A Escrow Agreement Document Sample for Real Estate Transactions outlines the terms and conditions under which a neutral third party holds funds or property until all contractual obligations are met. This document ensures security and trust for both buyers and sellers by detailing the responsibilities, timelines, and procedures for releasing assets upon transaction completion. It serves as a crucial legal safeguard in property purchases, minimizing risks and disputes.

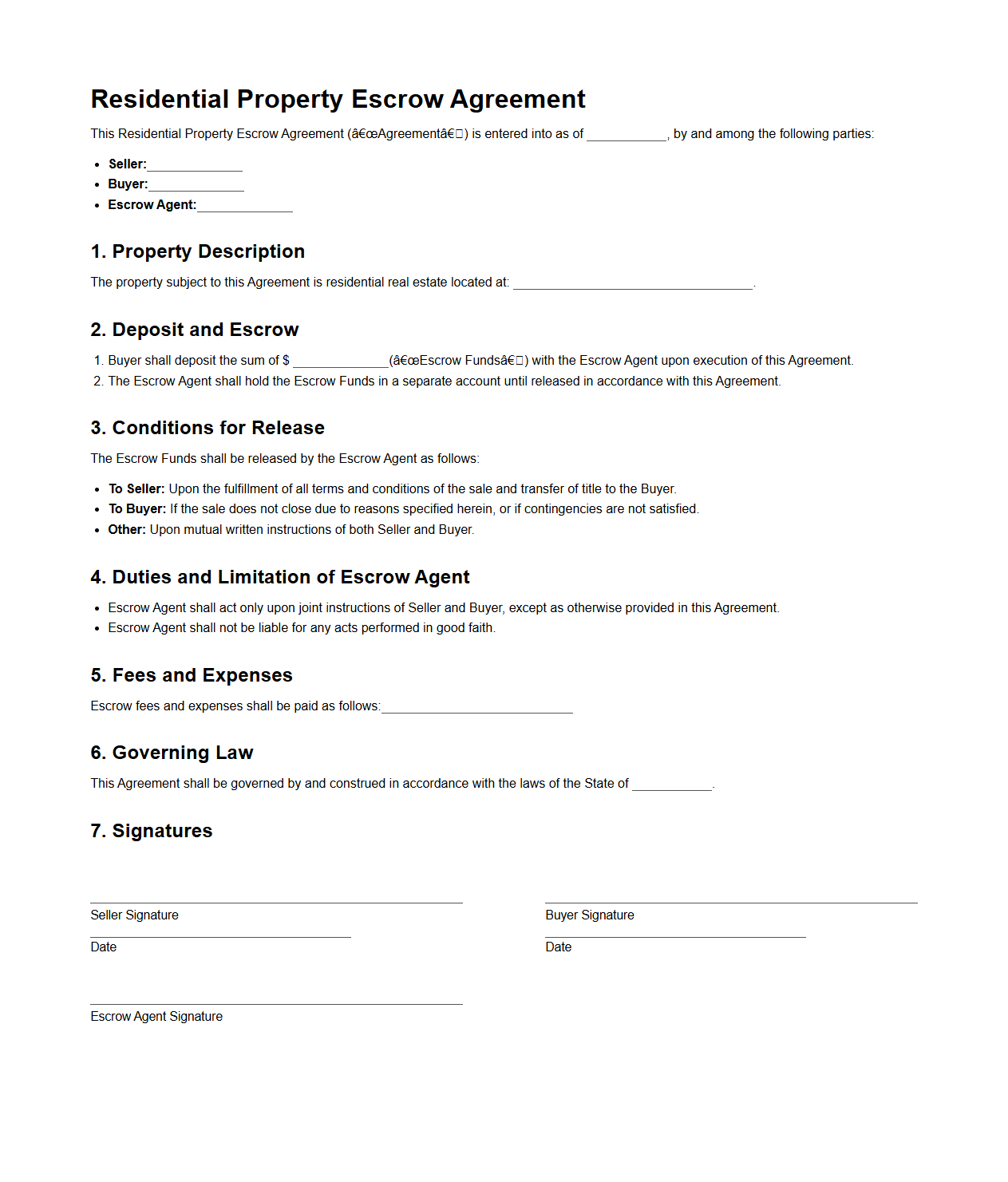

Residential Property Escrow Agreement Template

A

Residential Property Escrow Agreement Template document outlines the terms and conditions under which a neutral third party holds funds and documents during a real estate transaction. It specifies the responsibilities of the buyer, seller, and escrow agent to ensure secure and transparent handling of deposits, contingencies, and closing processes. This template helps prevent disputes by clearly defining the procedure for releasing funds upon fulfillment of contractual obligations.

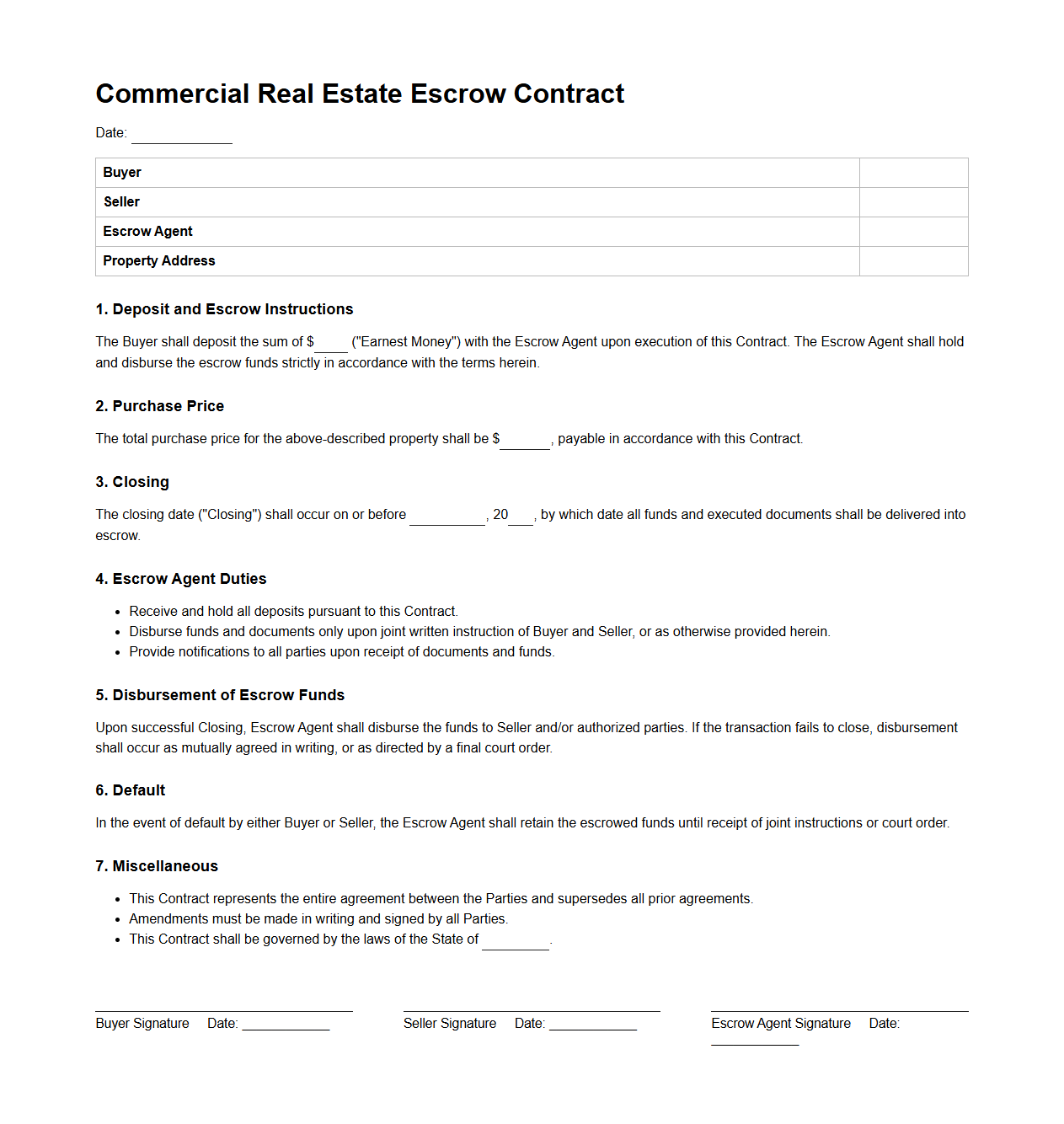

Commercial Real Estate Escrow Contract Sample

A

Commercial Real Estate Escrow Contract Sample document serves as a predefined template outlining the terms and conditions under which funds and documents are held by a neutral third party during a commercial property transaction. This sample ensures all parties agree on the escrow process, including deposit amounts, contingencies, and disbursement instructions, minimizing risks and disputes. Utilizing such a document streamlines negotiations and provides a legally binding framework critical for secure and transparent property exchanges.

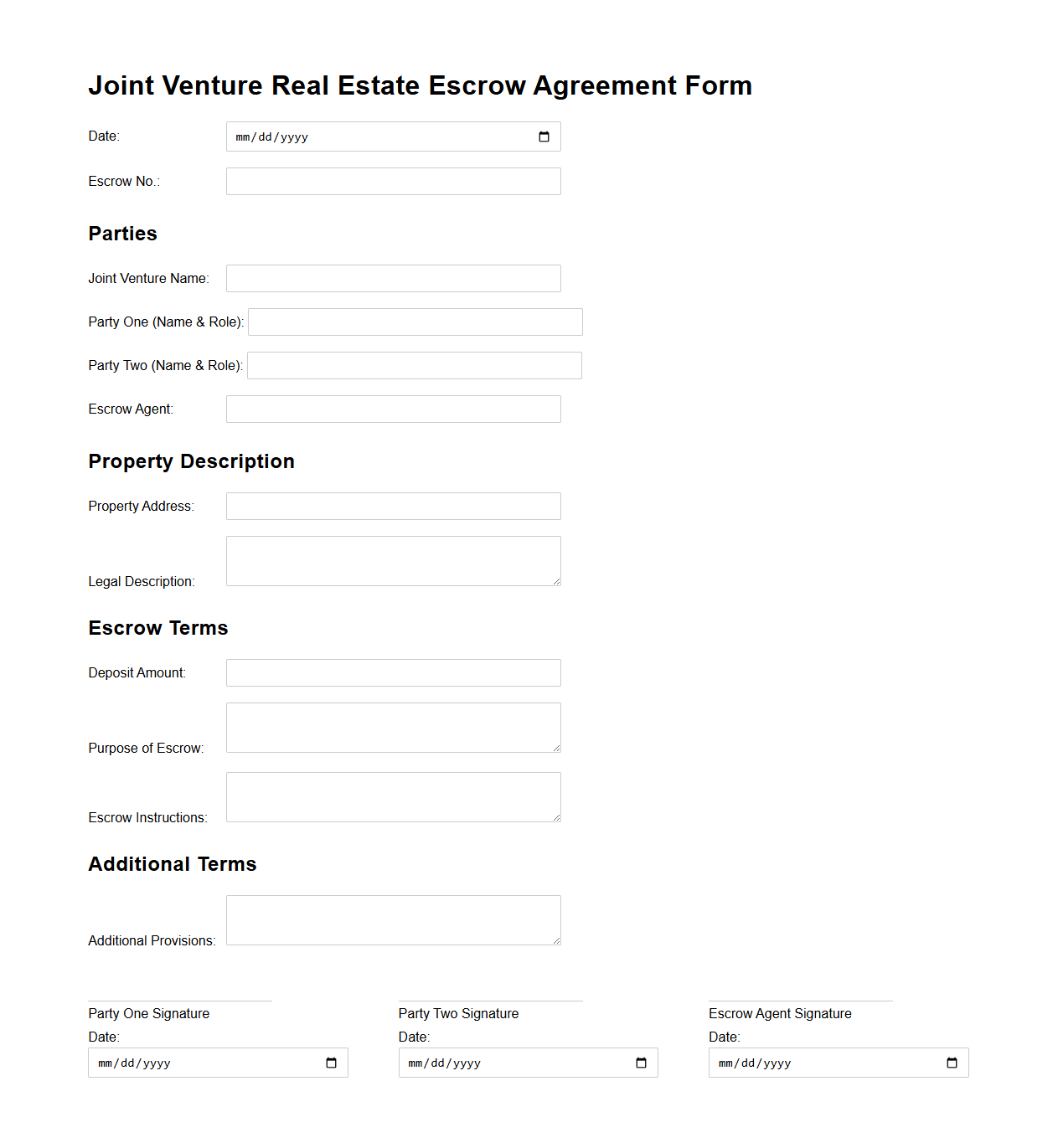

Joint Venture Real Estate Escrow Agreement Form

A

Joint Venture Real Estate Escrow Agreement Form is a legal document used to outline the terms and conditions under which escrow funds are held and disbursed during a joint real estate transaction. This form protects the interests of all parties involved by specifying roles, responsibilities, and procedures for handling deposits, payments, and contingencies. It ensures that the escrow agent acts as a neutral third party, facilitating a smooth transfer of property ownership and financial assets.

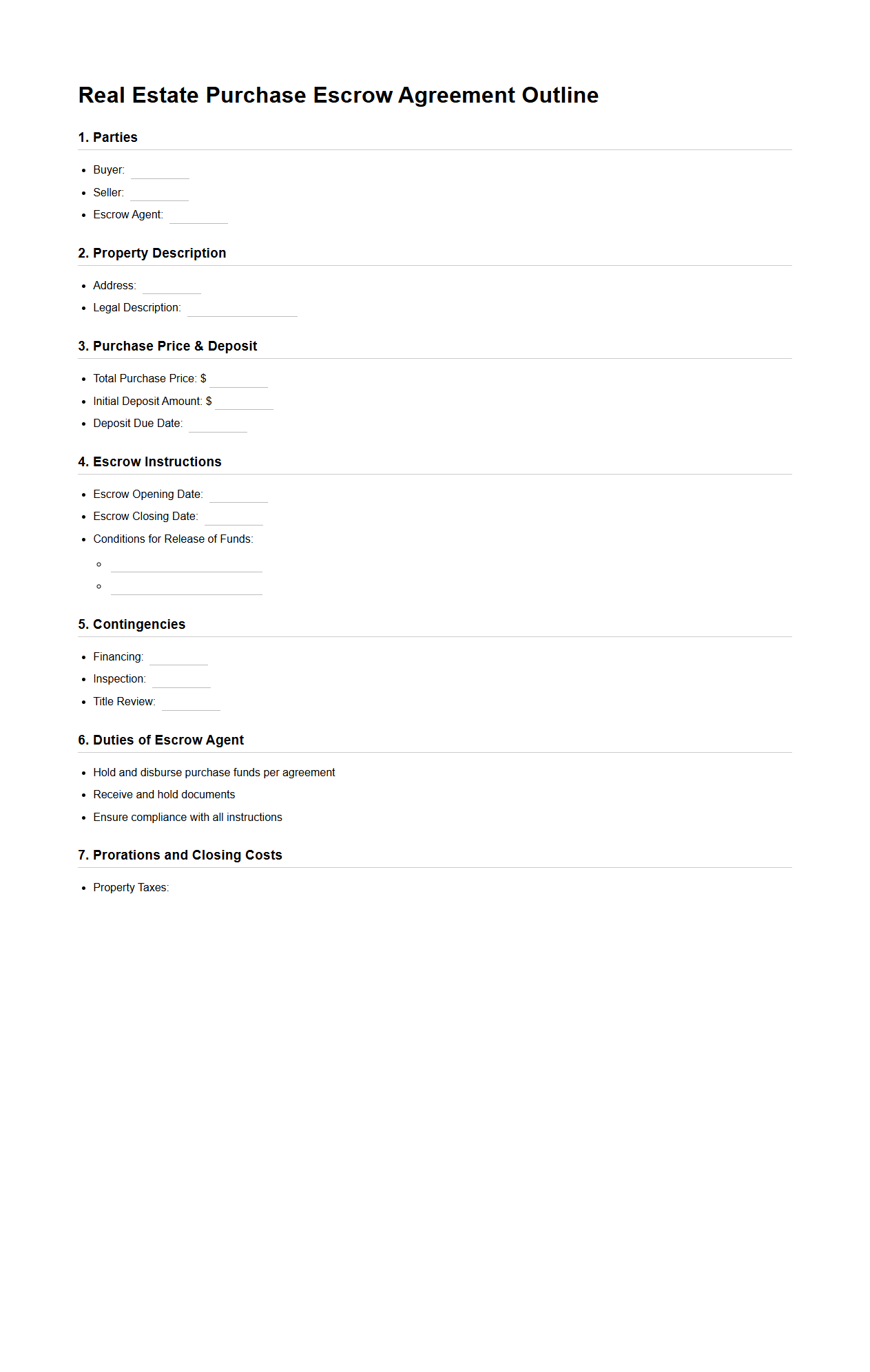

Real Estate Purchase Escrow Agreement Outline

A

Real Estate Purchase Escrow Agreement Outline document serves as a structured framework detailing the responsibilities and conditions agreed upon by the buyer, seller, and escrow agent during a property transaction. It defines the terms for holding and disbursing funds, the timeline for completing contingencies, and the process for resolving any disputes. This outline ensures clarity and legal protection for all parties involved in the escrow process.

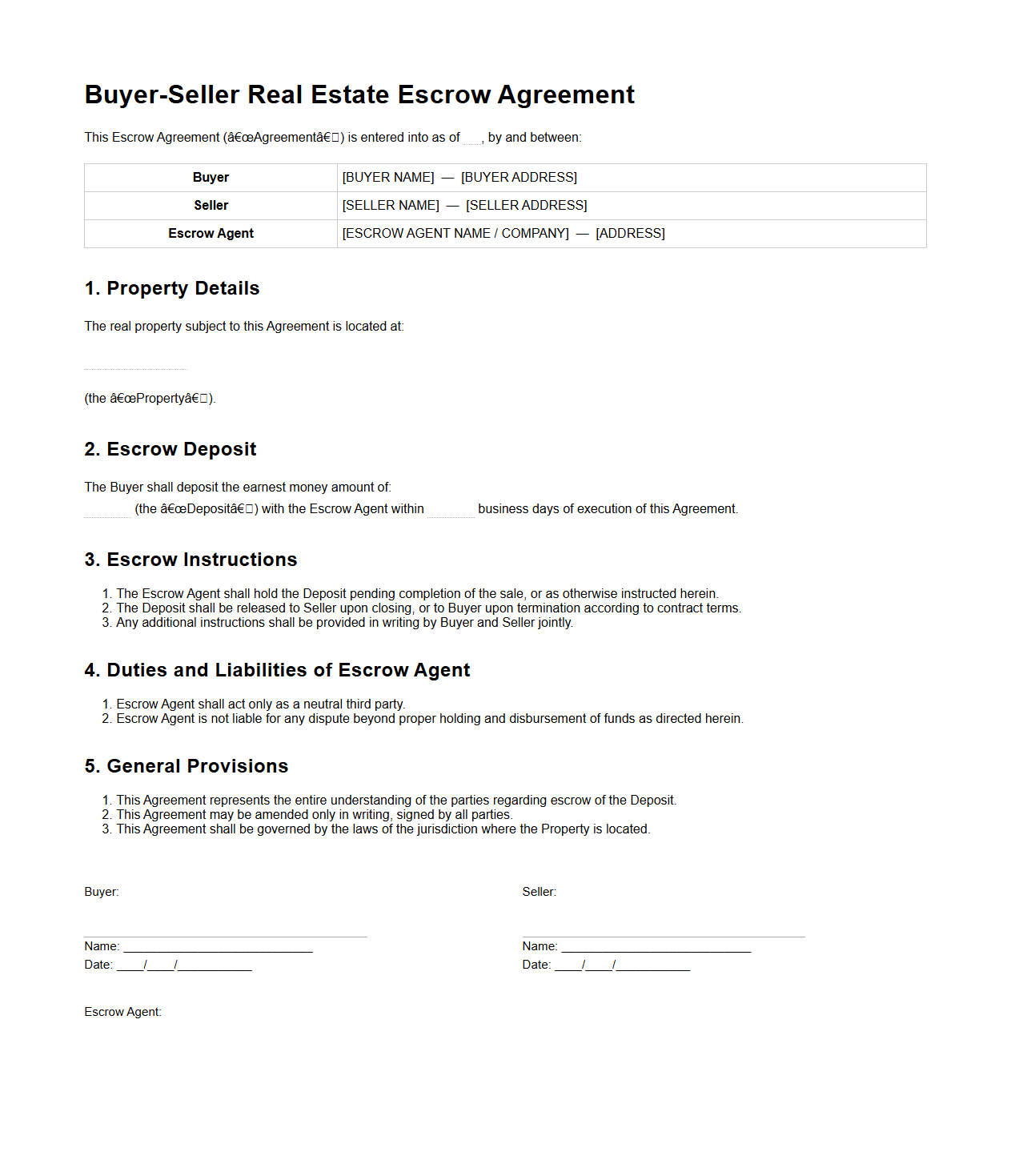

Buyer-Seller Real Estate Escrow Agreement Format

A

Buyer-Seller Real Estate Escrow Agreement Format document outlines the terms and conditions under which an impartial third party holds funds and property documents during a real estate transaction. It specifies the responsibilities, timelines, and obligations of both buyer and seller to ensure a secure and transparent exchange. This format helps prevent disputes by clearly defining the steps required for releasing the escrowed assets upon fulfillment of contractual conditions.

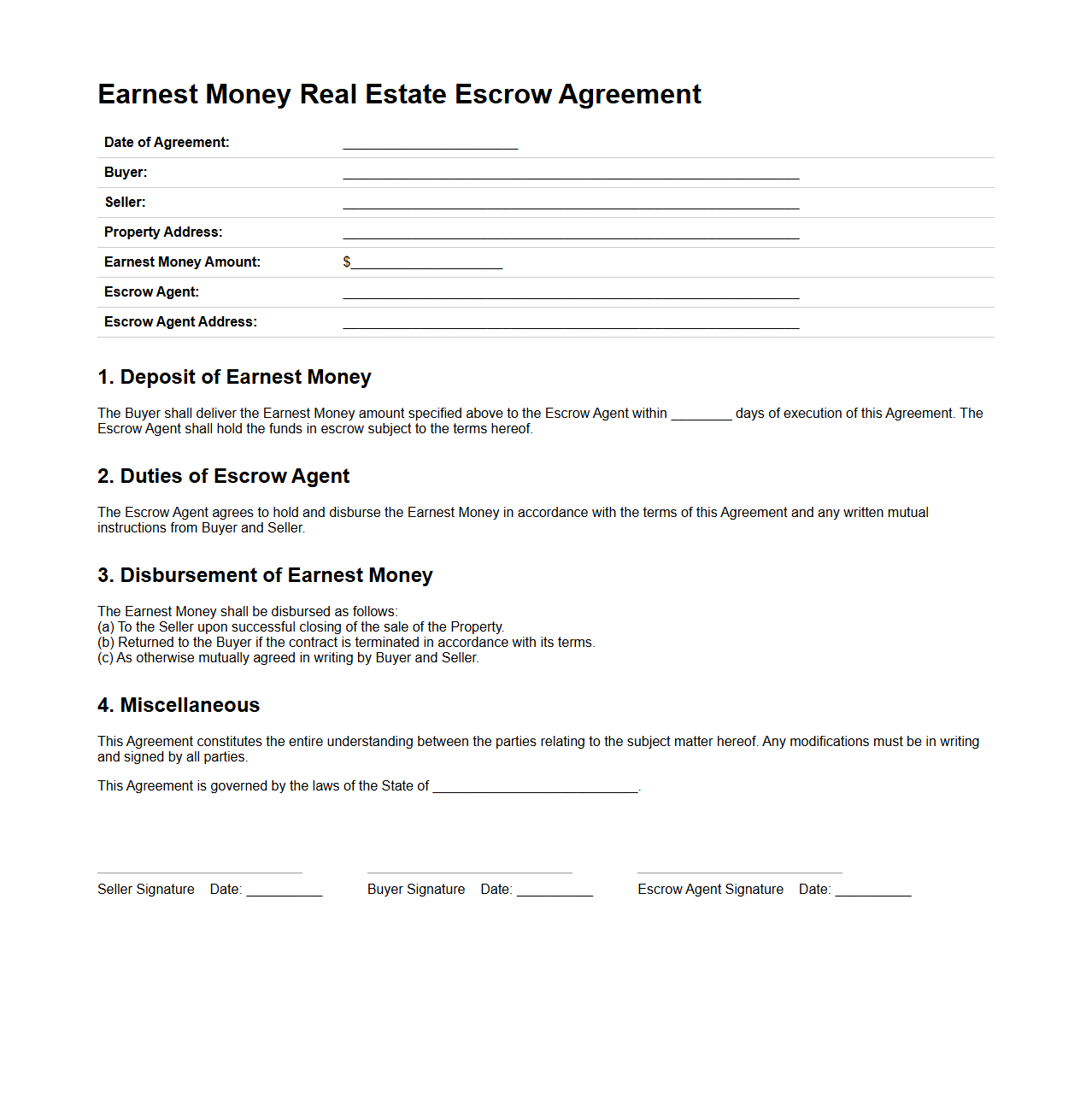

Earnest Money Real Estate Escrow Agreement Example

An

Earnest Money Real Estate Escrow Agreement document outlines the terms under which a buyer deposits earnest money into an escrow account during a property transaction. This agreement ensures that the funds are held securely by a neutral third party until the sale conditions are met or the transaction is terminated. It protects both the buyer and seller by specifying the circumstances for refund or forfeiture of the earnest money.

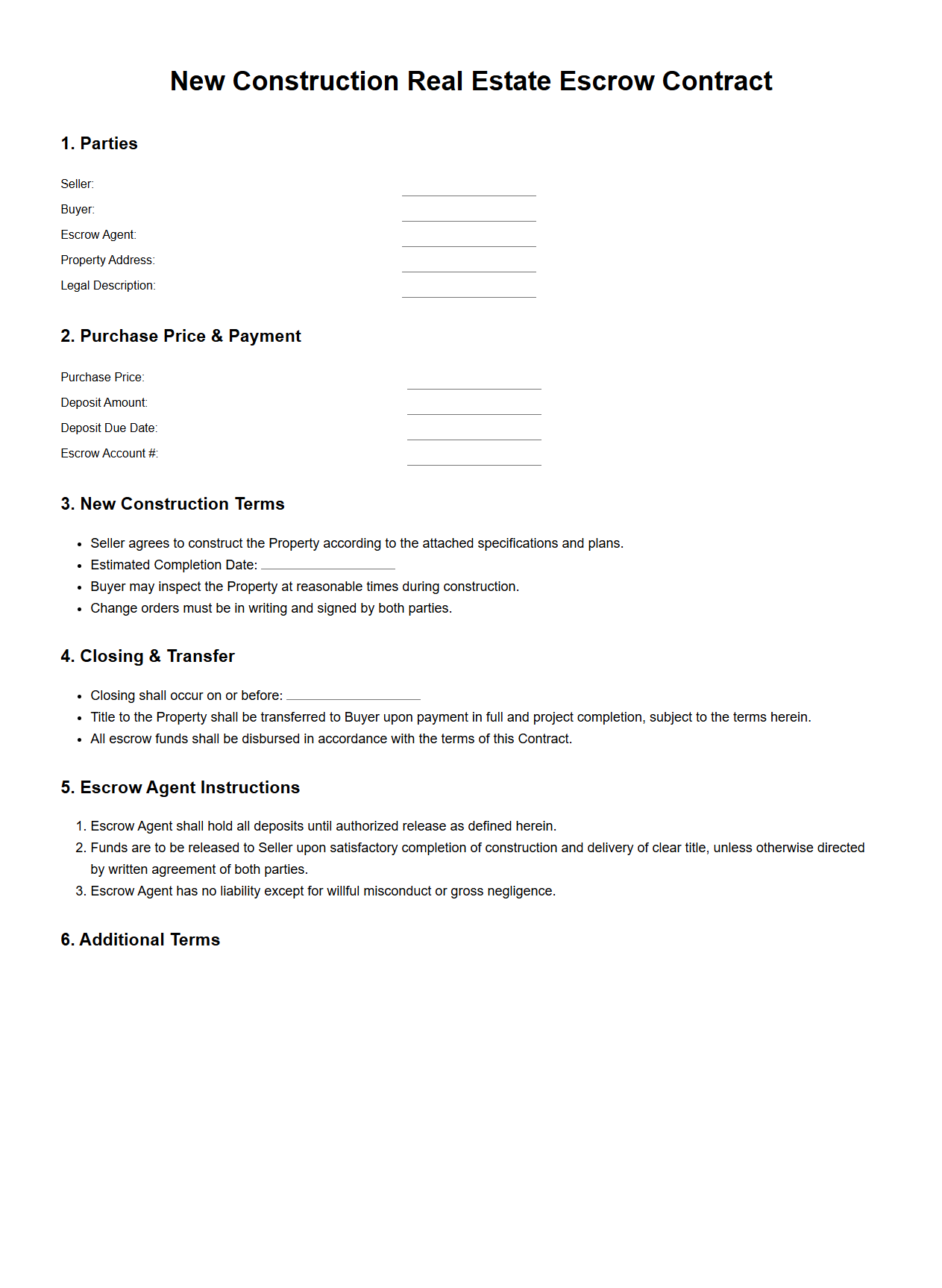

New Construction Real Estate Escrow Contract Sample

A

New Construction Real Estate Escrow Contract Sample document outlines the terms and conditions for holding funds securely during the purchase of newly-built property, ensuring both buyer and builder meet agreed-upon obligations before the transaction is finalized. It details payment schedules, contingencies, and responsibilities related to inspections, title clearance, and property delivery. This sample contract serves as a template to facilitate smooth financial exchanges and legal compliance in new construction real estate transactions.

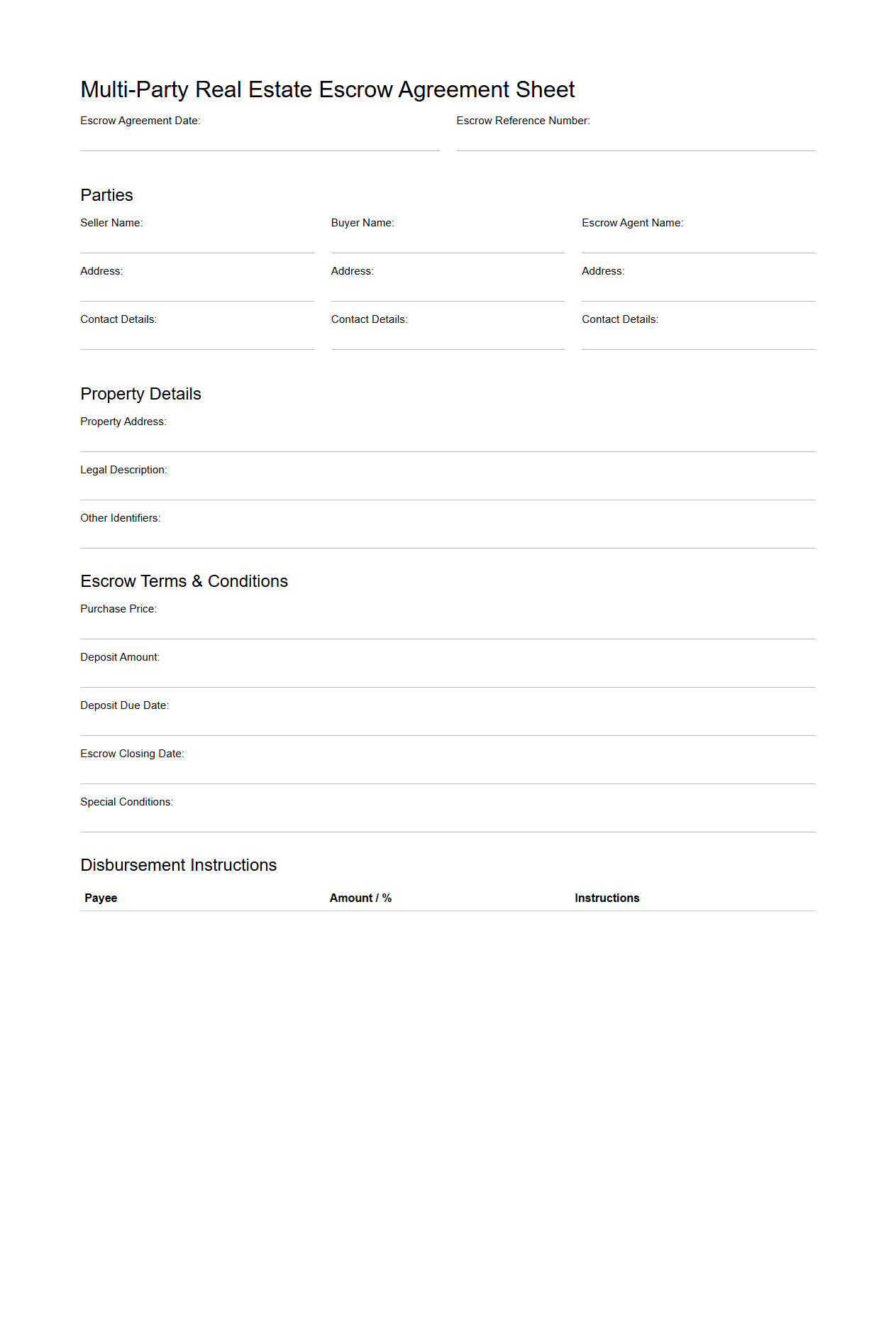

Multi-Party Real Estate Escrow Agreement Sheet

A

Multi-Party Real Estate Escrow Agreement Sheet outlines the terms and conditions under which multiple parties agree to deposit funds, documents, or assets with a neutral third-party escrow agent during a real estate transaction. This document ensures all parties fulfill their contractual obligations before the transaction is finalized, providing security and clarity throughout the process. It typically includes details on the responsibilities of each party, conditions for fund disbursement, and procedures for dispute resolution.

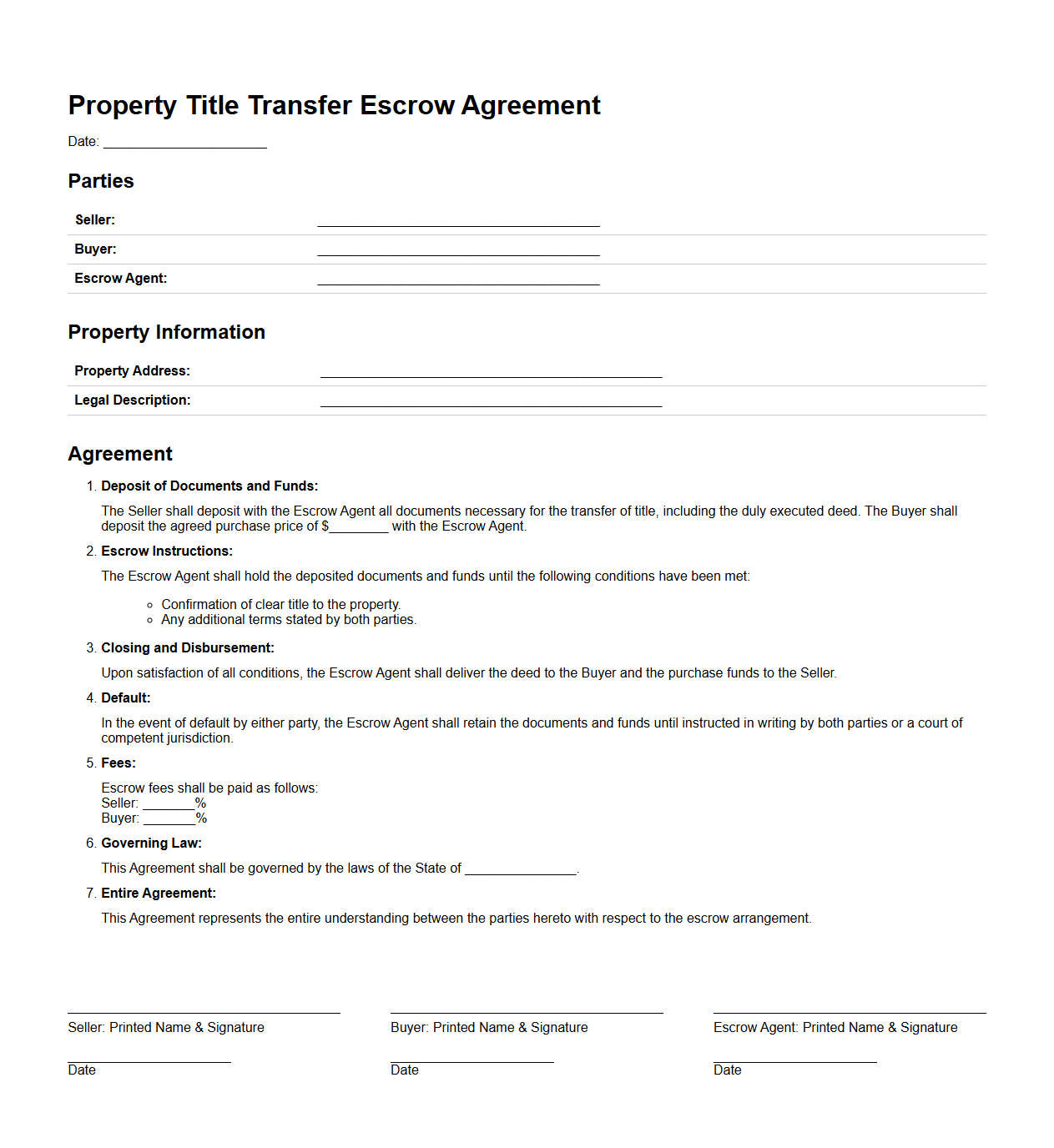

Property Title Transfer Escrow Agreement Model

A

Property Title Transfer Escrow Agreement Model document is a legally binding template that outlines the terms and conditions for holding and transferring property ownership through a neutral third party during a real estate transaction. This model ensures that the property's title is securely transferred only after all contractual obligations, such as payment and document verification, are met. It protects both the buyer and seller by providing a clear framework for the escrow process, minimizing risks and facilitating a smooth transfer of ownership.

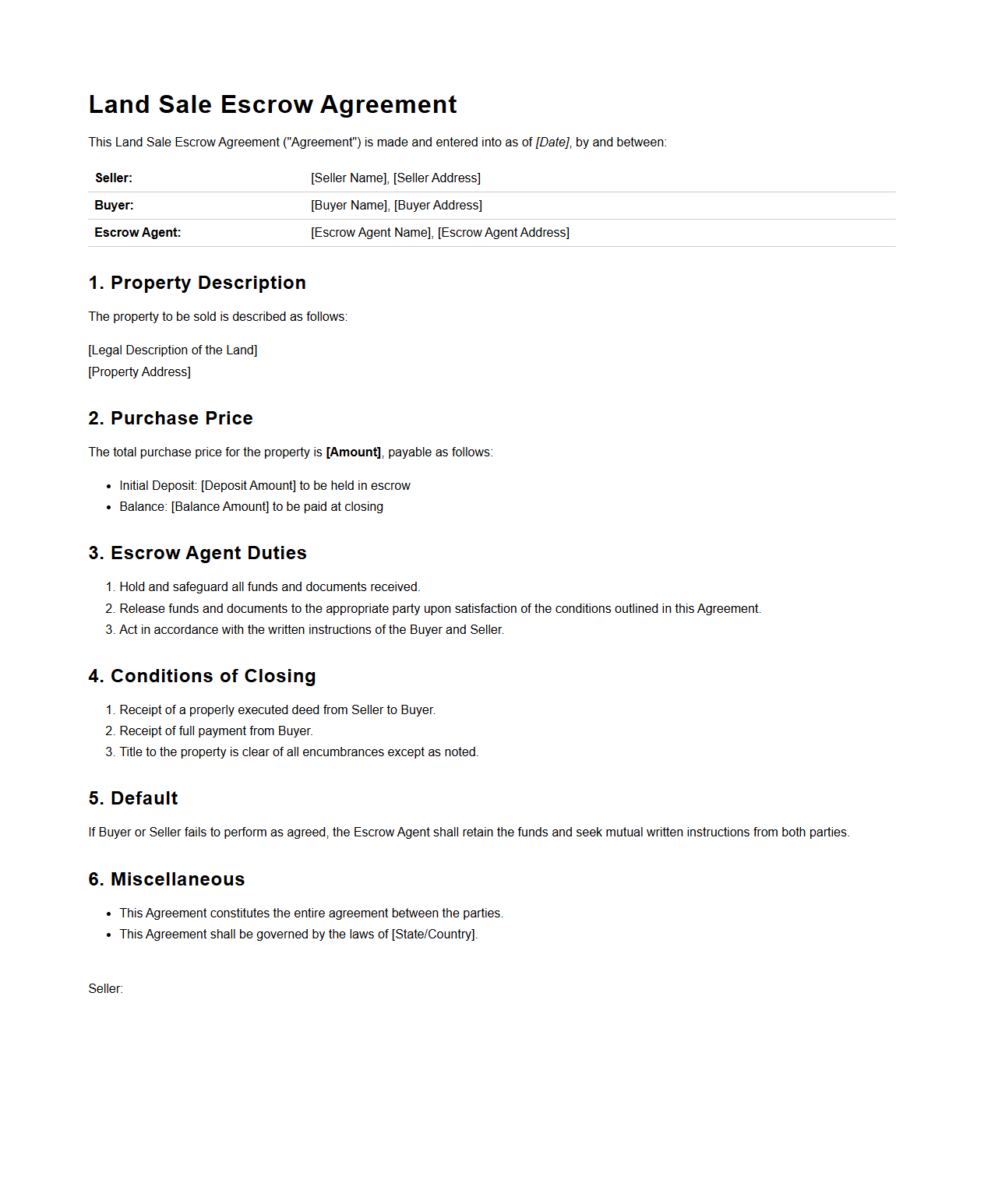

Land Sale Escrow Agreement Document Example

A

Land Sale Escrow Agreement Document Example outlines the terms and conditions under which a neutral third party holds funds and property documents during the sale of land. This document ensures that both the buyer and seller fulfill their contractual obligations before the transaction is finalized, protecting both parties from potential risks. It typically includes details about the escrow agent, payment schedule, and conditions for releasing the escrowed assets.

What specific conditions trigger the release of escrowed funds in the Escrow Agreement Document?

The release of escrowed funds is typically triggered by the fulfillment of predefined conditions outlined in the Escrow Agreement. These conditions often include the successful completion of contractual obligations by both parties. Verification of these conditions by the escrow agent is essential before any funds are disbursed.

How does the Escrow Agreement define material breach or default by buyer or seller?

A material breach or default is defined by the Escrow Agreement as a significant failure to perform contractual duties that impacts the transaction. This may include non-payment, failure to deliver goods, or violation of key contract terms. Such breaches often activate remedies or penalties specified within the agreement.

Are there stipulations for dispute resolution or arbitration within the Escrow Agreement?

The Escrow Agreement usually contains explicit dispute resolution clauses to handle conflicts between parties. Arbitration or mediation is commonly mandated as the primary method for resolving disputes efficiently. These provisions aim to minimize litigation costs and facilitate amicable settlements.

What documentation is required to amend or terminate the Escrow Agreement for a real estate transaction?

To amend or terminate the Escrow Agreement in real estate, written consent from all involved parties is required. Formal documentation such as signed amendments or termination notices must be submitted to the escrow agent. These documents ensure clear and legally binding changes to the original agreement.

How are third-party claims against escrowed assets addressed in the agreement?

The Escrow Agreement addresses third-party claims by establishing procedures to protect escrowed assets from unauthorized encumbrances. Claims may require notification to the escrow agent and possible withholding of funds pending resolution. This safeguards the interests of the contracting parties while managing external disputes.

More Real estate Templates