A Audit Report Document Sample for Public Companies provides a standardized template outlining the auditor's opinion on the financial statements' accuracy and compliance. It typically includes sections such as the auditor's responsibilities, management's responsibilities, and the scope of the audit. This sample serves as a crucial reference for ensuring transparency and regulatory adherence in public company reporting.

Independent Auditor’s Report Template for Public Companies

An

Independent Auditor's Report Template for Public Companies document serves as a standardized format to present an auditor's opinion on the financial statements of publicly traded entities. This template ensures compliance with regulatory requirements, such as those set by the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB). It includes sections detailing the auditor's responsibility, scope of audit, and conclusion, enhancing transparency and consistency for stakeholders.

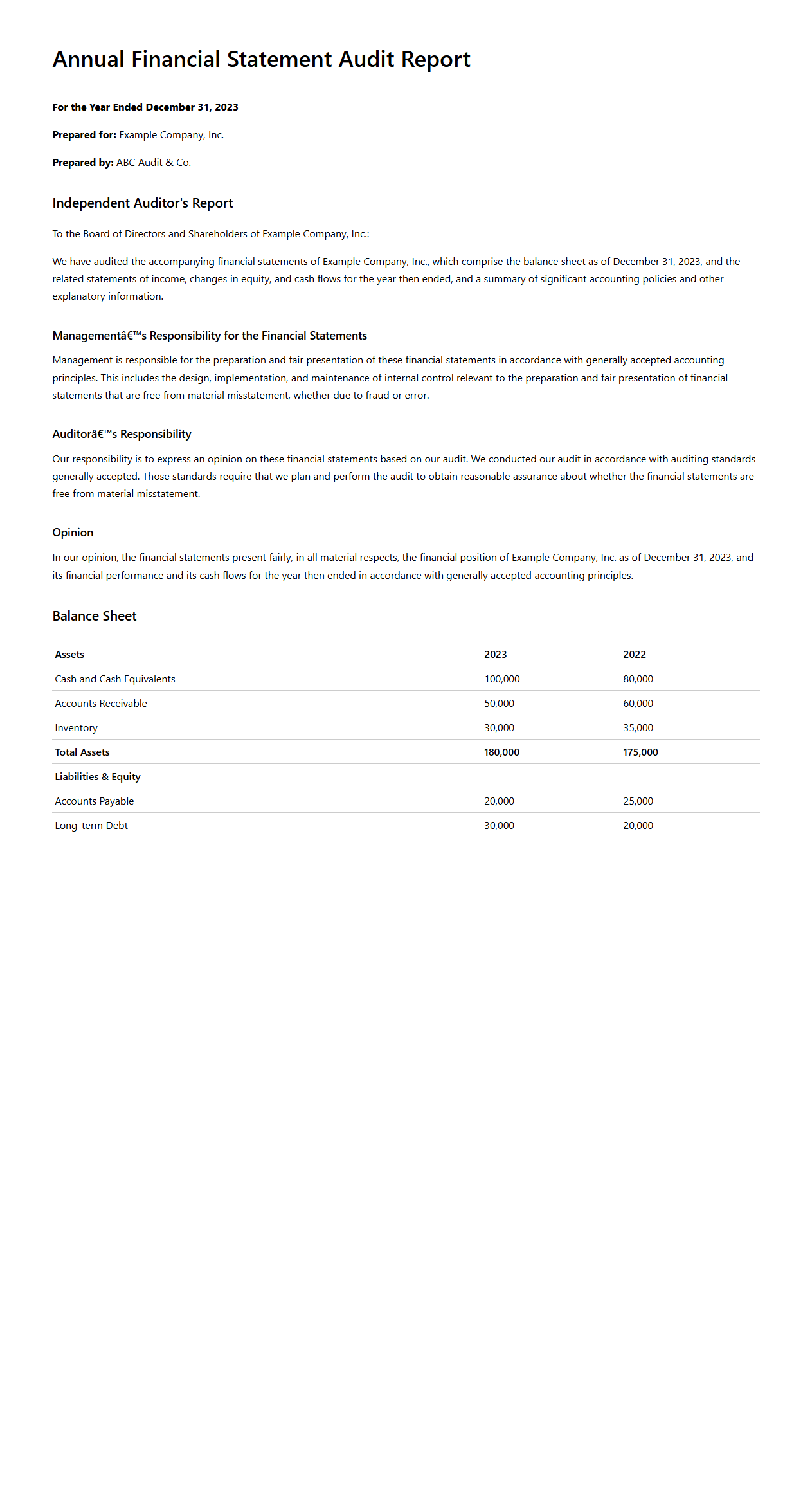

Annual Financial Statement Audit Report Example

An

Annual Financial Statement Audit Report Example document serves as a model illustrating the comprehensive evaluation of an organization's financial records conducted by an independent auditor. It includes essential components such as the auditor's opinion, balance sheet analysis, income statement review, and notes on accounting policies, demonstrating adherence to regulatory standards like GAAP or IFRS. Companies and stakeholders utilize this example report to understand the format, content, and level of detail required for transparent financial reporting and compliance verification.

Consolidated Group Audit Report Draft

The

Consolidated Group Audit Report Draft is a preliminary financial document prepared by auditors to summarize the combined audit findings of a parent company and its subsidiaries. It consolidates individual audit reports to present a unified view of the financial health and compliance status of the entire corporate group. This draft serves as a basis for review and discussion before the final audit report is issued.

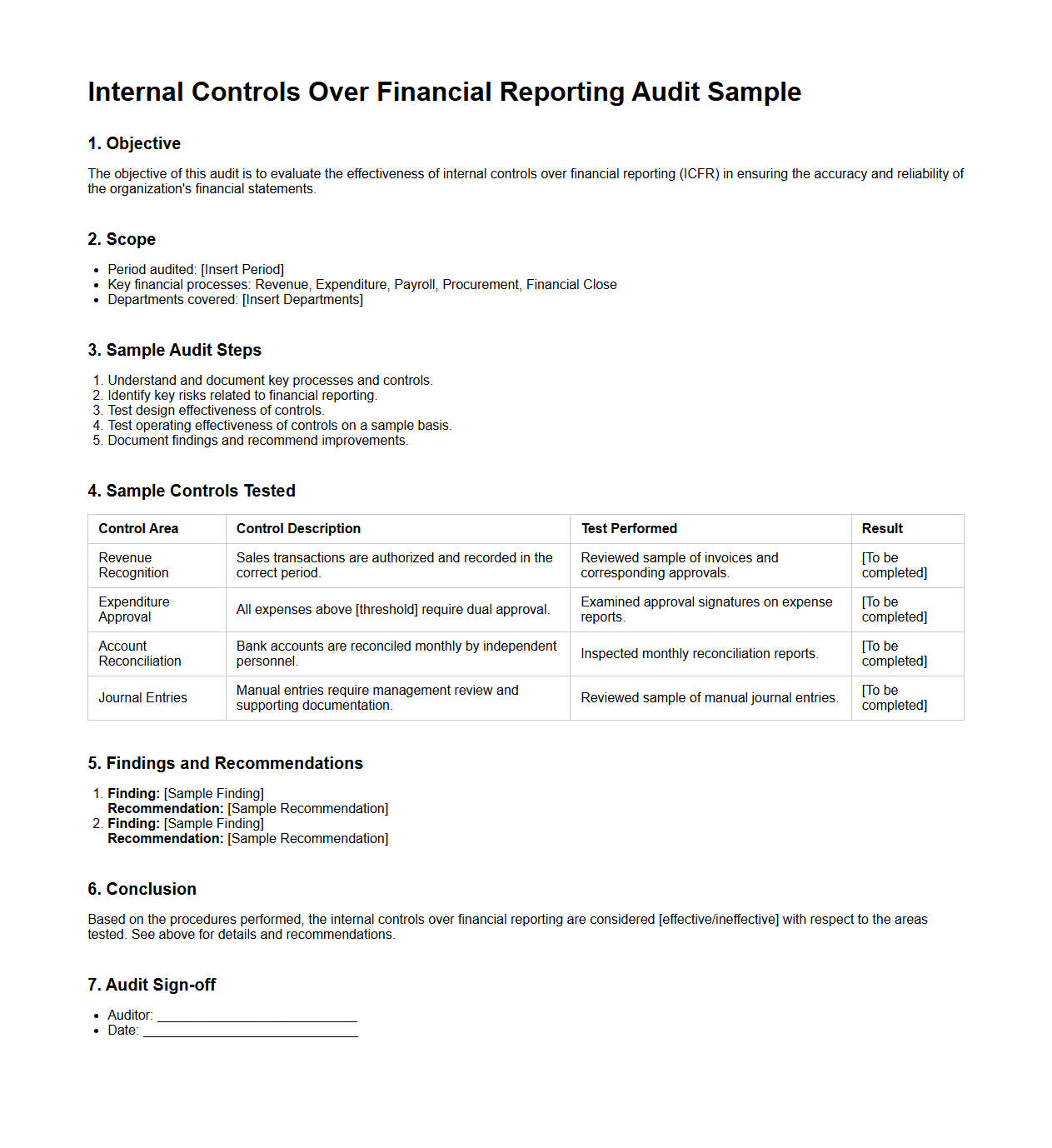

Internal Controls Over Financial Reporting Audit Sample

An

Internal Controls Over Financial Reporting (ICFR) Audit Sample document serves as a template or example outlining procedures and evidence used to evaluate the effectiveness of a company's internal controls related to financial reporting. This document helps auditors systematically assess risks, identify control deficiencies, and ensure compliance with regulatory requirements such as the Sarbanes-Oxley Act. It provides a structured approach to testing key controls, documenting findings, and supporting audit conclusions for accurate financial disclosures.

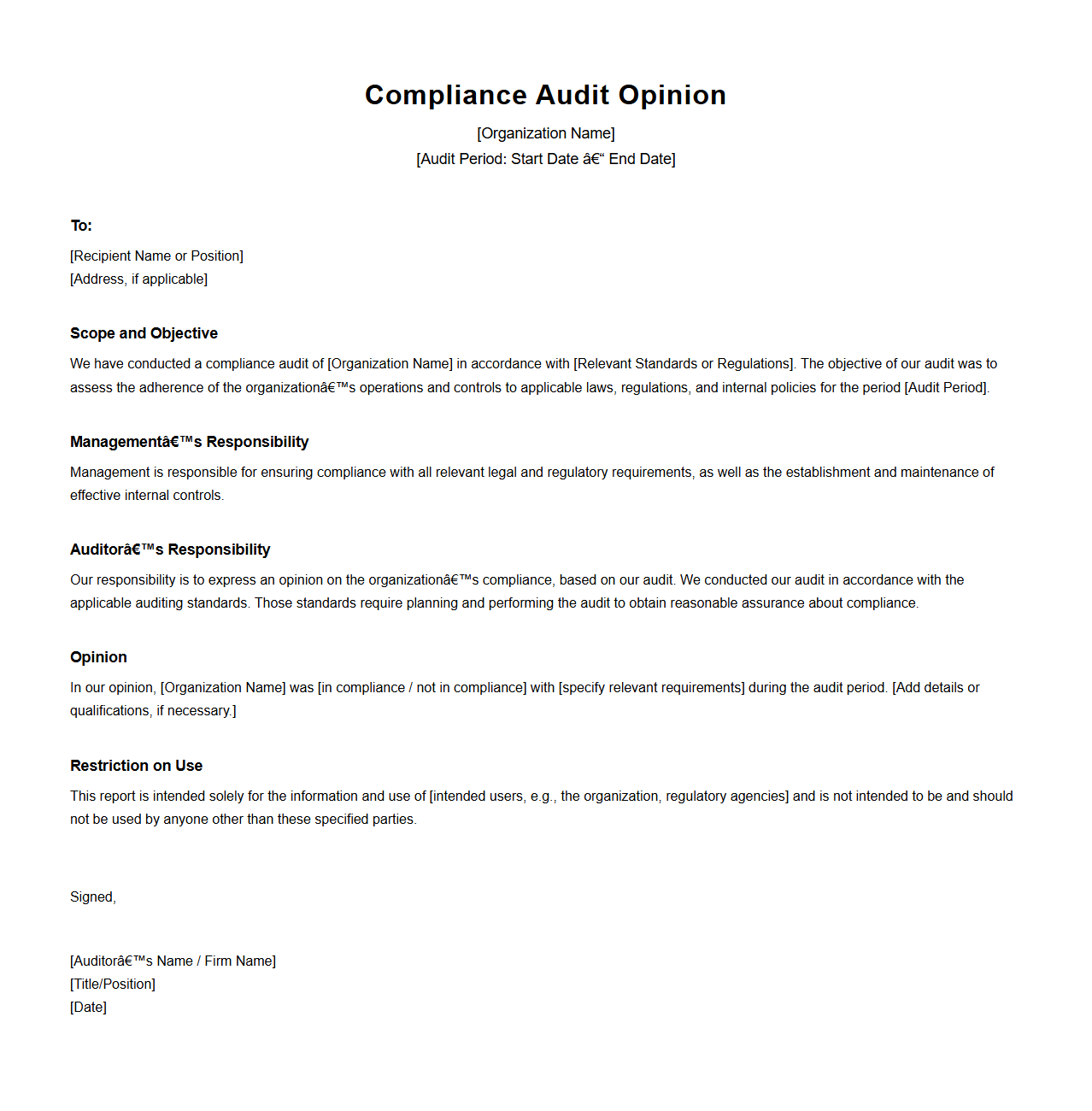

Compliance Audit Opinion Document

A

Compliance Audit Opinion Document is a formal report issued by an independent auditor that evaluates an organization's adherence to relevant laws, regulations, and internal policies. It provides an objective assessment of whether the entity's operations and financial practices comply with established standards, highlighting areas of conformity or non-compliance. This document is essential for stakeholders to ensure regulatory accountability and mitigate risks associated with legal violations.

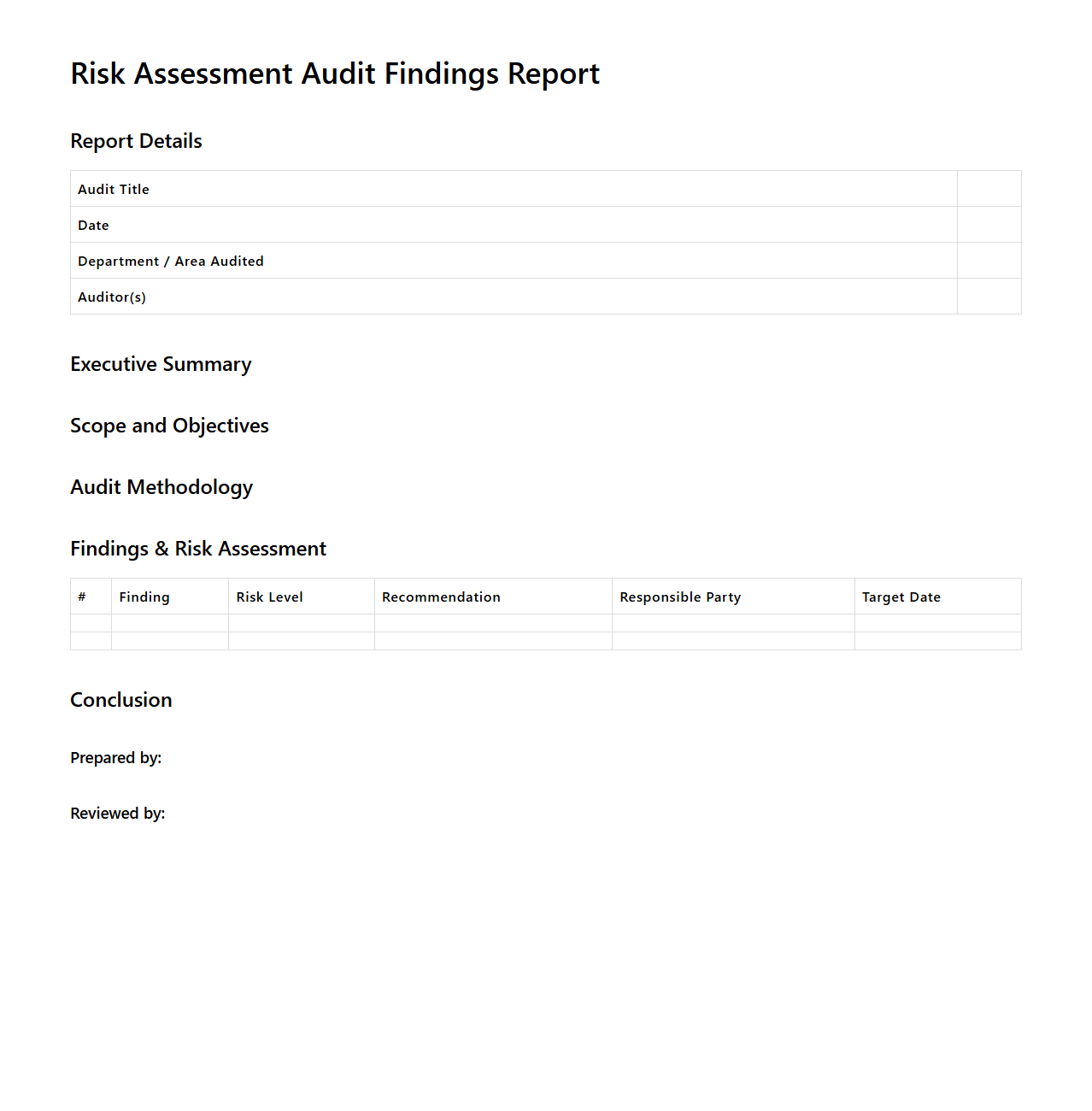

Risk Assessment Audit Findings Report

A

Risk Assessment Audit Findings Report documents the results of evaluating potential risks within an organization's processes, systems, or projects. It identifies vulnerabilities, assesses their impact and likelihood, and provides recommendations for mitigation strategies. This report serves as a critical tool for stakeholders to understand risk exposure and implement effective controls to enhance organizational resilience.

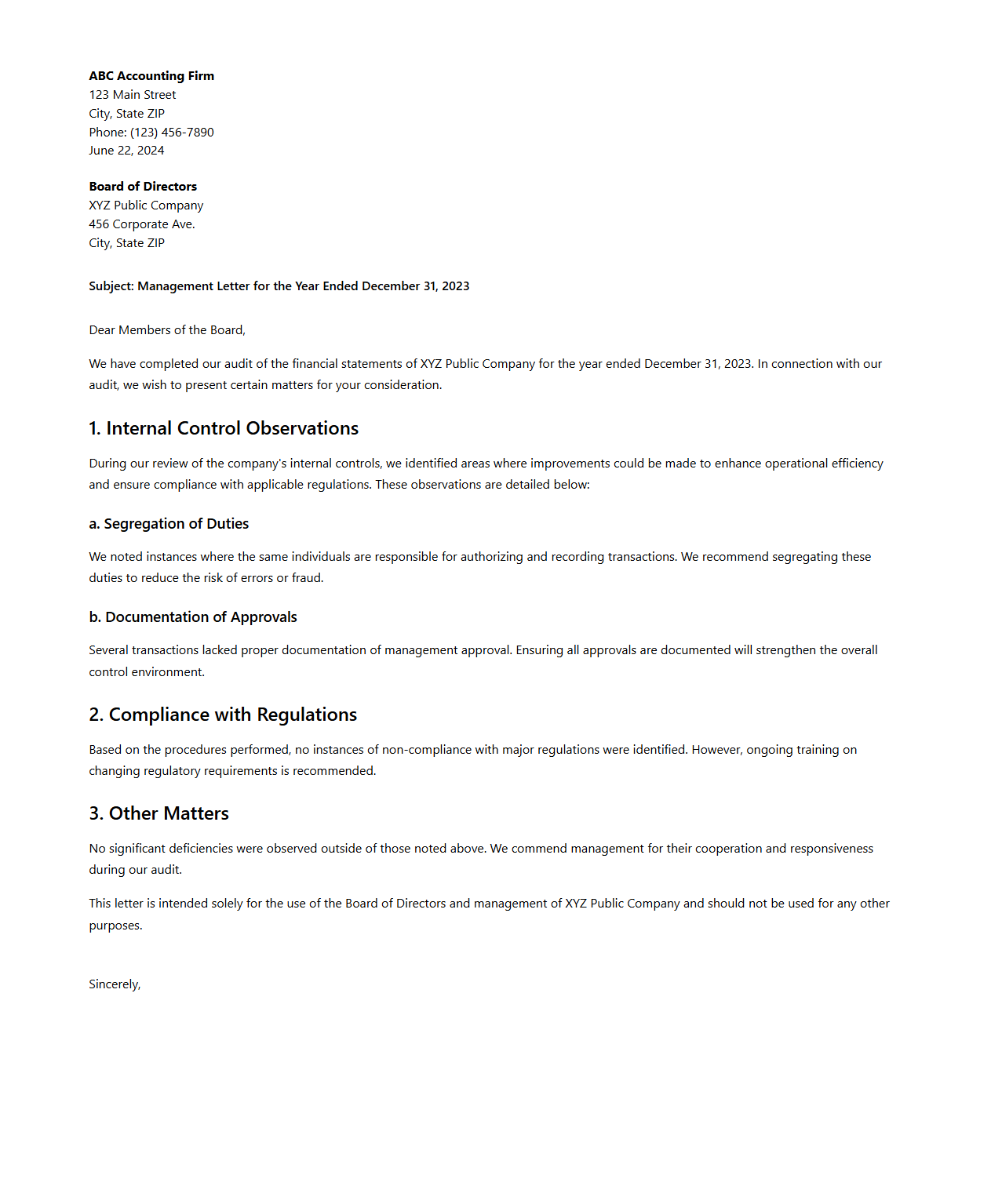

Management Letter Sample for Public Companies

A

Management Letter Sample for Public Companies document provides a template for auditors to communicate identified internal control weaknesses, compliance issues, and operational inefficiencies to a company's management. It is essential for ensuring transparency, regulatory compliance, and enhancing corporate governance in publicly traded organizations. This document often includes specific recommendations for improvement, risk assessments, and management's responses to audit findings.

Auditor’s Communication with Those Charged with Governance

The

Auditor's Communication with Those Charged with Governance document outlines crucial information exchanged between auditors and an organization's governing body during an audit process. It covers audit scope, significant findings, internal control deficiencies, and any instances of non-compliance, ensuring transparency and accountability. This communication enhances the governing body's ability to oversee financial reporting and risk management effectively.

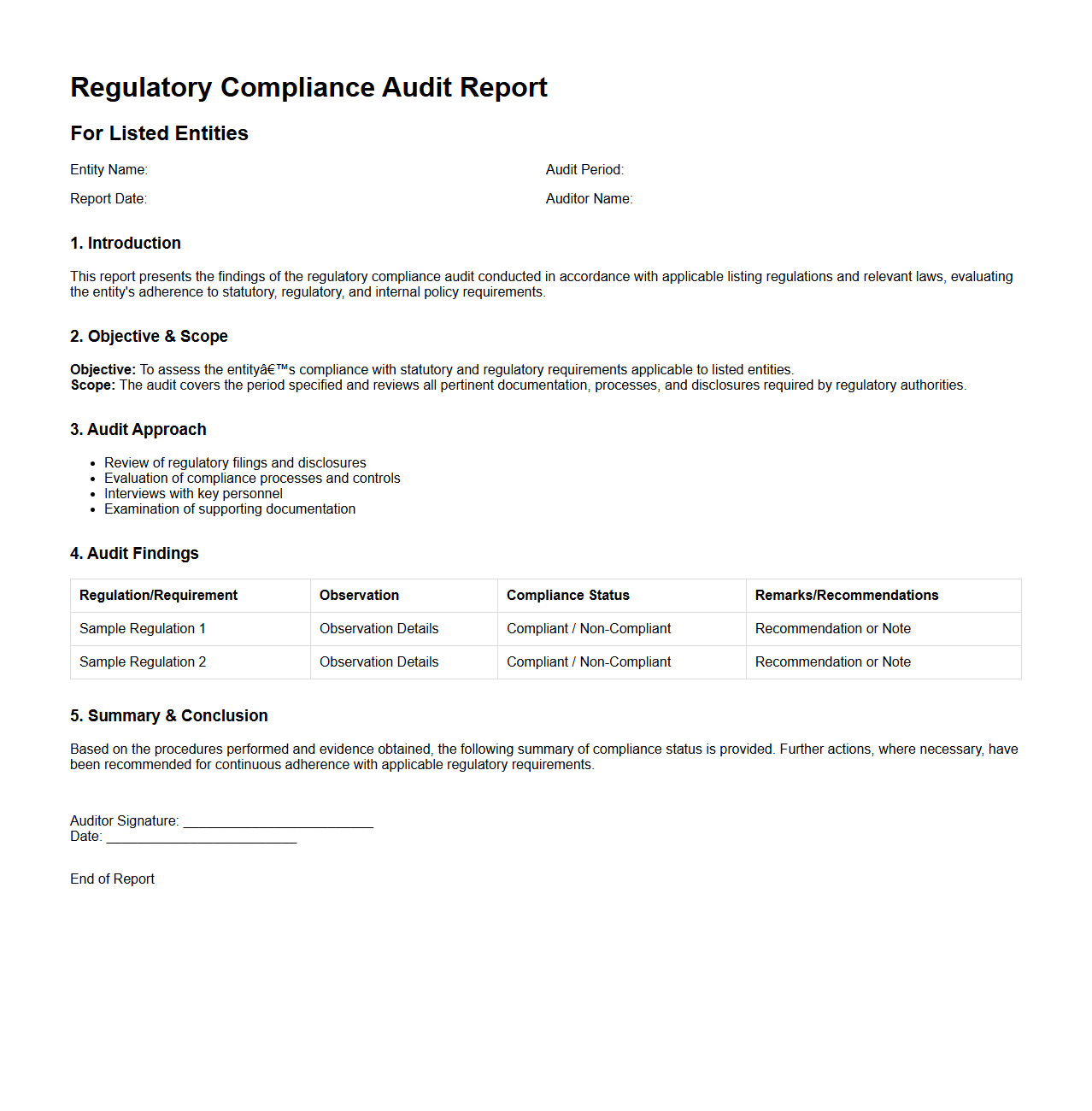

Regulatory Compliance Audit Report for Listed Entities

A

Regulatory Compliance Audit Report for Listed Entities is a detailed document that evaluates a company's adherence to legal and regulatory requirements set by securities regulators and stock exchanges. It includes an assessment of financial disclosures, corporate governance practices, and compliance with applicable laws to ensure transparency and accountability. This report helps protect investor interests and maintains market integrity by identifying potential risks and non-compliance issues.

Key Audit Matters Disclosure Sample

A

Key Audit Matters Disclosure Sample document outlines the critical areas identified by auditors during the audit process, highlighting significant risks and complexities faced in the financial statements. This sample serves as a guide for auditors to effectively communicate these matters to stakeholders, enhancing transparency and understanding of the audit focus. It typically includes descriptions of the nature of risks, audit procedures performed, and conclusions drawn on the audit findings.

What key compliance disclosures are required in public company audit reports under SEC regulations?

Public company audit reports under SEC regulations must disclose compliance with the Sarbanes-Oxley Act and relevant accounting standards such as GAAP. The report must include statements regarding management's responsibility for internal controls and the auditor's responsibility for expressing an opinion. Additionally, disclosures on legal proceedings or related party transactions are often required for complete transparency.

How does the audit report address material weaknesses in internal controls for public companies?

If material weaknesses in internal controls are identified, the auditor's report must explicitly state their nature and impact. The report communicates how these weaknesses affect the reliability of financial reporting. This disclosure helps investors understand risks related to the company's internal control environment.

What language must be included to indicate auditor independence in a public company audit report?

To indicate auditor independence, the audit report must include a clear statement affirming the auditor's compliance with independence rules. This ensures the audit is unbiased and free from conflicts of interest. The language typically confirms adherence to SEC and PCAOB independence standards.

Which sections of an audit report outline critical audit matters (CAMs) for public companies?

Critical Audit Matters (CAMs) are outlined in a dedicatedsection titled "Critical Audit Matters" within the auditor's report. This section details significant judgments, estimates, and areas of higher risk that were addressed during the audit process. It provides greater insight into the complexities that required auditor attention.

How are subsequent events after the balance sheet date disclosed in public company audit reports?

Subsequent events occurring after the balance sheet date are disclosed in a separate section or notes to the financial statements. The auditor evaluates whether these events require adjustment or disclosure to avoid misleading users. This ensures financial statements reflect all relevant information up to the audit report date.