A Loan Agreement Document Sample for Personal Loans outlines the terms and conditions between the lender and borrower, including loan amount, interest rate, repayment schedule, and obligations. This document ensures clarity and legal protection for both parties throughout the loan process. Customizing the sample helps address specific personal loan details and compliance requirements effectively.

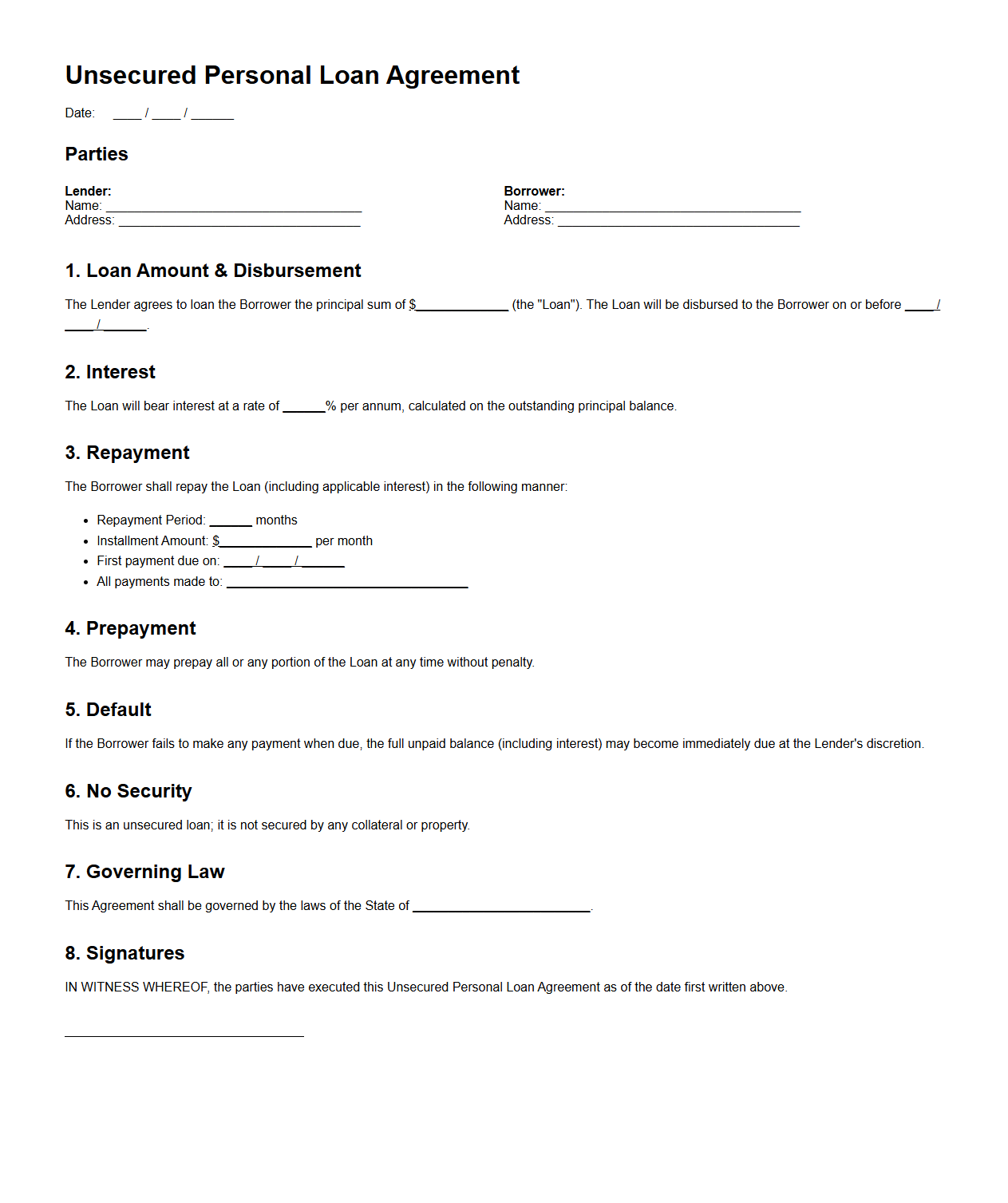

Unsecured Personal Loan Agreement Template

An

Unsecured Personal Loan Agreement Template document outlines the terms and conditions between a lender and borrower for a loan without collateral. This template clearly specifies the loan amount, interest rate, repayment schedule, and obligations of both parties to ensure legal protection and mutual understanding. Using this document helps streamline the loan process while reducing disputes by providing a standardized framework for personal loan agreements.

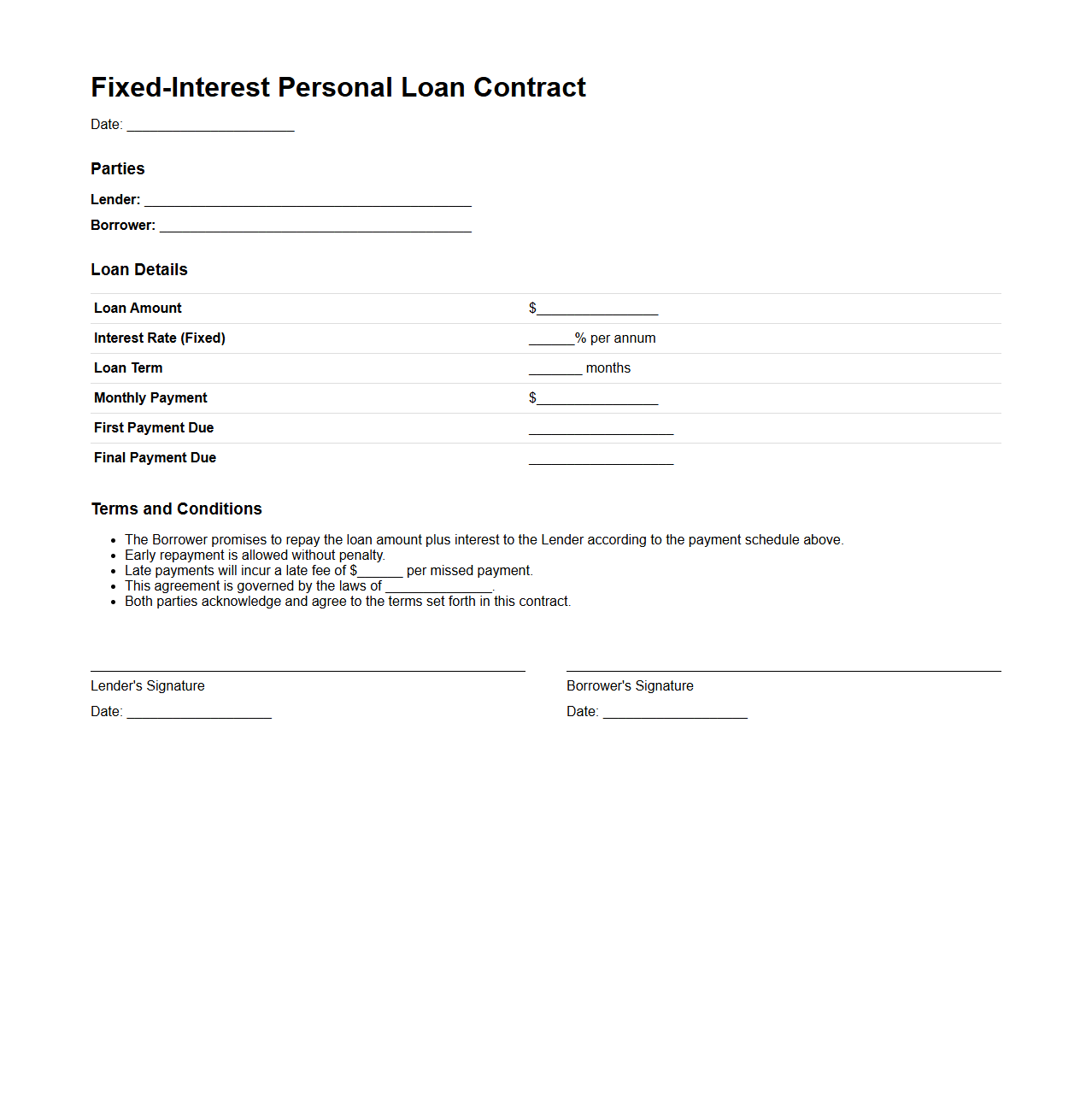

Fixed-Interest Personal Loan Contract Sample

A

Fixed-Interest Personal Loan Contract Sample document outlines the terms and conditions for a loan with a fixed interest rate, ensuring consistent repayment amounts throughout the loan term. It includes crucial details such as the loan amount, interest rate, repayment schedule, and obligations of both borrower and lender. This sample serves as a legal template to help borrowers understand their commitments and lenders maintain clarity in loan agreements.

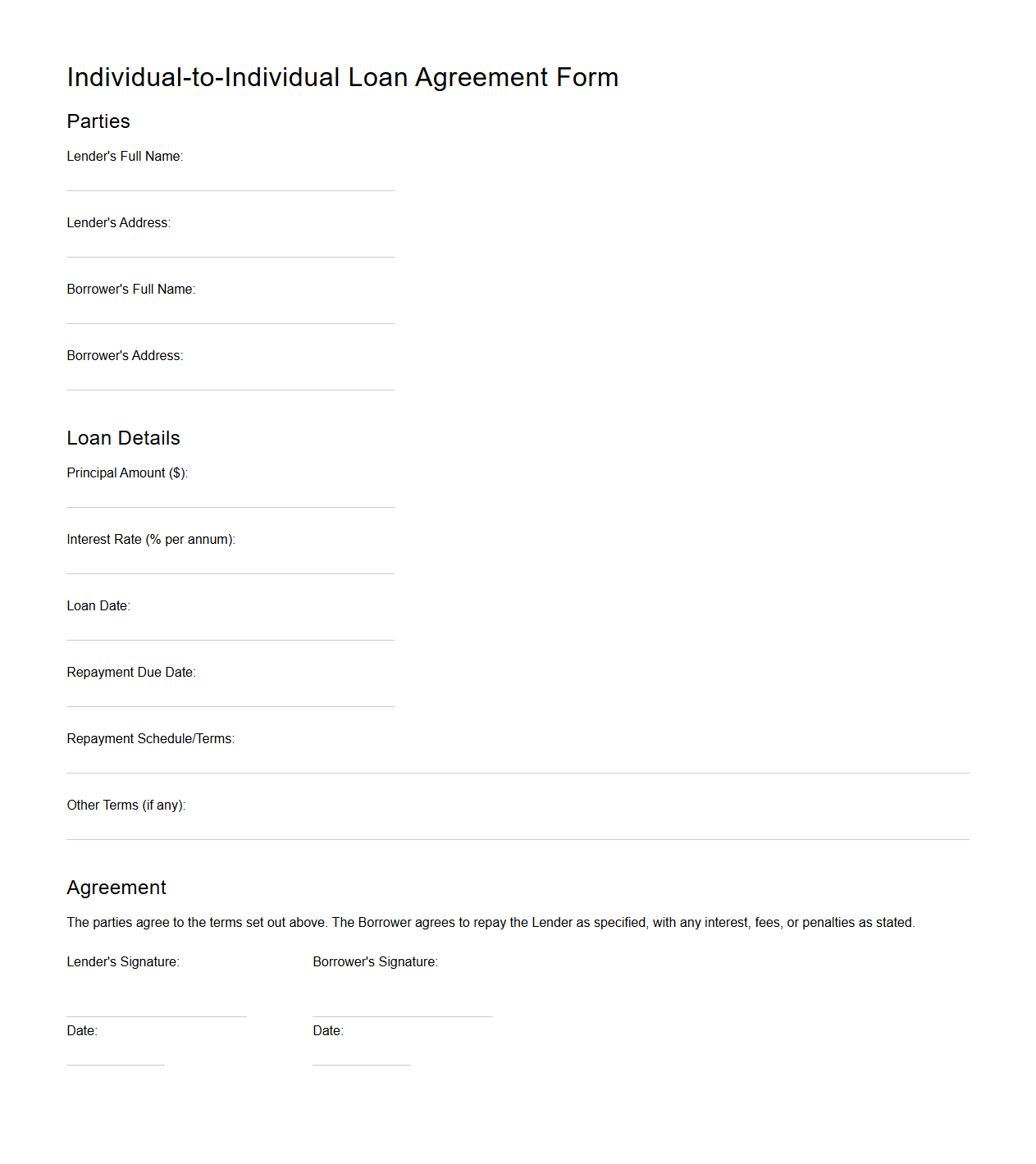

Individual-to-Individual Loan Agreement Form

An

Individual-to-Individual Loan Agreement Form is a legally binding document that outlines the terms and conditions of a loan between two private parties without involving financial institutions. It specifies the loan amount, interest rate, repayment schedule, and responsibilities of both lender and borrower to ensure clarity and reduce disputes. This form serves as essential proof of the loan agreement, protecting the interests of both individuals in personal lending transactions.

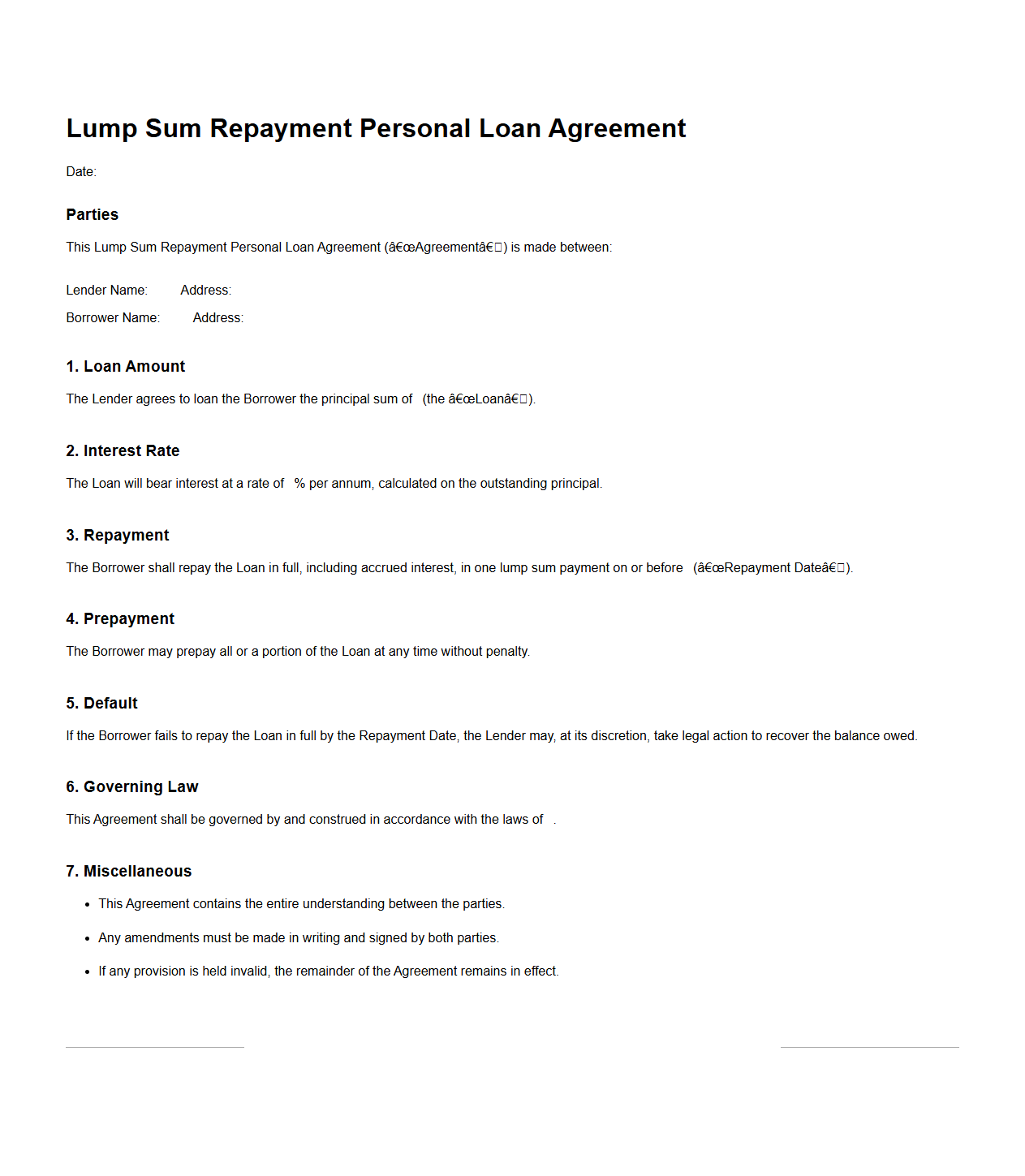

Lump Sum Repayment Personal Loan Agreement

A

Lump Sum Repayment Personal Loan Agreement document outlines the terms under which a borrower agrees to repay an entire loan amount in a single payment by a specified date. This agreement specifies the principal amount, interest rate, payment deadline, and any penalties for late payment. It legally binds both lender and borrower to the agreed repayment conditions, ensuring clarity and enforceability.

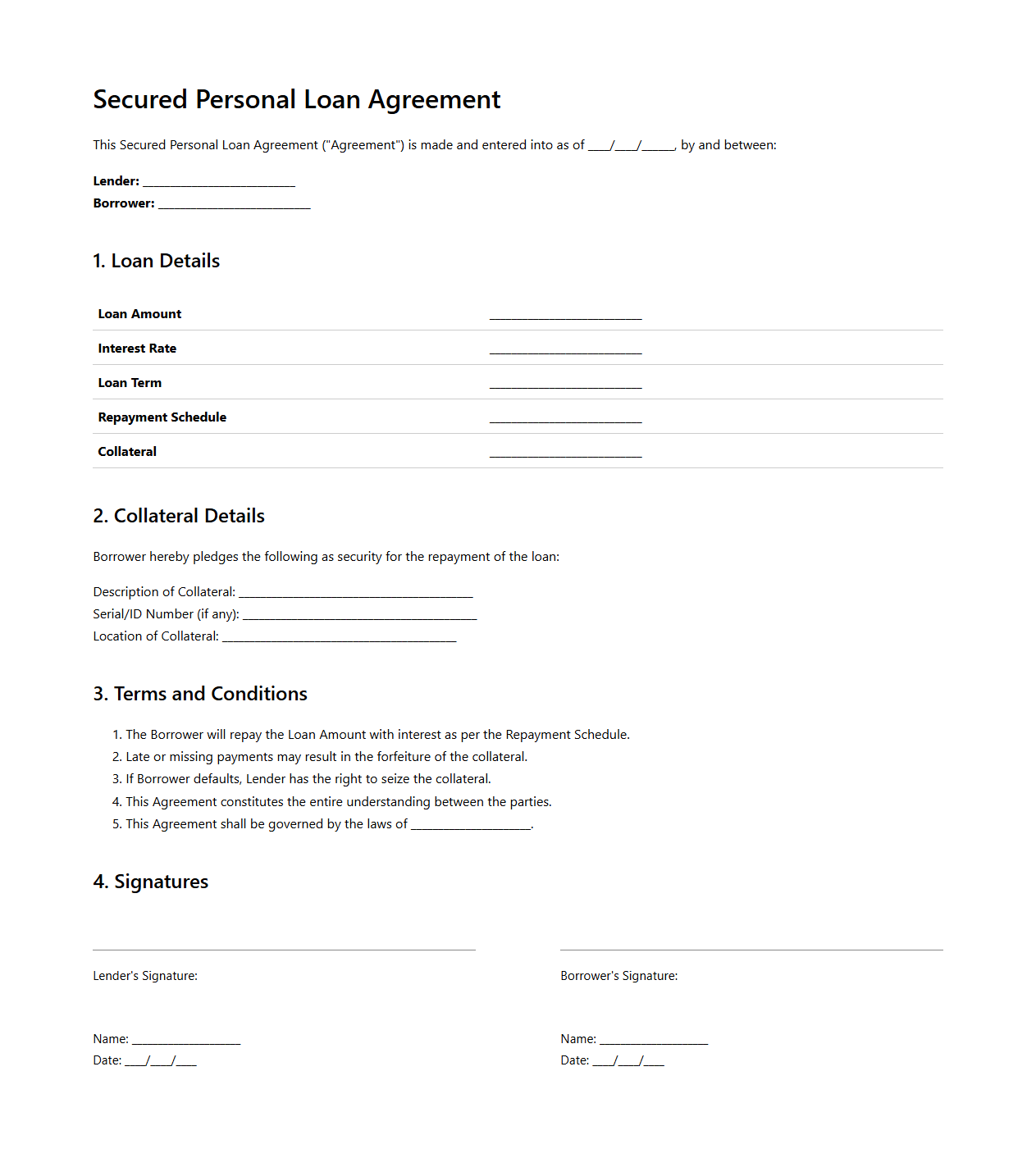

Secured Personal Loan Document Example

A

Secured Personal Loan Document Example serves as a template illustrating the essential paperwork required to obtain a secured personal loan, which involves using assets like a vehicle or property as collateral. This document typically includes borrower and lender details, loan amount, interest rates, repayment terms, and collateral description to ensure legal and financial clarity. Reviewing such examples helps borrowers understand contract obligations and prepare necessary documents efficiently during the loan application process.

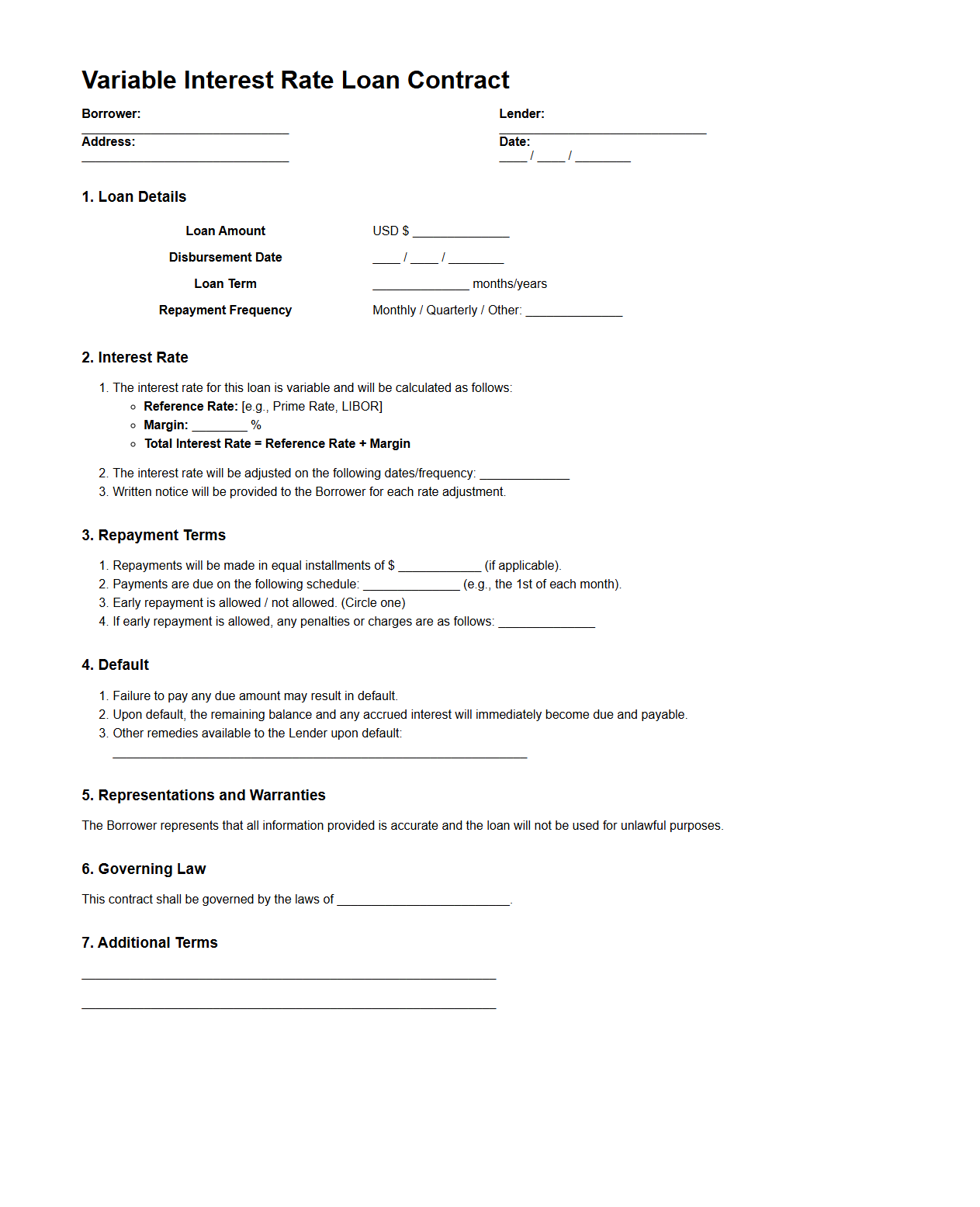

Variable Interest Rate Loan Contract Template

A

Variable Interest Rate Loan Contract Template is a legally binding document used to outline the terms and conditions of a loan with an interest rate that fluctuates based on a benchmark or index. It specifies key details such as the initial interest rate, adjustment periods, margin, and the method of calculating rate changes to ensure transparency between lender and borrower. This template helps standardize loan agreements, reducing disputes and providing a clear framework for managing interest rate variations over the loan term.

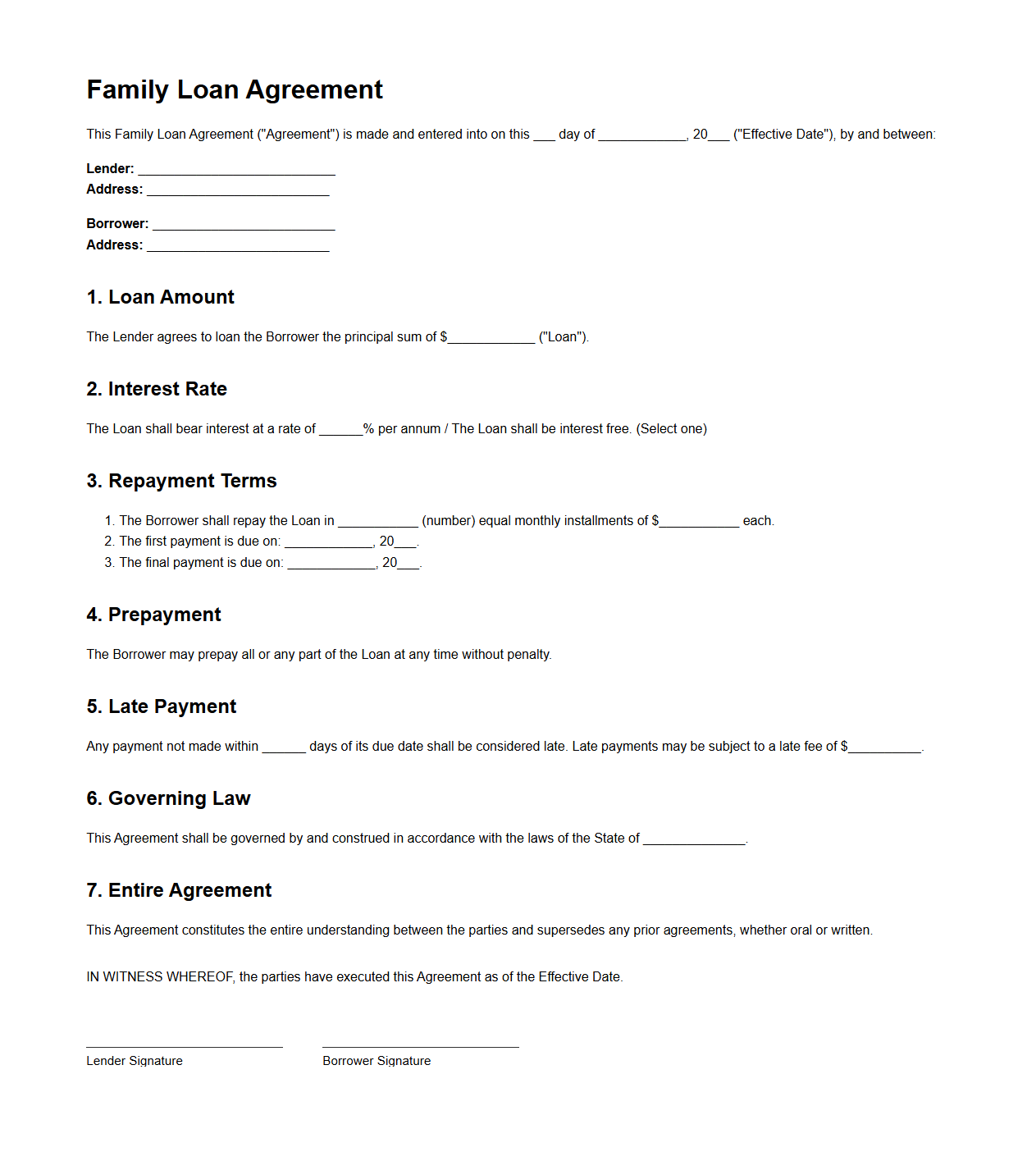

Family Loan Agreement Sample

A

Family Loan Agreement Sample document serves as a legally binding template to outline the terms and conditions of a loan between family members, ensuring clarity and preventing misunderstandings. It typically includes essential details such as loan amount, repayment schedule, interest rates, and responsibilities of both lender and borrower. Utilizing such a sample helps formalize informal loans within familial relationships, promoting transparency and protecting the financial interests of all parties involved.

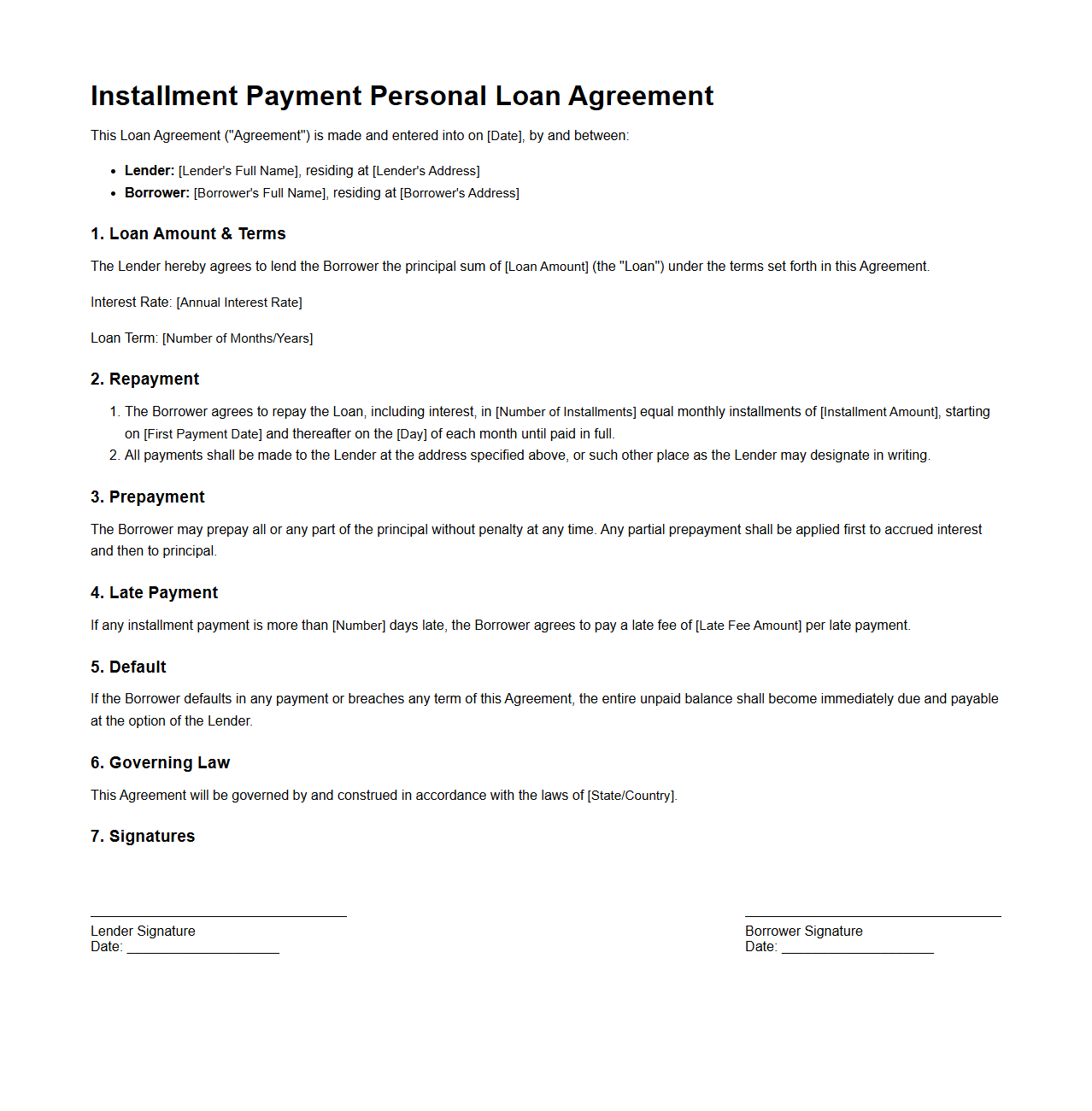

Installment Payment Personal Loan Agreement

An

Installment Payment Personal Loan Agreement document is a legal contract that outlines the terms and conditions between a lender and borrower for a loan repaid through scheduled fixed payments over a specified period. It specifies the loan amount, interest rate, repayment schedule, duration, and consequences of default. This document ensures both parties have a clear understanding of their obligations, protecting their rights and facilitating transparent financial transactions.

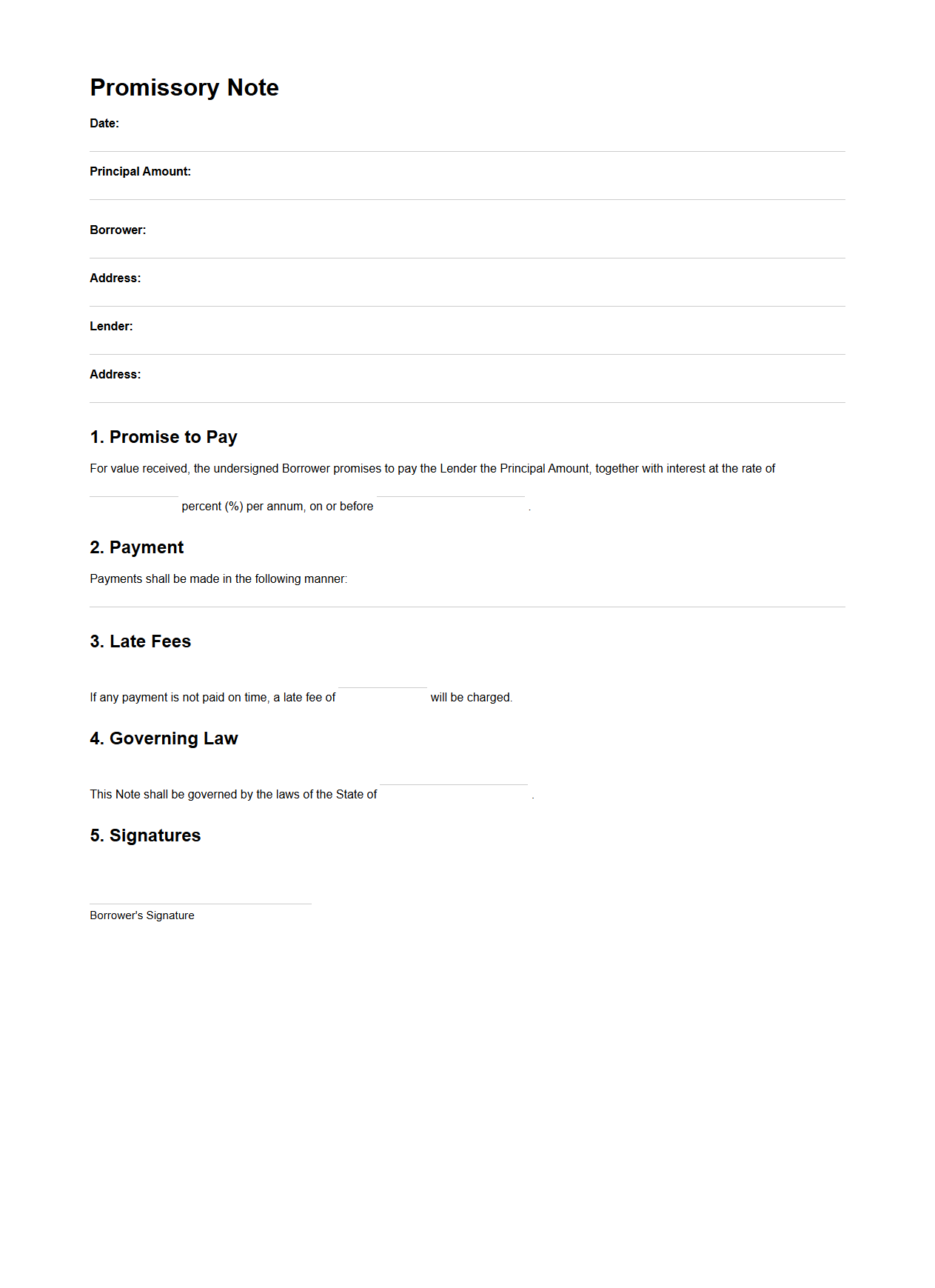

Promissory Note for Personal Loan

A

Promissory Note for Personal Loan is a legal document outlining the terms and conditions under which a borrower agrees to repay a loan to the lender. It specifies the loan amount, interest rate, repayment schedule, and consequences of default, serving as a binding agreement to protect both parties. This document ensures clarity and accountability, making it essential for personal loan transactions.

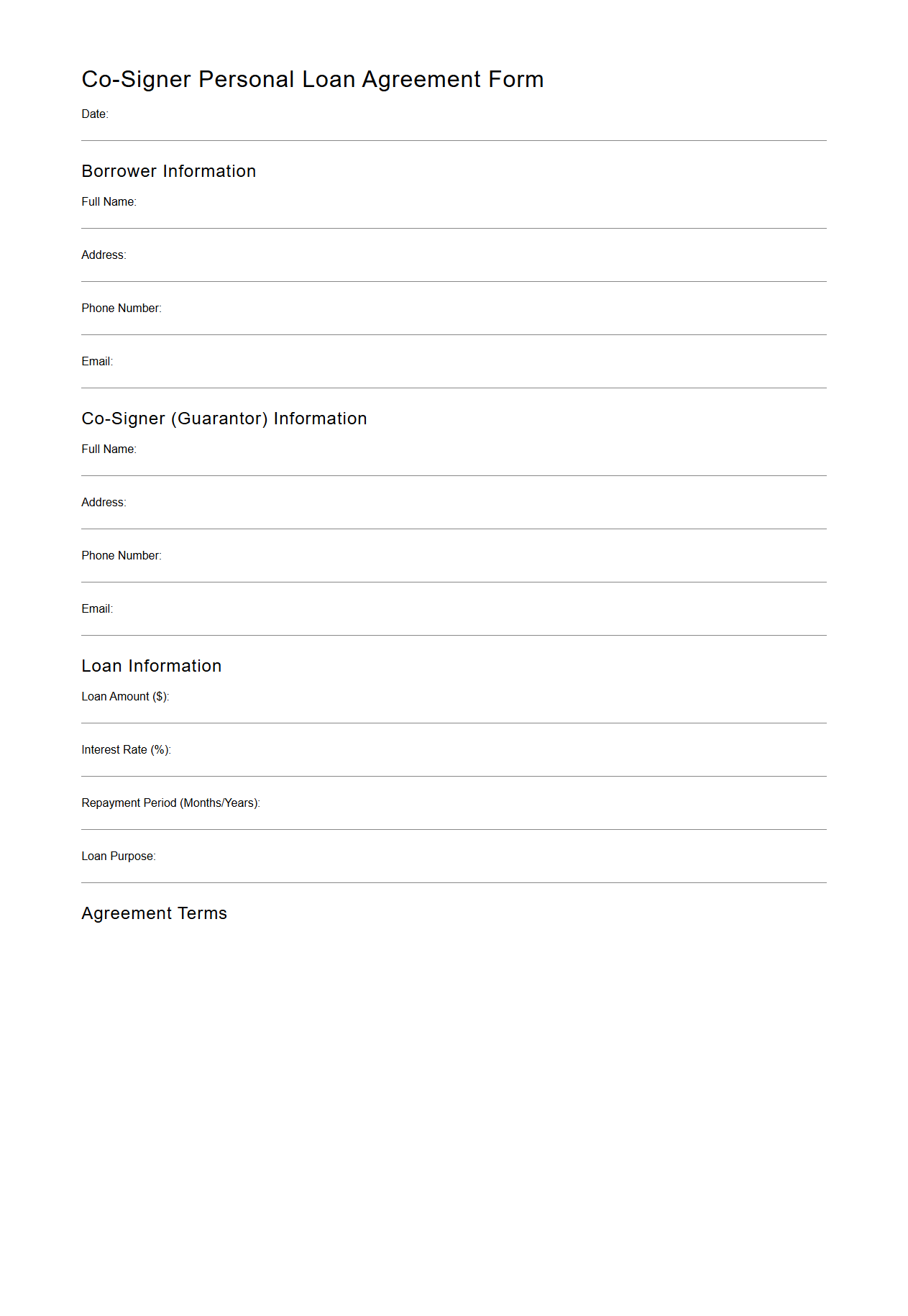

Co-Signer Personal Loan Agreement Form

A

Co-Signer Personal Loan Agreement Form is a legal document outlining the responsibilities of a co-signer who guarantees repayment of a personal loan if the primary borrower defaults. It details the loan terms, repayment schedule, and the co-signer's obligation to repay the debt. This form protects lenders by ensuring a secondary source of repayment and informs co-signers of their financial liability.

What clauses address early repayment penalties in the loan agreement?

The loan agreement includes a Prepayment Penalty Clause that specifies any fees incurred for early repayment. This clause ensures lenders are compensated if the borrower repays the loan before the agreed term. Typically, it outlines penalty amounts or percentages based on the outstanding principal.

How is the borrower's collateral described and detailed?

The borrower's collateral is described in the Security Interest Section of the loan agreement. It provides detailed information about the assets pledged, including their nature, location, and ownership status. This section ensures clear identification and valuation of the collateral securing the loan.

What are the stipulated interest rate adjustment conditions?

The loan document outlines interest rate adjustments within the Interest Rate Terms section. It specifies triggers for rate changes, such as market index fluctuations or borrower credit rating modifications. These conditions maintain balance between lender risk and borrower obligations.

Which sections outline default and remedy procedures?

The Default and Remedies Clause in the loan agreement describes consequences of borrower default. It includes steps lenders may take, such as accelerating the loan or initiating foreclosure. These procedures protect lender interests and encourage timely borrower compliance.

How is dispute resolution specified in the loan document?

The loan agreement defines dispute resolution mechanisms in the Governing Law and Arbitration Clause. It usually mandates arbitration or mediation before litigation to settle conflicts. This section promotes efficient and cost-effective resolution of disputes between parties.