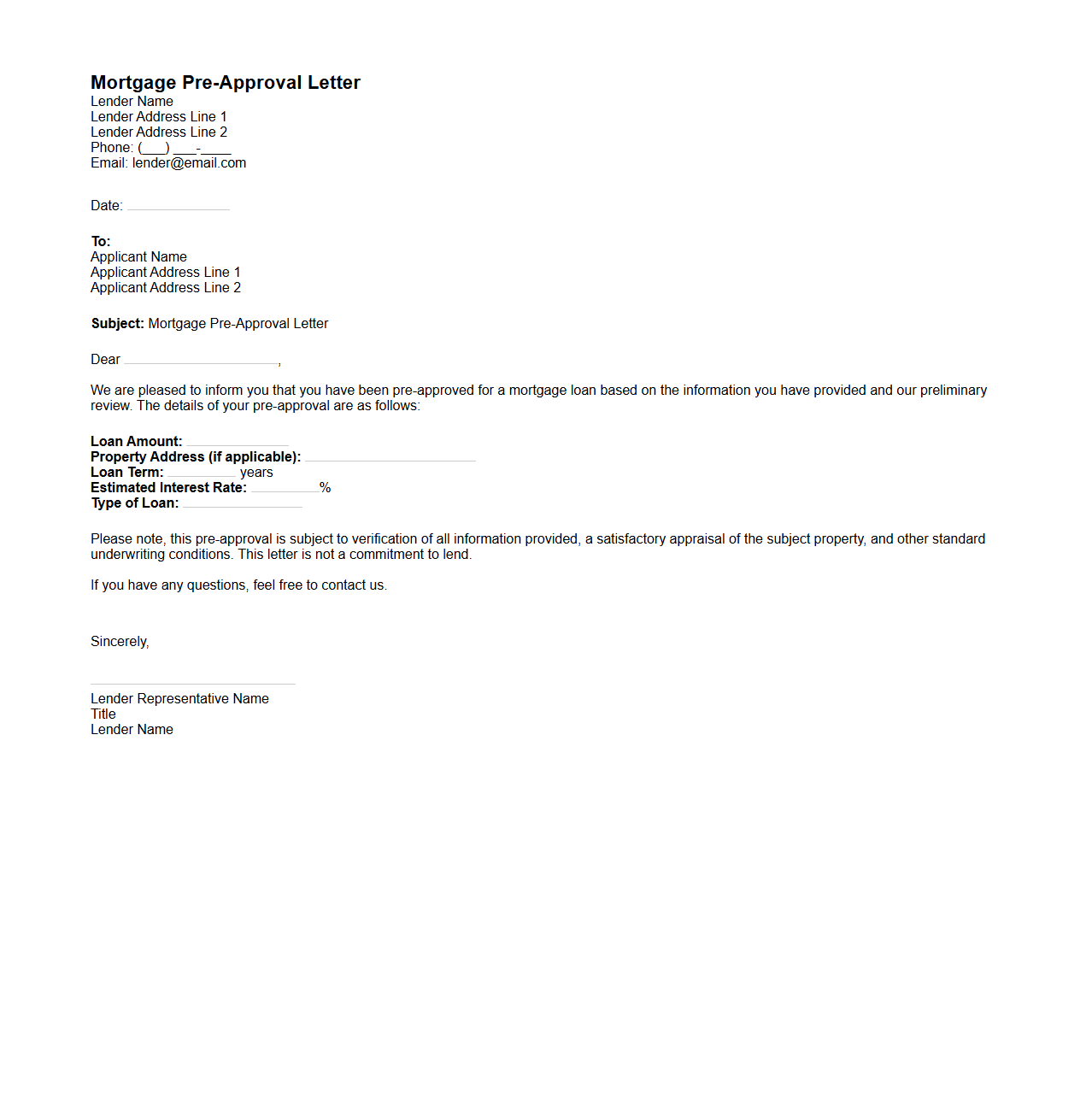

Mortgage Pre-Approval Letter Template

A

Mortgage Pre-Approval Letter Template document serves as a standardized form that outlines a lender's preliminary commitment to loan a specific amount to a homebuyer based on their financial qualifications. This template typically includes key details such as the borrower's creditworthiness, income verification, and estimated loan amount, which helps streamline the home buying process. Real estate agents and sellers often recognize this letter as a credible indication that the buyer is financially prepared to proceed with a property purchase.

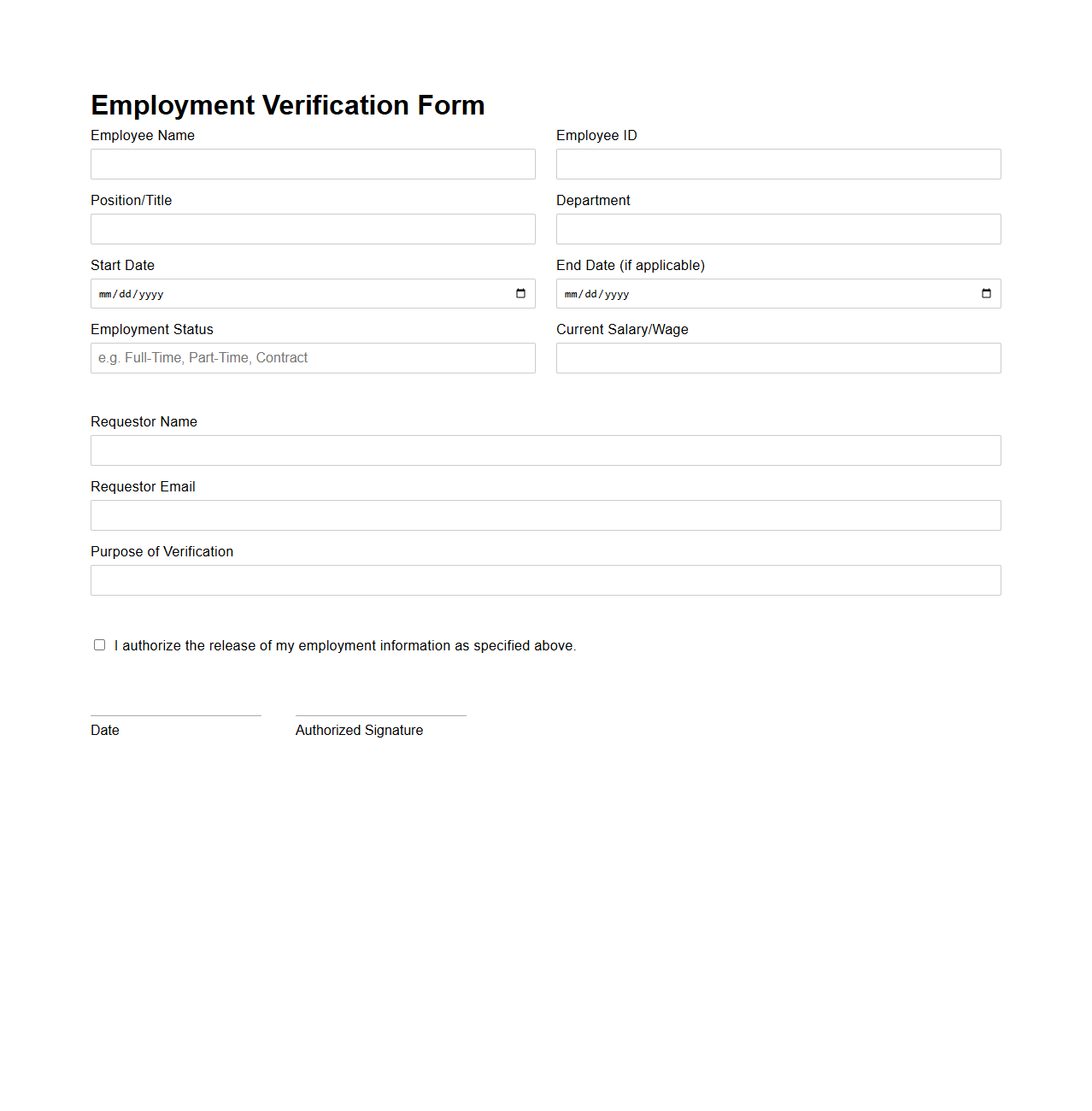

Employment Verification Form Sample

An

Employment Verification Form Sample is a standardized document used by employers to confirm an individual's current or past employment status, job title, and duration of employment. This form is essential for verifying work history during processes such as loan applications, background checks, or rental agreements. It typically includes fields for employer information, employee details, and official signatures.

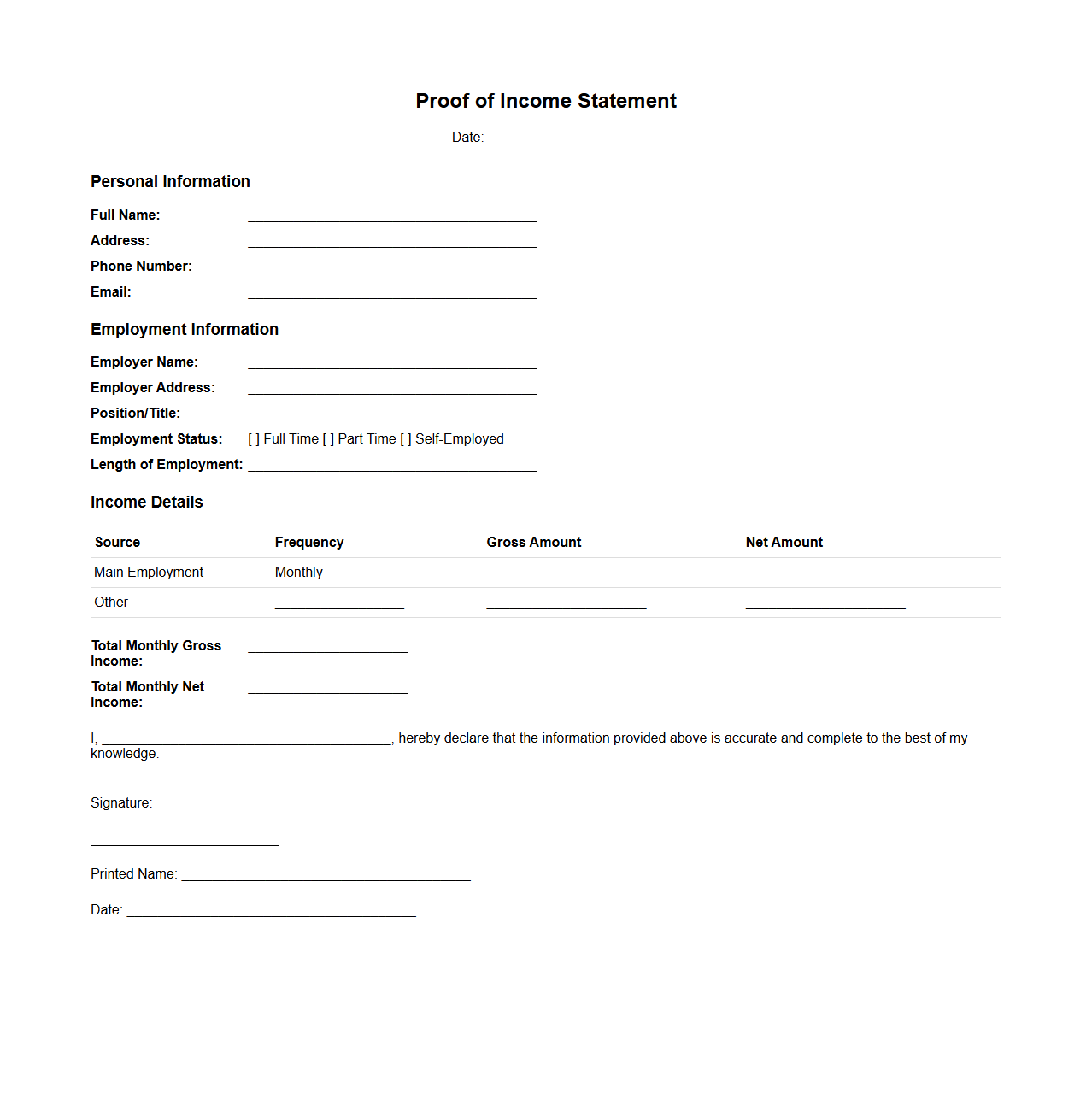

Proof of Income Statement Example

A

Proof of Income Statement Example document provides a detailed record verifying an individual's earnings from various sources such as employment, freelance work, or business activities. It typically includes information like salary amounts, payment dates, employer details, and any additional income streams, serving as evidence for loan applications, rental agreements, or financial assessments. This document helps lenders, landlords, and financial institutions accurately assess an individual's financial stability and repayment capacity.

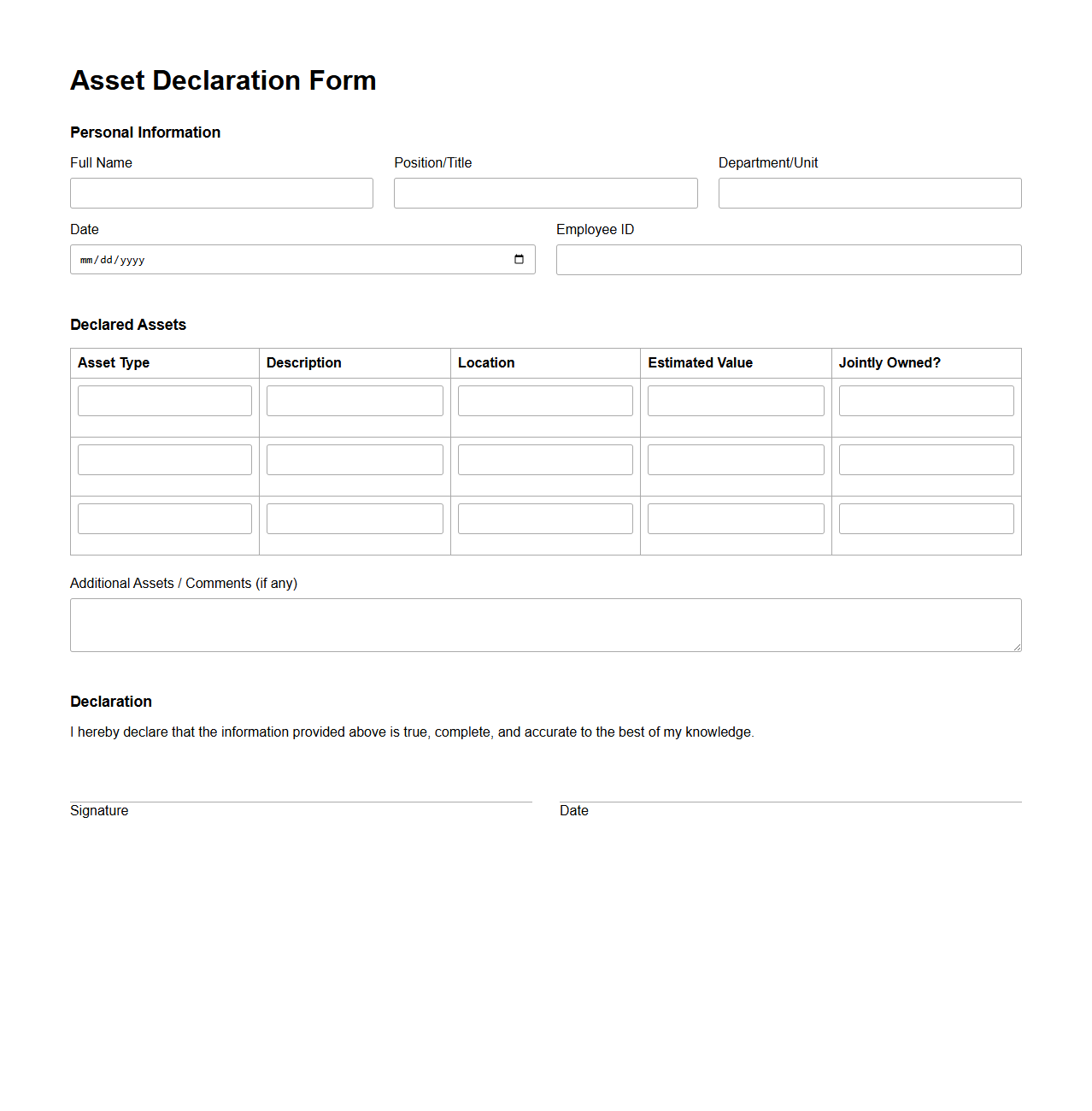

Asset Declaration Form Sample

An

Asset Declaration Form Sample document serves as a template for individuals to list their assets, including properties, investments, and valuables, to ensure transparency and compliance with legal or organizational requirements. It is commonly used in government, corporate, and financial institutions for monitoring financial integrity and preventing fraud or corruption. This sample aids in properly organizing asset details, making the declaration process efficient and standardized.

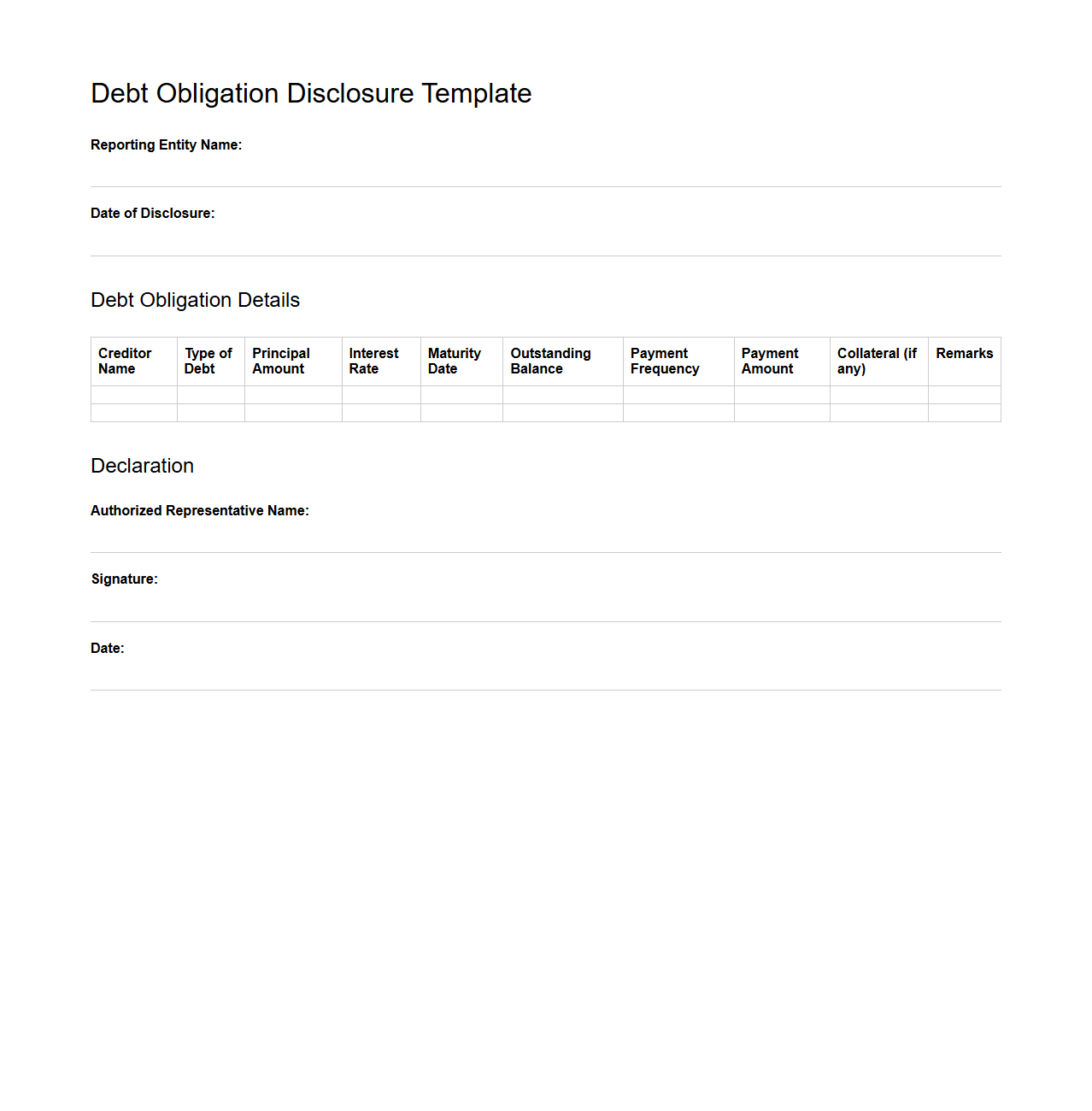

Debt Obligation Disclosure Template

A

Debt Obligation Disclosure Template document is a standardized format used to systematically report and disclose details related to financial liabilities and debt commitments of an individual or organization. This template ensures transparency by capturing critical data such as the type of debt, principal amount, interest rates, repayment schedules, and creditor information. Utilizing this document helps stakeholders assess financial obligations comprehensively, facilitating informed decision-making and regulatory compliance.

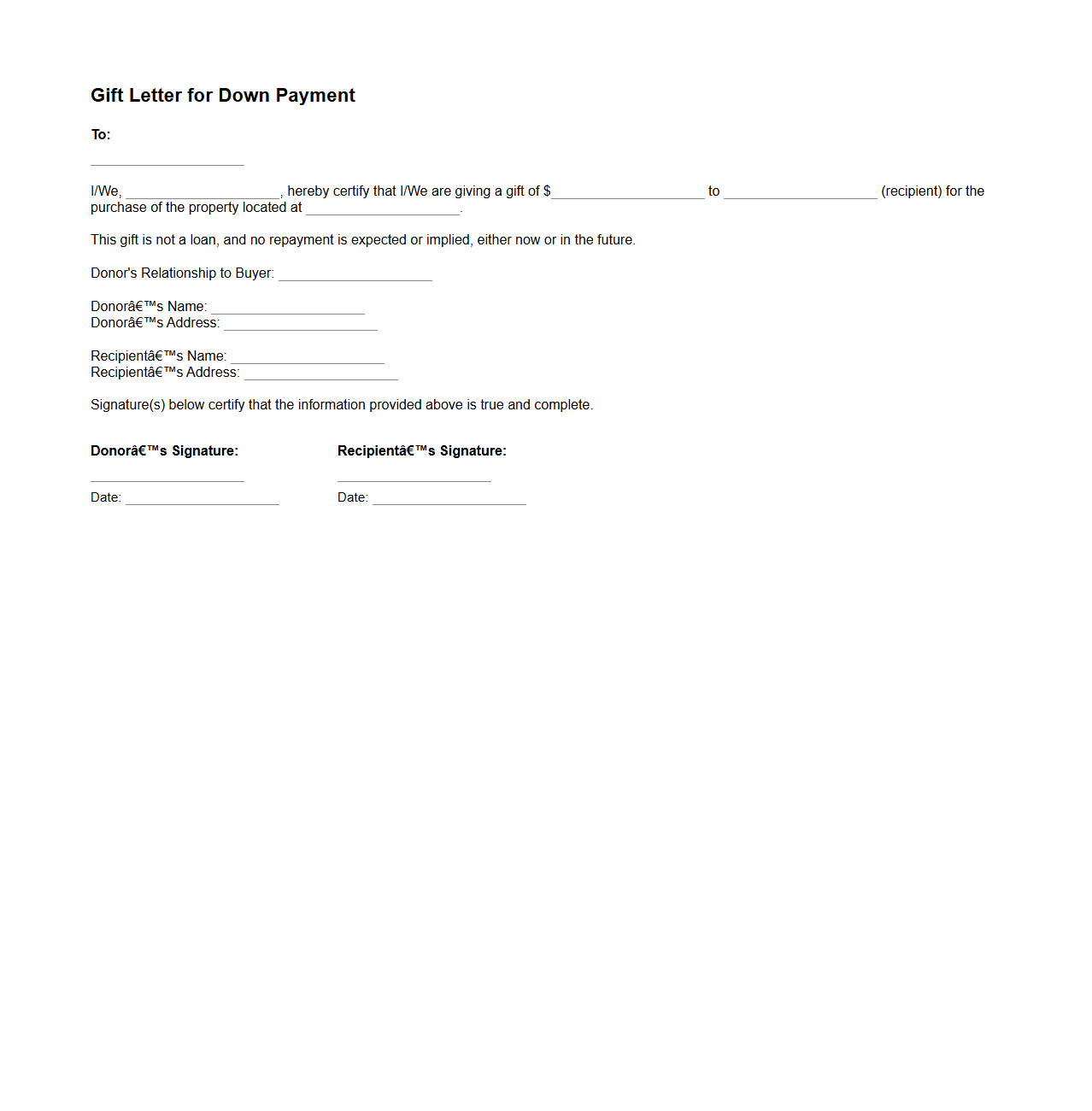

Gift Letter for Down Payment Sample

A

Gift Letter for Down Payment sample document serves as formal proof that a borrower's down payment funds are a monetary gift, not a loan, from a relative, friend, or entity. This letter typically includes the donor's name, the recipient's name, the gift amount, and a clear statement confirming no repayment is expected. Lenders require this document to verify the source of funds and ensure compliance with mortgage underwriting guidelines.

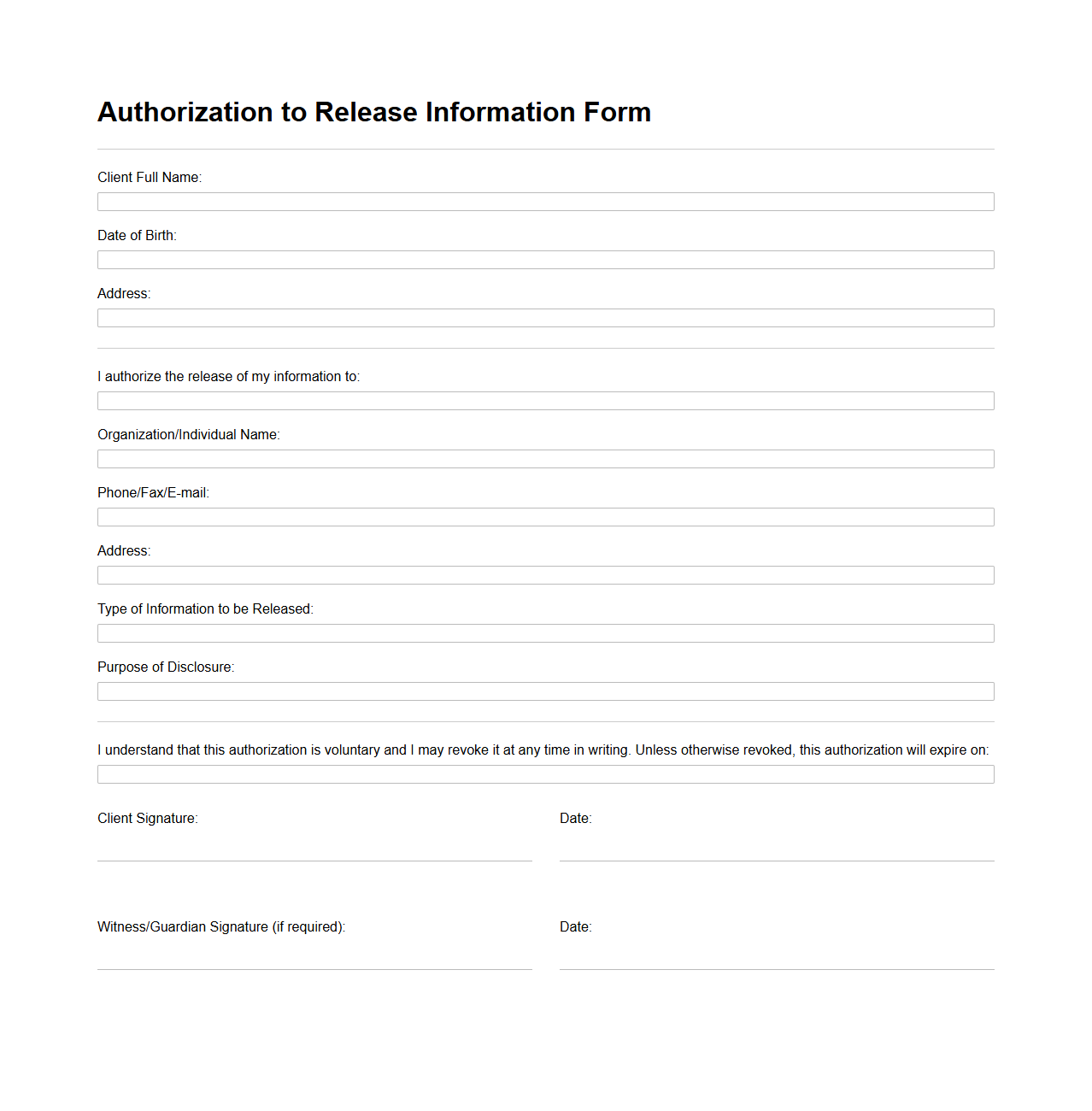

Authorization to Release Information Form

The Authorization to Release Information Form is a

legal document that grants permission for a third party to access and share specific personal or confidential information. This form is commonly used in healthcare, education, and financial sectors to ensure compliance with privacy laws such as HIPAA. It specifies the type of information to be disclosed, the parties involved, and the duration of the authorization.

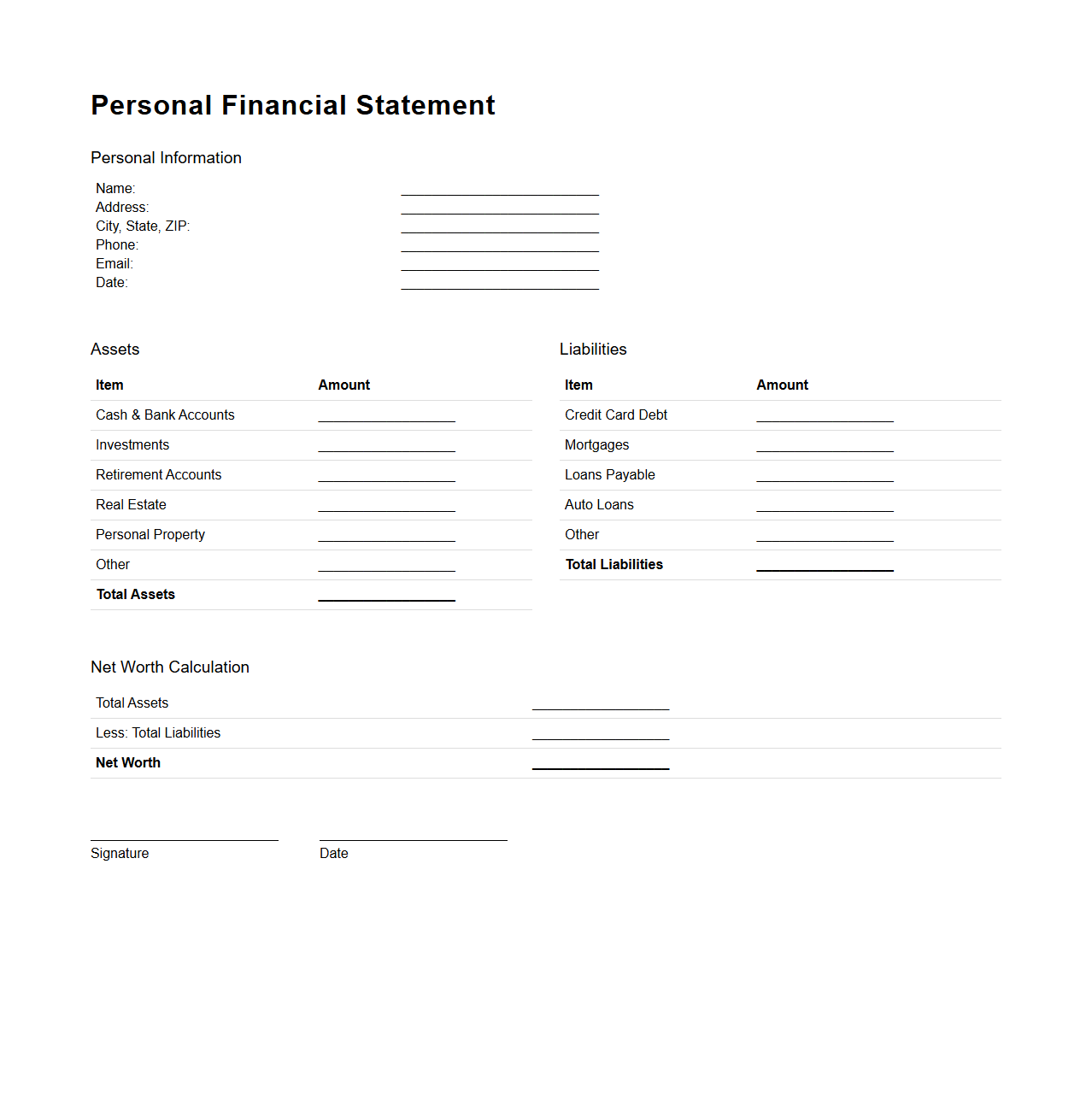

Personal Financial Statement Example

A

Personal Financial Statement Example document provides a detailed snapshot of an individual's financial position, outlining assets, liabilities, income, and expenses. This statement is essential for assessing creditworthiness, loan applications, and financial planning. It typically includes key elements such as bank balances, investments, real estate holdings, debts, and monthly income sources.

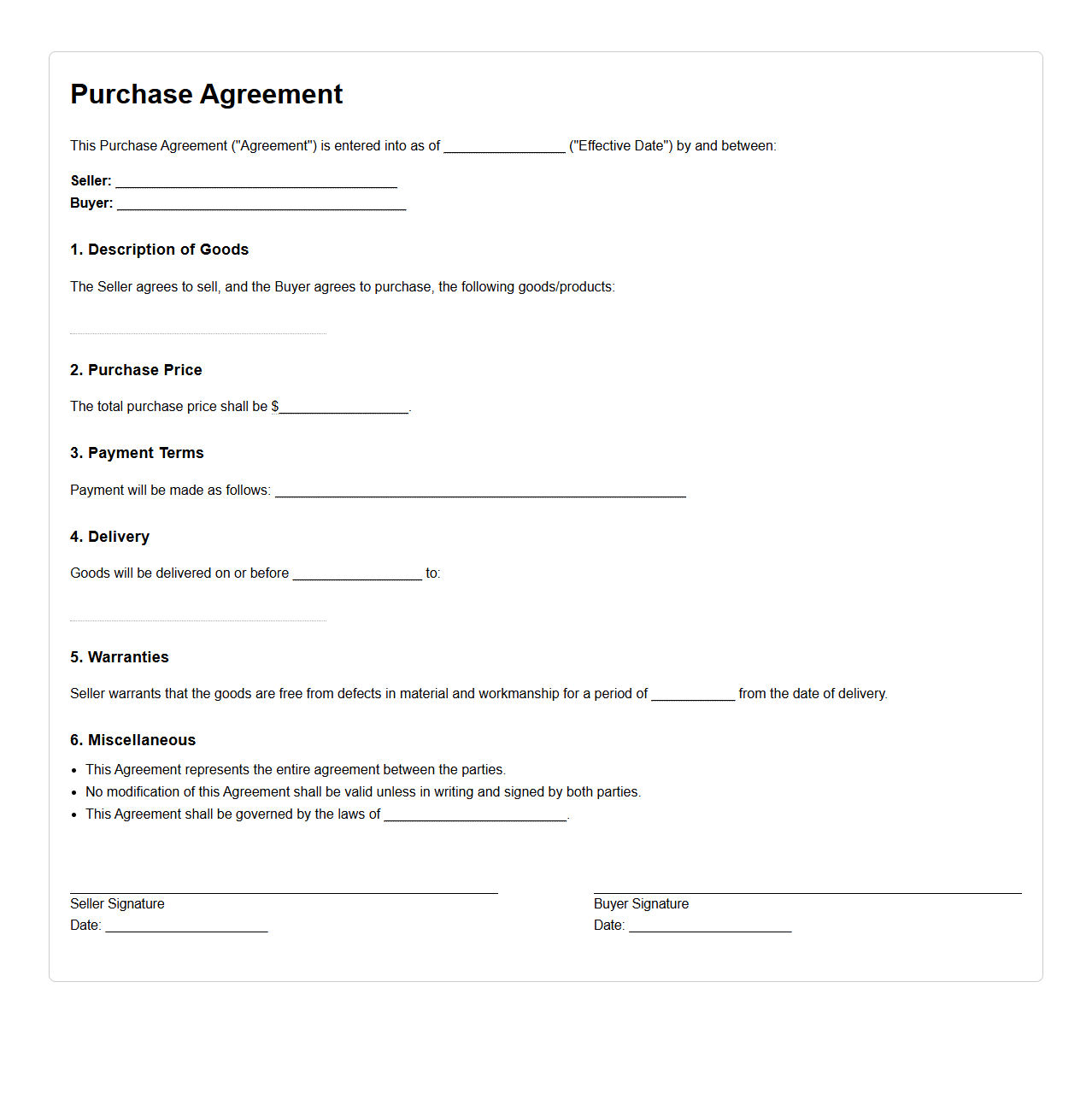

Purchase Agreement Document Sample

A

Purchase Agreement Document Sample serves as a crucial template outlining the terms and conditions between a buyer and seller for the sale of goods or property. It includes essential details such as the product description, purchase price, payment terms, delivery schedule, and warranties to ensure legal clarity and protect both parties' rights. Using this sample document helps streamline contract creation, reduce disputes, and provide a clear framework for transaction completion.

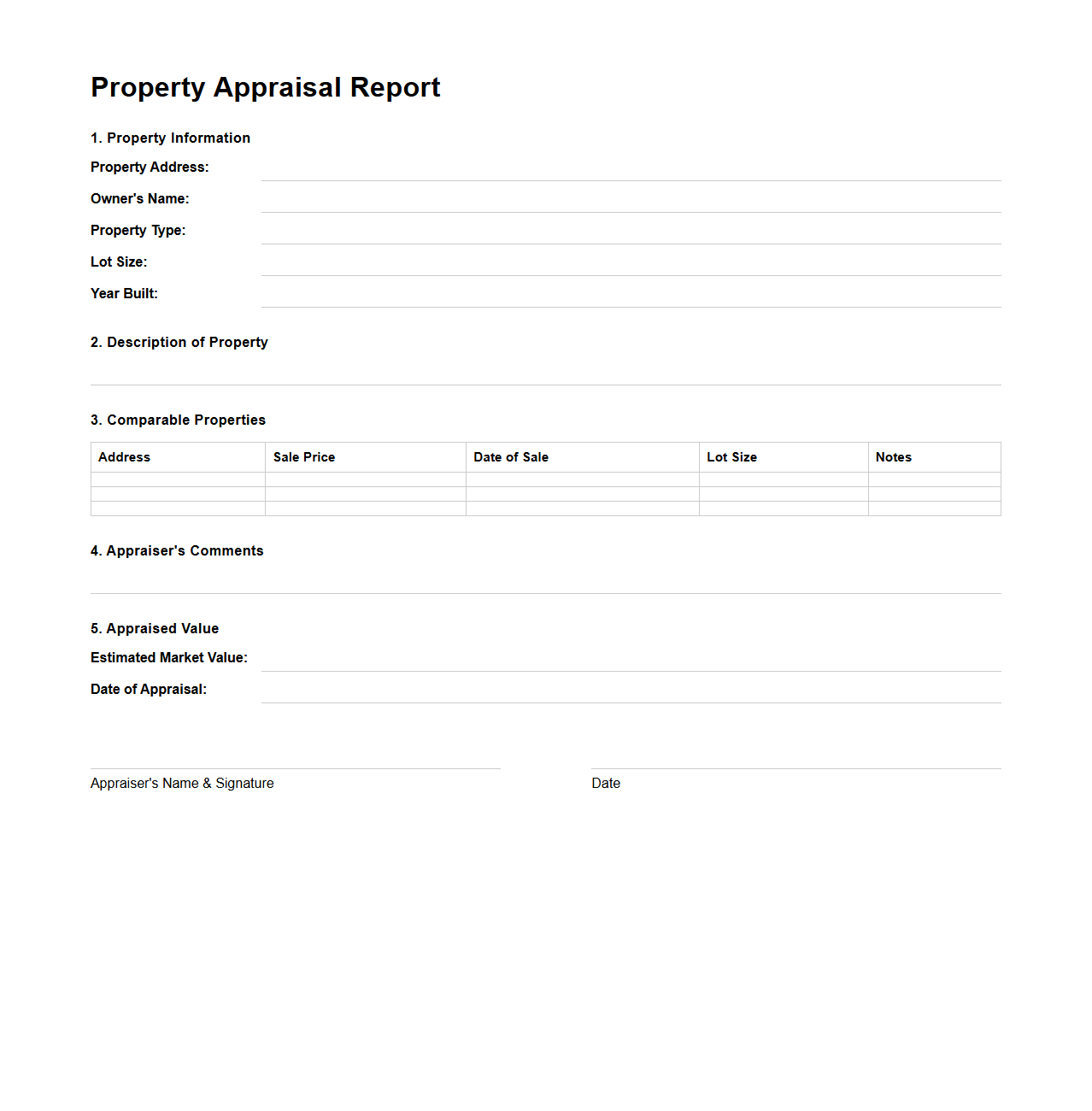

Property Appraisal Report Sample

A

Property Appraisal Report Sample document provides a detailed evaluation of a property's market value based on factors such as location, condition, and comparable sales data. It includes an analysis of the property's physical characteristics, recent improvements, and neighborhood trends to offer an accurate valuation. This report is essential for buyers, sellers, and lenders to make informed real estate decisions.

What verification documents are required for self-employed mortgage applicants?

Self-employed mortgage applicants must provide proof of income that typically includes tax returns, profit and loss statements, and bank statements. Additionally, lenders often require a business license or verification of business existence. These documents help confirm the stability and legitimacy of the applicant's income.

How recent must bank statements be for a mortgage application?

Bank statements submitted for mortgage applications should generally be from the last 30 to 60 days. Lenders use these recent statements to verify current financial status and cash flow. Providing up-to-date statements ensures accurate assessment of your financial health during the mortgage review process.

Are digital pay stubs accepted in mortgage document submissions?

Most lenders accept digital pay stubs as valid proof of income, provided they are official and include employer details. Electronic versions should be clear, legible, and often require direct transmission from the employer or payroll system. This helps maintain the authenticity and accuracy of income verification for the mortgage application.

What proof of gifted down payment is needed for mortgage approval?

To prove a gifted down payment, applicants must provide a gift letter stating that the money is a gift with no repayment required. Additionally, documentation showing the transfer of funds and the donor's financial information may be requested. This ensures the lender understands the source and nature of the funds in the transaction.

Which tax forms are mandatory for first-time homebuyer mortgage applications?

First-time homebuyers typically need to submit the last two years of IRS Form 1040 along with all corresponding schedules. These forms provide detailed income information necessary for lender evaluation. Accurate tax documentation is essential for verifying earnings and assessing eligibility for mortgage approval.