A Profit and Loss Statement Document Sample for Sole Proprietors provides a clear overview of income, expenses, and net profit for an individual business owner. This document helps sole proprietors track financial performance and make informed decisions to improve profitability. It typically includes detailed categories such as sales revenue, cost of goods sold, operating expenses, and taxes.

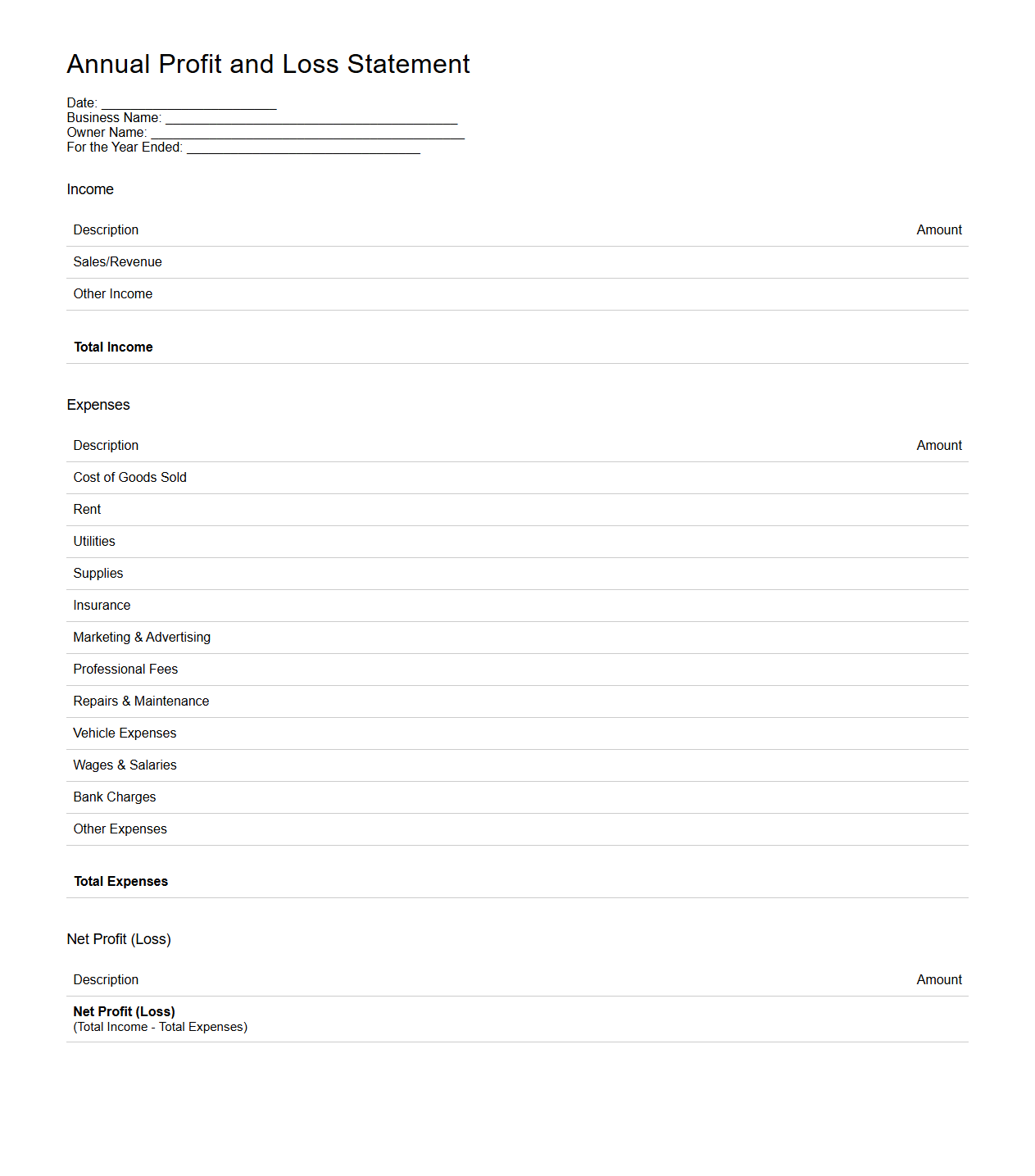

Annual Profit and Loss Statement Template for Sole Proprietors

An

Annual Profit and Loss Statement Template for Sole Proprietors is a structured financial document designed to help sole proprietors systematically record and summarize their income and expenses throughout the fiscal year. This template facilitates easy calculation of net profit or loss, providing clear insights into business performance and supporting tax reporting requirements. By organizing financial data efficiently, it enhances decision-making and financial planning for single-owner businesses.

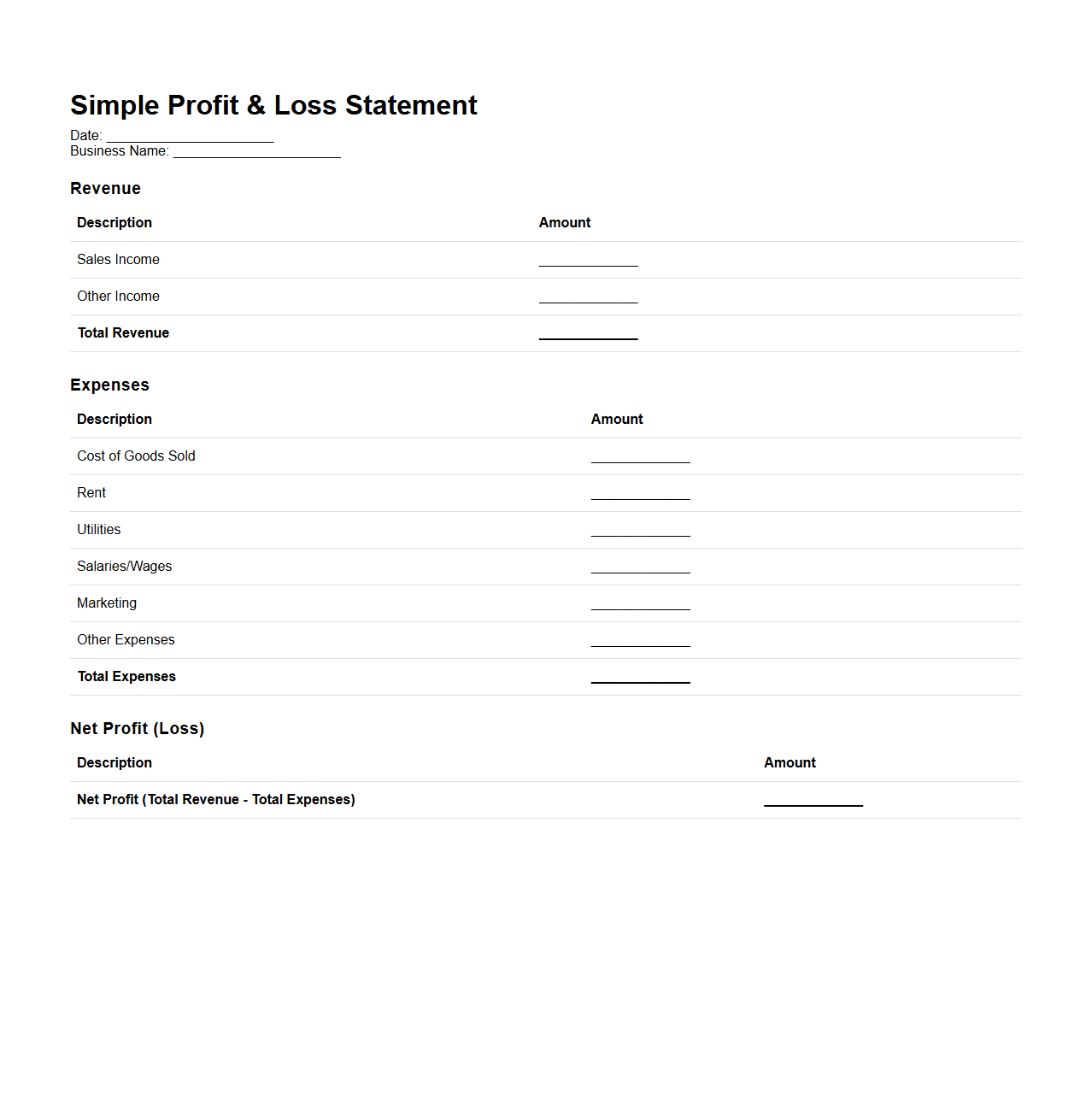

Simple P&L Statement Format for Sole Proprietorship

A

Simple P&L Statement Format for Sole Proprietorship document outlines the financial performance of a sole proprietorship by summarizing revenues, costs, and expenses over a specific period. It includes key sections such as gross income, operating expenses, and net profit, providing a clear view of profitability. This format is designed for ease of use, helping sole proprietors track financial health without complex accounting terminology.

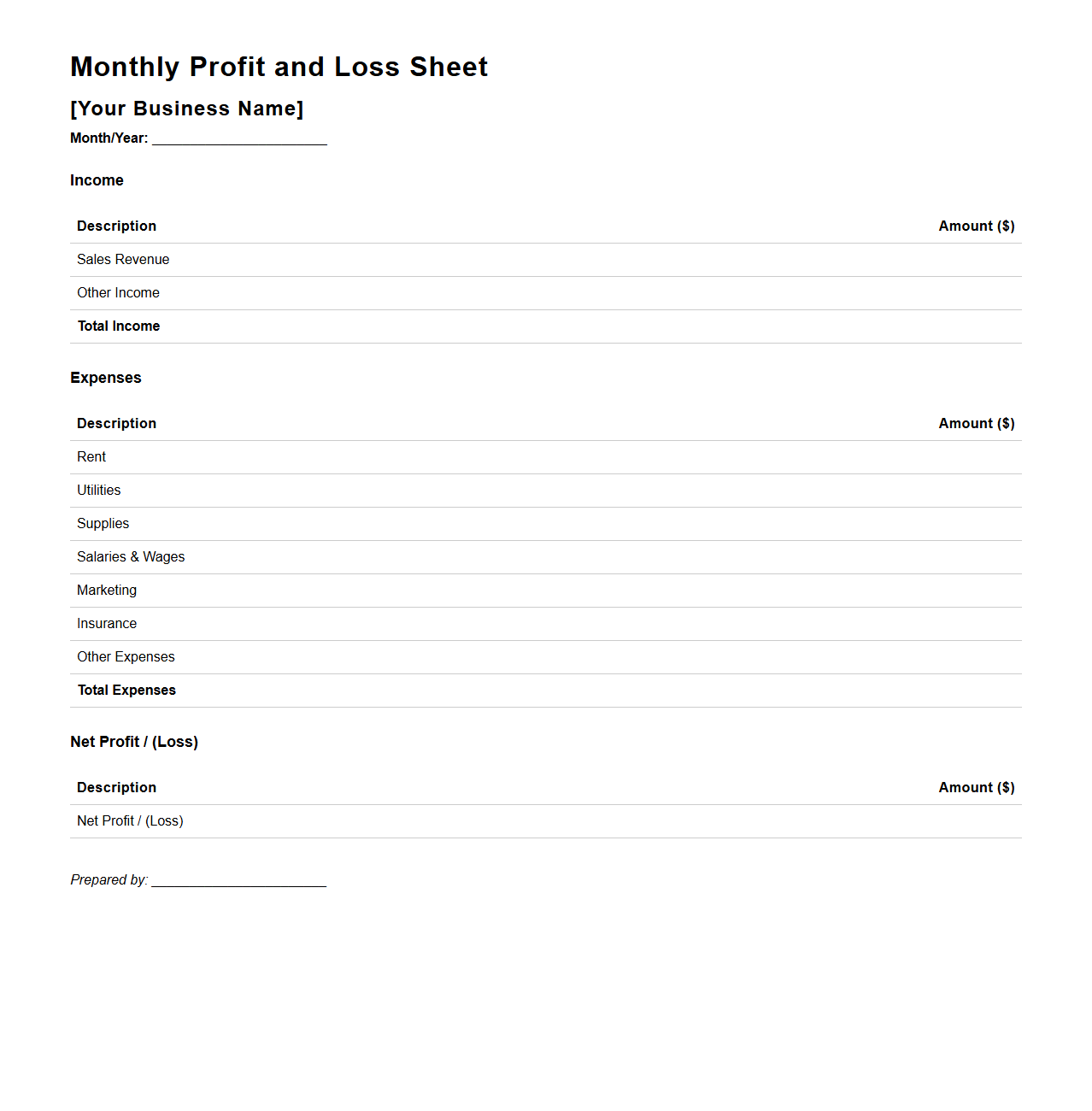

Monthly Profit and Loss Sheet for Sole Proprietor Businesses

A

Monthly Profit and Loss Sheet for sole proprietor businesses is a financial document that summarizes revenues, costs, and expenses incurred during a specific month. It helps track the business's profitability by detailing income sources and deducting all operational expenses. This sheet is essential for making informed decisions and ensuring accurate tax reporting for sole proprietors.

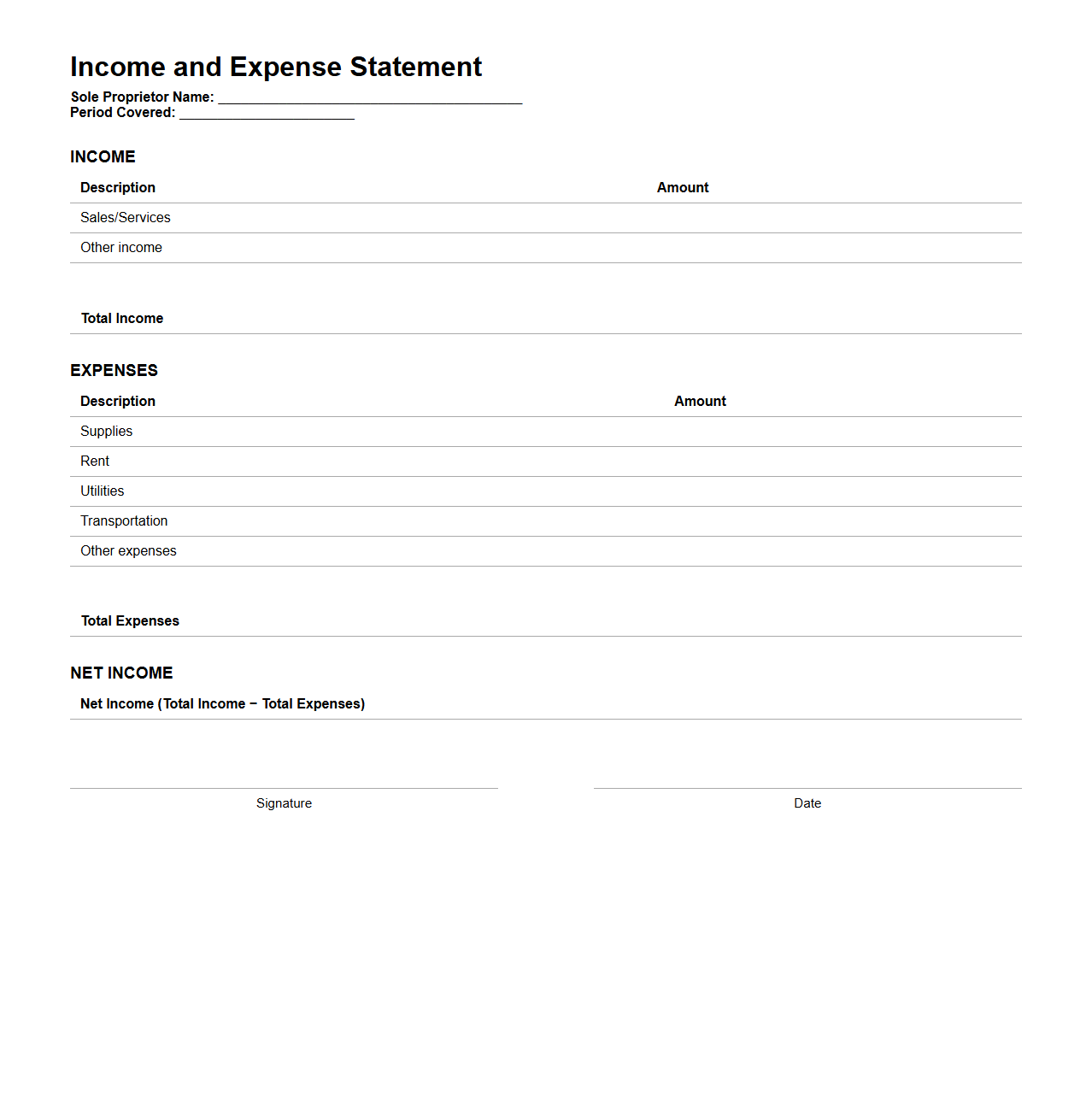

Basic Income and Expense Statement for Sole Proprietor

A

Basic Income and Expense Statement for Sole Proprietor is a financial document that summarizes a sole proprietor's revenues and expenditures over a specific period. This statement provides a clear overview of the business's profitability by detailing all income sources and categorizing expenses such as operational costs, supplies, and taxes. It serves as a crucial tool for financial management, tax reporting, and strategic planning for small business owners.

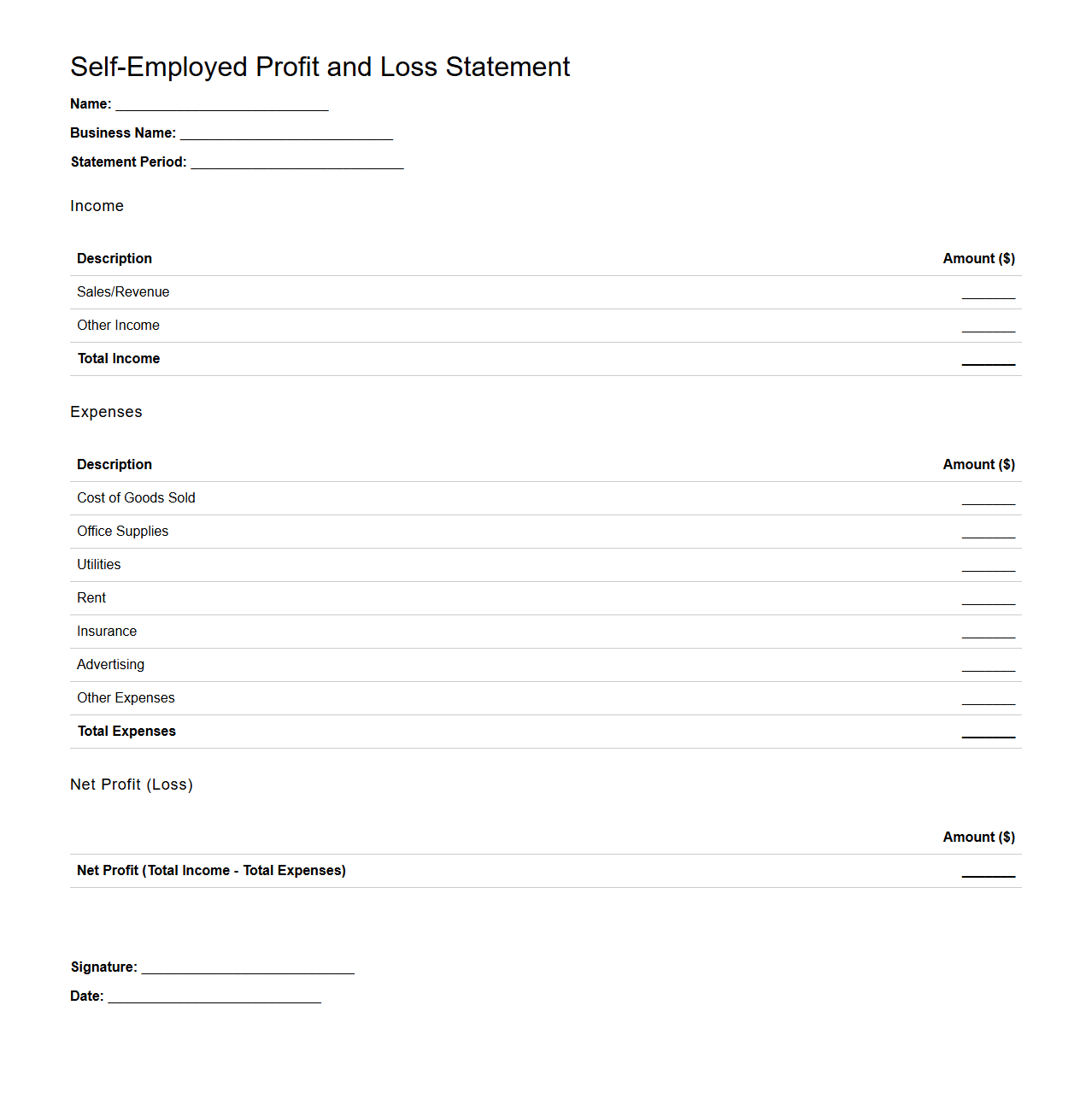

Self-Employed Profit and Loss Statement Example

A

Self-Employed Profit and Loss Statement Example document outlines the income and expenses of an individual running their own business, providing a clear summary of financial performance over a specific period. This statement helps track revenue streams, monitor deductible expenses, and calculate net profit or loss for tax purposes and business planning. It serves as a crucial tool for managing cash flow, preparing tax returns, and making informed financial decisions for self-employed professionals.

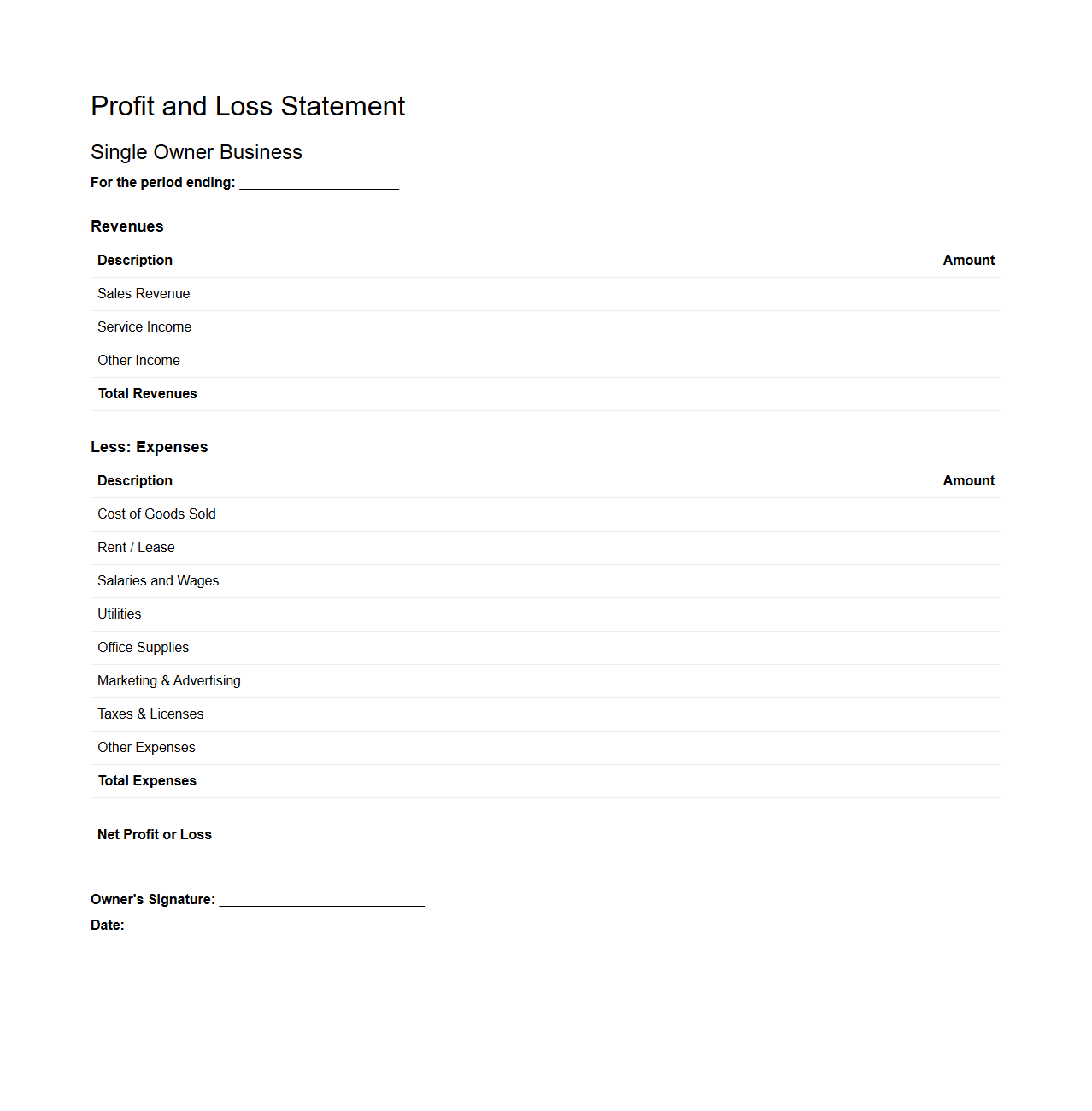

Single Owner Business Profit and Loss Statement Layout

A

Single Owner Business Profit and Loss Statement Layout document is a financial report format designed to summarize revenues, costs, and expenses over a specific period for a sole proprietorship. It provides a clear view of the business's net profit or loss by detailing income streams and deducting operating expenses, cost of goods sold, and taxes. This layout helps sole owners make informed financial decisions and manage cash flow effectively.

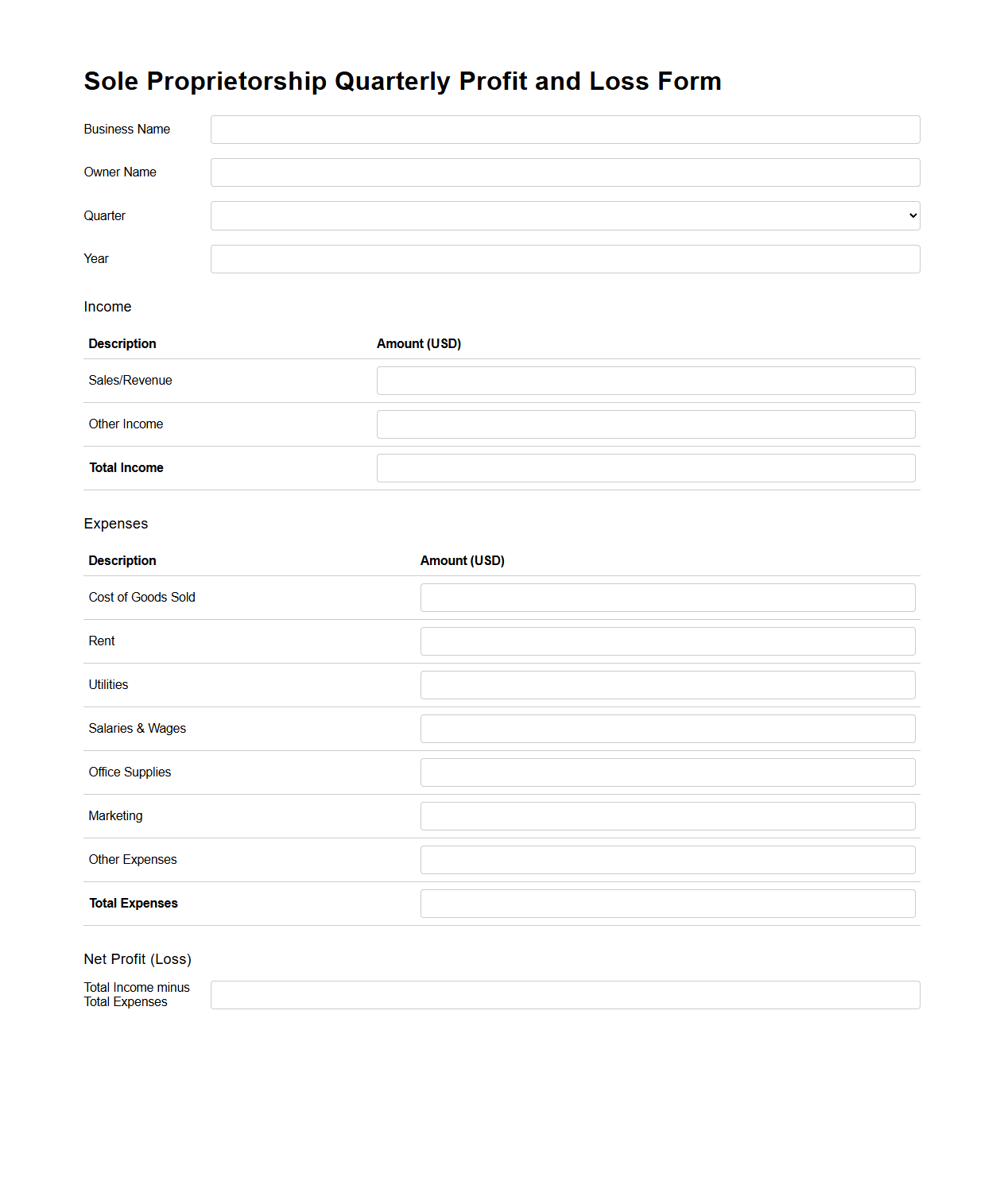

Sole Proprietorship Quarterly Profit and Loss Form

The

Sole Proprietorship Quarterly Profit and Loss Form is a financial document that tracks a business owner's income and expenses over a three-month period. This form helps sole proprietors measure their profitability and make informed tax payments throughout the year. Accurate completion ensures compliance with tax regulations and provides a clear snapshot of financial performance for better business decision-making.

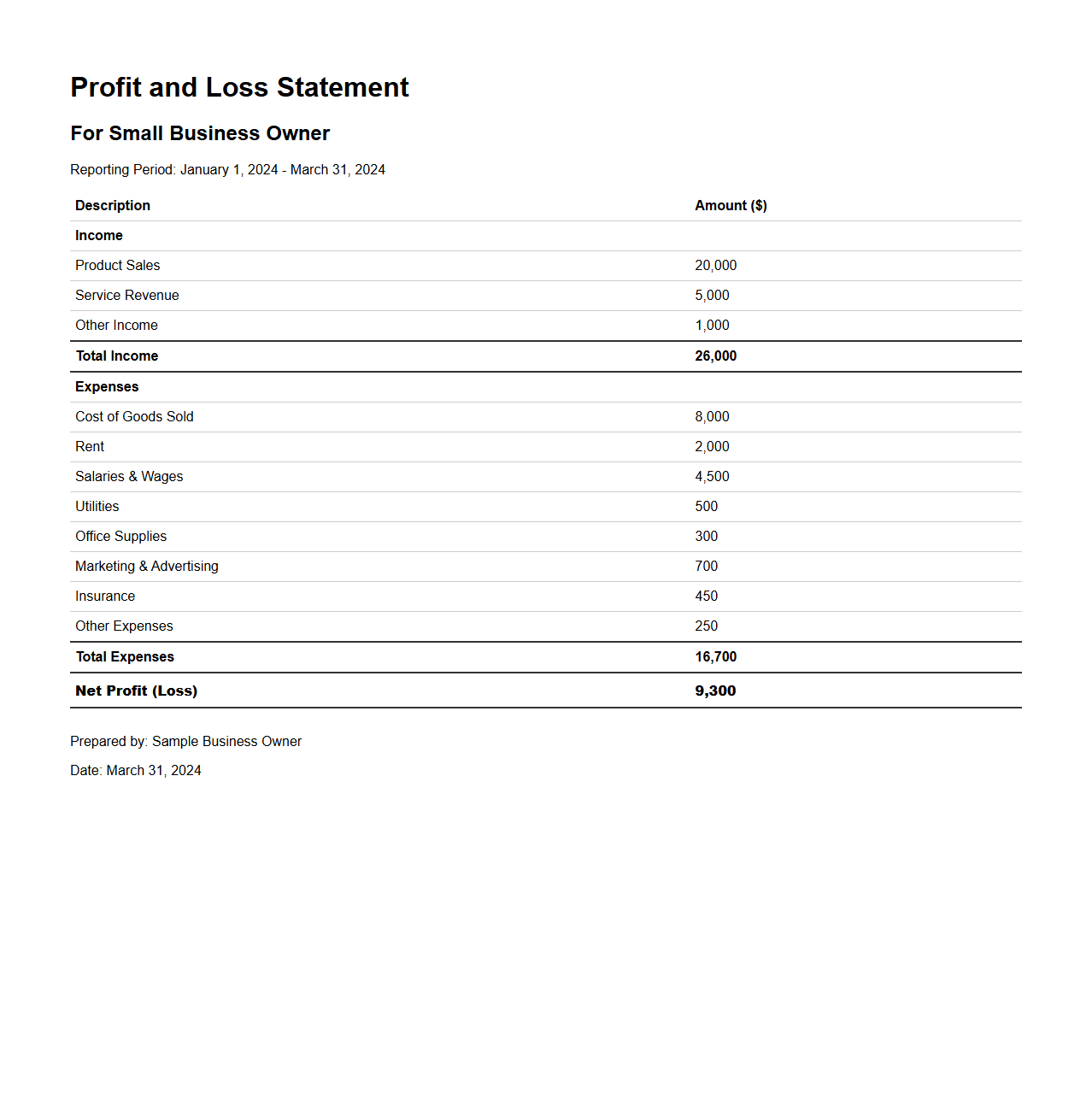

Small Business Owner Profit and Loss Statement Sample

A

Small Business Owner Profit and Loss Statement Sample document outlines a template used to summarize revenues, costs, and expenses incurred during a specific period. This financial report helps business owners analyze profitability, track operational efficiency, and make informed decisions based on clear income and expense data. Utilizing this sample ensures accurate financial tracking and aids in strategic planning for sustainable business growth.

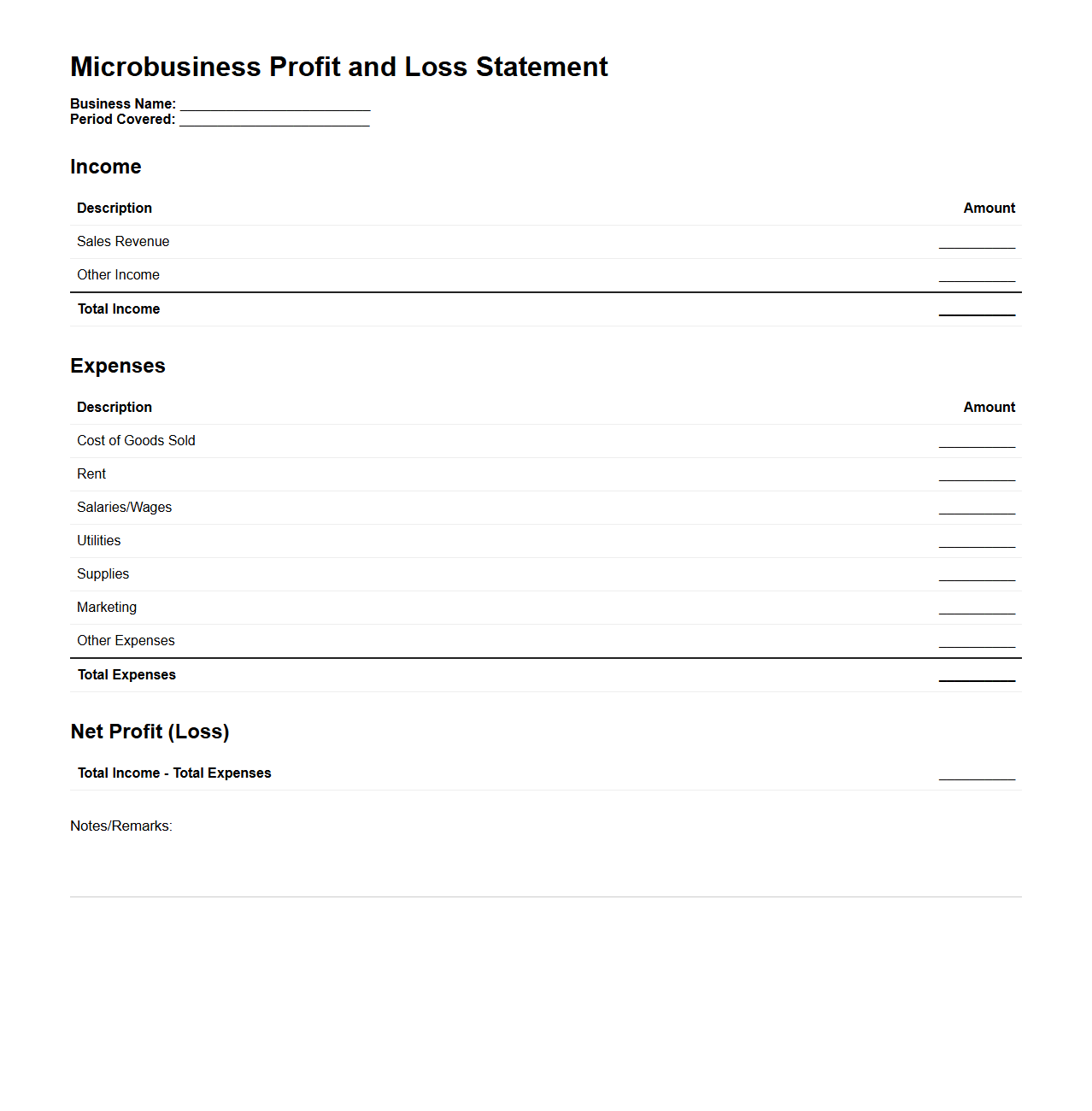

Microbusiness Profit and Loss Statement Example

A

Microbusiness Profit and Loss Statement Example document illustrates the financial performance of a small enterprise by detailing its revenues, costs, and expenses over a specific period. This example helps microbusiness owners understand how to track income versus expenditures, calculate net profit or loss, and make informed decisions for financial management. It typically includes categorized sections such as sales revenue, cost of goods sold, operating expenses, and gross profit to provide a clear snapshot of profitability.

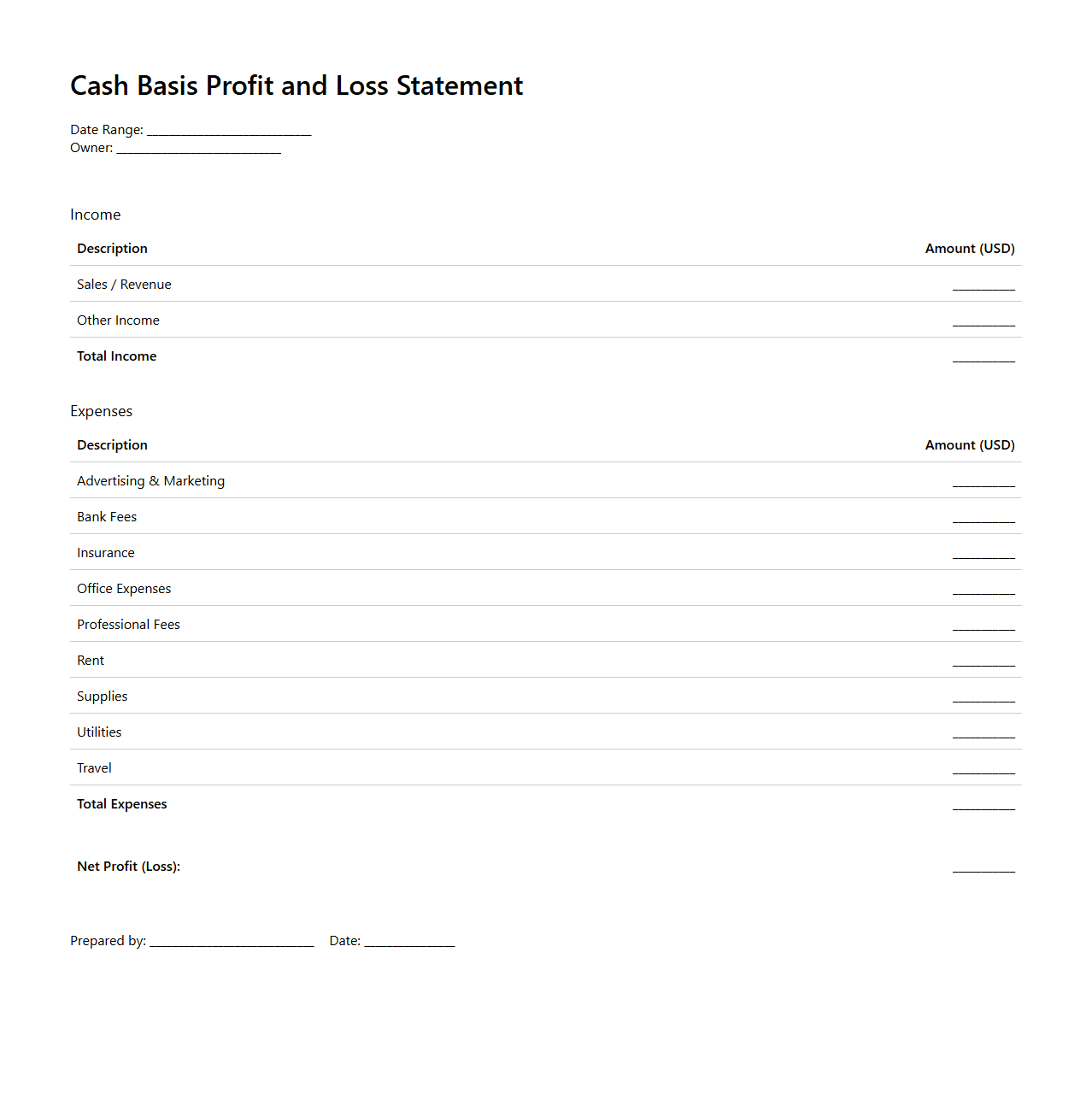

Cash Basis Profit and Loss Statement Template for Sole Proprietors

A

Cash Basis Profit and Loss Statement Template for sole proprietors is a financial document designed to track income and expenses based on actual cash received and paid during a specific period. This template helps sole proprietors accurately report their net profit by recording transactions only when money changes hands, simplifying tax preparation and cash flow management. It is essential for small business owners who prefer or are required to use cash accounting methods for more straightforward financial tracking and tax compliance.

What specific line items should a sole proprietor include in a profit and loss statement?

A sole proprietor's profit and loss statement must include revenue or sales, which represents the total income generated from business activities. Key expense categories such as cost of goods sold (COGS), operating expenses, and administrative expenses should be clearly itemized. Additionally, important line items like net profit or loss provide a concise summary of the business's financial performance during the reporting period.

How do you separate personal and business expenses on a sole proprietor's P&L document?

To maintain accurate financial records, a sole proprietor should separate personal and business expenses by using dedicated business accounts and credit cards. Business-related expenses must be recorded exclusively on the P&L, while personal expenses should never be mixed. Detailed bookkeeping through accounting software or spreadsheets ensures proper categorization and clarity for tax and financial reporting.

Which tax deductions should be documented in a sole proprietor's profit and loss report?

Sole proprietors should document key tax deductions such as home office expenses, vehicle costs used for business, and supplies directly related to their business operations. Expenses like travel, meals, utilities, and professional services should also be tracked meticulously. Proper documentation and categorization of these deductions help reduce taxable income and ensure compliance with tax regulations.

How often should a sole proprietor update their profit and loss statement for accurate financial tracking?

For effective financial management, a sole proprietor should update their profit and loss statement at least monthly to capture current financial data. Regular updates facilitate timely decision-making and help identify trends or issues early. Additionally, quarterly reviews can assist in preparing accurate tax returns and budgeting for upcoming business activities.

What supporting documentation is necessary to substantiate figures in a sole proprietor's profit and loss statement?

Supporting documentation such as receipts, invoices, bank statements, and contracts are essential to verify the accuracy of the profit and loss figures. Maintaining organized records ensures that all financial entries have credible evidence, which is critical during audits or tax filing. Proper documentation also enhances transparency and strengthens financial accountability for the business.