A Cash Flow Statement Document Sample for Financial Planning provides a detailed record of cash inflows and outflows over a specific period, helping businesses track liquidity and manage expenses effectively. This document is essential for forecasting future financial positions and ensuring sufficient cash availability for operational needs. Accurate analysis of cash flow statements supports informed decision-making and strategic financial planning.

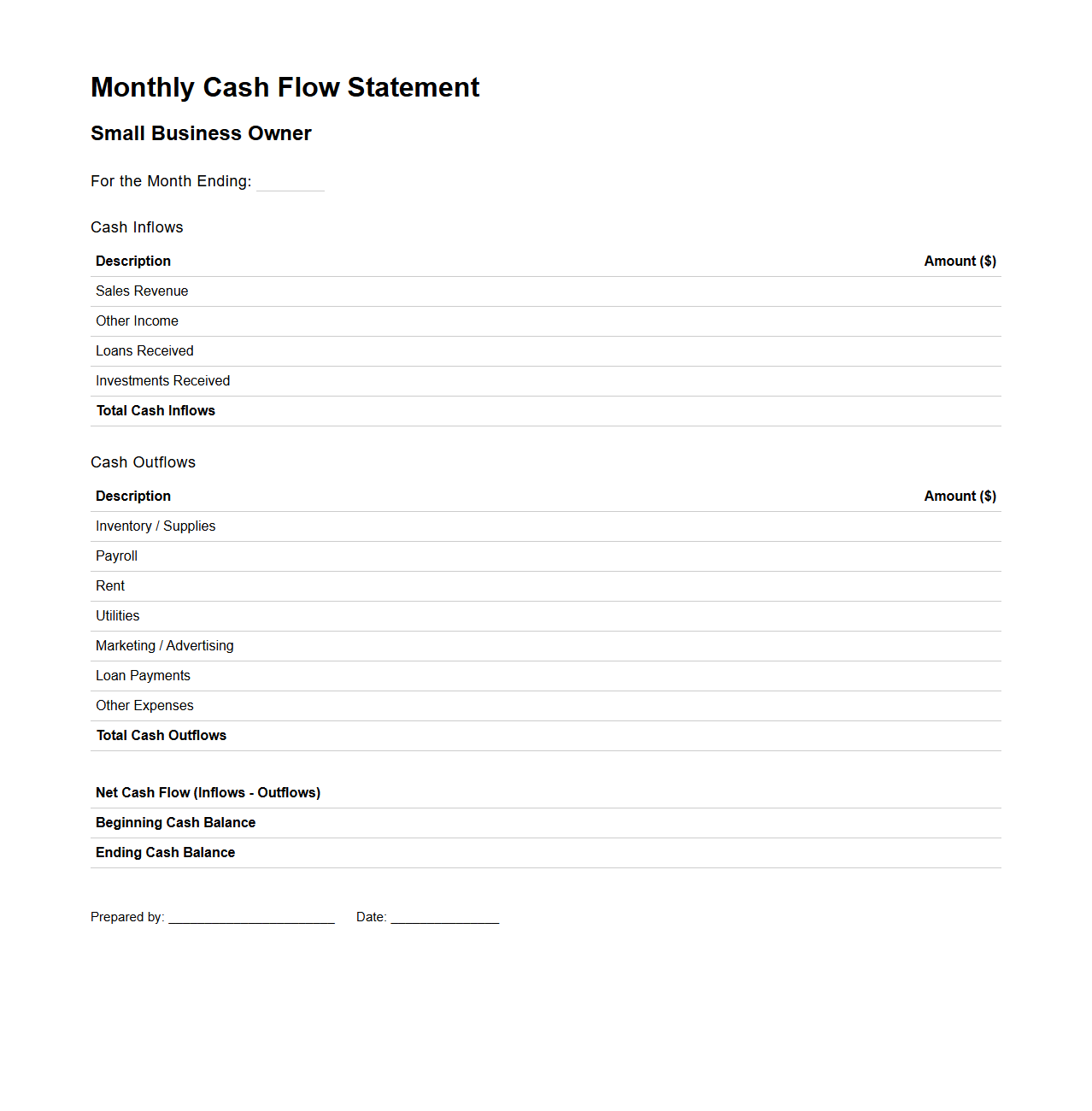

Monthly Cash Flow Statement for Small Business Owners

A

Monthly Cash Flow Statement for Small Business Owners is a financial document that tracks the inflows and outflows of cash within a business over a one-month period. It helps entrepreneurs monitor liquidity, manage expenses, and ensure there is enough cash available to meet operational needs. This statement provides essential insights into financial health, allowing for informed decision-making and improved budgeting accuracy.

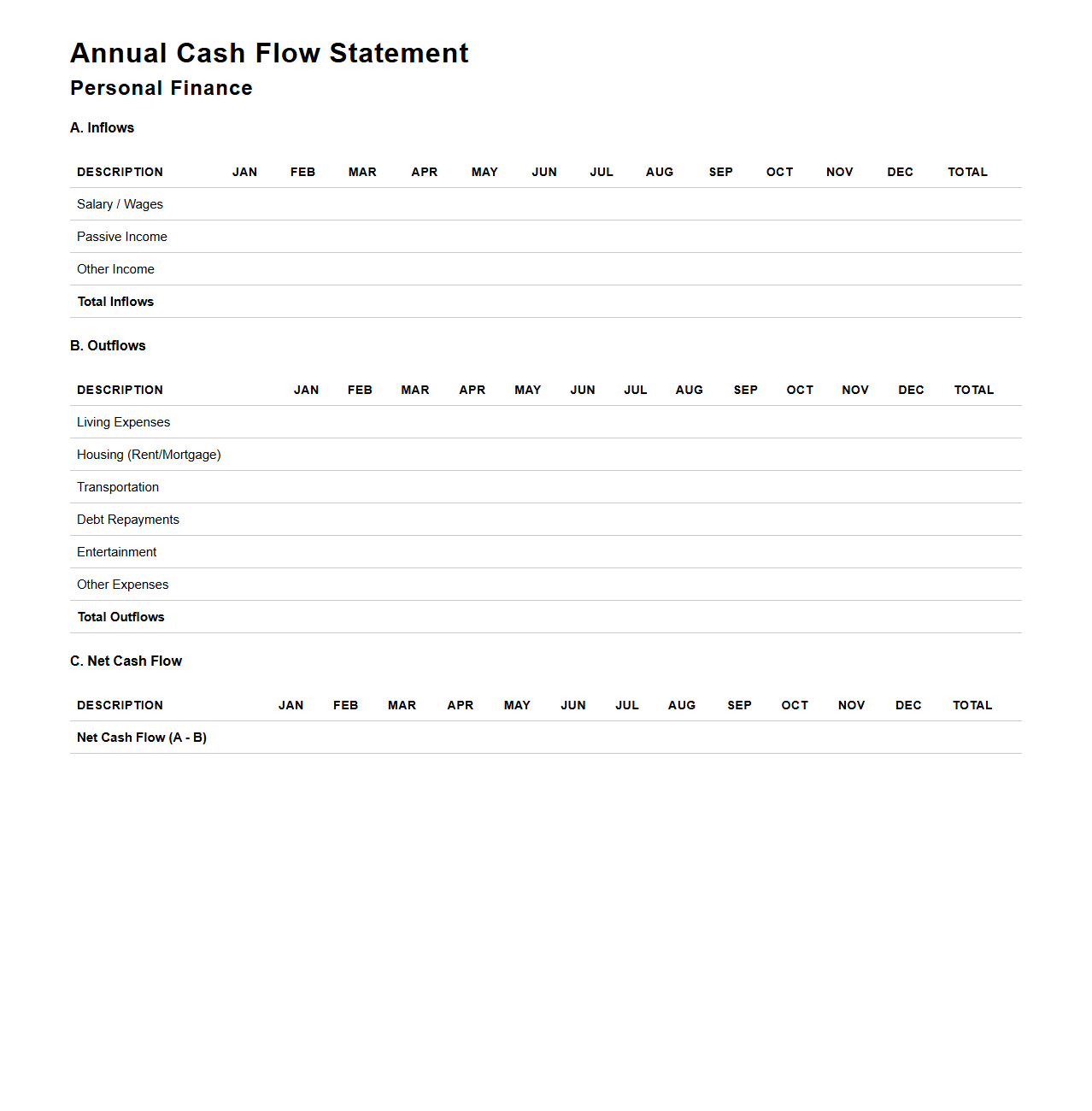

Annual Cash Flow Statement for Personal Finance

An

Annual Cash Flow Statement for personal finance is a detailed report that tracks all income and expenditures over a one-year period, providing a clear overview of how money flows in and out of an individual's finances. This document helps identify spending patterns, assess savings potential, and plan for future financial goals by comparing total income against total expenses. It is essential for budgeting, managing debt, and ensuring long-term financial stability by highlighting areas where adjustments may be necessary.

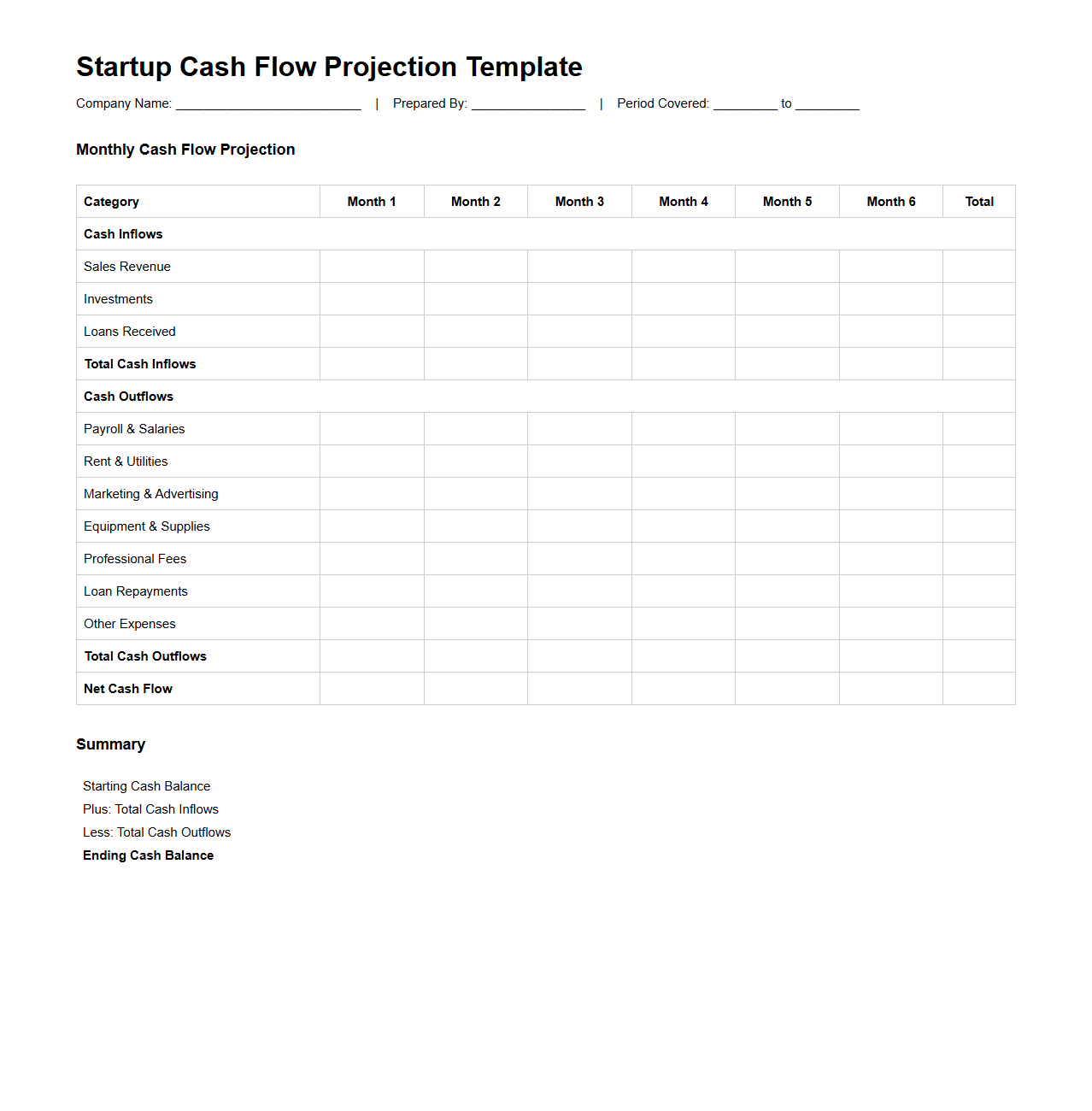

Startup Cash Flow Projection Template

A

Startup Cash Flow Projection Template document is a financial tool used by new businesses to estimate and track their incoming and outgoing cash over a specific period. It helps entrepreneurs forecast revenue, manage expenses, and ensure sufficient liquidity to sustain operations. This template is essential for budgeting, securing funding, and making informed financial decisions.

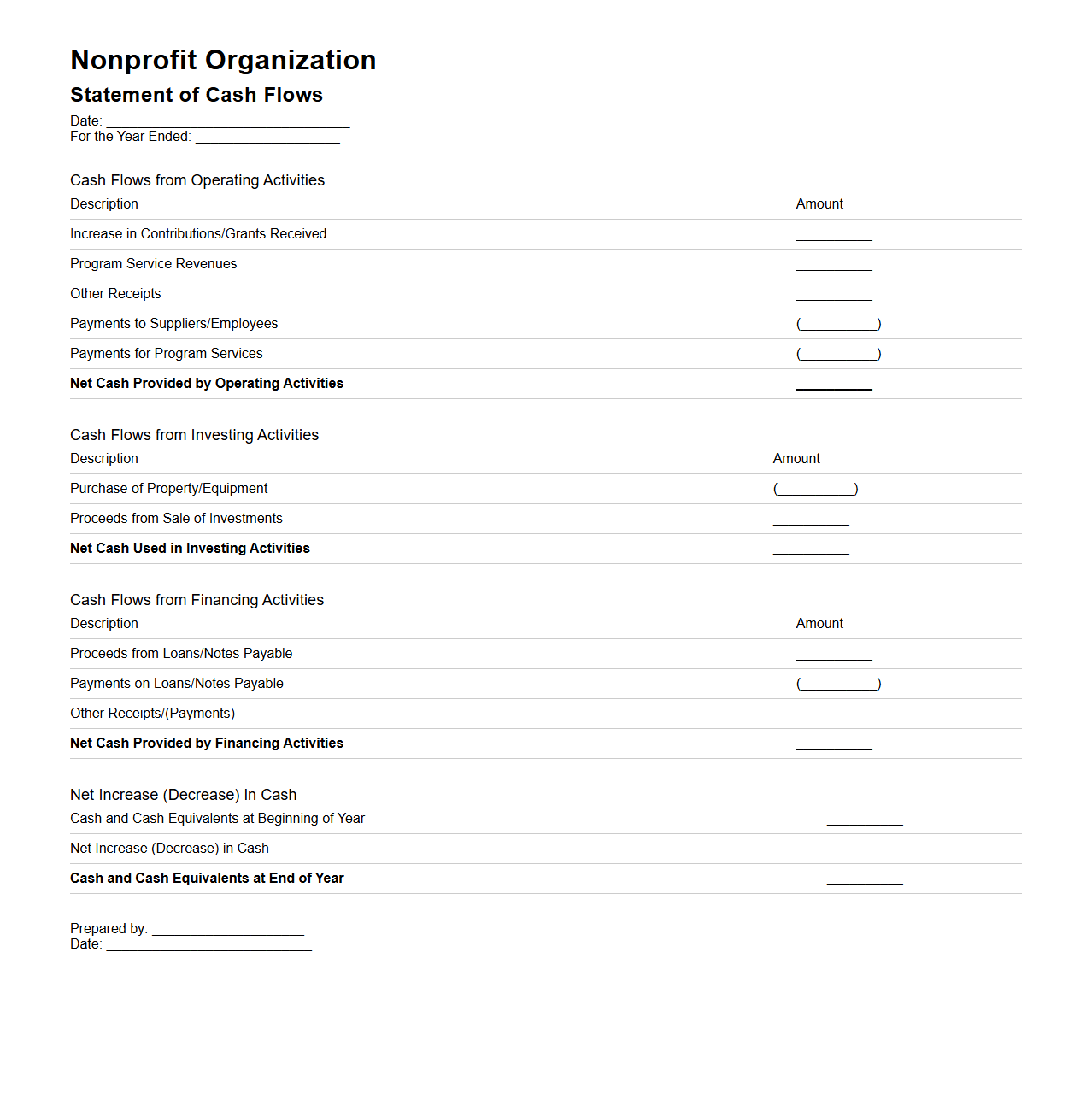

Nonprofit Organization Cash Flow Statement

A

Nonprofit Organization Cash Flow Statement is a financial document that tracks the inflows and outflows of cash within a nonprofit entity over a specific period. It provides detailed insights into the organization's liquidity by categorizing cash activities into operating, investing, and financing activities. This statement is essential for assessing the nonprofit's ability to maintain operations, fund programs, and manage reserves effectively.

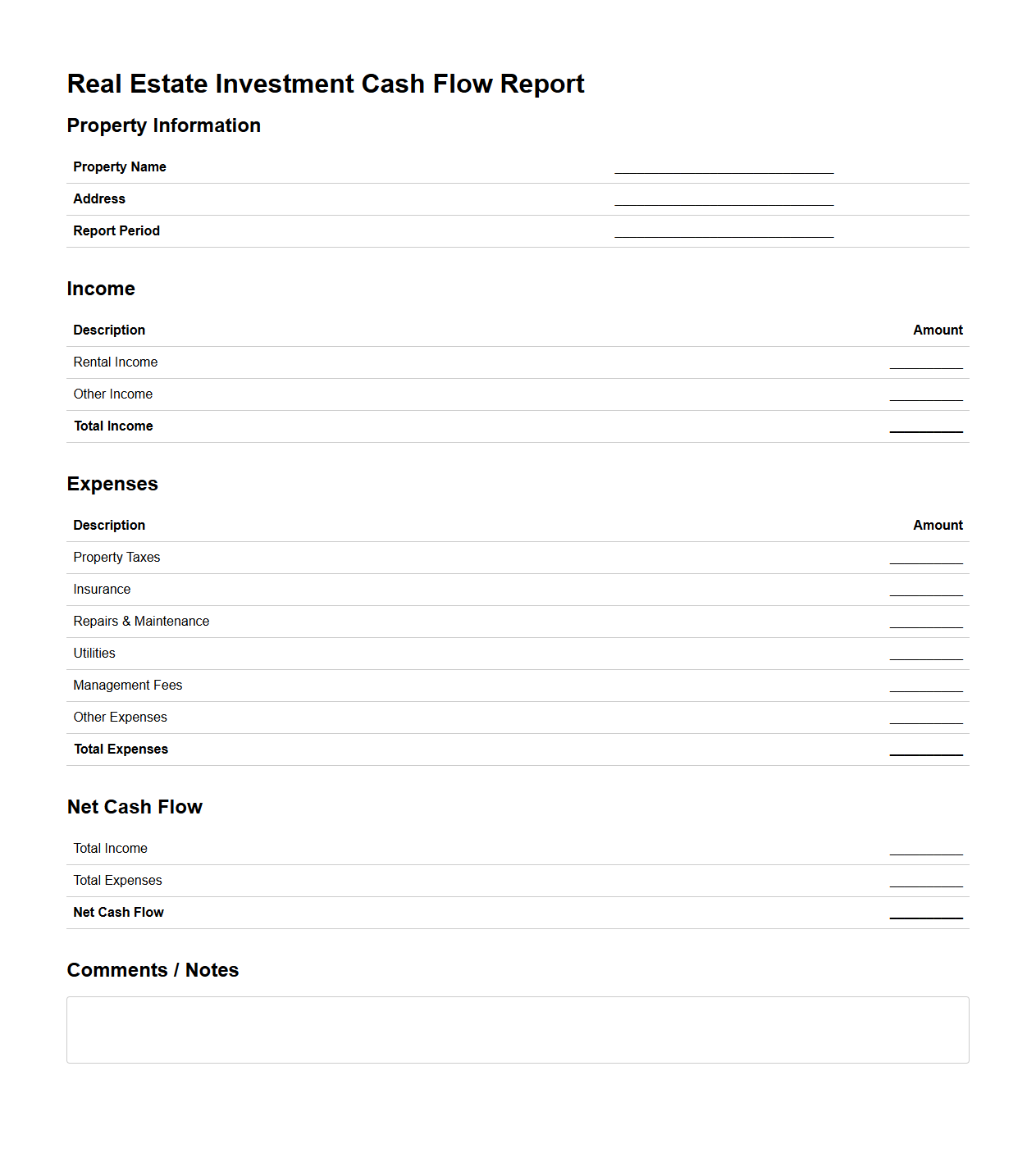

Real Estate Investment Cash Flow Report

The

Real Estate Investment Cash Flow Report is a detailed financial document that tracks the inflows and outflows of cash related to a property investment over a specified period. It includes rental income, operating expenses, loan payments, and capital expenditures, providing investors with a clear picture of the property's profitability and liquidity. This report is essential for evaluating investment performance, making informed decisions, and forecasting future cash flow trends.

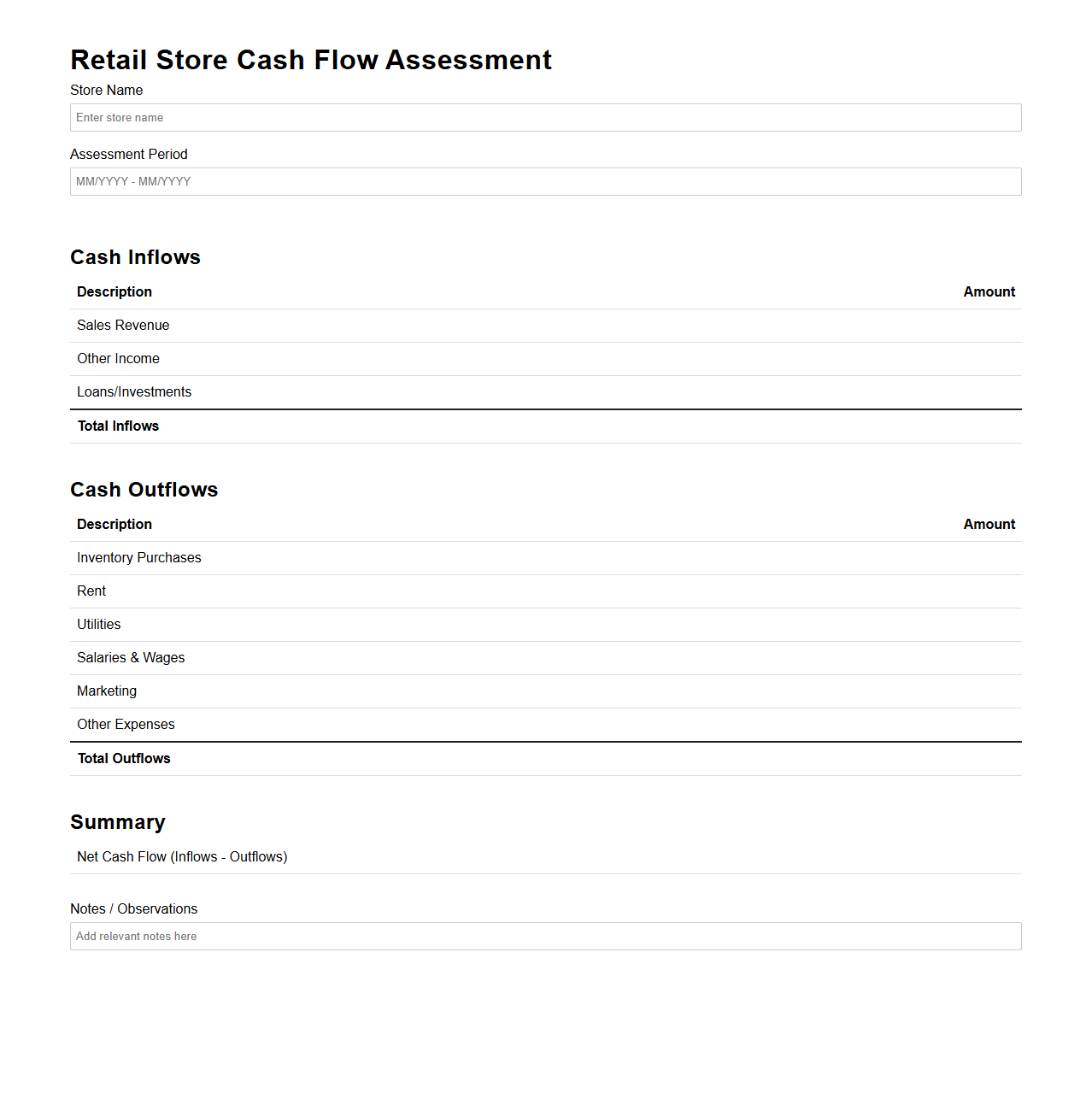

Retail Store Cash Flow Assessment

A

Retail Store Cash Flow Assessment document provides a detailed analysis of the inflows and outflows of cash within a retail business, highlighting the operational liquidity and financial health of the store. It tracks daily sales revenue, inventory purchases, payroll expenses, and other operational costs to forecast short-term cash availability. This assessment supports decision-making by identifying potential cash shortages or surpluses, helping retailers optimize budget planning and maintain smooth store operations.

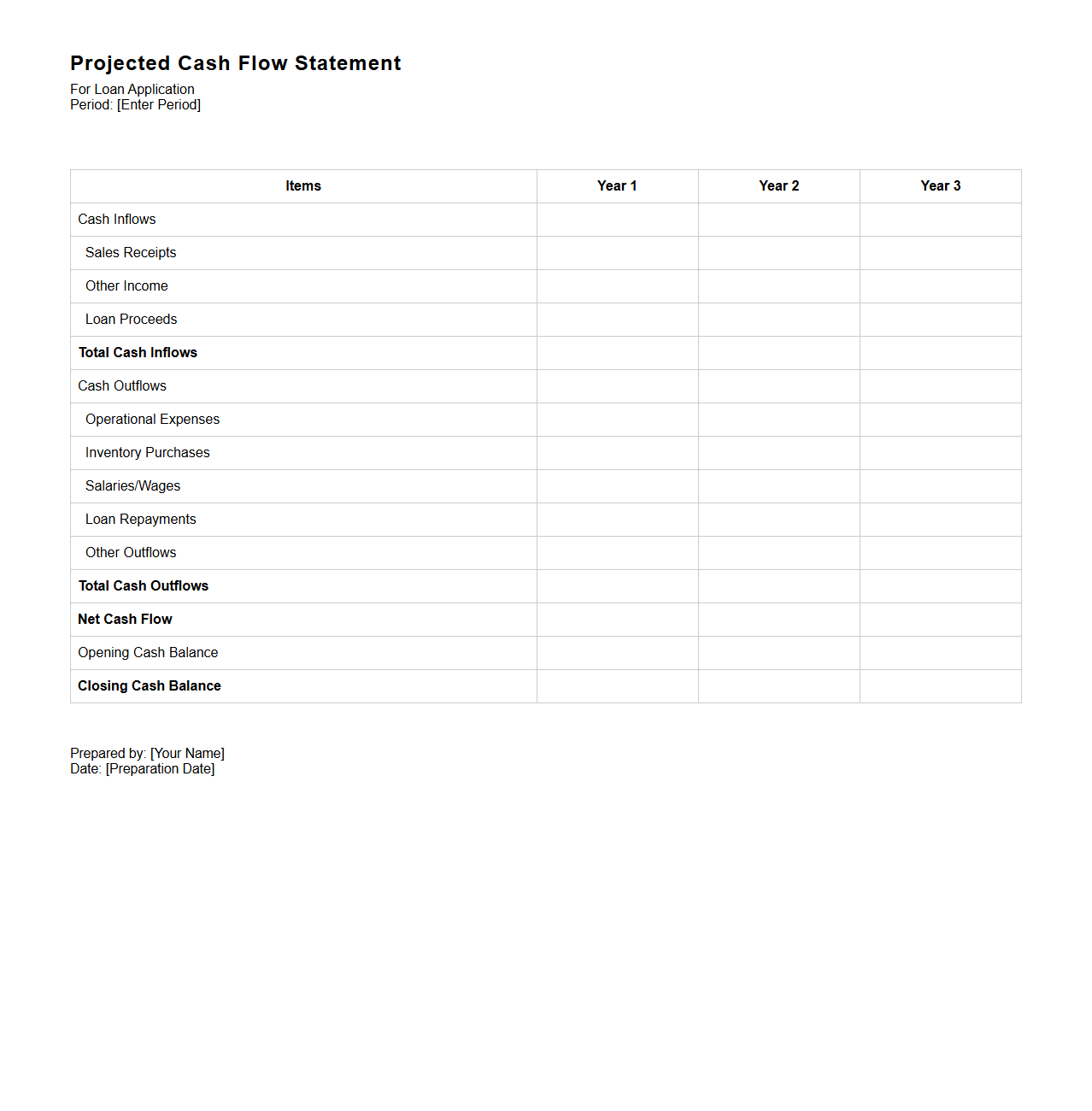

Projected Cash Flow Statement for Loan Application

A

Projected Cash Flow Statement for a loan application is a financial document that estimates future cash inflows and outflows over a specific period, demonstrating the borrower's ability to generate sufficient cash to repay the loan. It includes detailed projections of revenue, expenses, operating activities, and financing activities, providing lenders with a clear view of financial viability and risk. This statement serves as a critical tool in assessing creditworthiness and ensuring that the loan aligns with the borrower's financial capabilities.

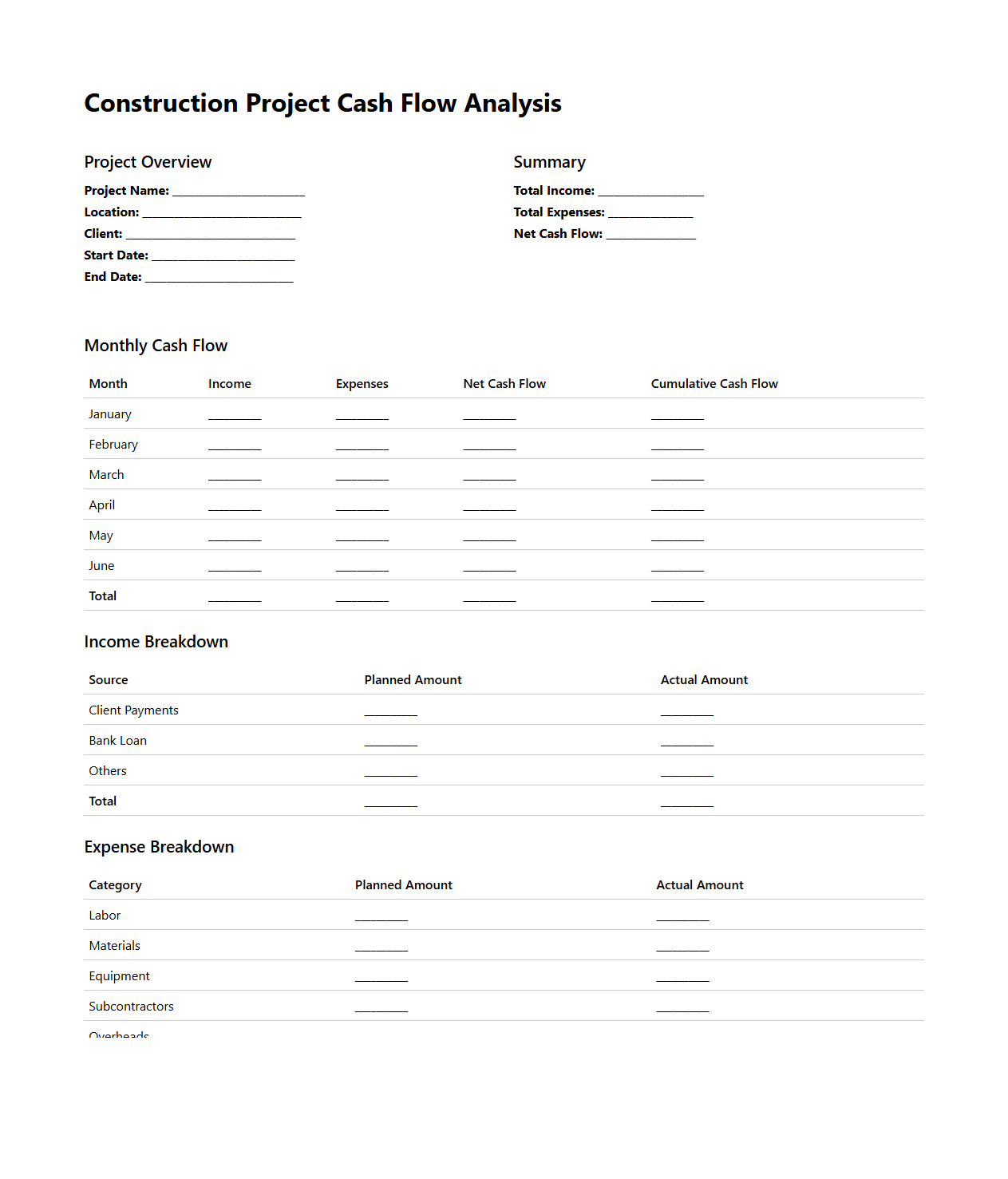

Construction Project Cash Flow Analysis

A

Construction Project Cash Flow Analysis document outlines the timing and amounts of cash inflows and outflows throughout the project lifecycle to ensure financial stability. It tracks expenditures such as labor, materials, and equipment costs against anticipated payments and funding sources. This analysis helps project managers forecast liquidity needs, avoid cash shortages, and optimize budget management.

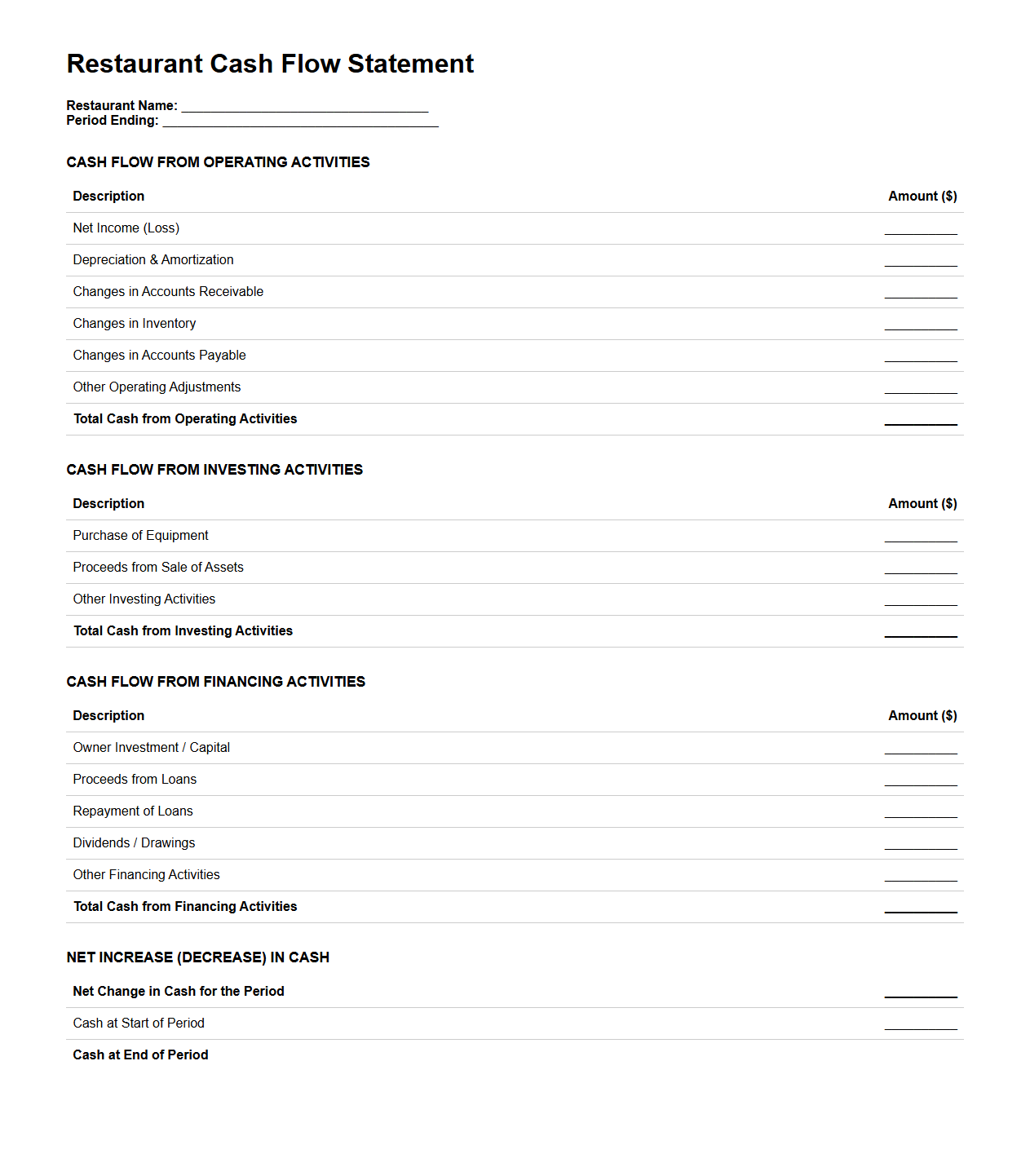

Restaurant Cash Flow Statement for Investors

A

Restaurant Cash Flow Statement for investors is a financial document that details the inflow and outflow of cash within a restaurant over a specific period. It highlights operational efficiencies, liquidity status, and the ability to generate cash to sustain and grow the business. This statement is crucial for investors to assess financial health, operational performance, and the potential return on investment.

Cash Flow Tracking Document for Side Businesses

A

Cash Flow Tracking Document for side businesses is a financial tool designed to monitor and manage the inflow and outflow of cash related to secondary income sources. It helps small business owners record all transactions, categorize expenses and revenues accurately, and forecast future cash availability to maintain liquidity. Regular use of this document supports informed decision-making and ensures the side business remains financially healthy and sustainable.

How does the cash flow statement reflect seasonal business fluctuations?

The cash flow statement highlights periods of increased cash inflows and outflows that correspond to seasonal sales cycles. It helps businesses identify when operating cash typically peaks or troughs, reflecting the seasonal nature of revenue and expenses. This insight aids in planning for cash reserves or financing needs during off-peak seasons.

What non-cash items significantly impact operating cash flows in financial plans?

Non-cash items such as depreciation, amortization, and asset impairments are key adjustments to reconcile net income to operating cash flows. These items reduce reported earnings but do not affect actual cash position, thus impacting operating cash flow calculations. Including these adjustments ensures financial plans accurately reflect true liquidity.

How can changes in working capital on the cash flow statement inform liquidity forecasts?

Fluctuations in components like accounts receivable, inventory, and accounts payable directly influence working capital changes, which in turn affect cash availability. An increase in working capital often signals cash outflows, while a decrease can boost cash inflows. Monitoring these changes enables more accurate predictions of short-term liquidity needs.

What patterns in financing cash flows indicate potential funding gaps?

Consistent negative financing cash flows, such as loan repayments exceeding new borrowings, may signal upcoming funding shortages. Conversely, sudden large inflows from financing activities can indicate reliance on external capital to bridge operational cash deficits. Identifying these patterns helps in preemptive measures to manage cash flow risks.

How does the cash flow statement validate projected capital expenditure in long-term planning?

The cash flow statement confirms whether sufficient cash resources are available to support forecasted capital expenditures without impairing operations. It shows the timing and magnitude of capital outflows alongside inflows, aligning spending plans with actual cash generation. This validation ensures long-term financial stability and project feasibility.