A Payment Receipt Document Sample for Transaction Records serves as a crucial proof of payment, detailing transaction specifics such as date, amount, and payment method. This document helps maintain accurate financial records for both parties involved in a transaction. It is essential for auditing, tracking expenses, and resolving any payment disputes efficiently.

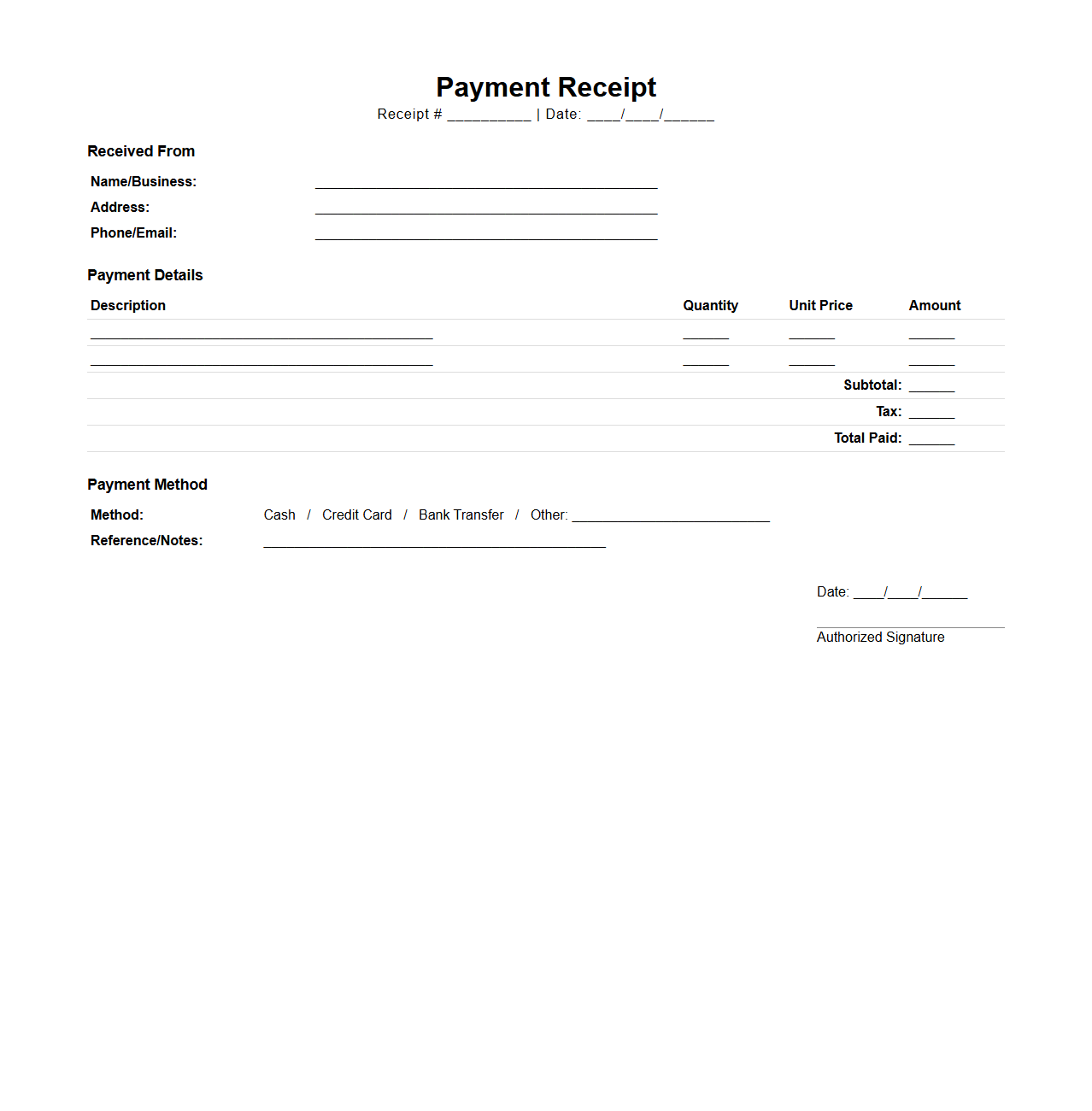

Payment Receipt Template for Business Transactions

A

Payment Receipt Template for Business Transactions is a standardized document used to formally acknowledge the receipt of payment from a customer or client. It typically includes essential details such as the payer's information, payment amount, date of transaction, payment method, and a unique receipt number. This template ensures clarity, accuracy, and professionalism in financial record-keeping and can be customized to align with specific business needs.

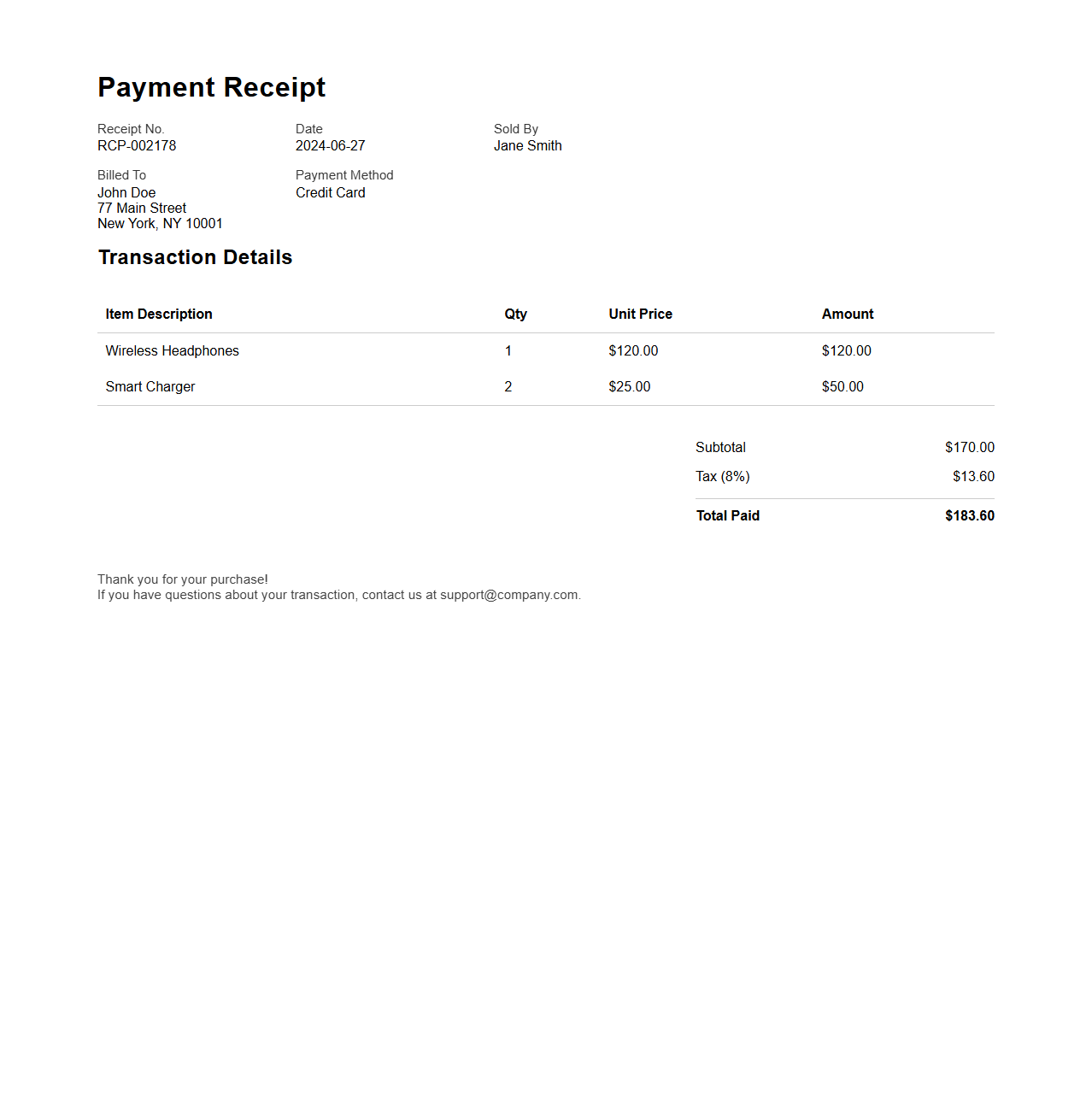

Sales Transaction Payment Receipt Example

A

Sales Transaction Payment Receipt Example document serves as a formal record confirming payment for goods or services purchased in a sales transaction. It typically includes essential details such as the buyer and seller information, date of transaction, description of items sold, payment method, amount paid, and receipt number. This document is crucial for both parties to verify the completion of payment and for maintaining accurate financial records.

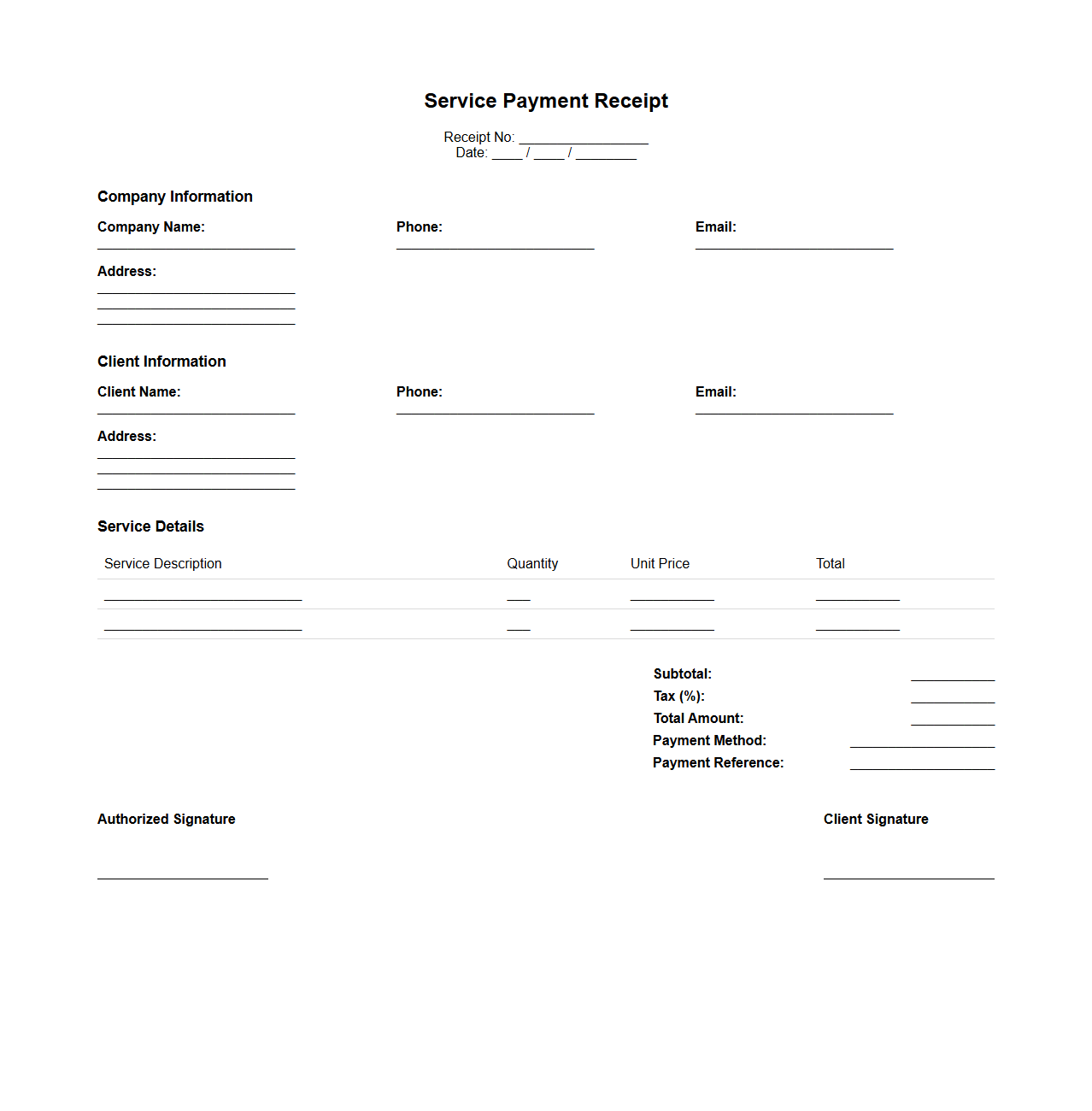

Service Payment Receipt Format for Clients

A

Service Payment Receipt Format for Clients is a standardized document used to acknowledge the payment received for services rendered. It typically includes essential details such as the client's name, payment amount, date of transaction, service description, and payment method. This format ensures transparency, helps maintain accurate financial records, and provides clients with proof of their payment for services.

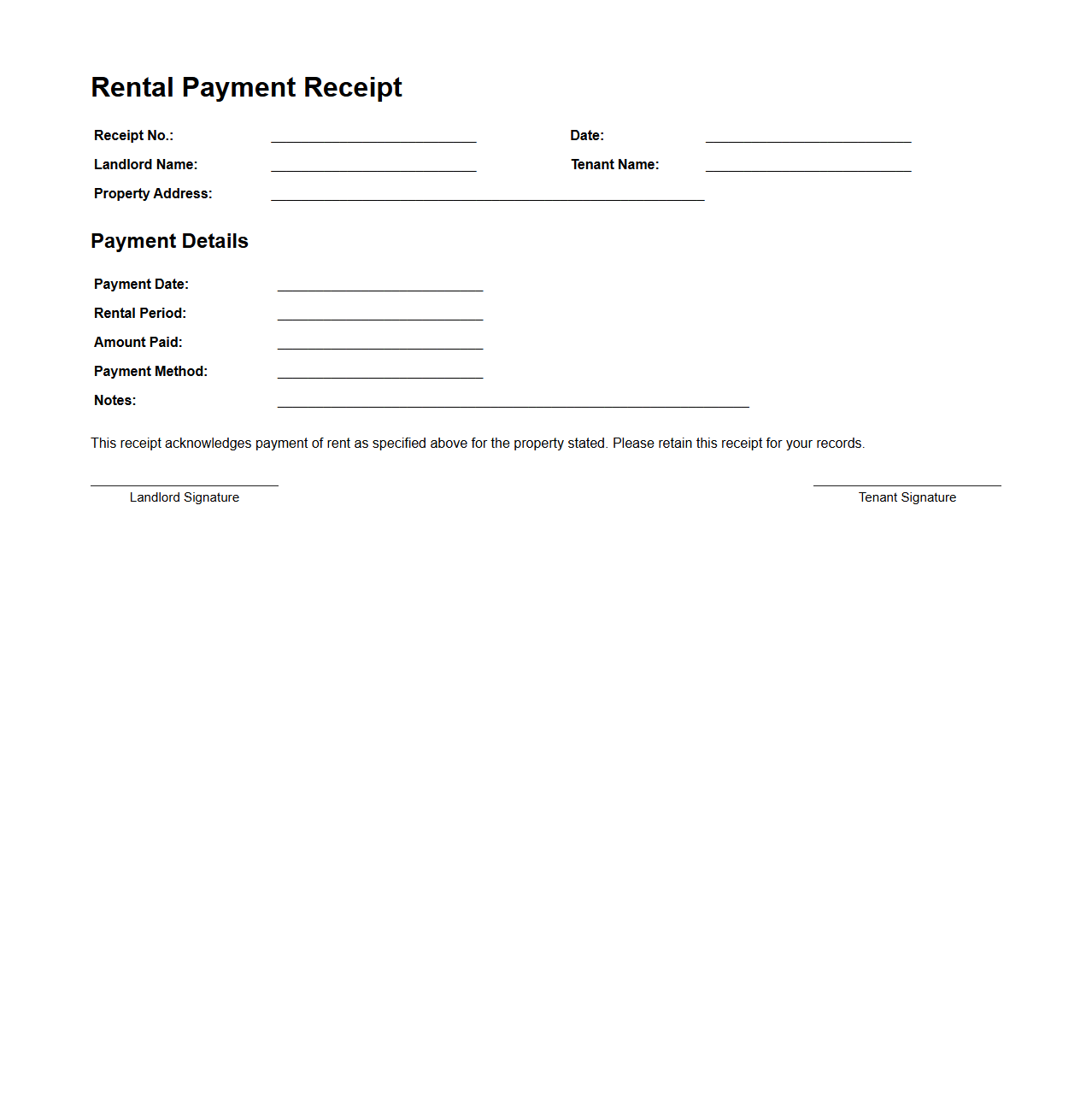

Rental Payment Receipt Sample for Landlords

A

Rental Payment Receipt Sample for Landlords document serves as an official record confirming a tenant's payment of rent for a specific period. It typically includes essential details such as the tenant's name, payment amount, date received, and rental property address. This document helps landlords maintain accurate financial records and provides tenants with proof of payment for legal and bookkeeping purposes.

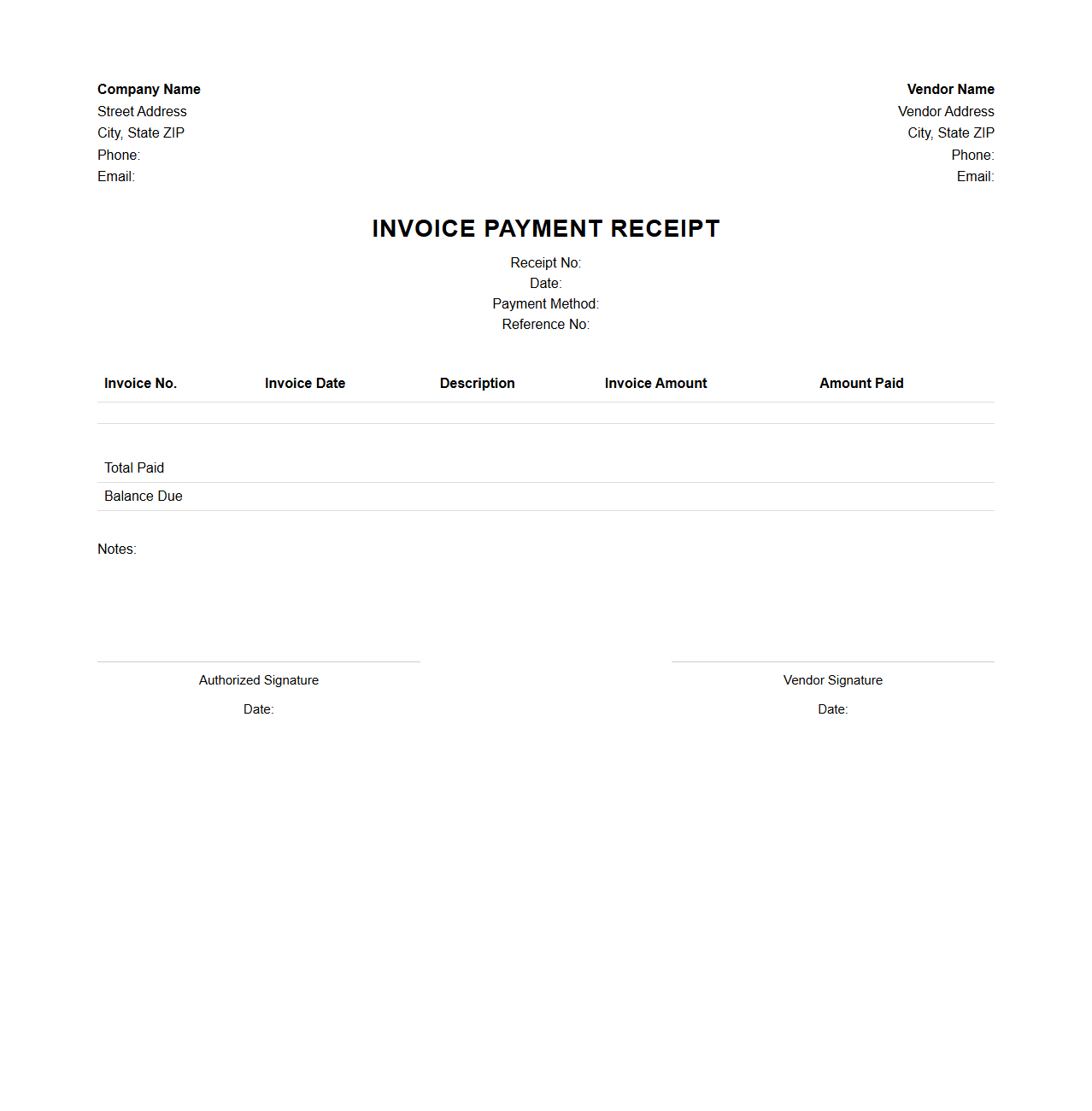

Invoice Payment Receipt for Vendor Payments

An

Invoice Payment Receipt for Vendor Payments document serves as formal proof that a payment has been made to a vendor against a specific invoice. It typically includes details such as the invoice number, payment date, amount paid, payment method, and vendor information to ensure transparency and accurate financial record-keeping. This document is crucial for both parties to reconcile accounts, track transactions, and maintain compliance with accounting standards.

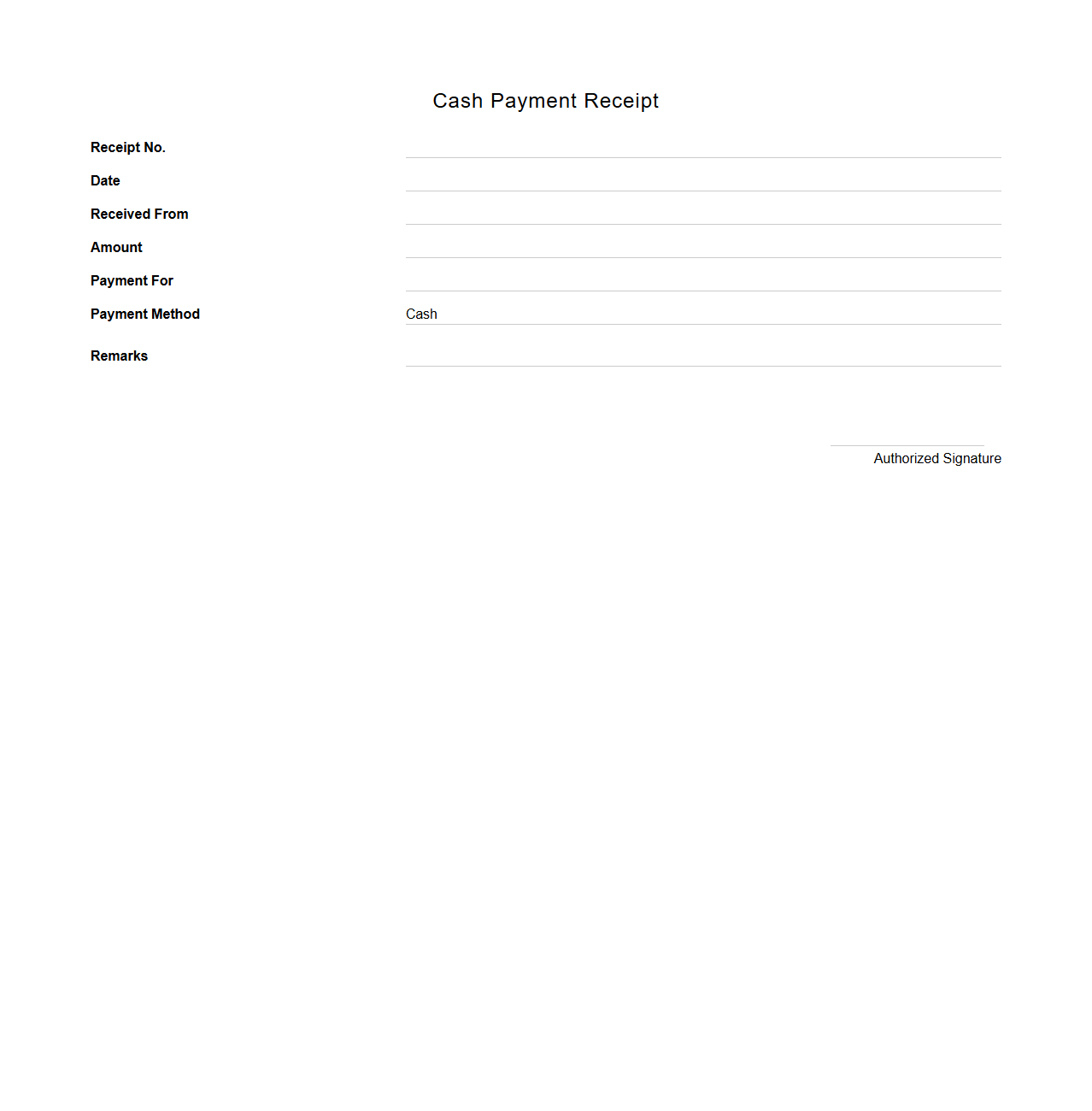

Cash Payment Receipt for Purchase Transactions

A

Cash Payment Receipt for Purchase Transactions is a crucial financial document that confirms the payment made in cash for goods or services acquired. It serves as proof of transaction, detailing the amount paid, date, and vendor information, ensuring transparency and accurate record-keeping for both buyer and seller. This receipt is essential for auditing purposes and helps maintain reliable financial accounts.

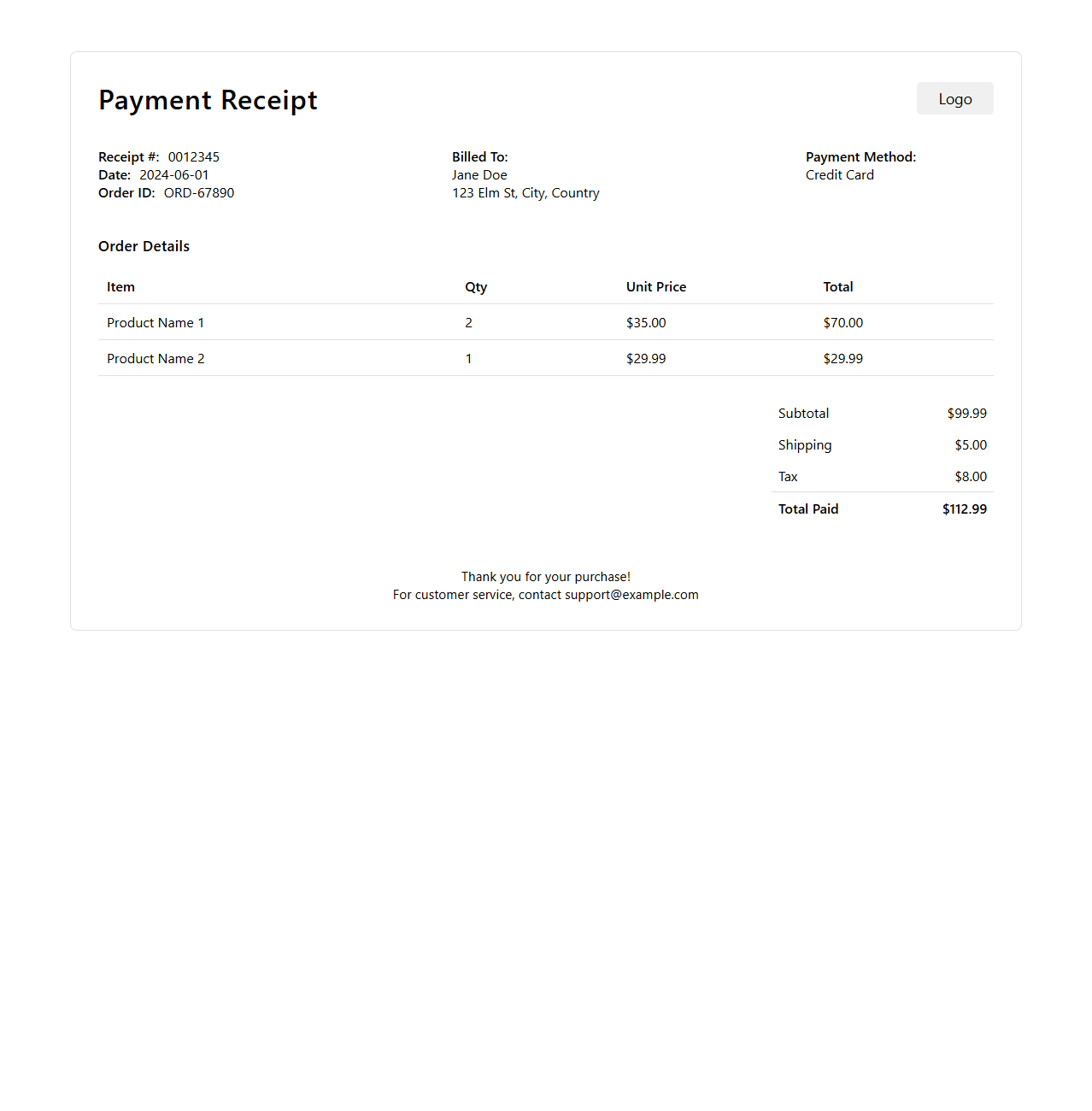

Online Payment Receipt Layout for E-Commerce

An

Online Payment Receipt Layout for an E-Commerce document outlines the structured format used to present transaction details to customers following an online purchase. It typically includes essential elements such as transaction ID, payment method, itemized purchase list, total amount paid, and date of transaction. This layout ensures clarity, legality, and professional communication between the retailer and the buyer.

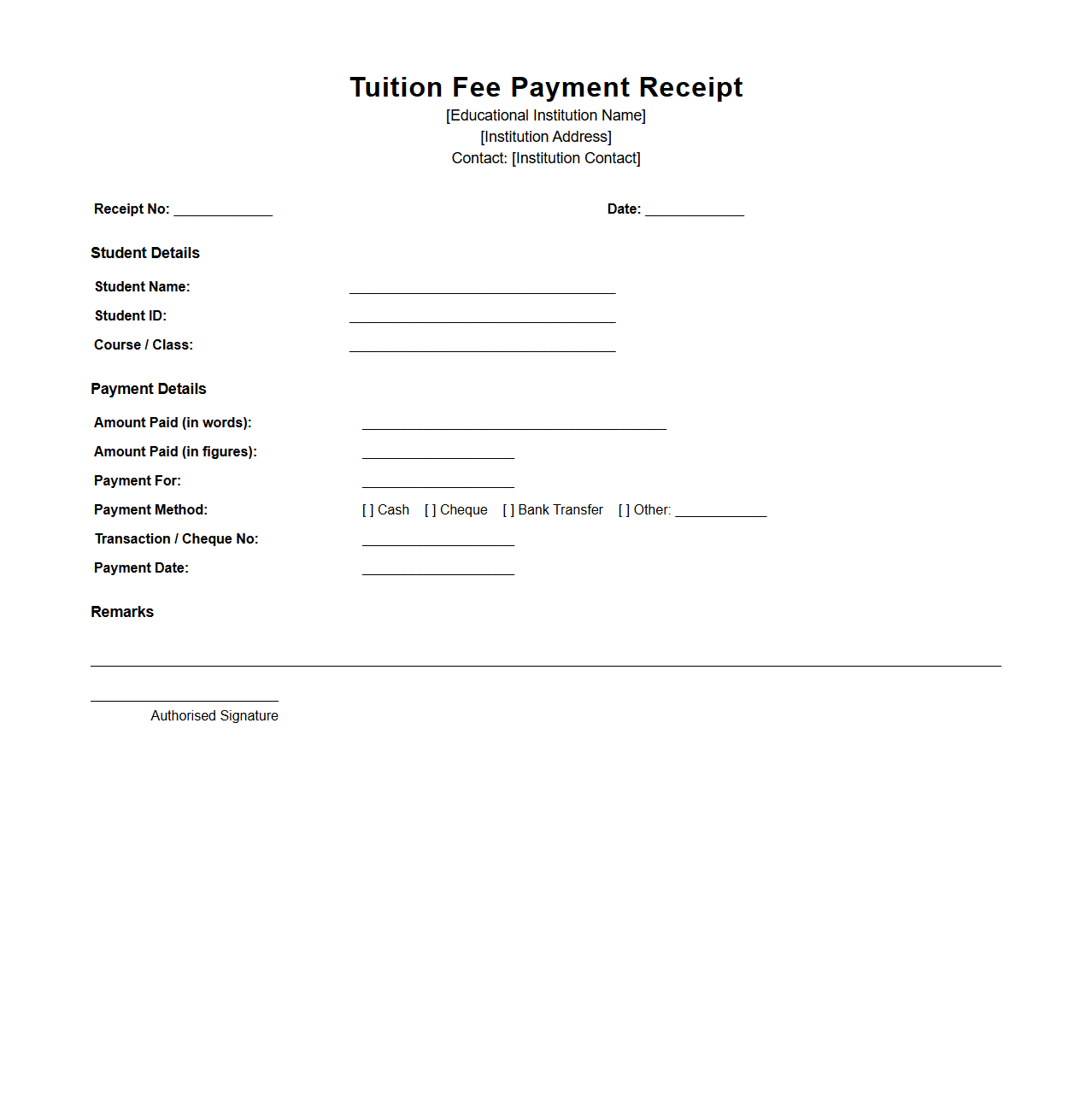

Tuition Fee Payment Receipt for Educational Institutions

A

Tuition Fee Payment Receipt for educational institutions serves as an official document confirming the payment of tuition fees by a student or their guardian. It typically includes essential information such as the payer's name, payment amount, date of transaction, and the institution's details. This receipt is crucial for record-keeping, financial audits, and may be required for future fee verification or scholarship applications.

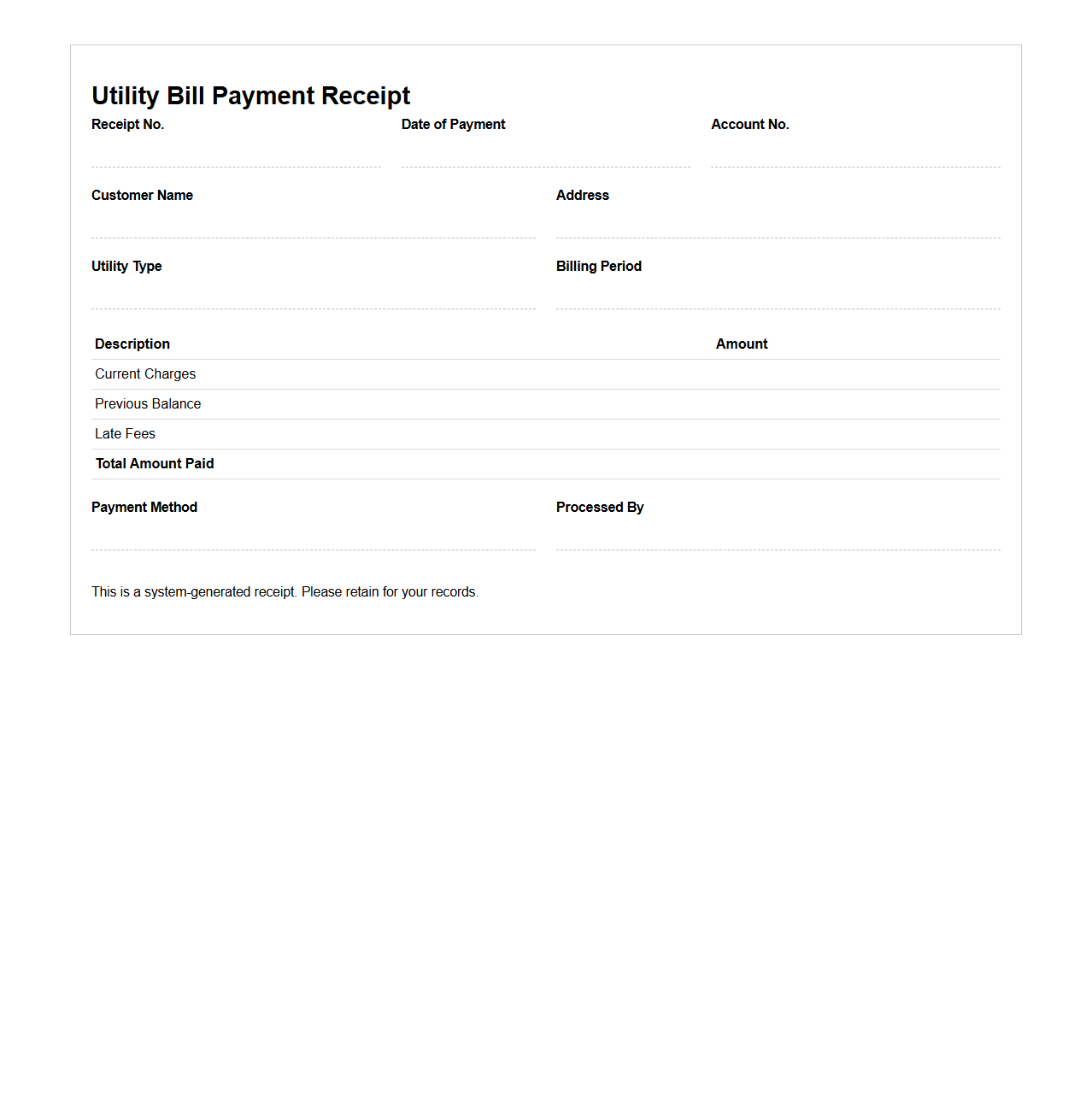

Utility Bill Payment Receipt for Household Records

A

Utility Bill Payment Receipt for Household Records is a document that serves as proof of payment for essential services such as electricity, water, gas, or internet. It includes crucial details like the account holder's name, payment amount, date of transaction, and the billing period. Maintaining these receipts helps track expenses, verify payments, and resolve potential disputes with service providers.

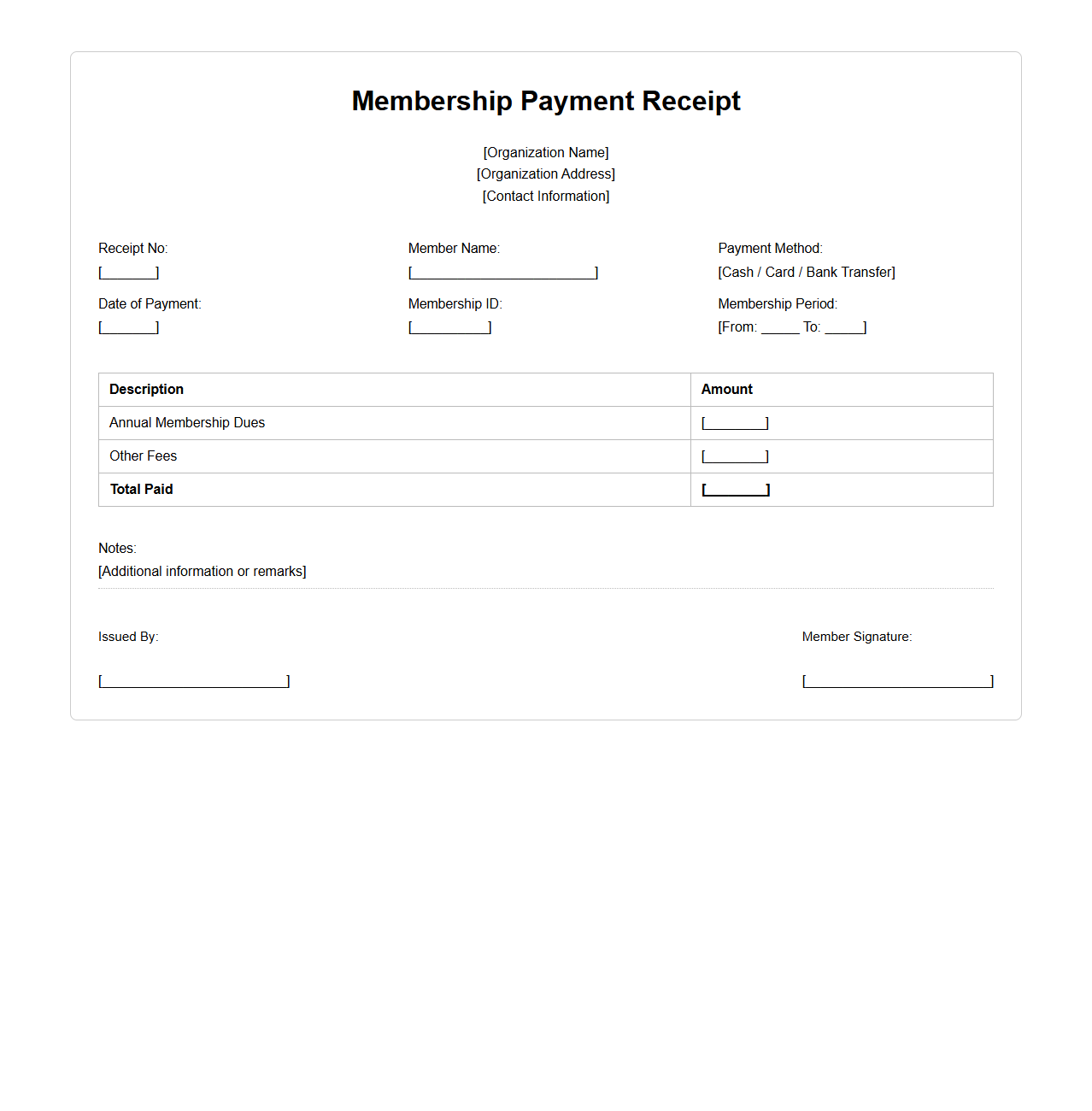

Membership Payment Receipt for Organization Dues

A

Membership Payment Receipt for Organization Dues is a formal document issued to acknowledge the payment of fees by a member to an organization. It details the member's name, payment amount, date of transaction, and the specific membership period covered. This receipt serves as proof of payment and helps both the member and organization maintain accurate financial records.

What security features ensure the authenticity of a payment receipt document?

The authenticity of a payment receipt is ensured through features such as digital signatures, encryption, and secure QR codes. These features prevent tampering and verify the receipt's origin. Additionally, watermarking and unique transaction IDs add layers of security for validation.

How are digital payment receipt documents archived for audit compliance?

Digital payment receipts are archived using immutable storage systems that ensure data integrity over time. Cloud-based repositories with role-based access controls enable secure and compliant storage. Automated backup and indexing facilitate easy retrieval during audits.

Which metadata fields are essential in a receipt for B2B transactions?

Essential metadata fields in B2B payment receipts include transaction date, invoice number, payment method, and vendor details. These fields support accurate reconciliation and audit trails. Including tax information and currency codes further enhances compliance and reporting.

How does OCR technology improve the accuracy of payment receipt record-keeping?

Optical Character Recognition (OCR) technology automates data extraction from payment receipts, reducing manual entry errors. It enhances efficiency by digitizing printed or handwritten information into searchable formats. This leads to higher accuracy and faster processing in record-keeping systems.

What are the legal retention periods for payment receipt documents in different jurisdictions?

Legal retention periods for payment receipts vary, commonly ranging from 3 to 7 years depending on the jurisdiction and tax laws. Companies must comply with local regulations such as GDPR in the EU or IRS requirements in the US. Proper retention ensures legal compliance and supports audit readiness.