A Financial Forecast Document Sample for Annual Planning provides a detailed projection of an organization's expected revenues, expenses, and cash flows over the upcoming fiscal year. This sample helps businesses allocate resources effectively and set realistic financial goals based on historical data and market trends. It serves as a critical tool for decision-makers to evaluate potential risks and opportunities during the annual planning process.

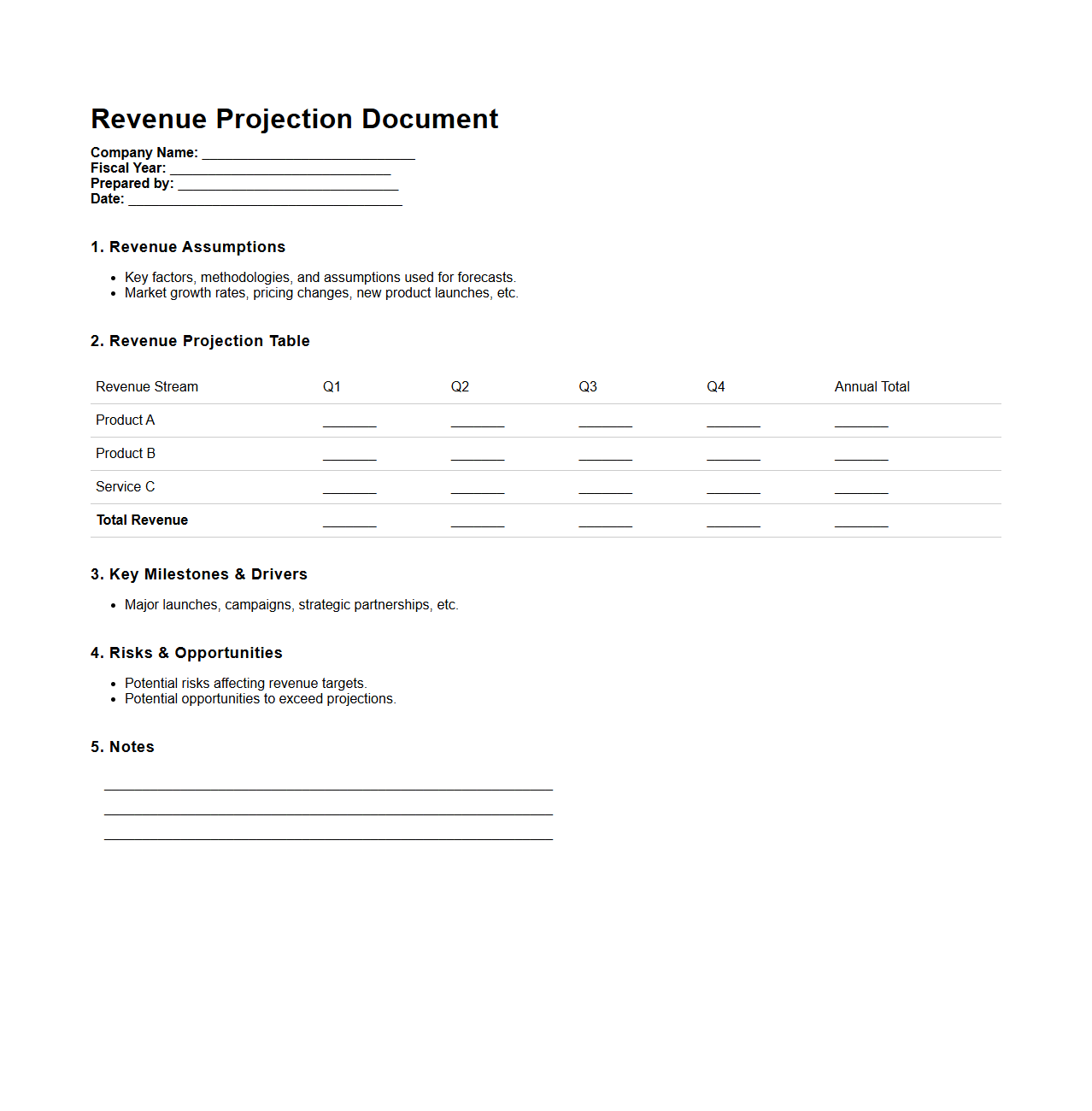

Revenue Projection Document Sample for Annual Planning

A

Revenue Projection Document Sample for Annual Planning is a detailed financial tool that estimates expected income over the fiscal year based on historical data, market trends, and sales forecasts. It helps organizations align budgets, set realistic growth targets, and allocate resources efficiently by providing clear visibility into potential revenue streams. This document plays a critical role in strategic decision-making and performance monitoring throughout the year.

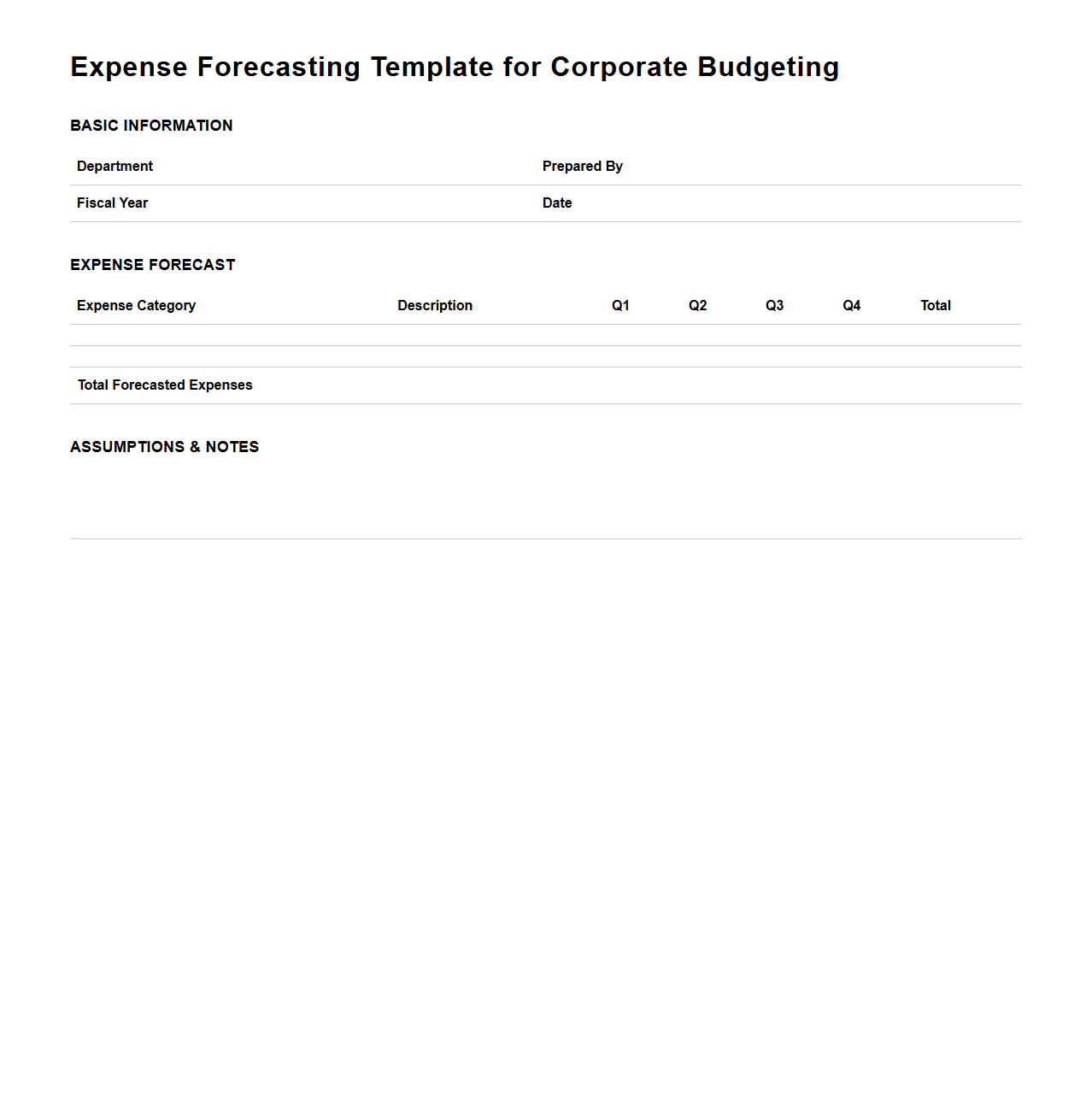

Expense Forecasting Template for Corporate Budgeting

An

Expense Forecasting Template for Corporate Budgeting is a structured document used to predict future costs based on historical data, planned initiatives, and market trends. It enables finance teams to allocate resources efficiently, monitor spending patterns, and identify potential financial risks or savings opportunities. This template typically includes categorized expense lines, projected amounts, and variance analysis to support accurate budget planning and decision-making.

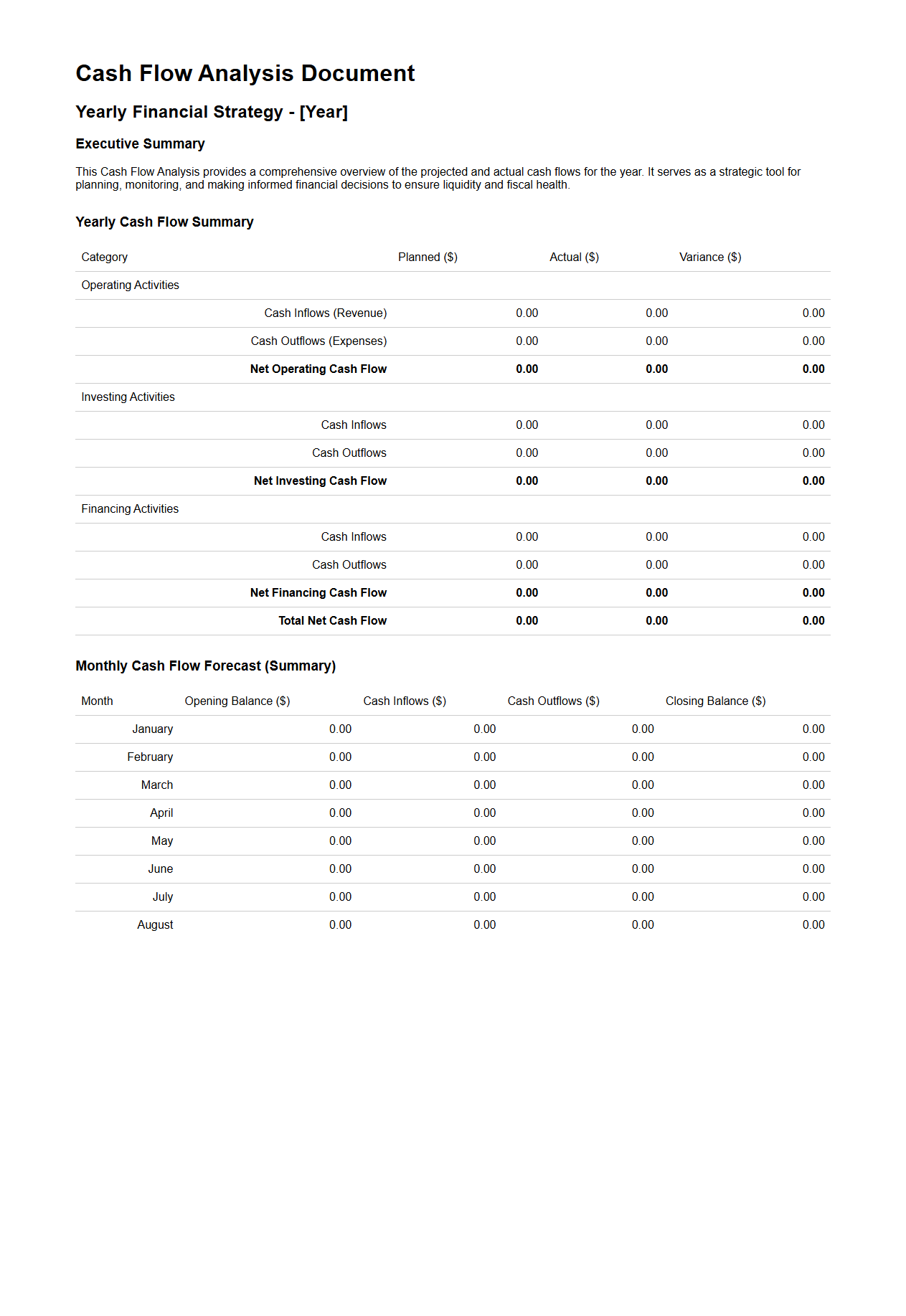

Cash Flow Analysis Document for Yearly Financial Strategy

A

Cash Flow Analysis Document is a critical financial report that outlines the inflows and outflows of cash over a specific period, typically annually, to help businesses manage liquidity and ensure operational stability. This document highlights the timing and magnitude of cash receipts and payments, enabling accurate forecasting and strategic decision-making for resource allocation. By analyzing cash flow trends, companies can identify potential shortfalls or surpluses, optimize investment opportunities, and improve overall financial planning in their yearly strategy.

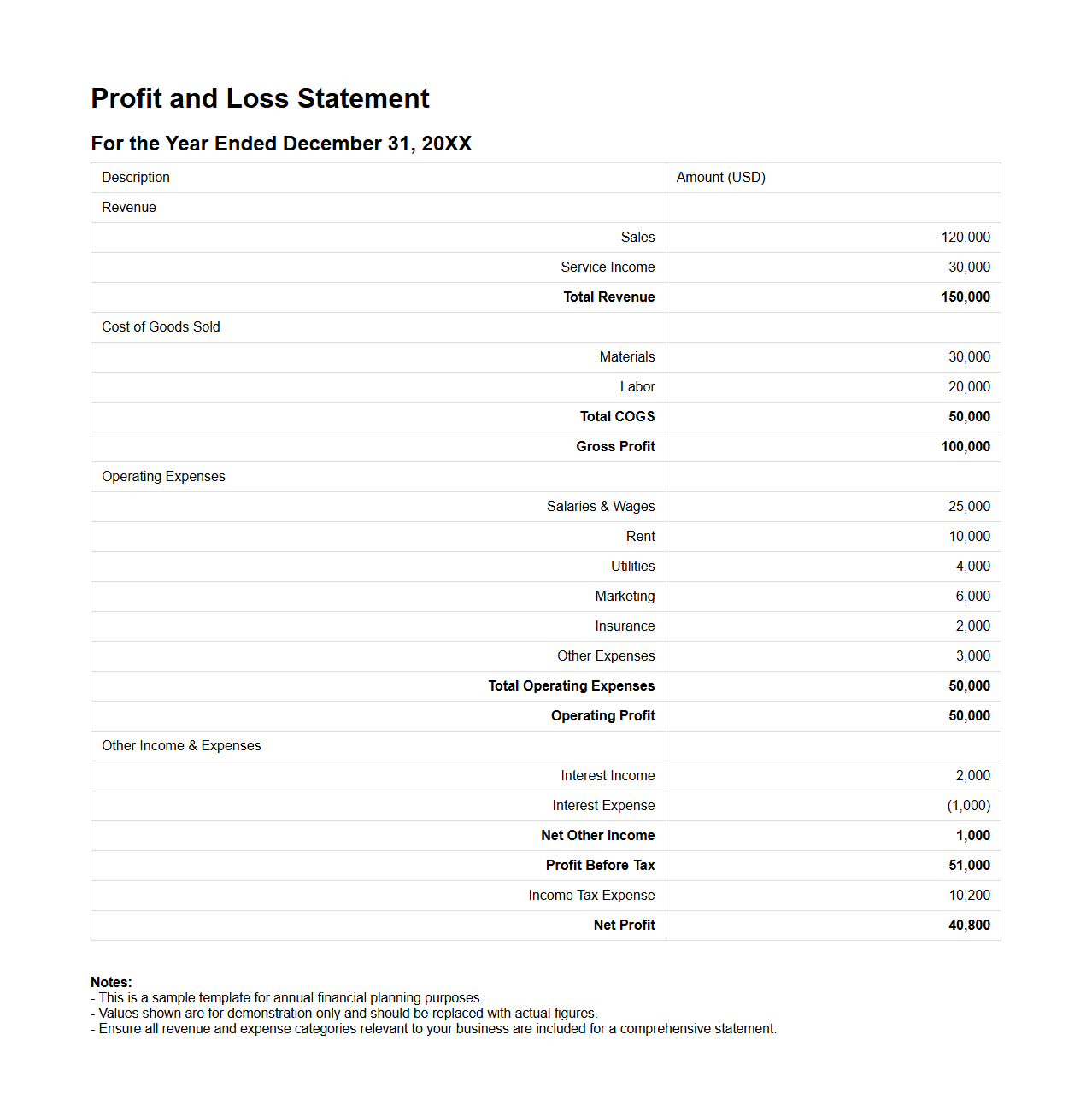

Profit and Loss Statement Sample for Annual Financial Planning

A

Profit and Loss Statement Sample for Annual Financial Planning is a detailed financial report that outlines a company's revenues, costs, and expenses over a specified fiscal year. This document helps businesses evaluate their financial performance by showing net profit or loss, guiding strategic decisions and budgeting. It is essential for identifying trends, controlling costs, and forecasting future profitability to ensure sustainable growth.

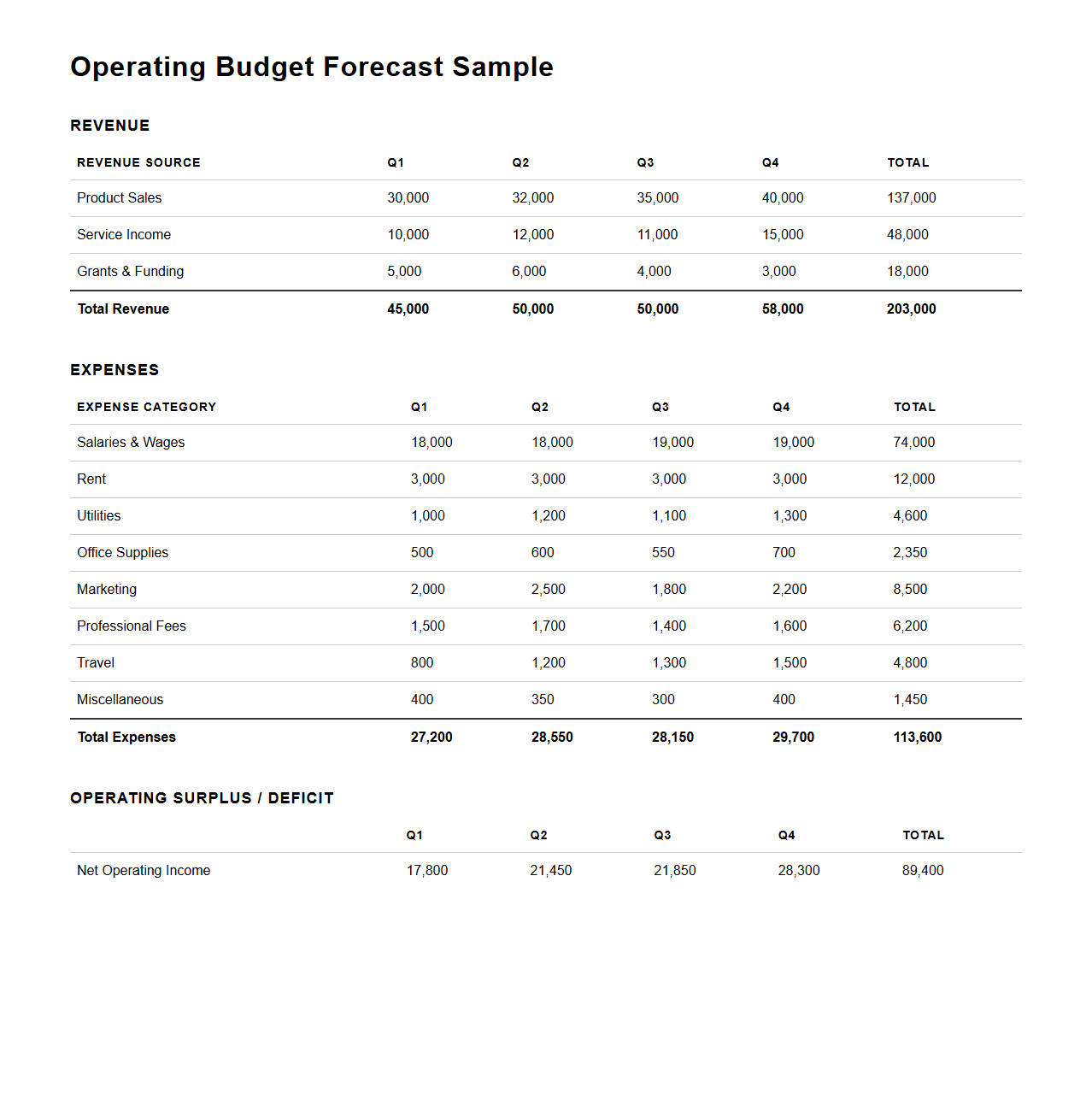

Operating Budget Forecast Sample for Organizations

An

Operating Budget Forecast Sample for organizations is a detailed financial plan that projects expected revenues and expenses over a specific period, typically a fiscal year. This document helps organizations allocate resources efficiently, anticipate cash flow needs, and guide decision-making processes to achieve financial stability. By using historical data and market trends, the forecast enables accurate planning and performance measurement against budgeted targets.

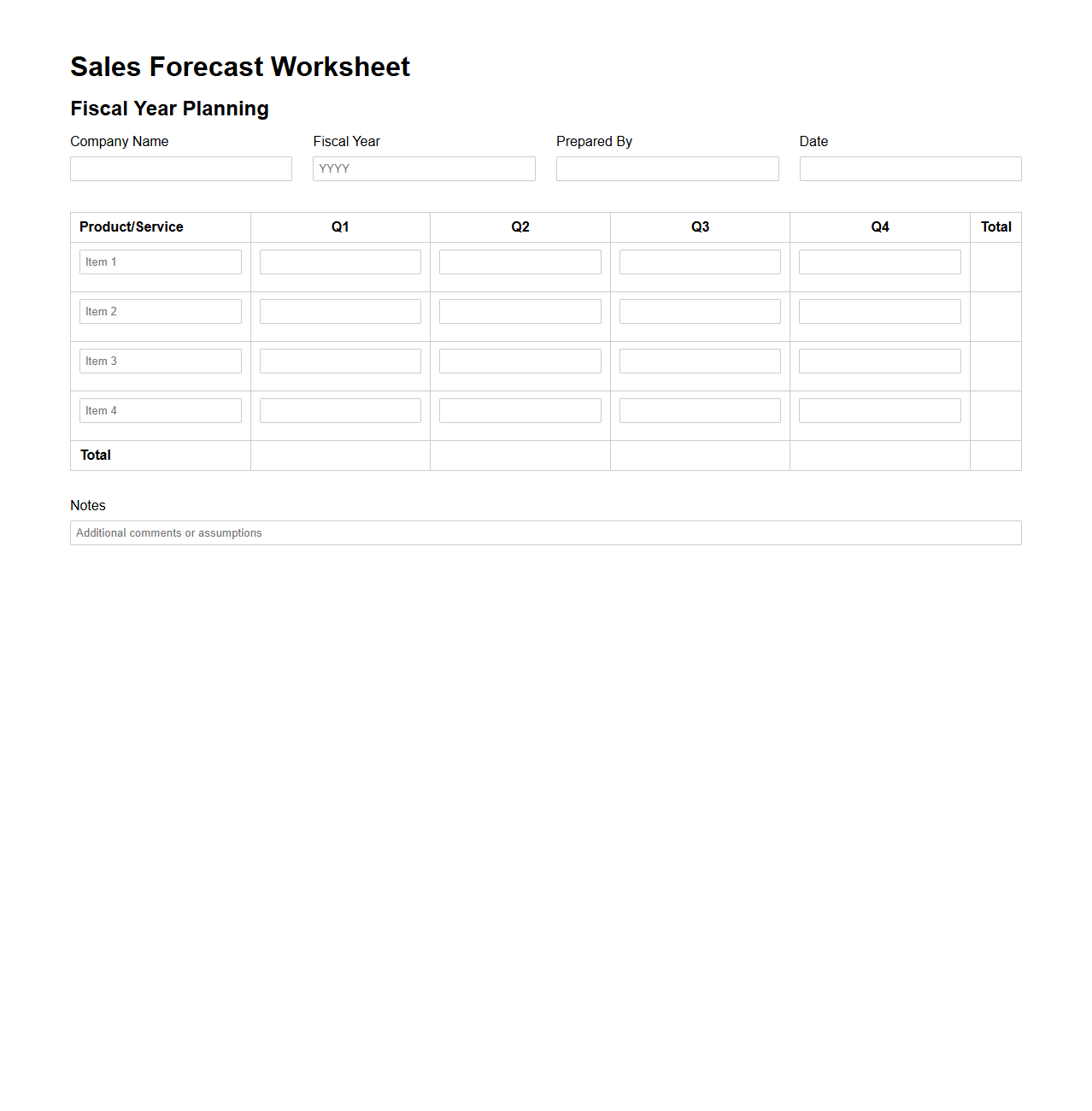

Sales Forecast Worksheet for Fiscal Year Planning

A

Sales Forecast Worksheet for Fiscal Year Planning is a strategic tool used to project sales revenue, helping businesses estimate future performance based on historical data, market trends, and sales pipeline insights. This document organizes monthly or quarterly sales targets, product categories, and customer segments to provide a detailed financial roadmap for the fiscal year. It supports budget allocation, resource planning, and goal setting by aligning sales expectations with organizational objectives.

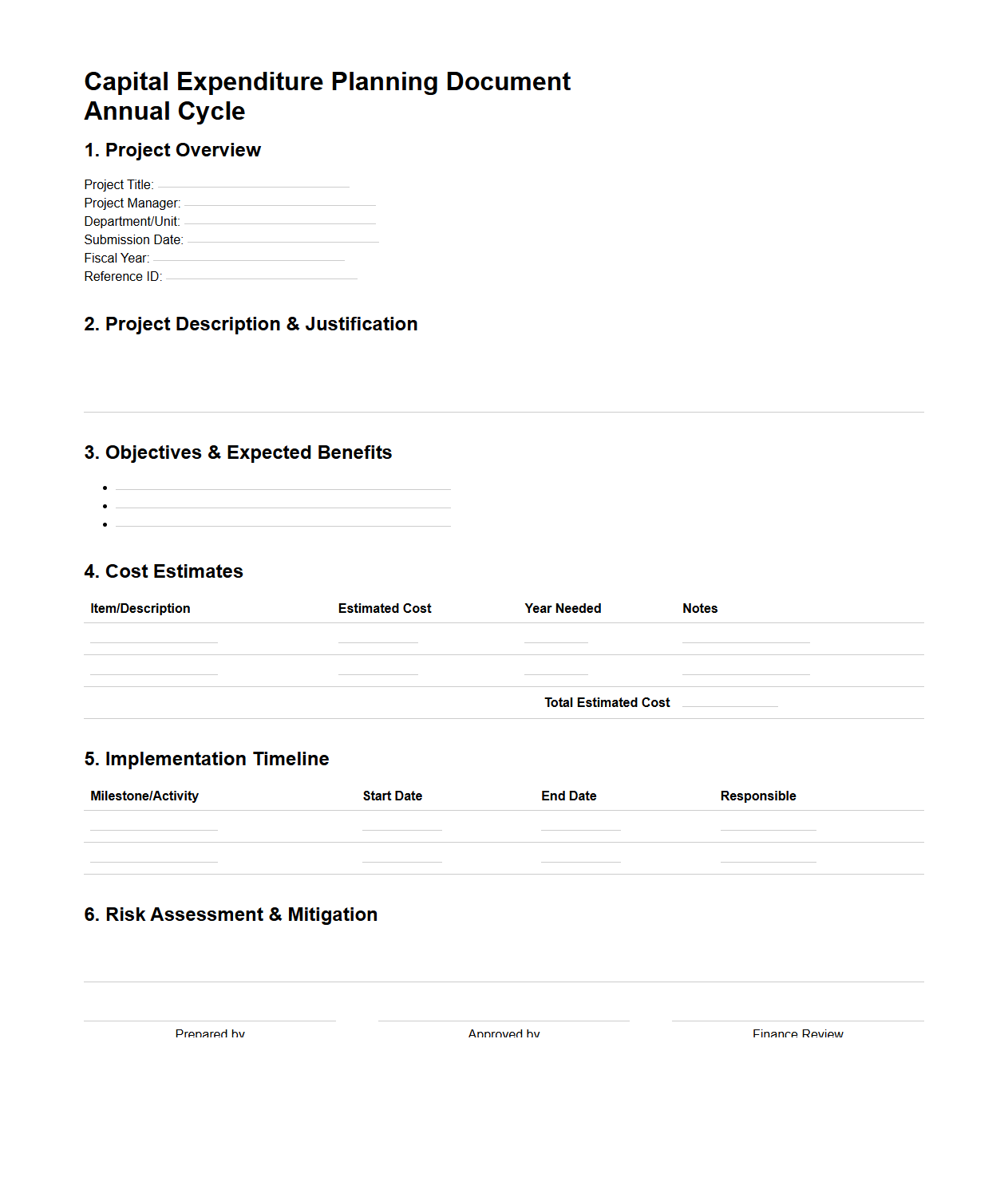

Capital Expenditure Planning Document for Annual Cycles

The

Capital Expenditure Planning Document for Annual Cycles outlines the strategic allocation of funds for long-term asset investments within a fiscal year. It details projected capital projects, budgeting requirements, and timelines to ensure efficient resource management and alignment with organizational goals. This document serves as a critical tool for decision-makers to prioritize expenditures and monitor financial commitments throughout the annual cycle.

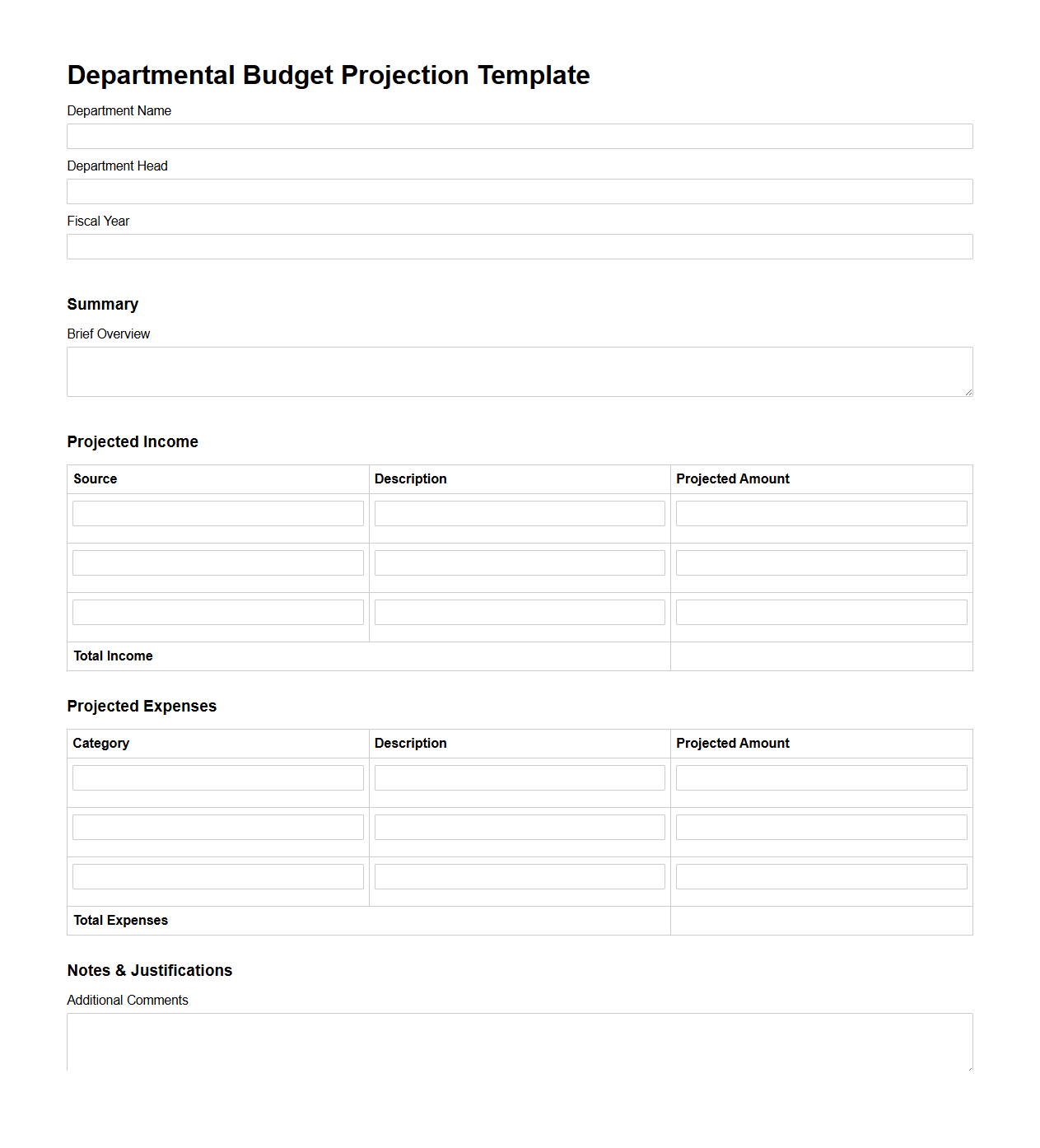

Departmental Budget Projection Template for Annual Reviews

The

Departmental Budget Projection Template for Annual Reviews is a structured tool designed to assist departments in forecasting their financial needs and allocations for the upcoming fiscal year. It enables precise estimation of expenses, revenue sources, and resource requirements, facilitating informed decision-making during budget planning sessions. This template ensures alignment of departmental goals with organizational financial strategies by providing clear, data-driven budget projections.

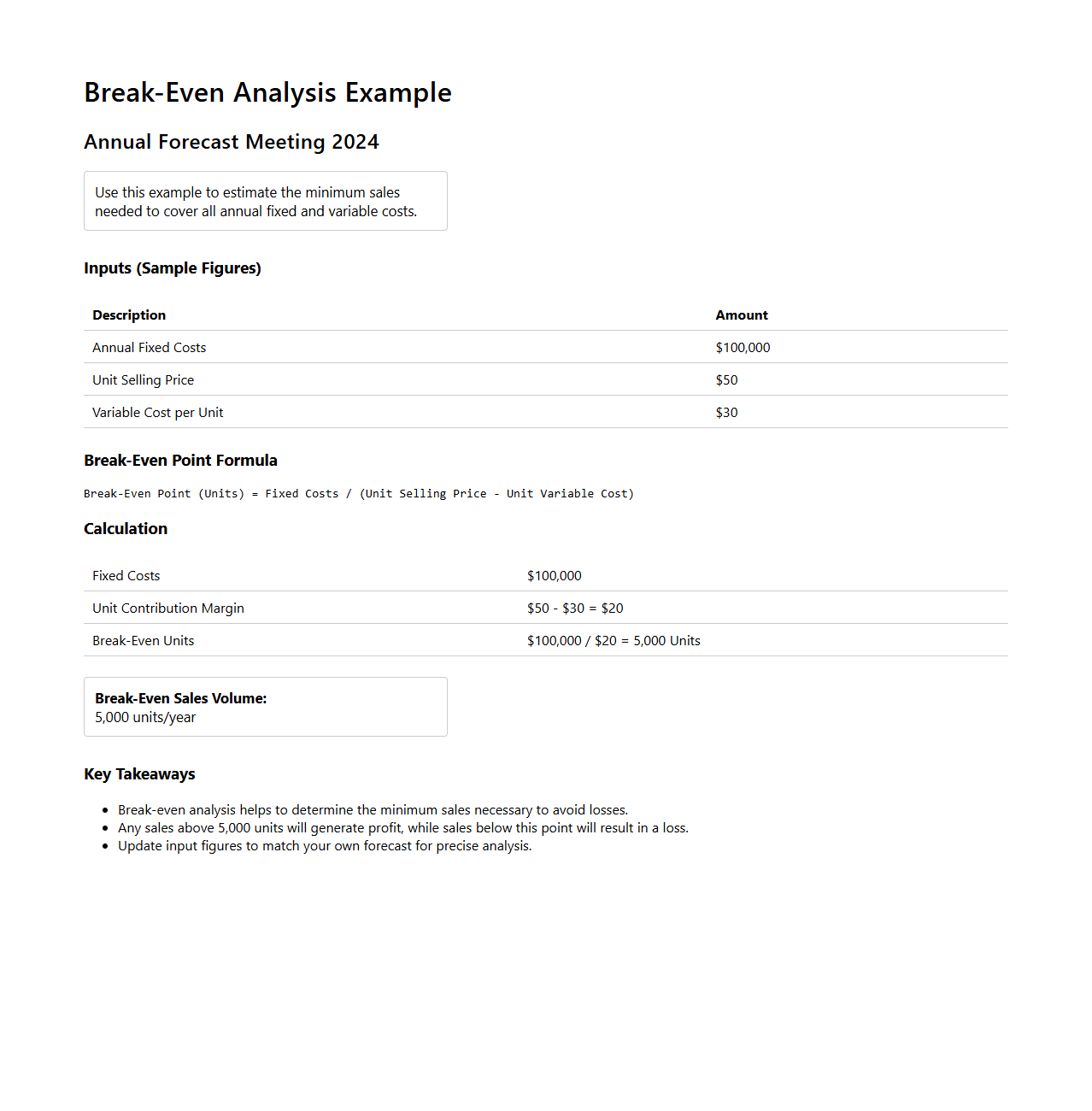

Break-Even Analysis Example for Annual Forecast Meetings

The

Break-Even Analysis Example for Annual Forecast Meetings document provides a detailed calculation to determine the sales volume required to cover total costs without generating profit or loss. It highlights fixed costs, variable costs, and sales price per unit, offering valuable insights for budget planning and decision-making. This tool helps businesses set realistic financial targets during annual forecasting sessions.

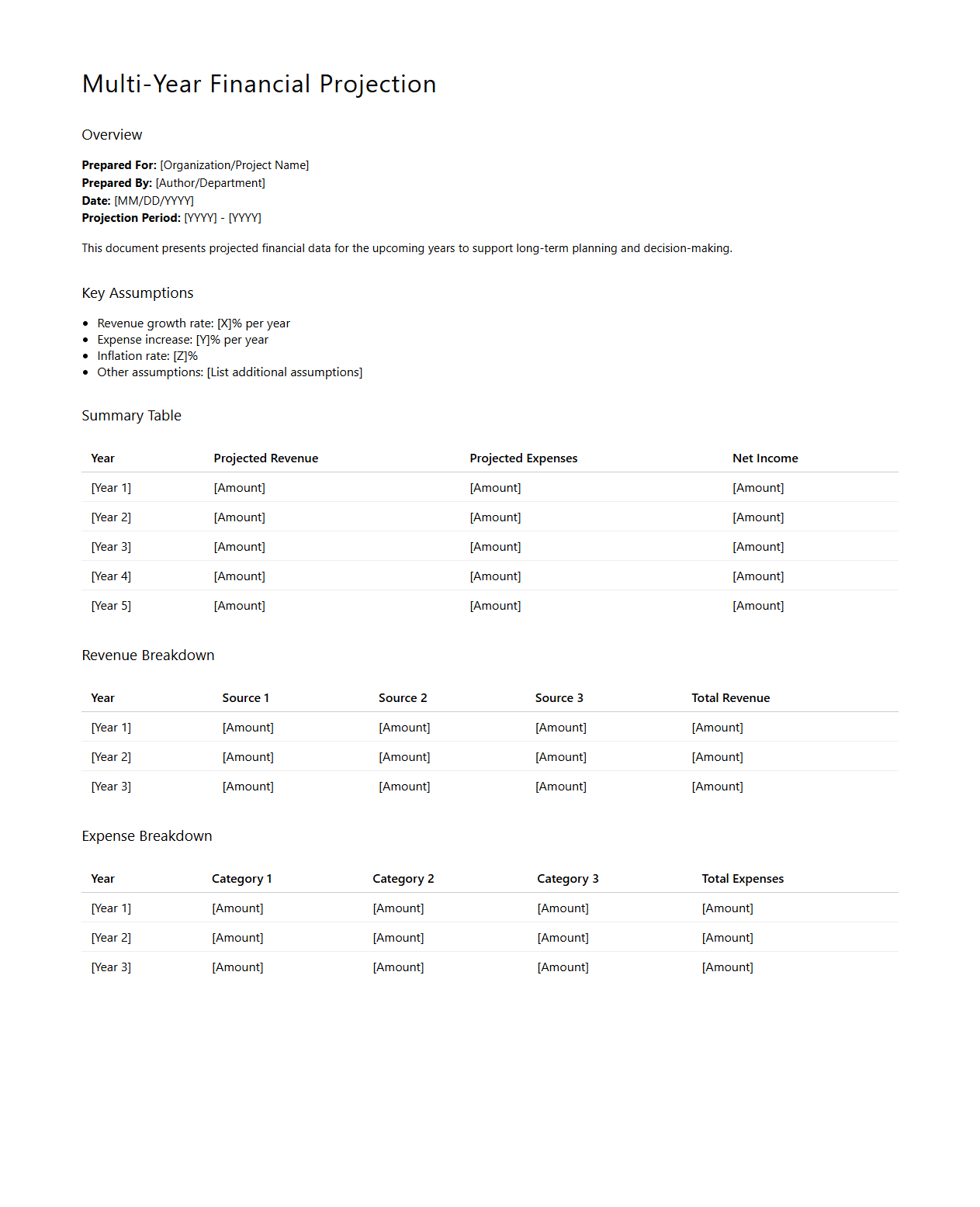

Multi-Year Financial Projection Document for Long-Term Planning

A

Multi-Year Financial Projection Document is a strategic tool used by organizations to forecast revenues, expenses, and cash flows over an extended period, typically three to five years or more. This document supports long-term planning by providing a comprehensive view of expected financial performance, enabling informed decision-making and resource allocation. It helps identify potential funding gaps, anticipate financial risks, and align organizational goals with sustainable fiscal strategies.

What key assumptions underlie revenue projections in the financial forecast document?

The financial forecast document bases its revenue projections on several critical assumptions including market demand, pricing strategies, and competitive landscape. These assumptions consider historical sales data, economic conditions, and anticipated product launches. Accurate assumptions ensure the forecast reflects realistic expectations and informs sound decision-making.

How are anticipated market trends integrated into annual planning forecasts?

Anticipated market trends are incorporated by analyzing industry reports, consumer behavior shifts, and technological advancements. These trends are used to adjust sales forecasts, marketing strategies, and resource allocation in the annual plan. Integrating trends ensures the plan remains adaptive and competitive throughout the fiscal year.

What scenario analysis methods are used for risk mitigation in the forecast?

Scenario analysis methods like best-case, worst-case, and most-likely case scenarios are applied to assess potential risks and uncertainties. Sensitivity analysis is also used to evaluate how changes in key assumptions affect outcomes. This approach enables proactive risk mitigation and contingency planning within the forecast.

How does the document address capital expenditure allocation for the planning year?

The document outlines the capital expenditure allocation based on prioritized projects, projected ROI, and cash flow considerations. It ensures alignment with strategic goals and operational needs by categorizing expenditures into maintenance, expansion, and innovation. Clear guidelines support effective budgeting and resource management for the planning year.

What metrics are tracked for variance analysis against the forecasted financial targets?

The document tracks key financial metrics such as revenue, expenses, gross margin, and EBITDA for variance analysis. Monthly and quarterly deviations are analyzed to identify causes and adjust operational strategies. Continuous monitoring supports accurate forecasting and improved financial performance.