A Source Code Review Document Sample for FinTech Solutions provides a detailed analysis of code quality, security vulnerabilities, and compliance with industry standards specific to financial technology applications. This document highlights critical issues, improvement recommendations, and best practices to ensure robust and secure software performance. Emphasizing thorough documentation supports transparency and facilitates efficient auditing processes in FinTech projects.

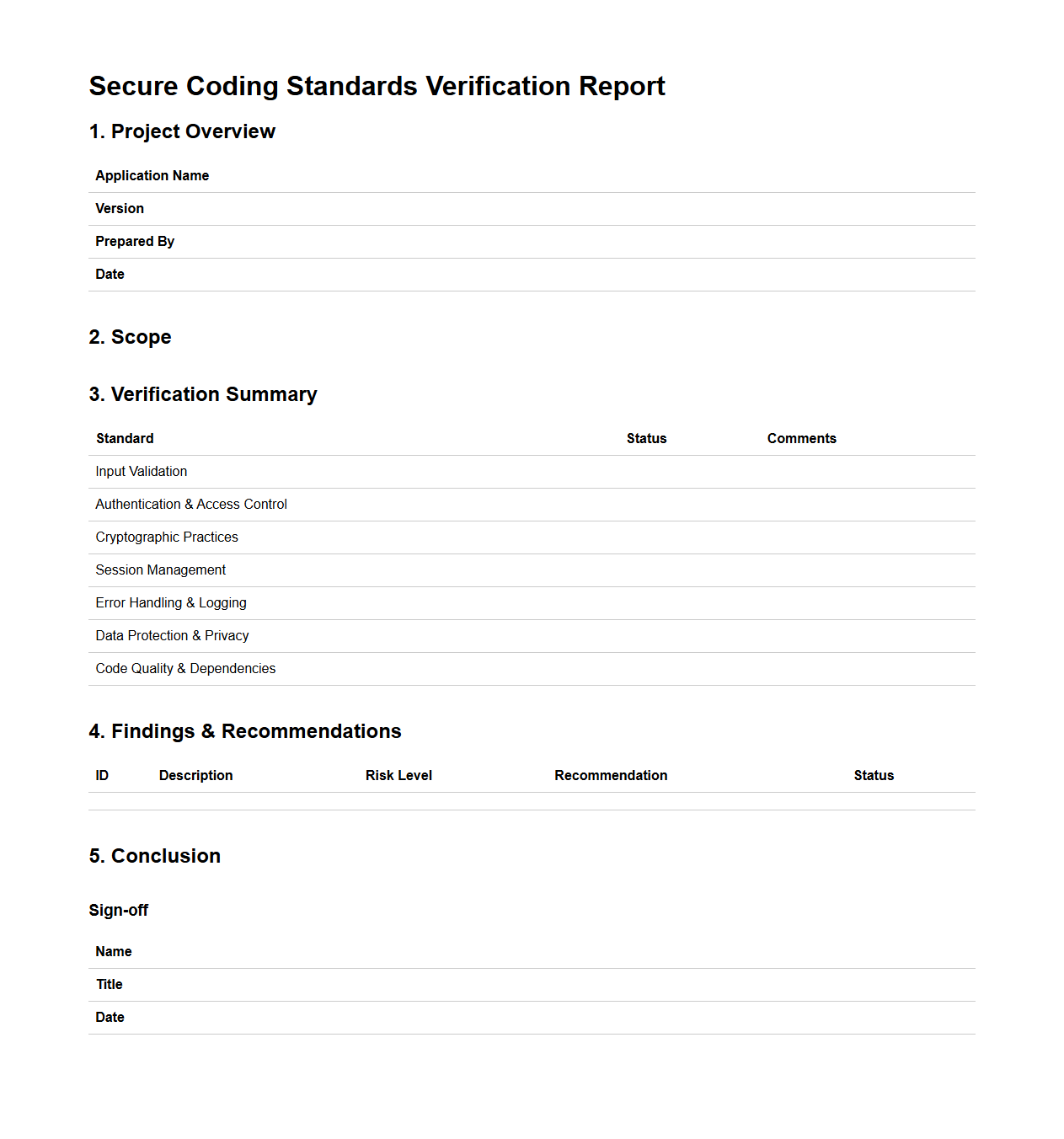

Secure Coding Standards Verification Report for FinTech Applications

The

Secure Coding Standards Verification Report for FinTech applications documents the evaluation of software code against industry-specific security guidelines to identify vulnerabilities and ensure compliance with regulatory requirements. It includes detailed findings on code quality, potential security risks, and recommendations for remediation to safeguard sensitive financial data. This report supports the overall risk management strategy by validating that secure coding practices have been effectively implemented throughout the development lifecycle.

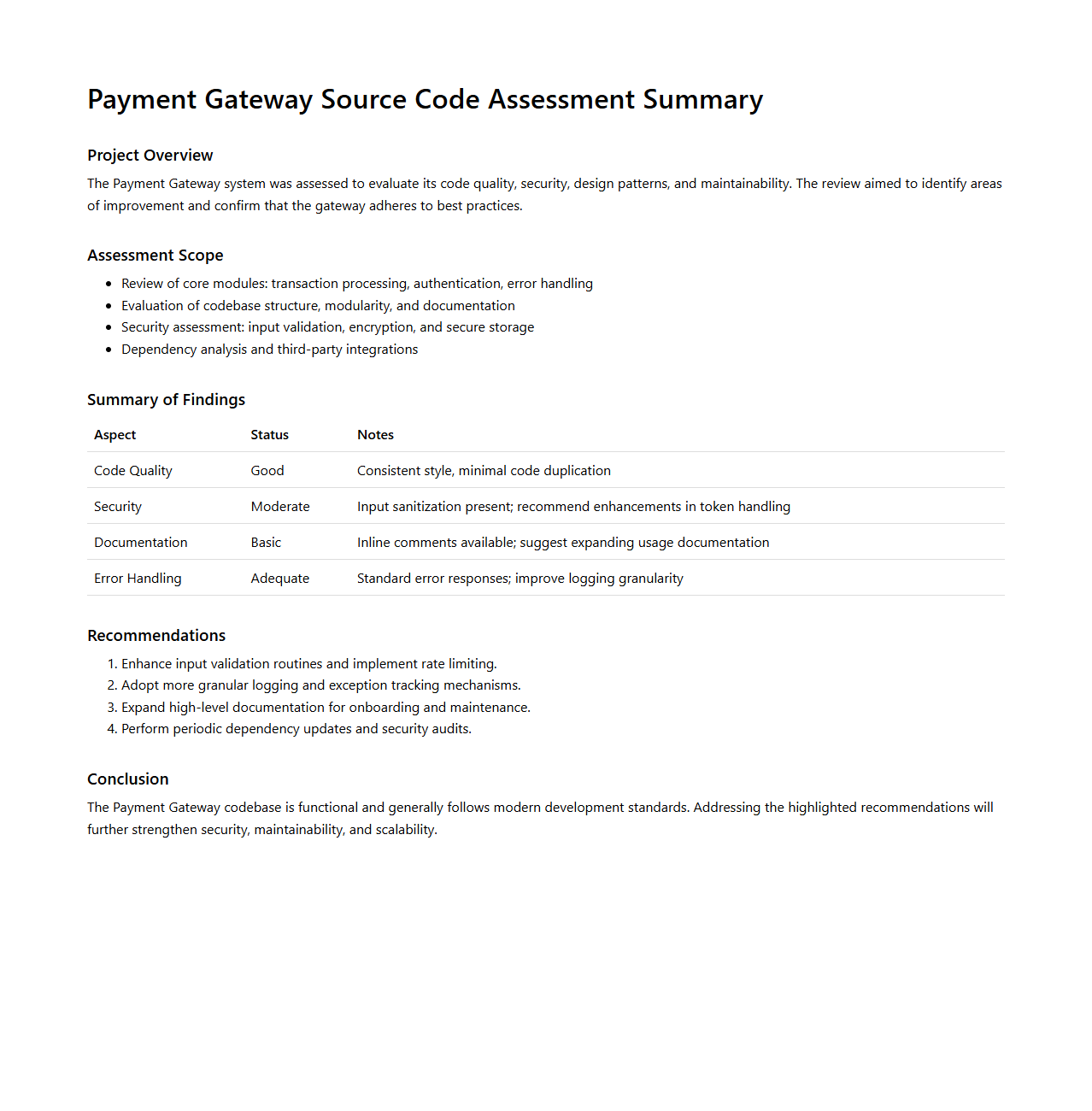

Payment Gateway Source Code Assessment Summary

The

Payment Gateway Source Code Assessment Summary document provides a comprehensive evaluation of the security, functionality, and compliance of the payment gateway's source code. It highlights vulnerabilities, coding quality, and adherence to industry standards such as PCI-DSS, ensuring the gateway's reliability and safety for processing transactions. This summary serves as a critical resource for developers, security teams, and stakeholders to understand risks and improvement areas in the payment processing system.

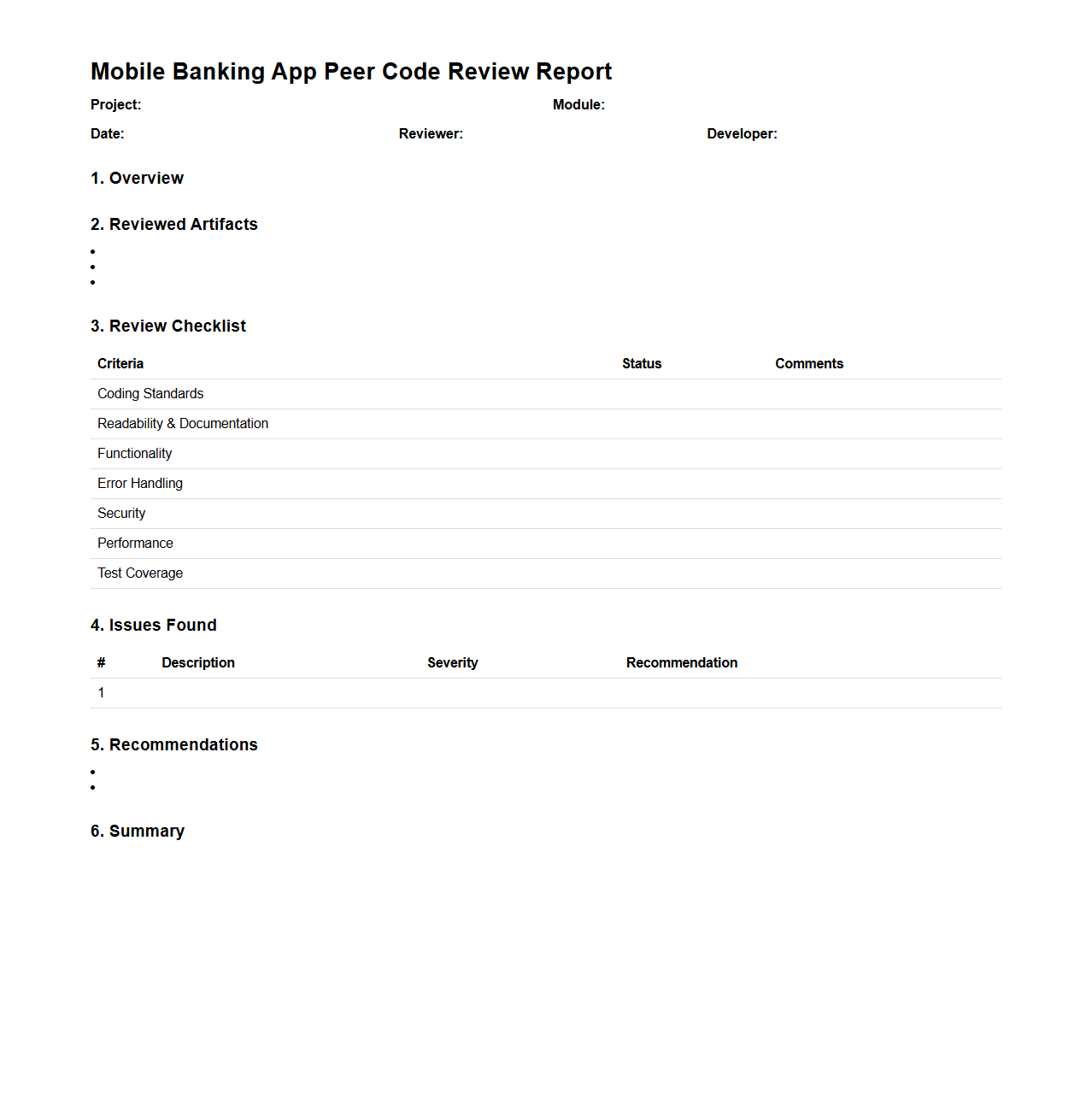

Mobile Banking App Peer Code Review Report

A

Mobile Banking App Peer Code Review Report document systematically evaluates the security, functionality, and performance of the app's source code through collaborative peer analysis. It identifies potential vulnerabilities, coding standards compliance, and integration issues that could affect user experience or data integrity. This report is essential for maintaining high-quality, secure mobile banking applications by ensuring thorough code inspections before deployment.

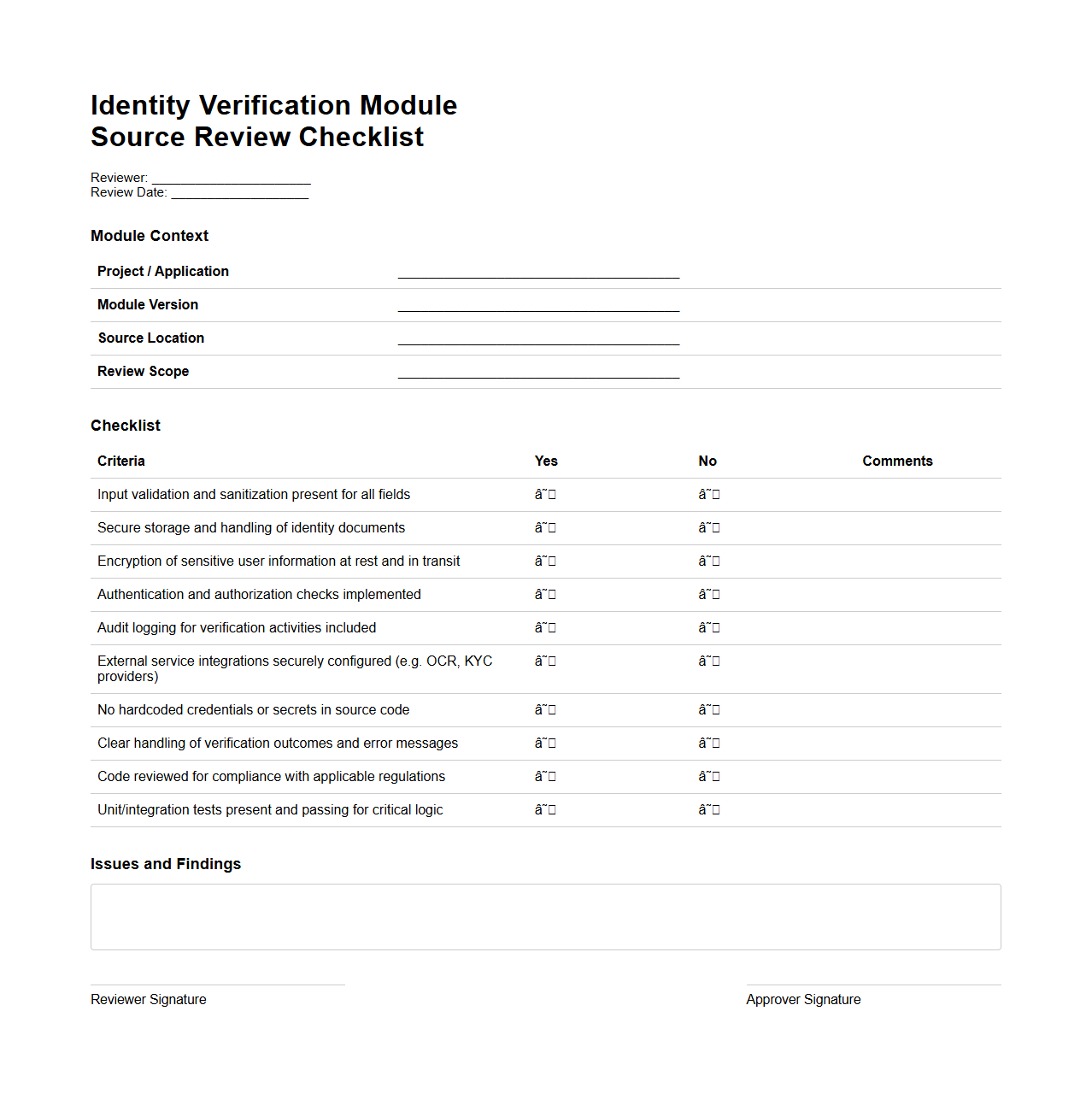

Identity Verification Module Source Review Checklist

The

Identity Verification Module Source Review Checklist document serves as a comprehensive guide to ensure all code components meet security and compliance standards during identity verification processes. It outlines critical checkpoints for reviewing source code, including authentication methods, data encryption, and user data handling practices. This checklist helps organizations maintain integrity and trust by systematically identifying potential vulnerabilities and enforcing best practices in identity verification modules.

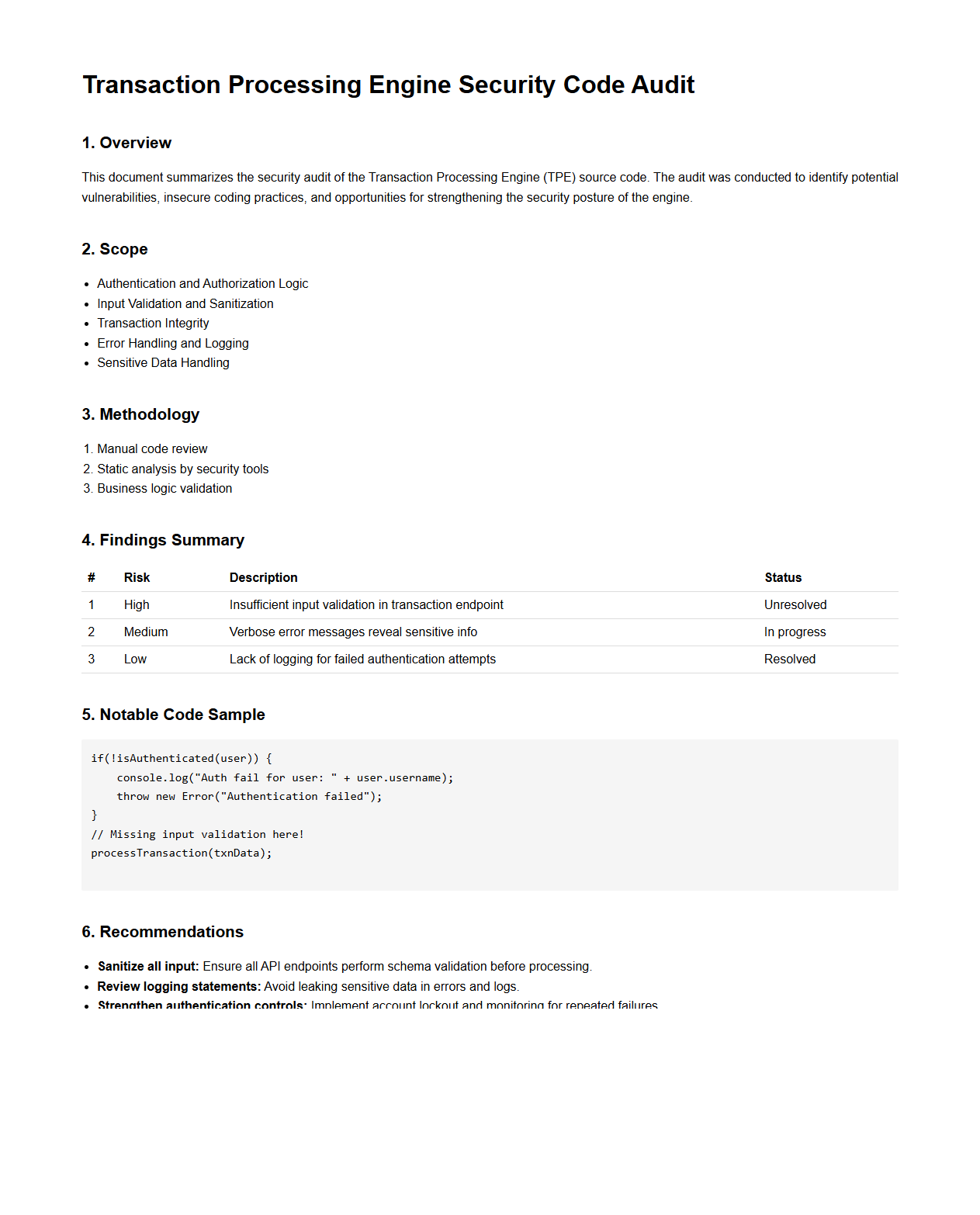

Transaction Processing Engine Security Code Audit

The

Transaction Processing Engine Security Code Audit document provides a comprehensive analysis of the security aspects within the codebase of a transaction processing system. It identifies potential vulnerabilities, ensures adherence to security best practices, and evaluates the effectiveness of implemented controls to protect transactional data integrity and confidentiality. By systematically reviewing code, this document helps organizations mitigate risks related to unauthorized access, data breaches, and transaction manipulation.

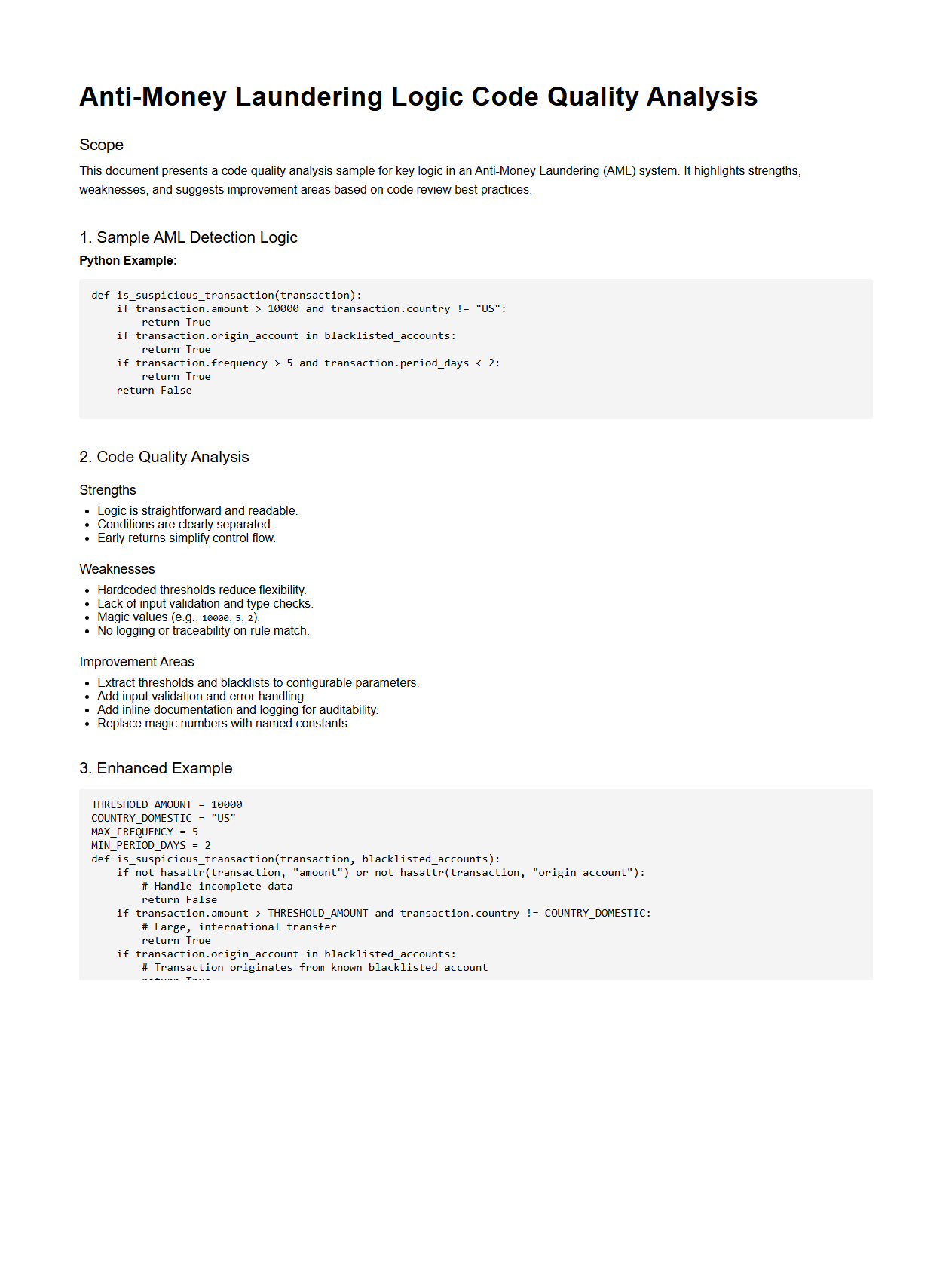

Anti-Money Laundering Logic Code Quality Analysis

The

Anti-Money Laundering Logic Code Quality Analysis document evaluates the effectiveness and reliability of code used in AML systems to detect suspicious financial activities. It focuses on identifying logical errors, ensuring compliance with regulatory standards, and improving the accuracy of transaction monitoring algorithms. This analysis helps financial institutions mitigate risks, reduce false positives, and enhance overall AML program efficiency.

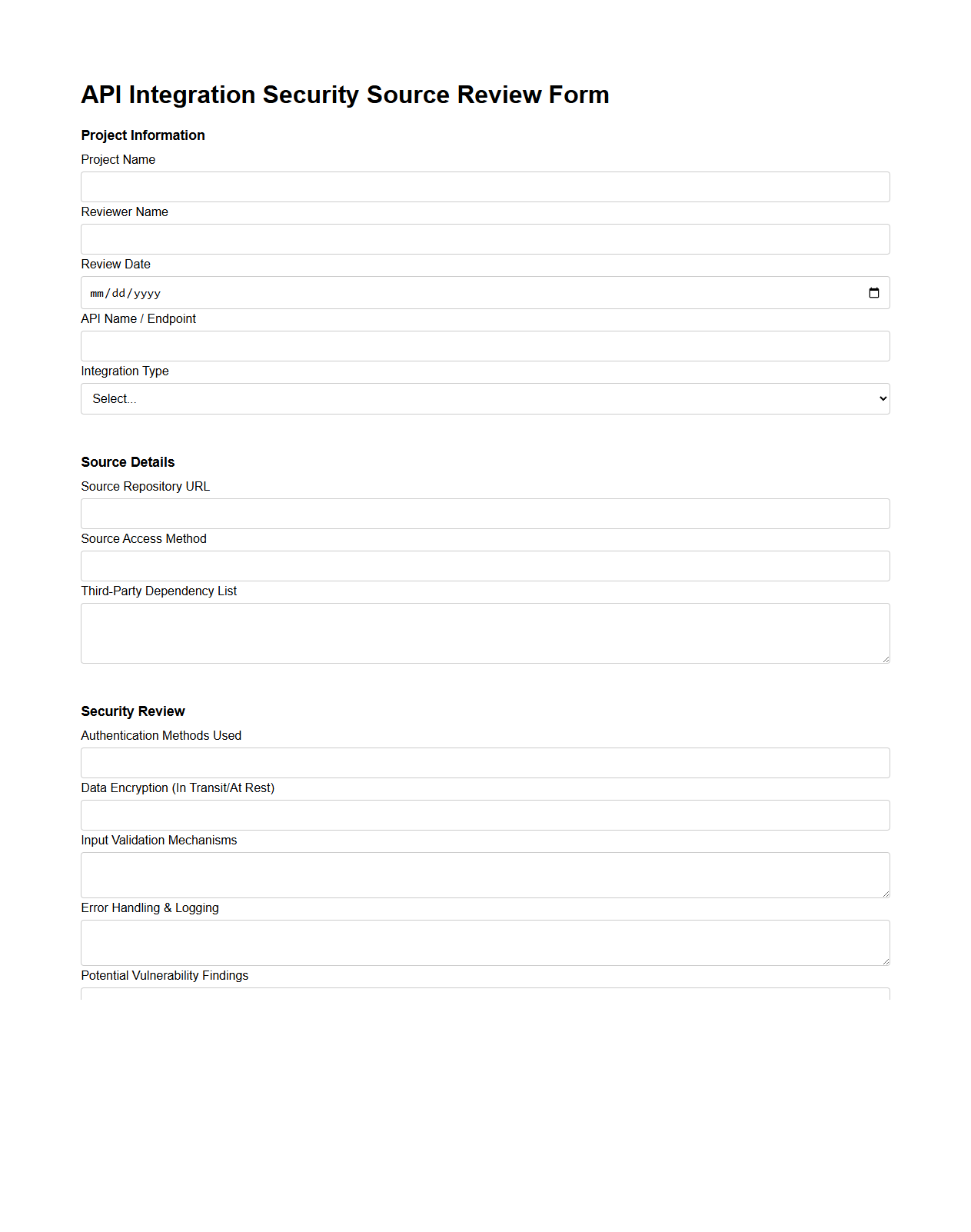

API Integration Security Source Review Form

The

API Integration Security Source Review Form document is a crucial tool designed to evaluate the security aspects of API integrations before deployment. It systematically assesses code, authentication methods, data handling, and potential vulnerabilities to ensure compliance with security standards. This form helps organizations mitigate risks by identifying security gaps and enforcing best practices in API development and integration.

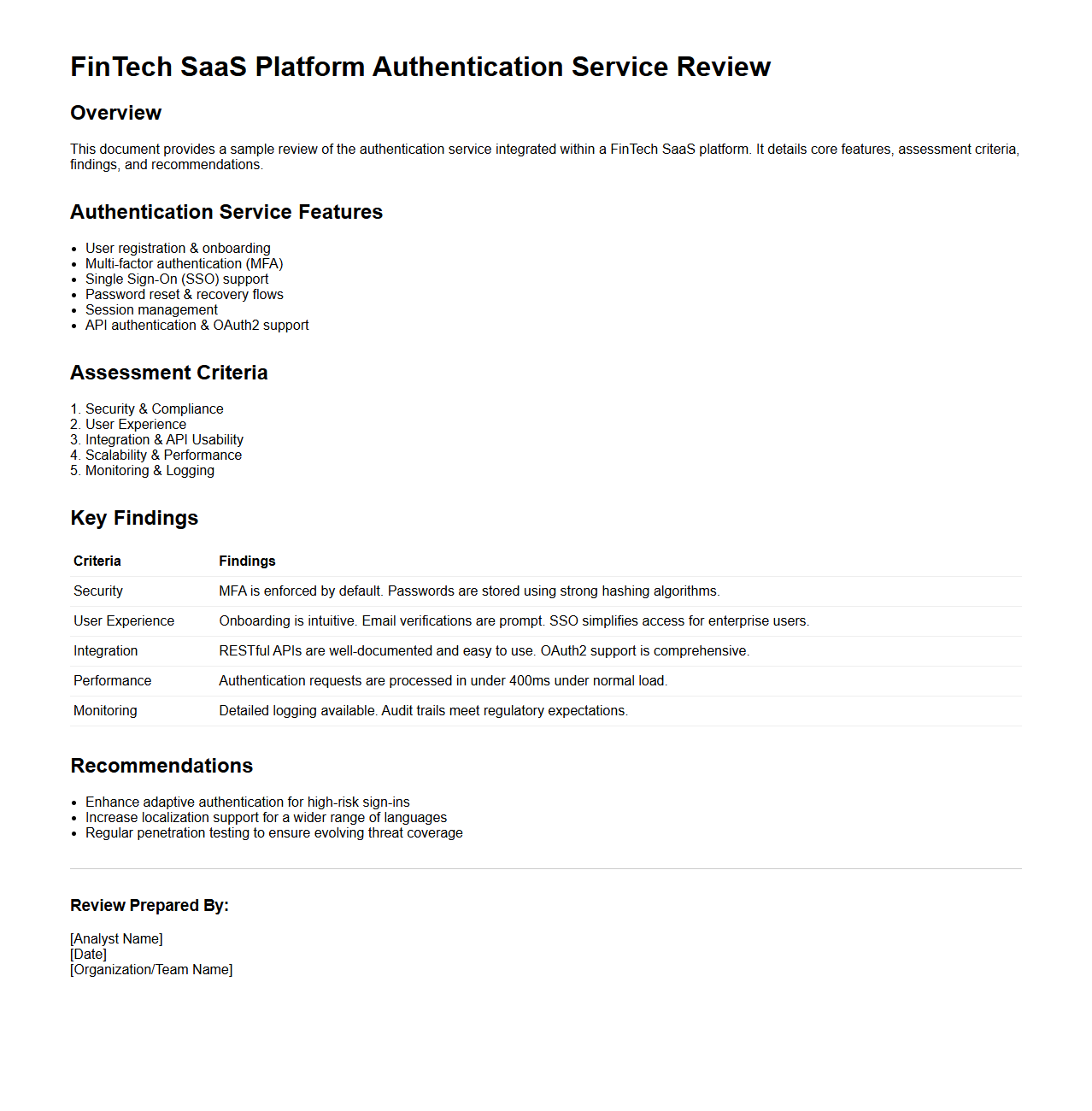

FinTech SaaS Platform Authentication Service Review

A

FinTech SaaS Platform Authentication Service Review document evaluates the security protocols and user identity verification methods used by financial technology software-as-a-service platforms. It assesses factors such as multi-factor authentication, encryption standards, compliance with regulations like PSD2 and GDPR, and integration capabilities with existing systems. This review is essential for ensuring robust protection against unauthorized access and maintaining trust in digital financial transactions.

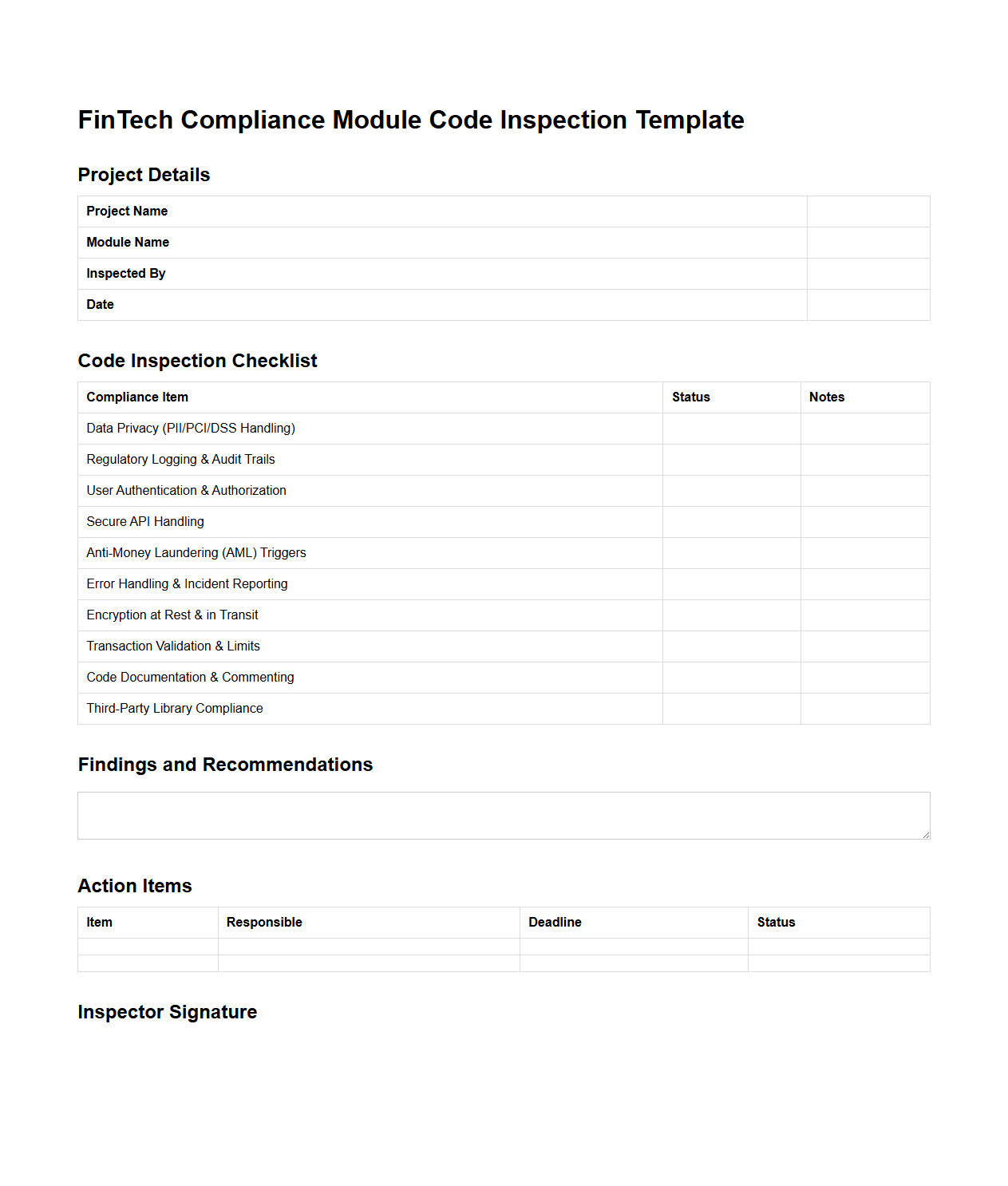

FinTech Compliance Module Code Inspection Template

The

FinTech Compliance Module Code Inspection Template document serves as a structured framework for reviewing software code in financial technology applications to ensure adherence to regulatory standards and industry best practices. It facilitates systematic identification of compliance risks, security vulnerabilities, and coding errors that could impact financial data integrity or consumer protection. By standardizing the inspection process, this template helps development teams maintain regulatory compliance and enhance the overall quality and reliability of FinTech solutions.

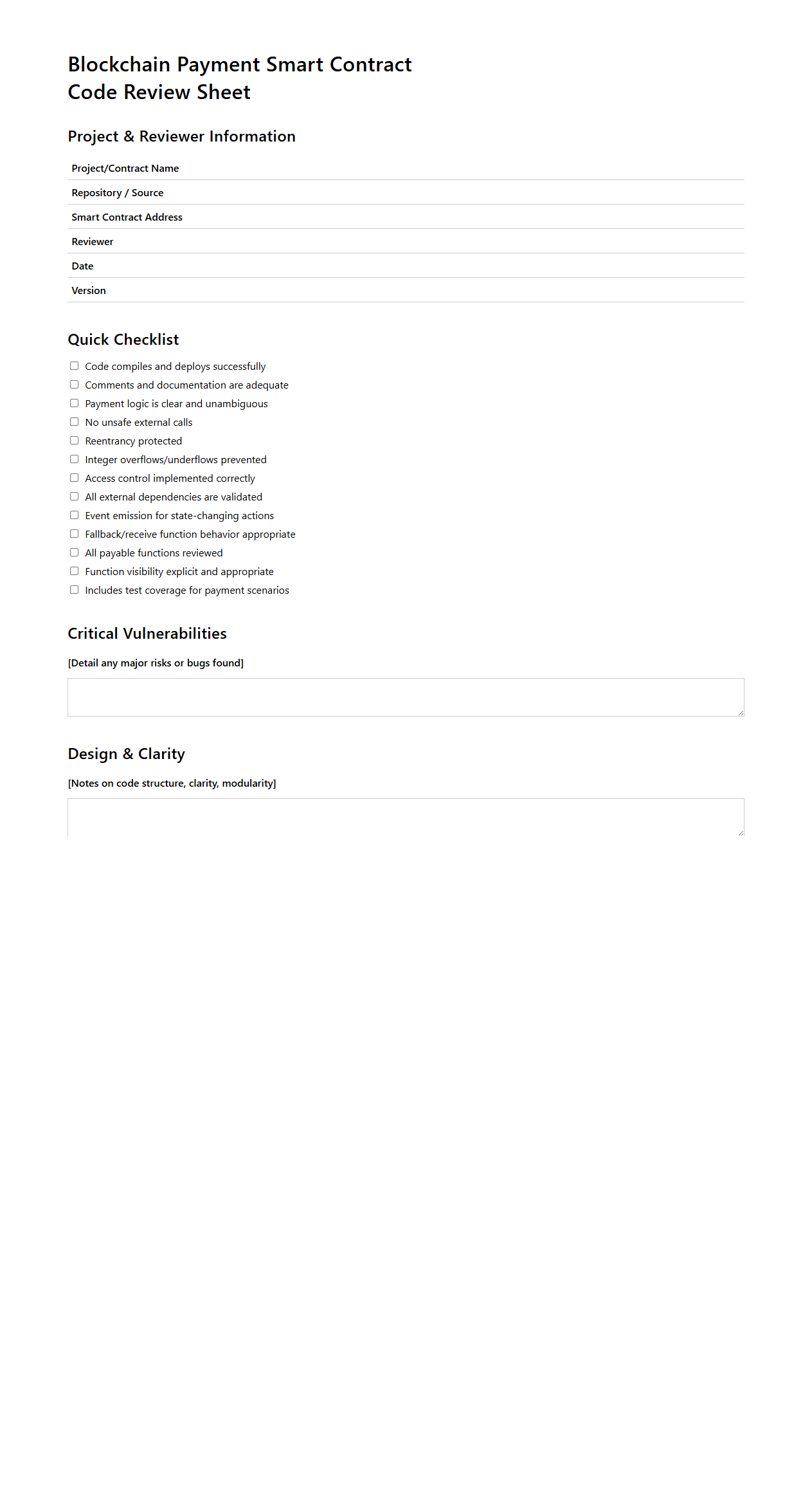

Blockchain Payment Smart Contract Code Review Sheet

The

Blockchain Payment Smart Contract Code Review Sheet document serves as a comprehensive checklist designed to ensure the security, functionality, and compliance of smart contracts handling blockchain-based payments. It systematically evaluates critical aspects such as transaction integrity, authentication protocols, error handling, and adherence to best practices in decentralized finance (DeFi) systems. This document aids developers and auditors in identifying potential vulnerabilities, ensuring robustness and reliability for secure payment processing on blockchain platforms.

What compliance frameworks are addressed in the source code review for FinTech solutions?

The source code review rigorously examines adherence to major compliance frameworks such as PCI-DSS, GDPR, and SOX that are critical for FinTech applications. It verifies that coding practices align with regulatory requirements to ensure data protection and financial transaction integrity. Additionally, the review highlights any non-compliance issues that could expose the system to legal or financial risks.

How does the document assess secure data handling and encryption protocols in the codebase?

The document evaluates secure data handling by reviewing the implementation of encryption protocols for data at rest and in transit. It checks for the use of industry-standard cryptographic algorithms and key management practices to safeguard sensitive information. The assessment also includes validation of proper data sanitization methods to prevent leakage or unauthorized access.

Does the review identify third-party dependencies and their impact on transaction integrity?

The review thoroughly identifies all third-party dependencies integrated within the codebase to ascertain their influence on transaction integrity. It assesses the security posture of these dependencies, ensuring they do not introduce vulnerabilities or compromise data accuracy. Furthermore, the document recommends mitigation strategies for any detected risks arising from external libraries or services.

Are API endpoints audited for authentication and authorization flaws in the document?

The document conducts a detailed audit of API endpoints focusing on authentication and authorization mechanisms to prevent unauthorized access. It verifies that robust controls such as OAuth, JWT, or multi-factor authentication are implemented correctly. The audit also identifies potential weaknesses that could be exploited to manipulate financial operations or access confidential data.

How does the document evaluate code sections related to real-time fraud detection logic?

The evaluation of real-time fraud detection logic centers on the robustness and efficiency of algorithms embedded in the code. The document analyzes the implementation of anomaly detection, rule-based triggers, and machine learning integration to ensure timely and accurate fraud identification. It also assesses the system's ability to handle false positives and maintain transaction flow without disruption.

More Technology Templates