The Payroll Summary Document Sample for HR Finance provides a clear overview of employee earnings, deductions, and net pay within a specified period. It ensures accurate tracking of salary disbursements and compliance with tax regulations, supporting efficient financial management. This sample serves as a standardized reference for payroll processing and reporting in HR and finance departments.

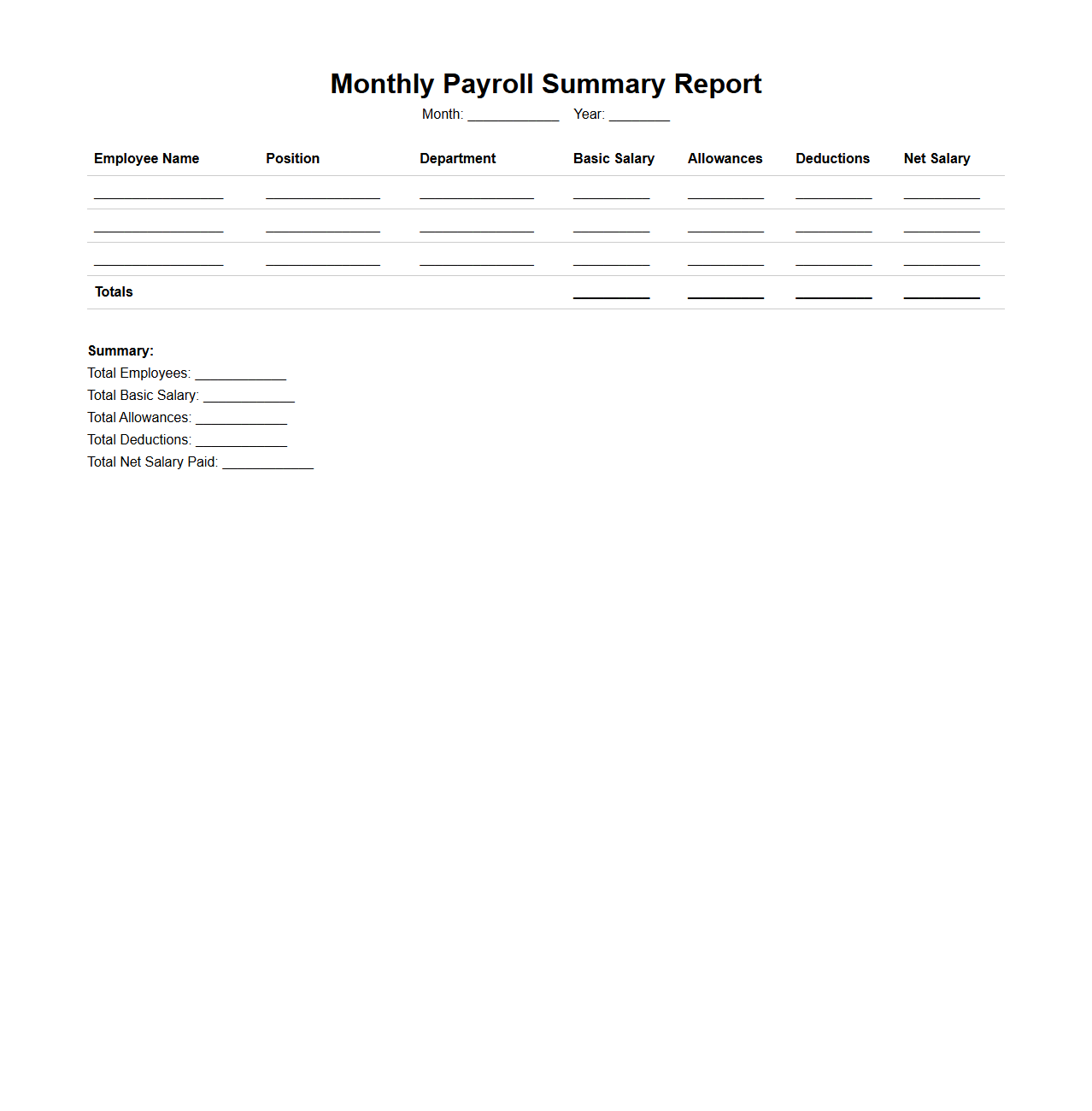

Monthly Payroll Summary Report Template

The

Monthly Payroll Summary Report Template document is a structured format used to compile and summarize employee salary details, deductions, taxes, and net pay for a specific month. It streamlines payroll processing by providing a clear overview of total wages, benefits, and statutory contributions, ensuring compliance with labor regulations. This template is essential for accurate financial reporting, auditing, and maintaining transparency in payroll management.

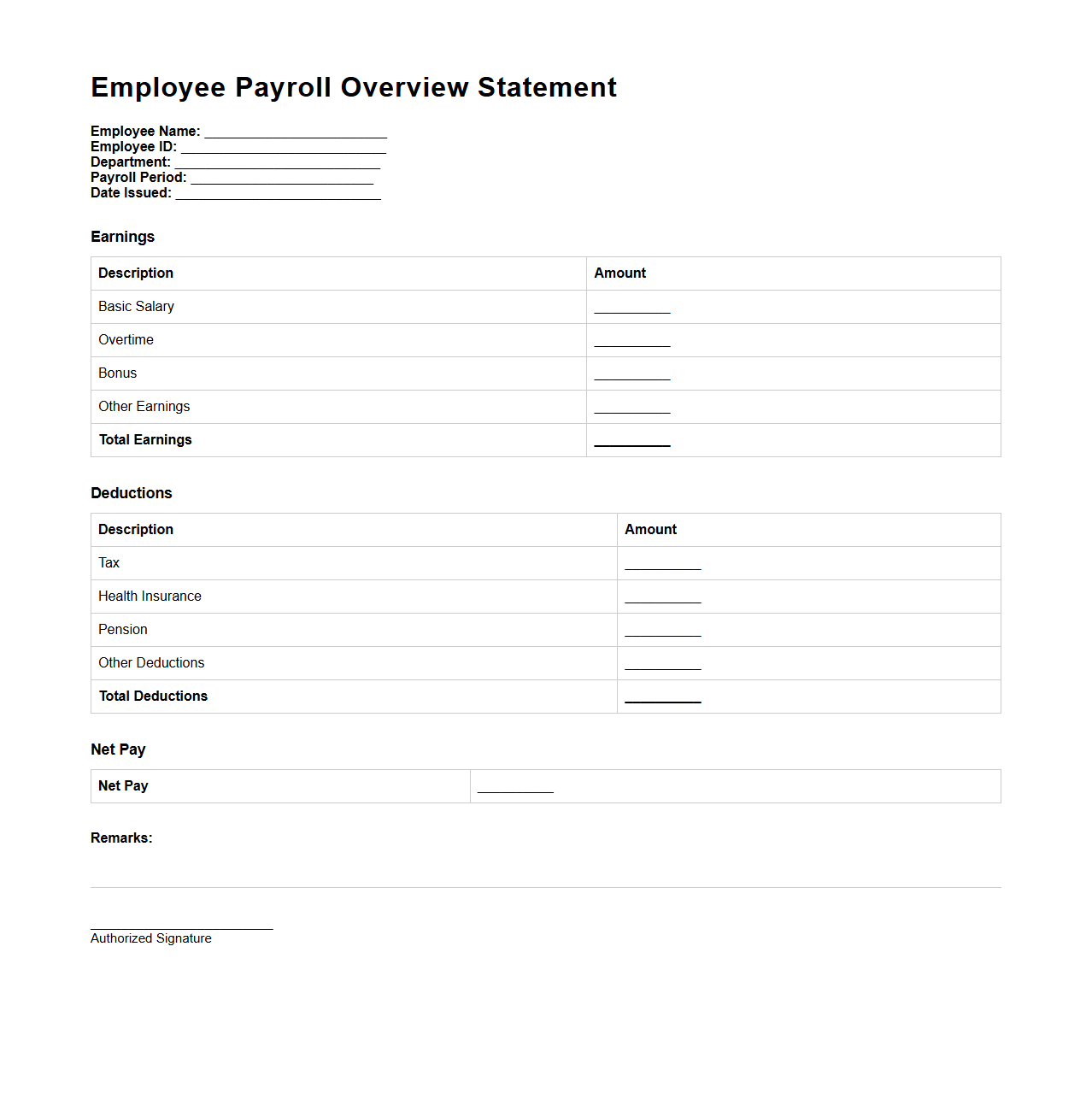

Employee Payroll Overview Statement

The

Employee Payroll Overview Statement document summarizes an employee's total earnings, deductions, and net pay over a specified period. It provides detailed information on wages, taxes, benefits, and other payroll components for accurate record-keeping and financial transparency. Employers and employees use this document to verify payment accuracy and fulfill tax reporting requirements.

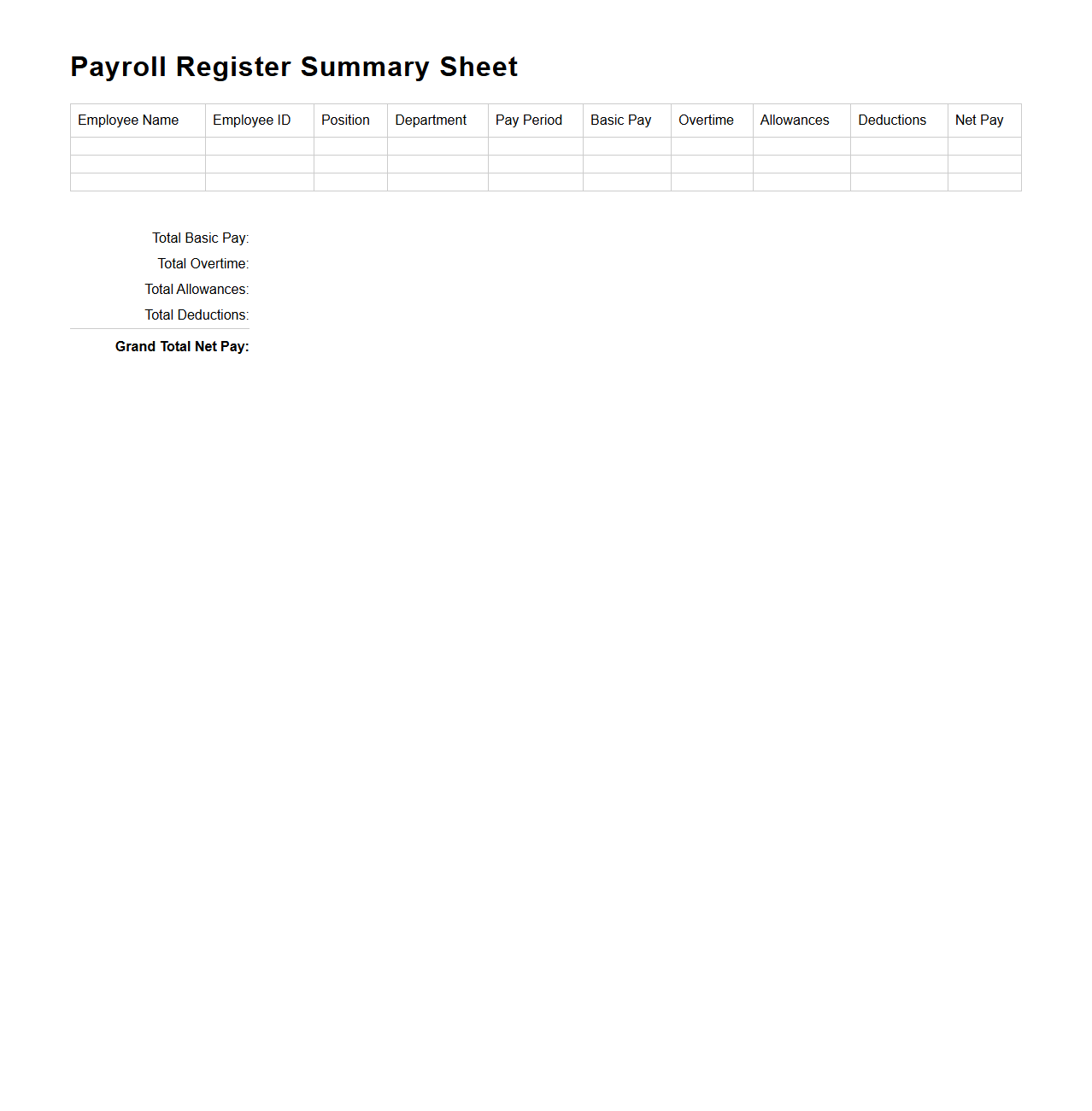

Payroll Register Summary Sheet

The

Payroll Register Summary Sheet is a comprehensive document that consolidates employee earnings, deductions, tax withholdings, and net pay for a specific payroll period. It serves as a crucial record for accounting and auditing purposes by summarizing payroll data in an organized format. This sheet helps businesses ensure accuracy in payroll processing and facilitates regulatory compliance.

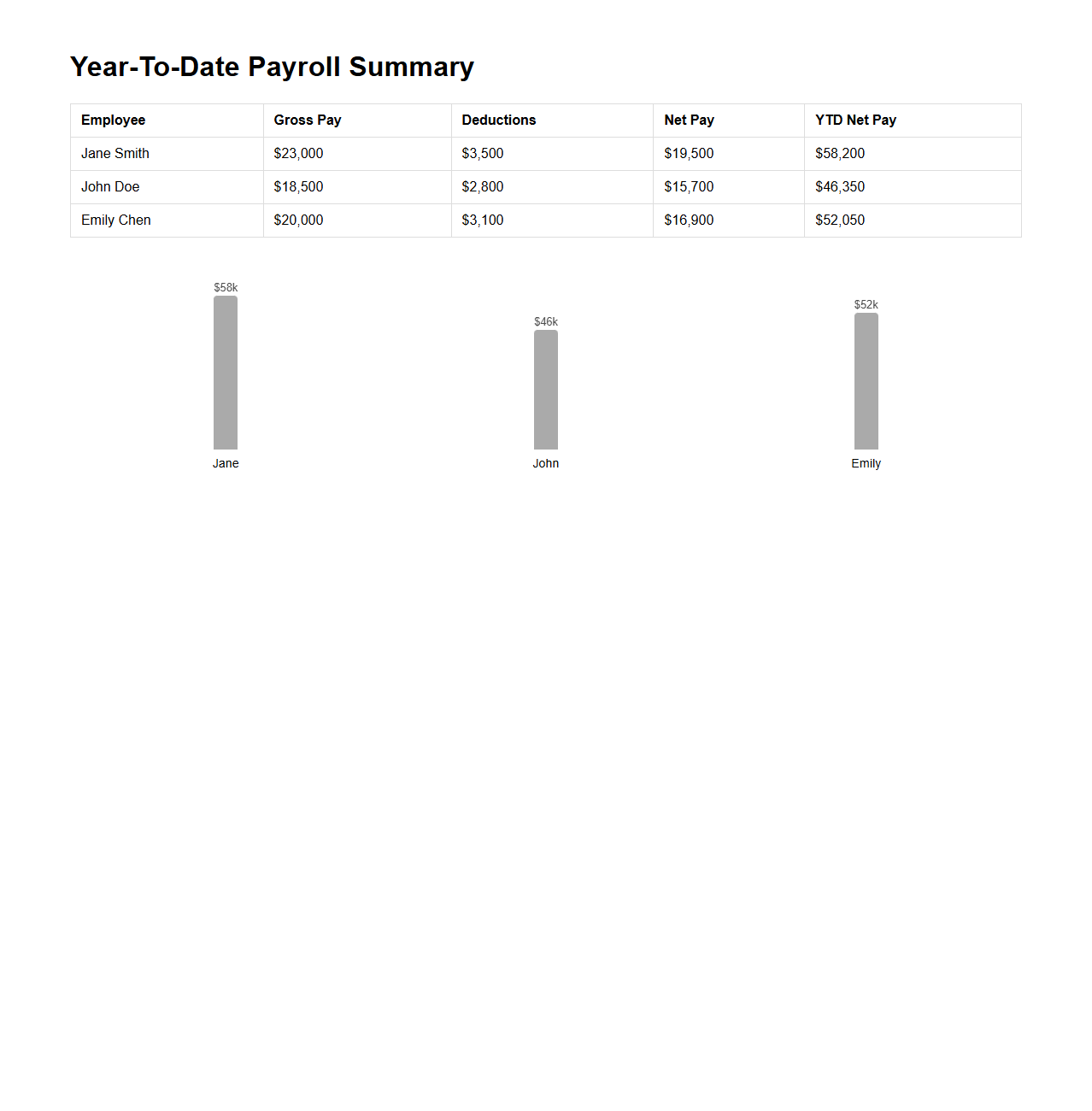

Year-To-Date Payroll Summary Chart

The

Year-To-Date Payroll Summary Chart document provides a comprehensive overview of an employee's cumulative earnings, deductions, and tax withholdings from the beginning of the calendar year up to the current date. It consolidates detailed payroll data such as gross pay, net pay, benefits contributions, and tax payments, enabling accurate tracking for financial planning and reporting. This document serves as a critical reference for payroll management, tax filing, and compliance purposes.

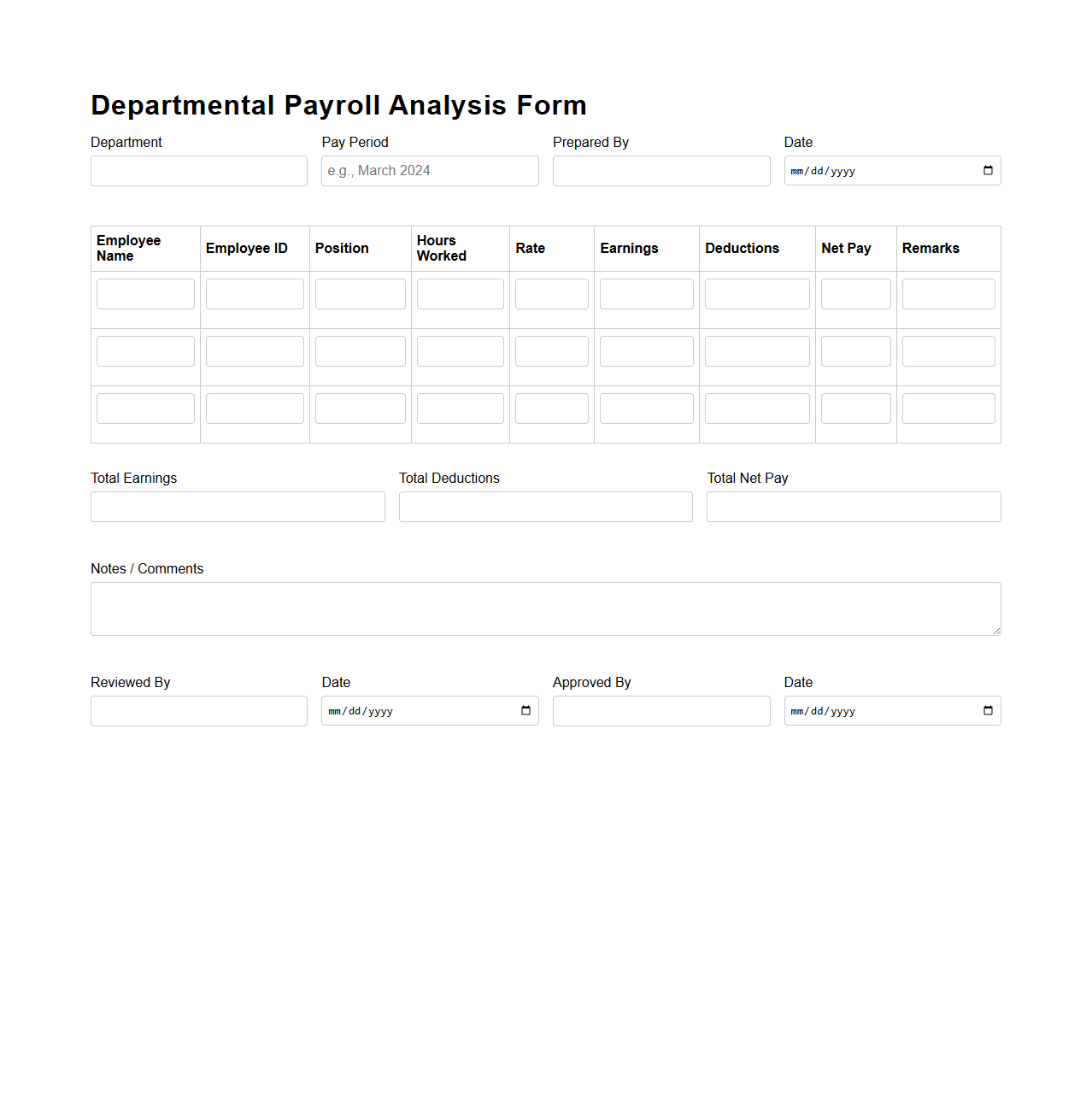

Departmental Payroll Analysis Form

The

Departmental Payroll Analysis Form is a critical document used by organizations to systematically review and allocate payroll expenses across various departments. It provides detailed insights into employee compensation, hours worked, and associated costs, helping track budget compliance and enhance financial reporting accuracy. This form supports effective payroll management by enabling departments to analyze labor costs and optimize resource allocation.

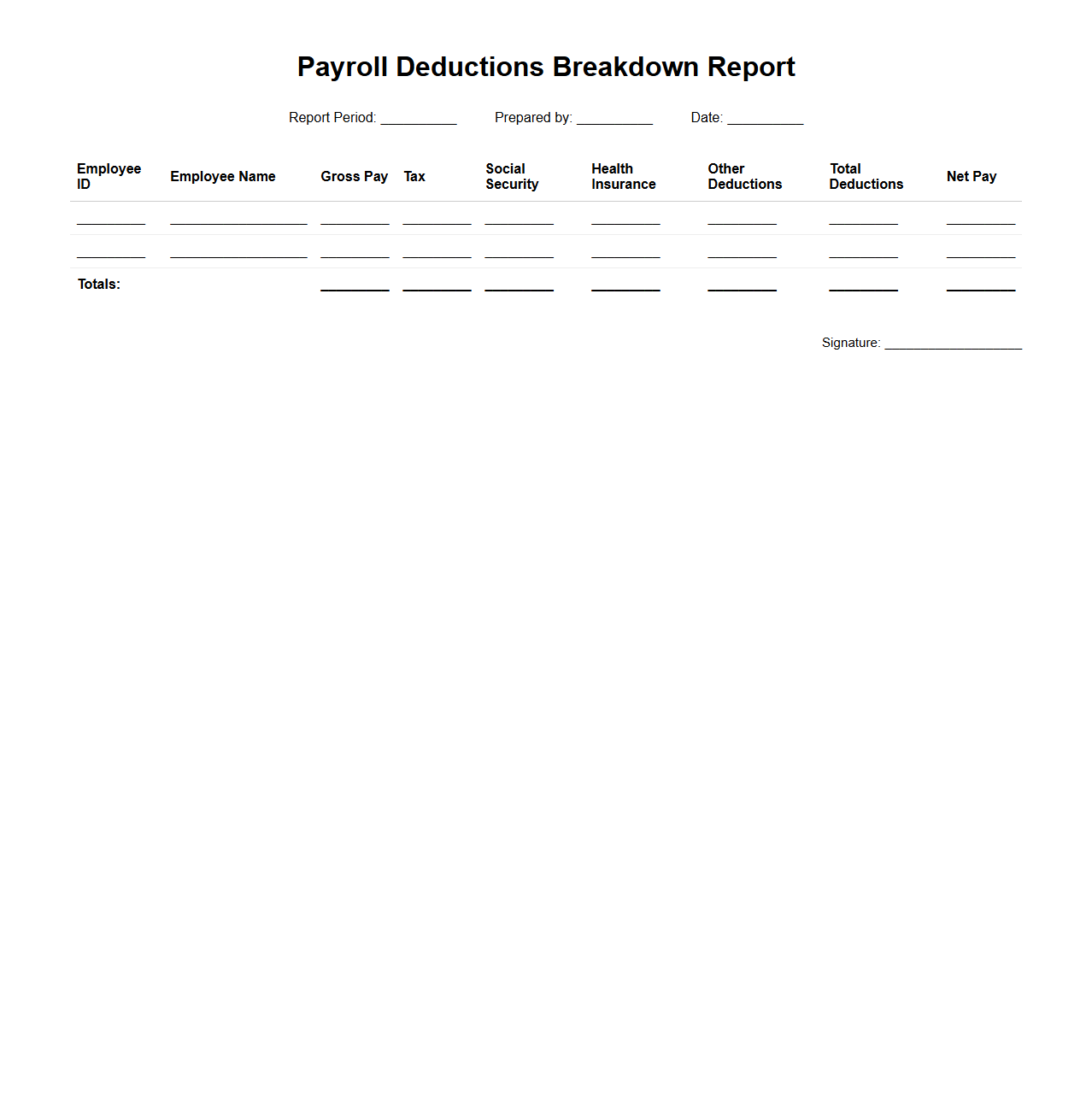

Payroll Deductions Breakdown Report

A

Payroll Deductions Breakdown Report is a detailed document that itemizes all deductions withheld from an employee's gross pay, including taxes, retirement contributions, health insurance premiums, and other voluntary or mandatory deductions. This report helps employers and employees clearly understand the allocation and distribution of payroll amounts, ensuring transparency and compliance with regulatory requirements. It is an essential tool for accurate financial accounting and payroll auditing processes.

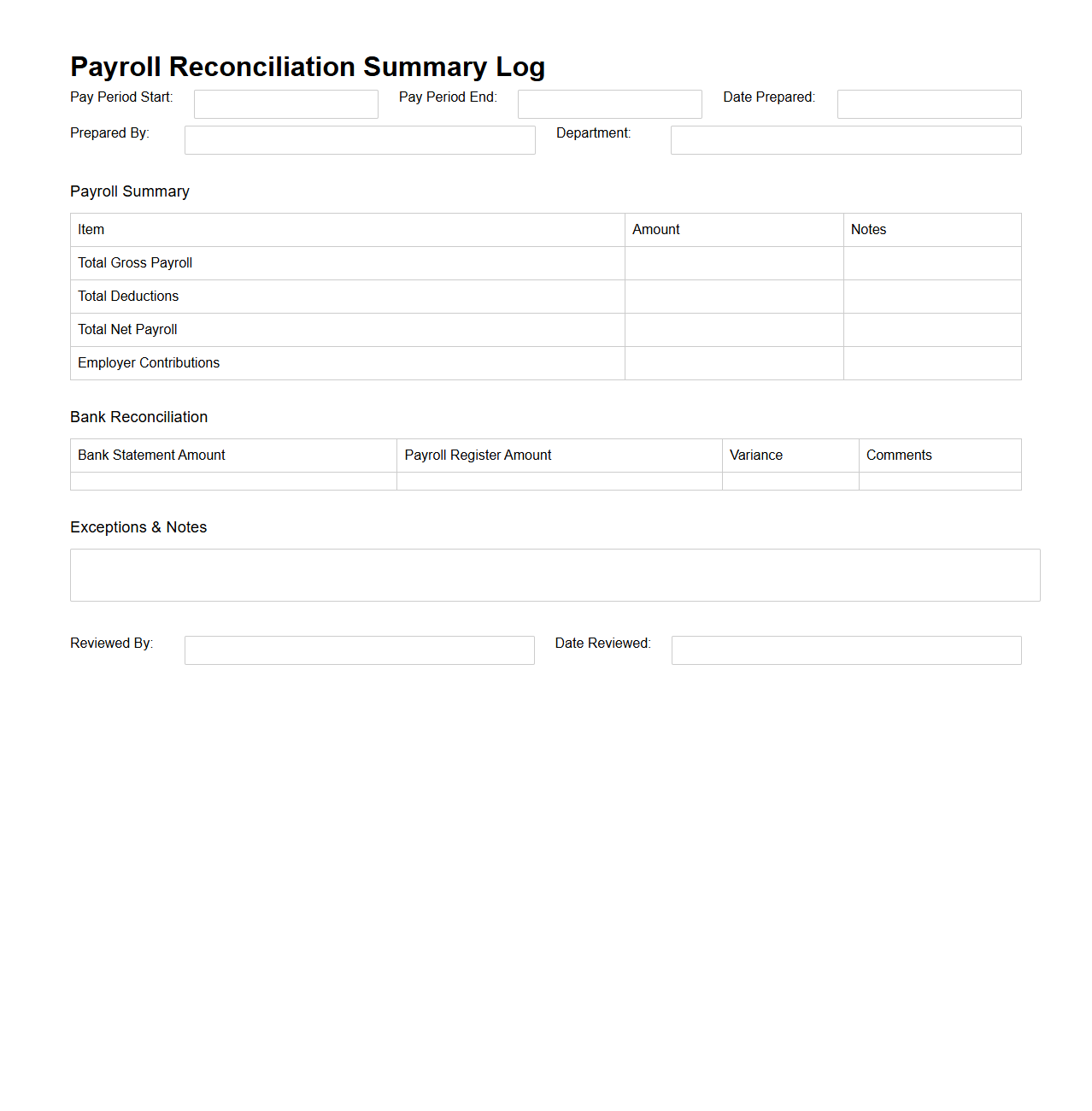

Payroll Reconciliation Summary Log

The

Payroll Reconciliation Summary Log document is essential for tracking and verifying payroll transactions by comparing employee payment records against payroll system data to ensure accuracy. It summarizes discrepancies, adjustments, and corrections made during the payroll process, providing a clear audit trail for financial and compliance purposes. This document helps organizations maintain accurate payroll records and supports effective internal controls.

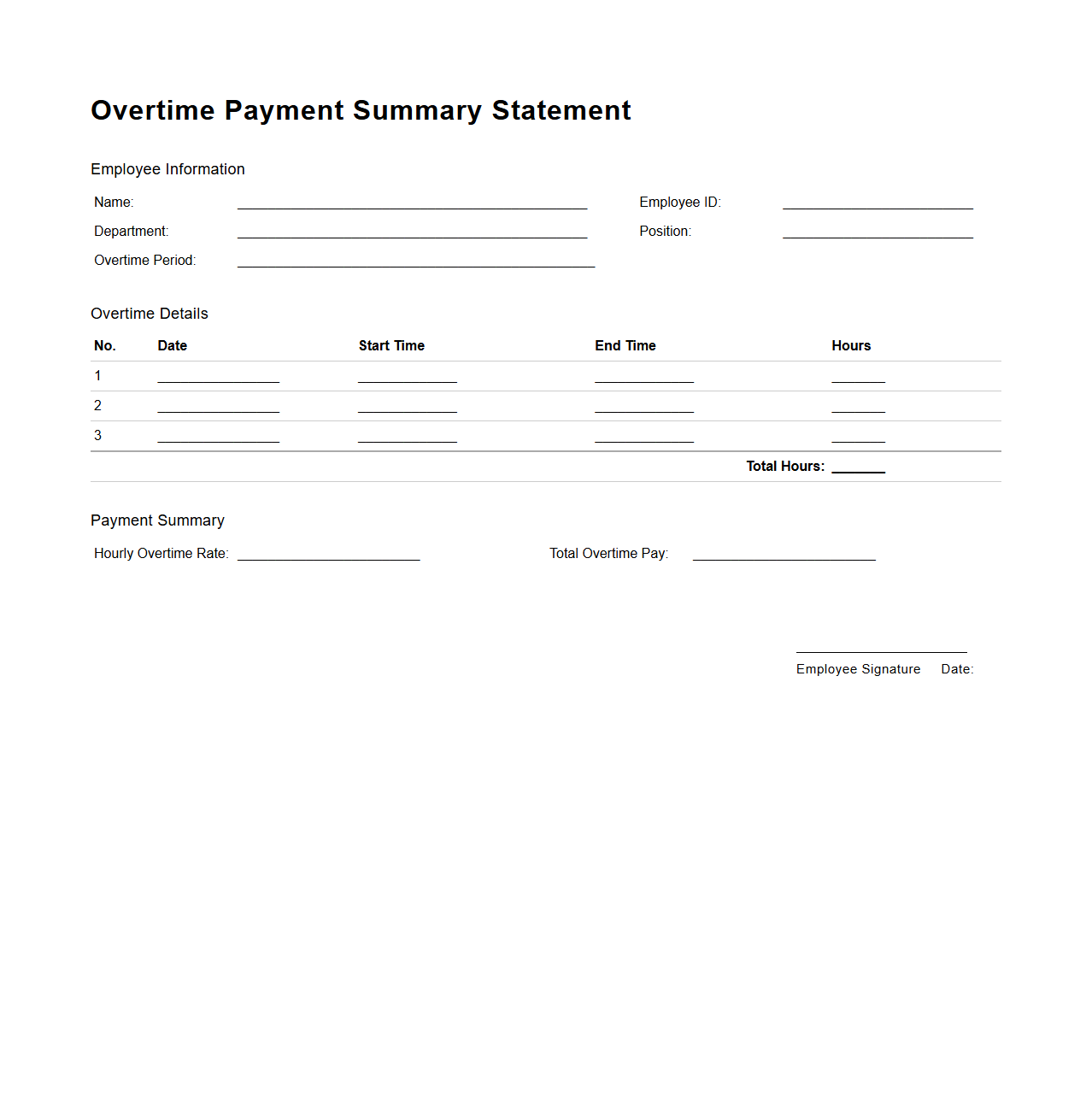

Overtime Payment Summary Statement

The

Overtime Payment Summary Statement document provides a detailed record of all extra hours worked by an employee beyond their regular working schedule, including the total overtime hours and the corresponding payments made. It serves as a transparent report for both employees and employers to verify accurate compensation in compliance with labor laws and company policies. This statement is essential for payroll management, ensuring that overtime pay calculations are precise and documented for financial and auditing purposes.

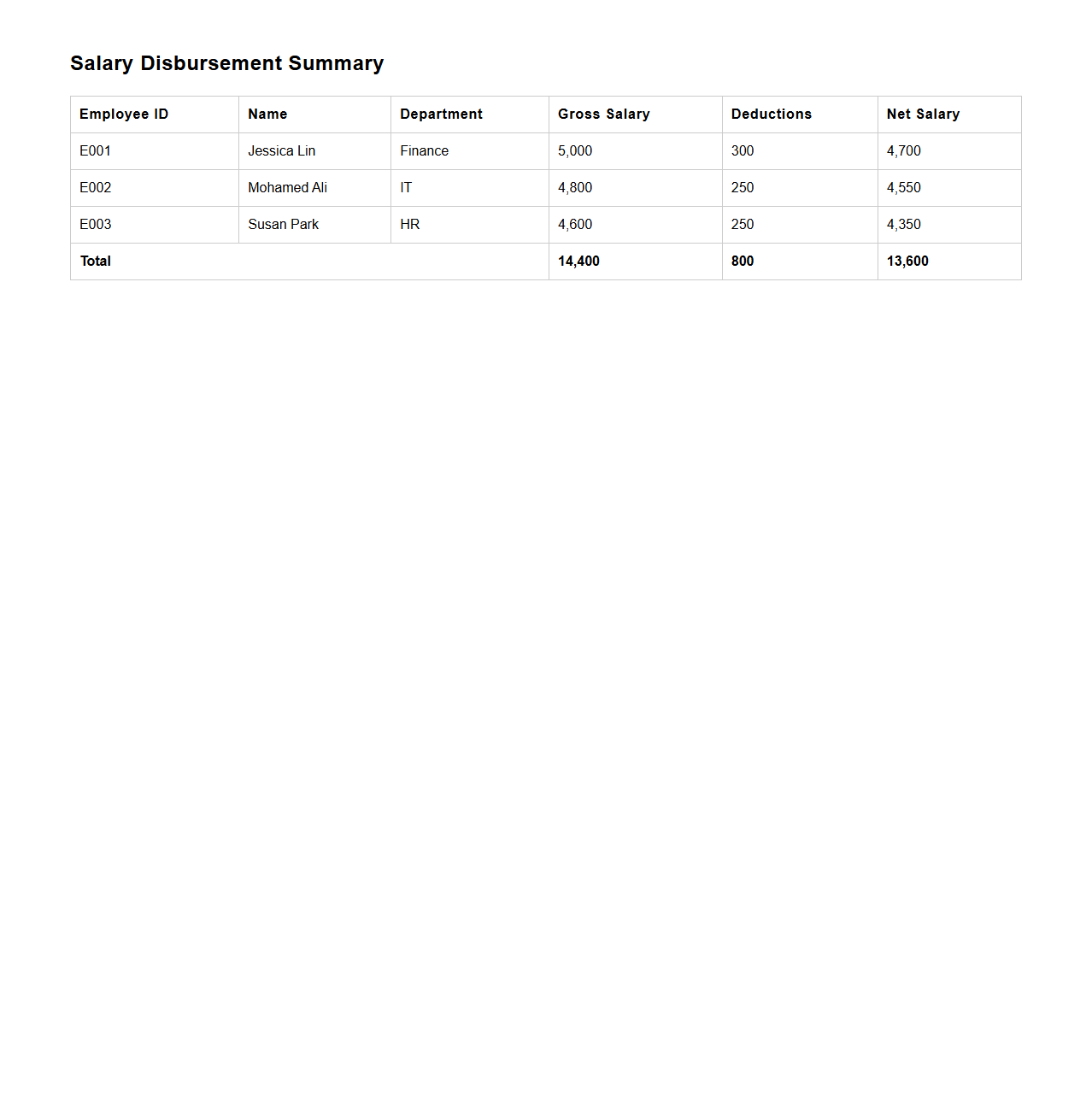

Salary Disbursement Summary Table

The Salary Disbursement Summary Table document provides a detailed overview of employee salary payments within a specified period, including gross pay, deductions, and net salary amounts. This table is essential for payroll management, ensuring accurate financial records and compliance with tax regulations. It serves as a

centralized payroll report that facilitates auditing and financial reconciliation processes.

Payroll Expense Summary Snapshot

The

Payroll Expense Summary Snapshot document provides a concise overview of an organization's total payroll costs over a specific period. It summarizes key payroll components such as salaries, wages, taxes, and benefits, enabling quick financial analysis and budget tracking. This document is essential for HR and finance teams to monitor labor expenses and ensure accurate reporting.

What are the key data fields required in a Payroll Summary Document for HR Finance reconciliation?

The Payroll Summary Document must include essential data fields such as employee identification, gross pay, tax deductions, and net pay. Additionally, it should detail benefits, allowances, and any contributions toward social security or retirement funds. These fields ensure a comprehensive reconciliation process between the HR and Finance departments.

How should tax withholdings be detailed in a Payroll Summary for compliance audits?

Tax withholdings should be itemized clearly by type, including federal, state, and local taxes, along with any additional deductions such as Medicare or Social Security. Each withholding must show the calculated amount and the corresponding tax period to ensure full compliance with audit regulations. This level of transparency aids in verifying accuracy and meeting statutory requirements.

What level of employee salary breakdown is optimal for a Payroll Summary requested by finance teams?

The optimal salary breakdown should present a detailed view of gross salary, bonuses, overtime pay, deductions, and final net salary per employee. Finance teams require this granular data to monitor payroll costs and perform accurate financial forecasting. Including standardized codes for each salary component enhances clarity and facilitates seamless data integration.

How can discrepancies in net pay shown on the Payroll Summary Document be quickly identified?

Discrepancies can be spotted by cross-referencing payroll inputs with employee contracts and previous payroll cycles to check for unexpected variations. Automated reconciliation tools that highlight mismatches between gross pay, deductions, and net pay boost efficiency. Maintaining an audit trail helps quickly pinpoint errors or anomalies in the Payroll Summary Document.

What digital formats are preferred for securely sharing Payroll Summary Documents between HR and Finance?

Secure digital formats like encrypted PDFs and password-protected Excel files are preferred for sharing Payroll Summary Documents. These formats safeguard sensitive payroll data during transmission and support audit-ready documentation. Implementing secure file-sharing platforms with strict access controls further enhances data confidentiality and compliance.