A Bank Reconciliation Document Sample for Cash Management helps businesses verify the accuracy of their financial records by comparing bank statements with internal cash records. It identifies discrepancies such as outstanding checks, deposits in transit, and bank fees, ensuring accurate cash flow management. This document enhances financial control and supports effective decision-making by maintaining up-to-date and precise cash balances.

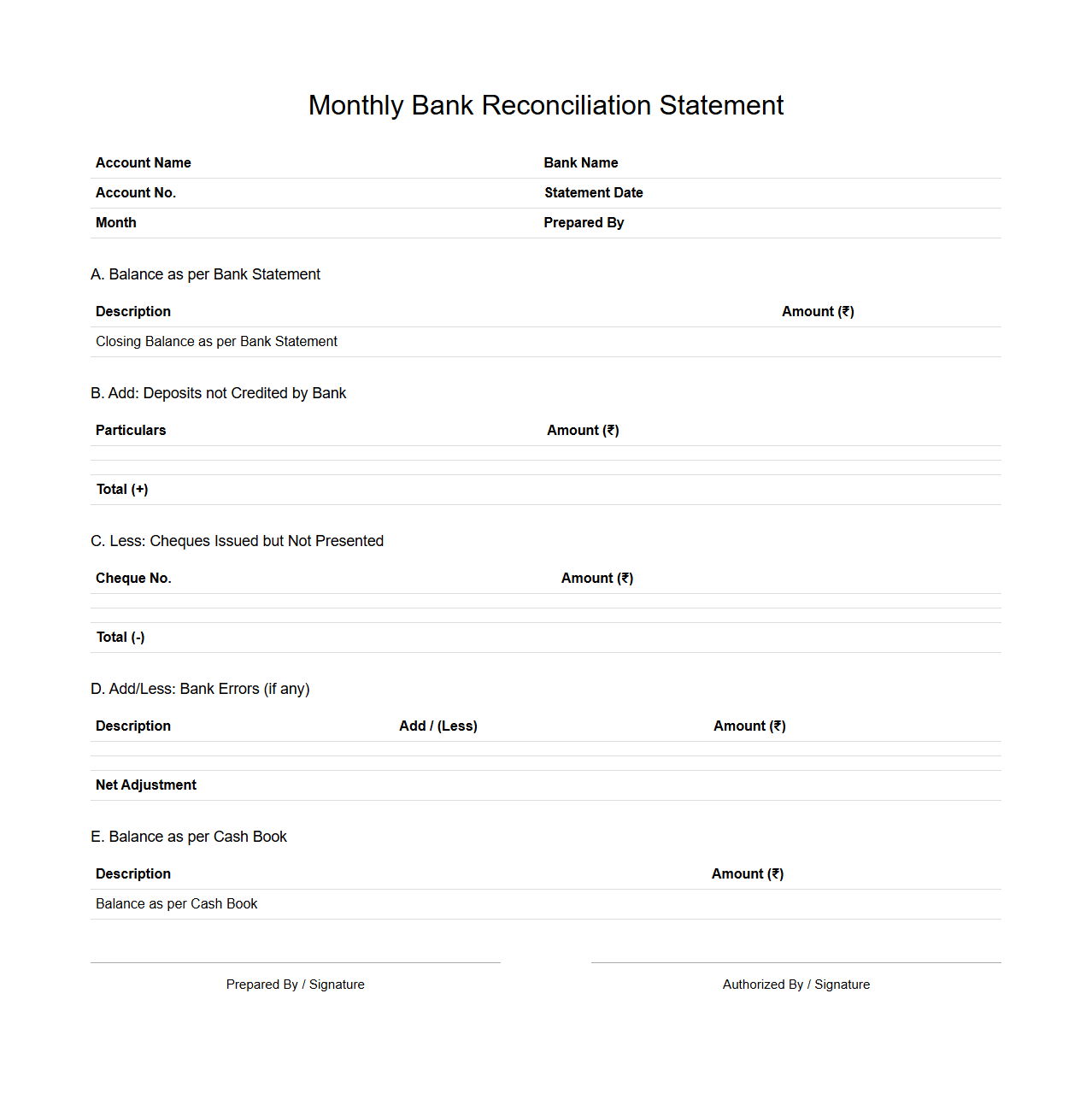

Monthly Bank Reconciliation Statement Template

A

Monthly Bank Reconciliation Statement Template document is a structured form used to compare and verify the financial records in a company's accounting system against the bank statement received each month. This template helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, ensuring accurate financial reporting. It streamlines the reconciliation process, saving time and reducing the risk of accounting errors.

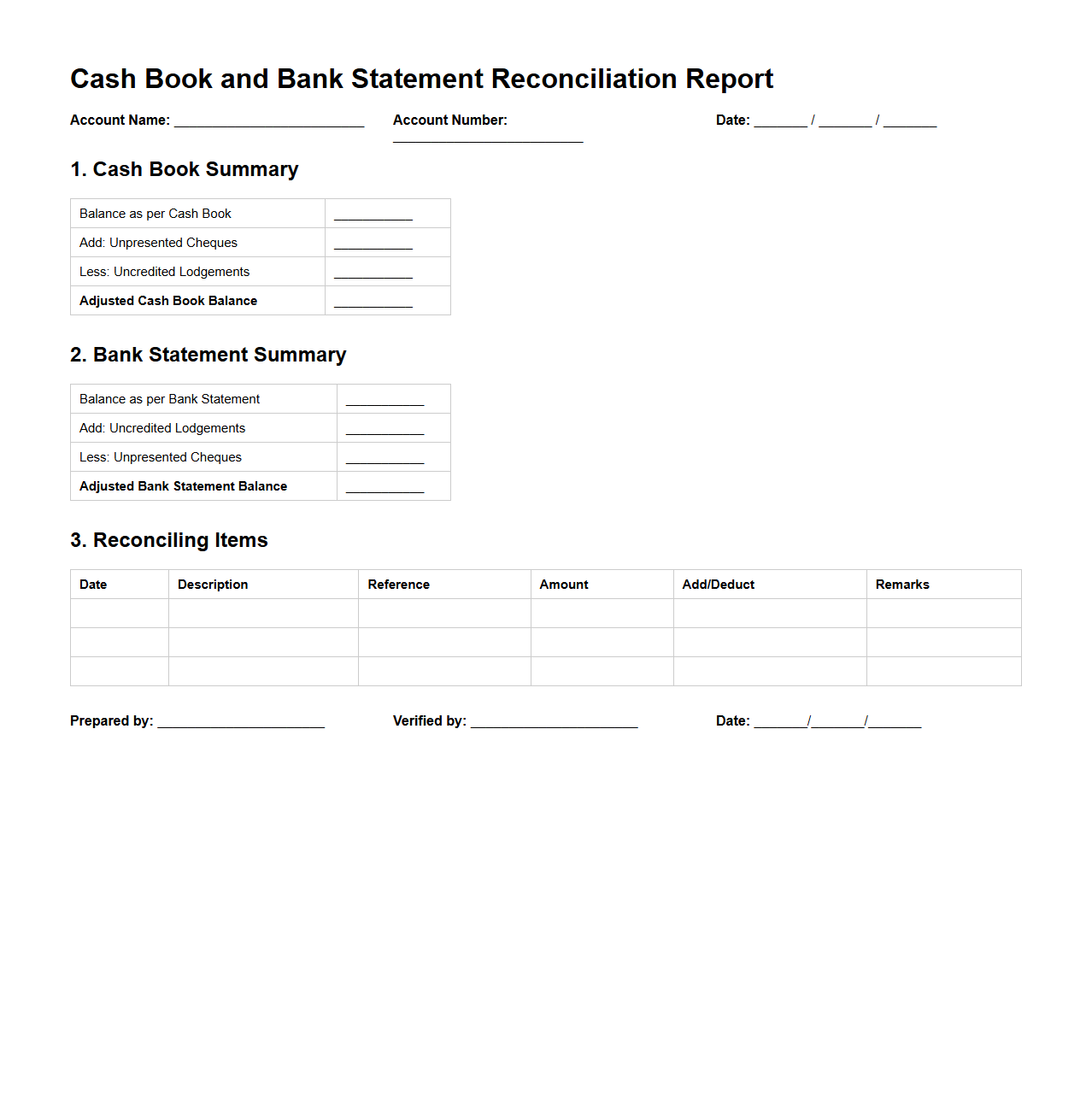

Cash Book and Bank Statement Reconciliation Report

The

Cash Book and Bank Statement Reconciliation Report is a financial document that compares the company's cash book records with the bank statement to identify and resolve discrepancies. It ensures accuracy by highlighting differences due to timing, errors, or unrecorded transactions, thereby maintaining integrity in financial reporting. This report is crucial for verifying cash balances and detecting potential fraud or accounting mistakes.

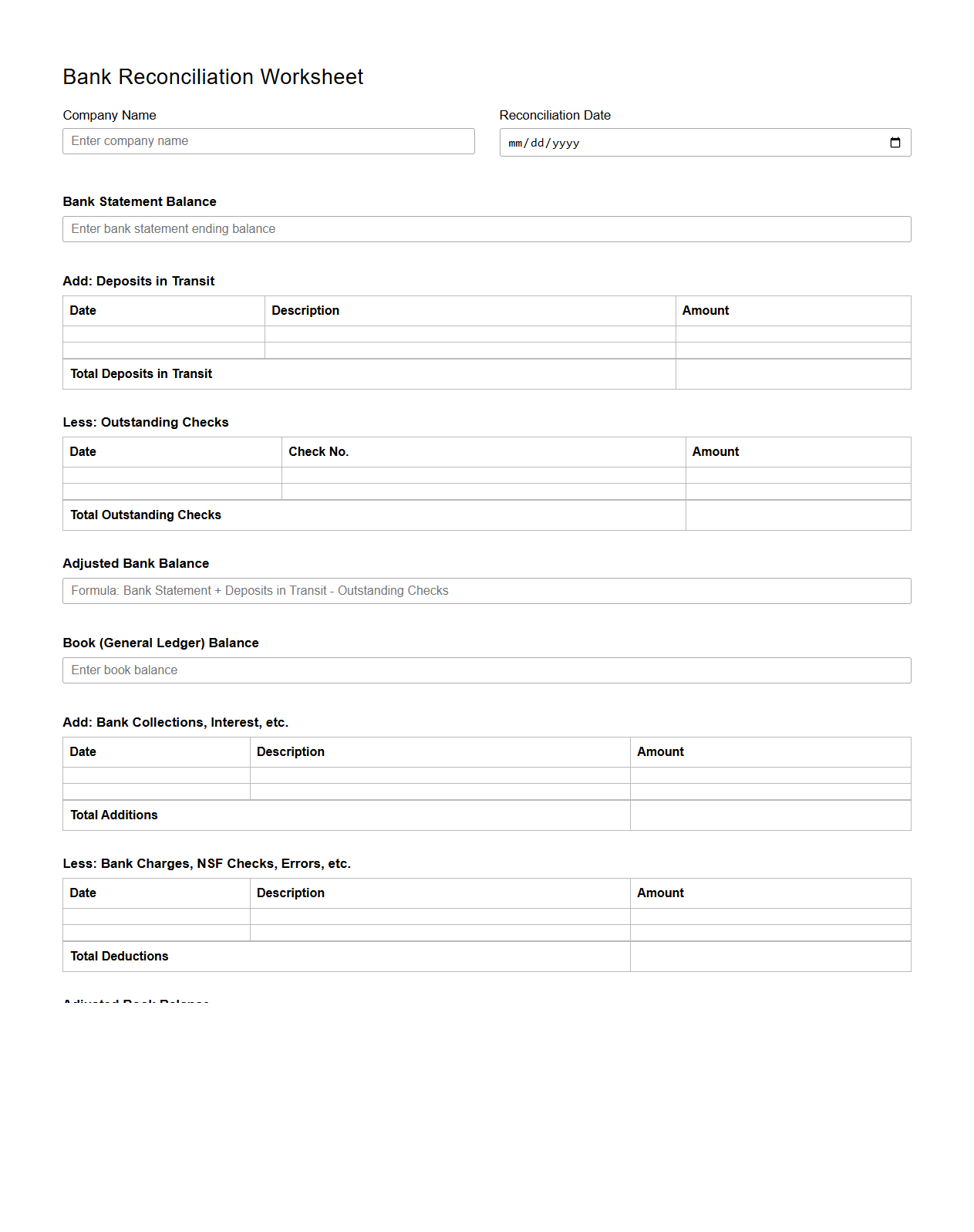

Bank Reconciliation Worksheet Format

A

Bank Reconciliation Worksheet Format document is a tool used to compare and match the company's accounting records with the bank statement. It helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, ensuring accurate financial records. This format typically includes columns for dates, descriptions, amounts, and reconciled balances to streamline the reconciliation process.

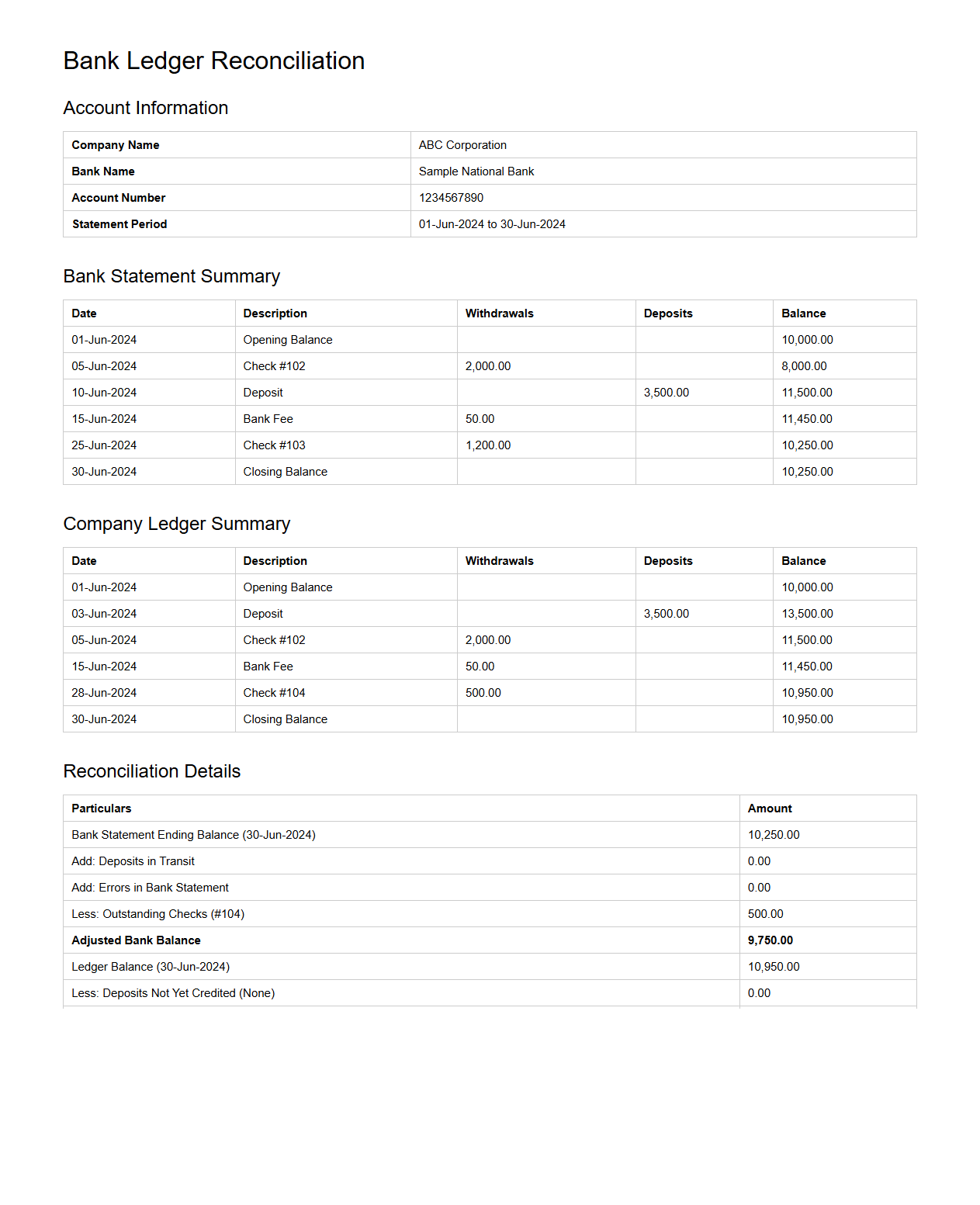

Detailed Bank Ledger Reconciliation Example

A

Detailed Bank Ledger Reconciliation Example document provides a comprehensive record aligning a company's bank statement with its accounting ledger. It highlights discrepancies, such as outstanding checks or deposits in transit, ensuring accuracy in financial reporting. This example serves as a practical guide to thoroughly verify transaction consistency and identify errors or omissions.

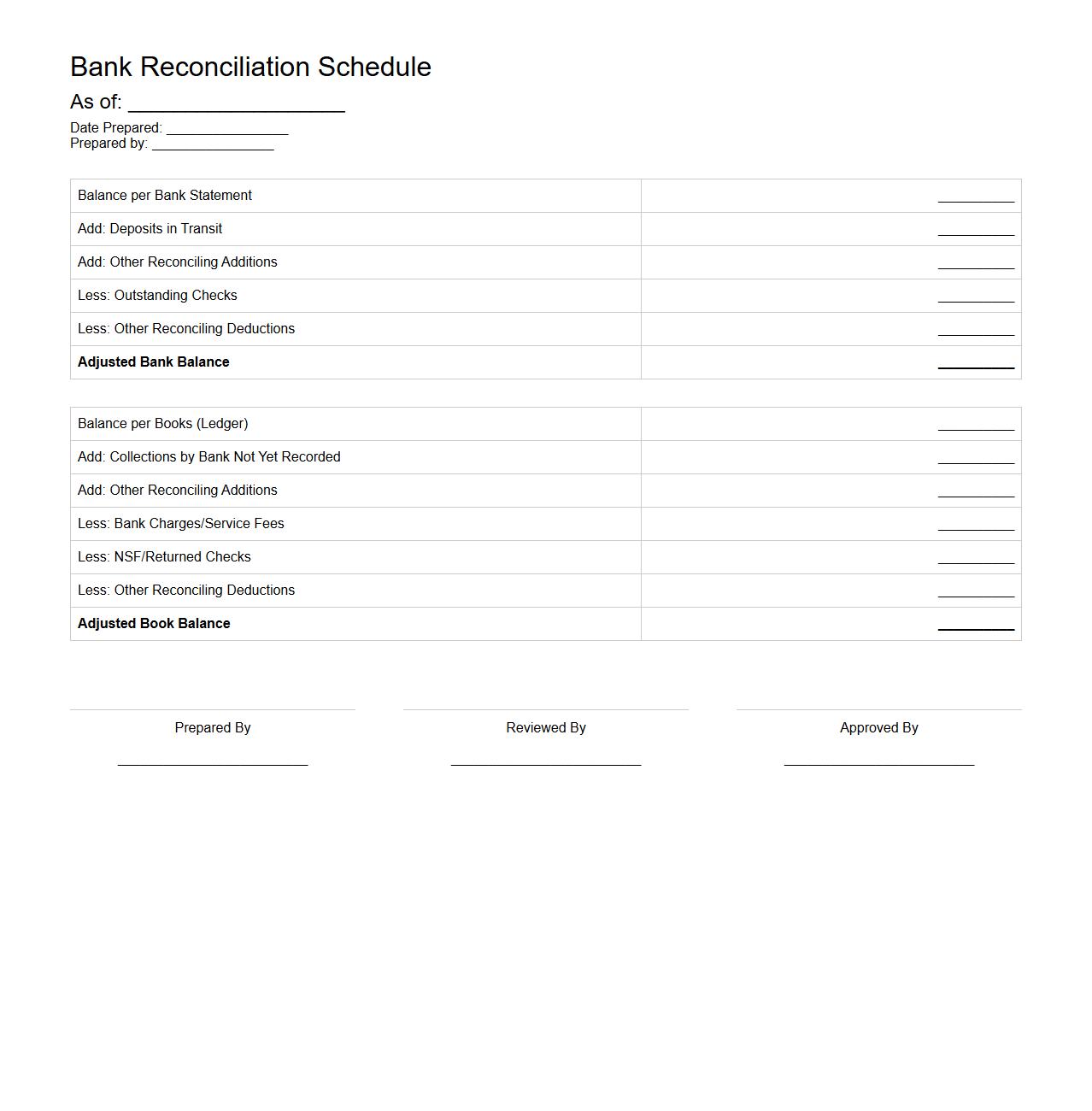

Bank Reconciliation Schedule for Cash Balances

A

Bank Reconciliation Schedule for Cash Balances is a detailed financial document that compares and matches the cash balance recorded in an organization's accounting records with the corresponding amount shown on the bank statement. It identifies discrepancies such as outstanding checks, deposits in transit, or bank errors to ensure accurate cash reporting and prevent fraud. This reconciliation process supports effective cash management and financial transparency by providing a clear summary of adjusted cash balances.

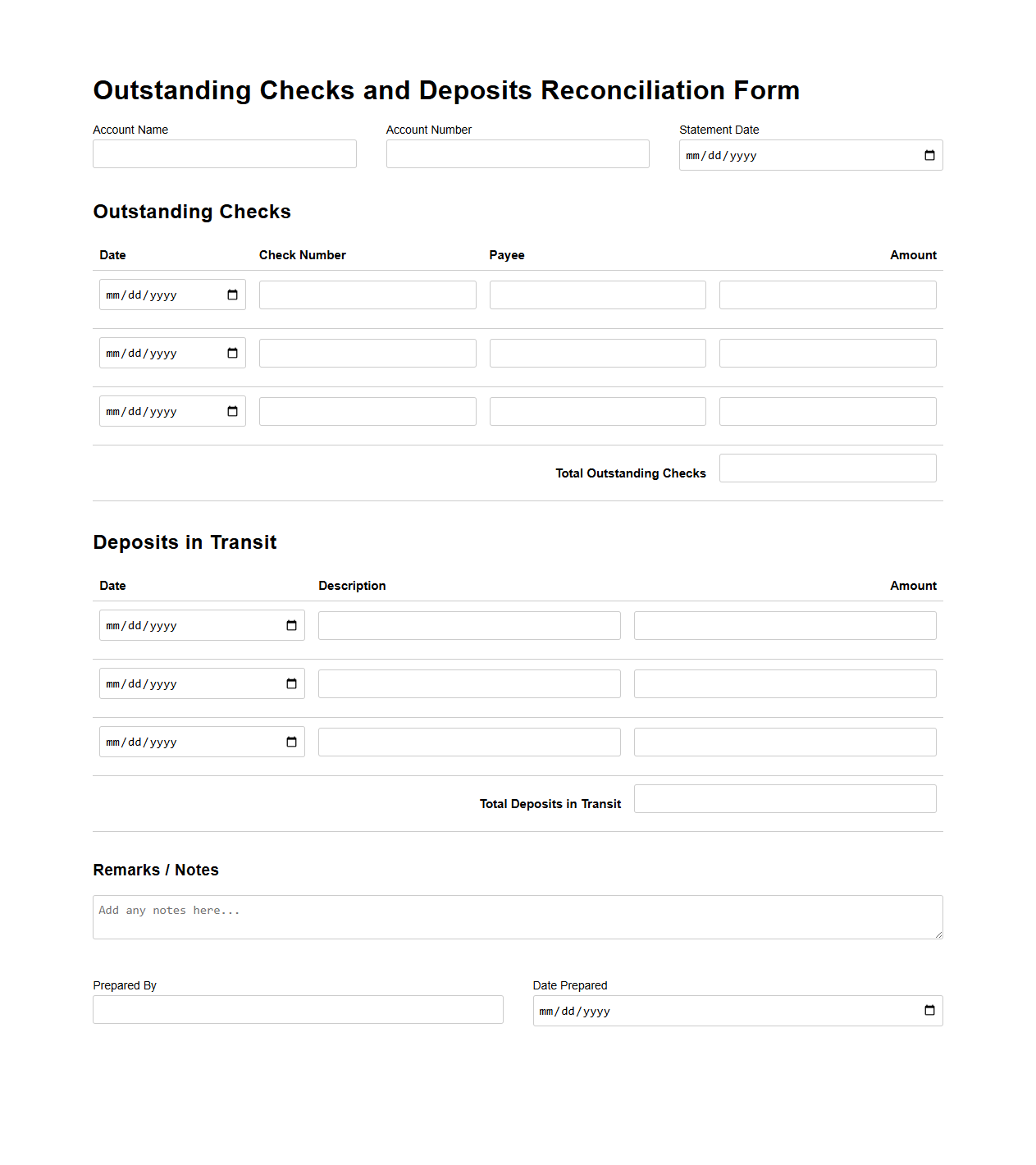

Outstanding Checks and Deposits Reconciliation Form

The

Outstanding Checks and Deposits Reconciliation Form is a financial document used to identify and resolve discrepancies between a company's bank statement and its internal records. It tracks checks issued but not yet cleared by the bank, as well as deposits made but not yet reflected in the bank statement. This form ensures accurate cash flow management and helps maintain reliable accounting records.

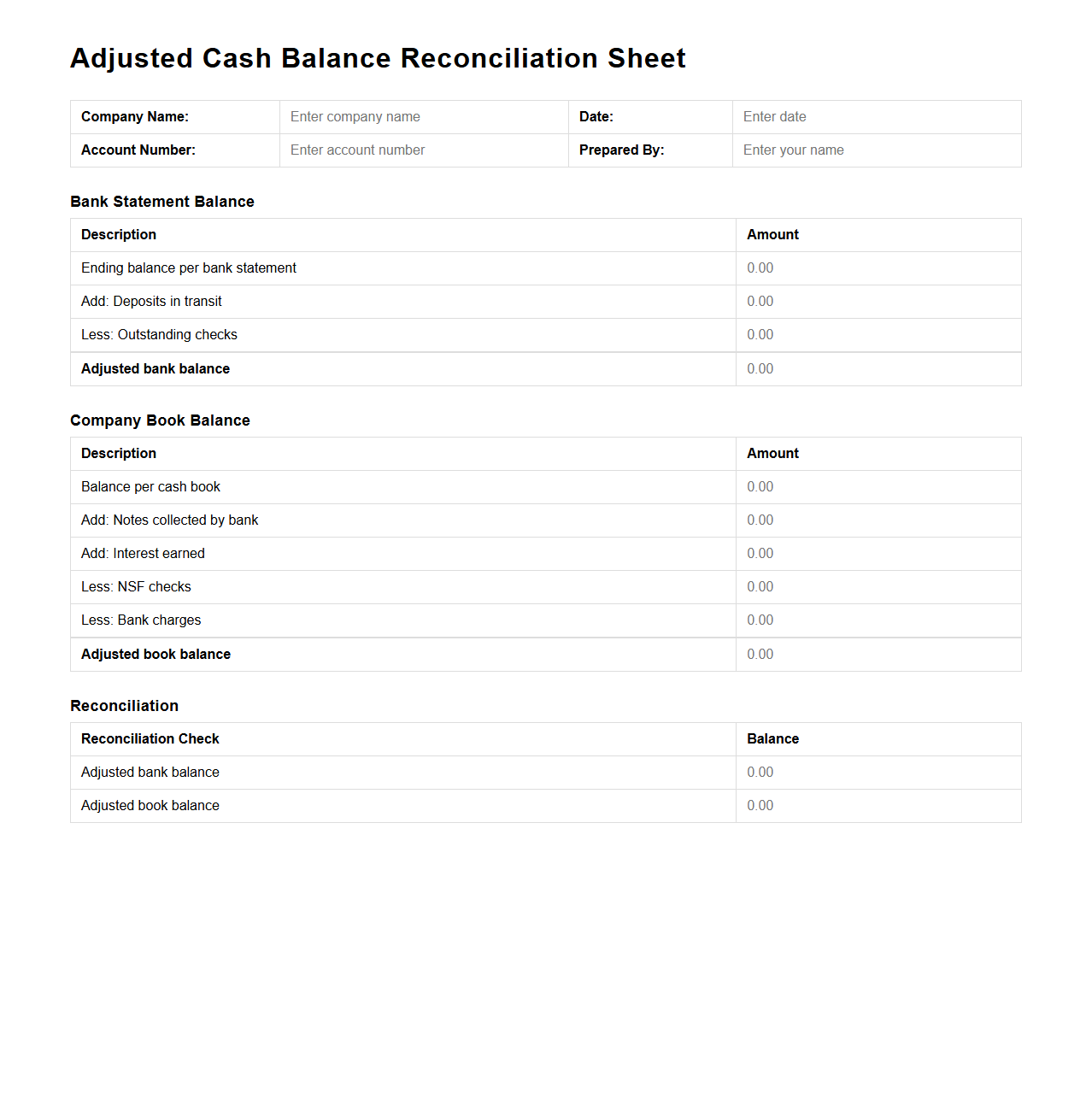

Adjusted Cash Balance Reconciliation Sheet

The

Adjusted Cash Balance Reconciliation Sheet document serves as a critical financial tool that aligns the company's cash records with the bank statement, ensuring accuracy in cash management. It identifies discrepancies such as outstanding checks, deposits in transit, and bank fees, providing a clear picture of the true cash balance. This reconciliation process supports accurate financial reporting and effective internal controls.

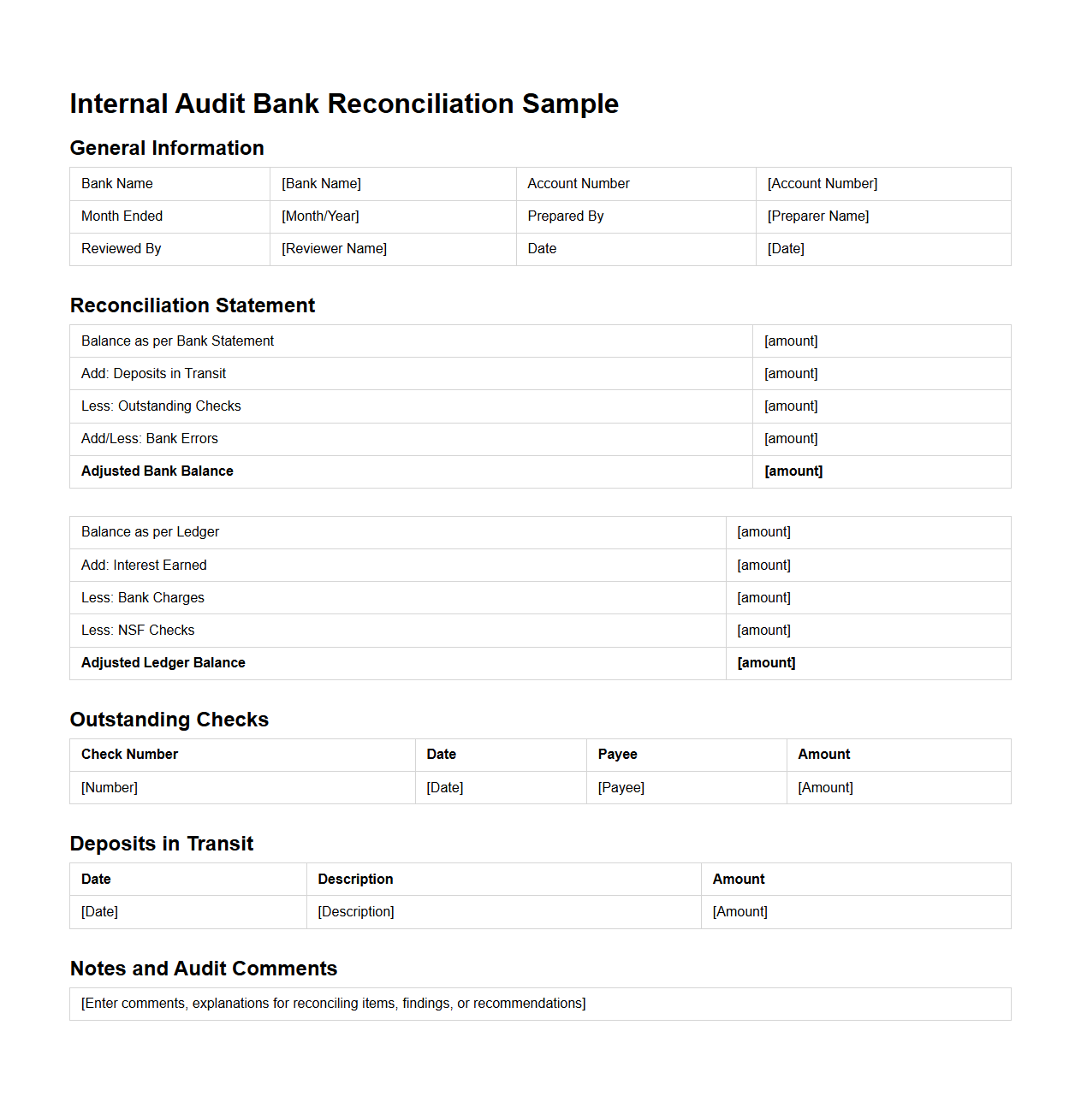

Internal Audit Bank Reconciliation Sample

An

Internal Audit Bank Reconciliation Sample document serves as a detailed template showcasing the process of verifying and matching the bank statements with an organization's internal ledger records. It highlights discrepancies such as timing differences, unauthorized transactions, and errors to ensure financial accuracy and integrity. This sample aids auditors in streamlining the reconciliation process and maintaining compliance with regulatory standards.

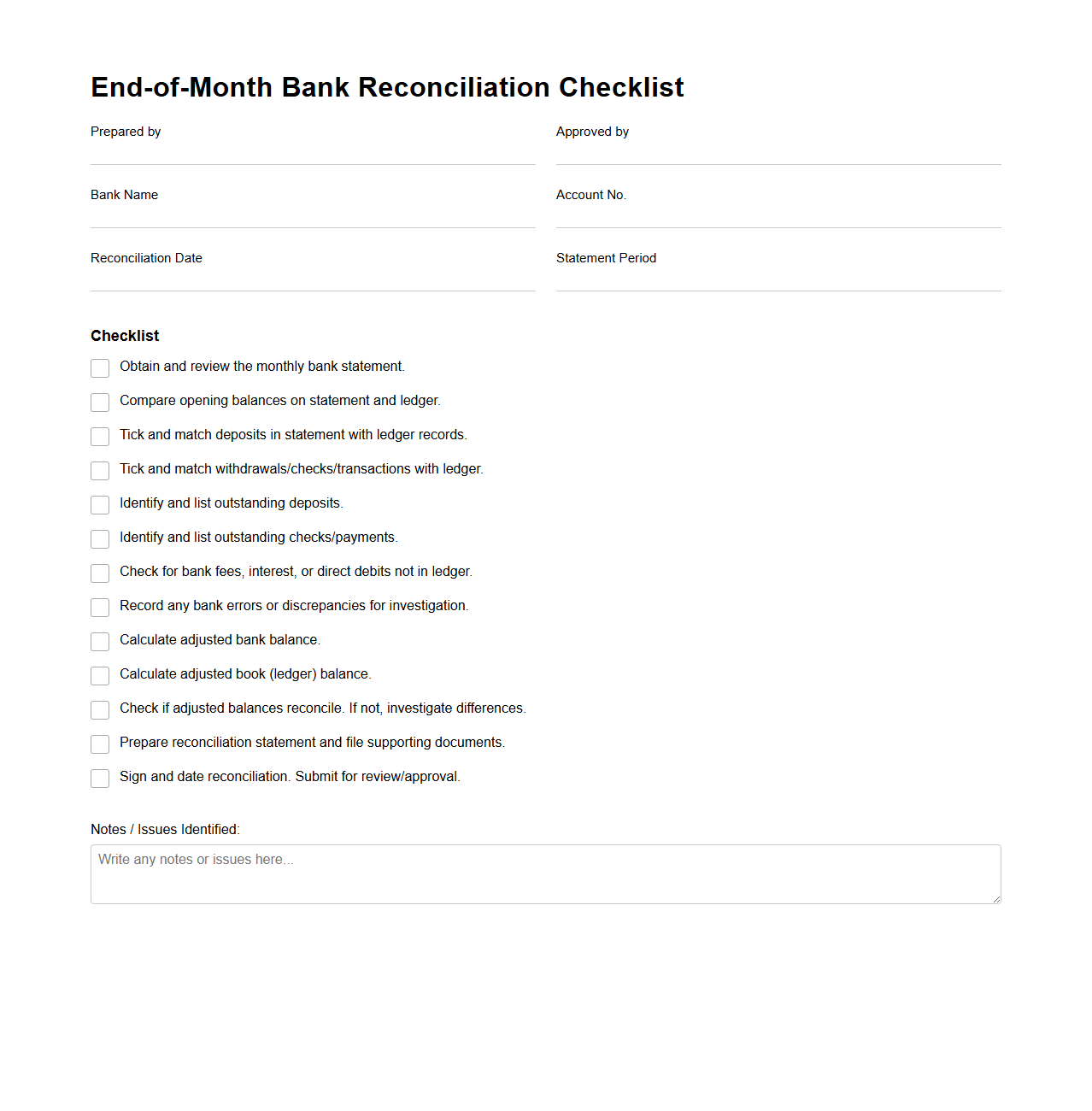

End-of-Month Bank Reconciliation Checklist

The

End-of-Month Bank Reconciliation Checklist document is a comprehensive tool designed to ensure the accuracy of financial records by matching the company's ledger with the bank statement. It includes verifying transactions, identifying discrepancies such as outstanding checks or deposits in transit, and confirming that all entries are correctly recorded. This checklist enhances financial control and supports timely identification of errors or fraud, contributing to accurate monthly financial reporting.

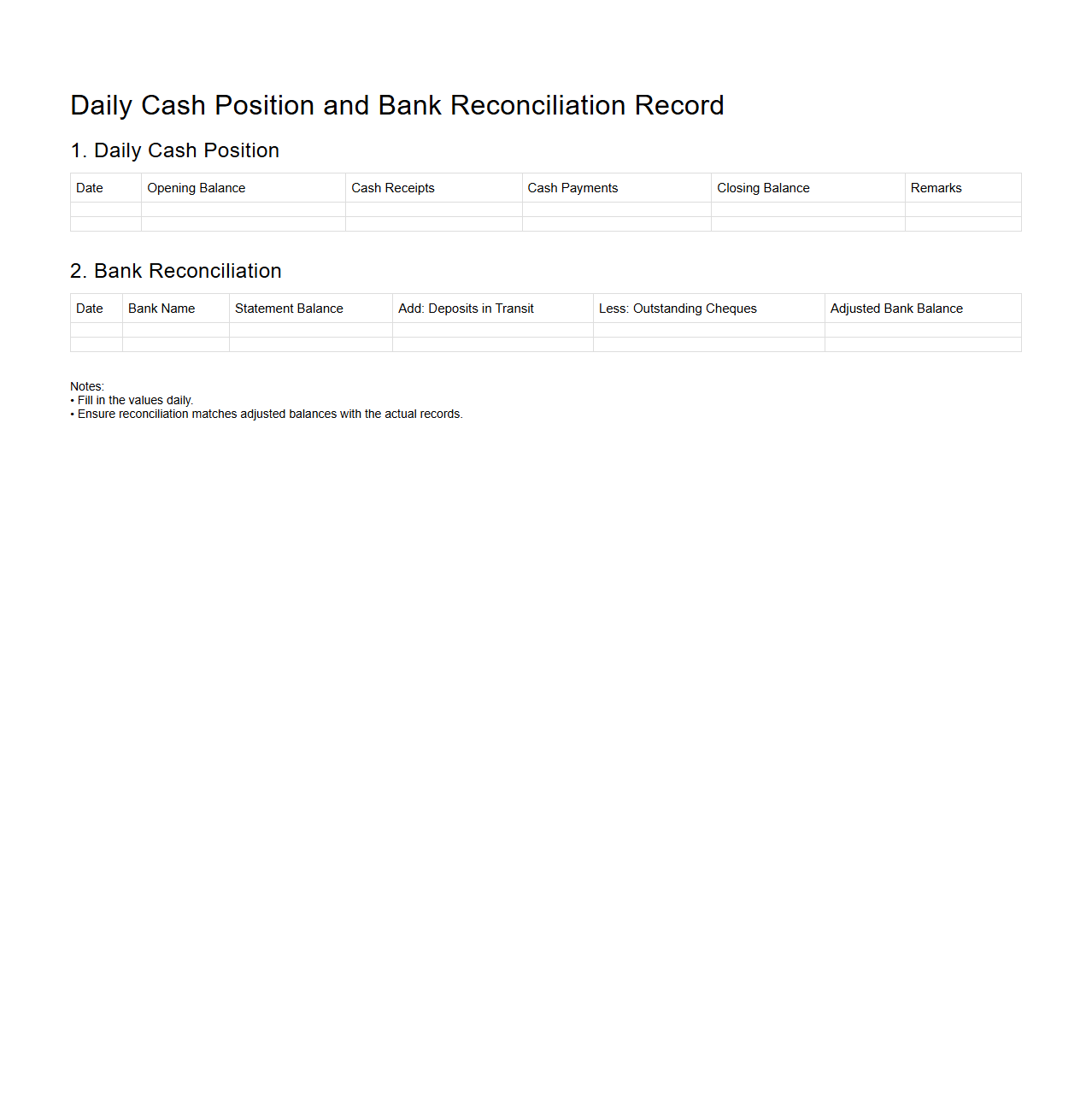

Daily Cash Position and Bank Reconciliation Record

The

Daily Cash Position provides a real-time snapshot of all cash inflows and outflows, helping businesses monitor liquidity and manage short-term financial obligations effectively. A Bank Reconciliation Record document compares the company's internal cash records with bank statements to identify discrepancies, ensure accuracy, and detect potential errors or fraudulent activities. Maintaining both documents is crucial for accurate financial reporting and efficient cash management.

What supporting documents are required for creating a Bank Reconciliation Statement in cash management?

To create a Bank Reconciliation Statement, essential supporting documents include bank statements, cash book entries, and deposit slips. These documents ensure accurate matching of transactions recorded in the company's books with the bank's records. Additionally, cheque details and payment vouchers may be required to validate specific entries involved in the reconciliation process.

How are unmatched transactions flagged in the bank reconciliation document workflow?

Unmatched transactions are automatically flagged by the reconciliation system when discrepancies arise between the bank statement and cash book entries. These flags serve as alerts, prompting further investigation to correct errors or omissions. The workflow often includes status indicators or color-coded markers to clearly identify and prioritize unresolved items.

Which cash management reports integrate directly with the bank reconciliation document?

Key cash management reports like the Cash Flow Statement, Deposit Summary, and Payment Analysis Reports directly integrate with the bank reconciliation document. This integration streamlines data flow, enhancing accuracy and efficiency in financial reporting. It also helps maintain consistency across various financial statements and management dashboards.

What data validation steps are included in the reconciliation document for cash discrepancies?

Data validation steps include verifying transaction dates, amounts, and reference numbers against bank records to identify cash discrepancies. The reconciliation process checks for duplicate transactions and validates authorization codes or signatures to prevent fraud. Automated validation routines also ensure compliance with accounting standards and organizational policies.

How does the system handle split deposits or transfers in automated bank reconciliation documents?

The system manages split deposits and transfers by allocating them across multiple ledger entries or accounts as per predefined rules. It automatically matches each portion of the deposit or transfer against corresponding transactions to maintain accuracy. This automation reduces manual effort and improves the reliability of bank reconciliation outcomes.