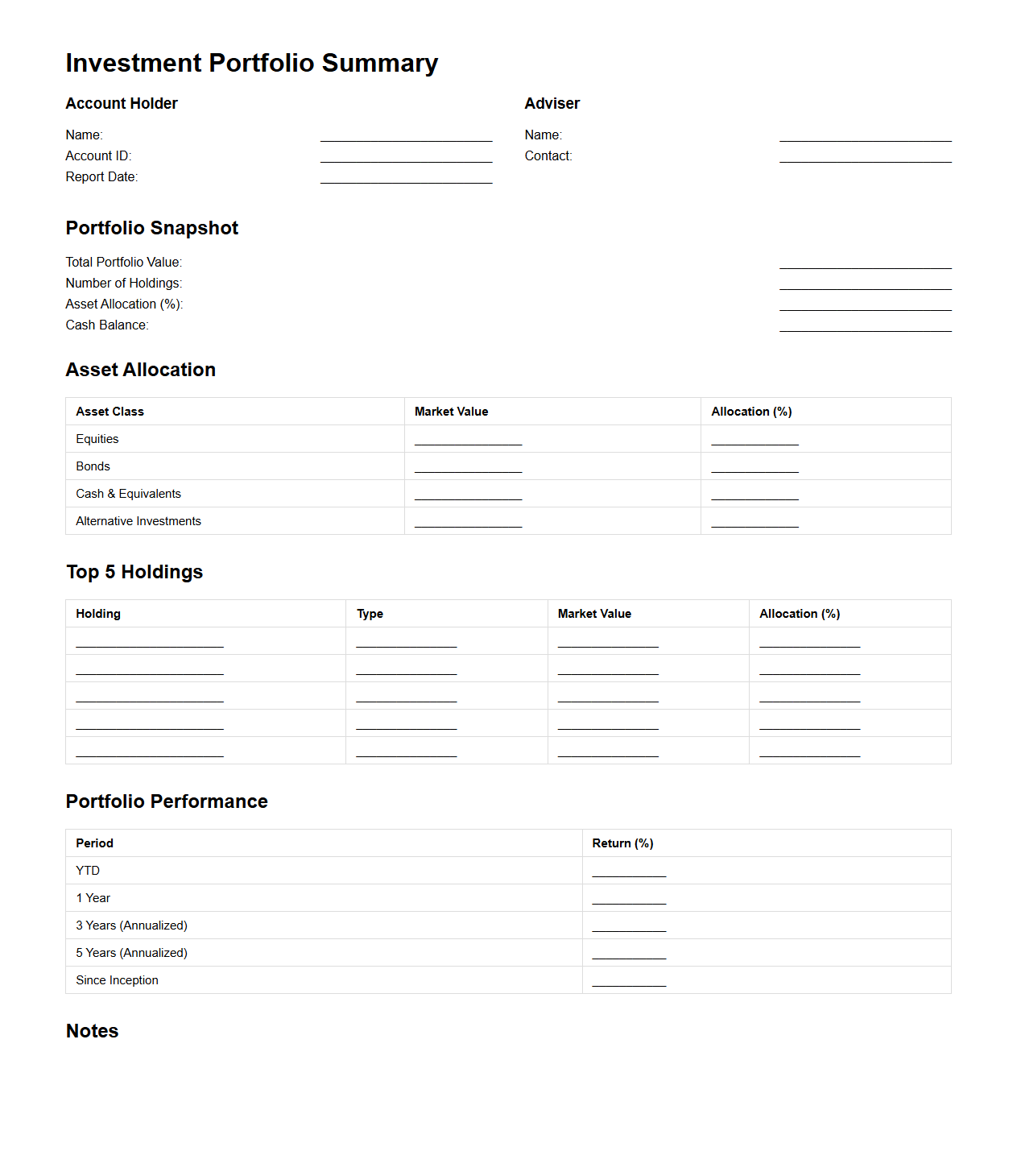

Investment Portfolio Summary Template for Asset Management

An

Investment Portfolio Summary Template for asset management is a structured document used to consolidate and analyze the performance, allocation, and risk metrics of various investments within a portfolio. It provides a clear overview of asset distribution across categories such as equities, bonds, and alternative investments, enabling efficient decision-making and tracking against financial goals. The template often includes key indicators like ROI, volatility, and benchmark comparisons to facilitate comprehensive portfolio evaluation.

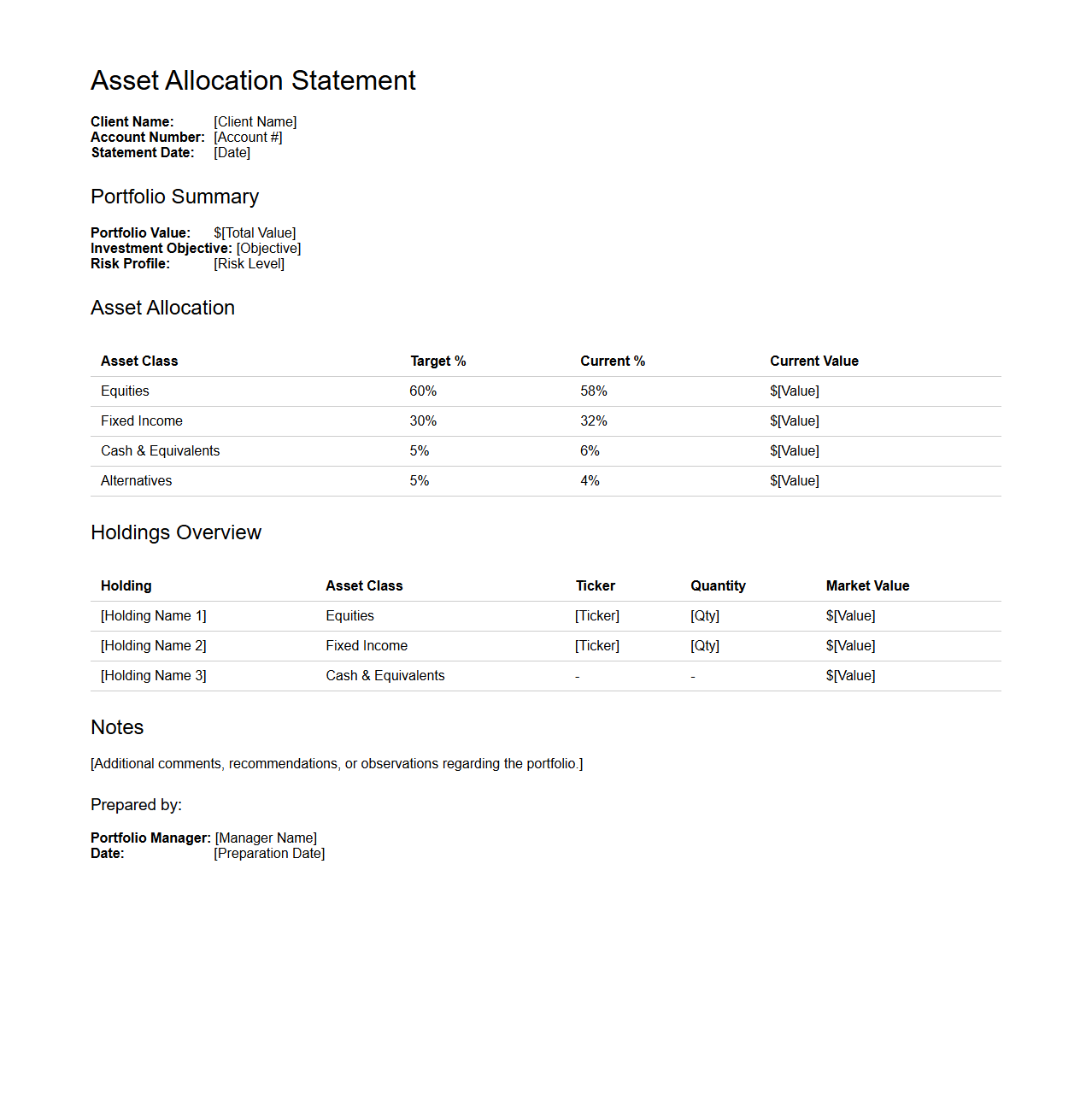

Asset Allocation Statement Example for Portfolio Managers

An

Asset Allocation Statement Example for Portfolio Managers document outlines the strategic distribution of investment assets across various categories such as equities, fixed income, and cash equivalents. It serves as a practical guide to help portfolio managers design, manage, and communicate optimal asset mixes that align with clients' risk tolerance, financial goals, and market conditions. This document typically includes model allocation percentages, risk assessments, and rebalancing strategies to ensure effective portfolio diversification and performance management.

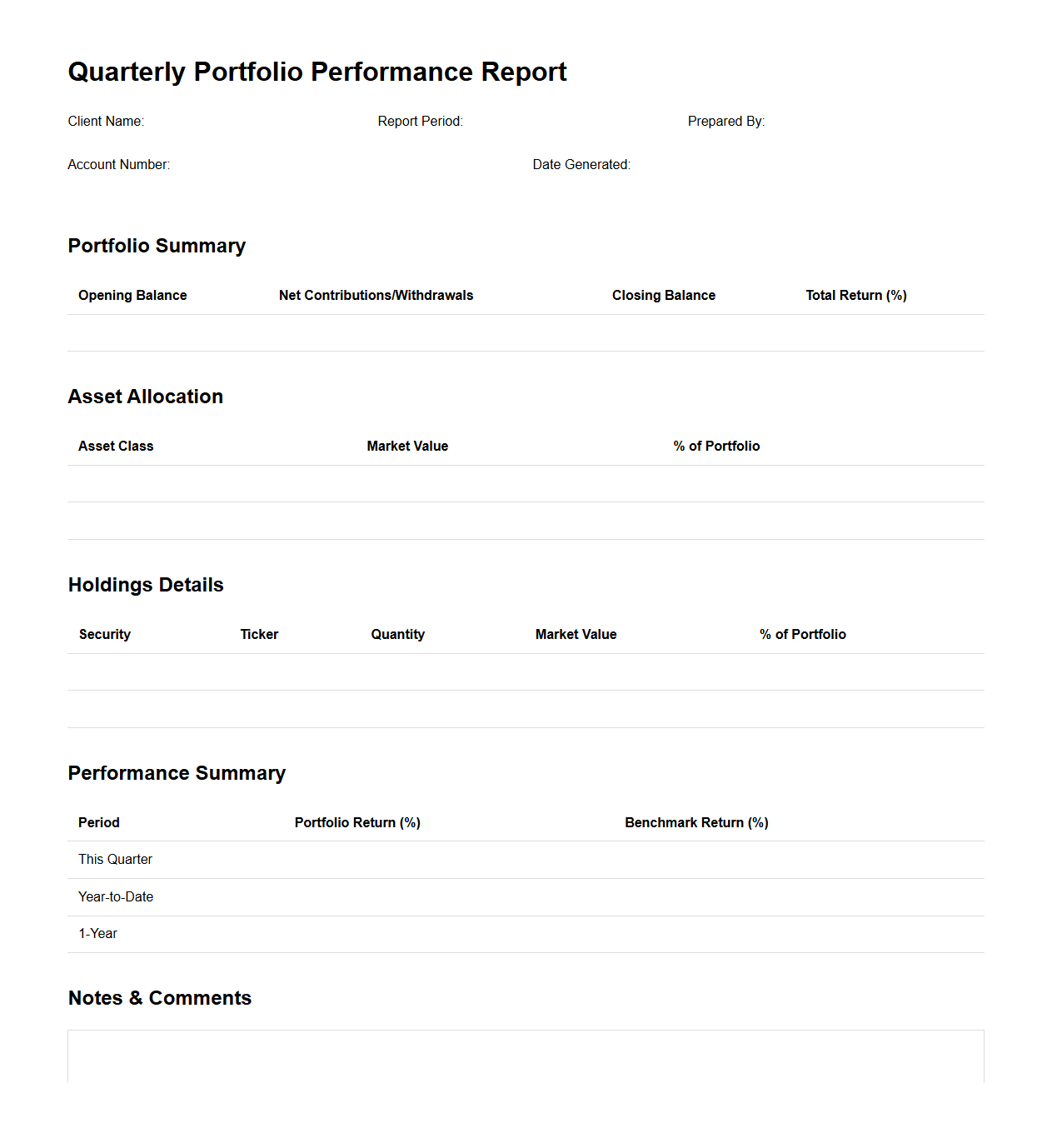

Quarterly Portfolio Performance Report Format

The Quarterly Portfolio Performance Report Format document provides a standardized template for evaluating and presenting the financial performance of investment portfolios over a three-month period. It typically includes key metrics such as portfolio returns, asset allocation, risk analysis, and benchmark comparisons to facilitate transparent and informed decision-making. Utilizing this format ensures consistent reporting, enabling stakeholders to track progress and assess the effectiveness of investment strategies.

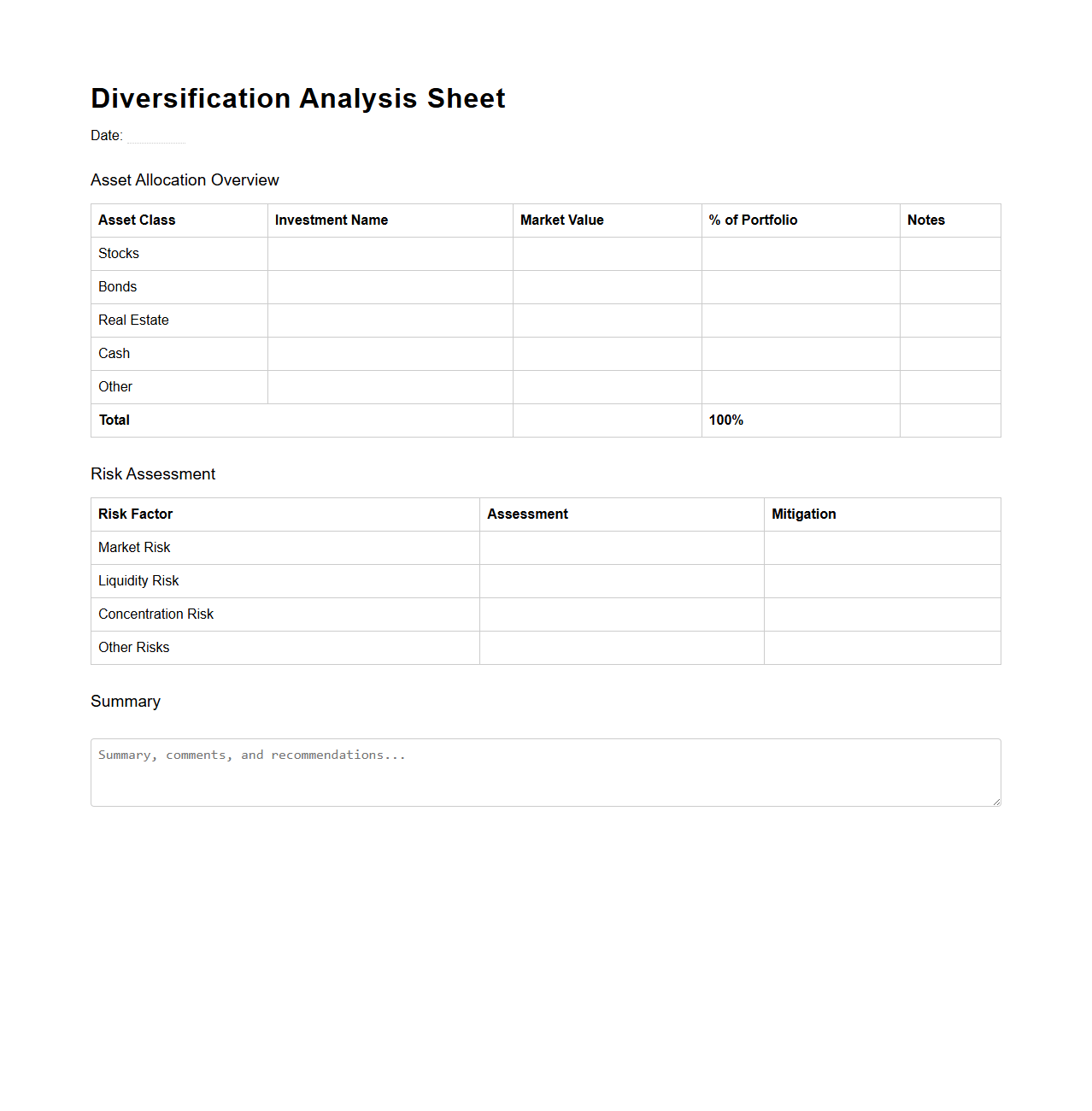

Quarterly Portfolio Performance ReportDiversification Analysis Sheet for Investment Assets

A

Diversification Analysis Sheet for Investment Assets is a financial tool used to evaluate the spread of investments across different asset classes, sectors, or geographic regions. This document helps investors identify concentration risks and achieve a balanced portfolio by assessing the proportion of various investment types. By analyzing this sheet, investors can make informed decisions to optimize risk-adjusted returns and enhance overall portfolio stability.

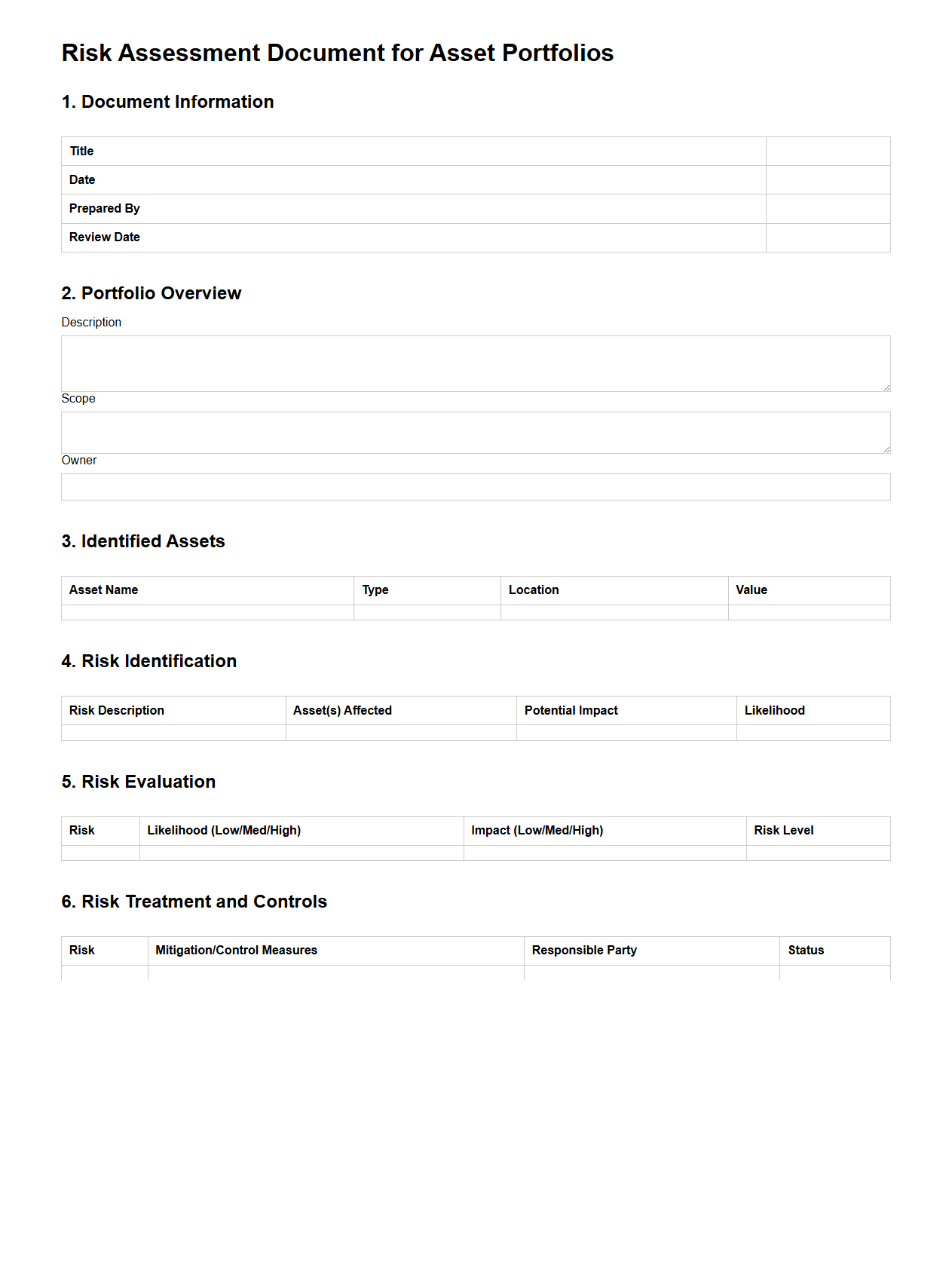

Risk Assessment Document for Asset Portfolios

A

Risk Assessment Document for Asset Portfolios systematically identifies, evaluates, and quantifies potential risks impacting the value and performance of diverse asset holdings. It incorporates risk metrics such as volatility, Value at Risk (VaR), and scenario analysis to provide a comprehensive understanding of exposure across market, credit, and operational risks. This document supports informed decision-making by outlining mitigation strategies and enhancing portfolio resilience against unforeseen financial uncertainties.

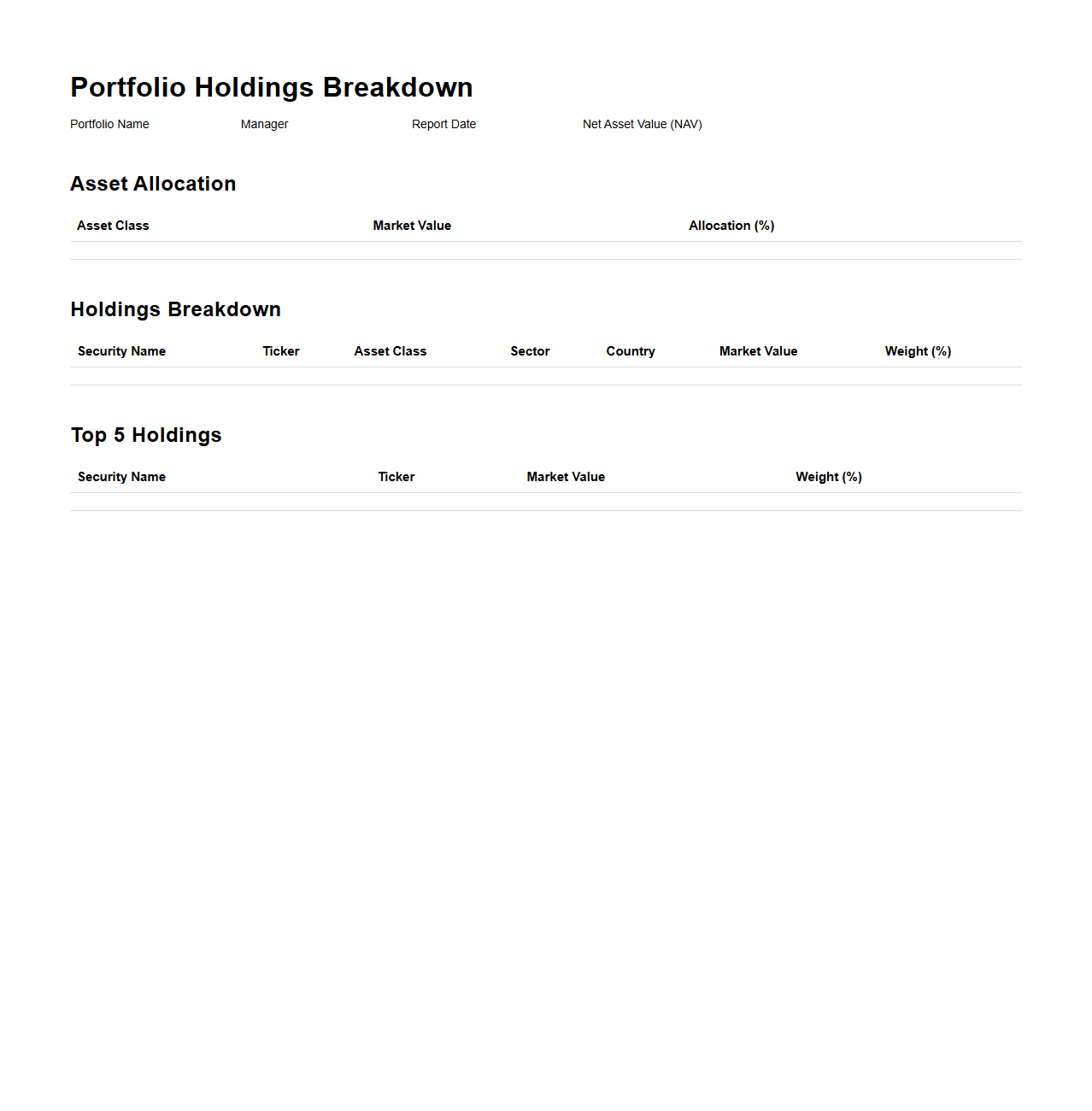

Portfolio Holdings Breakdown Template for Asset Managers

The

Portfolio Holdings Breakdown Template for asset managers is a structured document designed to provide a detailed analysis of investment assets within a portfolio. It categorizes holdings by asset class, sector, geographic region, and individual securities, facilitating transparent reporting and performance evaluation. This template aids asset managers in making informed decisions, ensuring regulatory compliance, and effectively communicating portfolio composition to stakeholders.

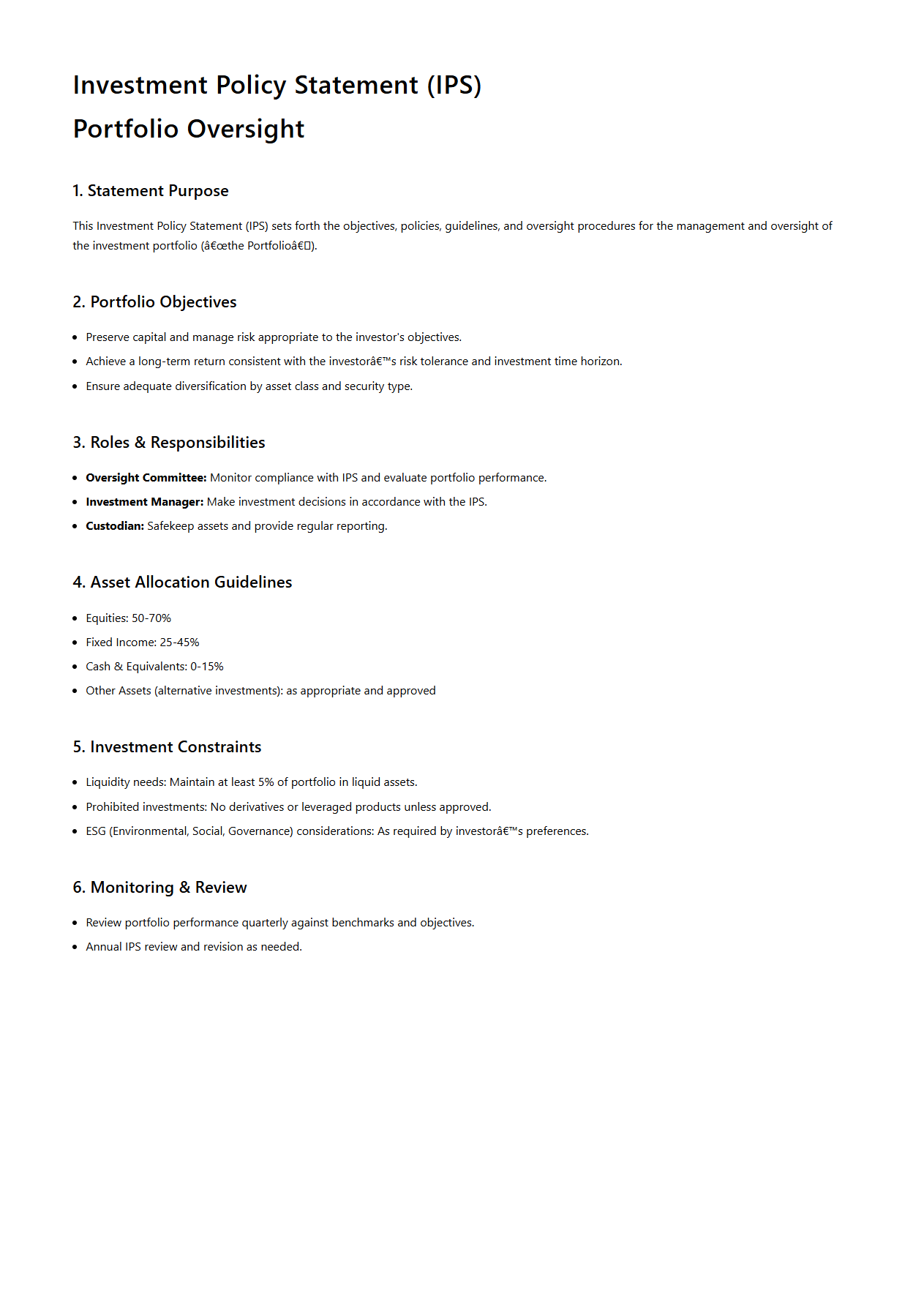

Investment Policy Statement Sample for Portfolio Oversight

An

Investment Policy Statement (IPS) Sample for Portfolio Oversight document serves as a strategic guide outlining the objectives, risk tolerance, asset allocation, and governance framework for managing an investment portfolio. It provides a clear framework for portfolio managers and stakeholders to ensure alignment with long-term financial goals and regulatory compliance. This document also defines roles, monitoring procedures, and performance review protocols to maintain disciplined and consistent investment decision-making.

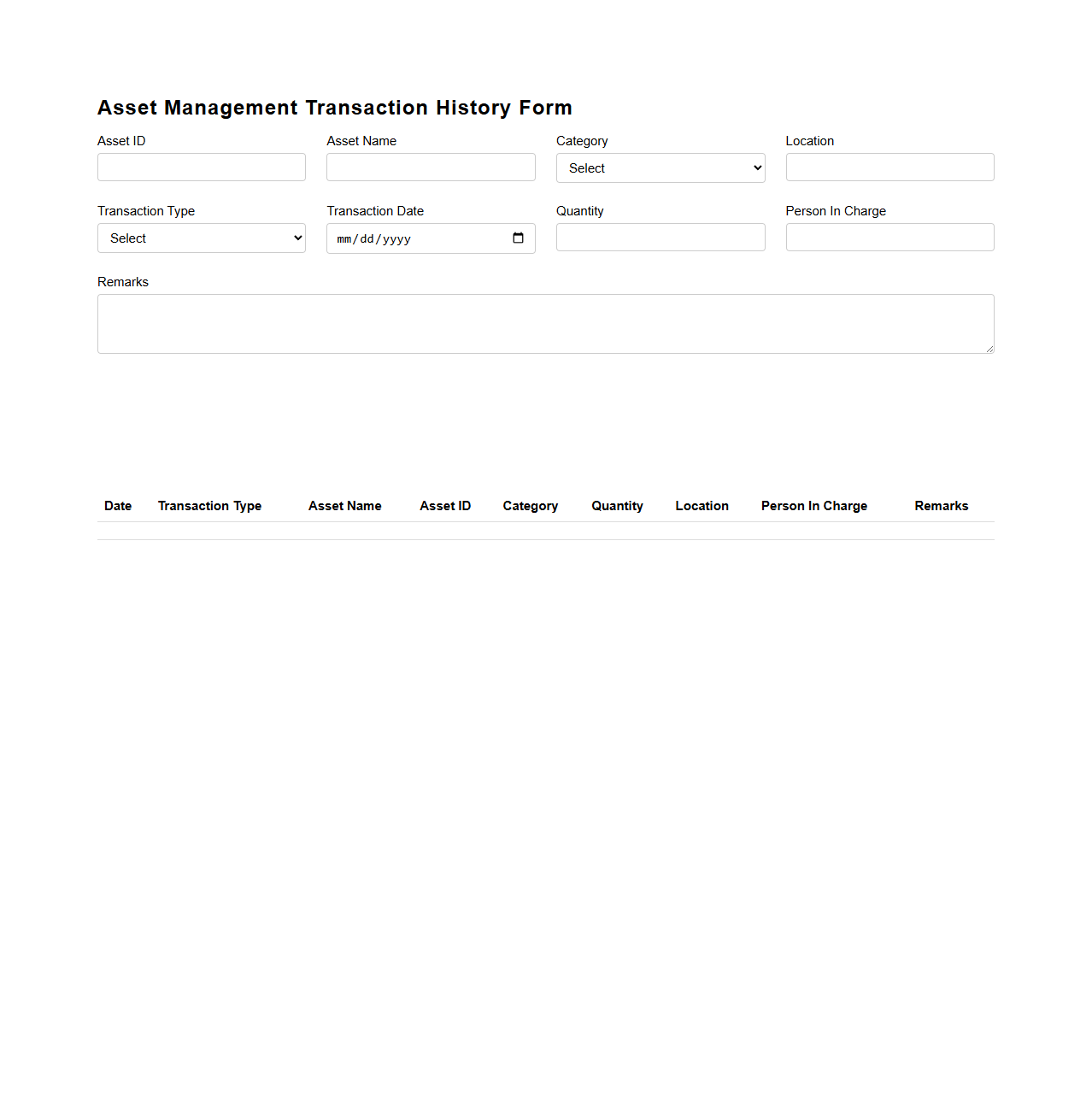

Asset Management Transaction History Form

The

Asset Management Transaction History Form is a critical document used to record and track all transactions related to company assets, including acquisitions, disposals, transfers, and depreciation. This form helps maintain an accurate and up-to-date record of asset activities, supporting effective asset control and financial reporting. It ensures compliance with audit requirements and enhances transparency in asset management processes.

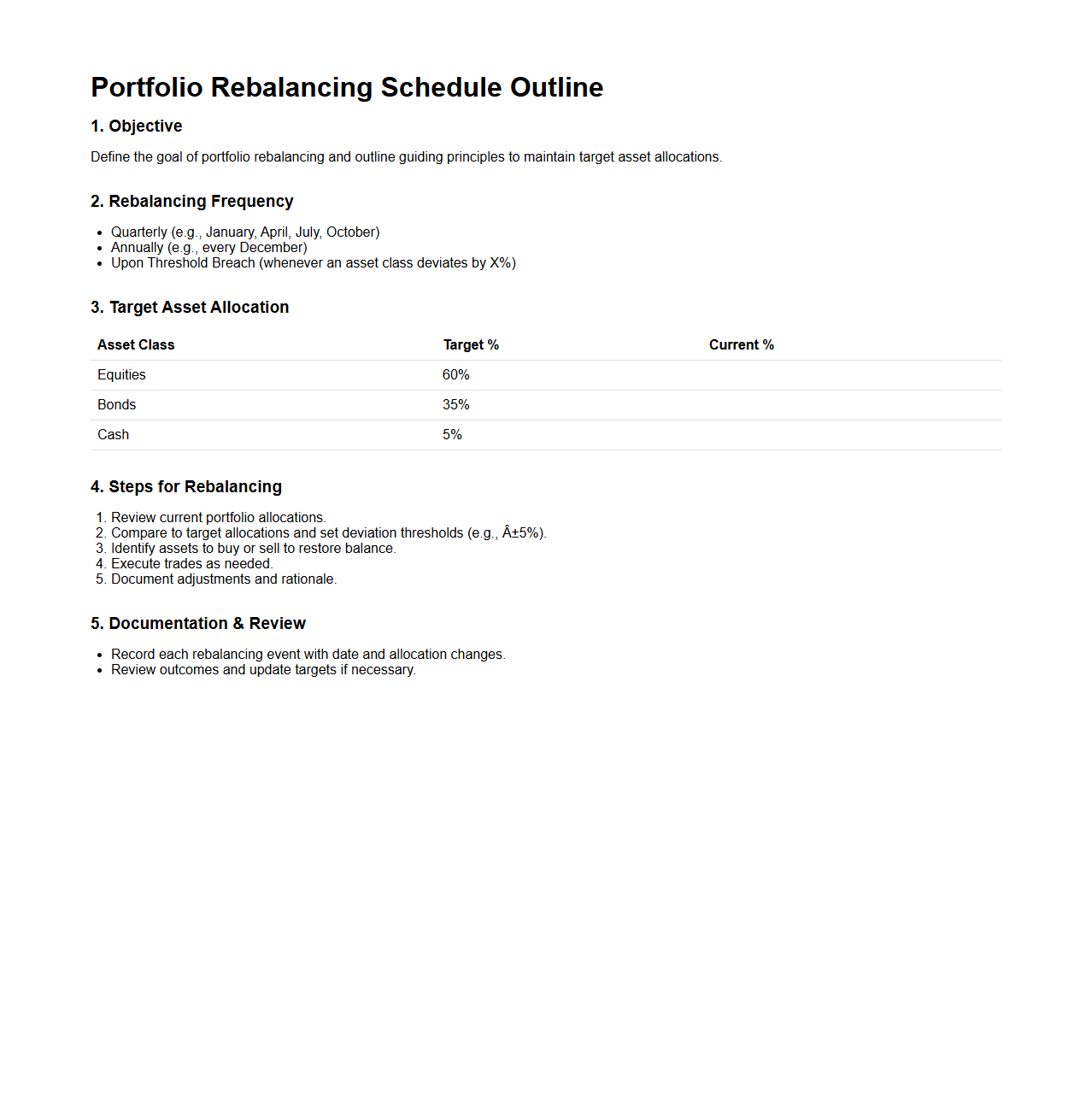

Portfolio Rebalancing Schedule Outline

A

Portfolio Rebalancing Schedule Outline document specifies the planned timing and criteria for adjusting asset allocations within an investment portfolio to maintain target risk levels and investment goals. It details the frequency, threshold triggers, and steps for periodic review and reallocation of assets such as stocks, bonds, and cash equivalents. This structured approach helps investors systematically manage portfolio drift and optimize long-term returns.

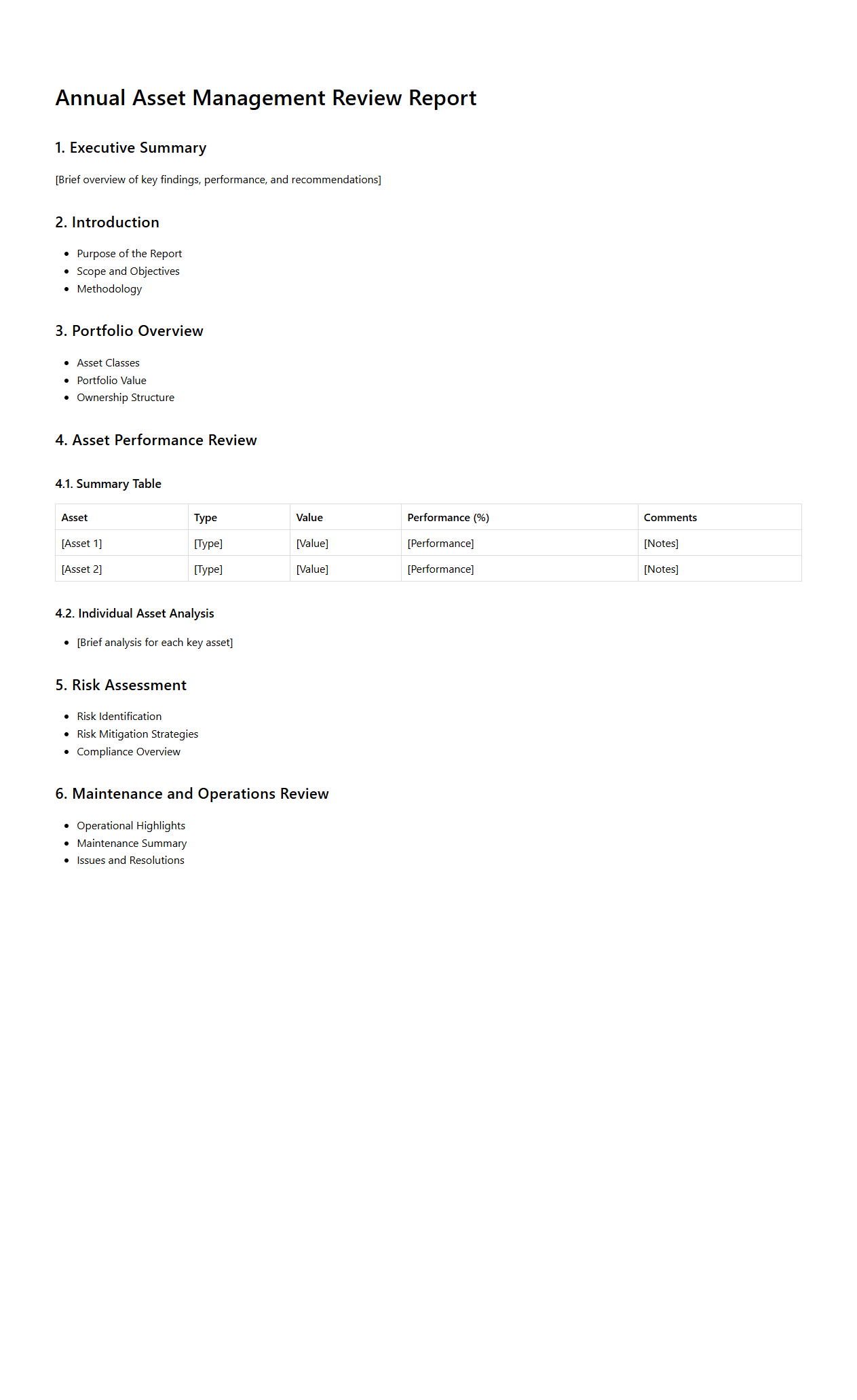

Annual Asset Management Review Report Structure

The

Annual Asset Management Review Report Structure document outlines a standardized framework for evaluating and summarizing the performance, condition, and strategic plans of asset portfolios over the past year. It includes sections such as asset inventory, financial analysis, risk assessment, compliance status, and recommendations for optimization or maintenance. This structured approach ensures comprehensive and consistent reporting, facilitating better decision-making and alignment with organizational goals.

Key Risk Metrics Detailed in the Investment Portfolio Document for Compliance Tracking

The Investment Portfolio Document emphasizes Value at Risk (VaR) as a primary risk metric to gauge potential losses under normal market conditions. It also details stress testing scenarios to assess portfolio resilience during extreme market fluctuations. Additionally, the document monitors exposure limits to ensure adherence to regulatory and internal risk thresholds.

Asset Allocation Strategies for Portfolio Diversification

The document outlines asset allocation strategies focused on diversification across various asset classes such as equities, bonds, and alternative investments. It highlights the importance of balancing risk and return by maintaining targeted allocation ranges to mitigate concentration risk. The strategy incorporates periodic reviews to realign allocations based on market conditions and investment objectives.

Benchmarks Used to Measure Portfolio Performance

The Investment Portfolio Document utilizes established market indices as benchmarks to evaluate portfolio performance objectively. Common benchmarks include the S&P 500 for equities and the Bloomberg Barclays Aggregate for fixed income. These benchmarks provide a standard for comparison, helping assess the portfolio's relative performance over time.

Liquidity Provisions and Restrictions Addressed in the Investment Portfolio Document

The document specifies liquidity requirements to ensure sufficient cash or liquid assets are available to meet short-term obligations. It also outlines restrictions on investments with limited liquidity, such as private equity or real estate holdings. Provisions include contingency plans to manage liquidity risks during periods of market stress.

Reporting Frequency and Data Granularity for Asset Monitoring

The document mandates monthly reporting to provide timely insights into portfolio performance and risk exposures. Data granularity includes detailed breakdowns by asset class, sector, and individual holdings to facilitate comprehensive analysis. This approach enables proactive management and adherence to investment guidelines.