A Reconciliation Document Sample for Bank Accounts provides a clear template to compare and match the bank statement with the company's accounting records. This document helps identify discrepancies such as outstanding checks, deposits in transit, or errors, ensuring accurate financial reporting. Using a standardized sample streamlines the reconciliation process and improves financial accuracy.

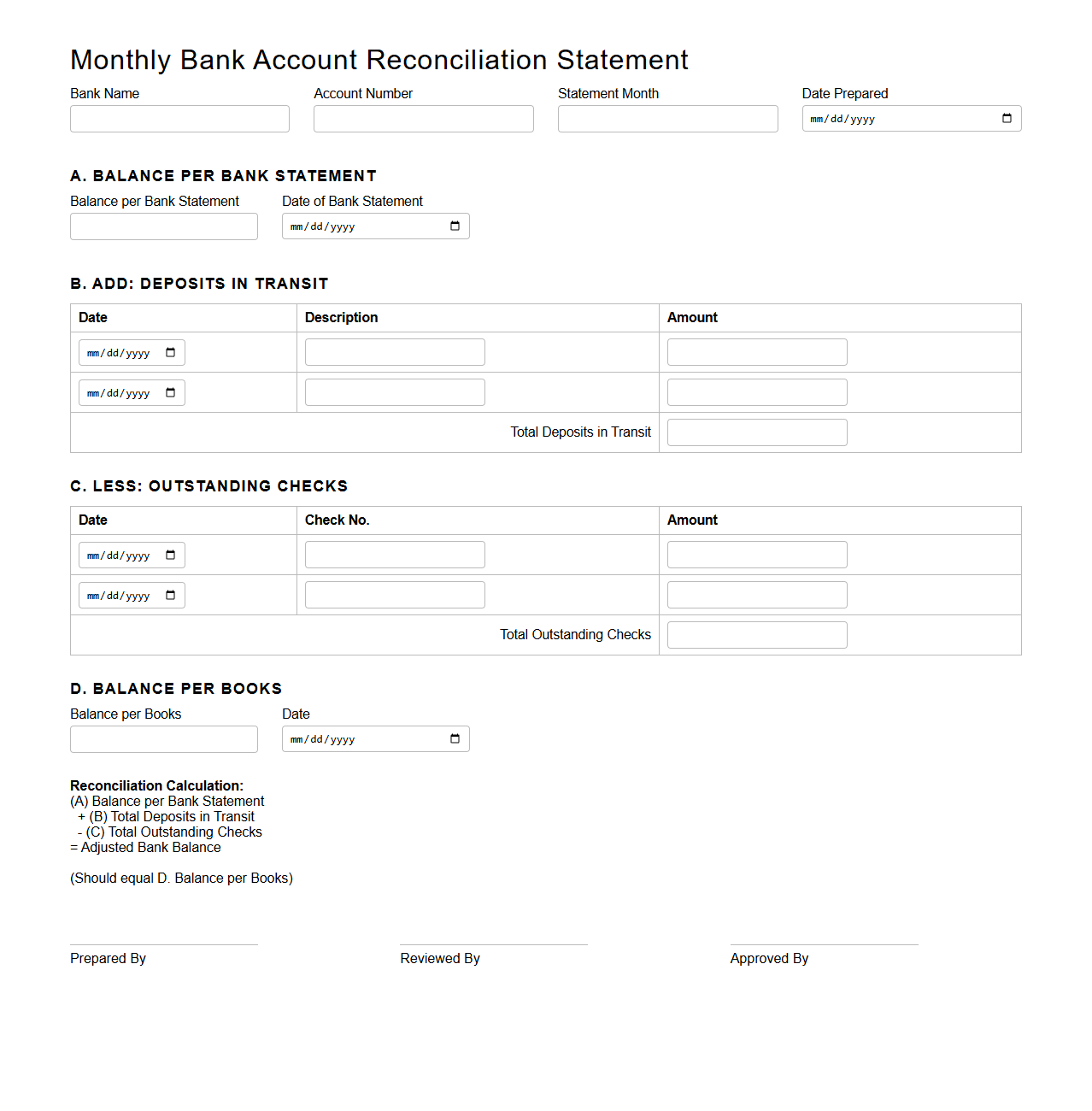

Monthly Bank Account Reconciliation Statement Template

A

Monthly Bank Account Reconciliation Statement Template is a structured document designed to systematically compare a company's internal financial records with bank statements. This template helps identify discrepancies such as outstanding checks, deposits in transit, or bank fees to ensure accuracy in financial reporting. Maintaining this reconciliation supports effective cash flow management and accurate accounting practices.

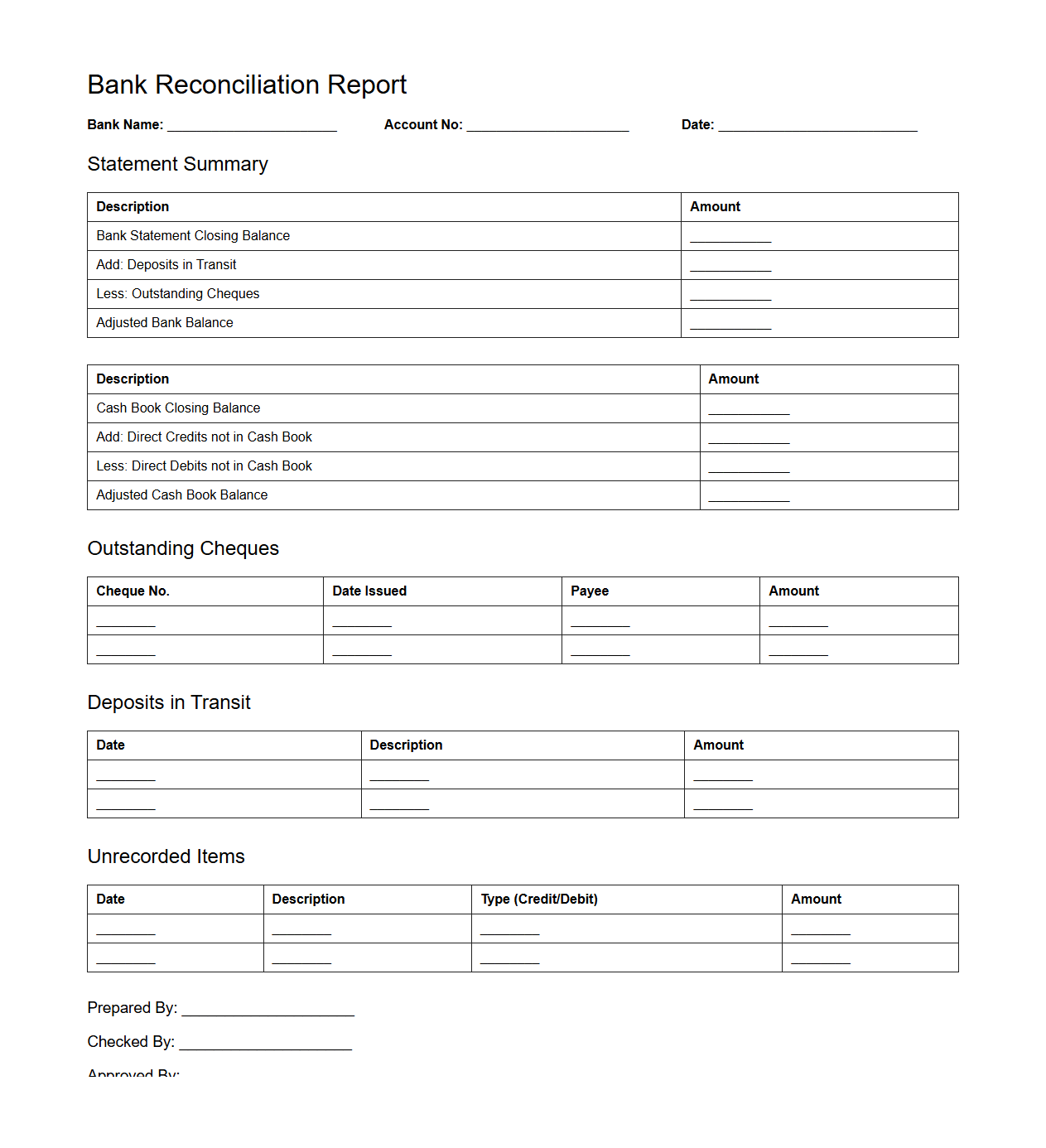

Standard Bank Reconciliation Report Format

The

Standard Bank Reconciliation Report Format document is a structured template used to compare a company's bank statement with its internal financial records, ensuring accuracy in cash transactions. This format typically includes columns for dates, descriptions, debit and credit amounts, and the reconciled balance to identify and resolve discrepancies. By maintaining this standardized report, businesses can promptly detect errors, fraudulent activities, and timing differences affecting their cash flow management.

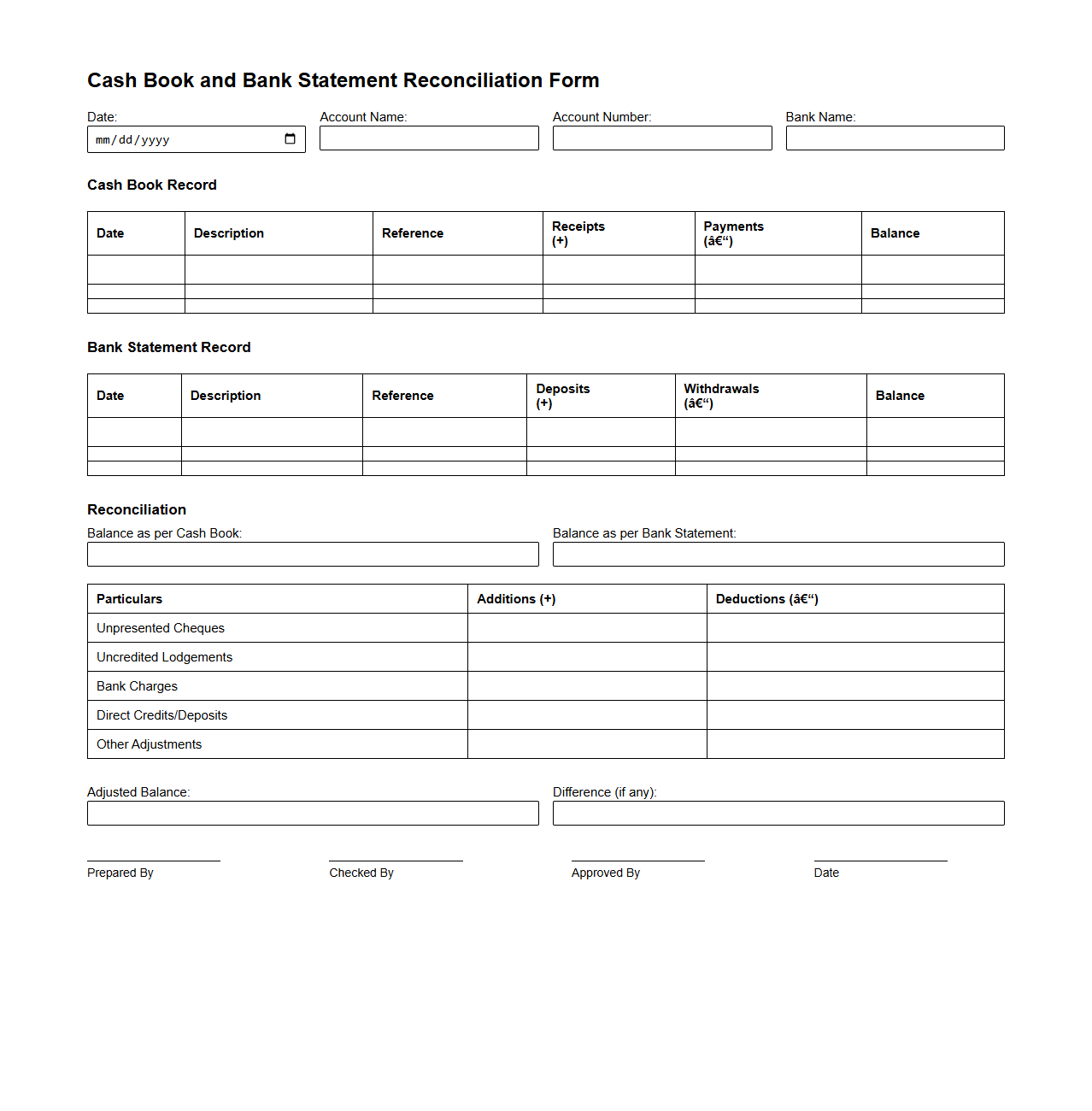

Cash Book and Bank Statement Reconciliation Form

A

Cash Book and Bank Statement Reconciliation Form is a financial document used to compare and match the balances recorded in a company's cash book with the corresponding bank statement. It identifies discrepancies such as outstanding checks, deposits in transit, or bank errors to ensure accurate financial records. This reconciliation process helps maintain financial integrity and supports effective cash flow management.

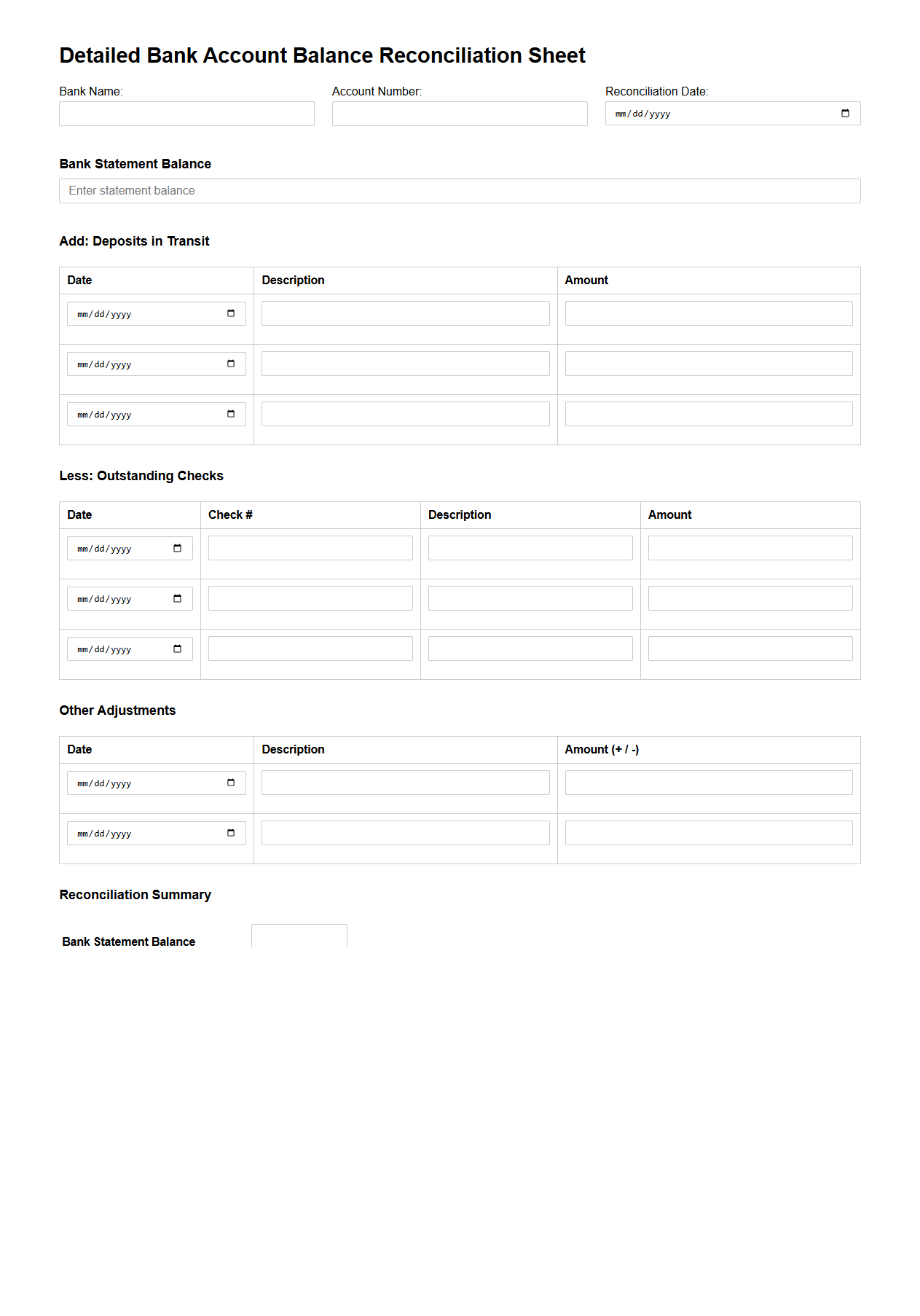

Detailed Bank Account Balance Reconciliation Sheet

A

Detailed Bank Account Balance Reconciliation Sheet is a financial document used to compare and match the balances in a company's accounting records with the corresponding bank statement. This sheet helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, ensuring accurate financial reporting and effective cash flow management. Regular use of this document supports internal controls and reduces the risk of fraud or accounting errors.

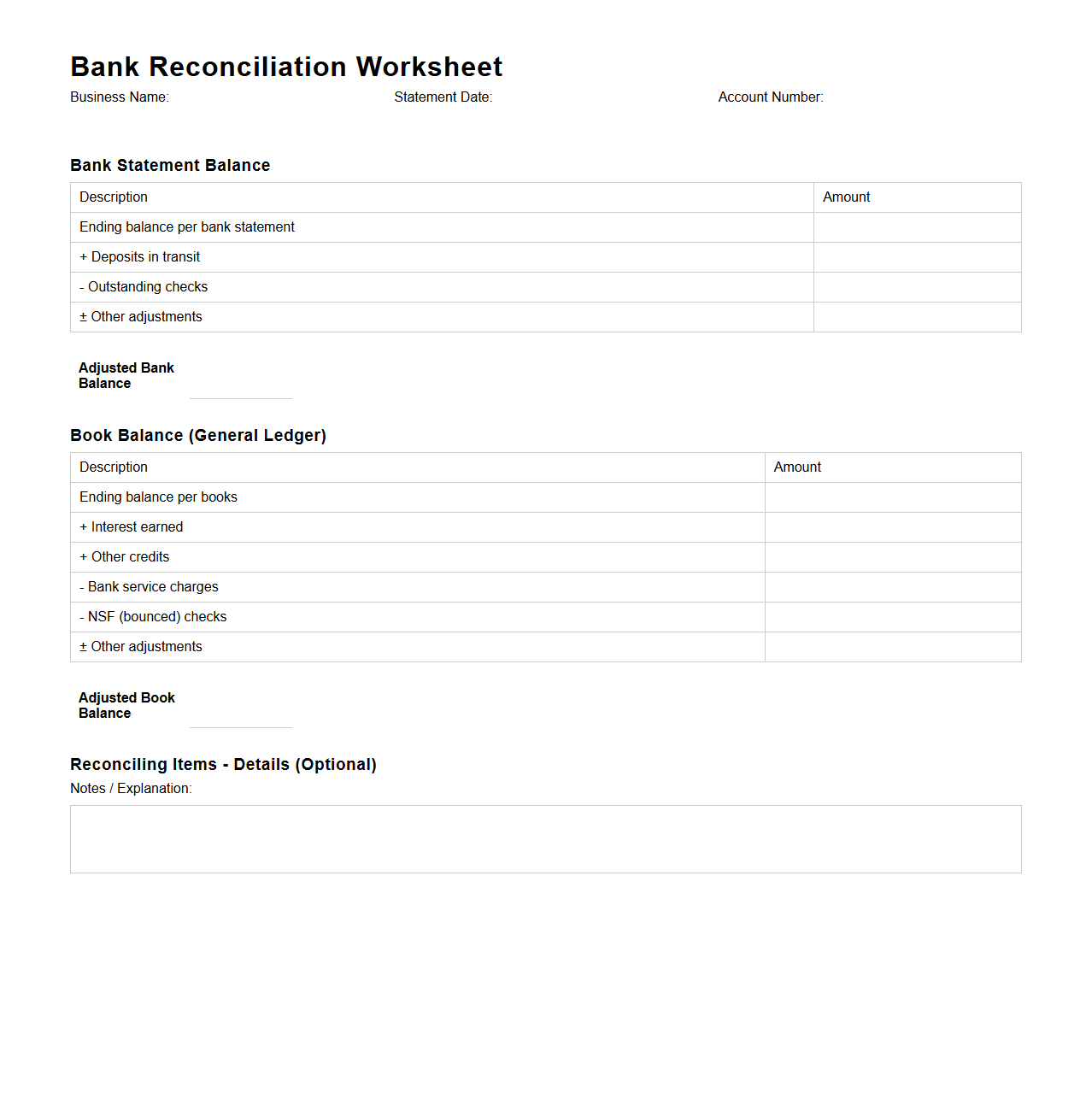

Bank Reconciliation Worksheet for Businesses

A

Bank Reconciliation Worksheet for businesses is a financial document used to match the company's internal records with the bank statement, ensuring accuracy and consistency in cash balances. It helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, providing a clear view of the actual cash position. Maintaining this worksheet regularly supports effective cash flow management and aids in detecting fraudulent activities or accounting mistakes.

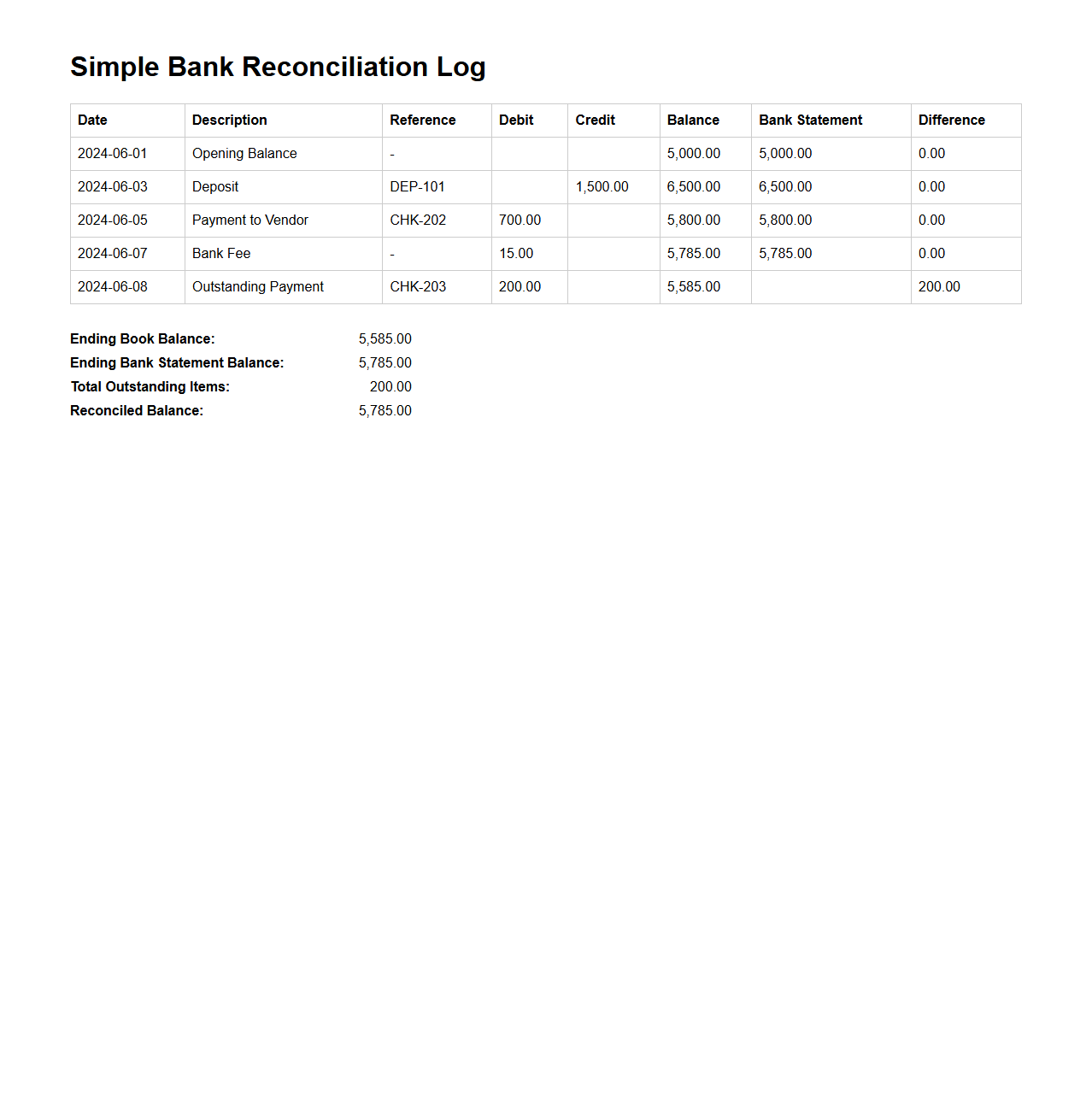

Simple Bank Reconciliation Log Example

The

Simple Bank Reconciliation Log Example document is a practical tool used to track and compare the bank statement with an organization's internal financial records. It helps identify discrepancies such as outstanding checks or deposits in transit, ensuring accuracy in cash flow reporting. This log simplifies the reconciliation process, making it easier for accountants and businesses to maintain accurate financial statements.

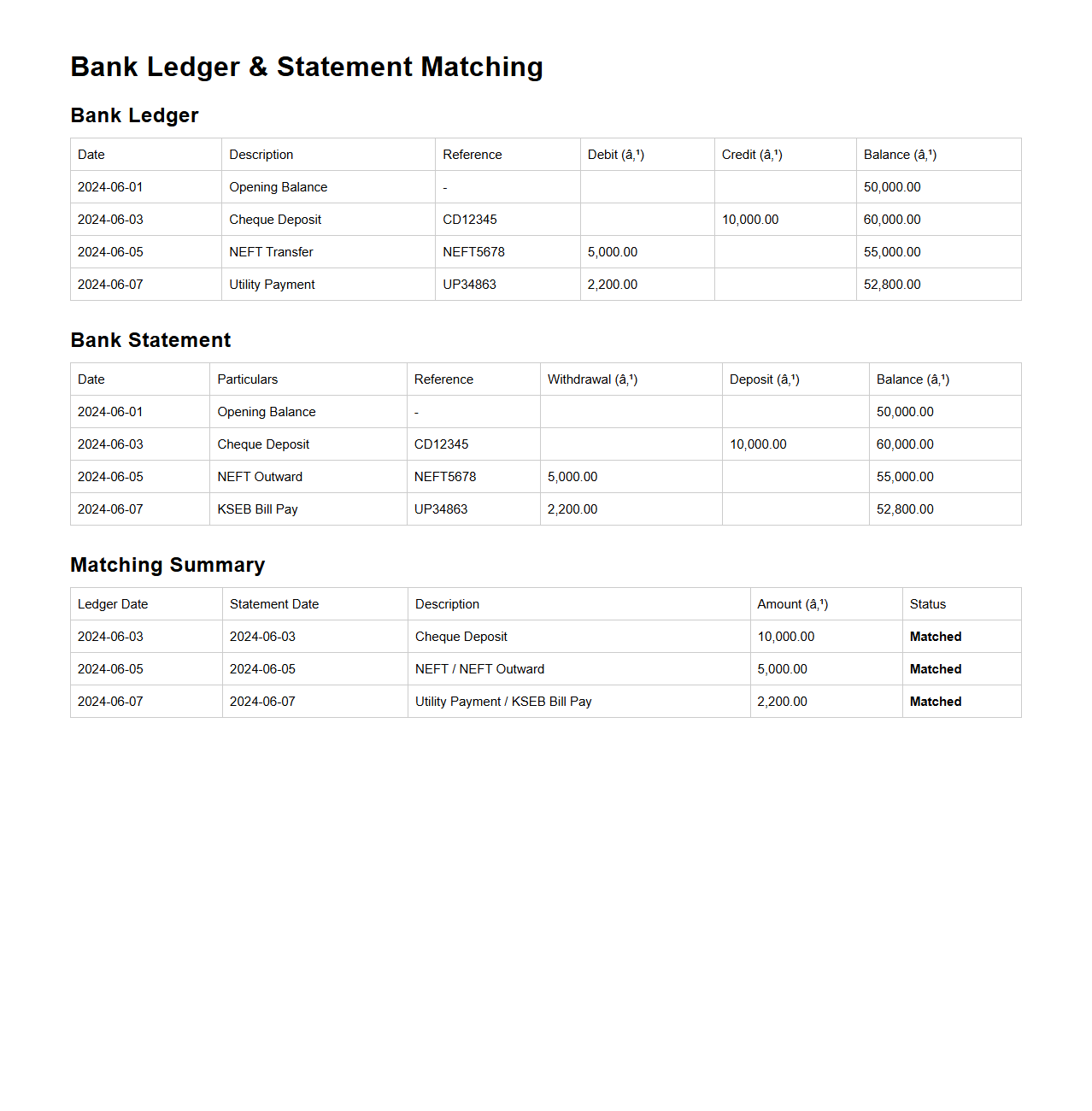

Bank Ledger and Statement Matching Sample

A

Bank Ledger is an accounting record that documents all transactions affecting a company's bank account, providing a detailed history of deposits, withdrawals, and balances. A Statement Matching Sample document is used to reconcile the bank ledger with the bank statement, ensuring that recorded transactions align perfectly with the bank's records to identify discrepancies. This process enhances accuracy in financial reporting and aids in detecting errors or fraudulent activities.

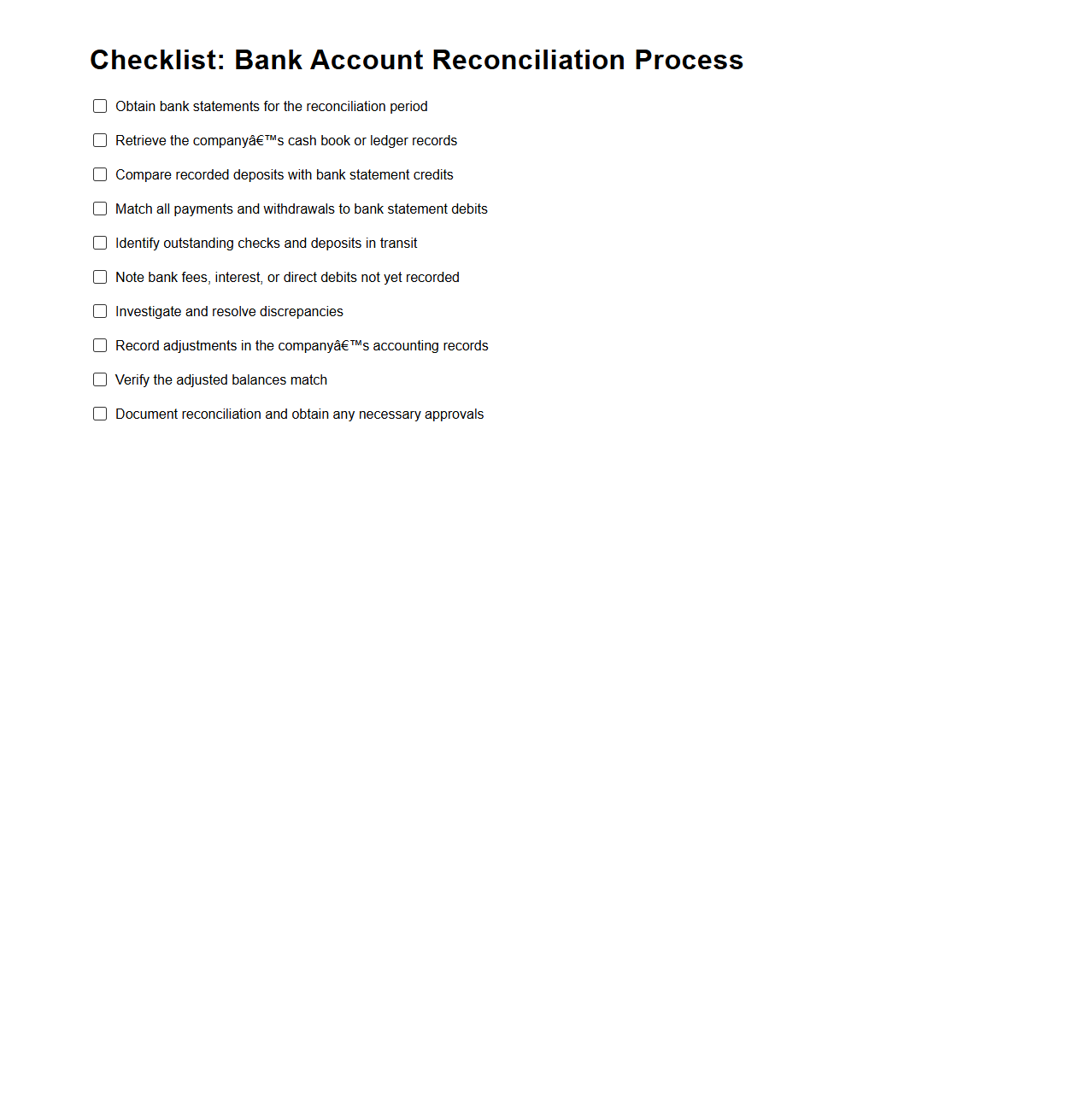

Checklist for Bank Account Reconciliation Process

The

Checklist for Bank Account Reconciliation Process document serves as a comprehensive guide to ensure accuracy and completeness in verifying financial transactions between a company's internal records and bank statements. It outlines step-by-step tasks such as matching deposits, withdrawals, and balances, identifying discrepancies, and verifying outstanding items to maintain financial integrity. This checklist helps streamline the reconciliation process, reduce errors, and facilitate timely detection of fraudulent activities or accounting mistakes.

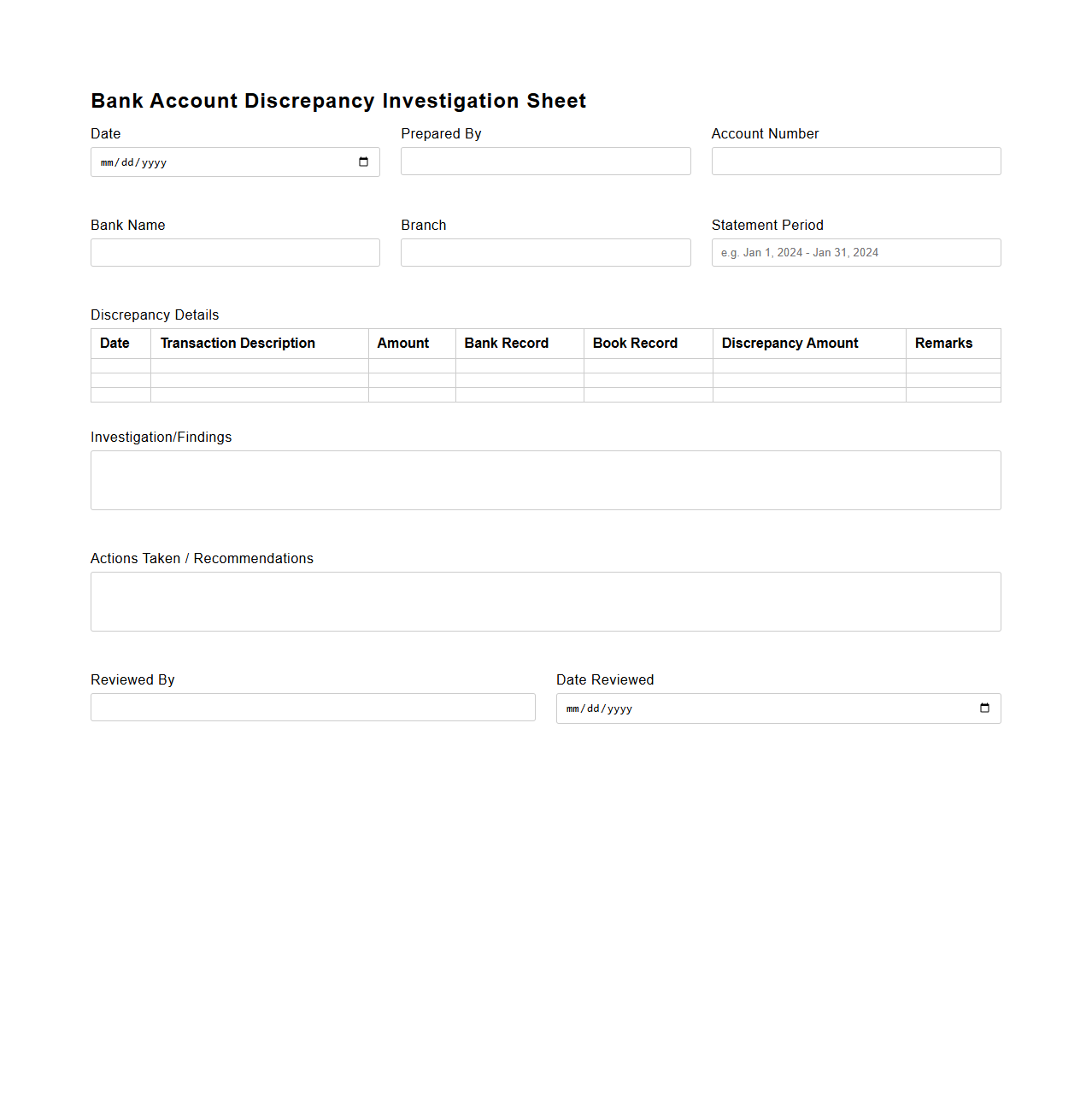

Bank Account Discrepancy Investigation Sheet

A

Bank Account Discrepancy Investigation Sheet is a critical financial document used to identify and resolve inconsistencies between recorded bank transactions and the actual bank statements. It systematically records details such as transaction dates, amounts, and descriptions to trace errors or unauthorized activities. This sheet helps maintain accurate financial records, ensuring compliance with accounting standards and facilitating prompt reconciliation.

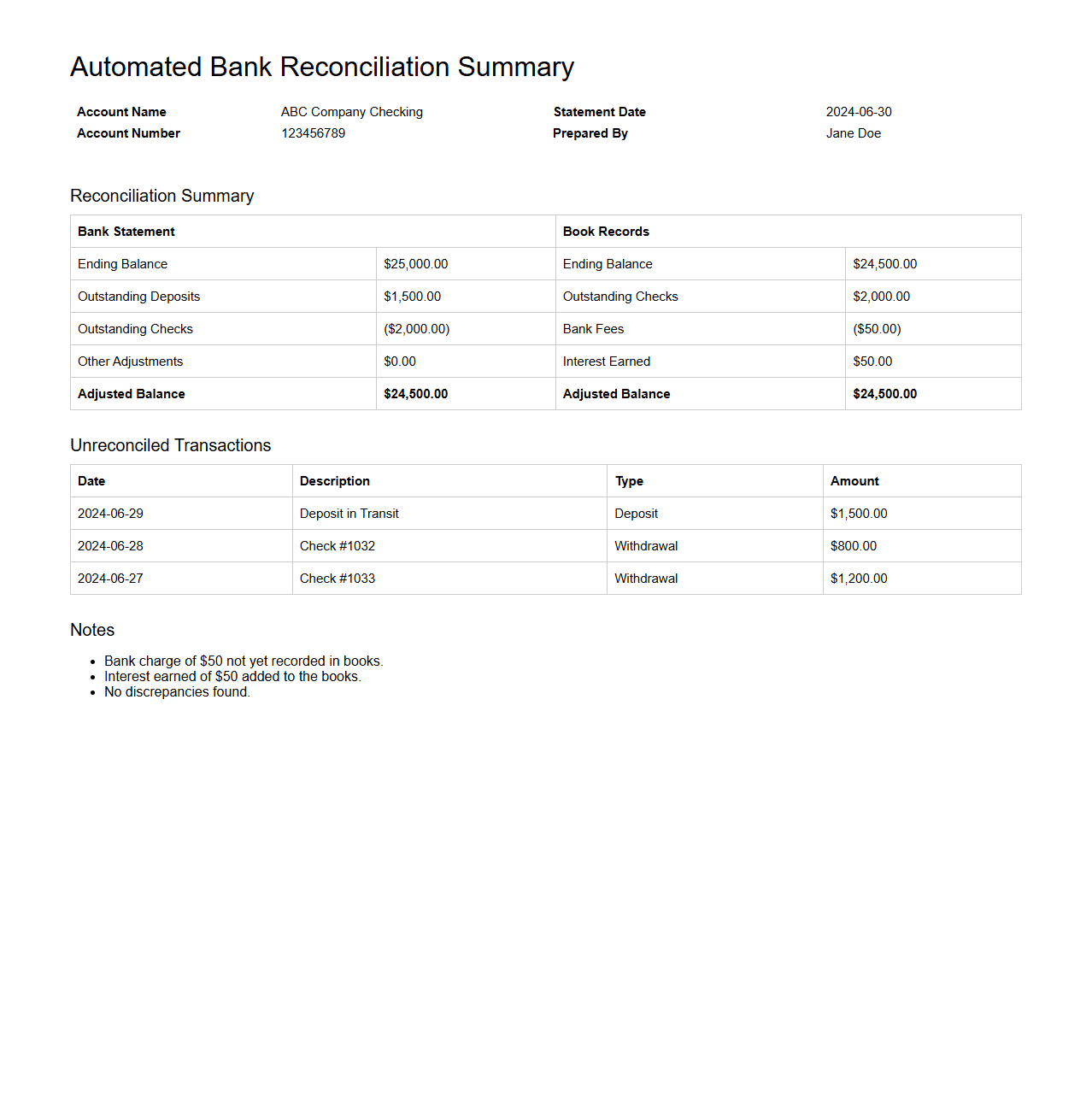

Automated Bank Reconciliation Summary Example

An

Automated Bank Reconciliation Summary Example document provides a clear overview of the process where software systems match a company's bank statements with internal financial records. This summary highlights discrepancies, outstanding transactions, and ensures accurate cash flow management by identifying mismatches promptly. Such documents streamline auditing, reduce manual errors, and enhance overall financial transparency.

What supporting documents are required for bank account reconciliation letters?

Supporting documents for bank account reconciliation letters typically include bank statements, deposit slips, and canceled checks. These documents provide evidence for transactions recorded on both the bank and company books. Additionally, transaction details such as receipts and payment vouchers ensure accuracy during reconciliation.

How should discrepancies be reported in a reconciliation document?

Discrepancies in a reconciliation document should be clearly identified and detailed with explanations. Each variance must be supported by documentation or investigation results to clarify the cause. Transparent reporting helps maintain integrity and facilitates timely resolution.

Which approval signatures are necessary on a reconciliation letter?

A reconciliation letter should include signatures from the accountant, department manager, and authorized finance officer. These approvals ensure oversight and accountability for the accuracy of the reconciliation. The signatures confirm review and acceptance of the documented balances and adjustments.

What is the recommended format for monthly reconciliation statements?

The ideal monthly reconciliation statement is organized with a clear summary of balances, transaction details, and adjustment explanations. It should present opening and closing balances alongside reconciled amounts for transparency. Including reconciled items in a tabular format enhances readability and auditing efficiency.

How are outstanding checks documented in bank account reconciliation?

Outstanding checks are documented by listing them along with their dates and amounts in the reconciliation statement. This ensures they are deducted from the bank statement balance to reflect the true cash position. Proper documentation prevents double-counting and misalignment between bank and book records.