A Premium Payment Document Sample for Fire Insurance serves as an official proof of payment for the insurance premium related to fire coverage. This document typically includes details such as the policyholder's information, payment amount, date of transaction, and policy number. It helps ensure transparency and acts as a reference for both the insurer and insured in case of claims or renewals.

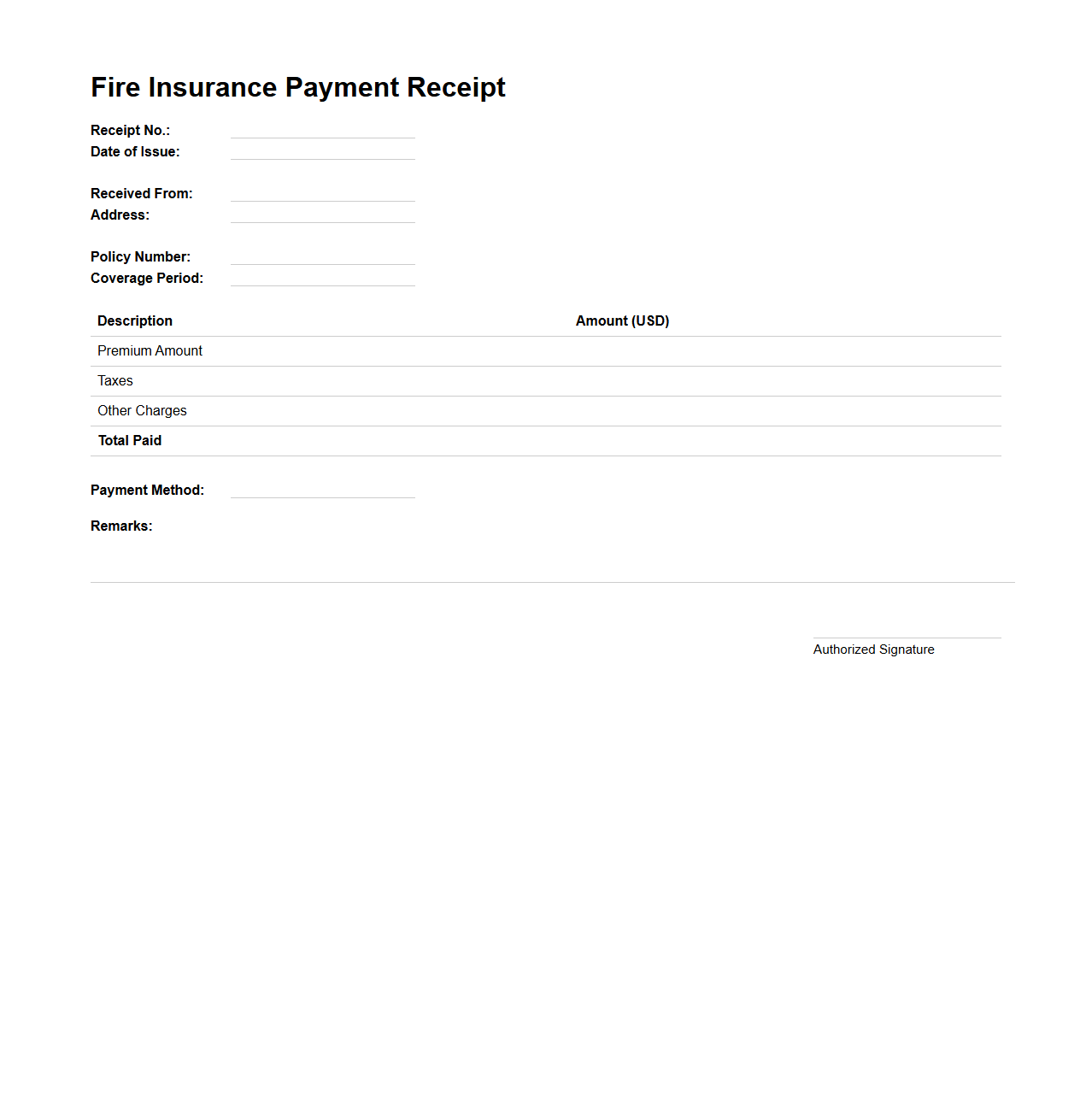

Fire Insurance Payment Receipt Template

A

Fire Insurance Payment Receipt Template is a structured document used to acknowledge the payment of premiums related to fire insurance policies. It records essential details such as the insured party's information, payment amount, date of transaction, and policy coverage specifics. This template helps maintain transparent financial records and serves as proof of payment for both the insurer and the insured.

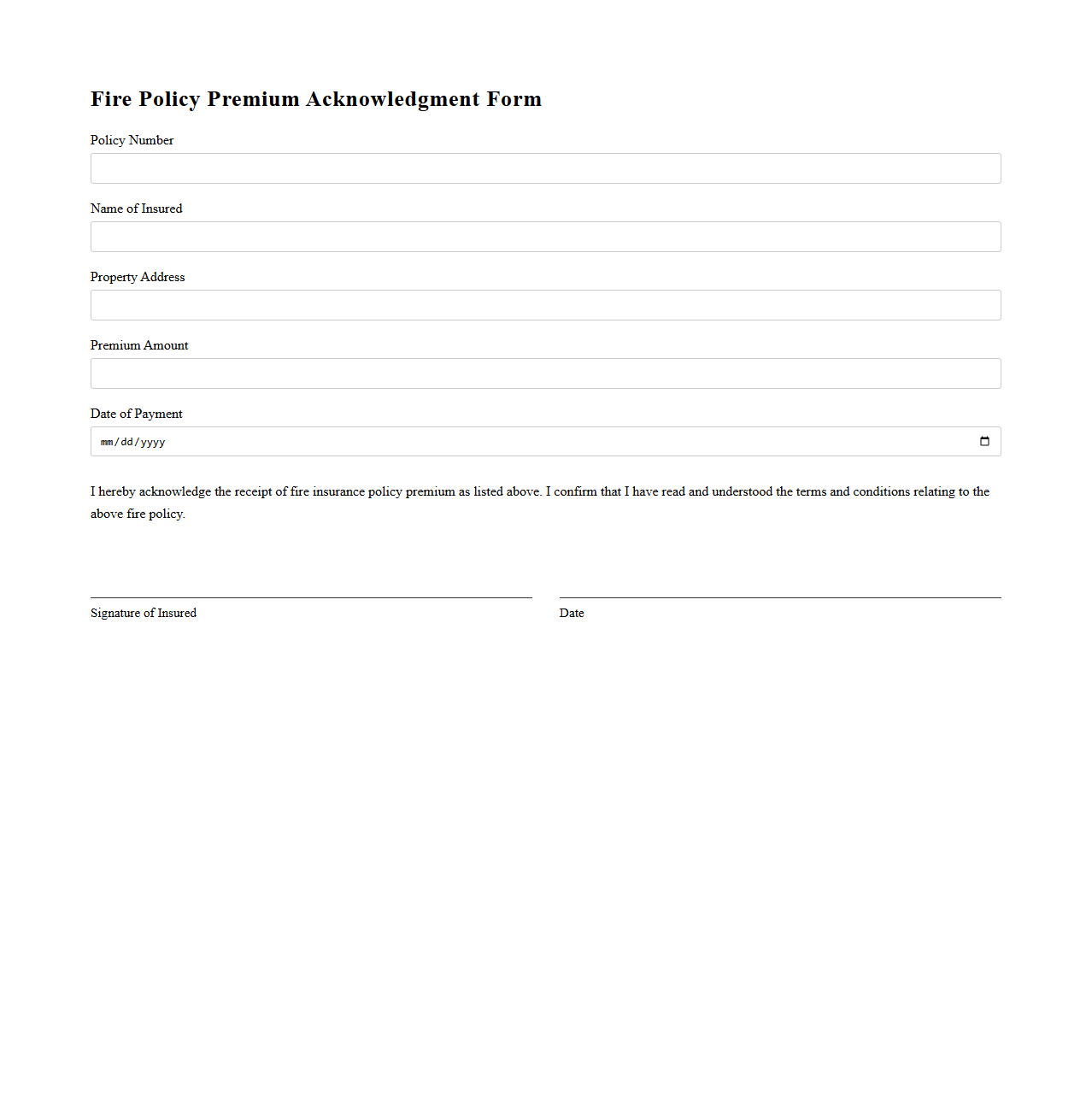

Fire Policy Premium Acknowledgment Form

The

Fire Policy Premium Acknowledgment Form is a crucial document used by insurance companies to confirm the receipt and acceptance of the premium payment for a fire insurance policy. It serves as proof that the policyholder has fulfilled their financial obligation, ensuring the fire insurance policy remains active and in force. This form helps prevent disputes by documenting the transaction date, amount paid, and policy details.

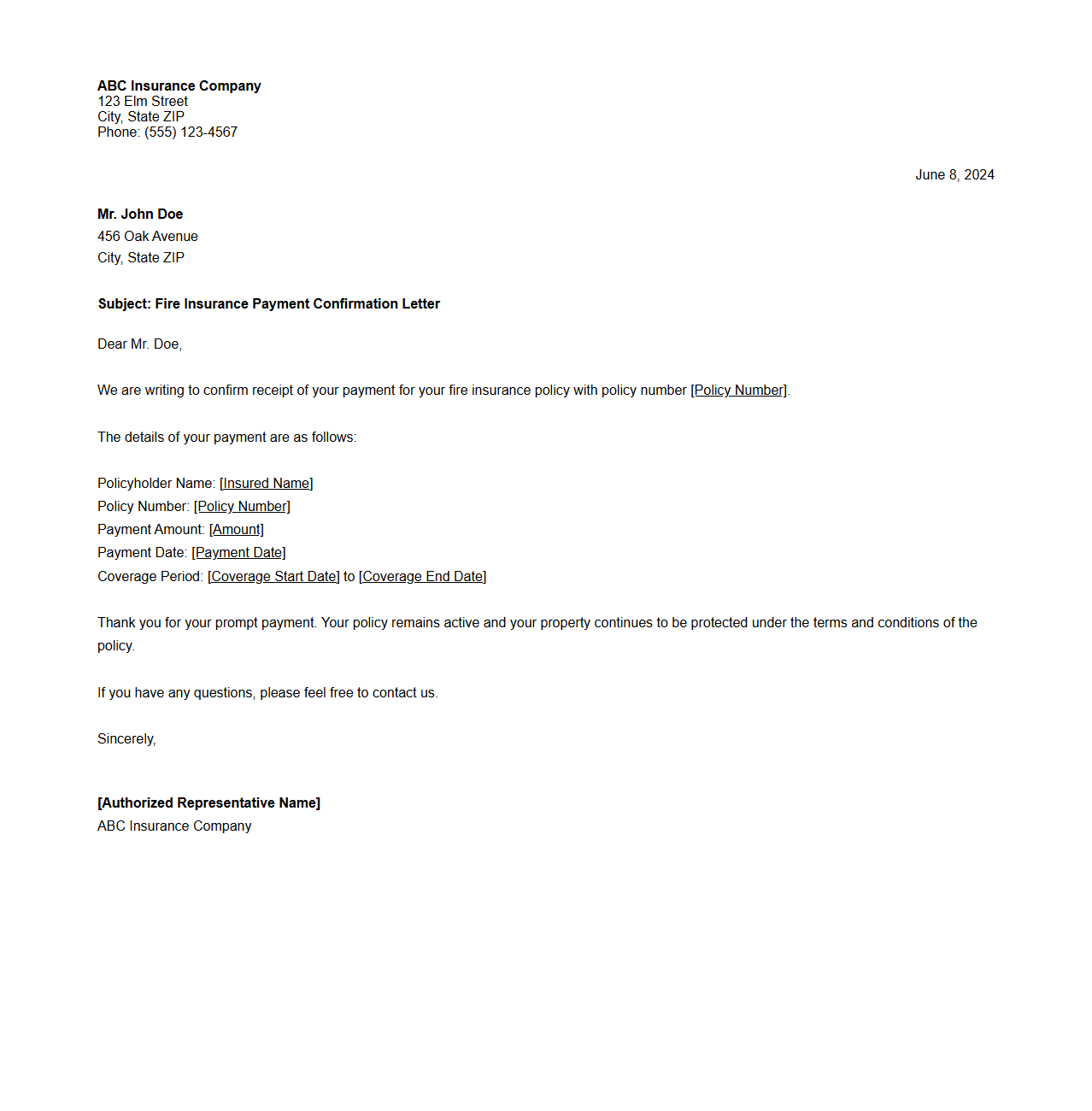

Fire Insurance Payment Confirmation Letter

A

Fire Insurance Payment Confirmation Letter is an official document issued by an insurance company to confirm the receipt of payment for a fire insurance policy. It serves as proof that the insured party has fulfilled their financial obligation towards the fire insurance coverage. This letter is essential for record-keeping and may be required for claims or legal purposes.

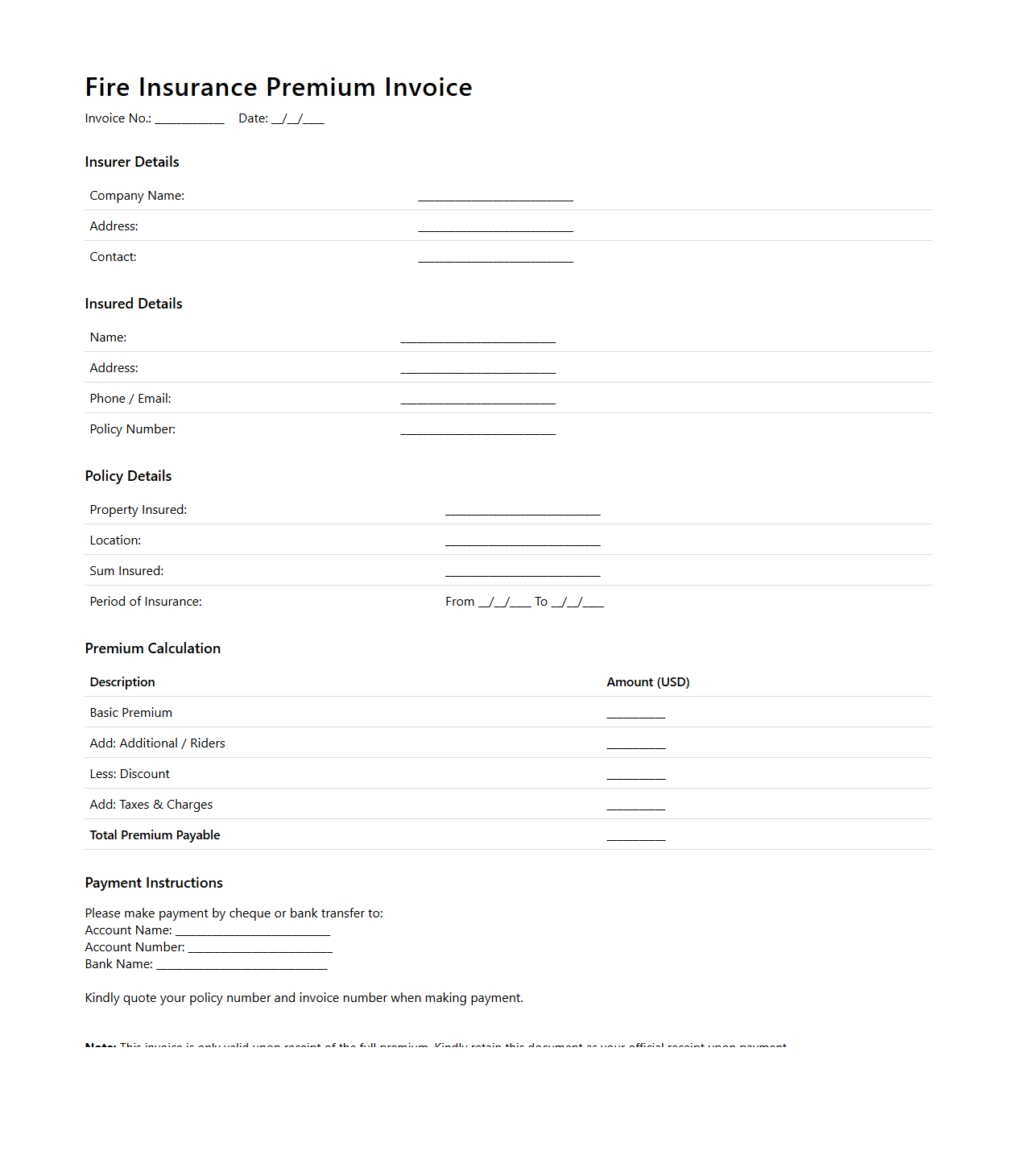

Fire Insurance Premium Invoice Sample

A

Fire Insurance Premium Invoice Sample document itemizes the cost details for fire insurance coverage, including policy information, insured property value, premium amount, and payment terms. It serves as an official bill from the insurance provider to the policyholder, ensuring clarity on charges and coverage period. This sample aids in understanding invoice format, facilitating accurate financial record-keeping and premium payment.

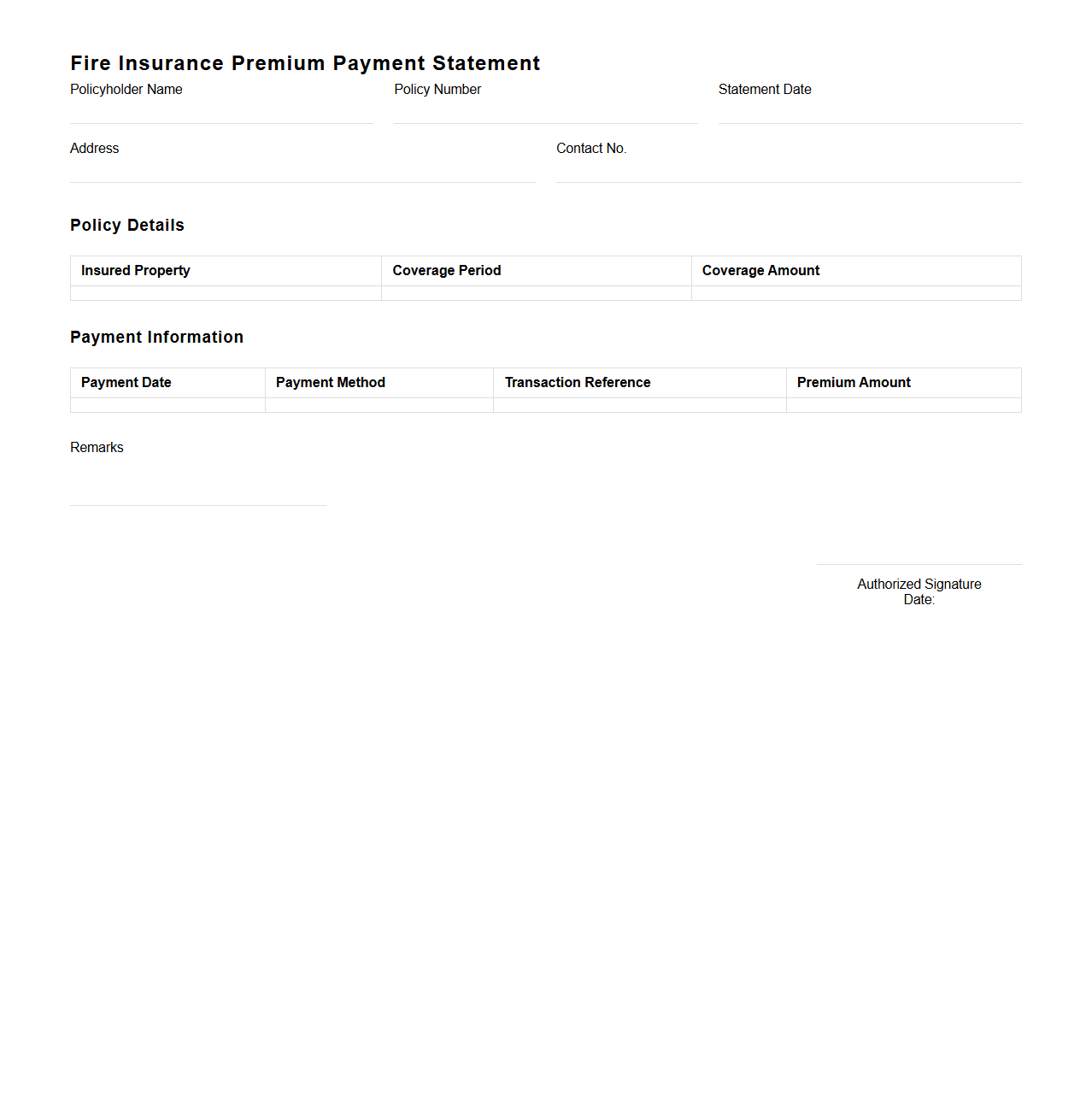

Fire Insurance Premium Payment Statement

A

Fire Insurance Premium Payment Statement is a document that details the amount paid by a policyholder towards their fire insurance coverage within a specified period. It typically includes information such as the policy number, payment dates, premium amounts, and coverage duration. This statement serves as proof of payment and helps both the insurer and insured keep track of premium-related transactions for fire insurance policies.

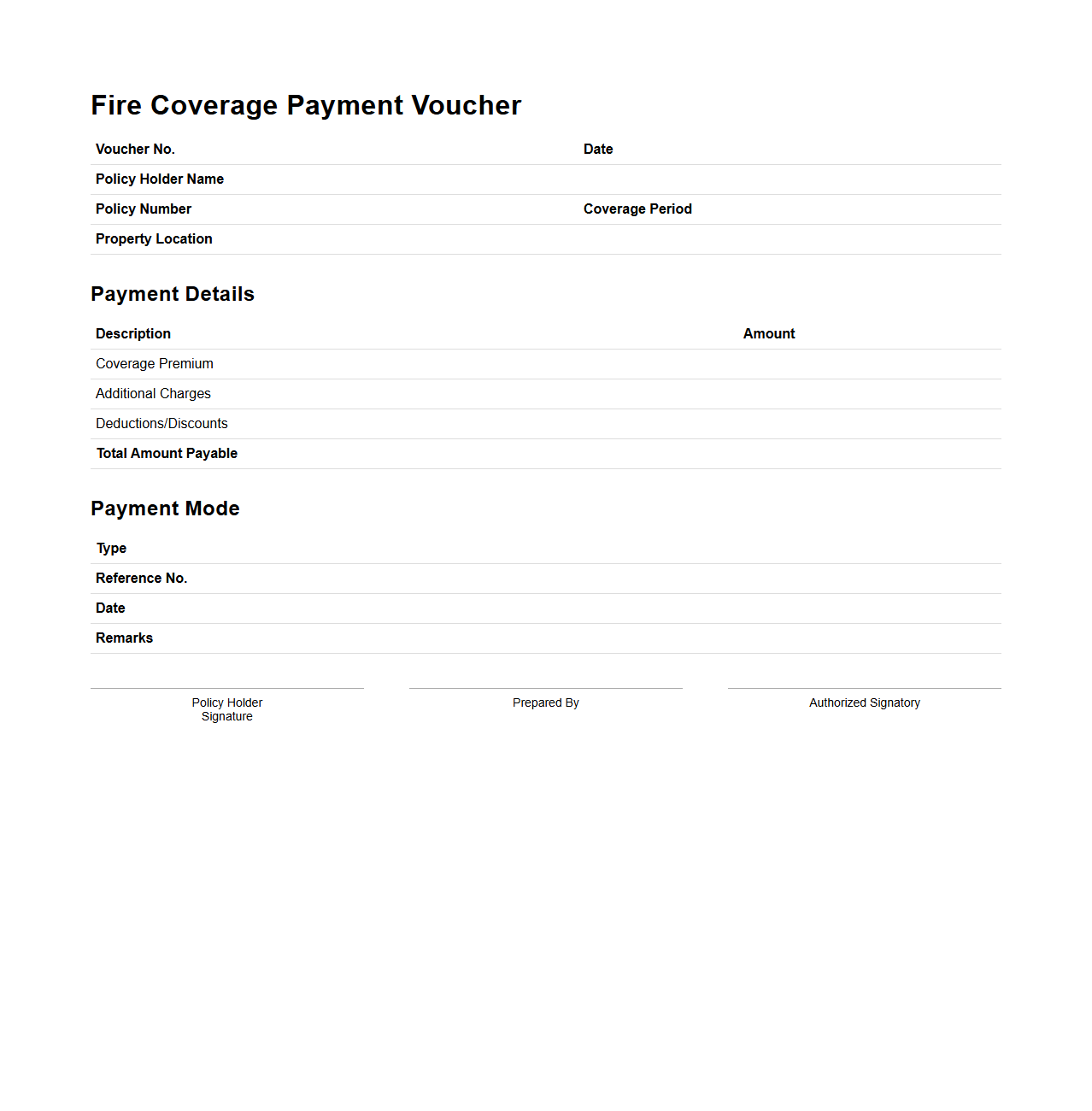

Fire Coverage Payment Voucher Format

A

Fire Coverage Payment Voucher Format document is a structured template used to authorize and record payments related to fire insurance policies. It includes essential details such as policyholder information, payment amount, payment date, and policy number to ensure accurate tracking and verification. This format helps maintain transparency and efficiency in processing fire coverage claims and premium payments.

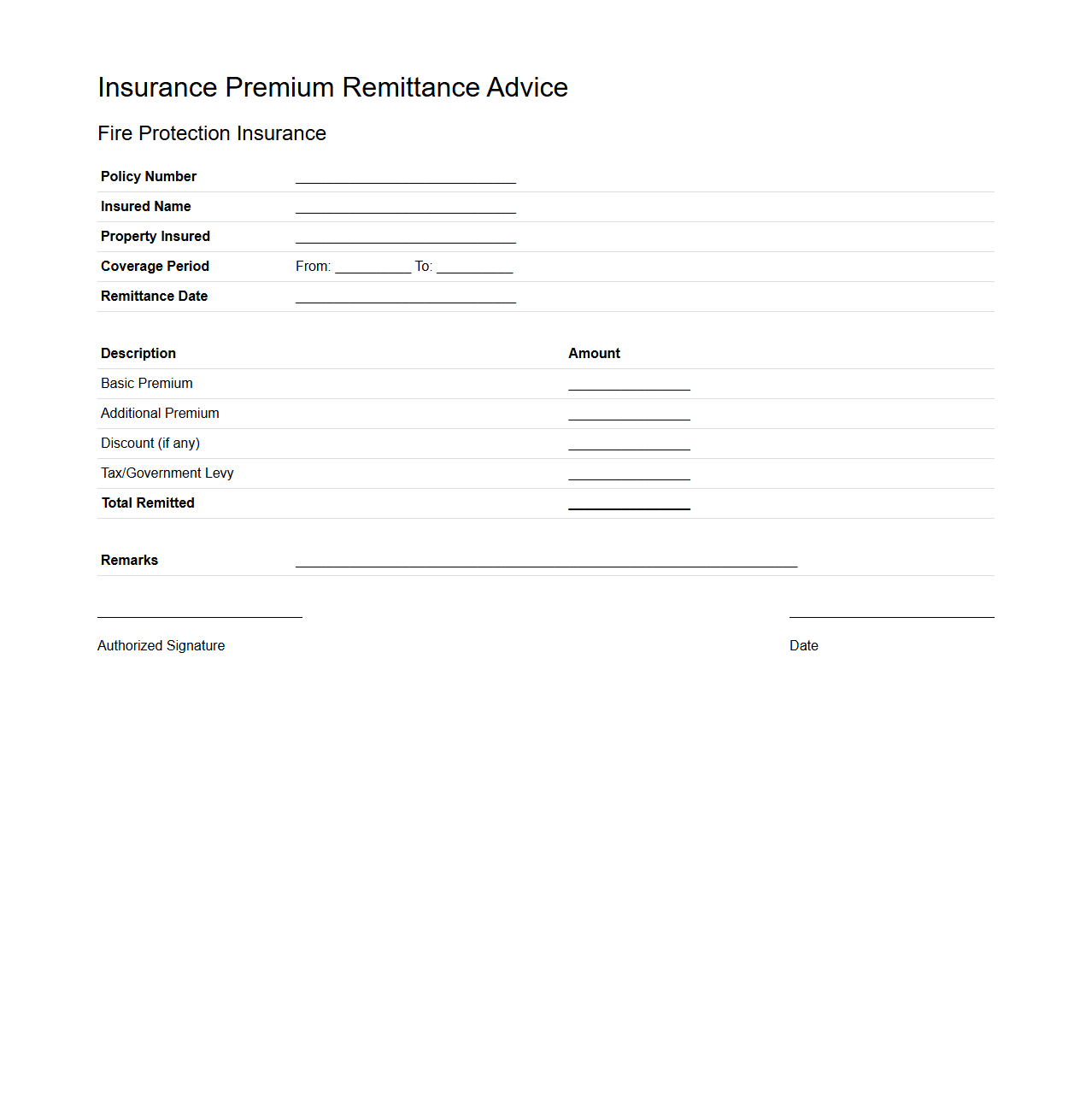

Insurance Premium Remittance Advice for Fire Protection

The

Insurance Premium Remittance Advice for Fire Protection document serves as an official record detailing the payment of insurance premiums specifically for fire protection coverage. It provides key information such as the amount paid, policy details, payment date, and the insured party's identification to ensure accurate processing and reconciliation between the insurer and the policyholder. This document is essential for verifying premium payments related to

fire insurance policies, aiding both accounting accuracy and compliance with insurance terms.

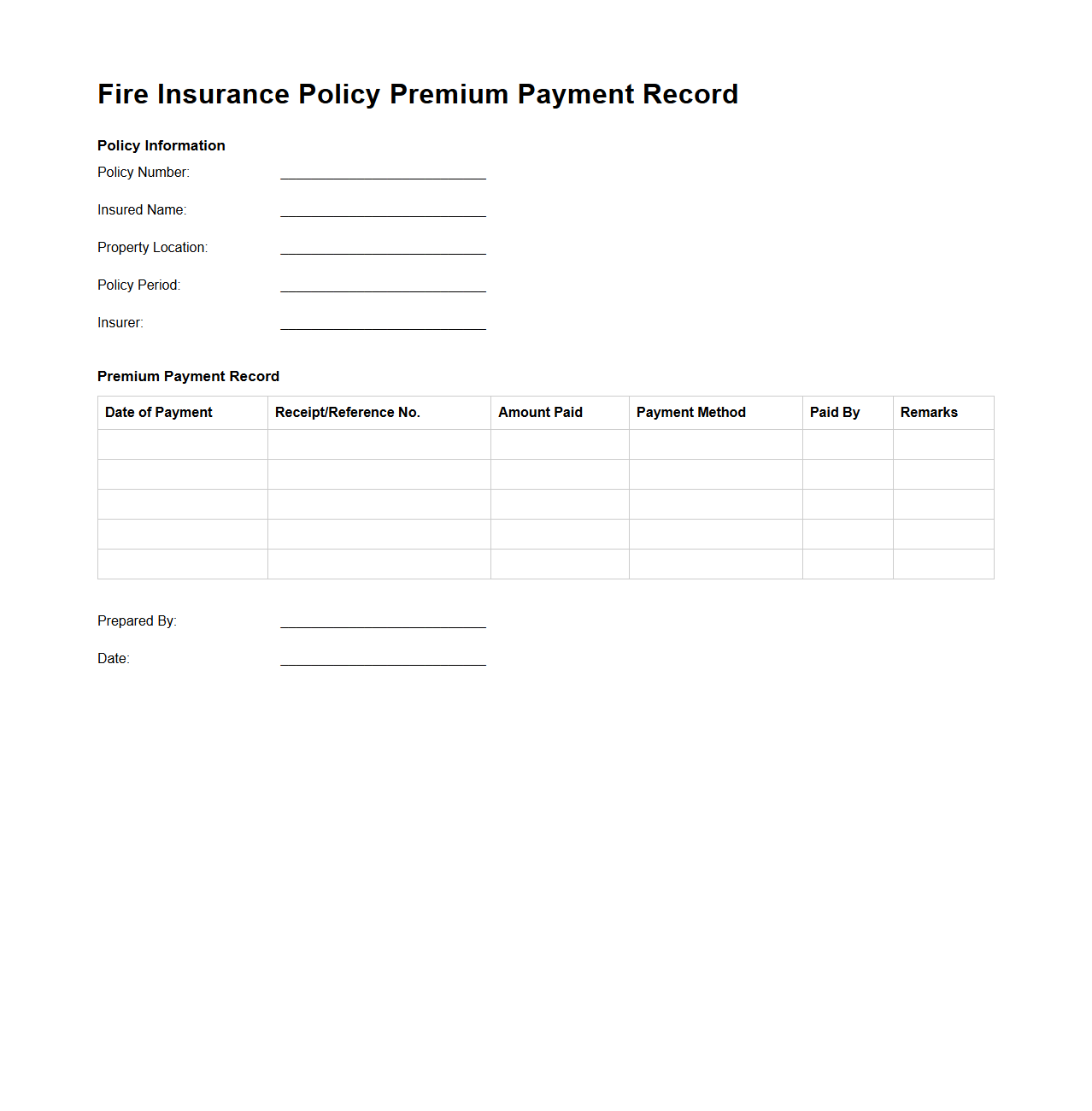

Fire Insurance Policy Premium Payment Record

A

Fire Insurance Policy Premium Payment Record document tracks all payments made towards the fire insurance policy, including dates, amounts, and payment methods. It serves as proof of premiums paid to ensure continuous coverage against fire-related damages. Maintaining this record helps policyholders avoid lapses and facilitates smooth claim processing.

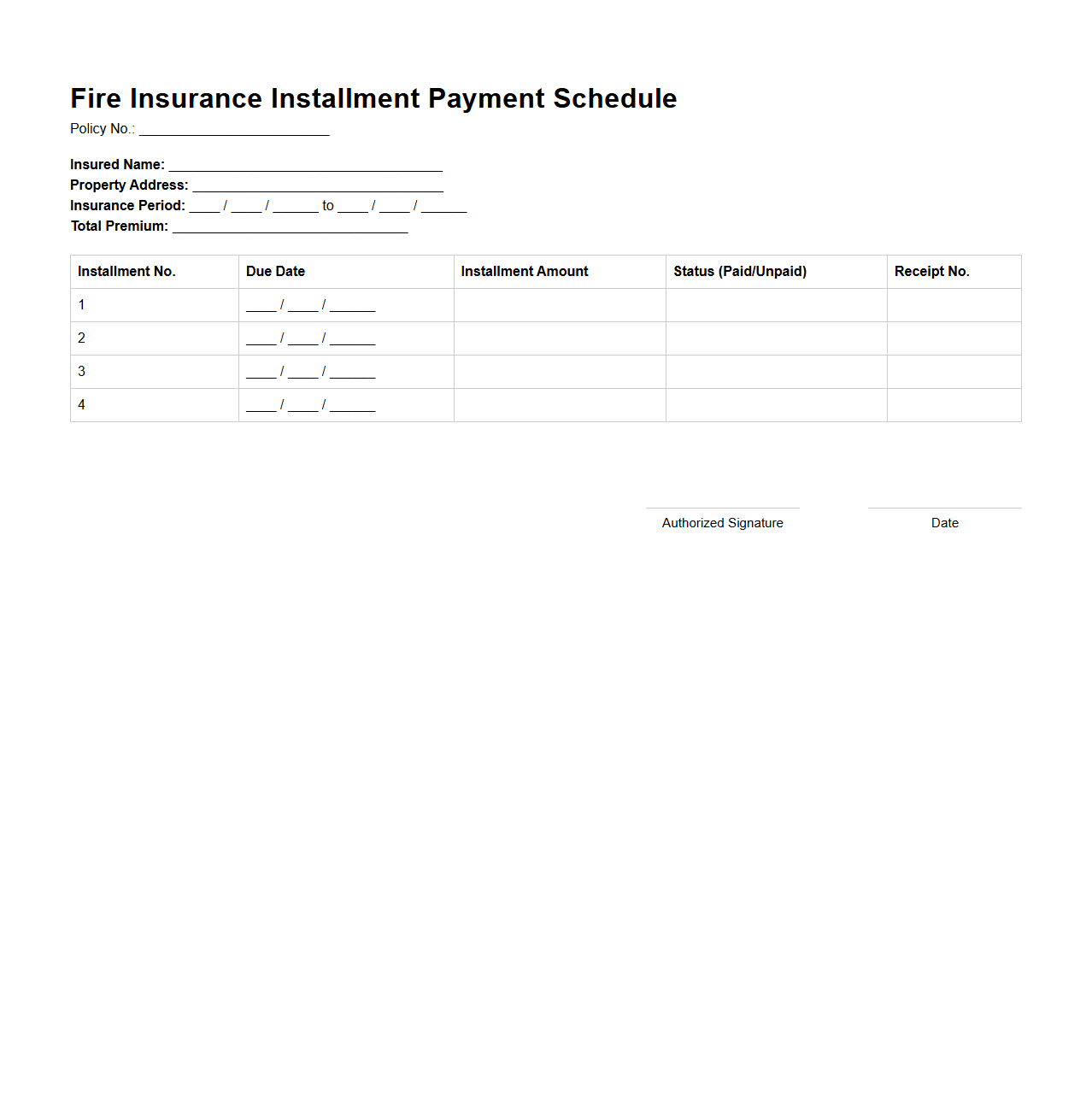

Fire Insurance Installment Payment Schedule

A

Fire Insurance Installment Payment Schedule document outlines the specific dates and amounts due for each payment toward a fire insurance policy, ensuring policyholders maintain continuous coverage. This schedule helps both the insurer and insured track premium installments, preventing lapses in protection against fire-related damages. Clear documentation of payment timing and values aids in financial planning and policy management.

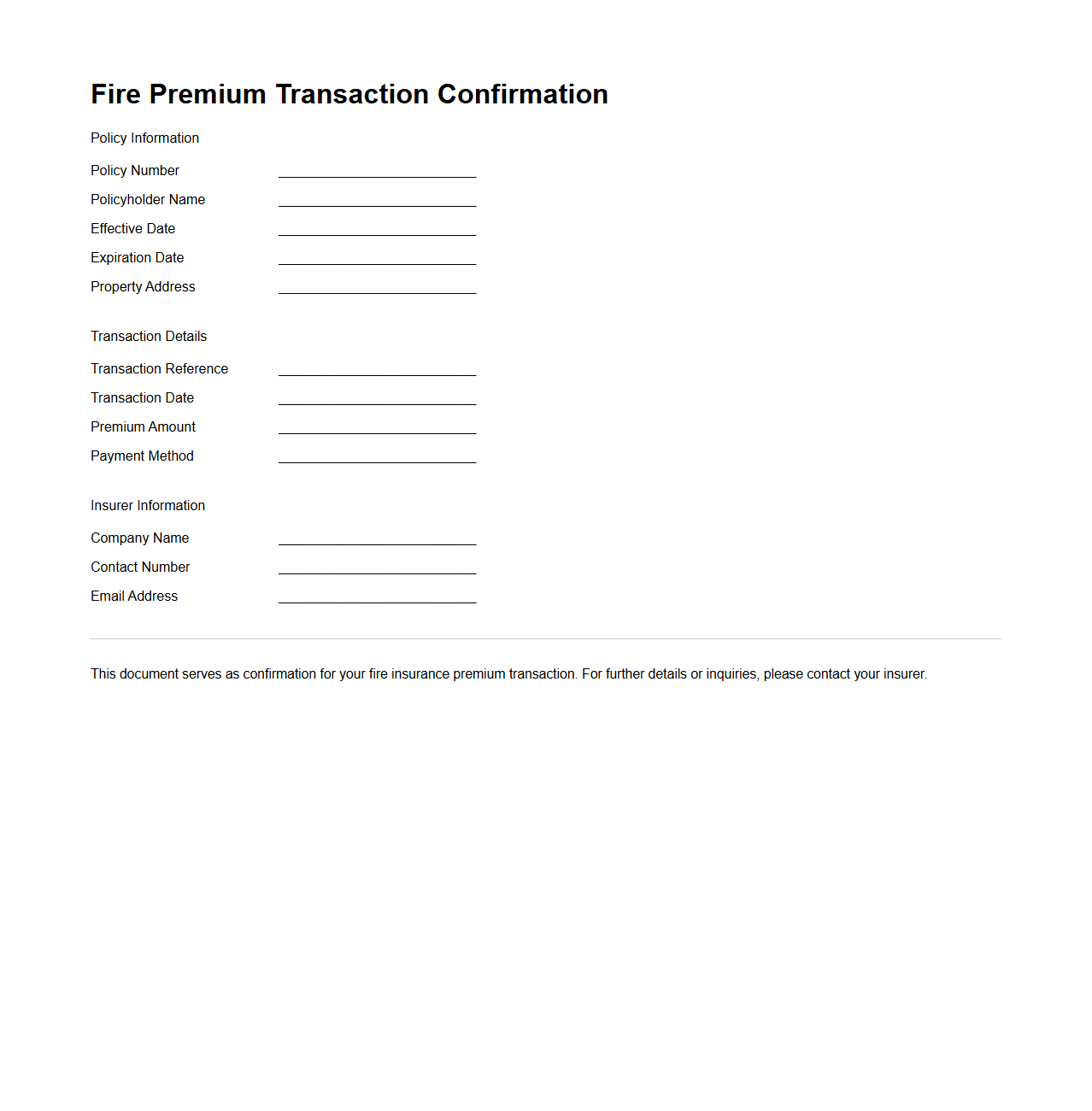

Fire Premium Transaction Confirmation Document

The

Fire Premium Transaction Confirmation Document serves as an official record verifying the details of a premium payment transaction made for fire insurance policies. It includes critical information such as the policyholder's name, payment amount, transaction date, and confirmation of receipt by the insurer. This document ensures transparency and provides proof of payment for both the insurance company and the insured party.

What essential information must be included in a Premium Payment Document for Fire Insurance?

The Premium Payment Document for fire insurance must contain the policyholder's name, policy number, and payment amount. It should clearly specify the coverage period that the payment corresponds to. Additionally, the document often includes the payment date and method to ensure proper tracking and record-keeping.

How does the Premium Payment Document validate coverage under a Fire Insurance policy?

The Premium Payment Document serves as proof that the policyholder has fulfilled the financial obligation for insurance coverage. By confirming the payment is received within the stipulated time, it ensures active protection under the fire insurance policy. This document acts as evidence during claim assessments to verify that the policy was in force when the incident occurred.

Which payment details in the document confirm the policyholder's compliance with premium requirements?

Key details include the exact premium amount paid as per the policy agreement, the payment date within the deadline, and the authorized payment method. These details prove that the policyholder has met the insurer's premium conditions. Consistency of these details with the insurance contract ensures uninterrupted policy validity.

What terms and conditions regarding premium payment are typically outlined in a Fire Insurance Premium Payment Document?

The document usually outlines the payment deadlines, consequences of late or missed payments, and refund policies in case of policy cancellation. It may also specify installment schedules or accepted payment modes. These terms clarify the obligations and rights of both insurer and insured concerning premium transactions.

How can discrepancies in the Premium Payment Document affect fire insurance claims processing?

Discrepancies such as incorrect payment amounts, missing dates, or mismatched policy numbers can delay or deny claim settlements. They raise doubts about the validity of coverage at the time of loss, complicating claim verification. Resolving these inconsistencies promptly is critical to ensure smooth claims processing and avoid financial disputes.