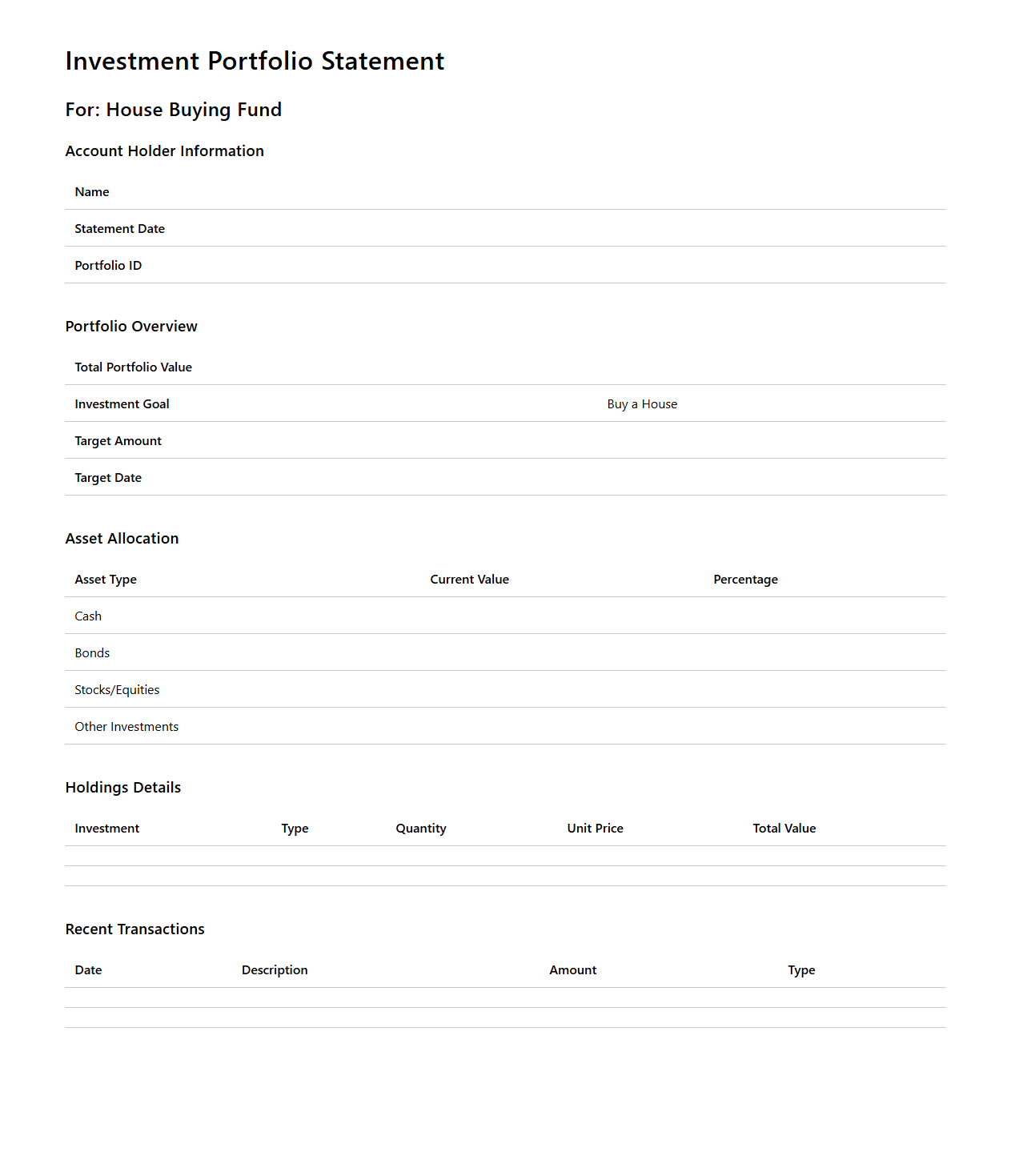

Investment Portfolio Statement for House Buying

An

Investment Portfolio Statement for house buying is a financial document outlining an individual's assets, including stocks, bonds, and other investments, to demonstrate financial stability and borrowing capacity to lenders. This statement helps mortgage providers assess risk by providing a clear picture of available funds and investment performance. It plays a crucial role in mortgage approval processes by validating the buyer's ability to afford down payments and ongoing mortgage payments.

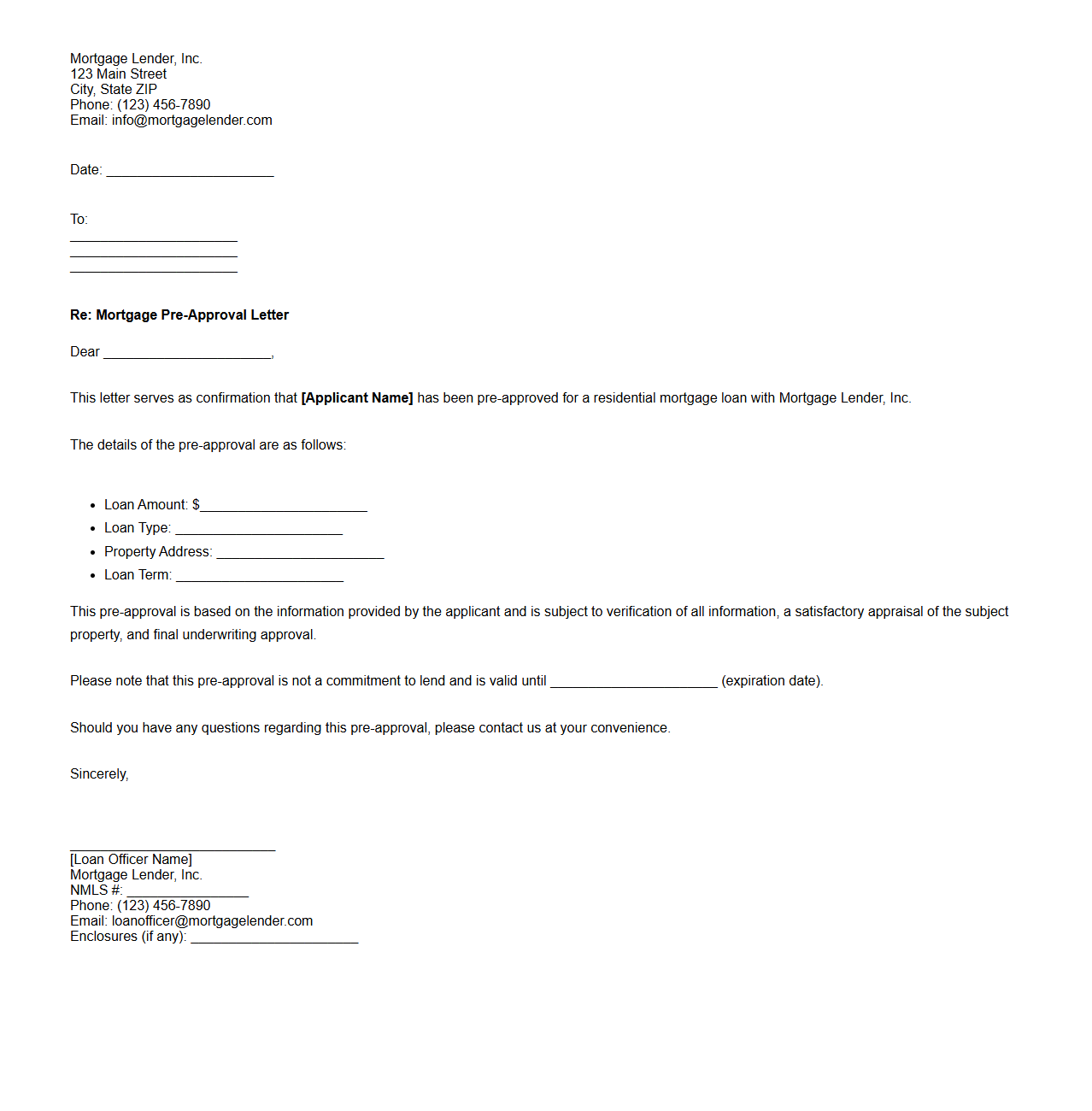

Mortgage Pre-Approval Letter for Property Deals

A

Mortgage Pre-Approval Letter is an official document from a lender stating the maximum loan amount a borrower qualifies for based on their financial information. This letter strengthens a buyer's position in property deals by demonstrating serious intent and financial readiness to sellers and real estate agents. It typically includes details such as the loan amount, interest rate estimates, and conditions pending final approval.

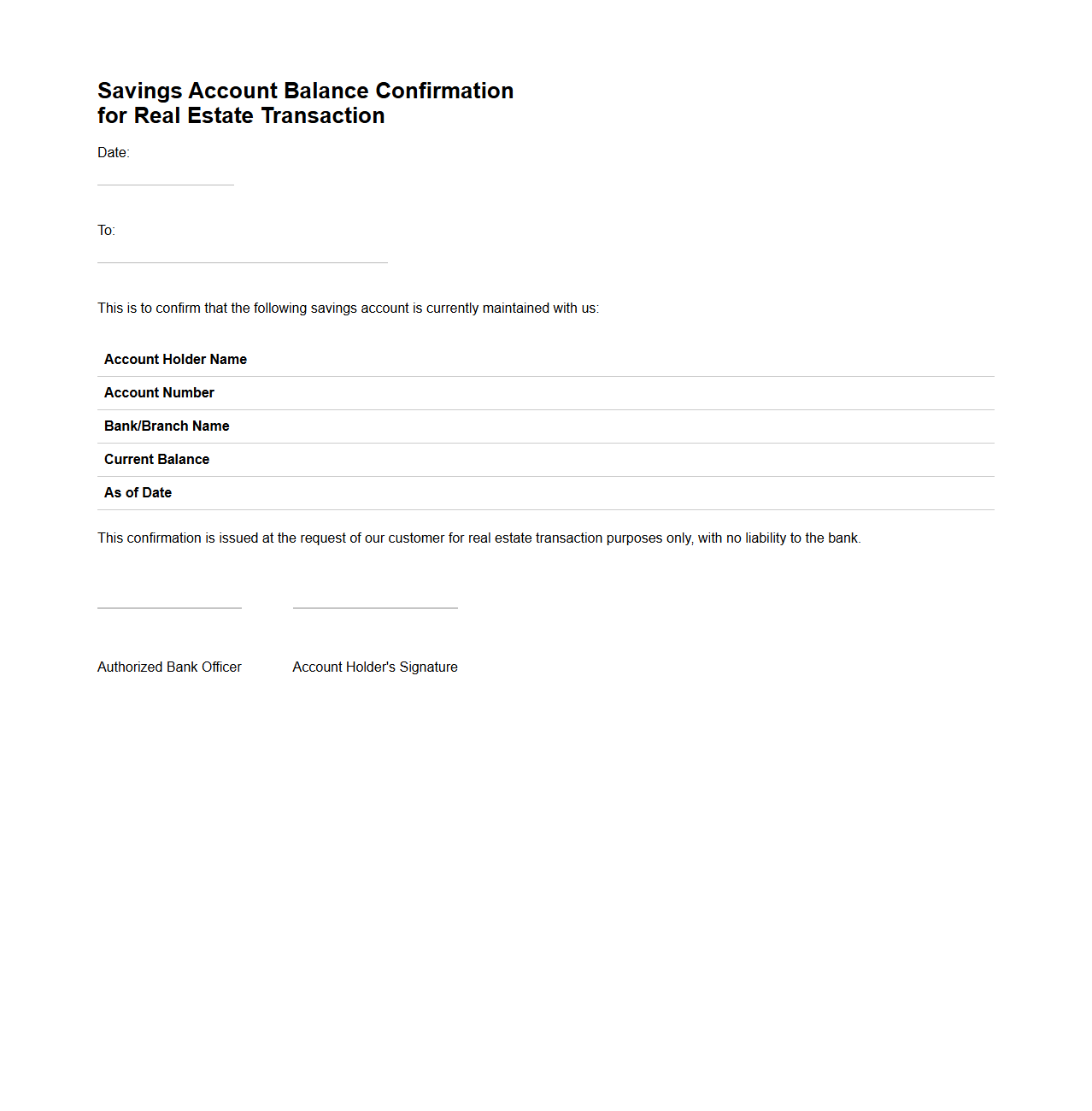

Savings Account Balance Confirmation for Real Estate

A

Savings Account Balance Confirmation for real estate documents is an official statement provided by a bank verifying the exact amount of funds available in a buyer's savings account. This confirmation is crucial during property transactions to prove the buyer's financial capability to cover down payments or closing costs. It ensures transparency and trust between buyers, sellers, and financial institutions involved in the real estate deal.

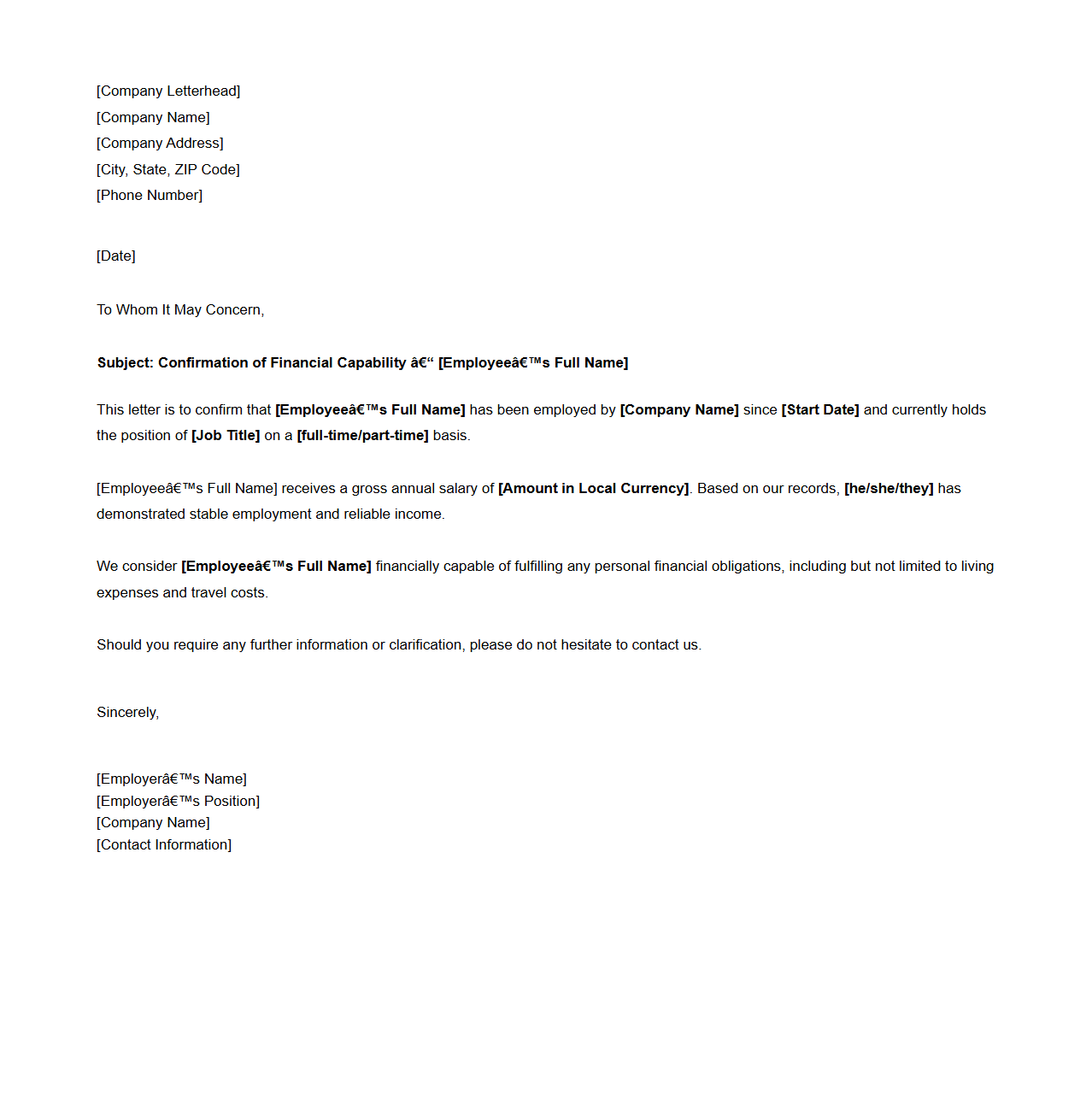

Letter from Employer Confirming Financial Capability

A

Letter from Employer Confirming Financial Capability is an official document issued by an employer that verifies an employee's ability to meet financial obligations. This letter typically outlines the employee's salary, job position, and confirms the employer's acknowledgment of the employee's financial stability. It is often required for visa applications, loan approvals, or rental agreements as proof of consistent income and financial reliability.

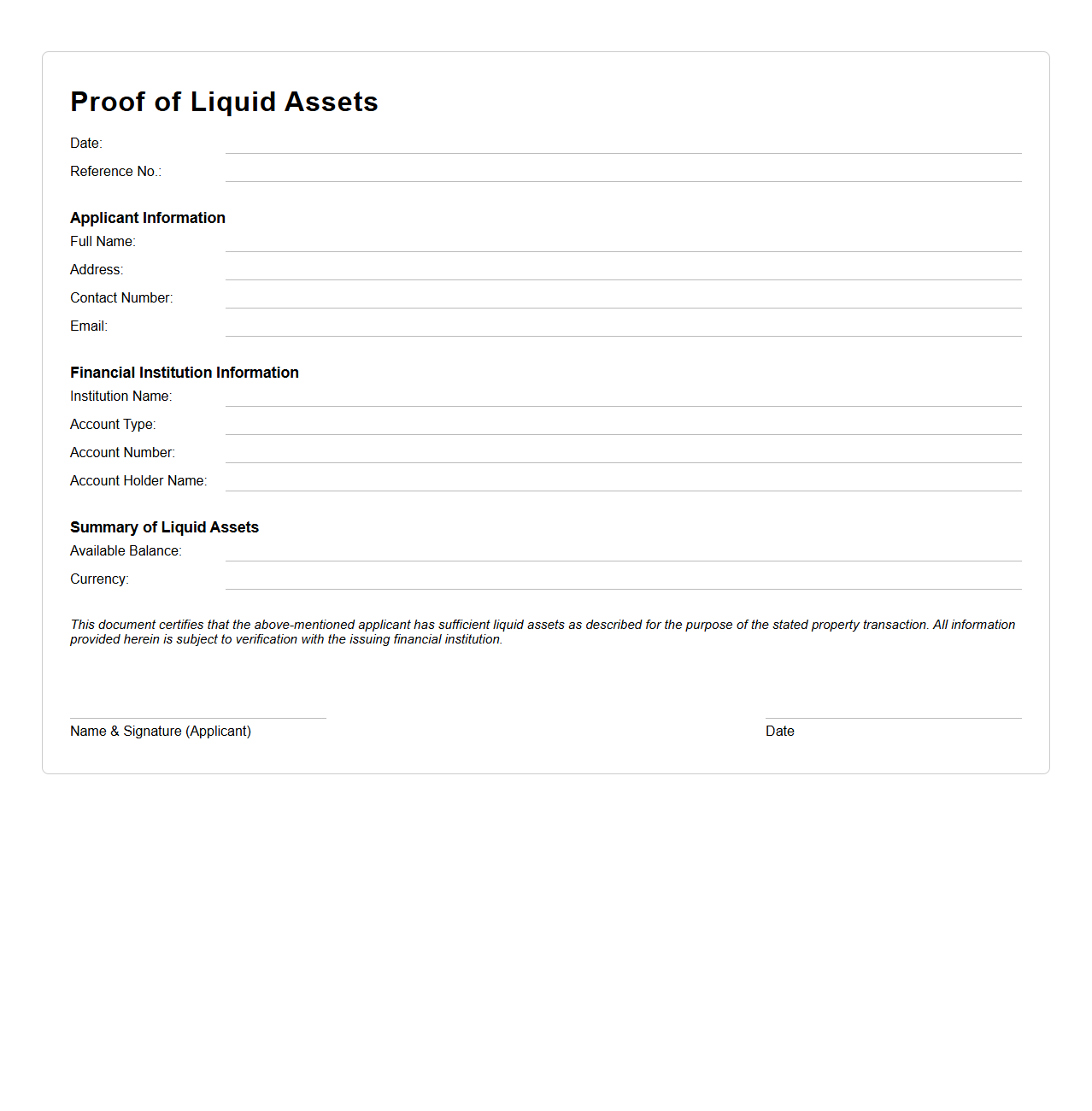

Proof of Liquid Assets Document for Property Transaction

A

Proof of Liquid Assets Document is a financial statement used in property transactions to verify that a buyer has sufficient readily available funds to complete the purchase. This document typically includes bank statements, investment account summaries, or other liquid asset records demonstrating the buyer's capability to fulfill payment obligations. Lenders and sellers rely on this proof to assess the financial stability and seriousness of the purchaser during the property acquisition process.

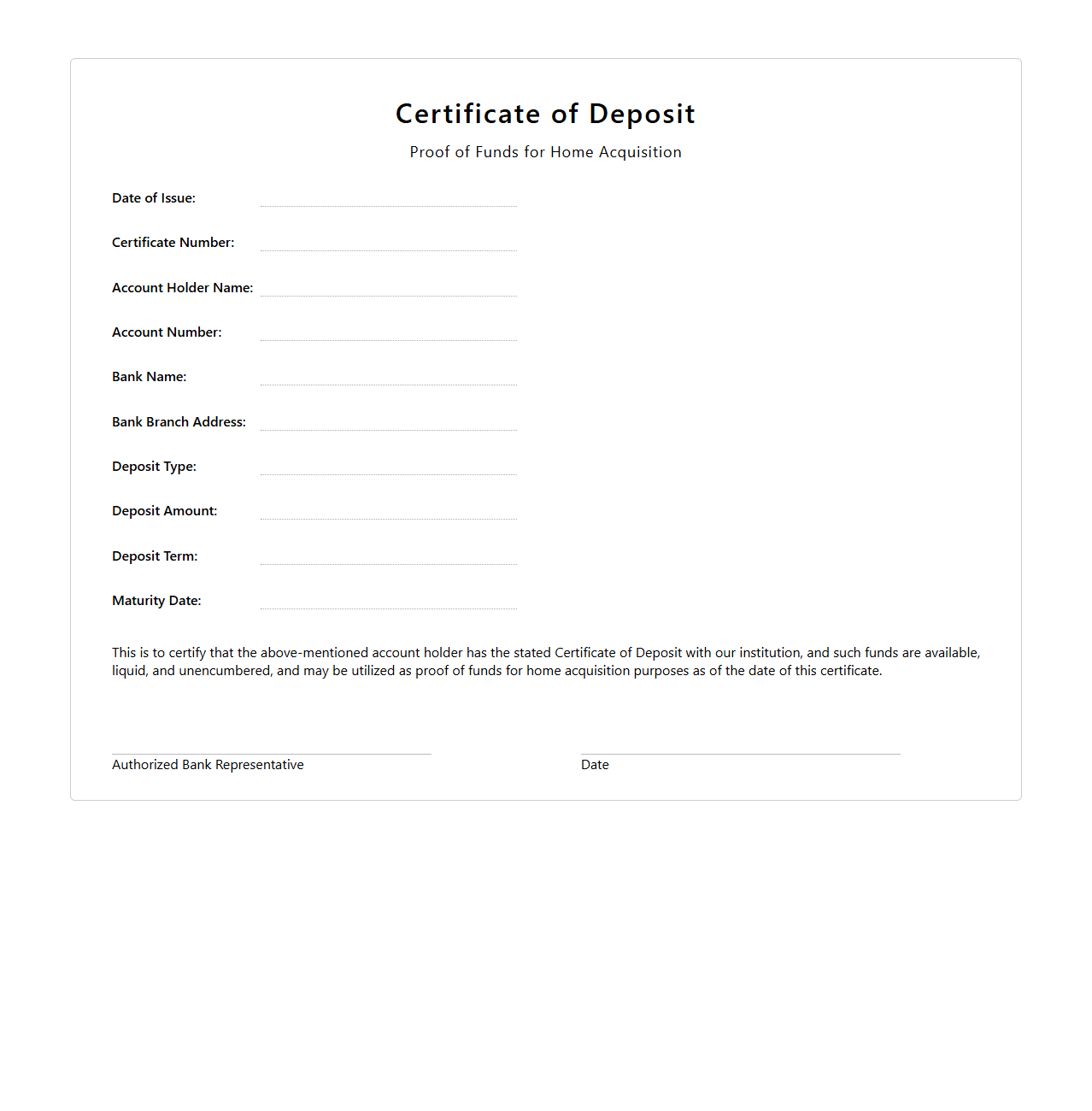

Certificate of Deposit Proof of Funds for Home Acquisition

A

Certificate of Deposit Proof of Funds for home acquisition is a financial document issued by a bank or credit union that verifies an individual's available funds in a fixed-term deposit account. This document provides sellers or lenders with assurance that the buyer has the necessary cash reserves to complete the home purchase, enhancing the credibility of the transaction. It includes details such as the account holder's name, the deposited amount, account number, and maturity date, serving as solid evidence of financial capability.

What specific bank statements qualify as valid Proof of Funds for property purchases?

Bank statements that are recent, typically within the last 30 to 60 days, qualify as valid Proof of Funds for property purchases. These statements must clearly show the account holder's name, the financial institution's name, and the available balance. Additionally, statements should avoid any unauthorized alterations to maintain their authenticity.

Are digital copies of Proof of Funds documents acceptable to most real estate agents?

Most real estate agents accept digital copies of Proof of Funds documents as long as they are clear, legible, and unaltered. Digital documents must come directly from the bank or financial institution via secure online portals or verified email communications. It's important to confirm with the agent beforehand to ensure they accept digital formats.

How current must a Proof of Funds letter be to satisfy mortgage lenders?

Mortgage lenders typically require Proof of Funds letters to be dated within the last 30 days to ensure the funds are readily available. Some lenders may accept documents up to 60 days old, but fresher documentation is favored for accuracy. Always verify specific lender requirements to avoid delays in the loan approval process.

Can investment or retirement account balances be used for Proof of Funds documentation?

Investment and retirement account balances can be used as Proof of Funds, provided the accounts are liquid or can be easily converted to cash. Documentation should include detailed statements showing ownership and current balances. Lenders and agents may require additional verification if funds need to be withdrawn or transferred.

What legal wording is essential in a Proof of Funds letter for overseas property acquisitions?

Essential legal wording in a Proof of Funds letter for overseas purchases includes a clear declaration of available funds and confirmation from the issuing bank. The letter should state that the funds are unencumbered and immediately accessible for the transaction. It must also comply with the regulatory requirements of both the originating and destination countries.

More Real estate Templates