A Payment Voucher Document Sample for financial transactions serves as a crucial proof of payment, detailing the amount, date, and recipient involved in the transaction. It helps maintain accurate financial records and supports audit trails by documenting authorization and payment verification. This voucher ensures transparency and accountability in managing company expenses.

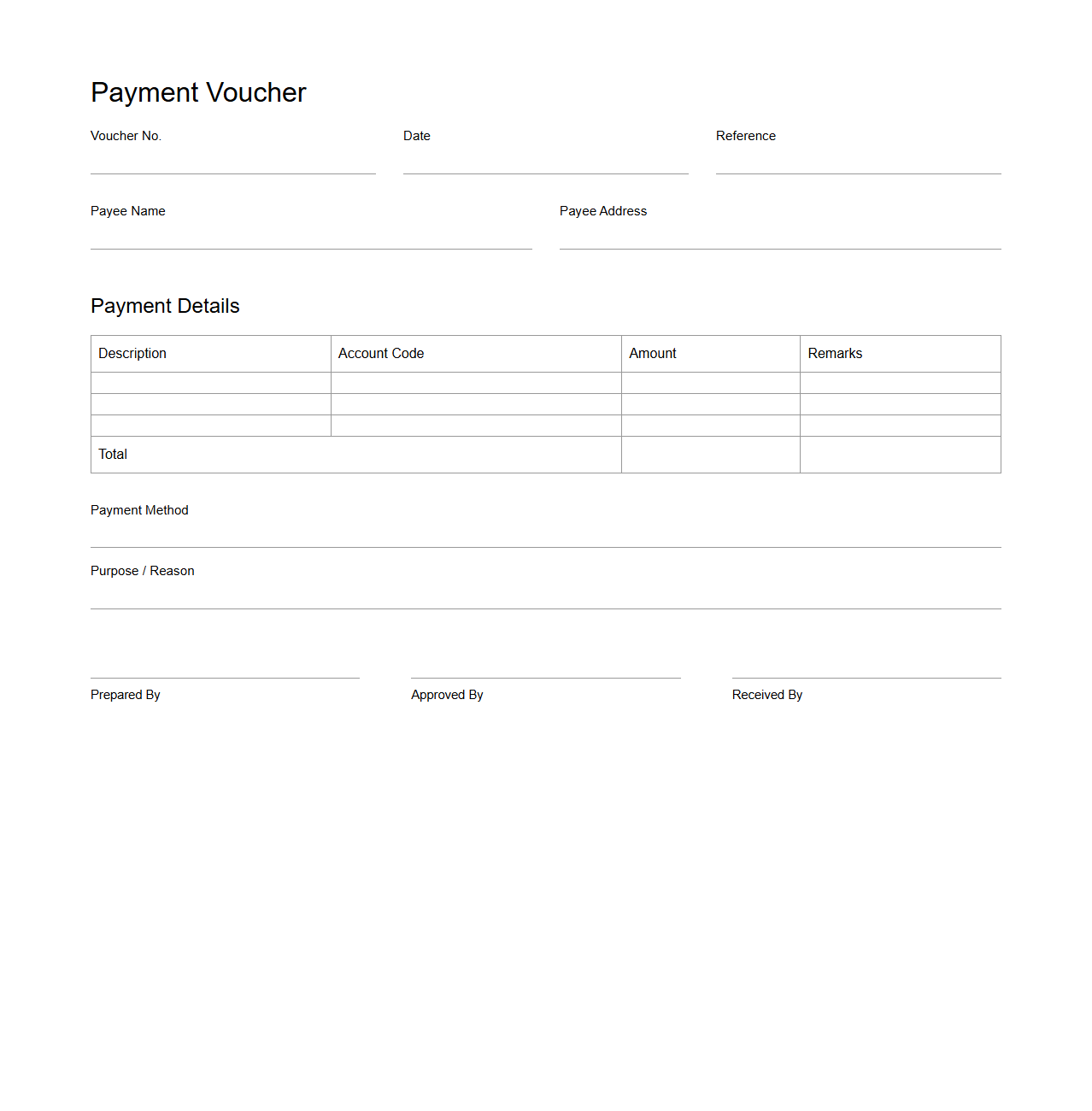

Payment Voucher Template for Business Transactions

A

Payment Voucher Template for business transactions is a pre-formatted document used to record and authorize payments made by a company. It typically includes details such as the payee's name, payment amount, date, purpose, and approval signatures, ensuring accurate financial tracking and accountability. This template streamlines the payment process, reduces errors, and serves as an essential audit trail for both internal and external financial reviews.

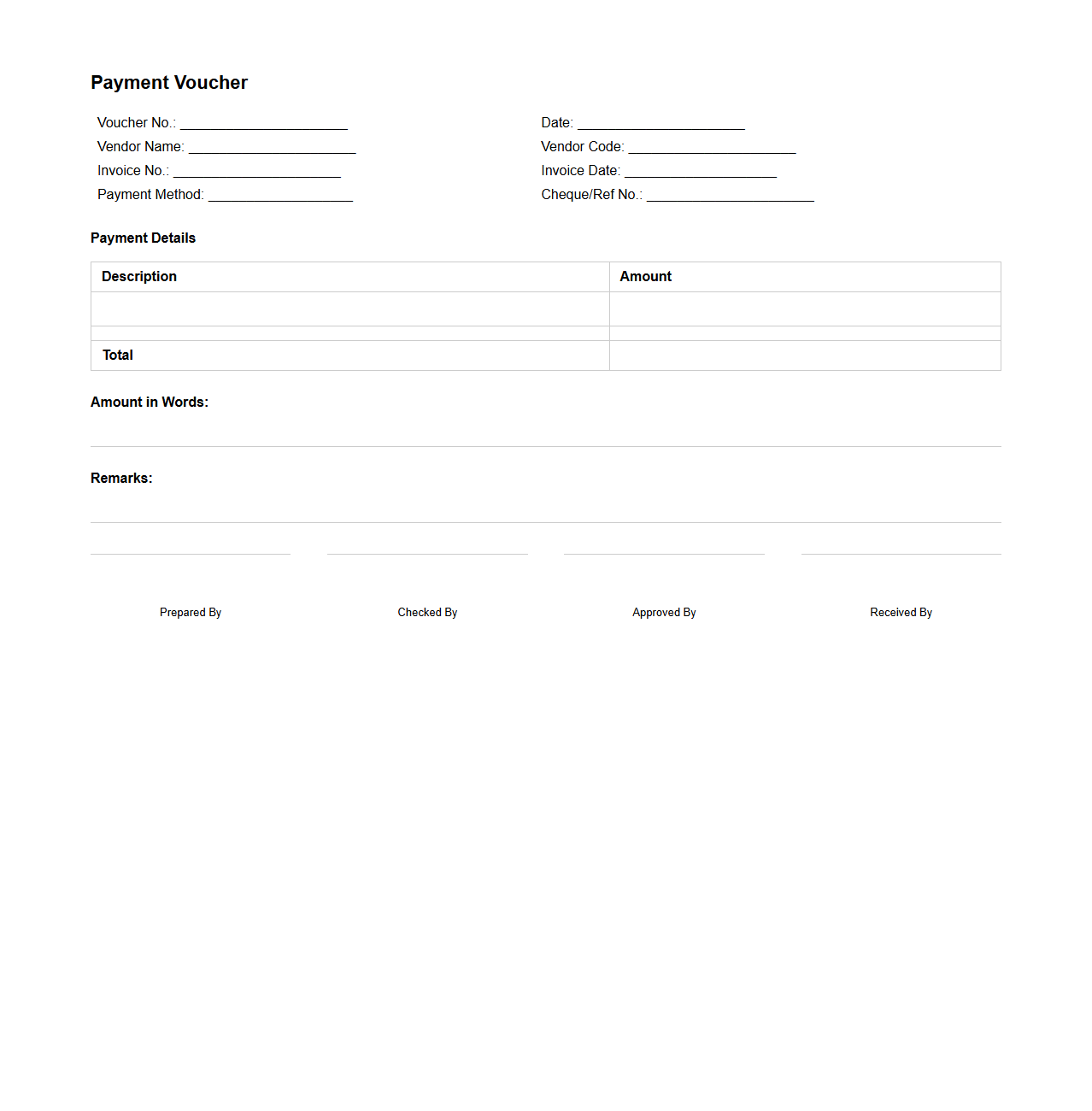

Payment Voucher Format for Vendor Payments

A

Payment Voucher Format for Vendor Payments is a standardized document used to authorize and record payments made to vendors or suppliers. It includes essential details such as vendor information, invoice number, payment amount, payment method, and approval signatures to ensure accurate and transparent financial transactions. This format facilitates effective payment processing, auditing, and financial record-keeping within organizations.

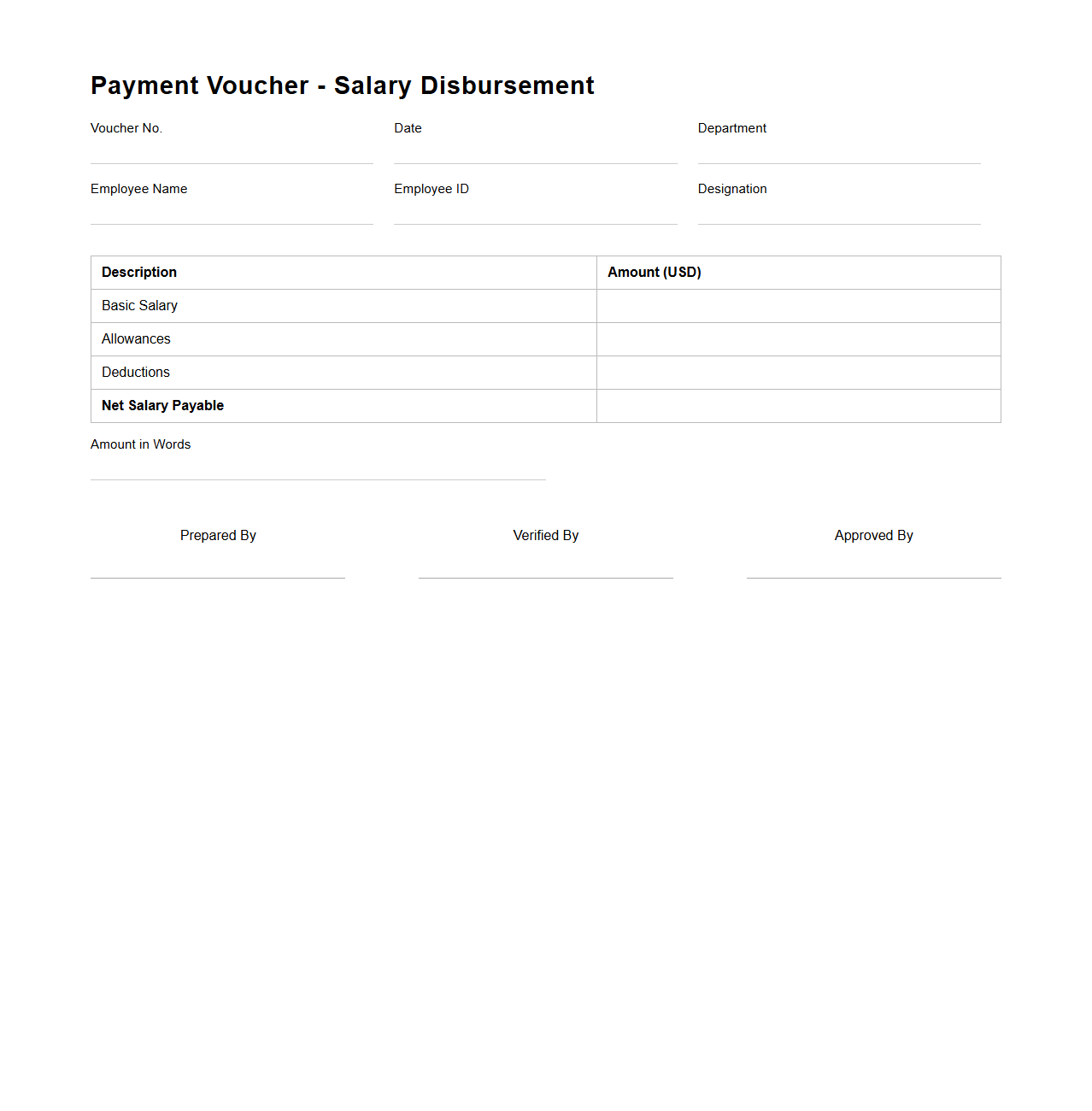

Payment Voucher Example for Salary Disbursement

A

Payment Voucher for Salary Disbursement is a financial document used to authorize and record the payment of employee salaries. It includes essential details such as employee name, salary amount, payment date, and payment method, ensuring accurate tracking and verification of salary transactions. This voucher serves as proof of payment and aids in maintaining transparent payroll records for auditing and compliance purposes.

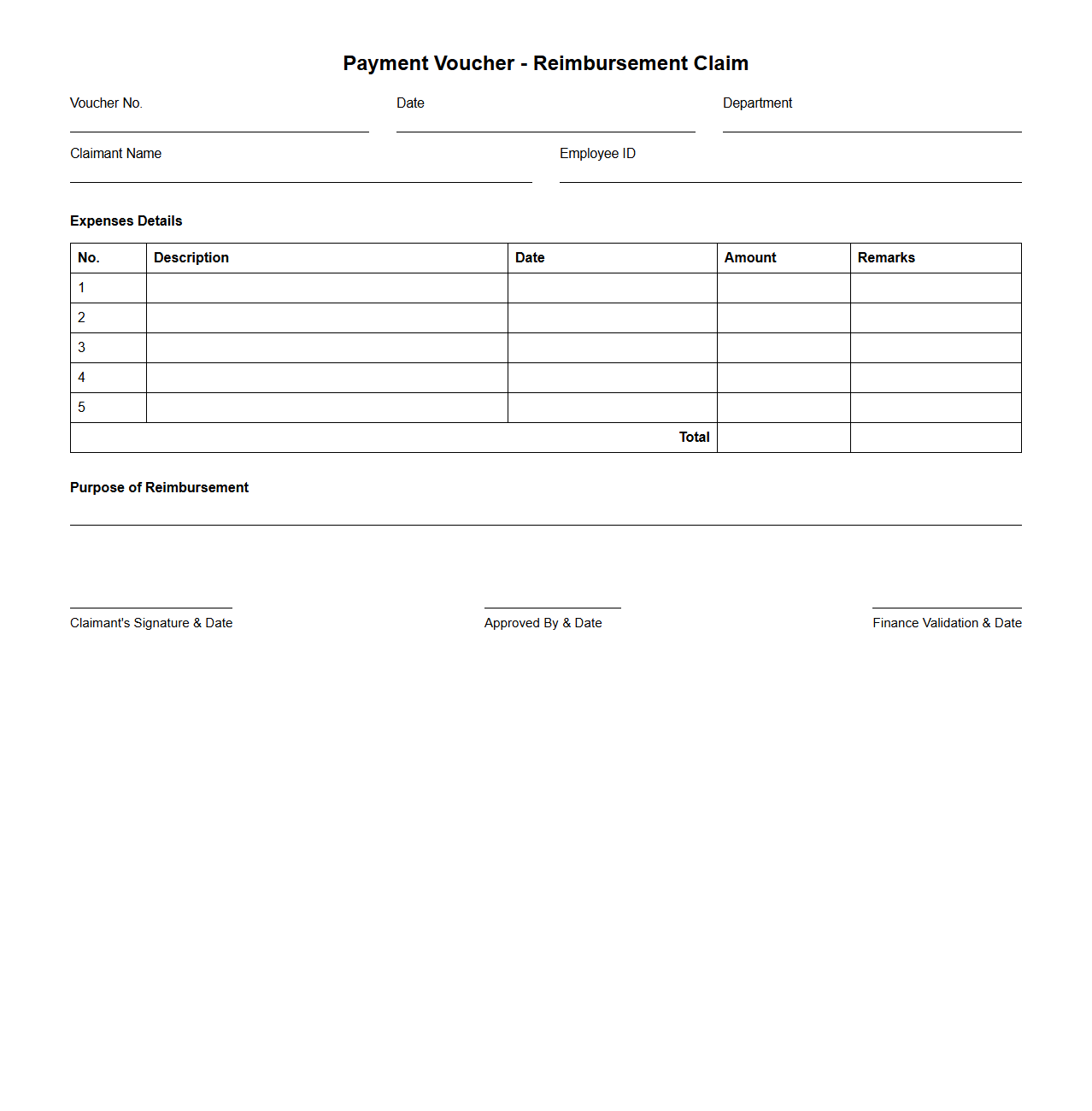

Payment Voucher Sample for Reimbursement Claims

A

Payment Voucher Sample for Reimbursement Claims document serves as a formal record used to request repayment for expenses incurred on behalf of an organization. It typically includes details such as the claimant's information, description of expenses, date of transactions, amount claimed, and supporting receipts. This document ensures transparency, accuracy, and proper authorization in the reimbursement process.

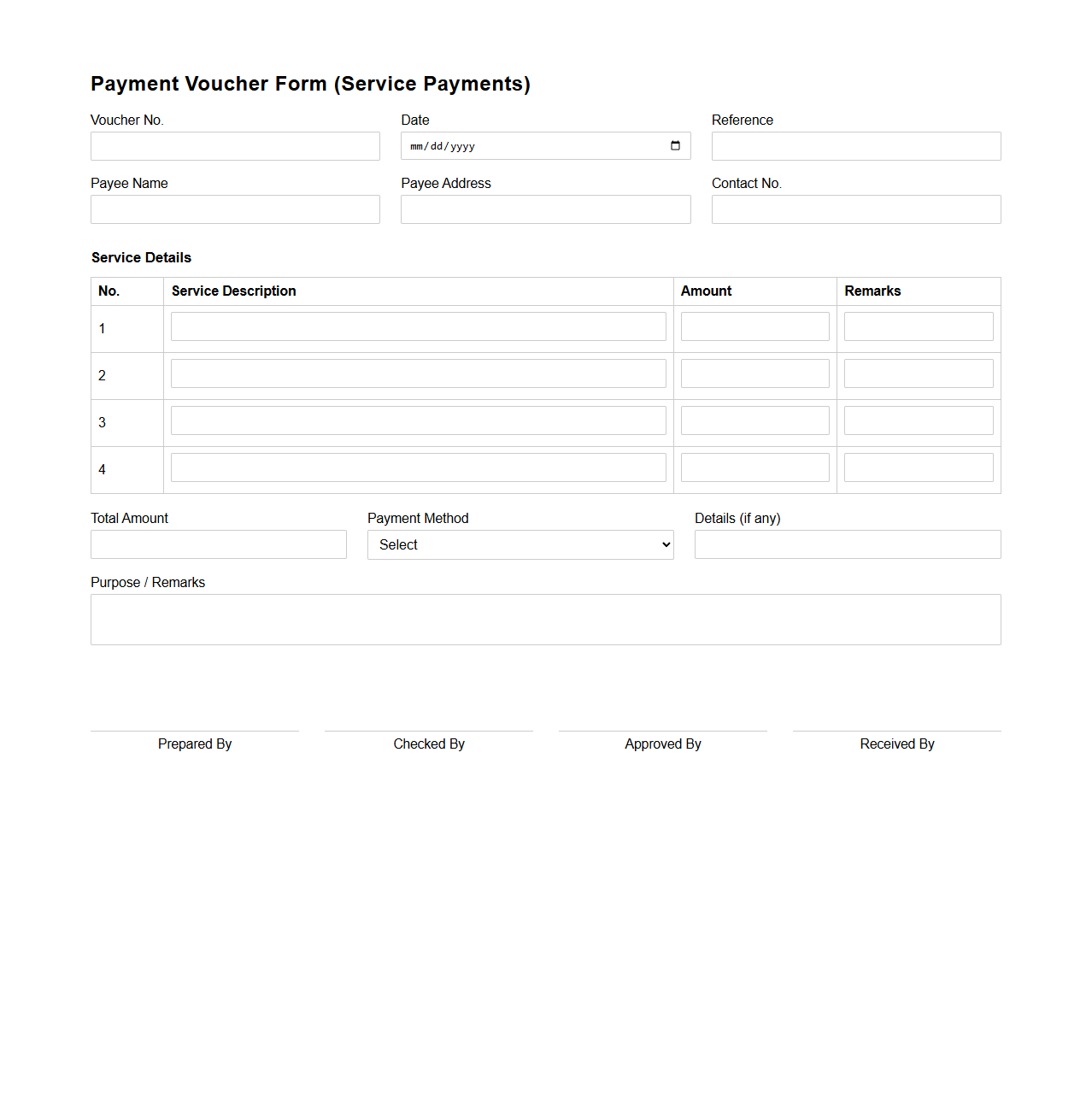

Payment Voucher Form for Service Payments

A

Payment Voucher Form for Service Payments document is a financial record used to authorize and process payments for services rendered. It includes details such as the service provider's information, payment amount, invoice reference, and approval signatures to ensure accurate and authorized disbursement. This form helps maintain clear accountability and audit trails within organizational payment processes.

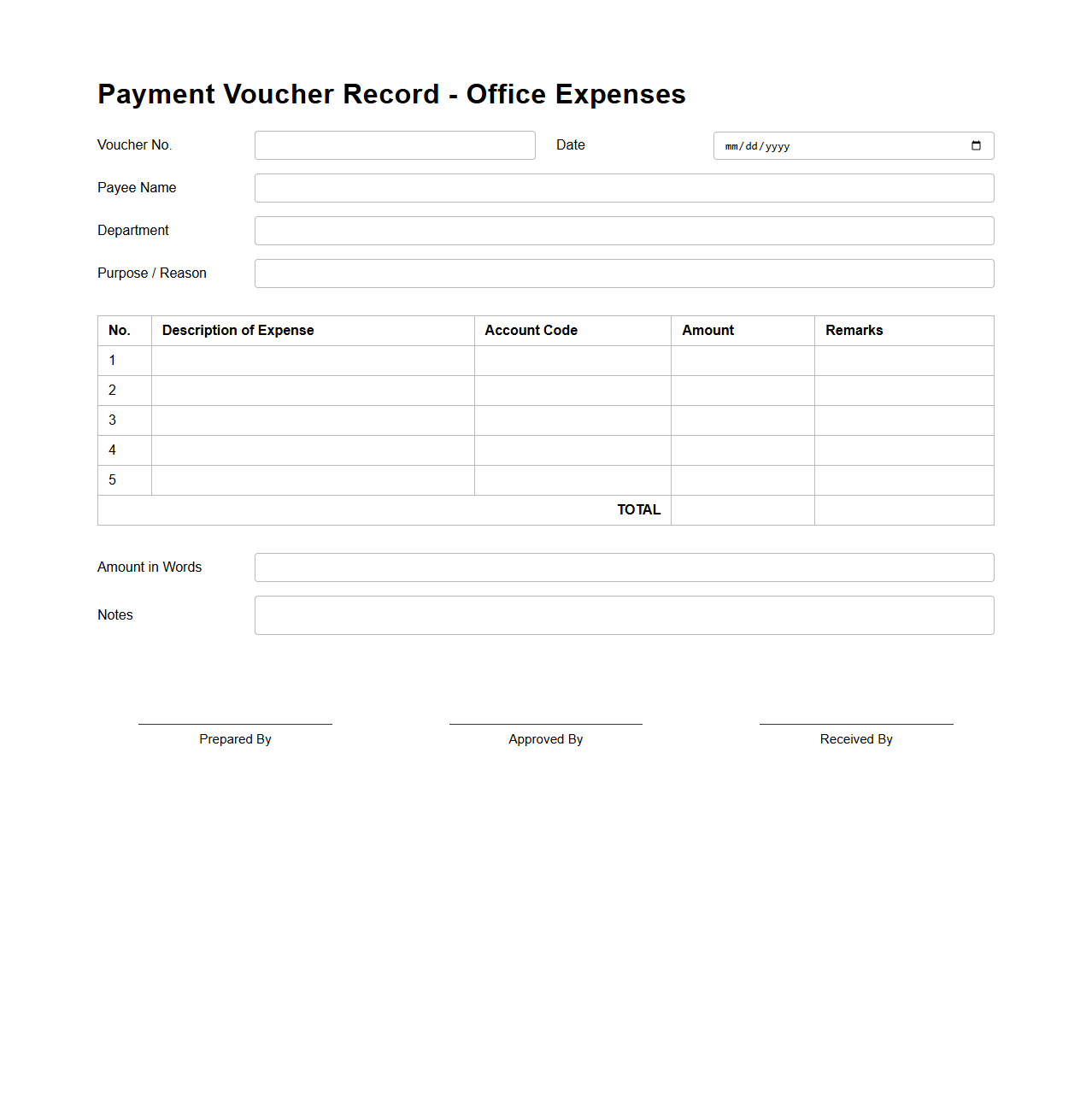

Payment Voucher Record for Office Expenses

A

Payment Voucher Record for Office Expenses document serves as a formal proof of payment made for various office-related costs, ensuring accurate financial tracking and accountability. It typically includes details such as the date, amount, payee, description of expenses, and authorization signatures, facilitating transparent record-keeping and audit compliance. Maintaining this document helps organizations manage budgets effectively and supports expense reimbursement processes.

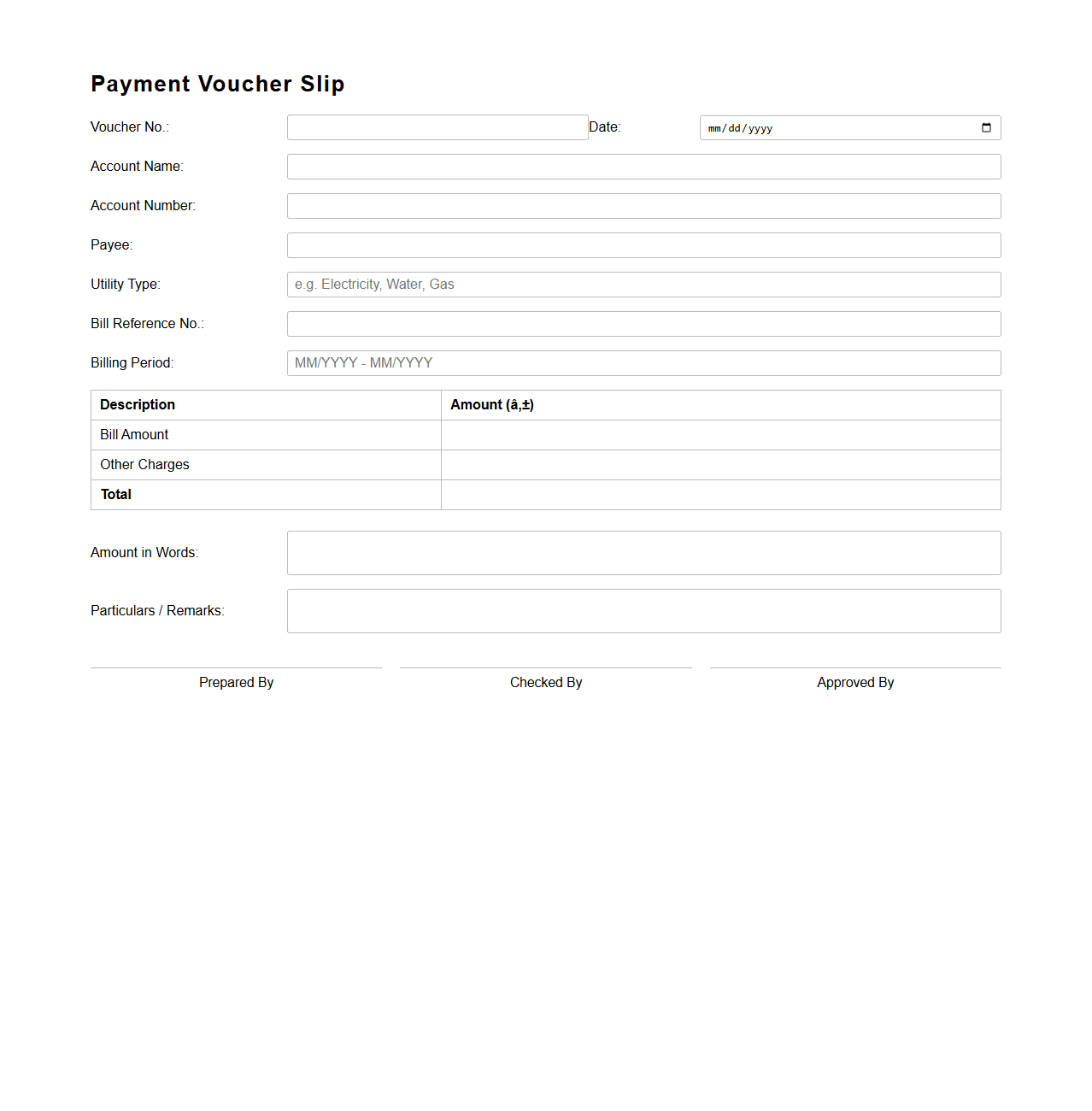

Payment Voucher Slip for Utility Bill Settlement

A

Payment Voucher Slip for Utility Bill Settlement is an official document used to authorize and record the payment of utility bills such as electricity, water, or gas. It contains details such as the payee's information, payment amount, date, and the specific utility account being settled. This slip serves as proof of transaction and helps maintain accurate financial records for both individuals and organizations.

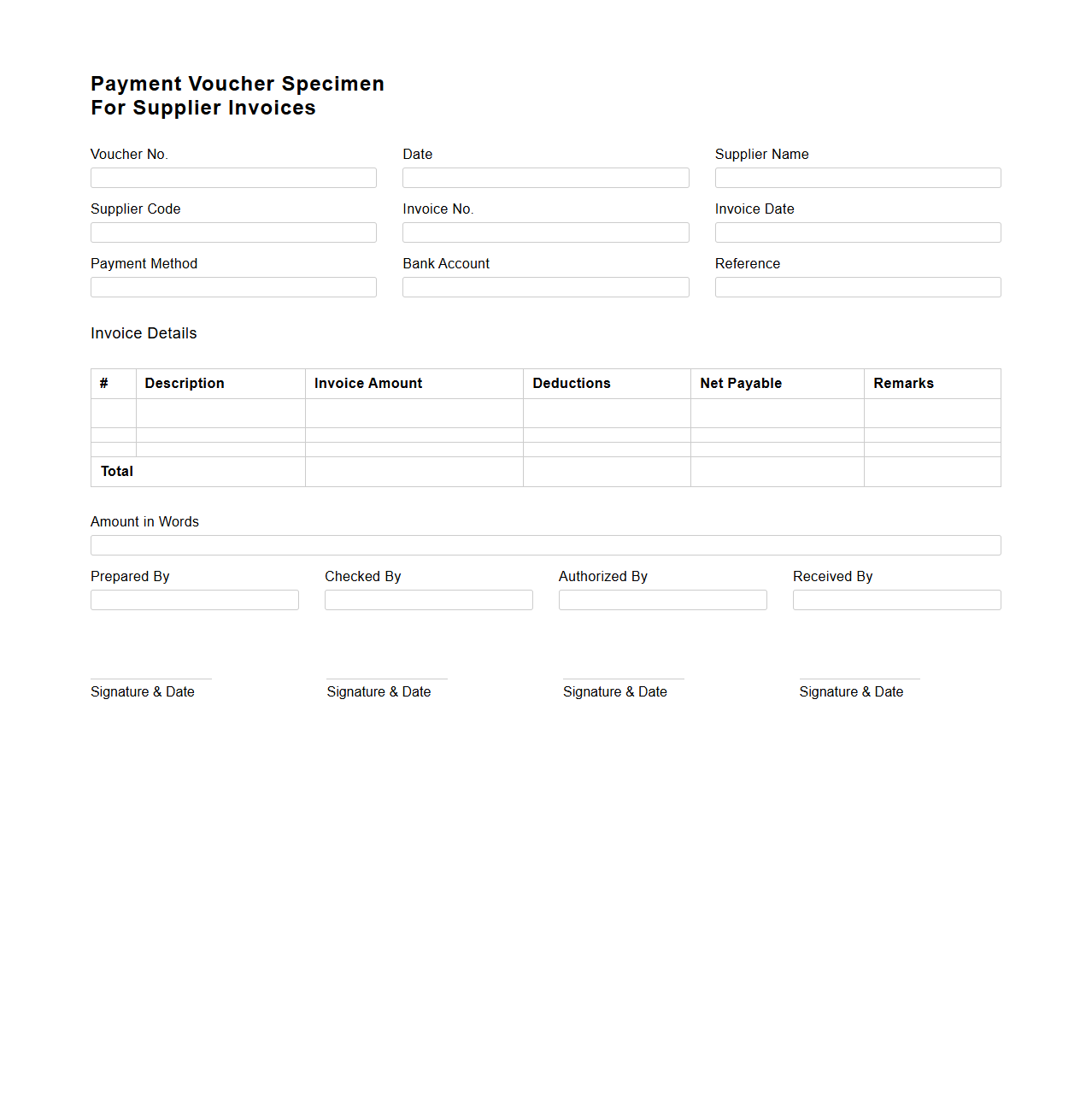

Payment Voucher Specimen for Supplier Invoices

A

Payment Voucher Specimen for Supplier Invoices is a standardized template used to document and authenticate payments made to suppliers. It includes essential details such as invoice number, payment amount, date, and approval signatures, ensuring accurate record-keeping and verification. This document facilitates transparent financial transactions and streamlines the accounts payable process for businesses.

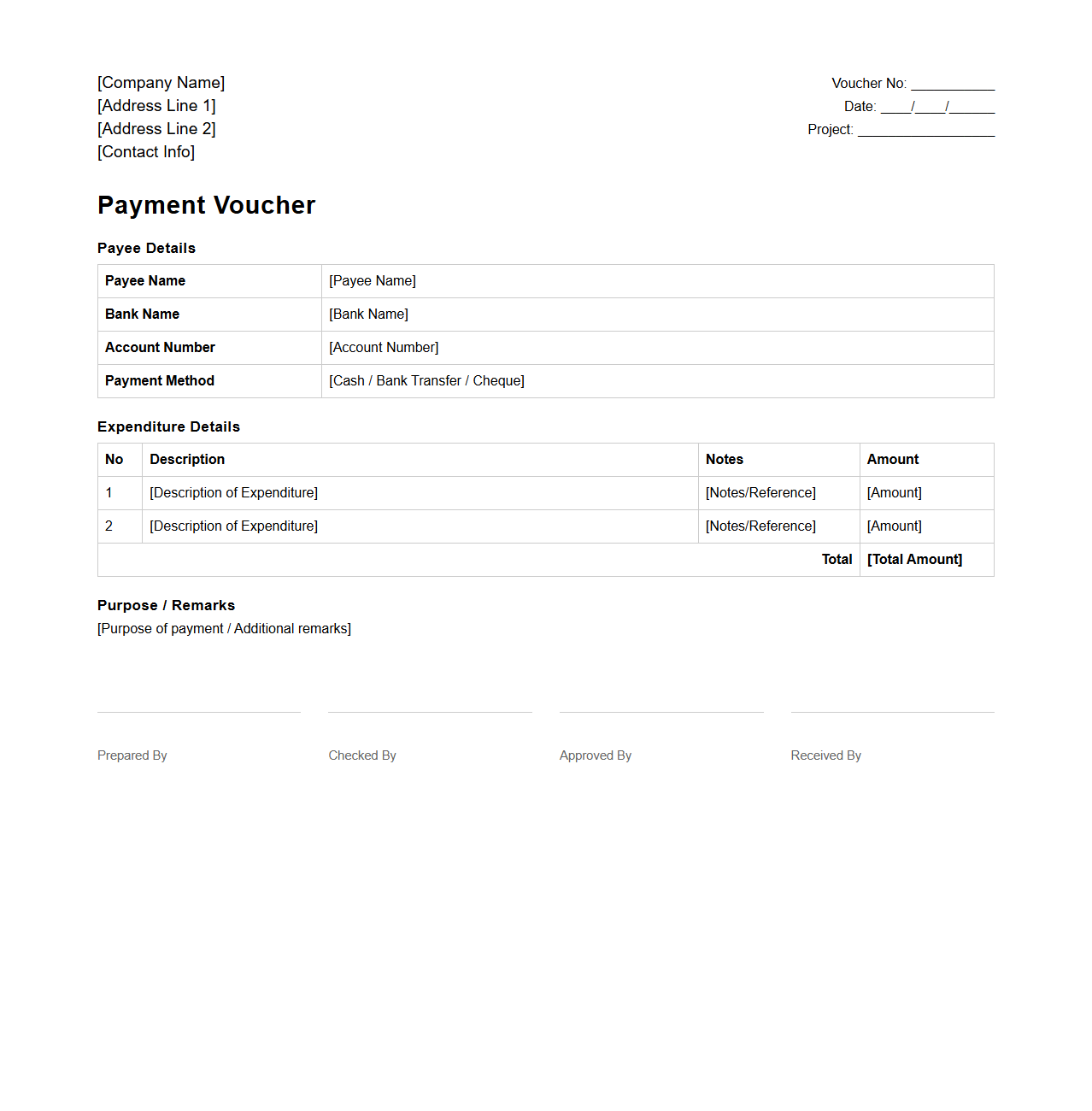

Payment Voucher Layout for Project Expenditure

A

Payment Voucher Layout for Project Expenditure document organizes essential financial details such as project codes, expense categories, vendor information, and approval signatures in a structured format. It ensures accurate tracking, verification, and authorization of payments related to project activities, promoting transparency and accountability. This layout facilitates efficient financial management by standardizing the documentation process for all project-related disbursements.

Payment Voucher Statement for Cash Advances

A

Payment Voucher Statement for Cash Advances is a financial document used to record and authorize the disbursement of cash advances to employees or departments. It details the amount advanced, purpose, recipient's information, and approval signatures, ensuring transparency and proper accountability. This statement serves as a key record for auditing and reconciliation in the organization's cash management process.

What essential details must a Payment Voucher Document include for accurate audit trails?

A Payment Voucher Document must include the payment date, payee details, and the amount paid to ensure a clear audit trail. It should also specify the purpose of the payment and the supporting invoice or receipt numbers. Proper documentation helps auditors trace every transaction back to its origin effortlessly.

How does a Payment Voucher Document ensure compliance with company expenditure policies?

The Payment Voucher Document enforces company expenditure policies by requiring detailed descriptions and prior approvals for all expenses. It serves as evidence that payments align with budget limits and authorized spending categories. Regular audits of vouchers maintain adherence to financial protocols.

Which authorization levels are required for validating a Payment Voucher in large organizations?

Large organizations typically mandate multiple authorization levels including department heads, finance managers, and sometimes executive approval depending on the payment amount. This multi-tiered validation enhances internal controls and reduces the risk of unauthorized disbursements. Clear delegation of authority ensures only valid vouchers are processed.

What common errors occur during the manual preparation of Payment Vouchers for financial transactions?

Manual preparation of Payment Vouchers often leads to errors such as incorrect amounts, missing signatures, or inadequate supporting documentation. These mistakes can delay processing and complicate audit verification. Human errors increase risks of fraud and financial discrepancies without proper checks.

How can digital Payment Voucher Documents enhance transparency in payment approval workflows?

Digital Payment Voucher Documents improve transparency by providing real-time tracking of payment approvals and electronic audit trails. Automated workflows ensure all necessary authorizations are obtained before release of funds. This reduces errors and increases accountability across the payment process.