A Bank Reconciliation Document Sample for account management helps verify the accuracy of financial records by comparing the company's ledger with bank statements. This document identifies discrepancies such as outstanding checks or deposits in transit, ensuring precise cash flow tracking. Effective use of this sample supports streamlined financial auditing and error resolution.

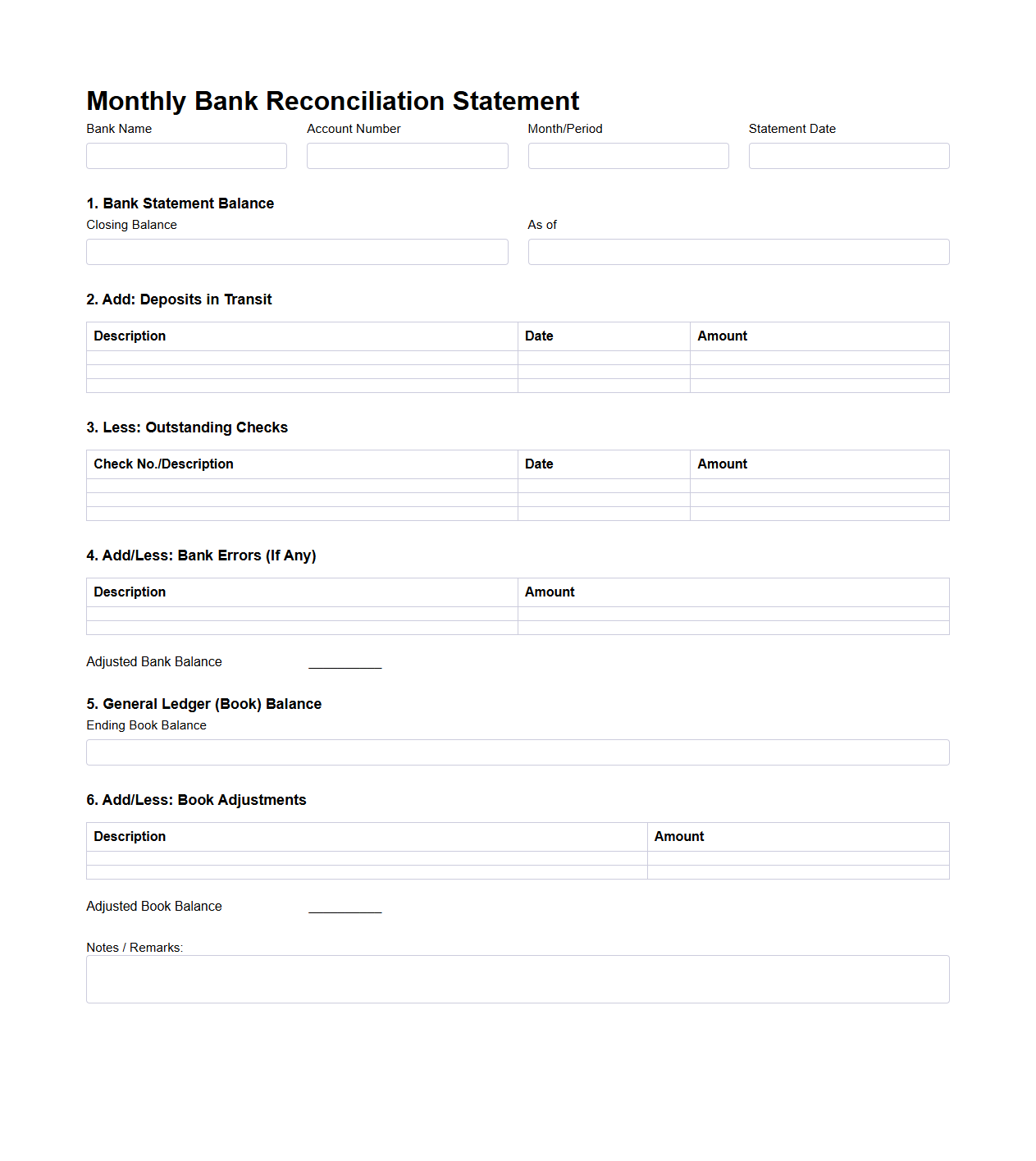

Monthly Bank Reconciliation Statement Template

A

Monthly Bank Reconciliation Statement Template document is a pre-formatted tool designed to match a company's internal financial records with its bank statement for a specific month. It helps identify discrepancies such as outstanding checks, deposits in transit, and bank errors, ensuring accurate cash flow management and fraud prevention. This template streamlines the reconciliation process, improves financial accuracy, and supports timely decision-making for business operations.

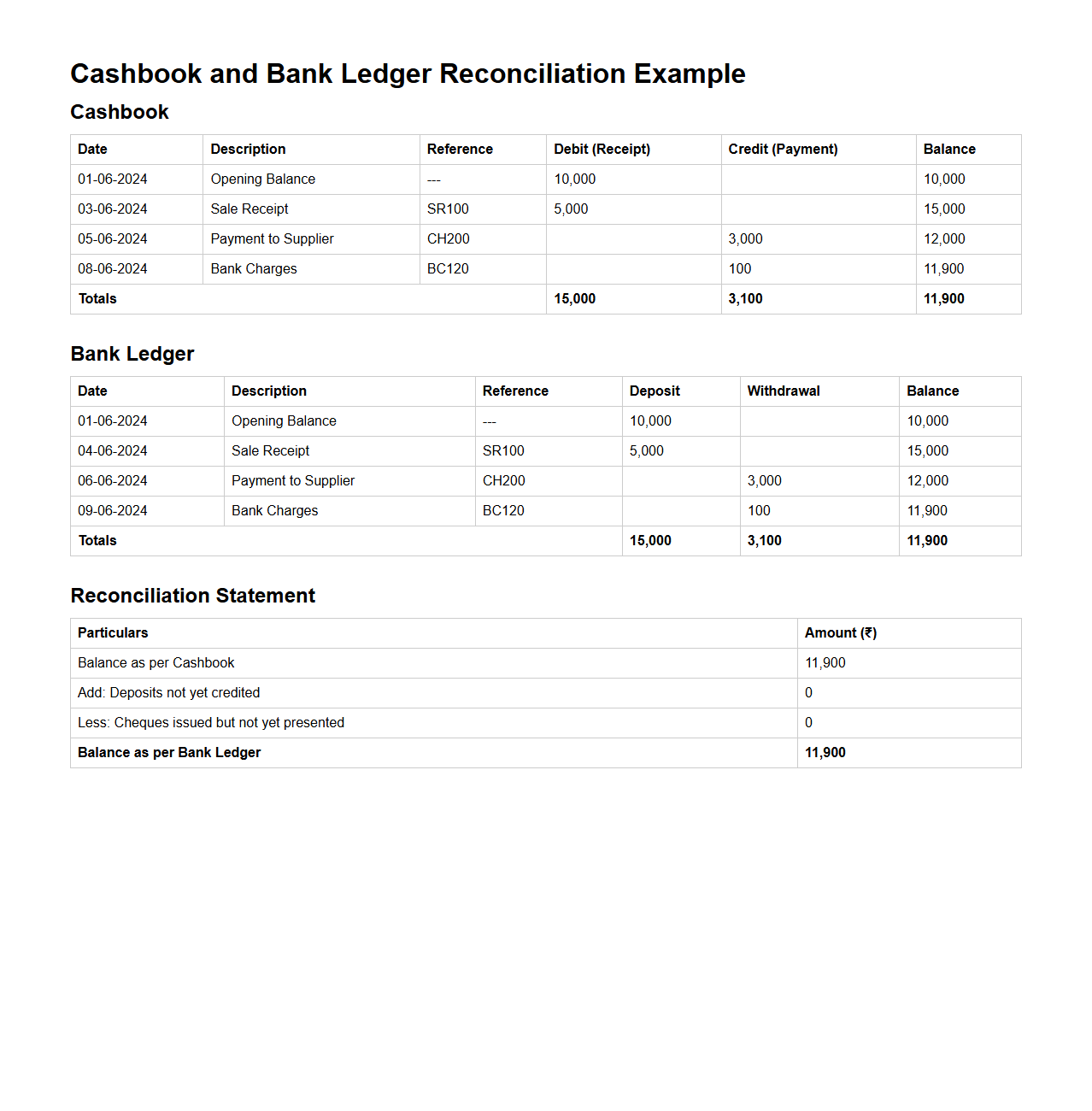

Cashbook and Bank Ledger Reconciliation Example

A

Cashbook and Bank Ledger Reconciliation Example document serves as a detailed record that compares and aligns the cashbook entries with the bank ledger to identify discrepancies and ensure accuracy in financial reporting. It highlights differences such as outstanding checks, deposits in transit, or bank fees that have not yet been recorded in the cashbook, facilitating corrective actions for accurate accounting. This document is essential for maintaining trustworthy financial records and improving internal controls within organizations.

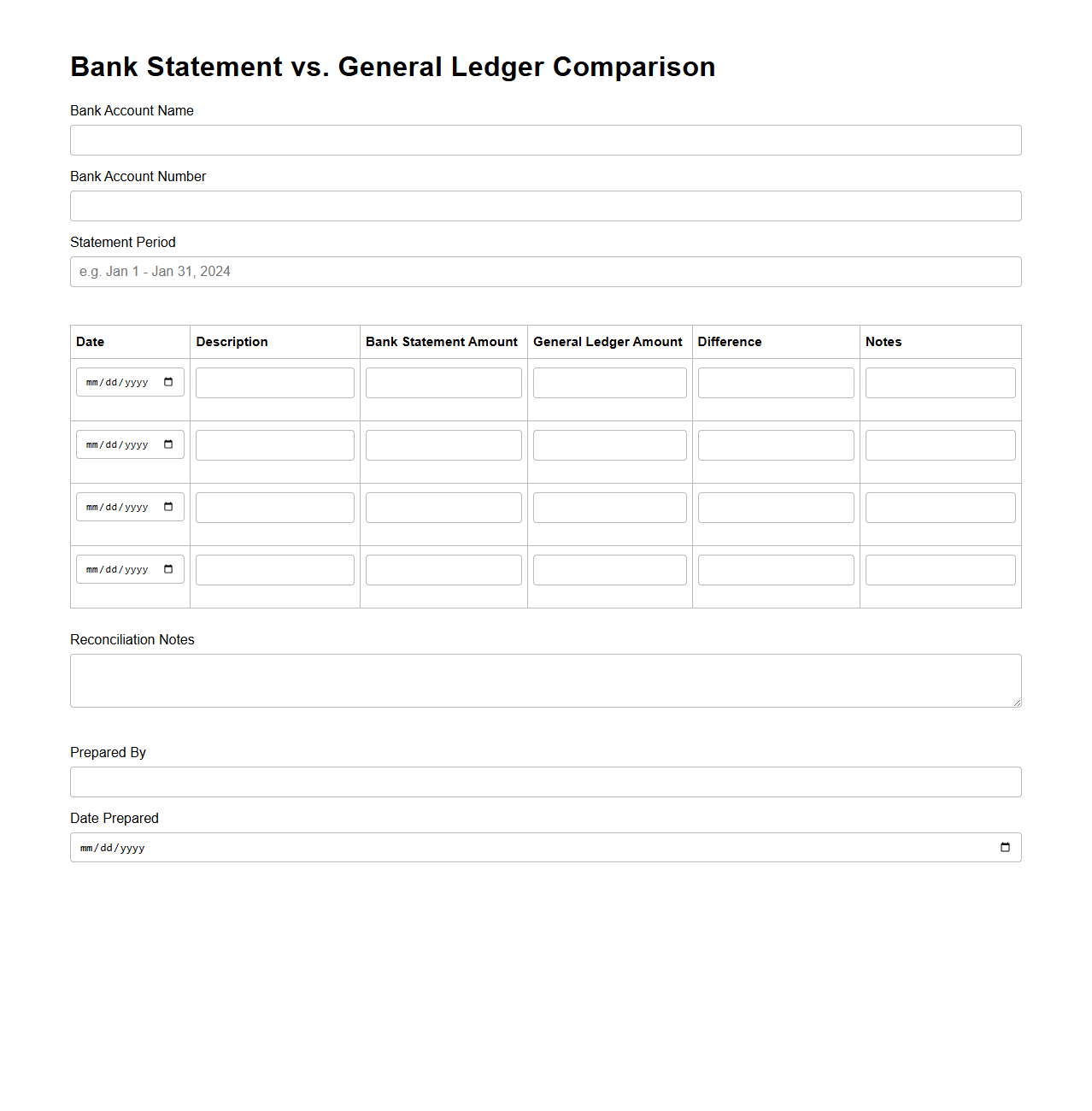

Bank Statement vs. General Ledger Comparison Form

The

Bank Statement vs. General Ledger Comparison Form is a financial document used to reconcile and verify the consistency between a company's bank statements and its internal general ledger records. This form helps identify discrepancies such as outstanding checks, deposits in transit, and unrecorded transactions, ensuring accurate financial reporting and preventing errors or fraud. Regular use of this comparison form supports effective cash flow management and compliance with accounting standards.

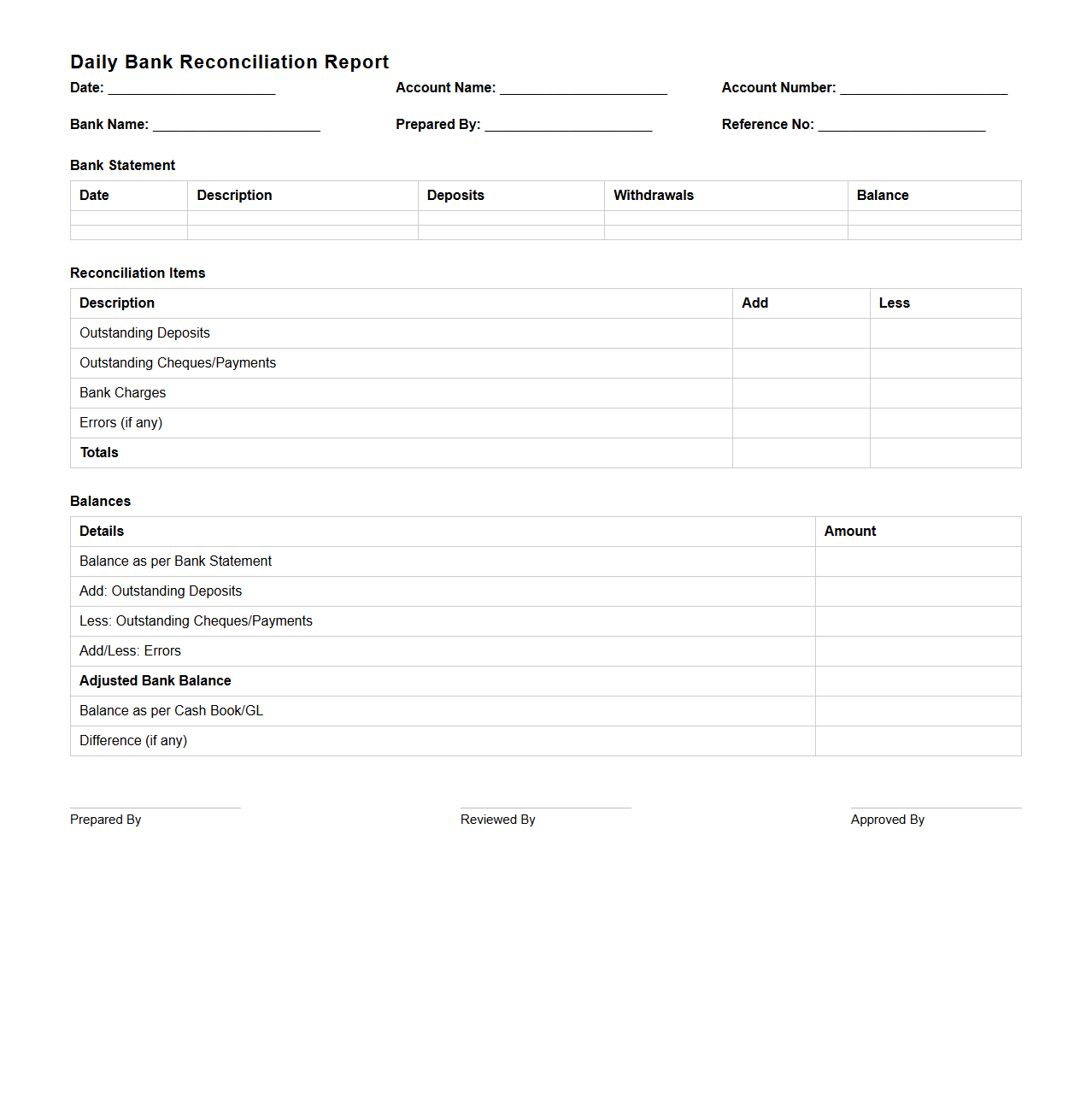

Daily Bank Reconciliation Report Format

The

Daily Bank Reconciliation Report Format document is a structured template designed to systematically compare a company's internal financial records with bank statements on a daily basis. It helps identify discrepancies such as outstanding checks or deposits in transit, ensuring accurate cash flow management and timely error detection. Using this format improves financial accuracy and supports efficient audit trails in accounting processes.

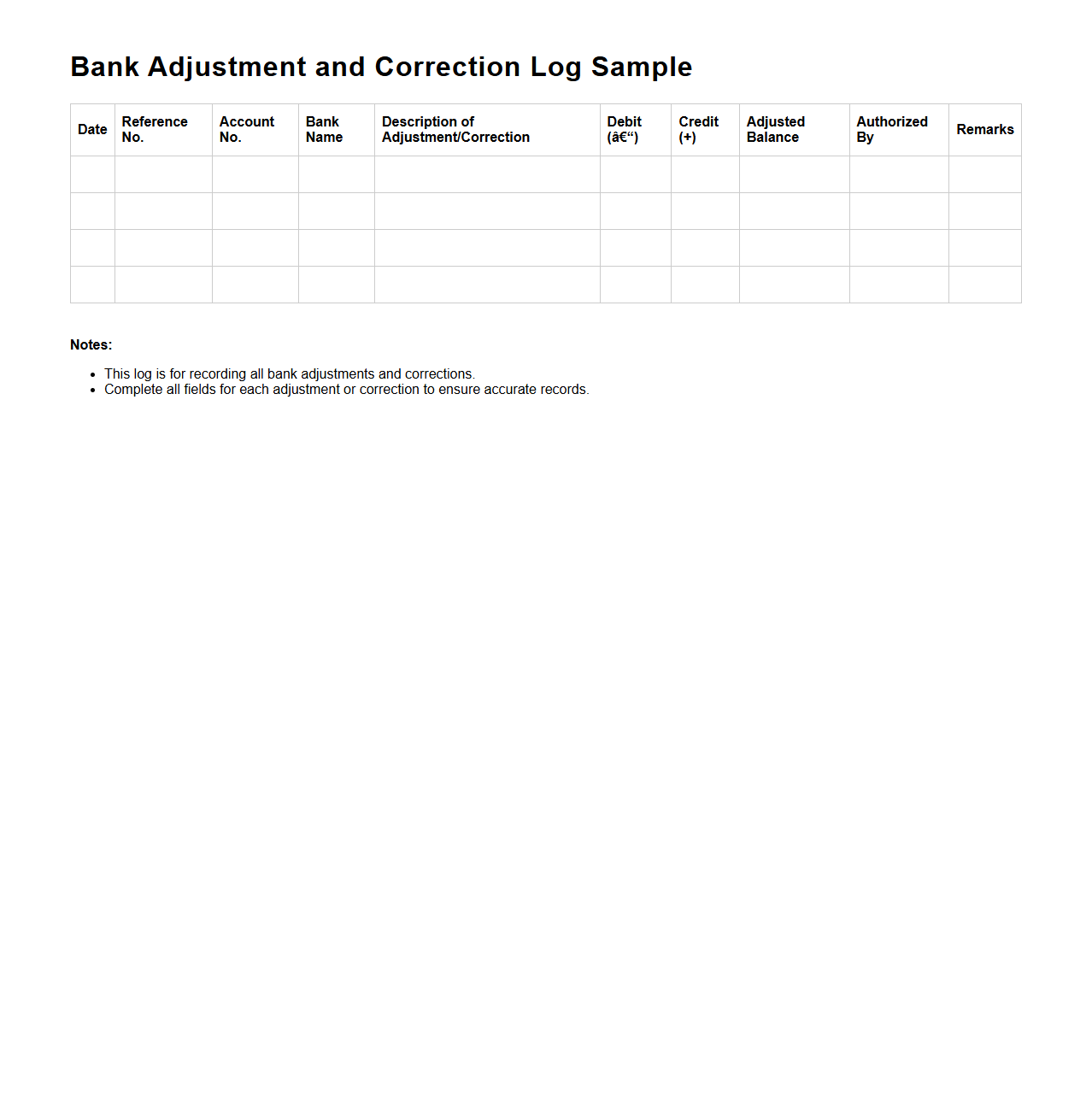

Bank Adjustment and Correction Log Sample

The

Bank Adjustment and Correction Log Sample document is a detailed record used to track and document all corrections and adjustments made to bank transactions. It includes information such as transaction dates, amounts, reasons for adjustments, and authorization details to maintain accuracy in financial reporting. This log ensures transparency and helps reconcile discrepancies between bank statements and company records.

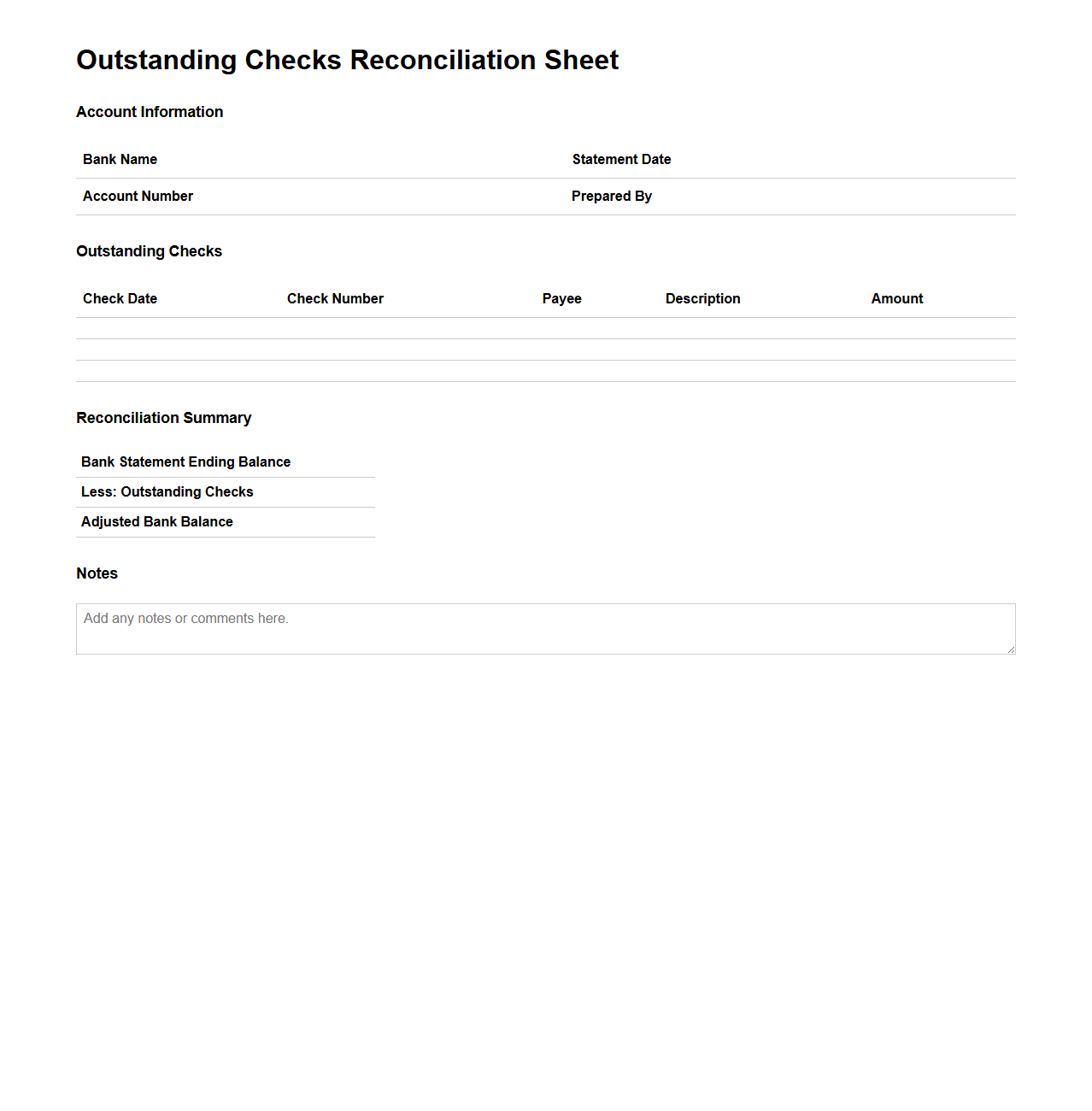

Outstanding Checks Reconciliation Sheet

An

Outstanding Checks Reconciliation Sheet is a financial document used to identify and track checks issued by a company or individual that have not yet been cleared or cashed by the bank. It helps reconcile the bank statement balance with the accounting records by listing all checks still outstanding at the end of a specific period. This sheet is crucial for accurate cash flow management and preventing discrepancies in financial reporting.

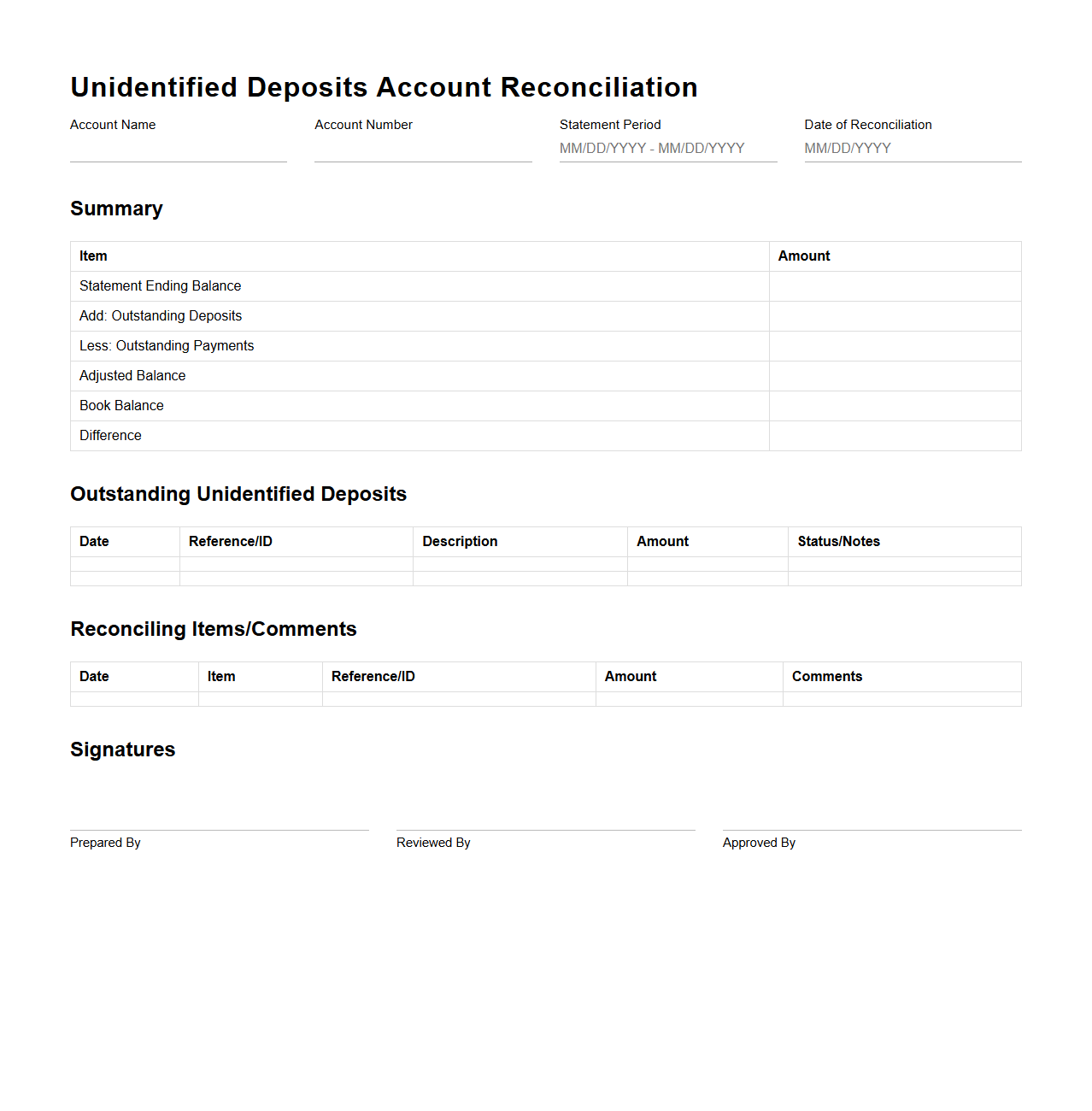

Unidentified Deposits Account Reconciliation Document

The

Unidentified Deposits Account Reconciliation Document is a financial record used to track and resolve deposits that have been received but not yet matched to specific customer accounts or transactions. This document helps in identifying discrepancies, ensuring accurate ledger balances, and maintaining transparent financial reporting. It plays a critical role in improving cash management by facilitating the timely allocation or investigation of unallocated funds.

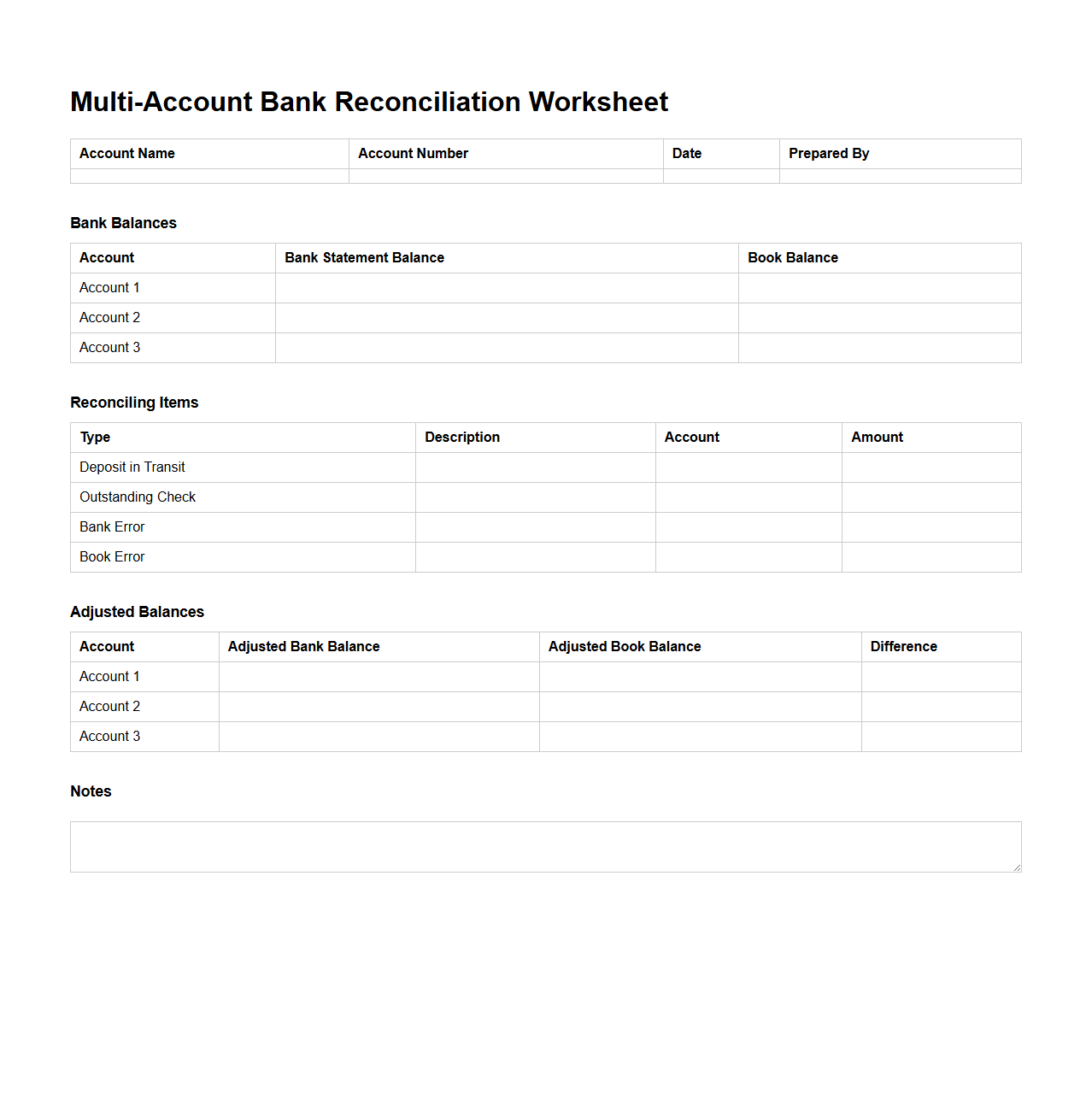

Multi-Account Bank Reconciliation Worksheet

A Multi-Account Bank Reconciliation Worksheet is a financial document designed to consolidate and reconcile transactions across multiple bank accounts within a single report. It helps ensure accuracy by matching company records with bank statements, identifying discrepancies such as outstanding checks or deposits in transit. This tool is essential for maintaining precise cash flow management and preventing accounting errors.

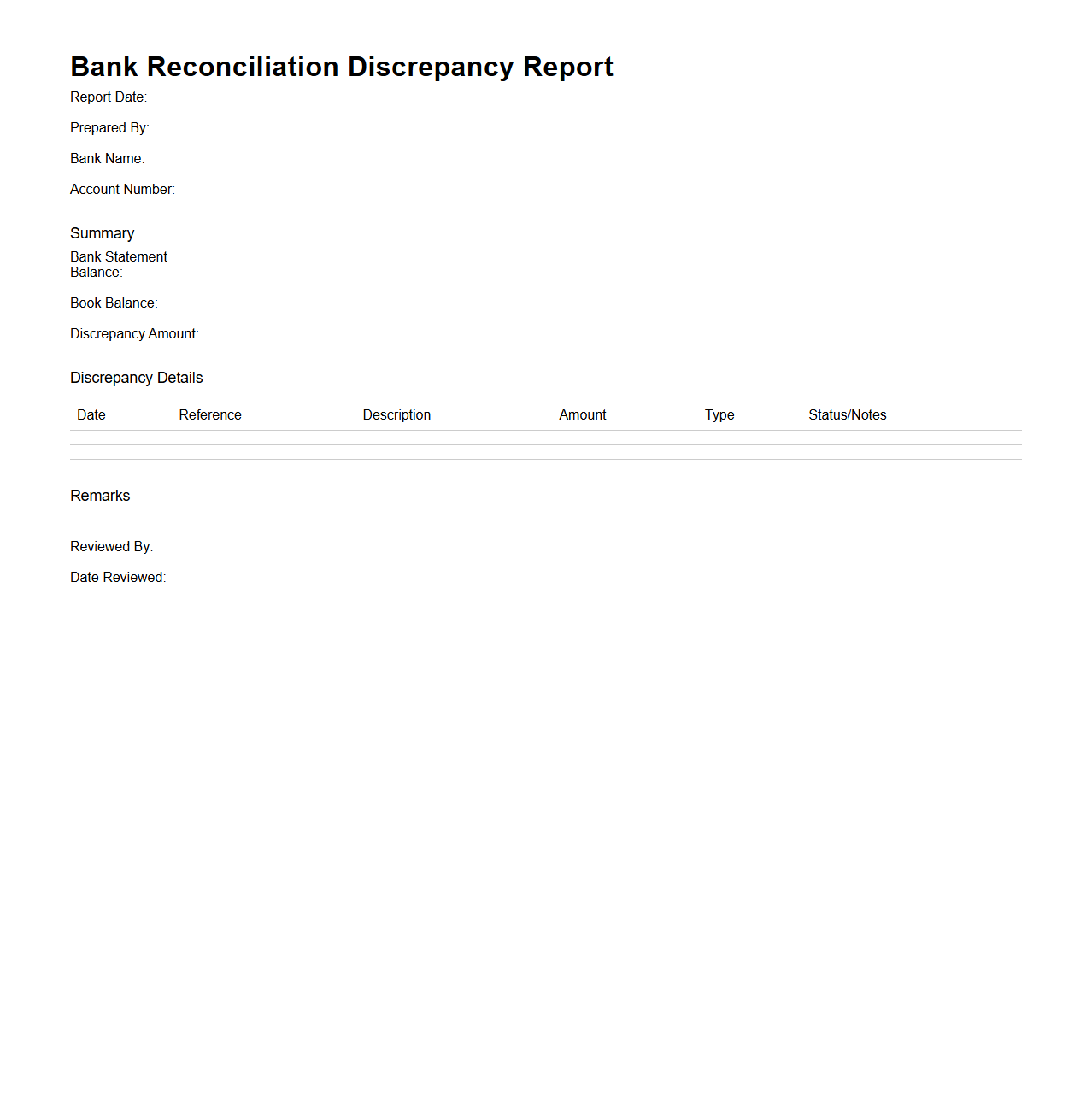

Bank Reconciliation Discrepancy Report Sample

A

Bank Reconciliation Discrepancy Report Sample document outlines inconsistencies between a company's internal financial records and the bank statement balances. This report helps identify errors such as unrecorded transactions, timing differences, or unauthorized withdrawals, facilitating accurate financial reporting. Businesses use this tool to maintain precise cash flow management and ensure compliance with accounting standards.

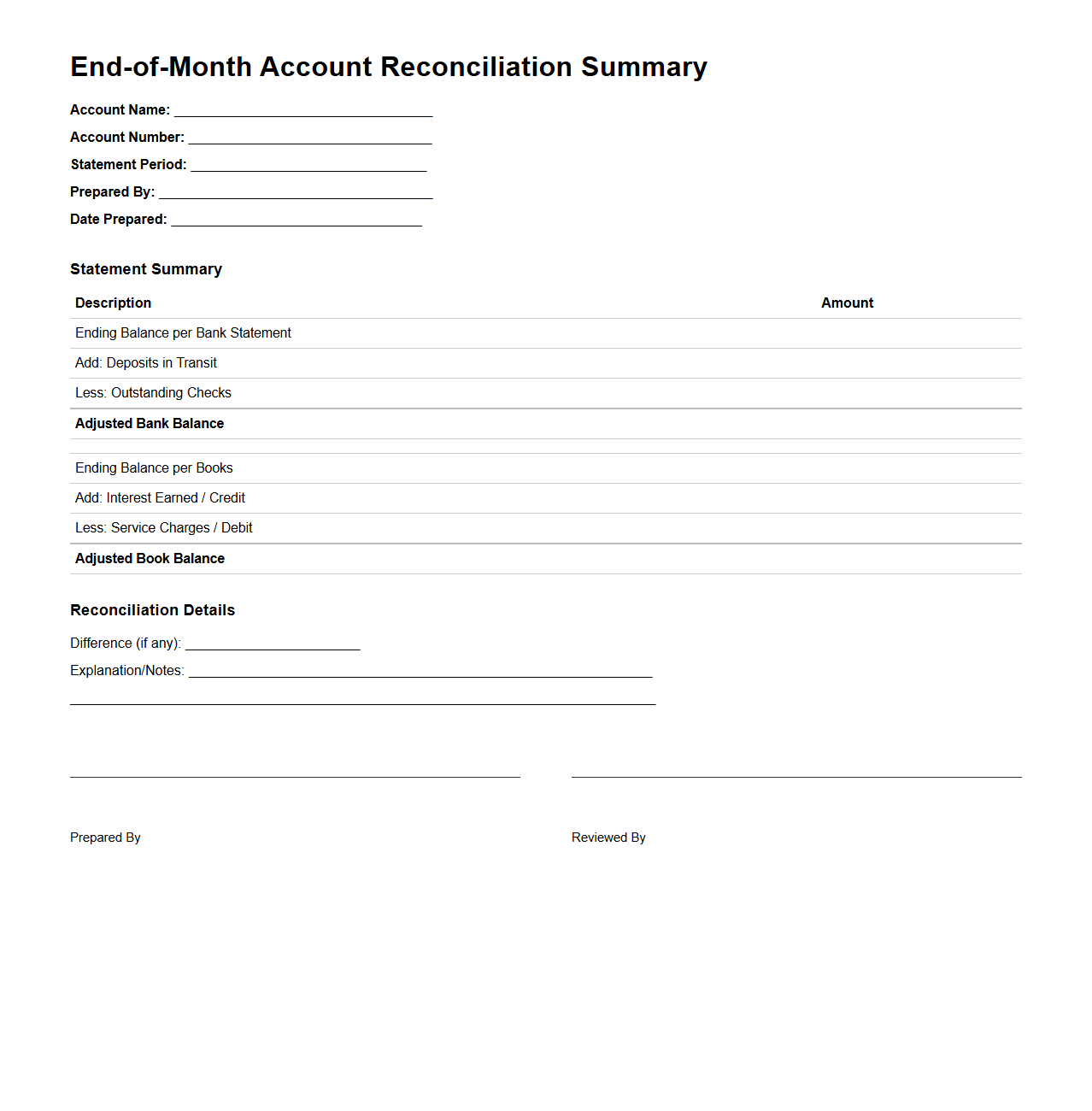

End-of-Month Account Reconciliation Summary

The

End-of-Month Account Reconciliation Summary document serves as a crucial financial report that verifies the accuracy and consistency of account balances by comparing internal records with external statements such as bank statements. It helps identify discrepancies, unauthorized transactions, or errors that may impact financial statements, ensuring compliance with accounting standards and regulatory requirements. This summary provides a clear overview of reconciled accounts, facilitating informed decision-making and streamlined financial management.

What unusual reconciling items commonly appear in bank reconciliation documents for account management?

Unusual reconciling items often include outstanding checks that have not yet cleared the bank and deposits in transit that are recorded in the books but not reflected on the bank statement. Bank fees or service charges that are deducted automatically by the bank may also appear unexpectedly. Additionally, errors such as duplicate entries or incorrect amounts can create unique reconciling challenges during reconciliation.

How is electronic funds transfer (EFT) tracked and documented in bank reconciliations?

Electronic funds transfers (EFTs) are meticulously tracked via electronic transaction records and bank statements to ensure accuracy in reconciliation. These transfers are documented with transaction dates, amounts, and reference numbers to maintain a clear audit trail. In bank reconciliations, EFTs are cross-verified against company ledger entries to confirm they match and identify any discrepancies quickly.

What backup documentation is required for adjusting journal entries in bank reconciliations?

Adjusting journal entries require supporting documents such as bank statements, deposit slips, cancelled checks, and internal transaction logs to validate the corrections. These documents provide evidence that changes are legitimate and accurately reflect the financial activities. Proper backup documentation ensures transparency and compliance during financial audits and reviews.

How do you handle unresolved discrepancies in month-end bank reconciliation reports?

Unresolved discrepancies in month-end bank reconciliation reports should be clearly documented and investigated promptly with the bank or internal departments. It is crucial to track all communications and findings related to these discrepancies for future resolution. If unresolved, these discrepancies are often flagged for further analysis in the next reconciliation cycle to maintain audit integrity.

What digital tools streamline audit trails for bank reconciliation documents in account management?

Digital tools like cloud-based accounting software, automated bank feeds, and transaction matching algorithms greatly enhance the efficiency of audit trails. These tools offer real-time updates, detailed logs, and secure documentation storage, simplifying the review process. Additionally, integrating artificial intelligence (AI) can detect anomalies and provide deeper insights into the reconciliation process.