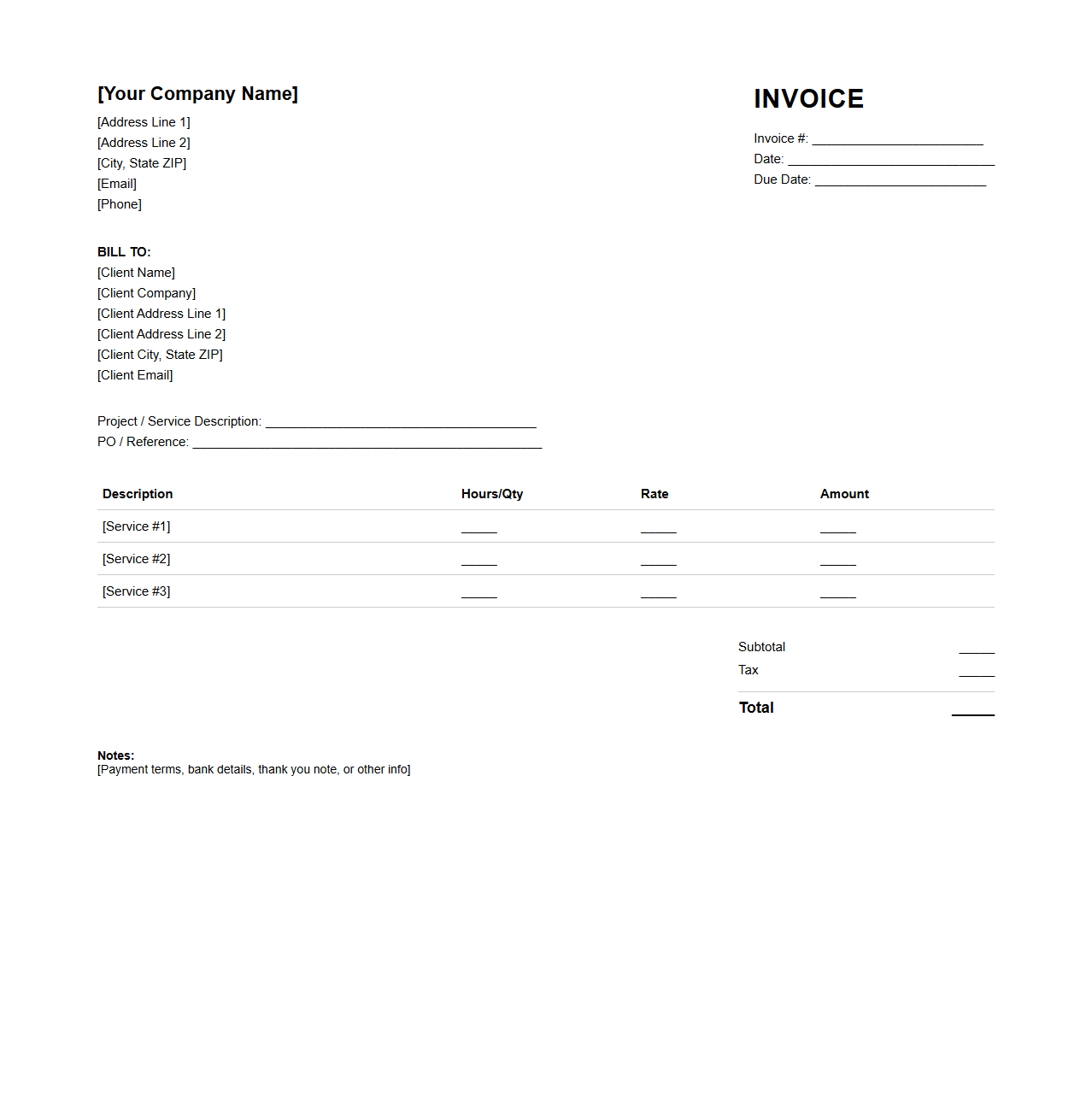

Professional Services Invoice Template

A

Professional Services Invoice Template document is a structured format used by businesses or freelancers to bill clients for services rendered. It typically includes essential details such as client information, list of services provided, hours worked, rates, total amount due, payment terms, and contact information. This template ensures accurate, clear, and consistent invoicing, streamlining the payment process and maintaining professionalism.

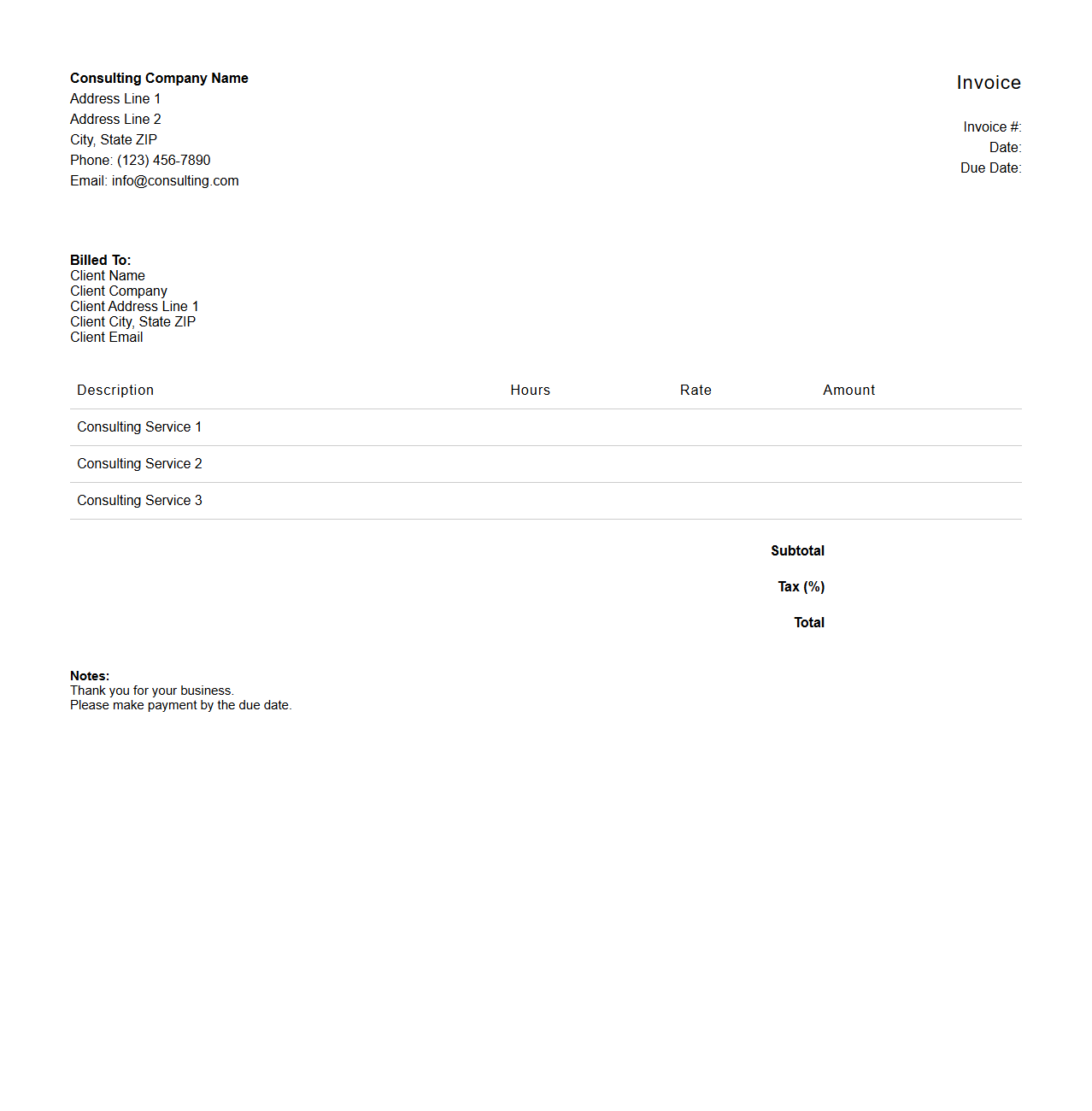

Consulting Fee Invoice Format

A

Consulting Fee Invoice Format document is a structured template used by consultants to bill clients for services rendered. It typically includes key elements such as consultant details, client information, description of services, hours worked, rate per hour, total amount due, and payment terms. This format ensures clarity and professionalism, facilitating timely payments and accurate record-keeping.

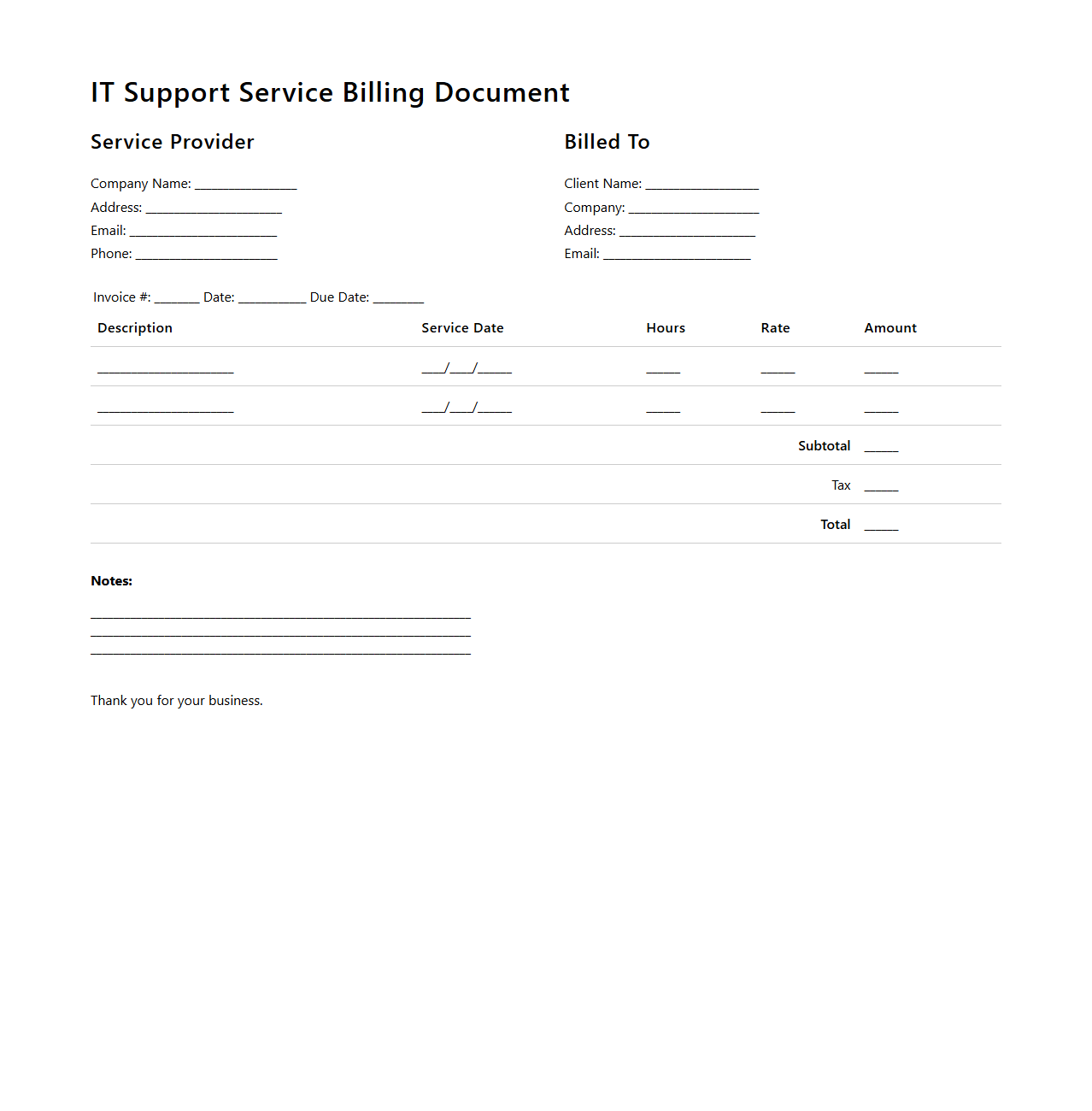

IT Support Service Billing Document

An

IT Support Service Billing Document itemizes the charges and services provided by an IT support company to its clients, detailing labor hours, types of support rendered, and any hardware or software costs. This document serves as an official record for invoicing, ensuring transparent communication of fees related to troubleshooting, system maintenance, and technical assistance. Accurate billing documents streamline financial management and help in auditing IT service expenses.

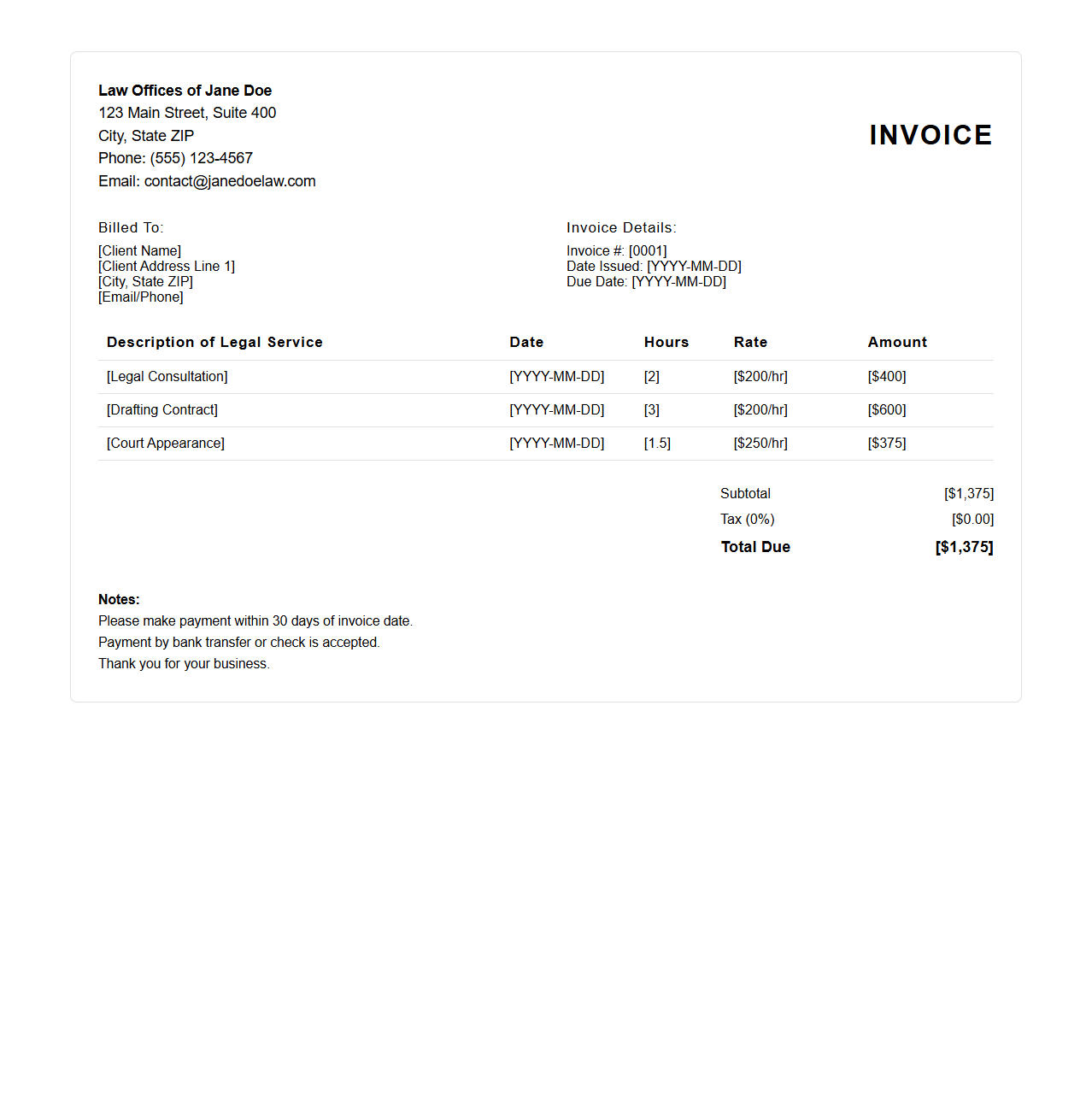

Legal Services Invoice Example

A

Legal Services Invoice Example document outlines the detailed billing information for legal services provided by attorneys or law firms, including itemized hours worked, hourly rates, and specific case expenses. This template helps ensure transparent communication between legal professionals and clients, facilitating accurate payment and record-keeping. It typically contains sections such as client details, case description, service dates, and payment terms.

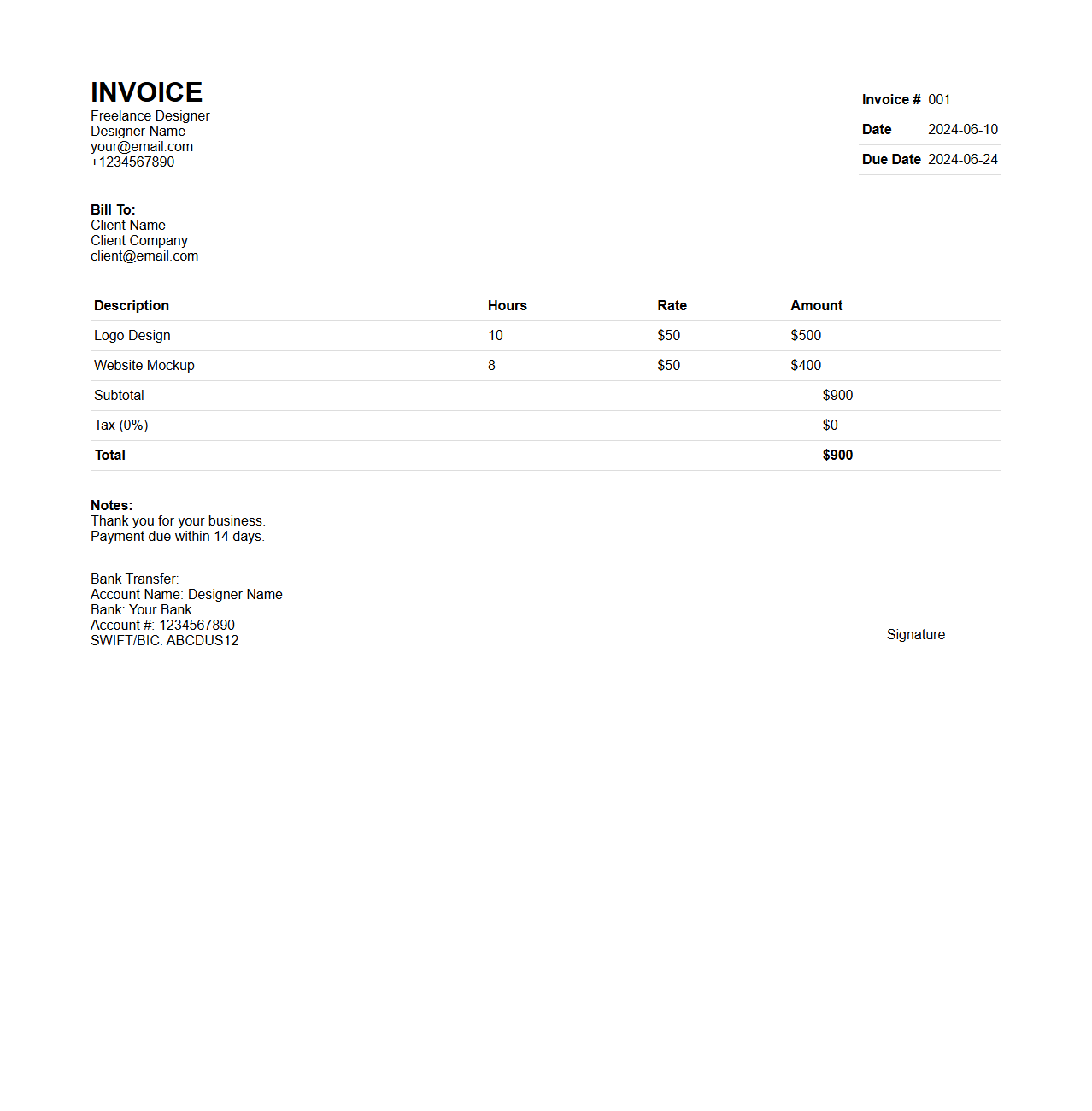

Freelance Designer Invoice Sample

A

Freelance Designer Invoice Sample document serves as a professional template that outlines the services rendered, hours worked, payment terms, and rates for freelance design projects. This document ensures clear communication between designers and clients, facilitating prompt and accurate payments. Using a standardized invoice helps maintain organized financial records and enhances client trust.

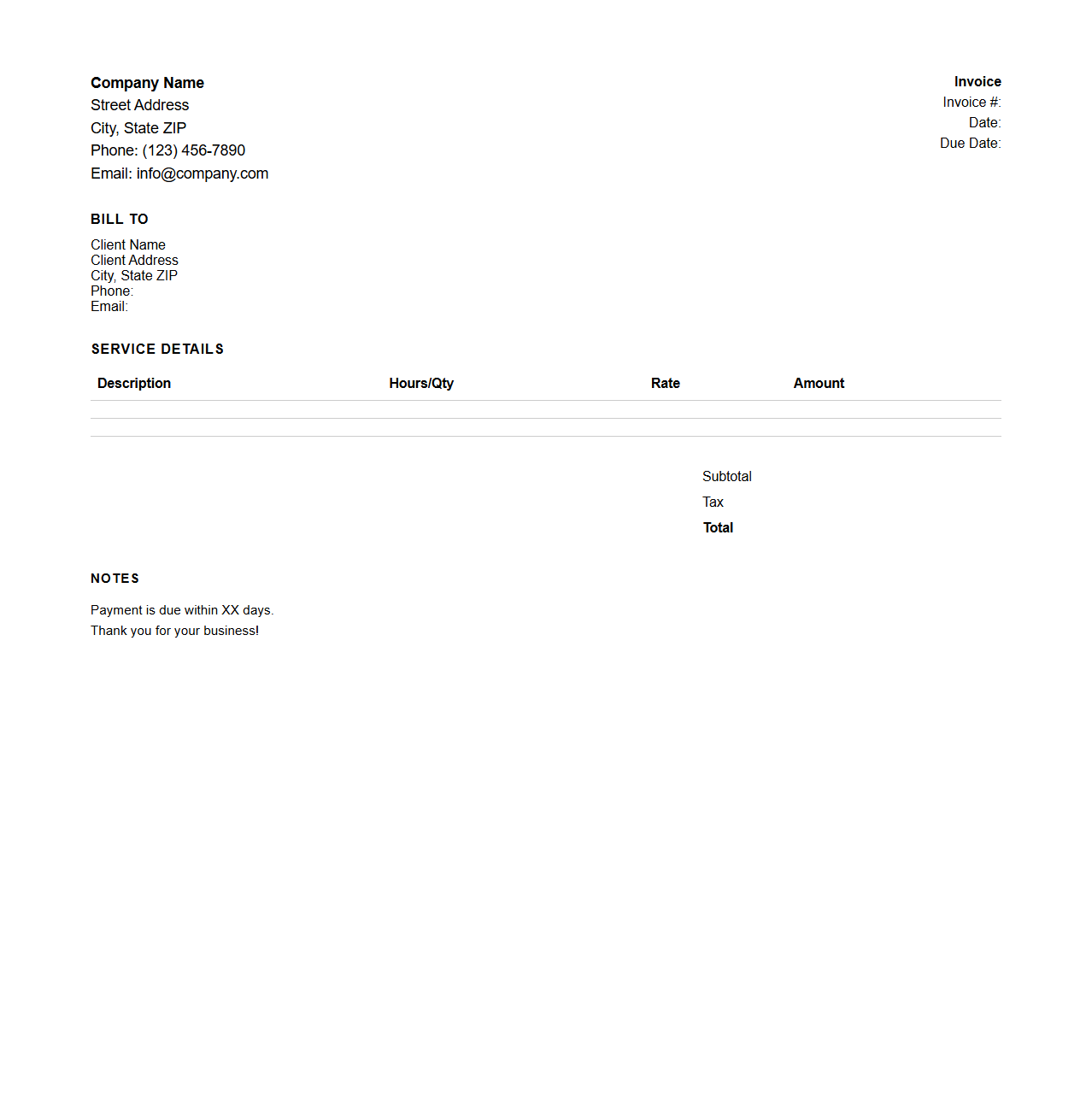

Maintenance Service Invoice Layout

A

Maintenance Service Invoice Layout document is a structured template used to itemize and record details of maintenance services provided, including labor, materials, and associated costs. It facilitates clear communication between service providers and clients by presenting essential information such as service descriptions, dates, charges, and payment terms in an organized format. This document ensures accurate billing, financial tracking, and compliance with contractual agreements in maintenance operations.

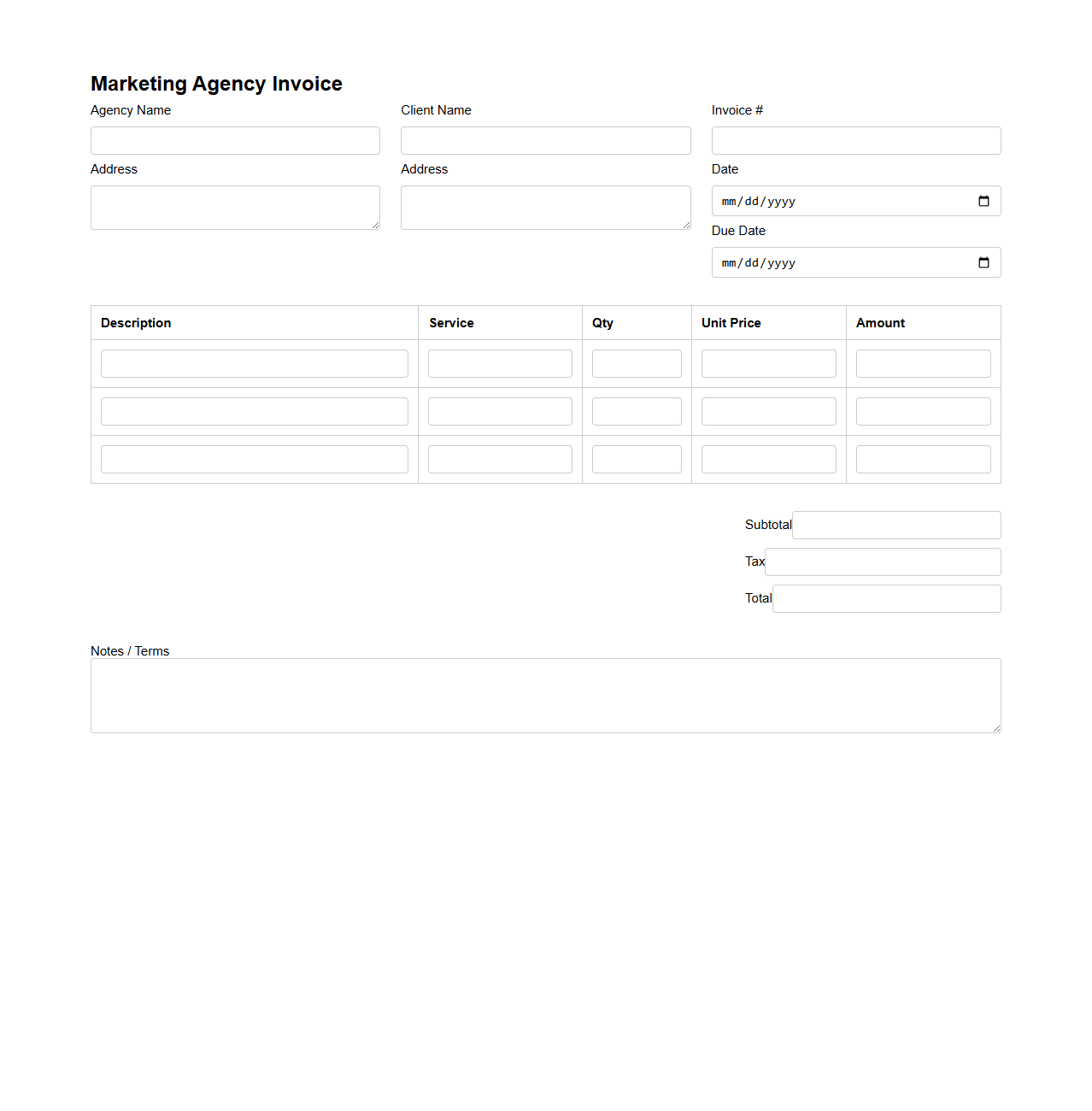

Marketing Agency Invoice Form

A

Marketing Agency Invoice Form document is a structured template used to bill clients for marketing services rendered, including campaigns, consulting, or creative work. It typically details the services provided, hours worked, rates, total amount due, payment terms, and client information to ensure clear and professional financial transactions. This form helps streamline accounting processes and maintain accurate records for marketing agencies and their clients.

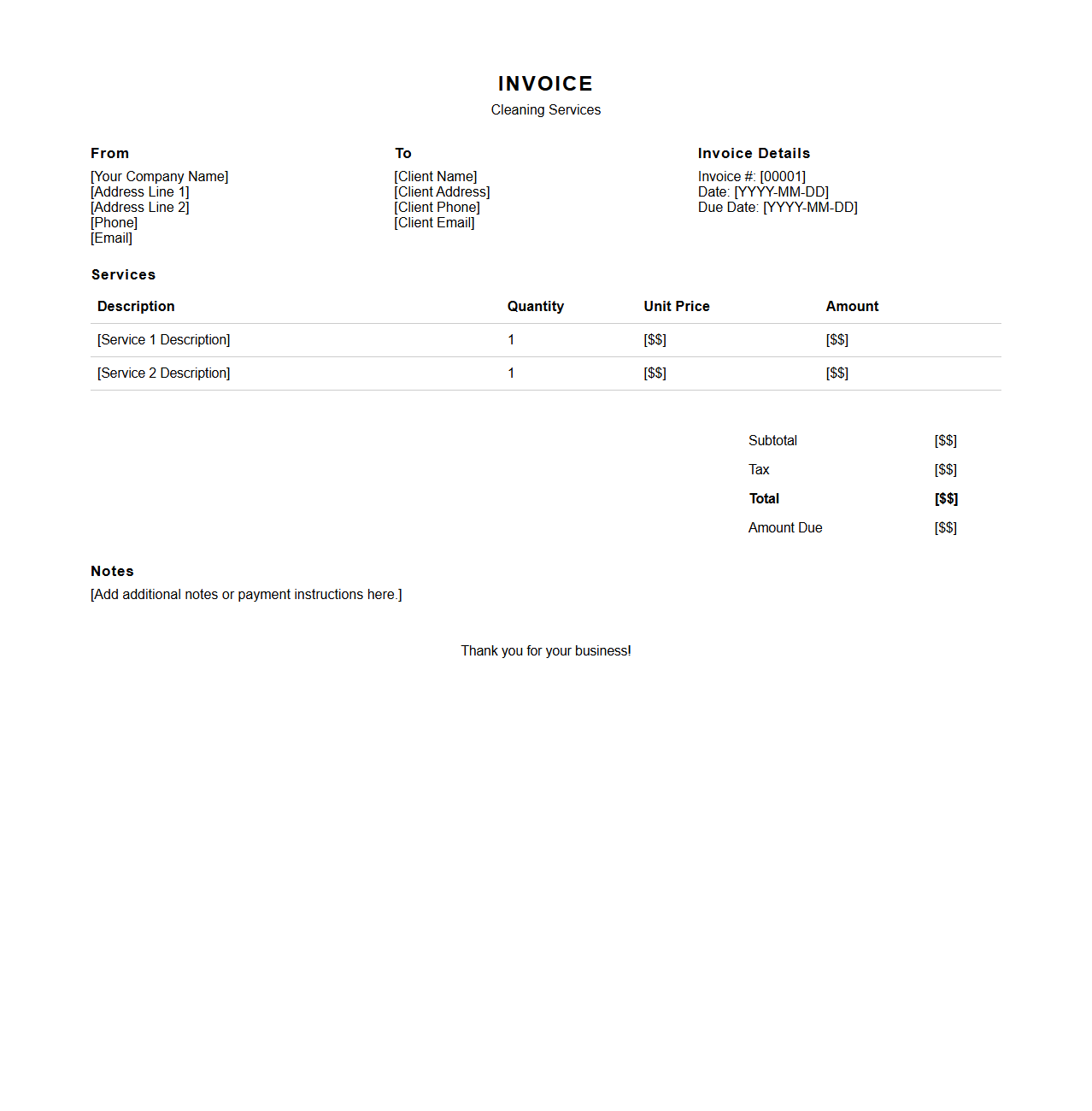

Cleaning Services Invoice Structure

A

Cleaning Services Invoice Structure document outlines the format and essential components required to bill clients accurately for cleaning services rendered. It typically includes details such as service description, hourly rates or flat fees, labor hours, materials used, taxes, and total amount due. This document ensures transparent communication between service providers and clients, facilitating timely payments and clear financial records.

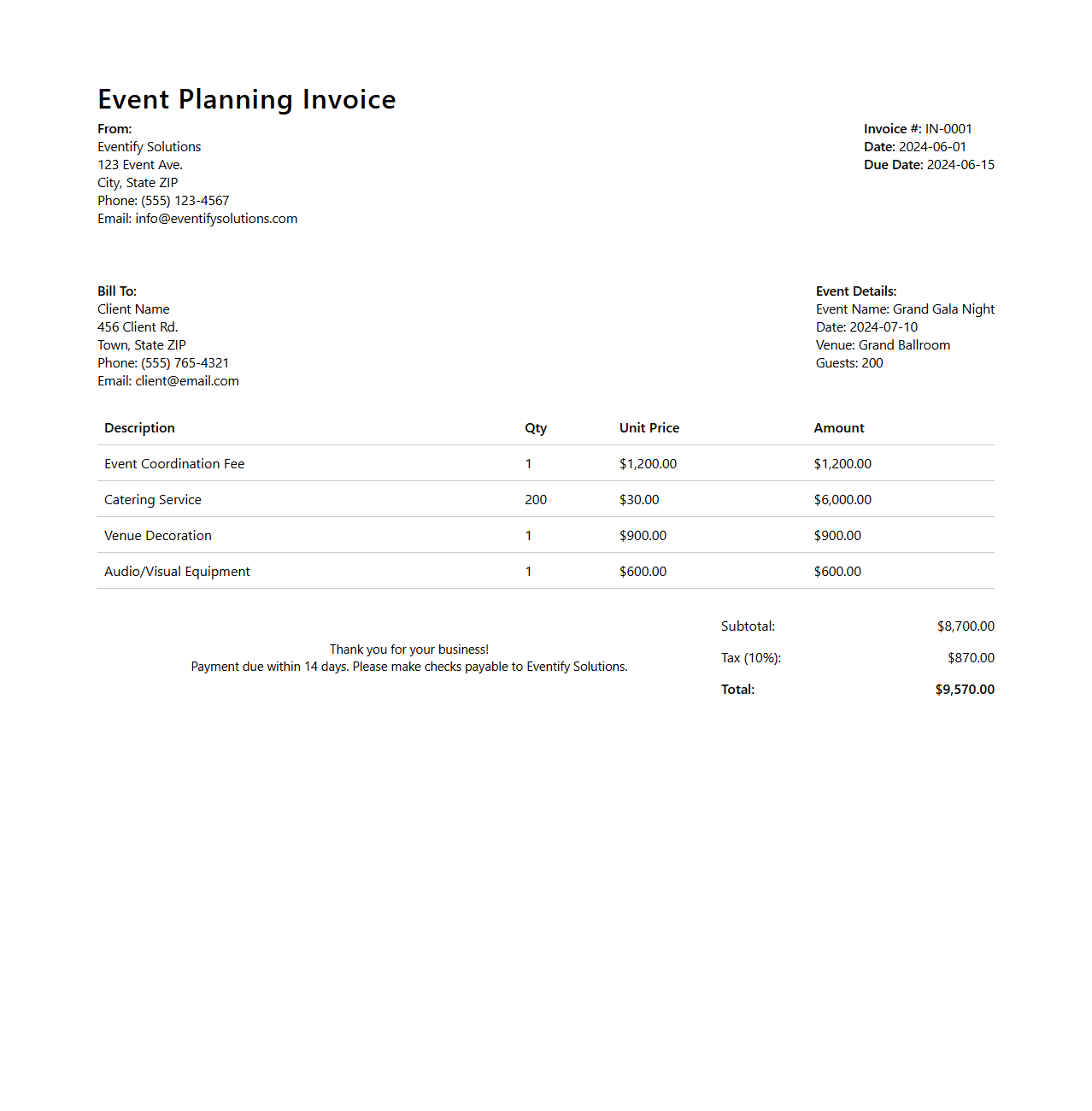

Event Planning Invoice Sample

An

Event Planning Invoice Sample document serves as a template that outlines the detailed costs and services provided by an event planner to a client. It typically includes essential information such as event details, itemized charges for services like venue booking, catering, decoration, and payment terms to ensure transparency and accurate billing. This sample helps streamline the invoicing process, ensuring professionalism and clarity in financial transactions related to event management.

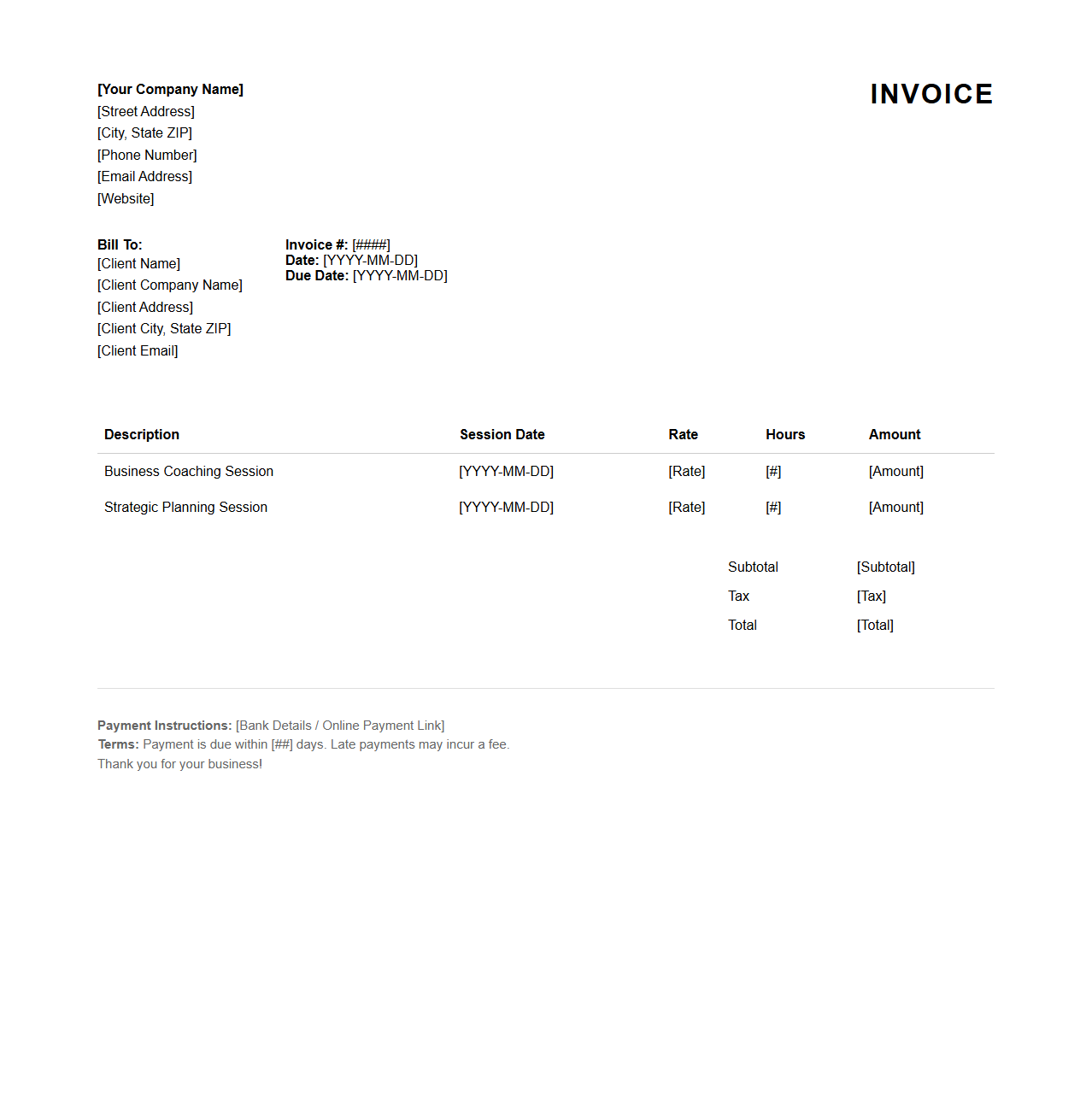

Business Coaching Services Invoice

A

Business Coaching Services Invoice document itemizes the professional coaching sessions provided to clients, including rates, dates, and payment terms. It serves as a formal request for payment, ensuring clear communication of services rendered and financial obligations. This document supports accurate record-keeping and facilitates efficient financial management for both coaches and clients.

What are the mandatory fields for an invoice document issued by service providers?

An invoice issued by service providers must include the service provider's name, address, and tax identification number. It should clearly state the invoice number, date of issue, and a detailed description of the services rendered. Additionally, the total amount payable, payment terms, and applicable tax details are essential for a valid invoice.

How should service providers specify taxable vs. non-taxable services on invoices?

Service providers should segregate taxable and non-taxable services by listing each service separately with the corresponding tax rate applied. A clear designation such as "Taxable" or "Non-Taxable" next to each line item helps maintain transparency. Including the total taxable amount and the total tax charged enhances clarity and ensures accurate tax reporting.

What electronic invoicing standards apply to service provider invoices?

Service providers must adhere to electronic invoicing standards like UBL (Universal Business Language) or PEPPOL (Pan-European Public Procurement On-Line) for standardized invoice exchange. Compliance with local electronic invoicing mandates, such as electronic signatures and secure data transmission, is also crucial. These standards improve interoperability and streamline invoice processing and validation.

How can service providers ensure invoice compliance with cross-border clients?

To guarantee compliance with cross-border invoicing requirements, service providers must include all relevant VAT or GST identification numbers and declare the correct currency. They should also be aware of and apply the invoicing rules specific to the client's country, including language preferences and data retention laws. Verifying cross-border tax treaties and exemptions helps avoid errors and penalties.

What best practices help prevent disputes in invoicing for recurring services?

Clear communication about the billing cycle, service scope, and any price changes upfront is key to avoiding disputes with recurring service invoices. Automating invoice generation ensures timely and consistent billing, while providing detailed line items enhances transparency. Maintaining an easily accessible client agreement and promptly addressing any invoice queries further reduces the risk of conflicts.