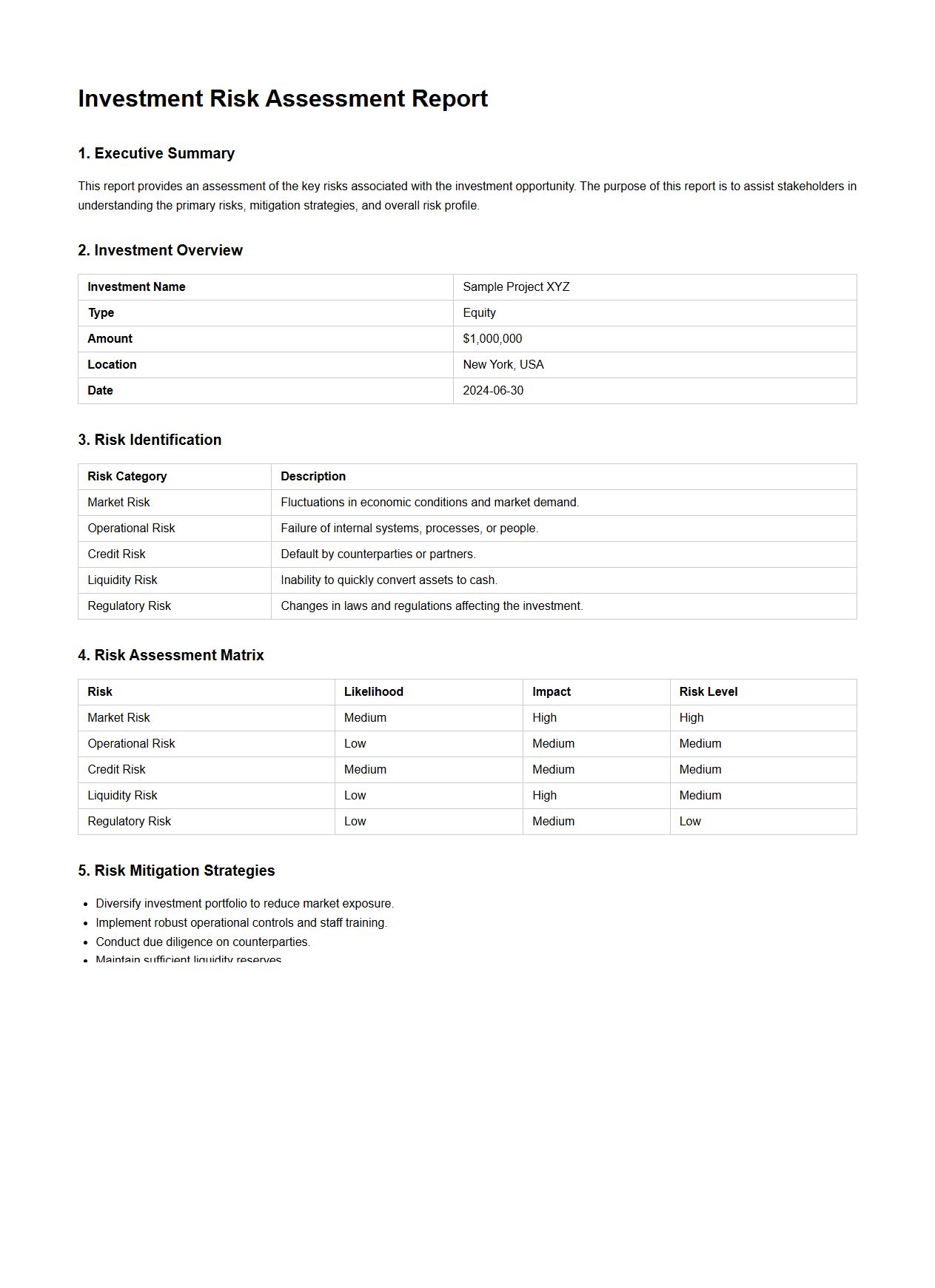

Investment Risk Assessment Report Sample

An

Investment Risk Assessment Report Sample document provides a structured evaluation of potential financial risks associated with specific investment opportunities, highlighting factors such as market volatility, credit risk, and liquidity concerns. This sample helps investors and financial analysts understand how to systematically identify, measure, and mitigate risks before committing capital. The report typically includes quantitative data, risk rating scales, and tailored recommendations designed to guide informed decision-making in portfolio management.

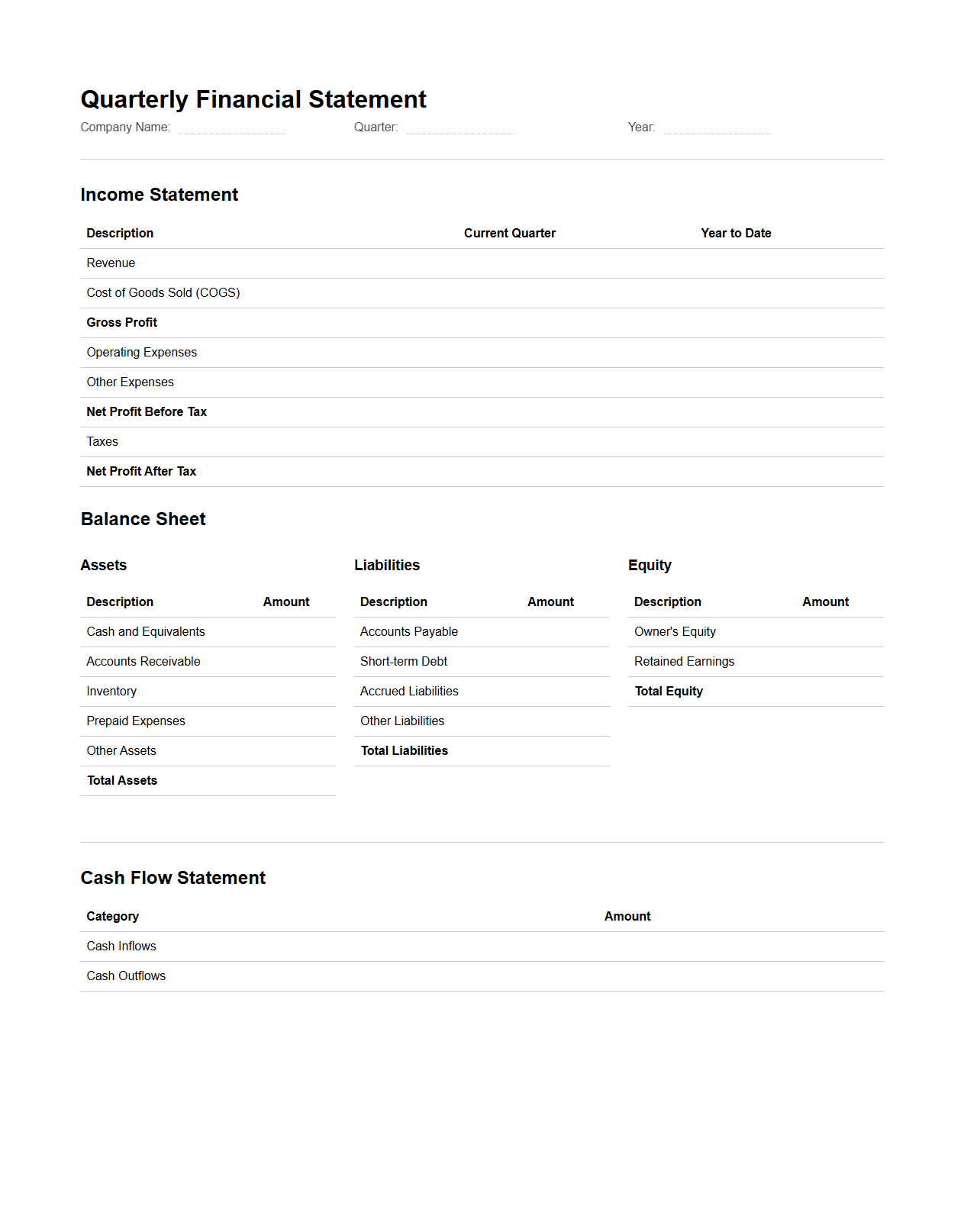

Quarterly Financial Statement Template

A

Quarterly Financial Statement Template document is a structured format used by businesses to report their financial performance over a three-month period. It includes key components such as income statements, balance sheets, and cash flow statements, providing a clear snapshot of revenue, expenses, profits, assets, and liabilities. This template streamlines the financial reporting process, ensuring consistency and accuracy for internal analysis and regulatory compliance.

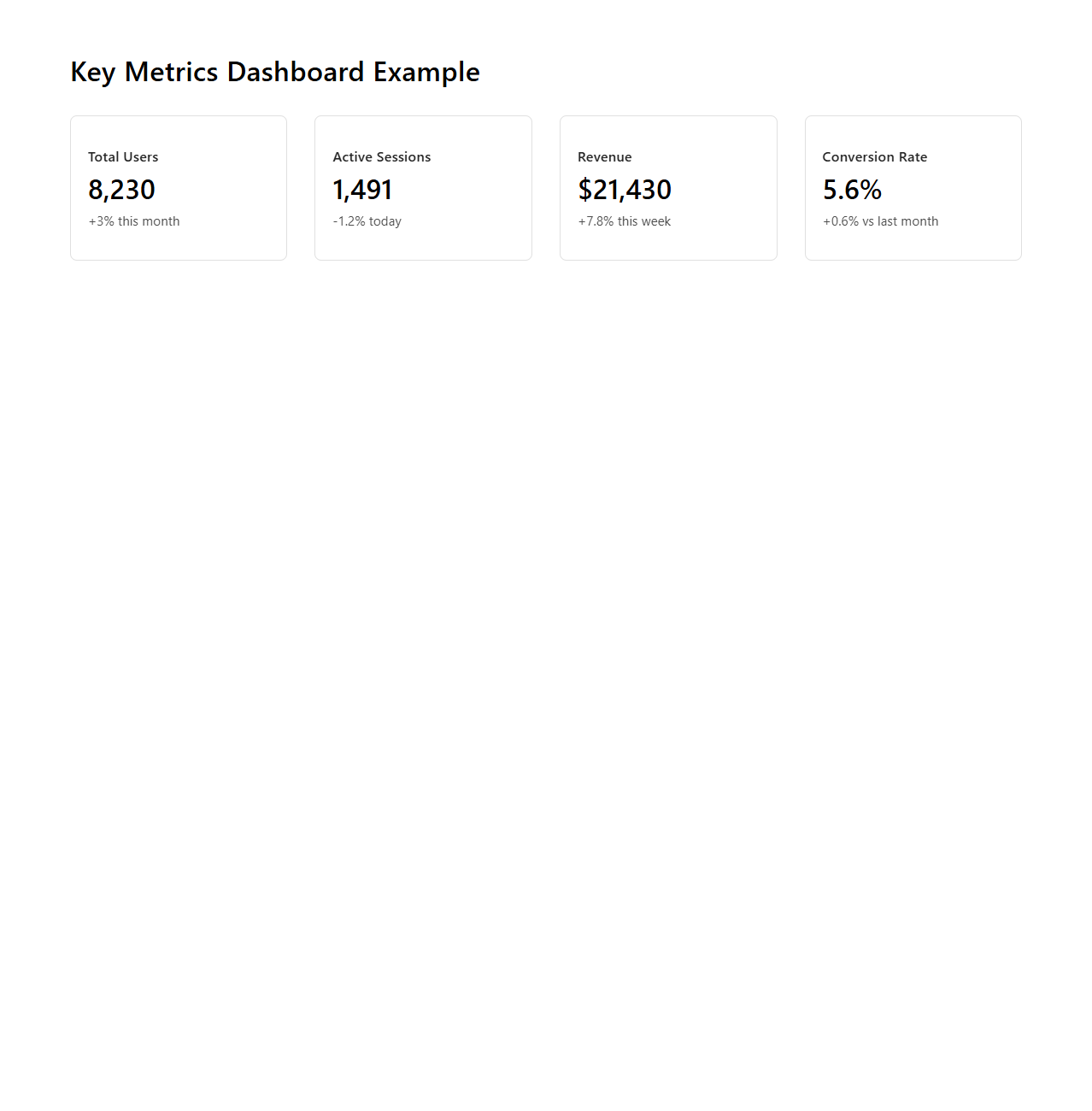

Key Metrics Dashboard Example

A

Key Metrics Dashboard Example document showcases a visual representation of crucial performance indicators for a business or project, enabling quick assessment and informed decision-making. It typically includes charts, graphs, and numerical data highlighting trends, progress toward goals, and areas needing attention. This document serves as an essential tool for stakeholders to monitor operational efficiency, sales performance, customer engagement, or financial health in real time.

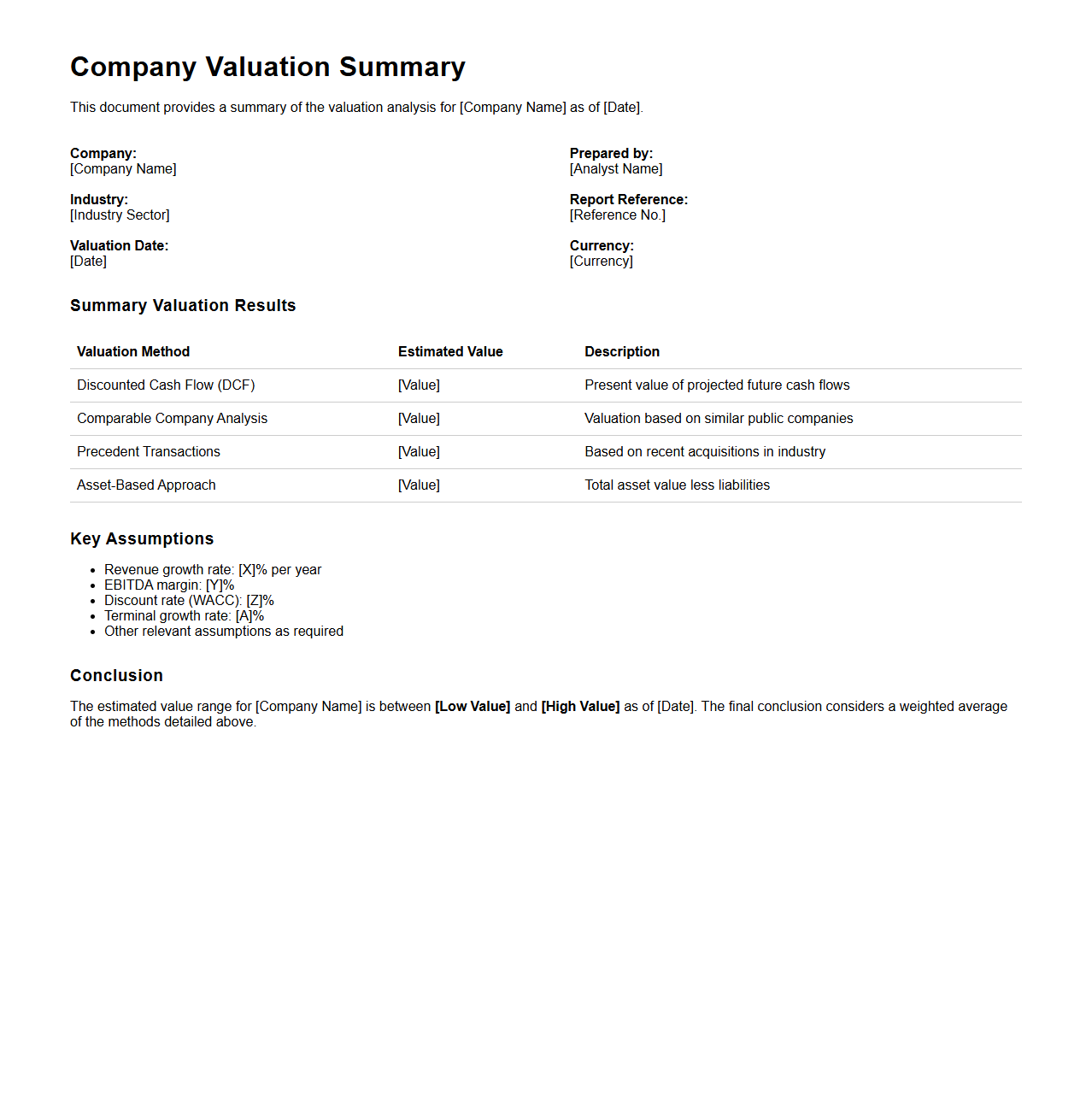

Company Valuation Summary Sample

A

Company Valuation Summary Sample document provides a concise overview of a business's estimated market value based on financial metrics, assets, liabilities, and market conditions. It typically includes key valuation methods such as discounted cash flow (DCF), comparable company analysis, and precedent transactions to present a well-rounded financial assessment. This summary aids investors, stakeholders, and management in making informed decisions regarding mergers, acquisitions, or investment opportunities.

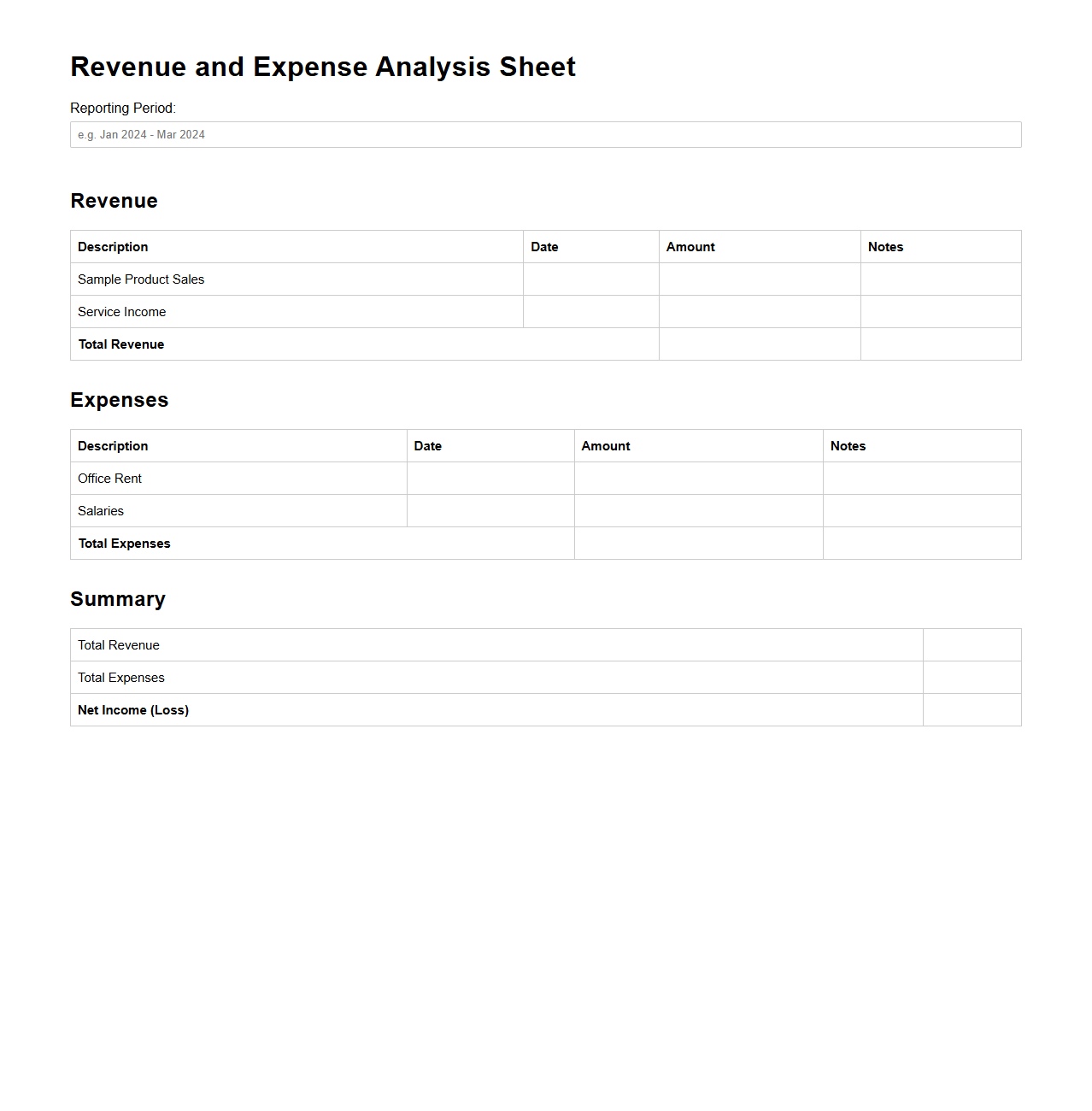

Revenue and Expense Analysis Sheet

A

Revenue and Expense Analysis Sheet is a financial document that systematically tracks and categorizes income and expenditures to provide clear insights into a business's profitability and cash flow. It helps identify trends, control costs, and improve budgeting accuracy by comparing actual figures against forecasts or past periods. This sheet is essential for making informed financial decisions and ensuring sustainable business growth.

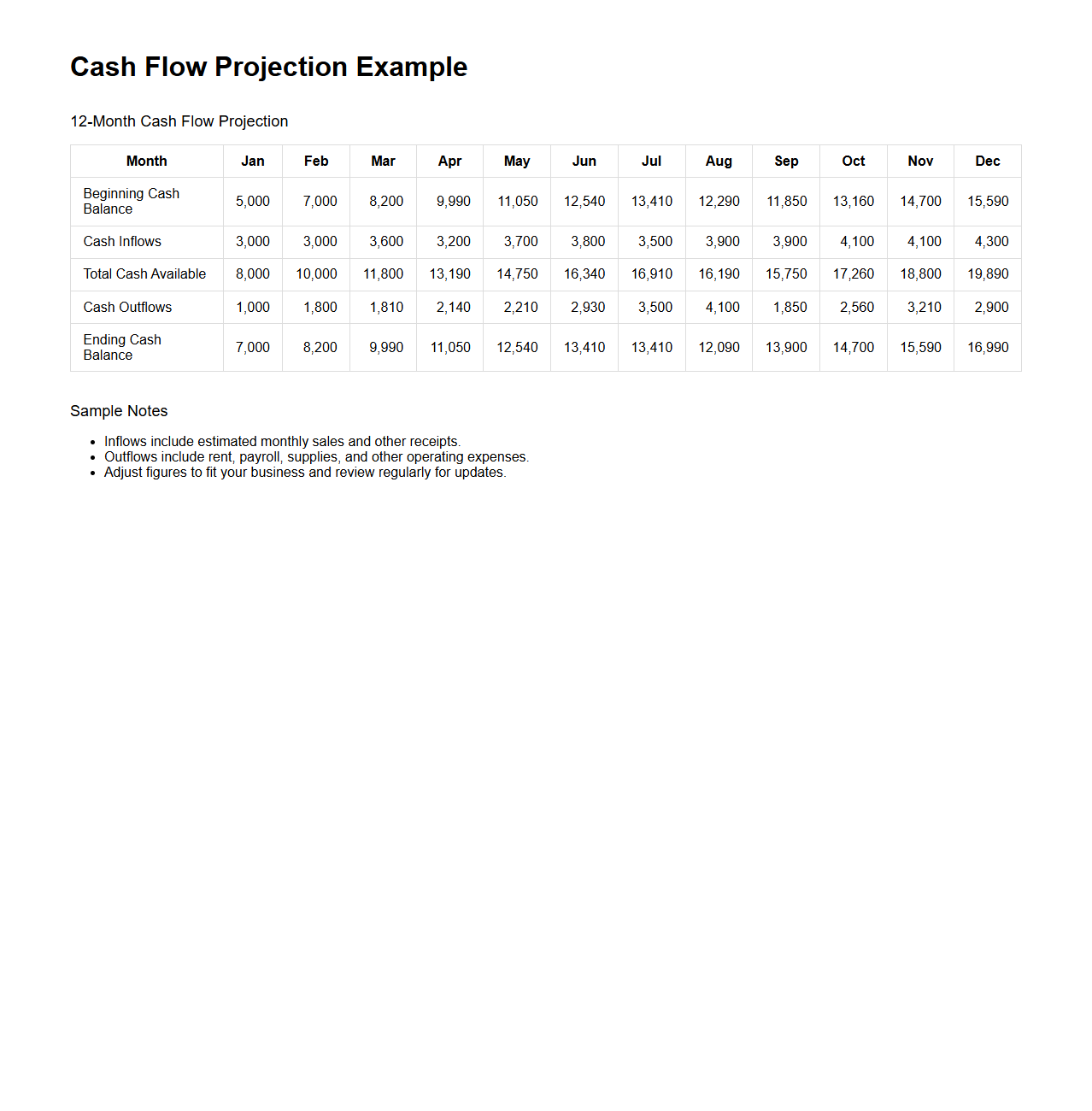

Cash Flow Projection Example

A

Cash Flow Projection Example document illustrates anticipated cash inflows and outflows over a specific period, helping businesses forecast their liquidity position. It includes detailed estimates of revenue, operating expenses, investments, and financing activities to provide a clear picture of financial health. This tool enables proactive financial planning, ensuring sufficient cash availability to meet obligations and avoid shortfalls.

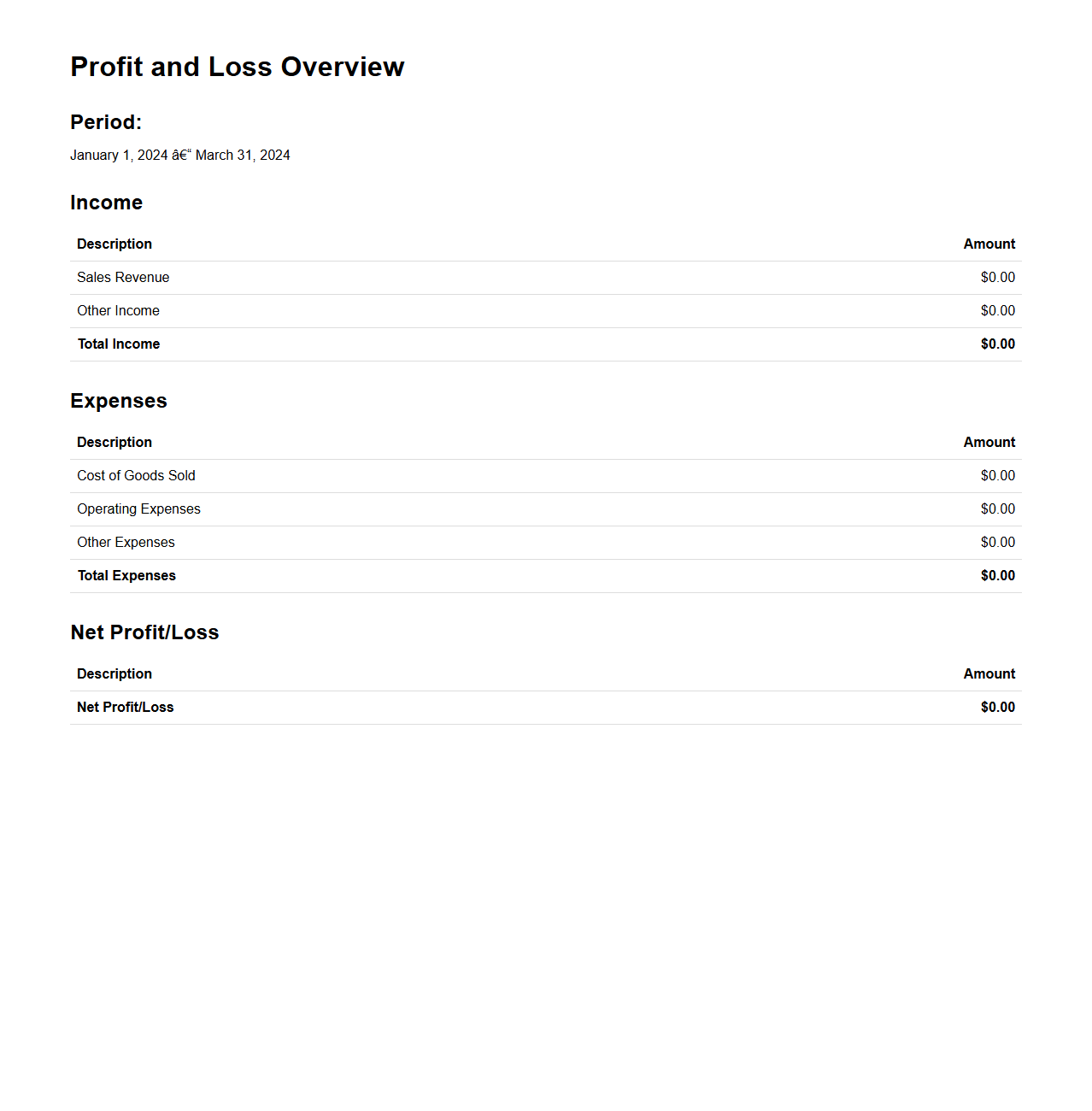

Profit and Loss Overview Document

A

Profit and Loss Overview Document provides a summarized financial statement that outlines a company's revenues, costs, and expenses during a specific period. This document helps stakeholders quickly assess the business's financial performance, including net profit or loss. It highlights key metrics such as gross profit, operating expenses, and net income to support informed decision-making.

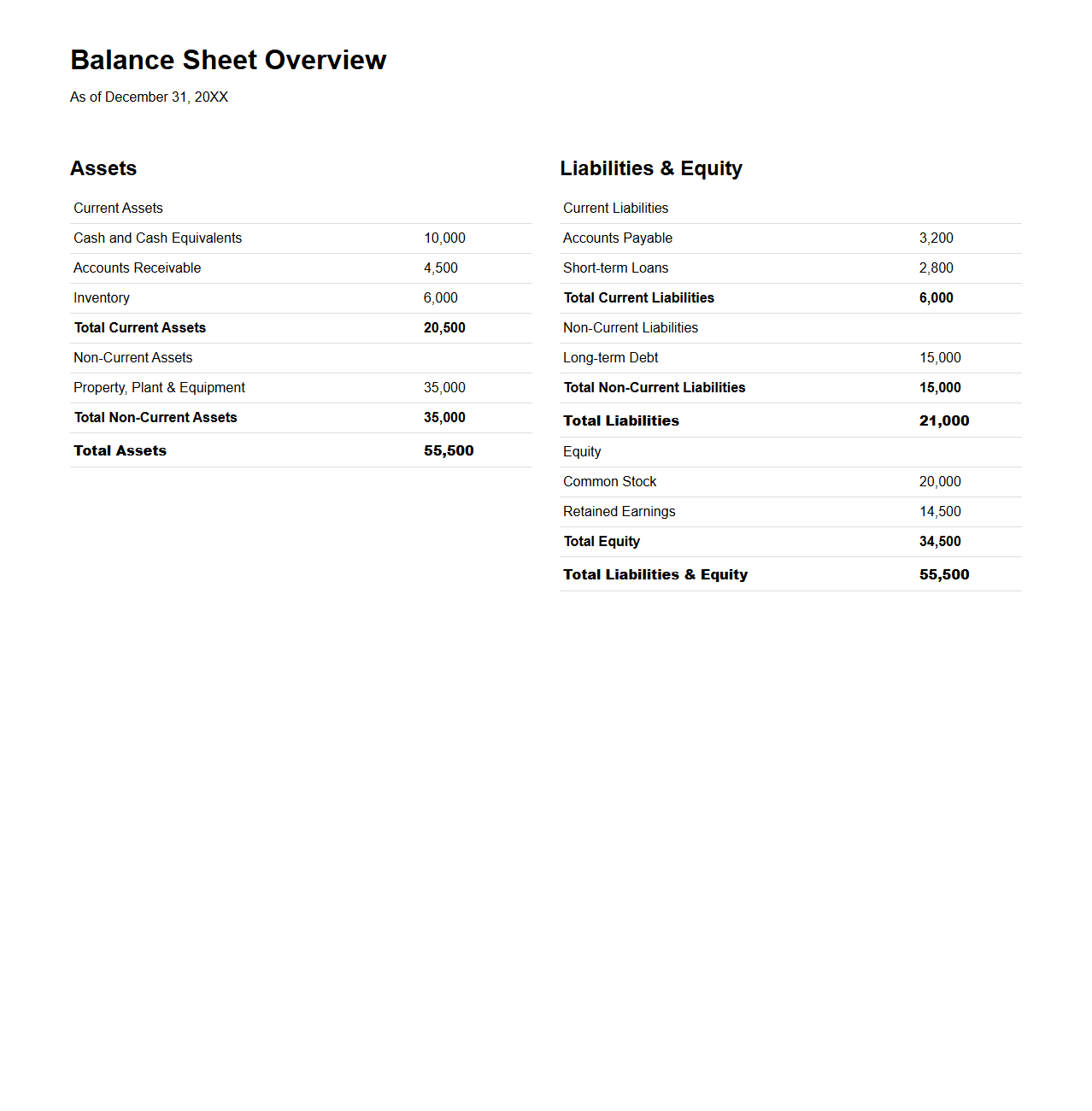

Balance Sheet Overview Sample

A

Balance Sheet Overview Sample document provides a concise snapshot of a company's financial position at a specific point in time, highlighting assets, liabilities, and shareholders' equity. This sample helps users understand the structure and key components of a balance sheet, facilitating accurate financial analysis and reporting. By reviewing this document, stakeholders can assess liquidity, solvency, and capital structure effectively.

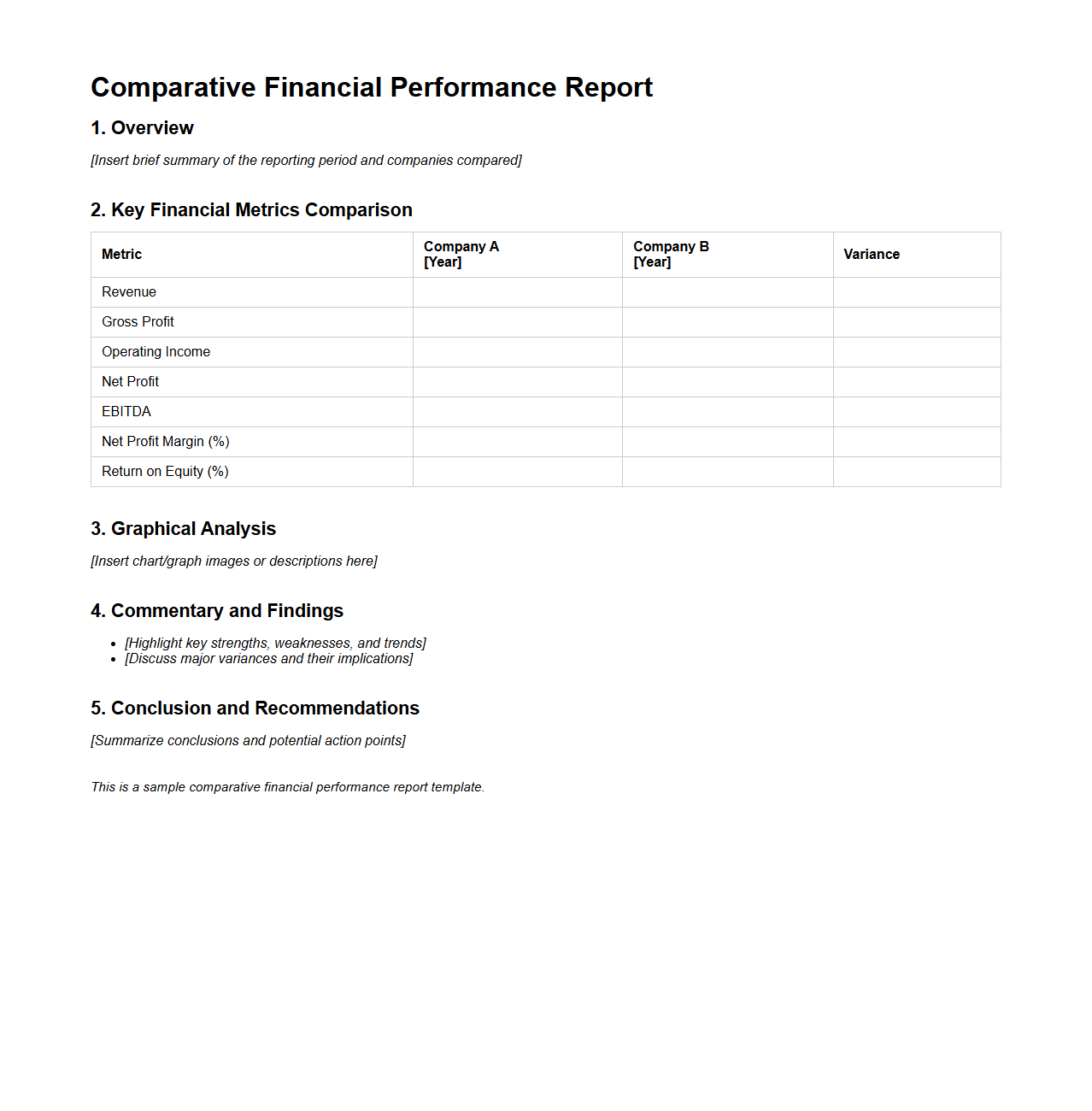

Comparative Financial Performance Report

A

Comparative Financial Performance Report is a document that analyzes and contrasts financial data over multiple periods to assess a company's economic health and operational efficiency. It typically includes key metrics such as revenue, expenses, profit margins, and cash flow, allowing stakeholders to identify trends and make informed decisions. This report is essential for benchmarking performance against competitors and industry standards.

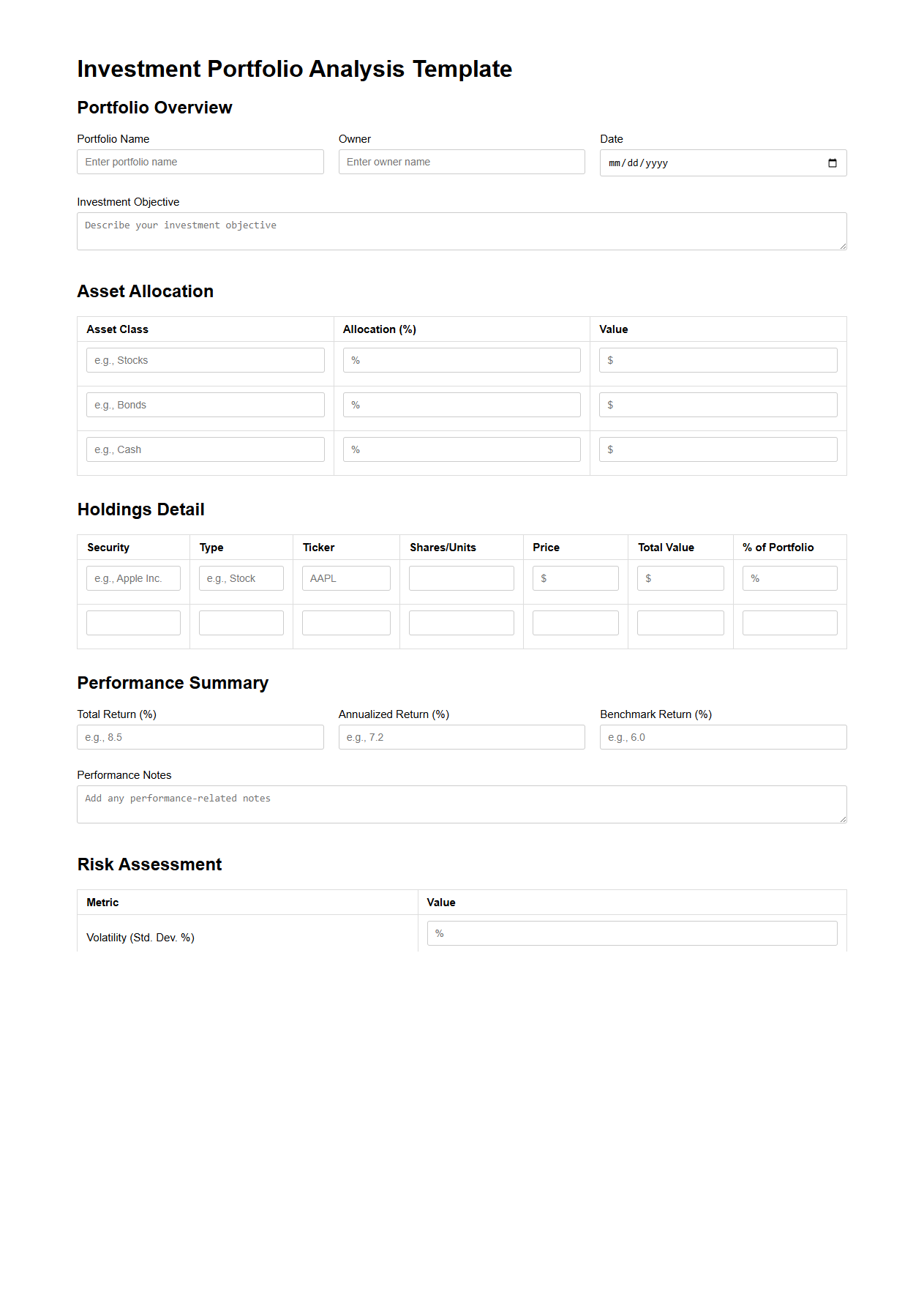

Investment Portfolio Analysis Template

An

Investment Portfolio Analysis Template document is a structured tool designed to evaluate and track the performance of various assets within an investment portfolio. It helps investors analyze asset allocation, risk factors, and returns, providing clear insights into portfolio diversification and potential growth. This template is essential for making informed decisions and optimizing investment strategies based on quantitative data.

What key financial ratios are highlighted to demonstrate investment viability?

The debt-to-equity ratio is prominently featured to show the company's financial leverage and stability. Additionally, the return on investment (ROI) is detailed to highlight profitability for potential investors. The current ratio is also presented to emphasize liquidity and the ability to meet short-term obligations.

How does the document address projected cash flow sustainability?

The document outlines a consistent positive cash flow projection to illustrate ongoing operational viability. It includes detailed assumptions about revenue inflows and expense outflows to ensure transparency. Furthermore, contingencies are factored in to maintain cash flow stability under varying market conditions.

What methodologies underpin the revenue growth assumptions presented?

The revenue growth assumptions rely on a combination of market trend analysis and historical sales data evaluation. Forecasting models incorporate both quantitative data and qualitative factors like consumer behavior shifts. Sensitivity analyses are also employed to test the robustness of these growth projections.

Are potential financial risks and mitigations clearly itemized for investors?

Yes, the document provides a comprehensive list of financial risks including market volatility, credit risks, and operational challenges. Each risk is paired with specific mitigation strategies to reassure investors. This detailed approach enhances investor confidence by addressing uncertainties proactively.

How are historical financial data trends contextualized against industry benchmarks?

Historical financial data is compared with industry benchmarks to provide meaningful context and performance evaluation. This benchmarking highlights areas of strength and identifies opportunities for improvement. It allows investors to gauge the company's competitive positioning effectively.