A Tax Return Document Sample for Individual Filing provides a clear example of how to accurately report personal income, deductions, and credits for a single taxpayer. This sample helps individuals understand the necessary sections, such as income sources, tax payments, and refund calculations. Using a well-structured document as a reference ensures compliance with tax regulations and facilitates error-free filing.

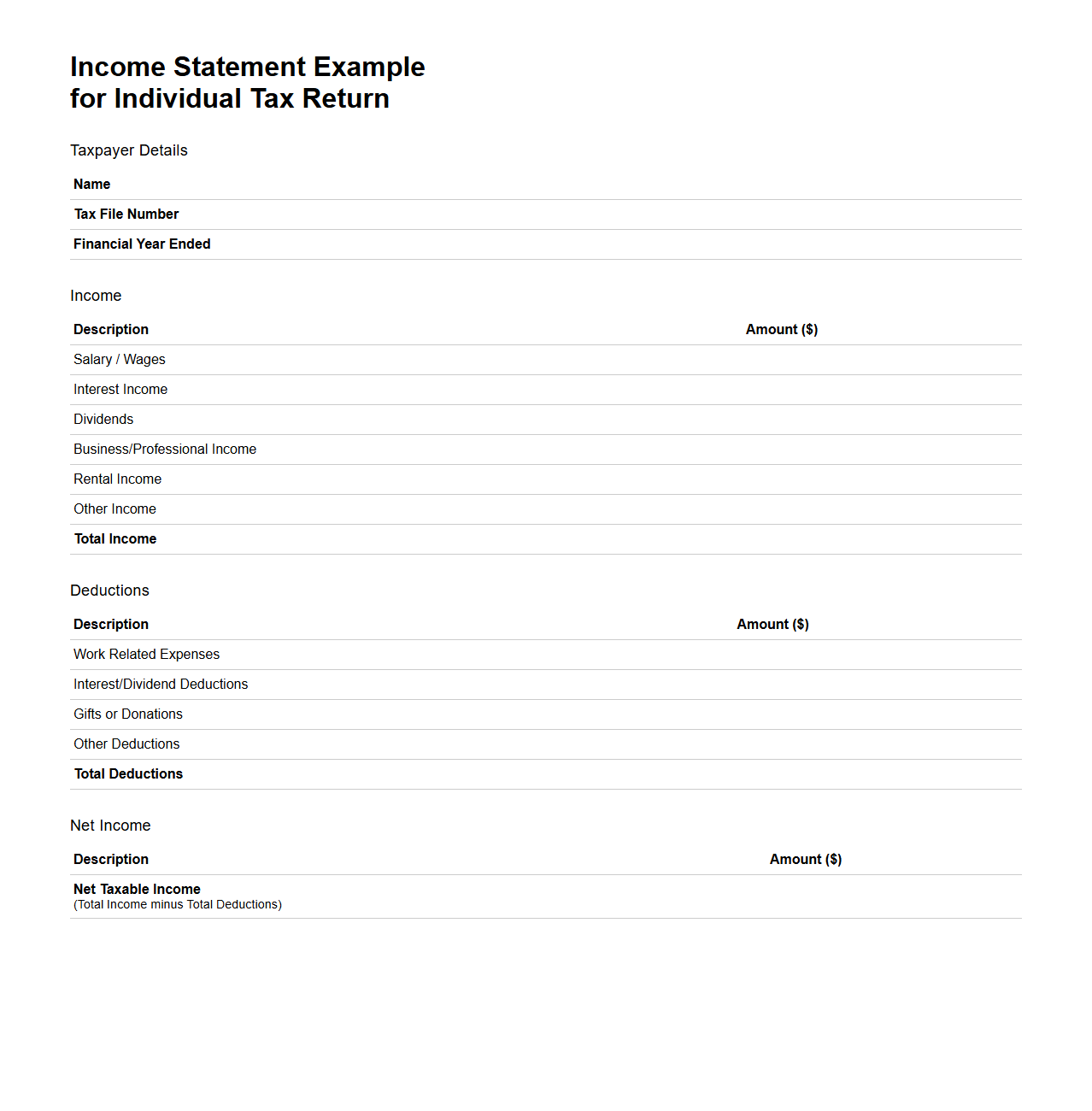

Income Statement Example for Individual Tax Return

An

Income Statement Example for Individual Tax Return document outlines a detailed summary of an individual's earnings, expenses, and deductions over a fiscal year. It provides a clear framework for reporting income sources such as wages, dividends, and rental income, alongside deductible expenses that reduce taxable income. This document is essential for accurate tax filing and ensuring compliance with tax regulations.

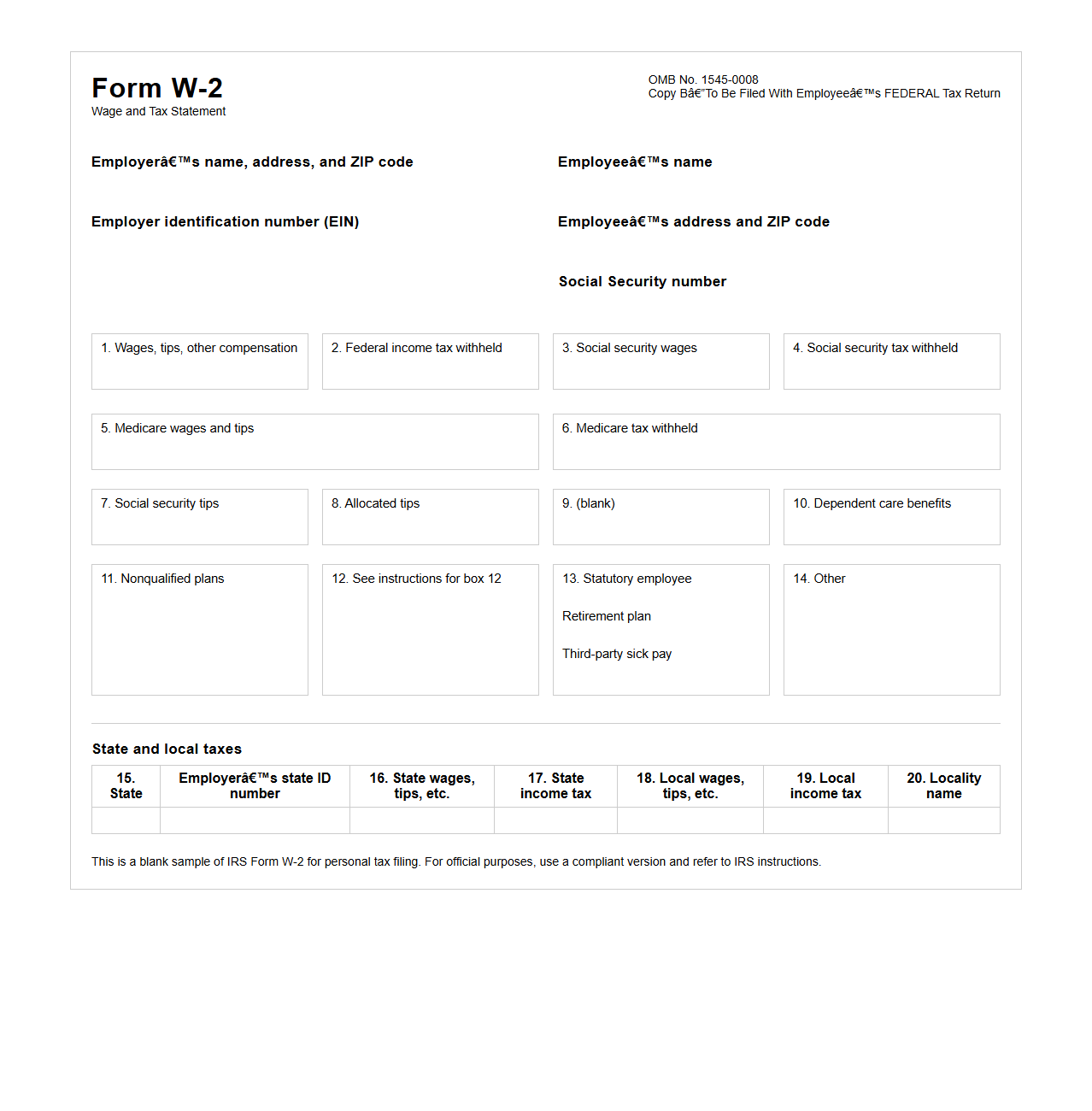

Form W-2 Sample for Personal Tax Filing

A

Form W-2 Sample for personal tax filing is a standardized document provided by employers that reports an employee's annual wages and the amount of taxes withheld from their paycheck. This form is essential for accurately completing individual tax returns, as it contains key details such as federal, state, and Social Security tax withholdings. Reviewing a W-2 sample helps taxpayers understand how to read their own form and ensures proper reporting to the Internal Revenue Service (IRS).

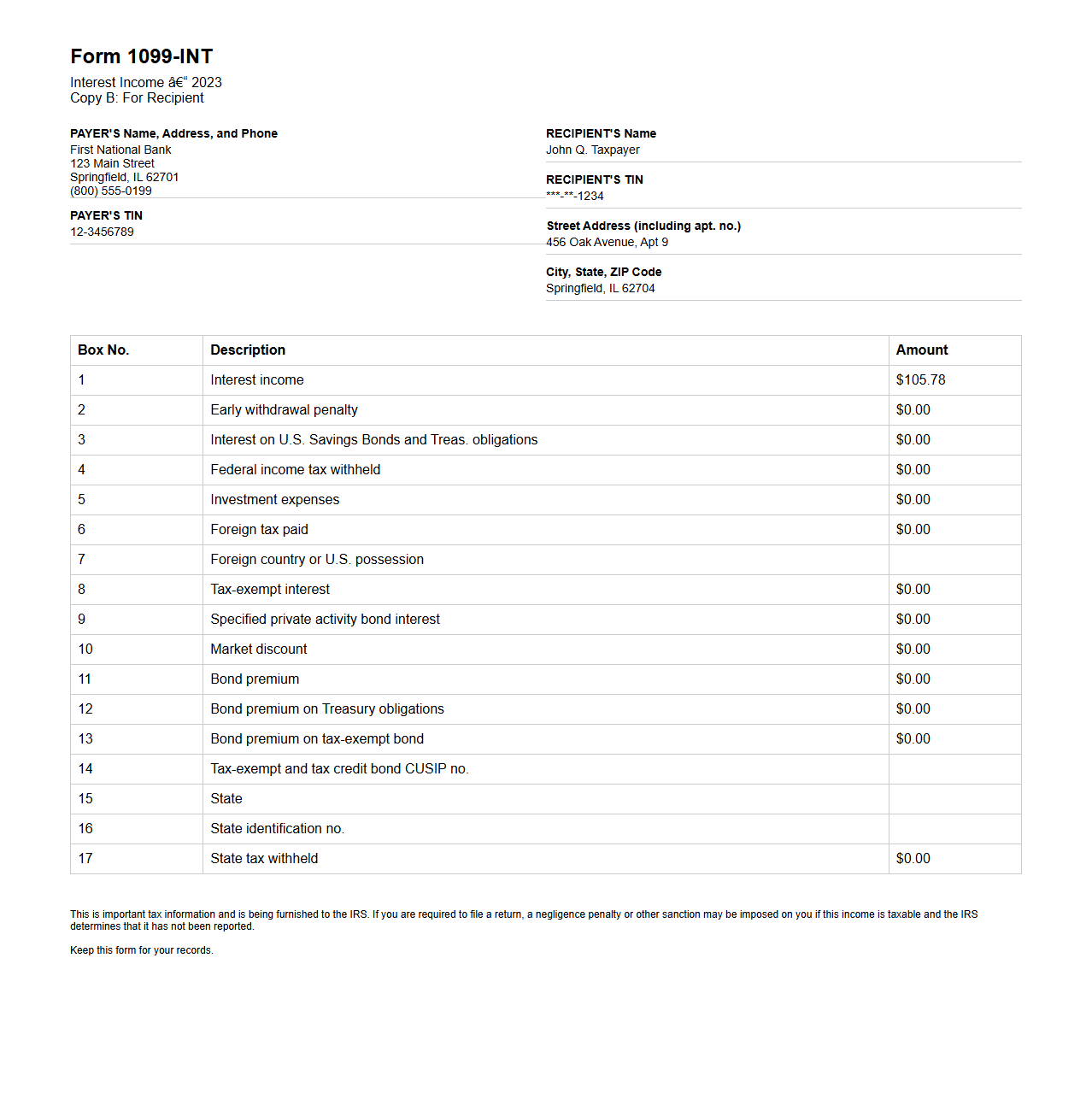

Form 1099-INT Example for Individual Tax Preparation

Form 1099-INT is a crucial IRS document used to report interest income earned by an individual during the tax year. This form details the amount of interest paid by banks, financial institutions, or other payers, which must be included when preparing individual tax returns. Understanding how to correctly incorporate

Form 1099-INT ensures accurate reporting of interest income and compliance with tax regulations.

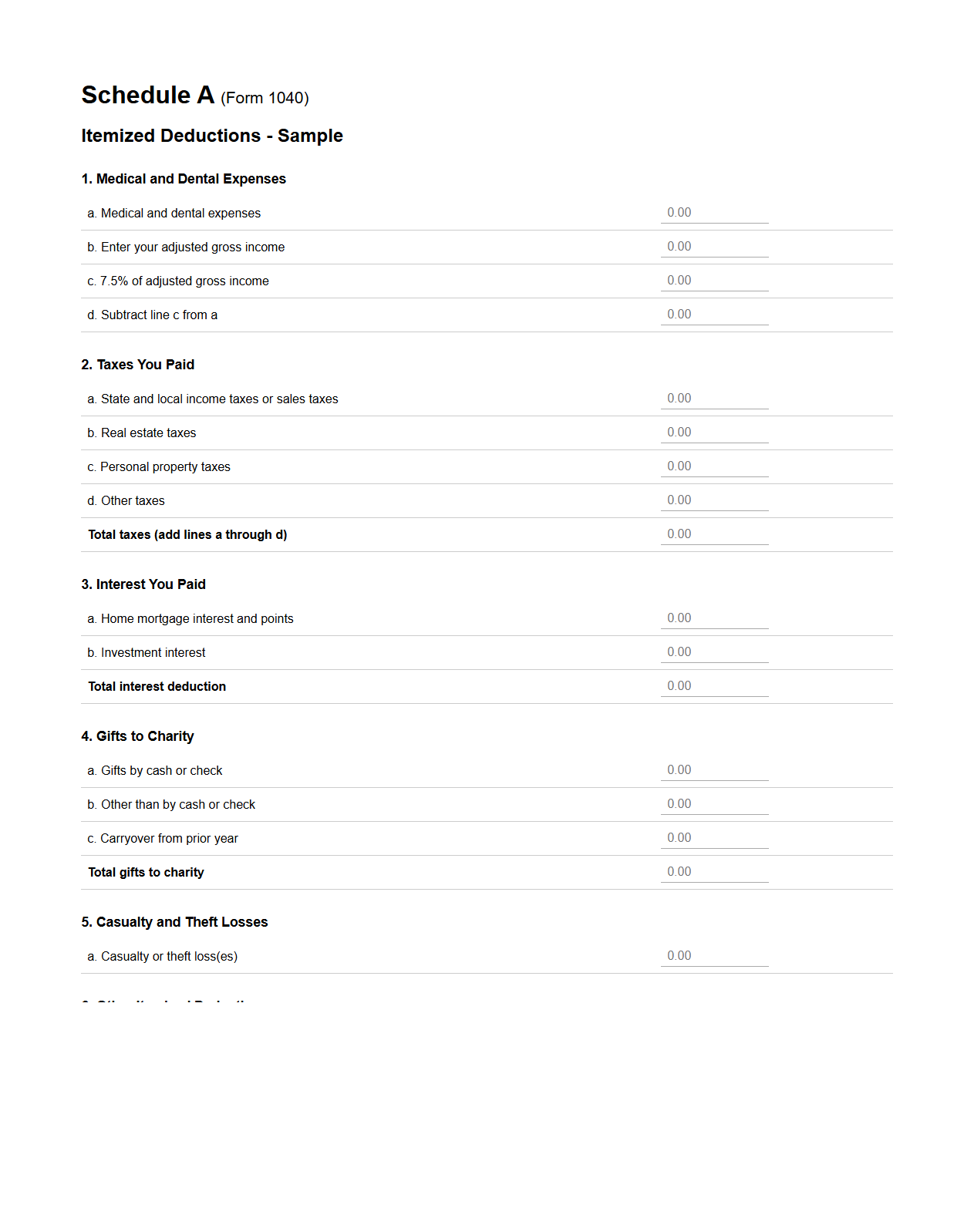

Schedule A Sample for Itemized Deductions

Schedule A Sample for Itemized Deductions is a tax form used by individuals to report and claim specific expenses that qualify for

itemized deductions on their federal income tax return. This document helps taxpayers reduce their taxable income by detailing deductible expenses such as medical costs, mortgage interest, charitable contributions, and state and local taxes. Properly completing the Schedule A can maximize potential tax savings by accurately reflecting eligible personal expenses.

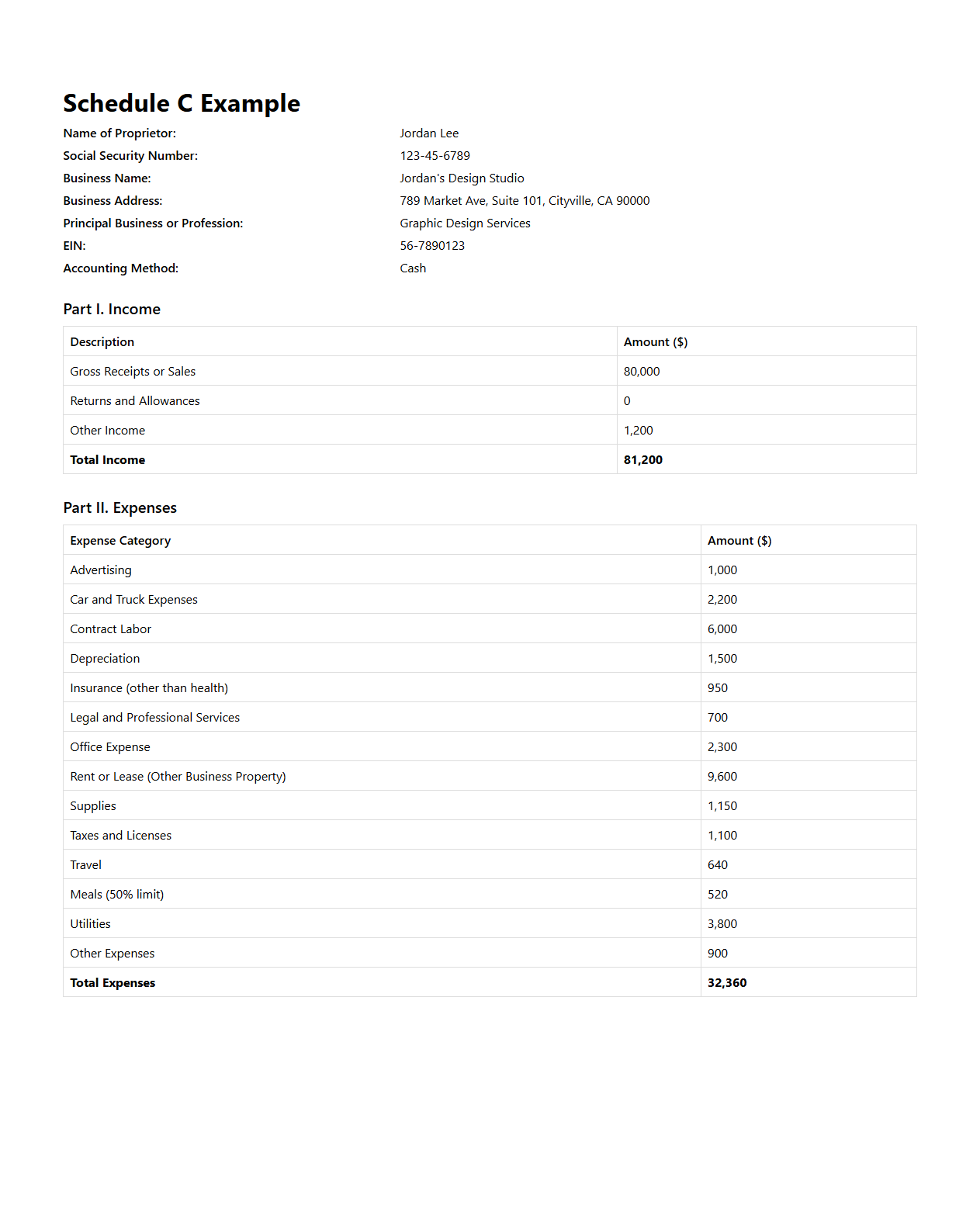

Schedule C Example for Sole Proprietor Tax Filing

Schedule C is a tax form used by sole proprietors to report income and expenses from their business operations. This document details

business profits or losses, including revenue, cost of goods sold, and deductible expenses, which directly impact the owner's taxable income. Proper completion of Schedule C ensures accurate calculation of self-employment tax and eligible deductions for sole proprietors on their federal tax returns.

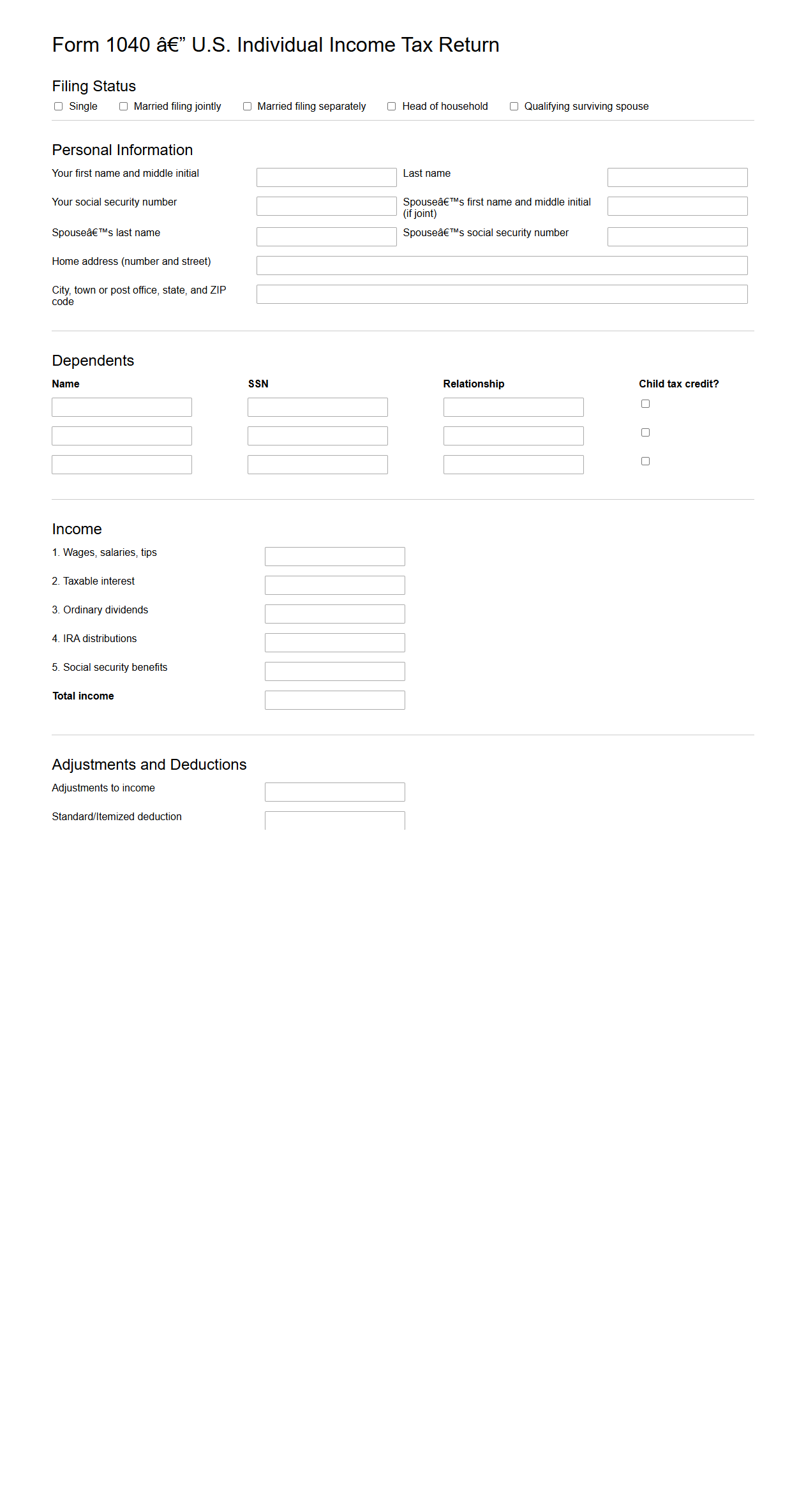

Form 1040 Example for Individual Taxpayer

Form 1040 Example for Individual Taxpayer is a federal tax document used to report an individual's income, calculate taxes owed, and determine eligibility for tax credits or refunds. This form includes sections for reporting wages, interest income, deductions, and other tax-related information. Understanding the

Form 1040 Example helps taxpayers accurately complete their annual income tax returns.

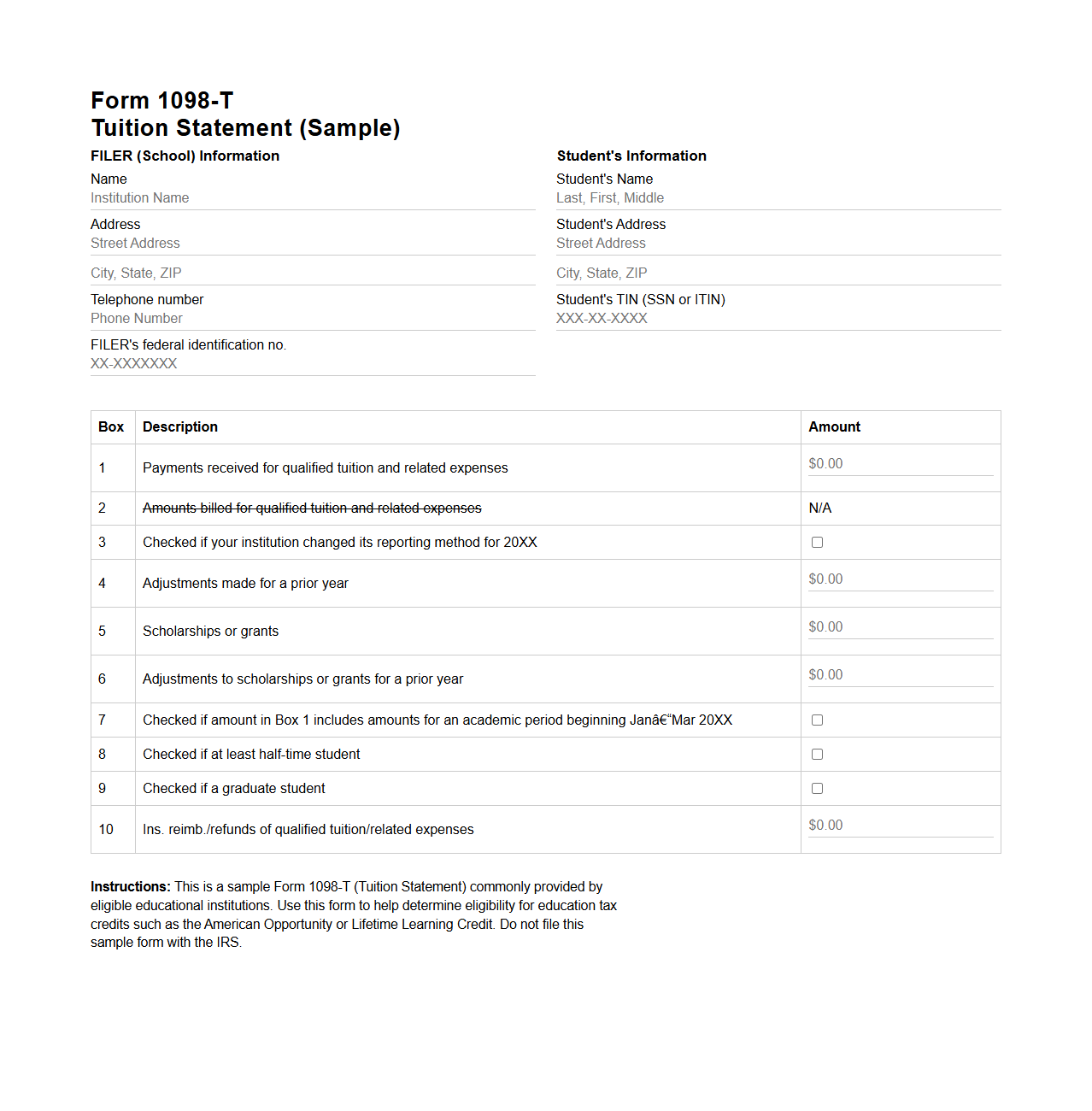

Form 1098-T Sample for Education Tax Credit

Form 1098-T Sample is an essential

education tax credit document provided by eligible educational institutions to report qualified tuition and related expenses. It helps students and parents claim education credits such as the American Opportunity Credit or Lifetime Learning Credit on their federal tax returns. The form includes details like amounts paid, scholarships received, and enrollment status, ensuring accurate tax benefits.

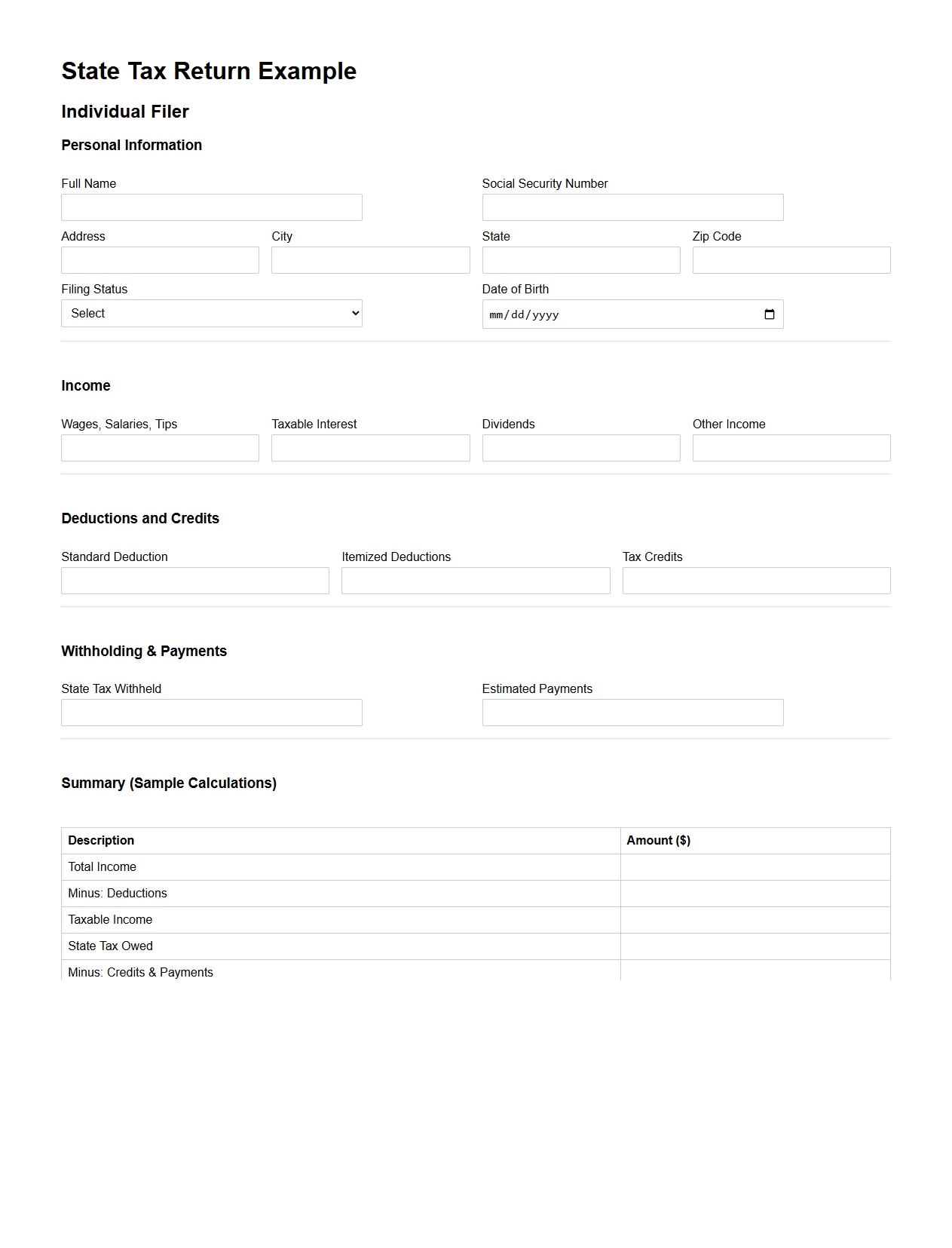

State Tax Return Example for Individual Filer

A

State Tax Return Example for Individual Filer document demonstrates how to accurately complete a state income tax form, including essential sections like income reporting, deductions, and credits specific to individual taxpayers. This example helps filers understand state-specific tax laws and ensures compliance with filing requirements. Reviewing such a document can reduce errors and improve the accuracy of one's state tax filing process.

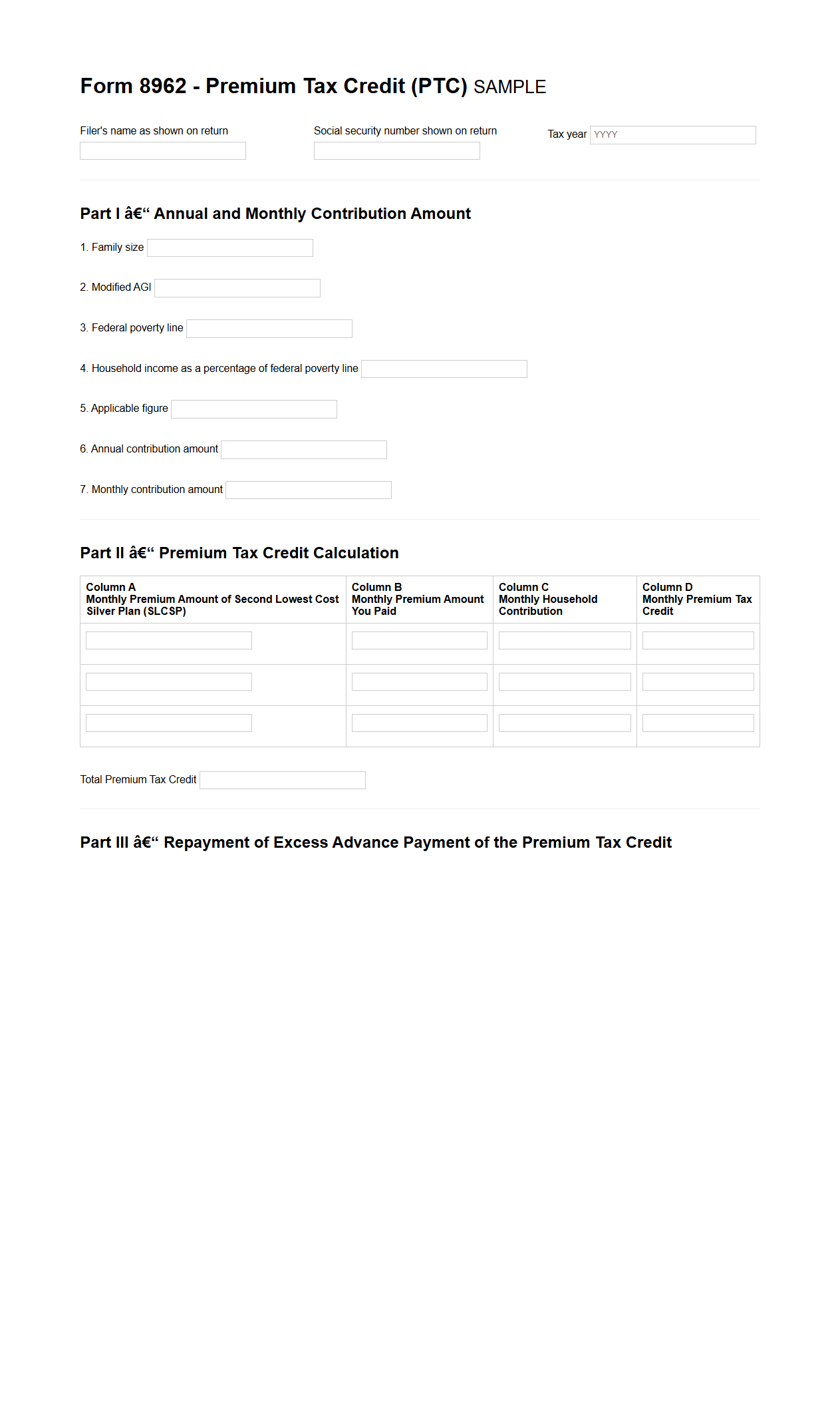

Form 8962 Sample for Premium Tax Credit

Form 8962 Sample for Premium Tax Credit document provides a detailed example of how to complete IRS Form 8962, which is used to calculate the

Premium Tax Credit (PTC) for health insurance purchased through the Health Insurance Marketplace. This sample illustrates the step-by-step process to reconcile advance payments of the premium tax credit with the actual credit amount based on income and coverage details. Taxpayers use this form to ensure they receive the correct amount of subsidy or repay any excess credit received during the tax year.

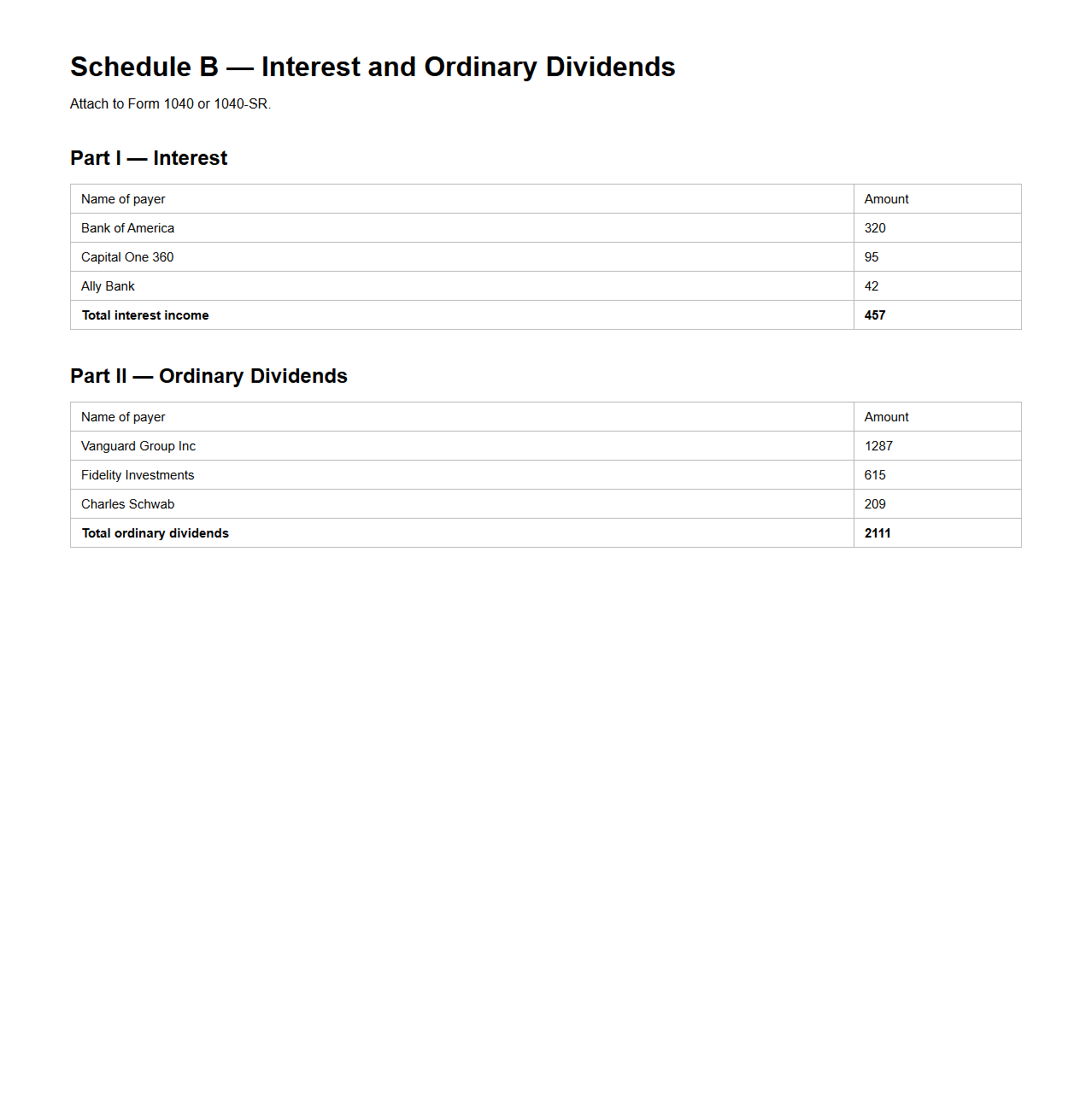

Schedule B Example for Interest and Dividend Income

A

Schedule B Example for Interest and Dividend Income document outlines how to report taxable interest and dividend earnings on your tax return. It includes sections to list the names of payers, amounts received, and any taxable interest or dividends exceeding $1,500. This schedule is essential for accurately calculating taxable income and ensuring compliance with IRS reporting requirements.

What supporting documents are required for an individual's first-time tax return filing?

For a first-time tax return filing, you must provide identification documents such as your Social Security number or tax ID. Additionally, supporting documents include income statements like W-2s or 1099 forms from employers or clients. Receipts and deduction proofs like charitable donations or medical expenses are also essential to validate any claims.

How should foreign income be reported in an individual tax return document?

Foreign income must be reported in the foreign income section or on specific schedules depending on your tax jurisdiction. You should convert all foreign earnings to your local currency using the official exchange rate at the time of income receipt. Proper documentation, such as foreign tax returns or payment proofs, should be attached to avoid potential double taxation.

Which sections of the tax return document apply to freelance or gig income?

Freelance or gig income is typically reported under the self-employment income section. This includes filling out schedules such as Schedule C or Schedule SE to detail earnings and expenses related to your freelance activities. Accurately reporting income here ensures proper calculation of self-employment taxes and allowable business deductions.

Are there specific fields for claiming home office deductions in the individual filing?

Yes, most individual tax return documents provide designated fields for the home office deduction. Taxpayers must document the square footage of the workspace and total home to establish the proportion used exclusively for business. Supporting details such as utility bills and rent or mortgage interest statements are necessary to validate this deduction claim.

How should corrected information be documented in an amended individual tax return?

When submitting an amended tax return, use the designated form like Form 1040-X or its equivalent in your jurisdiction to report corrected information. Attach supporting documents that explain and justify any changes made to the original return. Clearly identifying errors and providing the accurate data helps ensure the amendment is processed efficiently.