An Expense Report Document Sample for Business Reimbursement provides a clear template to track and itemize all business-related expenses accurately. It helps employees submit detailed records, including dates, descriptions, amounts, and supporting receipts, ensuring compliance with company policies. This organized format streamlines the approval process and guarantees timely reimbursement.

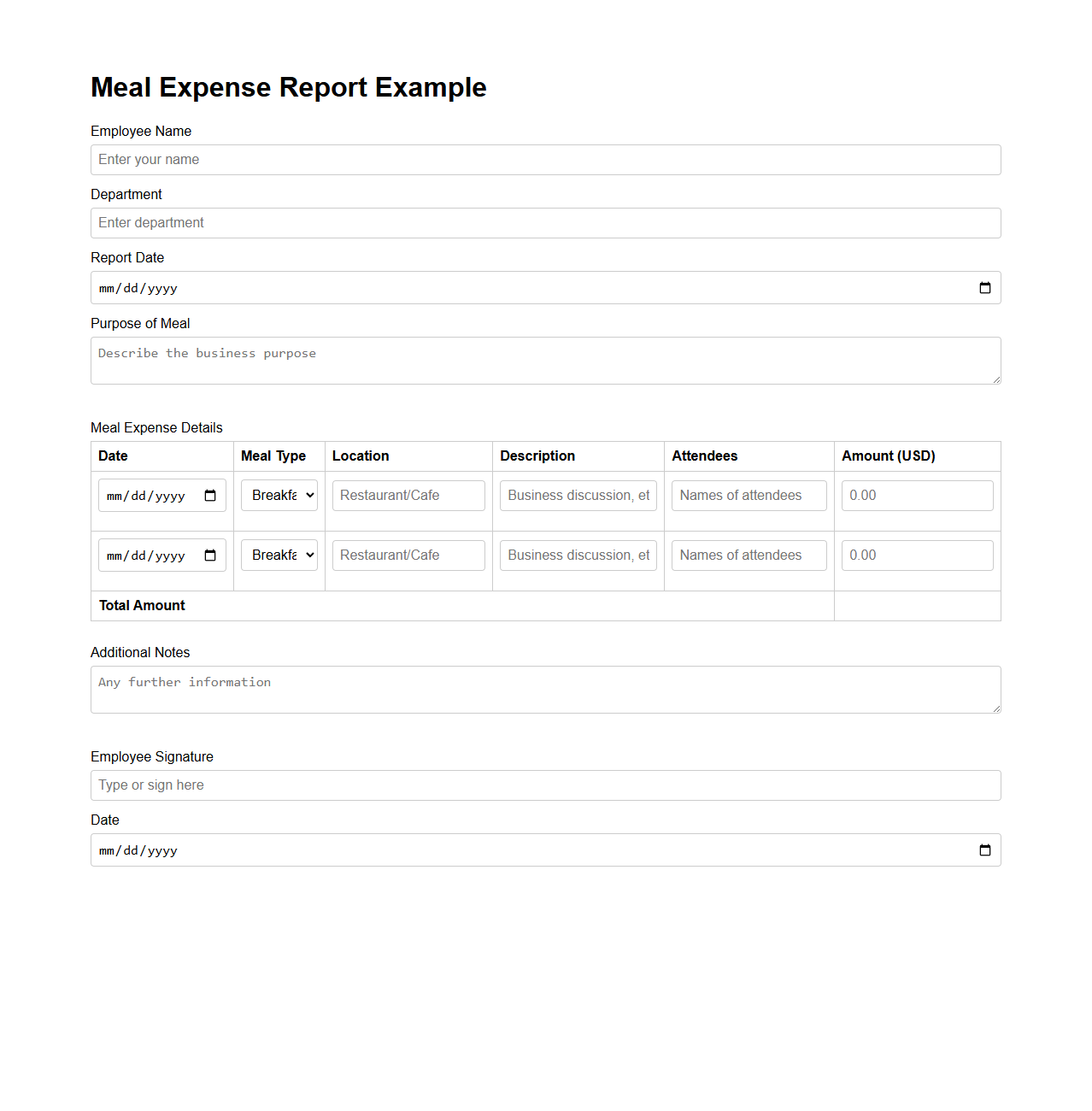

Meal Expense Report Example for Corporate Reimbursement

A

Meal Expense Report Example for Corporate Reimbursement is a detailed document that outlines the costs employees incur during business-related meals, ensuring compliance with company policies and tax regulations. It typically includes itemized expenses, dates, purposes of the meal, attendees, and receipts to facilitate accurate reimbursement processing. This report helps streamline accounting procedures, provides transparency, and supports budgeting for corporate travel and client meetings.

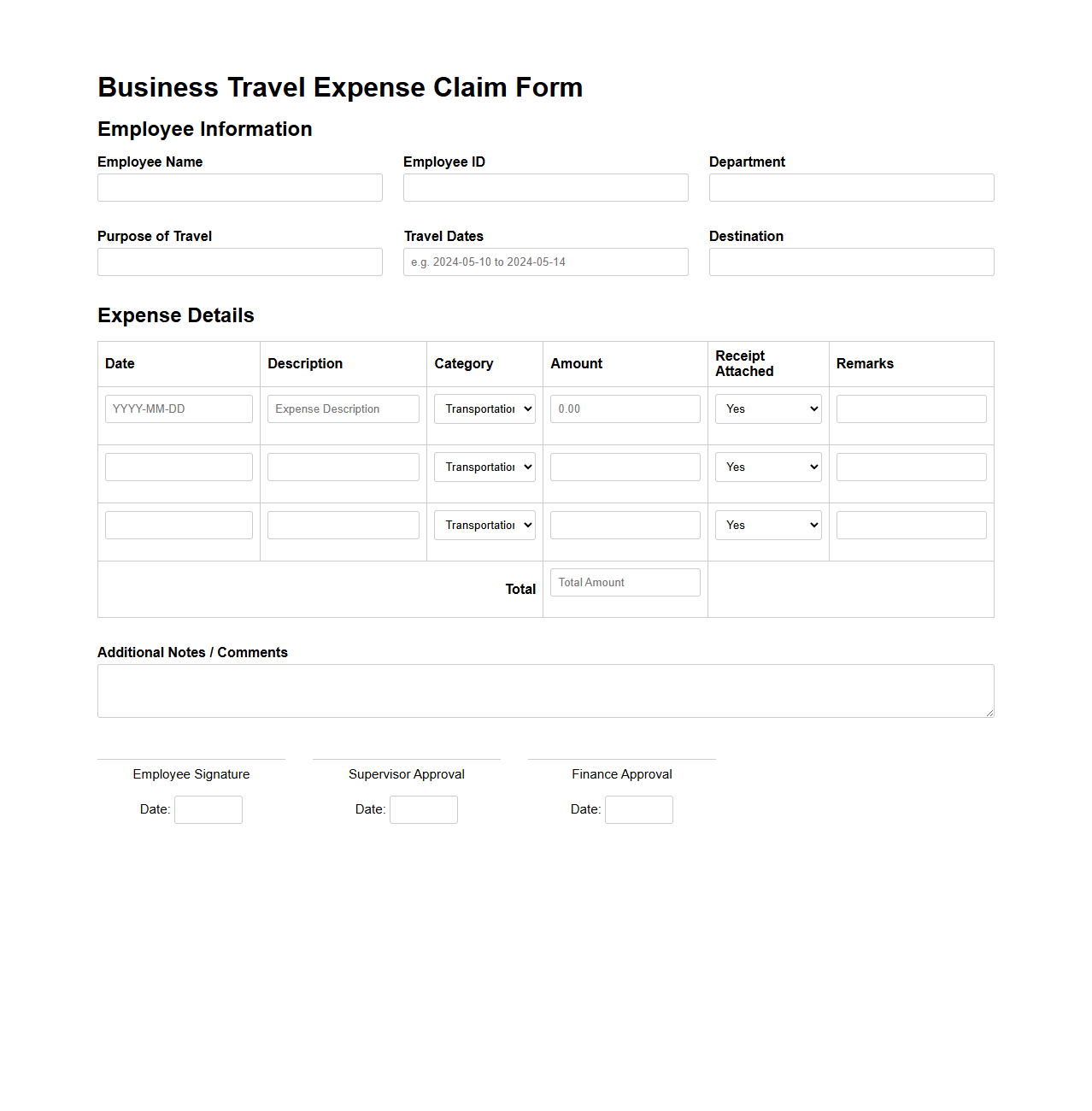

Business Travel Expense Template for Employee Claim

A

Business Travel Expense Template is a standardized document designed to help employees systematically itemize and submit their travel-related expenses for reimbursement. It typically includes fields for dates, destinations, transportation, accommodation, meals, and other incidental costs, ensuring accurate and efficient processing. This template streamlines financial tracking and compliance with company travel policies.

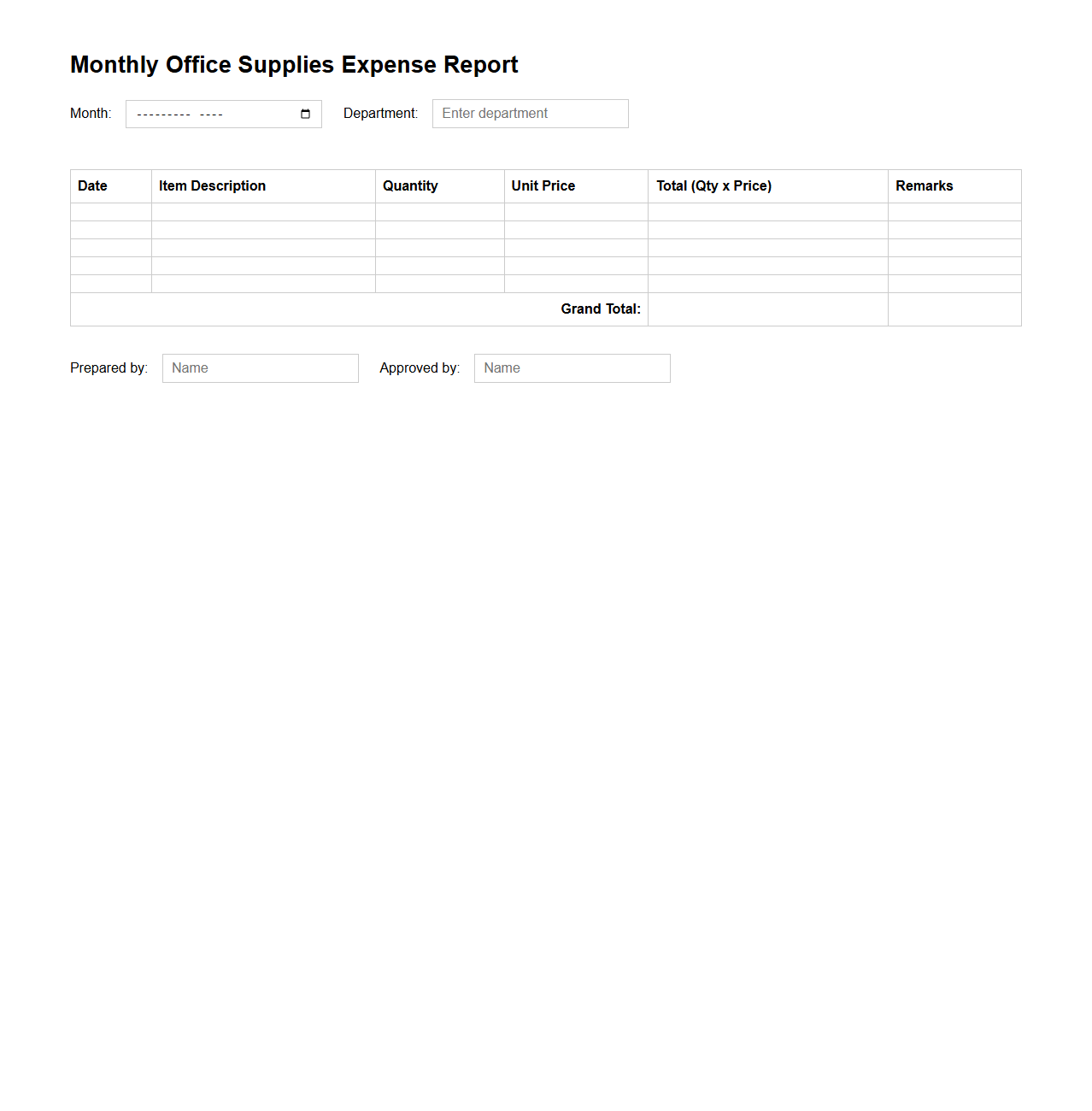

Monthly Office Supplies Expense Reporting Format

The

Monthly Office Supplies Expense Reporting Format document is a structured template used to track and record all expenses related to office supplies within a specific month. It categorizes costs by item type, quantity, unit price, and total amount, enabling accurate budget monitoring and expense management. This format helps businesses maintain financial transparency and supports effective decision-making by providing clear, organized data on office supply expenditures.

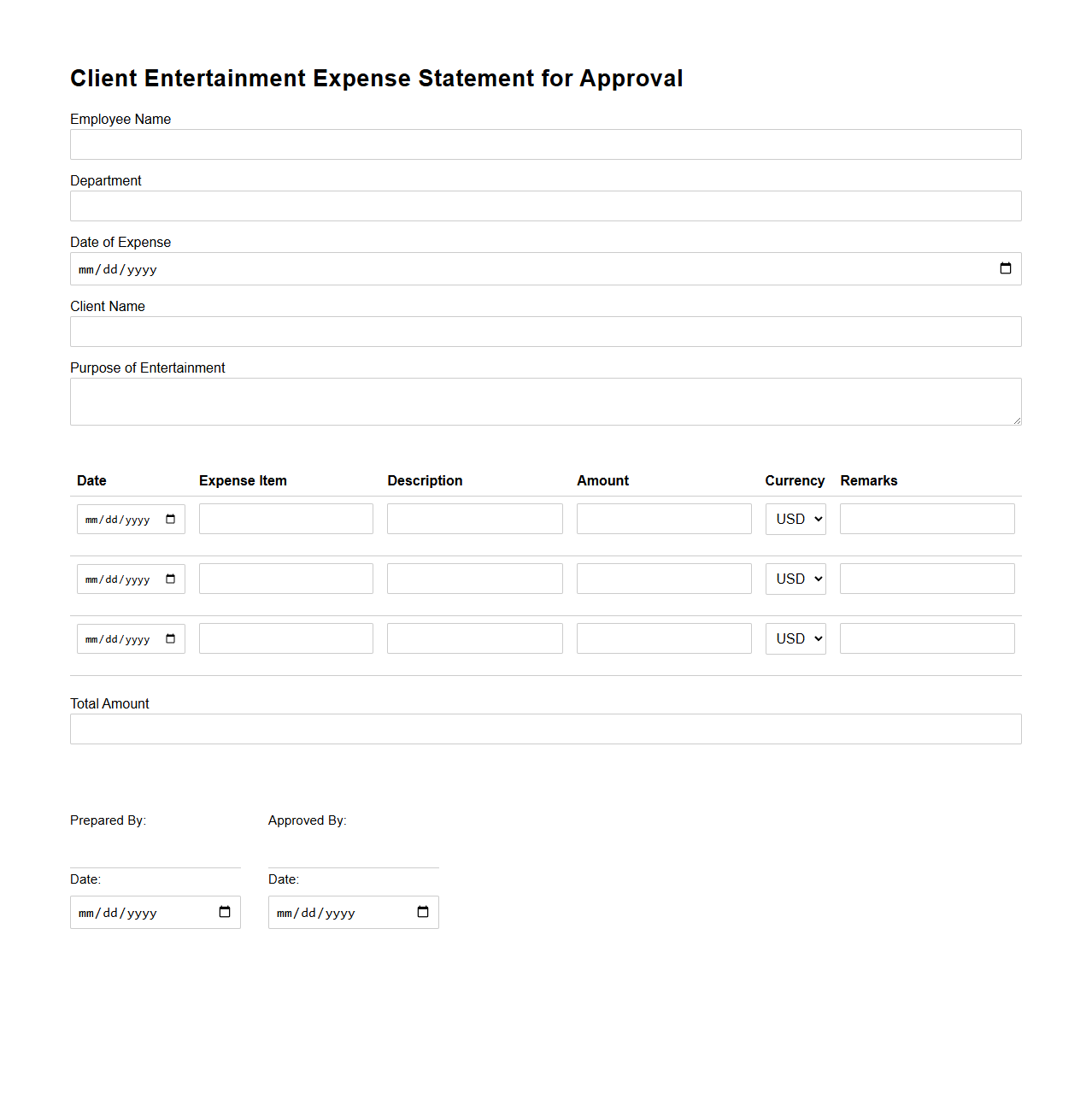

Client Entertainment Expense Statement for Approval

A

Client Entertainment Expense Statement for Approval document is a formal record detailing the costs incurred during business-related entertainment activities with clients, submitted for managerial review and authorization. It itemizes expenses such as meals, events, or gifts, ensuring transparency and adherence to company policies on client engagement spending. This document facilitates budget control and accountability within corporate finance processes.

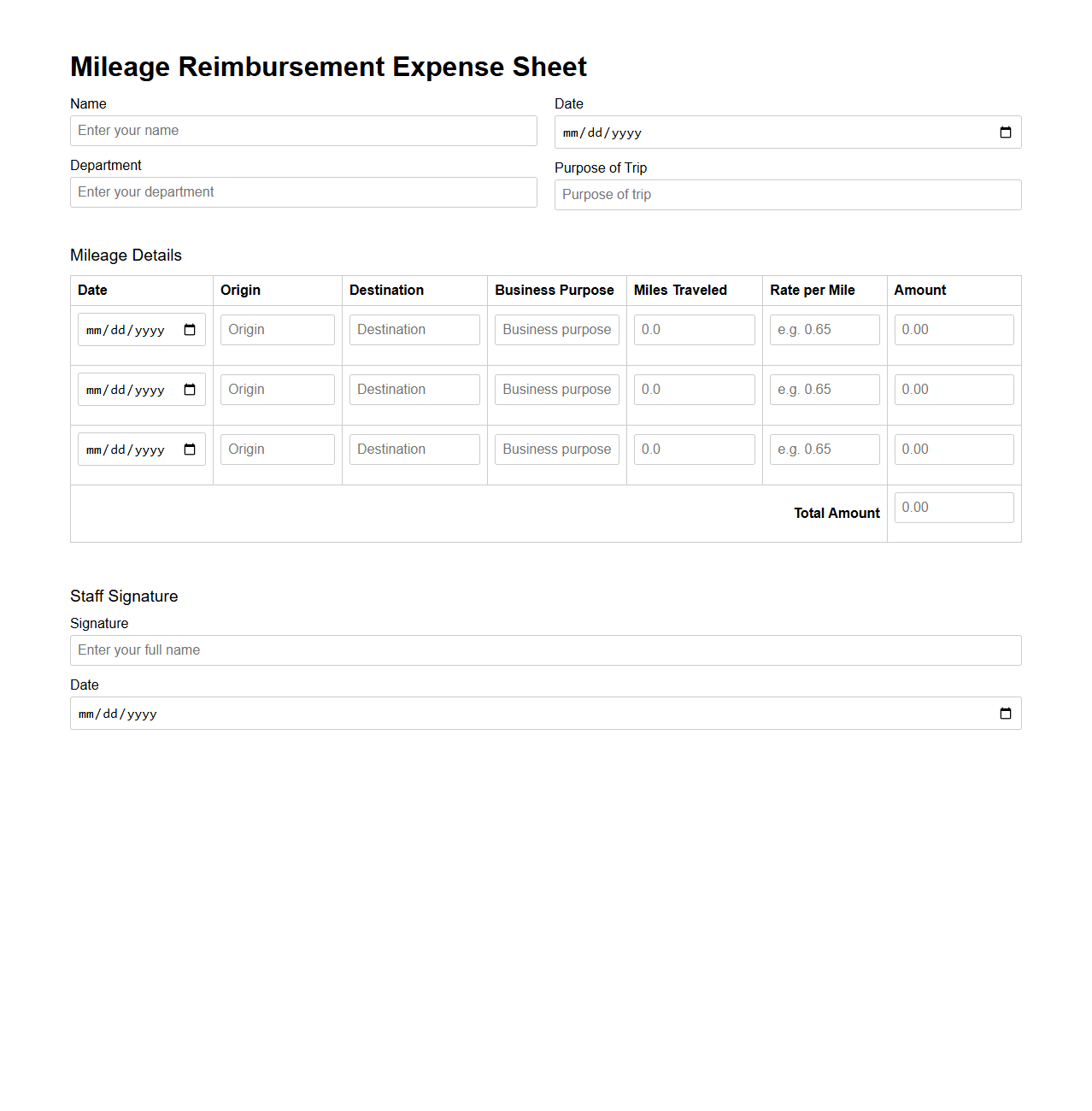

Mileage Reimbursement Expense Sheet for Staff

The

Mileage Reimbursement Expense Sheet for Staff document is used to accurately track and report the distance traveled by employees using personal vehicles for work-related purposes. It captures essential details such as date, starting point, destination, total miles driven, and purpose of the trip to calculate reimbursement amounts based on current mileage rates. This document ensures transparent, efficient processing of mileage expenses and supports compliance with company policies and tax regulations.

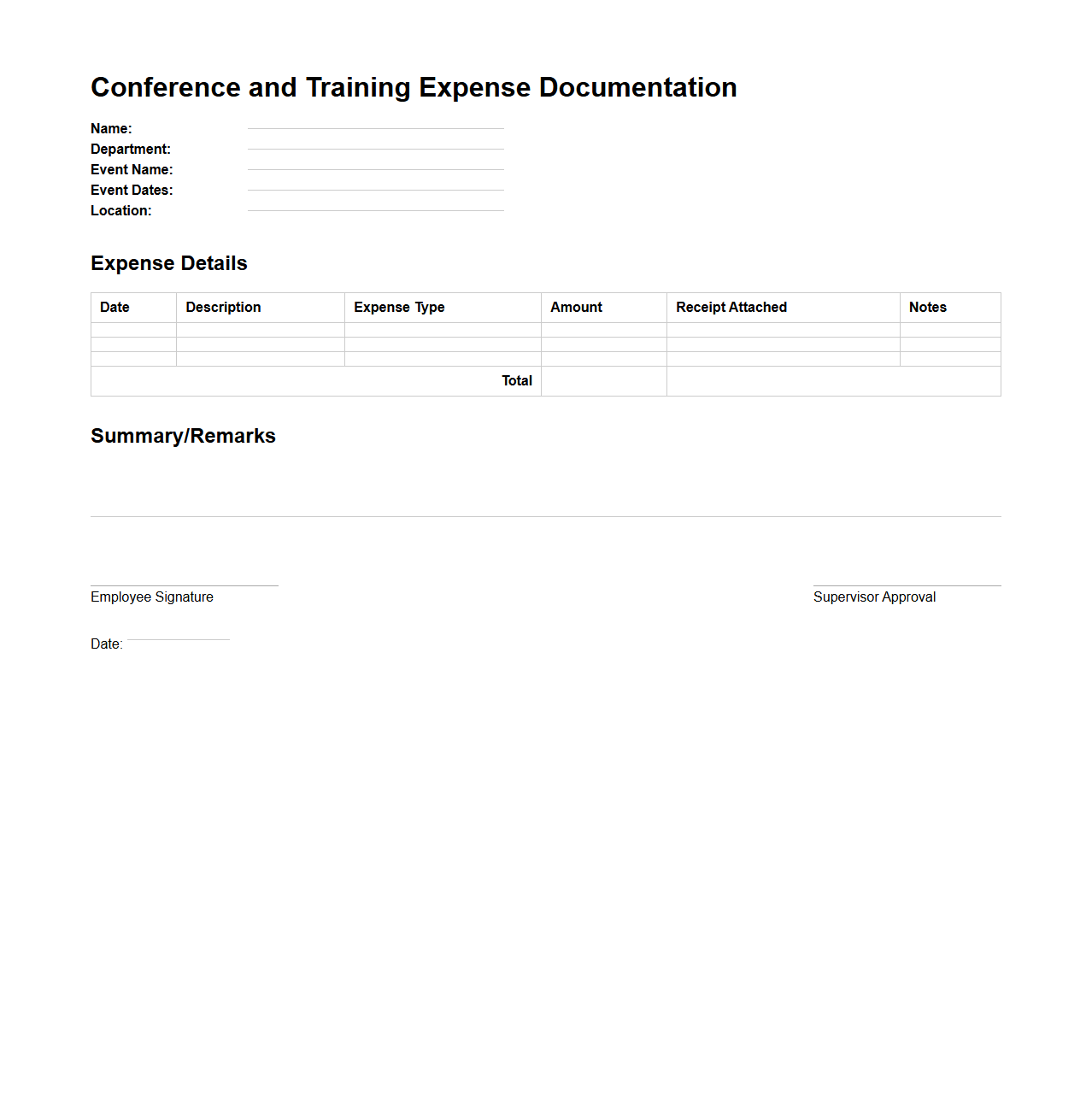

Conference and Training Expense Documentation Sample

A

Conference and Training Expense Documentation Sample document serves as a standardized template to record and verify expenses related to attending professional development events. It typically includes detailed sections for registration fees, travel costs, accommodation, and meal allowances, ensuring comprehensive financial tracking. This documentation is essential for reimbursement processes and maintaining transparent accounting practices within organizations.

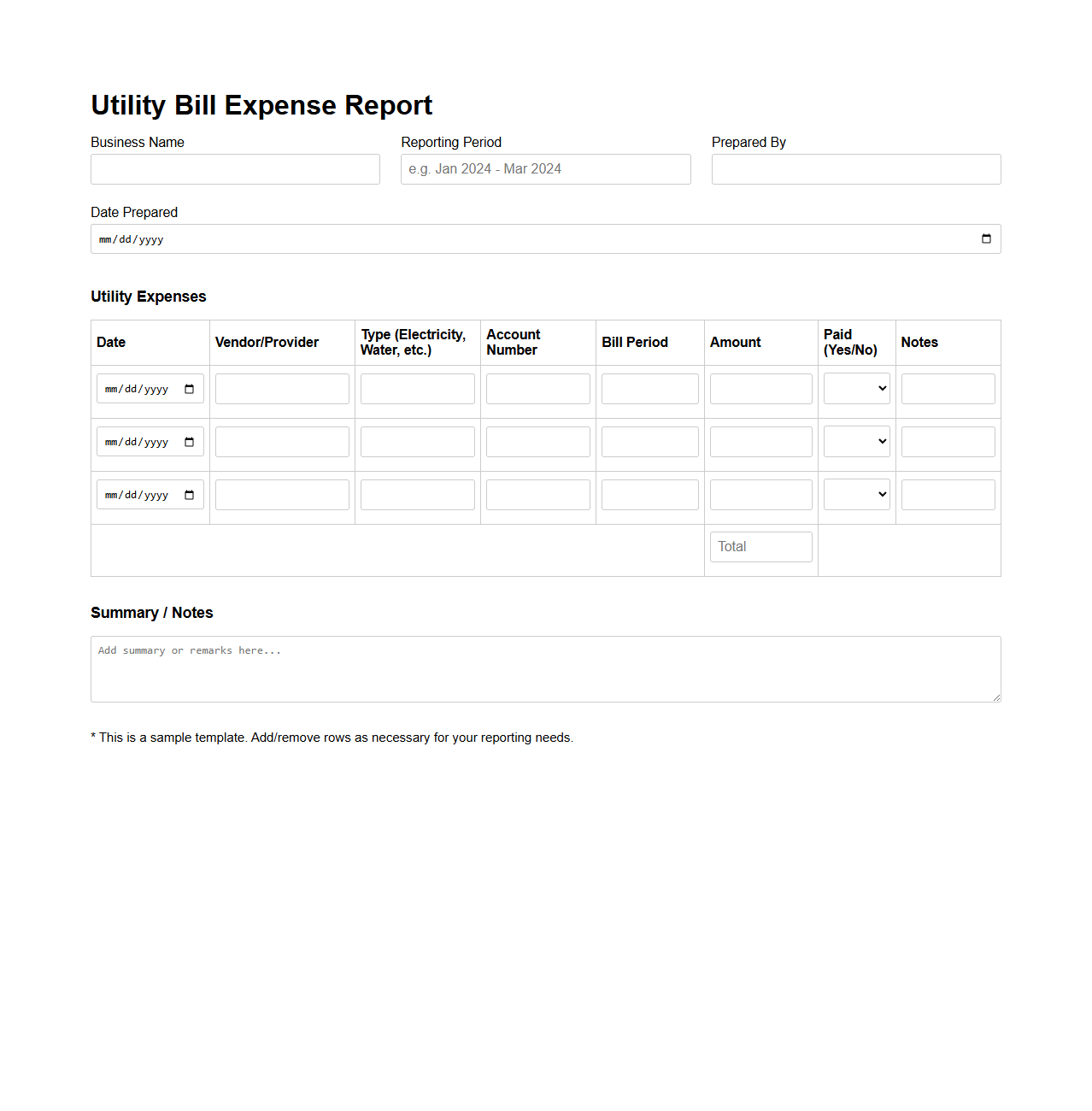

Utility Bill Expense Report for Small Business

A

Utility Bill Expense Report for small businesses is a detailed document that tracks and organizes all utility-related expenses, such as electricity, water, gas, and internet services. This report helps business owners monitor their operational costs, identify trends, and manage budgets efficiently. Accurate tracking of utility bills can also support tax deductions and improve financial decision-making for the company.

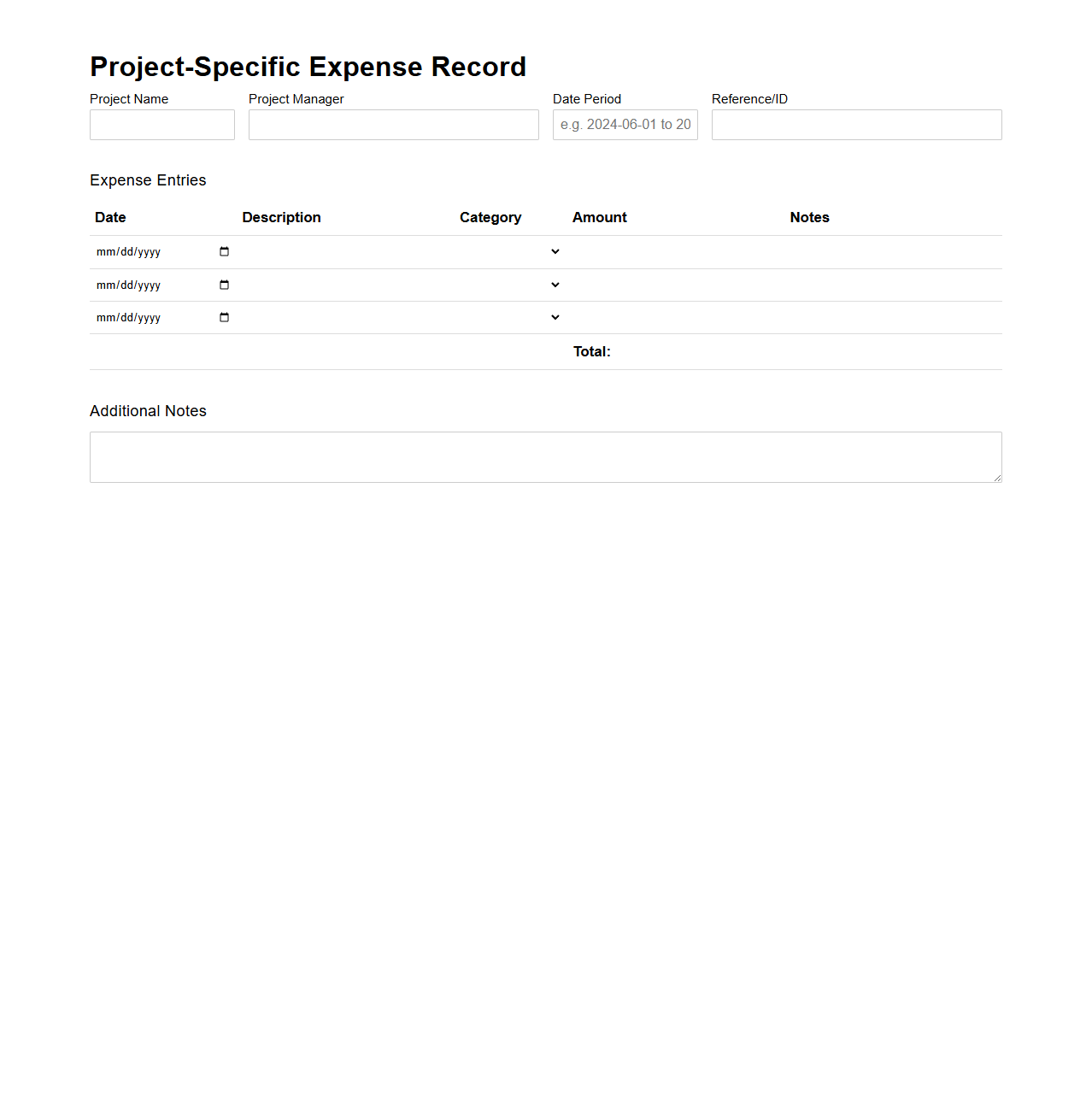

Project-Specific Expense Record Template

The

Project-Specific Expense Record Template document is designed to systematically track and manage all financial expenditures related to a particular project. It helps ensure accurate budgeting, efficient expense monitoring, and transparent reporting by detailing costs such as materials, labor, and overhead within one organized framework. This template supports better financial control and facilitates auditing by maintaining a clear record of project-specific transactional data.

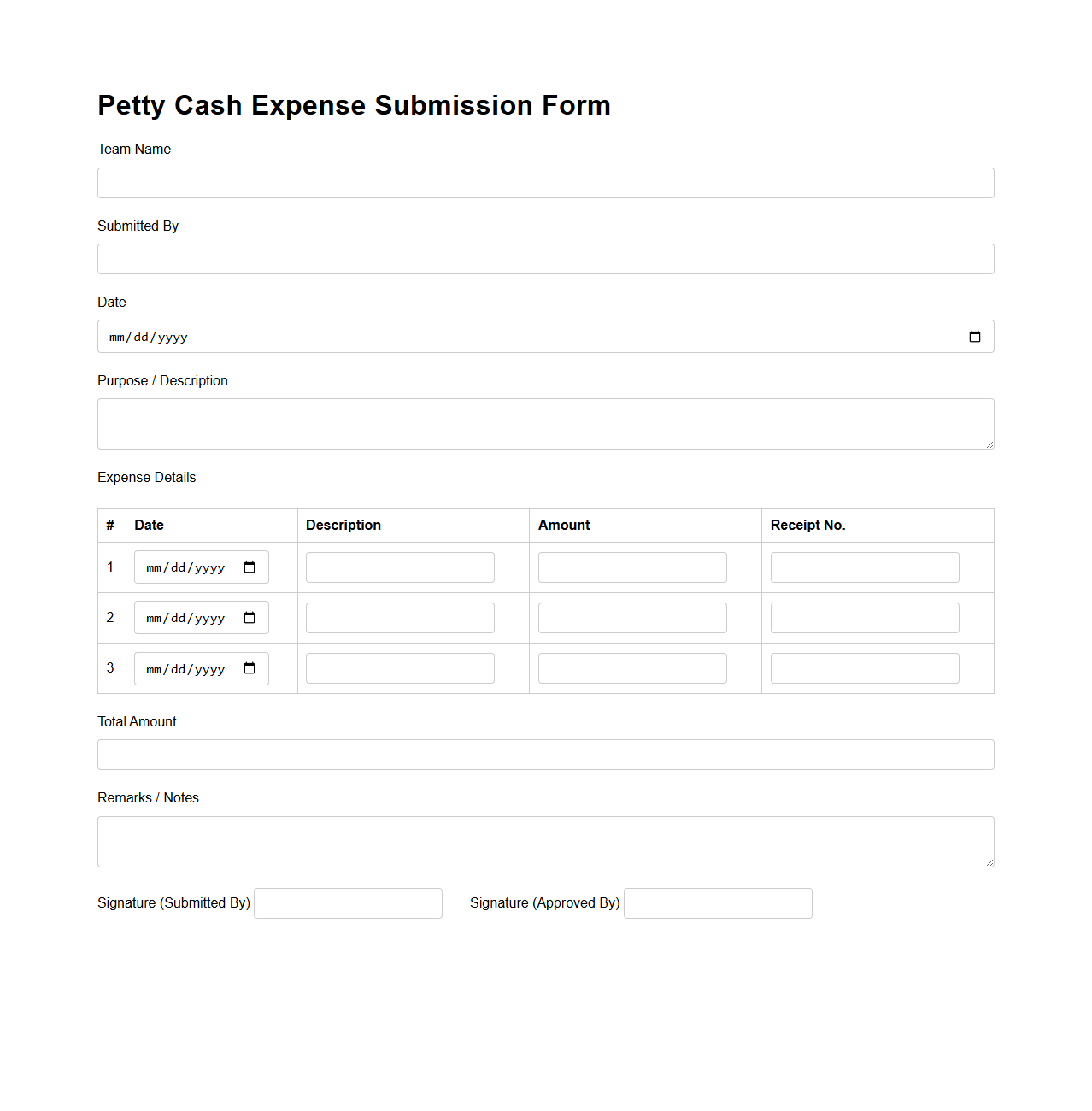

Petty Cash Expense Submission Form for Teams

The

Petty Cash Expense Submission Form for Teams document streamlines the process of reporting small, incidental business expenses incurred by team members. It captures essential details such as date, amount, purpose, and supporting receipts to ensure accurate tracking and reimbursement. This form enhances transparency and accountability within organizational financial management.

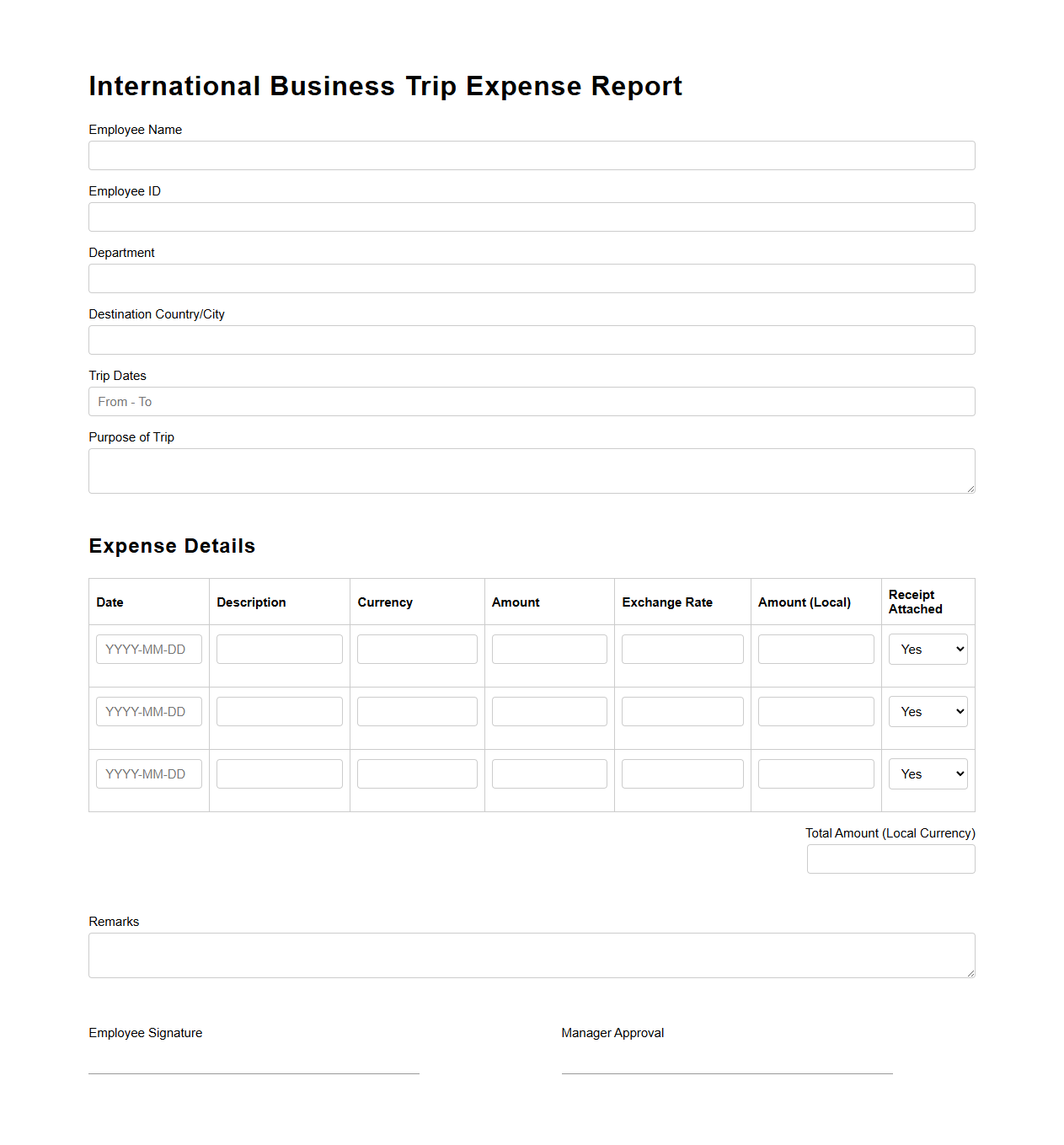

International Business Trip Expense Report Example

An

International Business Trip Expense Report Example document serves as a detailed template for recording and summarizing all costs incurred during overseas business travel. It typically includes sections for transportation, accommodation, meals, and miscellaneous expenses, ensuring thorough financial tracking and reimbursement accuracy for companies. This document streamlines expense management, supports compliance with corporate policies, and facilitates transparent reporting for international business trips.

What supporting receipts are mandatory for each expense category in the report?

Each expense category requires specific supporting receipts to ensure accurate documentation and compliance. For travel expenses, airline tickets and hotel bills are mandatory, while meal expenses necessitate itemized restaurant receipts. Additionally, any miscellaneous expenses above a certain threshold must be accompanied by detailed receipts to validate the claims.

How should currency conversions be documented for international expenses?

International expenses must include a clear record of currency conversions using the official exchange rate on the date of the transaction. Employees are required to provide proof of the exchange rate used, such as a bank statement or a recognized financial website printout. This documentation ensures transparency and accuracy in financial reporting across different currencies.

What is the approval workflow specified in the expense report document?

The approval workflow begins with the employee submitting the completed expense report along with all necessary receipts. It is then reviewed by the immediate supervisor for initial verification before being forwarded to the finance department for final approval. The workflow is designed to ensure proper oversight and adherence to company expense policies.

Are mileage or per diem allowances calculated according to company policy?

Mileage and per diem allowances are calculated strictly following the company policy to maintain consistency and fairness. Mileage rates are based on the current IRS standard or company-specific rates, while per diem allowances vary depending on the destination and duration of the travel. Employees must adhere to these guidelines to qualify for reimbursement.

What is the policy for reporting expenses incurred before official business travel dates?

The policy requires that any expenses incurred before official business travel dates must be clearly justified and pre-approved. Such expenses may include early hotel check-ins or transportation to the departure airport. Without prior approval, these expenses might be disallowed or require additional documentation for validation.