A Promissory Note Document Sample for Debt Acknowledgment serves as a formal written agreement where a borrower promises to repay a specified amount to a lender under agreed-upon terms. This document outlines key details such as the principal amount, interest rate, repayment schedule, and maturity date to ensure clarity and legal enforceability. Using a sample helps both parties clearly understand their obligations and protect their rights in financial transactions.

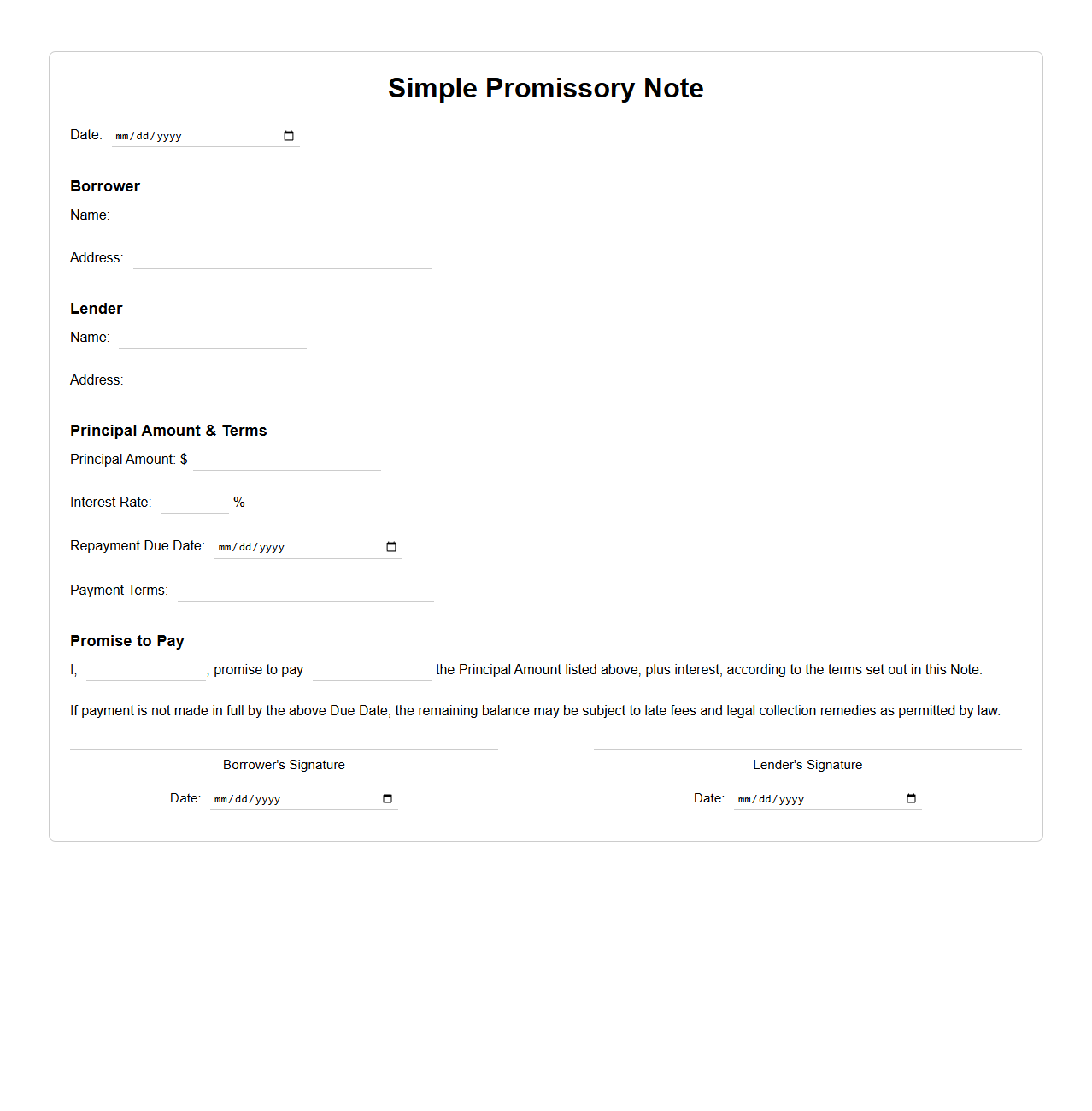

Simple Promissory Note Template for Personal Loan

A

Simple Promissory Note Template for Personal Loan document serves as a legally binding agreement outlining the terms and conditions under which one party promises to repay a loan to another party. It typically includes essential details such as the loan amount, interest rate, repayment schedule, and signatures of both lender and borrower. This template ensures clarity and protects the rights of both parties by formalizing the personal loan transaction.

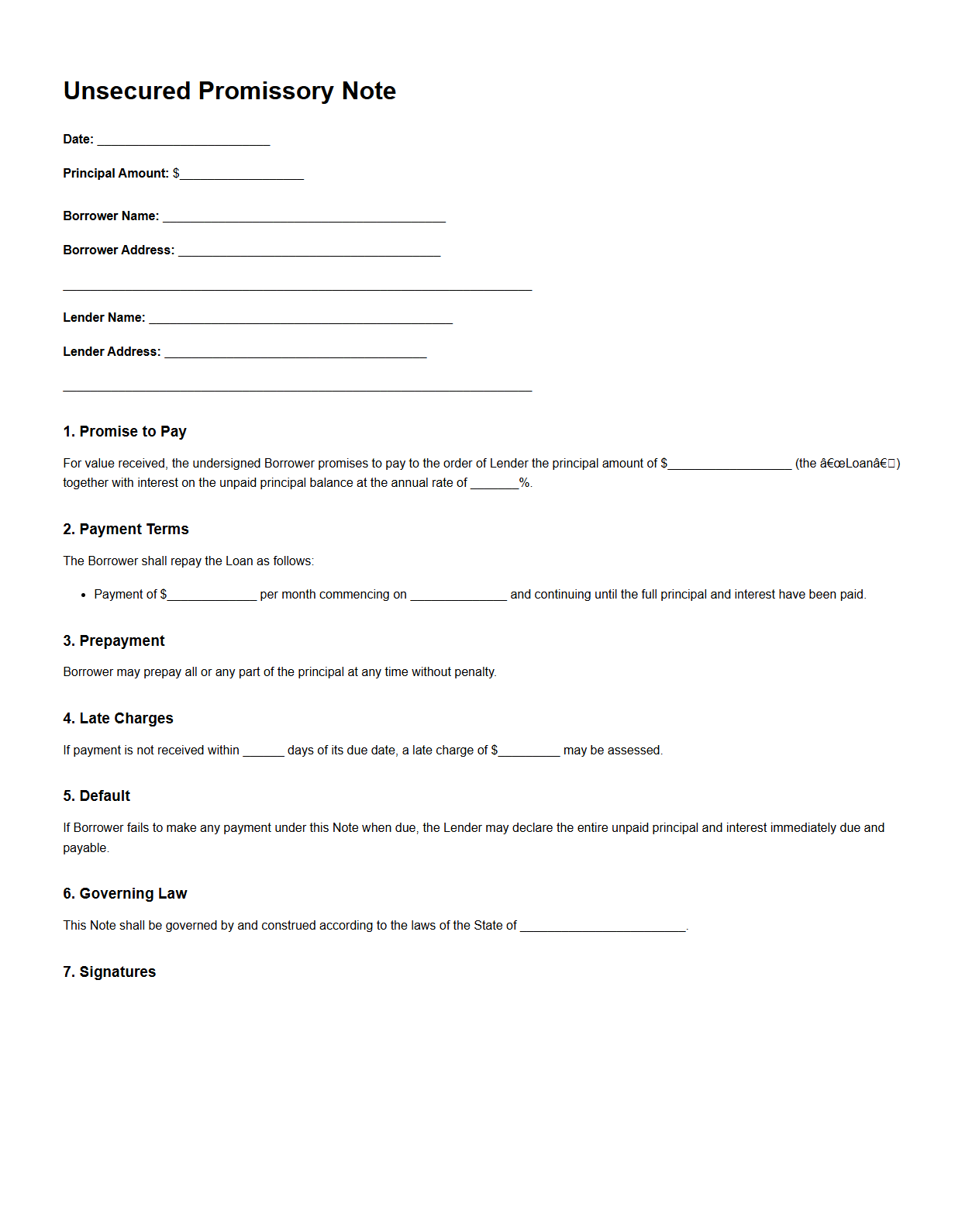

Unsecured Promissory Note for Debt Repayment

An

Unsecured Promissory Note for Debt Repayment is a legally binding document outlining a borrower's promise to repay a loan without collateral. It specifies the loan amount, interest rate, repayment schedule, and consequences of default. This note protects lenders by providing clear repayment terms while offering borrowers flexibility without risking assets.

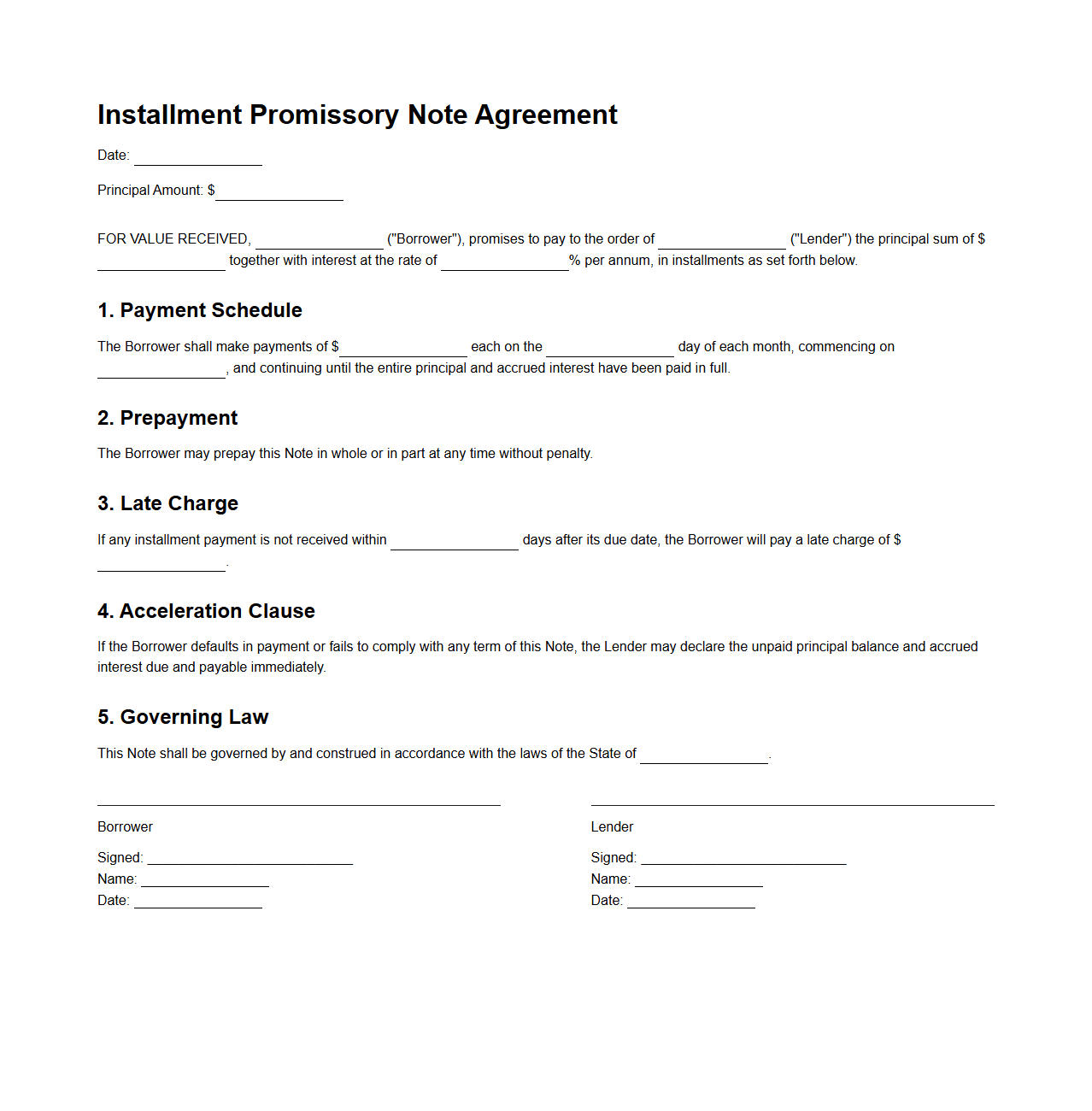

Installment Promissory Note Agreement Example

An

Installment Promissory Note Agreement Example document serves as a legally binding contract outlining the terms for repayment of a loan in scheduled installments. It clearly specifies the principal amount, interest rate, payment schedule, and consequences of default, ensuring transparent communication between lender and borrower. This document is essential for formalizing loan agreements where payments are made over time rather than in a lump sum.

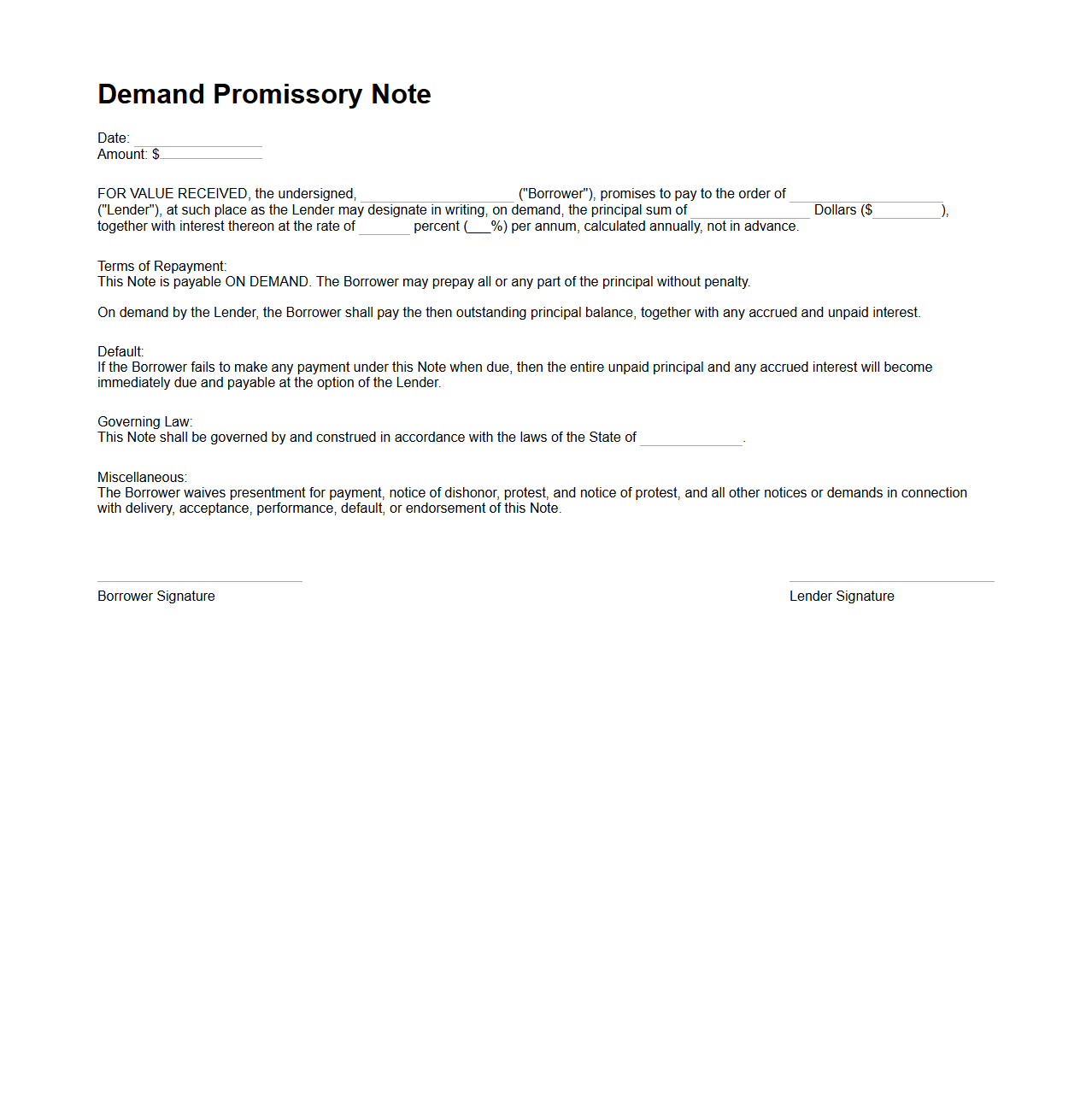

Demand Promissory Note Sample for Short-Term Loans

A

Demand Promissory Note Sample for short-term loans is a legal document outlining the borrower's promise to repay a specified loan amount upon the lender's request. It clearly states the loan terms, repayment conditions, interest rates, and the demand nature, meaning the lender can request repayment anytime. This document serves as proof of debt and protects both parties by ensuring clear, enforceable loan terms.

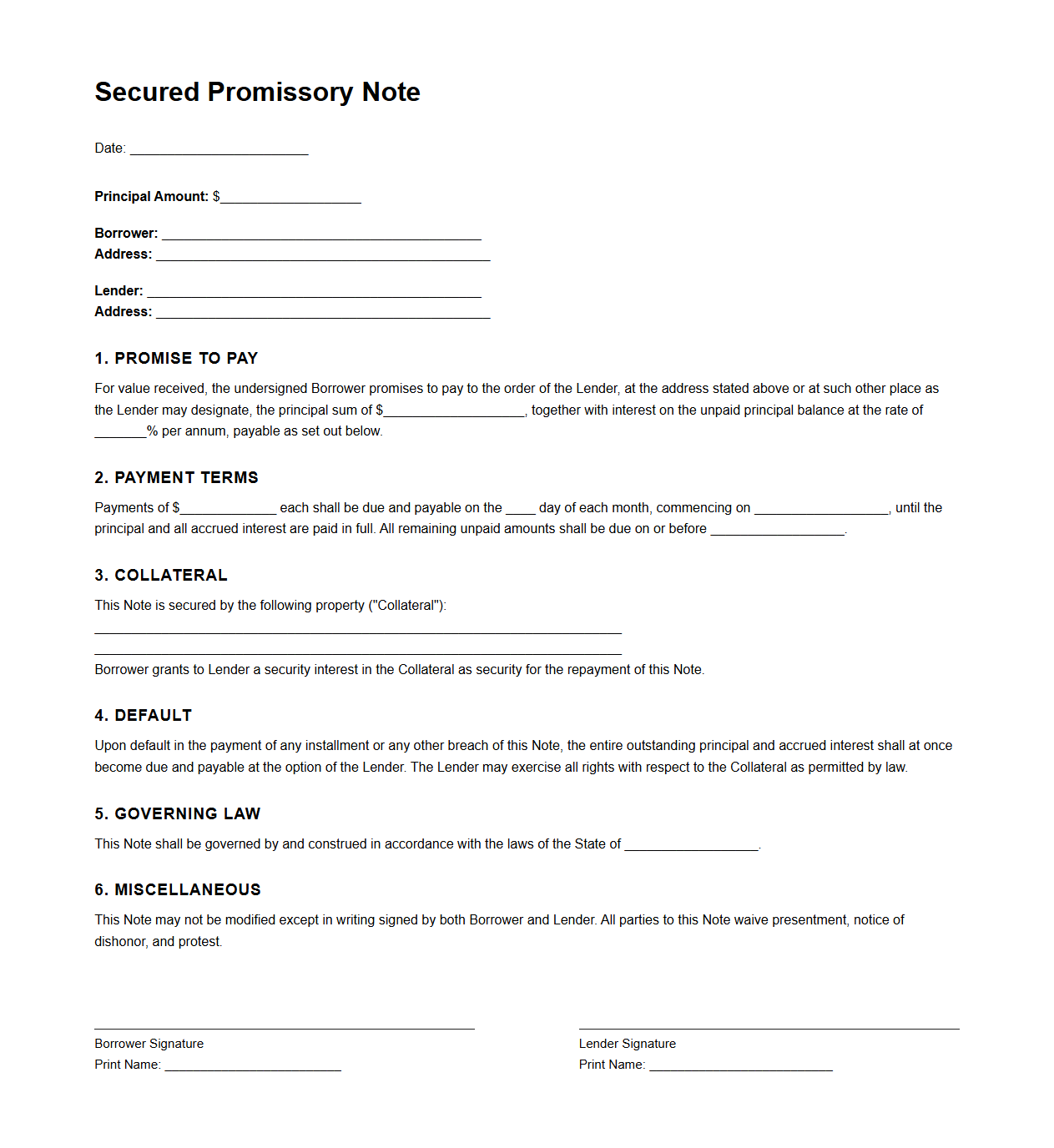

Secured Promissory Note Format with Collateral Terms

A

Secured Promissory Note Format with Collateral Terms document outlines a legally binding agreement where a borrower promises to repay a loan with specified terms, secured by collateral as protection for the lender. This format details the loan amount, interest rate, repayment schedule, and the description of the collateral pledged. It ensures both parties clearly understand their obligations, providing a framework to enforce repayment and claim assets if the borrower defaults.

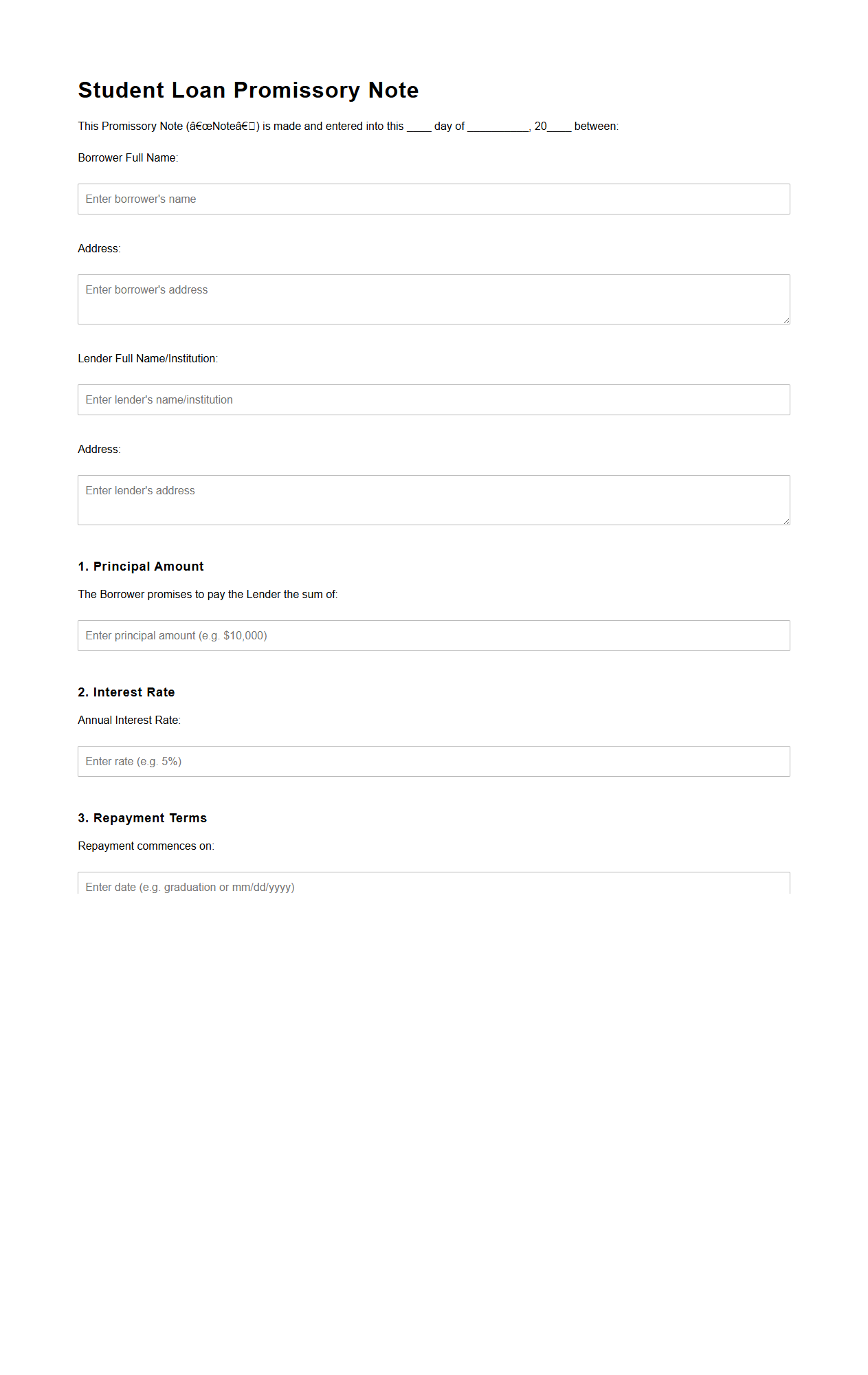

Student Loan Promissory Note Example

A

Student Loan Promissory Note Example document outlines the legally binding agreement between a borrower and lender detailing the terms of a student loan. It specifies the loan amount, interest rate, repayment schedule, and borrower responsibilities to ensure clear understanding and compliance. This document serves as proof of the borrower's commitment to repay the loan under the agreed conditions.

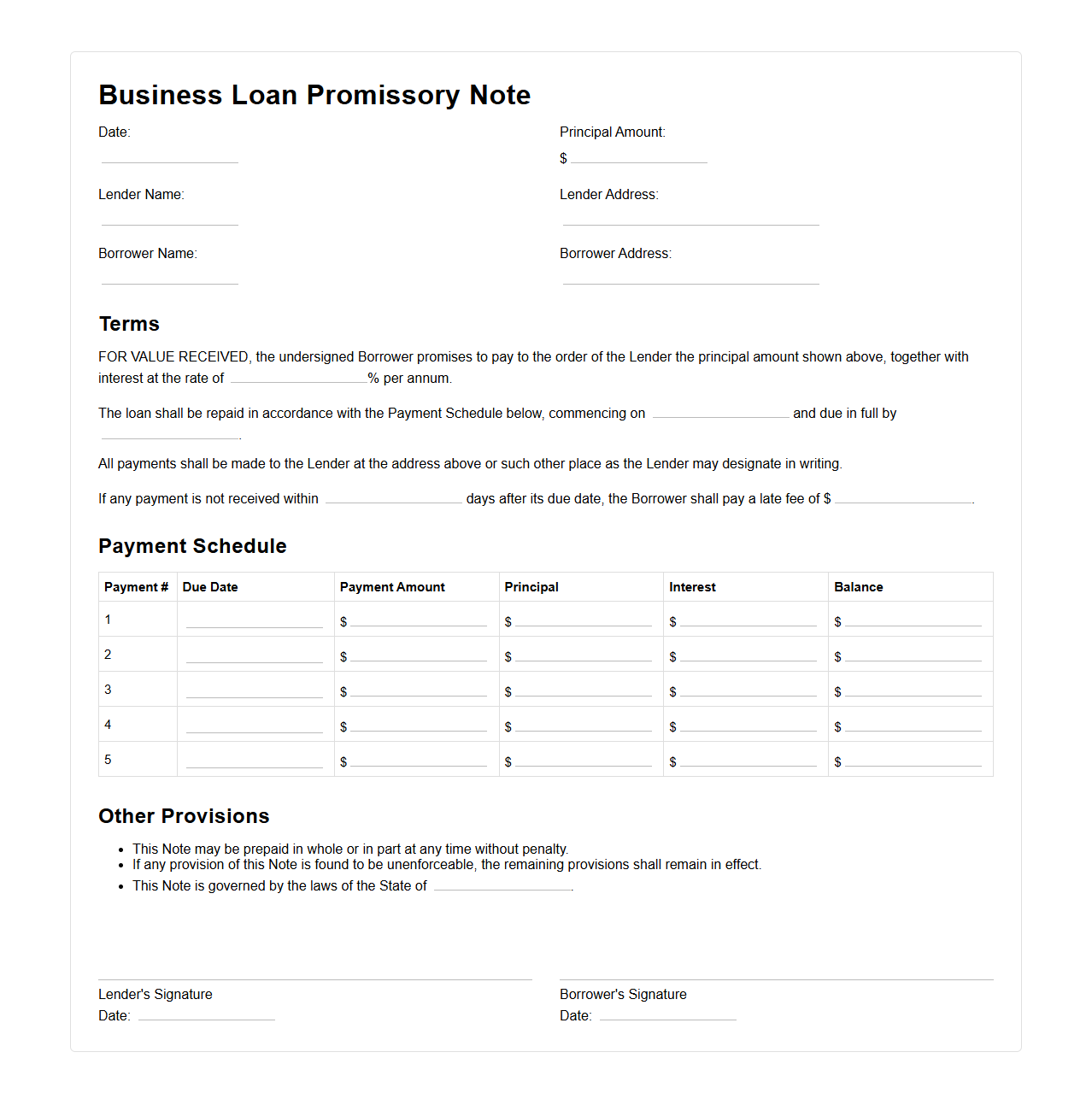

Business Loan Promissory Note with Payment Schedule

A

Business Loan Promissory Note with Payment Schedule is a legally binding document that outlines the terms of a loan agreement between a lender and a business borrower, including the loan amount, interest rate, and repayment timeline. This document specifies the detailed payment schedule, ensuring clarity on due dates and installment amounts to avoid any disputes. It serves as a critical reference for both parties to track loan repayments and enforce contractual obligations.

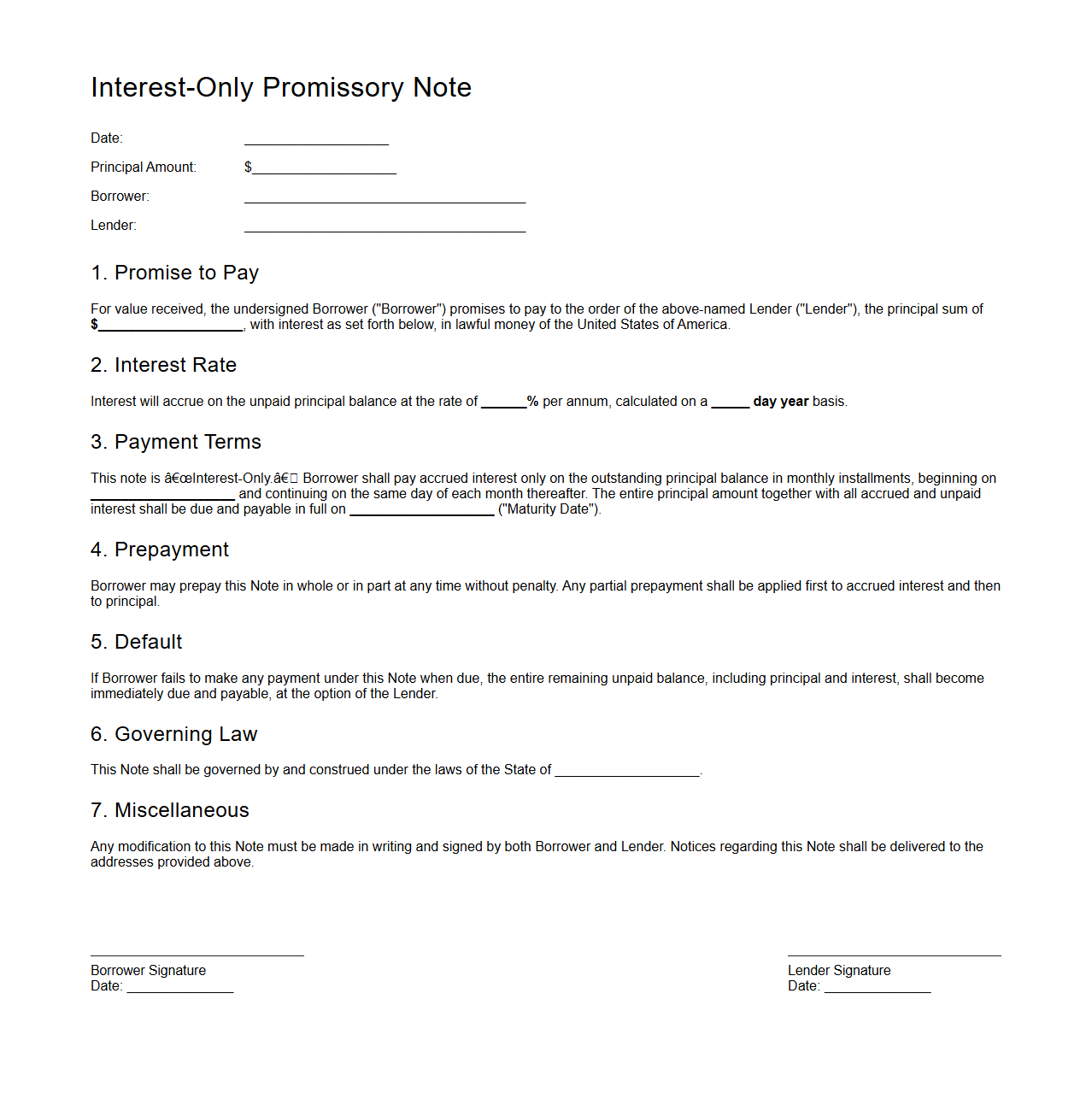

Interest-Only Promissory Note for Financial Agreements

An

Interest-Only Promissory Note is a financial agreement where the borrower is required to pay only the interest on the principal loan amount for a specified period, with the principal balance remaining unchanged during that time. This type of note is commonly used in mortgages, business loans, and bridge financing to provide lower initial payments and improve cash flow flexibility. The document outlines the interest rate, payment schedule, maturity date, and terms for repayment of the principal after the interest-only period ends.

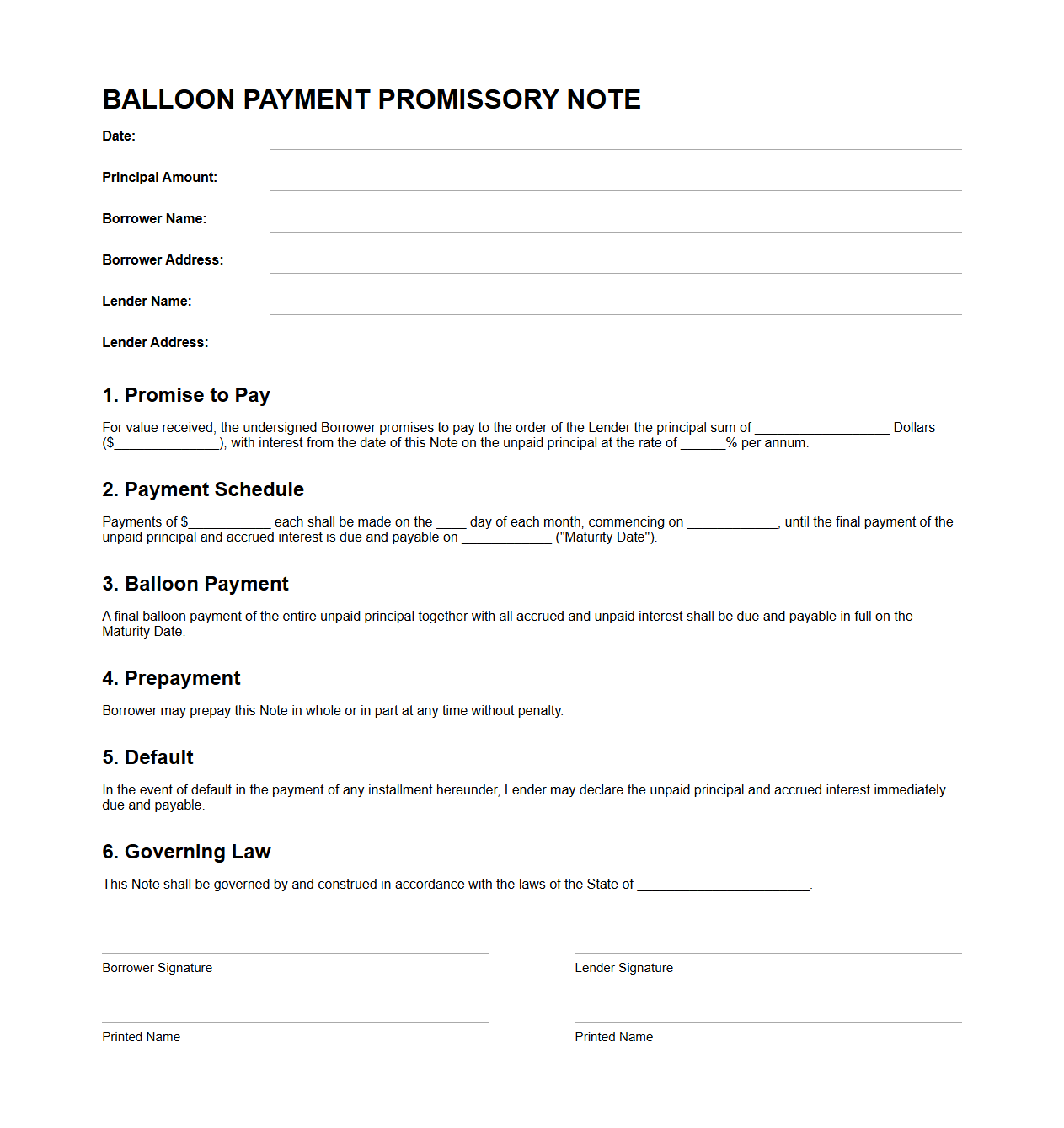

Balloon Payment Promissory Note Sample

A

Balloon Payment Promissory Note Sample document outlines the terms of a loan where the borrower agrees to make regular payments with a large lump sum payment, known as the balloon payment, due at the end of the loan term. This sample provides a clear format detailing the principal amount, interest rate, payment schedule, and maturity date, ensuring both parties understand the repayment obligations. It serves as a legal agreement to protect the interests of the lender while giving the borrower a structured path to fulfill the debt.

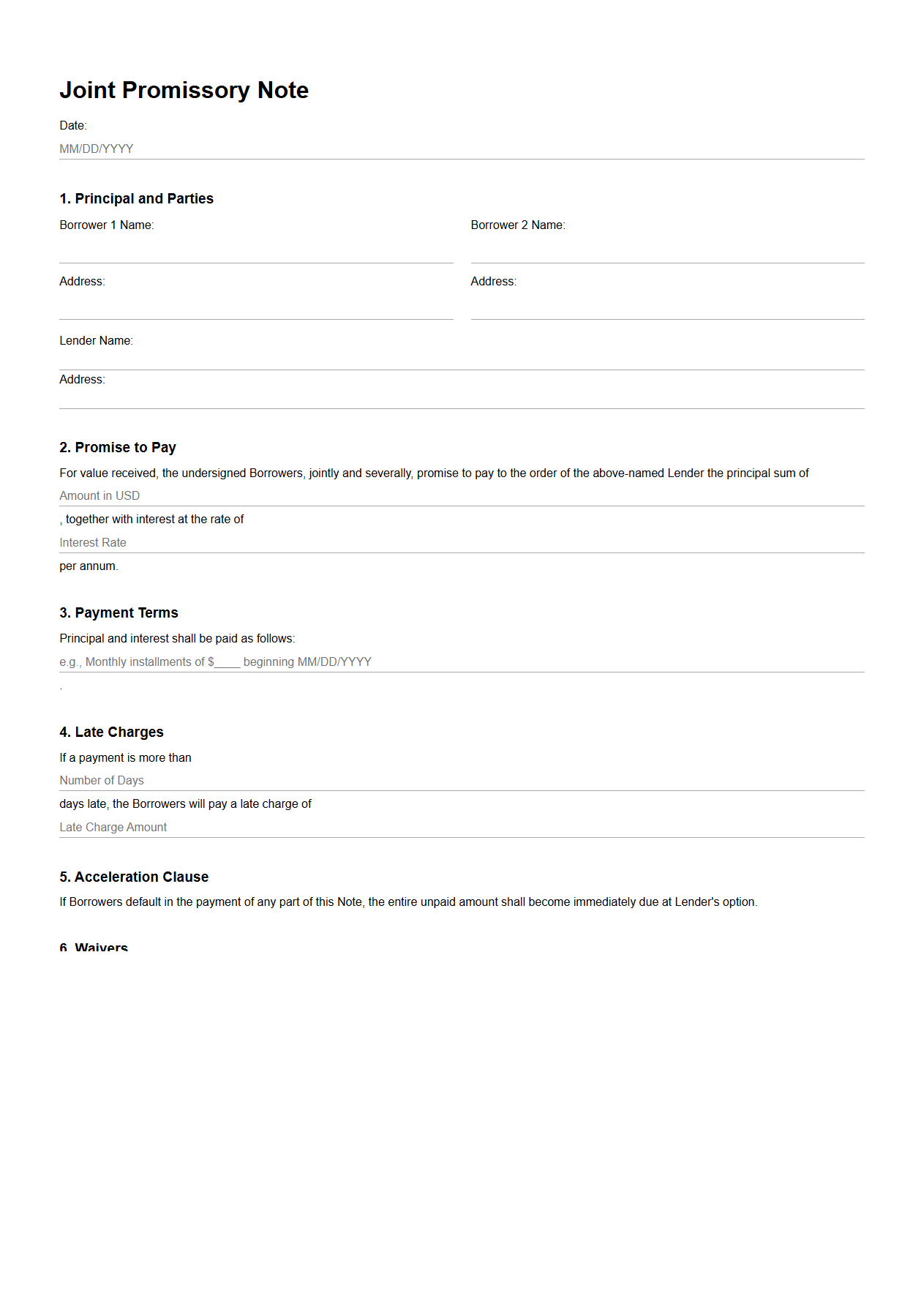

Joint Promissory Note Example for Multiple Borrowers

A

Joint Promissory Note Example for Multiple Borrowers document outlines the terms of a loan agreed upon by two or more parties who are collectively responsible for repayment. It specifies the principal amount, interest rate, payment schedule, and each borrower's liability in case of default. This document ensures clarity and legal enforceability in shared debt agreements.

What key clauses must a promissory note include for legal enforceability?

A promissory note must include the principal amount, interest rate, and the payment schedule to be legally enforceable. It also requires clear identification of the borrower and lender along with the maturity date. Without these key clauses, the note may be considered incomplete and unenforceable in court.

How does a promissory note differ from an IOU in debt acknowledgment?

A promissory note is a formal, written promise to pay a specified sum, while an IOU simply acknowledges a debt without detailed terms. Promissory notes include repayment terms and interest, making them legally binding agreements. IOUs lack these specifics and are generally less enforceable.

Are notarized signatures required on promissory notes for court acceptance?

Notarized signatures are not universally required for a promissory note to be accepted in court, but they add an extra layer of authenticity. The note must be clearly signed by the obligor to be valid. Notarization can help prevent disputes over signature validity in legal proceedings.

What remedies can a lender pursue if a promissory note is defaulted?

Upon defaulting, a lender can seek remedies such as filing a lawsuit to obtain a judgment for the owed amount. They may also pursue wage garnishment or asset seizure depending on the jurisdiction. Alternative dispute resolution methods like mediation can be options to resolve defaults.

Can interest rates in a promissory note be customized under local usury laws?

Interest rates in a promissory note can typically be customized but must comply with local usury laws that set maximum allowable rates. Lenders and borrowers must ensure the rate does not exceed these legal limits. Violating usury laws can render the interest clause void and impact enforceability.