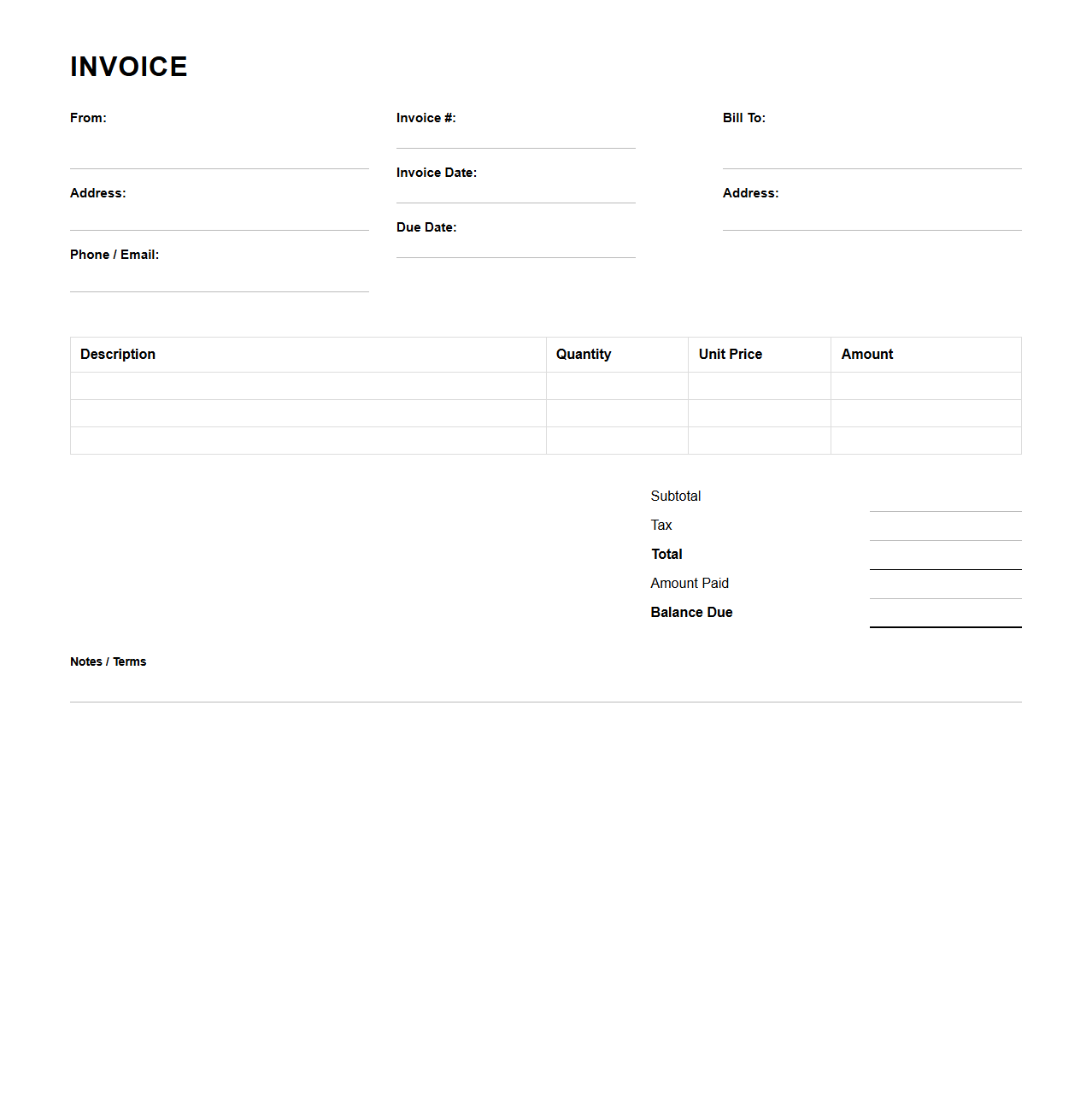

Standard Accounts Receivable Invoice Template

A

Standard Accounts Receivable Invoice Template is a pre-formatted document designed to streamline the billing process by clearly itemizing goods or services provided, payment terms, and due dates. This template ensures consistency and professionalism in invoicing, facilitating accurate record-keeping and timely payments for businesses. It typically includes essential elements such as invoice number, client details, payment methods, and a breakdown of charges, improving financial tracking and cash flow management.

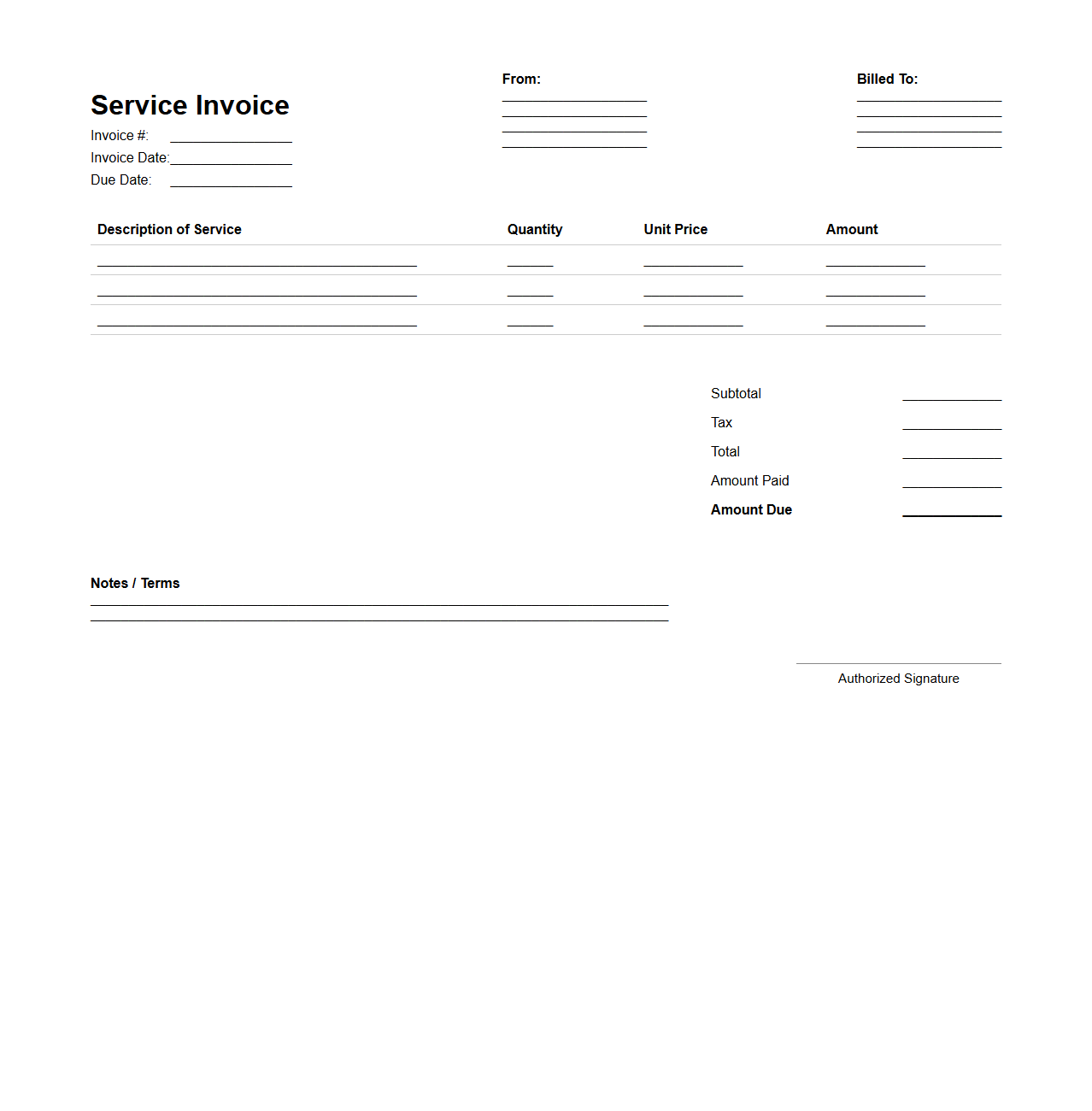

Service Invoice Format for Accounts Receivable

A

Service Invoice Format for Accounts Receivable is a structured document used by businesses to itemize and request payment for services rendered to clients. It typically includes essential details such as the service description, date of service, amount due, payment terms, and client information, ensuring accurate tracking and timely collection of receivables. This format streamlines financial record-keeping and supports efficient accounts receivable management by providing clear and consistent billing information.

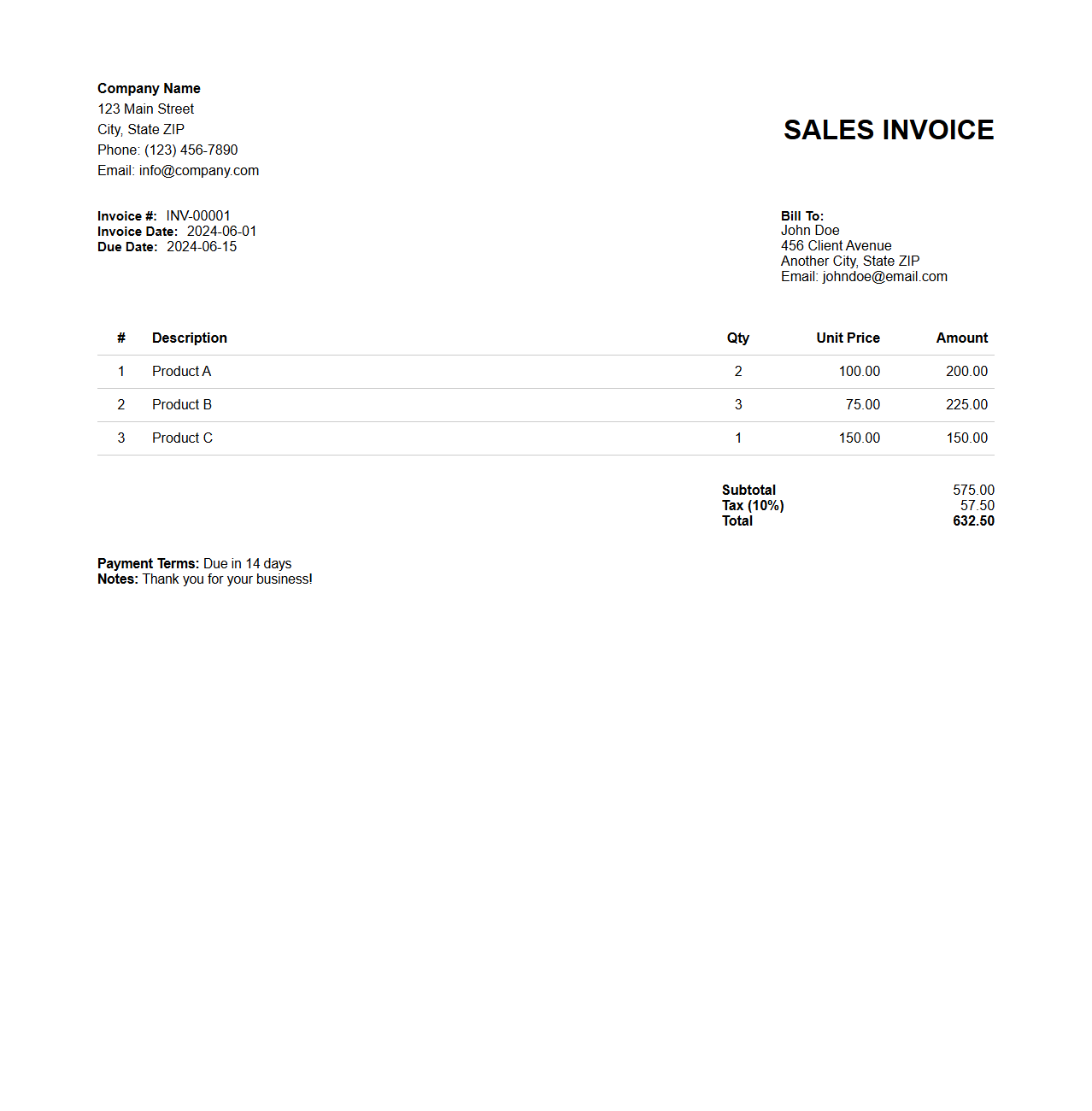

Product Sales Invoice Sample for Accounts Receivable

A

Product Sales Invoice Sample for Accounts Receivable is a detailed financial document used to record the sale of goods to customers. It includes essential information such as product descriptions, quantities, unit prices, total amounts, payment terms, and customer details to ensure accurate tracking of money owed. This invoice serves as a critical tool for businesses to manage outstanding payments, facilitate accounting processes, and maintain clear records of transactions.

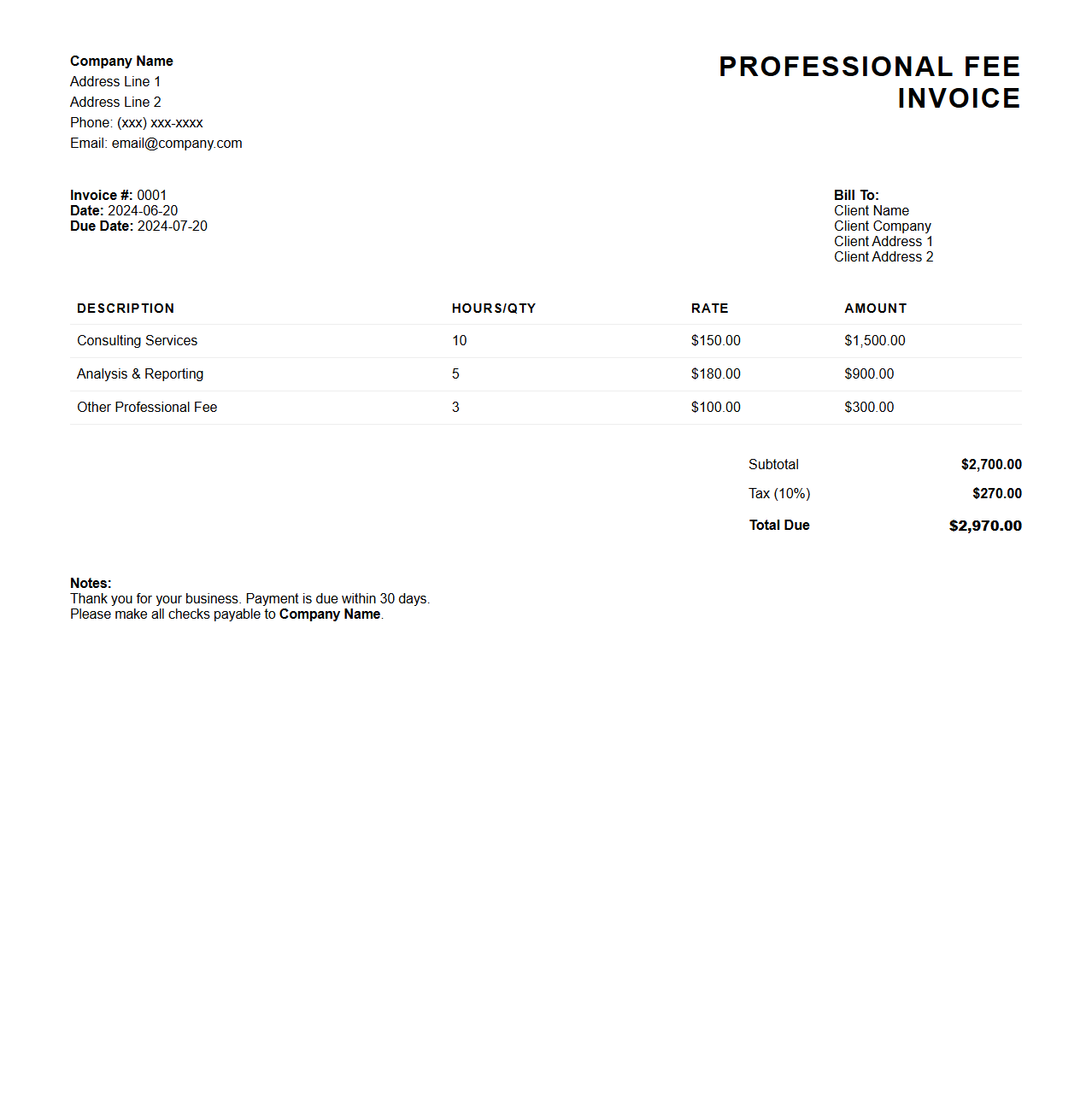

Professional Fee Invoice Layout for Accounts Receivable

A

Professional Fee Invoice Layout for Accounts Receivable is a structured template designed to clearly present billing details for services rendered by professionals. It typically includes essential information such as client details, service descriptions, hourly rates, total fees, payment terms, and due dates, ensuring accurate and efficient tracking of outstanding payments. This layout enhances financial record-keeping and facilitates timely collections, improving overall cash flow management.

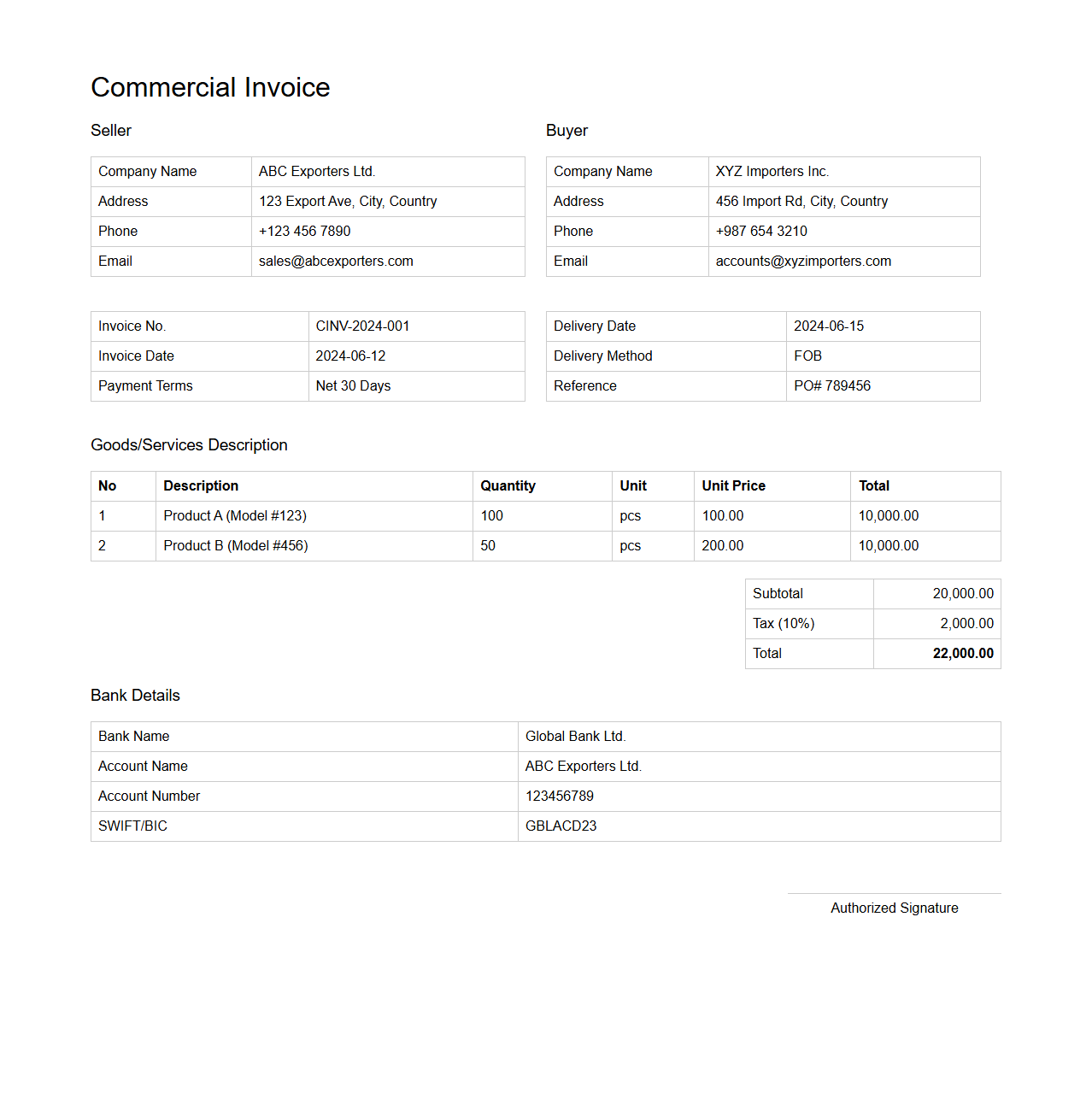

Commercial Invoice Sample for Accounts Receivable Transactions

A

Commercial Invoice Sample for Accounts Receivable Transactions is a detailed document outlining the sale of goods or services between a seller and buyer, used to request payment. It includes essential information such as invoice number, date, payment terms, item descriptions, quantities, prices, and total amount due. This document serves as a key record for accounting processes, ensuring accurate tracking of revenue and facilitating timely collection of receivables.

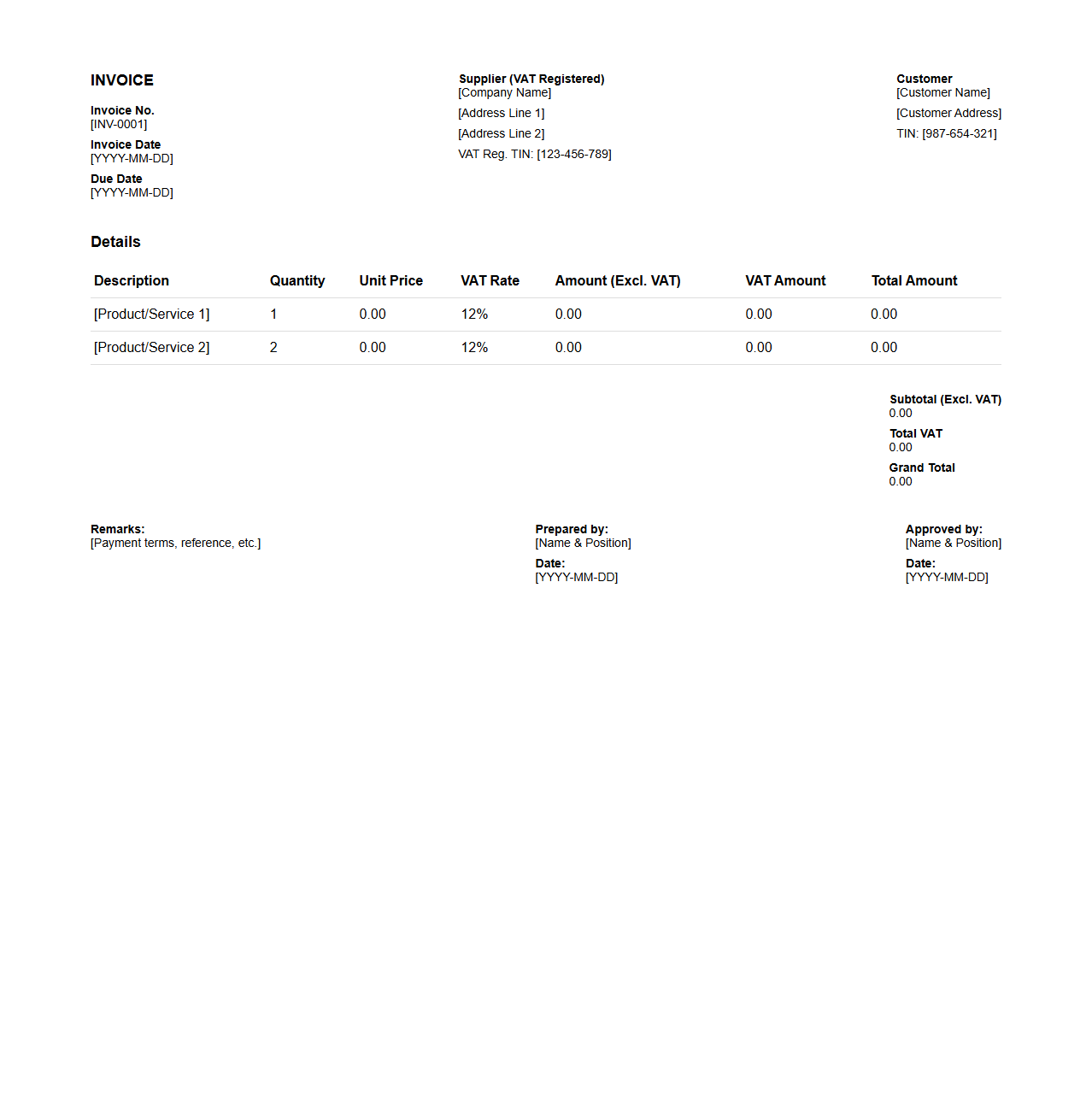

VAT-Compliant Invoice Format for Accounts Receivable

A

VAT-compliant invoice format for accounts receivable is a standardized billing document that meets all legal requirements for Value Added Tax (VAT) reporting and collection, ensuring accurate tax calculation and transparency. This format typically includes essential elements such as the supplier's VAT registration number, invoice date, unique invoice number, description of goods or services, VAT rate applied, and total VAT amount. Using a VAT-compliant invoice helps businesses maintain proper tax records, avoid penalties, and facilitate smooth VAT audits and submissions.

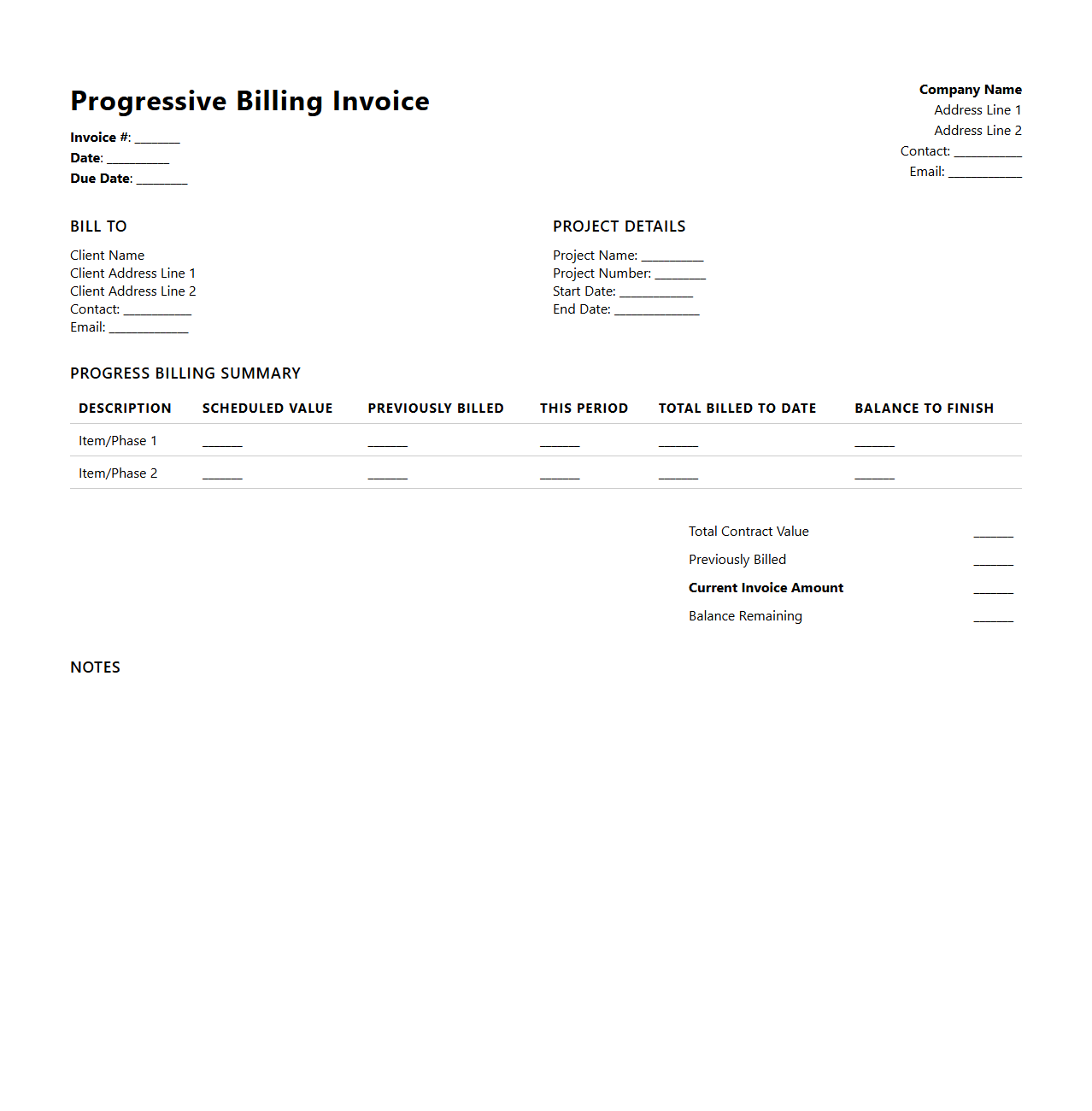

Progressive Billing Invoice Template for Accounts Receivable

A

Progressive Billing Invoice Template for Accounts Receivable is a structured document used to bill clients incrementally based on completed project milestones or percentage of work done. This template helps track partial payments efficiently, ensuring accurate financial management and timely cash flow. It includes fields for project details, billing stages, amounts due, and payment status to streamline the invoicing process.

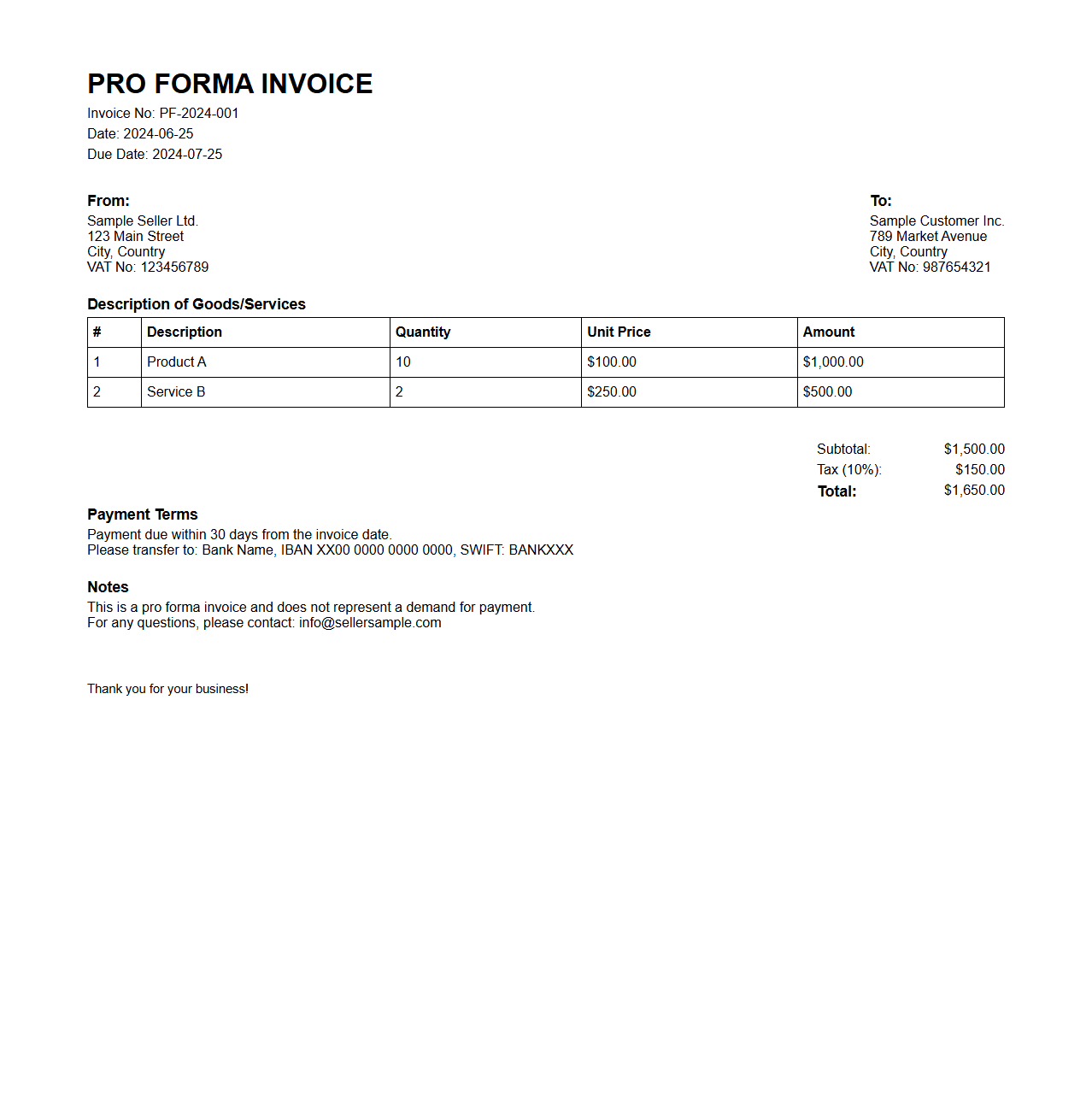

Pro Forma Invoice Example for Accounts Receivable

A

Pro Forma Invoice example for an Accounts Receivable document serves as a preliminary bill of sale sent to buyers before delivering goods or services, detailing quantities, prices, and terms. It helps the accounts receivable team track expected payments and manage cash flow by providing an official record of the transaction before the final invoice is generated. This document is essential for ensuring accurate financial forecasting and confirming order details with customers.

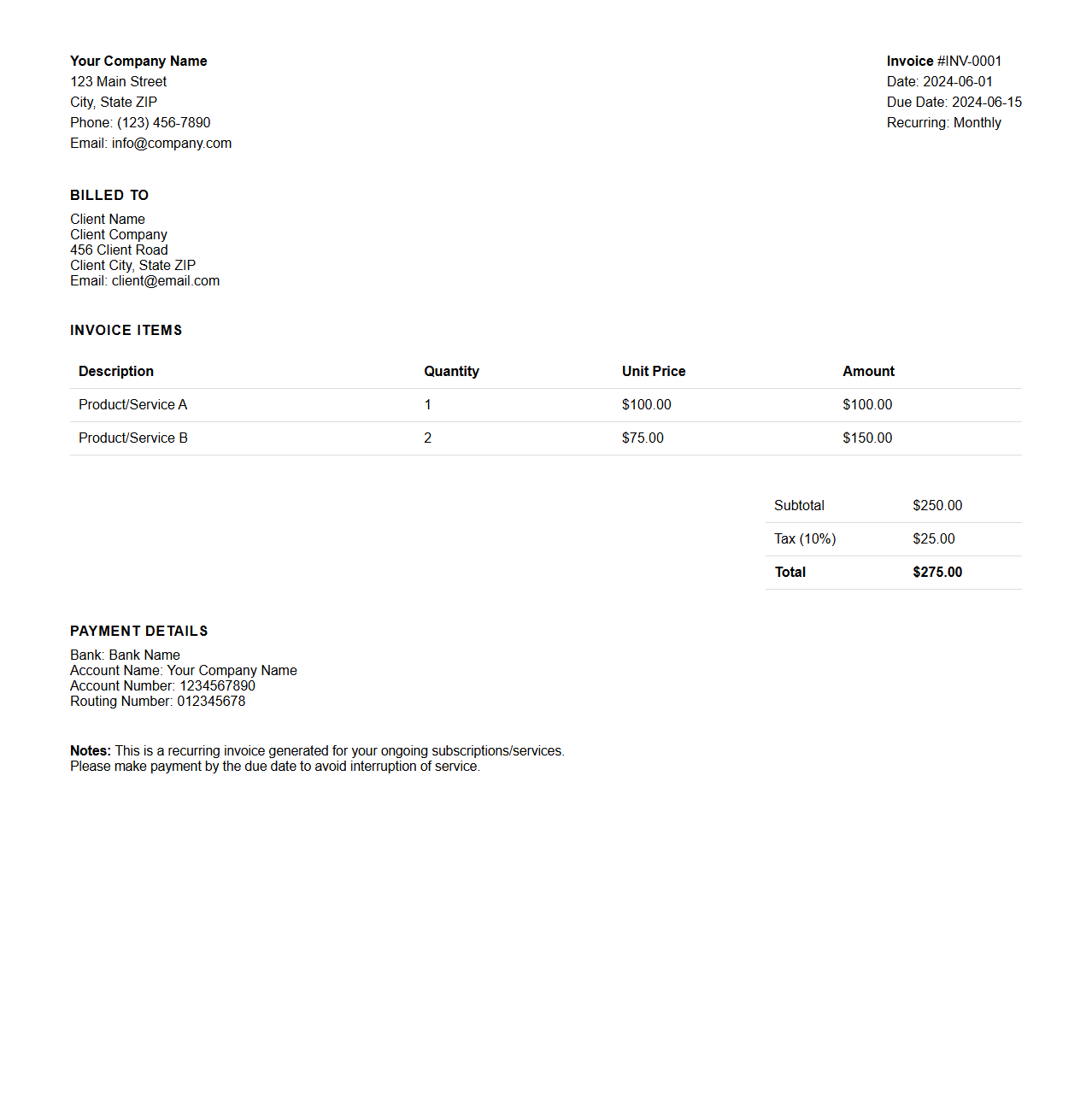

Recurring Invoice Sample for Accounts Receivable

A

Recurring Invoice Sample for Accounts Receivable is a template designed to automate billing processes by generating invoices at regular intervals for ongoing services or products. It helps businesses maintain consistent cash flow, reduce manual errors, and efficiently track outstanding payments. This document typically includes details such as client information, invoice frequency, payment terms, and a detailed list of billed items or services.

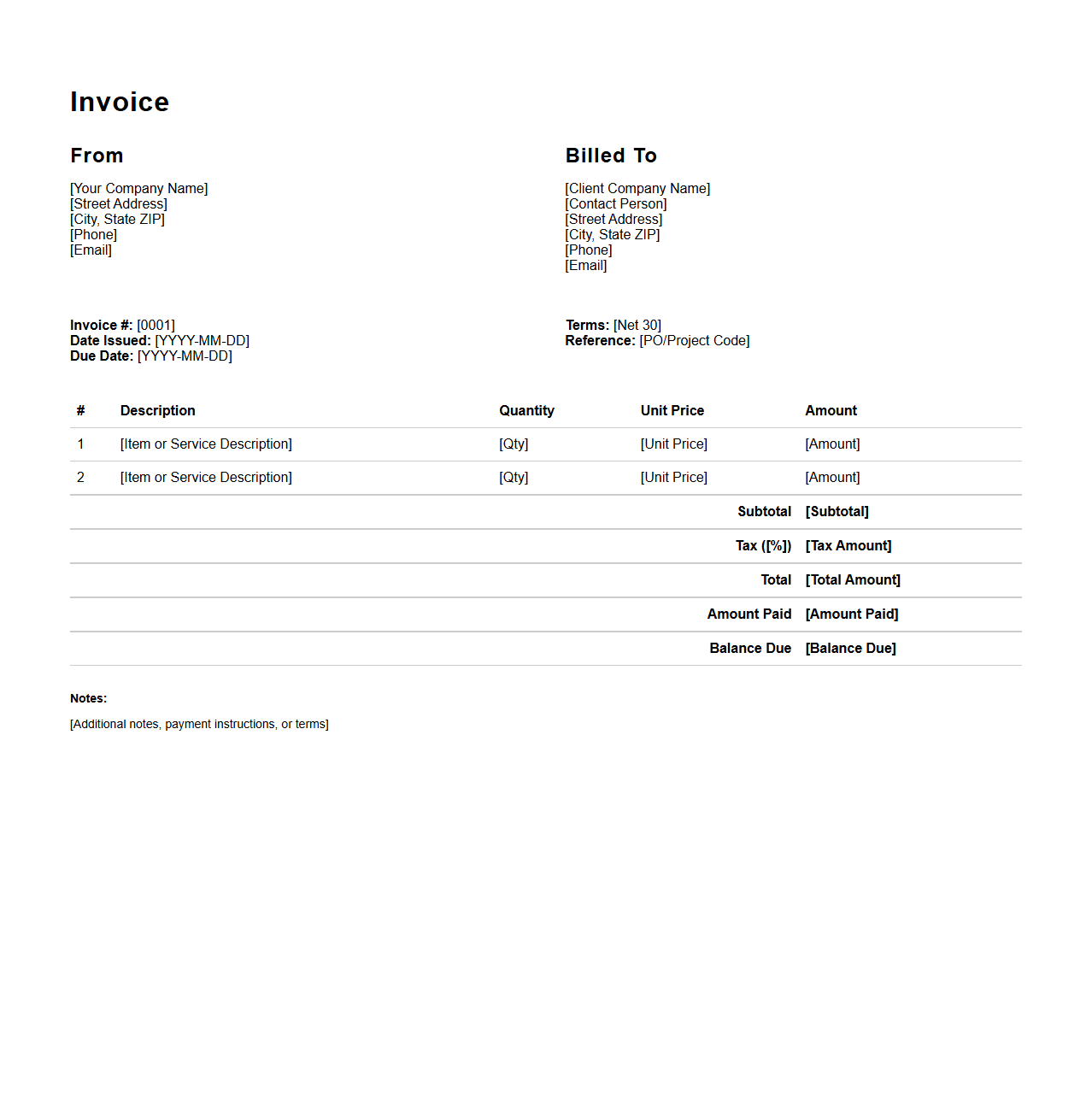

Detailed Itemized Invoice Format for Accounts Receivable

A

Detailed Itemized Invoice Format for Accounts Receivable document provides a comprehensive breakdown of all charges, including quantities, unit prices, and descriptions of products or services billed to a customer. This format ensures transparency and accuracy in financial transactions by clearly listing each item to facilitate easier verification and timely payment collection. It serves as a crucial tool for maintaining organized financial records and improving accounts receivable management.

What unique identifiers are required for custom invoice numbering in AR tracking?

Custom invoice numbering in Accounts Receivable (AR) tracking requires unique identifiers such as a sequential invoice number combined with a client-specific code. These identifiers ensure each invoice can be distinctly traced and retrieved in the system. Incorporating date stamps or project codes further enhances accuracy and reduces duplication risks.

How should disputed line items be annotated within AR invoice documents?

Disputed line items within AR invoices must be clearly annotated using standardized dispute codes or comments directly adjacent to the relevant line. This practice facilitates transparent communication and effective resolution tracking between billing and client teams. Additionally, including the dispute reason and status helps maintain a comprehensive audit trail.

What metadata is essential for automating invoice aging reports?

Automating invoice aging reports requires capturing essential metadata such as invoice date, due date, payment status, and customer details. This metadata enables accurate aging calculations and categorization of outstanding amounts by overdue periods. Integration with payment history is also crucial for real-time report accuracy.

How are partial payments reflected and documented in invoice records?

Partial payments are documented by updating the invoice balance to reflect the amount received while retaining the original invoice total. Payment records should include the date, amount applied, and any references to payment methods. This ensures transparency and keeps the accounts receivable ledger current.

What compliant digital signatures are necessary for electronic AR invoices?

Electronic AR invoices require compliant digital signatures adhering to regulations like eIDAS in the EU or UETA in the US. These signatures must ensure authenticity, integrity, and non-repudiation of the invoice document. Utilizing certified digital certificate providers strengthens legal acceptance and audit readiness.