Asset Register Template for Banking Institutions

An Asset Register Template for Banking Institutions is a structured document designed to systematically record and track all physical and financial assets owned by the bank, including equipment, technology, and real estate. This template ensures accurate asset management, facilitates regulatory compliance, and supports financial reporting by providing detailed information on asset value, location, acquisition date, and depreciation. Maintaining a comprehensive

asset register enhances the bank's ability to safeguard assets, optimize asset utilization, and streamline audit processes.

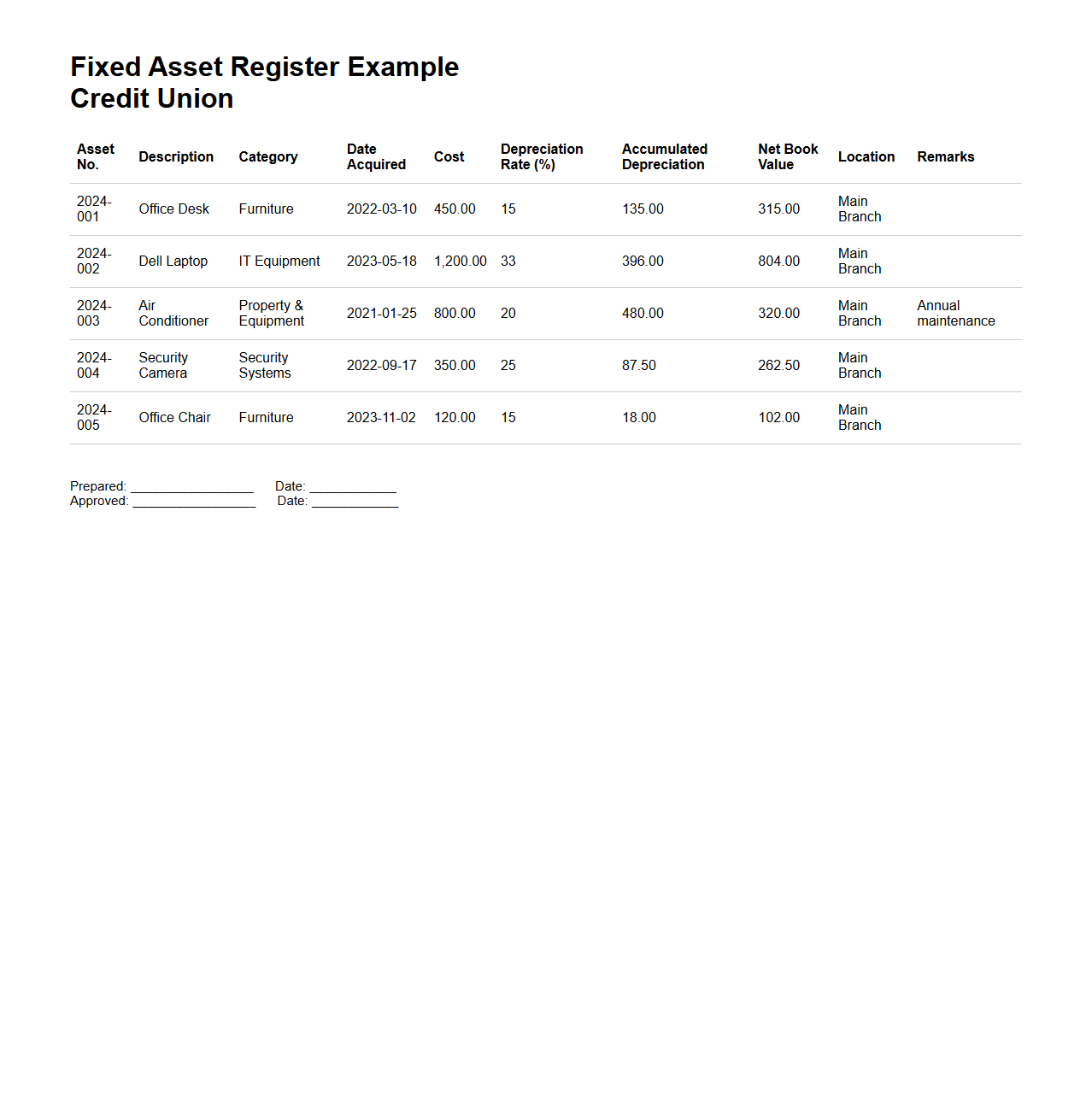

Fixed Asset Register Example for Credit Unions

A

Fixed Asset Register example for credit unions is a detailed document listing all tangible assets such as buildings, machinery, and equipment owned by the credit union. It includes critical information like asset descriptions, acquisition dates, purchase costs, depreciation schedules, and current book values to ensure accurate tracking and financial reporting. Maintaining this register helps credit unions manage asset lifecycles, support audit processes, and comply with regulatory requirements effectively.

Asset Tracking Spreadsheet for Investment Firms

An

Asset Tracking Spreadsheet for investment firms is a comprehensive document designed to monitor and manage the portfolio of assets efficiently. It includes detailed records of asset types, acquisition dates, market values, and transaction histories to ensure accurate tracking and reporting. This tool enhances decision-making by providing real-time insights into asset performance and compliance with investment strategies.

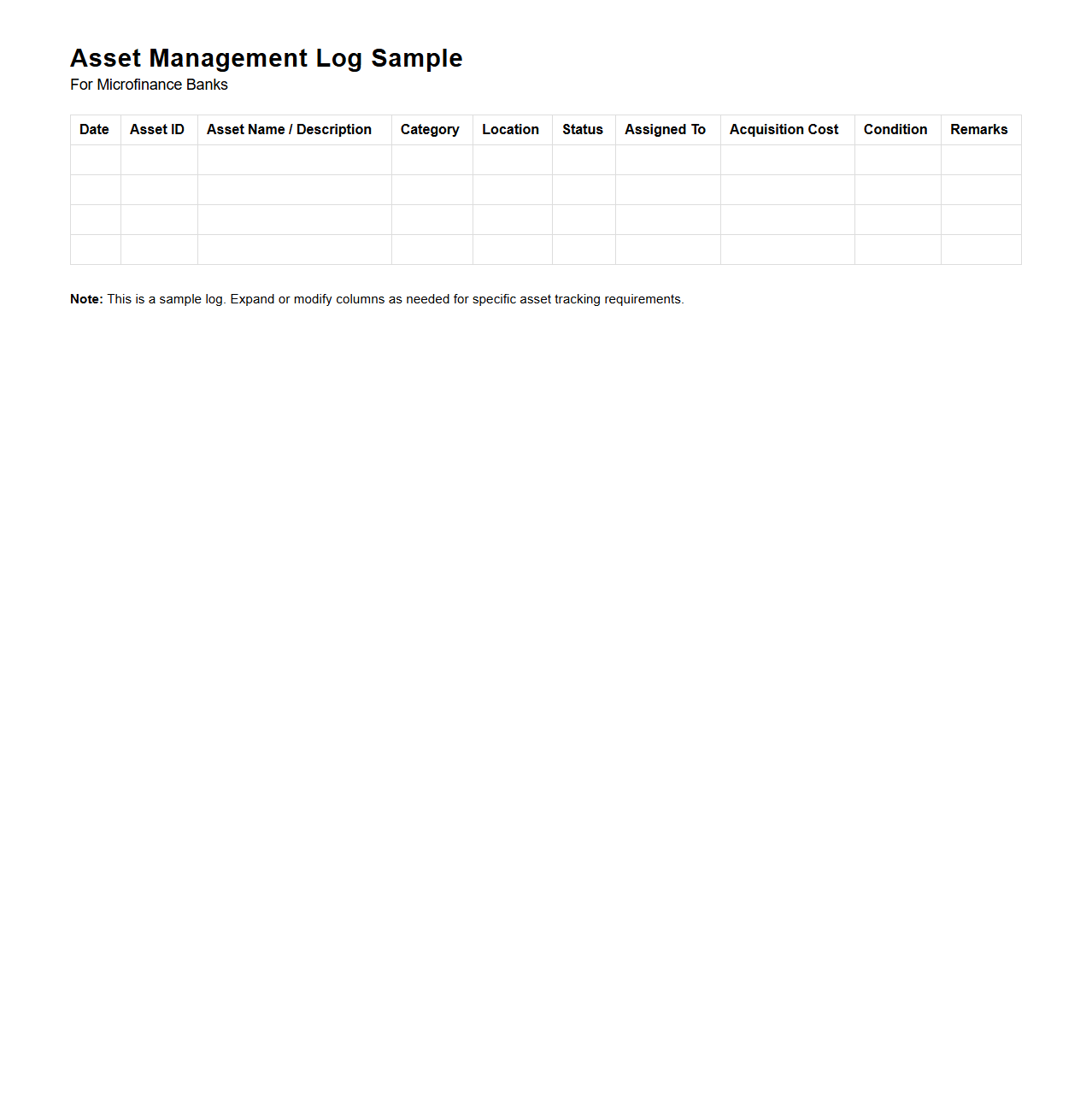

Asset Management Log Sample for Microfinance Banks

The

Asset Management Log Sample for Microfinance Banks document serves as a systematic record-keeping tool designed to track and monitor all physical and financial assets within a microfinance institution. It includes detailed entries such as asset descriptions, acquisition dates, maintenance schedules, and depreciation values, enabling efficient asset lifecycle management. This log helps ensure accurate accounting, regulatory compliance, and informed decision-making regarding asset utilization and investment.

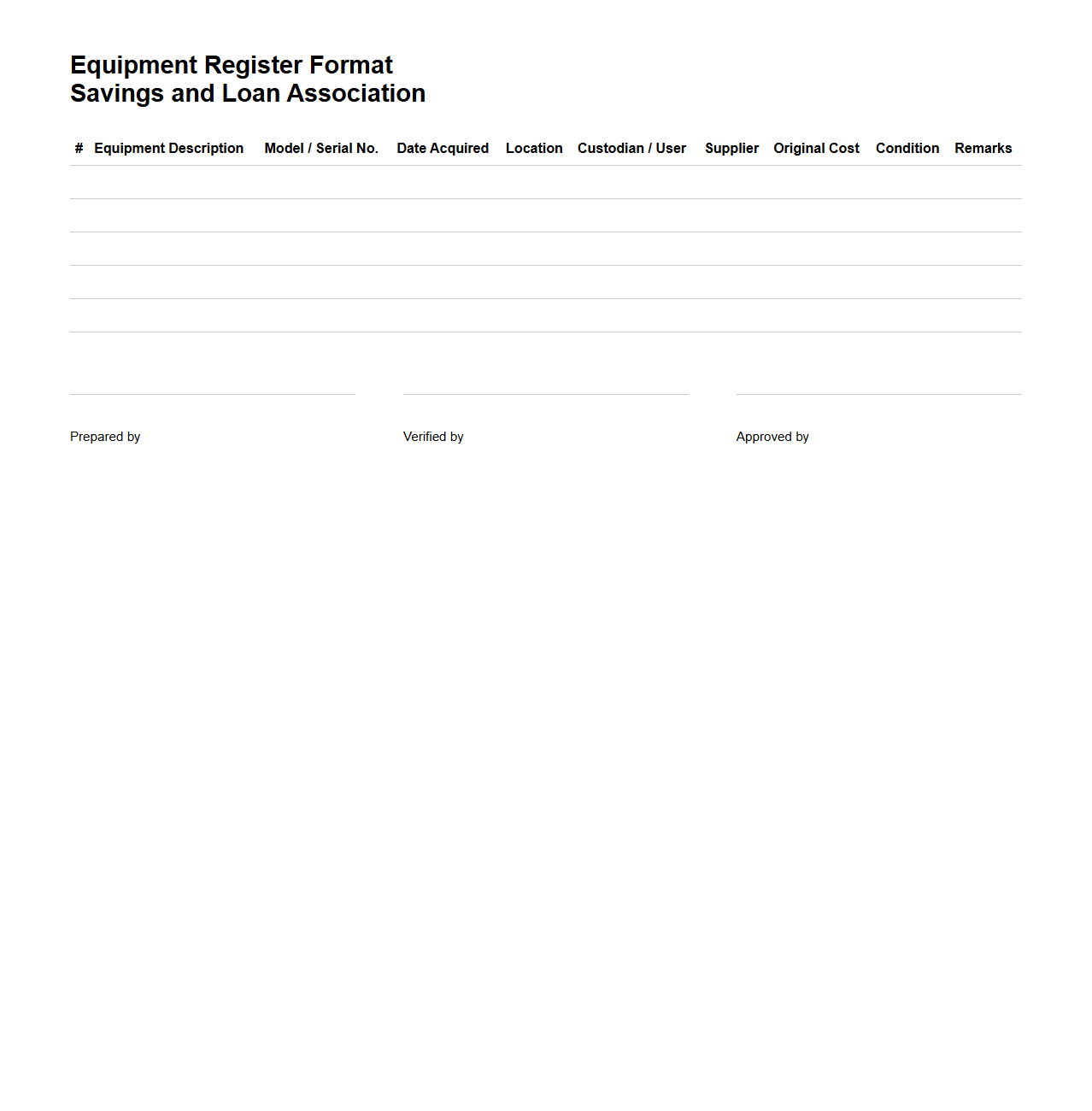

Equipment Register Format for Savings and Loan Associations

The

Equipment Register Format for Savings and Loan Associations is a structured document designed to systematically record and track all physical assets and equipment owned by the association. It includes detailed information such as equipment description, purchase date, serial numbers, condition, and depreciation status to ensure proper asset management and accountability. Maintaining this format helps streamline audits, facilitate maintenance schedules, and support financial reporting requirements.

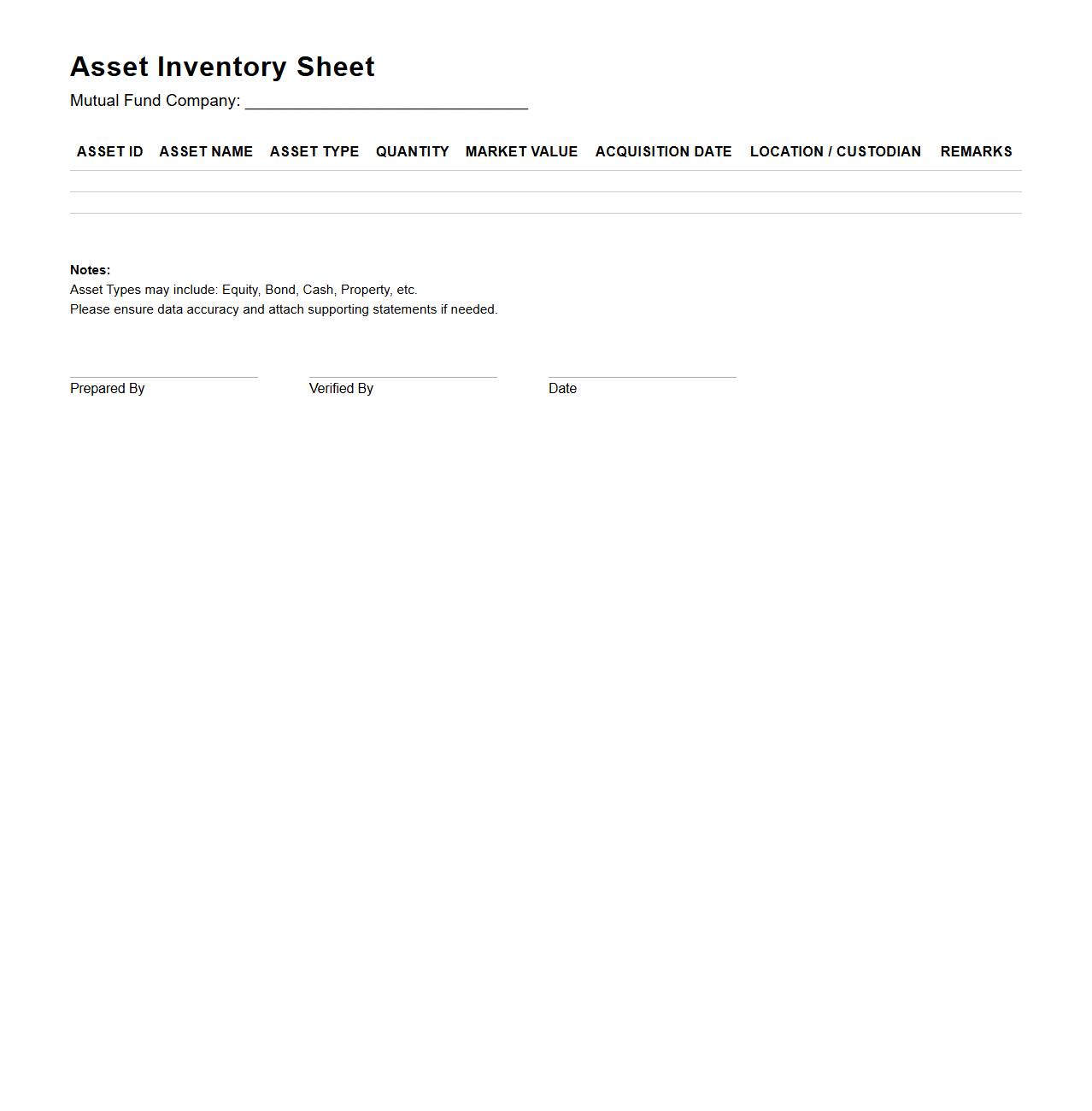

Asset Inventory Sheet for Mutual Fund Companies

An Asset Inventory Sheet for Mutual Fund Companies is a detailed document that lists all the financial instruments, securities, and other assets held within a mutual fund's portfolio. This sheet provides crucial data such as asset type, quantity, market value, and acquisition date, enabling fund managers to monitor and manage investments effectively. Maintaining an accurate

Asset Inventory Sheet ensures transparency, compliance with regulatory requirements, and aids in performance analysis and reporting.

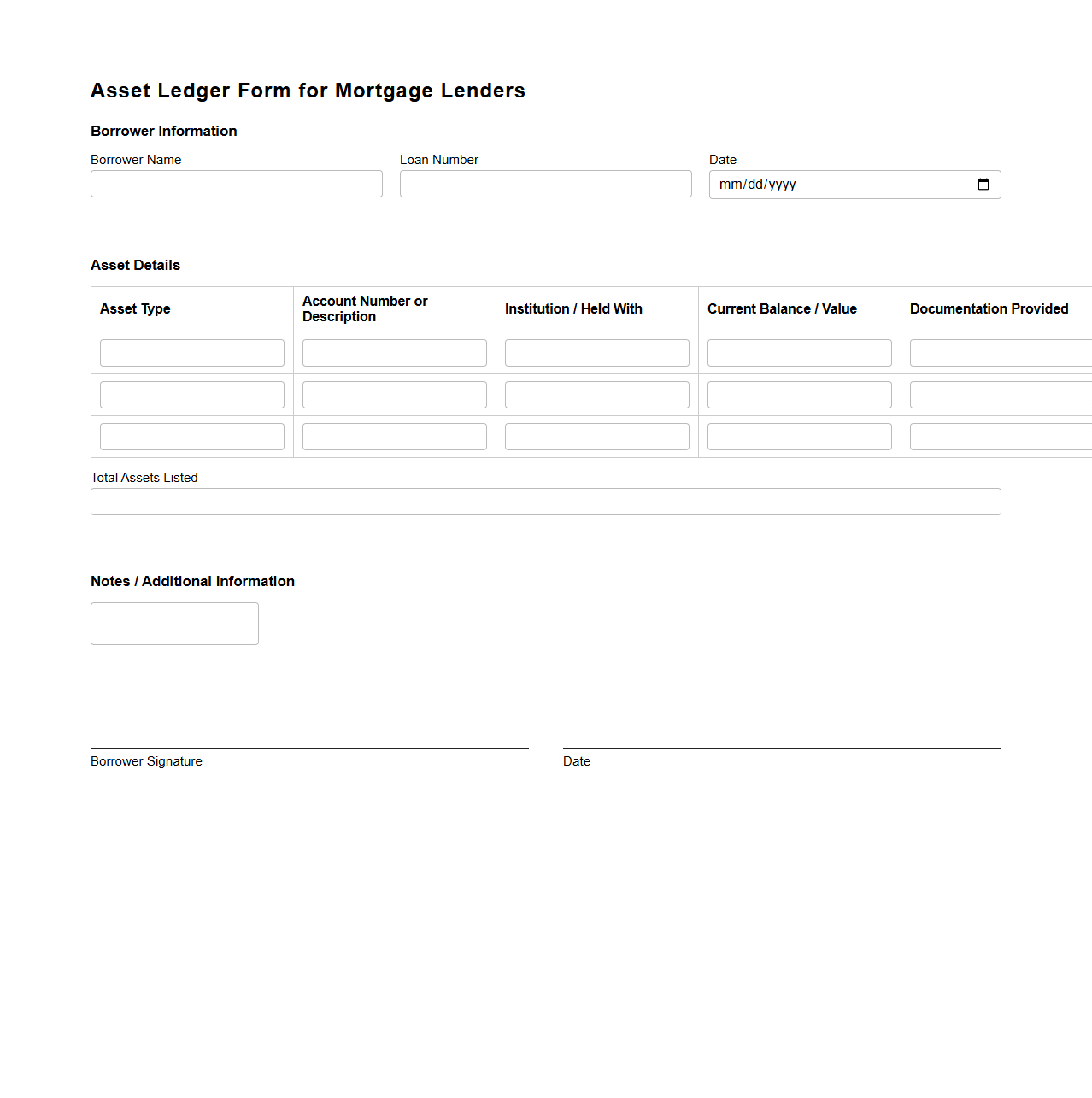

Asset Ledger Form for Mortgage Lenders

The

Asset Ledger Form for Mortgage Lenders is a detailed financial document that tracks and verifies a borrower's assets to assess their ability to meet mortgage obligations. It includes comprehensive records of bank accounts, investments, and other financial holdings, providing mortgage lenders with essential data for loan approval decisions. This form helps ensure transparency and accuracy in the mortgage underwriting process.

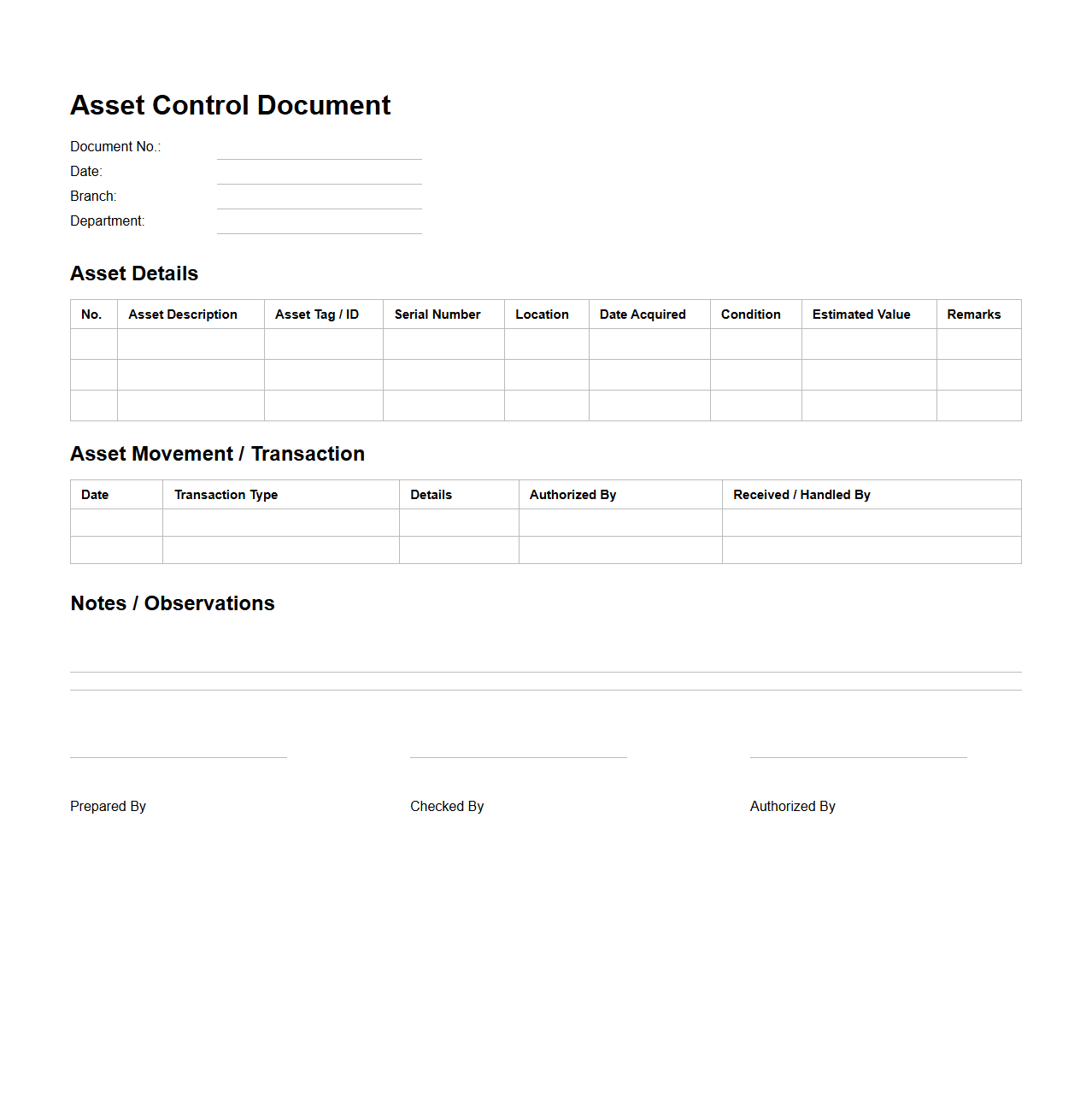

Asset Control Document for Commercial Banks

An

Asset Control Document for commercial banks is a formal record used to track and manage the bank's physical and financial assets, ensuring accurate accounting and regulatory compliance. It details asset identification, valuation, ownership, and maintenance schedules, facilitating effective risk management and audit processes. This document supports transparency and accountability in asset management, critical for sustaining financial stability and operational efficiency within banking institutions.

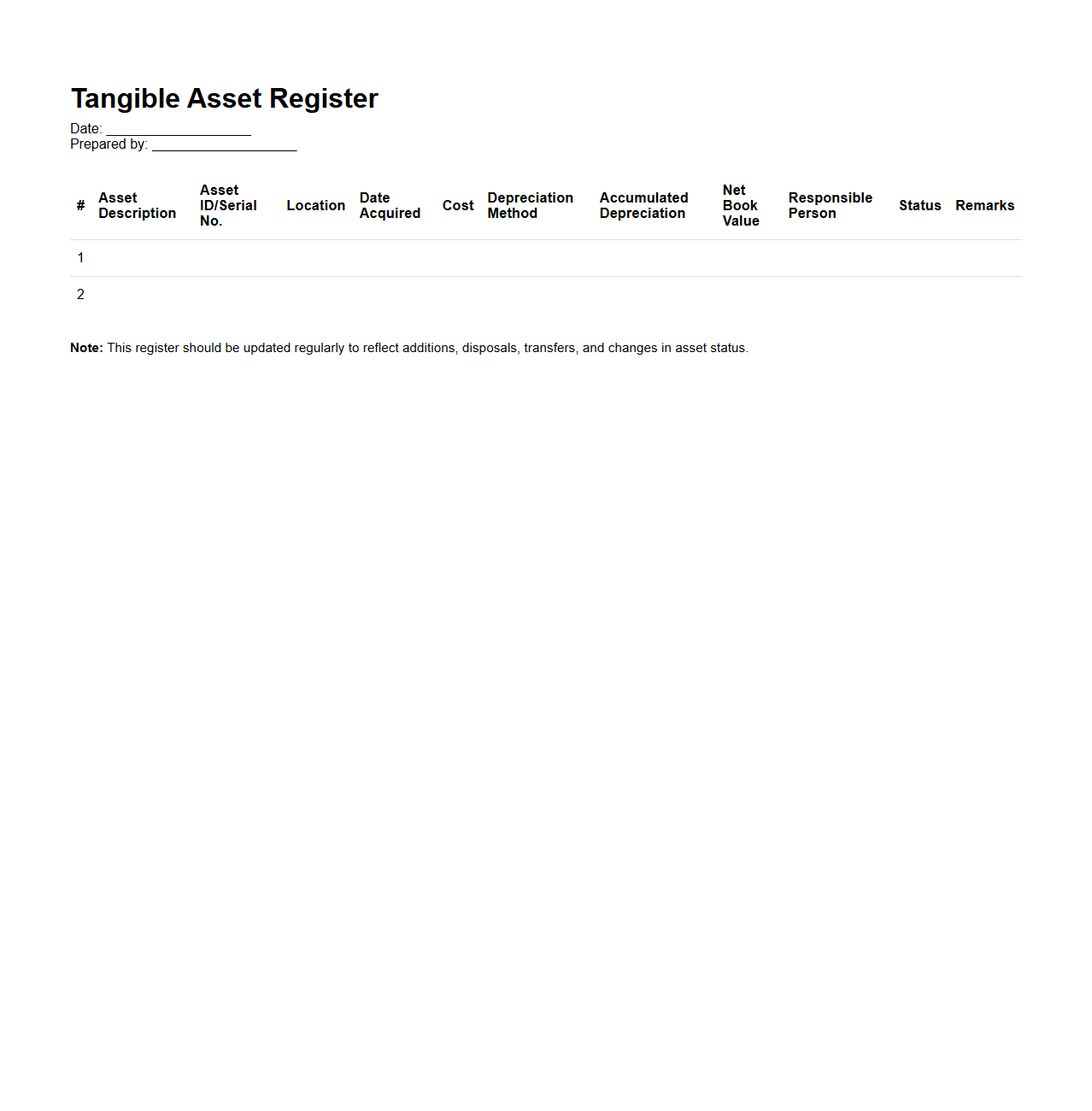

Tangible Asset Register for Finance Companies

A

Tangible Asset Register for finance companies is a detailed document that records all physical assets owned by the organization, including machinery, equipment, and property. This register helps track asset values, depreciation, and maintenance schedules, ensuring accurate financial reporting and compliance with accounting standards. Maintaining an up-to-date tangible asset register supports effective asset management and informed decision-making in finance operations.

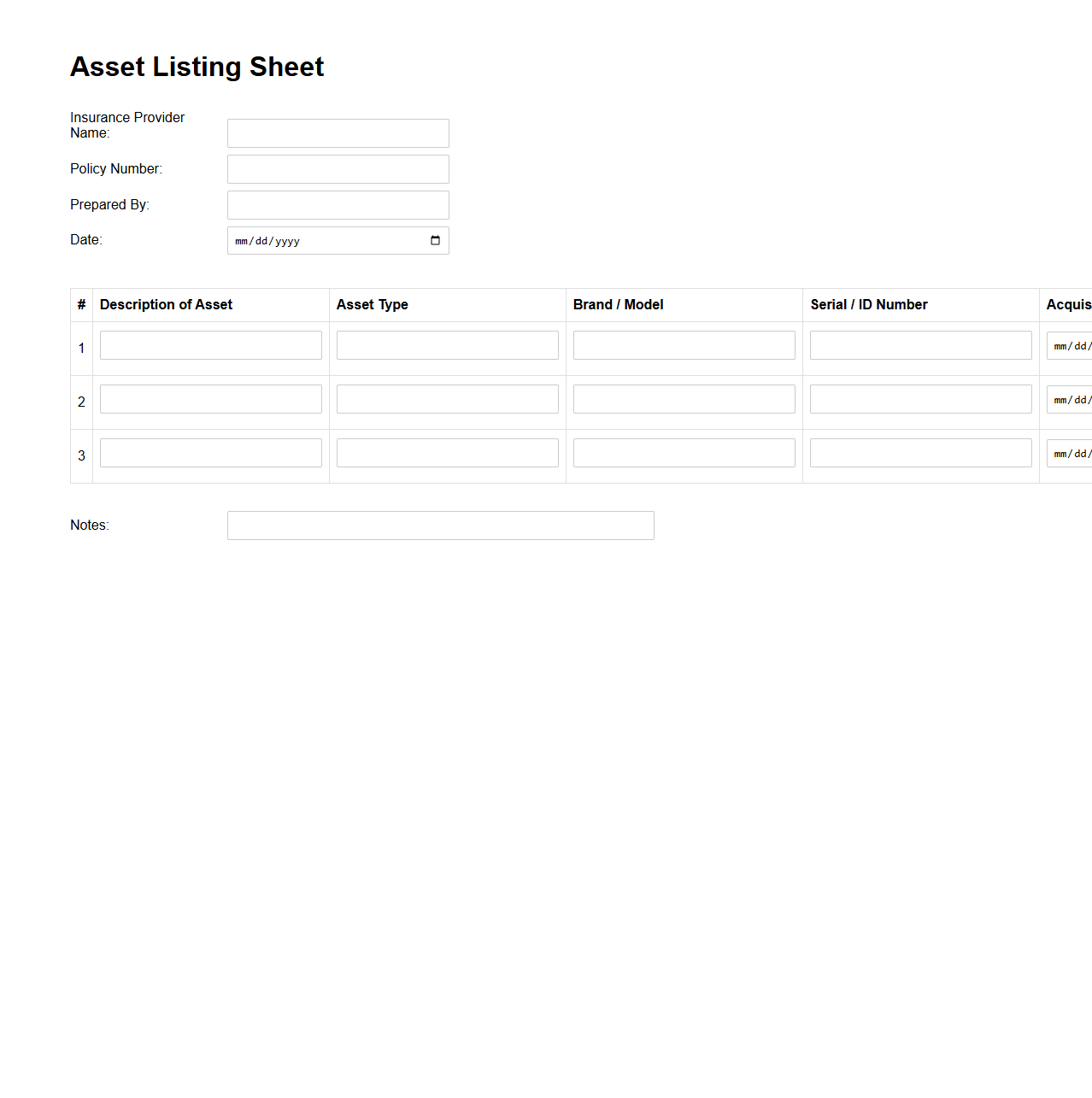

Asset Listing Sheet for Insurance Providers

An

Asset Listing Sheet for insurance providers is a detailed inventory document that outlines all assets owned by an individual or organization, including their descriptions, values, and conditions. This sheet serves as a critical tool for assessing risk, determining adequate coverage, and facilitating accurate premium calculations. Maintaining an up-to-date asset list ensures smoother claims processing and helps insurance companies validate policy limits effectively.

What key data fields should be included in an asset register document for regulatory compliance?

An asset register must contain asset identification details such as serial numbers and descriptions to ensure precise tracking. It should also include purchase information like acquisition date, cost, and vendor details. Additionally, regulatory compliance requires fields for location, custodian, and asset status to maintain transparency and control.

How often should an asset register document be updated in a financial institution?

Asset registers in financial institutions should be updated regularly, typically on a monthly basis, to reflect any additions, disposals, or transfers. Critical changes must be recorded immediately to maintain accuracy for audit purposes. Consistent updates support compliance with regulatory requirements and internal controls.

Which authentication methods are required for approving changes in the asset register?

Approval of changes in the asset register requires multi-factor authentication (MFA) to ensure authorized access. Role-based access control (RBAC) is often implemented to restrict modifications to designated personnel. These methods help maintain the integrity and security of the asset data.

How is asset depreciation recorded and reported in the asset register letter?

Asset depreciation must be recorded using recognized accounting methods such as straight-line or reducing balance. The register should include depreciation rates, accumulated depreciation, and current book value to provide a clear financial snapshot. This information is crucial for financial reporting and regulatory compliance.

What protocols are in place for auditing the accuracy of asset register documents?

Auditing protocols involve regular internal and external audits to verify asset existence and valuation. Physical verification processes are combined with system reconciliations to ensure records match actual assets. Any discrepancies identified must be promptly investigated and corrected to maintain register accuracy.