The Income Statement Document Sample for Corporate Finance provides a clear overview of a company's revenues, expenses, and net profit over a specific period. This sample helps financial analysts evaluate operational efficiency and profitability. It is essential for making informed business decisions and financial planning.

Consolidated Income Statement Template for Multinational Corporations

A

Consolidated Income Statement Template for Multinational Corporations is a financial reporting tool designed to aggregate revenue, expenses, and net income across multiple subsidiaries and international operations. This template ensures consistency in presenting financial performance, facilitating accurate comparison and compliance with global accounting standards like IFRS or GAAP. It enables multinational corporations to efficiently consolidate diverse currency transactions, intercompany eliminations, and segment disclosures into a unified financial statement.

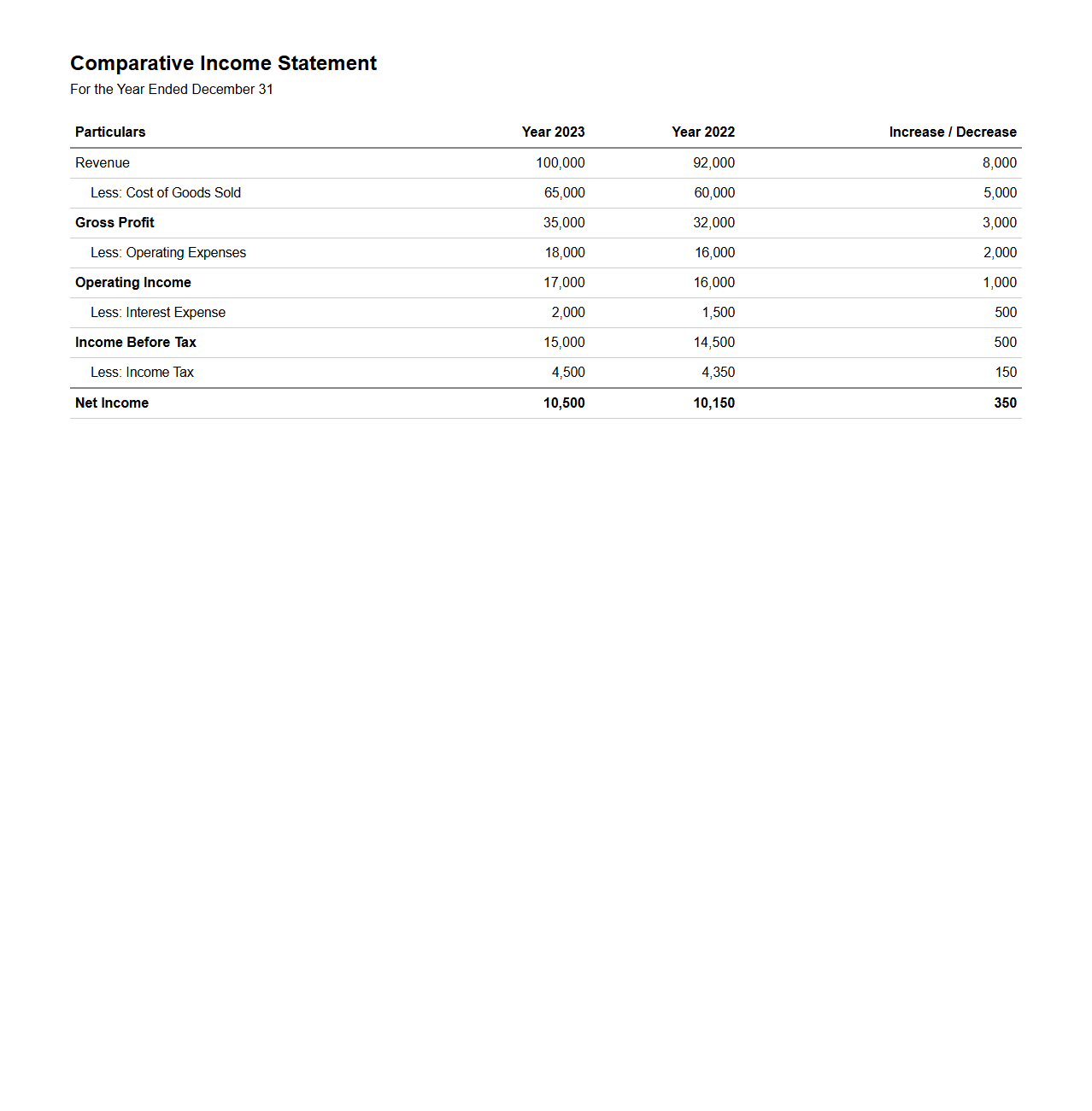

Comparative Income Statement Format for Annual Reporting

A

Comparative Income Statement Format for annual reporting presents financial performance data of consecutive fiscal years side-by-side, allowing for clear analysis of trends and changes in revenue, expenses, and net income over time. This format enhances decision-making by highlighting year-over-year variations, facilitating better evaluation of business growth and operational efficiency. Companies and stakeholders use this document to assess financial health and support strategic planning.

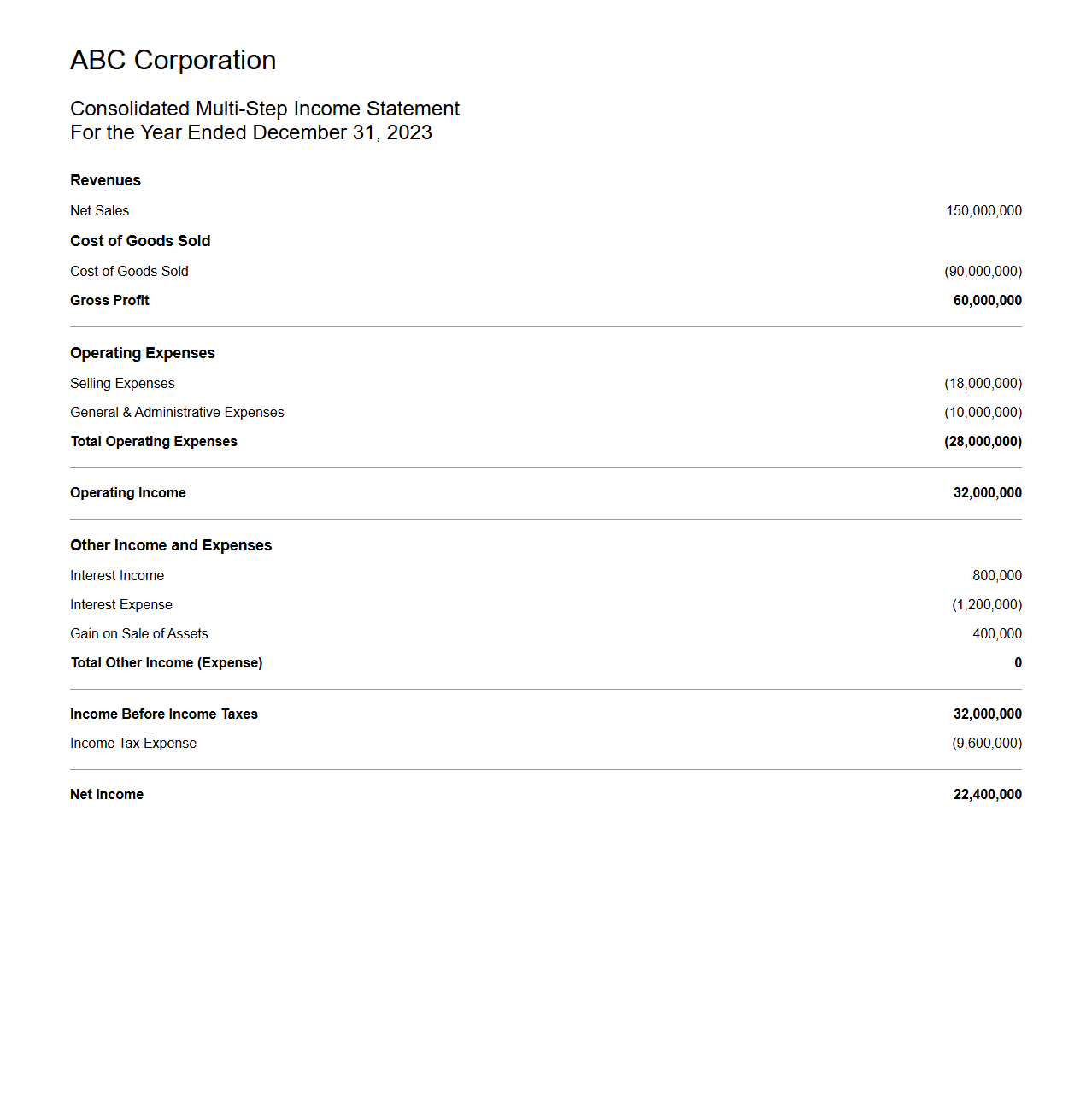

Multi-Step Income Statement Example for Public Companies

A

Multi-Step Income Statement Example for Public Companies document illustrates the detailed format used by public corporations to report their financial performance. It breaks down revenues, cost of goods sold, gross profit, operating expenses, and net income in multiple sections to provide clearer insights into profitability. This format enhances transparency for investors and regulators by distinctly separating operating results from non-operating activities.

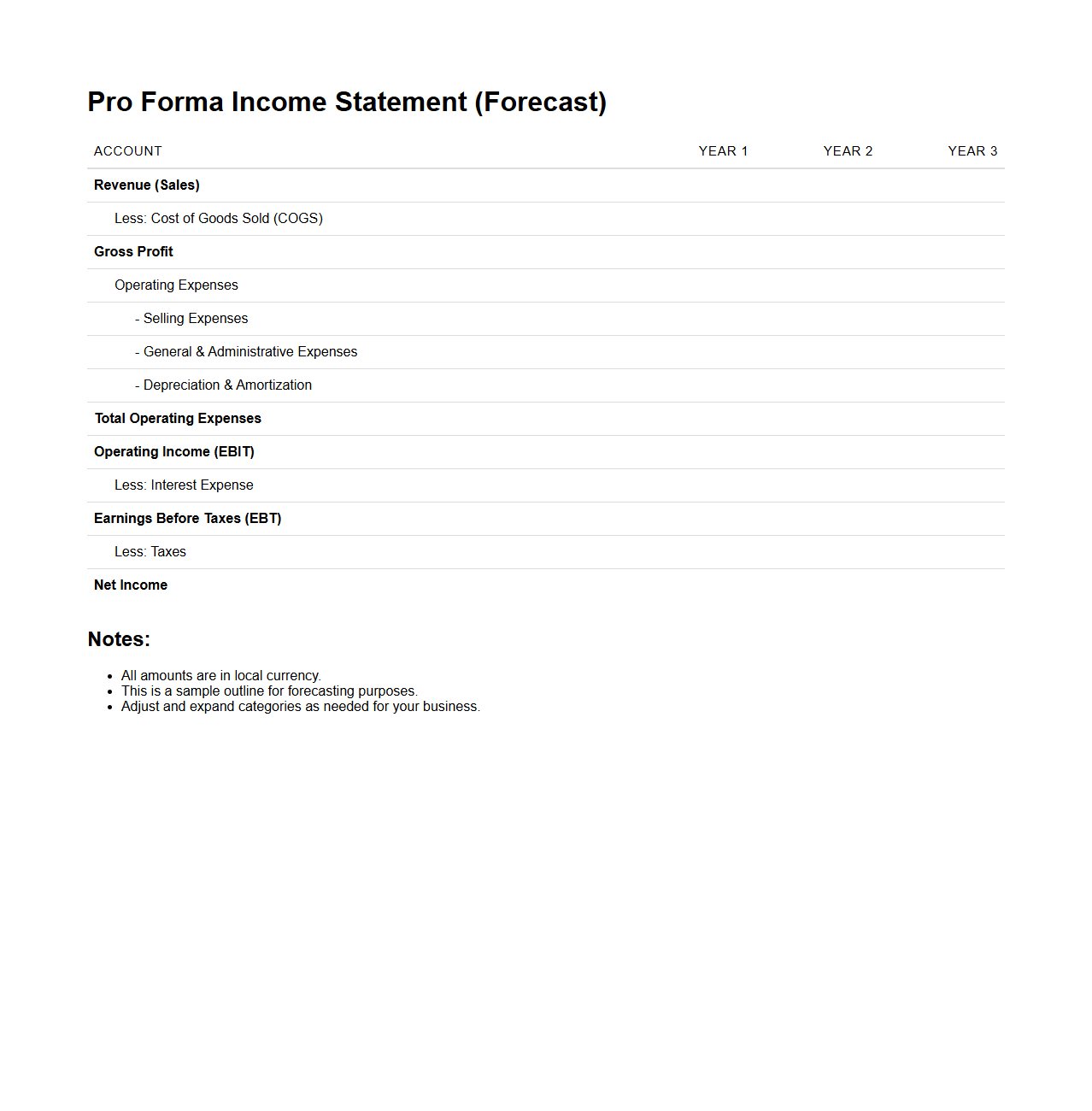

Pro Forma Income Statement Outline for Forecasting

A

Pro Forma Income Statement Outline for forecasting is a financial document projecting future revenues, expenses, and net income based on estimated business activities. It serves as a key tool for budget planning, investment analysis, and strategic decision-making by providing a structured format that highlights expected financial performance over a specific period. This outline helps companies anticipate profitability and identify potential financial challenges before they occur.

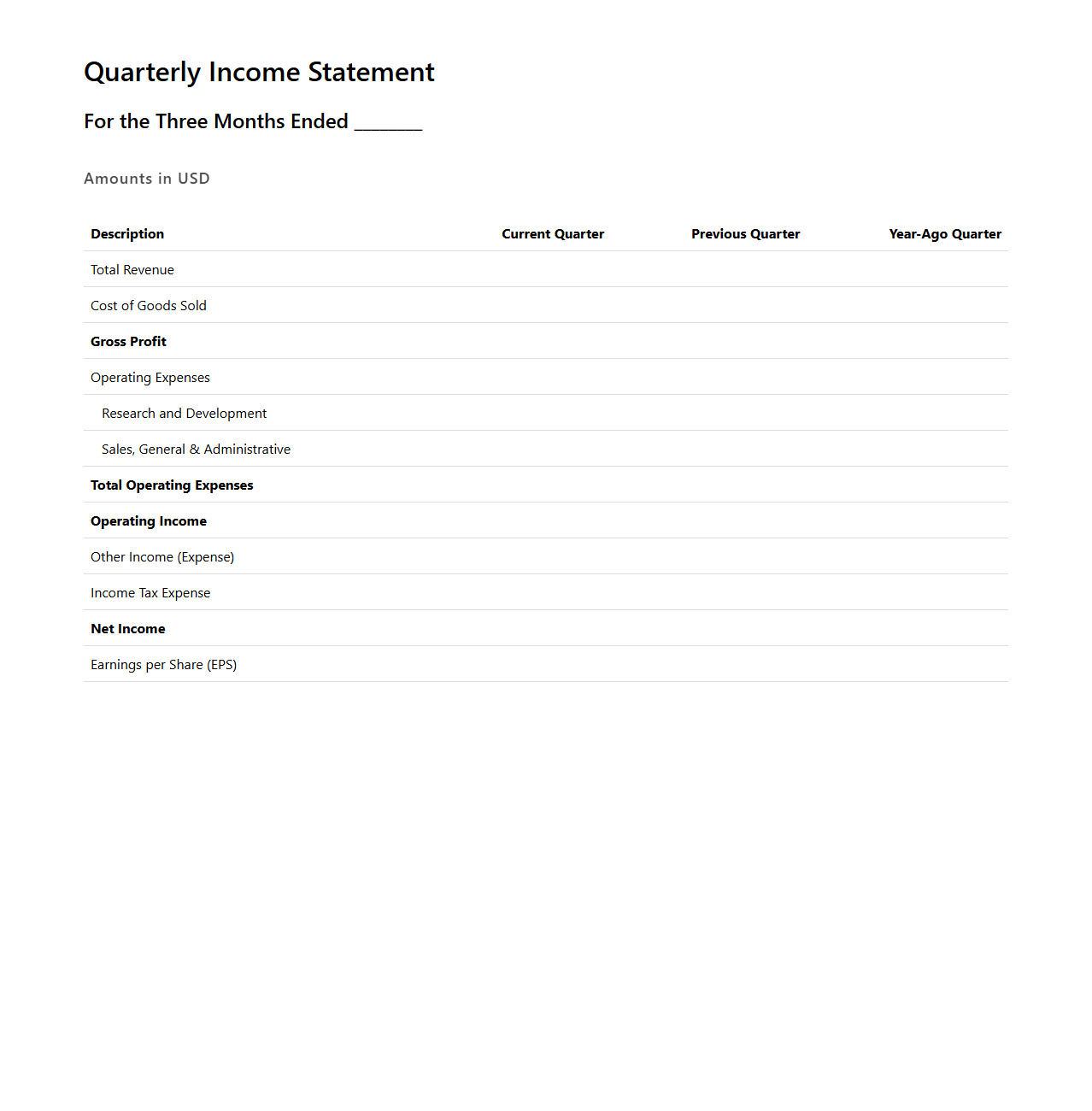

Quarterly Income Statement Layout for Financial Analysis

The

Quarterly Income Statement Layout for Financial Analysis document presents a structured summary of a company's revenues, expenses, and net profit over a three-month period. This layout facilitates the evaluation of operational efficiency, profitability trends, and expense management by segmenting data into key financial categories. It enables stakeholders to compare performance across quarters, identify growth drivers, and make informed investment or management decisions based on systematic financial insights.

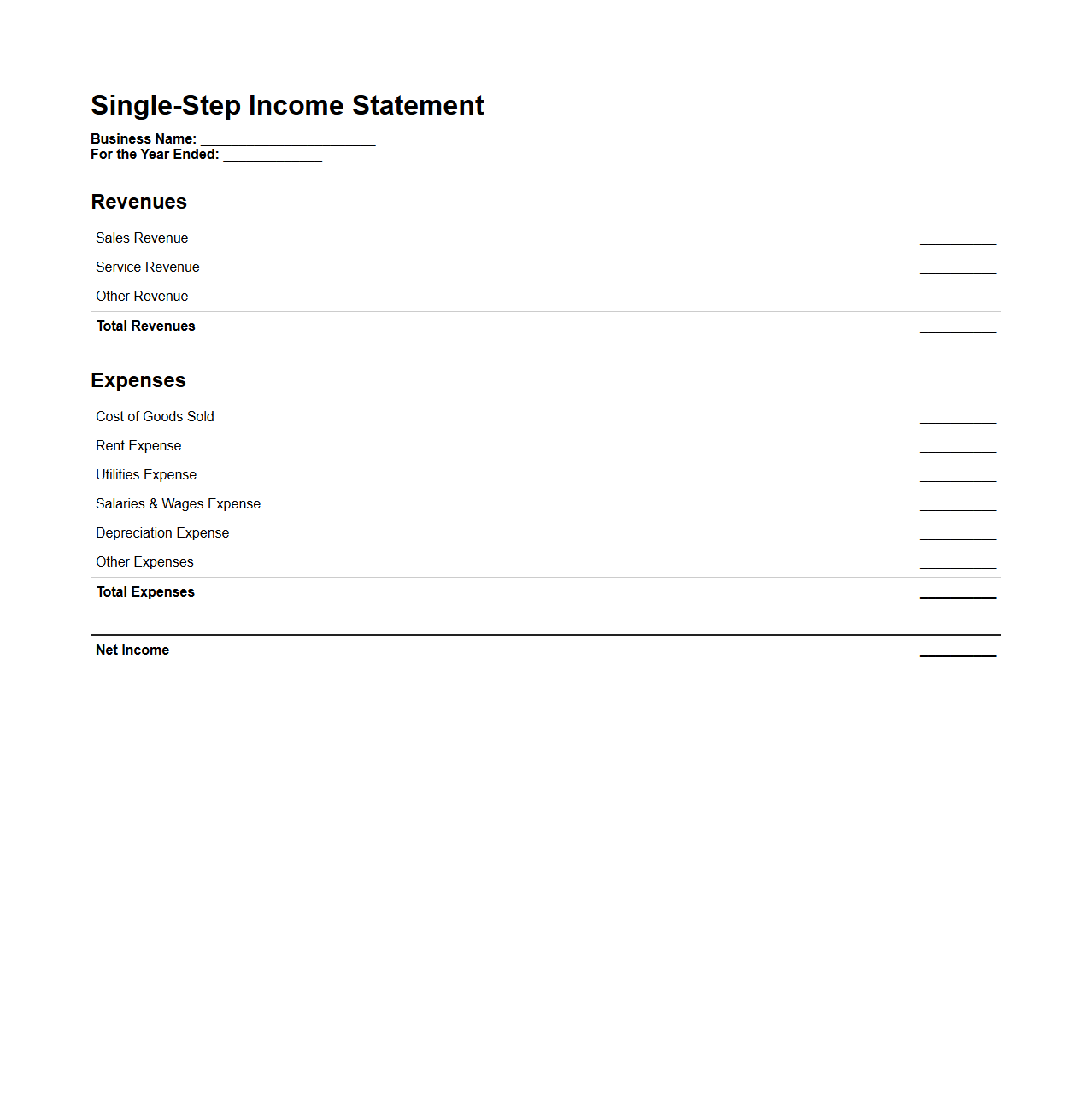

Single-Step Income Statement Design for Small Businesses

The

Single-Step Income Statement Design for Small Businesses is a simplified financial report format that consolidates all revenues and gains into a single category, and all expenses and losses into another, providing a clear overview of net profit or loss. This design helps small business owners quickly assess financial performance without the complexity of multiple subtotals or classifications. It emphasizes ease of use and straightforward presentation, making it ideal for small enterprises with limited accounting resources.

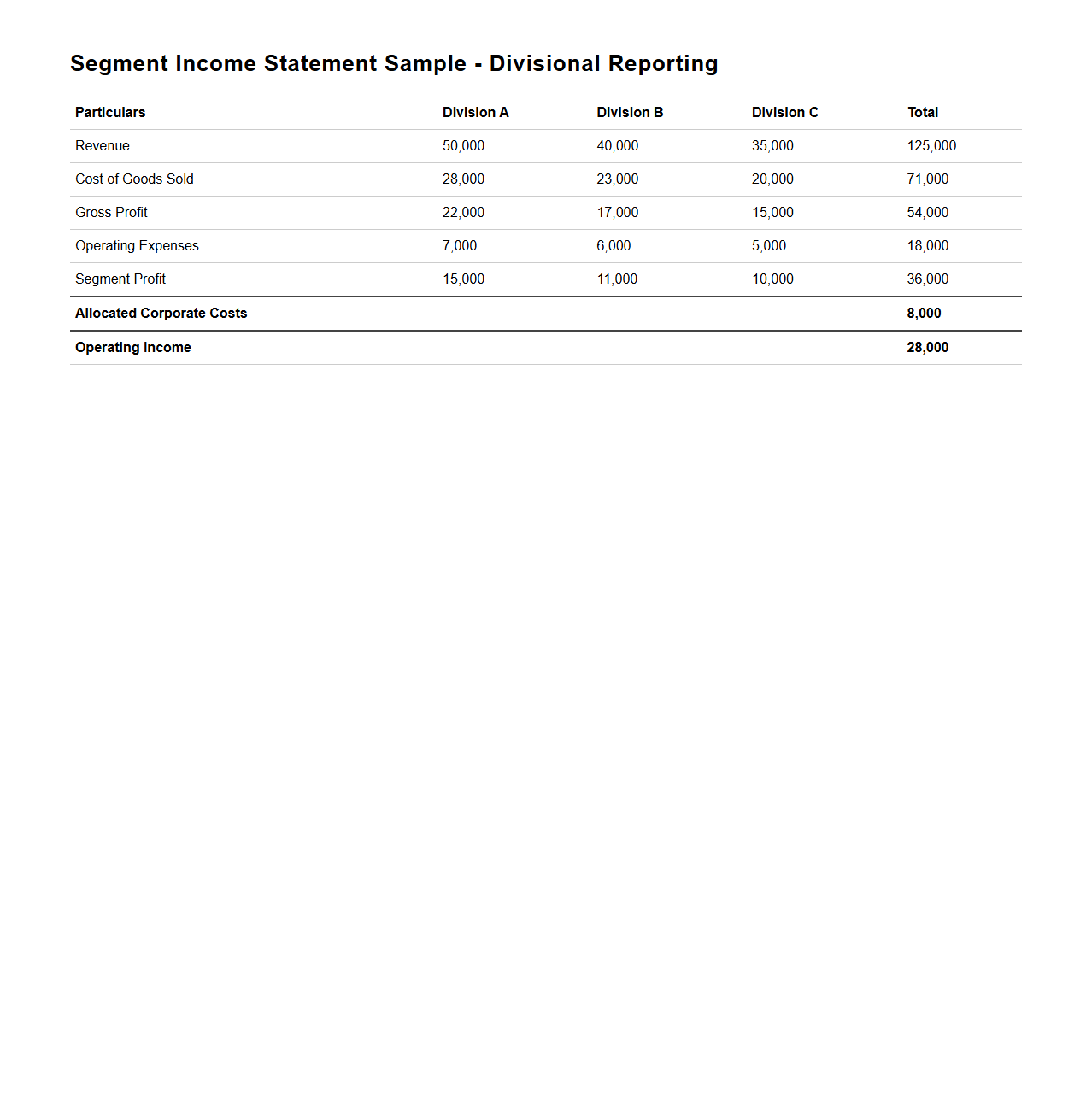

Segment Income Statement Sample for Divisional Reporting

A

Segment Income Statement Sample for Divisional Reporting document provides a detailed financial report that breaks down revenue, expenses, and profit for each division within a company. This format helps management analyze the performance of individual business units, facilitating better decision-making and resource allocation. It includes key metrics such as segment revenue, direct costs, gross profit, and operating income specific to each division.

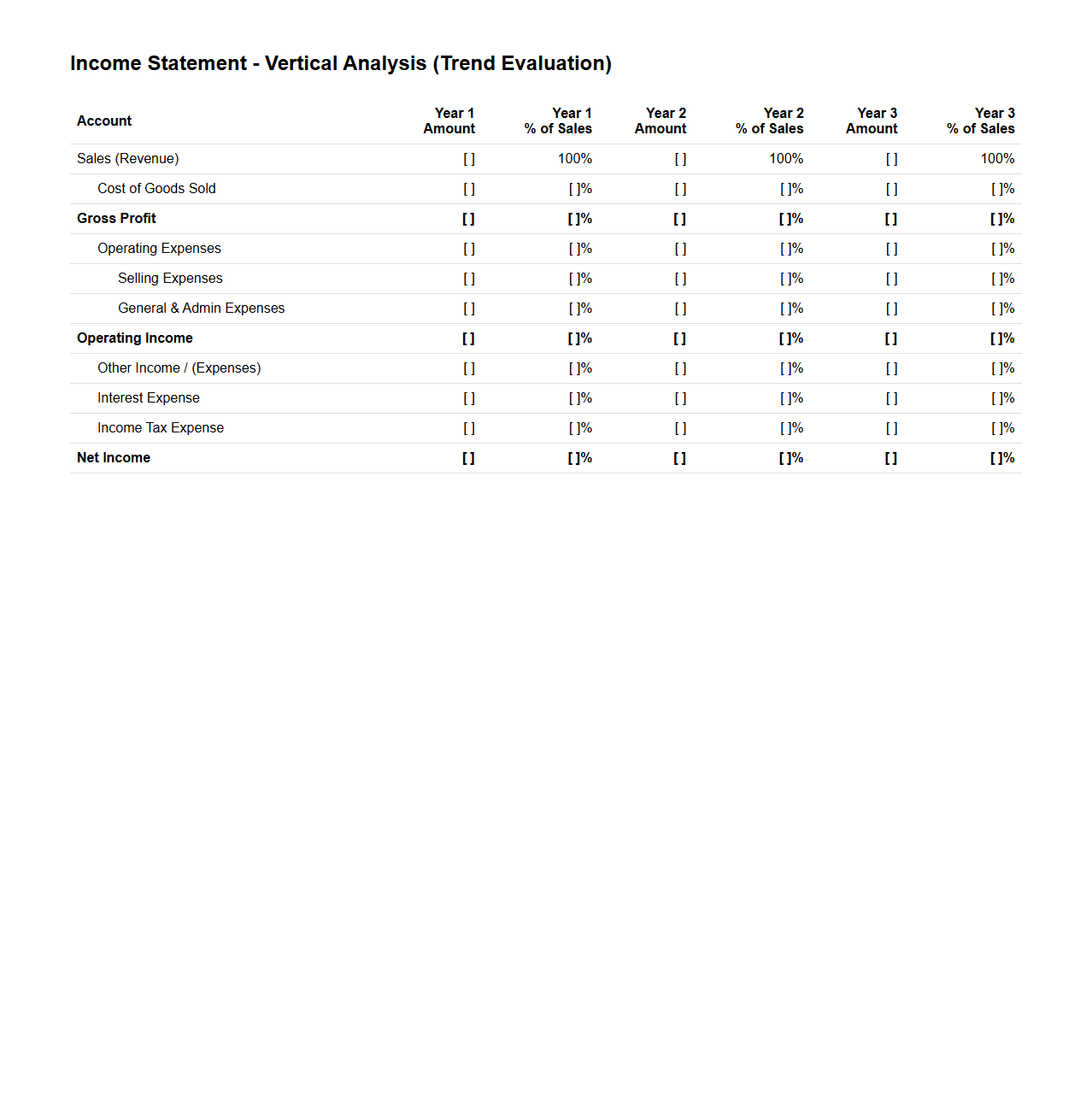

Vertical Analysis Income Statement Structure for Trend Evaluation

Vertical Analysis Income Statement Structure for Trend Evaluation document presents financial data by expressing each income statement item as a percentage of total sales revenue, enabling clear comparison across different periods. This method highlights the relative size of expenses, gross profit, and net income, facilitating the identification of patterns and trends over time. Analysts use this structured approach to evaluate performance efficiency and profitability changes within a company.

Vertical Analysis enhances decision-making by providing a standardized framework for trend evaluation in financial statements.

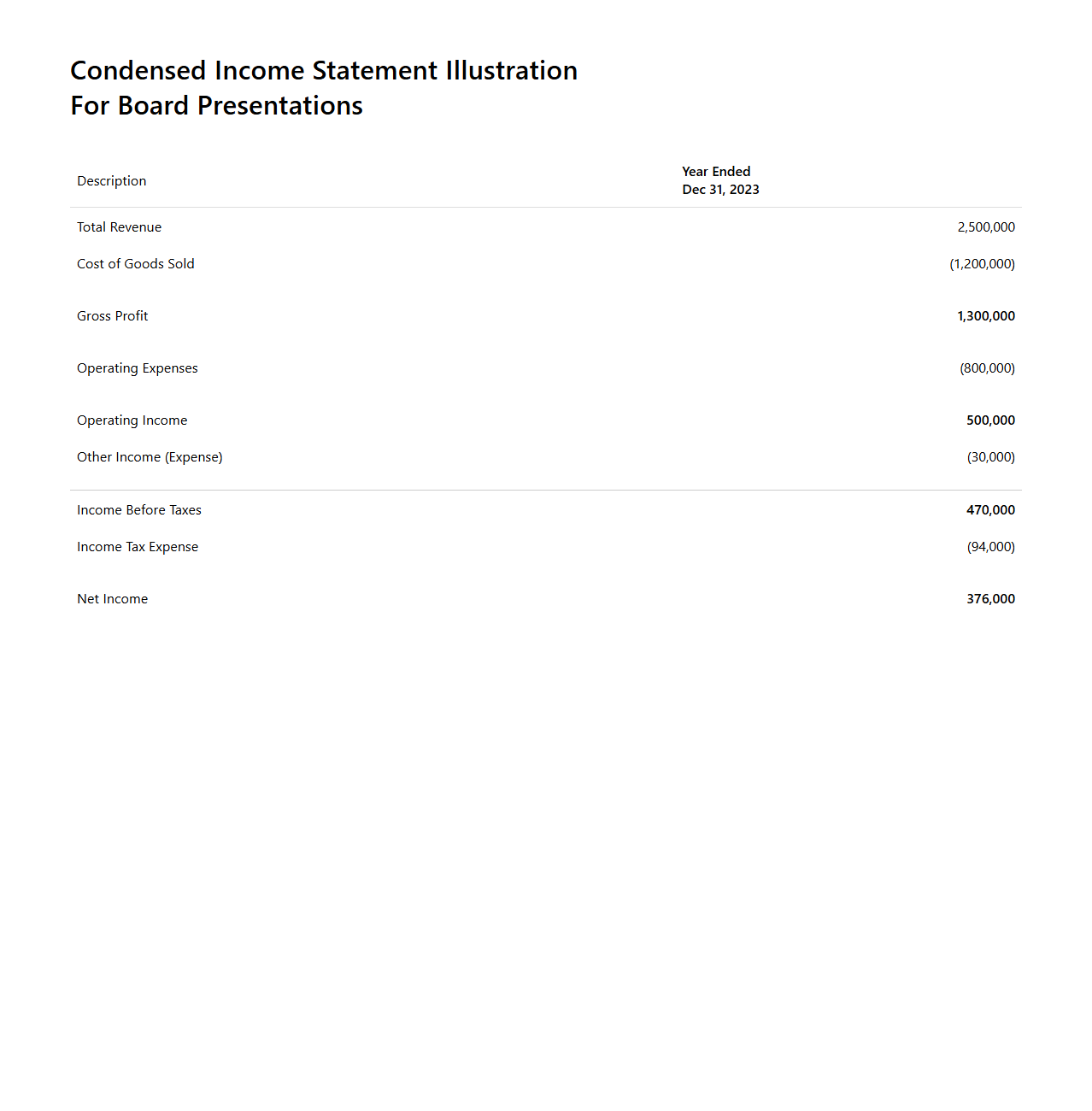

Condensed Income Statement Illustration for Board Presentations

The

Condensed Income Statement Illustration for Board Presentations document provides a simplified and clear overview of a company's financial performance by summarizing key revenue, expense, and profit figures. This concise format is designed to highlight critical financial metrics, making it easier for board members to quickly grasp important trends and results without detailed line-item analysis. It supports strategic decision-making by presenting essential income statement data in a visually accessible and focused manner.

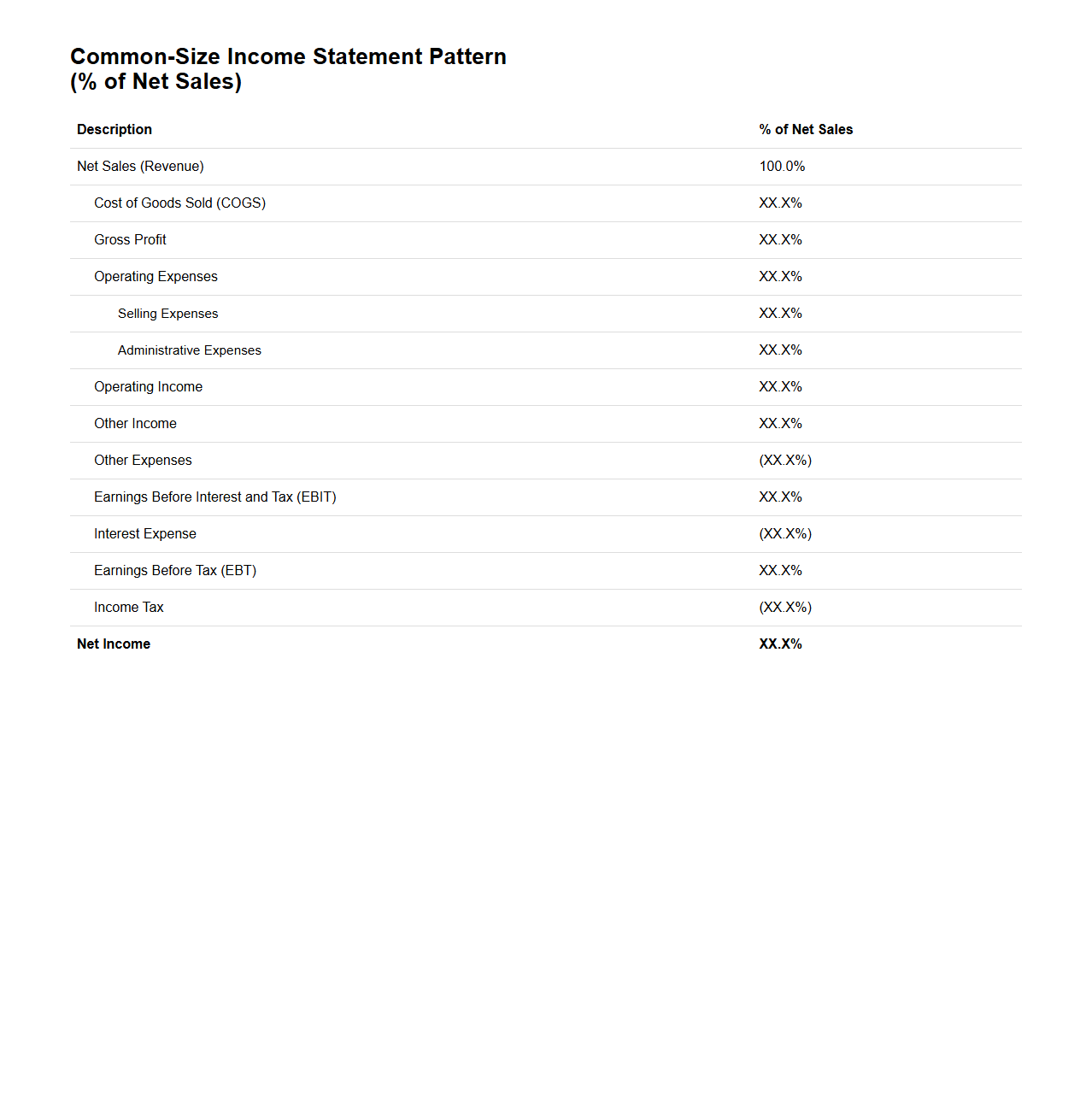

Common-Size Income Statement Pattern for Ratio Analysis

A

Common-Size Income Statement Pattern for Ratio Analysis standardizes financial data by expressing each line item as a percentage of total sales, enabling easy comparison across periods and companies. This method highlights cost structures, profit margins, and expense management, aiding in identifying trends and financial health. By using this document, analysts can perform precise ratio evaluations, facilitating informed decision-making in financial performance assessment.

How does the income statement document reflect non-operating income sources in corporate finance?

The income statement includes non-operating income under a separate section usually below the operating income. These income sources consist of gains or losses from investments, interest income, or asset sales that are not related to core business activities. Clearly distinguishing non-operating income helps provide a comprehensive view of the company's total profitability.

What are the key adjustments made for EBITDA in an income statement for investment analysis?

EBITDA adjustments exclude depreciation, amortization, interest, and taxes to focus on operational profitability. These adjustments give investors a clearer picture of the company's cash operating performance without non-cash expenses. EBITDA is widely used to compare financial performance across companies and industries.

How is deferred revenue reported in the income statement for corporate financial planning?

Deferred revenue itself is not directly reported on the income statement but appears as a liability on the balance sheet. Revenue recognition occurs in the income statement only when the related goods or services are delivered. Proper timing and recognition of deferred revenue are critical for accurate financial planning and reporting.

In what ways does segment reporting impact the corporate income statement presentation?

Segment reporting breaks down financial results by distinct business units or geographic areas. It allows stakeholders to assess the performance and risk of individual segments separately. This enhances transparency and helps in making more informed strategic decisions.

How are extraordinary items classified on the income statement for corporate finance audits?

Extraordinary items are reported separately below the income from continuing operations on the income statement. They represent unusual and infrequent gains or losses that are not expected to recur. This classification ensures clarity and prevents distortion of ongoing operational performance.