A Investment Proposal Document Sample for Venture Capital outlines the business opportunity, market potential, and financial projections to attract investors. It highlights key elements such as the value proposition, competitive analysis, funding requirements, and the expected return on investment. This document serves as a crucial tool for startups seeking to secure venture capital funding.

Executive Summary for Venture Capital Proposal

An

Executive Summary in a Venture Capital Proposal document is a concise overview highlighting the business opportunity, market potential, and funding requirements to attract investors. It encapsulates the startup's value proposition, growth strategy, and financial projections within a brief section designed to quickly inform and engage venture capitalists. This summary serves as a critical tool to secure initial interest and set the stage for detailed discussions.

Company Overview in Investment Proposal

A

Company Overview in an investment proposal document provides a concise summary of the business, highlighting its mission, vision, and core operations. It includes essential details such as the company's history, structure, market position, and key achievements to give investors a clear understanding of its foundation and potential. This section establishes credibility and context, helping investors assess the company's stability and growth prospects.

Market Analysis Section for VC Pitch

The

Market Analysis Section in a VC pitch document provides a detailed examination of the target market's size, growth potential, and key trends, backed by relevant data and research. It highlights customer segments, competitive landscape, and market opportunities, demonstrating the startup's understanding of the industry dynamics. This section aims to convince investors of the market's viability and the startup's strategic positioning for capturing value.

Products and Services Description for VC

A

Products and Services Description in a VC document outlines the core offerings of a company, detailing the features, functionalities, and benefits of each product or service. This section highlights how these offerings address market needs, differentiate from competitors, and generate revenue streams. Clear articulation of product-market fit and innovation potential enhances investor confidence and supports funding decisions.

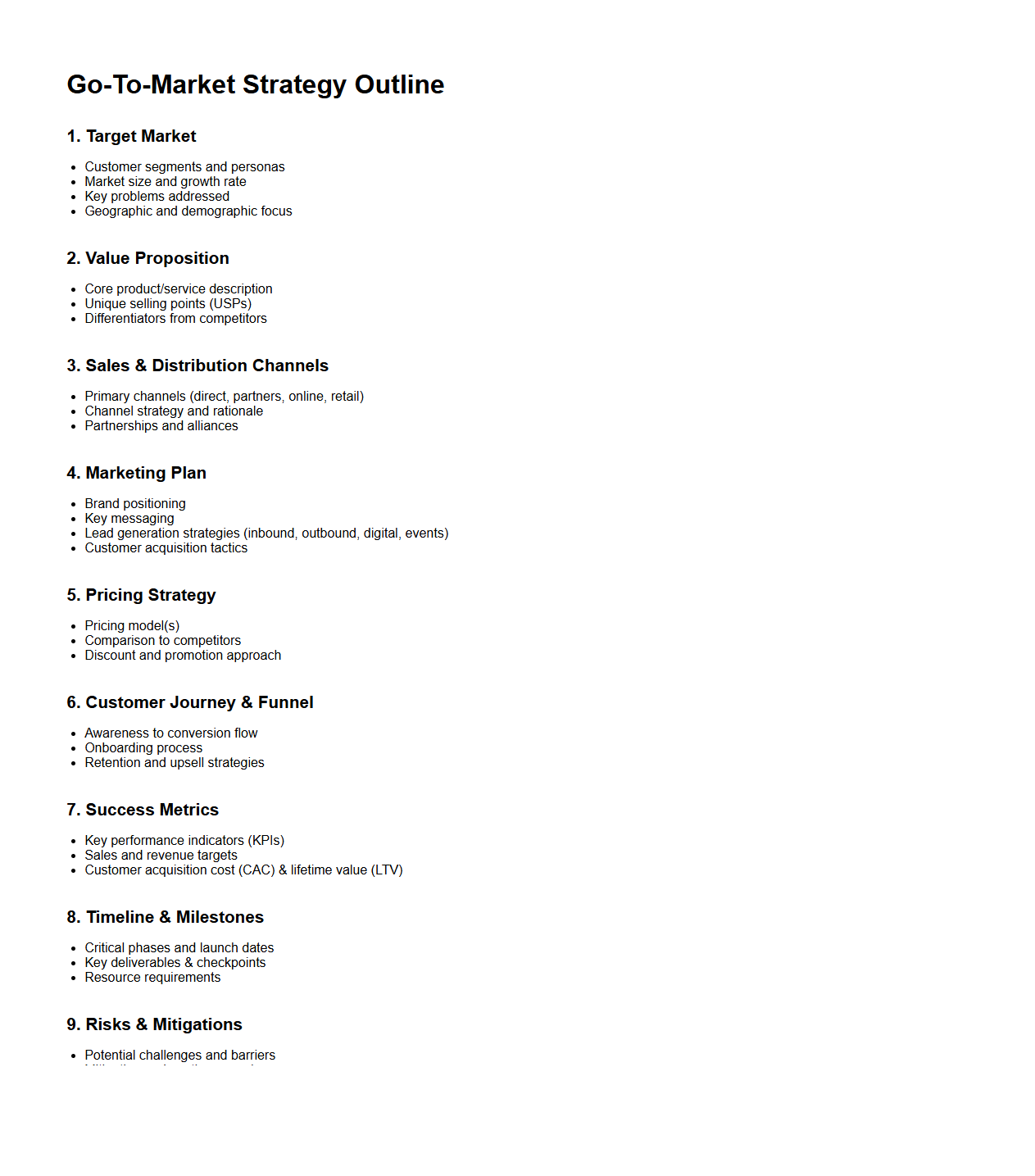

Go-To-Market Strategy Outline for Investors

A

Go-To-Market Strategy Outline for Investors document details a company's plan to deliver its product or service to the market effectively, highlighting target customers, sales tactics, and marketing channels. It provides investors with a clear roadmap of revenue generation, customer acquisition, and competitive positioning. This document serves as a critical tool to demonstrate the scalability and profitability potential of the business.

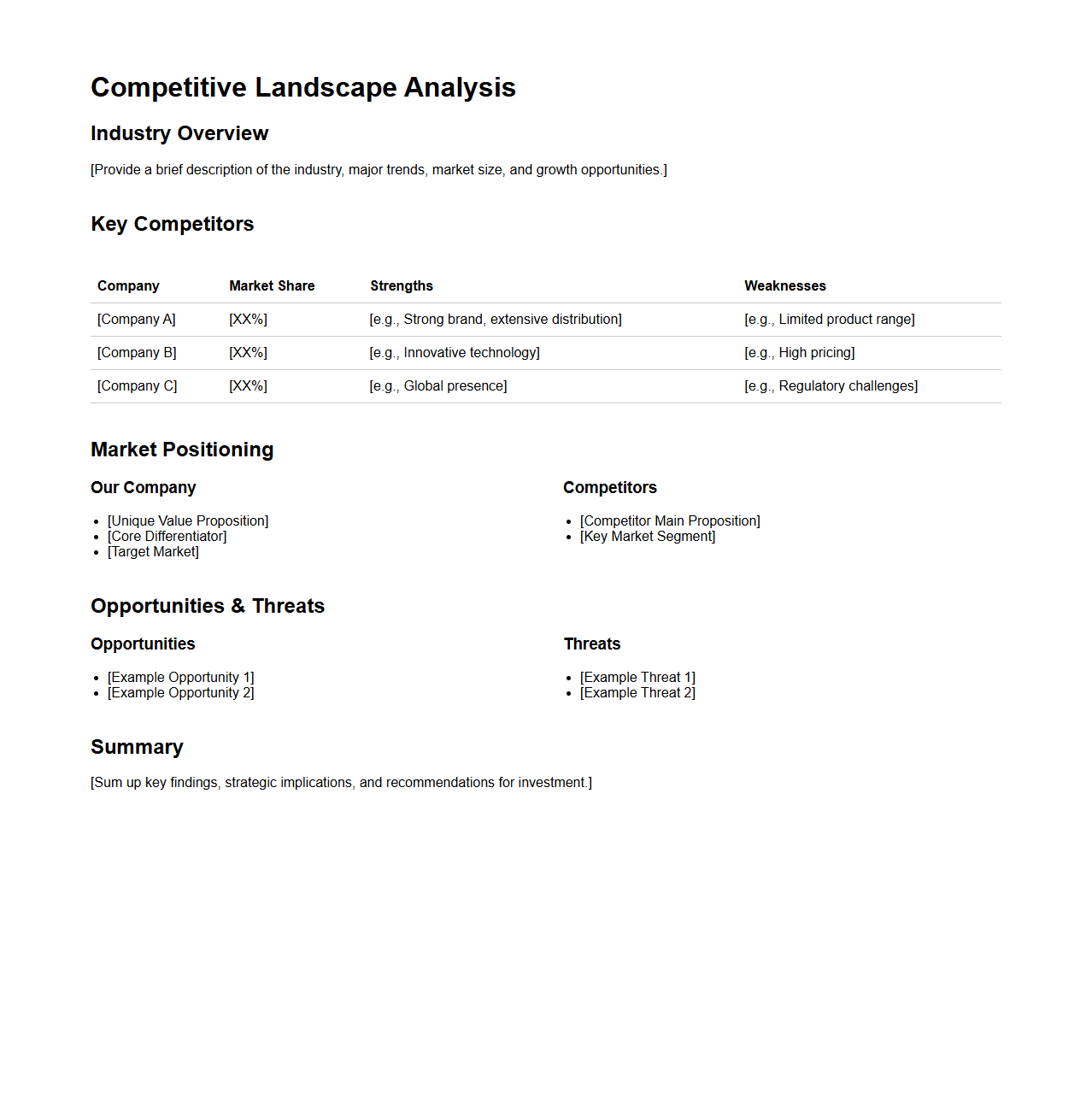

Competitive Landscape Analysis for Investment

Competitive Landscape Analysis for Investment documents provides a comprehensive evaluation of key market players, their strategies, market shares, and competitive advantages within a specific industry. This analysis enables investors to identify potential risks and opportunities by understanding competitor strengths, weaknesses, and market positioning. Incorporating

competitive landscape analysis enhances investment decision-making by offering insights into market trends and forecasting future industry dynamics.

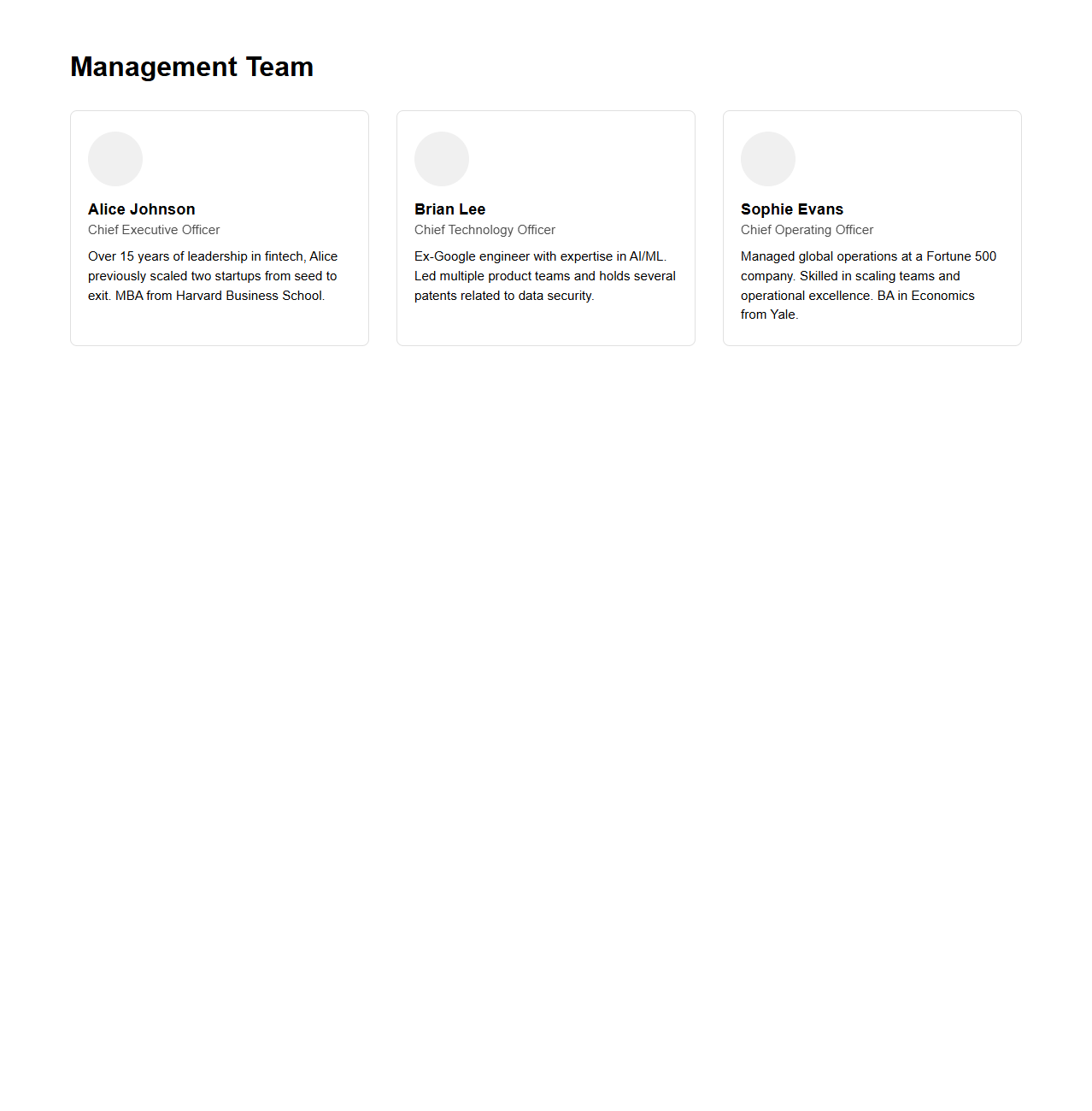

Management Team Profile in VC Proposal

A

Management Team Profile in a VC proposal document provides a detailed overview of the key members leading the startup, highlighting their relevant experience, skills, and previous successes. It emphasizes the team's ability to execute the business plan effectively and adapt to challenges, which is critical for investor confidence. This section also typically showcases the complementary strengths of team members to demonstrate a well-rounded leadership structure.

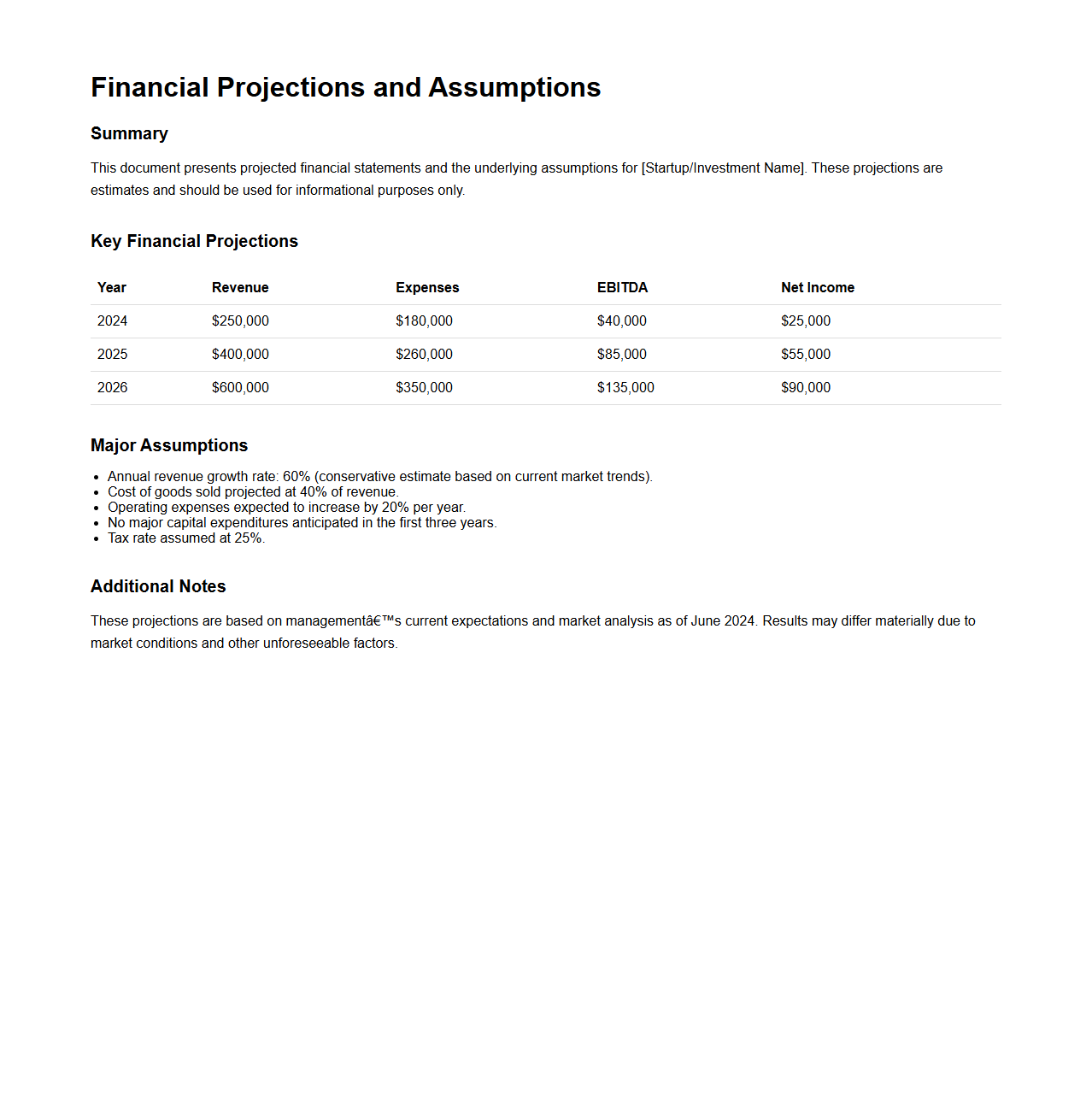

Financial Projections and Assumptions for Investment

Financial Projections and Assumptions for an Investment document provide anticipated financial performance metrics based on key business drivers and market conditions. This document outlines estimated revenues, expenses, cash flows, and profitability over a specific timeline, incorporating critical assumptions such as growth rates, cost structures, and economic factors. Investors rely on these projections to assess potential returns, risks, and the overall viability of the investment opportunity.

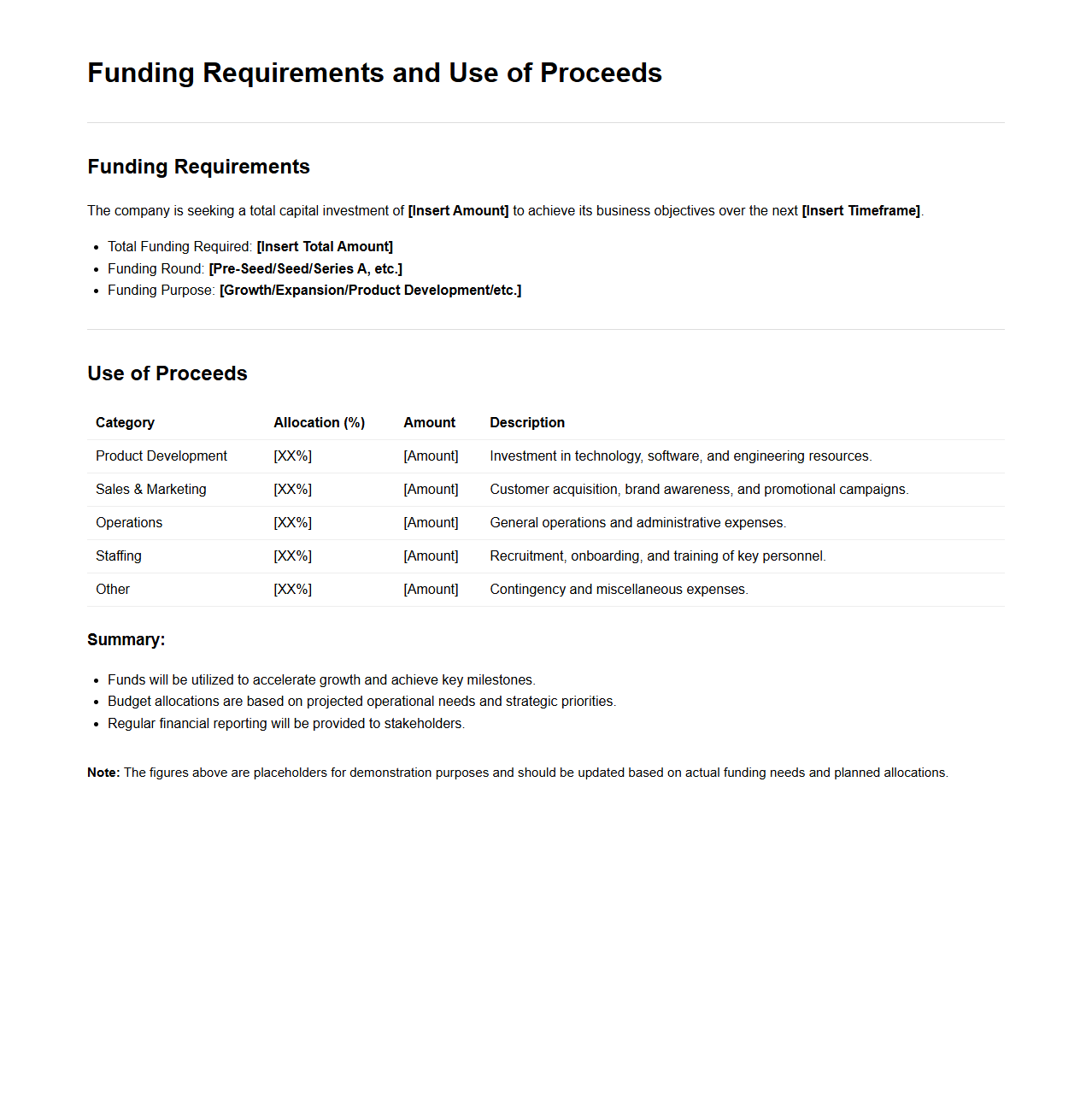

Funding Requirements and Use of Proceeds Section

The

Funding Requirements and Use of Proceeds section outlines the total capital needed for a project or business and details how these funds will be allocated across various expenses such as product development, marketing, and operational costs. This document provides investors with clear insights into the financial strategy and justification for the requested funding amount. Transparent presentation of funding requirements helps build investor confidence and supports effective financial planning.

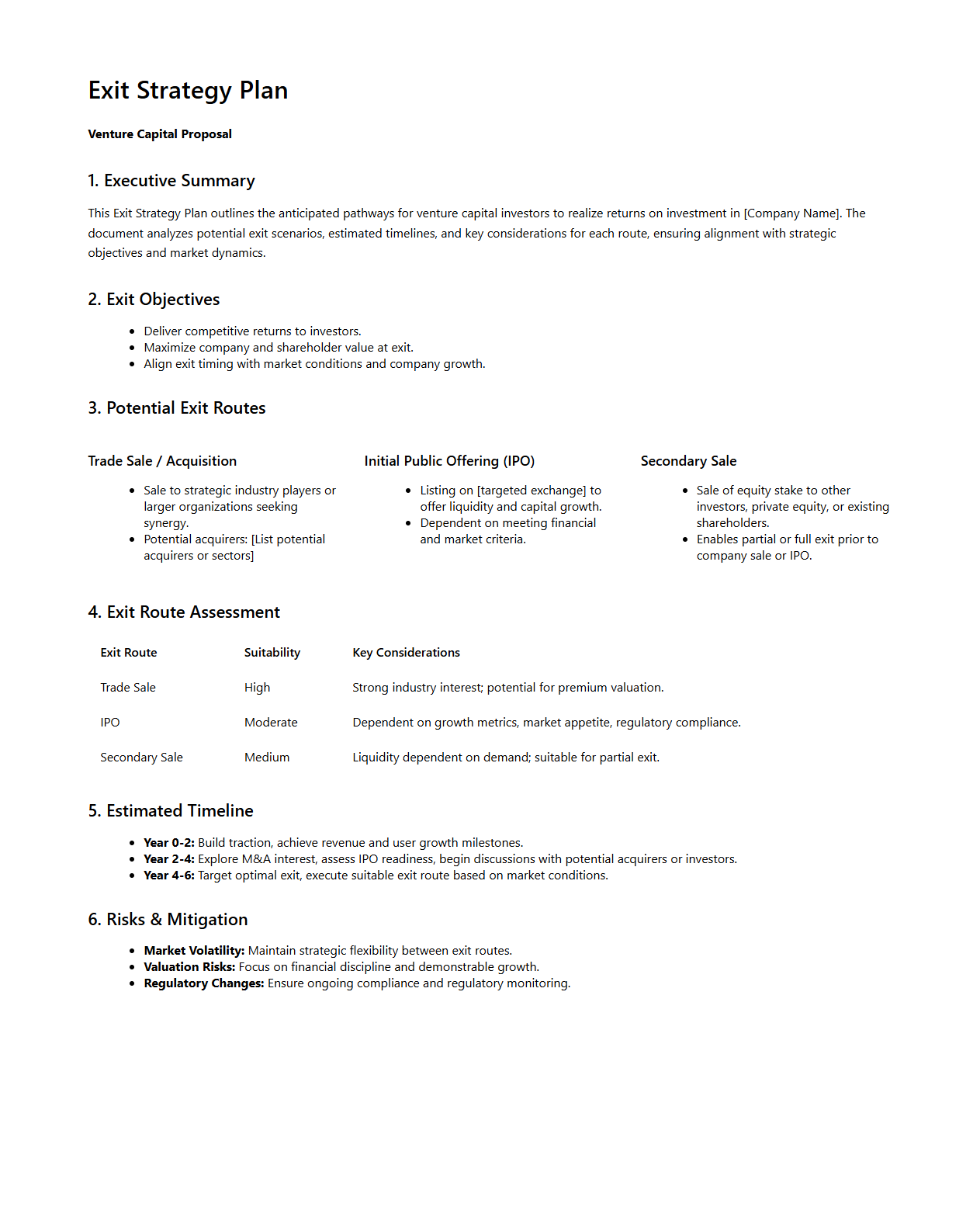

Exit Strategy Plan for Venture Capital Proposal

An

Exit Strategy Plan in a Venture Capital Proposal document outlines the approach for investors to realize returns on their investment by detailing potential methods such as initial public offerings (IPOs), mergers, acquisitions, or buybacks. This plan specifies timelines, target valuation milestones, and market conditions that guide the decision-making process for a profitable exit. Clear articulation of the exit strategy instills confidence in investors by demonstrating how the startup intends to achieve liquidity and maximize investment gains.

What key metrics should be highlighted in an investment proposal for early-stage startups?

Highlighting customer acquisition cost (CAC) and lifetime value (LTV) is crucial to demonstrate unit economics. Include monthly recurring revenue (MRR) growth and runway projections to show financial health and scalability. Additionally, metrics like burn rate and user engagement statistics help investors understand operational efficiency and market interest.

How should risk factors be framed to address venture capital concerns?

Risk factors should be presented with a balanced approach, emphasizing mitigation strategies alongside potential challenges. Clearly articulate how the management team plans to handle risks such as market competition, technology adoption, or regulatory hurdles. Transparency combined with a strong risk management plan builds investor confidence.

Which sections of the document most influence VC decision-making?

The executive summary sets the tone and must succinctly capture the startup's value proposition. The financial projections section provides insight into expected growth and profitability. Lastly, the team overview highlights the founders' expertise, which is critical for investors assessing execution capability.

What due diligence documents should be referenced in the proposal letter?

Include references to financial statements such as profit and loss statements and balance sheets for transparency. Mention any legal documents, including intellectual property rights, contracts, and incorporation papers. Also, reference market research or customer validation materials that support your claims.

How can market traction be visually presented to appeal to venture capitalists?

Use graphs and charts to show key growth indicators such as user acquisition and revenue trends over time. Visual timelines displaying milestones and partnerships enhance credibility. Additionally, highlighting customer testimonials or case studies with infographics can clearly convey market acceptance.