A Deed of Trust Document Sample for Property Security outlines the legal agreement between a borrower, lender, and trustee to secure a loan using real estate as collateral. This document details the terms under which the trustee holds the property title until the loan is fully repaid. It serves as an essential reference for understanding the rights and obligations of all parties involved in property-secured lending.

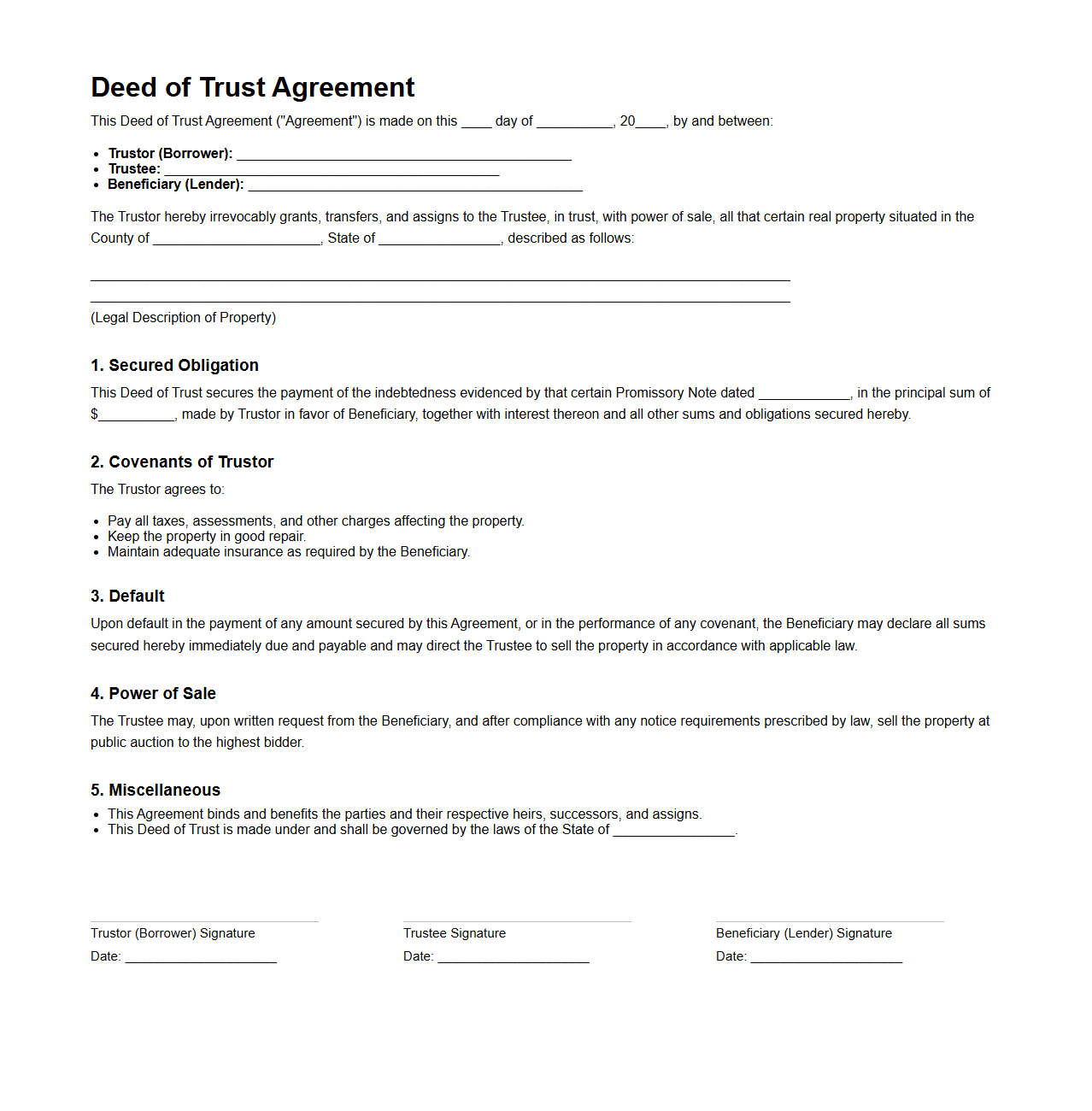

Deed of Trust Agreement Template for Real Estate

A

Deed of Trust Agreement Template for real estate is a legal document used to secure a loan on a property by transferring title to a neutral third party until the borrower repays the debt. This template outlines the terms and conditions between the borrower, lender, and trustee, including repayment schedules and foreclosure processes in case of default. Utilizing this template ensures clarity and protection for all parties involved in a real estate transaction.

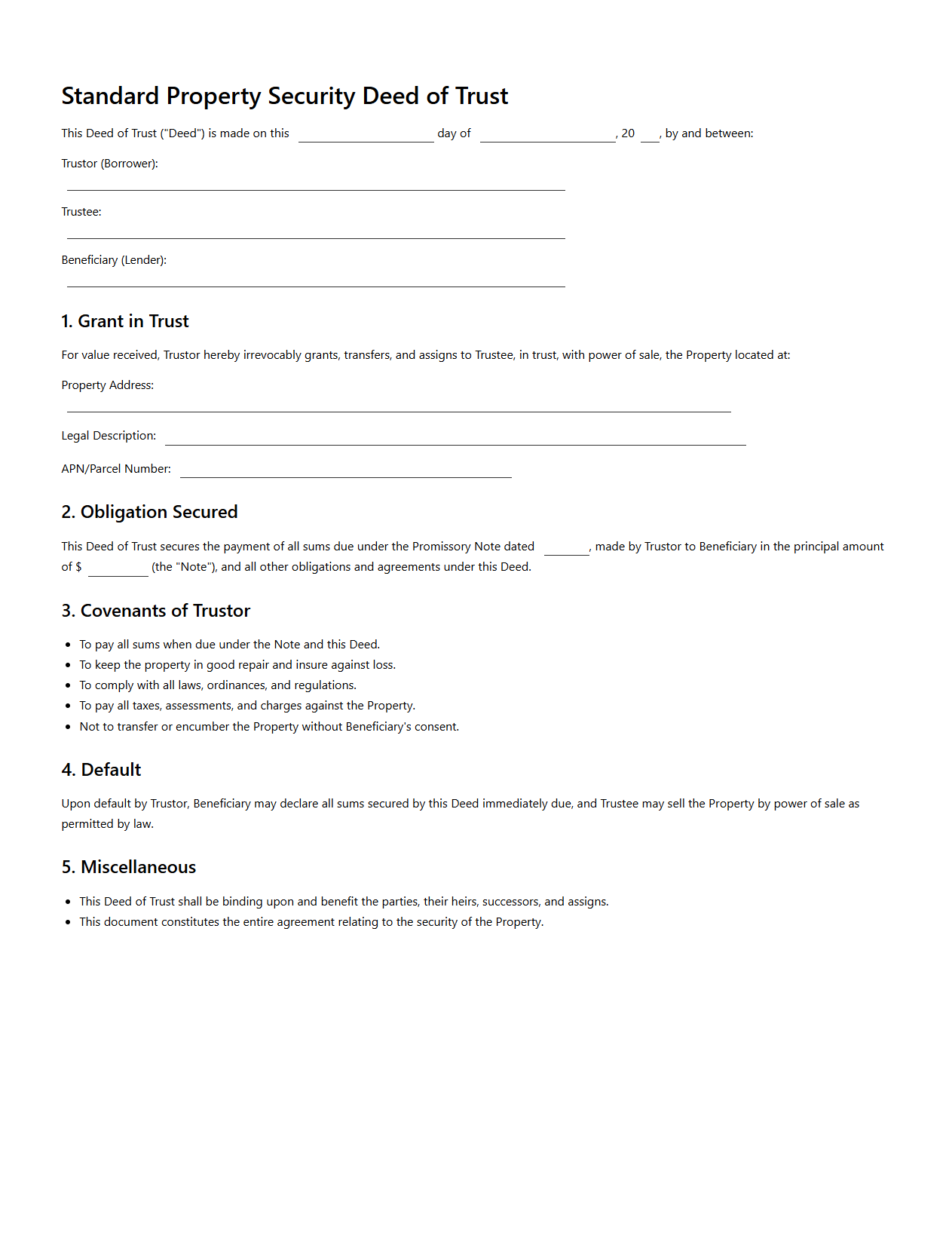

Standard Property Security Deed of Trust Form

The

Standard Property Security Deed of Trust Form is a legal instrument used to secure a loan on real estate property by transferring the title to a trustee while the borrower retains equitable ownership. This document outlines the borrower's obligations, lender's rights, and conditions under which the property can be sold if the loan defaults. It plays a critical role in protecting the lender's interest while providing a clear framework for foreclosure and property recovery processes.

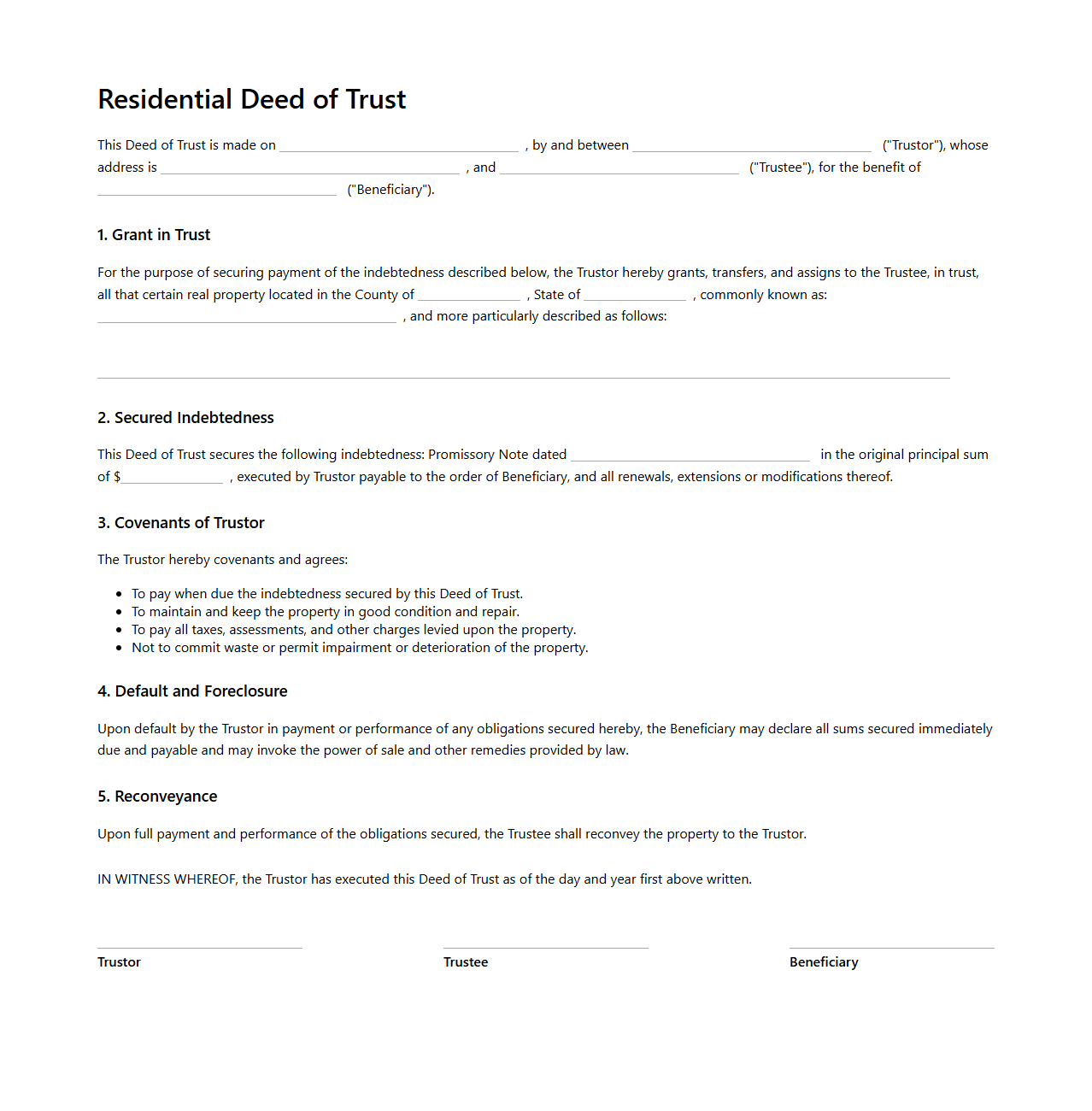

Residential Deed of Trust Document Example

A

Residential Deed of Trust Document Example serves as a legally binding template that outlines the agreement between a borrower and a lender concerning a residential property loan. This document specifies the borrower's obligations, the lender's security interest in the property, and conditions under which the property may be sold if loan terms are not met. Understanding this example helps parties ensure compliance with local real estate laws and protects both borrower and lender rights during the mortgage process.

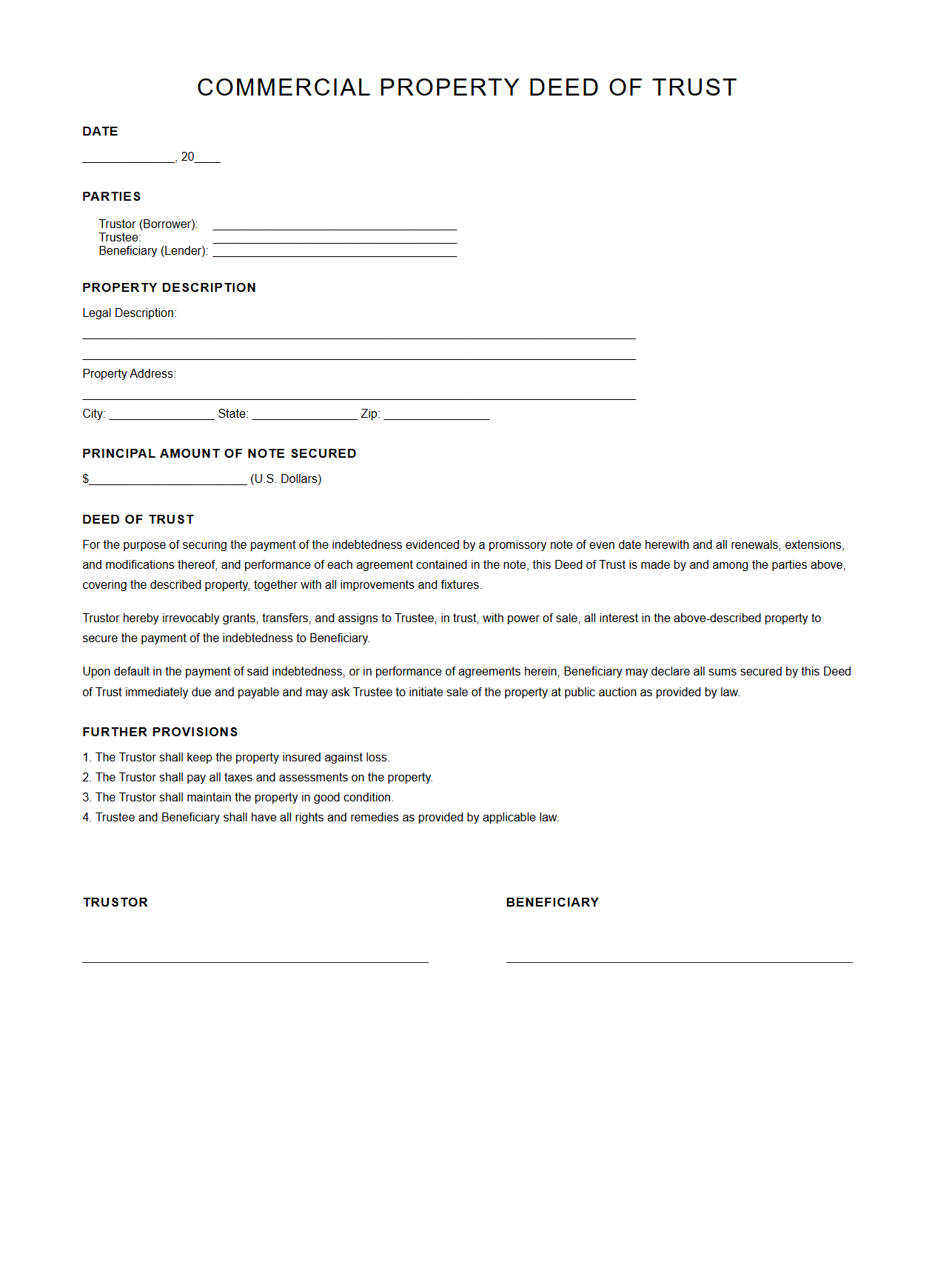

Commercial Property Deed of Trust Sample

A

Commercial Property Deed of Trust Sample document serves as a legally binding instrument that secures a loan on a commercial real estate property by transferring the title to a trustee until the debt is repaid. This document outlines the terms and conditions of the loan, property details, the lender's rights, and the borrower's obligations, ensuring both parties understand their responsibilities and protections. It is essential for investors, lenders, and lawyers to review such samples to draft accurate and enforceable agreements tailored to specific commercial real estate transactions.

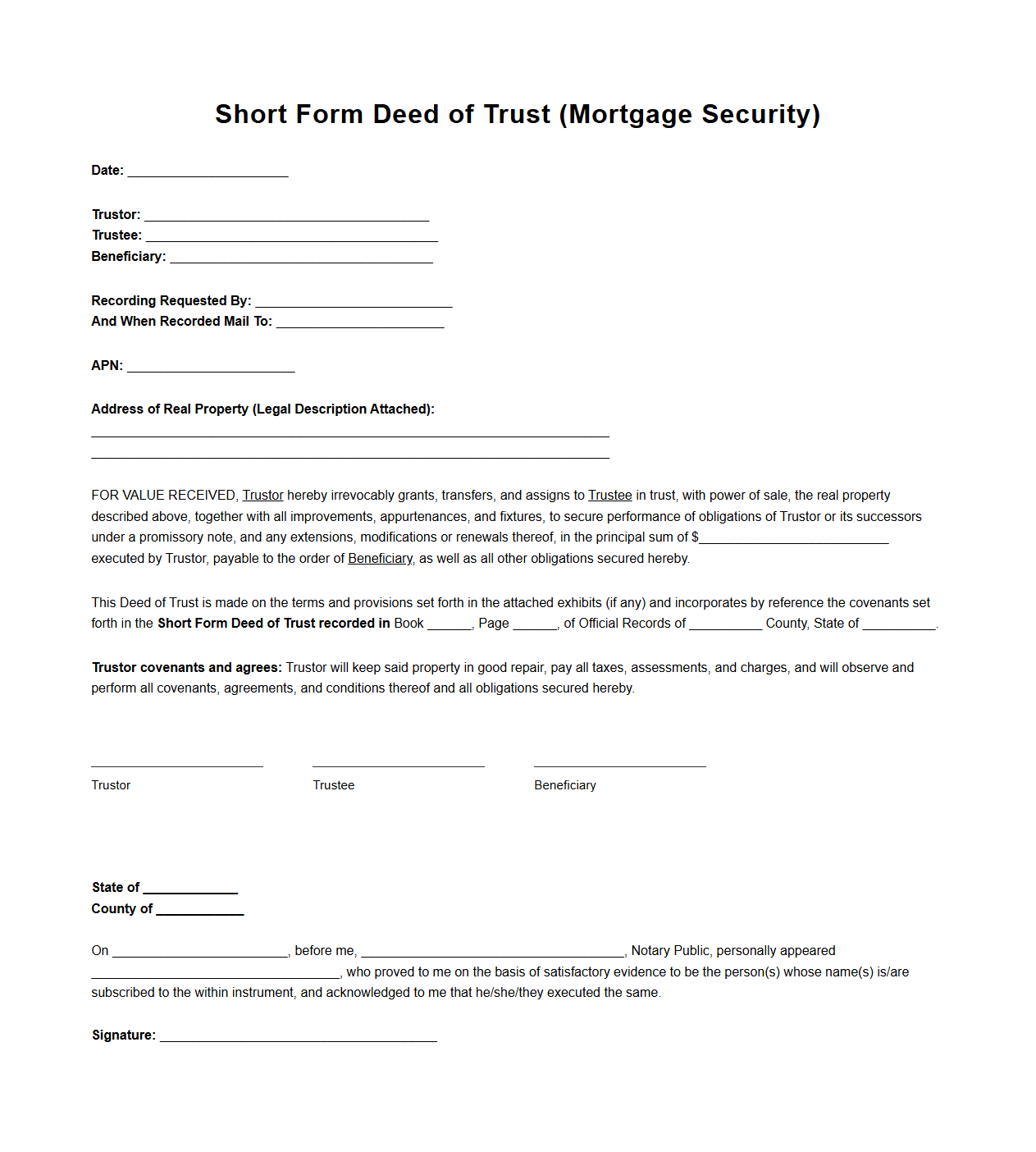

Short Form Deed of Trust for Mortgage Security

A

Short Form Deed of Trust is a simplified legal document used to secure a mortgage loan by transferring the title of a property to a trustee as collateral. This document outlines the borrower's obligation to repay the loan while allowing the lender to initiate foreclosure if the borrower defaults. It serves as an efficient and clear instrument to protect the lender's interest in real estate transactions.

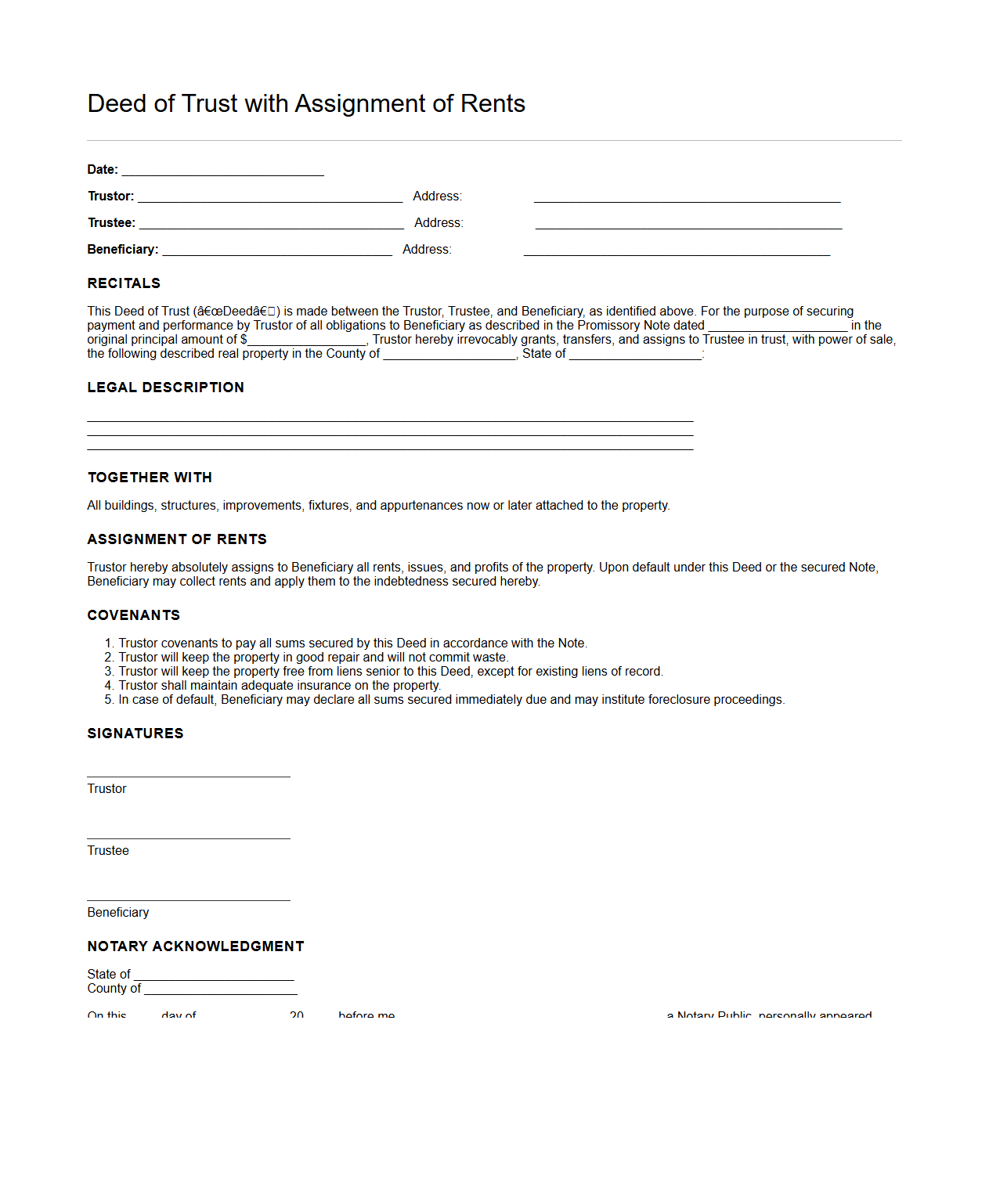

Deed of Trust with Assignment of Rents Example

A

Deed of Trust with Assignment of Rents is a legal document used in real estate financing where a borrower transfers property title to a trustee as security for a loan, while also assigning rental income from the property to the lender until the loan is repaid. This arrangement provides the lender with added protection by allowing direct collection of rents if the borrower defaults, ensuring repayment through property-generated income. An example document typically includes details of the parties involved, property description, loan terms, trustee powers, and specific language assigning rents to the lender.

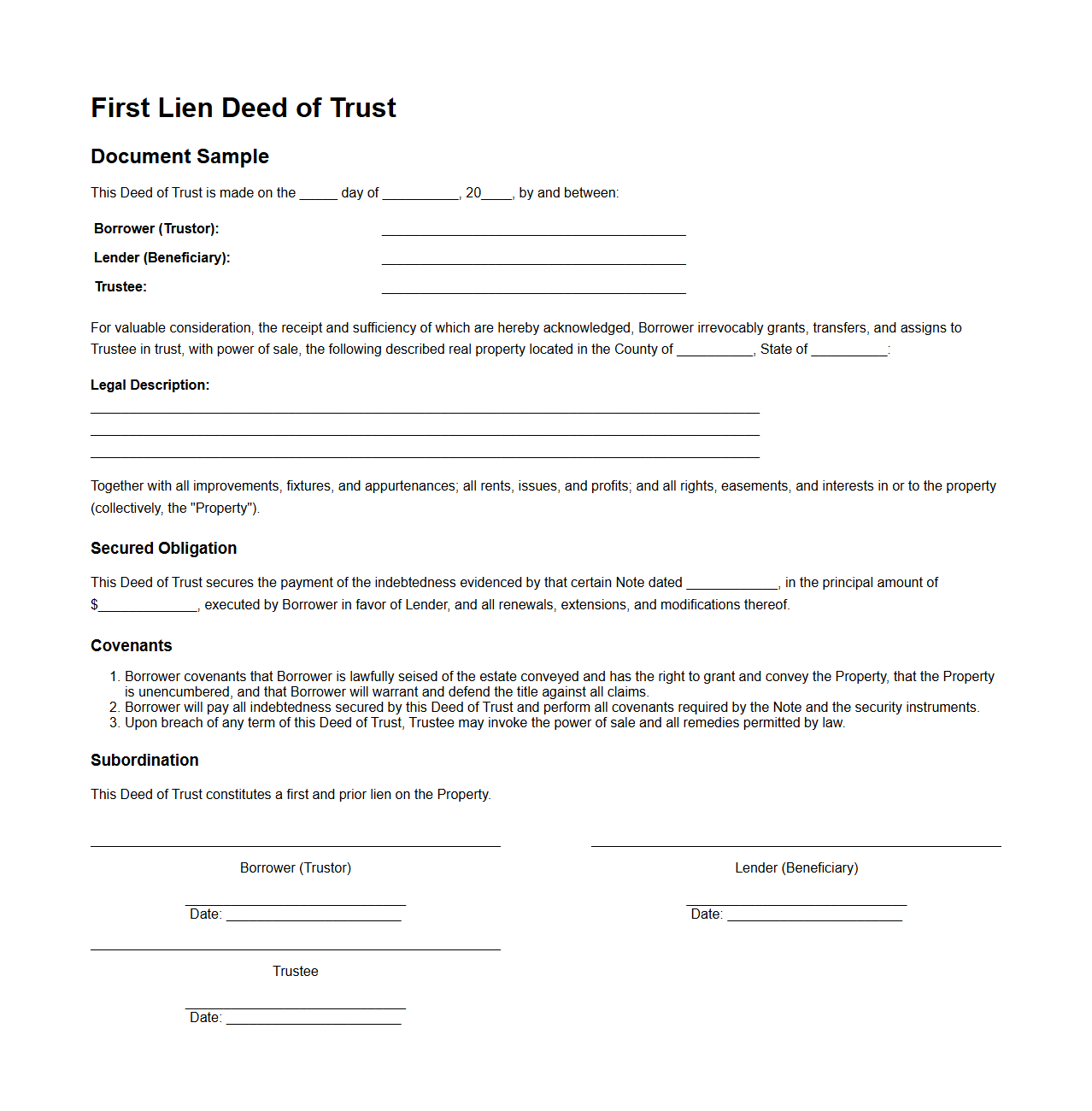

First Lien Deed of Trust Document Sample

A

First Lien Deed of Trust Document Sample serves as a legal template illustrating the primary security interest a lender holds over a borrower's property to secure a loan. It outlines key terms such as loan amount, repayment schedule, and conditions under which the lender can initiate foreclosure if the borrower defaults. This sample document is essential for understanding how first lien rights protect lenders and prioritize their claims over other creditors.

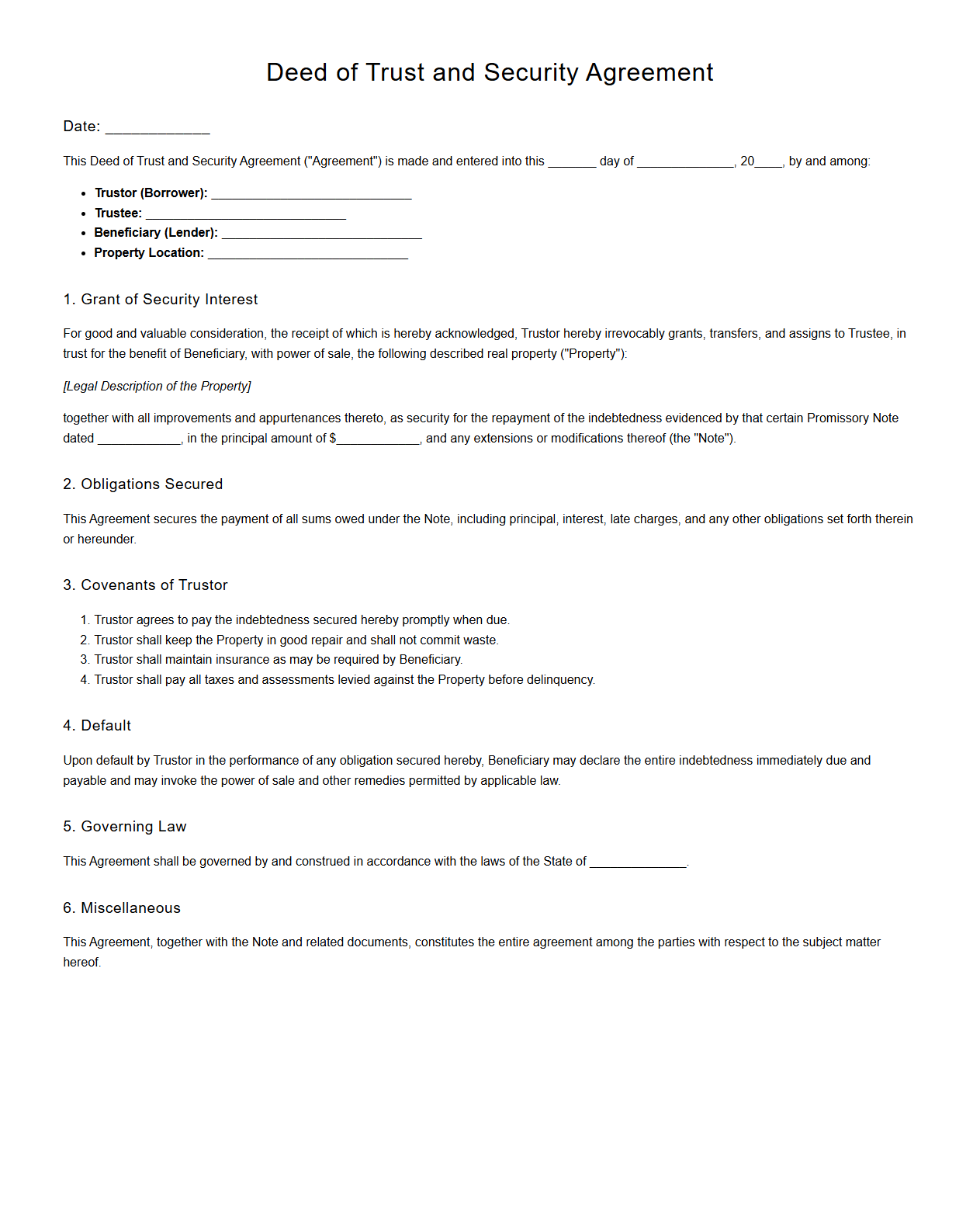

Deed of Trust and Security Agreement for Property Loan

A

Deed of Trust and Security Agreement is a legal document used in property loans to secure the borrower's obligation to repay the loan by placing a lien on the property. This agreement involves three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party (trustee) who holds the title until the loan is paid off. It ensures that if the borrower defaults, the trustee has the authority to sell the property and satisfy the outstanding debt, protecting the lender's financial interest.

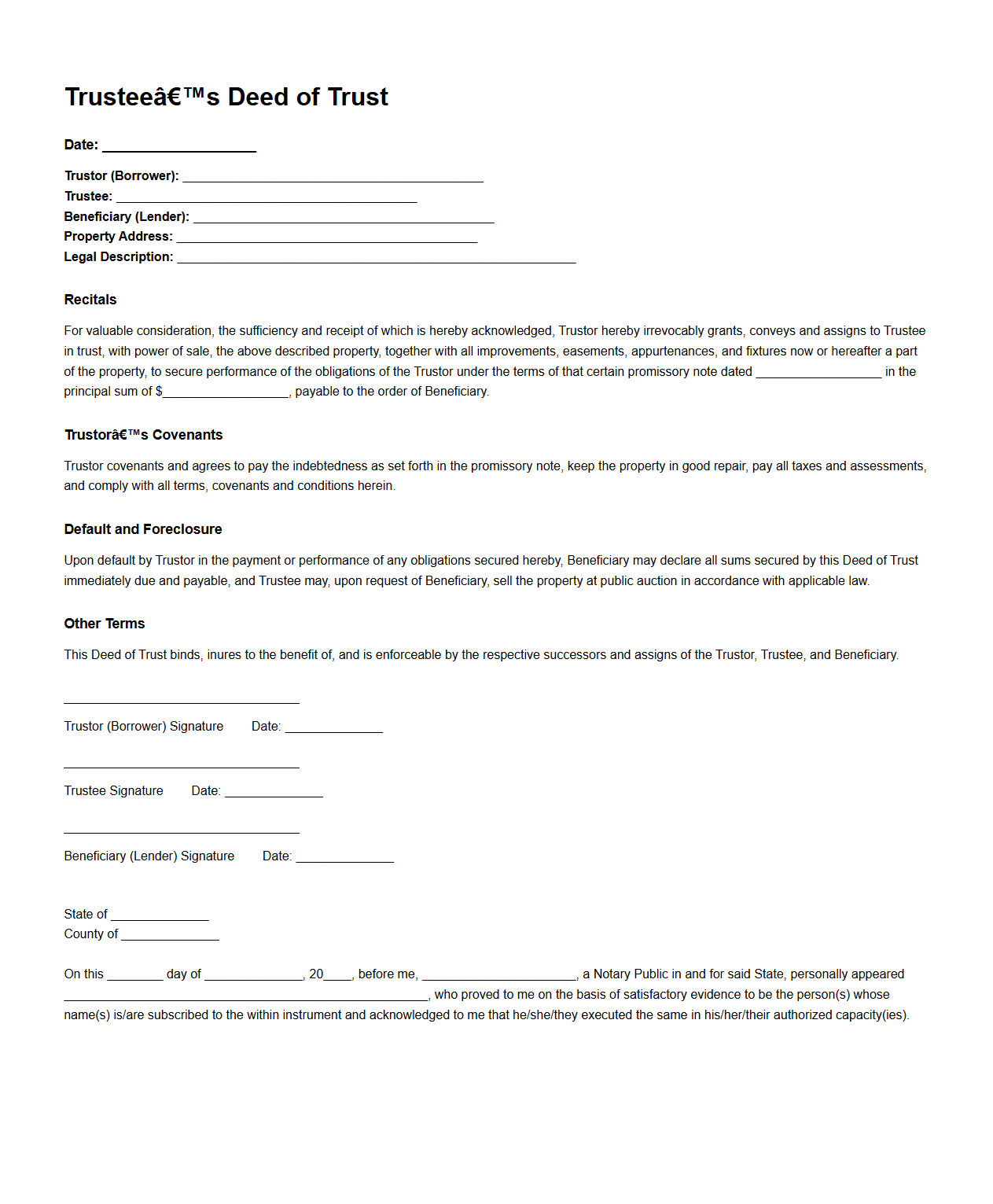

Trustee’s Deed of Trust Sample for Home Purchase

A

Trustee's Deed of Trust Sample for home purchase is a legal document that outlines the transfer of property title from the borrower to a trustee, securing a loan for the homebuyer. It specifies the terms of the trust agreement, including the roles of the borrower, lender, and trustee, and provides evidence of the lien on the property until the loan is fully repaid. This document is essential for ensuring the lender's interest is protected while enabling the borrower to obtain financing for the home purchase.

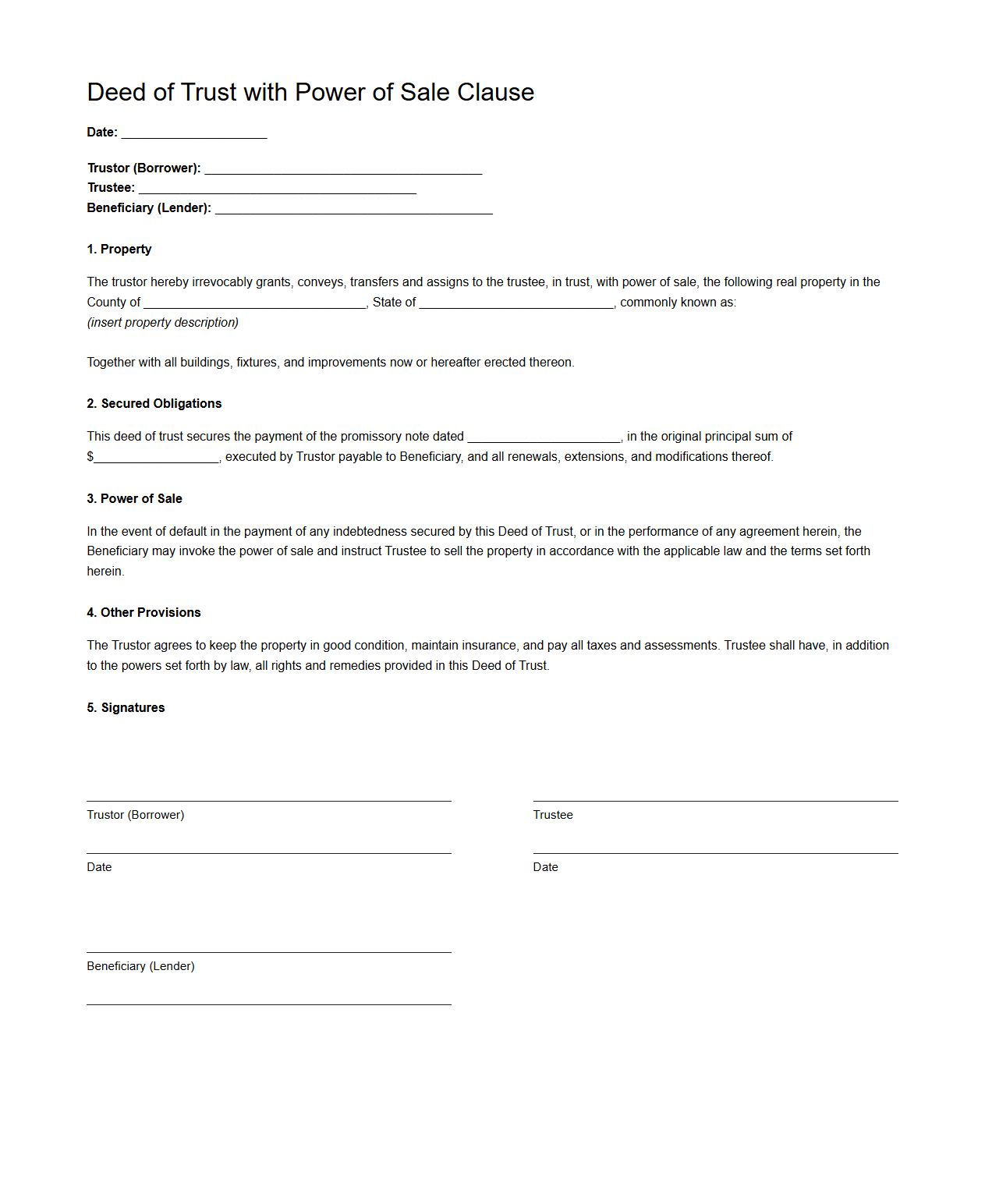

Deed of Trust with Power of Sale Clause Template

A

Deed of Trust with Power of Sale Clause Template is a legal document used in real estate transactions to secure a loan with property as collateral, transferring legal title to a trustee until the loan is paid. The power of sale clause allows the trustee to sell the property without court approval if the borrower defaults, expediting foreclosure. This template outlines the rights and responsibilities of the borrower, lender, and trustee, ensuring compliance with state laws and protecting all parties involved.

What clauses in a Deed of Trust protect the lender's interest if the borrower defaults?

The Acceleration Clause allows the lender to demand immediate repayment of the entire loan balance upon borrower default. The Power of Sale Clause permits non-judicial foreclosure, enabling the lender to sell the property without court intervention. Additionally, the Covenants ensure the borrower maintains the property and pays taxes, supporting the lender's financial protection.

How does the Deed of Trust address successor liability on property transfer?

The Successor Liability Clause holds any new property owner responsible for the existing loan obligations. It requires notification to the lender in case of property transfer, preventing unauthorized ownership changes. This clause ensures continuous protection of the lender's interests despite changes in ownership.

What are the requirements for recording a Deed of Trust to secure priority in title?

The Deed of Trust must be recorded in the county recorder's office where the property is located to establish public notice. Recording gives the lender priority over subsequent liens or encumbrances on the property. It is critical that the document includes accurate legal descriptions and borrower details for effective title protection.

How does the document handle release and reconveyance after debt repayment?

Upon full repayment, the trustee is obligated to execute a Reconveyance Deed, clearing the lien from the property title. This process officially releases the borrower from the Deed of Trust, restoring clear ownership. Timely recording of the reconveyance document is essential to prevent future claims against the property.

What are the notice provisions for foreclosure specified in the Deed of Trust?

The Deed of Trust requires the lender to provide written notice of default and intent to foreclose to the borrower. Notices typically include timelines for curing the default, giving the borrower an opportunity to resolve. These provisions ensure transparency and fair process before foreclosure proceeds.

More Real estate Templates