A Tax Return Document Sample for Individuals provides a clear example of how to accurately report income, deductions, and credits on a personal tax return. This sample helps taxpayers understand the required fields and proper formatting for submitting their financial information to tax authorities. Reviewing such documents ensures compliance and reduces the risk of errors during the filing process.

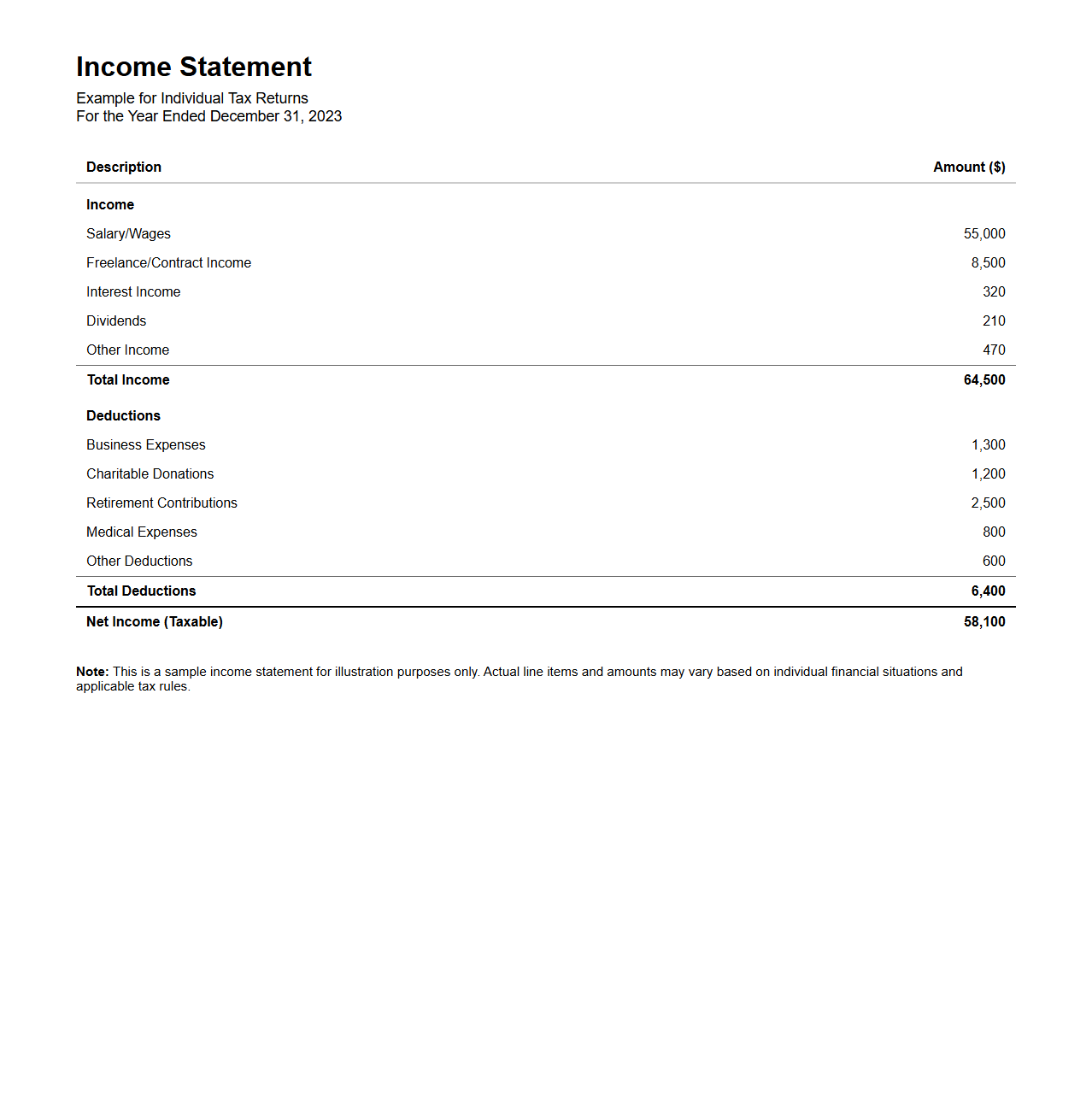

Income Statement Example for Individual Tax Returns

An

Income Statement Example for Individual Tax Returns is a detailed financial document that summarizes an individual's earnings, expenses, and net income over a specific tax year. It helps taxpayers accurately report their income sources such as wages, investments, and other revenue streams to calculate taxable income. This example serves as a practical guide for organizing financial information needed to complete individual tax filings efficiently.

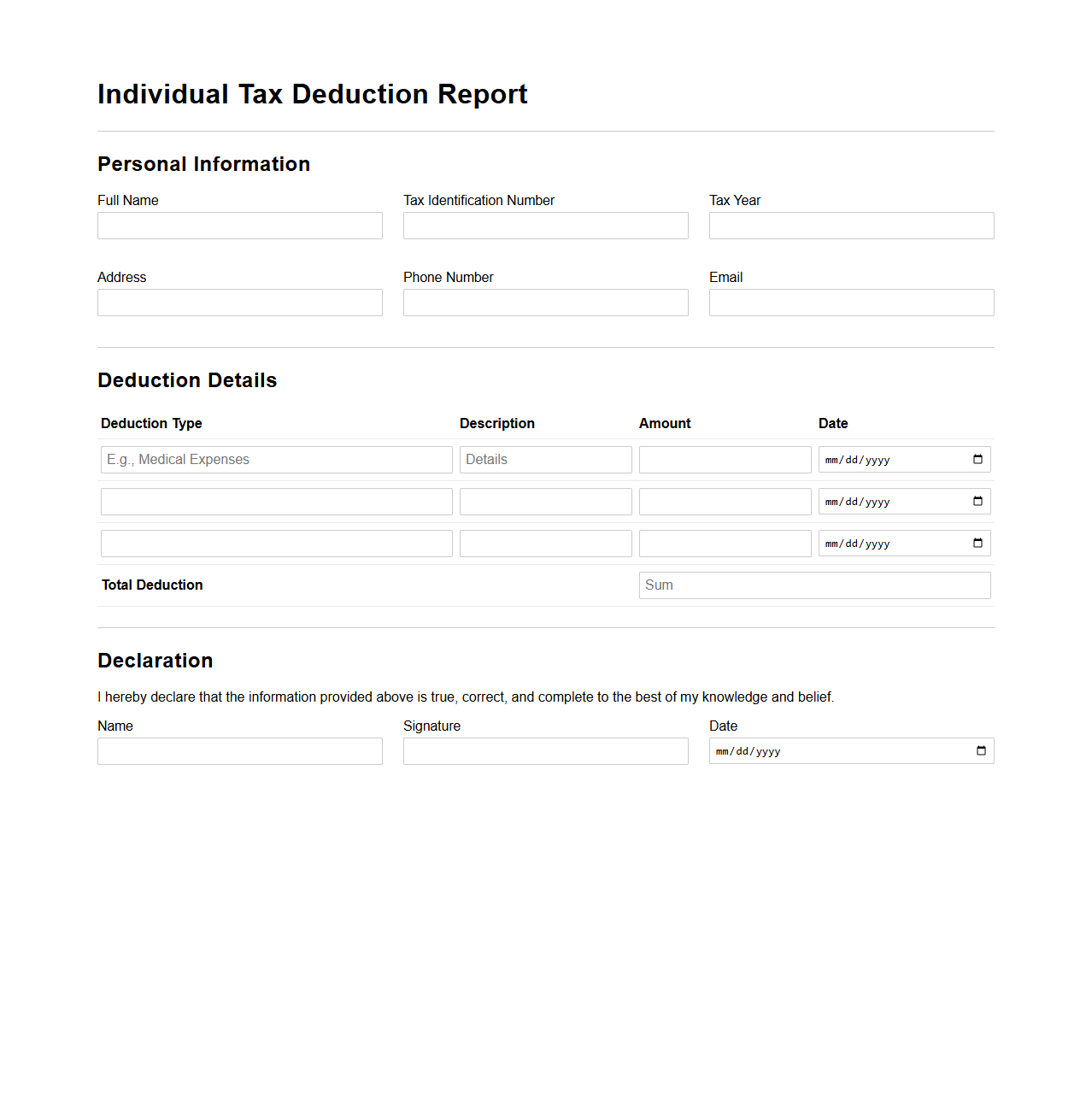

Individual Tax Deduction Report Template

The

Individual Tax Deduction Report Template document is designed to systematically track and itemize personal tax deductions for accurate financial reporting and tax filing. It organizes deductible expenses such as medical costs, educational fees, and charitable contributions, ensuring compliance with tax regulations and maximizing eligible tax benefits. This template facilitates efficient record-keeping and supports detailed documentation for audit readiness and tax return preparation.

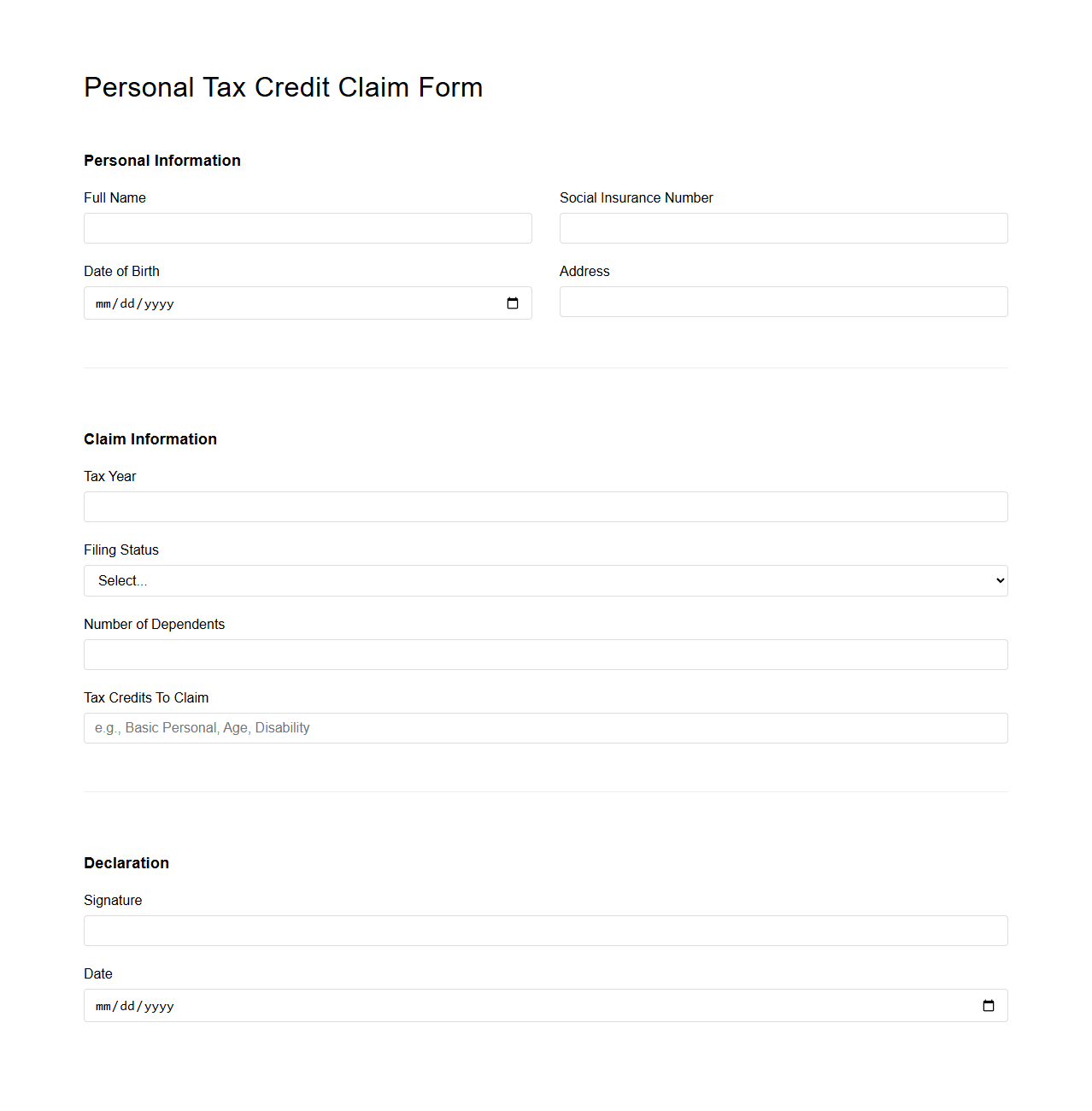

Personal Tax Credit Claim Form Sample

The

Personal Tax Credit Claim Form Sample is a standardized document used by taxpayers to claim tax credits and reduce their liability. It contains sections for personal information, tax credit entitlements, and employer details to ensure accurate tax deductions at source. This form helps individuals maximize their eligible credits in compliance with tax authority regulations.

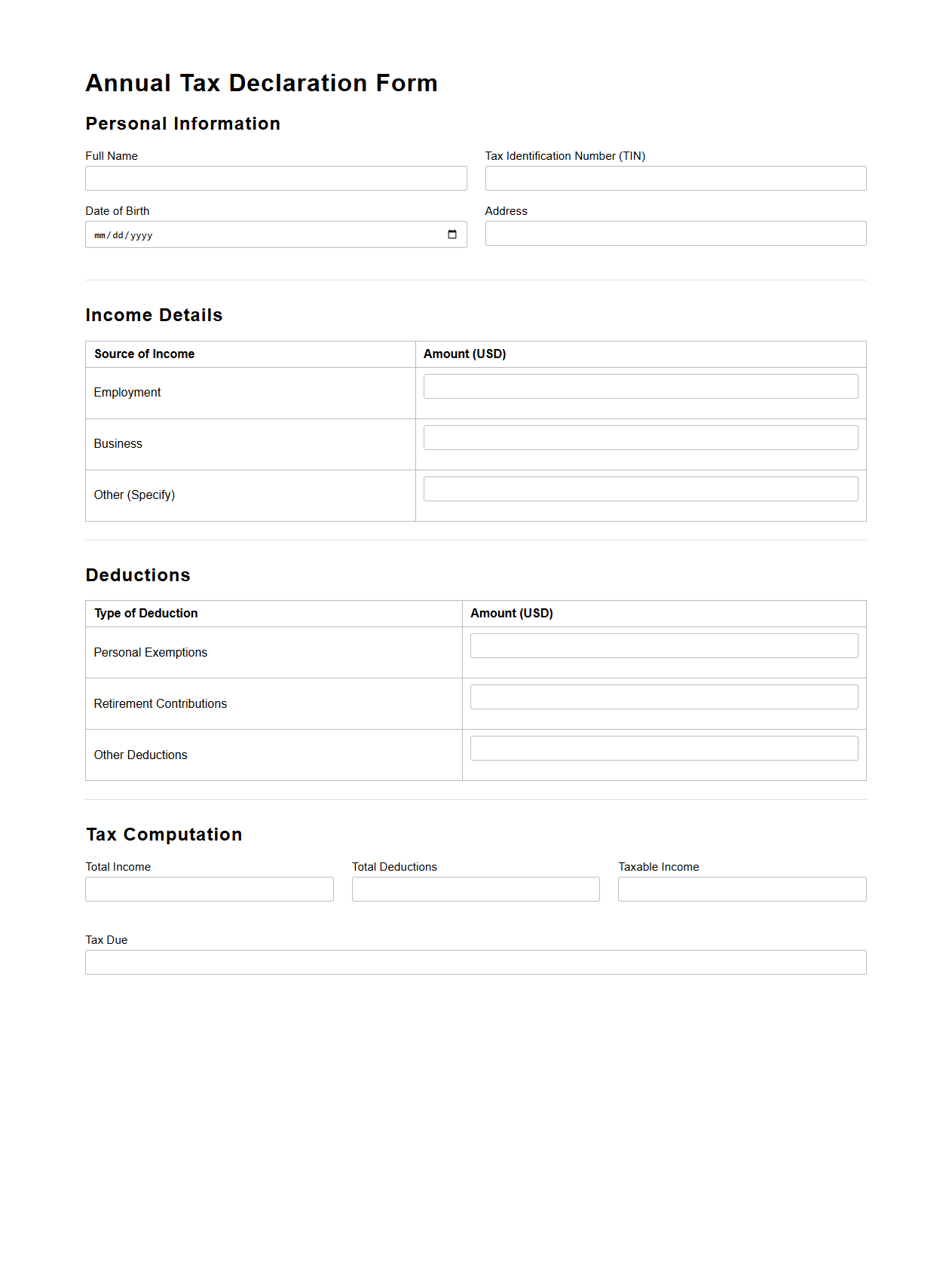

Annual Tax Declaration Sample for Individuals

The

Annual Tax Declaration Sample for Individuals is a standardized document that helps taxpayers accurately report their income, expenses, and deductions for the fiscal year. It serves as a template to guide individuals through the process of declaring taxable earnings, ensuring compliance with tax regulations and minimizing errors. Using this sample can simplify tax filing and improve the accuracy of submitted information.

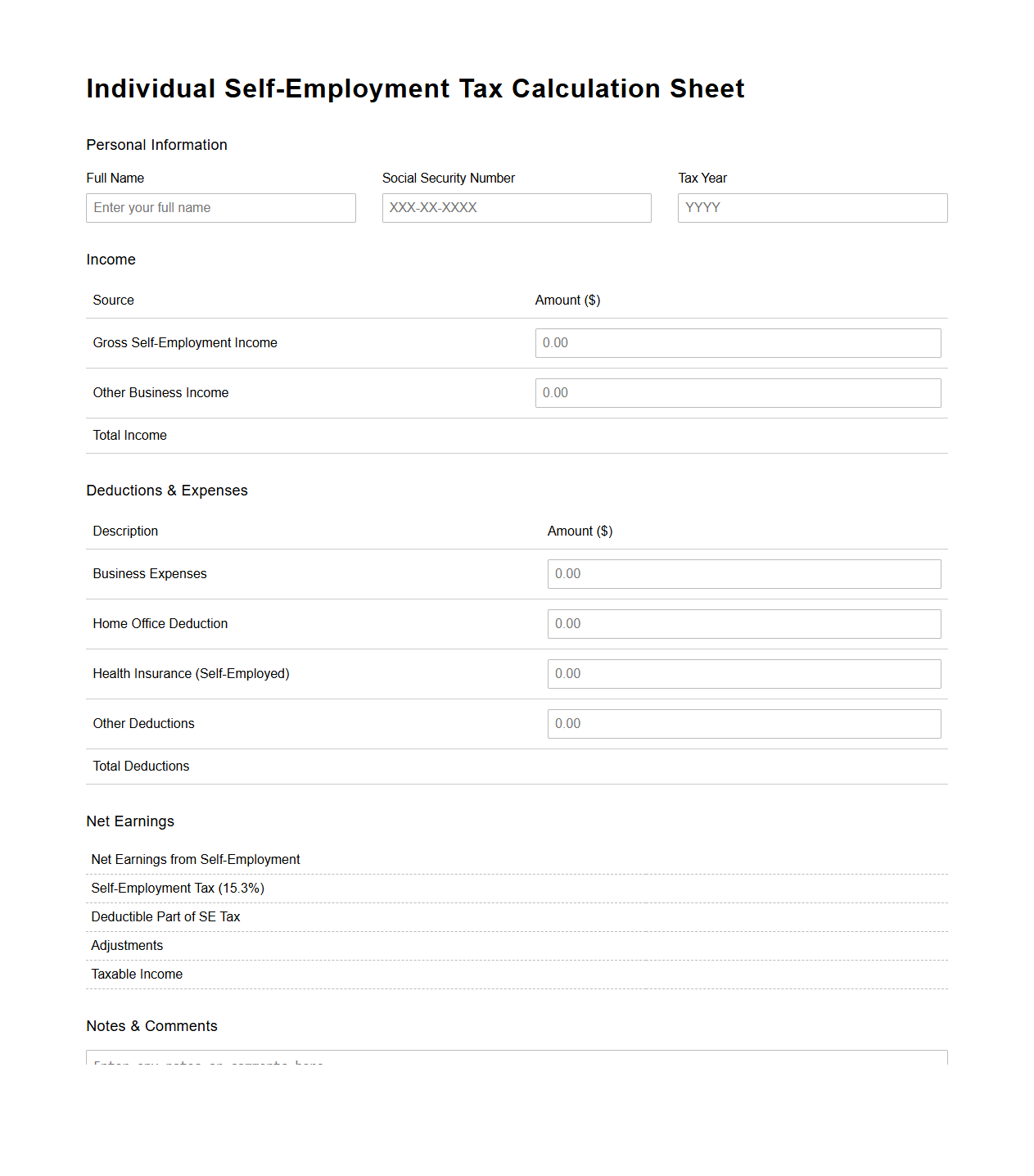

Individual Self-Employment Tax Calculation Sheet

The

Individual Self-Employment Tax Calculation Sheet is a detailed financial document used to accurately compute the self-employment tax owed by individuals who earn income outside of traditional employment. It itemizes net earnings from self-employment activities and applies the appropriate tax rates, including Social Security and Medicare contributions. This sheet ensures compliance with IRS regulations and assists in precise tax reporting and payment planning.

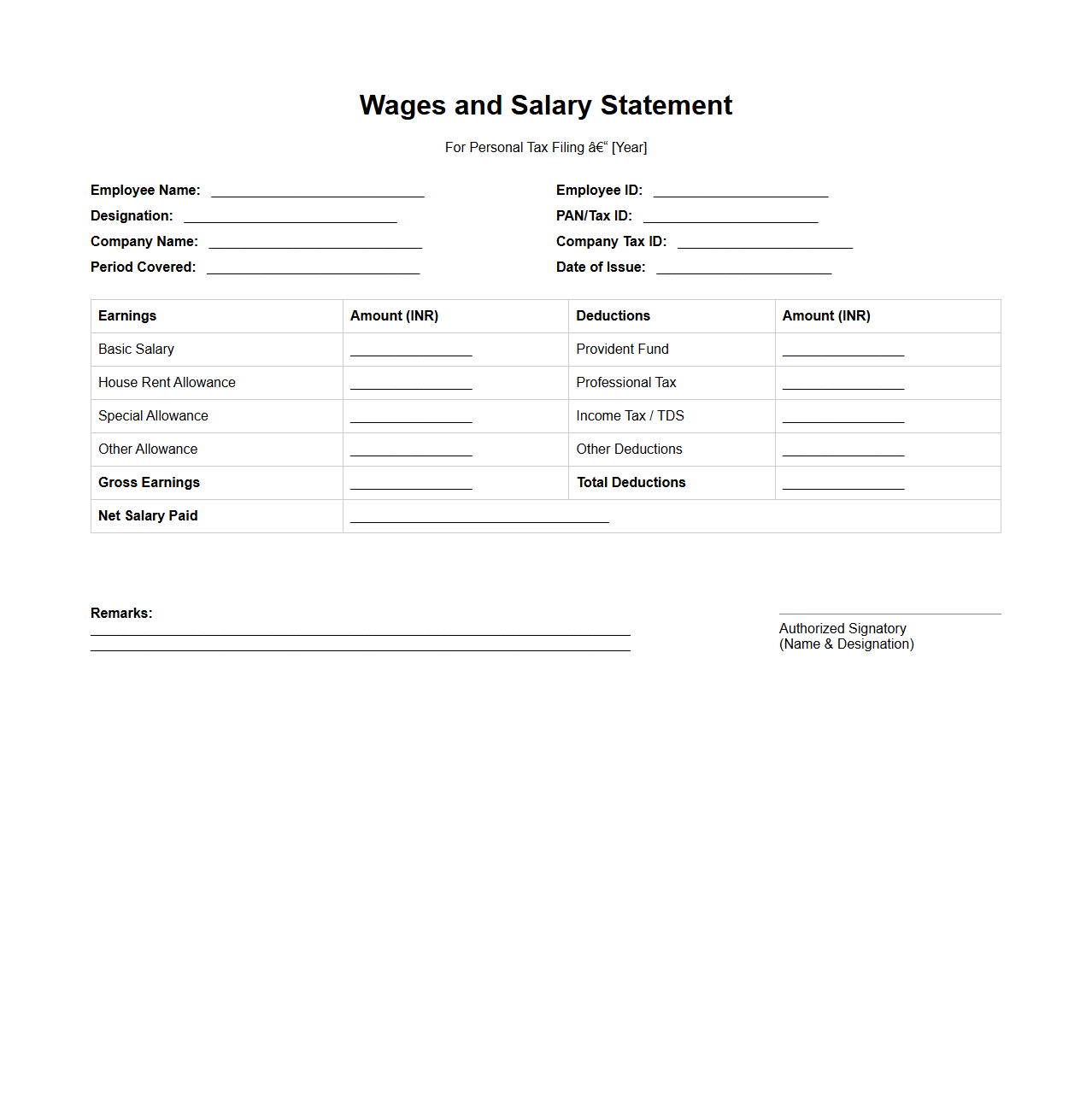

Wages and Salary Statement Format for Personal Tax Filing

A

Wages and Salary Statement Format for personal tax filing is a standardized document that details an individual's earned income over a specified period. This format typically includes information such as gross wages, deductions, net salary, tax withheld, and employer details, ensuring accurate reporting to tax authorities. Utilizing this statement facilitates proper income declaration, simplifies tax calculations, and aids in compliance with personal tax filing requirements.

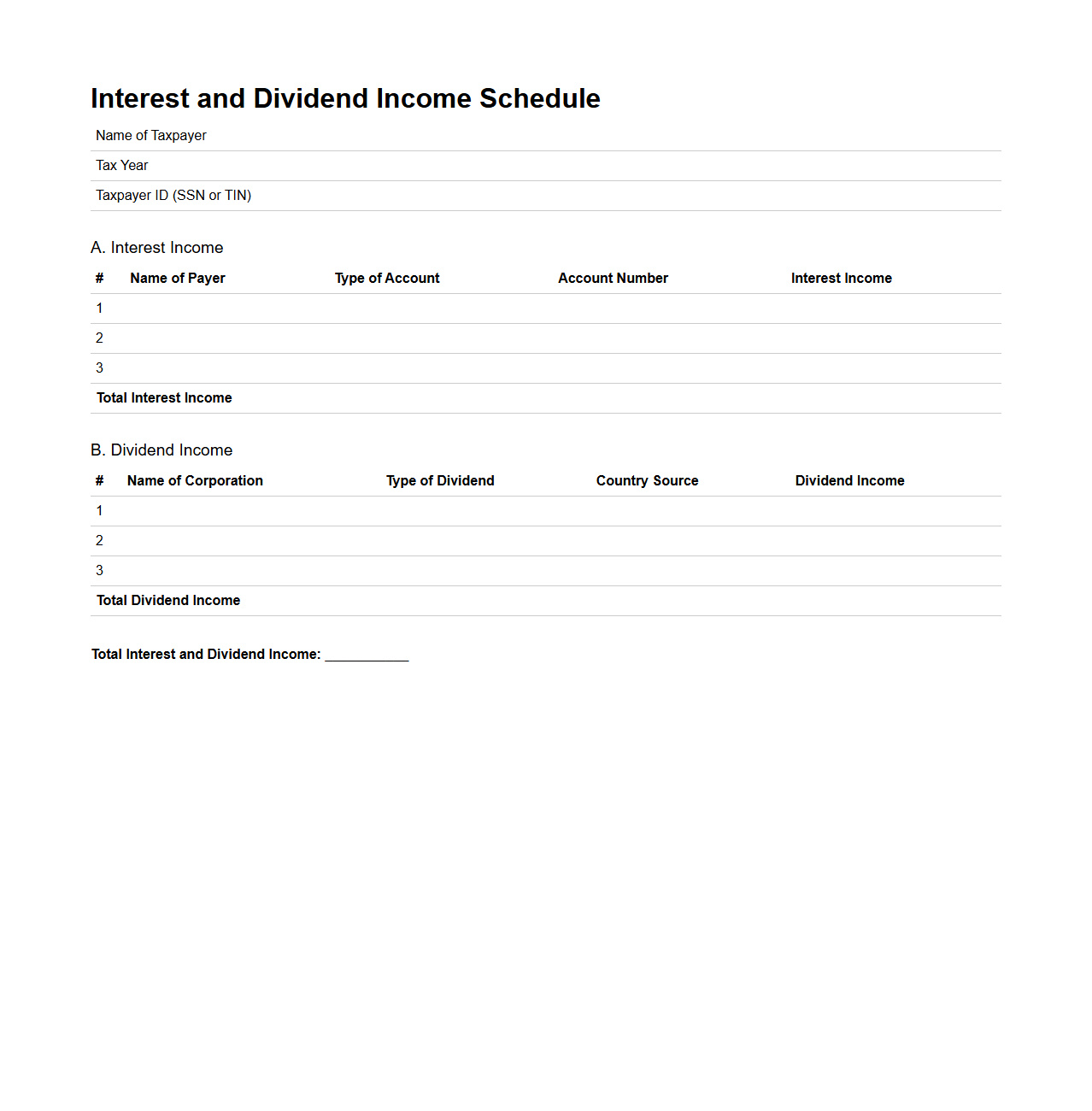

Interest and Dividend Income Schedule for Individual Returns

The

Interest and Dividend Income Schedule for Individual Returns is a tax document used to report all taxable interest and dividend income received by an individual during the fiscal year. It provides a detailed summary of income sources such as savings accounts, bonds, stocks, and mutual funds, which must be declared on the taxpayer's federal income tax return. Accurate completion of this schedule ensures proper taxation and helps avoid penalties from the IRS for underreported income.

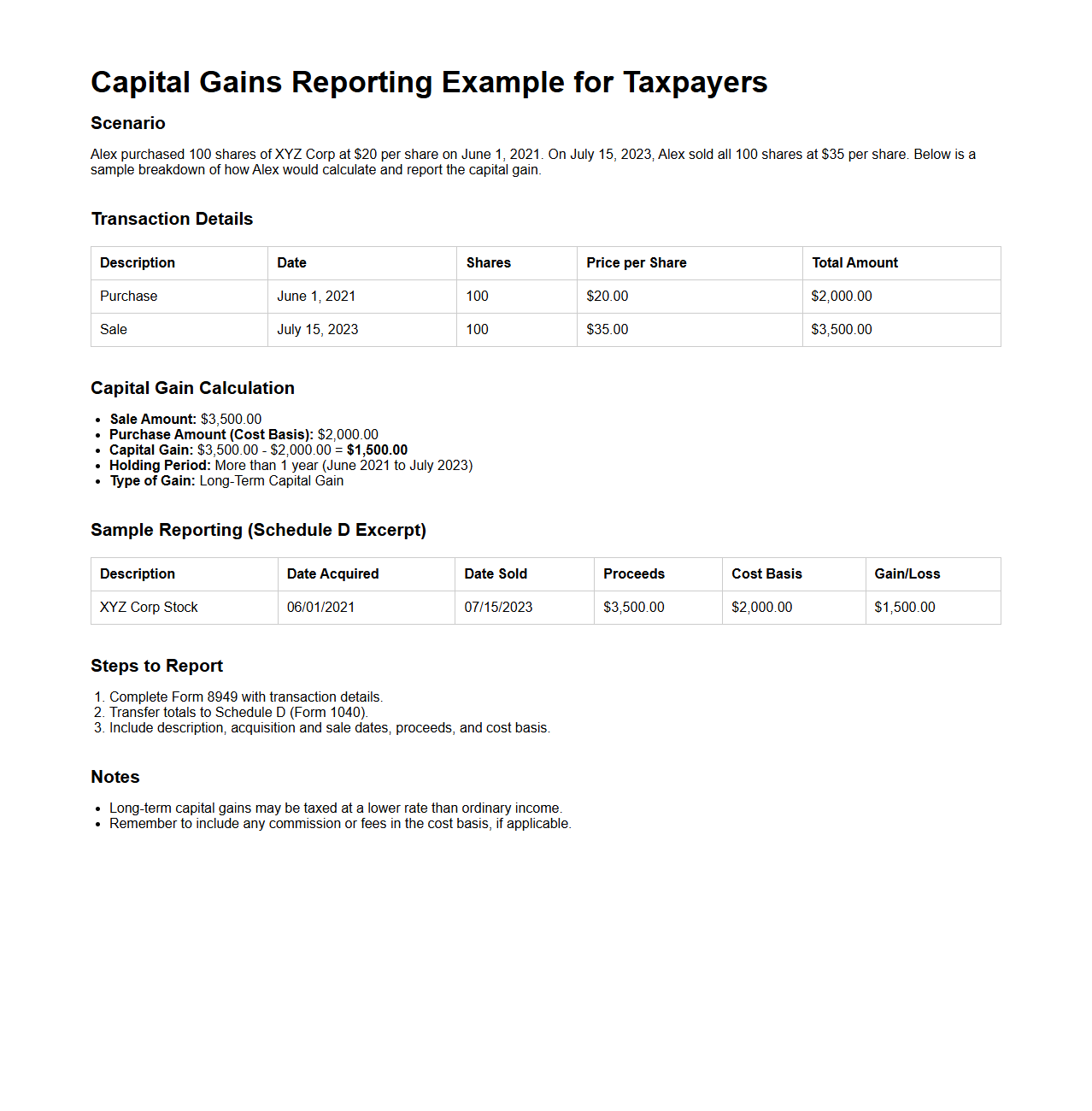

Capital Gains Reporting Example for Taxpayers

The

Capital Gains Reporting Example for Taxpayers document provides detailed guidance on how individuals should report profits earned from the sale of assets such as stocks, real estate, or other investments on their tax returns. It includes step-by-step examples illustrating the calculation of capital gains or losses, ensuring accurate declaration in compliance with tax regulations. This resource helps taxpayers understand the tax implications of their transactions and correctly fill out necessary forms like Schedule D or Form 8949.

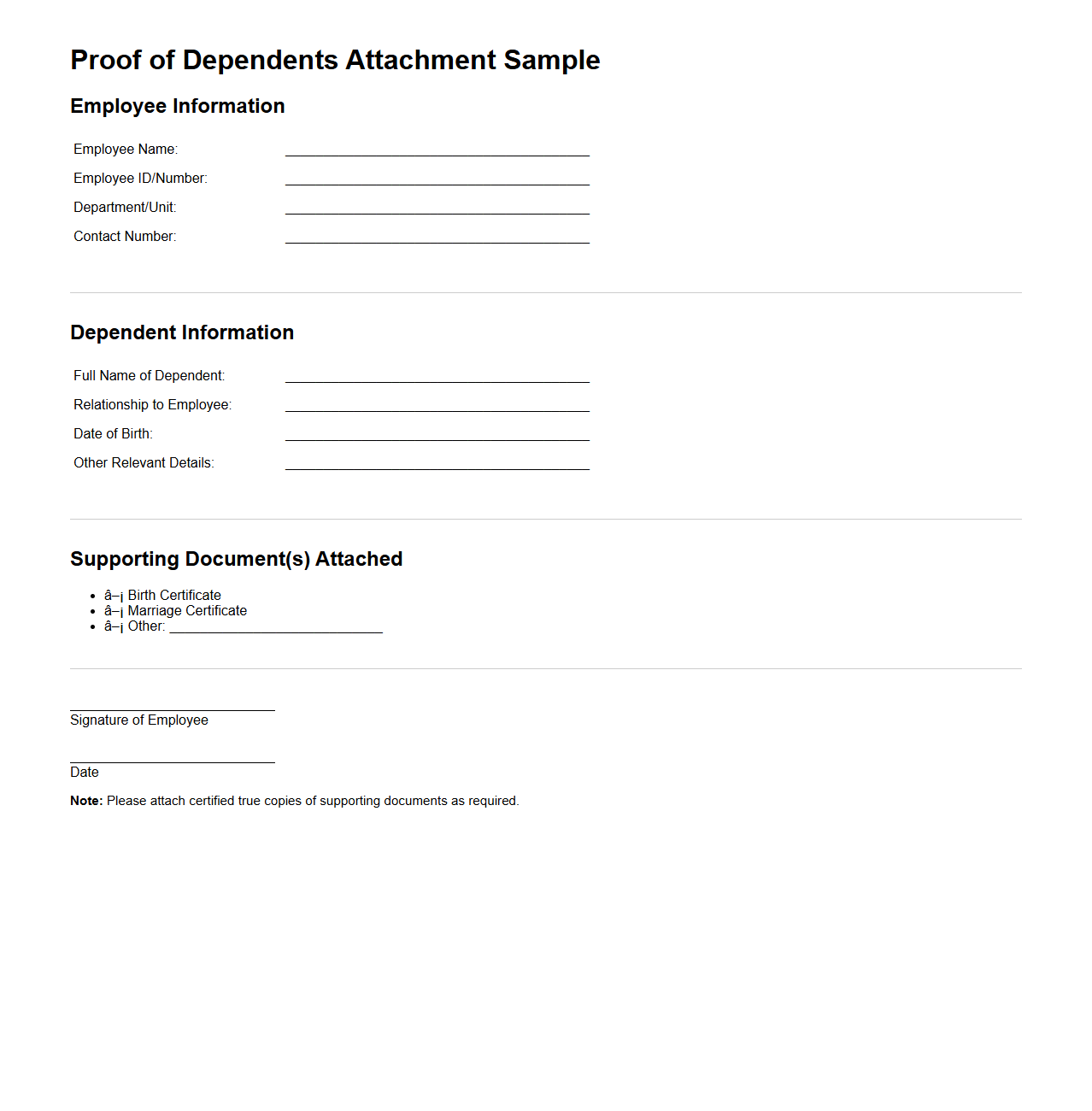

Proof of Dependents Attachment Sample

A

Proof of Dependents Attachment Sample document serves as an official form or template used to verify the existence and legitimacy of dependents claimed by an individual, often required for tax, legal, or benefit purposes. This document typically includes personal identification details, relationship verification, and supporting evidence such as birth certificates or guardianship papers to confirm dependent status. Organizations and agencies rely on this attachment to ensure accurate processing of benefits, allowances, or tax deductions linked to dependents.

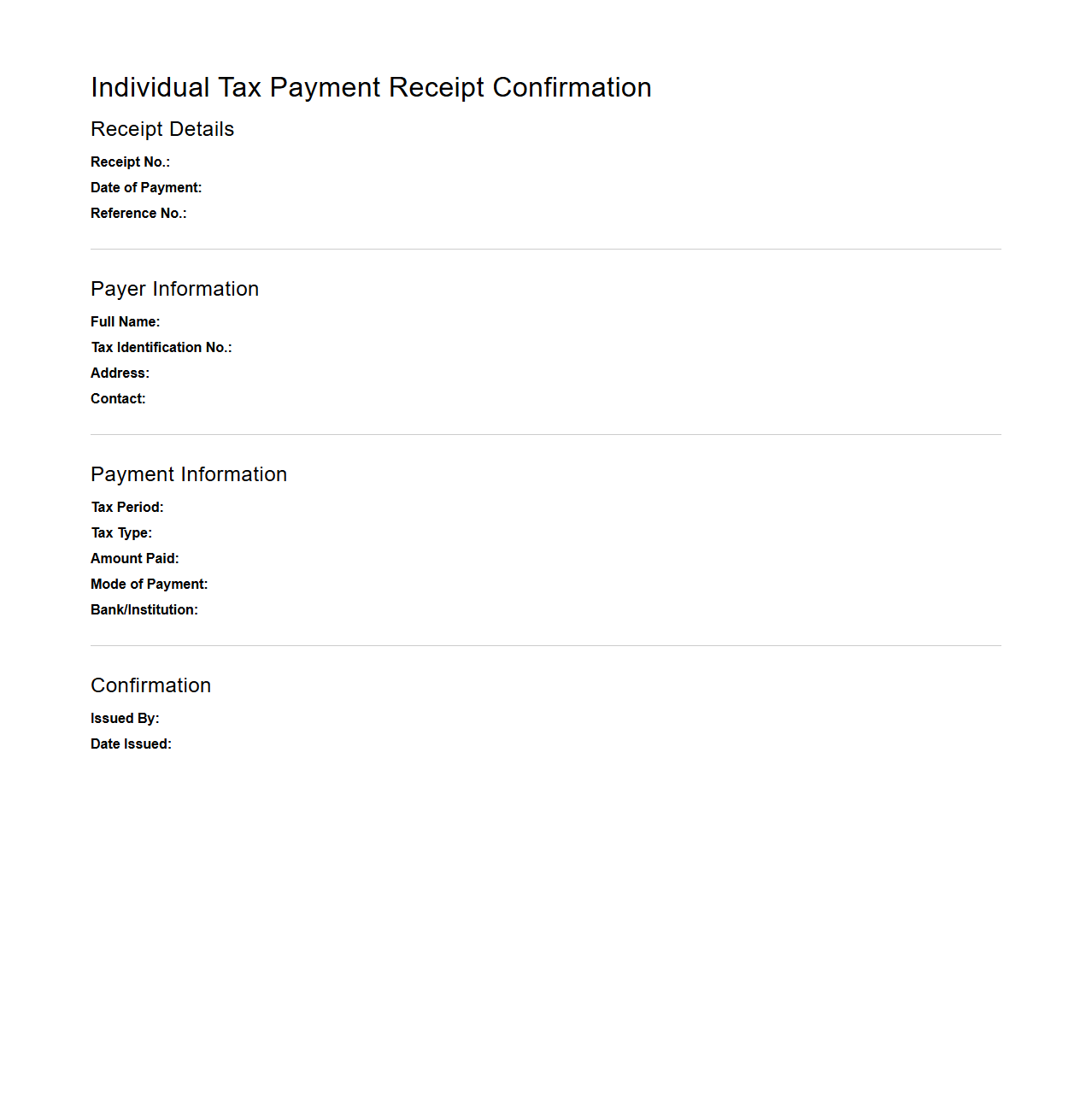

Individual Tax Payment Receipt Confirmation Template

The

Individual Tax Payment Receipt Confirmation Template document serves as an official record verifying the payment of individual taxes to the relevant tax authorities. It includes essential details such as the payer's name, tax identification number, payment amount, date of payment, and receipt number, ensuring transparent and accurate documentation of tax transactions. This template is vital for maintaining compliance with tax regulations and providing proof of payment for personal financial records or audits.

What supporting attachments are required for individual tax return letters?

When submitting an individual tax return letter, it is essential to include supporting attachments such as W-2 forms, 1099 statements, and mortgage interest statements. These documents provide verification of income and deductions claimed in the letter. Attaching complete and accurate documentation ensures the tax authority can effectively process and verify the tax return.

How should discrepancies in reported income be addressed in the tax return letter?

Discrepancies in reported income should be clearly explained with a detailed breakdown of the income sources in the tax return letter. Providing relevant documents, such as corrected W-2s or amended 1099s, helps clarify these differences to the tax agency. Transparency and thorough explanations prevent delays and potential audits during the review process.

What is the proper format for requesting a tax return correction via letter?

The proper format for a tax return correction request begins with a clear subject line stating the correction purpose. The letter should include the taxpayer's identification, the original return filing date, a description of the error, and the requested correction. Ending with a polite closing and contact details facilitates communication with the tax authorities.

How do individuals authorize a representative in a tax return correspondence?

Individuals must include a formal authorization statement in their tax return correspondence to appoint a representative. Attaching a Power of Attorney (Form 2848) or similar documentation grants the named representative authority to discuss or handle tax matters. This authorization ensures the representative can legally act on behalf of the taxpayer.

Which specific tax year should be referenced in the opening of the tax return document letter?

The opening of the tax return document letter should explicitly reference the tax year under review to avoid confusion. Including the calendar year, for example, "Tax Year 2023," clarifies the scope of the correspondence. Precise identification helps direct the letter to the appropriate records and personnel.