An Expense Report Document Sample for Employees outlines the format and details required to track and reimburse business-related expenses. It typically includes sections for itemized costs, dates, descriptions, and approval signatures to ensure accuracy and compliance. Using this sample helps streamline the submission process and facilitates efficient expense management.

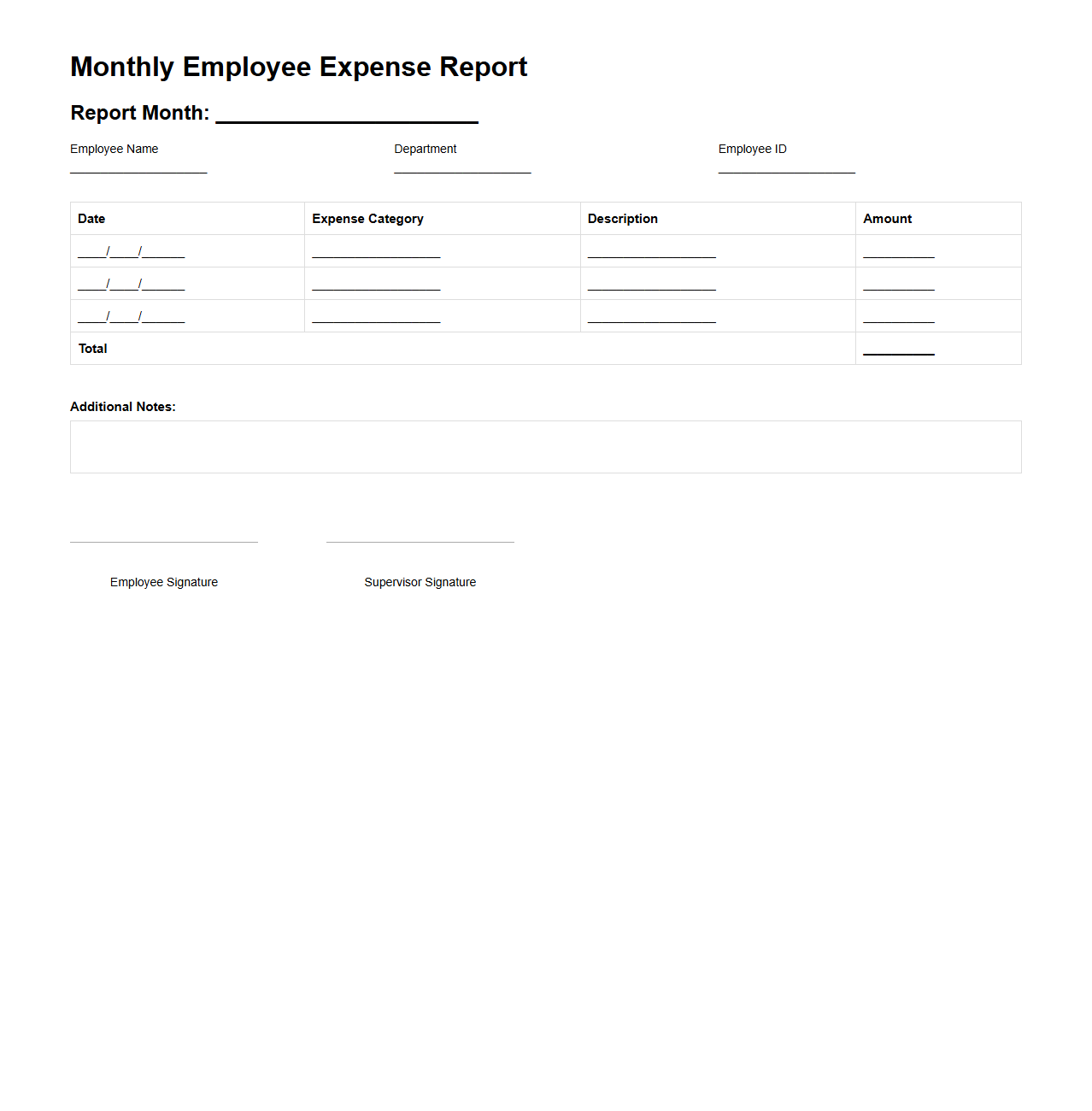

Monthly Employee Expense Report Sample

A

Monthly Employee Expense Report Sample document outlines the detailed record of expenses incurred by an employee during a specific month, including categories such as travel, meals, and office supplies. It serves as a standardized template to track, verify, and reimburse business-related expenditures efficiently. Companies rely on this document for accurate financial reporting and budget management.

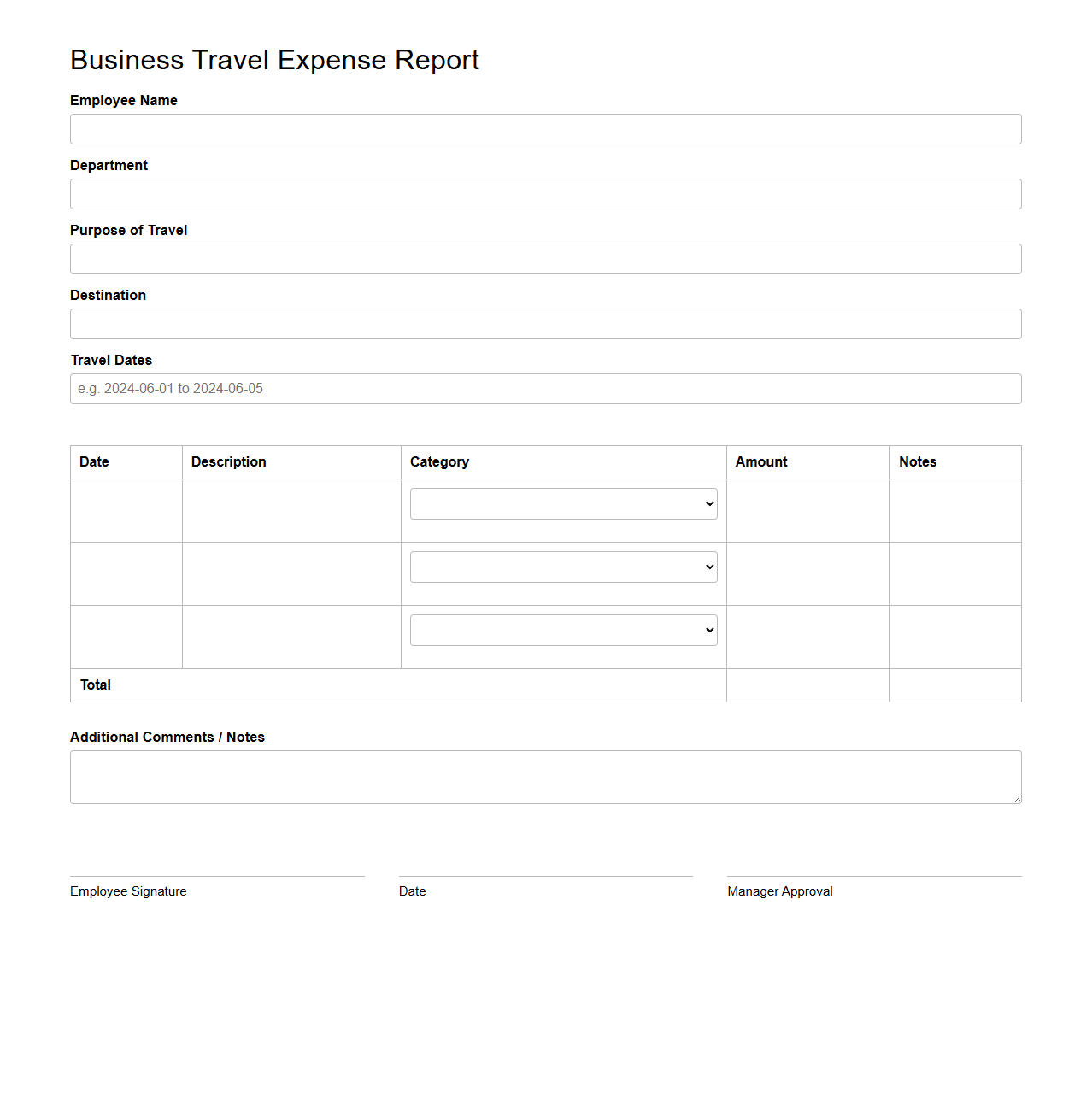

Business Travel Expense Report Template

A

Business Travel Expense Report Template document is a structured form used to record and itemize all costs incurred during business trips, including transportation, lodging, meals, and other related expenses. It helps organizations maintain accurate financial records, ensure reimbursement accuracy, and comply with company travel policies. This template streamlines the expense reporting process, making it easier for employees and finance teams to track and audit travel expenditures.

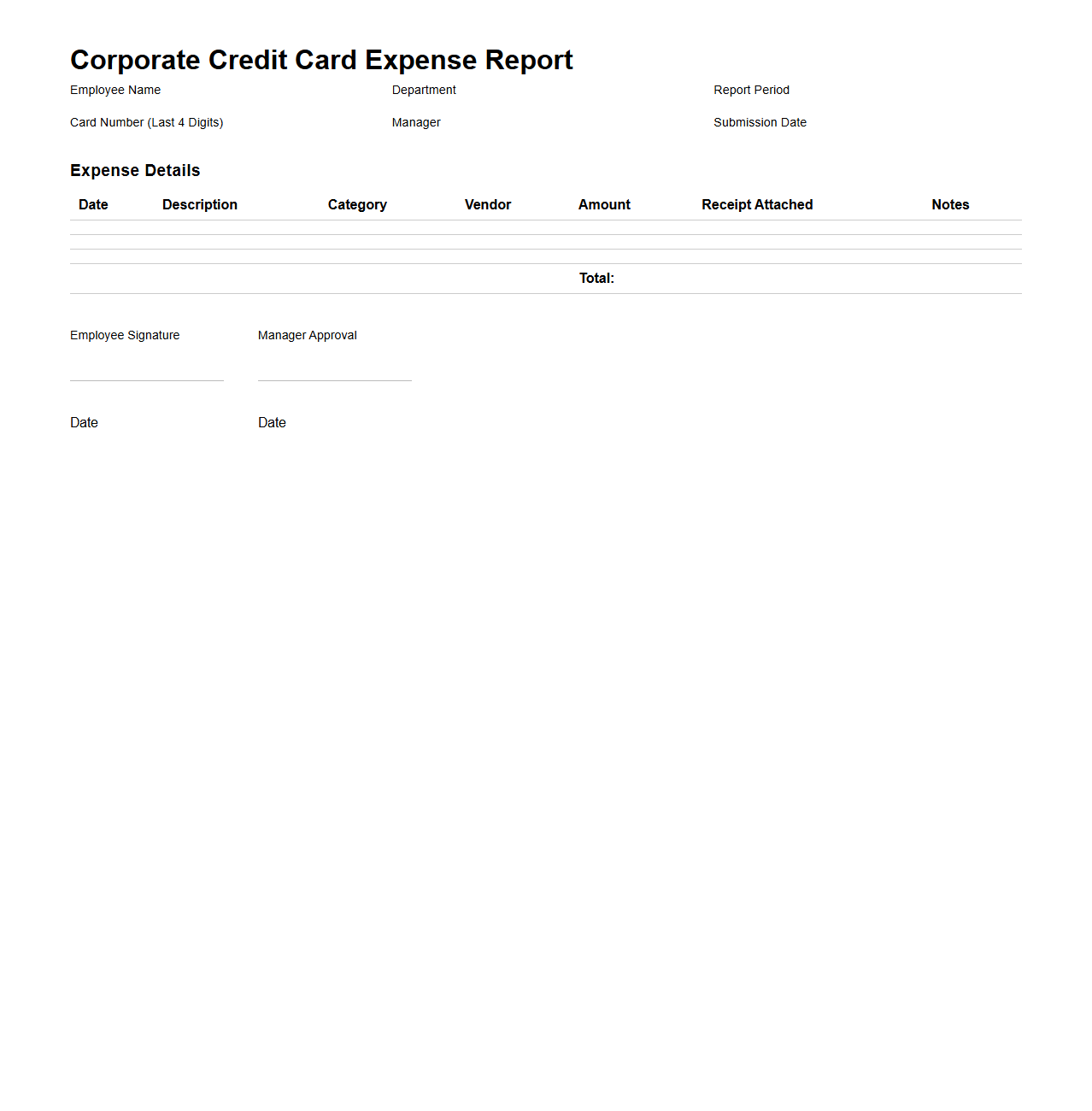

Corporate Credit Card Expense Report Example

A

Corporate Credit Card Expense Report Example document provides a detailed record of all purchases made using a company-issued credit card, helping organizations track and manage business expenses effectively. It typically includes transaction dates, vendor names, expense categories, amounts, and employee details to ensure accurate reconciliation and budget compliance. This report streamlines the auditing process, enforces spending policies, and supports financial transparency within the company.

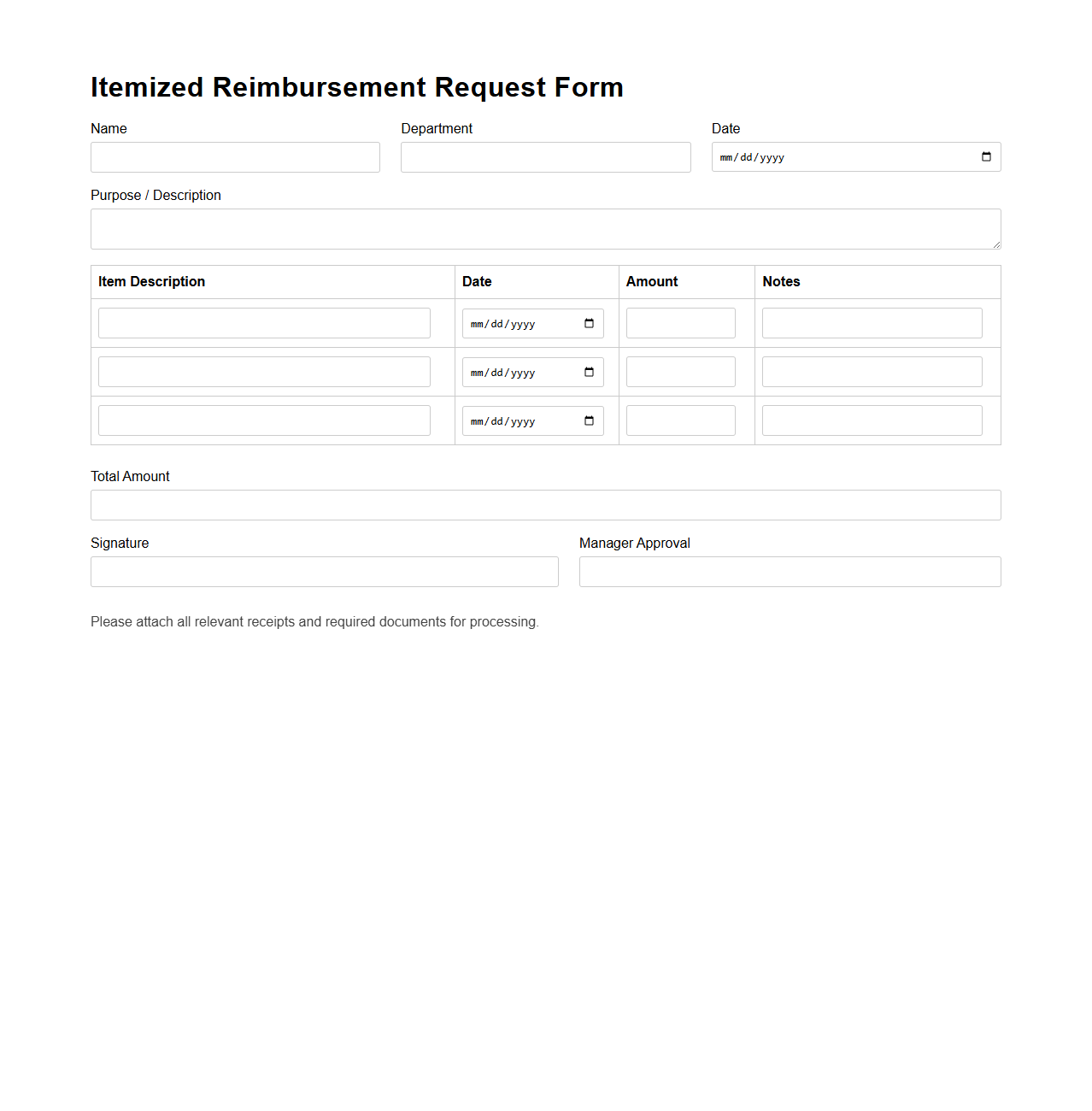

Itemized Reimbursement Request Form

An

Itemized Reimbursement Request Form is a detailed document used to submit expenses for reimbursement, listing each cost separately with descriptions, dates, and amounts. It provides clear evidence and justification for the requested funds, ensuring accurate processing by finance departments or employers. This form helps maintain transparency and facilitates efficient tracking of reimbursable expenditures.

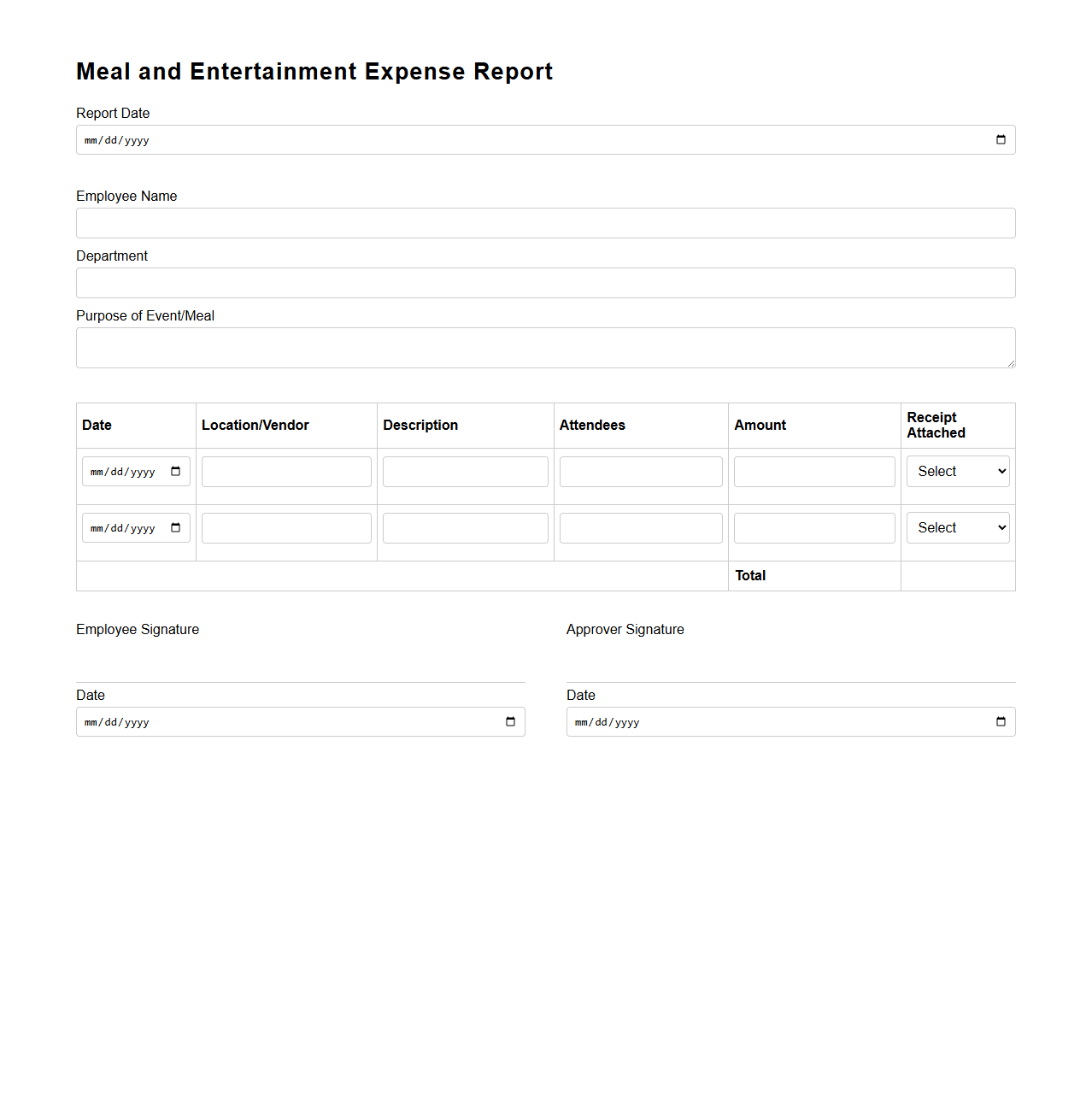

Meal and Entertainment Expense Report Format

The

Meal and Entertainment Expense Report Format document is a standardized template used by organizations to record and submit expenses related to business meals and entertainment activities. It typically includes fields for date, purpose, attendees, amount spent, and receipt attachments to ensure accurate tracking and reimbursement. This format helps maintain compliance with company policies and tax regulations by providing detailed and organized expense documentation.

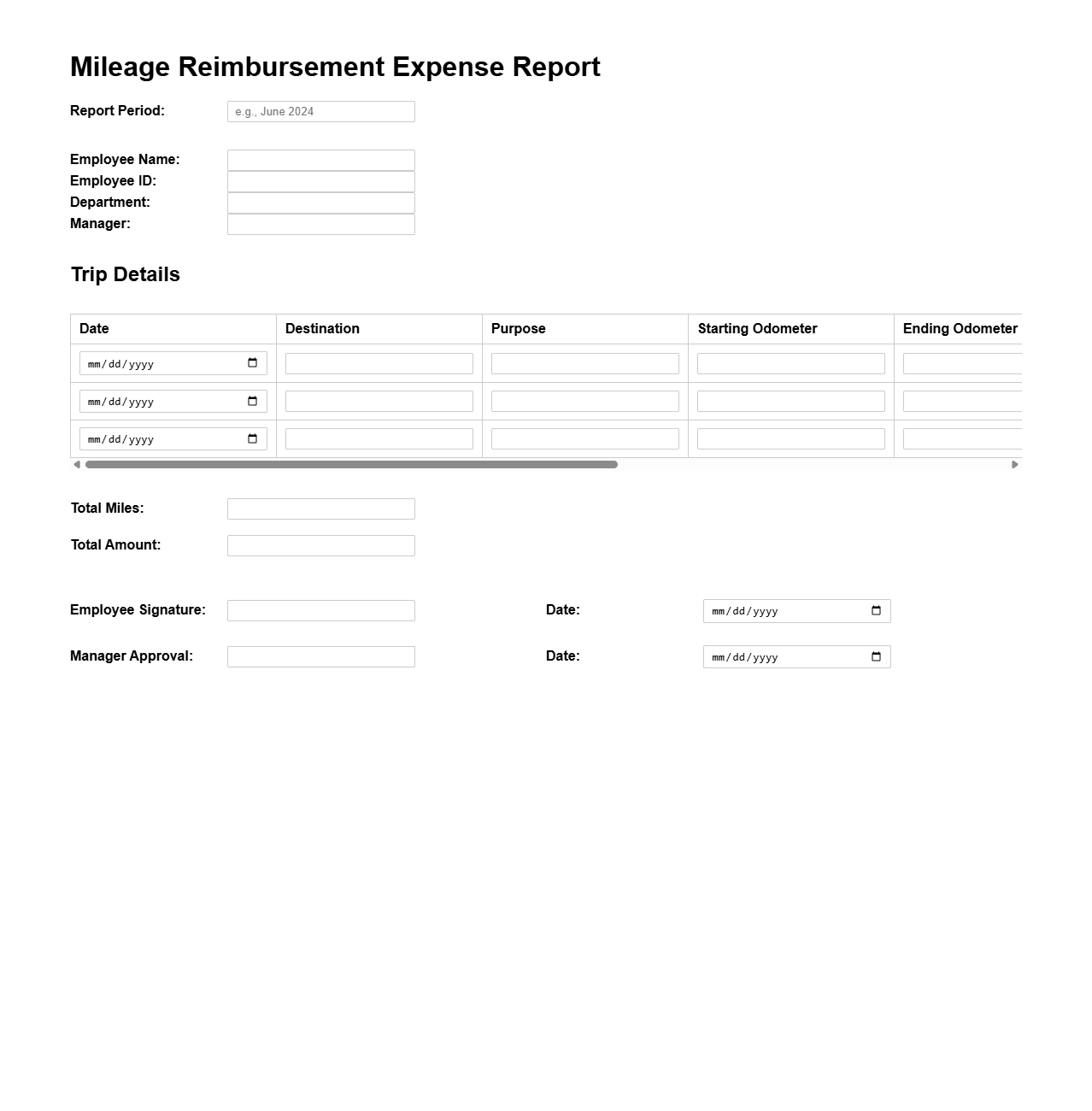

Mileage Reimbursement Expense Report Example

A

Mileage Reimbursement Expense Report Example document provides a detailed record of miles traveled for business purposes along with associated expenses that need to be reimbursed by an employer. It typically includes date, starting point, destination, purpose of the trip, total miles driven, and the reimbursement rate per mile. This document ensures accurate and transparent tracking of travel costs, simplifying financial management and compliance with company policies.

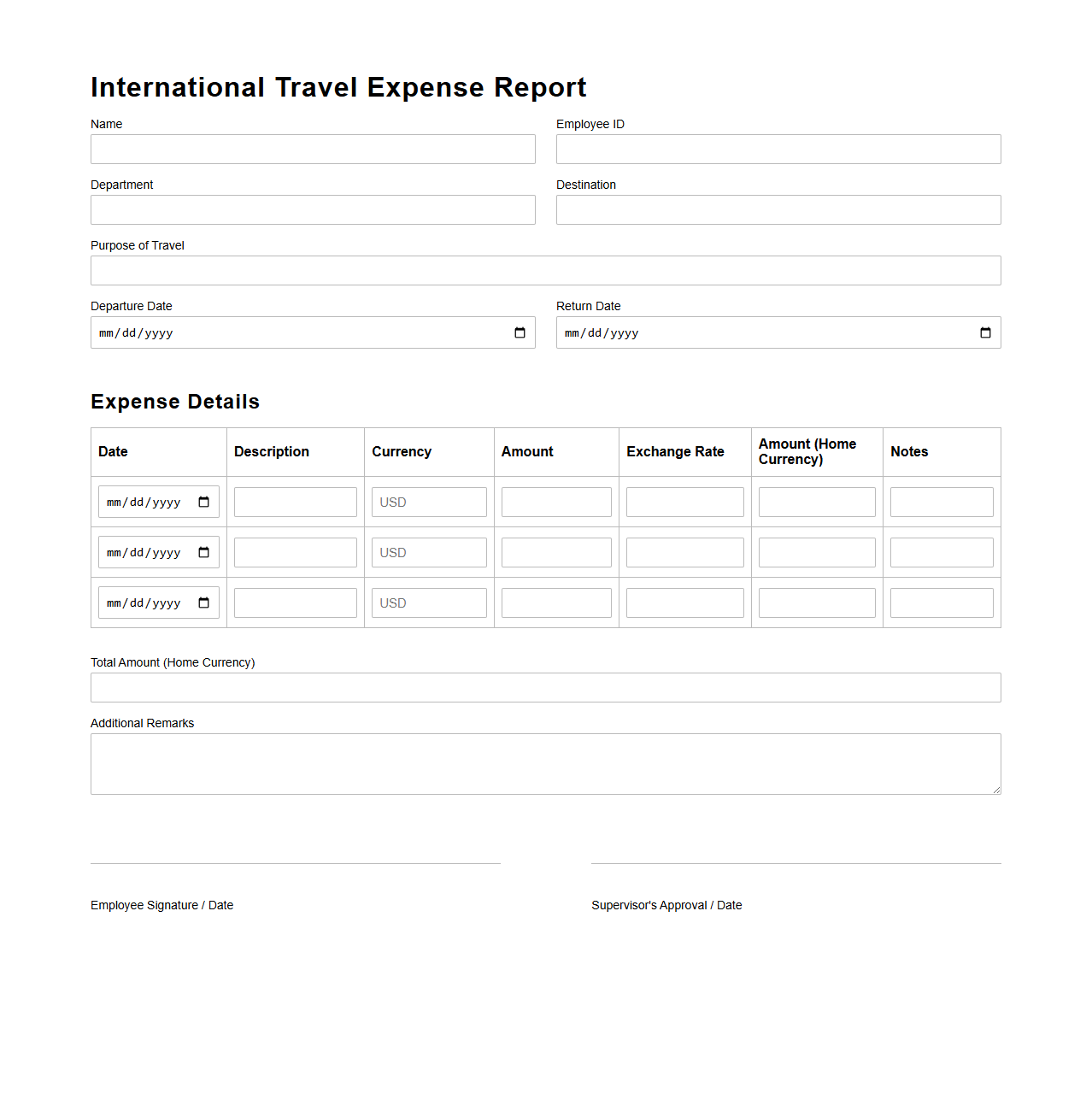

International Travel Expense Report Sample

An

International Travel Expense Report Sample document is a template used by employees or travelers to itemize and record expenses incurred during international trips, including airfare, accommodation, meals, transportation, and miscellaneous costs. This report ensures accurate tracking of expenditures for reimbursement, budget analysis, and financial auditing. Organizations rely on it to maintain compliance with travel policies and streamline accounting processes.

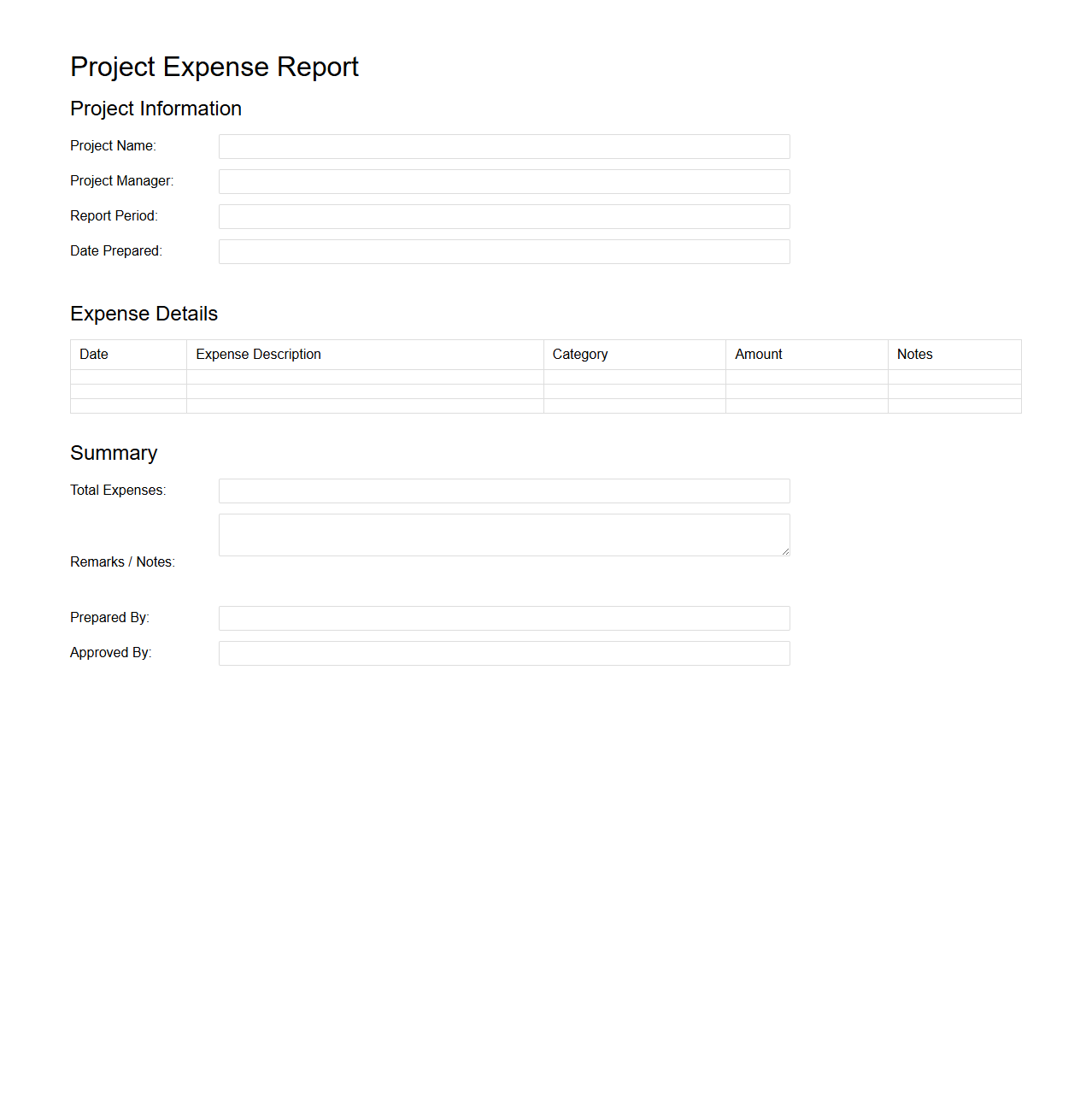

Project Expense Report Template

A

Project Expense Report Template is a structured document used to systematically track and record all costs associated with a specific project. It organizes expenses by categories such as labor, materials, and overhead, helping project managers maintain budget control and financial transparency. This template facilitates accurate reporting, simplifies audits, and supports effective decision-making by providing a clear overview of project expenditures.

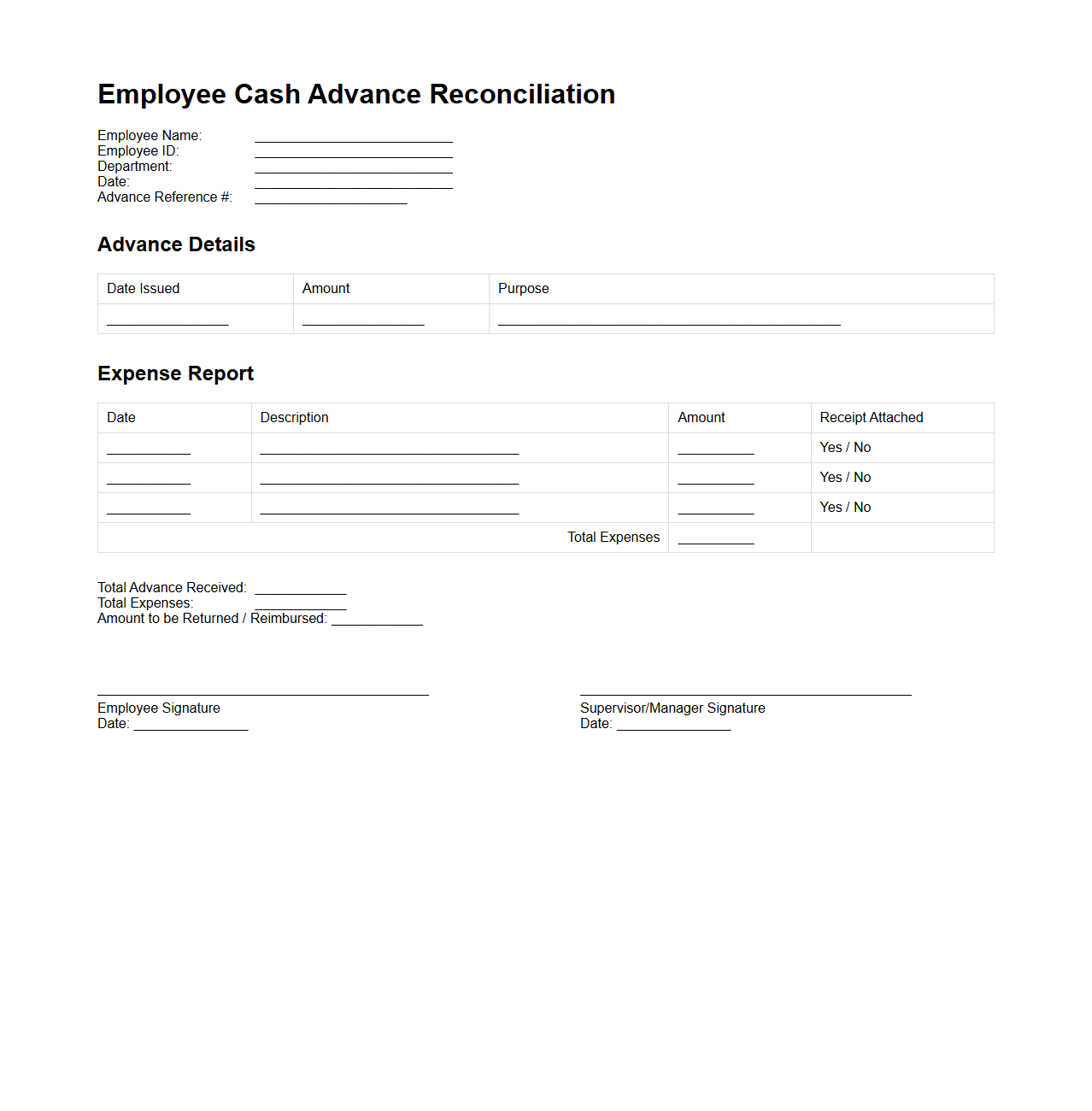

Employee Cash Advance Reconciliation Sample

An

Employee Cash Advance Reconciliation Sample document serves as a template to accurately track and verify cash advances given to employees for business expenses. It details the amount advanced, expenses incurred, receipts submitted, and the remaining balance or refund due, ensuring transparency and accountability. This document streamlines financial auditing and supports compliance with company policies on cash advances.

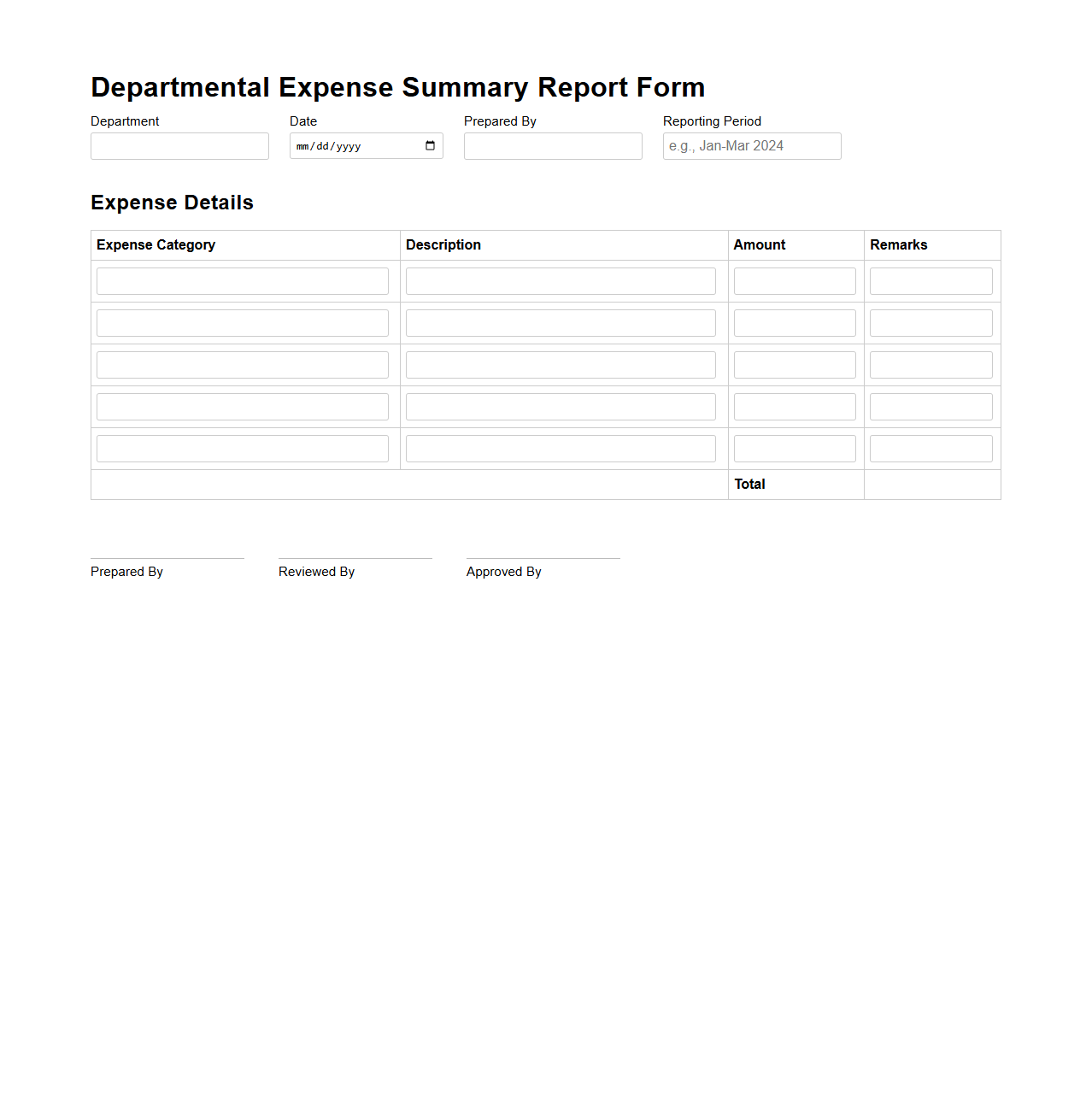

Departmental Expense Summary Report Form

The

Departmental Expense Summary Report Form document provides a detailed overview of all expenses incurred by a specific department within a defined time period. It consolidates cost data such as salaries, operational costs, and purchase expenses to aid in budget tracking and financial analysis. This report is essential for maintaining transparency and ensuring departmental spending aligns with organizational financial plans.

What specific expense categories require original receipts in the expense report document?

Original receipts are mandatory for all transportation expenses, including airfare, taxis, and car rentals. Employees must also provide original receipts for lodging and meals exceeding the company's per diem limits. Additionally, any expenses over a certain threshold, often $25 or more, require an original receipt to ensure proper validation.

How should employees document mileage expenses in the expense report form?

Employees must record the starting and ending locations along with the total miles driven for business purposes. The rate per mile should align with the current company or IRS reimbursement guidelines. A detailed log or mileage tracking app printout can be attached as supporting documentation for the expense report.

Are digital signatures accepted on the expense report document for reimbursement approval?

Most companies accept digital signatures provided they comply with internal authentication processes. Digital signatures help streamline the approval workflow and maintain a verifiable audit trail. However, some organizations may still require physical signatures for high-value or sensitive expense reports.

What is the deadline for submitting an expense report document after a business trip?

Expense reports must typically be submitted within 30 days following the completion of a business trip. This timely submission ensures prompt reimbursement and maintains compliance with company policies. Late submissions may be subject to delayed reimbursement or require additional approvals.

How are foreign currency expenses reported and converted in the expense report document?

Employees must report foreign currency expenses in the original currency and then convert them to the company's base currency using the exchange rate applicable on the date of the transaction. Exchange rates should be documented with a reliable source such as a company-provided rate or a financial website. Proper conversion ensures accuracy in reimbursement and accounting records.