A Income Statement Document Sample for Financial Analysis provides a detailed overview of a company's revenues, expenses, and net profit over a specific period. This document is essential for evaluating financial performance, identifying trends, and making informed business decisions. Accurate income statements help stakeholders assess profitability and operational efficiency effectively.

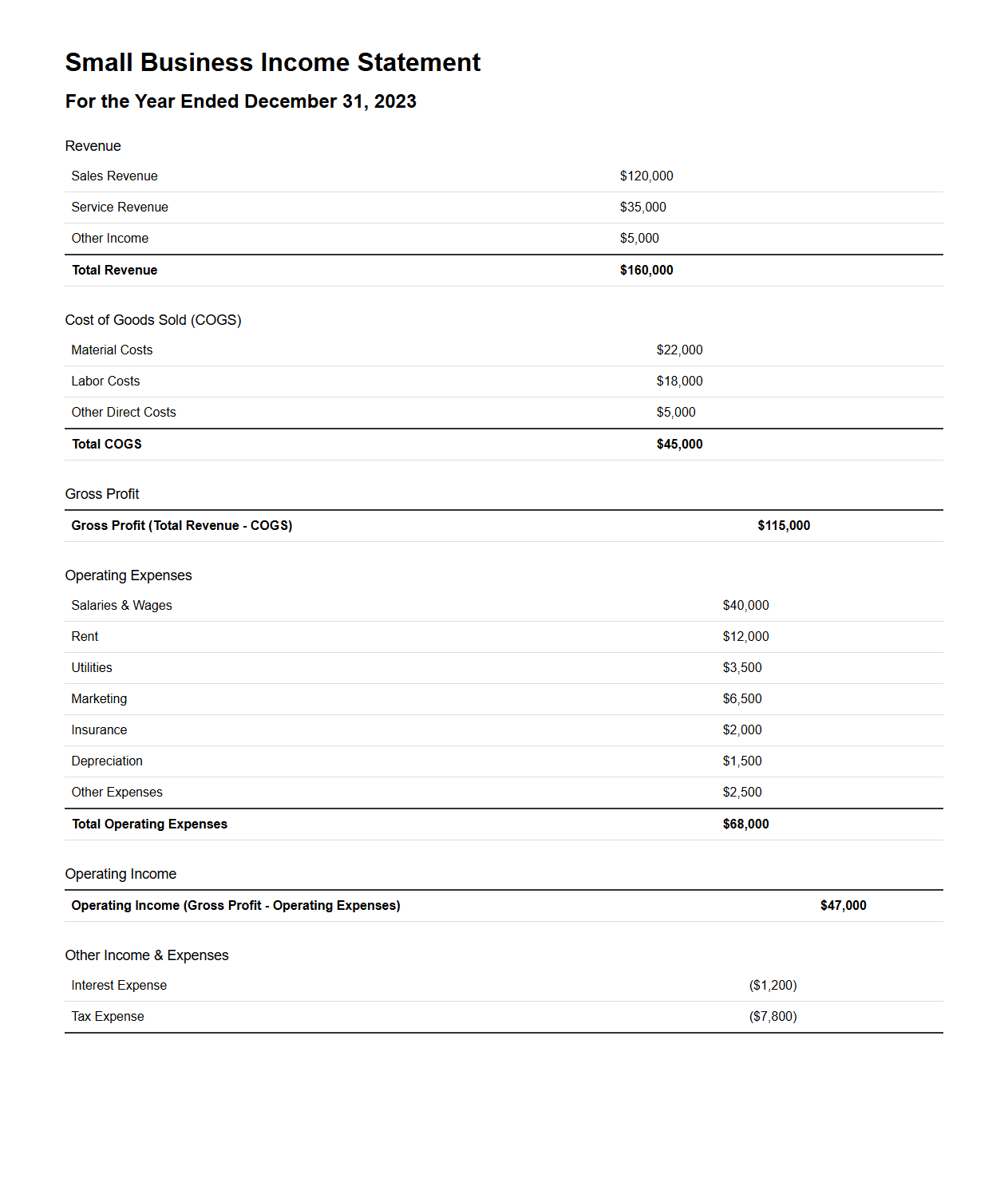

Small Business Income Statement Example for Financial Analysis

A

Small Business Income Statement Example for financial analysis is a detailed financial document that outlines revenues, expenses, and net profit over a specific period, helping business owners assess profitability. It includes critical line items such as gross sales, cost of goods sold, operating expenses, and net income, providing insight into operational efficiency. This example serves as a benchmark for comparing financial performance and making informed business decisions.

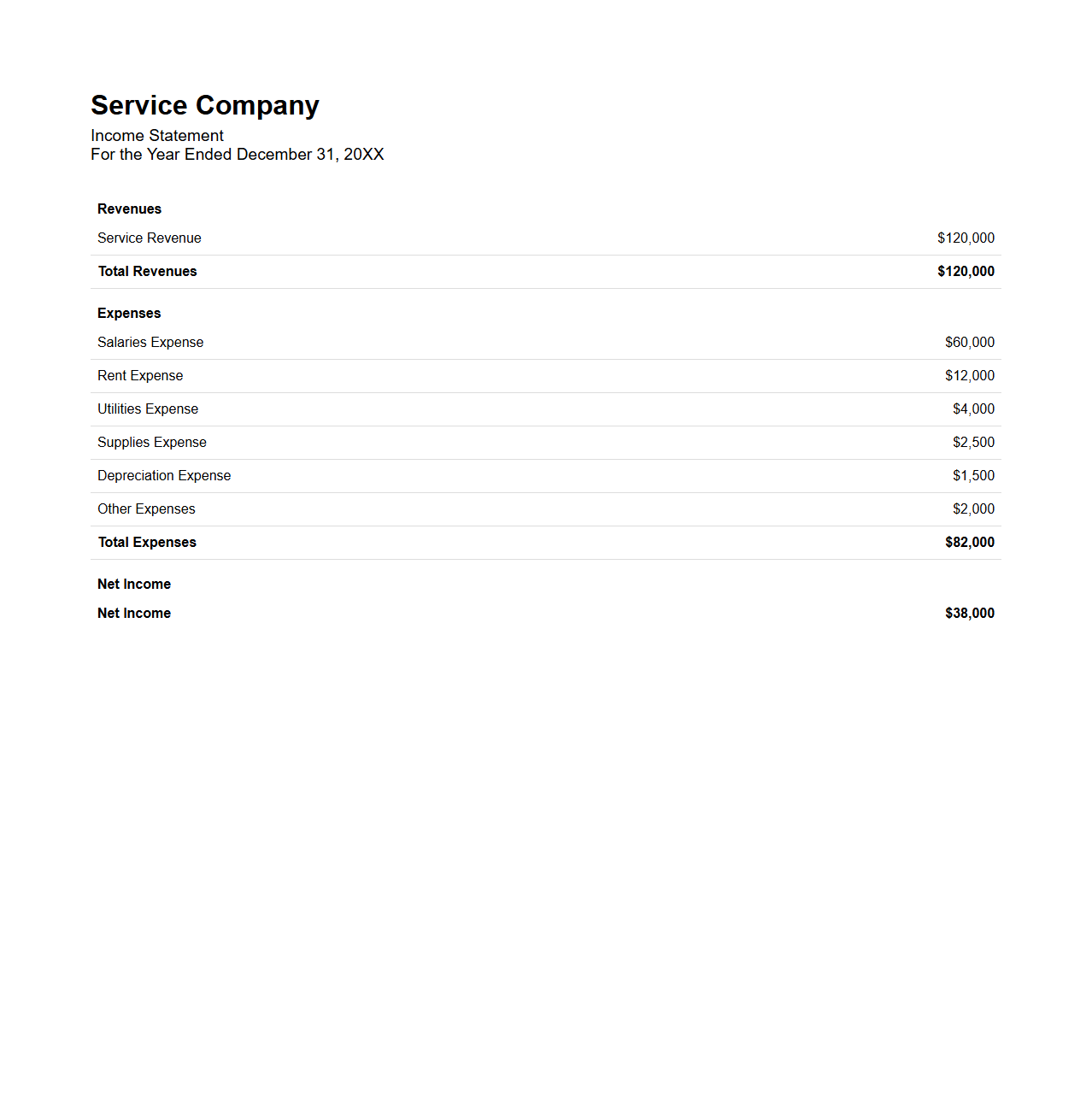

Service Company Income Statement Sample for Financial Review

A

Service Company Income Statement Sample for Financial Review document provides a detailed overview of revenue, expenses, and net income specific to service-based businesses. It highlights key financial metrics such as operating income, gross profit, and cost of services rendered to assess profitability and operational efficiency. This sample serves as a critical tool for stakeholders to analyze financial performance and make informed decisions.

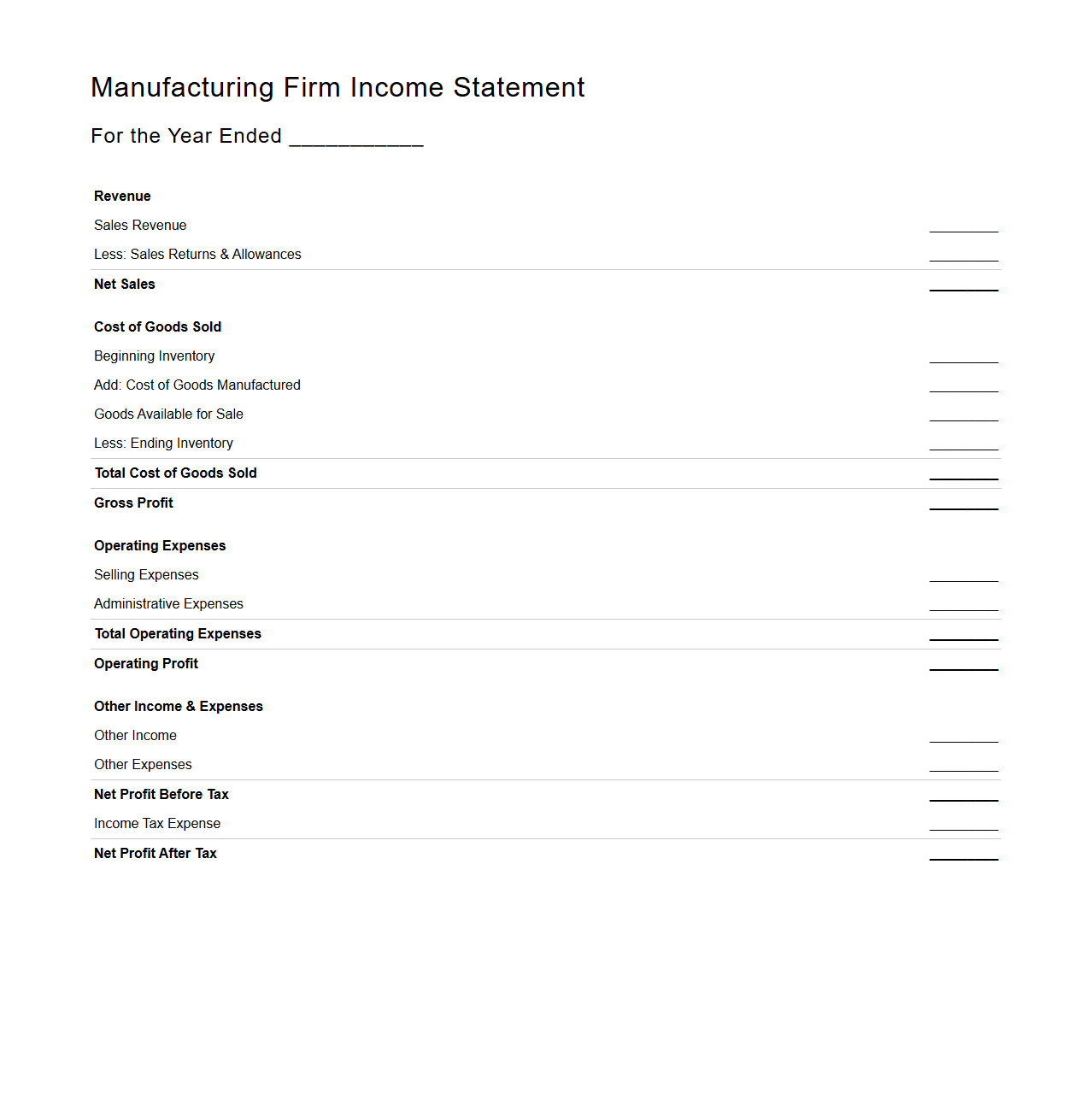

Manufacturing Firm Income Statement Template for Profit Analysis

A

Manufacturing Firm Income Statement Template for profit analysis is a structured financial report designed to detail revenue, cost of goods sold (COGS), gross profit, operating expenses, and net income specific to manufacturing businesses. It helps analyze profitability by breaking down direct and indirect manufacturing costs and comparing them against sales revenue over a defined period. This template aids decision-makers in identifying cost control opportunities and evaluating overall financial performance efficiently.

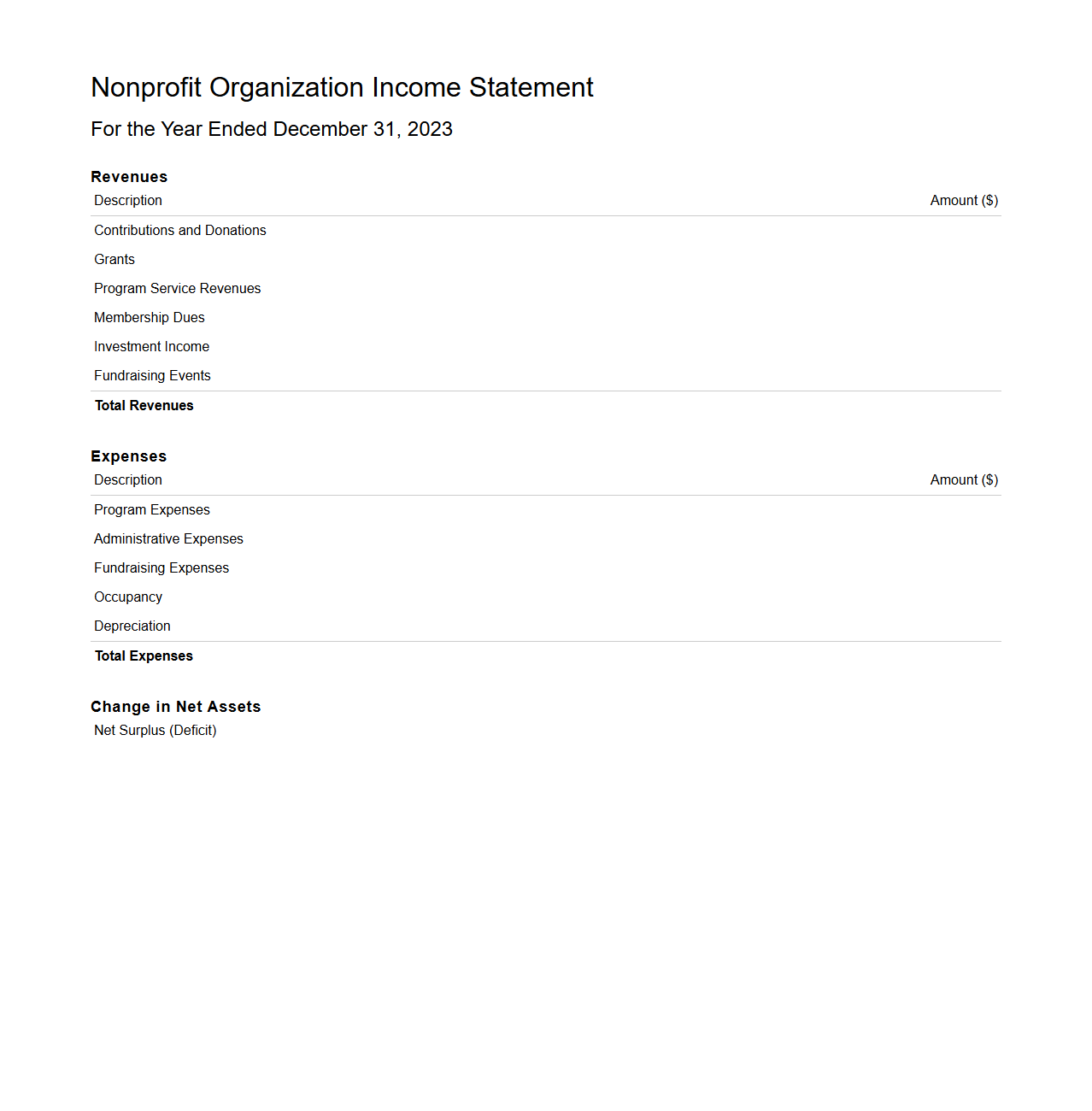

Nonprofit Organization Income Statement Example for Financial Assessment

A

Nonprofit Organization Income Statement example for financial assessment illustrates the revenues, expenses, and net income over a specific period, providing vital insights into the financial performance of the nonprofit. This document highlights key categories such as donations, grants, program service expenses, administrative costs, and fundraising expenditures, enabling stakeholders to evaluate financial health and resource allocation efficiency. It serves as a critical tool for transparent reporting, budget planning, and ensuring compliance with regulatory standards.

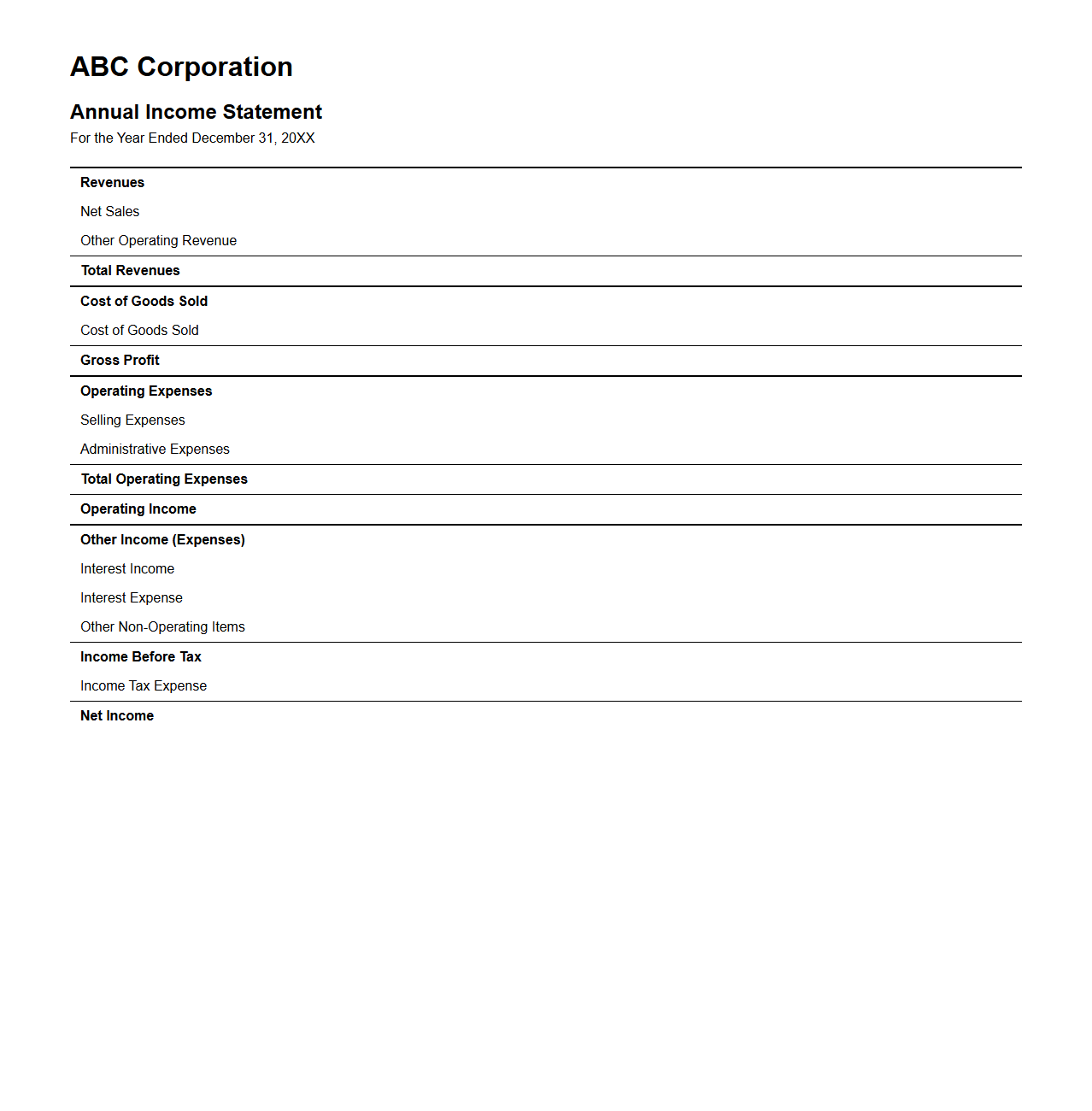

Annual Income Statement Format for Corporate Financial Analysis

The

Annual Income Statement Format for Corporate Financial Analysis is a structured financial document summarizing a company's revenues, expenses, and profits over a fiscal year. It provides critical data such as gross profit, operating income, and net income, essential for evaluating financial performance and making informed investment decisions. Analysts and stakeholders rely on this format to assess business profitability, operational efficiency, and growth trends.

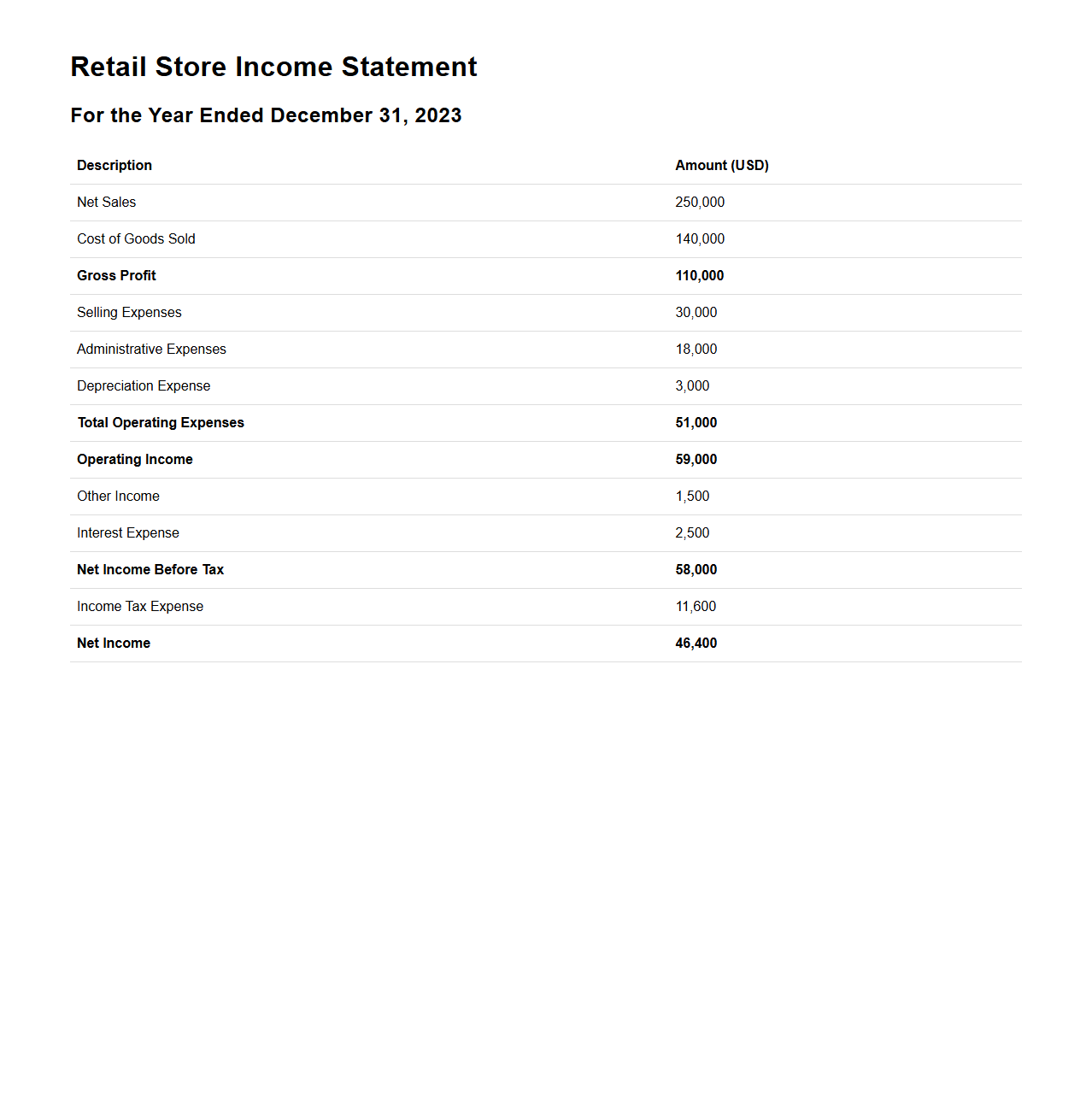

Retail Store Income Statement Sample for Performance Evaluation

A

Retail Store Income Statement Sample for Performance Evaluation document provides a detailed financial summary that highlights a store's revenues, cost of goods sold, operating expenses, and net profit over a specific period. This statement enables managers to assess profitability, identify cost trends, and make informed decisions to improve sales performance and operational efficiency. It serves as a critical tool for tracking financial health and guiding strategic planning within the retail sector.

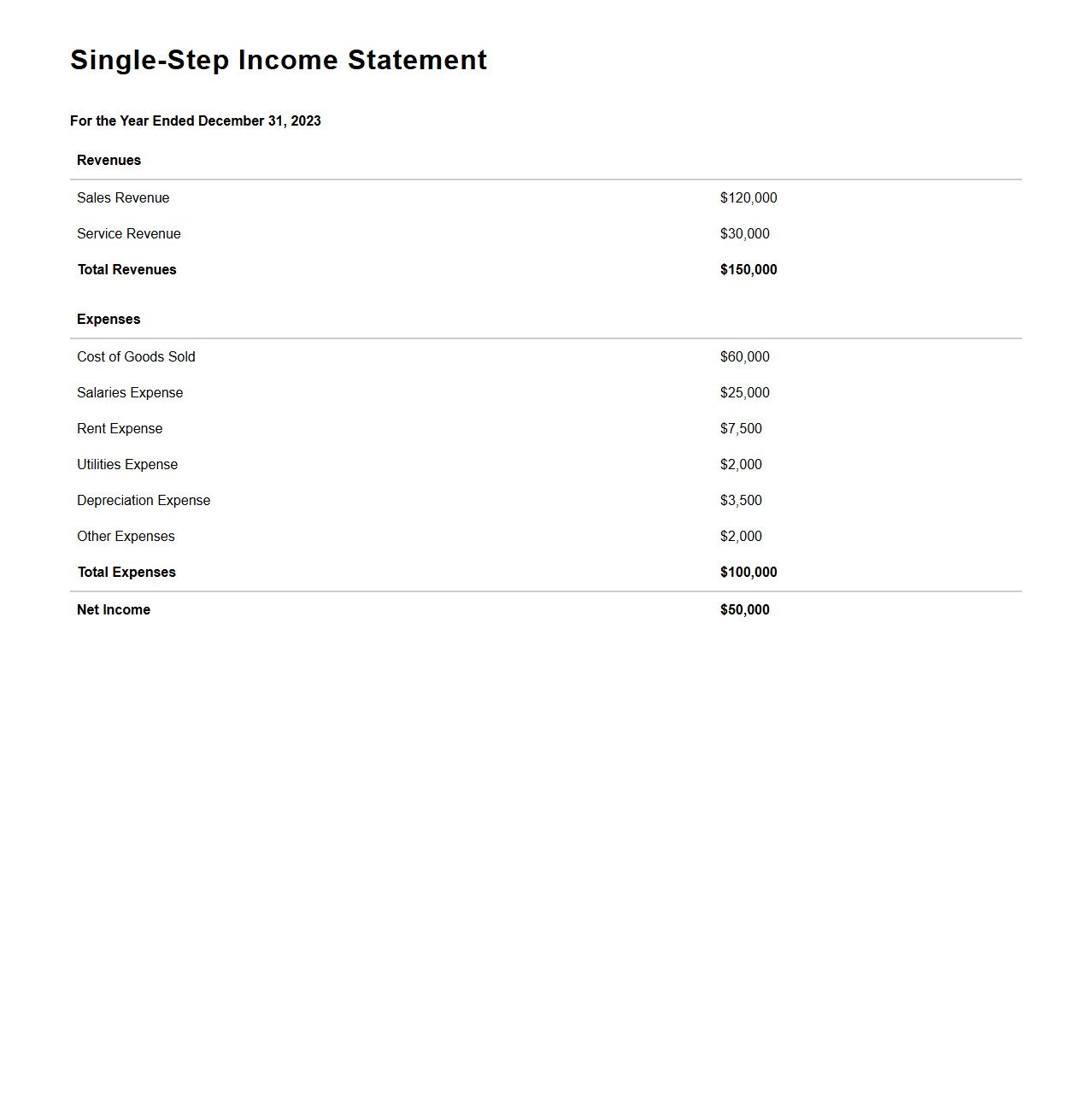

Single-Step Income Statement Example for Quick Financial Analysis

A

Single-Step Income Statement Example for Quick Financial Analysis document presents a simplified format that aggregates all revenues and expenses into two main categories, allowing for straightforward calculation of net income. This streamlined approach eliminates complex classifications, making it easier for stakeholders to quickly assess a company's profitability and financial health. It is particularly useful for small businesses and startups seeking concise financial summaries without detailed breakdowns.

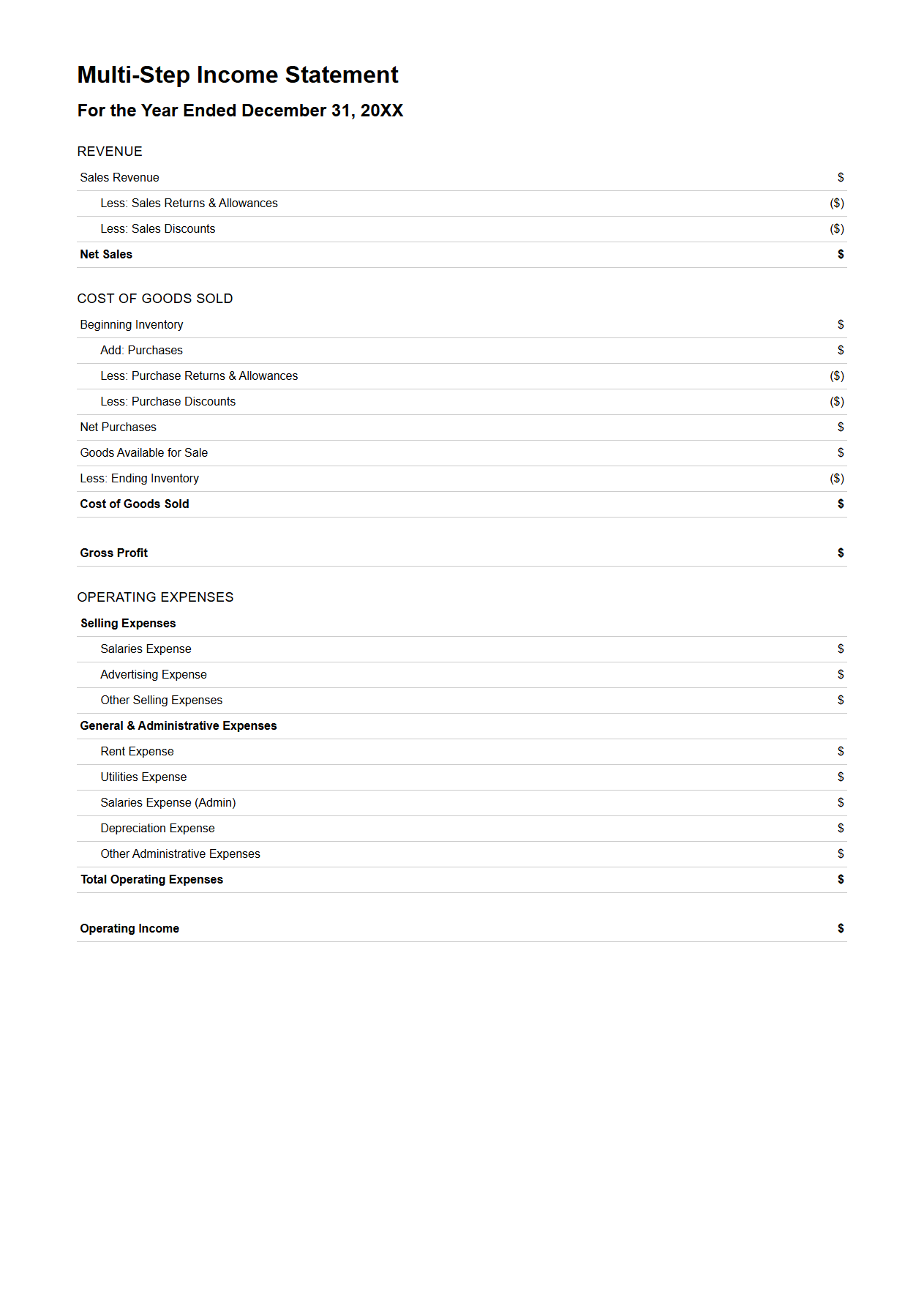

Multi-Step Income Statement Template for Detailed Financial Review

A

Multi-Step Income Statement Template is a financial document designed to provide a detailed and structured overview of a company's revenues, expenses, and profits over a specific period. It breaks down operating and non-operating activities, allowing for a comprehensive financial review by clearly separating gross profit, operating income, and net income. This template is essential for businesses aiming to analyze their financial performance with precision and transparency.

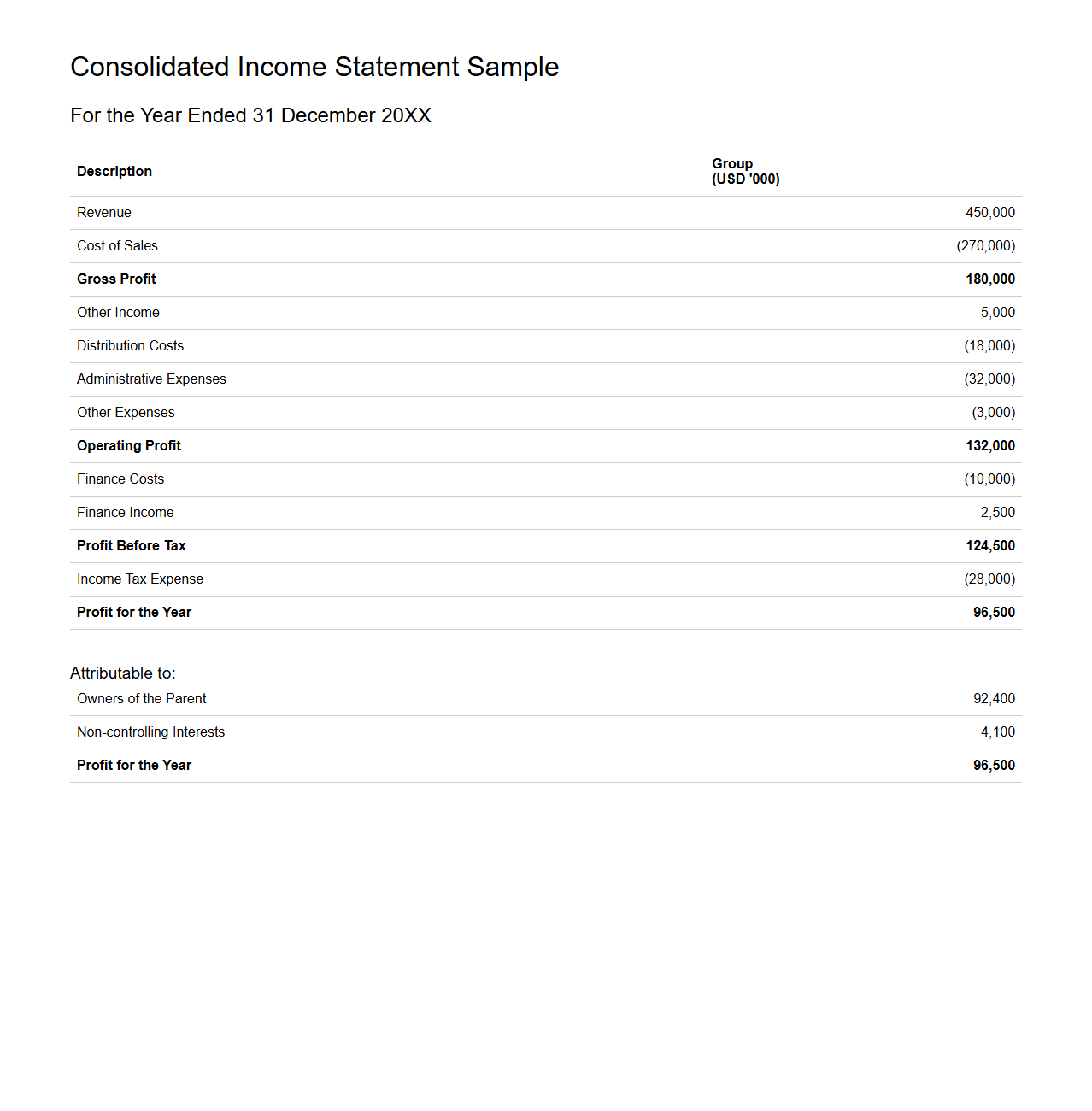

Consolidated Income Statement Sample for Group Financial Analysis

A

Consolidated Income Statement Sample for Group Financial Analysis is a financial document that combines the revenue, expenses, and net income of a parent company and its subsidiaries into a single report. It enables stakeholders to assess the overall profitability and financial performance of the entire corporate group. This statement is crucial for identifying trends, making investment decisions, and ensuring compliance with accounting standards like IFRS or GAAP.

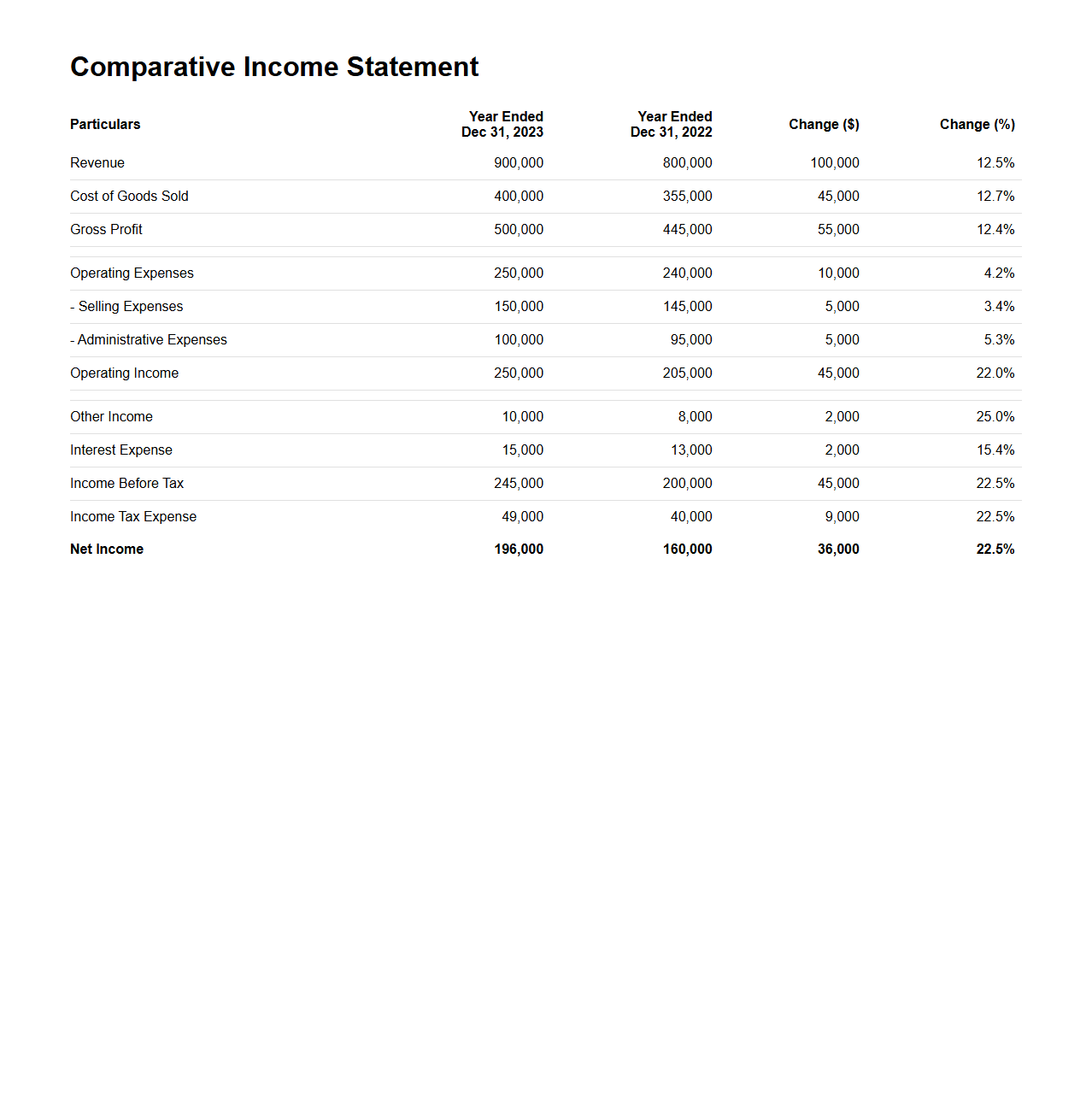

Comparative Income Statement Example for Year-over-Year Financial Analysis

A

Comparative Income Statement Example for Year-over-Year Financial Analysis document presents side-by-side income statements from multiple fiscal years to highlight changes in revenues, expenses, and net income. This tool enables analysts to identify trends, assess company performance, and make informed financial decisions by comparing financial data across different periods. It serves as a critical resource for detecting growth patterns, cost management effectiveness, and profitability shifts over time.

How can anomalies in year-over-year revenue trends be detected from the income statement document?

Analyzing year-over-year revenue trends involves comparing revenue figures across multiple periods to identify unexpected spikes or drops. Significant deviations from historical growth rates signal potential anomalies that require further investigation. Supporting notes and management commentary in the income statement document often highlight reasons for such irregularities.

Which line items in the income statement most impact EBITDA margin calculations?

EBITDA margin is primarily affected by operating expenses, including selling, general and administrative expenses (SG&A), and cost of goods sold (COGS). Depreciation and amortization are excluded since EBITDA focuses on earnings before these deductions. Accurate classification of operating income and expenses is crucial for calculating a reliable EBITDA margin.

What non-operating income figures require adjustment for comprehensive financial analysis?

Non-operating income items such as gains or losses from asset sales, interest income, and one-time settlement gains distort core business performance. Adjusting these figures gives a clearer view of sustainable earnings. Analysts typically exclude or separately analyze these to avoid skewed financial conclusions.

How does the classification of cost of goods sold affect gross profit analysis?

The classification of cost of goods sold (COGS) directly impacts the calculation of gross profit, which is revenue minus COGS. Misclassification can either inflate or reduce gross profit margins, misleading profitability assessments. Detailed scrutiny of COGS components ensures accurate analysis of product-level profitability.

What indications of aggressive revenue recognition can be identified in the income statement?

Signs of aggressive revenue recognition include unusually early booking of revenue, inconsistent recognition patterns, and large one-time increases in revenue without corresponding cash flow. Sudden changes in accounts receivable alongside revenue spikes also serve as red flags. Such practices can misrepresent true financial health and require careful examination.