A Medical Examination Document Sample for Term Insurance provides a detailed template outlining the necessary health information and test results required by insurance companies before approving term life coverage. It typically includes medical history, physical examination details, and laboratory test outcomes to assess the applicant's risk profile accurately. This document ensures transparency and helps streamline the underwriting process for term insurance policies.

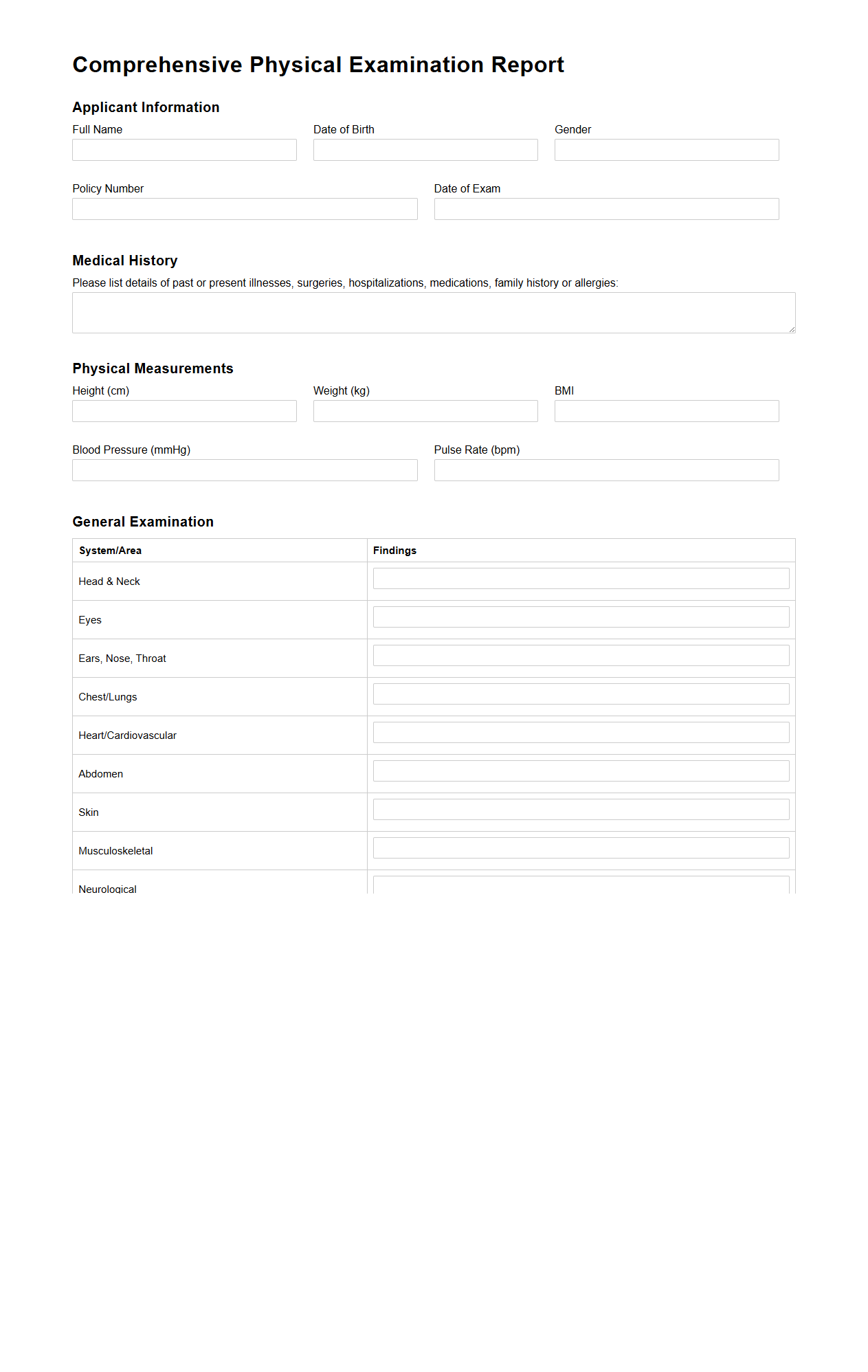

Comprehensive Physical Examination Report Template for Term Life Insurance

A

Comprehensive Physical Examination Report Template for Term Life Insurance is a structured document used to record detailed health information during the medical assessment of an insurance applicant. It includes vital signs, medical history, physical examination findings, and laboratory test results to evaluate the applicant's overall health status. This template ensures consistency and thoroughness in capturing critical data that insurance underwriters use to determine eligibility and premium rates.

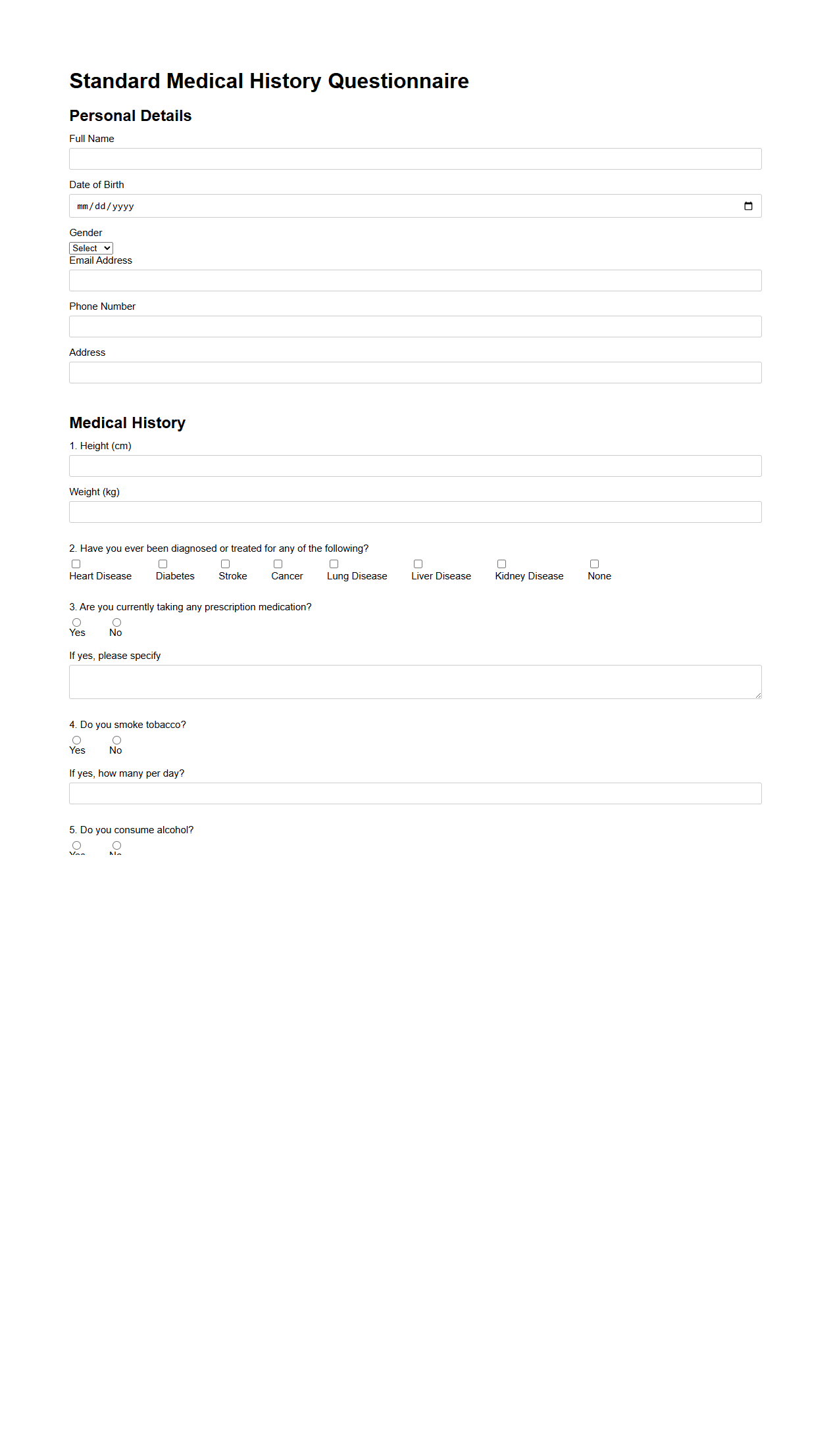

Standard Medical History Questionnaire for Term Insurance Eligibility

The

Standard Medical History Questionnaire for Term Insurance Eligibility is a crucial document used by insurance providers to assess an applicant's health status and potential risk factors before issuing a policy. It contains detailed questions regarding past and current medical conditions, surgeries, medications, and family medical history to evaluate eligibility and determine premium rates. Accurate completion of this questionnaire ensures transparent risk assessment and helps streamline the underwriting process for term insurance.

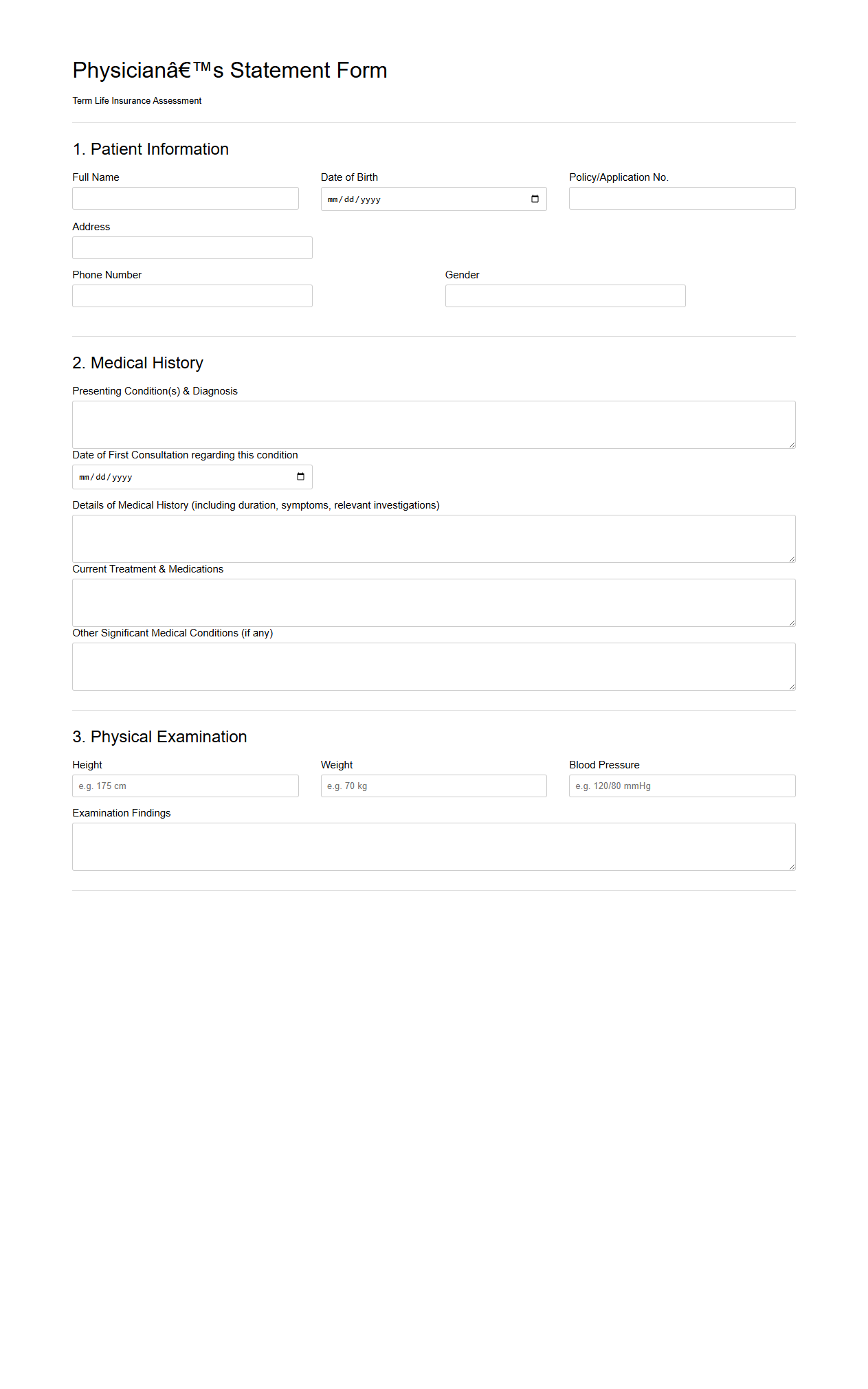

Physician’s Statement Form for Term Life Insurance Assessment

A

Physician's Statement Form for Term Life Insurance Assessment is a medical document completed by a licensed physician to provide detailed health information about the insurance applicant. It includes data on medical history, current health conditions, medications, and any recent treatments, which helps insurers evaluate the risk and determine policy eligibility. This form is a crucial part of the underwriting process, ensuring accurate risk assessment for term life insurance coverage.

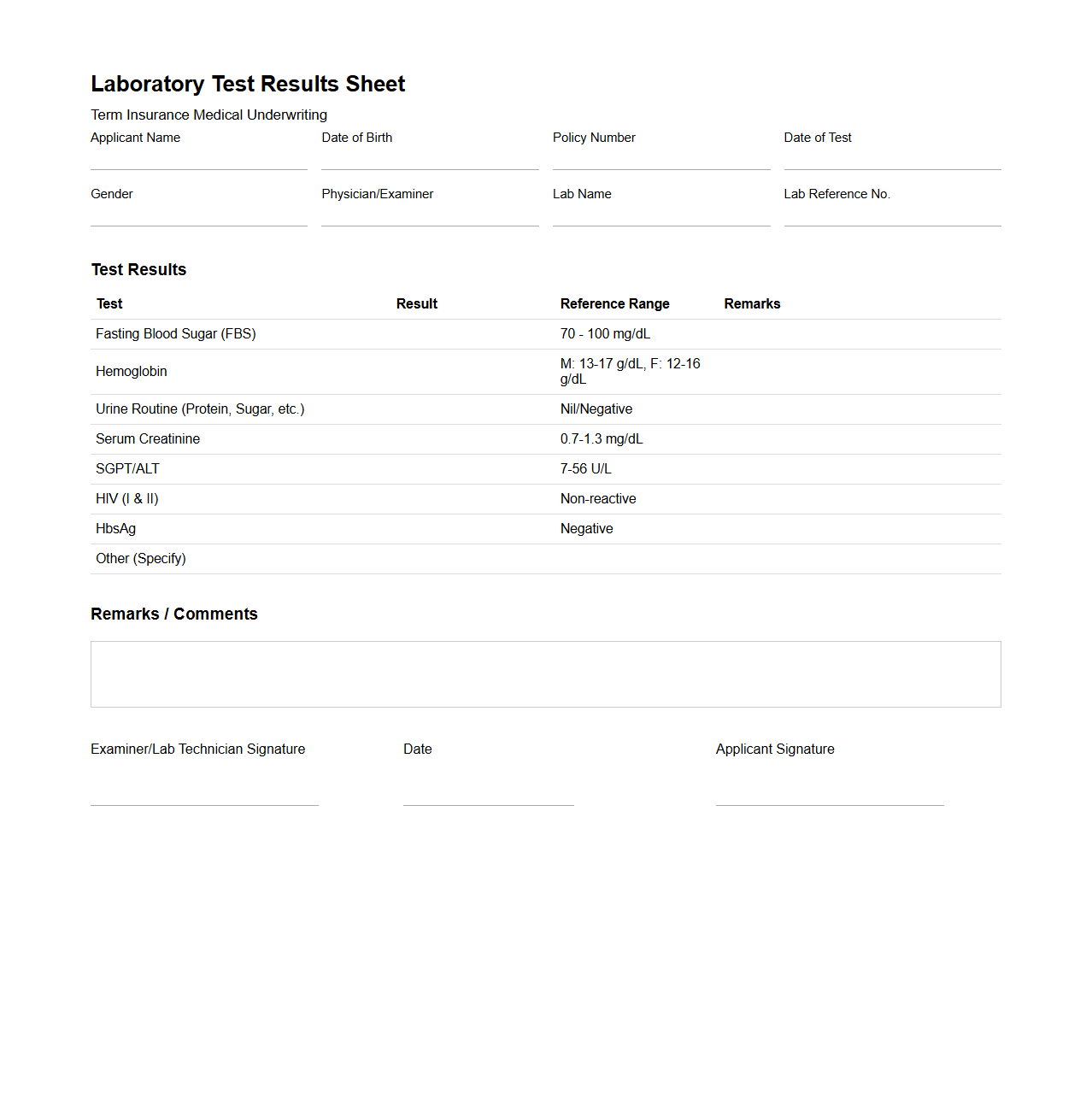

Laboratory Test Results Sheet for Term Insurance Medical Underwriting

A

Laboratory Test Results Sheet for Term Insurance Medical Underwriting is a critical document that records all medical test outcomes required to assess an applicant's health status. It includes key biometric data such as blood pressure, cholesterol levels, blood sugar, and other diagnostic markers that insurers use to evaluate risk. Accurate results on this sheet help determine eligibility and premium rates for term life insurance policies.

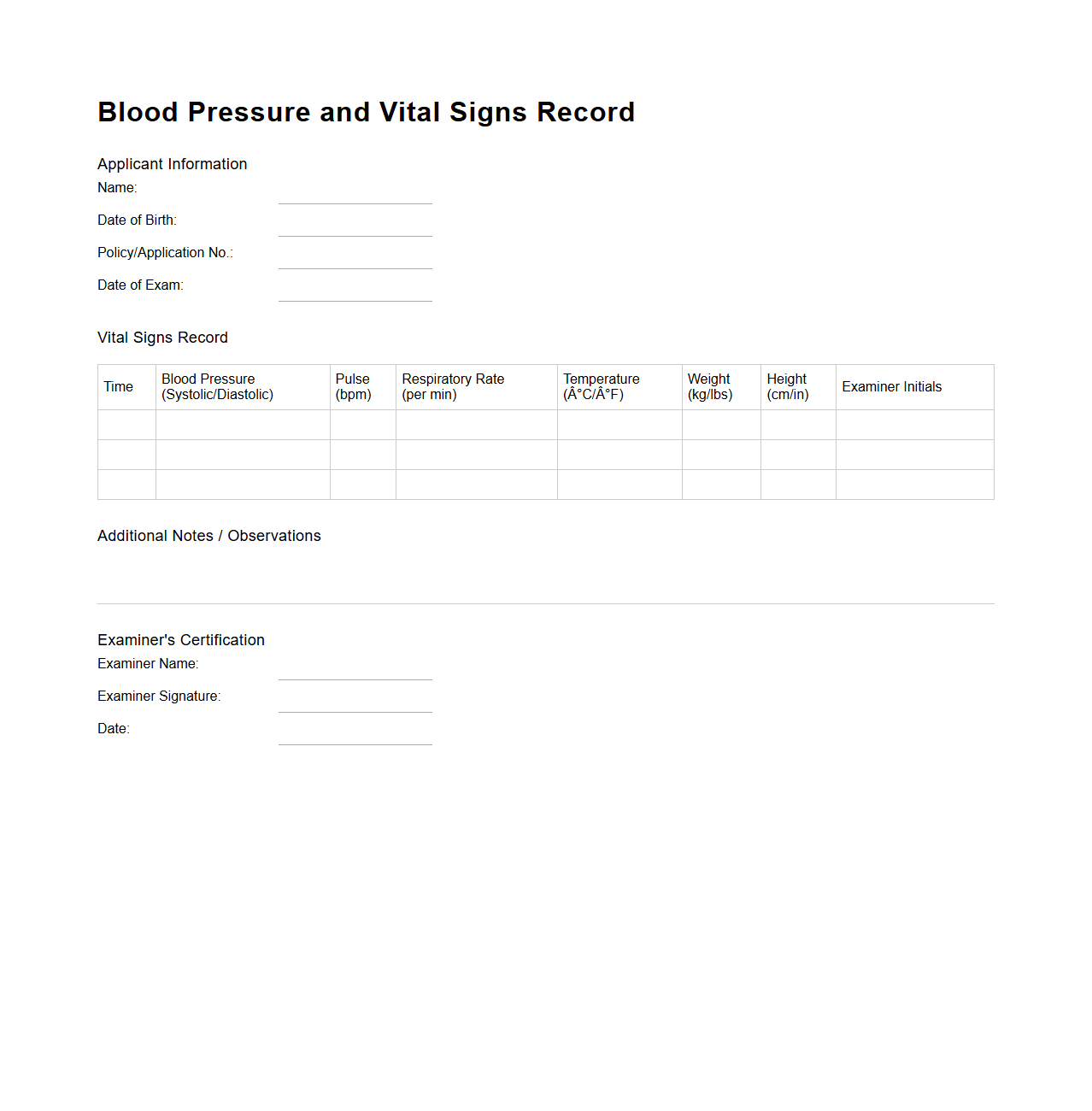

Blood Pressure and Vital Signs Record for Term Life Insurance Application

The

Blood Pressure and Vital Signs Record is a critical document used in Term Life Insurance applications to assess an applicant's health status. It includes measurements such as blood pressure, heart rate, temperature, and respiratory rate, which help underwriters evaluate the risk profile and determine appropriate policy terms. Accurate recording of these vital signs ensures a fair premium calculation and supports the insurer in providing adequate coverage.

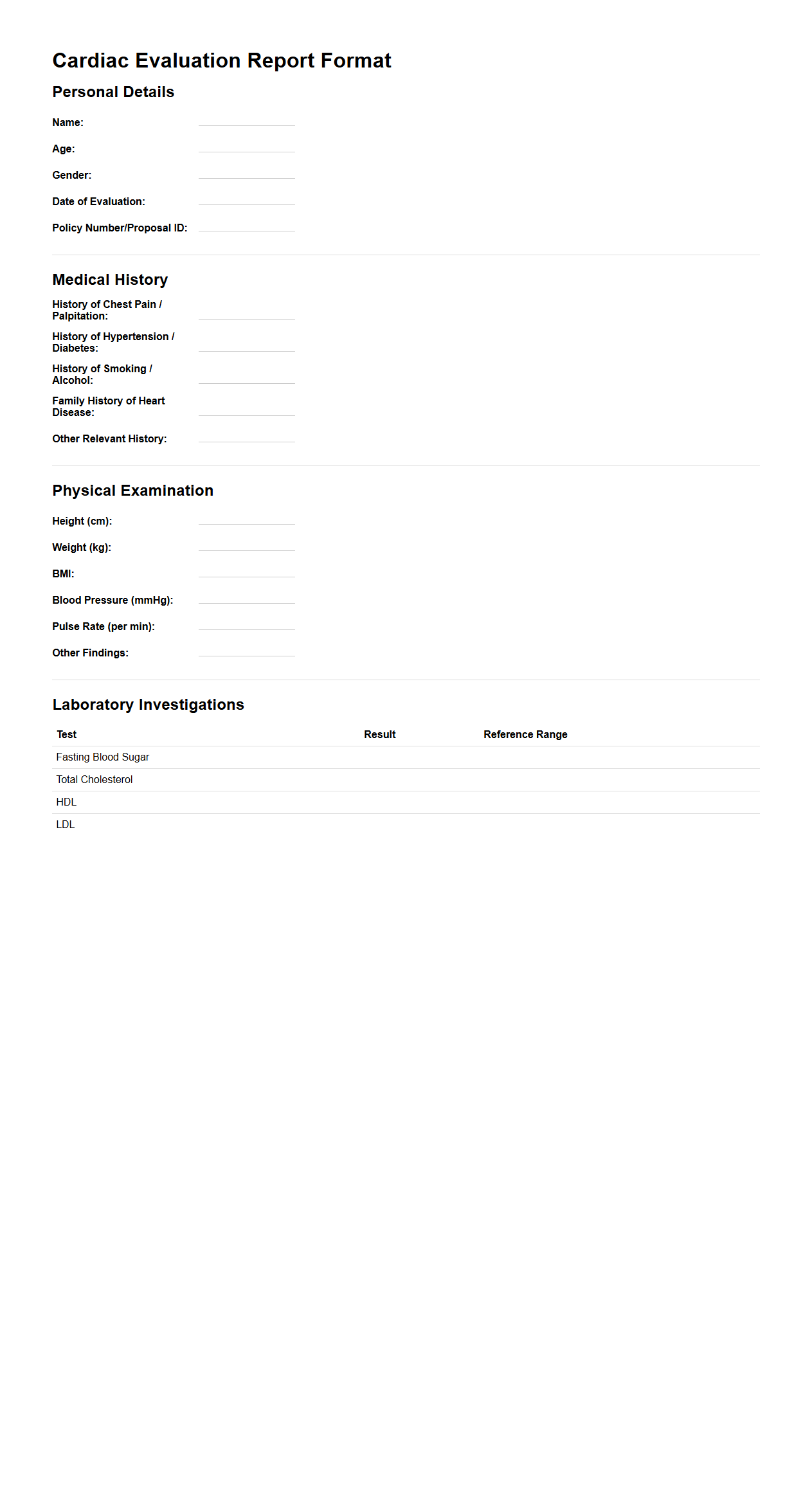

Cardiac Evaluation Report Format for Term Insurance Screening

The

Cardiac Evaluation Report Format for Term Insurance Screening document outlines the standardized procedure and criteria used to assess an individual's heart health during the insurance underwriting process. It typically includes parameters such as ECG results, blood pressure readings, lipid profiles, and any history of cardiovascular disease. This report ensures accurate risk assessment to determine eligibility and premium rates for term life insurance policies.

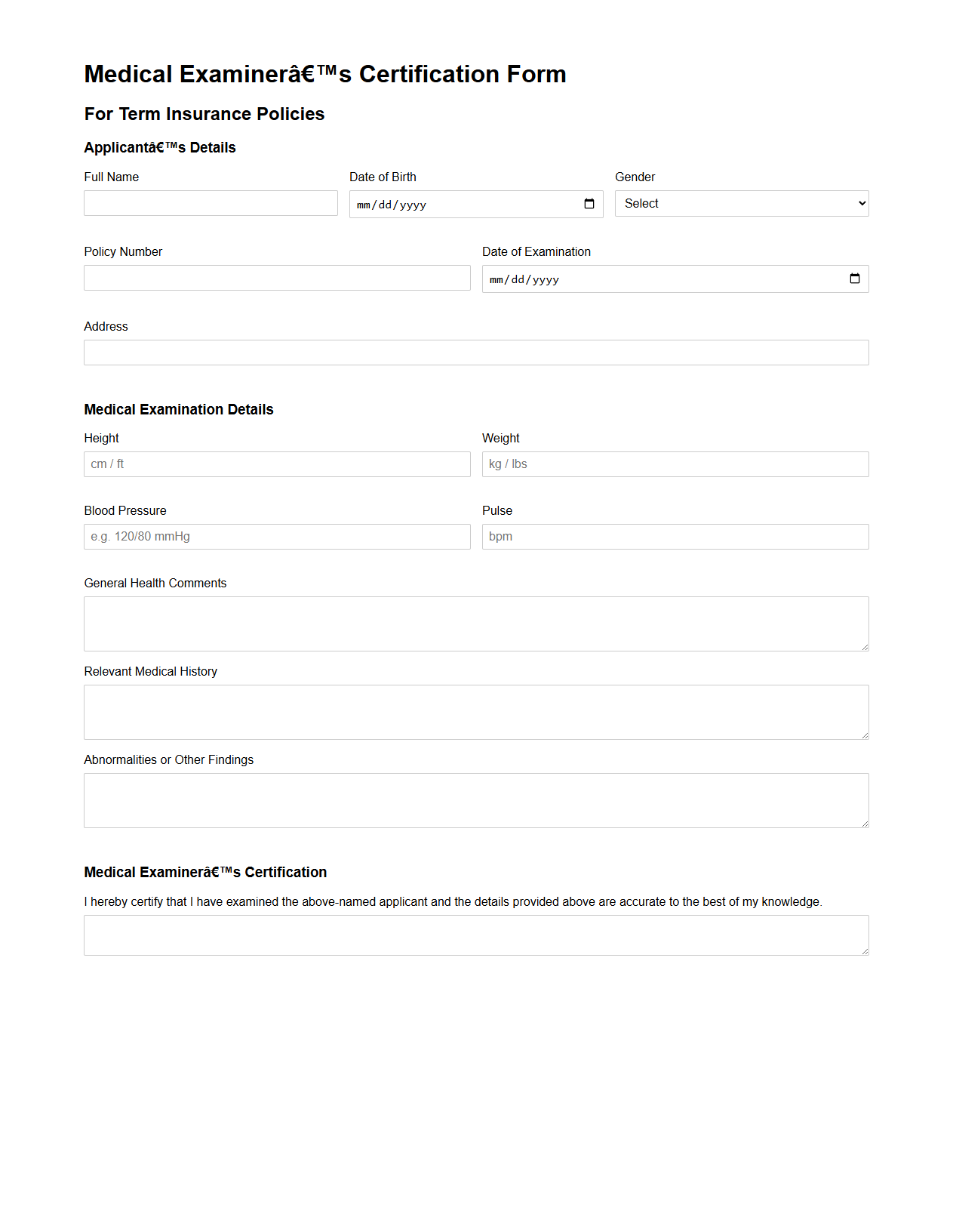

Medical Examiner’s Certification Form for Term Insurance Policies

The

Medical Examiner's Certification Form for Term Insurance Policies is a critical document completed by a licensed medical examiner to validate the applicant's health status during the insurance underwriting process. It includes detailed medical information such as vital signs, physical examination findings, and relevant medical history, ensuring accurate risk assessment by the insurer. This certification helps insurers determine eligibility, premium rates, and policy terms based on the applicant's verified medical condition.

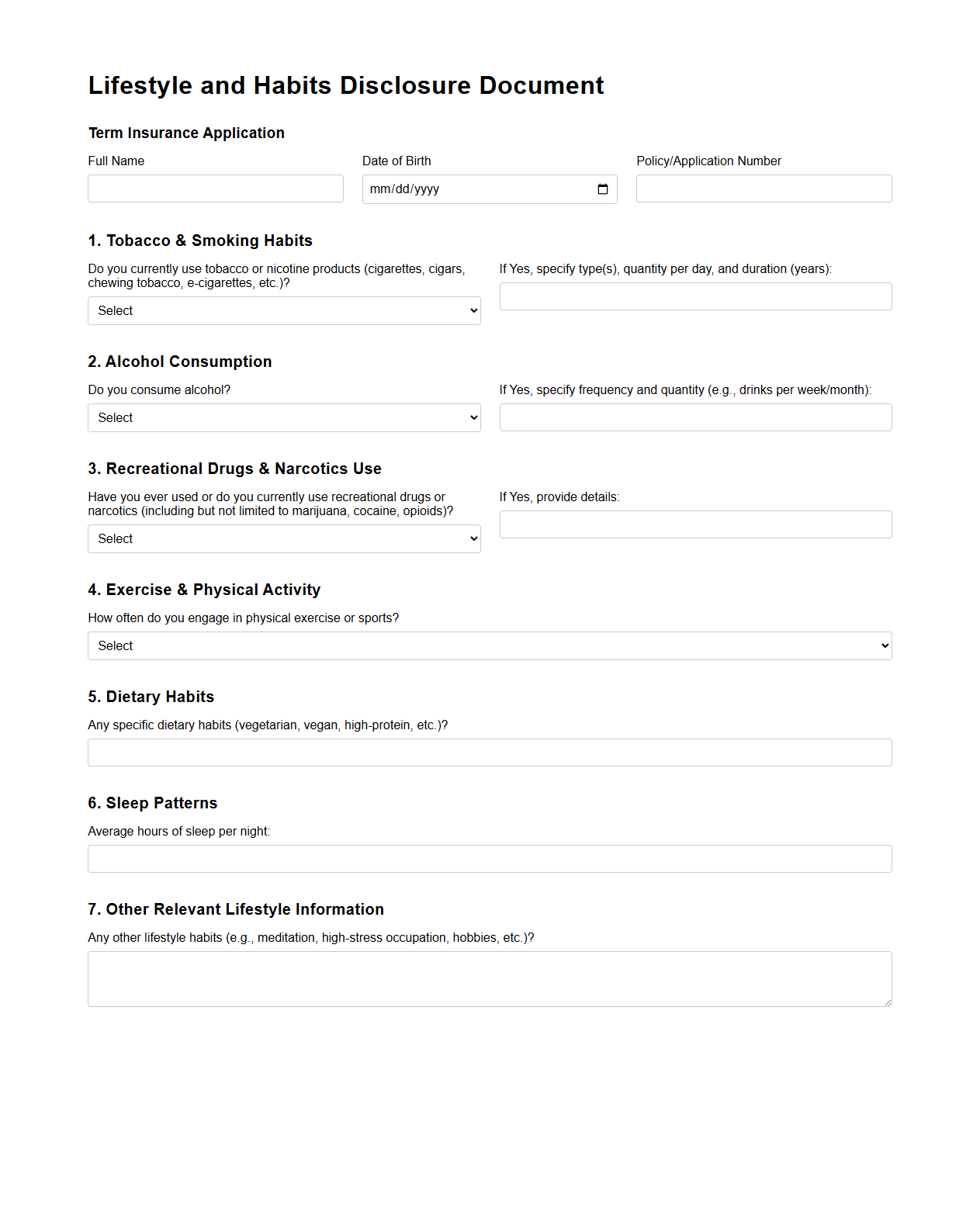

Lifestyle and Habits Disclosure Document for Term Insurance Applicants

The

Lifestyle and Habits Disclosure Document for Term Insurance Applicants is a crucial form that collects detailed information about an applicant's daily routines, health practices, and risk-related behaviors such as smoking, alcohol consumption, and exercise frequency. Insurers use this document to assess the applicant's risk profile accurately, which directly impacts premium rates and policy eligibility. Providing truthful and comprehensive lifestyle details ensures transparent underwriting and minimizes the risk of claim denial in the future.

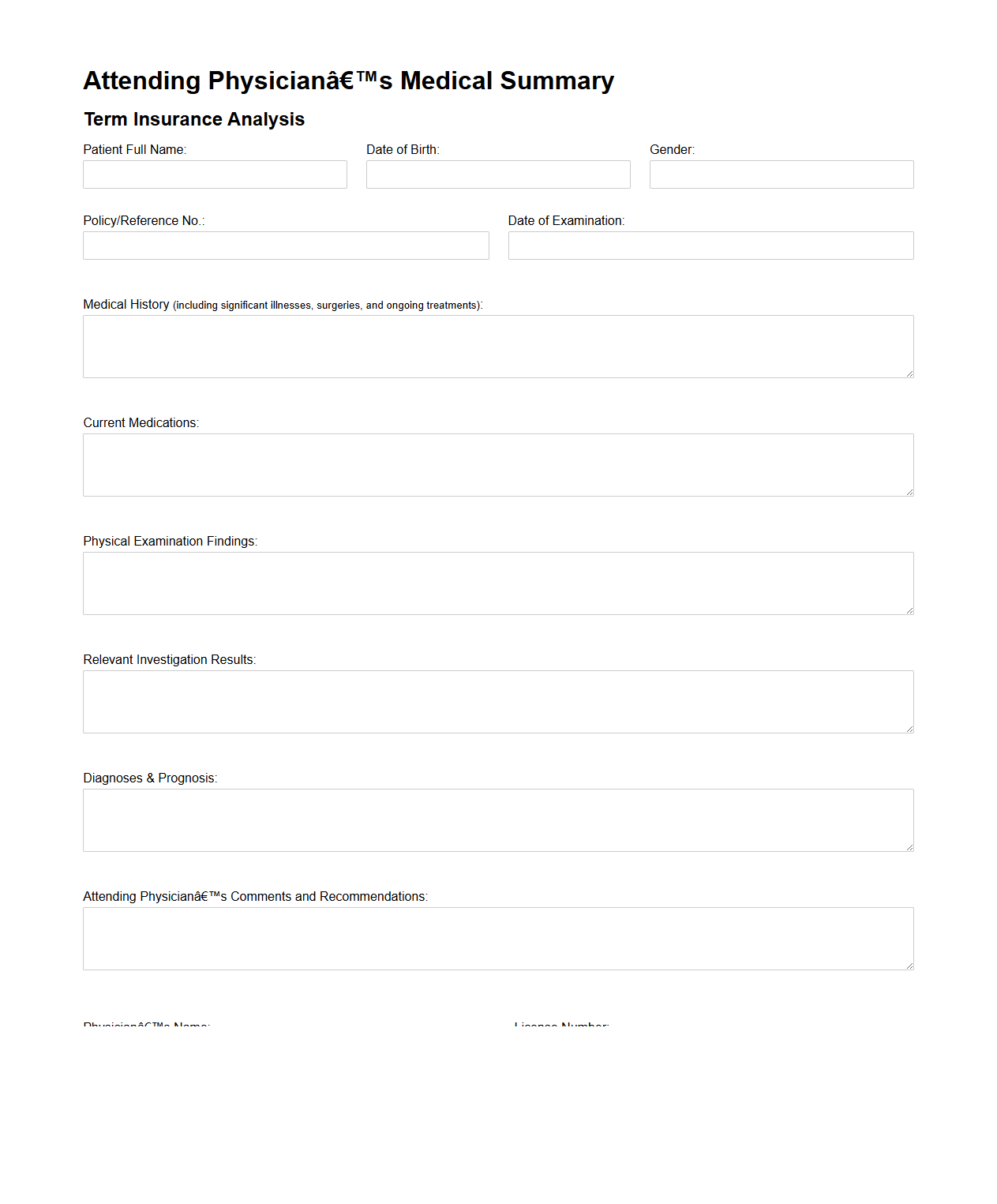

Attending Physician’s Medical Summary for Term Insurance Analysis

The Attending Physician's Medical Summary for Term Insurance Analysis document provides a detailed report from the insured individual's primary doctor, outlining their medical history, current health status, and any ongoing treatments. This summary is essential for insurance companies to accurately assess risk and determine eligibility for term life insurance coverage.

Medical summaries ensure a thorough evaluation of health factors, helping insurers make informed underwriting decisions.

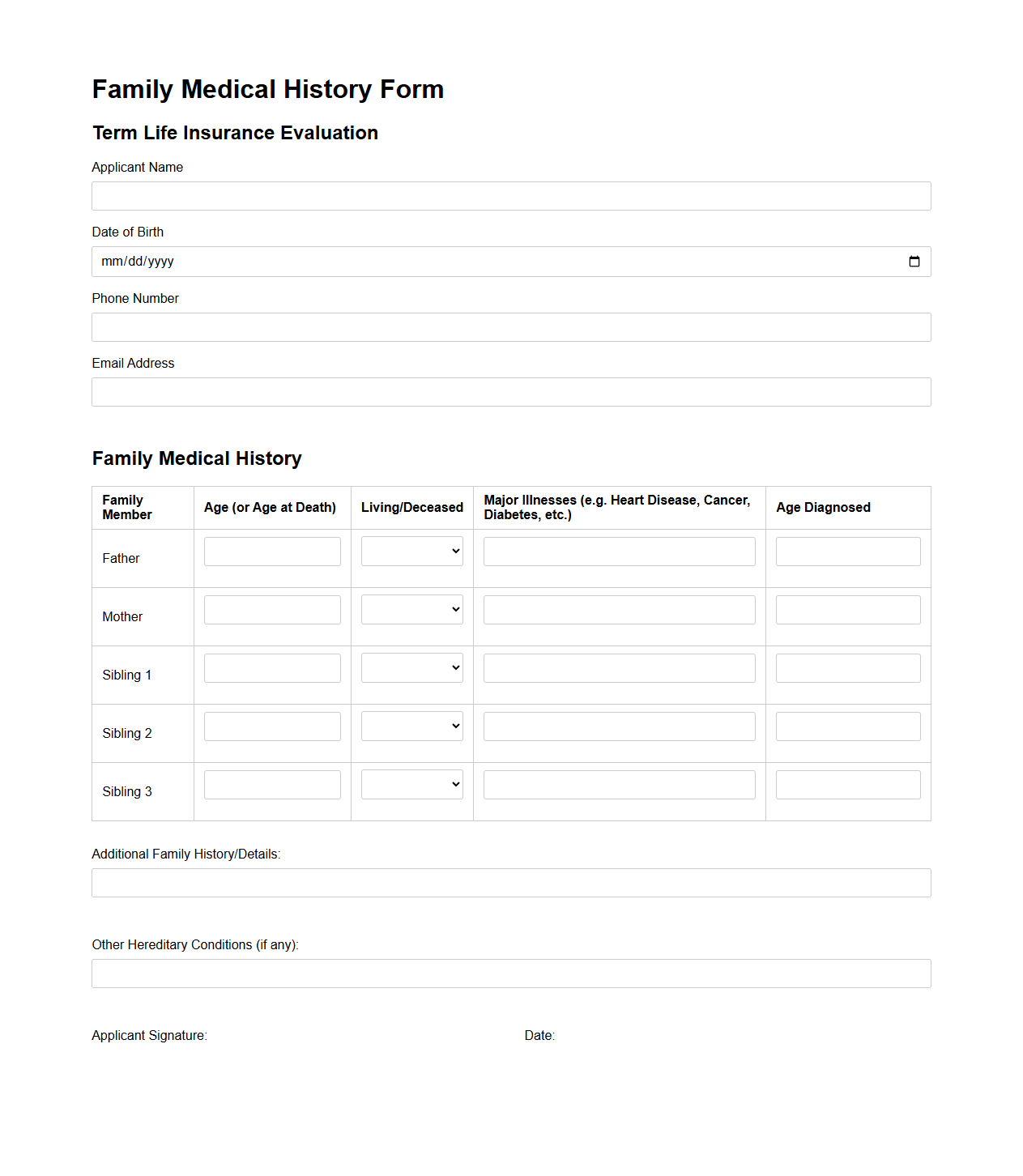

Family Medical History Form for Term Life Insurance Evaluation

A Family Medical History Form for Term Life Insurance Evaluation is a critical document that collects detailed health information about an applicant's immediate family members. This form helps insurers assess genetic predispositions to hereditary diseases, significantly impacting the risk profile and premium rates. Providing accurate data on conditions like heart disease, cancer, and diabetes ensures a precise underwriting process for

term life insurance coverage.

What personal health information does the Medical Examination Document require for term insurance eligibility?

The Medical Examination Document mandates comprehensive personal health information including medical history, current health status, and any ongoing treatments. It requires details about allergies, medications, and prior hospitalizations. This information is essential for assessing overall health and insurance eligibility.

How does the document assess pre-existing medical conditions impacting term insurance?

The document contains a dedicated section to record pre-existing medical conditions, documenting their nature, duration, and treatment history. It also evaluates the severity and control of these conditions through medical reports and physician notes. This thorough assessment helps insurers determine risk and policy terms.

What specific medical tests and results must be included in the examination document?

The examination document requires results from essential medical tests such as blood tests, urine analysis, ECG, and chest X-rays. These tests provide quantitative data on the applicant's health status. Accurate documentation of test results is crucial for insurance risk evaluation.

How is the applicant's lifestyle or occupational risk documented for insurance evaluation?

The applicant's lifestyle and occupational risks are recorded through detailed questionnaires covering habits like smoking, alcohol use, and exercise routines. Additionally, the nature of the applicant's occupation and exposure to potential hazards are documented. This information helps insurers gauge potential risk factors associated with lifestyle and work environment.

Which sections detail physician verification and authentication of the medical information provided?

The document includes specific sections for physician verification, requiring signatures, license numbers, and contact details of the examining doctor. This ensures the authenticity of the medical data supplied. Proper authentication is mandatory for validating the Medical Examination Document in the insurance process.